The City of Cape Town has announced plans to replace its current validators in its buses and at the stations from the beginning of December until the end of January next year. According to the City these devices will be able to support modern and convenient payment methods in future. The replacements will be done in phases, starting on Tuesday 2 December until Friday 30 January next year, if all goes as planned.

“Our validators at the MyCiTi stations and on the buses are reaching the end of their life and, much like a mobile phone that needs to be replaced after a certain period, we now need to replace these validators with the more modern version. For now, the new single validators are replacing the old separate “IN” and “OUT” ma-

chines on the buses and streamlining the boarding process for commuters,” said the City’s Mayco member for Urban Mobility, Rob Quintas.

All work is planned for after hours and during off-peak times to minimise the disruption for commuters.

From Tuesday 2 December, commuters will notice replacement validators are activated at one station gate at the Stadium, Granger Bay, Refinery, Sandown and Janssens stations Around Thursday 4 December replacement validators will be activated on the first 10 buses.

Customers may encounter a mix of old and new validators while the installations are still under way and commuters are encouraged to use the old separate IN and OUT validators.

The City will be changing validators in its buses and stations from the beginning of December

At stations customers should continue to tap in and tap out on any old validator or replacement validator in order to enter or exit. These devices were also being used to replace info terminals at all stations where commuters view their card balance and transaction history.

6530

thulani.magazi@novusmedia co.za or unathi.obose@novusmedia.co.za

shafiek.braaf@novusmedia.co.za

gurshwin.heinze@novusmedia.co.za

alexandra.fortuin@novusmedia.co.za

thulani.magazi@novusmedia.co.za

Novus Media

mediaombud@novusmedia co.za

www cityvision.co.za facebook.com/City Vision Live x.com/Cityvisionlive 067 495 2886 (News

UNATHI OBOSE

Members of various men’s organisations in Khayelitsha and surrounding areas held a men’s dialogue to discuss issues affecting them

The event, held at Harare Library in Khayelitsha on Wednesday 19 November, was organised by the Western Cape Department of Social Development (DSD). The organisations included Amadoda Aqotho, Fathers Connect Foundation and Sakh’ indoda Community Organisation.

The event coordinator and DSD probation officer Makhaya Jezile described the

event as part of celebrating International Men’s Day. He said the aim is to empower and educate men about their roles not only in their homes, but in the community at large.

Jezile said they also encouraged men to speak out instead of bottling things up.

“This is also a platform for men to share their experiences. We know that in many instances men are the ones who are always on the wrong side. Some of them have issues of substance abuse, perpetrators of gender-based violence, crime, rape and so on. We want to hear the root cause of all these things and come up with solutions. It

is a man-to-man conversation.”

He also spoke about absent fathers, something he said is destroying many families Jezile emphasised not all perpetrators of crime come from poor families.

“In many cases boys who are raised by their mothers always see her as their role-model. They develop an anger against their fathers.”

Themba Baleni, the founder of the Fathers Connect Foundation, described his organisation’s role as giving hope, championing changes in perception and the way that men do things “We are dealing more with mental health. We want them

to change their way of thinking and stop using their masculinity to bully the female We encourage men to walk away from trouble or keep quiet,” said Baleni Local resident Michael Tshayisa described the event as educational, a session that provided much motivation. He said it was easy for men to share their feelings and stories under one roof.

“I separated from my girlfriend of 18 years last year. She went back to her ex-boyfriend And bear in mind we already have three children. I was going crazy, but fortunately I didn’t attack her I got comfort from friends and neighbours.”

UNATHI OBOSE

For the first time in its history the Khuseleka Neighbourhood Watch in Ward 96, in Mkhaza, Khayelitsha, has been recognised by the City of Cape Town, having received a Neighbourhood Watch Service Excellence Group award.

The Awards were held at the Civic Centre in Cape Town on Saturday 22 November

The Khuseleka NHW chair Lazola Somazembe said the award came as a surprise because its members had not expected to receive anything. But, he added, with hard work everything is possible.

