Riding the business wave

Riding the business wave

B.C's Seair expands operations

B.C's Seair expands operations

By DavID olSeN

By PeTer PIGoTT

By JaMeS MaraSa

BrIaN DuNN

DavID Carr

roB SeaMaN

| By Matt Nicholls

Riding the business wave

Riding the business wave

B.C's Seair expands operations

B.C's Seair expands operations

By DavID olSeN

By PeTer PIGoTT

By JaMeS MaraSa

BrIaN DuNN

DavID Carr

roB SeaMaN

| By Matt Nicholls

“Leadership and learning are indispensable to each other.”

– John F. Kennedy

As a leader in many facets of aviation, Canada has long been lauded for its achievements on the world stage – be they in product development, training, navigation or implementing processes. Such positive acclamation extends to the safety realm as well.

As Canada’s director general of civil aviation (DGCA), Martin Eley, suggests in Wings’ cover story, “Building a new model,” pg. 18, “Canada’s safety record is among the best in the world, and Transport Canada (TC) is committed to maintaining and improving aviation safety.”

But while TC continues to work hard to strengthen its civil aviation performance management regimen and improve its inspection schedule, inspector training performance monitoring and quality assurance, there are cracks in the armour – and professional associations nationwide are more than a little concerned.

A spate of recent accidents to close out 2011, particularly in northern Canada, coupled with cuts in the number of TC inspectors, changes due to internal reorganization, and the introduction of Safety Management Systems (SMS) has many in the industry (and in the mainstream media) questioning the strength and service levels of our national regulator.

Based on feedback from industry leaders I have spoken with over the past couple of years, it’s a valid criticism. And as David Olsen notes in his piece, stark questions are being asked about the current regulatory model and whether or not the framework needs to be changed. Should TC be re-established as a statutory authority for civil aviation safety

at arm’s length from the government which, like the Transportation Safety Board, reports to Parliament and not solely to the government of the day? Is there a better model for TC – and what’s the best way to foster and implement change?

The answer is yes, there must be a better model – the current one needs to be carefully analyzed by industry and government and changes need to be made in the auspices of creating the safest regulatory environment possible.

The

ATAC president/CEO John McKenna is currently waiting for a date to discuss it with TC. The working group’s vision of a new system centres around improved communication with stakeholders, more deregulation to industry and improved service via the creation of a Civil Aviation Advisory Board to provide a forum for effective two-way feedback between certificate holders and the authorities. Establishing a TC working group made up of industry leaders and department leaders to review key regulatory priorities is another key recommendation.

current regulatory system in Canada is not broken –its processes are burdensome

and confrontational.

Fortunately, leaders from key industry associations have shown their commitment to finding potential solutions by establishing a sound action plan for change. Last May, the Air Transport Association of Canada (ATAC) presented an action plan at its symposium on “Transport Canada Level of Service” to deal with just these issues. The plan details 21 recommendations on communications, deregulation and targeted service improvement.

Top daTa BuRsTs in this issue

1. $100 million: The amount airbus will pay to fix wing cracks in a380 jets. (pg. 8). 2.: sunwing airlines operates 23 leased aircraft and flies to 44 international destinations. (pg. 15) 3. Transat a.T. is expected to add $20 to $25 million in margins next year. (pg. 34). 4. 132,000: number of annual aircraft movements at Vancouver Harbour waterfront airport (pg. 38). 5. naV canaDa has invested $1.7 billion since 1996 on navigation enhancements. (pg. 43)

As Dennis Lyons, president of the Manitoba Aviation Council (MAC), aptly points out, the current regulatory system in Canada is not broken – its processes are simply burdensome and confrontational, instead of collaborative. Having the opportunity for TC and key members of the industry to meet and address issues to create a more a viable system makes sense. “This new system would very likely look different from what we have today, and if done properly, I am sure there would be some services delivered by other agencies allowing TC to focus on oversight of all the industry,” Lyons suggests.

Wings applauds the work done by ATAC and supports industry leaders on both the rotary- and fixed-wing sides who are working to make the regulatory framework as efficient and safe as possible. Change only comes through careful analysis and an openminded collaboration on all fronts…a buy-in from both industry and government. | w

Your feedback is always welcome. Please contact me at mnicholls@annexweb.com.

ediToR Matt nicholls mnicholls@annexweb.com 416-725-5637

pRoduCTion aRTisT Brooke shaw fligHT deCK

Ray canon, David carr, Paul Dixon, Brian Dunn, Frederick k. Larkin, neil MacDonald, James Marasa, carroll Mccormick, David olsen, Peter Pigott, Rob seaman assoCiaTe puBlisHeR alison de groot adegroot@annexweb.com 1-888-599-2228 ext. 246

adveRTising sales adam szpakowski aszpakowski@annexweb.com 1-888-599-2228 ext. 246 sales assisTanT stephanie DeFields sdefields@annexweb.com 1-888-599-2228 ext. 257 gRoup puBlisHeR scott Jamieson sjamieson@annexweb.com

pResidenT Mike Fredericks mfredericks@annexweb.com

wings Magazine

P.o. Box 530, 105 Donly Dr. s., simcoe, on n3Y 4n5 Tel.: 428-3471 Fax: 429-3094

Toll Free: 1-888-599-2228

Publication Mail agreement #40065710

Return undeliverable canadian addresses to circulation Dept., P.o. Box 530, simcoe, ont. n3Y 4n5

e-mail: subscribe@wingsmagazine.com

Published six times per year (Jan/Feb, Mar/apr, May/ Jun, Jul/aug, sep/oct, nov/Dec) by annex Publishing & Printing inc.

Circulation

e-mail: subscribe@wingsmagazine.com

Ph: 866-790-6070 ext. 208

Fax: 877-624-1940

Mail: P.o. Box 530, simcoe, on n3Y 4n5

subscription Rates

canada – 1 Year $ 30.00

(includes gsT - #867172652RT0001)

usa – 1 Year $ 42.00

Foreign – 1 Year $ 65.00

occasionally, wings magazine will mail information on behalf of industry-related groups whose products and services we believe may be of interest to you. if you prefer not to receive this information, please contact our circulation department in any of the four ways listed above.

no part of the editorial content of this publication may be reprinted without the publisher’s written permission. ©2012 annex Publishing & Printing inc. all rights reserved. opinions expressed in this magazine are not necessarily those of the editor or the publisher. no liability is assumed for errors or omissions. all advertising is subject to the publisher’s approval. such approval does not imply any endorsement of the products or services advertised. Publisher reserves the right to refuse advertising that does not meet the standards of the publication.

Printed in canada issn 0701-1369

40 Aviall stocking locations around the world means we have a location close to you. Aviall works hard to provide you with exactly what you need, precisely when you need it. Aviall Delivers.

Bombardier has won an order for five allbusiness-class-configured CSeries 100s by Swiss high-end operator PrivatAir. The order, which includes options for a further five CS100s, is valued at approximately US$636 million if all five options are exercised. The deal was announced at the Bahrain air show in January.

Geneva-based PrivatAir operates a fleet of business jets and exclusively business class commercial aircraft, including the Bombardier Global Express and Boeing 737, for private charter and on behalf of partner airlines such as Lufthansa. “The CSeries aircraft represent cutting-edge technology and are true 21st-century jetliners,” said Greg Thomas, president and chief executive officer for PrivatAir. “It is very well suited for our route expansion plans.”

PrivatAir is the 11th CSeries customer, pushing Bombardier past the halfway point of 20 customers by the time the aircraft enters service in late 2013. Hopes for an order from Bahrain-based Gulf Air appear to have been dashed at the last minute.

Nevertheless, the existing order book underscores the versatility of the CSeries. “Included among the 11 customers are major network carriers, national carriers, premium airlines serving city centre airports, a low-cost airline, leasing companies and now, with the order from

Privatair, a full service provider to airline partners,” said Philippe Poutissou, vicepresident of marketing for Bombardier Commercial Aircraft. “This diversity of customers speaks volumes about the flexibility of the CSeries aircraft family to meet air transport requirements worldwide.”

Raymond Jaworowski, an analyst with the Connecticut-based consultancy Forecast International, told the Montreal Gazette that the CSeries, “is on its way to being a successful program – one that will make money for them.”

