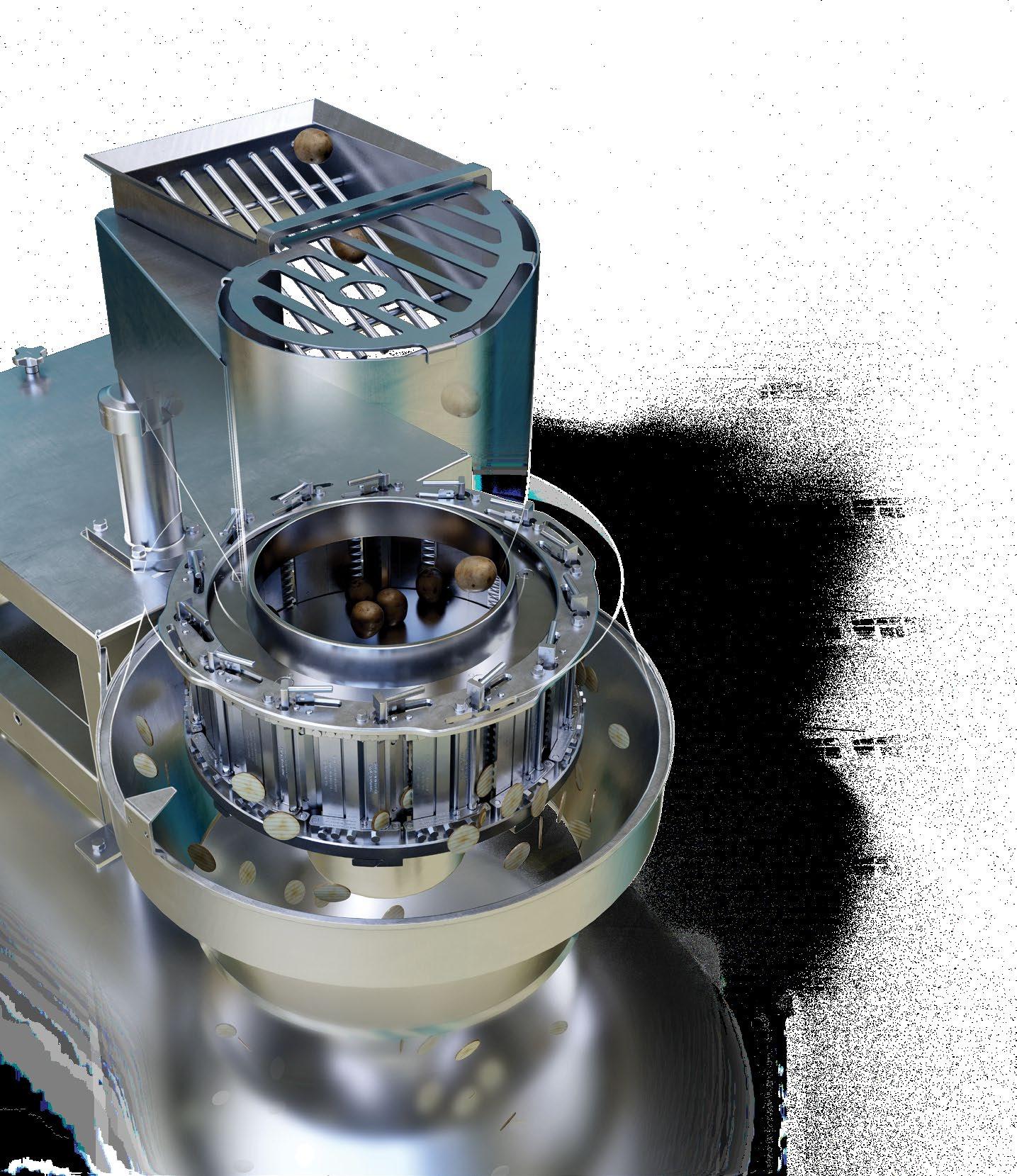

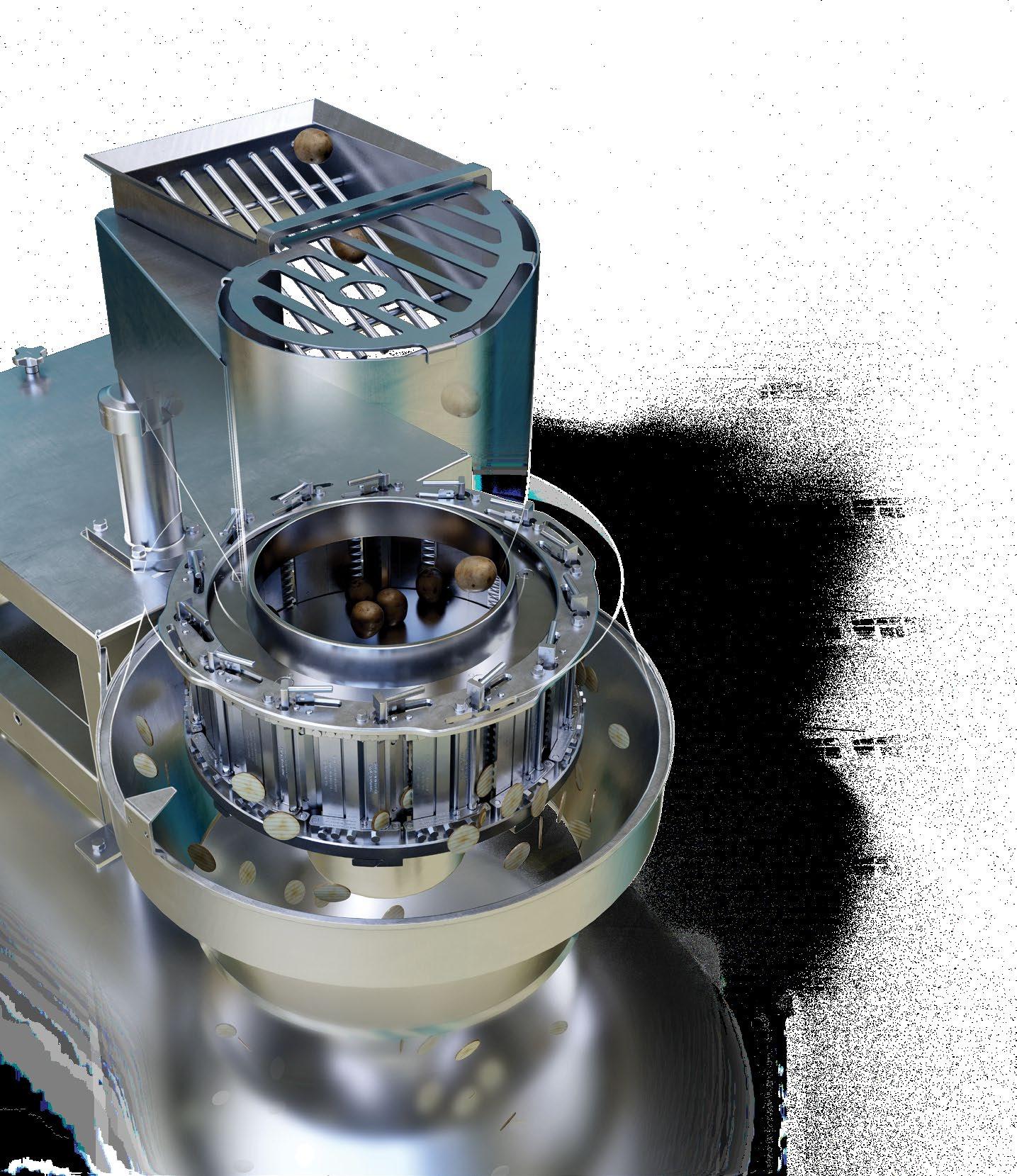

Urschel designs and manufactures high capacity, precision food cutting machinery designed for rugged production environments.

Sanitary and dependable in design. Rely on Urschel cutting solutions to effectively process all types of products.

The Urschel global network of sales and support has expanded. Urschel Canada in Ontario offers complete sales and support throughout Canada.

Contact Urschel Canada to learn more: 647-910-5017 | canada@urschel.com

FEBRUARY/MARCH 2026 • VOL. 86, ISSUE 1

Reader Service Print and digital subscription inquiries or changes, please contact Angelita Potal, Customer Service

Tel: 416-510-5113 Fax: 416-510-6875

Email: apotal@annexbusinessmedia.com

Mail: 111 Gordon Baker Rd., Suite 400, Toronto, ON M2H 3R1

ED ITOR | Nithya Caleb ncaleb@annexbusinessmedia.com 437-220-3039

ASSOCIATE EDITOR | Steven McGoey smcg oey@annexbusinessmedia.com 416-510-5206

ASSOCIATE PUBLISHER | Kim Barton kbarton@annexbusinessmedia.com 416-510-5246

MEDIA DESIGNER | Alison Keba akeba@annexbusinessmedia.com

ACCOUNT COORDINATOR | Cheryl Fisher cfisher @annexbusinessmedia.com 416-510-5194

AUDIENCE DEVELOPMENT MANAGER | Anita Madden amadden @annexbusinessmedia.com 416-510-5183

GROUP PUBLISHER/DIRECTOR OF PRODUCTION | Paul Grossinger pgrossinger@annexbusinessmedia.com

CEO | Scott Jamieson sjamieson@annexbusinessmedia.com

Publication Mail Agreement No. 40065710

Subscription rates

Canada 1-year – $90.12 per year

Canada 2-year – $132.55 Single Issue – $15.00

United States/Foreign – $169.68 All prices in CAD funds

Food in Canada is published 6 times per year by Annex Business Media. Occasionally, Food in Canada will mail information on behalf of industry related groups whose products and services we believe could be of interest to you. If you prefer not to receive this information, please contact our Audience Development in any of the four ways listed above.

