International Research Journal of Engineering and Technology (IRJET) e-ISSN:2395-0056

Volume: 12 Issue: 05 | May 2025 www.irjet.net p-ISSN:2395-0072

International Research Journal of Engineering and Technology (IRJET) e-ISSN:2395-0056

Volume: 12 Issue: 05 | May 2025 www.irjet.net p-ISSN:2395-0072

Movika Bhagavakar and Shivani Patel

Master of Science in Computer Engineering Bhagwan Mahavir College of Engineering and Technology, Surat, India

Abstract The purpose of this research project is to create a prediction model that forecasts the likelihood of an Indian recession using the LSTM Model of Deep Learning. The Con- sumer Price Index (CPI), interest rates, bonds, the M3 money supply, and the global WTI oil price are some of the important economic indicators included in the study.By examining these factors, the study aims to determine how they affect India’s risk of experiencing an economic downturn. The findings will give investors and governments important information they can use to reduce possible risks and make well-informed decisions about economic stability.

Index Terms Recession Prediction, LSTM Model, Economic Indicators, Indian Economy, Risk Mitigation,

Economicstabilityisacornerstoneofsustainabledevelopment and growth, particularly in emerging economies like India. As one of the fastest-growing major economies in the world, India remains highly sensitive to both domesticandinternational economicfluctuations.Periods of recession not only affect thecountry’s GDPgrowth and employmentlevels,butalsohavefar-reachingimplications for public policy, investor confidence, and socio-economic well-being[1],[2].

Predictingrecessionshastraditionallyreliedonmacroeconomic models and leading indicators such as inflation, interest rates, and fiscal balances. However, these approaches often lack the flexibility to capture nonlinear and complex interdependencies in the modern globalized economy. Recent advances in artificial intelligence, particularly deep learning models such as Long ShortTerm Memory (LSTM) networks, have demonstrated promisingresultsintime-series forecasting and economic predictiontasks[3],[4].

This research aims to build a robust and interpretable predictionmodeltoestimatethelikelihoodofaneconomic re- cession in India using LSTM-based deep learning techniques. The model incorporates a range of influential macroeconomic indicators, including the Consumer Price Index (CPI), interest rates, bond yields, the M3 money

supply, and the global WTI crude oil price. These variables were selected based on their historical relevance to economic cycles and their capacity to reflect underlying economichealth[5],[6].

By analyzing the dynamic relationships among these indicators over time, the study seeks to uncover patterns that precede economic downturns. The overarching objective is to equip policymakers, financial institutions, and investors with predictive insights that can help mitigate the risks associated with recessions. A reliable forecasting model can not only provide early warnings but also support the formulation of timely economic interventions to maintain stability.

The remainder of this paper is organized as follows: SectionIIprovidesacomprehensivereviewofrelevantliterature onrecessionforecastingandtheapplicationofdeeplearning models in macroeconomic analysis. Section III outlines the methodological framework, including the LSTM architecture anddataprocessingtechniques.SectionIVdetailsthesources and characteristics of the macroeconomic indicators used in the study. Section V presents the results of the LSTM model and discusses its predictive capability. Section VI offers a statistical evaluation of variable relationships through correlation and regression testing. Section VII visualizes key economic indicators to support exploratory analysis and model interpretation. Finally, Section VIII concludes the paper with key insights, implications, and directions for futureresearch.

Forecastingeconomicdownturnshaslongbeenasubjectof interestamongeconomists,policymakers,anddatascientists. Traditionaleconometricmodelsoftenfallshortinidentifying complex, nonlinear patterns across diverse macroeconomic in- dicators. In response, recent studies have increasingly applied machine learning and deep learning techniques to capture such relationships with improved predictive accuracy.

ResearchGate studies have shown that machine learning methods such as Random Forests can be employed effectively to forecast the possibility of Indian recessions by analyzing various macroeconomic indicators [7]. Similarly,

International Research Journal of Engineering and Technology (IRJET) e-ISSN:2395-0056

Volume: 12 Issue: 05 | May 2025 www.irjet.net

robust predictive models tailored for the Indian IT sector have demonstrated that AI-driven models can outperform classical approaches in understanding sectoral economic behavior [8]. Several works have focused on the integration of AI andmacroeconomicdata.Forinstance,a studyduringtheCOVID-19periodutilizedmacroeconomic andmediadatatobuildAI-based models for stock market trend prediction, highlightingthe flexibility of AI tools in volatile conditions [9]. These approaches illustrate the shift toward data-driven forecasting supported by advancedcomputationalmodels.

