Bliss Industries has the experience combined with 21st century technologies for your size-reduction or pelleting needs. Call today!

Bliss Industries, LLC is a leading manufacturer of pelleting, cooling and size reduction equipment. Founded in 1981, Bliss Industries maintains a reputation of manufacturing the most efficient, reliable and well-built equipment in the industry.

Developed from a design concept proven worldwide, the range of Pioneer Pellet Mills continues to expand. Overall reliability, maximum efficiency, ease of operation and maintenance combine to provide lower operating costs to each owner. With the ability to provide a wide range of die sizes, die speeds and drive power, Bliss can more than meet your requirements for high quality at a reasonable cost.

Proudly Manufactured in the USA

Bliss Industries, LLC P.O. Box 910 • Ponca City, Oklahoma U.S.A. 74602

Phone (580) 765-7787 • Fax (580) 762-0111

Internet: http://www.bliss-industries.com

E-mail: sales@bliss-industries.com

Pinnacle Renewable Energy has begun initial production at its newest pellet plant in Smithers, B.C. Safety was top of mind throughout the planning, construction, and now the operation of the plant, which will produce 125,000 tonnes annually at full capacity.

In an effort to mitigate climate change, one B.C. company has discovered a way to develop high performance bioplastics from wood.

Two years ago, Comox Valley Firewood, a salvage firewood company, bought a new wood processor. Since then, the company has doubled its production and found its niche in the industry.

From a North American perspective, 2018 was one of the best years for the wood pellet trade, with an estimated 23.8 million tonnes produced. Seth Walker and William Strauss delve into what’s next in the 2019 wood pellet market outlook.

Over the past 10 years, the development of biomass heating projects has increased significantly. But as with any new technology adoption, mistakes were bound to happen. Ecostrat’s Pat Liew outlines some typical biomass blunders.

The new year has brought big changes for the magazine

ast year was a big one, both for the biomass industry and for us as a magazine.

The year was brimming with new project announcements, technology investments, and plant openings. Pinnacle commissioned two new pellet plants and Skeena BioEnergy’s pellet plant in Terrace, B.C. is full steam ahead, to name a few.

From a policy perspective, the Canadian government continued to rally behind clean technology, moving ahead with funding initiatives and its national Clean Fuel Standard. In January, Canada became the 160th member of the International Renewable Energy Agency. Membership will mean more international visibility of our cleantech sector.

A second major change is taking place off the pages of the magazine or our website. We’re introducing a first-of-its-kind workshop: OptiPellet.

Hosted by Canadian Biomass, with support from our friends at the Wood Pellet Association of Canada, OptiPellet is focused on current and future stateof-the-art pellet production technology. Speakers will present on challenges and opportunities for automation and optimization in wood pellet plants.

As for the magazine, in the fall we celebrated our 10th anniversary, reflecting on years past and looking forward to the next 10 years ahead. Reflection often inspires change, and I can report that year 11 is already bringing a number of changes for us.

For one, we have transitioned to a quarterly publication. As you may have already noted on our cover, Canadian Biomass is now publishing as Winter, Spring, Summer, and Fall issues. Fewer pages is never something an editor wants to hear, but we’re changing with the times as more and more of our audience consumes our content online, as well as in the magazine.

In this issue, our new associate editor, Ellen Cools, takes readers inside Pinnacle Renewable Energy’s newest pellet plant in Smithers, B.C., where safety is king. Read more on page 10. We also share the latest from a Canadian company developing bioplastics from wood on page 16.

OptiPellet is modelled after our OptiSaw forum for lumber producers put on by our sister publication Canadian Forest Industries. The goal is a time-effective learning and networking opportunity for the pellet industry.

To ensure the right people attend, registration is limited to pellet plant management and owners, process engineers, continual improvement managers, optimization staff, researchers and design consultants.

OptiPellet takes place in Richmond, B.C., on June 12, (co-located with OptiSaw on June 13). It is conveniently timed the day after the Wood Products Safety Summit, put on by WPAC in partnership with WorkSafeBC and us as the media sponsor, in Prince George.

Have ideas about what technology you want to see at OptiPellet? Email me at mchurch@annexbusinessmedia.com.

I hope to see you there!

Volume 19 No. 1

Editor - Maria Church (226) 931-1396

mchurch@annexbusinessmedia.com

Associate Editor - Ellen Cools (416) 510-6766 ecools@annexbusinessmedia.com

Contributors - Gordon Murray, Chirs Cloney, William Strauss, Seth Walker, Tamar Atik, Pat Liew

Editorial Director/Group Publisher - Scott Jamieson (519) 429-3966 ext 244 sjamieson@annexbusinessmedia.com

Account Coordinator - Stephanie DeFields Ph: (519) 429-5196 sdefields@annexbusinessmedia.com

National Sales Manager - Ross Anderson Ph: (519) 429-5188 Fax: (519) 429-3094 randerson@annexbusinessmedia.com

Quebec Sales - Josée Crevier Ph: (514) 425-0025 Fax: (514) 425-0068 jcrevier@annexbusinessmedia.com

Western Sales Manager - Tim Shaddick tootall1@shaw.ca Ph: (604) 264-1158 Fax: (604) 264-1367

Media Designer - Alison Keba

Circulation Manager – Jay Doshi jdoshi@annexbusinessmedia.com Ph: (416) 442-5600 ext. 5124

President/CEO Mike Fredericks

Canadian Biomass is published four times a year: Winter, Spring, Summer and Fall. Published and printed by Annex Business Media.

Publication Mail Agreement # 40065710 Printed in Canada ISSN 2290-3097

Subscription Rates: Canada - 1 Yr $57.00; 2 Yr $102.00 Single Copy - $9.00 (Canadian prices do not include applicable taxes) USA – 1 Yr $93.50 US; Foreign – 1 Yr $106.00 US

CIRCULATION mchana@annexbusinessmedia.com Tel: (416) 510-5109 Fax: (416) 510-6875 or (416) 442-2191 111 Gordon Baker Rd., Suite 400, Toronto, ON M2H 3R1

Annex Privacy Officer Privacy@annexbusinessmedia.com Tel: 800-668-2374

Occasionally, Canadian Biomass magazine will mail information on behalf of industry-related groups whose products and services we believe may be of interest to you. If you prefer not to receive this information, please contact our circulation department in any of the four ways listed above. No part of the editorial content of this publication may be reprinted without the publisher’s written permission ©2019 Annex Business Media, All rights reserved. Opinions expressed in this magazine are not necessarily those of the editor or publisher. No liability is assumed for errors or omissions. All advertising is subject to the publisher’s approval. Such approval does not imply any endorsement of the products or services advertised. Publisher reserves the right to refuse advertising that does not meet the standards of the publication. www.canadianbiomassmagazine.ca

AT PETERSON WE NEVER STOP DEVELOPING THE ULTIMATE INDUSTRY LEADING EQUIPMENT.

For over 35 years, we’ve built our business around building the most productive mobile chipping and grinding machines in the industry. Day after day, we partner with our customers by giving them the best tools for the job and exceptional support when they need us.

Visit us at www.petersoncorp.com today and see why Peterson is the industry leader for disc and drum chippers, horizontal grinders, blower trucks, screens and stacking conveyors.

Get the right sized product, sort it out, and stack it higher with Peterson!

Let us know how we can help grow your business!

B.C. is making several policy changes to revitalize the province’s coastal forest sector, including establishing a coastal fibre recovery zone. Premier John Horgan announced the changes at the annual Truck Logger Association convention in Vancouver in January.

The changes are part of the Coast Forest Sector Revitalization Initiative, a government program that aims to “reverse a systemic decline that has taken place in the coast forest sector over most of the last two decades,” according to a news release.

The initiative has five goals, which will be executed through legislative, regulatory

and policy changes in the next two years:

• Rebuilding solid wood and secondary industries so more B.C. logs and fibre are processed in B.C.