Annex Privacy Officer

Privacy@annexbusinessmedia.com 800-668-2384

No part of the editorial content of this publication can be reprinted without the publisher’s written permission @2026 Annex Business Media. All rights reserved. Opinions expressed in this magazine are not necessarily those of the editor or the publisher. No liability is assumed for errors or omissions.

Mailing address

Annex Business Media

111 Gordon Baker Rd., Suite 400, Toronto, ON M2H 3R1 Tel: 416-442-5600 Fax: 416-442-2230

ISSN 1188-9187 (Print) ISSN 1929-6444 (Online)

According to the Bank of Canada’s (BoC’s) Business Outlook Survey for Q4 2025, business sentiment was subdued but remained above its survey low from Q2 2025.

Firms reported that sales growth was weak last year largely due to the economic effects of trade tensions. They’re expecting sales growth to improve slightly in 2026, with modest growth in exports. A small, but increasing share of businesses, reported higher sales to non-U.S. markets in response to trade tensions with the United States. In other good news, most firms did not report binding capacity constraints or labour shortages. However, with demand expected to remain soft in 2026, the majority of surveyed businesses plan to maintain or decrease current staffing levels.

While companies would like to make capital investments, they are prioritizing spending on routine maintenance, partly because of continued traderelated uncertainty. They also expect inflation to remain stable in 2026, roughly between 2.5 and 3 per cent.

BoC conducted the Business Outlook Survey between Nov. 6 and 26, 2025, through in-person, video and phone interviews with senior managers of about 100 firms selected to reflect the composition of Canada’s GDP. The survey found that trade-related

uncertainty and the broad economic effects of tariffs weighed on the outlooks of many firms. Businesses are concerned about financial, economic and political conditions, slowing demand, and cost pressures. However, the share of firms planning or budgeting for a recession in Canada over the next 12 months has eased from 33 to 22 per cent. This is the lowest level reported in 2025, though it remains above 2024 levels.

Firms reported weak sales growth over the past 12 months, with one-third of businesses citing a decline in sales volumes due to:

• lower business spending or delays in purchases because of ongoing trade uncertainty;

• reduced orders from clients in sectors subject to U.S. tariffs; and

• pessimistic outlooks among some businesses reliant on household spending. Additionally, businesses do not expect negative effects from tariffs or trade tensions to worsen this year. Plus, firms that aren’t strongly impacted by U.S. trade policies have positive expectations for future sales due to:

• steady demand from clients who are less exposed to trade tensions; and

• their own efforts to grow their business by offering less-expensive products or providing services and technologies with broad market appeal to limit dependence on any one sector.

Given soft demand, most firms are holding off on capital investments and focusing on routine maintenance. They’re not planning to increase the size of their workforce over the next 12 months. One of the concerns is the share of firms planning staff reductions. It rose to its highest level since 2016 in Q4 2025.

This survey shows that trade-related uncertainty continue to negatively impact businesses, but we can expect modest growth. It also reveals Canadians’ resiliency to the great ‘rupture’ in world order that Prime Minister Mark Carney referred to in his speech at the World Economic Forum in Davos, Switzerland, in January.

I’d like to leave you this quote from Carney’s speech: “Building a strong domestic economy should always be every government’s immediate priority. And diversification internationally is not just economic prudence—it is the material foundation for honest foreign policy. Because countries earn the right to principled stands by reducing their vulnerability to retaliation.”

This survey gives us a sense of what Canadian manufacturers including F&B processors plan to do in 2026. I hope it aligns with your plans. If not, I’m all ears.

Nithya Caleb ncaleb@annexbusinessmedia.com

Beyond Meat is moving beyond plant-based chicken and burgers and into the beverage market for the first time in its 17-year history. Beyond Immerse, which gets its protein from peas, comes in two options: one with 10 g of protein and 60 calories and one with 20 g of protein and 100 calories. Both contain 7 g of fibre to promote gut health as well as Vitamin C and electrolytes. The drink, which comes in three flavours, will be available for a limited time on Beyond Meat’s new direct-to-consumer website, Beyond Test Kitchen. The move comes amid a slump in plantbased meat sales & a decline in company fortunes.

FedDev Ontario invests in Imagoh Foods, Redstone Food Group

The Federal Economic Development Agency for Southern Ontario is investing $1.5 million in Scarborough-based Imagoh Foods and $2 million in Mississauga-based Redstone Food Group to help them adopt advanced technologies and build production capabilities. Imagoh specializes in the production of Asian-inspired ethnic food that are sold in more than 500 stores in Canada. Redstone manufactures private label baked goods for the retail and foodservice sectors. Redstone intends to use the funds to buy new machinery and AI control systems. Imagoh plans to incorporate advanced manufacturing equipment in its plant.

Innodal’s anti-Listeria processing aid approved by USDA-FSIS Quebec-based food safety solutions provider Innodal receives a No Objection Letter from the U.S. Depart-

ment of Agriculture’s Food Safety and Inspection Service (USDA-FSIS) for Inneo, a food processing aid for eliminating Listeria monocytogenes. This determination allows U.S. meat and poultry processors to use Inneo as a surface treatment and directly mixed into ready-to-eat formulations.

Foods ceases operations

B.C.-based plant-based seafood startup Konscious Foods is no longer in business. The website is down and the company phone number is also not working. Headquartered in Richmond, B.C., Konscious Foods manufactured frozen plant-based sushi rolls, onigiri and poke bowls. It was established in

> Olymel appoints Daniel Rivest as the company’s next CEO. Current CEO Yanick Gervais has decided to leave the position in July 2026, after 10 years at the company. Currently serving as COO, Rivest joined Olymel in 2016. He has more than 20 years of experience in food processing. Gervais will remain with the organization as a strategic advisor until October 2027.

> Halifax-based Cove Soda appoints Bryan Crowley as CEO and board member, Craig Olikiewicz as chief commercial officer and Joe Lee as chief operating officer. Crowley has more than 25 years of leadership experience.

> Hain Celestial, parent company of Sleepytime Tea, appoints Alison Lewis as the latter’s CEO and president. With 35 years of experience

2023 by Yves Potvin, who also founded two successful plant-based businesses: Yves Veggie Cuisine, which was discontinued by Hain Celestial last year, and Gardein, now part of Conagra Brands.

The Canadian Food Innovation Network awards $768,509 to nine foodtech projects through its Innovation Booster Program. Industry partners will match these funds, resulting in a total investment of $1.56 million. The Innovation Booster funding recipients are: BetterTable Solutions (British Columbia); BetterCart Analytics (Saskatchewan); CO2Brew (Alberta); Colibri Vanilla (Quebec); Hinbor (British Columbia); Localize Your Food (Alberta); Revo Biochem (Alberta); ThisFish (British Columbia); and U Technology Corporation (Alberta).

in the industry, Lewis previously served as chief growth officer at Kimberly-Clark, chief marketing officer at Johnson & Johnson Family of Consumer Companies and senior vice president and chief marketing officer, North America, at the Coca-Cola Company.

Kraft Heinz names Steve Cahillane as the company’s new CEO. He will also join the board of directors and serve as CEO of Global Taste Elevation, following Kraft Heinz’s planned separation into two independent, publicly traded companies. Cahillane most recently served as chair, president and CEO of Kellanova until its acquisition by Mars.

You can reduce your product’s added sugars and artificial sweeteners when you use this natural source of sweetness.

California Raisins contain naturally occurring organic acids like tartaric, propionic and glutamic acids, which inhibit mold growth and act as natural preservatives.

California Raisins have a low water activity; they’re the perfect fit in lowmoisture snacks, cereals, bars and confections.

California Raisins contain 2.2% tartaric acid—a natural flavour enhancer. They’re also packed with Maillard reaction precursors, so when roasted, baked or processed at high temperatures, they make everything taste richer.

California Raisins’ skins are strong enough that they maintain their shape and integrity during manufacturing, building volume in the finished product.

The natural sugars in California Raisin juice concentrate, paste and whole, chopped raisins help bind wet and dry ingredients.

The plump, soft “chew” of California Raisins does wonders for mimicking fat’s richness. Put raisins to work in low-fat baked goods, cookies and cakes.

Because California Raisins hold water and build natural viscosity, they help maintain a soft, appealing texture without the need for texturizers or preservatives.

No matter how you look at it, it all adds up to California Raisins being a star and must-have product for bakery formulations!

Visit CaliforniaRaisins.ca/professionals for more information.

Cizzle Brands acquires Flow Water’s co-manufacturing business Cizzle Brands acquires Flow Water for approx. $83.75 million. However, certain assets relating to Flow’s consumer packaged goods business, including brand-related intellectual property and trademarks, will remain with Rucker Investments, who will continue to operate that business under the Flow brand. Cizzle will focus exclusively on Flow’s beverage co-manufacturing business. Once the acquisition is complete, Cizzle will change the name of the business to Cizzle Brands Manufacturing and its manufacturing facility in Aurora, Ont., will become known as the CWENCH Hydration Factory. Flow went into receivership last year. In fall 2025, the court approved its sale to one of the lenders, Rucker Investments.