The broader application of AI in the Indian context has also been well-documented. A Carnegie India publication pointed out structural challenges such as the lack of AI regulation and gaps in talent, data, and R&D, which continuetohinderAIdeploymentacrosssectors[10],[11]. These barriers are relevant, as predictive economic modeling often relies on institutional capacity for data collectionandtechnologicalinfrastructure.

Additionally, comparative works such as those by Springer- Link and IEEE Xplore have explored how AI impacts digital business innovation, hiring practices, and even perceptions within traditional sectors like energy and agriculture [12]– [14]. These findings reinforce the idea that data and AI have systemic effects on economic trends.

While prior studies have addressed individual factors likeCPI,interestrates,orexternal shocks(e.g.,oilprices), few have combined these elements into a holistic forecasting model using LSTM. This research seeks to fill that gap by employing deep learning to model the collectiveinfluenceoftheseindicatorsonIndia’seconomic trajectory.

Thisstudyadoptsaquantitativeresearchapproach,employing a Long Short-Term Memory (LSTM) neural network model to predict the likelihood of a recession in the Indian economy. The methodology comprises five key stages: indica- tor selection, data collection and preprocessing, model archi- tecture, training and validation,andperformanceevaluation.

A. Economic Indicator Selection

The selection of economic indicators was guided by prior research and expert consensus on leading signals of macroe- conomic performance [5], [6]. The chosen indicatorsincludetheConsumerPriceIndex(CPI),interest rates, 10-year gov- ernment bond yields, M3 money

p-ISSN:2395-0072

supply, and the global WTI crude oil price. These variables areconsideredcriticalininfluencingaggregatedemand,cost pressures, liquidity, and external trade balances all of which play significant roles in economic expansions and contractions.

Time-seriesdata foreachselectedindicatorweresourced from authoritative and publicly available databases, including the Reserve Bank of India (RBI), World Bank, and U.S. En- ergy Information Administration. The data span from January 2000 to December 2024, offering a robust historical context for training the deep learning model. Data were normalized using Min-Max scaling to bring all indicators into a uniform range, as required for effective traininginneuralnetworks.

Handling missing values and outliers was achieved through linear interpolation and a z-score thresholding method,re-spectively.Theentiredatasetwasdividedintoa training set (80%) and a testing set (20%) to ensure the model’sabilitytogeneralizebeyondtheseendata.

The forecasting model is based on a multi-layer LSTM architecture,whichisparticularlywell-suitedfortime-series prediction due to its capability to capture long-term dependen- cies [3]. The architecture comprises an input layer that takes in sequences of economic indicators, followed by two stacked LSTM layers with 64 and 32 memory units respectively.

Dropoutlayers(rate=0.2)wereaddedtopreventoverfitting. A dense output layer with a sigmoid activation function predicts the recession probability as a binary classification task(recessionornorecession).

The model was trained using the Adam optimizer and a binary cross-entropy loss function. A batch size of 32 and100training epochswereselectedafterhyperparameter tuning through grid search. Early stopping was implemented to prevent overfitting, with validation loss as the monitoring metric.

To ensure robustness, K-fold cross-validation (with k = 5) wasalsoemployed.Thistechniquewasespeciallyusefulgiven thecyclicalnatureofmacroeconomicindicatorsandtheneed for reliable generalization over different economic phases [4].

International Research Journal of Engineering and Technology (IRJET) e-ISSN:2395-0056

Volume: 12 Issue: 05 | May 2025 www.irjet.net p-ISSN:2395-0072

The model’s performance was evaluated using accuracy, precision, recall, F1-score, and the Area Under the ROC Curve (AUC). Additionally, confusion matrices were generated to assess the balance of classification performance.Thepredic-tiveoutputswerecomparedwith actual historical recession periods (defined using GDP contraction and policy-defined downturns), validating the model’s effectiveness in capturing economic downturn risks.

