Jetfire inkjet and Versafire toner presses empower printers to match each job to the most efficient production method. Integrated through our Prinect workflow system, this connected digital environment delivers real-time insight, automation, and control — helping you optimize capacity, cost, and quality. What can HEIDELBERG digital do for you? Scan the QR code to request FREE samples.

ISSN 1481 9287. PrintAction is published 6 times per year by Annex Business Media. Canada Post Publications Mail Agreement No. 40065710. Return undeliverable Canadian addresses to: Circulation Department, 111 Gordon Baker Rd., Suite 400, Toronto, ON M2H 3R1. No part of the editorial content in this publication may be reprinted without the publisher’s written permission. © 2026 Annex Business Media. All rights reserved. Opinions expressed in this magazine are not necessarily those of the editor or publisher. No liability is assumed for errors or omissions. All advertising is subject to the publisher’s approval. Such approval does not imply any endorsement of the products or services advertised. Publisher reserves the right to refuse advertising that does not meet the standards of this publication. Printed in Canada.

12 Wish list from packaging clients

What brands want from their custom-pr inted label and packaging supplier s in 2026

A ser ies of acquisitions by Transcontinental raises concerns about shr inking diversity in in-store marketing

22 Are you ready for the changes?

What Bill 149 means for Ontar io print f acilities and allied companies

25 At 50, Trans continental sharpens focus

It doubles down on retail, publishing and pr inting

GAMUT

5 News, Calendar, People, Installs,

NEW PRODUCTS

10 Alec Couckuyt Growth in wide format printing offers new opportunities 12 25 30 18

28 Introducing new solutions from HP, APP Canada, Canon, Fujifilm, Xerox, SwissQprint, Kongsberg PCS and Mimaki

SPOTLIGHT

30 Doug Laxdal, owner, The Gas Company

FROM THE EDITOR

4 Nithya Caleb Modest growth expected this year

CHRONICLE

8 Nick Howard Bobst machines that made history

TECH REPORT

According to Bank of Canada’s (BoC’s) Business Outlook Survey for Q4 2025, business sentiment was subdued but remained above its survey lows in Q2 2025.

The percentage of inflation businesses expect in 2026, according to Bank of Canada’s latest Business Outlook Survey. 3%

Firms reported that sales growth was weak last year largely due to the economic effects of trade tensions. They’re expecting sales growth to improve slightly in 2026, with modest growth in exports. A small, but increasing share of businesses, reported higher sales to non-U.S. markets in response to trade tensions with the United States. In other good news, most firms did not report binding capacity constraints or labour shortages. However, with demand expected to remain soft in 2026, the majority of surveyed businesses plan to maintain or decrease current staffing levels.

While companies would like to make capital investments, they are prioritizing spending on routine maintenance, partly because of continued trade-related uncertainty. They also expect inflation to remain stable in 2026, roughly between 2.5 and 3 per cent.

BoC conducted the Business Outlook Survey between Nov. 6 and 26, 2025, through in-person, video and phone interviews with senior managers of about 100 firms selected to reflect the composition of Canada’s GDP. The survey found that trade-related uncertainty and the broad economic effects of tariffs weighed on the outlooks of many firms. Businesses are concerned about financial, economic and political conditions, slowing demand, and cost pressures. However, the share of firms planning or budgeting for a recession in Canada over the next 12 months has eased from 33 to 22 per cent. This is the lowest level reported in 2025, though it remains above 2024 levels.

Firms reported weak sales growth over the past 12 months, with one-third of businesses citing a decline in sales volumes due to:

• lower business spending (e.g. on insurance, advertising and construction) or delays in purchases because of ongoing trade uncertainty;

• reduced order s from clients in sectors subject to U.S. tariffs; and

• pessimistic outlooks among some

businesses reliant on household spending.

However, the balance of opinion on future sales indicators is positive, as a greater number of firms see improved indicators than the number of companies seeing deteriorated ones. Still, the balance remains below its historical average.

Additionally, businesses do not expect negative effects from tariffs or trade tensions to worsen this year. Plus, firms that aren’t strongly impacted by U.S. trade policies have positive expectations for future sales due to:

• steady demand from clients who are less exposed to trade tensions; and

• their own efforts to grow their business by offering less-expensive products to financially constrained households, serving higher-income consumers, or providing services and technologies with broad market appeal to limit dependence on one sector.

Given soft demand, most firms are holding off on capital investments and focusing on spending on routine maintenance. Similarly, they’re not planning to increase the size of their workforce over the next 12 months. One of the concerns is the share of firms planning staff reductions. It rose to its highest level since 2016 in Q4 2025.

This survey shows that trade-related uncertainty continue to negatively impact businesses, but we can expect modest growth. It also reveals Canadians’ resiliency to the great ‘rupture’ in world order that Prime Minister Mark Carney referred to in his powerful speech at the World Economic Forum in Davos, Switzerland, in January.

I’d like to leave you this quote from Carney’s speech: “Building a strong domestic economy should always be every government’s immediate priority. And diversification internationally is not just economic prudence — it is the material foundation for honest foreign policy.”

This survey gives us a sense of what print clients plan to do in 2026. It should help us plan our strategy & ensure we’re meeting the needs of the market.

NITHYA CALEB Editor ncaleb@annexbusinessmedia.com

Reader Service

Print and digital subscription inquiries or changes, please contact Angelita Potal 416-510-5113 apotal@annexbusinessmedia.com

Fax: 416-510-6875

Mail: 111 Gordon Baker Road, Suite 400, Toronto, ON M2H 3R1

Editor Nithya Caleb ncaleb@annexbusinessmedia.com 437-220-3039

Contributing writers

Nick Howard, Alec Couckuyt, Treena Hein, Nicole Brios-Bolton and Lee Eldridge

Associate Publisher

Kim Barton kbarton@annexbusinessmedia.com 416-435-9229

Media Designer Lisa Zambri lzambri@annexbusinessmedia.com

Account Coordinator

Melissa Gates mgates@annexbusinessmedia.com 416-510-5217

Audience Development Manager Urszula Grzyb ugrzyb@annexbusinessmedia.com 416-510-5180

Group Publisher/VP Sales Paul Grossinger pgrossinger@annexbusinessmedia.com

CEO Scott Jamieson sjamieson@annexbusinessmedia.com

Subscription rates

For a 1 year subscription (6 issues): Canada — $45.61 +Tax Canada 2 year — $74.79 +Tax United States — $103.96 Other foreign — $202.61 Single Issue — $8.00 + Tax All prices in CAD funds

Mailing address

Annex Business Media 111 Gordon Baker Rd., Suite 400, Toronto, ON M2H 3R1 Tel: 416-442-5600 Fax: 416-442-2230

Occasionally, PrintAction will mail information on behalf of industry related groups whose products and services we believe could be of interest to you. If you prefer not to receive this information, please contact our Audience Development in any of the four ways listed above.

Annex Business Media Privacy Officer Privacy@annexbusinessmedia.com 800-668-2384

ISSN 1481 9287 Mail Agreement No. 40065710 printaction.com

Transcontinental and grocer Metro extend their marketing service agreement for three years. The agreement includes Metro’s continued participation in Raddar, Transcontinental’s print and digital flyer, as well as other printing services, in-store marketing services, and content solutions. Additionally, Transcontinental renews its 40-year

printing agreement with The Globe and Mail for another 10 years. In another major company shakeup, Transcontinental sells its packaging business to ProAmpac Holdings for approx. $2.22 billion, as it wants to focus on its retail services and printing, educational and publishing businesses.

The Burke Group of Companies acquires Edmonton-based Cowan Graphics, a Canadian large format printing and signage company with nearly 80 years of industry expertise, as well as Sign Craft Digital Imaging, a Calgary-based provider of custom signage, digital imaging, and wide-format solutions. For over three

decades, Sign Craft Digital Imaging has been specializing in high-quality interior and exterior signage, vehicle wraps, trade show displays, and digital printing. The acquisition allows Burke to enhance its in Calgary and better serve customers seeking cohesive branding and signage solutions. Founded in 1945, Cowan Graphics is recognized for its expertise in large format printing, vehicle wraps, building and environmental signage, retail and event signage, murals, decals and specialty graphics. The addition of this expertise enhances Burke’s production capacity and technical depth, particularly for high-impact, high-volume projects.