• Increasing fibre availability for domestic mills by improving harvest performance.

• Upholding a credible auction system by verifying independent timber sale licenses.

• Creating stronger business relationships between BC Timber Sales, major licensees and First Nations.

• Amending the Forest and Range Practices Acts and auditing the private man-

aged forest land regime to re-establish public trust.

These reforms come after six months of consultation with First Nations, industry and labour.

As part of the program, the fee for log exports will be based on harvest economics, beginning July 1, 2019.

The waste policy will also be reformed, with the goal of redirecting some of the two million

cubic metres of wood waste to pulp and paper producers, as well as the bio-products and bioenergy sector. In the spring, a coastal fibre recovery zone will be established, along with penalties for leaving more waste than acceptable, based on new lower waste benchmarks in harvested areas.

Penalties will also be increased for reporting waste late.

Meanwhile, BC Timber Sales will engage with First Nations and other licensees in area-based planning to create better landscape-level planning and forest management practices. BC Timber Sales will also work with these groups in business arrangements that would result in all parties sharing timber volume, expertise and/or capital, as well as decision-making and mutual benefits.

Canada is the newest member of a global intergovernmental organization that aims to foster the growth of renewable energy, a move that will increase the visibility of our cleantech sector.

Canada joins 159 member countries in the International Renewable Energy Agency (IREA) to support the transition to sustainable energy through international co-operation.

“The growing green economy is among the greatest economic opportunities for Canada in a generation,” Natural Resources Minister Amarjeet Sohi said in a news release. “Becoming an IRENA member will accelerate Canada’s efforts to build a clean

energy future that will bring new economic growth and thousands of new, well-paying jobs.”

According to the release, membership in IREA means Canada will promote its expertise in the development and deployment of renewable energy technologies, increase the presence and visibility of its cleantech sector internationally and demonstrate its leadership in renewable energy. The forum will also allow Canada to help shape the ongoing global dialogue on renewable energy and climate change, including on issues such as energy access and gender equality.

The federal government is investing $645,000 in two Indigenous forestry projects in Yukon.

The Teslin Tlingit Council received $595,000 to purchase biomass wood chip boilers, as part of a larger project that aims to reduce reliance on non-renewable heating fuels and help cre-

ate jobs by installing direct heating systems.

“Teslin’s biomass project, which is field predominantly by the community’s waste wood, is providing local opportunities in the forestry sector and in the professional trades,” said Blair Travis Hogan, executive councillor, Teslin Tlingit Council, in

a statement. “The 13 large buildings connected to the biomass district heating network, including the Teslin School, will now be able to avoid burning heating fuel, which is estimated to be about 100,000 litres per year.”

The remaining $50,000 will help Na-Cho Nyäk Dun

Development Corporation develop a solution for the lack of local seeds used to restore land impacted by nearby mining. This will help the First Nation of Na-Cho Nyäk Dun to conduct a feasibility study and create a business development plan for sourcing local seeds.

Timberlands International Inc., a subsidiary of Active Energy Group, has received two five-year commercial cutting permits to harvest 100,000 m3 annually on the Great Northern Peninsula in Newfoundland.

This will support the operation of a new $19.7M wood pellet plant in Hawke’s Bay, N.L. AEG’s external investors will provide funding to build the proposed plant.

According to a news release, the cutting permits stipulate that 25 per cent of the harvest be made available to commercial sawmills for first right of refusal. “Wood fibre requirements of 148,000 m3 would be provided via the cutting permits and by purchase from existing forest operators,” the release says.

The Hawke’s Bay plant will produce 55,000-65,000 metric tonnes annually of CoalSwitch wood pellets to be exported to Poland. AEG has agreed to provide wood pellets to Cobant, a Polish research, development and coal recovery/production company, to supplement coal use in Poland’s residential heating market.

The company predicts the plant will result in 25 new fulltime jobs in plant operations, as well as 30-50 positions in harvesting and trucking.

“This agreement is a significant achievement for the company and for the Province of Newfoundland and Labrador, and will reap rewards for all parties in the years to come. We look forward to becoming part of the community on the Great Northern Peninsula and working with stakeholders to provide positive economic opportunities as we rebuild this important industry together,” said Richard Spinks, managing director of Timberlands International.

The federal government is giving Competitive Green Technologies a leg up to research and develop a biomass-based nylon for automobile manufacturing and other industries.

Agriculture and Agri-Food Canada (AAFC) announced it’s investing $499,433 in the company, which is working with the University of Guelph’s Bioproducts Discovery and Development Centre (BDDC) in Ontario to develop a new biocomposite material from resin and natural fibres derived from agricultural waste.

“We are really happy to have created an impact by working with AAFC on this project – nano-enhanced, ag biomass-based hybrid bio-composites for light-weighing automotive. AAFC funding has resulted in an industry needle-mover. As a farmer and president of Competitive Green Technologies, I am absolutely delighted to see the value-add to agriculture through this innovative technology break-through,” Mike Tiessen, president of Competitive Green Technologies, said in a government news release.

The global bioplastics and biocomposites sector is entering the plastics market at a growth rate of 30 per cent annually, according to the release.

To keep 350 jobs at the Barrette-Chapais sawmill in Chapais, Que., the company has decided to invest $70 million in an industrial wood pellet plant that will process much of their residuals.

The new plant, called Granule 777, will produce 210,000 metric tonnes of wood pellets per year, primarily for export.

“Basically, this new company was created to sustain the mill’s jobs and to provide market alternatives for residuals,” explained Benoit Barrette, president of Granule 777 and the Barrette-Chapais sawmill. The sawmill, which processes close to one million cubic metres of wood – one of the largest in Quebec – produces a lot of sawdust, shavings and chips that must be recovered in order to remain profitable.

“There have always been ups and downs in the chip market, especially the latter, but one thing is inevitable – newspaper consumption is going down,” Barrette added. “So we decided to create an alternative ourselves.”

The majority of the pellet plant supply will come from sawmill by-products,

but residual forest biomass could also be used.

The Granule 777 plant will mostly export their pellets. The company has only one industrial client in Canada, which consumes around 90,000 metric tonnes of pellets.

The products will be exported through the Port of Grande-Anse, where more than $15 million has been invested. According to the current plans, different industry players will be able to use this export infrastructure, but there are still some loose ends to tie up with the Quebec government before an official announcement is made.

The company began constructing the new pellet plant in August 2017. The plant is expected to produce its first pellets by the end of July 2019 and create around 40 jobs –20 at the mill and 20 in transportation.

Natural Resources Canada has invested $15 million in the project on top of the $70 million, and Canada Economic Development has announced a $5 million repayable contribution.

The Quebec government is also investing $7 million.

By Gordon Murray

t the Wood Pellet Association of Canada (WPAC), we advocate on behalf of our membership. Here are some of our recent activities:

Last fall, WPAC and the marketing team at Shaw Resources, Dan Coffey and Sue Hoyt, with financial support from Forestry Innovation Investment, co-ordinated a four-week social media campaign on wood pellet heating. The campaign ran from Oct. 8 to Nov. 5, using Facebook and Instagram. Both English and French advertisements targeted all of Canada except for the largest cities with natural gas grids. Campaign results included:

• Main social media platform responses: Facebook

• Total impressions: 465,941

• Website page views: 7,677

• Unique users: 4,111

• Increase in website traffic over previous four weeks: 1,000 per cent

• Increase in website traffic over same four weeks in prior year: 2,000 per cent

• Top English language provincial activity: Ontario – 29 per cent; Nova Scotia – 19 per cent; British Columbia – 13 per cent

• Top French language provincial activity: Quebec – 90 per cent; New Brunswick – 9 per cent

• Significant conversation on the pros and cons of wood pellets

• Most popular page viewed: Job Smart

• Positive comments:

• Love wood pellet stove

• Easy to use

• Safer than wood stove

• Circulates heat well and evenly

• Saves money

• Cheaper than alternatives

WPAC members can request the full campaign report.