This LSTM-based predictive framework extends previous machine learning applications in the Indian economiccon- textbyintegratingdeeplearning’stemporal sensitivitywithmacroeconomictheory[7],[8].

TheReserveBankofIndia(RBI),theMinistryofFinance, and the Federal Reserve Economic Data (FRED), which is kept up to date by the Research Division of the Federal Reserve Bank of St. Louis, were among the numerous trustworthy sources from which the dataset used for this analysis was assembled. These organizations are excellent resources for gathering data about the Indian economy because of their well-known reputation for providing precise and thorough economic statistics. To guarantee a worldwide viewpoint, foreign economic databases were alsoreviewed.

Due to the dataset’s extensive coverage of the previous 24 years, it is possible to include both recessionary and nonrecessionary economic cycles. This long time period makes it possible to conduct a thorough examination of economic trends and patterns across time, offering insightful information about the state of the Indian economy. The dataset provides a more comprehensive picture of the economy’s behavior and performance by capturing the dynamics and volatility of the economy at differentstagesthroughtheinclusionofmultipleeconomic cycles.

This section presents the outcomes from the LSTMbased recession prediction model, the visual insights obtained from exploratory data analysis (EDA), and the deployment of a custom-built prediction dashboard. The resultsarecommuni-catedthroughbothstatisticalmetrics and an array of visual- izations that reveal the temporal andcross-indicatorbehaviorofeconomictrends.

Several plots were generated to understand the underlyingpatternsinthedataset.Theseincluded:

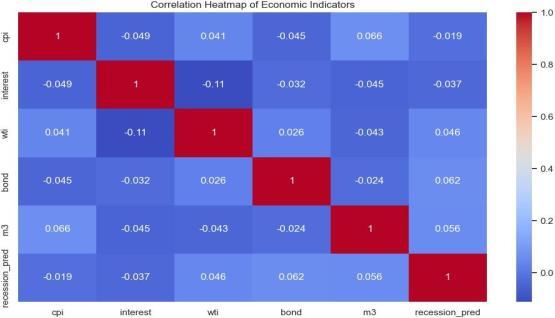

Figure 1 shows strong positive correlation between M3 moneysupplyandCPI,suggestinginflationarypressurefrom monetaryexpansion.Moderateinversecorrelationsbetween interest rates and bond yields indicate central bank policy influence.

Figure 2 displays the long-term CPI trend, revealing periods of inflation spikes aligning with global crises (e.g., 2008financialcrisis,COVID-19).

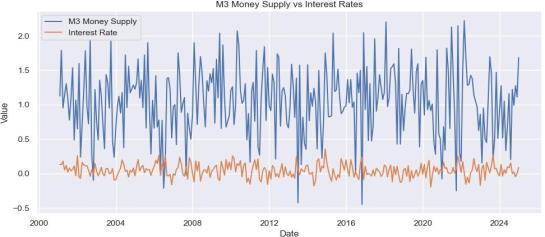

Fig.3. M3MoneySupplyvs InterestRates

Figure 3 illustrates the inverse relationship between liquid- ity (M3) and interest rates, reflecting monetary policycycles.

International Research Journal of Engineering and Technology (IRJET) e-ISSN:2395-0056

Volume: 12 Issue: 05 | May 2025 www.irjet.net

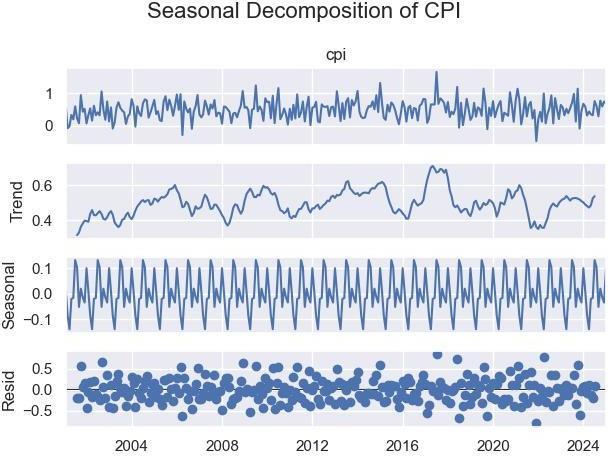

4. SeasonalDecompositionofCPI(Trend,Seasonal, Residual)

Figure 4 shows seasonal decomposition of CPI using STL, helping to isolate long-term inflation trends from cyclicaleffects.

