International Research Journal of Engineering and Technology (IRJET) e-ISSN: 2395-0056

Volume: 12 Issue: 10 | Oct 2025 www.irjet.net p-ISSN: 2395-0072

International Research Journal of Engineering and Technology (IRJET) e-ISSN: 2395-0056

Volume: 12 Issue: 10 | Oct 2025 www.irjet.net p-ISSN: 2395-0072

Mrs. Salma Khan1

1 Research scholar, Singhania University, ***

Abstract - The emerging landscape of commerce has another robust movement in the payment system in India, introduced by the National payments corporation of India (NPCI) UPI payment, neobanking,digitalwalletsande-baking applications, are rapidly conquering the market, with consumers opting for mobile friendly applications other payment medium have seen a incline downwards. The study investigates the channels of awareness for these innovative applications, usage patterns, consumer perception relatingto its simplicity and user adaptability and the merchant’s acceptance. The study assesses the dominance in the payment system, the preferences, and the barriers of the digital leap of digital wallets and e-banking applications

Key Words: Digital wallets, G-Pay, PhonePe, Paytm, Amazon Pay, NEFT, IMPS, RTGS

1.INTRODUCTION

The conventional means of conducting transactions with cash and lose money have been replaced by technological innovations. At the present time, mobile phones have smartly and digitally taken over the functions of checks, credit, and debit cards, etc. The financial technologies (Fintech) used in banking sector has been the catalyst for introductionofvariousinnovationssuchasdigital wallets basedonunifiedpaymentsystemandtheseveralmodesof digitalpaymentsthroughe-bankingapplications

A financial transaction application that works on mobile devices is known as a digital wallet. The Users passwords andpaymentinformationaresecurelystoredanditreplaces yourcardswhileshopping,theseprogramslettheuserpay usingthemobiledevice.

Userscaneasilyandswiftlymakepaymentsonline withdigitalwallets.

With digital wallets, opening and maintaining a bank account is no longer dependent upon actual banksandbusinesses.Asanoutcome,theyconnect peopleandcompaniesinremotelocations.

Beforeusingadigitalwallet,ausermustaddfunds fromaconnectedbankaccount.

Digital wallets can be used for a variety of transactions, including sending money to friends andfamilythatliveoverseas.

Billpayments,payingpowerbills,andbookinggas cylinders, buying train/flight tickets, recharging mobiledevicesaresomeoftheavailableservices.

Trading and checking the balance of cryptocurrenciesbothrequireadigitalwallet.

Duetothemanyadvantagesthatdigitalwalletsprovide,they havebecomesufficientlypopular.

- Security- Password safety and biometric validation are offeredfordigitalwallets.

-Absenceofaminimummonthlybalance-Usersarefreeto addanyamountofmoneytheyrequire.

-Fast&Convenient-Quickandeasytransactionsaremade possiblethroughuncomplicatednessandusability.

- Multiple Transactions-It can be utilised for a variety of operations,suchasaddingamobilenumber,scanningaQR code,payingbills,andcompletingonlinepurchases.

-24/7customersupport-Chatbotsareusedindigitalwallet appstoenable24/7communication.

-Rewards-Transactionsdonethroughdigitalwalletsoffers numerouscashbacksanddiscounts.

Therearethreedifferentkindsofdigitalwallets:

A closed wallet is a type of payment system that enablesuserstoconducttransactionsviaanappor website.

International Research Journal of Engineering and Technology (IRJET) e-ISSN: 2395-0056

Volume: 12 Issue: 10 | Oct 2025 www.irjet.net p-ISSN: 2395-0072

Companies frequently produce these wallets for theirclientstoutilise.

Users who utilise closed wallets are limited to carrying out transactions with the wallet's issuer usingthefundstheyhaveonhand.

The wallets collect the funds from cancellations, returns,orrefunds.

Userscannotmakepaymentstopartiesotherthan thewallet'sissuerusingclosedwallets.

AnillustrationofaclosedwalletisAmazonPay.

Semi-closedWallet:

Users can conduct transactions at the businesses andlocationsindicatedinasemi-closedwallet.

Thesewalletshavearestrictedservicearea;thus, theymayonlybeusedatenterprisesthatacceptthe contractoragreementofthewallet'sissuer.

