6 McCarthy

The time for hesitation’s through.

8 On the Fly 13 Airline Insider By

On the Web

Carr

Second Coming

20 Multifunction Airline

The many hats of Winnipeg’s Perimeter Aviation, by Carroll McCormick.

24 Completions Management in High Gear

Montreal-based BJAC Services makes its mark by guiding owners through the intricacies of turning a green aircraft into a finished product, by Drew McCarthy.

28 Montreal’s ACASS

James Careless reports on the 15-year evolution of Montreal’s ACASS, offering a wide range of services to corporate owners/operators worldwide.

32 Aircraft Sales and Values

Rob Seaman provides an overview of the aircraft resale market including the challenges that are facing buyers and sellers today.

36 A Look Back

Raymond Canon looks at the Cessna T50 Crane, the twin-engined aircraft that is all but forgotten except by the aircrew that flew it during the WWII era.

38 Airport Revitalization

Michelle McConwell discusses how the Community Airport Partnership Program is breathing new life into Saskatchewan’s airports.

41 One on One

Darren Locke speaks with Ken Bittle, president of Thunder Airlines.

54 Purser

The truth is, it’s hell all over.

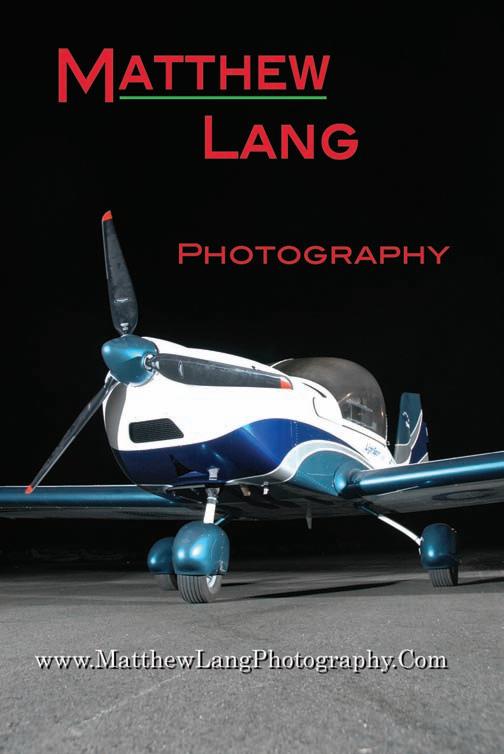

ON THE COVER

Air Canada A-320 takes off from Vancouver International Airport. (Photo by Matthew Lang)

The most efficient companies in twenty-six countries demand the most efficient large-cabin business jets and fuel is just one reason. Falcons not only match many smaller planes in fuel economy, high-tech design lets them use hundreds of small airports other wide-cabins can’t. City-hopping, ocean-hopping, flying-more-people-to-more-places proves again: Less is more.

DREW MCCARTHY is the editor of Wings.

During the recent federal election campaign, the Canadian Airports Council (CAC) issued a statement calling on our political parties to address the issue of Canada’s aviation competitiveness in the global market. With the economy, environment and health care topping Canadians’ list of concerns, the plight of aviation was never heard. Four days before the election, only the Bloc and the NDP had responded to an aviation policy questionnaire sent to them by the CAC (also posted at http://www.cacairports.ca/english/).

The time for hesitation’s through We’re not very attractive right now

The ongoing battle over our ability to compete is rooted in the fact that aviation has never been fully acknowledged as a major driver in the Canadian economy. The CAC, ATAC and other Canadian associations have continually argued that aviation competitiveness is fundamental to improving our world standing in international trade and tourism. Unfortunately, roadblocks such as airport rent, limited air access to foreign markets, inadequate resources for border services, and aviation security fees still exist and continue to impact our competitiveness as an air service destination.

In a speech delivered in September, Transat A.T. president and CEO Jean-Marc Eustache told a Montreal audience that “Canada is currently not attractive to air carriers, either as a hub or as a gateway to North America, due to federal policy that has turned Canada’s airports into ‘cash cows’ for the government.” Airport rent alone represents a $300 million a year expense that airports have to pass on to air carriers and their passengers. Evidence of our unattractiveness can be seen by the fact that in excess of 2.2 million Canadians are crossing the border annually to fly out of U.S. airports in places such as Buffalo, Plattsburg, Burlington or Bellingham.