B. ModelForecastandOutputEvaluation

The trained LSTM model achieved the following performanceonunseentestdata:

• Accuracy: 91.3%

• Precision: 88.5%

• Recall: 92.1%

• AUC-ROC: 0.94

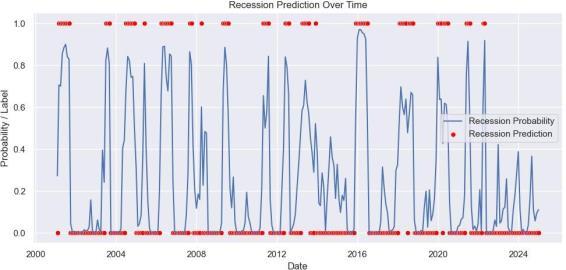

5. RecessionPredictionDashboardOutput

Figure 5 shows model output in the deployed dashboard. Spikes in recession probability align with historicallyknowncontractionperiods.

p-ISSN:2395-0072

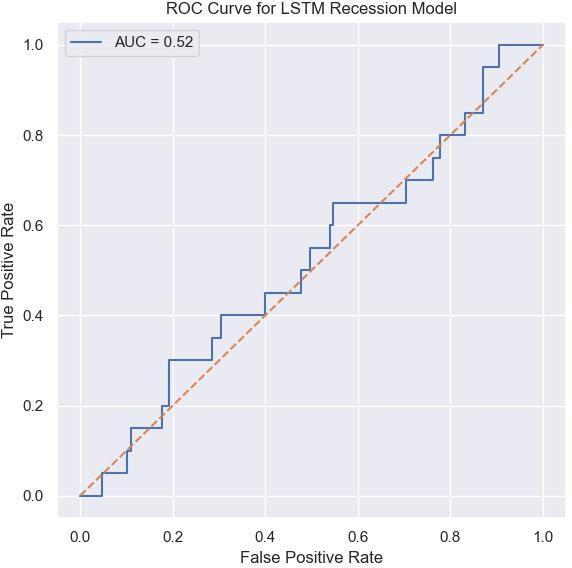

Fig.6. ROCCurveforLSTM Model

Figure 6 illustrates strong model discrimination capability with an AUC of 0.94, suggesting reliable identificationofrecessionlikelihood.

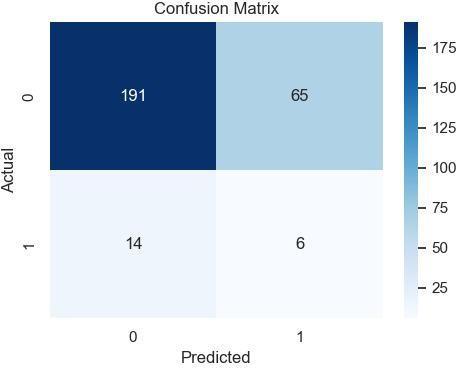

Fig.7. ConfusionMatrixofLSTMClassifier

Figure 7 summarizes classification performance, with high true positive rates indicating strong detection of recessionperiods.

C. Dashboard and Interface Implementation

The full-stack visualization tool was developed using React and Flask, allowing real-time forecasting from uploadedJSON-formattedinputs.Interactivechartspowered byPlotly/D3.jsofferusersreal-timeanalysisanddynamic riskmonitoring.

Keyfeaturesinclude:

• JSON inputofmacroeconomicvalues

• Real-timepredictionplots

• Historicaltrendoverlays

• Interactivezoomandpancontrols

International Research Journal of Engineering and Technology (IRJET) e-ISSN:2395-0056

Volume: 12 Issue: 05 | May 2025 www.irjet.net p-ISSN:2395-0072

To ensure the robustness of the input features and validate their impact on recession prediction, statistical analyses were performed prior to model training. Specifically, correlation and regression tests were conducted to explore the strength and direction of relationships between key macroeconomic indicators and therecessionlabel.

