Sample Read

© All rights reserved

Price : ` 695

Fourth Edition : January 2026

Published by :

Taxmann Publications (P.) Ltd.

Sales & Marketing :

59/32, New Rohtak Road, New Delhi-110 005 India

Phone : +91-11-45562222

Website : www.taxmann.com

E-mail : sales@taxmann.com

Regd. Office : 21/35, West Punjabi Bagh, New Delhi-110 026 India

Printed at :

Tan Prints (India) Pvt. Ltd.

44 Km. Mile Stone, National Highway, Rohtak Road Village Rohad, Distt. Jhajjar (Haryana) India

E-mail : sales@tanprints.com

Disclaimer

Every effort has been made to avoid errors or omissions in this publication. In spite of this, errors may creep in. Any mistake, error or discrepancy noted may be brought to our notice which shall be taken care of in the next edition. It is notified that neither the publisher nor the author or seller will be responsible for any damage or loss of action to any one, of any kind, in any manner, therefrom.

No part of this book may be reproduced or copied in any form or by any means [graphic, electronic or mechanical, including photocopying, recording, taping, or information retrieval systems] or reproduced on any disc, tape, perforated media or other information storage device, etc., without the written permission of the publishers. Breach of this condition is liable for legal action.

For binding mistake, misprints or for missing pages, etc., the publisher’s liability is limited to replacement within seven days of purchase by similar edition. All expenses in this connection are to be borne by the purchaser. All disputes are subject to Delhi jurisdiction only.

Module-wise Marks Distribution I-5

Previous Exams Trend Analysis (Syllabus 2022) I-7

Module-wise Comparison with Study Material I-13

SECTION A DIRECT TAXATION

MODULE 1 BASICS OF INCOME-TAX ACT

CHAPTER 1.1

MODULE 2 HEADS OF INCOME

CHAPTER

CHAPTER

CHAPTER

CHAPTER

MODULE 3 TOTAL INCOME AND TAX LIABILITY OF INDIVIDUALS AND HUF

CHAPTER

CHAPTER 6.3 VALUATION

CHAPTER 6.4

Ans.

Since Mr. Ratan does not own more than 10 vehicles at any time during the previous year 2025-26, he is eligible to opt for presumptive taxation scheme under section 44AE. `1,000 per ton of gross vehicle weight or unladen weight per month or part of the month for each heavy goods vehicle and `7,500 per month or part of month for each goods carriage other than heavy goods vehicle, owned by him would be deemed as his profits and gains from such goods carriage. Heavy goods vehicle means any goods carriage, the gross vehicle weight of which exceeds 12,000 kg.

Heavy Vehicles:

Other Vehicles:

The presumptive income of Mr. Sarath under section 44AE for A.Y. 2026-27 would be `5,08,500 [1,71,000 + 3,37,500] chargeable under the head ‘Profits and gains from Business or Profession’.

2.4

INCOME

FROM CAPITAL GAINS

A QUICK REVIEW

SECTION 45(1): BASIS OF CHARGE:

u Capital Asset

u Transfer

u Capital Gain: Short-term or Long-term

u Not Exempt u/s 54/54B/54D/54EC/54F/54G/54GA/54GB

SECTION 2(14) CAPITAL ASSET:

u Any kind of property

u Held by an assessee

u Whether or not connected with B & P

u Any Securities held by Foreign Institutional Investor which has invested in such securities in accordance with the regulations made under SEBI Act, 1992.

u Any unit linked insurance policy (ULIP) issued on or after 01.02.2021, to which exemption under section 10(10D) does not apply on account of:

n Premium payable exceeding ` 2,50,000 for any of the previous years during the term of such policy or

n The aggregate of premium exceeding ` 2,50,000 in any of the previous years during the term of any such policy, in case where premium is payable by a person for more than one ULIP issued on or after 01.02.2021.

u But does not include:

n Stock in trade (Not for securities held by FII’s)

n Personal effects: Movable property held for personal use (except: Jewellery, drawings, paintings, archeological collections, sculptures or any other work of art)

n Rural Agriculture land (Agriculture land in India not situated in: Area in the limits of municipality or cantonment board having a population of 10,000 or more OR Within 2 kms of limits of municipality or cantonment board having population of more than 10,000 but upto 1,00,000; within 6 kms if population more than 1,00,000 but upto 10,00,000 or within 8 kms if population more than 10,00,000).

n Gold bonds, 1977 or 1980 or National Defence Gold bonds 1980

n Special bearer bonds, 1991

n Gold Deposit Bonds, 1999 or Deposit certificates issues under Gold Monetisation scheme 2015 or 2018.