The same problem holds true in the air cargo industry. Carriers are flying to near-border airports and unloading cargo onto trucks for the final leg of the journey into Canada.

While waiting with bated breath for an open skies agreement with the EU to be completed, Canada needs to be looking beyond Europe to signing agreements with countries in Asia, the Middle East and South America. The United States has already completed its agreement with the EU and has more than 90 bilateral agreements signed around the world, compared to a mere handful for Canada.

The effects on both trade and tourism for the country cannot be underestimated. Internationally, tourism is a $6 trillion industry employing 220 million people around the world – two million of them in Canada. “Our ability to capture a fair share of this market is seriously threatened by federal policies,” says CAC president and CEO Jim Facette.

Progress is painfully slow. In 2007, the House of Commons Standing Committee on International Trade’s “Ten Steps to a Better Trade Policy” recommended that the government should expand its network of air services agreements around the world.

Now is the time for the new government to act on that recommendation and to quickly address other concerns such as airport rents and security fees. In a world moving as quickly as ours, there is no time for hesitation.

WINGS MAGAZINE

PO Box 530, 105 Donly Dr. S., Simcoe, ON N3Y 4N5

Tel.: 428-3471 Fax: 429-3094

Toll Free: 1-888-599-2228

PUBLISHER TIM MUISE tmuise@annexweb.com

EDITOR DREW MCCARTHY dmccarthy@annexweb.com

ASSOCIATE EDITOR ANDREA KWASNIK akwasnik@annexweb.com

SENIOR ASSOCIATE EDITOR RICHARD PURSER

PRODUCTION ARTIST KRISTA MISENER

OTTAWA CORRESPONDENT KEN POLE

AVIONICS EDITOR ROB SEAMAN

FLIGHT DECK RAY CANON, JAMES CARELESS, DAVID CARR, BRIAN DUNN, DARREN LOCKE, CARROLL McCORMICK, BLAIR WATSON

ADVERTISING SALES MARK MCWHIRTER mmcwhirter@annexweb.com

SALES ASSISTANT PAULINE CECILE pcecile@annexweb.com

VP/GROUP PUBLISHER DIANE KLEER dkleer@annexweb.com

PRESIDENT MIKE FREDERICKS mfredericks@annexweb.com

PUBLICATION MAIL AGREEMENT #40065710

RETURN UNDELIVERABLE CANADIAN ADDRESSES TO CIRCULATION DEPT., P.O. BOX 530, SIMCOE, ON N3Y 4N5 e-mail: awebster@annexweb.com

Periodical postage paid at Buffalo, NY. USPS 021-029, ISSN 0701-1369. Published six times per year (Jan/ Feb, Mar/Apr, May/Jun, Jul/Aug, Sep/Oct, Nov/Dec) by Annex Publishing & Printing Inc. US Office of publication c/of DDM Direct.com, 1175 William St., Buffalo, NY 14206-1805. US postmasster send address change to P.O. Box 611, Niagara Falls, NY 14304. Printed in Canada ISSN 0701-1369

CIRCULATION e-mail: awebster@annexweb.com Ph: 866-790-6070 ext. 208 Fax: 877-624-1940

Mail: P.O. Box 530, Simcoe, ON N3Y 4N5

SUBSCRIPTION RATES

Canada – 1 Year $ 34.00 (includes GST - #867172652RT0001) USA – 1 Year $ 50.00 Foreign – 1 Year $ 65.00

From time to time, we at Wings Magazine make our subscription list available to reputable companies and organizations whose products and services we believe may be of interest to you. If you do not want your name to be made available, contact our circulation department in any of the four ways listed above.

No part of the editorial content of this publication may be reprinted without the publisher’s written permission. ©2008 Annex Publishing & Printing Inc. All rights reserved. opinions expressed in this magazine are not necessarily those of the editor or the publisher. No liability is assumed for errors or omissions.

All advertising is subject to the publisher’s approval. Such approval does not imply any endorsement of the products or services advertised. Publisher reserves the right to refuse advertising that does not meet the standards of the publication.

Sustainable Environment.

ATR has been committed to sustainable development for a long time now. Its aircraft emit very low levels of carbon dioxide—a clear advantage in the battle against global warming . By regularly reducing its levels of consumption, ATR actively contributes to the preser vation of the planet’s resources.