Campbell’s to acquire 49 per cent stake in Rao’s pasta sauce manufacturer

Campbell’s to acquire 49 per cent of La Regina, the makers of Rao’s tomato-based pasta sauces, for US$286 million. The purchase is to be paid in two tranches with the deal expected to close in the second half of fiscal 2026. Campbell’s acquired Rao’s in 2023 as part of its US$2.7 billion purchase of Sovos Brands. Rao’s portfolio of products includes pasta sauces, dry pasta, frozen entrées, frozen pizza and soups. Based in Scafati, Italy, La Regina was founded in 1972 and has been a Rao’s partner since 1993. La Regina also operates a facility in the U.S. in Alma, Ga.

Lee Li Holdings to invest $533M in Ontario

First Choice Beverage, Global Beverage and Logistics Centre and Imperial Chilled Juice, subsidiaries of Lee Li Holdings, is expanding an existing

plant and building a new facility in Mississauga, Ont., at a cost of $533 million. Totalling over 100,000-sf, the facility would focus on plastic bottle manufacturing for tea, coffee, sparkling water and flavoured water. It would also introduce a white label line that produces and bottles beverages for store-brand customers. The facility will offer turnkey co-manufacturing of juices and dairy alternative products as well as warehousing solutions for multinational brands and local retailers. The investment would be supported with a loan of up to $90 million from Invest Ontario.

Cornu Holding SA and its Canadian subsidiary, TBI, will establish a new artisan baked goods production facility in Edmundston, N.B., at a cost of approx. $32.5 million. The facility will produce the company’s flagship product, puff pastry flutes, for distribution across Canada and the United States. To support this investment, the provincial government is providing a payroll rebate of up to $575,000, tied to the creation of up to 50 new full-time positions by the end of 2031. Additionally, a conditional grant of up to $1.1 million will support equipment purchase.

soymilk powder processing plant Alinova Canada is investing $24 million to build Canada’s first non-GMO soymilk powder processing plant in Morrisburg, Ont. A joint venture between Japanese soymilk producer Marusan-Ai and Ontario-based David J Hendrick International, Alinova Canada’s new facility will produce over 1,200 metric tonnes of soymilk powder per year. Ontario is providing $1.5 million in funding.

Terra Bioindustries’

Toronto-based Terra Bioindustries says its proprietary malt ingredient, Terra Malt, receives nonnovel determination from Health Canada, and is officially recognized as a food ingredient.

Terra malt is a malted barley extract made from upcycled brewers’ grains. In pre-commercial trials, it was used as a flavour and colour enhancer in beverages, baked goods, savoury sauces and non-alcoholic beer. www.terrabioindustries.com

Key Technology introduces its Compass optical sorter for leafy greens. Designed to inspect fresh-cut product straight from the field, this belt-fed system combines high-performance foreign material detection and removal with hygienic product handling. It is suitable for sorting spinach, arugula and other unwashed, fresh-cut leafy greens. www.key.net

PPM Technologies introduces the third generation of its FlavorWright All-inOne seasoning system. This portable solution combines liquid and dry seasoning in a single plugand-play unit for continuously coating snacks, nuts, confectioneries, cereals, vegetables, fruits and frozen foods. It is suitable for processors with small to medium production requirements. www.ppmtech.com

• Fluid Milk for Superior Results

Available in 20 kg & 1000 kg totes and various M.F options (2%, 3.25%, 3.8%) to deliver consistent texture, avour, and performance in premium bakery applications.

• Buttermilk for Exceptional Taste

Offered in 1 kg, 20 kg, and 1000 kg totes. Provides the perfect acidity and moisture balance for high-quality baked goods, including everything from cakes and scones to pancakes and fermented doughs.

Dr. Amy Proulx

e often think about food safety as the regulations and codes of practice that allow for food to be prepared in a sanitary and hygienic environment. But the human dynamics allowing for food safety systems to function well are critical too.

In food safety teams, decisions must be made under high stress. It’s easy to fall into disruptive behavioural patterns when working under pressure. Interpersonal conflict can affect decision making. Food safety teams may be overruled by business leaders, leading to anger and frustration. Food safety team members may be required to stop manufacturing lines or halt shipments, creating inter-departmental friction.

Leaders must address conflict in appropriate ways to reduce impacts on the morale and trust within the organization. Creating a unified purpose within the organization, with visible commitments to food safety goals allows people to anchor themselves to a shared ideal during times of conflict. Leadership sets up policies to arbitrate conflicts. And leaders model values of quality management that focus on authentic root causes of problems instead of blaming people. Is a person ever the root cause of a conflict? Absolutely, but usually there are underlying causes. Has the employee been trained properly? Are work instructions in a language and level that are useful for the employee? Are supervisors actively involved and engaged in rapid feedback and coaching rather than waiting for major problems to emerge? Do employees have the right resources and sufficient time to do their tasks? Are other workplace situations causing friction and

Creating a unified purpose within the organization, with visible commitments to food safety goals allows people to anchor themselves to a shared ideal during times of conflict.

tension, such as pressure from audits, negotiations with unionized workers, or financial pressures felt by the entire company? All of these can become root causes for negative behaviours.

Employers have the right to provide constructive feedback to employees as well as to use proper human resources procedures for reporting and dismissing employees. Employers must investigate allegations of harassment and violence, create policies and provide training and behavioural reinforcement within the workplace.

Workers have the responsibility to participate in training, and to report harassment and violence to management. In companies meeting the minimum number of employees (more than 20 in most provinces) a joint health and safety committee is required.

Workers have the right to refuse unsafe work. This is hard to determine when harassment often happens through hardto-observe behaviours. It is also difficult if employees must report harassment but do not have clear neutral parties to commu-

nicate with within the company. Proactively scouting out behavioural issues, and empowering supervisors to practice conflict management can minimize the impacts and reduce ministry intervention.

When I worked in food inspection, an incident of psychological safety got seared into my memory. A worker made a mistake with a metal detector. This worker was reported to HR and subsequently fired within a very short time. The workers were terrified to talk to the inspection staff. I asked the production supervisor to perform the same task, and they made the same mistake. On root cause analysis, we found the operating procedure and work instructions were incorrect. Further, employees lost trust due to hasty actions by the management. An integrated response, with both food safety and human factors, could have retained this team’s trust.

I take this issue quite seriously because of my own lived experience. I was bullied in one of my first jobs. It got to the point where I was ready to leave the industry. I used to draft standard HACCP operating procedures. My supervisor would literally rip them up, throw them in the trash in front of me, and scream that I was ‘being an idiot for wasting resources’. They didn’t provide constructive feedback.

Food safety professionals often face conflict in the workplace. It takes leadership, but it’s important to create practices that allow for psychological safety, where people can work together.

Dr. Amy Proulx is professor and academic program co-ordinator for the Culinary Innovation and Food Technology programs at Niagara College, Ont. She can be reached at aproulx@niagaracollege.ca.

If Quebec’s Bill 96 feels less like a language law and more like a game of Tetris, you’re not alone. More than three years after its adoption—and with key provisions now in force—food companies are still grappling with how to fit their brands, labels, and marketing materials into Quebec’s newly revised French-language framework.

Equal French, (almost always) everywhere

As a general rule, all text appearing on a product, its container, its wrapping, or any accompanying material must be in French. This requirement applies to permanent labels and non-permanent ones alike —think hang tags, shrink wraps, inserts, and even paperboard sleeves or plastic bands that are often wrapped around jars and bottles. Other languages are permitted, but only if French is at least equally prominent and available on terms no less favourable.

One of the most relied-upon exceptions to the rule above remains the exemption for “recognized” trademarks in a language other than French, provided no French version of the trademark is registered. As of June 1, 2025, if a recognized or registered trademark appearing on a product includes a generic or descriptive term (for example, words describing the nature or characteristics of the product, flavour profile, etc.), that generic or descriptive text must now appear in French on the product or on a permanently affixed support.

In other words, “recognized” trademark status is no longer a free pass when it comes to descriptive or generic wording.

Melissa Tehrani and Julia Kappler

product

The regulations also carve out various exceptions to the requirement that a “generic term or a description of the product” in a trademark be translated, such as an exemption for “the name of the product as sold”. However, the scope of this exception is unclear. Regulators appear to view the “name of the product as sold” as the primary or house brand, rather than sub-brands, variants, or product-line extensions. Therefore, whether a mark qualifies as the “name of the product as sold” will depend heavily on how it is presented, positioned, and perceived in the marketplace. Mock-ups matter. Layout matters. Context matters.

While our courts have maintained common-law trademarks are “recognized” under the Trademarks Act, recent interactions with the Office québécois de la langue française suggest unregistered marks may face greater scrutiny. In some cases, businesses have been asked to provide documentation confirming a mark is recognized—a tall order without a certificate. Add to that the reality that retailers, not trademark practitioners,

are the first line of compliance, the risk calculus changes quickly.