Hughes&Co and Delta4 Digital merge to form a single, expanded agency under the Delta4 Digital brand, creating one of the largest creative and digital teams in Niagara, Ont. Hughes&Co specializes in creative work. Delta4 Digital focuses on digital engineering, product design, UX, and enterprise-level development.

UPM and Sappi sign a non-binding letter of intent to form a graphic paper joint venture, which would include the entire UPM Communication Papers business and Sappi’s graphic paper business in Europe. The joint venture would be owned 50/50 by

UPM and Sappi. It would operate as an independent company, managing its own operations, resources, and decisions within agreed shareholder boundaries.

Thomson Reuters unveils a new brand identity and name for its book printing and fulfillment business. Part of the company’s Global Print Segment, Core Print Solutions provides digital and offset printing, binding, warehousing, inventory management, and distribution services to customers.

Adobe launches Adobe Photoshop, Adobe Express and Adobe Acrobat for ChatGPT, bringing its apps to the platform’s 800 million users. The launch of these apps for ChatGPT builds on Adobe’s conversational-based solutions powered by agentic AI and the model context protocol. To use Adobe’s apps in ChatGPT, users can type the name of the app followed by an instruction. For example, to blur the background of an image with Photoshop, users can type: “Adobe Photoshop, help me blur the background of this image.” ChatGPT then automatically surfaces the app and uses contextual understanding to guide the user through the action.

March 16-19,

TAGA NextGen Minneapolis, Min.

March 25-27, 2026

PPC 2026 Spring Outlook & Strategies Conference Louisville, Ky.

April 22-22, 2026

Hybrid Fusion 2026 Packaging Summit Sarasota, Fla.

April 8-10, 2026

ISA International Sign Expo 2026 Orlando, Fla.

April 26-29, 2026

FTA Forum, Infoflex 2026 Milwaukee, Wis.

May 19-22, 2026

FESPA Global Print Expo 2026 Barcelona, Spain

June 10, 2026

PAC Global Disruptors Summit 2026

Toronto

June 16-17, 2026

Print & Digital Convention 2026

Düsseldorf, Germany

July 17, 2026

PrintForward Golf Tournament Richmond, B.C.

PaperWorks Industries, a producer of recycled paperboard and folding carton packaging, acquires Color Craft Graphic Arts. Founded in 1929 and based in Manitowoc, Wis., Color Craft produces packaging for food, beverage, and household goods. With this acquisition, PaperWorks adds two paperboard mills and six converting facilities across the United States and Canada.

General Formulations (GF), a manufacturer of pressure-sensitive media, film, and laminates, names Andrew Bishop as sales VP. In this role, Bishop will lead sales strategy, customer engagement, and team development. He has more than two decades of leadership experience in sales, marketing, strategy, and organizational development. Prior to joining GF, Bishop served as president of RecogNation, a Baudville Brands Company, where he led sales and customer experience initiatives while also training and educating organizations on the power of recognition and gratitude in the workplace. Earlier in his career, Bishop served as executive vice president and director of sales & marketing at Jarob, a custom fabricator and large-format digital printer specializing in wayfinding, decor, and signage. Bishop earned a bachelor’s degree in business administration from Murray State University. He also holds a certificate in organizational culture leadership from CultureCon.

Tower Litho, Toronto, expands its digital production capabilities with the installation of the HP Indigo 18K B2 digital offset press.

Tecnau appoints Ron Trickel as vice president of service, engineering, purchasing, and manufacturing. Trickel brings a wealth of experience and a proven track record of leadership in service and operations. After serving in the U.S. Air Force, Trickel joined StorageTek in 1987, where he advanced through roles in quality engineering and regional service leadership during the company’s transitions to Siemens-Nixdorf Printing Systems, Océ, and ultimately Canon. From 2007 onward, he held executive leadership positions within Océ and Canon’s production print division, where he managed a nationwide service organization supporting thousands of customers. His efforts were instrumental in building strategic partnerships with major enterprise clients and guiding the organization’s evolution from monochrome toner systems to high-speed colour inkjet technology.

Staples Canada appoints Jens Cermak as CEO. With 30 years of experience in retail, finance, and operations, Cermak brings extensive leadership credentials to his new role. Most recently serving as CEO of Amica Senior Lifestyles, Cermak led the organization’s strategic initiatives across an organization of 5,000 team members. Prior to Amica, he spent 13 years at TJX Canada in progressively senior roles, including SVP, director of operations where he led 400+ stores with more than 20,000 team members across Canada. His career also includes senior finance positions at internationally recognized brands including Grand & Toy, Pepsi, and Labatt. Brian McDougall, who has been serving as interim CEO, will support the leadership transition and continue as chief retail officer.

MPI Print & Packaging, Mississauga, Ont., recently invested in a Canon ImagePress V1000 with SDD Booklet Making Accessory and the Canon ImagePress V1350 with Plockmatic BLM5035.

Premier Printing, Winnipeg, installs a CABS4000 Perfect Binding line from Standard Finishing Systems and their manufacturing partner, Horizon International. The system is the first-of-itskind to be installed in Canada.

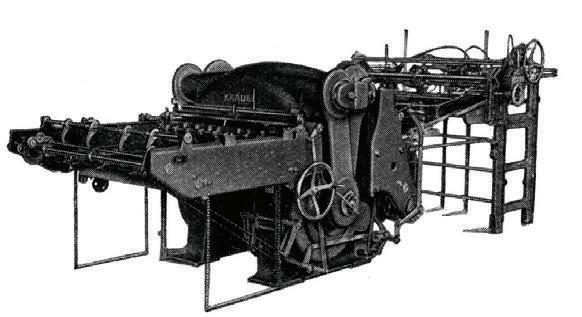

In this two-part series, we celebrate the innovations that made Bobst a premium supplier of printing technology

By Nick Howard

ngulf and Devour’ is the humorous nom de plume of the American conglomerate Gulf & Western. G+W, which began life in 1934, bashing out car bumpers during the worst years of the Great Depression, grew exponentially, primarily through acquisitions, eventually spreading its tentacles into every sphere of commerce, including Madison Square Garden, the New York Rangers and Knicks, and the biggest trophy of all, Paramount Pictures. Today, Paramount Skydance Corporation continues the legacy, while the rise of Gulf & Western is studied at universities.

The Swiss firm Bobst established a similar track record, particularly during the last 50 years. But one pre-war breakthrough would jolt it into the stratosphere: the evolutionary Bobst platen die cutter. The rise of Bobst is therefore worth studying.

In 1890, Joseph Bobst relocated from the Swiss-German town of Balsthal to the Swiss-French city of Lausanne, where he established a small printing supply business from his apartment. Bobst learnt to speak French and trained as a typesetter. In 1918, he registered his fledgling company under the name J. Bobst & Fils SA. The early days saw Joseph Bobst active in repairing and selling used printing presses, while also representing Koenig & Bauer in Switzerland. He had two sons: Otto and Henri. After Joseph’s death in 1935, Henri, who was a masterful designer, changed die cutting forever.

Business was lethargic following the end of the Second World War. In 1924, the company, suffering from

This Bobst SP1080-E was rebuilt by Howard Graphic Equipment and sold to Houghton-Boston in Saskatoon, Sask.

dismal sales, sold its line, including their bespoke Mirakel hand-fed letterpress platen press, cardboard slitters and sheeters, to Marinoni, France’s largest and most illustrious printing machinery manufacturer. Production moved to France, as did Joseph’s two sons, who gained employment with Marinoni. Soon after, in 1927, Marinoni relocated the Bobst business to Switzerland. The French company was facing severe financial difficulties, so Henri Bobst repurchased the original Bobst business in 1936.

The year Joseph Bobst established his printing supply company.