Meanwhile, Poutissou’s comments raised speculation that Bombardier’s mystery buyer of 10 CSeries aircraft at last year’s Paris air show is a group consisting of financial backers of Odyssey Airlines, a planned all-business-class trans-Atlantic operator based at London’s City Centre Airport. British Airways currently operates two premium class flights daily to New York from the City Centre Airport using Airbus A318 aircraft, with a fuel stop in Ireland. The CSeries is expected to cross the Atlantic non-stop in a 32-seat configuration.

Canadian North has added three Boeing 737s and is partnering with the Edmonton International Airport and FBO operator Executive Flight Centre (EFC) to grow its industrial charter business. Canadian North and EFC expect to build up to 500 additional staff to service industrial clients – primarily the oil and gas and mining sectors, working in northern Alberta and northern Canada.

EFC, which operates 10 FBOs in western Canada, has extensively renovated and upgraded the largest hangar at the airport specifically to meet the Canadian North requirement. “The Canadian North Charter Terminal/Executive Flight Centre T3 offer everything we need to provide a seamless travel experience for our valued charter customers,” said Tracy Medve, president of the airline.

“Executive Flight Centre is pleased to have partnered with Canadian North and the Edmonton International Airport to create this much-needed northern gateway for the expanding industrial charter business,” said Dean Buckland, president of EFC. “We look forward to playing a leadership role in fuelling future developments and expansion of the industry charter market here in Edmonton.”

Tiny cracks discovered in the wing component of the Airbus A380 will be costly to repair but are not expected to slow sales for the superjumbo in 2012. In February, the European air safety regulator ramped up a directive to inspect all A380 aircraft when Qantas Airways grounded one of its airplanes after discovering 36 small fractures in the metal brackets that support the wing rib. The European Aviation Safety Agency had earlier issued a directive for an estimated 20 aircraft. All 68 A380s in service will have been inspected by mid-March.

The cracks are no apparent threat to safety. Singapore Airlines, the launch customer, has repaired its fleet. Philippa Oldham, head of transport at the U.K.’s Institution of Mechanical Engineers told

the BBC that, “these cracks seem like minor irritants. One would expect some teething troubles with any new aircraft.” Airbus has a temporary solution and is working on a permanent fix, but like any trip to the dentist, there is a cost. Airbus is not talking numbers, but Der Spiegel, an influential German magazine, reports the repair will be approximately $1.3 million per aircraft, bringing the final bill close to $100 million.

Air France and Emirates operate the A380 to Montreal and Toronto, respectively. Airbus does not expect cracks to dampen sales prospects over the next 12 months. The airframer predicts orders for 30 aircraft in 2012, an almost threefold increase over 2011. Even so, the fractures are an embarrassment to the manufacturer’s flagship airplane, and Airbus has ordered an internal investigation.

Rival Boeing has also experienced manufacturing difficulties with its 787 Dreamliner, which recently entered service with Japan’s All Nippon. Boeing must repair flawed shim work in the aft fuselage of up to 50 airframes. Boeing describes the latest setback for the chronically delayed airliner as a minor problem that will take days rather than months to fix and does not require immediate repairs to the five 787s in service.

Montreal-based American Iron and Metal (AIM) has added a Pilatus PC-12 NG to its fleet for greater versatility. A

global supplier of metal components for electronics assembly, AIM also owns and operates paper mills and is involved in paper manufacturing.

“We really like the Pilatus PC-12 as it allows us to access locations we previously could not reach efficiently, and do so in a very safe manner with greater operating economics. We see the PC-12 as a complementary addition to our current fleet of a helicopter and [Falcon 2000] jet,” said Ron Black, chief operating officer with AIM.

AIM was attracted to the single-engine PC-12 for its cabin size, advanced avionics suite and economies in both the purchase price and operational costs. “It can economically complete our one to twohour range trips and short field sorties. It can transport six to eight people 300 to 500 nautical miles almost as quickly as our jet but at an economy that allows us to use the leverage of business aviation deeper into the company,” said David Wickware, director of aviation.

Pilatus Centre Canada, the exclusive

authorized sales and service centre for Pilatus Aircraft of Switzerland in Canada, has delivered an estimated 105 PC-12 aircraft. “Canada is home to almost 10 per cent of the worldwide fleet of PC-12s, a testament to the [aircraft’s] ability to efficiently service Canada’s vast geography,” said Stan Kuliavas, director of sales. Prospects look good for the PC-12 NG as operators of aging twin-pistonengined aircraft look for replacements.

Bombardier was able to reveal that Garuda Indonesia and Ethiopian Airlines are the previously unidentified customers for six CRJ1000 NextGen regional jets and five Q400 NextGen turboprops respectively. Garuda is purchasing 18 CRJ1000s, with the remaining 12 coming from Nordic Aviation Capital, a Danish leasing company. Garuda has placed options for a further 18 CRJ1000s.

Bombardier also announced the sale of two more Q400s to Seattle-based Horizon Air.

“Key to our success this year will be our ability to expand our global reach and gain traction in new and exciting markets,” said Guy C. Hachley, president and chief operating officer for Bombardier.

Bombardier also received a welcome boost in Singapore from Export Development Canada (EDC), which used the air show to sign an agreement with China’s ICBC Financial Leasing, for the procurement and leasing of Bombardier aircraft. ICBC is a major player in the Chinese aircraft leasing market, in addition to other global leasing activities. The agreement recognizes that both Bombardier and ICBC are well-positioned to serve growing global demand for regional air travel.

The Montreal-based airframer rounded out the show by announcing it will open a full-scale owned and operated service centre in Singapore in 2013 to

support its growing Asia-Pacific business. “By 2030, there could be more than 1,100 business jets in service in the Asia-Pacific region, and we are ready and committed to support our existing and future customers, which we expected will make up a large portion of that fleet,” said Eric Martel, president of Bombardier customer services and specialized and amphibious aircraft.

The new facility will be the second service centre operated by Bombardier outside of North America, bringing the total number to 10 worldwide. It will be capable of performing a variety of light to heavy maintenance tasks on all Learjet, Challenger and Global aircraft.

News at the Singapore Air Show that Indonesian low-cost carrier Lion Air had confirmed its record breaking order for 230 Boeing 737s was not

unexpected, but dominated the headlines all the same. Several Canadian companies also made news at Asia’s largest air show, including British Columbia’s Viking Air, which brought a DH6 Twin Otter Series 400 to Singapore for the first time, and handed over the first of two Series 400s to OK Tedi Mining of Papau, New Guinea.

Viking Air announced orders for a further 15 aircraft from customers in Chile, Nigeria, Panama, Tahiti and Turkey. The largest order came from Istanbul-based Seabird Airlines and covers six aircraft configured with straight floats for water-based operations. Seabird will also act as exclusive representative for the Series 400 in Turkey. Lagos-based Caverton Helicopters, which has two legacy Twin Otters, will become the first airline to operate the Series 400 in western Africa.

“The growing list of international customers is market validation and approval for the new Twin Otter Series

400,” said Robert Mauracher, vice president of business development for Viking. The aircraft’s popularity with our new customers is due to its operational versatility, quick change interior and internal passenger to cargo flexibility.”

The aircraft, which was launched in 2007, is able to operate from remote and rugged air strips in any environment. Viking pegs the order book for the Series 400 to be more than $350 million.

Fractional operator Jet-Share Canada has added a third Cessna Citation 560 to its fleet, making the aviation firm the largest turbine-based fractional company headquartered at Toronto’s Pearson International Airport.

Jet-Share also operates a Citation Bravo, Citation VII and single King Air aircraft. With a range of just over 1,850 nautical miles, the 560 can transport

passengers nonstop directly to the Caribbean or west to Calgary. The aircraft has been completely refurbished including an updated interior and full exterior repaint.

Founded in 2002, Jet-Share is one of Canada’s first fractional aircraft ownership groups. Minimum share of an owner is one-third. The arrival of the 560 signals an uptick in the market for Jet-Share, which had put earlier expansion plans on hold as a result of soft demand. When not in use by its owners, the Citation will be available for charter and sub-charter.

The Vancouver Airport Authority (VAA) has cut the ribbon on Canada’s first Ground Run-up Enclosure (GRE), a massive-three-sided steel facility that

will reduce noise from engine run-ups from regular aircraft maintenance by up to half.

