International Research Journal of Engineering and Technology (IRJET) e-ISSN: 2395-0056

Volume: 12 Issue: 06 | Jun 2025 www.irjet.net p-ISSN: 2395-0072

International Research Journal of Engineering and Technology (IRJET) e-ISSN: 2395-0056

Volume: 12 Issue: 06 | Jun 2025 www.irjet.net p-ISSN: 2395-0072

Pramono Ajie1 , Jaka Windarta2 , Singgih Saptadi3

Master of Energy, Graduate School, Diponegoro University, Semarang City, Indonesia

Abstract - Electricity demand in Indonesia especially Java and Bali system is projected to grow significantly over the next decade. Bali, as a global tourist destination, promotes renewable energy development through the BaliCleanEnergy policy (Governor Regulation No. 45/2019). However, most of Bali’s current electricity is still supplied by fossil-fuel-based plants, with primary energy sources imported from other provinces. In line with the cleanenergy vision, large-scale coalfired power plants are no longer a viable optioninBali, despite rising electricity needs.

To address this, PLN as the state electricity company in Indonesia plans to construct the 500 kV Java-Bali Connection (JBC) transmission project as outlined in the Electricity Supply Business Plan (RUPTL) 2021–2030. The project will connect Java’s power system to Bali via a +185 km circuit transmission line, including a + 6.5 km submarine cable across the Bali Strait, enabling Bali to access lower-cost electricity fromhighefficiency power plants in Java [1]

This study aims to assess the technology and economic feasibility of the JBC project. It includes: (1) a 10-year load forecast for Bali; (2) a transmission voltage level analysis among 66 kV, 150 kV, and 500 kV options; (3) an ampacity analysis of the submarine cable; (4) an economic evaluation using Net Present Value (NPV), Internal Rate of Return (IRR), Benefit-Cost Ratio (B/C), and Payback Period; and (5) a sensitivity analysis for scenarios such as increased generation costs, rising investment costs, and reduced energy transfers. The findings aim to support energy policy and infrastructure decisions to ensure long-term power supply reliability and promote clean energy in Bali.

Key Words: Power Transmission, Load Forecast, Voltage Level, Ampacity, Submarine Cable, Economic Feasibility, Sensitivity Analysis

ThecontinuousgrowthinelectricitydemandacrossJavaand Balinecessitatesthedevelopmentofrobustandsustainable energyinfrastructure.BaliProvince,recognizedgloballyasa premiertourismdestination,hasdeclareditscommitmentto cleanenergythroughtheenactmentofGovernorRegulation No. 45/2019 on Bali Clean Energy, aimed at transforming Bali into an eco-friendly, green tourism island. However, despitethisprogressivevision,Bali’selectricitysupplystill largely relies on fossil-fueled generation, including diesel,

coal, and liquefied natural gas (LNG), which are predominantly imported from outside the island. This dependencynotonlyraisesenvironmentalandcostconcerns butalsoposesriskstosupplysecurity.

In response, PT PLN (Persero) has proposed a strategic infrastructure project within the 2021–2030 Electricity Supply Business Plan (RUPTL), the 500 kV Java-Bali Connection (JBC). This high-voltage transmission link will interconnectBaliwiththeJavapowersystem,enablingthe transfer of lower-cost electricity generated by highly efficient Ultra Supercritical coal power plants in Java. The JBC is not only a technical solution to mitigate projected power deficits in Bali, but also a strategic enabler of the province’s clean energy vision, by reducing reliance on small-scale,fossil-basedgenerationunits.

Technically, the JBC spans approximately + 185 km, includinga+6.5kmsubseacablecrossingtheBaliStrait[1]. Beyondenhancingenergysecurityandsupplyreliability,this projectisexpectedtosignificantlylowerBali’sBasicCostof ElectricitySupply(BPP)byoptimizinggenerationresources acrossthetwoislands.

This study aims to conduct a comprehensive technoeconomic analysis of the 500 kV JBC project, with specific focus on its capacity to address Bali’s electricity demand forecast over the next 10 years, determine the optimal transmission voltage level, assess cable current-carrying capacity, and evaluate economic viability using financial indicatorssuchasNetPresentValue(NPV),InternalRateof Return (IRR), Benefit-Cost Ratio, and Payback Period. Sensitivityanalysesarealsoconductedtotesttheproject’s feasibilityundervariousscenarios,includingfluctuationsin BPP,investmentcostchanges,andenergytransfervolumes.

Through this analysis, the study contributes data-driven insights to support national energy transition strategies, while offering practical recommendations for investment planning,technologyselection,andinter-islandtransmission development.

To address the electricity supply challenges in Bali, two primaryalternativesareconsidered:(1)theconstructionof new Power Plant facilities on the island, and (2) the developmentofa500kVJava-Baliinterconnectionnetwork.

International Research Journal of Engineering and Technology (IRJET) e-ISSN: 2395-0056

Volume: 12 Issue: 06 | Jun 2025 www.irjet.net p-ISSN: 2395-0072

2.1.1

BaliProvincerecordedapeakelectricityloadof980MW in 2020, which decreased to 771 MW in 2021 due to pandemic effects. The demand began to recover in subsequentyears,reaching915MWin2022and1075MW in2023.InOctober2024,thesystemreachedanewall-time peakloadof1157.6MW[2].TheSystemprimarilysupplied byanexisting400MWsubmarineinterconnection150kV from Java and 944 MW of local generation. Local capacity included372MWfromoil-firedplants,192MWfromdualfuelLNG/oilunits,and380MWfromthecoal-basedCelukan Bawangpowerplant.Effortsareunderwaytophaseoutoil usebyregasifyingexistingoil-basedunits[1].