SECTION 2(47): TRANSFER:

It Includes:

Sale, Exchange or Relinquishment of capital asset

u Extinguishment of any RIGHT

u Compulsory acquisition

u Conversion of capital asset into stock

u Maturity or Redemption of Zero-coupon bond

u Possession of Immovable property u/s 53A of Transfer of Property Act, 1882

u Acquiring shares or membership of Housing Co-operative Society for enjoyment of immovable property.

SECTION 2(42B): SHORT-TERM CAPITAL GAIN:

Gain on short-term Capital Asset

SECTION 2(29B): LONG-TERM CAPITAL GAIN:

Gain on Long-term Capital Asset

SECTION 2(42A): SHORT-TERM CAPITAL ASSET:

If Holding period is upto 12/24 Months:

12 Months for following capital assets:

u Security listed in a recognized stock exchange

u Units of UTI/ Units of equity-oriented Fund

u Zero Coupon Bond

24 Months for following capital assets:

u Other assets

Explanation:

u Shares in Company under liquidation: Exclude period after the date of liquidation

u Property acquired u/s 49(1): Include the holding period of previous owner

u Shares in INDIAN Amalgamated Co.: Include holding period of shares in Amalgamating Co.

u Shares in INDIAN Resulting Co.: Include holding period of shares In Demerged Co.

u Equity shares in RSE (Company) in demutualization Scheme: Include holding period of membership in RSE when it was not a company

u Original/Right shares: Holding period from date of allotment

u Right to Subscribe for shares: Date of offer to Date or renouncement

u Bonus Shares: Holding period from date of allotment

u Specified shares or sweat equity shares: Holding period from date of allotment

u Units allotted in the consolidation scheme of mutual fund: Include holding period of units prior to Consolidation scheme.

u In case of Capital Asset, declared under Income Declaration Scheme, 2016: Holding period shall be reckoned from the date on which such property is acquired, if the date of acquisition is evidenced by a deed registered with any authority of state government. In any other case, the period for asset shall be reckoned from 01.06.2016.

u In case of conversion of physical gold to EGR or vice versa: The holding period for the purpose of capital gain shall include the period for which the Gold was held by the assessee prior to conversion into the Electronic Gold Receipt and similarly the holding period for the purpose of capital gain shall include the period for which the Electronic Gold Receipt was held by the assessee prior to conversion into the Gold.

SECTION A : DIRECT TAXATION

SECTION 2(29A): LONG TERM CAPITAL ASSET:

If Holding period is more than 12/24 Months.

Section 45(1A): Capital gain on Insurance claim received on destruction of capital asset because of:

u Flood, Typhoon, cyclone, earthquake or other natural disasters

u Riots or civil disturbance

u Accidental fire or explosion

u Action of enemy (with or without war)

n Year of chargeability: PY in which money or asset is received

n Sale consideration: Money + FMV of asset

n Indexation: Upto year of damage or destruction

Section 45(1B): Capital gain on ULIP Receipts:

u Any unit linked insurance policy (ULIP) issued on or after 01.02.2021, to which exemption under section 10(10D) does not apply on account of:

n Premium payable exceeding ` 2,50,000 for any of the previous years during the term of such policy or

n The aggregate of premium exceeding ` 2,50,000 in any of the previous years during the term of any such policy, in case where premium is payable by a person for more than one ULIP issued on or after 01.02.2021.

n Profit or gain on such ULIP shall be taxable in the year of receipt under 112A.