During 2019, WPAC is planning to co-operate with the Quebec Wood Export Bureau on a comprehensive Canadian wood pellet market study for our membership. We will involve members in designing the study.

WPAC’s Safety Committee includes members from most Canadian wood pellet producers. Since 2014 we have made remarkable progress in making our industry safer and improving our relation-

ship with safety regulators.

One of our recent goals has been to collaborate with other international wood pellet trade associations on the topic of safety. To that end, on Nov. 15, I, along with Scott Bax, senior vice-president of operations for Pinnacle Renewable Energy, led a safety session during the European Pellet Council’s general assembly in Hanover, Germany. The session featured presentations and videos on the Canadian wood pellet safety journey and a workshop and quiz on the topic of combustible dust mitigation. We used a combustible dust video produced by WorkSafeBC, which, due to popular demand, was subsequently translated into German by WorkSafeBC for distribution to a European audience.

The House of Commons Standing Committee on Environment and Sustainable Development is a permanent committee, comprising nine members of parliament (Liberals, Conservatives and NDP), established by the standing orders of the House of Commons in Ottawa. The committee’s mandate is to examine, inquire and report on matters related to the environment and sustainable development.

The Committee invited WPAC to present on the topic of clean growth and climate change in Canada. On Dec. 11, I discussed the global and Canadian wood pellet industry, the nature of our raw material supply, our growing exports, and how, with more regulatory support, our industry could play a greater role in reducing Canada’s GHG emissions – both in repowering coal power plants and in domestic and commercial heating – and in doing so, provide even more well-paying jobs, especially in rural areas.

I visited Japan in early January this year as part of a delegation with representatives of Pinnacle Renewable Energy, Pacific BioEnergy, and Canadian National Railway (CN). Our group included Jean-Jacques Ruest, CEO of CN. Our purpose was to reassure our Japanese customers of CN’s commitment to providing timely and reliable transportation from Canadian pellet plants to Western Canadian ports. Japanese power plants must have confidence that Canadian pellet producers can meet their contract supply obligations. Our agenda included a visit to Showa Shell’s Keihin Biomass Power Plant in Kawasaki and a seminar and dinner at the Canadian embassy attended by senior representatives from 25 Japanese customers, including trading houses, independent biomass power plants, and coal power plants that are co-firing with wood pellets.

Our wood pellet delegation also met with the Japanese Ministry of Economy, Trade and Industry (METI) to discuss Canadian wood pellet supply and sustainability. We have invited METI to visit Canada to see our industry first hand.

On Jan. 10, I met with the Japan Coal Energy Center (JCOAL) in Tokyo. JCOAL is a trade association and research organization with 172 industrial members – including pellet customers Sumitomo, Mitsubishi, Kansai Power, and Osaka Gas, among others – and is supervised by METI.

Doubt is beginning to emerge in Japan about the future role of nuclear energy, following the Fukushima disaster. Public opinion has remained solidly opposed to nuclear power. Consequently, the Japanese government believes the country may need to rely on a greater proportion of thermal energy than previously believed. Since this will mean continued reliance on coal, METI is now considering options for mitigating GHG emissions. METI has instructed JCOAL to investigate the potential for increasing the proportion of biomass co-firing and is focusing on Canada as a supply source. To this end, WPAC hosted a visit by JCOAL to Canada during the week of Jan. 28. We visited the University of British Columbia, Canadian pellet plants, port facilities and met with academics, B.C. government representatives from forests and trade, Canadian pellet producers, and transportation companies.

As executive director of WPAC, I am often so preoccupied with organizing and implementing advocacy efforts on behalf of our membership that I don’t take sufficient time to report back to our membership. All these activities are essential for the growth and prosperity of the Canadian wood pellet industry. I encourage members to contact me for more information and for copies of all reports and presentations. •

QUALITY WORLDWIDE — For decades, KAHL pelleting plants with a capacity of 1.5 – 12 t/h per mill have been applied successfully for compacting organic products of different particle sizes, moisture contents and bulk densities.

AMANDUS KAHL USA Corp. 105 Hembree Park Drive, Suite L Roswell, GA 30076 · USA · 001-770-521-1021 sales@amanduskahlusa.com · akahl.us

AMANDUS KAHL GmbH & Co.KG SARJ Equipment Corp. 29 Golfview Blvd · Bradford · Ontario L3Z 2A6, CANADA 001-905-778-0073 · rbmacarthur@sympatico.ca

By Ellen Cools

The past year has seen many changes for Pinnacle Renewable Energy: in February 2018, the company completed an initial public offering; in March, it commissioned its Entwistle, Alta. facility; and in September, it acquired a 70 per cent interest in a pellet plant in Alabama.

But the company did not stop there. In November 2018, Pinnacle began production at its newest pellet plant in Smithers, B.C.

According to management, safety was top of mind throughout the planning, construction and now operation of Canada’s newest wood pellet facility, which features some of the latest dust suppression, spark detection and explosion prevention systems. In conjunction with Pinnacle’s safety culture and programs, the company is setting a high standard for the industry.

With six plants already in B.C. and one in Alberta, why did Pinnacle decide to build a new one in Smithers?

According to Leroy Reitsma, Pinnacle’s president and chief operating officer, the company saw an opportunity to partner with West Fraser and create a mutually beneficial solution.

West Fraser’s Smithers sawmill is located in a region that features a mix of spruce, pine, balsam and some incidental hemlock and cedar. During the mountain pine beetle epidemic, the sawmill was focused on harvesting pine from the areas east of Smithers. However, as this sawmill transitioned back into the areas more to the west of the community, the amount of balsam and pulpwood increased. A local solution was needed to address this, Reitsma says.

West Fraser and Pinnacle have joint ownership of the new plant; West Fraser owns 30 per cent and Pinnacle the remaining 70 per cent. As part of the project, the partnership acquired the site of Northern Engineered Wood Products (Newpro), an independent particle board manufacturer that had ceased operations in Smithers. Particle board markets are wood species sensitive; they prefer pine and spruce, and cannot accept balsam.

Andritz pellitizers at Pinnacle Renewable Energy’s new pellet plant in Smithers, B.C. Photo courtesy Pinnacle Renewable Energy.

Logistically, developing a new plant in Smithers was also a good fit, Reitsma says. The facility is located roughly 350 kilometers away from the Westview Wood Pellet Terminal, the company’s wholly-owned port in Prince Rupert, B.C., which makes transportation of the pellets both cost and carbon footprint efficient.

Likewise, construction of the facility was efficiently executed. It began in March 2018 and finished on time in November.

“The way that we build projects is by contracting more than 80 per cent of the project costs before commencing construction, including major equipment and our installation crews. As a result, on site execution is highly focused on ensuring that the equipment is expedited to the site in a timely manner and that the installation crews are able to safely meet their schedule,” Reitsma explains.

The partnership budgeted $33 million to both acquire the Newpro site and build the new facility. The company has hired 20 full time employees to run the operation.

At full capacity, the new facility will produce 125,000 metric tonnes per year. Currently, it is in the initial phases of production, but Reitsma expects the plant to be operating at full capacity in the latter half of 2019.

The plant runs a mix of fibre – roughly half is traditional sawmill residuals, such as sawdust and shavings, and the rest is harvest residuals – primarily supplied by West Fraser. These residuals go through the standard process to become wood pellets, Reitsma says. “We’ve got drying, particle size breakdown, and then the pelletization process and shipping.

“Given the size of the plant, we’ve been able to come up with a very efficient design for that level of production,” he adds.

The facility was built along the same lines as the rest of Pinnacle’s fleet, using equipment the company is already familiar with, including a Stela dryer, with Bliss hammering capacity and Andritz pelletizers.