There is a two-year sell-through grace period (until June 1, 2027) for noncompliant products manufactured before June 1, 2025. However, this grace period does not apply to new product launches.

Nevertheless, Quebec has extended that grace period for products manufactured between June 1, 2025, and December 31, 2025, that are subject to recent federal labelling changes, including the amendments to the Food and Drug Regulations relating to:

• front-of-package nutrition symbols;

• new or revised labelling requirements;

• Vitamin D disclosures;

• hydrogenated fats and oils; and

• certain amendments affecting cannabis-related products.

For food companies, this matters. Many manufacturers are undertaking significant packaging overhauls to comply with these requirements. Forcing simultaneous compliance with Quebec’s new Frenchlanguage rules would have meant multiple redesigns in rapid succession.

In an environment where label space is premium, smart sequencing—and early legal review—can make the difference between a smooth transition and an expensive reprint. For food companies, that means treating language compliance as a design, branding, and operational issue, not just a legal one.

Melissa Tehrani leads GowlingWLG’s Advertising & Product Regulatory group. Her email ID is melissa.tehrani@gowlingwlg.com. Julia Kappler is a lawyer in the same group. She can be reached at julia.kappler@gowlingwlg.com.

Carol Zweep

Today, consumers are seeking adventures in the foods they eat. They are willing to try global flavours and ingredients with unique combinations. Hybrid products are being invented such as cronut (croissant donut), cruffin (croissant muffin), buffin (bagel muffin), brookie (brownie cookie) and crookie (croissant cookie). Innovative packaging can add appeal to consumers and compliment the introduction of novel baked goods. There is much interest in the product’s journey and tackling food insecurity with attention to local sourcing and sustainable farming practices. The focus on sustainability extends to the package and selecting eco-friendly options. Other driving forces behind bakery packaging trends include convenience, portion control, an on-the-go lifestyle, e-commerce growth, innovation in packaging materials and extending shelf life. The packaging also serves to promote company brand identity and capture consumer attention.

Bakery products are diverse and each product category have unique packaging requirements. There are baked goods for immediate consumption or short shelf life such as bread products, cakes and pastries. Bread products are usually sold in polyethylene or paper bags. Cakes and pastries can be sold in paperboard boxes (with or without transparent windows). For these products, clear plastic clamshells and trays are used to prevent

damage during transportation and handling. Baked goods with longer shelf life, such as cookies, require moisture and/or oxygen barrier to maintain freshness. The popular package format uses multi-layer laminated materials made into flat or stand-up pouches. Lastly, frozen bakery and desserts are usually contained in a moisture barrier plastic wrap or bag within moisture resistant paperboard boxes. The move to more sustainable packaging requires a varied approach based on the product’s needs. Reduction of packaging material use, or reuse of packaging is the preferred approach. Switching to materials that increase recycling rates or promote composting will decrease waste going to landfill. Paper-based bags and fibre boxes can be recycled or composted. FSC-certified papers ensure use of sustainably sourced raw materials. Incorporation of PCR (post-consumer recycled) materials promotes the circular economy by reusing existing resources. For plastics, switching to materials such as PET for rigid clamshell containers and trays facilitates recycling. Changing from multi-layer barrier materials to monomaterial or recyle-ready alternatives

with enhanced barrier properties, will ensure more materials can be captured for recycling. Use of appropriate package components (inks, labels, adhesives) ensure the entire package can be recycled.

Smart packaging technology integration into packaging is gaining momentum. Augmented realityenabled packaging allows consumers to experience immersive content such as virtual tours and product tutorials. Integration of QR codes and NFC (near field communication) tags allows information, such as ingredient and nutrition details, to be shared with consumers. They’re also a means to tell stories of sustainability or baking techniques. Advances in antimicrobial active packaging prolongs the product’s quality without using preservatives.

Packaging can be used to sell the product by differentiation through design. However, there are challenges. There are constant regulatory changes (food safety, environmental, nutrition labelling), on-going competition, fluctuations in raw material pricing, evolving consumer preferences and retail expectations. Delighting the consumer with a package that is aesthetically pleasing and sustainable must be balanced with functionality to protect and preserve the baked goods and inform the consumer about the product.

Carol Zweep is an associate with PAC Global, a not-for-profit, trusted advisor for its member-based global packaging network.

Alex Barlow

anadian bakeries have little control over some of their most important ingredients. Vanilla is a clear case in point: it is foundational to all manner of baked goods but is sourced from a highly concentrated and fragile supply base, with most of the processing happening outside of the country.

Madagascar produces 3/4th of the world’s vanilla, leaving the global market unusually exposed to disruption. Vanilla must be hand-pollinated and cured for months before processing, so supply cannot adjust quickly when shocks occur. The result is extreme price volatility: in the 2010s, prices swung from US$40 to more than US$700 per kg, driven by cyclones, hoarding, export controls and speculation.

Canada rides at the end of this commodity rollercoaster. Vanilla does not grow here, and most of the processing turning beans into usable industrial ingredients is imported from the U.S. or European flavour houses. The result is a double exposure: global shocks upstream and limited leverage over cost, consistency and performance downstream.

Vanilla is hard to substitute. Although synthetic vanillin now makes up the majority of global vanilla flavour use, it is a nonviable replacement in many categories. Vanillin underperforms in fat-heavy and high-heat applications and doesn’t meet the standards for organic, clean-label, or premium products. When the global vanilla market swings, Canadian processors often can’t easily pivot. They pay the premium or face difficult reformulation decisions. The vulnerability is compounded by the location of

processing. Canada’s ingredient supply chain is strong in primary production and finished food manufacturing, but the value-defining stages in between— extraction, concentration, formulation and stabilization—are largely offshore. That means Canadian food companies are price takers for value-added vanilla ingredients and have little control over consistency or cost. This is the problem Montreal-based Colibri Vanille is working to solve.

Founded by Chantale Caron, Colibri focuses on producing clean label, singleorigin vanilla formats with an emphasis on traceability and formulation quality. Caron, a long-time advocate for direct trade and ethical sourcing, set out to give Canadian buyers access to vanilla ingredients processed closer to home and to bring more extraction and formulation work into Canada.

In late 2025, Colibri received funding through the Canadian Food Innovation Network’s Innovation Booster program to help scale its processing capabilities. Working with the CÉPROCQ applied research centre in Quebec, the project focuses on developing two industrial vanilla formats: an MCT-based extract and a shelf-stable powder. The oil-based extract is designed to reduce flavour loss in fat-rich bakery applications, where alcohol carriers often underperform. The powder targets dry mixes, offering consistent flavour delivery without clumping or solubility issues. Both formats meet clean label requirements and are developed and produced in Canada.

Operationally, these formats expand formulation options for Canadian bakeries. Shelf-stable powders simplify

inventory planning and dry-mix use, while MCT-based extracts help maintain flavour in fat-rich applications where alcohol carriers fall short. Just as importantly, developing these products domestically builds formulation know-how and application-specific intellectual property that stays in Canada.

Vanilla is a clear illustration of a broader challenge facing Canada’s agri-food sector. Canadian Agri-Food Policy Institute’s latest agri-food risk report found that nearly 60 per cent of industry stakeholders see trade barriers and protectionism as the top threat to the sector, while also pointing to chronic underinvestment in domestic processing capacity and regulatory barriers that limit the scaling of value-added infrastructure. Taken together, these risks reinforce one another: heavy reliance on imports coincides with thin domestic processing capacity, leaving Canadian food companies exposed to external shocks.

Canada has made progress in building its own midstream muscle, but not yet at the scale or breadth required. Colibri’s project shows how even a small player can move the needle by targeting a specific processing gap and partnering with public research to prove it. Scaling that kind of focused innovation is needed to make Canada’s food sector more resilient, productive, and more self-directed.

Such a shift would not eliminate disruption. Cyclones and trade skirmishes don’t look to be disappearing any time soon. But it would give Canadian food companies greater control over cost, consistency and performance. In an increasingly volatile global food system, competitiveness will depend less on avoiding disruptions than on having the processing capability to respond when they inevitably occur.

Alex Barlow is vice president, programs, for the Canadian Food Innovation Network.

Andreas Duess

or the past decade, social media has been the promised land for food brands. Post consistently, engage with your audience, and watch your business grow—that was the playbook. But something fundamental has broken. In 2026, social media isn’t just changing; it’s dying. And the culprit isn’t a single platform failure or algorithm tweak. It’s something far more systemic: the cost of content creation has collapsed to nearly zero, while consumer attention remains the scarcest resource on the planet.

Since ChatGPT launched in November 2022, we’ve witnessed an explosion of content that defies comprehension. A 2024 report from AI detector Copyleaks found AI-generated web content has surged by 8,362 per cent in just 16 months. Moreover, a report from AI code review platform Graphite found that more than half of all new articles published online are written by AI.

This is a catastrophe for anyone trying to reach consumers through social channels.

Consumer attention is a non-flexible asset

The brutal reality for food brands is that while content production scales infinitely, human attention does not. A study from Microsoft found that human attention span had already declined from 12 seconds in 2000 to just 8 seconds by 2015. We now have shorter attention spans than goldfish. Research from UC Irvine shows this decline is measurable and accelerating, directly correlated with increased digital device use. But the real damage shows up in engagement metrics. And those numbers tell a grim story for brands.