Section 45(2): Capital on conversion of capital asset into stock:

u Conversion before 01-04-1984: Not a transfer

u Year of chargeability: Year in which asset is sold

u Sale consideration: FMV on conversion date

u Indexation: Upto year of conversion

u Business Income: Sale Price LESS FMV on conversion date

Section 45(2A): Transfer of securities by depository (Demat a/c):

u Income will be of the beneficial owner

u Account wise FIFO method will be used

u Date of entry in to Demat account will be considered

Section 45(3): Capital gain on transfer of Capital Asset by Partner/member to Firm/AOP/BOI

Sale consideration: Amount recorded in Books

Section 45(4): Capital gain on transfer of a capital asset by Firm/AOP/BOI to Partner/Member:

Sale consideration: FMV of asset on transfer

Cost of Acquisition for partner/ Member: Value for which asset is transferred

Section 45(5): Capital gain on transfer by way of compulsory acquisition:

u Year of chargeability: Year in which 1st part of initial compensation received

u Indexation: Upto year of compulsory acquisition

u Enhanced compensation:(Fully taxable in the Year in which Enhanced compensation is received)

u If initial compensation received by Legal Heir: Taxable in hands of deceased

u If enhanced comp. received by legal heir: Taxable in hands of legal heir

u If compensation is reduced then capital gain will be recomputed u/s 155

Section 45(5A): Taxability of capital gains in case of specified agreement:

u Applicable to Individual/HUF who enters into a specified agreement for development of a project.

u Capital gain chargeable in the year in which the certificate of completion for the whole or part of the project is issued by competent authority.

u Consideration: Stamp duty value of his share being land or building or both, on the date of issue of completion certificate + Cash if any paid.

u This provision is not applicable where the assessee transfers his share in the project before completion certificate being issued. In such case taxability shall be in the year of such transfer and consideration shall be determined according to normal provisions.

Specified agreement: Registered agreement in which a person owning a land or building or both, agrees to allow another person to develop real estate project on such land or building or both, in consideration of a share, being land or building or both in such project, whether with or without payment or part of the consideration in cash.

SECTION 46: DISTRIBUTION OF ASSETS BY COMPANY IN LIQUIDATION:

u Transfer by Company: YES (if sold in market) and NO (If distributed to shareholders)

u Transfer for shareholder: YES (transfer of shares to company)

u Capital Gain: Money + Fair Market Value of assets on date of distribution

Less: Deemed dividend u/s 2(22)(c)

Less: Indexed cost of acquisition

SECTION 46A: CAPITAL GAIN ON BUY-BACK OF SHARES OR SPECIFIED SECURITIES BY COMPANY:

For Buy back of securities other than shares of domestic companies, capital gain shall be taxable for the holder as usual, but in case of buyback of shares of domestic company, any sum paid by company shall be treated as dividend income (Other Sources) and sale consideration shall be taken as NIL, resulting into Capital Loss.

SECTION 47: TRANSACTIONS NOT REGARDED AS TRANSFER:

u HUF ----- members (on partition)

u Transfer under gift, will, etc. (not acquired in ESOP) [upto A.Y. 2024-25]

SECTION A : DIRECT TAXATION

u Holding co. ----- 100% Indian subsidiary co.

u 100% subsidiary ------ Indian holding co.

u Amalgamating Co. ------ Indian amalgamated co.

u Foreign amalgamating co. ----- foreign amalgamated co.

n Only Indian co. Shares

n 25% Shareholders remain same

n Not taxed in country of foreign amalgamating co.

u Amalgamating Banking co. ----- Amalgamated Banking institution

u Demerged co. ----- Resulting Indian Co.

u Foreign demerged co. ---- foreign resulting co.

n Only Indian co. shares

n Shareholders holding 75% value remain same

n Not taxed in the country of foreign demerged co.

u Predecessor Co-operative Bank ---- successor co-operative Bank

u NO TRANSFER For shareholders of Amalgamating co., demerged co. or predecessor co-operative Bank

u Non-resident ----- Non-resident (Bonds/Global Depository Receipts/Shares of public co. bought in FC)

u Transfer of agriculture land in India before 01-03-1970

u Transfer to Art gallery, etc.

u Bond/ Debentures/Debenture stock ---- converted into Shares/Debentures

u Transfer of land of sick industrial co.