“We are happy, I don’t want to lie. The certificate motivates us to do more now

The fact that there are people who see and recognise what we are doing makes us feel so special. We will keep going.” Somazembe added the job the Watch is doing is not for the faint-hearted. He described the dangerous conditions it works in, and that

members need more protective working equipment.

“We are just volunteers. We are getting no stipend from the City. We only have jackets, touches, bicycles and bibs only. Even they are not enough. Some of our members don’t have them but they are working. If we can have enough equipment we can be happy.” Somazembe said Khuseleka NHW had 22 members only.

Harare Police Station sector commander on Sector Two Sgt Thembinkosi Mapongwana, who works with Khuseleka, said the certificate meant a lot to crime fighters in the area

“These are the people who are always on the ground fighting crime,” he said. “Sometimes they experience things first-hand. They are dedicated to their job. For them to be honoured is a great achievement on its own.”

Ward 96 councillor Lucky Mbiza urged community members to work with the

NHW instead of disrespecting them.

“Some of the community members don’t take NHW members seriously. Others think that they are informants for the officers, which is wrong The NHW is working closely with the officers. If people are expe-

riencing any problem they can inform the members of NHW and they will contact the [patrolling] police van.”

He also congratulated Khuseleka on the receiving the award, seeing it as the start of many good things to come.

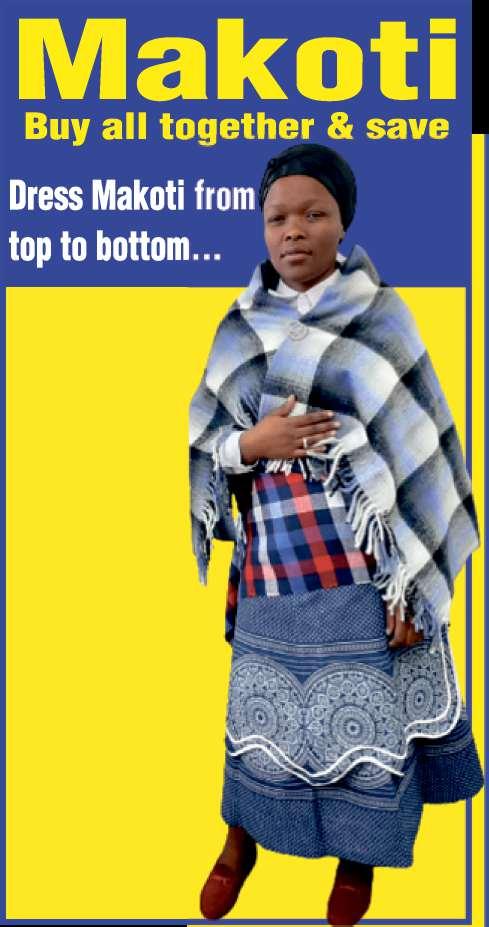

A new South African National Civic Organisation (Sanco) Philippi Zonal leadership was elected at a two-day conference, held at Mzamomhle Primary School hall in Brown’s Farm, on Saturday 22 and Sunday 23 November.

The conference sought to resurrect the long-standing civic organisation, which had become dysfunctional and hamstrung by much in-fighting.

Newly elected chair Anele Madondile described the new leadership as a structure that would “serve the people”.

He said their priority is to restore the hope and dignity of the community

The Sanco Philippi Zonal comprises of 19 branches with community elected structures.

Madondile said the organisation aims to ensure service delivery for the local community. “We have the challenge of crime in Philippi, which has a negative impact on the City’s provision of service delivery in our communities. Sometimes City employees are robbed when they come to work in our areas, which makes it difficult for the services to reach our people.

As Sanco members, we have an obligation to intervene on that and ensure we root out the criminal elements in our areas.”

Elaborating on the resolutions of the conference, Madondile said it is to fight crime and revive the Philippi Development Forum (PDF), and to coordinate developments in the area

Highlighting some of the challenges facing the civic organisation, Madondile said a few individuals within the organisation used it for personal gains.