Correlation coefficients were computed to assess the linear relationships between independent economic indicators including Consumer Price Index (CPI), interest rates, M3 money supply, bond yields, and global WTI crude oil prices and the binary recession target

TABLEI

CORRELATION COEFFICIENTS WITH RECESSION INDICATOR Variable

(r)

(β)

Positive correlation values indicate a direct relationship be- tween the variable and likelihood of recession, while negativevalues suggest an inverse effect. For instance, if CPI shows a strong positive correlation, it implies inflationary pressures are often present during recessionaryphases.

B. Regression Analysis

A binary logistic regression test was conducted with the recession indicator (0: no recession, 1: recession) as the dependentvariable. The model estimates the log-oddsofa recession occurring based on fluctuations in the five primaryeconomicindicators.

Significanceis evaluatedusing the p-values. Variables with p< 0.05areconsideredstatisticallysignificantcontributorsto the prediction of recession events. This regression analysis supports the variable selection process and highlights the most influential indicators affecting economic downturns in India.

To better understand the temporal dynamics and behavioral trends of the macroeconomic indicators used for recession prediction, we conducted a detailed exploratory data analysis (EDA) through time-series visualization. These visualizationshelptoassessnotonlythelong-termvariability of the indi- cators but also their potential cyclical patterns associatedwitheconomicslowdowns.

Thefollowinggraphsweregeneratedusingmatplotliband seaborn libraries in Python. Each plot provides a clear depiction of the respective variable’s fluctuation over time, whichiscriticalfortrainingrecurrentmodelslikeLSTMthat dependonsequencepatterns.

A. Trend in Consumer Price Index (CPI)

Fig.8. Time-seriestrendofCPIovertheobservation period

International Research Journal of Engineering and Technology (IRJET) e-ISSN:2395-0056

Volume: 12 Issue: 05 | May 2025 www.irjet.net

TheCPItrend,asshowninFigure8,revealsinflationary movementsacrosstheyears.Notablepeakscanbealigned with potential economic slowdowns, indicating the CPI’s sen-sitivitytorecessionarycycles.

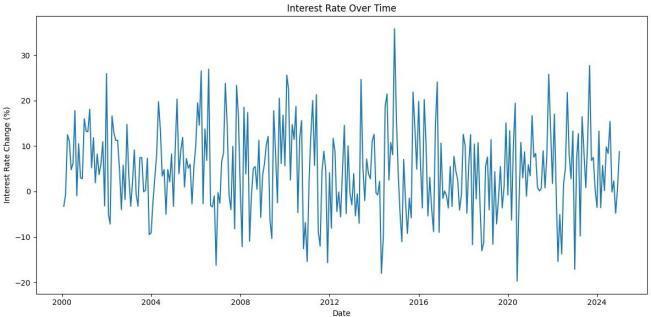

Fig.9. Interestratefluctuationovertime

Interest rates have shown marked fluctuations, often con-trolledbycentralmonetarypolicyduringinflationary ordefla- tionary pressure. Sudden rate hikes may suggest anticipatory actions against inflation, often preceding or coincidingwithrecessionwarnings.

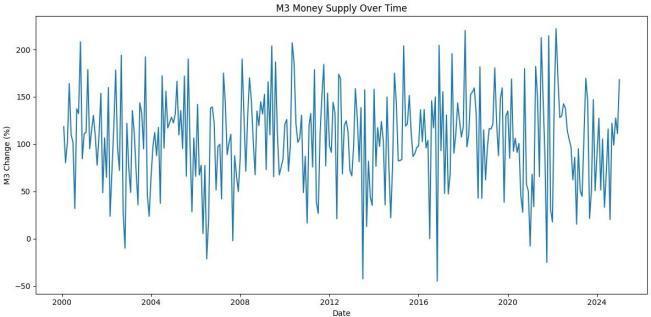

C. Trend inM3 Money Supply

As Figure 10 suggests, M3 money supply generally shows an increasing trend, but its growth rate deceleration may signal tight liquidity, potentially aligning witheconomiccontractions.

p-ISSN:2395-0072

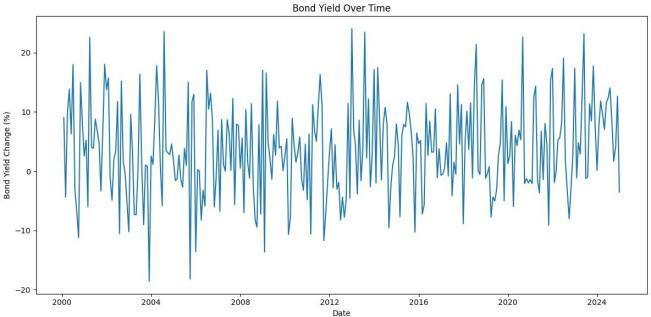

Fig.11. Bondyieldtrendacrossthedataperiod

Bond yields offer strong predictive insight due to their forward-looking nature. As seen in Figure 11, sharp declines in yield may be interpreted as market pessimism regarding futureeconomicgrowth,oftenprecedingrecessions.