u Firm ---- Company

n All assets and liabilities are transferred

n All partners will remain in same proportion in capital account

n Consideration in shares only

n Partners held atleast 50% voting power till 5 years

u Sole proprietorship ---- company

n All assets and liabilities are transferred

n Consideration in shares only

n Proprietor holds atleast 50% voting power till 5 Years

u Pvt. Co./ Unlisted Public co. ---- LLP

u Shareholders of Pvt. Co. or unlisted Public Co. ---- share in LLP

n All assets and liabilities are transferred

n All shareholders become partners in LLP

n Capital proportion and profit-sharing ratio will remain same

n Consideration to shareholders only by way of profit share and capital contribution

n Shareholders shall hold atleast 50% profit share till 5 years

n Turnover in 3 PPY should not be more than 60 Lakhs

n Total Assets in 3 PPY should not be more than 5 Crore.

u Transfer in scheme of lending of securities

u Transfer of units by unit holders on consolidation of plans within a mutual fund scheme not to be regarded as transfer.

u Redemption by an individual of Sovereign gold bonds issued by RBI not to constitute transfer

u Transfer by borrower in the scheme of reverse mortgage.

u Transfer of Government Security outside India by a Non-Resident to another Non-Resident.

u Transfer of units by a unit holder in the consolidation scheme of mutual fund in lieu of allotment of new units in the scheme.

u Transfer of a capital asset, being physical gold to the Electronic Gold Receipt issued by a Vault Manager or such Electronic Gold Receipt to physical gold shall not be considered as ‘transfer.

u Transfer of a capital asset (being an interest in a joint venture held by public sector company) in exchange of shares in a company incorporated outside India by a foreign company will not be treated as transfer.

SECTION 47A: CONDITION FOR WITHDRAWAL OF EXEMPTIONS U/S 47:

(1) Holding to 100% subsidiary and vice versa:

u If capital asset is converted into stock in 8 years OR

u 100% holding is ceased within 8 years

n Capital gain chargeable in the hands of transferor

n Capital gain: Price of transfer LESS Cost of Acquisition

n Year of chargeability: Year of transfer

n Section 45(2) applicable

(2) Firm/proprietorship to Company, Pvt. Co./unlisted public co. to LLP If conditions of section 47 breached

SECTION 48: COMPUTATION OF CAPITAL GAIN:

Sale consideration

LESS: Transfer exp.

Cost of Acquisition/Cost of Improvement

LTCG/STCG

LESS: u/s 54/54B/54D/54EC/54F/54G/54GA/54GB

Taxable LTCG/STCG

u STT not allowed as deduction

u The cost of acquisition or the cost of improvement shall not include the amount of interest claimed u/s 24 or Chapter VIA.

Note: Resident Individual and HUF is given the option to claim benefit of indexation on Long-term Land and Building acquired before 23.07.2024 and transferred on or after 23.07.2024, but this shall be only at the time of computation of tax. In total income LTCG will be included without indexation only. If the option is exercised than tax rate shall be 20% instead of regular 12.5%.

Calculation of Indexation:

u If acquired by assessee himself: COA × CII of Year of transfer CII of Year of Acquisition

u If received u/s 49(1): COA of previous owner × CII of year of transfer CII of Year when previous owner purchased the asset

Note: CII = Cost Inflation Index

n If Asset acquired or held by Assessee or previous owner before 01-04-2001 then CII of 2001-2002 will be used.

Proviso 1: Method of calculating capital gain for NR: (exemption can be claimed u/s 115F)

u Shares/ Debentures of Indian company bought in FC

u Calculate Capital Gain in Foreign Currency (in which asset purchased) and then convert into Rupees

u Rupee appreciation gains on redemption of Rupee denominated Bonds issued outside India shall not be included in the full value of consideration

u Rates to be used:

n For Cost of Acquisition: Avg. TT buying and selling rate ----- as on date of acquisition

n For transfer expense: Avg. TT buying and selling rate ----- as on date of transfer

n For Sale consideration: Avg. TT buying and selling rate ---- as on date of transfer

n For Capital gains ----- TT buying rate ----- as on date of transfer

Section 49: Cost of Acquisition in certain cases:

u Section 49(1): Under gift, will, succession, inheritance, in liquidation, member to HUF, under trust, cases not transfer u/s 47: COA is cost of previous owner (who actually paid for the asset)

u COA of sweat equity shares: FMV taken for perquisite

u COA for Assets which have been declared under the Income Declaration Scheme, 2016 and on which tax, surcharge and penalty have been paid according to the scheme: FMV of the asset taken into consideration for the purpose of the scheme.