Joseph’s son Henri was an incredible innovator, and, in 1934, he signed an agreement with the German firm H.W. Casack to combine Casack’s roll-feed equipment with Bobst’s newly developed horizontal platen die-cutting technology. This radical invention, which would become the ‘Autovariable,’ was first exhibited at the Foire de Paris. The machine operated from a reel of board, die cut, then sheeted, before passing through printing towers. A unique transport system allowed for variations in sizes, unheard of at the time. The Autovariable and its later cousin, the IRT (which handled corrugated materials up to 10 mm thick), would remain an essential element of Bobst history well into the late 1980s. Packaging

firms such as Kellogg’s and the cigarette and shoebox industries adopted these machines. Mercury was the only U.S. company that had anything similar in North America. However, one firm challenged Bobst’s patents. In 1938, at the height of the Third Reich, Dresden’s Sächsische Cartonnagen Maschinen A.G. (SCAMAG, now known as Kama) sued Bobst in a Berlin court, claiming Bobst infringed on its existing German patents. SCAMAG, a larger firm with several advanced technologies, appeared, on paper at least, to rule the day in an assumed friendly courtroom. To their surprise, and in the midst of Nazi hysteria, Bobst won!

1940 marked a watershed moment when, under the watchful eye of Henri Bobst, a novel toggle-action cutting and creasing device, first developed for the Autovariable, was employed with a sheet feeder and delivery. The AP900 was revolutionary, given that most folding cartons were still being die-cut on letterpress platens or cylinders. The 25 x 35 in. platen would now be known as the Autoplaten. The AP900 was constructed like a printing press, making it easier to run. Although promoted as the ‘world’s first’, the AP900 wasn’t one. In 1936, four years earlier, SCAMAG introduced a similar sheetfed concept: the Tempo. SCAMAG also developed a reel-fed

version, the DF50B, while Leipzig’s Karl Krause had also been designing their C107-76 Tia sheet-fed version. Another notable presence was France’s Chambon (now part of Komori), which built roll-fed machines but used rotary cutting cylinders. Beechnut candy boxes in the U.S. were almost exclusively produced on this French machine as far back as the 1930s. The concept of a purpose-built die-cutting ‘platen’ was well underway. This is where brilliant design triumphs, and why Henri Bobst is revered today. The AP900 was not only exceptionally effortless to use, but also to make ready. The other manufacturers used giant arms to lift and lower the top platen. Bobst chose to eliminate these and drive the base upward toward a fixed platen, thereby ensuring easy access to slide-in dies, counter sheets, and make ready. This one feature immediately drew interest to Bobst and away from others.

However, the war was still years from ending, and Switzerland, although technically neutral, was a hub of spies. Further, circuitous routes to

collapsed markets were near impossible to navigate. When the war ended in 1945, some businesses began to recover. Bobst was eager to promote the AP900, which quickly took off in Europe. In Chicago, the cork was popped, and innovations kept coming. Bobst showcased a larger 42-in. version in 1950. The SP1080 would soon be their most successful machine. The size was ideal, particularly for the American market. In 1956, the 51-in. SP1260-E, now including a stripping unit, followed shortly after with 55 in. and 65 in. models, all based on the original AP900. Not resting with the Autoplaten, management sensed an urgency to expand into symbiotic fields. Folder-gluers were rapidly developed alongside die cutters. Tackling head-on Jagenberg, Escomat,

International, and Post, all of which had decades more experience, quickly made Bobst a leader in this field. The Media and Domino series were as embraced as the Autoplaten. In 1957, corrugated became an important segment with the introduction of SPO1575, the first of many. That same year, Bobst went further afield, forming a joint venture with New Jersey-based Champlain, which manufactured rotary Gravure presses for packaging. Champlain had also developed an inline die cutter and the world’s first Blanker. It proved an invaluable partner for the Swiss firm. By 1965, Bobst purchased the remaining shares of Champlain and established Bobst-Champlain as a division. …to be continued

Howard Iron Works, is a printing historian, consultant, and certified appraiser of capital equipment. He can be reached at nick@howardgraphic.com.

Designed & Manufactured in Czech Republic B2 format in either Single Side or Double Side in 1 pass

By Alec Couckuyt

ide format printing continues to be one of the fastest-growing and most dynamic segments within the printing industry. Commercial printers across North America are expanding into this field, through acquisition or organic growth, recognizing its potential for new revenue streams and diversification.

The combination of maturing inkjet technologies, the digital transformation of workflows, and expanding substrate options has made wide format printing an essential part of many PSP portfolios.

At this year’s Printing United Expo, the momentum behind wide format was unmistakable. Nearly every major OEM showcased new technologies, from high-speed rollto-roll and hybrid presses to automated workflow systems and sustainable ink solutions. The scale and variety on display confirmed one thing: wide format printing has evolved into a highly sophisticated, technology-driven business.

The global large format printer market is projected to grow from roughly US$9 billion in 2023 to nearly US$13 billion by 2030, representing steady annual growth of around 5 per cent CAGR, according to Grand View Research’s 2024

The expansion is fuelled by rising demand in retail display graphics, architectural decor, events, and vehicle wraps—areas requiring customization, fast turnaround, and striking visual quality.

The year when the global large-format printer market is estimated to hit US$13 billion.

Commercial printers are entering the market not simply to chase volume, but also to capture higher-margin applications. The real opportunity lies in specialty work such as decor, experiential branding, interior design, and customized environments, where creative value outweighs price competition.

The combination of maturing inkjet technologies, the digital transformation of workflows, and expanding substrate options has made wide-format printing an essential part of many print service providers’ portfolios.

The evolution of digital inkjet technology has redefined what’s possible in wide format. Today’s presses can handle ever-larger substrates, both rolls and rigid sheets, across a wide spectrum of materials: vinyl, soft-signage fabrics, acrylics, aluminum composites, wood, and textured decor media.

Hybrid systems can switch between roll-fed and flatbed operation, while UV-LED curing, latex, and water-based inks extend durability and environmental performance.

Digitization is also transforming production efficiency. From auto -

mated nesting and cutting workflows to full MIS integration, PSPs can now track costs, manage substrates, and deliver jobs faster and with greater consistency. Those who leverage data-driven workflows are seeing measurable gains in both productivity and profitability.

For print service providers contemplating wide format investments or expansion, the decision landscape has become more complex, and more strategic. Here are 10 key factors to consider.

1. Match equipment to your application mix

Choose technology based on what you actually intend to produce, whether retail displays, architectural decor, exhibition graphics, or wraps. Width, substrate type, finishing requirements, and speed all matter.

2. Understand your substrate ecosystem

Availability, cost, and supplier lead times can make or break profitability. Specialty media are often where margin opportunities lie, but they require planning.

3. Evaluate ink, maintenance costs carefully Ink technologies vary widely in coverage yield and durability. A lower machine price can be offset by higher running costs.

4. Prioritize reliability and support

With machines running multiple shifts and handling highvalue jobs, service responsiveness and uptime are strategic differentiators.

5. Integrate workflow and automation

Invest in connectivity between your RIP, prepress, and MIS systems to improve quoting accuracy, scheduling, and cost visibility.

6. Plan for post-print finishing

Finishing such as cutting, routing, laminating, mounting, and installation often represents 30–40 per cent of total labour and production time. Finishing capacity must align with print speed and volume. A highspeed printer without corresponding finishing throughput can easily become a bottleneck.

7. Acknowledge labour challenges

Skilled operators, installers, and finishing technicians remain in short supply across the industry. Training, cross-skilling, and automation are essential to maintain productivity and consistency. Many PSPs are addressing this by standardizing workflows and implementing automated cutting and handling systems.

8. Differentiate by niche

Avoid competing purely on commodity banners. Instead, focus on applications that require craftsmanship and creativity: vehicle wraps, decor, experiential environments, or sustainable signage.

9. Highlight sustainability

Many brand owners and retailers are demanding eco-friendly production. Inks with low VOCs, recyclable media, and waste-reduction practices can become part of your unique value proposition.

10. The OEM landscape

The wide format field includes a strong mix of global OEMs: HP, Canon, Epson, Agfa, Durst, Fujifilm, Roland, Mimaki, and SwissQprint, among others, each offering a distinct technology focus. Some excel in high-end hybrid or roll-toroll systems; others lead in decor or textile printing.