The2021–2030ElectricitySupplyBusinessPlan(RUPTL) showsinBalielectricitysalesgrowthof~10%during2012–2016,followedbya-0.58%declinein2017duetoreduced residential and industrial demand. Although 2018 saw a recovery (4.6%), the COVID-19 pandemic in 2020 significantlysuppressed economicactivity, resultingin a13.32%dropinelectricitysalesinthebusiness,public,and industrialsectors[1]

The data indicates that in the Bali power system, the highestgrowthinenergysaleshasconsistentlybeendriven bybusinessconsumers,followedbytheresidentialsector. Anexceptionoccurredin2020,whentheCovid-19pandemic andtheenforcementoflarge-scalesocialrestrictions(PSBB) ledtoasignificantdeclineinelectricitydemandacrossthe business, public, and industrial sectors. Furthermore, the dailyloadprofileoftheBalisystemrevealsthatthehighest peakdemandtypicallyoccursduringnighttimehours,witha considerabledifferencebetweenpeakandoff-peakdemand levels.

TheProvinceofBalipresentsadistinctivedemographic andeconomicprofile,shapedbyitsrichculturalheritageand traditions. As of 2024, Bali’s population reached approximately 4.43 million [3]. Economically, Bali has emerged as one of Indonesia’s fastest-growing provinces, primarilyduetoitstourism-driveneconomy.In2023,the tourismsectorcontributedover50%toBali’sGrossRegional DomesticProduct(GRDP),reinforcingtheisland’sstatusasa world-renowned travel destination. This sector, encompassing hospitality, transportation, and related services, plays a central role in the regional economy. Nonetheless, agriculture remains vital, especially in rural areas,althoughitscontributionhasbeensteadilydeclining. In addition, the industrial sector comprising handicrafts, textiles, and food processing has shown progress but continuestolagbehindtourism.

Bali’seconomyexperiencedamajorsetbackduringthe COVID-19pandemic,withsharpdeclinesintourismseverely affecting the region’s GRDP in 2020 and 2021. A strong recoverybeganin2022,markedbya4.84%GRDPgrowth, reflecting the rebound of tourism and broader economic activity [3]. Despite this recovery, Bali continues to face structuralchallenges,includingover-relianceontourismand unevendevelopment.Movingforward,achievinginclusive andsustainableeconomicgrowthwillrequirediversification beyondtourismandstrategicenvironmentalmanagementto ensurelong-termprosperityforallBalinesecommunities.

Toestimatefutureelectricitydemand,thestudyusesthe LowEmissionsAnalysisPlatform(LEAP)softwareundera Business-As-Usual (BAU)scenario.Thekeyinputsinclude populationsize,GrossRegionalDomesticProduct(GRDP), economicgrowthrate,electricityconsumption,numberof customers,andpeakloaddata.Thesedatasetsaresourced from Bali’s Bureau of Statistics (BPS) between 2010 and 2024,alongsideelectricitysalesandcustomerdatafromthe 2021–2030ElectricitySupplyBusinessPlan(RUPTL)issued byPTPLN(Persero).

According to BPS, Bali’s population grew from 4.15 million in 2015 to 4.31 million in 2020, with an annual growth rate of 0.75%. During the same period, household GRDPincreasedbyanaverageof2.89%peryear,business GRDPby2.76%,publicGRDPby4.47%,andindustrialGRDP by 1.64%. In 2015, electricity sales reached 4,594 GWh, growingatanannualrateof1.86%until2020.Thenumber of electricity customers also increased, averaging 5.28% growthperyearfrom1.18millionin2015[1][3]

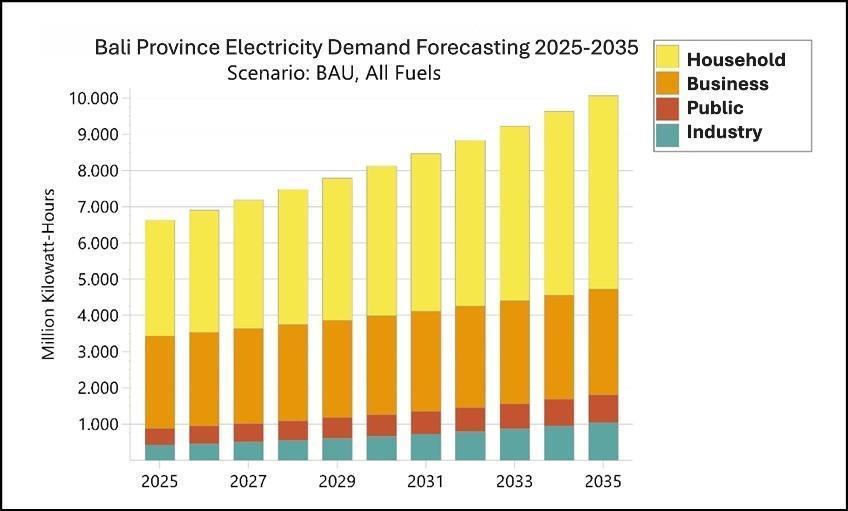

UsingLEAP,theelectricitydemandforecastingforBali Provincefrom2025to2035isshowninchart1andTable1

Volume: 12 Issue: 06 | Jun 2025 www.irjet.net

Table -1: BaliProvinceElectricityDemandForecasting 2025-2035(GWH)

No

1

2

3

4

Thepeak loadprojectionforBaliProvincewascarried out using the Low Emissions Analysis Platform (LEAP) software.Thisprojectionreliedheavilyonhistoricaldataas theprimaryinput,specificallytherecordedpeakelectricity loadsfrom2015to2024.Accordingtoavailabledata,Bali’s peakloadwas695.2MWin2015,825MWin2017,966MW in2019,980MWin2020,followedbyadeclineto771MW in2021duetotheCOVID-19pandemic.Theloadrebounded to915MWin2022,reached1,075MWin2023,andpeaked atarecord1,157.6MWin2024[2].