In fact, one of the main reasons for choosing these suppliers was the repeatability of performance, Reitsma says. “We’ve got a higher probability of repeatability of performance when we’re using equipment that we’ve learned through management initiatives to optimize, and that’s really what drove us towards the suppliers that we selected for Smithers.”

Ultimately, the pellets produced at Smithers will be integrated with the supply from Pinnacle’s other mills, to be exported to customers in Europe and Asia through Westview.

The construction of this plant was not without its hiccups.

“There’s always challenges in construction – that’s why we have a great team that can overcome those challenges, and I think they’ve done a nice job of not allowing the things that did arise to stand in their way of delivery,” Reitsma says.

He emphasizes how impressed he was by the team, including Chris Barber, Pinnacle’s general manager of strategic capital, Darren Swaan, the senior project manager, John Grime, the construction manager, Jaden Tupper, the junior project manager, and Bill Penno, the safety officer on site.

Speaking with Canadian Biomass, Penno agrees that there were a few challenges during construction, but says that the project ran smoothly overall. Penno, whose formal title is construction safety advisor at Pinnacle, was in charge of worker safety at the site.

“Every construction worker is coming from a different background,” he explains. “We’re trying to get everyone working safely together, trying to get them to buy into Pinnacle’s safety culture.

“Although I do not have a role in the plant’s operational safety on a day-to-day basis, anytime I am at the plant, I try to look out for the safety of everyone while I am there, construction workers and operational workers alike,” he adds.

Each employee received safety training before starting work, and several policies were implemented to ensure continued safety. One of those policies is “Take Two,” where employees are encouraged to stop and take two minutes to think about their task and how to do it safely, says Penno.

Part of this includes performing field level hazard assessments (FLHAs), whereby workers identify all the hazards and risks associated with a task before starting it, and reassess if something changes during the task. Penno recommends this as a safety best practice.

Other steps include “working safely for yourself, for your family, and your coworkers,” he says.

In the event of an emergency, Pinnacle has several protocols in place, such as confined space rescue and rescues from height.

“If we had to go into confined space, we’d always have a rescue team behind, depending on the space we went into,” Penno explains. “If it’s a space that we could rescue ourselves, we would practice getting the first aid equipment to the work platform, onto the lift and securing it, and then bringing it down to the ground and treating the person on the ground.”

For such rescues, Pinnacle hires outside agencies to provide training.

When it comes to fueling the future of your business, our commitment covers your operation’s entire life cycle. From the first feedstock analysis in the field, through non-stop biofuel production. For Georgia Biomass, this meant

building the world’s largest biomass plant, backed up by a new ANDRITZ dedicated service center in their own backyard. Find out how our world- class processing solutions and services can fuel your business at andritz.com/ft.

Every year, millions of tons of industrial waste are turned into millions of dollars of reusable materials. CPM and Di Più Systems help make that happen.

We’ve joined forces to bring you the world’s best mechanical and hydraulic briquetting technology.

Together, we’re taking the fossil out of fuel.

“No task at Pinnacle is so important or urgent that it can’t be done safely,” he adds.

This focus on safety extends far beyond the construction process. Pinnacle’s safety program, Owning Safety, is also a key part of the company’s safety culture, and has been implemented across all facilities.

“It really starts with our employees, with our Owning Safety program,” Reitsma explains. “It’s a cultural thing that we have made a core part of who we are. When we add people to our workforce, there’s a lot of focus on hiring people who want to live our values. And from there, we back that up with management, training and facilities which are designed to reflect those values.”

As part of the operations process at each plant, the managers perform a dust audit. “Every plant has a dust management tool, a check that they do every day going through the plant, checking for dust levels,” Penno elaborates. “It’s rated on a scale of one to five, five being clear of dust, four a minimal amount of dust, and if we ever hit two or three, that means you have to stop and get things clean.”

Employees at each plant are also encouraged to record observations, identifying hazards and recognizing other employees’ good safety practices.

All plants have emergency response plans in place, such as spill response and emergency evacuation protocols.

Thanks to the Owning Safety program and these best practices, Penno says “the workers are very in-tuned to the safety culture.”

Owning Safety also applies to the contractors Pinnacle work with.

“As we select contractors to work for us, we check that they are registered with WorkSafeBC and that they are insured. We check that the mobile equipment the contractors bring onto site are safety certified and we check that the workers they bring to the worksite are certified to do the work required of them,” Penno shares.

Of course, a big part of safety at a pellet plant is installing the proper safety equipment, and the Smithers facility features a range of them, such as explosion vents (including flameless ones) on the conveyors.

The flameless vents “pop open if there happens to be a pressure build up because

of a deflagration inside of a conveyor,” Penno explains. “They’re engineered to quench the gas stream while directing the flow at such an angle that minimizes the chance of harm. This relieves the pressure in the conveyors so the conveyors don’t explode; just the explosion panel itself would pop.”

The conveyors and bins at the plant also feature CV Technology fire suppressant technology. According to Penno, “They sense a pressure change, and automatically inject a chemical compound into that conveyor that suppresses an explosion or fire before it can materialize.”

In the pneumatic conveyance system a spark detection system from Grecon detects and triggers a suppression of sparks with water.

Temperature sensors in the equipment also help prevent fires and explosions. “When a bearing starts to get hot, it alerts and shuts down the drive before we start having a fire,” Penno explains.

The facility also features cameras, bin level sensors and Sonic Aire dust control technology in the ceiling. The fans oscillate and turn in different directions, blowing air to keep dust from accumulating on high surfaces that workers may have difficulty cleaning.

Keeping the dust from accumulating is “one of our most important acts of owning safety,” says Penno, “as removing dust from our buildings reduces the risk or chance of a combustible dust explosion from occurring.”

In Penno’s experience, Pinnacle has come a long way with these safety practices.

When he joined the company in 2014, WorkSafeBC was concerned about safety at Pinnacle’s plants. But since creating the Owning Safety program, Pinnacle has been working hand-in-hand with WorkSafeBC, Penno says. In fact, he refers to Pinnacle and WorkSafeBC as “partners in safety.”

This focus on safety will only continue in the future as Pinnacle grows, Reitsma adds.

“Alongside of that, we continue to advance new projects that will increase our production capacity in line with the growth of the market that is set to maintain a 17 to 20 per cent year-over-year growth for the next five to 10 years,” he says.

Editor’s note: Speaking of safety, Canadian Biomass and its sister publications, CFI and Pulp & Paper Canada, are working with WPAC on the Wood Products Safety Summit in Prince George, B.C. on June 11. Stay tuned for more details.•

By Tamar Atik

In the pursuit of mitigating climate change, one B.C. company has developed a method to make bioplastics from wood. But rather than another bio-alternative for plastic straws and containers, Advanced BioCarbon 3D Ltd. (ABC3D) is creating a wood-based engineered grade high performance plastic.

Canadian Biomass spoke with chief executive officer Darrel Fry and environmental scientist Kim Klassen to learn more about this innovative process.

“People often think of bioplastics as single-use with low-value functionality, but our products are incredibly highfunctioning with exceptionally high heat resistance while being lightweight,” Fry says. “As an example, our goal is to be

able to 3D print something like a piston for your car from this material – there’s such high heat resistance, and it’s also very strong.”

The company’s focus is on addressing the broader issue of climate change, rather than the over-production of single-use plastics, Klassen says. “If we have extreme weather events happening all the time, it’s going to interrupt every part of society. So, climate change, above all other environmental concerns, is important and that is what this company addresses through product development, through sustainable bioplastics made from renewable resources.

“Our products are carbon negative,

so that’s not just reducing the impact on climate change; we’re actually helping to remove greenhouse gases from the atmosphere.”