For PSPs, the message is clear: evaluate manufacturers based on fit, not just reputation. Consider substrate flexibility, ink technology, workflow integration, and after-sales service as integral parts of your ROI equation.

Where the opportunity lies for PSPs

Wide format printing has moved far beyond posters and banners. It now sits at the intersection of technology, creativity, and strategy, enabling printers to deliver branded experiences in stores, airports, offices, and public spaces.

Yet, success in this segment isn’t only about investing in technology. It’s about ensuring the operational ecosystem including skilled people, automated workflows, and finishing capabilities can support consistent, high-value output. Those who align these elements will build both efficiency and differentiation.

For PSPs ready to embrace that challenge, the next phase of wide format isn’t just about printing bigger. It’s about thinking bigger: strategically, technologically, and creatively.

• Providing Used Printing Equipment Dealer since 2006 • We buy Your Surplus Printing & Finishing Equipment For Export and Our Stock Showroom: 6176A Kestrel Rd Mississauga ON L5T1Z2 Office: 65 Lorenville Drive, Brampton L6X 3A5 Cell: 416-824-0236 or 647-835-6224

Tel/Fax: 905-450-2748 Email: gr_trade@hotmail.com Buy & Sell Used Printing Equipment

CPG brands want their print partners to not only know design and offer exceptional printing services, but also fully understand all aspects of marketing.

What brands want from their custom-printed label and packaging suppliers in 2026

By Treena Hein

Going back in time to the very start of packaging for the first commercial products, brands have always wanted professional, timely and innovative results from their print and design partners. But as Canada’s print industry marks the start of another exciting year, it’s wise to note the things brands are looking for now. And the stakes – regarding the right labels and packaging for a given product – are extremely high, explains Olivier Chevillot, executive creative director at Pigeon Brands, based in Toronto and Montreal.

“About 70 per cent of new products

on the shelf disappear in about a year because they don’t stand out and they are not well executed,” he explains. “A really good design is needed, and for that you need a full team, with experts in regulatory and every other aspect.”

Yes, this requires a large investment, Chevillot notes, but it’s a must for product survival.

Philippe Morin, Pigeon Brands’ vice president of production, adds that today’s CPGs are looking for expert technical guidance and support through the entire process from their print provider.

“I also encourage printers to demonstrate their added value by pro-

actively requesting early access to designs,” he says. “If they are involved early, there can be technical things that are flagged and the whole process is more efficient. I think CPG brands will always choose the printer who provides a lot of technical communication and is more proactive.”

For Tempo Flexible Packaging in Innisfil, Ont., most customers and especially CPG brands are looking for a print-packaging partner who can connect design intent to manufacturing reality, explains client experience, marketing and sustainability manager Katie Cruikshank.

“Many brands don’t need support with the creative development of the design. They need support bringing their vision to shelf efficiently and reliably.”

Tempo therefore focuses on providing this support, whether that’s exploring sizing and style options or supporting larger, longer-term initiatives like transitioning to recycle-ready films and integrating recycled content.

For Alain Paquette, owner of Artcraft Label in Burlington, Ont., printing firms should understand today’s brands are focusing strongly on targeting specific markets.

“Along with this, we’ve seen an increase in refreshing the branding for certain product lines like fresh produce and sauces at the three or four-year mark, where in the past, that typically happened around the 10-year mark,” Paquette reports. “I find newer companies tend to do this. The life cycle of the branding is shorter than it used to be. We also are

2023

The year when Ferox Estate Winery Niagaraon-the-Lake, Ont., released its first white vinefera icewine variety.

seeing there is more variation in SKUs, more flavours with each product. That trend seems here to stay, so there is more customization needed for each SKU.”

Paquette is therefore stressing that printers need to understand design as well as all aspects of marketing.

“They want an experienced firm who understands the point of view of the designer but can make suggestions about design changes that will give the design a freshness that will last for years,” he says. “We push back with designers where it’s appropriate, and we also use our expertise to suggest enhancements to make the

I think CPG brands will always choose the printer who provides a lot of technical communication and is more proactive.

– Philippe Morin, Pigeon Brands’ vice president of production

design better than what they expected. We also do a lot of advising about colour management to ensure the colour stays true and remains consistent to the brand on all the labels. We do a detailed validation of this. We also look at the packaging process end to end to make sure the label will not be affected during handling.”

Let’s look at a customized label, created for Ferox Estate Winery Niagara-on-the-Lake, Ont., by Artcraft Label and design firm G+ International. Ferox owner and master winemaker Fabian Reis needed a stunning look for his first-ever release of a white vinefera icewine variety, which became the 2023 Silver Lion Collection Riesling Icewine. In general, Reis’ assistant winemaker and viticulturist Cubby Sadoon lists adaptability, communication and the willingness to absorb

various ideas and execute a single vision as traits they need from a printing partner. Specific knowledge of compliance, print production, packaging and material science are also crucial – but for Ferox, so is expertise in sustainability.

Sadoon explains that “we are a certified sustainable vineyard and winery, and the use of certain materials at Artcraft and processes allowed us to keep that mantra on track.”

Design of the Silver Lion icewine label began with an idea G+ International CEO Gerald George presented to Sadoon and Reis, a concept that was a departure from the last icewine Ferox launched in 2017.

“It began with an idea that an icicle was the most holistic image to describe what icewine is, and while Fabian and I had some reservations about the concept, we were told by Gerald to trust the process and see” a mock-up, says Sadoon.

About a week later, they were presented with a digital mock-up “and were amazed.”

The label was honed over the next month, and then Artcraft worked its magic to transform the label from digital to print.

“Their ability to [not only] work with us and meet our standards, but also suggest ideas that allowed us to fine-tune how we executed our label is a hallmark feature of working with Artcraft,” says Sadoon. “I always like to say that G+ International and our collaborators create art, and Artcraft executes that directive. If there was a wishlist regarding customized labels and printed packaging for 2026,

specially for Artcraft, it would be, ‘move a little closer to Niagara from Hamilton to allow me to pick your brains more often!’”

Similarly to Ferox Winery, Tempo’s clients also value sustainability. An example project that demonstrates this involved Tempo partnering with a leading retailer to integrate recycled materials into multiple private label packaging lines. Because each product category had distinct performance and regulatory requirements, the customization process was intentionally rigorous and iterative, says Cruikshank. There were several phases, from material selection and supplier alignment, production trials, and extensive testing to validation of product protection, runnability and overall pack integrity.

“Throughout the process, we worked side-by-side with the customer and other stakeholders to troubleshoot challenges, refine specifications and ensure the final structures met both sustainability targets and functional expectations,” says Cruickshank. “The result was a set of packaging solutions that balanced higher recycled content with the demands of real-world use. This year, two of the products developed through this collaboration were nominated for a global sustainable packaging award, an outcome that reflects the strength of the partnership and the level of technical and cross-functional co-ordination required to deliver meaningful change.”

Hughes Decorr created a corrugated base for the Soft Soap Body Club multipack. The design decreased the weight of the primary packaging by 55 per cent per display-ready pallet.

Hughes Decorr in Toronto recently submitted a display project focused on sustainability for the Pac Global Awards – its Soft Soap Body Club multipack packaging project, completed in collaboration with Costco Canada and Colgate-Palmolive. Hughes Decorr specializes in delivering customized marketing-at-retail solutions, collaborating closely with clients for ongoing brand merchandizing, new product launches or specialty brand launches (where a brand is tied in with a movie premier, for example), explains sales VP Stephen Longmire.

“Our customers are looking for brand consistency, communication of key messaging and timely completion,” he says. “Our customer projects do take time as we work with our in-house structural and graphic designers, as well as co-packing divisions within the Planet Group of Companies.”

Hughes Decorr uses many types of print technologies including flexo, litho and digital, but Longmire notes that their single-pass inkjet in particular has allowed for much faster production compared to their flatbed UV digital printer.

The percentage of CPG products that fail annually, according to Olivier Chevillot, executive creative director at Pigeon Brands.