He vowed that they will closely monitor any action within the organisation. “Sanco is a community organisation. It was established to service the needs of the community. But we’ve seen some leaders once they have a problem with their political organisations they use Sanco members to fight their political battles.”

He added that the organisation’s mandate is clear; to fight for the betterment of the community, working with ward councillors to this end.

New leaders of SANCO Philippi Zonal are Felicia Mafumana (deputy chair), Nomnde Maxhegwana (secretary), Thelela Nkqayi (deputy secretary), Bukela Nelisane (treasurer) and Sibusiso Dalasile (organiser).

Some of the new elected leadership of SANCO Philippi Zonal: From left: Nomonde Maxhegwana (secretary), Thelela Nkqayi (deputy secretary), Anele Mandondile (chair), Felicia Mafumana (deputy chair), Bukela Nelisane (treasure) and Sibusiso Dalasile (organiser)

PHOTO: SUPPLIED

Lwandle police officers registered a murder case after a woman was gunned down by unknown people at Ndzuzo Street in Nomzamo on Wednesday 19 November. The incident occurred at 19:30.

Police spokesperson Sgt Mthokozisi Gama said a preliminary report indicated that a 29-year-old woman was on her way from work when she was shot and killed by unknown men who then fled the scene

“The woman was declared dead on the scene by medical personnel. The motive for the killing is subject to investigation at this stage.”

Ward 86 councillor Xolani Diniso described the incident as terrible, saying it happened on the eve of 16 Days of Activism for No Violence against Women and Children. “This shows crime is high in our communities and we need to deal with it decisively. Our women and children are not safe. We are appealing to anyone with information on the incident to report it to the nearest station Lwandle is becoming a crime zone But our officers are trying their best to fight it.”

He urged the men to stand up and cleanse their bruised image.

“Our image (as men) has been tarnished by thsse hooligans, who rape and kill wom-

en and children. We no longer are respected or trusted by our women and children because of the few individuals who are doing wrong.”

Having lost her first leg at just one year old, prosthetics have given her a second chance at a full life.

Nokuthula Yonke (24) from Lansdowne faced a difficult upbringing Raised in foster care, and born with spina bifida, Princess Nonny, as she is affectionately known, has overcome much adversity in her short two decades

“I was born with level four spina bifida I was born with both legs, but due to my disability my health had been going up and down I lost my first leg when I was a year and six months, and now I am a double below-theknee amputee,” she says She has been a patient of the Orthotic and Prosthetic Centre (OPC) Pinelands for almost 20 years, having received her first prosthetic leg at the age of five through an outreach clinic to Maitland Cottage Hospital in the early 90s

With the help of these prostheses, the Lansdowne local has gone on to compete in pageantry earning 1st Princess of Miss Wheelchair South Africa 2021 and playing professional international sport in provincial and national colours in wheelchair basketball, shotput, discuss and adaptive surfing, among other achievements She is also a fulltime student

“Prosthetics has improved my life so much as an athlete and a part of society I can do so many things I never imagined I could

do, such as hiking and walking more than 10-20km from one place to another I am able to ride the bike in the gym, pick up weights These are all the things I used to see on Instagram reels growing up and never imagined I would be able to do,” she says

She receives ongoing care, with pin lock prostheses made to fit her active lifestyle

On Wednesday 5 November, we observed International Prosthetics and Orthotics Day, aimed at creating awareness and celebrating the role played in empowering those with disabilities November is also Disability Awareness Month

Mr Bongani Mlambo, Facility Manager at OPC Pinelands, says they treat a variety of ailments in the management of disability, pain and injury

“The Orthotic and Prosthetic Centre in Pinelands is the only Western Cape Department of Health and Wellness centre that services the province with orthotic, prosthetic and footwear services, excluding the Eden region where these services are outsourced to a private service provider The Orthotic and Prosthetic Centre currently operates 122 outreach clinics across 21 different locations,” he says