Anne Murray, vice-president of community and environmental affairs with the VAA, said that 24-hour operations are vital for the airport, but need to be balanced with remaining a “good neighbour.”

The $12-million GRE, located adjacent to the airport’s south terminal, stands as tall as a five-storey building and effectively redirects noise up rather than out, while absorbing it with specialized panels perforated by louvred vents for aerodynamic purposes. It is the first structure of its kind at a Canadian airport, and is an integral component in YVR’s Noise Management Plan.

The GRE will provide time and fuel efficiencies to air carriers operating out of the airport’s southern sector by reducing taxiing distances and time. It will also offer environmental benefits with a glycol recovery system for de-icing of propeller aircraft during winter operations.

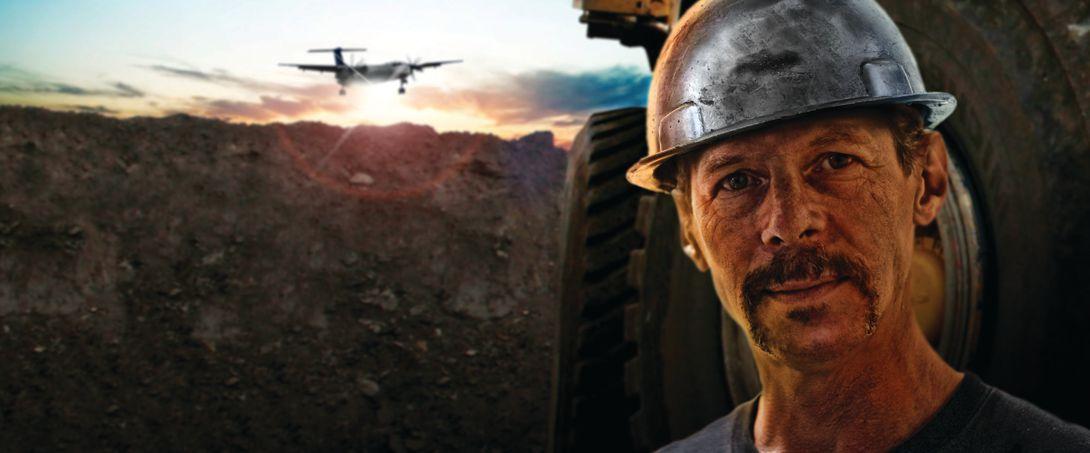

Mine and rig operations don’t depend on the weather. Transporting staff and hot-shot parts to the jobsite shouldn’t either. WAAS Flight Management Systems enable precision-like LPV approach procedures with lower minima that get them on-site, on time, every time.

Contact your Authorized Universal Avionics dealer or visit uasc.com to learn more.

By Rob Seaman |

In the Nov/Dec 2011 issue of Wings, we saluted different generations of aviation families, and explored the influence some multigenerational relationships have had on the aviation industry. We received much positive feedback – so much so, we felt compelled to highlight a few more industrious aviation families, specifically with a GTA connection.

As with many aspects of aviation, pilots tend to take centre stage but not all “father” influences have produced top high fliers. The engineering, design, support and AME sectors have had their share of multigenerational influences as well. Take Bill Arsenault, vice-president and co-founder of the Mid-Canada Mod Center, for instance. In business since 1997, the firm has become well known in North America for its avionics expertise, industry-first mods and STCs. Bill grew up around airplanes, while his father, Tony, was very well respected for his service and support work.

Tony Arsenault had one of those early three-digit AME licences. He started in Quebec at Nordair, then went to Canadair, and then looked after an executive Convair 580. Later in his career, he was one of the first hired at Execaire in Montreal. From there, he went to Toronto to work for Kenting Aviation and Skycharter. After Skycharter, Tony spent two years in Africa and then returned to work at Austin Airways in Timmins. He started his own overhaul company and earned what was then known as a “B” licence – with a list of endorsements a mile long.

At Toronto’s Skycharter, another father/ son combination have made their mark: Richard and Irving Shoicet. Richard now runs the show at this popular FBO since his father’s passing a few years ago. Under his leadership, the FBO and hangars so long associated with the north end GA side of YYZ have undergone upgrades and improvements.

Skycharter was founded in 1968 by Richard’s father, entrepreneur and airline transport pilot Irv Shoichet. Irv was definitely a trendsetter. By employing the most experienced people, using the latest aircraft and maintaining them to top standards, the Skycharter fleet became the largest privately owned fleet in Canada at the time,

Irv was definitely a trendsetter, employing the most experienced people, using the latest aircraft and maintaining them to top standards.

numbering 11 executive jet aircraft. Irv had marketing savvy; all of the aircraft and hangars were clearly identified with clean, bright, white paint and orange banding and distinctive company logo. While this may seem common today, such was not the case when Irv was getting started.

No review of aviation pioneers in the Toronto area would be complete without mentioning Wayne and Carl Millard. The Millard name is linked to the careers of many pilots and engineers who earned their stripes flying one of Carl’s dated fleet of cargo and sometimes, passenger transports.

Today, Wayne Millard continues the family legacy. Since their exit and tear down of the iconic old facilities at the north end of YYZ, Wayne has built a new facility at the Region of Waterloo International Airport. He is setting up the new Millard Air hangar as a heavy commercial aircraft maintenance facility and plans to attract business to the Canadian market from the U.S and around the world, developing a niche for this at YKF.

Another name not to be missed is that of Leavens – Jeff in particular, who succeeded his uncle John. Leavens Aviation was

established in 1927 and over the past 84 years, has been an air carrier, an aircraft manufacturer and more recently a parts supplier and engine overhauler. Sadly, in June 2011, Jeff, Lea Anne, Heather and Bruce Leavens – the last family members involved with the business – announced the closing of their dynasty and avocation.

One last name is that of my family. I am a third-generation aviation family man. Both my grandfathers were carpenters and both worked in aviation – in the case of my maternal grandfather, it was a career choice that started with the Bristol Box Kite and concluded with Concorde. My father and mother also worked in the business and met when they were both at Bristol Aircraft. My father – an aircraft engineer in those days – also worked at Gloucester Aircraft. When we immigrated to Canada in 1958, he started with de Havilland. He later left aviation to pursue other engineering interests but remained an avid glider pilot and instructor for many years.

So for me, too, being around aircraft and involved with them has always been a natural part of life. I’m obviously in some very fine company, and it’s an honour to be part of the diverse aviation workforce in Canada – one rich in family connections. | w

Rob Seaman is a Wings writer and columnist.

Depart f from m th t e ordinar y a and d a arrive e at t thhe exttraorrdi d na n ry y wi w th h s supperior r ae a rospacce e pr prodduc u ts s from m BASF F -

T The e Chemmical a Compaanyny.

BAASF is proud to intro r duce c a b bro r ad d p por r tfol o io o of produccts f for t the A Aerros o pa p c ce e i indusstr t y:

Caabi b n Inteterior o s

St S r ruct c ural M Mater e ia i ls

Seatining g Commponennts ts

Fu F el a and n Lubricaant t Sol o ut utioons s

Co C atings g and d S Spepeci c alty P Pigme m ntts

F Flamme e Retardrdanantts a and Fire Pr P ot otec e tion o

Ot t O he her r Innno n va vation o s

At t B BASFF, w we e cr c eate chemi m st stry.

Get the free mobile app for your phone http://gettag.mobi

By David Carr |

Ten years ago, Air Canada celebrated the first anniversary of Tango, its short-lived, no-frills brand, with one-cent fares on the return portion of a roundtrip ticket. Unfortunately, the penny promotion was weighed down by user fees and other charges, leaving Robert Milton, Air Canada’s CEO to complain to this magazine that air transport was the only consumer business blocked from giving free samples.

Ever since, Canadian air transport correctly shifted course to a user pay system, which included local management of airports and the groundbreaking sale of NAV CANADA, the air navigation system (see, “Controlling their destiny,” pg. 43). Airlines have been accused of deception – or worse – for failing to roll third-party charges and taxes in advertised fares, either in print or online.

In the murky world of airline pricing, the current half-loaf approach to fare advertising is frustrating. How murky are the waters right now? For example, planning a trip to England this spring on Air Transat, the added charges are slightly higher or lower than the advertised fare, depending on the day of departure.