The main challenge in the Soft Soap Body Club multipack project was the fact that at Costco, while bottles are often bundled using plastic handles (though there’s been a shift toward paper alternatives), Soft Soap’s bottle has a seamless transition from cap to bottle. Adding a handle near the cap is therefore impossible. The Hughes Decorr team explored the idea of a paper-based ‘boot’ for the bottle, and since its shape curves inward, a corrugated solution seemed viable. Among other reduced environmental impacts, the redesign resulted in a 55 per cent decrease in the weight of the primary packaging per display-ready pallet, yielding an annual reduction of 23.4 tons of packaging based on yearly sales of 1,700 pallets.

So, as 2026 gets underway, we may not know yet which new products or how many will be launched by CPG brands this year, but we do know Canada’s print industry is prepared, with expertise in sustainable options and revolutionary ideas. Here’s to another exciting year of partnerships and innovation.

The Vareo PRO is the most ideal perfect binder for print finishing specialists and printing plants that use conventional printing modes or are engaged in digital printing. Whether for medium, short or ultra-short runs, right down to runs of one copy, the Vareo PRO is an all-rounder and stands for outstanding binding quality. The first book produced with the three-clamp perfect binder is already available for sale.

mullermartini.com/vareopro

In an industry that rewards both precision and longevity, Teckmark Label Systems (Hamilton, ON) stands as aseasoned veteran. With 32 years in operation and leadership boasting four decades of print expertise, Teckmark has built its reputation on knowing exactly which tools are needed to stay ahead of the curve. Their latest strategic move? The seamless integration of the Taurus Laser nishing system.

In an industry that rewards both precision and longevity, Teckmark Label Systems (Hamilton, ON) stands as aseasoned veteran. With 32 years in operation and leadership boasting four decades of print expertise, Teckmark has built its reputation on knowing exactly which tools are needed to stay ahead of the curve. Their latest strategic move? The seamless integration of the Taurus Laser nishing system.

For many labels shops, introducing new hardware can feel like a disruption. However, for the team at Teckmark, the transition was remarkably smooth. The learning curve for the shop oor was minimal and Teckmark’s operators were able to master the machine quickly, ensuring that production didn't skip a beat. This ease of use is a testament to the Taurus’ intuitive design, making it an accessible leap for companies looking to modernize their nishing department.

For many labels shops, introducing new hardware can feel like a disruption. However, for the team at Teckmark, the transition was remarkably smooth. The learning curve for the shop oor was minimal and Teckmark’s operators were able to master the machine quickly, ensuring that production didn't skip a beat. This ease of use is a testament to the Taurus’ intuitive design, making it an accessible leap for companies looking to modernize their nishing department.

The true value of any equipment investment lies in the doors that it opens. For Teckmark, a rm with fewer than 50 employees, the Taurus Laser wasn't just a replacement for old methods—it was a growth engine. "It broadens our o ering, so we are doing work we wouldn’t have had without it." - Peter Stewart, Teckmark Label Systems

The true value of any equipment investment lies in the doors that it opens. For Teckmark, a rm with fewer than 50 employees, the Taurus Laser wasn't just a replacement for old methods—it was a growth engine. "It broadens our o ering, so we are doing work we wouldn’t have had without it." - Peter Stewart, Teckmark Label Systems

When a company with 40 years of industry "know-how" gives a stamp of approval, it carries weight. Teckmark is highly satis ed with the Taurus, noting that while this speci c unit excels in the low-to-medium volume niche, it is a highly recommended solution for anyone looking to enter the world of digital label nishing. For Teckmark, the Taurus Laser isn't just a machine—it’s the next chapter in a 32-year history of excellence.

When a company with 40 years of industry "know-how" gives a stamp of approval, it carries weight. Teckmark is highly satis ed with the Taurus, noting that while this speci c unit excels in the low-to-medium volume niche, it is a highly recommended solution for anyone looking to enter the world of digital label nishing. For Teckmark, the Taurus Laser isn't just a machine—it’s the next chapter in a 32-year history of excellence.

Total Solutions Inc. (Burlington, ON) has been a cornerstone of the label industry for 30 years, building a reputation on deep technical expertise and a commitment to providing cutting-edge production tools. To celebrate three decades of service, they are expanding their hands-on capabilities by adding the Taurus Laser nishing system to their state-of-the-art demonstration center.

Total Solutions Inc. (Burlington, ON) has been a cornerstone of the label industry for 30 years, building a reputation on deep technical expertise and a commitment to providing cutting-edge production tools. To celebrate three decades of service, they are expanding their hands-on capabilities by adding the Taurus Laser nishing system to their state-of-the-art demonstration center.

The addition of the Taurus Laser marks a signi cant milestone for the demo center. Rather than viewing nishing as an afterthought, Total Solutions Inc. has integrated the Taurus alongside their existing high-end printing equipment to showcase a complete, end-to-end work ow.

The addition of the Taurus Laser marks a signi cant milestone for the demo center. Rather than viewing nishing as an afterthought, Total Solutions Inc. has integrated the Taurus alongside their existing high-end printing equipment to showcase a complete, end-to-end work ow.

By bringing the Taurus into their facility, Total Solutions Inc. is highlighting the future of label conversion. The system is designed for label shops that need:

By bringing the Taurus into their facility, Total Solutions Inc. is highlighting the future of label conversion. The system is designed for label shops that need:

Precision Cutting: Intricate shapes that traditional mechanical dies simply can't achieve.

Precision Cutting: Intricate shapes that traditional mechanical dies simply can't achieve.

Zero Die Costs: The ability to switch jobs instantly without waiting for custom tooling.

Zero Die Costs: The ability to switch jobs instantly without waiting for custom tooling.

Ease of Use: An intuitive interface that allows operators to go from le to nished product in minutes.

Ease of Use: An intuitive interface that allows operators to go from le to nished product in minutes.

Experience the Future Firsthand

Experience the Future Firsthand

Total Solutions Inc. invites industry professionals to see the Taurus Laser in action. This machine is manufactured in Italy by DPR Labeling, the industry leader in label nishing equipment. Whether you are looking to bridge the gap in your nishing department or want to explore a full digital label press setup, their experts are available to walk you through the technical speci cations and ROI bene ts.

Total Solutions Inc. invites industry professionals to see the Taurus Laser in action. This machine is manufactured in Italy by DPR Labeling, the industry leader in label nishing equipment. Whether you are looking to bridge the gap in your nishing department or want to explore a full digital label press setup, their experts are available to walk you through the technical speci cations and ROI bene ts.

Book your private demo today and experience the speed and precision of the Taurus Laser for yourself. Contact our team to schedule a personalized session at our demo center: Email: nathan@totalsolutionsinc.com

Book your private demo today and experience the speed and precision of the Taurus Laser for yourself. Contact our team to schedule a personalized session at our demo center:

Email: nathan@totalsolutionsinc.com

Phone: (888) 878-4765

Phone: (888) 878-4765

The Taurus Laser Digital Label Finisher is a game-changing solution for businesses looking to move away from the limitations of physical dies and mechanical cutting. Manufactured by combining high-speed laser technology with a fully digital work ow, the Taurus allows for unmatched design exibility and rapid production.

The Taurus Laser Digital Label Finisher is a game-changing solution for businesses looking to move away from the limitations of physical dies and mechanical cutting. Manufactured by combining high-speed laser technology with a fully digital work ow, the Taurus allows for unmatched design exibility and rapid production.

The most signi cant advantage of the Taurus Laser is its completely digital work ow. The Taurus uses a highpowered, sealed CO2 laser to cut any shape directly from a digital le. This allows for:

The most signi cant advantage of the Taurus Laser is its completely digital work ow. The Taurus uses a highpowered, sealed CO2 laser to cut any shape directly from a digital le. This allows for:

Instant Job Changes: Switch between di erent label shapes and sizes in seconds. Complex Geometry: Achieve intricate cuts, sharp angles and perforations

Instant Job Changes: Switch between di erent label shapes and sizes in seconds.