ABC3D makes its products from wood chips by extracting the resins from wood. “Using a closed-loop manufacturing system, we are able to produce a sustainable product that is non-toxic and renewable,” Klassen says. “The process uses green chemistry and starts with wood chips from the forest industry that are mixed with a solvent and put through a series of pressurized heating and cooling phases to extract the resin from the wood chips. All solvent from the manufacturing process is put

back into the system to be reused again.”

This technology was developed by ABC3D’s founders Hélène Bélanger and Ross Prestidge, who researched the process for more than a decade. The production of commercial resins is not new but it’s the quality of the resin the company is producing that creates these advanced sustainable materials.

The company currently operates a pilot plant and is working to scale production to have retail sales of 3D filaments available by the first quarter of 2019.

ABC3D’s head office is located in Rossland, B.C., but the wood to plastics process takes place under the same roof as MIDAS (Metallurgical Industrial Development Acceleration and Studies) Fab Lab in Trail, B.C., which is an applied research, commercialization and digital fabrication training facility.

Being an on-demand print centre, the MIDAS Fab Lab is one of ABC3D’s target customers and in their target client market. They are currently testing the product with ABC3D, while Selkirk College and ABC3D were recently awarded a $300,000 grant from the government of British Columbia’s organization, BCIC Ignite, to purchase equipment for testing and producing filaments. Besides on-demand print centres, other target clients include the 3D printer manufacturers themselves and OEM (original equipment manufacturers) suppliers.

Other verification and development has been done by the National Research Centre Industrial Materials Institute (NRC-IMI) in Boucherville, Que. “The feedback from them is that they were happy with the results they received from their testing,” Fry says. “The project results, in their words, were, ‘well above their expectations.’”

The company is currently using hardwood trees to make its products, so Fry says they aren’t competing with the forest industry for fibre.

“There currently is no viable market for those hardwood trees,” he explains. “We’re actually helping to create a new market for fibre. The cost to the forestry companies is already there to cut down and process unwanted species, so what we’re saying is, they’ll still have those costs, but now they’ll have an

opportunity where they can continue to harvest that tree, take it out of the forest, and bring it to market.”

The process also works well with softwoods and future testing will reveal the exact methodology required to extract the highest quality resins from those species.

After demonstrating the process to a 10 tonne scale per day of wood chips, the next goal is the commercial scale (in two years) where volumes are expected to reach 60-250 tonnes of wood chips a day.

“We are targeting to have our sales in 3D filaments start in the first quarter of 2019 and then roll out a number

of different filaments with additional characteristics such as carbon fibre reinforced filament, conductive filament and filaments that are reinforced with other wood fibres, beyond our first products, which are a blended traditional printing filament,” Fry says.

“Our company is proving that from wood we can make sustainable, economical, high performance plastics,” he adds. •

By Ellen Cools

With the recent release of a new climate change report by the UN Intergovernmental Panel on Climate Change, many in the industry might be wondering what they can do to mitigate the impact of climate change.

Daniel Francoeur, owner and operator of Vancouver Island, B.C.-based Comox Valley Firewood (along with his wife, Chatrawee Sritip), believes he has discovered a way to make the industry more sustainable: salvaging wood from burn piles and turning it into firewood.

The company has been in the firewood business for 12 years, Francoeur says, starting as “just a chainsaw, a truck and an axe.”

However, in 2015, they began a salvaging operation, based in Courtenay, B.C., after signing a contract with a large B.C. logging company to salvage wood from the company’s burn piles for usable firewood. He pays a nominal fee in return for the wood, and also gets wood from a few other smaller logging companies.

Since then, the couple has hired three employees and bought 1.2 hectares (three acres) of land on which they operate. One employee runs a John Deere excavator in the bush, taking apart the burn piles, while another runs the wood processor alongside Francoeur, and a truck driver moves the wood to the wood lot.

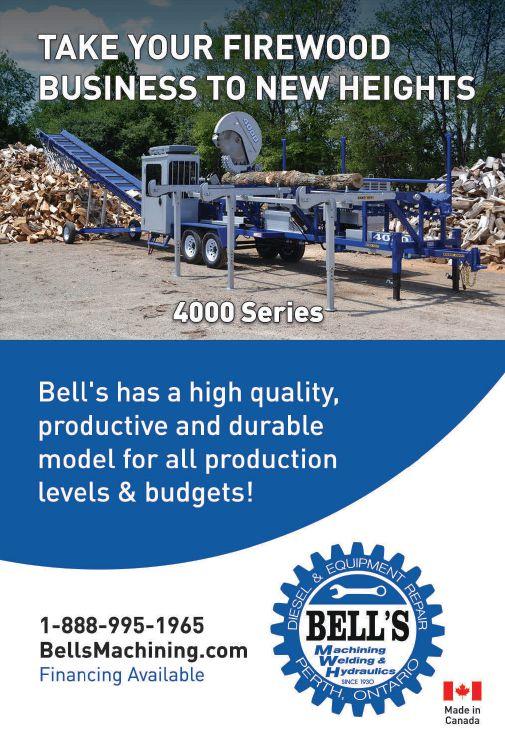

But the biggest change? Two years ago, Francoeur bought a wood processor that has almost doubled his production.

He purchased the processor “because the demand for the firewood locally grew bigger, and some of the smaller guys were getting out,” he explains.

“After the logging company opened the land for me, I had access to a fair amount of wood that was going to get burned. So instead of just burning it and wasting the wood – the biomass is huge – I started going after the burn pile with my excavator, which has got a grapple on it, and taking it apart,” Francoeur elaborates.

“I realized the potential that was sitting in front of the company,” he adds. “Then it was time to purchase the wood processor.”

The processor is Bell’s Machining’s 4000 Series firewood processor, which has won awards at the Paul Bunyan Show two years in a row, according to Francoeur.

Made with a Cat motor and featuring an attached conveyor, the processor can be pulled behind a truck as needed.

However, Francoeur has found the most efficient way of transporting wood is to keep the wood processor on his woodlot and bring his Isuzu bin truck to it.

“We put two bins side by side on the ground, and the

conveyor, which is attached to the wood processor, moves right to left,” he explains. “So I load one bin, and we move it to the other side; we load the other bin.”

“The wood is not touched by humans anymore – it’s all mechanized,” he continues. “We’ve got a small skid steer from John Deere that loads the deck for the wood processor, and then the wood processor has an in-feed table, and a guy in the cab pushes a button, and the in-feed table feeds the saw. Then the wood gets cut, goes into a trough, and down there, there’s a splitter that splits all the wood. The wood gets pushed systematically to the conveyor, and from the conveyor to the bin.”

At the end, once the bin is full, Francoeur simply picks it up and puts it on the truck.

Consequently, the work is much more efficient and less tiring for him and his employees. And since they’re not as tired, they can produce more.

“We’re just trying to find the right balance,” he says. “You go too big, you can lose everything.”

The processor requires a lot of maintenance, he admits. “It’s wear and tear, right? The machine is working a lot of hours. It’s well-built, but it’s a different level of stress,” he elaborates. “Instead of stressing about tiring physically, you’ve got to be on top of it mechanically – change the oil and make sure everything’s safe.”

However, it’s “nothing we couldn’t handle,” Francoeur says, and the positives far outweigh the negatives.

In fact, thanks to this increased efficiency, Comox Valley Firewood will be producing over 1,000 cord this year – maybe even 1,200 cord of firewood, says Francoeur.

The cord is full cord – four foot by four foot by eight foot – as opposed to face cord, he adds.

Before buying the processor, Comox Valley Firewood was producing 400 or 500 cord a year.

“I believe we are one of the biggest producers right now in British Columbia,” Francoeur says.

He expects to be able to pay for the excavator and processor within three to four years of operation, while also paying for his livelihood and his employees’ wages.

But who is driving this demand? His customers are mainly local: local business people, homeowners and campgrounds (both provincial and private).

Yet it’s the quality of wood produced by the processor that has really driven demand in recent years.