But consumer advocates are confusing frustration with transparency. In a Globe and Mail column, financial advisor Preet Banerjee likens the current airline pricing model to buying gasoline (another commodity larded with layers of taxation. For example, if the price per litre were 50 per cent higher at the cash register, than what is posted on roadside signage? It is flawed logic. Airlines do not wait until after the transaction to bulk up the ticket with additional charges. It’s more like the add-on of sales taxes at the point of purchase, except on a more eye-popping scale.

Four years after the government first announced it would require airlines to advertise the full price of a ticket, it is unlikely that there is a consumer who doesn’t see a posted airfare and automatically multiply by two (or more if the fare is deeply discounted).

Steve Fletcher, minister of state for transport, has dusted off the “all-in-one” airfare advertising pledge, declaring that the government will enhance “consumer protection while promoting fair competition” by ensuring “truth in [airline] pricing and

Added charges are an immovable lump that distorts the price an airline charges to deliver a product.

advertising” will occur by the end of 2012, when Canadian airlines will be required to advertise the full prices of airfares.

But putting to one side the richness of an elected politician championing truth in advertising, it is not clear how rolling every tax or user fee into the advertised fare makes airline pricing more transparent. It will certainly not lower fares.

The portion of the fare airlines have traditionally resisted putting in the shop window includes NAV CANADA and airport improvement fees, the air traveller security charge, taxes in addition to the HST and GST, and charges levied by foreign governments on international flights. These charges can gobble up between 30 and 70 per cent of the cost of a ticket depending on the route and point of origin according to a study conducted by York University’s Schulich School of Business.

Whereas airline pricing is fluid depending on the hour, day and time of year travelled, added charges are an immovable lump that distorts the price an airline charges to deliver a product. Where the government has a case, is the addition of fuel surcharges,

which a friend once likened to “chipping in for the gas.” Europe and the U.S. have already moved to regulate all-in pricing, and Canadian airlines have already jumped ahead of the government’s timetable. Will this be enough to satisfy government regulators, or will the Canadian Transport Agency (CTA) go deeper into the weeds by insisting, among other things, that an ancillary service such as baggage checkin fees be included in the posted fare?

The solution was as simple as airlines being more upfront by advertising the full fare alongside a highly visible box that separates charges the industry has no control over. The question is, why now?

If the Harper government is sincere in protecting air travellers and promoting competition, it is clearly working from the bottom of the pile.

Instead of grandstanding, the government should focus on making Canadian air transport more competitive by reducing airport rents and reversing the drain of an estimated 2.2 million Canadians who travel to U.S. border airports every year to take advantage of cheaper flights. But it won’t, because it doesn’t cost anything to kick the airline industry yet again. | w

David Carr is a Wings writer and columnist.

| By Brian Dunn

expect more bang for

David Neeleman, the man behind the launch of JetBlue Airways, once remarked that people who invest in aviation are “the biggest suckers in the world,” while former American Airlines president/CEO Robert Crandall called the airline industry “a nasty, rotten business.”

Well, the proof is in the pudding. During the past several years in Canada alone, more than 40 carriers have come and gone, including Wardair, Canada 3000, Canadian Airlines International, Intair, Jetsgo, Skyservice, Zip and Zoom.

But that didn’t deter Mark Williams from launching Sunwing Airlines in November 2005, after working for three of the defunct carriers – Wardair, Canadian and most recently, Skyservice, where he was president and chief operating officer. He left before the company went under in March 2010. Given the checkered history of the Canadian aviation sector, why did Williams even bother? After all, he’s often flying the same routes as some of his competitors.

“Starting a stand-alone airline today is not a recipe for success,” he says. “But back in 2005, tour operator Sunwing Vacations was doing well enough that I suggested to them they should start their own airline instead of getting a third party to fly their customers. And working with a tour operator offers tremendous synergies.”

Sunwing Vacations’ in-house airline began with two Boeing 737-800s to operate scheduled and charter flights from Canada to the U.S., Mexico, the Caribbean, Central and South America as well as domestic flights in the summer. In September 2009, Sunwing merged with Signature Vacations and SellOffVacations, Canada’s largest discount travel retailer, and signed a partnership deal with TUI Travel plc, which owns 49 per cent of the company. The remaining 51 per cent is privately held in Canada.

In December 2010, parent company Sunwing Travel Group acquired Caribbean Nexus Tours, one of the leading ground handlers and tour operators in the Dominican Republic and Mexico, giving more destination tour choices and flexibility to the Sunwing Group.

Last year, they arranged a wet lease deal with EuroAtlantic Airways to acquire two Boeing 767-300ERs for flights from

“We offer five-star service at three-star prices. We believe a vacation should start at the airport.”

Toronto to Lisbon, London, Paris, Rome and Porto as well as Montreal to Paris. Sunwing also operated service to Amsterdam in conjunction with Netherlandsbased ArkeFly. Today, Sunwing operates 23 leased aircraft and flies to 44 international destinations from 31 Canadian gateways, with North Bay the latest addition. It also added service to Nassau, La Ceiba in Honduras, Belize, Aruba and Saint-Martin this winter and will add Barcelona and Glasgow this summer, when it will also shift from Charles de Gaulle airport in Paris to Orly.

The airline is offering service to Europe again this summer using the two 767s, because it was pleased with the experience. “It’s a big commitment getting into widebodies,” explains Williams. “We tested the waters last summer and we’re comfortable with the results.” Many of its 737-800s and pilots used in winter are sent to Europe in the summer where they are leased by other operators.

What sets Sunwing apart from the competition? “We offer five-star service at three-star prices,” says Williams. “We believe a vacation should start at the

airport. We offer hot meals, free wine, free headsets and hot towels. We don’t try to nickel and dime our customers. We’re trying to emulate the good parts of Wardair.” (which provided good service at lower-than-average prices before being acquired by Canadian in 1989)

Sunwing’s load factors are over 90 per cent and it competes successfully against other Canadian carriers in the popular sun destination market. Hence Air Canada’s desire to start a low-cost model which is meeting resistance from the airline’s unions.

“We carried a million round-trip passengers in fiscal 2010-2011 (ended Sept 30) and we expect to carry 1.25 million passengers in 2011-2012,” Williams predicts. Sunwing is profitable, he says, and made a positive contribution to TUI’s bottom line.

Sunwing has been singled out by both Air Transat and Air Canada for hiring foreign pilots under a federal program at the expense of Canadian pilots.

“Last winter, we operated 19 aircraft. In the summer, we’re down to four. It’s difficult to hire part-time pilots in Canada for three months or less. In 2005, we started with 28 full-time pilots. Today, we’re up to 150.” | w

Brian Dunn is a Wings writer and columnist.

George Petsikas replenishing as NACC boss

Tucked away in a building behind Ottawa City Hall, sharing the floor with the Canadian Airports Council and the Tourism Industry Association of Canada (TIAC), is George Petsikas’s office. Grabbing a quick lunch between meetings, the president of the National Airlines Council of Canada (NACC) talked about the advocacy group.

A senior director of government and industry affairs at Air Transat, Petsikas trained at McGill University in aviation law. When asked about his job, he laughed: “I am able to combine my two interests – which are arguing and aviation – I mean law and aviation!”

In 2008, the four largest capacity airlines in Canada – Air Canada, Westjet, Air Transat and Jazz – withdrew from the Air Transport Association of Canada (ATAC) to form the NACC. When asked why, Petsikas explained, “The NACC was formed with the strict focus on major airline issues, both domestic and international. ATAC has a very wide-ranging membership that is its strength to a certain point, but also as far as we were concerned, tended to deviate from what we considered to be critical to issues that were front and centre in our work like resource allocation. In the U.S., you have more than one airline association and we felt we could do something similar in Canada strictly devoted to large air carrier issues.”

The NACC’s three pillars are safety, cost competitiveness and environment (sustainability). “This is what we share and work together for – but we are competitors,” he emphasized. “We have strict competition law guidelines not to discuss issues of commercial interest or market development like pricing – that is absolutely taboo. We do, however, share information on areas that are to the benefit of everybody – you don’t want to compete, for example, on safety. On cost competitiveness, we all share an interest with respect to ensuring a regulatory tax infrastructure and cost framework that allows us to keep a cap on costs. This translates into lower fares for our customers. These infrastructure costs are things like airport rents which has been a bugaboo for years, the airport security charge – one of the highest in the world – and fuel excise tax.”