Fromthishistoricaldataset,anaverageannualelectricity loadgrowthrateofapproximately6.47%wasdetermined. TheresultsofthepeakloadprojectionsforBaliProvincefor the years 2021 to 2035, generated through the LEAP softwareareshowninthetable2.

Table -2: PeakLoadProjectionofBaliProvince2025–2035(MW)

ThepeakloadprojectionresultsobtainedfromtheLEAP (LowEmissionsAnalysisPlatform)softwareshowanotable discrepancywhencomparedtotheprojectionspresentedin theRUPTL2021–2030.Forinstance,intheyear2030,the RUPTL projects a peak load of 1,515 MW. In contrast, the LEAP-basedprojectionestimatesasignificantlyhigherpeak load, resulting in a difference of 265.4 MW. This indicates thattheLEAPprojectionanticipatesasubstantiallygreater electricitydemand,highlightingtheimportanceofreviewing andaligningforecastingmethodologiestoensureaccurate energyplanningforBaliProvince.

Basedontheanalysisofelectricitydemandprojections forBaliProvinceusingtheLEAP(LowEmissionsAnalysis Platform)software,theprojectedelectricitydemandforthe BaliSub-Systemisshownintable3.Theseprojectionsserve as critical input for technology analysis and economic analysis

Table -3: Projectedelectricitydemand

Accordingtotheanalysisresults,thepeakloadintheBali sub-systemisprojectedtoreach1,570.59MWin2028,while theavailablesupplycapacityoftheexistingsystemis947.4 MW[1].Giventheprojectedloaddemand,additionalsupply fromtheJBCinterconnectionwillberequired,amountingto 720MWin2028andanother720MWby2035.

ReserveMarginisoneoftheessentialcriteriaforenabling power transfer between subsystems within an integrated grid. According to the Regional Balance of the Java-Bali system, the Reserve Margin(RM) was recorded at 61% in 2022anddecreasedto41%in2023.Thesefiguresreflectthe system’scapabilitytomeetpeakdemandwhilemaintaining sufficientbackupcapacity.TheannualReserveMarginforthe Java-Balisystemissummarizedinthefollowingtable:

Table -4: RegionalBalanceoftheJava-BaliSystem

Year 2022

Year 2023

The existing table illustrates that the Java and Bali subsystems are currently interconnected via a 150 kV submarine cable. Based on the data, the Java subsystem remainstechnicallycapableoftransferringpowertotheBali subsystem.However,thelimitedcapacityofthecurrent150 kV submarine cable is insufficient to meet Bali’s projected peakloaddemand.Therefore,thedevelopmentofa500kV HVAC/HVDC submarine cable is expected to resolve this

International Research Journal of Engineering and Technology (IRJET) e-ISSN: 2395-0056

Volume: 12 Issue: 06 | Jun 2025 www.irjet.net p-ISSN: 2395-0072

transmission bottleneck. This infrastructure upgrade is aligned with the Power Balance of the Bali subsystem, in whichpowertransferfromJava isessentialtoaddressthe projectedsupplydeficitandensuresystemreliabilityinBali.

2.4 Comparison Fuel Payment and Fixed Operation & Maintenance Cost

BeforeBeforedecidingontheconstructionofthe500kV HVAC/HVDCsubmarinecable,itisnecessarytoreconsider components C and D, which are critical elements in calculating the Basic Cost of Electricity Supply (BPP), particularly due to the annually fluctuating fuel prices. A comparativecostanalysisofcomponentsCandDbetween theJavaandBalisystemsshouldbeconductedbyassuming equivalentcapacitydevelopment,eitherthroughgeneration ortransmissioninfrastructure.

The components of Generation Cost are defined as follows:

1. Component A (Capacity Payment / Investment Cost): Paymentforcapacitytocovercapitalexpendituresduring development,includingfinancingandconstruction-phase costs.

2. ComponentsBandD(Fixed&VariableO&M):Payments foroperationandmaintenance,includingbothfixedand variablecosts.

3. ComponentC(FuelPayment):Basedonactualelectricity usageandthecostoffuelsupplyandtransportation.

4. Component E (Electrical Interconnection Payment): Payment to cover the costs of building and developing electricalinterconnectioninfrastructure,bothcapitaland construction-related.

Since the main scope of the Java-Bali Connection (JBC) project is transmission, including the submarine cable (SKLTET) and overhead transmission lines (SUTET). ComponentEisassumedtofunctionallyreplaceComponent A.Meanwhile,ComponentsCandDfortheJBCtransmission option are assumed to be 95% of the Generation Cost of electricitytransferredfromJavatoBali,recognizingthatfuel costsformthelargestportionoftotalelectricitygeneration costs.

Reference values for the Java Transfer to Bali BPP are taken from the Indonesian Ministerial Decree No. 169.K/HK.02/MEM.M/2021. A comparative table presents Component C and D values across three considered alternativesisshownintable5.

Table -5: TableofInvestmentandComponentsC&D Comparison

Based on the results shown in the comparative table, it is evident that Components C and D representing fuel and operationalcosts aresignificantlylowerfortheJavasystem compared to the costs associated with constructing a new powerplantontheBaliside.Thisindicatesthattransferring electricity from Java to Bali via the proposed 500 kV submarine cable is more economically feasible than developing equivalent generation capacity locally in Bali, particularlyduetothelowerfuelandoperationalexpensesin Java.