Social media engagement rates have been in free fall:

• X: Per Statista, engagement dropped 38 per cent YoY from 2023 to 2024, despite impressions nearly doubling. More content, less engagement— exactly what you’d expect when attention is fixed but supply is infinite.

• TikTok: Despite being the” engagement king,” SAAS company HRtech found TikTok’s engagement rates plummet 35 per cent YoY in 2024.

As AI-generated content floods social media, genuine engagement evaporates.

• Instagram: Reach declined 12 per cent YoY in 2025, per social media analytics software company Socialinsider.

The pattern is unmistakable. As AI-generated content floods the zone, genuine engagement evaporates.

For Canadian F&B companies, this presents an existential challenge. Many have built entire marketing strategies around organic social reach. That playbook is dead.

Consider the math: You’re competing not just against other food brands, but also against an infinite content machine churning out posts 24/7. Your carefully crafted Instagram story about sustainable farming practices is buried under a

tsunami of AI-generated lifestyle content, memes, and made for advertising junk.

The solution isn’t to abandon social media entirely—at least not yet. But it is time for a fundamental strategic shift. Focus on building direct relationships with consumers by doing these five things:

1. Email and SMS: Unglamorous but effective. Your email list is an asset you own. Social followers are not.

2. First-party data: Invest in systems that capture consumer preferences, purchase behaviour, and feedback directly. This data is infinitely more valuable than social media vanity metrics.

3. Community building: Create spaces where your most engaged customers gather—whether that’s a Discord server, a private community, or exclusive events. We see fantastic results in private communities where people aren’t exposed to data harvesting or irrelevant marketing and can connect authentically with others.

4. Content that actually matters: If you’re going to create content, make it substantial enough that it can’t be replicated by a chatbot. Examples include original research, behind-the-scenes stories, founder perspectives—things that require human insight and experience.

5. Paid media with purpose: Organic reach is dead. If you’re going to use social platforms, treat them as paid distribution channels, not community spaces. For years, the food industry has treated social media as free marketing. Those days are over. The brands that adapt fastest, that recognize social media as a distribution tool rather than a relationship tool, will be the ones still standing when the dust settles.

Andreas Duess is an expert in AI, data, and consumer packaged goods. As co-founder of 6 Seeds, he helps CPG brands accelerate product development using AI. His email ID is andreas@6seedsconsulting.com.

Beverage brands are designing drinks that deliver a range of wellness benefits

— BY REBECCA HARRIS —

Sometimes, a drink is just a drink. But increasingly, beverages are boosted with electrolytes, magnesium, antioxidants, caffeine, probiotics, prebiotics, amino acids and more—formulated not just for refreshment, but also for functional benefits. These functional beverages—designed to address specific health and wellness needs—are gaining traction as consumers look beyond basic hydration. According to Grand View Horizon, the functional drinks market in Canada is expected to reach US$7.88 million by 2030, with a CAGR of 9.4 per cent.

“We want our food and beverage to do more for us, so it’s all about drinks with benefits,” says Jo-Ann McArthur, president of Nourish Food Marketing, a Toronto-based agency.

Within the broader functional beverage space, enhanced hydration is a key trend. The 2025 Nourish Trend Report notes consumers want water that offers more—whether it’s energy, digestive support, skin benefits, or other functional perks. To meet this demand, brands are delivering electrolytes, balanced energy, vitamins, etc., in formats that fit consumers’ lifestyles. As Ben Graham, associate director, health and well-being, Unilever, explains, “There’s huge consumer adoption as people realize that enhanced hydration and electrolytes aren’t just for elite athletes, which may have been the perception in the past.”

Unilever’s Liquid I.V. brand offers a powdered hydration mix designed to rapidly rehydrate the body. Two lines are currently sold in Canada: Hydration Multiplier and Hydration Multiplier Sugar-Free. The products, which are sold in travel-friendly packages, come in a range of flavours including Tropical Punch, Lemon Lime, Strawberry, Passion Fruit, and Firecracker.

Graham observes that consumers are becoming more accepting of powdered formats. “There is a much greater appetite for powdered hydration… Not only is it the convenience factor, but also the efficacy. You can fit a lot more electrolytes into that format compared to the ready-to-drink format.”

Coca-Cola is another company focused on water with benefits. Its Vitaminwater brand has seven flavours in its full-sugar lineup and three zero-sugar options.

“Convenience and taste remain essential, but we’re also seeing strong demand for balanced options, such as zero-sugar varieties,” says Laura Cutsey, vice-president of marketing & partnerships at Coca-Cola Canada. “Younger generations like Gen Z and Millennials, in particular, are drawn to functionality and flavour, while Gen X and Boomers value wellness benefits like antioxidants, energy and vitamins for health maintenance.”

Beyond Vitaminwater, Cutsey notes Coca-Cola’s portfolio includes hydration and electrolyte support with Powerade and Body Armor, antioxidant and electrolyte infused water options like Smartwater, and Fairlife high-protein dairy beverages.

Brands are responding to the demand for enhanced hydration by delivering electrolytes, vitamins and more in formats that fit consumers’ lifestyles.

Cutsey says the company expects the category to continue expanding as consumers prioritize wellness and seek beverages that fit seamlessly into their lifestyles.

“Our focus will remain on listening to consumer preferences, identifying emerging trends and offering more choices across our portfolio—delivering great taste, convenience and options that meet a variety of needs.”

For many consumers, functional hydration is closely tied to performance—both physical and mental.

“People are becoming more educated about their health and how clean and functional ingredients—like electrolytes—can impact how they feel day to day,” says Scott Currie, CEO of WakeWater, which focuses on functional hydration and better-for-you energy. “People are looking for products that do more than just taste good. They want solutions that support energy, focus, performance and recovery.”

WakeWater’s lineup is formulated around those needs. Its Electrolytes – Rapid Rehydration mix delivers 2,900 mg of electrolytes per serving and contains no sugar. For a boost of balanced energy, the WakeWater Plus – Energy Mix combines electrolytes, essential vitamins, 85 mg of caffeine from green tea, and L-theanine.

Another option with a kick is the ready-to-drink WakeWater Caffeinated Sparkling Water. The drink has 85 mg of caffeine per can from natural green tea.

Currie says the brand’s target audience is active, health-conscious consumers, from runners and gym-goers to busy professionals, athletes and students.

“It’s a broad audience, but the common thread is people who care about what they put in their body and want products that support performance and daily wellness,” he says.

When it comes to the caffeine buzz, Nourish Food Marketing’s McArthur notes that energy drinks—a big part of the functional beverage category—are evolving.

“There’s a movement away from jittery energy and towards less stimulation and less sugar,” she says. “Younger generations in particular are prioritizing calm, focus and a good night’s sleep.”

McArthur points to an interesting launch from Monster: Flrt, a new women-focused, sugar-free energy drink with ingredients that support skin and hair health, such as collagen and biotin. It also has 200 mg of caffeine and comes in four flavours: Guava Lava, Strawberry Fling, Sunset Squeeze and Berry Tempting.

The launch is well in line with one of the trends identified by the 2026 Nourish Trend Report: functional drinks that address beauty concerns. These include collagen drinks, skin-supporting smoothies and probiotic beverages marketed for skin health.

“We do see a supplement-to-beverage migration, so if you can come up with a tasty beverage that’s convenient—and we know there’s a preference for that over pills—I think that’s important,” she says.

Other functional benefits consumers are looking for—younger ones in particular—include support for mental well-being, hair and skin, and gut health, adds McArthur.

One innovator in this space is Toronto-based Crazy D’s Sparkling Prebiotic Soda, founded by Darren Portelli in 2016. Each can of soda delivers 8 g of fibre. There are four flavours in the lineup: Thrilla in Vanilla, Ginga’ Kick, Rockin’ Rolla Cherry Cola and Twisted Citrus.

“Rather than adding isolated sugars and then trying to correct for them later, we formulate using whole, fibre-containing ingredients where the sweetness and the functional benefit come from the same source,” Portelli says. “In some ways, it’s a nod to when soda originated as a herbal tonic made with real ingredients, now formulated using modern nutritional science.”

Looking ahead, McArthur says the functional beverage category will continue to grow, with personalization being the way of the future. People will look closely at specific health and wellness deficiencies and look for beverages that address them.

WakeWater’s Currie has a similar view. “Overall, we think this category is just getting started,” he says. “People are getting smarter about what goes into their bodies and they’re looking for solutions that provide real functionality that they can feel good about. We think there will be increased demand for personalization where consumers want products specific to them and their specific occasions.”

As consumer demand shifts toward more tailored and functional offerings, there’s plenty more opportunity for beverage manufactures to make every sip count.

In an industry increasingly defined by automation, consolidation and cost pressure, Grant’s Bakery has chosen a different path — BY

SEVERINE LAVOIE —

From its facility in Huntingdon, Que., a multi-generational family bakery has built a strong reputation around a product category many companies have gradually stepped away from: fruitcake. At the same time, it continues to serve local markets with artisan breads, rolls and sweet goods made by hand.

Nearly a century after its founding, Grant’s operates in a food sector facing a more volatile operating environment, marked by rising input costs, labour shortages, regulatory changes and shifting consumer expectations. Yet the company has built resilience by operating at a scale that supports hands-on production, while focusing on niche markets.