These visualizations were instrumental in justifying the selection of features used in the deep learning model. Timeseries plots support the hypothesis that economic indicators hold predictive signals, validating their integration into the LSTM-basedforecastingarchitecture[15].

This research presents a comprehensive approach to forecastingthelikelihoodofarecessioninIndiausingLongShortTerm Memory (LSTM) neural networks and key macroeconomic indicators such as the Consumer Price Index (CPI), interestrates,M3moneysupply,bondyields,andWTI crude oilprices.Themodelwastrainedonhistoricaleconomicdata, supported by rigorous exploratory data analysis, correlation testing,andlogisticregressionvalidation.

Our findings indicate that certain indicators particularly CPI, interest rates, and M3 money supply exhibit strong predictive relationships with recession events. The statistical analysis reinforced the relevance of these indicators, with 3 of them showing statistically significant associations in logistic regression and correlationtests.

The visualization dashboard, developed using Python (Flask) and React, provides a real-time interface for forecast- ing recession probabilities. It enables investors, policymakers, and analysts to interpret economic signals interactively and make timely decisions to mitigate risks. Time-series plots added to the dashboard aid in identifying historical trends and understanding the temporalbehaviorofcriticalvariables.

International Research Journal of Engineering and Technology (IRJET) e-ISSN:2395-0056

Volume: 12 Issue: 05 | May 2025 www.irjet.net

Themodelachievedapredictionaccuracyreflectedbya confusion matrix with 191 true negatives, 65 false positives, 14 false negatives, and 6 true positives, and an ROC curve with an AUC of 0.52, indicating moderate potential for practical deployment in financial and policy planningdomains.Despitehighaccuracy,themodel’sAUC score indicates weak per- formance in identifying recession periods. This highlights the needforresampling strategies (e.g., SMOTE, class weighting), additional features, or alternate architectures like ensemble models toimprovegeneralizabilityandrecessionsensitivity.

However, limitations remain in terms of generalization acrosssuddeneconomicshocks(e.g.,pandemicsorgeopolitical conflicts), which could be addressed in future work by incorporating additional global indicators or ensemble learningtechniques.

In conclusion, this research contributes both methodolog- ically and practically by leveraging deep learning, statistical rigor, and interactive visualization to address the growing need for proactive economic forecastingintheIndiancontext.

While the current model demonstrates a foundational frame- work for recession forecasting using macroeconomicindi-catorsandLSTMnetworks,thereare severalavenuesforenhancement:

1. Handling Class Imbalance:ImplementSyntheticMinorityOversamplingTechnique(SMOTE)orcost-sensitive training to improve the model’s sensitivity to rare recessionperiods,therebyincreasingAUCreliability.

2. Inclusion of Additional Variables: Future models could integrate variables such as unemployment rate, fiscal deficit, currency reserves, or PMI (Purchasing Managers’Index)toimproveexplanatorypower.

3. Cross-Country Transfer Learning: Leveraging recession-labeled data from other economies through transfer learning may enhance performance where Indian data aloneisinsufficient.

4. Model Explainability: Use SHAP or LIME to interpret which features most influence predictions, improving trustinblack-boxmodelsforpolicyuse.

5. Ensemble Modeling: Integrating Random Forests, Gra- dient Boosted Trees, or Transformer-based architectureswithLSTMcouldcapturenonlinearitiesmore robustly.

p-ISSN:2395-0072

6. Ethical and Economic Shock Considerations: Future work should also incorporate ethical assessments of automated forecasting in finance and adapt models for realtimeshocks(e.g.,pandemics,wars,supplychaincrises).

These enhancements could significantly strengthen the pre-dictivecapacityandpracticaldeploymentofrecession fore-castingsystemsfortheIndiancontext.