The effects of these lead to the phenomenon that Petsikas called “cross border

I am able to combine my two interests – which are arguing and aviation –I mean law and aviation!

leakage.” “You have almost five million Canadians who annually make the decision to not travel on Canadian carriers from Canadian airports and would rather go south of the border to Plattsburgh, Bellingham and Buffalo. They say, ‘Hey, this is a better deal and we’ll fly from here.’ Why is that? Well, because those U.S. airports have cheaper operating costs because of the different policies that are applied to them.

Petsikas maintains that the U.S. and other countries view air transport as a major economic engine, as a facilitator of broader economic activity. “And if you have a sound competitive air transport system, you’ve got more productivity, goods going to market faster, cheaper imports, and of course you connect the country to the rest of the world, which is what as the major airlines in Canada we do,” he says. “To that end, we’ve produced a major study, which is on our website www. airlinecouncil.ca and which underlines the impact of the four NACC carriers on the Canadian economy.”

In 2010, the four current member airlines carried in excess of 50 million passengers and directly employed almost 43,000 people. Their total revenues exceeded $17 billion and their total expenditures in Canada

By Peter Pigott |

were slightly less than $15 billion. Their estimated total economic output impact was $27.4 billion, and they created 113,300 jobs.

“Sound public policy does not tax economic facilitators,” said Petsikas, “such as the air carriers in this country. You do what you can to keep their costs low so that they can produce more. You prime the engine by keeping the cost base low and then the ‘engine’ will produce more travellers, more tourists – tourism is a huge business in Canada.

Petsikas had recently been interviewed in the media with regard to the airlines having to quote full fare, a government regulation that will be effective as of January 2012. “The full fare quote,” he said, “has addressed a number of our concerns. When it was first debated, we wanted to have a level playing field because if we as Canadian carriers were subject to a certain price on a segment and the U.S. or EU competitor wasn’t, then obviously it skews the optics as to whose has the cheaper fare. For the consumer, the cheaper fare isn’t required to include the taxes that are high enough to begin with. The government will be developing the regulatory framework over the next nine to 12 months and the NACC will be front and centre with our input.”

With a president like Petsikas, there is no doubt of that. | w

Peter

Pigott is a Wings writer and columnist.

By david olsen wiTH files fRoM MaTT niCHolls

wAas 2011 a bad year for Canadian aviation and is the level of aviation safety in this country stagnating? Is our regulatory system working at the top of its

surprising these issues are coming to the forefront.

In the latest International Civil Aviation Organization (ICAO) report “State of Global Aviation Safety – 2011” released last December, ICAO secretary general Raymond Benjamin stressed, “we will need to do more to maintain this [impressive] record” [of safety]. The ICAO report also clearly outlines that the state of global aviation is excellent, and that the global accident rate has essentially remained unchanged in the past 10 years.

However, statistics and trends are only part of the story. In accidents and incidents, there is always a “why” the incident occurred in the first place – indeed multiple “whys.” For example, the Transportation Safety Board (TSB) January 2012 progress report of the investigation into the fatal First Air Flight 6560 Boeing 737 accident at Resolute Bay on Aug. 11 last year, classified the accident as Controlled Flight Into Terrain (CFIT). TSB was pursuing “several concurrent avenues of investigation, to understand why the aircraft struck terrain one nautical mile east of the runway.” Another important question: are we taking the right approach to regulations in Canada and specifically, can we do better? Do other countries have more efficient systems?

The CBC investigated these and other pressing questions in a compelling piece last November, exploring the importance of safety management systems (SMS) and the responsibility for compliance with regulations. Surprisingly, director general of civil aviation (DGCA) Martin Eley said, “it’s not our job to make sure you’re compliant.”

a dangerous experiment with the lives of Canadian air passengers.”

The CBC charged TC with insufficient monitoring/audit and enforcement and improper use of SMS. But the key point is TC did not introduce SMS because it felt like it – it is an international obligation. The issue is not that TC, in a non-political regulator role, ignores safety. It does not –and in fact, as Eley told Wings, Canada has been a world leader in the adoption of safety regulation, SMS and more.

“Canada’s safety record is among the best in the world, and TC is committed to maintaining and improving aviation safety,” Eley said. “TC is implementing and strengthening a civil aviation performance management regimen that includes a national risk-based plan and inspection schedule that is in keeping with the plan, inspector training performance monitoring and quality assurance.”

game?

Intriguing questions all and given the way 2012 began with the fatal crash of a Keystone Air Service Piper PA-31 at North Spirit Lake on Jan. 10, followed shortly by a fatal RCMP helicopter crash near Chilliwack, B.C., the next week, it’s not

This response signalled what appears to be a fundamental shift in the role of our national regulator, at a time when the government was under fire from many sources for what was perceived as a cutback on safety oversight. Critics pointed to cuts in the number of TC inspectors just when accidents in northern aviation, float plane and helicopter operations appeared to be increasing. One newspaper even accused the government of “conducting

But the question remains, as a government department, controlled by the minister and political party forming the government, can TC be non-political – or is it an instrument of the government of the day with all that that implies? And if the current political policy is to cut expenditures, cuts may bite into national and international statutory duties and functions of the safety regulation branches of TC. Should TC be re-established as a statutory authority for civil aviation safety at arms length from the government and which, like the TSB, reports to Parliament and not solely to the government of the day? These general principles are behind the civil aviation authorities of some states, particularly Australia, the U.K. and other Commonwealth countries (see “Beyond our borders,” page 22).

In May of last year, the Air Transport Association of Canada (ATAC) presented an action plan at its symposium on “Transport Canada Level of Service” to deal with just these questions. The event brought together 10 national and regional associations to explore how TC could improve service to industry. The group developed an action plan with 21 recommendations on

“Our industry and the travelling public are economically disadvantaged because the regulatory process is inefficient, expensive, overly bureaucratic.”

– Merlin Preuss, VP government and regulatory affairs, Canadian Business Aviation Association

communications, delegation and targeted service improvement. The plan was presented to the minister of transport in October last year, and according to ATAC president/CEO John McKenna, is currently waiting for a date to discuss.

One of the key findings of the report was that, in its current incarnation, TC must be all things to all people – and this model is difficult to pull off. TC covers every facet of transport –even pipelines – and is on one hand an instrument of government political policy (which can be notoriously fickle) while on the other, the guardian of public safety, with national and international obligations. It’s hard to do both. The question is, how can we organize our safety assessment, monitoring and enforcement more effectively?

Dennis Lyons, president of the Manitoba Aviation Council (MAC), maintains that the current regulatory system in Canada is not broken; however

its processes are burdensome and confrontational, instead of collaborative. He recognizes that some in TC are working to improve on these shortcomings. “Our safety rate is still one of the best in the world, so even with the bad press, industry and TC are doing a lot right,” Lyon says.

Merlin Preuss, vice-president government and regulatory affairs for the Canadian Business Aviation Association (CBAA), has a unique perspective on TC’s operations having served as DGCA for more than seven years prior to joining CBAA. He highlights the aviation safety record, documented by ICAO and TSB, as confirmation that industry, the travelling public and Canada’s trading partners need have no concerns about TC’s safety regulatory process.

“However, our industry and the travelling public are economically disadvantaged because the regulatory process is inefficient, expensive, overly bureaucratic, too prescriptive and unable to keep up with technological change and risk management innovations,” he says. As a result, Preuss notes, there are ongoing compliance costs, loss of competitive advantage and lost growth opportunities.

McKenna agrees and adds that part of the problem with TC is organizational: discrepancies that exist between TC regional operational units and national headquarters in Ottawa. The regional operations are the direct link with industry, supplying most of the services, while Ottawa establishes standards, guidelines and policies.

McKenna also suggests a human resources shortage, which causes backlogs of work, reduces the required level of service to industry and continues to be a major hindrance. “TC’s structure and culture make it difficult, if not impossible, to maximize use of existing human resources and until things change, progress will be very slow.”