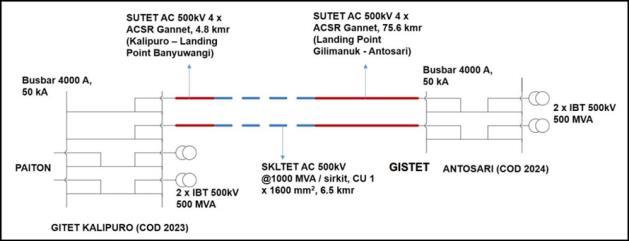

Aninvestmentvaluecomparisonwasconductedbetween the development of a new power plant in Bali and the construction of the 500 kV Java-Bali Interconnection. Accordingtothe2021–2030ElectricitySupplyBusinessPlan (RUPTL), the planned Java-Bali 500 kV interconnection includes the construction of a transmission line from the Kalipuro Substation (GITET Kalipuro) on the Java side, througha500kVExtraHighVoltageOverheadTransmission Line(SUTET)totheBanyuwangilandingpoint.Fromthere, poweristransmittedviaa500kVsubmarinecable(SKLTET) totheGilimanuklandingpointinBali.Finally,theconnection continuesfromGilimanuktotheAntosariSubstation(GISTET Antosari)viaanother500kVExtraHighVoltageOverhead TransmissionLine.TheSingleLineDiagramoftheJava–Bali Interconnectionisillustratedinthefollowingfigure.

Fig -1:SingleLineDiagramofthePlannedJava-Bali500kV Connection(HVAC)

International Research Journal of Engineering and Technology (IRJET) e-ISSN: 2395-0056

Volume: 12 Issue: 06 | Jun 2025 www.irjet.net p-ISSN: 2395-0072

Selectingtheappropriatevoltageleveliscrucialtoensure the efficiency, reliability, and economic viability of the transmission infrastructure. The discussion includes an evaluationoftechnicalcriteriainfluencingvoltageselection andacomparativeanalysisofavailablevoltagealternatives.

2.6

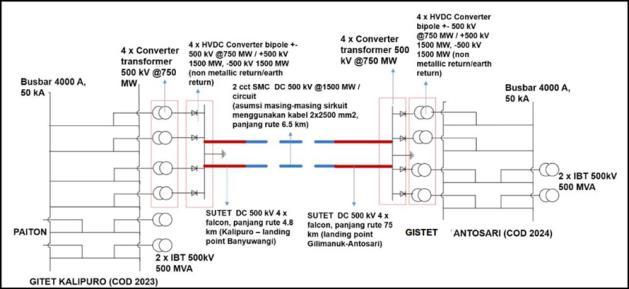

IntheJava-Baliinterconnectionproject,theselectionof appropriatetransmissiontechnologymustconsiderseveral criticalfactors,includingtransmissiondistance,investment and operational costs, reliability, and ease of integration. Giventheproject’scharacteristics,HighVoltageAlternating Current (HVAC) is more suitable than High Voltage Direct Current(HVDC),basedonthefollowingconsiderations:

a. TransmissionDistance

The underwater cable span between Java and Bali is relatively short approximately 6.5 km. For such short distances,HVACismoreefficientandcost-effective,asit doesnotrequireconverterstations,unlikeHVDC.HVAC systems can transmit power over short to medium distanceswithminimallosses[4]

b. InvestmentandOperationalCosts

HVAC:

Forshort-distancetransmission,HVACofferssignificantly lower capital costs since it does not involve expensive converterstations.Operationalcostsarealsolower,with minimalneedforreactivepowercompensation.

HVDC:

HVDCsystemsrequiresubstantialinitialinvestmentdue to the need for converter stations at both ends of the cable. For a short distance like Java-Bali, the cost outweighsthepotentialbenefits.

c. ReliabilityandIntegration

HVAC:

HVAC is easier to integrate with the existing AC power gridsinbothJavaandBali.Itisalsoamatureandproven technologyinIndonesia,offeringhighreliability.

HVDC:

WhileHVDCisknownforhighreliability,itinvolvesmore complex integration processes with existing AC infrastructure. Such complexity is unnecessary for a short-distanceprojectlikeJava-Bali.

Thevoltagelevelforatransmissionsystemisinfluenced byseveraltechnicalfactors,includingtransmissiondistance, power transfer capacity, and the characteristics of the existinggrid.Thisstudycomparesvariousstandardvoltage levels used by PLN for High Voltage (HV) and Extra High Voltage(EHV)three-phaseoverheadtransmissionsystems, namely66kV,150kV,275kV,and500kV,todeterminethe mosttechnicallyappropriateoption.

Highervoltagelevelsgenerallyofferbetterreliabilityand lower power losses due to their ability to transmit larger powercapacitiesoverlongerdistances.However,theyalso introduceincreasedoperationalrisks,suchasvoltagesurges and the need for more complex protection systems. Moreover, the choice of high voltage levels is affected by environmentalconsiderationsandnationalenergypolicies. High-voltage transmission systems typically have a more significant environmental impact, particularly in terms of land use and visual aesthetics. Consequently, this analysis alsoconsiderstheenvironmentalimpactofeachvoltagelevel andtheinfluenceofgovernmentpoliciespromotingenergy efficiencyandgreenhousegasemissionsreduction policies thattendtofavorhighertransmissionvoltagestominimize lossesandimproveoverallnetworkefficiency.