“The product is the best, it’s all even, every piece that comes out of the wood processor is 15 inches or we do custom cuts. Every piece is the perfect length because of the way the machine is designed,” he explains.

Eventually, “Word came out about town, and the logging company let me season the wood on the land for one year. So all the wood is already pre-dried or pre-seasoned wood.”

“The wood is all even, so the people really like it, so we’ve gotten a lot more calls,” Francoeur continues. “I can barely handle my business right now. I’m getting 25 phone calls every day now for the last six weeks for firewood.”

To meet this demand, he will eventually hire more employees. Francoeur is also considering purchasing a logging truck, because he is now paying a logging truck three to five times per month to move wood from the mountain to the woodlot.

The same B.C.-based logging company has also offered Francoeur land further north on the island to set up the same business. But he hasn’t made his move yet.

For him, one of the biggest payoffs is how the processor has helped him grow a sustainable operation and become an example for renewable operations in forestry.

“We’re really happy with preventing the waste of the wood, either rotting in the bush, or when we finish logging here, they put it in piles and burn it. So the biomass and the waste of our natural resources is minimized quite a bit now,” he says. “I think that could be done in other places in Canada, too, because we all use firewood.”

“A lot of people want to say, ‘Oh, the industry shouldn’t be burning, they shouldn’t be wasting wood,’ but you’ve got to find a way to make money. We finally found a niche here, in a way, that’s going to save a lot of that biomass,” he continues. “Instead of burning all that debris at the end, we’re taking probably 50 per cent of it out of there, and salvaging it, cleaning wood and keeping people’s houses warm.” •

By Seth Walker and William Strauss

From a North American producer’s perspective, 2018 was one of the best years in quite some time for the wood pellet trade. After several years of tempered development following the ramp up of the Drax power station in the UK, new markets and consumers drove strong growth in global demand. Imports to Denmark, South Korea and Japan all increased at least 40 per cent from previous highs, with Japanese wood pellet imports more than doubling. Better market conditions and less inventory also led to strong growth in North American and European heating markets after several weak years.

Overall, wood pellet trade in 2018 is estimated at 23.8 million tonnes, a whopping 26 per cent increase from 2017’s 18.9 million tonnes. This article will provide an outlook for what to expect from key markets in the years to come.

Industrial pellet demand is estimated at 17.5 million tonnes in 2018. FutureMetrics projects that this will climb to 29 million tonnes in 2023.

Nearly 60 per cent of this new demand growth is projected to come from Asia, with most of the remainder from increased demand in the UK and the re-emergence of a significant industrial pellet market in the Netherlands.

In 2018, UK pellet demand increased significantly for the first time in several years with the commissioning of EPH’s 396 MW Lynemouth Power Station conversion and the conversion of a fourth unit at the Drax power station. Moving forward, growth will be primarily driven by a ramp up to full operation at Lynemouth and increased availability at the Drax power station. In 2020, UK demand will increase again

with the scheduled commissioning of MGT’s 299 MW Teeside CHP plant, expected to use up to 1.5 million tonnes per year.

The Netherlands has a history as a major market for industrial wood pellets. In 2010, the Netherlands was the biggest market for industrial wood pellets – used for co-firing to meet renewable energy goals. The market rapidly declined when a new renewable energy subsidy scheme was introduced in 2012. The new SDE+ scheme required new sustainability standards to be developed before biomass co-firing could qualify for subsidies. That sustainability criteria were finally approved in 2015.

In 2016, subsidies were awarded for co-firing at four power plants: RWE’s Amer and Eemshaven power stations, Engie Rotterdam and Uniper Maasvlakte 3 (MPP3). Unit 9 at the Amer power

station, which had previously co-fired under the old subsidy scheme, resumed co-firing significant amounts of wood pellets in the fourth quarter of 2018.

The other plants will likely begin cofiring in 2019 and 2020, making the Netherlands a major market for industrial wood pellets again. The ramp up in cofiring demand in the Netherlands is expected to quickly approach 2.5 million tonnes.

Japanese wood pellet imports are on pace to exceed one million tonnes for the first time in 2018, approximately double the amount of imports from 2017. Through the first three quarters of 2018, 63 per cent of Japan’s wood pellet imports came from Canada and 31 per cent from Vietnam. Due to the fixed price and long contract length of the Feed-in-Tariff subsidy that supports renewable energy in Japan, long-term contracts from strong counter-parties, like those in Canada and the U.S., are the preferred way most Japanese buyers procure wood pellets. We expect to see continued rapid expansion in Japanese wood pellet imports in the years to come with imports projected to exceed five million tonnes in 2023. Our full detailed analysis on Japan is available in FutureMetrics’ 2018 Japanese Biomass Outlook.

In South Korea, renewable energy is promoted by a renewable portfolio standard (RPS) that requires utilities to source an increasing amount of their energy from renewable sources. Tradable Renewable Energy Certificates (RECs) are used to demonstrate compliance. Utilities have three ways of meeting the RPS: produce RECs themselves, purchase RECs on an exchange, or pay a fine equal to 150 per cent of the average REC price during the year. Utilities have found that co-firing wood pellets is one of the most cost-effective ways of meeting the RPS.

However, due to uncertainty regarding the value of RECs, the price of power and the price of pellets, South Korean buyers have a more difficult time entering into long-term contracts. Nevertheless, there have been instances of successful contract negotiations with

North American producers, particularly with dedicated biomass plants (as opposed to major utilities co-firing at coal stations).

South Korean demand is largely responsible for the rapid development of wood pellet production capacity in Southeast Asia. In 2018, South Korea’s wood pellet imports are projected to have reached 3.4 million tonnes, with more than 95 per cent of that volume coming from Southeast Asia.

While industrial pellet markets get the bulk of market analysts’ attention, heating markets make up a significant amount of total global demand and FutureMetrics forecasts continued strong growth over the next five years. Warm winters and low competing fuel prices, particularly for heating oil, slowed pellet heating demand growth in North America and Europe over the last few years. While a recent fall in oil prices raises some

concern, for the most part pellets still enjoy a significant cost savings over fossil-based heating fuels in Europe and, with the notable exception of natural gas in the U.S., North America as well.

For the most part, pellet heating demand is supplied by local producers, so it has less of an impact on global trade. While the U.S., Germany, France, Austria, Sweden and others have substantial pellet heating demand, the only market that has a significant impact on global trade is Italy, where pellets are primarily used for home heating. We estimate that Italy imported 2.3 million tonnes of pellets in 2018. The market is likely even larger as there is a black market for wood pellets in Italy to avoid a 22 per cent value-added tax (VAT) – estimated at 200,000 to 300,000 tonnes by the Wood Pellet Association of Canada.

The U.S. has one of the largest pellet heating markets in the world. Annual demand in 2018 is estimated at 2.5 to 3.0 million tonnes. About 85 per cent of U.S. demand is met by small- and

medium-sized domestic producers, roughly 10 per cent is imported from Canada and five per cent comes from industrial producers in the U.S. South.

For the last several years, the U.S. pellet market has had a glut of inventory, but that has cleared and producers are now worried about shortages in the market

over the 2018-2019 heating season, primarily due to fibre supply issues in the East (about 50 per cent of the U.S. market is in the Northeast). We expect to see moderate growth in the U.S. heating market over the next several years, but nothing like what is expected in industrial markets.

North American pellet exports will have increased to an all-time high in 2018. U.S. pellet exports are projected to increase to 6.2 million tonnes, up 20 per cent from 2017. Canadian pellet exports are projected to increase to 2.4 million tonnes, up 12.6 per cent from a year prior. FutureMetrics projects that U.S. exports will increase to 8.5 million tonnes in 2023 while Canadian exports will increase to 3.7 million metric tonnes.