u COA for property received in gift: value taken for that section

u COA of units allotted in the consolidation of scheme of mutual fund: Cost of original units

SECTION 50: COA AND CG FOR DEPRECIABLE ASSET:

Always Short-Term Capital Gain: Physical block exhaust or accounting block exhaust

Short-Term Capital Gain: Sale value LESS (Opening WDV + purchase)

SECTION 50A COA AND CG FOR ELECTRICITY COMPANY:

Long-Term Capital Gain/ Short-Term Capital Gain: Sale value LESS Actual cost

SECTION 50AA CAPITAL GAINS IN CASE OF MARKET LINKED DEBENTURES:

Where capital asset being:

u Unit of a Specified Mutual Fund acquired on or after 01-04-2023

u Market Linked Debentures

u Unlisted bonds and unlisted debentures which is transferred or redeemed or matures on or after 23.07.2024,

u Capital gain shall be taxable as STCG irrespective of Holding Period at regular rate of tax.

Notes:

(1) Market Linked Debenture means a security by whatever name called, which has an underlying principal component in the form of a debt security and where the returns are linked to market returns on other underlying securities or indices and include any security classified or regulated as a Market Linked Debenture by the SEBI

(2) Specified Mutual Fund means a Mutual Fund by whatever name called, where not more than 35% of its total proceeds is invested in the equity shares of domestic companies. The percentage of equity shareholding held in respect of the Specified Mutual Fund shall be computed with reference to the annual average of the daily closing figures.

SECTION 50B: CG IN SLUMP SALE:

Lump sum sale value LESS Net worth of undertaking.

u For long-term Holding period should be more than 36 months

u Holding period of undertaking will be considered for Long-Term Capital Gain or Short-Term Capital Gain

u Net worth: Total of assets LESS liabilities

u Fair Market Value shall be deemed to be the sale consideration if Sale consideration is less than FMV.

SECTION 50C: DETERMINING FULL VALUE OF CONSIDERATION ON TRANSFER ON LAND & BUILDING BOTH:

u If sale consideration is less than stamp duty value: Stamp duty value shall be taken as sale consideration

u When AO may refer to valuation officer:

n If assessee claims that stamp duty value > FMV and when such case is not under appeal/revision/reference

2.148

SECTION A : DIRECT TAXATION

u Sale consideration after receiving valuation report: Stamp value or value of report WEL

u If date of agreement and date of transfer are not same then Stamp Duty value on the date of Agreement shall be considered, provided that whole or part of consideration should be paid by account payee cheque/bank draft or ECS through bank account on or before the date of agreement.

Note: However, if stamp duty value doesn’t exceed 110% of such consideration then actual consideration shall be deemed to be the full value of consideration.

SECTION 50CA: DETERMINING FULL VALUE OF CONSIDERATION ON TRANSFER OF UNLISTED SHARES:

If consideration is less than FMV than, FMV shall be taken as the consideration

SECTION 50D:

When sale consideration cannot be determined then FMV shall be sale consideration

SECTION 51: ADVANCE MONEY RECEIVED:

u Deduct form Cost of Acquisition before indexation (if received before 01.04.2014)

u Advance money recd. by previous owner will be ignored

u Never deduct advance money from cost of improvement

u Excess of advance money over COA is not taxable

u Where any sum of money received as an advance or otherwise in the course of negotiations for transfer of a capital asset, has been included in the Total income of the assessee for any Previous Year, then such amount shall not be deducted from the Cost of Acquisition. (if received on or after 01.04.2014)

SECTION 55A: REFERENCE TO VALUATION OFFICER FOR CALCULATION OF FAIR MARKET VALUE:

u If claimed value is estimated by registered valuer: Fair Market Value as per AO > such value

u In any other case: Fair Market Value as per AO > claimed value by 15% of claimed value or by ` 25,000 (WEL) OR

u Having regard to the circumstances it is necessary to do so.