For Grant’s, success has not been defined by chasing volume or competing on price. The approach has been slower and more demanding — but deliberately so.

A story built on adaptation

Grant’s Bakery traces its roots to Henry Grant, who arrived in Canada from England as an 11-year-old child in search of opportunity. After working on farms and learning various trades, Grant found his calling in baking and entrepreneurship.

The first Grant’s Bakery opened in the

mid-1920s in Lennoxville, Que., operating out of a small woodshed behind the family home. Like many food businesses of the era, it struggled through the Great Depression, forcing Henry to adapt repeatedly by relocating, taking outside work and finding creative ways to keep the business alive. After the Second World War, Henry’s sons, Charlie and Gordon, re-established the bakery in Huntingdon, where it has operated continuously since 1945. Over time, the business evolved alongside changing markets, expanding capacity and refining its focus.

“What defines our story is recognizing opportunities and not being afraid of hard work,” says Sarah Grant, fourth-generation family member and head of quality and operations. “That legacy is still what drives us today.”

By the late 1960s, Grant’s faced a familiar decision for independent bakeries: compete in the increasingly crowded white sliced bread market or pursue a different path. The turning point came in the 1980s,

when third-generation baker Richard Grant recognized an opportunity others were abandoning: fruitcakes. As efficiency pressures pushed many manufacturers out of seasonal, labour-intensive categories, Grant’s doubled down on quality, high fruit content and traditional methods.

Today, fruitcakes account for approx. 65 to 75 per cent of Grant’s sales, with production beginning as early as June and peaking in the weeks leading up to the holidays. In peak years, the bakery has produced up to 300,000 lb of Christmas cakes. The remainder of its output comes from artisan-style breads, rolls, donuts and sweet goods sold primarily within local and regional markets.

“We sit somewhere between a small and medium-sized business,” Grant says. “We’ve survived by serving markets that larger,

automated brands can’t—or don’t want to—serve.”

Like much of the broader food sector in Canada, Grant’s Bakery is operating in far

less predictable conditions than it once did. Weather-related crop variability, shipping delays and port disruptions have forced the bakery to order key inputs months in advance, increasing inventory risk and tying up capital. Regulatory pressures

have also intensified. Changes to Quebec’s extended producer responsibility framework have nearly tripled Grant’s packaging-related compliance costs since 2023.

Federal front-of-package labelling requirements also required packaging redesigns and potentially reformulation, even for traditionally made breads where sodium plays a functional role. Quebec’s push toward fully digital traceability systems adds further cost for smaller, craftbased food producers.

Despite these pressures, Grant’s has resisted short-term fixes that would compromise quality or identity. Instead, the bakery carefully manages pricing, absorbs costs where possible and focuses on customers who value craftsmanship over convenience.

“Grant’s Bakery is a strong example of the resilience of Canada’s multi-generational, family-owned food businesses,” says Denise Allen, president and CEO of Food Producers of Canada. “For more than 80 years, the company has adapted to industry change while maintaining a commitment to quality, employees and the communities it serves.”

Labour is one of the food industry’s most pressing challenges, and Grant’s Bakery is no exception. Unlike many manufactur-

ers, however, the company has chosen to operate with limited automation.

“There isn’t a machine that can replace hands, eyes and smell when it comes to working with dough,” Grant says. “The dough tells you what it needs.”

While doughs are mixed mechanically, shaping and monitoring are still done largely by hand. Fermentation times and temperatures are adjusted through experience rather than automation, allowing Grant’s to maintain consistency without relying on additives commonly used to stabilize dough in highly automated production.

The bakery trains most employees internally, prioritizing adaptability over prior experience. Workers are trained for multiple roles, providing flexibility during peak production periods. When staffing shortages arise, management steps onto the production floor. For Grant’s, human-led production is not about resisting progress, but about protecting craftsmanship and control, even when that choice makes the business harder to run.

Fruitcake may be seasonal, but at Grant’s it shapes operations for most of the year. Production runs from June through November, allowing inventory to be built gradually ahead of peak demand. Grant’s operates

with a core team of 10 to 12 employees year-round, nearly doubling to 23 or 24 during fruitcake season. Many seasonal workers return year after year, some with more than a decade of experience.

Fundraising is still a critical channel. Grant’s supplies fruitcakes and cookies to service clubs, schools and charitable organizations across Eastern Canada, supporting community initiatives while sustaining production scale.

As many manufacturers exit seasonal categories in pursuit of year-round efficiency, Grant’s has leaned into seasonality as a strategic advantage rather than a liability.

At Grant’s Bakery, innovation is focused less on trend chasing than on consistency and refinement. Much of the company’s effort goes into maintaining product quality amid supplier reformulations, ingredient variability and regulatory change. When trans fats were banned federally, Grant’s invested in reformulating its fruitcake recipes without compromising taste or texture.

Selective experimentation also plays a role. The bakery’s ChocoFruit Explosion cake, combining fruitcake with dark chocolate and all butter, is designed to appeal to younger consumers without displacing core offerings.

As the Canadian food industry grapples with rising costs, labour shortages and regulatory complexity, Grant’s Bakery offers a reminder that scale and automation are not the only paths to viability.

By remaining intentionally manual, niche and deeply connected to its community, the Quebec-based family business has built resilience. Rather than chasing growth for its own sake, Grant’s stays focused on strengthening its core products and serving customers who value authenticity. In an industry often driven by efficiency metrics and short-term pressures, Grant’s Bakery shows doing things the harder way can still be the smarter way.

GLP-1 medications are causing consumers to eat less and are set to become more accessible, raising new challenges for the food industry — BY TREENA HEIN —

Many of those leading the Canadian grocery and restaurant sectors already have a firm grip on the fact that GLP-1 medications are taking a big bite out of food consumption, but there are others who still don’t understand just how serious the situation is.

“The number of people on these drugs is so significant that it is impossible for the food industry to ignore,” says Dr. Sylvain Charlebois, senior director of the Agri-Food Analytics Lab at Dalhousie University, and co-host of The Food Professor Podcast. “It’s a really fascinating phenomenon. We are looking at one in five people taking these medications. And if your spouse or someone else you live with is taking them, your own diet will change. You’ll be less likely to indulge in sugary and high-fat snacks, alcohol and so on, if your spouse isn’t indulging with you.”

The Pareto rule for frequently purchased products indicates that 20-30 per cent of North American adults (so-called super-consumers) account for the consumption of 70-80 per cent of ice cream, coffee,

soda, cigarettes, etc. For candy, it’s been estimated that 34 per cent of consumption is from only nine per cent of adults. Now, many of these ‘Pareto’ consumers are taking, or likely will very soon start taking, GLP-1 medications, which Dr. Marion Nestle, professor emeritus at New York University, described in the New York Times as “an existential threat to the food industry.”

Charlebois further sounds the alarm for 2026, reporting that generic versions of GLP-1 drugs are coming onto the market early in the year at about a third of the current price of about $500/month.

“This is expected to cause a huge spike because the drugs will be affordable for people without a drug plan,” he explains. “And if you are eating less because of these drugs, the money you save will be enough to pay for the medication.”

While Charlebois does acknowledge that food companies always innovate, he doesn’t feel that overall, the industry recognizes more than innovation is needed – a recognition that the food market is entirely different now is required.

“I’ve had some emails from food industry executives, and some don’t see the impact that’s already here and that it’s going to get bigger,” he says. “They think the impact is transitory or they just don’t want to see it. But based on our numbers, it’s here to stay. It’s transformational. There is no other way to say it.”

Use of GLP-1 medications is expected to ramp up in 2026, increasing the number of consumers who eat less and don’t crave snack foods.

Among those food companies taking the situation very seriously is Lactalis Canada.

“The era of GLP-1 is redefining ‘better for you,’ as consumers want more function per calorie,” explains a spokesperson. “To continue to meet consumer needs, we are actively developing snacks and beverages that are nutrient dense and have added functional benefits in easy-to-consume forms for those with reduced appetite, like sippable or spoonable options. Our goal is to ensure that dairy remains the leading choice for consumers who want healthier, more satisfying options without compromising taste, convenience or nutrition.”

This exactly aligns with the findings of a new survey conducted by Charlebois and his team. They are currently analyzing the results of this second survey on GLP-1 medications (part of an ongoing ‘longitudinal’ study) in which they recently contacted 3600 Canadian households by phone. The team already notes that while GLP-1 drug use may be shrinking portions, these drugs “are also expanding the oppor-

tunity for grocers who understand that the future of food retail isn’t about selling more—it’s about selling smarter.”

When the Agri-Food Analytics Lab (with partner research firm Caddle) first examined GLP-1 usage in 2023, 10 per cent of Canadian households reported using the drug. About 27 per cent of users (about 800,000 people) were taking the drug solely for weight loss.

By late 2025, that group had nearly doubled. About 14 per cent of households now report GLP-1 use, and 34 per cent of users (about 1.4 million Canadians) taking it solely for weight loss.

Charlebois and his colleagues note that if we assume a conservative 10 per cent reduction in grocery purchases among this group alone (a figure supported by both survey datasets), then in 2025, the grocery sector experienced a collective reduction in sales of roughly $720 million. In 2023, it was about $400 million ($412 million in today’s dollars), which means annual sales revenue erosion tied to GLP-1 users jumped by over $300 million over two years.