Complex Geometry: Achieve intricate cuts, sharp angles and perforations

The Taurus isn't just exible, it's also fast. Designed for high-speed production environments, it can reach nishing speeds up to 70 meters per minute (approx. 230 feet per minute) depending on the con guration. The Taurus is a comprehensive nishing system that handles multiple processes in a single pass: Lamination, Varnish and More: Adds a layer of durability and protection to your labels.

The Taurus isn't just exible, it's also fast. Designed for high-speed production environments, it can reach nishing speeds up to 70 meters per minute (approx. 230 feet per minute) depending on the con guration. The Taurus is a comprehensive nishing system that handles multiple processes in a single pass: Lamination, Varnish and More: Adds a layer of durability and protection to your labels.

Digital Cutting: High-precision laser cutting (kiss-cut, full cut, and perforation).

Digital Cutting: High-precision laser cutting (kiss-cut, full cut, and perforation).

Waste Removal: Automatically strips the matrix (excess material) from the roll.

Waste Removal: Automatically strips the matrix (excess material) from the roll.

Slitting & Rewinding: Slits wide webs into individual rolls, ready for application.

Slitting & Rewinding: Slits wide webs into individual rolls, ready for application.

Technical Highlights:

Technical Highlights:

Max Web Width: Up to 350 mm (13.78”)

Max Web Width: Up to 350 mm (13.78”)

Laser Source: 225W or 350W CO2 sealed laser

Laser Source: 225W or 350W CO2 sealed laser

Input Roll Diameter: Up to 500 mm (19.68”)

Input Roll Diameter: Up to 500 mm (19.68”)

Scan the QR code to visit the Taurus webpage and see the machine in action

Scan the QR code to visit the Taurus webpage and see the machine in action

A series of acquisitions by Transcontinental raises concerns about the lack of diversity

By Nithya Caleb

In 2025, printing giant Transcontinental made a series of acquisitions in the in-store marketing space that raised concerns about increased consolidation in the industry, limited competition, and reduced business opportunities for SMEs. I spoke to a cross-section of printers about this as well as raised this concern with Patrick Brayley, senior VP, retail services and printing sector, Transcontinental, when I interviewed him in Dec. 2025.

First, the context. In June 2025, Transcontinental acquired Middleton Group, a provider of retail services and point-of-purchase display solutions. Founded in 1952 and based in

Markham, Ont., Middleton Group employs 65 people and provides creative, end-to-end retail marketing solutions such as large-format printing, custom retail fixtures, and display systems. For Transcontinental, this acquisition brought in-house screen printing capabilities.

Then in Aug. 2025, it acquired two Canva Group businesses, Mirazed (Saint-Hubert, Que.) and Intergraphics Decal in Winnipeg. Mirazed is recognized for its expertise in screen printing as well as large format digital printing, the production of promotional displays and point-of-purchase signage. Intergraphics specializes in industrial screen and digital printing.

These acquisitions allowed Transcontinental to establish a presence in Winnipeg, increase exposure in Western Canada and in the south shore of Montreal. Prior to the acquisitions, Transcontinental’s in-store presence was primarily in Ontario. The Canva Group acquisitions added screen printing capacity, as well as strengthened Transcontinental’s design team and presence in the Quebec market. All of these acquisitions enable Transcontinental to manufacture all types of ISM applications such as promotional point-of-purchase (POP), store branding, decor, wayfinding (including fabrics), back-of-house and fabrication of displays (including wood, metal, and plastics).

“We’re able to reach a broader part of the country and also keep shipping costs as low as possible for our customers to maximise their return on investment as it relates to their stores,” explained Brayley.

We often hear about print being dead and the decline of brick-and-mortar retail. Both perceptions are inaccurate. Physical stores are becoming experiential destinations for consumers. According to a 2025 study by Retail Council of Canada (RCC) and financial solutions provider Adyen, more than three-quarters of Canadians shop in-store at least once a week. Sixty-two per cent of Gen Z enjoy the in-store shopping experience. Further, 42 per cent prefer shopping in-store to avoid shipping fee or delays and return hassles.

“Many Canadians continue to value in-person shopping for the experience, convenience, and potential cost savings it offers. From being able to try products firsthand to avoiding shipping fees, these in-store benefits remain important. Retailers who prioritize seamless, memorable experiences are well-positioned to build lasting customer loyalty in a competitive landscape,” said Santo Ligotti, VP of marketing and member services, RCC, at that time.

Brayley shared that 80 per cent of retail transactions are occurring in physical stores and retailers are faced with ever rising expectations from Canadian consumers.

“There’s a natural momentum in the system to offer a better experience in store. Basket sizes tend to be larger,

The Canadian in-store marketing sector is going through a period of consolidation.

The year Transcontinental acquired multiple business in the in-store marketing sector.

and they tend to be more profitable baskets as well. So the retailers also have certainly a benefit to offering a delightful in-store experience,” stressed Brayley, who also noted that there’s a breakdown of silos between sales channels now. Phigital (physical + digital) is the marketing philosophy brands are adopting now.

Richard Kouwenhoven, president and CEO of B.C.-based Hemlock Printers, concurs. Hemlock services multi-location retail clients in apparel, cosmetics, technology, hardware, etc. It has the capability to create diverse applications including store materials, window graphics, point of purchase, displays, and floor graphics.

“We’ve definitely experienced growth in the sector over the past few years. It is a promising area of our business and an area of focus for our

business,” he said. “I do get a sense that brands are focusing on building a strong retail presence. This may be a smaller retail presence, a move away from the larger big box type sales channels and more to their own retail channels. Their own managed retail gives them the opportunity to position their brands in a really controlled way and create a complementary strategy between in-store and online. Obviously, the retail locations serve as a compliment to the online sales channel.”

I also spoke to Antony Rubino, MD of Resource Integrated in Aurora, Ont. It offers varied applications—anything from a fabric light box to battery-operated digital displays or a combination of both using different elements like aluminium or plastic framing, light boxes, light boxes with motion LEDs, digital signage, etc., for mainly tele-

More imagination, more creativity, more agility, and more technology. We have to be investing in technology in order to bring these solutions to people in a faster and a more creative way. – Antony Rubino, MD, Resource Integrated

communications and quick service restaurants. Rubino also views ISM as a fast-growing sector for his company.

To succeed in ISM, one needs to be very innovative and solutions-oriented besides having good technology.

“It’s really about the efficiencies of delivering that product from the time you get the file to the time it arrives in store. The job isn’t done when it leaves the dock. The job’s done once it’s in the hands of the store manager and they know what to do with it and they’ve put it up or you’ve managed the installation. So there’s a lot more complexity on logistics and process. It’s about how do you create better systems around that. You really do need to be very responsive to customer requirements and also innovative,” said Kouwenhoven.

“More imagination, more creativity, more agility, and more technology. We have to be investing in technology in order to bring these solutions to people in a faster and a more creative way,” stressed Rubino.

Kouwenhoven suggests having a combination of equipment that gives a lot of versatility in terms of media and product. Hemlock has two different types of rigid UV inkjet printers and three different types of roll-to-roll devices so that they can do a huge range of products for both indoor and outdoor. He added it’s important to heavily collaborate with customers.

“Look at what materials are the best fit. What’s the best performance in store? Is it going to last for the time it

Retails stores and malls are becoming experiential destinations requiring innovative display solutions to keep attracting consumers.

cerning. Brayley was quick to dismiss any concerns about the lack of competition in the sector.

“The retail industry in general is very dynamic. It’s evolving on a daily basis and it’s very large. So the companies selling into the retail environment are also very numerous. There’s a wealth of opportunities out there in the market and it’s going to continue to shift. From our standpoint, we’re here to be the best partner that we can to our customers and we’re going to do that in the context of a very competitive and dynamic ecosystem for many, many years to come,” he said.

needs to. Bringing ideas to the table that will make things better and really collaborating in a deep level with the customer. Understand how their systems work. What tools are they using? How do they manage their internal communication and their store network? How does that all work? So really understanding that part of it is important because that’s how you find efficiencies,” advised Kouwenhoven.

The same rules, as for commercial printing, apply to ISM work, explained Rubino.

“In a lot of ways it’s meeting deadlines, hitting budgets and it’s making the client look good,” he said. “I’ve always tried to be the type of business owner that wants to add as much value as possible. It’s easy to say, but you really have to go that extra mile.”