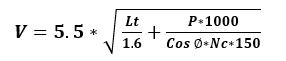

The planned Paiton (Java side) – Antosari (Bali side) transmissionline,knownastheJava-BaliConnection(JBC), aimstomeetfutureelectricitydemandinBalithroughlowcostenergysupplyfromlarge-scalepowerplantsinJava.The economicallyoptimalvoltagelevelcanbeestimatedusingthe followingformula[5]:

Where:

Lt=transmissionlinelength(km)

P=powertobetransmitted(MW)

Cosφ=powerfactor

Nc=numberofcircuits

Byinputtingthefollowingvalues:P=720MW(planned load),Lt=+ 100km(Kalipuro–Antosari),cosφ=0.9andNc=1 (N-1 condition), the calculated optimal voltage level is approximately 404 kV

International Research Journal of Engineering and Technology (IRJET) e-ISSN: 2395-0056

Volume: 12 Issue: 06 | Jun 2025 www.irjet.net p-ISSN: 2395-0072

ThecloseststandardvoltagelevelusedbyPLNis500kV, whichoffersthebesttrade-offbetweenpowertransmission capacityandsystemstabilityovermediumtolongdistances. Althoughhigher voltage levels reduce transmissionlosses, theyrequiregreaterinvestmentinelectricalequipmentand infrastructure.Incontrast,lowervoltagelevelsmayreduce capitalcostsbutresultinincreasedpowerlosses.

Thisrecommendationprovidesatechnicalreferencefor futureplanninganddevelopmentoftransmissionsystems, especially considering the evolving energy demand and technological advancements. According to the National ElectricitySupplyBusinessPlan(RUPTL)2021–2030,theJBC transmissionline is slated to operate at 500kV.Hence,all subsequenttechnicalcalculationsinthisstudywilladoptthe 500kVtransmissionsystemasthedesignbasis.

Accordingtoloadforecasts,powertransferthroughthe submarinecableisprojectedtoreach720MWby2028,with anadditional720MWrequiredby2035,resultinginatotal capacity of 1440 MW. In the initial phase, two-circuit submarinecableswithatransfercapacityof720MWwillbe constructed.Inthesecondphase,anadditionaltwocircuits will be added, bringing the total to four circuits and increasingtheoveralltransfercapacityto1440MW.

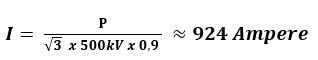

Usinga500kVACsystemwithaminimumpowerfactor of 0.9 and two three-phase cable circuits (single-core per phase),thecurrentpercableiscalculatedas[6]: (2)

Eachcablemustthereforesupportapproximately924A. Thecableselectionmustensurethisampacitythresholdis met throughout the planning horizon, without requiring future upgrades, while remaining technically and economicallyoptimal.

The projected peak load in Bali is expected to reach 1,780.4MWby2030.Constructingasingle800MWpower plantwouldaccountfor45%ofthetotalBalisubsystemload, posingahighblackoutriskintheeventofaplantfailure.To mitigate this risk, alternatives such as building multiple smaller units (e.g., 2×400MW, 3×300 MW, or 4×200MW) havebeenconsidered.However,theseoptionssignificantly increaseinvestmentcostsandareeconomicallyunfeasible Similarly, a 2×800 MW plant, as proposed in the Java-Bali interconnectionplan,wouldbecost-prohibitive.

Incontrast,theJava-BaliHVACinterconnectionoffersa morereliableandcost-effectivesolution.TheN-1redundancy

designensuressystemstabilityevenifonetransmissionline orsubseacablefails.Additionally,thesystemincludesaspare cablephaseandprotectiverockdumpingmeasuresagainst externalthreatssuchasanchorstrikes.

Based on the analysis from sections 2.1 to 2.9, it is concluded that the Java-BaliHVAC interconnection is both moreeconomicalandmorereliablethanbuildingnewlargescale power plants or implementing an HVDC scheme. Therefore,furthereconomicanalysiswillfocusexclusivelyon theHVACinterconnectionoption

Aneconomicanalysiswasconductedfortheselectedproject alternativebasedontechnologyevaluation:thedevelopment ofthe500kVJava–BaliConnection(JBC)transmissionline usingHVACtechnology.Thefeasibilityassessmentcompares thetotalfinancialbenefitsgeneratedagainstthetotalcosts incurred throughout the project lifecycle. This section identifies and quantifies the cost and benefit components, accompanied by relevant explanations and underlying assumptions.

Thissubsectionoutlinesthefollowingkeyaspects:

a. The HVAC submarine cable to be constructed has a transmissioncapacityof2×720MW,inaccordancewith systemdemandprojectionspresentedinsubsection2.2.3.

b. Theeconomicanalysisincorporatesseveralassumptions and justifications, including equipment manufacturing countries(e.g.,USA,Europe,Japan,China,India),currency denomination for cost estimation, exchange rates, escalation rates, inflation, and discount rates. Inflation ratesarebasedonthe10-yearhistoricalaveragefromthe IndonesianBureauofStatistics(BPS)forIDRandOECD dataforforeigncurrencies.

The exchange rate is basedon the JISDOR rate published on April 11, 2025, from Bank Indonesia.

Inflation rate: 3.02% BPS Data (2015–2024), excludingoutlierdata.

Discount rate: 5.89%, equal to PLN’s 2023 WeightedAverageCostofCapital(WACC).

c. Theassumedelectricityproductioncost(BPP)fromJava toBaliisIDR1,023.51/kWh,basedonMinisterialDecree No.169.K.HK.02.MEM.M.2021.

d. The end-user electricity tariff is IDR 1,444.7/kWh, assumed to remain constant throughout the analysis period.