SECTION 55(1)(B): COST OF IMPROVEMENT:

u Goodwill of business, right to manufacture any article, right to carry on business: NIL

u Other assets: Capital expense incurred by assessee himself or previous owner (if asset acquired u/s 49(1))

u Expense incurred before 01-04-2001: IGNORE

SECTION 55(2): COST OF ACQUISITION:

u Goodwill of business of profession, right to manufacture any article, right to carry on business, tenancy right, trade mark or brand name, stage carriage permits, loom hours:

n Purchased: Purchase price

n Self-generated: NIL

n Acquired u/s 49(1): Cost of previous owner (self-generated: NIL)

u Original shares: Actual amount paid

u Bonus shares: NIL (if allotted before 01-04-2001 then FMV on 01-04-2001)

u Right to subscribe shares: NIL

u Right shares: Actual amount paid

u COA for person who purchases right to acquisition: Price paid to Co. + price paid to seller of right

u Equity shares acquired in demutualization of stock exchange: COA of membership of stock exchange

u Cost of Acquisition of trading or clearing rights: NIL

u For Other Assets:

n If acquired by assessee or previous owner before 01-04-2001: FMV on 01-04-2001 can be opted

n In case of a capital asset, being land or building or both, the fair market value of such an asset on 01-04-2001 shall not exceed the stamp duty value of such asset as on 01-04-2001 where such stamp duty value is available.

Cost of Long-term capital assets referred in section 112A:

Cost of long-term capital asset being:

(A) Equity shares of listed company on which STT is paid both at the time of purchase and transfer or

(B) Units of equity-oriented fund or units of business trust on which STT is paid at the time of transfer.

If acquired before 01.02.2018 than cost of acquisition shall be higher of

(i) cost of acquisition of such asset and

(ii) lower of

u Fair market value of such asset or

u Full value of consideration received or accruing as a result of transfer of capital asset.

Fair market value means:

If listed on stock exchange on 31.01.2018:

Traded on 31.01.2018: Highest price on that date.

Not traded on 31.01.2018: Highest price on last traded date.

If units are not listed on stock exchange on 31.01.2018: Net asset value.