Captain Bradley Small, Air Line Pilots Association (ALPA) vice-president and International Federation of Airline Pilots’ Association (IFALPA) director, is concerned by the inordinate time taken to enact recommendations of the TSB

into improved regulations. “For example, take the RESA recommendations stemming from TSB’s investigation of the Air France Airbus A340 crash on Aug. 2, 2005 runway over-run in Toronto,” Small says. “Six years later, this recommendation is finally being processed into regulations.” Furthermore, ALPA is calling for “archaic flight time and duty time regulations for aircrews to be revamped” while industry is still trying to have science-based regulations approved.

Eley admits that TC does have a problem with processes on a number of issues, but is working to find a workable solution for industry – particularly when it comes to TSB investigations. “Transport Canada is working hard at streamlining internal processes and redefining its

regulatory governance so that regulatory amendments resulting from a TSB recommendation can be implemented more quickly,” he says. “A modernized CARAC (Canadian Aviation Regulatory Advisor Council) process will also contribute to implementing these recommendations sooner.”

While industry experts contacted by Wings agree Canada has one of the safest, if not the safest operating environment in the world, they all contend that the nation’s regulating body isn’t so much as broken, as it is dysfunctional – and in its current state, is not producing the desired results. Preuss maintains the safety and economic benefits of the IMS (TC’s civil aviation integrated management system)

in 2010, icao recorded 121 scheduled commercial flight accidents compared to 113 in 2009 – a marginal rate increase. and while overall fatalities in 2010 were below those in 2005 and 2006, there was an increase from 2007 to 2010.

Preliminary 2011 statistics published by TsB canada in January 2012 show that in general, after the accident “blips” from 2008 to 2010, 2011 was generally a good year – things did not get worse. The bad news is, helicopter accidents did increase. The other issue is public perception. in our instant society with instant communications, video and news reports can create in the public mind a perception that all is not well, even if the dry statistics show otherwise.

statistics can also be confusing – and in some cases, misleading. The aviation safety network (asn, a service of the Flight safety Foundation) statistics to Dec. 31 2011 show global multi-engine airliner fatal accidents and total fatalities reflect a downward trend, and that for total worldwide fatalities, 2011 was the second “safest” year since 1945 – the third-safest year as noted by number of accidents. For 2011, asn recorded 28 fatal airliner accidents, resulting in 521 fatalities in the air and on the ground: lower than the 10-year average of 764 fatalities.

But this information comes with caveats. a multiengine airliner is defined by asn as one where the basic model has been certified for carrying 13 or more passengers, which means that many aircraft used in demanding environments in the arctic and sub-arctic, africa, south america and asia are not included. and a multi-engine airliner may or may not be an icao “scheduled commercial flight.” TsB canada, on the other hand, has a clearly defined set of parameters for its statistics, which are readily available on its website (http://www. tsb.gc.ca/eng/).

and, more critically, SMS have yet to be realized. Nevertheless, he points out that these systems indicate that, “TCCA is uniquely situated to make rapid decisions that could provide economic benefits to industry and the traveling public while improving an enviable safety performance.”

McKenna reiterates that inadequate HR planning, budget cuts and attrition have resulted in industry frustration with delays in getting even basic paperwork processed. Lyons agrees, adding that MAC has waited several months to meet the minister. MAC and other industry groups, including organized labour, have identified the dysfunctionality to the Minister and suggested a TC Industry Advisory Council.

ALPA’s Small suggests the role of Transport Minister should be just that – a dedicated minister to focus on transport issues. The current position is Minister of Transport, Infrastructure and Communities.

“Far too often, the Minister (Denis Lebel) is too busy to meet on transport issues because of the demands of infrastructure and communities,” says Small.

Eley disagrees and notes the diverse nature of the position is accurately reflected in the current portfolio. “Transportation systems, infrastructure and communities are intrinsically linked,” he argues. “The Minster of Transportation, Infrastructure and Communities, supported by Transport Canada and Infrastructure Canada, serves Canadians through the promotion of safe, secure, efficient and environmentally sustainable transportation systems and public infrastructure in Canada.”

Another issue TC faces, say industry experts, is organizational – it is hindered by the current management structure in its goal of meeting the needs of the aviation industry, the travelling public and employees (for

example, pilots, AMEs). Lyons suggests that although the current system relies on risk management and level of service systems, privately operated aircraft and those who maintain them outside the AMO system are never audited for compliance, obviously a real concern.

“The level of service model doesn’t work,” he says, “nor is it enforced by TC, while every company appears to have major delays with TC for service delivery.”

Another service concern, notes McKenna, is the fact TC rarely interfaces with passengers – something critics maintain is highly worthwhile and in many ways, is a missed opportunity. The U.K.’s Civil Aviation Authority (CAA, see “Beyond our borders”) has a consumer protection group and recently launched a dedicated website portal for passenger advice and support.

From his vantage point, Preuss maintains TC’s current organization and management

“Canada’s safety record is among the best in the world, and TC is committed to maintaining and improving aviation safety.”

– Transport Canada director general of civil aviation, Martin Eley

“Our safety rate is still one of the best in the world, so even with the bad press, industry and TC are doing a lot right.”

– Dennis Lyons, president of the Manitoba Aviation Council

structure leads to confusion and inequities in the marketplace and extra overhead costs to government and taxpayers. He stresses that regulatory standardization across the market is essential for a level economic playing field and productive working relationships between regulators and those regulated.

“Except for the oversight of, and service to, the large airlines,” he says, “Canada’s aviation safety program is delivered by five regions, and aviation safety officials report in-line to the regional directors general.”

Preuss adds that, although on paper TC headquarters has authority to ensure program activities adhere to national standards, in reality, without a clear line of authority over regional officials, it is very difficult and often impossible to do. The result is that standardization issues often force industry to go “region shopping” to find the most efficient way to get necessary approvals and authorizations.

To ALPA, it’s obvious that with present fiscal restraints and staff levels, TC is barely keeping its head above water, “having to give its attention primarily to

crisis issues, to the detriment of less demanding but nevertheless required actions to improve safety,” says Small.

Building a new mousetrap So, could there be a better way to regulate, monitor and improve aviation safety in the future – and if so, how? Lyons offers an emphatic “yes.” He contends that if TC and industry met to boldly address the issues, a more a viable system could be designed and implemented.

“This new system would very likely look different from what we have today, and if done properly, I am sure there would be some services delivered by other agencies allowing TC to focus on oversight of all the industry.”

Coming together on issues surrounding SMS is also paramount, says Small. The SMS program is based on the principle that operators and employees are best placed to determine their risks and should be able to fix safety deficiencies before they become accidents. “However, an important oversight role for the regulator is to ensure that operators have an effective SMS program, and ALPA feels that the aviation industry is so varied and complex that a single focal point for the regulatory system must remain,” he says.

Preuss maintains TC should reorganize its model based on mode instead of region. “[With this model] you would end up with modal assistant deputy ministers (ADMs) instead of one safety and security ADM. The regional structure would be left to support personnel in the field, providing a focus for politically driven regional issues.” Preuss adds that while creating a civil aviation authority has some appeal, it could be an expensive proposition for industry, and favours making existing processes more efficient and effective, not making change for change sake.

McKenna agrees, particularly when it comes to SMS. “SMS was intended to make operators more responsible and accountable for safety, and industry has gone a long way to embrace that culture,” he says.

McKenna identifies the problem that Transport Canada regional operational units either

resist changing from their traditional role to the new SMS supervisory mandate, or they are insufficiently trained. “Thus industry is asked to accept the new regulatory supervision and inspections, but TC inspectors are often unclear as to their modified mandate. They tell carriers that their Quality Assurance Program doesn’t meet requirements but they won’t say what needs correcting – consequently, the previous relationship, where TC assisted carriers to improve safety, has become one of strict enforcement.”

Industry experts Wings spoke with suggest actions needed to improve the safety regulation model include better communication, delegation and

cooperation, including sharing lessons learned during audits. Preuss also places high importance on reducing what appears to be a risk-averse mentality in TC, with performance-based regulations and risk management based SMS solutions needed to replace prescriptive regulations to mitigate safety risks. Preuss echoes McKenna in calling for improved delegation to industry, to reduce delays for important and costly issues.