International Research Journal of Engineering and Technology (IRJET) e-ISSN: 2395-0056

Volume: 12 Issue: 06 | Jun 2025 www.irjet.net p-ISSN: 2395-0072

e. Transmission losses are estimated at 2.03%, while distribution losses are estimated at 6% of the energy transmitted via high-voltage transmission lines. These values are based on the 2023 Electricity Statistics publishedbyDirectorateGeneralofElectricityMinistryof Energy and Mineral Resources Government of the RepublicofIndonesia.

f. Operationandmaintenance(O&M)costsfordistribution areassumedtobeequivalenttotransmissionO&Mcosts, at2.14%.

g. Theeconomicanalysisperiodspansfrom2028to2057, aligning with the 30-year design life of the submarine cable.

h. The project financing scheme assumes 100% equity fundingbyPLN.

i. The financial feasibility indicators used in the analysis include:

InternalRateofReturn(IRR)greaterthantheWACC ordiscountrate

NetPresentValue(NPV)greaterthanzero(NPV>0)

Benefit-CostRatio(BCRatio)greaterthan1

PaybackPeriod(PP)analysis

TheeconomicanalysisoftheJava–BaliConnection(JBC) projectincludesseveralcostcomponents:EPC(Engineering, Procurement, and Construction) costs, non-EPC costs, and Operation&Maintenance(O&M)costs.Costestimationsare expressedinIndonesianRupiah(IDR),asthefeasibilitystudy assumes funding from APLN and applies PLN’s Weighted AverageCostofCapital(WACC)of5.89%.Thescopeofwork alignswiththatdescribedinsubsection2.5.

TheEPC(Engineering,Procurement,andConstruction) cost represents the expenses required for project development,encompassingengineeringdesign,equipment procurement, and construction activities. In this analysis, EPC costs are estimated based on vendor quotations and manufacturerpricereferences.TheEPCcostestimation is developed in accordance with the scope of work for the Java–Bali Connection (JBC) project, which adopts a High VoltageAlternatingCurrent(HVAC)scheme,asjustifiedin points2.1to2.9.ThetablebelowpresentsasummaryofEPC costsfortheJBCHVACsystem.

Thenon-EPCcostsincludethefollowingcomponents:

1. OwnerCost

This comprises development-related expenses such as feasibility studies, initial mobilization, Right of Way (ROW), land acquisition (including landing points in Banyuwangi and Bali, as well as tower site areas), permittingandconsultancyfees,commissioning-related costs, and other miscellaneous expenses (e.g., Factory Acceptance Test and engineering meetings). These are assumedtoaccountfor10%ofthetotalEPCcost.

2. ContingencyCost

Acontingencyallowanceisincludedtocoverunforeseen expenses and potential scope changes during project execution, assumed at 10% of the total EPC cost (excludingVAT).

3. ValueAddedTax(VAT)

AVATof12%isappliedtothedomesticportionofthe EPCcost.

Thecompositionofnon-EPCcosts coveringpermitting, landacquisition,initialoperationalneeds,contingency,and VAT fortheHVACschemeissummarizedinthefollowing table.

Table -7: EstimatedNonEPCCostPlanfortheHVAC Scheme

The Operation and Maintenance (O&M) costs are assumedtobe2.14%oftheTotalProjectCost,encompassing both EPC and non-EPC expenditures. These costs are

International Research Journal of Engineering and Technology (IRJET) e-ISSN: 2395-0056

Volume: 12 Issue: 06 | Jun 2025 www.irjet.net p-ISSN: 2395-0072

incurred annually throughout the operational life of the transmissioninfrastructuredevelopedundertheJava–Bali Connection (JBC) project. The O&M costs are categorized intothefollowingcomponents:

a. FixedO&MCost:

Fixed operational and maintenance costs refer to recurring annual expenses required to ensure the continued functionality and reliability of the transmissionsystem.Theseincludecostsassociatedwith routine maintenance, equipment replacement, installation of new materials, and other scheduled activitiesnecessarytosustainsystemperformance.

b. VariableO&MCost:

Variablecostsaregenerallyembeddedwithinthefixed O&M cost structure and cover expenses that may fluctuate depending on system usage or other operationalvariables.

The estimation of O&M costs is derived from annual operationalperformanceevaluationsoftransmissionassets andindustrybestpractices.Forthisanalysis,theO&Mcosts applied are those associated with transmission and distributionsystems.Specifically,theannualO&Mcostfor transmission is assumed to be 2.14% of total project investment,and,forthepurposeofthisfeasibilitystudy,the samepercentageisappliedtothedistributionsegment.

This assumption ensures a consistent and conservative approach to estimating lifecycle operational expenses, enabling a robust techno-economic assessment of the JBC project.

BeforeThefinancialbenefitoftheprojectisdefinedasthe marginbetweentherevenuegeneratedfromelectricitysales toend-usersandtheBasicCostofElectricitySupply(BPP) enabled by the 500 kV Java–Bali Connection (JBC) transmissionsystem.

TheelectricitytransmittedfromJavatoBaliviathe500 kV Java–Bali Connection (JBC) will be supplied by power plants located in East Java, such as the Paiton Coal-Fired Power Plant (PLTU Paiton). Based on the Decree of the Minister of Energy and Mineral Resources No. 169.K/HK.02/MEM.M/2021 concerning the Basic Cost of ElectricitySupplyforPTPLN(Persero)in2020,theBPPfor electricitygeneratedinEastJavaandtransferredtoBaliis setat6.26UScentsperkWh.

Thisanalysisevaluatesthepotentialrevenuegeneratedby PLNfromelectricitysalesduetotheoperationofthe500kV Java–BaliConnection(JBC)transmissionsystem,whichhas aninstalledtransfercapacity of1,450MW.Theprojection spans a 30-year operational period, referencing demand forecasts, consumer electricity tariffs, tariff schemes, and projectedloadgrowthacrossJavaandBali.