Toacceptpaymentsusingmobilewallets,retailers mustengageintocontractsoragreementswiththe issuers.

OpenWallet:

Open wallets, provided by banks, enable users to conductanykindoftransaction.

Users can transfer funds with ease through open wallets,whichprovidefreedom.

Paymentscanbemadebothonlineandoffline.

Transactionscanbemadeusingopenwalletsfrom anylocationintheworldprovidedthesenderand recipient both have accounts on the same application.

Some of the examples of wallets in the digital age are as follows

Google Pay: With the Google Pay app, users can make purchasesonanyapporwebsiteusingdebitorcreditcard information saved to their Google Accounts, Google Play, Chrome,YouTube,Androidphones,andwatches.

Paytm:Oneofthemostwell-knownpaymentappsisleading the way by enabling users to make payments via UPI and digitalwalletsthatarequicker,wiser,andsafer.

ApplePay: UsersofiPhones,iPads,andApplewatchesget exclusive access to the streamlined Apple Pay digital software.Userscanconducttransactionsforbothin-person andonlinepurchases.

PayPalOneTouch:ThestandardservicesprovidedbyPayPal are enhanced with the PayPal One TouchTM app. By allowinguserstoskiptheloginscreenanddoawaywiththe needtoinputpasswords,itenablesthemtomakepayments or transfer funds more quickly. The mobile wallet app for PayPalcanbeusedonatablet,laptop,ordesktopaswell.

The term "e-banking" refers to the procedure of using electronicsourcestoinstantlytransfermoneyfromonebank account to another. This process is also referred to as "electronic fund transfer" (EFT). Computer banking and mobilebankingarebothincludedintheterm"e-banking." Ebanking is a part of e-commerce, which also comprises efinance,e-money,andotherelectronicfinancialservicesand products.Thebanksareofferingpaymentservicesonbehalf oftheircustomers.E-bankingcomesinavarietyofformats, including Internet banking, ATMs, debit cards, and credit cards. E-banking can be used anywhere, at any time, and does not necessitate the physical movement of money. Simpleandpracticalforeverydaybankingtransactions.Asa result of the speed, reliability, and convenience that this optionoffers,peoplearealsoadoptingbanktransfersasa modeofpaymentmorefrequently.

Benefitsofbankstransfer

-Reliable and safe- Due to the established identification verification involved with the transaction process, bank transfers are regarded as a safe and secure mode of payment.

-Convenient-enablesforquickandsimplemoneytransfers atthetouchofabuttonwithoutphysicallyvisitingthebank.

-Fast-Provideforquickandsimplemoneytransfers.

-Affordable-Itissimpleandfreetosendmoneyinminutes tofriendsandrelatives.

-Customer friendly- digital channels deliveringvarious financialproductsandservicesinalucidform

Waystotransferfunds

)

Tomeettheneedsofone-to-onebasistransfers,the(NEFT) protectedsystemwaslaunched.TheNEFTsystemenables nearreal-timefundtransfersandoffersbatchsettlementson an hourly time slot basis. The system offers capabilities including accepting cash for initial transactions, starting transfer requests without any higher or lower amount restrictions,facilitatingone-waytransfersto15Recipients,

International Research Journal of Engineering and Technology (IRJET) e-ISSN: 2395-0056

Volume: 12 Issue: 10 | Oct 2025 www.irjet.net p-ISSN: 2395-0072

receiving verification of the date and time of credit to the beneficiaries'accounts,etc.ToanyIndianbankthatsupports NEFT, money can be sent using this mechanism on an individualbasis.

A real-time electronic cash transfer technique called Immediate Payment Service (IMPS) allows money to be creditedtothebeneficiaryaccountrightaway.All365days of the year, including Weekends and other bank holidays, IMPStransfersareavailableonareal-timebasis.Interbank remittancescanbestartedviaIMPSusingavarietyofmeans, includingmobilebanking,onlinebanking,Text,ATMs,etc. Thisserviceisaccessibleeverydayandnight.TheReserve BankofIndia(RBI)andtheNationalPaymentsCorporation ofIndia(NPCI)arebothresponsibleformanagingtheIMPS service(RBI).