The team notes that “GLP-1 users are pulling back sharply from sweet snacks, bakery treats, packaged cookies, candy, chocolate, salty snacks and carbonated

beverages,” with GLP-1 drugs suppressing appetite and curbing impulse snacking. However, “at the same time, new opportunities are emerging: nutrient-dense foods, high-protein products, premium ready-to-eat meals, smaller formats and other items tailored to portion control and satiety. Grocers who anticipate this shift and re-align their assortments accordingly will be far better positioned than those who wait to react.”

In May 2024, Nestle launched a product line in the U.S. that’s “high in protein, is a good source of fibre, contains essential nutrients and is portion-aligned to a weight loss medication user’s appetite.”

GLP-1 users often also experience slowed digestion, so fibre intake is important, as is avoiding foods high in fat. This product line consists of 12 frozen meals, including whole grains or protein pasta bowls, sandwich melts and pizzas, gluten-free options and several air-fryer-ready choices.

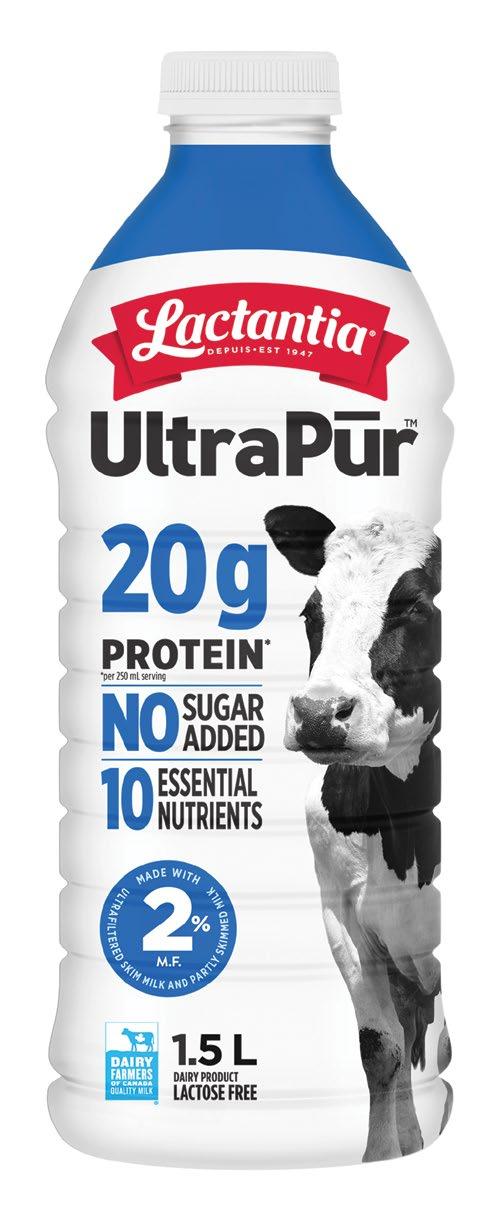

Dairy companies are also capitalizing on the GLP-1 trend as various studies have linked GLP-1 use to bone density loss. As Lactalis Canada explains, because “GLP-1s compress calorie intake, every bite counts, and dairy’s natural richness in high-quality protein and calcium is central to preserving muscle and bone health during calorie restriction. Lactalis Canada’s portfolio is well aligned with the needs of consumers taking GLP-1 appetite suppressants with high-protein and Greek yogurt, cottage cheese, and ultra-filtered milk products – all of which deliver concentrated nutrition in smaller portions, perfectly suited for suppressed appetites.”

While innovation is always a positive move, Charlebois returns to the idea that food companies need to be honest about the negative impact of GLP-1 drugs. In his view, the current company restructuring that is being carried out by major players like Kellogg, Keurig and Kraft-Heinz are at least in part due to GLP-1 drug use.

“I think food industry leaders need to recognize publicly that GLP-1 drugs are a headwind for them with their current business model,” he says. “It would be useful to the industry if the big firms acknowledged publicly that this is a problem. We know it is problem. I’ve said it many times, that it should be humbling for the food industry, because Big Pharma is cashing in on, and fixing, a problem that the food industry created, with many food companies having a focus on calorie-dense, high-fat and high sugar products. It is time to look in the mirror and go in new directions.”

However, Charlebois flags another major issue the food industry in Canada and beyond must grapple with. As he recently wrote in Canadian Hog Journal, this other “looming threat” is quiet, slow, difficult to reverse – and, like GLP-1, one “that few in the industry appear prepared for.”

Charlebois is referring to the fact that fertility rates are falling below replacement levels across much of the world.

27%

About 27 per cent of users (about 800,000 people) were taking the drug solely for weight loss in 2023.

When asked about how this has affected Lactalis’s marketing, the spokesperson explains that “we’re broadening our health-and-wellness platform to highlight protein, calcium and nutrient-rich dairy for all consumers. This helps those on GLP-1s – and anyone focused on maintaining strength and bone health –see dairy as a trusted solution.” This includes the company’s Siggi’s High Protein and Lactantia UltraPūr product lines, but also new product formats like BFit No Sugar Added milkshakes.

“Immigration policies may adjust, and population levels may stabilize temporarily, but the long-term trend is clear: global population growth is slowing, and in many places, reversing,” he wrote. “While the world has historically worried about overpopulation and the stress it would place on food systems, the more pressing concern now may be how to sustain food systems with fewer people to feed and fewer workers to produce food.” Sustainability requirements are yet another challenge facing Canada’s food companies.

In the face of all these unprecedented challenges, those who reach their target market with new offerings and tailored messaging set themselves up to secure as much of the market share as possible.

$300

34%

34 per cent of users (about 1.4 million Canadians) report taking GLP-1 solely for weight loss.

New Lancet reports link ultra-processed foods to worsening health outcomes, raising tough questions for food companies

— BY JACK KAZMIERSKI—

Aseries of reports published in late 2025 in the medical journal the Lancet paint a damning picture of ultra-processed foods and their negative impact on human health. The questions are, what can the food industry do about it, especially now that consumers seem to be taking note?

According to the Lancet, “The rise of ultra-processed foods (UPFs) in human diets is damaging public health, fuelling chronic diseases worldwide, and deepening health inequalities.”

While not condemning any individual corporation or food product, the Lancet notes that, “addressing this challenge requires a unified global response that confronts corporate power and transforms food systems to promote healthier, more sustainable diets.” No doubt, that’s much easier said than done.

Before this challenge can be addressed, all stakeholders would have to agree on a definition: What puts a food item into the UPF category? This step alone is proving to be quite contentious.

According to the Lancet, “UPFs are identified by the presence of sensory-related additives that enhance the texture, flavour, or appearance of foods.” However, the publication admits this concept isn’t universally accepted: “Some critics argue that grouping foods that might have nutritional value into the UPF category, including fortified breakfast cereals and flavoured [yogurts], together with products such as reconstituted meats or sugary drinks, is unhelpful.”

Jo-Ann McArthur, president of Toronto-based Nourish Food Marketing, agrees the conversation about UPFs must begin with a clear definition. “However,” she says, “the definition varies. I think that when we’re talking about ultra-processed foods, what we’re really getting at are those hyper-palatable foods where [ingredients] are combined in a way where you’re not getting the satiety signals to your brain, so you just keep eating.”

Currently, the NOVA Food Classification system, which was designed at the University of Sao Paulo in Brazil, groups foods according to how much processing they have undergone. However, McArthur explains this classification system erroneously, “puts products like yogurt or tofu in the same category as soda

Food industry experts are calling for a revision in the NOVA food classification system because certain health-forward foods like yogurts and bread are considered ultra-processed and lumped in with foods that are indisputably unhealthy.

and candy. It’s probably not the right approach.”

Even if we could agree on a definition, McArthur argues there’s a bigger picture to consider.

“It’s a food system issue too because of the subsidies given to corn and soy and other commodities,” she says.

The Lancet is more direct when they point the finger of blame: “At the core of the UPF industry is the large-scale processing of cheap commodities, such as maize, wheat, soy, and palm oil, into a wide array of food-derived substances and additives, controlled by a small number of transnational corporations. The UPF industry is emblematic of a food system that is increasingly controlled by transnational corporations that prioritize corporate profit ahead of public health.”

While some would argue that all foods aside from whole foods should be considered processed, and therefore “bad,” others don’t see the matter as completely black and white.

“I always have issues putting values on certain foods and saying that this food is good and this food is bad,” McArthur says. “Think about the reality of two working parents with kids, a limited budget, and the need to get food on the table quickly. They don’t have an hour to shop and prep, so this whole idea of just eating whole foods may work in a prefect world, but it costs more and takes longer to prepare.”

UPFs became increasingly popular in the 1970s, she explains, when a growing number of women entered the workforce and had less time to cook at home. While processed foods were a convenient solution, however, the added convenience came at a price. McArthur notes the advent of processed foods seems to correlate with obesity rates, although proving causation is another matter.

“When you look at North American obesity rates, they started going up in the ‘70s,” she says, “and they stopped increasing last year for the first time. That’s due to GLP-1 [medication].”

With consumers becoming more aware of the pros and cons of UPFs, and with some government mandates already in place to limit certain additives, food producers need to think about how they can continue to make a profit while dealing with the challenges UPFs present.