Boeing successfully completed a high-pressure test, known as “high blow,” on the 787 Dreamliner static test airframe at its Everett, Wash. factory on September 27. The test is one of three static tests that must be cleared prior to first flight. During the test, the airframe reached an internal pressure of 150 per cent of the maximum levels expected to be seen in service – 14.9 lbs. per square inch gauge (psig). It took nearly two hours to complete the test, as pressure was slowly

increased to ensure the integrity of the airplane.

A company partly owned by the Vancouver Airport Authority and its financial partners have won a US$2.5 billion contract to privatize Chicago’s Midway Airport, the second biggest airport in the big U.S. Midwestern city.

Chicago Mayor Richard Daley announced the 99-year contract to operate Chicago’s smaller airport at a Sept. 30 news

conference in the Illinois city.

Separately, Vancouver Airport Services along with its financial partners, subsidiaries of Wall Street banking giant Citigroup Inc. and Manulife Financial Corp. said the contract means Midway will be the first privatized major airport in the United States.

The Vancouver Airport Auth-

ority operates Vancouver International Airport, Canada’s second busiest airport, which expects to handle 17.9 million passengers this year. The Vancouver Airport Authority is spending $1.4 billion to expand the airport ahead of the 2010 Winter Olympics, which will be held in Vancouver and other parts of southern B.C.

On page 11 of the September/ October issue, we incorrectly featured a photo of a Falcon 50 in the news piece “Aircelle to Supply Engine Nacelle For Learjet 85.” Thanks to Mel Goddard (AME Cat. 1, 2) of Fenelon Falls, Ont. for pointing out the error.

Aerospace is quickly becoming one of Prince Edward Island’s fastest-growing industries providing a diverse range of equipment repair, electronics, interiors and engineering ser-

Honeywell is adding 12 new positions at its facility at Slemon Park, P.E.I. The province is home to Honeywell’s Centre of Excellence for Fuel Controls Repair and Overhaul for North America. The facility at Slemon Park, near Summerside, currently employs approximately 100 people.

vices to clients around the world. The industry employs approximately 850 skilled workers and accounts for 25 per cent of international exports for the province. P.E.I. aerospace companies have annual sales of approximately $287 million.

Since the beginning of 2008, seven airlines have adopted The Boeing Company’s new Performance Improvement Package (PIP) for their 777 fleets. The PIP, scheduled for April 2009 introduction into service, is committed on 10 Boeing 777 fleets totaling 170 airplanes. The improved fuel burn eliminates three million pounds (1,360,800 kilograms) of carbon dioxide (CO2) emissions per airplane each year, further reducing the environmental impact of air travel. Continental Airlines, Air New Zealand, and Delta Air Lines were the first to adopt the innovative improvement package when it was introduced in late 2007. This year, El Al Israel Airlines, Austrian Airlines AG, Air France, KLM-Royal Dutch Airlines and British Airways have signed for the PIP. Two of the seven 2008 customers are unidentified.

The PIP package includes low-profile vortex generators, improved RAM air system and drooped ailerons.

Embraer celebrated the opening of its 47,700-square-foot hangar at the Phoenix-Mesa Gateway Airport on September 15. The new facility is dedicated to fullservice care for the company’s Phenom 100, Phenom 300, Legacy 450, Legacy 500 and Legacy 600 executive jets.

The new Embraer facility consists of a hangar, workshops and office space, for an estimated investment of $10 million US. The company’s commitment to the community is to create approximately 60 jobs over the next five years.

Partners in the Embraer project include the State of Arizona, the City of Mesa, and the PhoenixMesa Gateway Airport Author-

ity. Architectural and engineering firm Barge Waggoner Sumner and Cannon Inc. designed the new facility and Chase Construction was the builder. Both are based

The International Civil Aviation Organization, acting on behalf of the Government of Argentina and the Argentine Aeronautic Administration (AAA), has awarded Viking Air Ltd. of Victoria, B.C. the heavy-maintenance contract for complete overhaul and engine upgrade for one of eight DHC-6-200 Twin Otters operated by the AAA.