RealTimeGrossSettlement,sometimesknownasRTGS,isa technique of sending money that allows for instantaneous transfers of funds. With the help of this online payment method, the recipient of the funds given by the sender can receivethemassoonasthepaymentprocessingtransactionis started. Gross Settlement in this context refers to the individual processing of transactions rather than batch processing.ThelowestamountthatmaybesentusingRTGSis Rs. 2 lakhs, and it is frequently used for transactions with higherdollaramounts

2.1 Objectives

1- To assess the medium of awareness among the customersregardingdigitalwallets

2- TocomparetheusageofdigitalwalletsandE-bank transfers

2.2 Scope

Inthisstudy,thepaymentservicesprovidedbybanksonline anddigitalwalletswereexploredandexamined,aswellas customerawarenessoftheseservicesfore-commerceand other financial activities online and offline in HyderabadTelangana,India.Furthermore,thisstudyaimstodetermine variables that affect how user’s engagement with digital wallets and bank transfers for e-commerce and other financialoperations.

2.3 Data Collection

Tocomprehendthelevelofawarenessofdigitalwalletsand usage of digital wallets and banks electronic payment system, the study aims to determine the customers preference towards their trustworthy digital payment system.

Primarydataiscollectioninformofasurveyquestionnaire; Thequestionnairecontains12closedendedquestionswhich wascollectedfrompeoplefromvariedbackgroundandage groups across Hyderabad- Telangana. The questionnaire containsthedistinctdemographics,thecommonpayment option utilized, medium of awareness relating to digital wallets,simplicity,widelyacceptedmethodologyofpayment system,valuebargains,thefavourablemodeofpayment.The survey was collected from 103 people in the city of Hyderabad-Telangana,India.

Existing research work in the area is examined to understand the earlier studies carried out; it aids as a secondarysourceofdata.

The data collected is organised using Microsoft excel representingthedatacollected.Descriptiveanalysisisused to assess the medium of awareness and Chi-square test is used to compare and assess the usability, simplicity, and accessibility with retailers; it has been done in statistical packageforsocialsciences(SPSS)software.

Bhawna Mukaria 2021

The study highlights the various payment and money transfer methods users are offered on the market. It illustrateshowthedevelopmentofdigitalpaymentmethods, notablywiththeuseofsmartphones,hasimprovedpeople's livesandmadethemmoreconvenient,especiallyduringthe COVID-19period.

Ankita Khothari- 2021

ThestudyexaminesthesignificanceofeWalletsinIndia'sdig italtransformation,users'perceptionsofadoption,andhurd lestoeWalletuseamongusersandnonusersinthecityofUd aipur, the study infers the Indian Banking industry may changebecauseofthe“DigitalIndiaProgramme”

M Mohana Priya 2021

Thestudyshowcasestheriseofdigitalandmobilepayments anditsenhancedeffectsofretailer’srelationshipwiththeir customers. It studies the pattern of transformation how merchantsengageandrewardtheircustomers,benefitsand convenienceofcashlesspayments,itsaccessibilityandswift formofpaymentmethod.Thestudyanalysestheperception and impact of digital wallet on the retailers in the city of Chennai.

K.Vinitha 2019

The study appraises the satisfaction of Internet Banking, Mobile Banking, Mobile wallet and card payment system usersinChennai,thestudyisdescriptiveinnature,andthe sampletechniqueutilisedisnon-probabilitysampling.The studyhasimplicationsforbanks,websitedevelopers,ande-

International Research Journal of Engineering and Technology (IRJET) e-ISSN: 2395-0056

Volume: 12 Issue: 10 | Oct 2025 www.irjet.net p-ISSN: 2395-0072

paymentapplicationdevelopersinunderstandingtheneeds ofe-paymentsystemusersthroughthelensoftechnological advancementsandincastingoutane-paymentsystemthat can be used without fear of hacking and by providing digitallysafeandsecureddigitalbanking.

The study aims to determine the variables that motivate clients to use M-Wallet payment services. It assesses the level of client satisfaction with M-Wallet payment service providers' services. The study determines the challenges that customers have while using the M-Wallet payment service.

The study evaluates the technological innovations in payment system, between buyer and seller and between banks,itshowcasesthedifferentphasesofpaymentsystem inIndiaduetothedevelopmentofinformationtechnologyin bankingsector.