The interconnection is intended to transmit electricity frommajorgenerationcentersinJavatotheislandofBali, aiming to improve supply reliability and reduce Bali’s relianceonlocalfossil-fuel-based(diesel)powerplants.

Assuming:

50% utilization rate of the total installed capacity (1,450MW),

Aloadfactorof76.6%,

Transmissionlossesof2.03%anddistributionlosses of 6%, as reported in the 2023 Electricity Statistics issuedbytheDirectorateGeneralofElectricity(DJK),

AdjustmentforEnergyNotServed(ENS),

Theestimatedannualtransferableenergyis:

Transferred Energi =

(1,450 MW×50%×76.6%×8,760 hours)–ENS–Losses= 4,376,062 MWh/year

Using the average electricity retail tariff for unsubsidized household consumers in Bali (R1/TR segment) of IDR 1,444.7/kWh,andtheBasicCostofElectricitySupply(BPP) of IDR 1,023,510/MWh, the annual gross revenue is estimatedasfollows:

Annual Revenue =

4,376,062 MWh × (Rp1,444,700 Rp1,023,510) = IDR1.843trillion

Consequently, the projected cumulative revenue over 30 yearsis:

30-Year Revenue = Rp1.843trillion/year×30=IDR55.29trillion

Thissubstantialrevenuepotentialunderscoresthefinancial viabilityoftheJava–Balitransmissioninterconnection.The projectenhancesPLN’srevenuemarginfromregionswith high electricity demand while contributing to national supply efficiency by leveraging Java’s energy surplus and minimizing the need for new power plant investments in Bali.

Volume: 12 Issue: 06 | Jun 2025 www.irjet.net

Theeconomicfeasibilityassessmentofthe500kVJava–Bali Transmission and Submarine Cable Project was conducted using a comprehensive financial approach to evaluate key performance indicators, namely the Internal RateofReturn(IRR),NetPresentValue(NPV),andPayback Period(PP)underabasecasescenario.

Tocapturetheproject’sfinancialresilience,asensitivity analysiswasalsocarriedoutunderthefollowingscenarios:

Variations in the Basic Cost of Electricity Supply (BPP),

Increasesintotalprojectcosts(EPCandnon-EPC),

Fluctuationsinpowertransfercapacity.

TheanalysisemployedtheDiscountedCashFlow(DCF) method[7][8],incorporatingassumptionsrelatedtocapital investment, operational lifetime, discount rate, and load utilization,toestimatethelong-termeconomicreturnsofthe interconnection infrastructure. Key assumptions for EconomicFeasibilityAnalysisareshownintable8.

Table -8: KeyAssumptionsforEconomicFeasibility Analysis

Intheeconomicfeasibilityassessmentofthe500kVJavaBaliTransmissionandSubmarineCableProject,itisassumed that 100% of the project financing including both EPC (Engineering,Procurement,andConstruction)costsandnonEPC costs, will be fully funded by PLN (Indonesia’s stateowned electricity company). Furthermore, the applicable ValueAddedTax(VAT)willalsobeborneentirelybyPLNas partofthetotalprojectinvestment.

Thesummaryofinvestmentbudgetrequirementsforthe developmentofthe500kVJava–BaliConnectionprojectis shownintable9.Thisincludesallcapitalcomponentssuch as EPC costs, non-EPC costs, and Value Added Tax (VAT), fullyfinancedbyPLN.

Table -9: EstimatedConstructionCostof500kVJava–BaliConnectionHVAC

TOTALTOWER&TRANSMISSIONLINE500KV(MillionIDR)

TOTALSUBMARINECABLE500KV1x1600mm²CU(6CABLE&1SPARE) (MillionIDR)

TOTALGITET500KV (MillionIDR)

TOTALPROJECTCOSTESTIMATEFORJAWABALICONNECTION(EXCLUDEVAT)

TOTALPROJECTCOSTESTIMATEFORJAWABALICONNECTION(INCLUDEVAT)est.startat2026

Toassesstheeconomicfeasibilityoftheproject,twokey financialindicatorsareused:InternalRateofReturn(IRR) and Net Present Value (NPV). A project is considered economicallyviableiftheIRRexceedsthediscountrateand the NPV is positive. Based on the Ministerial Decree of Energy and Mineral Resources No. 169.K/HK.02/MEM.M/2021, the Basic Cost of Electricity Supply(BPP)forelectricitytransferredfromJavatoBaliis IDR 1,023.51 per kWh. Meanwhile, the average consumer tariffisIDR1,444.7perkWh,whichservesastherevenue base for PLN. The analysis assumes a 30-year operational periodwithaconstantconsumertariff.Asummarytableof theeconomicanalysisresultsisprovidedbelow

International Research Journal of Engineering and Technology (IRJET) e-ISSN: 2395-0056

Volume: 12 Issue: 06 | Jun 2025 www.irjet.net p-ISSN: 2395-0072

Table -10: TableofEconomicFeasibilityAnalysisfor theJava-BaliConnection(JBC)Project"

Theresultsoftheeconomicanalysisconcludethatthe500 kVJava-BaliConnectionProjectiseconomicallyfeasible,as indicated by an IRR exceeding the WACC (>5.89%), a positiveNetPresentValue(NPV),aBenefit-CostRatio(BCR) greaterthan1,andaPaybackPeriodinwhichthecumulative cashflowcoversthetotalinvestmentcost.