Despite the promising opportunities in the sector, a series of acquisitions by Canada’s largest printer is con-

The percentage of Gen Z who prefer to shop in physical stores. 62%

Kouwenhoven agrees the sector is competitive both regionally and nationally, as there are a lot of providers.

“From the Hemlock perspective, it doesn’t really change our approach at all in terms of in terms of how we want to evolve our services in this space. I think it’s really just an indicator of how important this space is,” he said. “Consolidation is a larger trend that is happening in our industry as well as in many other mature industries. So, it doesn’t mean that a regional player can’t succeed in this environment because a lot of it still comes down to responsiveness, process, the technology and the people involved. There’s still those traditional things that actually do make a difference. We’re definitely focused on that.”

Rubino wasn’t overly concerned about the consolidation. He believes a medium-sized shop like Resource Integrated can react very quickly to client needs and cater to the needs to of small retailers, who require region-specific and more customized solutions than the Walmarts and Loblaws of the world.

“Larger organisation gives people less choice. With consolidation comes scale. I’m not interested in that. These types of consolidations leave space for independents like us to be faster, more flexible and more personal in our approach. There is something to that personal one-on-one relationship that makes a big difference in this industry,” he said. “This consolidation gives clients other opportunities to look for those who are going to help them grow their business in a way that’s not price or commodity based.”

While there is a certain level of consolidation, there’s, at this point, enough opportunities for Canadian printers to capitalize.

One of the most significant trends for 2026 is the accelerating shift toward digital printing. The move to digital isn’t necessarily about replacing flexo or offset – it can be about supplementing those systems to handle short-to-medium runs, personalization, and SKU variability profitably. Digital complements traditional platforms by taking on jobs that would otherwise be inefficient or unprofitable with analog systems.

Konica Minolta’s toner-based label platform makes this transition simple. This proven technology delivers operator-friendly reliability, consistent colour, and minimal maintenance, without the complexity or overhead of inkjet or hybrid systems. Shops that add digital gain the agility to capture high-margin short-run work, reduce waste, and improve turnaround times - all without needing specialized operators or major workflow overhauls. In a time where finding skilled labour is a serious challenge for printers, this is essential.

To truly capitalize on this trend, unifying your systems with intelligent workflow solutions is essential. Platforms like AccurioPro Flux automate tasks, streamline job setup, and connect processes - customized to your shop’s needs - so you can scale profitably in a market demanding speed and flexibility.

SKU counts are skyrocketing as brands diversify with regional versions, seasonal launches, and personalized products. This surge in variability means shorter runs, faster turnarounds, and more frequent artwork changes. Digital is simply better equipped to meet those demands. It delivers near-instant changeovers, on-demand versioning, variable data, and predictable cost structures -making it the ideal complement to flexo for short and mid-size runs.

This isn’t just a production shift - it’s a new revenue stream and profitability opportunity. Konica Minolta projects the converter volume to grow by nearly $2 billion by 2030, with much of that growth perfectly suited for digital. To capitalize, print shops need a press with an easy-to-use ecosystem that unifies workflows, automates prepress, and connects MIS to production. Streamlined integration turns SKU complexity into a competitive advantage, reducing touchpoints, eliminating bottlenecks, and enabling profitable growth in a market demanding speed and flexibility.

Converters and printers are embracing digital embellishment in labels as brands demand more ways to make products stand out. Foil, spot varnish, textures, and even security patterns are no longer reserved for luxury runs - they’re becoming essential for differentiation in crowded markets.

For print providers, this is a clear opportunity. Investing in digital embellishment technology creates a competitive advantage by enabling quick turnaround times and offering design options tailored to each brand’s audience. That helps customers stand out - which helps you stand out.

It’s easier than ever to implement; modern workflows simplify file prep, ensure precise registration, and provide proofing tools that minimize trial-and-error. Expect continued innovation to make premium finishes even more accessible. The takeaway: digital embellishment isn’t just possible - it’s practical, profitable, and a powerful upsell when paired with short-run digital labels.

Author: Rob Gradishar

Director of Production Print, Konica Minolta Business Solutions Canada

LinkedIn Profile: https://www.linkedin.com/in/rob-gradishar-785408a/

2026 will be the year brands ask for more from print: faster turnarounds, shorter runs, and personalized products that stand out. That demand translates into opportunity – particularly in labels. For commercial printers looking to expand and label converters looking to modernize, digital label presses have matured to deliver speed, agility, and profitability without complexity. Supplement your traditional equipment with digital technology that boasts smart automation, enabling your team to confidently take on more SKUs, more variability, and more value-added work. This blueprint highlights three trends shaping the market – and how to capitalize on each to build high-margin growth.

AFFIX Label & Print saw the increasing need for flexibility amid growing demand and harnessed the opportunity to expand in-house capabilities, elevate product quality, and strengthen client experience. Specializing in custom label printing for short and mid-volume runs, AFFIX needed both a high-performance, easy-to-use press and a strategic partner to improve profitability while ensuring long-term control. Konica Minolta’s AccurioLabel 230 - printable on diverse substrates with variable data, quick changeovers, and stablecolour - was the ideal fit for high-mix, fast-paced work in a compact package. Since installing the AccurioLabel 230, AFFIX has transformed its production process, enhancing print quality and broadening service offerings - resulting in a 40% increase in revenue per job.

Konica Minolta is committed to building smarter, more sustainable, and more profitable label solutions - integrating hardware, workflow, embellishment, and expert service tailored to real production environments.

Expect 2026’s SKU-driven market to demand more automation, smarter AI-based controls and enhanced workflow integration to reduce touchpoints, errors, and operating costs. Our vision for the next decade is clear: empower customers to win more business, handle more complexity, and do it all with less friction and greater flexibility. With Konica Minolta and the broadest portfolio of production and industrial print solutions in the industry, you get a trusted partner, a proven platform, and a team that’s ready to help you grow.

Ontario’s Working for Workers Act has upended longstanding hiring habits.

By Nicole Biros-Bolton and Lee Eldridge

On January 1, Ontario’s Working for Workers Act (Bill 149) and its supporting regulation upended longstanding hiring habits. If your print business has 25 or more employees in Ontario on the day you post a job, new rules will apply to how you advertise roles, disclose pay, utilize AI in hiring processes, and even how you communicate with candidates. Internal-only postings and generic “always hiring” talent calls are excluded, but most public job ads for pressroom, prepress, estimating, customer service, and plant leadership roles will be in scope.

While these changes require operational adjustments, the legislation addresses real barriers in Ontario’s labour market. Pay transparency benefits workers who cannot afford to invest hours in applications, interviews, and reference co-ordination for roles that ultimately will not meet their financial needs; a burden that falls disproportionately on single parents, caregivers, and workers from equity-deserving groups who have less margin for speculative job searches. Public salary disclosure also accelerates the identification and correction of pay equity gaps: when compensation is visible, systemic

undervaluation of work performed by women and racialized employees becomes harder to sustain and easier to address. Removing “Canadian experience” requirements opens doors for internationally trained workers whose skills have been discounted by proxies that correlate with national origin. In short, Bill 149 is not simply about what employers must disclose; it is about creating a hiring landscape where talent is evaluated on merit and where workers can make informed decisions about where to invest their time and energy.

What changes: Every public posting must include either a specific pay rate or a pay range for the position. If the top of the range is less than $200,000/ year, the spread cannot exceed $50,000. (If pay will exceed $200,000, you still must disclose a range, but the spread limit does not apply so the range can be wider, if needed.) What counts as wages: Salary or hourly pay, commissions, and non-discretionary bonuses. (Variable compensation plans and commission arrangements can complicate disclosures: If the pay structure for the role is complex, get legal advice on how you should word it in the posting.)

Many print industry job postings still omit pay details (about 62 per cent in 2025), and that will no longer fly. Posting a salary range reduces churn, speeds up hiring, and lowers the risk of inequities surfacing later. Examples meeting the rule are:

• Pressroom super visor: $75,000 to $95,000 per year.