The Study investigates the extent to which self-service bankingtechnologyanddigitalpaymentsystemshavegrown and spread in India, it inspects the customer awareness, usage,andfactorsinfluencingtheuseofself-servicebanking tools, examines the quality of services offered by selected commercial banks in Kerala using self-service banking instruments, evaluate the effectiveness of consumers' securitypractiseswhenusingself-servicebankingtools.

Thestudydeterminesbuyerbehaviourinrelationtotheuse of electronic wallet services. Because of technology advancements, the manner of making payments has been digitalized; the study seeks to determine the level of acceptance among customers. The primary goal of this research is to determine the familiarity of mobile wallet services and the factors that drive buyers to use E-wallet services. The survey revealed that clients see electronic wallets, which are considered a high-tech platform for monetary transactions, as reliable and comfortable. The reportrevealsthatwhileelectronicwalletserviceproviders areprimarilytargetedatyoungpeople,otheragegroupsof respondentsshouldbeconcerned.

The study carried out an experimental investigation for paperlesselectronicfinancialtransactions,payingparticular attentionto electronicwallets.Thestudyaimstoexamine how much younger generations are aware of the new payment method. Since most goods and services are now availableonlinethankstotechnologyimprovements,clients may make electronic payments for them. The study's

findings indicate that because digital wallets are directly related to online commerce and financial institutions and service providers are prospering, they are growing in popularity in the modern world. The primary service that clientsuseistypicallytopaytheirbills.

Thestudyexaminespioneeringsystemofbankinganditisa positive influence on the economy and it has enormous social consequences. The study shows the benefits and drawbacks of cutting-edge banking techniques. The study instigates banks and other economic performers to revolutionizetheirbankingservices.Itupsurgescustomer’s understandingofelectronicbanking.

ThestudyreviewedthespecificapplicationsofPaytmand payUmoneytoevaluatetherequirementsofGenerationY customers for methods of electronic payment. The study further illustrates how the new digital payment method affectscustomersandthechallengestheyencounterwhile working with it. the study states thatmobile applications haveastrongergrowthrateforonlinepaymentawareness. Andduetotheirenhancedfeaturesandimprovedsecurity, PaytmandPayumoneyhavelargelysupplantedtraditional andothere-banking.ItalsoconcludesthatPaytmandPayu Money'spaymentsystemsaresomewhatsimplerthanthose ofotherdigitalpaymentsystems.

Thestudyadoptedacomparativemethodologytoexamine the various forms of online payment systems. The study's primary finding is that most consumers choose cash on delivery(COD)forpurchasesmadeonlinebecausetheriskis lower and debit cards make it simple to make payments. Since they are aware of the conveniences given by online shopping,consumersalsoprefertousecreditcardstomake payments.Consumerswereunawareofmobilewalletasan onlinepaymentoption.Thestudyalsorevealsthattoday's internet shoppers prefer net banking. It is concluded that young people make up most of the consumers who use variouspaymentmethods.

Thepurposeofthisresearchwastoexplainhowelectronic paymentsareusedinIndia.Italsotriestocomprehendthe various payment methods that clients employ. Electronic paymentsystemsareoneof theways totrademoneyin a worldofelectroniccommerceusingplasticcards.According tothesurvey,digitalpaymentsgivecustomersthefreedom to pay for expenses like taxes, fees, recharges, fines, and purchasingatunusualplaces.Eventhoughtherearemany differentelectronicpaymentsystems,theirfeaturesarenot greatly different. The commercial viability of e-commerce payment systems depends on their usability, industry

International Research Journal of Engineering and Technology (IRJET) e-ISSN: 2395-0056

Volume: 12 Issue: 10 | Oct 2025 www.irjet.net p-ISSN: 2395-0072

consensus, cost, consumer preference, authentication, accessibility,anddependability,authorization,publicpolicy, andnon-refundability.Theauthorsuggeststakingauser's fingerprintforeachtransactionasasecuritymeasurethat digitalwalletprovidersshouldconsider.

Tella & Abdulmumin 2015

Thestudycentredontheconsumers'happinessusingonline paymentattheuniversityofIlorin,Nigeria,itexaminedthe variables affecting that level of customersatisfaction. The study'sfindingsindicatethattheindividualswhoresponded arehappywiththewagee-paymentmethod.However,other people feel less contented because it is hard to define the issues that arise while using an e-payment system. The report concludes by pointing out that service providers shouldconsidersecuritywhenplayingasignificantrolein digitalpayments.