The centre works on referrals from a number of hospitals and facilities across the province and treat patients with ailments and injuries including scoliosis, spina bifida, cerebral palsy, stroke, or spinal cord injury, clubfoot, hip

dysplasia, athletes with injuries such as ankle sprain or shin splint, diabetic foot, arthritis, amputations, trauma, chronic pain management and other foot deformities

The facility manufactures aides from scratch, specially customised to the need and body of the patient They also offer ready to purchase aides procured from a local supplier

The centre treats both adults and children from eight weeks old

OPC Pinelands treats patients on referrals only For orthotic services, patients are referred from community health care centres, primary health care centres, community organisations, geriatric services, insurance providers, government organisations, pediatric services, private and non-profit organisations For prosthetic services you need a referral from the Western Cape Rehabilitation Centre Amputation clinic or Groote Schuur Hospital Amputation clinic

As South Africans gear-up for Black Friday on 28 November, the National Financial Ombud (NFO) urges consumers to think twice before swiping their way into a financial hangover

While seasonal discounts may offer short-term appeal, the longterm consequences of overspending on credit, including high-interest debt and depleted savings, can undermine essential financial goals and lead to post-holiday hardship

The NFO has also cautioned that digital fraud tends to spike during the year-end holiday season

Nerosha Maseti, Credit and Banking Division Lead Ombud at the NFO, said Black Friday, known for massive sales and long lines, is a shopper’s adrenaline rush with jaw-dropping discounts, limited-time offers and the thrill of snagging the perfect deal “But beneath the buzz lies a financial minefield Swipe-happy spending can spiral into credit-card chaos and lurking digital scams are ready to pounce when vigilance slips To win the day truly, smart shoppers arm themselves with a plan, stay sharp online and keep their budgets on lockdown ” Impulsivespending

Many South Africans use credit to fund Black Friday purchases, but impulsive spending can lead to unmanageable debt Maseti said the risks of such expenditure include high-interest credit card

balances or short-term loans, depletion of savings intended for essential goals like home ownership, education or emergencies and financial strain after the holiday season, when unexpected credit card or loan repayments become due, leaving consumers with limited funds for essential living expenses

She advised consumers to set a spending budget and stick to it; prioritise long-term financial goals over seasonal bargains; and keep credit balances low

The NFO also sounded the alarm on a surge in credit-card scams Fraudsters tend to zero in on Black Friday shoppers using non-bank and store-branded credit cards, especially those tied to big-name retailers

“These criminals contact cardholders by phone,” Maseti warned, “impersonating representatives from these companies, and deceive unsuspecting consumers into revealing their confidential One-Time Pins (OTPs) to make unauthorised purchases at large merchants, leaving victims responsible for charges

“While this scam has been known in traditional banking circles for many years its rising prevalence in the non-bank credit card market is deeply concerning The NFO is worried such fraud will escalate over Black Friday with high transaction volumes and increased consumer activity

“It is crucial for cardholders to

remember that no legitimate company will ever ask them to share confidential information such as card numbers, passwords, or OTPs ”

A recent case investigated by the NFO revealed a new trend, with the consumer losing R120 000 after responding to a social media advert offering discounted airline tickets

After submitting her phone number and email via a link she was contacted through WhatsApp and instructed to download an app from the Google Play Store to access promo codes Though the link appeared secure the app was fraudulent and embedded with malware

Soon after installation the consumer’s phone began overheating and behaving erratically

The unexpected activation of the camera’s green light raised immediate concerns On checking her banking app the consumer discovered two unauthorised transactions and swiftly reported the incident to both her bank and the police

Despite her prompt action within just 27 minutes after the transactions,the bank denied liability, citing that the payments had been authorised via selfie-authentication on her trusted device The consumer escalated the matter to the National Financial Ombud (NFO), seeking a full refund Following investigation the NFO found that the funds had

already been utilised before the fraud was reported, leaving no opportunity for recovery Also, the bank provided evidence that biometric authentication was used to approve the transactions