• CSR, commercial sheetfed offset: $52,000 to $62,000 per year. Examples that do not:

• Competitive salary and benefits

• $60,000 to $120,000 (the spread here is too wide when the top-end

If you are using AI-enabled tools to screen applicants for interviews, you must disclose this in the job posting.

is below $200,000).

Recommendation: Before you publish ranges, run an internal equity check. If your posted range is higher than current employees are earning for the same work, expect to field some hard questions around payequity concerns.

If you are using AI-enabled tools to screen, assess, or select applicants for interviews, you must reveal this in the job posting.

You can no longer state “Canadian experience required,” “must have worked in Canada,” or even “Canadian experience preferred” in postings or application forms.

Jan. 1, 2026

The date on which Ontario’s Working for Workers Act came into effect.

From resume parsers in your applicant tracking system to built-in algorithms in job boards, AI can be working behind the scenes. Non-disclosure can put you offside here. Disclosure alone is not the whole risk story; bias in AI tools and privacy controls come into play too.

Inventory every tool, plug-in, and recruiter workflow that touches your inbound job applications. Confirm enterprise-grade privacy (e.g. data not used for model training) and ensure there is a human-in-the-loop review process prior to decision-making.

Sample language you could adapt for your needs:We use AI-assisted tools to help screen and assess submitted applications. All decisions include human review. We use enterprise systems with privacy safeguards.

Bill 149 is about creating a hiring landscape where talent is evaluated on merit and where workers can make informed decisions about where to invest their time and energy.

This rule targets systemic barriers that keep internationally trained press operators, bindery leads, estimators, and designers from being fairly considered. Even beyond postings, relying on “Canadian experience” as a filter for hiring can also carry human rights legislation risks: tribunals focus on the effect of a requirement, not your intent.

Recommendation #1

Focus on specifying the work and standards, not the country. Examples:

• experience with G7 colour management;

• five years operating Heidelberg XL or equivalent sheetfed press;

• estimating experience across sheetfed, digital, and wide format using Avanti; and

• knowledge of Ontario employment legislation (for HR/finance roles). Recommendation #2

Add a welcoming line that clearly states your position here, such as: “We welcome applicants eligible to work in Canada with equivalent experience gained globally.”

The posting must state whether you are filling an actual open role (a backfill or a newly created position you will staff now) or not (e.g.building a talent pipeline or doing market research). Candidates invest real time in tests, portfolio pulls, and shop visits. This disclosure avoids speculative applications and sets expectations.

Sample language you could adapt for your needs: “This posting is for an

New rules apply to how you advertise roles in Ontario.

existing vacancy.” or “This posting is not for an existing vacancy; we are building a qualified candidate pool.”

If you interviewed a candidate for a publicly posted job—virtual or in person—you must inform them within 45 days of their last interview whether a hiring decision has been made. Phone or online pre-screens that do not test suitability are not considered “interviews” for this point. This means that “ghosting” a candidate after a plant tour or panel interview will now risk a complaint. The fix is simple: standardize your close-out messages and put ownership on hiring managers to update the candidates that they have taken the time to interview.

Recommendations:

• Establish boilerplate documents for both the “no” and the “we’re still deciding” notes that you need to send out.

• Trigger a reminder at 30 and 40 days from the interview date.

• Log the communication in your ATS or a shared tracker so that you can refer back to it if questioned.

• Run a pay audit: List every role and employee. Flag gaps for substantially similar work, especially if patterns appear to correlate with factors such as gender or race. Build a plan to address gaps before your salary ranges go public in new job postings.

• Tune-up your job architecture: Clean up titles and descriptions so they match what people actually do on the floor, in prepress, and in client service. Align pay ranges to

levels and responsibilities.

• Refresh posting templates: Add fields for pay, vacancy status, AI disclosure, and your 45-day communication commitment.

• Inventory AI: Document how your ATS, job boards, resume filters, and recruiter tools are currently using AI. Ensure privacy protections are in place, and conduct human-in-the-loop reviews –AI can help you move more quickly through applications but should not be making any decisions for your company.

• Train interviewers: Replace “Canadian experience” questions with skills-based prompts.

• Set procedures for recordkeeping around hiring processes: Keep hiring records, postings, interview dates, and decision notices on file for three years.

• Communicate internally:Tell staff what’s changing and why. Consistency across plants and shifts prevents confusion.

• Coordinate with your recruiters (if needed): Ensure external partners follow your templates and disclosure practices.

• Vague pay: Statements like “competitive salary” will be non-compliant.

• Overly large pay ranges: Keep the spread ≤ $50,000 when the top of the range is ≤ $200,000.

• Geography proxies: “Local experience,” “Ontario industry experience,” or “worked in Canada” can act as Canadian-experience stand-ins and create human-rights exposure.

• Unsuper vised AI: Black-box fil-

• Every public posting must include a pay rate or range; if the top of the range is less than $200k, range “spread” must be less than $50k.

• Posting clearly states whether or not this is an existing vacancy.

• AI disclosure present if any AI screens, assesses, or selects applicants.

• No “Canadian experience” requirements.

Process

• Interview definition understood by hiring teams; phone pre-screens kept non-evaluative (if they are used at all).

• 45-day notice templates and reminders in place to follow up with all interviewed candidates.

• A recordkeeping system to retain postings, interview dates, and decision notices for a period of at least three years.

• Pay audit completed; gaps addressed or planned.

• Job architecture updated; titles and descriptions match the work being done.

• AI tools inventory completed; privacy and human review verified.

• Recruiters aligned to your templates and disclosures.

ters without human review or enterprise privacy.

• Inter view drift during pre-screening: A “quick Zoom” that turns into suitability questions still counts as an interview, and starts the 45-day clock on providing an update to the candidate.

The number of days you have to inform a candidate about the outcome of their application. 45

For a sector battling skills shortages and succession gaps, Bill 149 is not red tape for its own sake. Transparent pay helps qualified candidates self-select into your pipeline. Clear vacancy status respects potential employees’ time. AI disclosure builds trust as technology scales. Removing “Canadian experience” grows your talent pool and lowers human-rights complaint risk.

The practical work is front-loaded: Aligning existing pay, standardizing templates, and ensuring interviewers are properly trained and knowledgeable here. Do that once, then execute consistently. You will reduce time-tohire, shrink abandonment, and avoid complaints that steal leadership focus away from production.

By Nithya Caleb

Printing giant Transcontinental enters its 50th year with a renewed focus on retail services and printing, educational and publishing businesses. In 2025, the company took several strategic initiatives to ensure it continues to be efficient, meets client requirements and remains a formidable establishment within Canada’s printing and graphic arts industry for the next 50+ years.

One of the most important steps it took in 2025 was to divest its pack-

aging business. In December, it entered into an agreement to sell its packaging business to ProAmpac Holdings for approx. $2.22 billion, including the company’s debt and lease obligations. This transaction is expected to close in Q1 2026. It follows the 2024 sale of its industrial packaging operations to Hood Packaging for approx. US$95 million.

“The decision really followed a strategic review process in the context of an industry that’s going through a rapid wave of a sizeable consolidation. We determined that it was in the best interests of the organisation’s stakeholders to make the divestiture at this time and in

doing so with, you know, ProAmpac being the acquirer, we were able to find a strong strategic fit, and a strong culture fit as well,” explained Patrick Brayley, senior VP, retail services and printing sector, Transcontinental.

“We ultimately had an opportunity to say, do you want to be consolidating or be consolidated, so to speak, and the decision was made to go for the latter of the two options.”

Transcontinental is well-known for its retail services. It has multi-year partnership agreements with several retailers for a wide range of services. For instance, in December, Transcontinental and grocer Metro extended their marketing service agreement for three years. The agreement included Metro’s continued participation in Raddar, Transcontinental’s print and digital flyer, as well as other printing servi-

ces, in-store marketing services, and content solutions. Each week, Raddar is distributed to 4.8 million households in Quebec and British Columbia through Canada Post.

Apart from helping retailers develop their item price promotional content, creating marketing products and direct mailers, Transcontinental offers analytics-related solutions to their retail clients to help them attract and retain consumers.