Salodkar et al. 2015

The study highlighted the use of electronic wallets, their deployment,andtheirsignificancemovingforward.Thegoal ofthe project isto design a newarchitecture that enables consumerstosendmoneyquicklyandsecurely.Thestudy investigatesthefunctionality,value,andpotentialofadigital walletinthefuture.Thestudyconcludesthatprovidersof servicesandbanksshouldfocusonthepliabilityandsafety of the transactions while considering future technological developments and the needs of the customer. Users of ewalletswillhavethefreedomtoshopandmakepayments whenevertheywant.

Aparna et al. 2015

ThisstudyinvestigatestheuseofelectronicwalletsinIndia and its various forms. A thorough investigation of the similarities between 12 different types of electronic payments,includingapplepay,googlewallet,etc.,wasdone. Accordingtothereport,Indianswillsoontakeadvantageof digital wallets more frequently as the nation strives to become a technologically advanced one. Less technical understanding,widespreadinternetaccessibilitychallenges, andsecurityconcernswereidentifiedasthemainbarriersto theuseofdigitalwallets.Thestudyconcludedthatenhanced securityprovidedbydigitalwalletscanhelpcontrolhacker scamsinofflinepayments.

Sultana & Kumar

The study explored consumers preference for cash along withvariouspaymentoptionsoverplasticmoneyaswellas the reasons why they do. Additionally, it indicates promotionalactionsbeconductedtoencouragetheuseof electronic payment. Because carrying cash can be risky, people find it easier to utilise plastic cards to make purchases.Asaresult,paymentmethodsinstorescannow includebothcashandnon-cashtransactions.Thefindings

showed that most users completed their purchases in physical stores and thought that paying with cash was simple. Respondents with greater levels of education and moneytendtouseplasticcardsmorefrequently.According to the study's concluding statement, socio-demographic characteristicssignificantlyinfluencedpaymentbehaviour.

The study carried out a qualitative investigation on the acceptabilityofmobilepaymentsystemsbycustomers.The study'sobjectivesweretoexaminecustomerusagepatterns and willingness to adopt mobile payments as well as the variablesaffectingmarketgrowthordeclineinm-payment adoption.Paymentsvia mobiledevicesisoneofthe many applicationsthatarerelatedtomobiletelephonyalongwith m-advertisingandentertainmentservices.

The study presented an empirical foundation for technological advancement within digital commerce and primarily addressed payment via electronic wallet. When traditionalpaymentmethodslikecash,checks,cards,etc.are used instead of e-commerce, various problems arise. The studydiscussesthemanypaymentmethods,includingdebit cards,mobiledevices,andothers,aswellastheadvantages ofthetechnologyinvolved.Therevariouskindsofsecurity thatarecommonlyemployedforonlinepaymentsecurity, includingSET(secureelectronictransaction),whichdenotes a more challenging security system dependent on digital documents, and SSL (secure socket layer), which denotes confidencestuckbetweenanonlinemerchantandcustomer. The study's significant finding indicates that the mobile walletisbestbecauseitispractical,easytouse,andsecure. Thereportconcludesbypointingoutthatthesupplierhas implemented I-pay out methods for security and safety purposestopleasecustomers.

The study was done inShivamogga district, on banking services, The primary tasks were to look at people's borrowing and depositing habits as well as to evaluate bankingservicesamongthegeneralpopulationwithafocus on villages in the Shivamogga district. The survey also examinedhowwellthepublicunderstoodthemanyservices that the government had made accessible to them via commercial banks, cooperative banks, and main land development banks. Utilising empirical data from stratificationandareasampling,whichincludedmorethan 80 homes in the vicinity of the villages of Shivamogga district,thestudyofpeople'sbankinghabitswasconducted.

The study was undertaken on the issue of corporate governanceinbanksandhowfinancialtechnologywillcause

International Research Journal of Engineering and Technology (IRJET) e-ISSN: 2395-0056

Volume: 12 Issue: 10 | Oct 2025 www.irjet.net p-ISSN: 2395-0072

anessentialshifttothewaybanksoperate.Theywouldbe able to improve their internal operations and offer better client service because of it. Technology will dismantle all barriers and promote international banking. To fully reap the rewards of the changes in technology and business processes, banks would need to engage in substantial Business Process Re- Engineering and address issues like good organizationalarchitecture, customer-centric operationmodel,utilisetechnologytoderiveeconomiesof scaleandhowtoproducecostefficiencies.