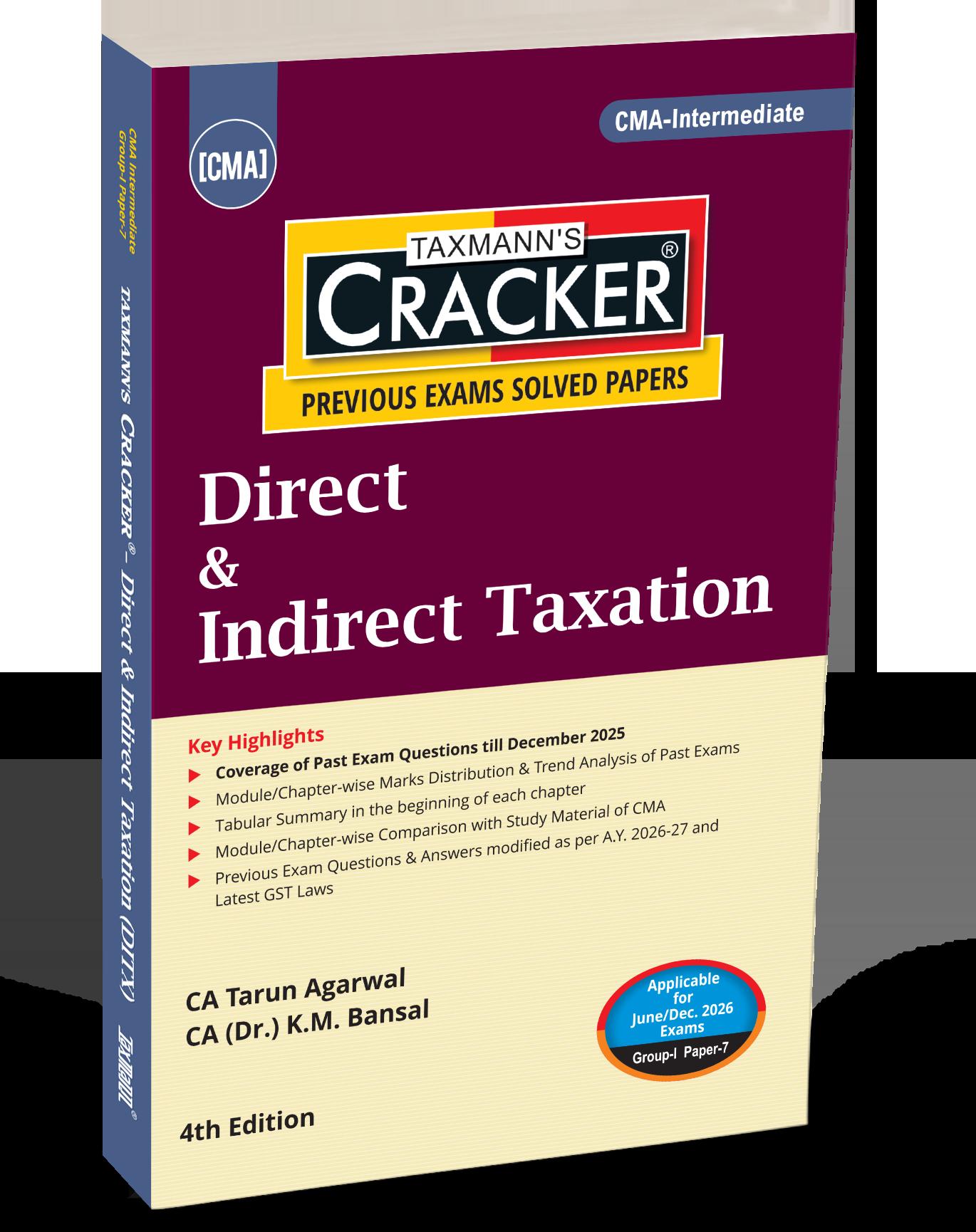

DIRECT & INDIRECT TAXATION

(DITX | DT & IDT) | CRACKER

AUTHOR : Tarun Agarwal, K.M. Bansal

PUBLISHER : Taxmann

DATE OF PUBLICATION : January 2026

EDITION : 4th Edition

ISBN NO : 9789375613329

NO. OF PAGES : 628

BINDING TYPE : Paperback

Rs. 695

DESCRIPTION

Direct & Indirect Taxation – CRACKER is a focused, exam-oriented compilation of fully solved past examination questions for CMA Intermediate – Group I | Paper 7, structured strictly in accordance with the CMA Syllabus (2022 onwards) and the Institute's examination pattern. Designed as a strategic preparation and revision tool, the book enables students to master taxation through question-based learning, examiner-aligned solutions, and trend-based topic prioritisation. The Present Publication is the 4th Edition for the June/Dec. 2026 Exams. It is authored by CA. Tarun Agarwal & CA. (Dr) K.M. Bansal, with the following noteworthy features:

• [Complete Past Examination Coverage] Includes all relevant MCQs, theory, and practical questions asked in CMA Intermediate examinations up to December 2025, arranged module-wise and chapter-wise as per the CMA syllabus.

• [Module-wise Marks Distribution & Trend Analysis] Dedicated analytical sections highlighting question frequency, compulsory questions, marks weightage, and question categories, helping students identify high-scoring and repeatedly tested areas.

• [Chapter-opening Tabular Summaries] Each chapter begins with a concise tabular snapshot covering:

o Core provisions

o Frequently examined concepts

o Practical application focus

o Facilitates quick revision and pre-study orientation

• [Examiner-oriented Solutions] Answers are presented in a stepwise, presentation-focused format aligned with CMA evaluation standards, emphasising:

o Proper working notes

o Logical sequencing

o Accurate statutory references

• [Updated for Latest Law] All solutions are revised in line with:

o Income-tax provisions applicable to A.Y. 2026-27

o Latest GST law, including ITC, valuation, registration, returns, and compliance

o Current Customs law provisions relevant to the CMA syllabus