With pricing and demand growth strong in industrial wood pellet markets, we expect to see new major industrial pellet mills to be developed in the U.S. South after several years of measured growth. In addition, the U.S. Pacific Northwest is well positioned to supply some volume to rapidly growing Asian pellet markets. Maine is poised to become a new significant exporter.

In western Canada, new growth will likely be more measured. Forest fire losses and the end of the high harvest rates from dead stands killed by the

mountain pine beetle are affecting sawmill production and thus sawmill residual output. Pellet producers must procure forest residuals to maintain production rates. Eastern Canada will see the development of several smallto medium-sized industrial pellet mills as sawmillers in those regions look for markets for their residuals. •

William Strauss is the

of FutureMetrics. www.futuremetrics.com.

The triple-pass dryer for wood chips and biomass by Uzelac Industries has a number of unique advantages over similar dryers. Its bolt-on tire design reduces maintenance and increases tire life, while the overhead drive reduces wear on the rollers. Access doors on the outer and intermediate cylinders allow for easy inspection and cleaning of all three cylinders of the drum. Uzelac Industries also custom-designs and manufactures its own equipment, offers project management and 3D modeling, and supports hundreds of dryer installations in North America with parts and service. www.uzelacind.com

Thompson Dryers believes products should work like they are supposed to. Armed with this belief and more than 70 years of experience, Thompson designs industrial rotary dryer systems for the biomass, forest, ethanol, livestock feed, and fertilizer industries – primarily in North America and Europe. Proprietary technology ensures products are dried uniformly with minimal air pollution, little material degradation, and low fire risk. Thompson also offers a wide range of solutions to handle all dryer repair and maintenance needs including alignment and resurfacing, inspections, parts, drive, bearings, trunnions, drum crack repair and more. www.thompsondryers.com

Stela Laxhuber GmbH specializes in low temperature belt drying technology. Continuous developments and customizable optimization in various applications allows Stela to be called a technology leader in this expanding market. One of the greatest benefits using high efficiency belt dryers reflects by usage of waste heat or other low-temperature

8 April 2019: Pre-conference Focus Days

9-10 April 2019: Argus Biomass Conference London Hilton on Park Lane, London, UK

Senior industry participants

focus day and workshop attendees

Hear from an unrivalled speaker faculty, including:

Hear from an unrivalled speaker faculty, including:

Gordon Murray Executive Director, Wood Pellet Association of Canada

Gordon Murray Executive Director, Wood Pellet Association of Canada

Michael Schytz, Head of Fuel and Logistics, Hofor

Michael Schytz, Head of Fuel and Logistics, Hofor

Associate sponsors:

Scott Bax Senior Vice President Operations, Pinnacle Renewable Energy

Scott Bax Senior Vice President Operations, Pinnacle Renewable Energy

Søren Alsing, Head of Fuel, Bioenergy and Thermal Power, Ørsted

Søren Alsing, Head of Fuel, Bioenergy and Thermal Power, Ørsted

Yoshinobu Kusano Senior Advisor, Renova

Yoshinobu Kusano Senior Advisor, Renova

James Behan, Trading and Sales Director, Peltrade

James Behan, Trading and Sales Director, Peltrade

Fredrik Tärneberg, Manager Energy Products, Södra

Fredrik Tärneberg, Manager Energy Products, Södra

Arnold Dale, VicePresident, Bioenergy, Ekman

Arnold Dale, VicePresident, Bioenergy, Ekman

sources. The latest development of the Stela RecuDry system with heat recovery scores an energy savings of around 35-55 per cent compared to common standard drying systems.

www.drier.com

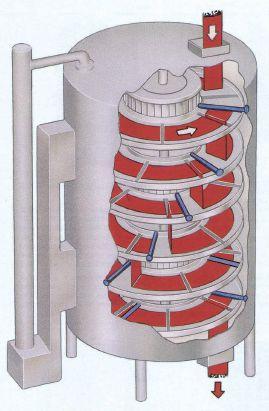

The Wyssmont Turbo Dryer Thermal Processor has long been used in vapour recovery systems, heat recovery systems, and environmentally sealed systems specially designed with condensers for products such as biomass and biofuels. The processor recently produced one million pounds of torrefied wood for a test burn in a mixed coal power plant. It operates at 300°C to produce wood with a heating value equivalent to coal. The Wyssmont Turbo Dryer Thermal Processor can be the best solution for your drying needs.

www.wyssmont.com

PDI offers complete drying packages including installation, design, and project management of the drying island. As project managers, engineers, and drying experts, PDI provides safe, timely, and efficient drying system projects. PDI drying systems are designed to meet the diverse needs of today’s manufacturers. The result is innovative equipment that provides cost-effective and environmentally compliant performance, adhering to even the most stringent guidelines. PDI’s customized solutions use advanced technology to ensure a consistent, quality finished product. www.playerdesign.net

Dieffenbacher high-capacity drum dryers are well recognized for their efficiency and reliability. They are the ideal solution for drying wood particles for particleboard and pellet production, strands for OSB production, disintegrated seasonal annual crops and other biomass. The dryer internals are designed according to the material characteristics for high thermal efficiency and low moisture fluctuation. Dieffenbacher drum dryers meet high safety standards. The perfect integration of energy systems and drum dryers creates additional value for customers, from the planning phase through the complete lifecycle. www.dieffenbacher.de/en

As with most machinery, frequent and thorough maintenance can extend the life of biomass dryers and help avoid unexpected dryer shutdowns.

Canadian Biomass asked dryer manufacturers for their top tips and best practices for maintaining biomass dryers to avoid downtime. Here’s what experts from Thompson Dryers, Uzelac Industries and Player Design had to say:

1. Create a lubrication/cleaning schedule. Make sure the bearings, tires and tracks, and chain are lubricated (not over lubricated), and the burner, ducting, and bases are free from excess build up.

2. Implement bi-weekly checks of moving components to ensure the dryer is tracking and aligned properly.

3. Schedule annual inspections. Even though you may not see a problem, you are likely looking at the dryer every day and things are easily overlooked.

4. The dryer drum and trunnion wheels should be properly aligned every one to two years to extend the life of the dryer.

5. Regularly resurface drum

tracks and trunnion wheels to reduce stress loading and shock vibrations. Resurface seal rings to ensure proper sealing, which reduces the risk of explosions and fires.

6. If headplates show signs of cracking, installing stiffening rings can prevent flexing and stop the headplate from cracking. Simply repairing cracks will not stop the flexing.

7. If your burner isn’t working, make sure to check the ignitor and flame sensor for problems first.

8. A recycle air system set-up controls the temperature in the ducting, which avoids the costly and expensive practice of rebuilding refractory.

9. Changes in fuel usage can indicate a leaking seal. Monitoring fuel usage and checking seals regularly can prevent seals from leaking.

10. Implement a dryer training program for new operators to reduce the chance of accidents and prevent misuse of equipment. Make sure to review the equipment operating manual prior to use.

GEA has become the preferred supplier of drying technology in the bio-ethanol industry, providing distinguished product quality. To increase efficient energy usage, systems can be heated by turbine exhaust gases or utilize exhaust gas-recycle which also renders the system inherently safe. The Feed-Type Ring Dryer is designed for drying feed and fibrous materials where extended drying times are required without product damage. Features include a cold disintegrator for breaking up agglomerates and a manifold for recycling heavier and wetter particles back to the disintegrator. GEA also has experience drying other moist materials including corn fibre/gluten, wheat

and corn feed, cellulose and lignin. This dryer is capable of evaporative capabilities of up to 30 tonnes per hour. GEA will pair the Ring Dryer with a Fluid Bed Cooler for final powder conditioning.

www.gea.com

ECP’s Z8 Rotary Dryer is a patented reverse

flow, impinging-stream dryer design with increasing thermal-velocities providing maximum heat-transfer with multi-stage dehydration within drum embodiment. The material first passes through a single-pass section and then through a reverse-flow triple-pass section, and then repeats the process. This provides uniform dehydration of all particle sizes with no overheating of fines with increased production capacity and minimized VOC emissions. The Z8 Rotary Dryer can be designed as a drop-in replacement for Single-Pass and Conventional Triple-Pass Rotary Dryers. ECP’s technology includes trunnion bases, saddle drives and high efficiency cyclone collectors.

www.ecpisystems.com •

By Pat Liew

Over the past 10 years the development of biomass heating projects has increased significantly. The Northeast United States led the way, motivated by replacing fossil fuels with biomass in public buildings. Biomass Resource Energy Center (BERC) has been at the forefront of promoting the push towards biomass heating. As in any new technology adoption, mistakes were bound to happen. Over the 10 years of biomass heating development in North America, I witnessed many mistakes that often led to project failure. Here are some of the typical mistakes I see.