Thestudyspecifiedtheneedforongoingevaluationofthe manylawsconnectedtobankingandcommercearisingdue totherevolutionsarounde-banking.Thesettingupofthe multidisciplinary high level standing committee for legal interpretations and reviewing the technological and legal requirements of E-banking uninterruptedly and recommending appropriate measures when essential. Encourage banks to innovate and, when appropriate or required,developnewpractisesandcustomstosupplement thebankingregulationsthatareperiodicallyineffectwillbe crucialinsuchfutureandcontinuingconsiderations.Banks havehistoricallybeenattheforefrontofutilisingtechnology to enhance their offerings, capabilities, and effectiveness. The usage of the internet by banks as a means of getting instructions and providing clients with their goods and servicesisontherise.

The study has states that the introduction of ATMs has altered how bank branches cash counters. For routine bankingtasksincluding cashdeposits,withdrawals,check collections,balanceinquiries,etc.,customersarenolonger required to visit branches. New "convenience banking" options have been made possible through e-banking and internetbanking.Banktransactioncostshavedecreaseddue tointernetbankingascompartedtobranchbanking.

Table -1:

Range 4

Minimum 1

Maximum 5

Sum 206

Count 103

Source: primary

The awareness medium of digital wallets is evaluated through descriptive analysis carried out using Microsoft excel. The analysis exhibits the mean that is the average responseforthemediumofintroductionofdigitalwalletsto be through friends, median the central tendency or the middle value is internet & friends , meaning half of the respondents about 51.5 from the total 103 have either selectedinternetorfriendsasthesourcesofawarenessof digital wallets, and mode represents the most frequent channelofawareness’selectedbytherespondentswhichis internet. The internet stands out as the most popular channelofawarenesswithtelevisionandbillboardsbeing leastpopular.

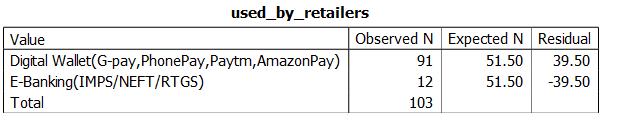

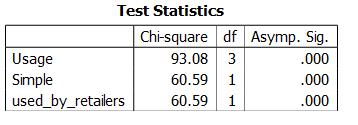

Table -2:

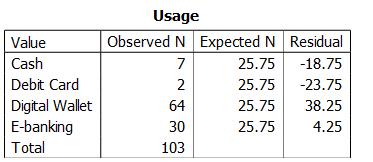

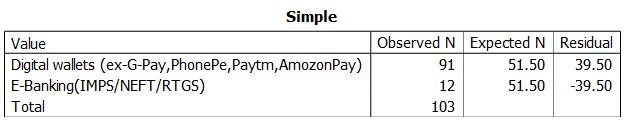

Comparison between digital wallets and E-bank transfer

Source: primary

International Research Journal of Engineering and Technology (IRJET) e-ISSN: 2395-0056

Volume: 12 Issue: 10 | Oct 2025 www.irjet.net p-ISSN: 2395-0072

Theabovedataisrelatingtothecomparisonbetweendigital wallets and E-bank transfer based on the usage on the parameterofsimplicityandavailabilitywithretailers.ChisquaretesthasbeenconductedthroughSPSSsoftware;data have been sorted in MS-excel. Digital wallets is the most preferredmethodofpaymentusedbeing64withe-banking following with an observed 30 being secondary to digital wallets,digitalwalletsbeing simpler and readily available with retailers with most respondents giving strong representation withonlyfewrespondentschoosinge-bankingassimpleand used by retailers. The analysis exhibits superior performance by digital wallets when compared with ebankingtransfers

Thelargepositiveresponsetowardsdigitalwalletsshowsit outperforming the banks transfers. Digital wallets have a user-friendlypaymentsystemassistedbyQRscansmakingit quick to adopt as compared to lengthy banks transfer processeslikePOSintegrationandretailerpreferencesetc.It seemstobeevidentthatdigitalwalletshaverapidlygained popularity as a form of payment, with many customers alreadypreferringthemtocreditcards/Debitcardsandebanking. Businesses can profit from accepting digital paymentswhilesafeguardingtheirearningsfromfraudby carefully handling digital wallet orders. Digital wallets triumphs e-banking transfer in the mobile first market in India.