“We’re not talking about delegating responsibility, but administrative processes such as temporary approvals of additional aircraft on an operating certificate, or delegation of authority to host professional pilot exams,” says McKenna.

when it comes to regulation around the globe, there isn’t a one-size-fits-all approach. so, how do some of canada’s icao partners regulate the skies? are their models better and offer solutions to enhance the canadian standard?

in the u s., the Federal aviation administration (Faa) has great strengths, but just as many weaknesses note its critics, including trying to fulfil a dual role of promoting and regulating u s. aviation. in the u k., the civil aviation authority (caa) has a sound formula that seems to work, as a number of countries have taken a similar route, such as australia (where the civil aviation safety authority of australia is an independent statutory authority), new zealand and others.

The caa, is a public corporation, established by British Parliament in 1972 as an independent specialist aviation regulator. it boasts a unique situation in that it receives no government funding and is required to be self-supporting. it also reports to Parliament rather than the government of the day, although the minister can give direction on certain matters.

important information can also be gleaned from annual reports. Transport canada presents an annual report to the governor general; and the Minister of Transport has a statutory responsibility to table in Parliament each year a brief overview of the state of transport. every five years, an expanded, more comprehensive review is tabled as per section 52 of the canada Transportation act (1996), as amended June 2007. But brief is the operative word. The 2010 report on canadian aviation and aviation safety amounted to just three-and-a-half pages. compare this with the 2011 report of the u k.’s caa at 110 pages – and the 2010/2011 report of the civil aviation safety authority (casa) of australia at 192 pages. Perhaps, aLPa’s view that canada should look around the globe and glean best practice deserves consideration.

Lyons pinpoints fixing CARAC as a key issue, citing the enactment of regulations from many years ago being enacted, which contradict newer NPA’s still in the queue (for example, TAWS/GPWS, while new aircraft are being built with EGPWS). ALPA’s Small agrees and details three other key actions: Accelerate the regulator’s response time and decisionmaking process for changes that do not imply or require regulatory change. Re-vamp the regulatory change presently effected through the CARAC process. Streamline CARAC attendance to stakeholders who really need to be there. Keep the group as small as possible. When a Notice of Proposed Amendment (NPA) is approved by the Civil Aviation Regulatory Committee (CARC), it often becomes moribund or dies before going to Gazette I. This needs to be fixed.

Such suggestions would

certainly help, and Eley contends changes are in the works to help streamline TC’s processes. “Transport Canada works in partnership with other international civil aviation authorities on topics of interest regarding SMS requirements and implementation activities,” he says. “The department benefits from collaboration and sharing of lessons learned and best practices. Looking ahead, TC is taking action to:

Improve the responsiveness of the rulemaking process. Increase the effectiveness of system-based surveillance. Introduce internal quality assurance assessments, as part of the Integrated Management System (IMS).

Complete the National Organization Transition Implementation Project (NOTIP)

“Once completed, these initiatives will collectively define how Transport Canada’s Civil Aviation Directorate will operate in the years to come,” says Eley.

Changes like these can’t come soon enough, notes McKenna, who suggests that Canada, “once having inspired many of the changes promoted by ICAO, is now lagging behind because of structural inefficiency and cultural resistance to ideas it came up with a few years ago. Other jurisdictions are pushing forward to adapt to the new reality.”

Preuss concurs, noting that the government is slow to use what is already available to improve safety performance and reduce regulatory and cost burdens. Small has a practical suggestion – visit other agencies, discuss how each manages regulatory issues and changes, then take the best methods of each and tailor that to Canadian needs.

“Canadians are resourceful people,” he says, “and with determination to improve what is already a relatively healthy system, they can create the regulatory system that they need and deserve.” | W

“TC’s structure and culture make it difficult, if not impossible, to maximize use of existing human resources.”

– John McKenna, president/CEO, Air Transport Association of Canada

opeRaTing aiRCRafT in THe winTeR pResenTs uniQue CHallenges

By peTeR pigoTT

in a country “blessed” with frigid winter conditions for a good portion of the year, it’s not surprising aviation firms and universities studying the effects of winter conditions on aircraft have plenty of examples to work with.

And as Dr. Michael W. Holm, the technical officer, ICAO Meteorology Division aptly noted at the recent Winter Ops 2011

conference, most of the research reveals that “snow and planes don’t mix.” Holm might have continued that statement to note that the combination of ice and planes could be fatal.

Sponsored by the Flight Safety Division (FSD) of the Air Canada Pilots Association (ACPA), the International Winter Operations Conference was held last Oct. 5-6 in Montreal. Under the theme of “Safety is No Secret,” some 250 delegates from 18 countries came together to share their expertise in operating safely in winter conditions.

Led by two eminently qualified pilots, ACPA president captain Paul Strachan and FSD chairman captain Barry

Wiszniowski, the conference brought together experts from around the world – aircraft and power plant manufacturers, pilots, air traffic controllers, de-icing service providers and safety investigators – to share their experience in safe winter operations, specifically de-icing.

The presentations ranged from operations in active frost conditions, to implementing takeoff and landing performance assessments, to ice in the fuel, to cold weather testing – all interspersed with panel discussions. And while all sessions were informative and noteworthy, none could match the immensity of author Allan J. McDonald’s presentation from his book Truth, Lies and O-Rings: Inside the

Space Shuttle Challenger Disaster, which opened the conference. More than whistle blowing on the aerospace industry, it was a warning on lessons still unlearned on de-icing.

“Over the past 25 years, a number of fatal aircraft accidents have been attributed in part, to ice formation on the ground, prior to takeoff,” said Arlene Beisswenger, a consultant at the Anti-icing Materials International Laboratory at the Université du Québec à Chicoutimi. And indeed, one could not escape the seminal tragedy that focused attention on ice and snow: the Dryden air crash.

On March 10, 1989, an Air Ontario Fokker F-28 Mk 1000 with 65 passengers

and crew of three crashed off the end of the runway at Dryden, Ont. The captain had not done a proper “walk-around” or asked for de-icing, and by the time the aircraft took off, the half inch of wet snow on the wings had turned into opaque ice. Twenty-one passengers and three crew members were killed.

Occurring soon after the Arrow Air crash at Gander (256 U.S. military personnel were killed), the Dryden tragedy led to the scrapping of the investigating agency the Canadian Aviation Safety Board and the appointing of a Commission of Inquiry under the Honorable Virgil Moshansky. His report – and specifically the findings regarding ice build-up on the wings – led

With winter operations, a pilot’s focus of attention shifts to runway conditions, and stopping criteria is paramount.

to a better technical understanding of this phenomenon, and made Canada a world leader today in preventive measures.

“The de-icing industry has come a long way since the Dryden incident,” Aeromag 2000’s director Denis Gordon said. “Regulation changed from inspection to training. People don’t realize all the work and effort that is now done behind the scene – the testing of all glycol products, holdover time charts that are revised annually, standards and procedures that are updated prior to the next de-icing season.”

Meeting annually, the SAE G12 Aircraft Ground De-icing Committee of de-icing experts, aircraft manufacturers and regulators from around the world, address

a vestergaard Beta de-icing vehicle about to commence activities in a heavy snow event.

all areas of ground de-icing procedures. “What is good about a committee like the G12,” Gordon said, “is the more information we have available, the better we are able to train the people that are involved in the day-to-day de-icing operations.”

leading the way

Canada is fortunate to have two academic institutions that are world leaders in the science of de-icing. Established in 1994, the Anti-Icing Materials International Laboratory (AMIL) at the Université du Québec à Chicoutimi studies and simulates ice formation. AMIL is the only laboratory in the world, Beisswenger said, that is accredited to qualify de-icing and anti-icing fluids used to protect airplanes prior to takeoff for icing protection and aerodynamic acceptance. Clients range from Dow Chemical Company to China’s Beijing Aviation.

AMIL operates five cold chambers capable of simulating freezing rain, drizzle and fog, frost, snow and ice pellets. To simulate medium and strong winds, or to reproduce aircraft flight conditions,

on Jan. 21, 1995, another tragic aviation event occurred on canadian soil that ultimately shaped the way current de-icing activities are performed in canada and on the global scale.

on this day, a Boeing 747-400, registration cnRga, operated by Royal air Maroc, was preparing for a scheduled flight from Mirabel international airport (YMX), Que., to casablanca, Morocco, with a stop in new York city. The aircraft was parked in the de-icing centre at the airport. The four engines were running during the de-icing operation. The flight crew heard “dégivrage terminé” (de-icing completed), and the captain asked the co-pilot to inform the apron controller that the aircraft was ready to taxi. Taxi instructions were issued. The aircraft started to move forward and overturned the two de-icing vehicles that were still in front of the aircraft’s horizontal stabilizers. The two vehicle drivers sustained minor injuries; the three occupants of the cherry-pickers received fatal injuries.