A sensitivity analysis was conducted for five different scenariostoevaluatetheeconomicresilienceoftheJava–Bali 500kVtransmissionprojectundervaryingconditions.The followingsummarizeseachscenario:

1. Sensitivity 1:

IncreaseinJavaBPPby10%Inthisscenario,theJava BasicCostofElectricitySupply(BPP)increasesby10% toIDR1,126/kWhduetorisingcomponentcosts(e.g., components C and D in power generation units). All otherparametersfollowthebase-caseassumptions.The resultingfinancialindicatorsareshowninTable11

Table -11: EconomicAnalysisResultofJBC–Sensitivity Scenario1

2. Sensitivity 2:

Maximum Feasible BPP This scenario identifies the maximumBPP(IDR 1,258/kWh)atwhichtheproject remainseconomicallyviable,withtheIRRequaltothe WACC (IRR = WACC). The economic outcomes are showninTable12

Table -12: EconomicAnalysisResultofJBC–Sensitivity Scenario2

3. Sensitivity 3:

30% Increase in Project Cost Considering the upper limitofcostestimationaccuracy,a30%increaseintotal project cost is assumed. The revised cost figures and economicindicatorsareshowninTable13.

Table -13: EconomicAnalysisResultofJBC–Sensitivity Scenario3

Sensitivity 4:

50% Reduction in Power Transfer If power transfer from Java decreases by 50% (to 360 MW) due to derating of major power plants and lower reserve marginsintheJavasubsystem,theresultingeconomic viabilityissummarizedinTable14

Table -14: EconomicAnalysisResultofJBC–Sensitivity Scenario4

5. Sensitivity 5:

Minimum Power Transfer This scenario assesses the minimum power transfer (305 MW) at which the projectstillmeetstheeconomicviabilitythreshold(i.e., IRR equals WACC). The detailed analysis is shown in Table15.

Table -15: EconomicAnalysisResultofJBC–Sensitivity Scenario5

Thecomparisonofsensitivityanalysisresultsfromthefive developedscenariosispresentedintheSensitivityAnalysis Table.ItcanbeobservedthatinSensitivityScenarios1,3, and4,theIRRremainshigherthanPLN'sWACC(>5.89%), the NPV is positive, and the Benefit-Cost Ratio exceeds 1. Meanwhile, in Sensitivity Scenarios 2 and 5, the project is considered marginally feasible, where the IRR equals the WACC.

International

Volume: 12 Issue: 06 | Jun 2025 www.irjet.net p-ISSN: 2395-0072

Based on the comprehensive economic and technology analysisconductedforthedevelopmentofthe500kVJava–BaliTransmissionandSubmarineCableConnectionproject, severalkeyconclusionsaredrawn.First,electricitydemand in Bali Province is forecasted to grow significantly, from 6,632GWhin2025to10,066GWhby2035,withthepeak load increasing from 1,571 MW in 2028 to 2,436 MW in 2035. This indicates a pressing need for enhanced power transmissioncapacitybetweenJavaandBali.

Technicalassessmentsyieldarequiredtransmissionvoltage ofapproximately404kV.Accordingly,andinalignmentwith PLN’s standardized voltage levels, a 500 kV system is deemedmostappropriateforimplementation.Theprojected transmission current is approximately 924 A per cable, whichwillbedeliveredthroughtwocircuitsofthree-phase ACsubmarinecables,eachutilizingasingle-coredesign.

From a financial perspective, the project demonstrates strongeconomicviability.TheInternalRateofReturn(IRR) exceeds the Weighted Average Cost of Capital (WACC) of 5.89%,theNetPresentValue(NPV)ispositive,theBenefitCostRatio(BCR)isgreaterthanone,andthepaybackperiod occurswithinsevenyears indicatingthattheinvestment willberecoupedinarelativelyshortoperationaltimeframe.

Sensitivity analyses further validate the robustness of the project. Even under scenarios where the Basic Cost of Electricity Supply (BPP) increases by 10% (to Rp.1,126/kWh)orthetotalprojectcostescalatestoIDR8.8 trillion, the project continues to show an IRR above the WACC, a positive NPV, and a BCR exceeding unity. Furthermore,tomaintainprojectfeasibilityattheminimum threshold (IRR = WACC), the analysis indicates that the maximumBPPallowableisRp.1,258/kWh,andtheminimum sustainablepowertransfercapacityis305MW.

Overall,the500kVJava–Baliinterconnectionprojectisboth technicallyfeasibleandeconomicallyjustifiable,makingita strategicinfrastructureinvestmenttosupportIndonesia’s futureenergyreliabilityandregionalgridstability.

[1] PLN, Electricity Supply Business Plan (RUPTL) PT PLN (Persero) 2021–2030,Jakarta:PTPLN(Persero),2021.

[2] R.Nampu,“PLNRecordsPeakElectricityConsumption in Bali Reaching 1,157.6 MW,” Antara News, Oct. 16, 2024. [Online]. Available: https://www.antaranews.com/berita/4402377/plncatat-beban-puncak-konsumsi-listrik-di-bali-capairekor-11576-mw.[Accessed:Dec.29,2024].

[3] BPS Bali Province, 2024. [Online]. Available: https://bali.bps.go.id/id/statistics-table?subject=519 [Accessed:Jan.19,2025].

[4] P.Kundur, Power System Stability andControl,NewYork, NY,USA:McGraw-Hill,1994.

[5] Fahad, J.Q and Chillab, R.K. Design Aspects of High VoltageTransmission. Bulletin of Electrical Engineering and Informatics.2020;Vol.9,No.3.

[6] BaylisC.RandHardyB.J.TransmissionandDistribution ElectricalEngineering.Oxford:ElsevierLtd.2007

[7] A. Siyal et al., “Techno-Economic Analysis of HVDC TransmissionLineProjectofChina-PakistanEconomic Corridor(CPEC),” IEEE Xplore,2018.

[8] RossSA,WesterfieldRW,Jordan,BD.Fundamentalsof corporate finance (11th ed.). New York: McGraw-Hill Education.2016.