It is surprising how many projects do not go through a fuel supply due diligence process. Wood fuel is the largest variable cost of each biomass heating project. In some regions, wood fuel price and quality can often fluctuate significantly. Many biomass heating projects are built without concern for that fluctuation. This leads to some projects stopping operations for certain periods of time, and some to revert to heating oil or natural gas.

Many biomass heating project developers think that once a project is built, suppliers will come rushing through the door. This is certainly not my experience. I have seen projects where my company was the only bidder, or where there were no bidders at all. This is because sawmill owners and loggers typically do not spend much time online searching for RFPs and RFQs, especially in areas where biomass heating projects are rare. Successful projects directly source out all the potential wood fibre suppliers, notifying them about the bidding process.

Tree chip, paper chip, clean chip, fuel chip, bole wood chip – all those terms can mean the same or different things. Wood biomass terms are not standardized, and therefore the same terms can have different meanings in different regions. The best way to avoid mistakes in terminology is to visit the supplier site and examine the fuel product before signing a contract. Otherwise, a biomass heating project

runs a risk of contracting fuel that is not compatible with its equipment.

Biomass heating projects are more successful if the technology adapts to the market’s feedstock, and not the other way around. For example, a project in northern Pennsylvania installed a boiler that accepted feedstock with moisture content (MC) lower than 15 per cent, based on what was available

from a sawmill next door. However, that sawmill eventually shut down, and the biomass project could not find other suppliers in the woodshed that could supply material lower than 15 per cent MC. Prior to deciding on technology, each biomass heating project should clearly understand the type of wood fuel available in the market.

To operate smoothly without fuel supply disruptions depends on a geographical region. Weather affects logging and trucking operations, so regions with heavy snowfall are prone to fuel supply disruptions, and therefore projects located in those regions require larger storage capacity. Again, discussing these issues with suppliers directly is the best way to understand how big fuel storage capacity should be to mitigate against fuel supply disruptions.

Weather is just one potential cause of fuel supply disruption. Others include vendor default, equipment failure, and

catastrophic event. A robust fuel supply disruption plan is necessary for each project to prevent surprises down the line. New biomass heating projects often lack such plans, leading to preventable shut downs. For example, biomass heating projects often rely on just one fuel vendor. If that vendor defaults, and there are no planned back-up vendors, then the project runs short of fuel. Having a good fuel supply disruption plan can easily prevent such situations.

One of the common mistakes in the preconstruction phase of a biomass heating project is miscommunication between the construction project manager and plant operations manager. The project manager’s goal is to ensure that construction is completed on time and under budget, while the operations manager’s goal is to ensure that there is little to no downtime. Because these objectives are misaligned, miscommunication can be a problem down the line.

In one case, for example, the project manager purchased a cheap storage facility to stay under budget, without asking the operations manager for an opinion. Storage problems have caused significant downtime since the project became operational. Therefore, it is important for a project manager and the plant operations manager to engage in open communication to ensure the project is not compromised, for example, by potential budgetary savings.

There are many more potential mistakes that can happen when developing a biomass heating project. A comprehensive due diligence process is the only way to minimize the chance of potential failure. This is especially the case on the feedstock supply side of things. Fuel is an ongoing cost; therefore, making sure that all potential issues are weeded out prior to or during construction will save the variable costs associated with running a biomass heating project in the long-term. •

Pat Liew is the business development manager for Ecostrat Inc. www.ecostrat.com

By Chris Cloney – director of DustEx Research Ltd. based in Halifax

hen reading the article “Learning from close calls: NB mill takes action after two fires,” published by www.woodbuiness.ca last June, I was struck by the willingness of the company involved to not only state that they had a near-miss incident, but to explain in detail the lessons learned from the fires.

On June 1, 2018, Fornebu Lumber in Bathurst, N.B. had two fire incidents. The first occurred when a piece of wood was jammed in a planer. Although this was cleared by operators, they did not know that the blower and ducting had transferred embers outside to the dust collector system, which caused a second fire.

we went outside the borders and tried to understand incidents across the globe – what impact could this have on safety here at home?

For the last two years, DustEx Research Ltd. has focused on tracking, capturing, and generating lessons learned from combustible dust fires and explosions. In the first six months of 2018, they recorded 75 fires, 14 explosions, nine injuries, and one fatality in North America. Internationally, an additional 14 fires, 12 explosions, 31 injuries, and eight fatalities were found.

This information is being compiled into an open, free-to-use, online database so that operators, technical specialists, and safety professionals can search, sort, and understand the industries, materials, and equipment most often involved in dust fires and explosions.

“This platform will serve to reduce financial and personal losses from combustible dust fires and explosions across Canadian industries.”

Both fires were eventually extinguished with no injuries and minimal damage to the facility, although it could have been much worse.

In his article, Christian Fournier, the former safety and training co-ordinator at Fornebu Lumber, shares several lessons learned so that other companies in the Canadian forest industry can improve their performance and keep their people safe.

How would process safety across the nation be impacted if more companies in Canada were open to sharing and learning from these incidents? What if

Although more information over time is required to draw strict conclusions, some observations from the first half of 2018 include:

• The number of dust explosions in North America appears to be increasing compared to historical data, although the severity may be decreasing.

• Wood processing, food processing, and agricultural activities account for 60 per cent of the fire and explosion incidents.

• Around the world, dust collectors accounted for the highest number of fires (25) and had a modest number of explosions (3).

• Storage silos, elevators, and conveyors accounted for the highest number of explosions (14) and had a more moderate number of fires (15).

• Wood and wood processing had the largest number of high-damage incidents (reported greater than $1 million in losses) while agriculture and food production had the largest number of high-severity incidents (reported injuries and fatalities).

This information is useful for understanding the current status of combustible dust safety and categorizing the fire and explosion incidents observed. It also gives us a yard-stick to measure our progress as a community.

However, it is also limited in the scope of the lessons learned. The majority of incidents are reported from local news media who may have a limited or incorrect understanding of the processes involved. When more detailed forensic investigation is completed, this information is generally not shared with the community.

Improving the incident reporting platform with more in-depth analysis of ignition sources, process safety deficiencies, progression of the fire or explosion in time, and the human elements involved, are all goals for the next phase of the database development. Combined with an openness and willingness from the community to share lessons learned from past near-misses, this platform will serve to reduce financial and personal losses from combustible dust fires and explosions across Canadian industries.

We encourage you to learn most about the Combustible Dust Incident Database and download the incident reports for free at www.dustsafetyscience. com/Canadian-Biomass-2018. •

PDI Drying Systems are designed to meet the diverse needs of today’s manufacturers

PDI Drying Systems utilize precise airflow management and retention time controls, ensuring consistent outlet moisture

Capacity ranges of 1-20 tons/hour • Low fuel consumption • Low emissions

Complete controls integration • Structurally engineered drums and rings • Low horsepower requirements

Effective moisture control • Custom flighting packages

PLAYER DESIGN INC. PO Box 712, 29 Second Street, Suite 2

Presque Isle, ME 04769

Tel: 207-764-6811