The Transportation safety Board of canada determined that the flight crew started to taxi the aircraft before its perimeter was clear, following confusion

in the radio communications. The following factors contributed to the accident:

• a lack of de-icing procedures within Royal air Maroc

• non-compliance with procedures on the part of the canadian airlines international Ltd. de-icing crew

• inadequate or inappropriate communications equipment

• incomplete training of snowman 1 (the chief de-icing attendant)

• a regulatory framework less demanding of foreign air carriers than of canadian carriers

• a lack of operational supervision

• a lack of adherence to radio protocol

The fallout of the Mirabel accident resulted in widespread changes on the global scale to de-icing facility procedures, engines-on de-icing procedures, communication and radio protocols. even today, the Mirabel accident is cited to reinforce the need for visual hold procedures to enhance verbal communication procedures in engines-on de-icing operations.

or in-cloud icing and freezing fog, AMIL uses two low-speed wind tunnels that can be operated at subfreezing temperatures. Other specialized equipment includes different apparatuses to measure the adhesion of ice by centrifuge, flexion, torsion or traction. With such world-class facilities, Beisswenger and her team manage research projects for airlines relating to de-icing and developing tests in freezing precipitation simulation.

From the University of Waterloo’s Department of Civil and Environmental Engineering, Dr. Susan Tighe, P.Eng., is the Canada Research Chair in Pavement and Infrastructure Management. Said Tighe: Measuring the surface conditions of a runway and properly assessing the wheel-braking capability is crucial in the planning for the safe landing or takeoff of an airplane, especially when the runway is contaminated during heavy rainstorms or

Mask, president of CORANNA Flight Safety Investigative Services. Mask discussed the use of routine Flight Data Analysis (FDA) and its value in improving overall safety.

“Winter conditions often influence variations in stable approach criteria, single-engine taxi procedures, use of reverse thrust and gate wait events as examples,” he said. With a sophisticated FDA program in place, an airline would be able to ascertain seasonal variations within their event set (flight safety measurements). A comprehensive parameter set with a programmer and flight data analyst is a necessity and Applied Informatics and Research Inc. can provide a realistic event playback capability suited to an airline’s needs.

“How much fan and spinner ice build up is acceptable before de-icing the engine?” asked Andy Mihalchik, flight operations from GE Aviation? Mihalchik discussed engine operations from the flight

service providers, centralized de-icing facilities and subject matter experts that is the envy of the world.”

To prove his point, Chaput mentioned companies such as Dan-Ice Canada, Chinook Mobile Heating and Deicing Corporation, and AIM Systems – all leaders in their field. Dan-Ice Canada has already implemented automated holdover time determination systems at Calgary, Toronto and Montreal airports, and currently has a commercial contract with Westjet. These systems measure meteorological conditions and send electronic de/antiicing fluid holdover time reports right to the flight deck, allowing the pilots to make correct de-icing decisions.

Chinook Mobile Heating and Deicing Corporation of Smiths Falls, Ont., has just signed its first commercial contract with Finnair for its non-glycol de-icing system for aircraft and engine fan blades

snow/ice during the winter.”

None of the commercially available friction measurement devices take the aircraft Anti-Skid Braking System (ASBS) into account in measuring runway surface characteristics. As a consequence, Tighe helped develop a new system to more accurately predict the braking performance of an aircraft by mimicking its actual stopping characteristics as closely as possible – and the first prototype machine has already been tested.

“With winter operations, a pilot’s focus of attention shifts to runway conditions, and stopping criteria is paramount,” said Bryon

crew perspective. When engine de-icing is not an option, the ice shed procedure must be accomplished, he warned, early on taxi-out. And spraying aircraft de-icing fluid into the engine is not approved.

“Dryden was certainly a wake-up call,” said Michael Chaput, president of Montreal-based Deicing Innovations, a firm that assists other aviation organizations with the design and implementation of customized de-icing strategies. “Since then, Transport Canada has played a leading role in funding ground de-icing research and the end result is a national system of air carriers, airports, de-icing

that uses heated, moisture-laden air as a medium. And in addition to Toronto and Vancouver, Amsterdam’s Schiphol Airport will soon have AIM Systems advanced LED-based electronic message boards for its airport and de-icing operations.

As ACPA director of communications Paul Howard noted, the purpose of Winter Ops 2011 was to share Canadian expertise in winter conditions with the rest of the world. It certainly accomplished its goal and underscored the importance of this important segment in Canadian aviation – an absolute necessity especially given our harsh and unpredicable climate. | w

By JaMes MaRasa

The departure lounge is as well appointed as that of any executive fixed-base operator. However, where one might traditionally expect to see BlackBerry-wielding businessmen dressed in suits and ties, those waiting to board North Cariboo Air on this day are more comfortably outfitted in hooded sweatshirts and work boots. The turboprops on North Cariboo’s ramp at Edmonton International are not bound for conventional business aviation hubs like Toronto or Teterboro – rather, the destinations today are Wabasca and Conklin Leismer in the oil fields of Alberta.

A perennial windfall to the economy of Canada’s only debt-free province, the oil sands speak for roughly 140,000 square kilometres of Northern Alberta real estate. Provincial government figures claim proven oil reserves of some 171.3 billion barrels, making the oil sands the third-largest crude oil reserve in the world. As the price of oil fluctuates between roughly $80 and north of $110 per barrel, the Canadian Energy

Research Institute estimates the oil sands will create more than $307 billion in tax revenue across Canada over the next 25 years. With new jobs continually being added to an industry that has already experienced considerable growth, the transport of workers to remote regions of Northern Alberta has revealed itself to be a major undertaking. As much as they aim to capitalize on this growth by moving people to and from the oil fields, in doing so, air operators must safely traverse inherent logistical challenges.

James Wakulchyk, North Cariboo’s quality assurance manager for flight operations, captains one of the company’s Dash-8 300s on the day I join the crew on a flight to Conklin. As the aircraft levels off at flight level 210, the ride is mostly smooth but flying the Alberta skies comes not without its seasonal hazards. Embedded in the broken cloud layers this afternoon are thunderstorms building with the summer warming of the prairie horizon.

As he monitors the more threatening cells on the aircraft’s weather radar, Wakulchyk

adjusts the heading bug to keep a safe distance. However, with the Cold Lake Air Weapons Range paralleling our track less than 10 miles off the right wing, room to manoeuvre is limited. In close proximity to an air-weapons range is no place for complacency, and Conklin-bound aircraft must duck below the 7,000-foot floor of Cold Lake’s restricted airspace before manoeuvring for an approach. As the Dash-8 descends out of controlled airspace the sky dissolves to a low overcast and radio chatter from the Edmonton Centre frequency fades. Before the aircraft banks right toward the airstrip, Wakulchyk remarks that on a clear day, it is possible to see CF-18 Hornets from 4 Wing Cold Lake dogfighting overhead.

On touchdown, Wakulchyk uses a balance of beta-range pitch and brakes to smoothly slow the turboprop. “Technically, this is a gravel runway,” he says as we taxi towards the portable terminal building. “We just get it down and get it stopped.”

Flight into uncontrolled airspace and remote airstrips typically gets oil sands flying, bringing what Wakulchyk describes as

The value MaNIFeSTS ITSelF IN The PreServaTIoN oF

“the potential for higher risk.” All the same, he insists that conceivable hazards are well mitigated through standard operating procedures and airport-specific training for flight crews. “We treat every airport with respect,” he says. “When deciding whether or not a flight can be undertaken at a remote airstrip, we always assess the risk first.”

The Conklin Leismer Aerodrome, operated by Leismer Aerodrome Limited, serves a long-term oil sands development project. Despite the remote setting and limited access, Wakulchyk explains that Statoil – a Norwaybased energy company – has invested heavily in the airport infrastructure. Among its other facilities, Conklin boasts a full weather

station and an aerodrome advisory service staffed by former Flight Service Specialists. Wakulchyk sums up his praise for the airport’s services in a single word: “Excellent.”