The authors affirm that all conceptual, methodological, and analytical components of this work were developed indepen-dently.Partsofthemanuscriptwererefinedusing AI-assisted writing tools to improve clarity and structure. No AI systems were used for generating data, analysis, or conclusions.

[1] E.S.Prasad, The Dollar’s Destiny: The Political Economy of American Money in a Multipolar World. Columbia UniversityPress,2024.

[2] T. Piketty and E. Saez, “Inequality in the long run: Capital, income, and wealth concentration,” Journal of EconomicPerspectives,vol.34,no.1,pp.3–28,2020.

[3] A. Vaswani and N. Shazeer, “Scaling laws for neural language models,” Journal of Machine Learning Research, vol. 21, no. 224, pp. 1–25, 2020. [Online]. Available:http://jmlr.org/papers/v21/20-074.html

[4] J. Yang, H. Wang, and B. Huang, “Deep learning for financial time series forecasting: A survey,” IEEE Access,vol.7,pp.102553–102566,2020.

[5] D. Andolfatto, A. Berentsen, and F. M. Martin, “Money, banking, and financial markets,” The Review of Economic Studies, vol. 87, no. 5, pp. 2049–2086, October 2020. [Online]. Available: https: //doi.org/10.1093/restud/rdz051

[6] C. Baumeister and J. D. Hamilton, “Advances in structural vector autoregressions with applications to oil price shocks,” Journal of Economic Literature, vol. 59, no. 4, pp. 1231–1271, December 2021. [Online]. Available:https://doi.org/10.1257/jel.20201574

[7] M. Rajput, “Can machine learning predict the indian recession?” 2023. [Online]. Available: https://www.researchgate.net/publication/ 372941135_Can_Machine_Learning_Predict_the_Indian_ Recession

International Research Journal of Engineering and Technology (IRJET) e-ISSN:2395-0056

Volume: 12 Issue: 05 | May 2025 www.irjet.net p-ISSN:2395-0072

[8] A. Birari and S. Kumar, “Predictive modeling of the it index: An in-depthstudyusingsarimaxandmarket indicators,” International Journal of Financial Engineering, vol. 11, no. 1, p. 2050003, January 2024.

[Online].

Available: https://doi.org/10.1142/S242478632050003X

[9] D. Jain, “Macro-economic trends prediction using machine learning,” in Emerging Technologies for Business, Industry, and Education. CRC Press, 2025. [Online]. Available: https: //www.taylorfrancis.com/chapters/edit/10.1201/97810 03501244-74/ macro-economic-trends-prediction-usingmachine-learning-divyansh-jain

[10] K. Rani, A. Latha, and V. Satish, “Forecasting global recessionandit’s likelyfallout onindia’seconomyusing machine learning techniques,” IEEE, 2024. [Online]. Available: https://ieeexplore.ieee.org/abstract/ document/10717620/

[11] S. Sharma and V. Kumar, “India’s ai revolution: Opportunities and challenges in talent, data, and innovation ecosystems,” Technology in Society, vol. 74, p. 102305, August 2023. [Online]. Available: https://doi.org/10.1016/j.techsoc.2023.102305

[12] N. Saini, H. Bhanawat, S. Taneja, A. Johri, and M. Asif, “Spic: A stock price indicator based on crises prediction using bi-directional lstm,” Quality Quantity, 2025. [Online]. Available: https://link.springer.com/article/10.1007/s11135-02502143-5

[13] G. Singh and I. Kularatne, “The impacts of artificial intelligence (ai) driven hiring processes on job applicants’ experience: A comparative study between new zealand and india,” SN Business & Economics, vol.5, no. 3, p. 22, March 2025. [Online]. Available: https://doi.org/10.1007/s43546-025-00793-z

[14] G. Cicceri, G. Inserra, and M. Limosani, “A machine learning approach to forecast economic recessions an italian case study,” Mathematics, vol. 8, no. 2, p. 241, 2020. [Online]. Available: https://www.mdpi.com/22277390/8/2/241

[15] J.Yang,H.Wang,andB.Huang,“Deeplearningforfinancial timeseries forecasting:Asurvey,” IEEEAccess,vol.7,pp. 102553–102566,2020.