Based on the specific facts of the complaint, it was evident that the compromise originated from the consumer’s interaction with a fraudulent third-party app, which contained malware capable of remote access and biometric simulation

Maseti said no proof was provided that the transactionshad taken place as a result of maladministration or safety and security failures on the part of the bank “By downloading the fraudulent app, the consumer essentially handed over her phone,” she said, “including all the information stored on her phone, to the criminals and this resulted in the fraud

The NFO accordingly could not conclude that the bank was liable for the consumer’s loss ”

Anti-fraudtips:

. Never share your OTP with anyone, even if they claim to be from your credit provider

. End suspicious calls immediately and contact your credit provider directly using an official phone number and not the number provided by the scammers

Bescepticalofsocialmediapromotions.

. Verify legitimacy: Check official airline websites or verified social media accounts before engaging

. Avoid sharing personal info: Never post your phone number or sensitive details publicly

Thinktwicebeforedownloading apps

. Use trusted sources – only download apps from verified developers with strong reviews and a high download count

Monitoryourbankaccountsclosely

. Check transactions daily, especially after suspicious activity

. Report fraud immediately to your bank and file a police affidavit if needed

Consumers facing challenges are encouraged to contact the NFO on tel: 0860 800 900 or email: info@ nfosa co za

See pages 12 and 13

As the nation gears for another Black Friday spending, City Vision reached out to Capetonians to get their take, plans and preparations for the day.

.Nokuphiwo Phantsi from Island informal settlement in Makhaza said Black Friday means nothing to her She said she sees no difference in prices. “Looking at the prices, I see no difference to food prices. You will find that some items decrease with a few cents, not even a rand,” Phantsi

.Tholeka Mthini, also from Island informal settlement, has mixed feelings about Black Friday. She said there are some items that are cheaper but others are still the same price. “On food there are some items that you get at a cheaper price, but when you buy clothes there is little change in terms of prices. It is worse on electrical appliances,” she stated.

.Khanyisa Ncediwe, another Island informal settlement resident, differed from her friends. She said that a lot of things are cheaper on Black Friday “I’m looking forward to it. I can’t wait. I want to buy certain items on Black Friday. Even this coming Friday I’ll make sure that I get something for my children. There is a lot that you get with little money,” she said.

.Avumile Dywili: “For me Black Friday is mostly hype. Every year you see people rushing, but the discounts are not that impressive. I do not think it is worth stressing over I am skipping it completely this year because I would rather save for December.”

.Luvo Totana said: “I think Black Friday can be worth it, but only if you go in with a plan.

“Sometimes the specials look big, but when you compare prices it is not always a real saving. I am only buying small things I actually need, such as toiletries. I am not planning to overspend this year.”

Two thirds of South Africans (64,3%) are relying on significant Black Friday deals on groceries and food to take the edge off what has been one of the toughest years financially for households across the country.

This is the disturbing reveal from a survey conducted by the country’s leading debt counselling company Debt Rescue, to ascertain the mindset of consumers, ahead of this year’s major pre-festive season shopping event on Friday 28 November While Black Friday has grown far beyond a single day of deals, since first bursting onto the retail scene in South Africa in 2012, driven by online retailers such as Takealot, it has since evolved into a shopping “season” that encompasses Cyber Monday on 1 December – setting the tone for the festive holiday retail experience – and generating a real sense of excitement and expectation among consumers over the past decade

This year it seems that sentiment has shifted, with a sizeable segment of South Africans now viewing Black Friday through a vastly different lens, having battled their way through another turbulent year of financial stress and strain, driven by relentless price increases and (still) high interest rates

“Insights from the survey we conducted are deeply concerning, showing that more than half of our participants cannot afford Black Friday shopping at all this year,” said CEO of Debt Rescue Neil Roets, “with as many confessing that the shopping event and the advertising campaign around it have become a source of financial pressure and potential debt, and no longer engenders excitement ”