1) BhawnaMukaria:users’perceptiontowardsmobile wallets:astudyofselectedgovernmentandprivate wallets,2021

2) -AnkitaKhothari:Progressivedigitaltransformation inbanking-Astudyone-wallettool,2021

3) MMohanaPriya:Astudyondigitalwalletpayment optionanditsimpactonbusinessperformanceof retailersinChennai,2021

4) K. Vinitha: Effect of Information Communication TechnologyonUsageofElectronicpaymentsystem andUserSatisfaction,2019

5) Gayathiry D: receptiveness on mobile wallet in digitalera:consumerandmerchants’perspectivein Coimbatorecity,2019

6) Radhika R: Technological innovations in payment systemsinIndiancommercialbanks–anempirical studyoncustomersperceptioninChennaicity,2017

7) JubairT:efficacyofself-servicetechnologiesinthe bankingsector:anempiricalstudyinKerala,2017

8) Varsha & Thulasiram: Acceptance of E-wallet Services:AStudyofConsumerBehavior,2016

9) Kalyani:AnEmpiricalStudyabouttheAwarenessof PaperlessE-Currency

a. TransactionlikeE-WalletUsingICTinthe YouthofIndia,2016

10) G Anbalagan: A study on innovative banking practicesinspecialvillages-withreferencetoSalem district,TamilNadu,India,2015

11) Dv, V., Yamuna, N., & G, N. S.: A Study on New DynamicsinDigitalPayment, a. System–withspecialreferencetoPAYTM andPayUMoney,2015

12) Chirag Parmar: A Comparative Study on Various PaymentOptionsinOnline a. Shopping,2015

13) KaramjeetKaur&Dr.AshutoshPathak:E-Payment SystemonE-CommerceinIndia2015

14) Tella & Abdulmumin: Predictors of Users’ SatisfactionwithE-paymentSystem:aCaseStudyof StaffattheUniversityofIlorin,Nigeria,2015

15) AmbarishSalodkar,KaranMorey,Prof.Mrs.Monali Shirbhate:ElectronicWallet2015

16) R.R. Aparna, Tanvi Ostwal, Trupti Baliga B and NanditaSreekumar:Overview a. ofDigitalwalletsinIndia,2015

17) M. Sadika Sultana and K. Sasi Kumar: A study on customerpaymentbehaviour

18) in organized retail outlets at Coimbatore district,2015

19) Dr.SanjeevPadashetty&Prof.KrishnaKishoreSV: Anempiricalstudyonconsumeradoptionofmobile paymentsinBangalorecity–Acasestudy, 2013

20) Upadhayaya.A:ElectroniccommerceandE-wallet, 2012

21) Ravi.C.S,KundanBasavaraj:CustomersPreference and Satisfaction towards Banking Services with Special Reference to Shivamogga District in Karnataka,2012

22) https://www.cbi.eu/node/849/pdf

23) https://www.citibank.com/tts/sa/latam/icginnovationexpo/receivables/assets/docs/eCommerce_Digital_ Consumer_Payments.pdf

24) https://investor.dlocal.com/wpcontent/uploads/reports/2021/Q2/the-ultimateguide-to-unlocking-e-commerce-growth.pdf

25) https://corporatefinanceinstitute.com/resources/c ryptocurrency/digital-wallet/

26) https://www.techtarget.com/whatis/definition/dig ital-wallet

27) https://paytm.com/blog/payments/mobilewallet/digital-wallets-features-advantagespopularity-and-more/

28) https://bettermoneyhabits.bankofamerica.com/en/ personal-banking/what-is-a-digital-wallet

29) https://partner.visa.com/site/explore/digitalwallets.html

30) https://www.fiserv.com/en/about-fiserv/resourcecenter/brochures/digital-wallet-infographic.html

31) https://www.juniperresearch.com/press/digitalwallet-users-exceed-5bn-globally-2026