“I see a perfect storm coming,” says McArthur. “You have a rise in the awareness that ultra-processed foods are the ‘bad guy,’ and you have front-of-the-pack labelling in Canada. I think we’re facing a massive reformulation wave with processed foods in Canada in terms of high sodium, high fat and high sugar. Food companies need to do an honest assessment of their ingredients list.”

Some American companies already had to deal with similar

challenges when they were told certain food and colour additives were to be banned, McArthur explains. Although they initially protested, they ended up reformulating.

“I think companies need to take a hard look at everything on their ingredient list to see if there’s a way to evolve or to clean up that list,” she says.

The other piece of the puzzle is the consumer. The Lancet notes, “UPFs are aggressively marketed and engineered to be hyper-palatable, driving repeated consumption and often displacing traditional, nutrient-rich foods.”

Educating consumers about the various levels of processing and how they affect the taste, texture and nutritional value of a given food is key. Further, consumers need to be able to distinguish a UPF from a minimally processed food.

“They also need to understand why a food was processed,” says McArthur. “Everything goes through some [processing], even from a safety standpoint. Consumers need to understand the difference between harmful processing and beneficial food technology.”

However, even with a better understanding of processing, it’s difficult for some consumers to cut back on UPF consumption, simply because these foods have been engineered to appeal to the senses. It’s difficult for many to replace their go-to comfort foods like chips and candy with broccoli or cauliflower, even though they might understand that one is healthier than the other.

Although the battle for consumers’ taste buds and their grocery budgets is complex, a growing number of corporations are taking note, and looking at solutions that will keep them profitable while offering healthier options that consumers will want to purchase.

“The dialogue about the food we eat has evolved over time as diets and lifestyles have changed,” a Maple Leaf Foods spokesperson told Food in Canada. “The conversations today about ‘ultra-processed foods’ reflect a broader focus on overall health and nutrition. Even though there is no universal definition of ‘ultra-processed foods,’ we at Maple Leaf Foods strive to deliver on our promise of sustainably produced, high quality protein with great taste, and we will continue to advance our commitment to deliver uncompromising quality.”

McArthur offers food manufacturers the following advice: “Look at your ingredient list. Can you make it shorter? Can you make sure it contains ingredients that I can pronounce and understand? If people can read the label, and if they can relate to the ingredients, they’ll see it as real food, and some will be more likely to buy it.”

Factors fuelling this surge — BY DOUGLAS HART —

Whether buying a pound of coffee at the grocery store or ordering a latte at Starbucks, Canadians are feeling the sting of rising prices. While Canada’s overall inflation rate stood at 2.1 per cent for 2025, food prices rose 4 per cent. Leading that increase was coffee, with prices up 27.8 per cent by the end of Nov. 2025—well ahead of beef, which rose 17.7 per cent over the same period.

I recently conducted an in-store price check at major grocery stores and coffee shops in Toronto. At the time of writing, Starbucks-branded coffee at grocery stores sold for between $17.75 and $18.50 per lb, while Tim Hortons coffee reached $22.68 per lb. Private-label grocery store brands ranged from $14.75 to $17 per lb. These prices represent a dramatic increase from just over $7 per lb in 2020.

In-cafe coffee prices have also climbed. Tim Hortons typically sells a small coffee

for $1.59, although prices can vary by location. Starbucks charges $2.85 for a small brewed coffee. One notable exception is McDonald’s, which is using coffee as a loss leader by offering small coffee for $1.

Canadians’ love of coffee helps explain why price increases are so noticeable. On average, Canadians drink 2.8 cups of coffee per day, consuming approx. 663 million lb annually. That demand translated into $6.2 billion in coffee sales in 2024. According to StatsCanada, $4.8 billion of those sales occurred at restaurants, with the remaining $1.4 billion coming from stores.

While most coffee sales by dollar value occur at coffee shops/restaurants, the majority of coffee by volume is consumed at home. About 73 per cent of coffee is brewed at home, with the remaining 27 per cent consumed outside. Fast-food chains dominate the out-of-home market. Perhaps unsurprisingly, Tim Hortons accounts for more than 70 per cent of hot brewed cof-

fee sales in Canada, followed by Starbucks and McDonald’s. Tim Hortons and Starbucks also sell significant volumes of coffee through major grocery chains.

Grocery retailers have faced sharp increases in the cost of the coffee they purchase. In its Sep. 30, 2025, food inflation report, Loblaw reported a 40.9 per cent YoY increase in the publicly traded cost of raw coffee. The company cited U.S. tariffs on Brazilian products as a major contributor. The report also noted that Brazilian producers were holding back inventory amid market uncertainty, tightening global supply.

Coffee beans come from red cherries grown on coffee plants in regions between the Tropics of Cancer and Capricorn. Coffee requires stable temperatures between 15 C and 30 C, consistent rainfall, rich soil, and frost-free conditions. Droughts, excessive rain, or frost can reduce yields.

Arabica beans—generally milder and more aromatic—grow at higher elevations, while the hardier Robusta beans grow at lower altitudes. Brazil, Vietnam, Colombia, Indonesia, and Ethiopia collectively account for roughly 74 per cent of global coffee production, with Brazil alone supplying about 30 per cent of the world’s coffee.

Climate change has become one of the most significant drivers of rising coffee prices. Floods, droughts, rising temperatures, and increasingly erratic weather patterns have reduced coffee supplies worldwide. In 2025, Brazil’s Arabica production fell by 18.4 per cent due to poor flowering, frost, and an unusually dry summer.

Vietnam has faced similar challenges. Rising temperatures and drought caused coffee production to decline by 15 per cent in 2025. The Vietnam Coffee and Cocoa Association has warned exports could fall by an additional 15 per cent over the next two years if climate pressures persist. With global supply constrained, prices have continued to rise.

In July 2025, the Trump administration imposed tariffs on coffee and other agricultural products imported into the United States, including a 50 per cent tariff on Brazilian coffee and even higher rates on Vietnamese coffee. This move was highly questionable, given that the U.S. produces only about 1 per cent of the coffee it consumes. The argument that tariffs were needed to protect domestic producers simply does not hold water—or coffee.

These tariffs pushed roasted coffee prices in the U.S. up by 21 per cent by Sep. 2025. Although the tariffs were lifted in November, the higher prices largely remained due to ongoing supply shortages. Since Canada imports much of its roasted coffee from the U.S., higher American prices quickly translated into higher costs for Canadians. Further, Canada imposed a 25 per cent retaliatory tariff on various U.S. goods, including coffee, on March 4, 2025, in response to

U.S. trade actions. While this tariff was lifted in Sept. 2025, it made coffee expensive in the interim.

Demand for coffee is largely, but not entirely, inelastic. While overall consumption may not decline much as prices rise, how and where consumers buy or consumer coffee is changing.

Grocers report that some customers are trading down from premium brands to private label alternatives, purchasing coffee only when it is on sale, or switching from single-serve pods to lower-cost options. Convenience comes at a price: single-serve systems such as Keurig and Nespresso can cost approx. $1.30 to $1.70 per pod respectively. As a result, some consumers are abandoning pods altogether and returning to ground coffee.

Traditionally coffee was, and sometimes still is, sold in grocery stores in 1-lb bags. Suppliers have reduced the size of their coffee packages to provide cover for the more than 25 per cent rise in the price of coffee.

George Fowler of Remarkable Coffee, a coffee roaster and owner of cafes in Toronto, is seeing changes in his business as a result of higher coffee prices. He has seen consumers cut back on coffee as general inflation is squeezing people’s pockets. He

is also seeing high coffee prices impacting profitability.

“Coffee shops are not increasing coffee prices to match their higher coffee costs and are therefore taking a hit on margins to keep customers,” said Fowler. To reduce costs, he is seeing some coffee shops buying less Arabica beans and buying more of the less expensive Robusta beans.

Higher prices for beverages at coffee shops have shifted consumer behaviour. Some customers are opting to brew coffee at home rather than purchasing lattes and cappuccinos at premium prices. Among these at-home consumers, a segment is investing in high-end espresso machines. While the upfront investment is high, the per-cup cost is low as these consumers purchase their own beans. These buyers are increasingly sourcing specialty beans from countries such as Vietnam, Guatemala, Indonesia, and Papua New Guinea to replicate or improve on cafe-quality coffee at home.

The forces driving coffee prices higher are unlikely to fade in the near term. Climate change, persistent supply disruptions, and ongoing production challenges in major coffee-growing regions are expected to continue. As a result, prices may rise further before the market stabilizes. Regardless of the cost, Canadians will still gladly pay for their much-needed daily coffee fix.

Jennefer Griffith

anada’s food economy is one of the country’s greatest strategic advantages—and the numbers prove it. Across the entire value chain—from agriculture and food manufacturing to distribution, retail, and foodservice—more than 2.36 million Canadians (11.4 per cent of the national workforce) contribute to a system that sustains the country. In total, the food economy includes more than 397,000 establishments that anchor communities, drive innovation, and generate over $143 billion in GDP.

Within this ecosystem, F&B manufacturing is the engine. It is Canada’s largest manufacturing sector by employment, providing jobs for more than 315,000 people in 2024, and it also leads the manufacturing sector in GDP, contributing $35.8 billion.

But behind these strong numbers lies a growing constraint to businesses that is more than just a labour shortage.