The survey results showed 50,38% of those polled believe Black Friday pushes people into unnecessary debt, while 25,3%

feel stress or pressure to buy what they cannot afford

It’saboutsurvival

Roets said for most consumers this major shopping event was no longer about being able to splurge on little luxuries once a year, but rather to provide them with short-term relief by saving on essential items they need to stock the grocery cupboard and, at the same time, free up a little cash to spend on a special festive season meal for the family

This is the time of year when consumers are bombarded with relentless Black Friday advertising, making it difficult to resist impulse purchases However, insights from the Debt Rescue survey indicate that this year will be different, more than half of those polled (58,3%) saying they would buy only essentials such as food and household items

The survey results showed that, although a significant number of people intended to participate in Black Friday despite their economic challenges, they would largely spend on food and groceries while 19,9% would look for deals to help them afford clothing and school uniforms for the year ahead

In addition, survey outcomes showed respondents would avoid incurring new debt at all costs, even for discounted items, 60,9% opting to pay for their Black Friday purchases using either cash or their debit cards only, and only 3,5% saying they will use credit “This tells us that consumers are going to act with extreme caution this year when it comes to emptying their wallets,” Roets explained “People are really feeling the pinch, and I believe this is being driven by a fear of getting into even

more debt

‘With the average citizen now spending around 80% of their income servicing debt every month, and millions more unable to afford even the basic necessities, this is understandable and commendable ” Aquietercrisis

“It’s no secret that financial stress is eroding the peace of mind of millions of people across the country,” Roets pointed out “Worrying about how to put enough food on the table for your family, or whether you will be able to meet your debt repayments every month, deeply impacts the emotional health and overall well-being of human beings and, by all indications, the pressure of retail events like Black Friday seems to be exacerbating this ”

Findings from the newly released 2025 Cumulate Financial Resilience Index substantiate this, showing that 29% of South Africans report money pressure harming their mental health, while 42% constantly worry about their finances

Released by independent financial behavioural specialists, Cumulate identifies “financial stress syndrome” as a widespread condition affecting even well-educated, high-earning South Africans The index explained it as a state of “middle-class poverty” that had a profound impact on health, relationships and wealth-building capabilities

“It’s a quiet crisis inside the minds of people,” Gary Kayle, CEO of Worth, a local financial education brand, said in a recent interview with Jeremy Maggs for Moneyweb@Midday

“With many households on the brink of financial ruin, ” said Roets, “and millions more barely able to live from paycheck to paycheck, the sad truth is that South

Africans will be forced to use their credit facilities over the December holidays, just to enjoy some kind of festive cheer, even if this means serving up three nutritious meals for the family

“My advice to those who have fallen into a debt trap is to seek help from a registered debt counsellor who can assist them to manage their financial predicament This has been a very successful solution for thousands of consumers who are plagued by over-indebtedness ”

Winners of the different leagues in the rugby competitions of the Western Province Rugby Union attended the awards evening on Wednesday 19 November at Kelvin Grove in Newlands.

The event brought to a conclusion the official 2025 season and clubs can now concentrate on pre-season training before the festive season, a short break, before it is back to full training in January

The event was a combined celebration of winners of 2024 and 2025 as no trophies were handed out last year

This meant that last year’s winners could only pose with the trophy

Special awards were handed out to Grant Albertyn of Kuils River Rugby Club and Neels du Toit of Helderberg Rugby Club who both passed on

Not only clubs were rewarded for their

efforts on the rugby field, but referees received awards and Council members received their blazers

In attendance were Stormers players Seabelo Senatla, Warrick Galant and Connor Evans, and management who handed out the trophies to all the recipients Clubs that were honoured included Villager, Hamiltons, Primrose and Caledonian Roses

Villager topped Super League A, while Hamiltons and Maties received special awards for celebrating 150 years

Villager and Hamilton were the WP’s representatives in the Gold Cup and after Villager eliminated Hamiltons in the quarters and beating College Rovers in the semi-final, they lost in the final to Naka Bulls The two teams were commended for their efforts in the competition