The contract will be carried

out at Viking’s repair and overhaul facility at Victoria International Airport, and encompasses aircraft inspection and overhaul, major “D” check, installation of Pratt & Whitney Canada PT6A27 engines and Hartzell 3 blade props, complete paint, flight testing and certification to return the aircraft to service. Ted Gerow, Viking’s director of maintenance, will assist on site at the Quilmes,

in Nashville, where an Embraer Service Center provides support for its commercial E-Jets and the Legacy 600 and Lineage 1000 executive jets.

Argentina facility to disassemble the aircraft and prepare for shipping to Viking Air.

Nav Canada, the company responsible for Canada’s air navigation system, recently added two Bombardier Canadair Regional Jet CRJ200ERs to its stable of flight inspection aircraft. They join a Dash-8-100 and will replace two CL-600 Challengers.

The CRJs are C-GNVC (c/n 7519, ex N660BR)

Events Calendar

NOVEMBER 2008

ATAC 2008 Annual

General Meeting and Tradeshow

Nov. 10-12

Calgary, AB http://www.atac.ca/index. html

FEBRUARY 2009

Asian Business Aviation Conference & Exhibition (ABACE 2009) Feb 11-12

Hong Kong http:web.nbaa.org/public/ cs/amc/

MARCH 2009

NBAA Inaugural Light Business Airplane Exhibition & Conference March 12-14

San Diego, CA http://web.nbaa.org/public/ cs/lba/2009/

Aircraft Interiors Expo

March 31-April 2

Hamburg, Germany http://www.aircraft interiorsexpo.com

APRIL 2009

Canadian Technical Security Conference & Trade Show

April 27-29

Mississauga, ON http://www.pdtg.ca/ CTSC005.htm

and C-GFIO (c/n 7526, ex N662BR), both formerly serving with Atlantic Coast Airlines and later Independence Air. They were first Canadian-registered in mid2007, and entered service in mid-2008 for ILS calibration. They are equipped with Rockwell Collins Head-up Guidance System.

Airports Canada Conference and Exhibition April 28-30

Ottawa-Gatineau, ON http://www.canadas airports.com/

For a full list of events, please visit www.wingsmagazine.com

Bombardier Aerospace in August announced the appointment of Brad Tolbard as director, business development, Bombardier Service Center Network. An expert in the field of aviation interior modification, Tolbard brings nearly 15 years of industry experience to his new role with Bombardier

StandardAero, a Dubai Aerospace Enterprise company, has selected Scott Shiells as its new airframe program director for the business aviation sector. Sheills will have full responsibility for establishing and executing plans to maximize growth of the airframe MRO business.

Sheills comes to Standard

Aero from Duncan Aviation where he was project manager on maintenance and modification projects. He was previously director of maintenance for Steen Aviation, worked in field service for Lockheed Support Systems, and served in the U.S. Navy as an engine technician and flight engineer.

Aircraft Services.

Tolbard will be responsible for the service center network’s strategy regarding the interior market. He has held similar positions at Bombardier Flexjet, JetCorp and most recently Atlantic Aero.

Christian Kennedy has been named international sales manager, Canada, for Dassault Falcon. He is responsible for sales and marketing of the full line of large-cabin Falcon business jets in the Canadian market. Kennedy most recently held sales and marketing positions with charter operators XOJET and Guardian Jet.

Kennedy has nearly 20 years of business aviation experience. He started his aviation career as a pilot with Sony Aviation in 1989 at Teterboro Airport, N.J., where he was type rated in the Falcon 10, Falcon 50 and Falcon 900.

In 1995, he joined Gulfstream Aerospace, first as a demonstration pilot and later as sales director, Midwest and New England.

As of September 18, Grob Aerospace accepted that Bombardier has cancelled the agreement with Grob Aerospace to continue the development of the Learjet 85 primary and secondary structure. Grob said this decision by Bombardier

Aerospace is an unfortunate result of uncertainty surrounding the current interim insolvency of Grob Aerospace GmbH in Germany. While this outcome is regrettable, the company said, it is a matter of fact that Bombardier needs

to take whatever measures it deems necessary in order to protect the timeline of its program. The parties have agreed to cooperate and to jointly remove the Bombardier program from the TussenhausenMattsies facility.

SUBJECT: A LOOK BACK CF-104 ARTICLE IN WINGS JULY/AUGUST 2008

Attention Editor:

I think there is an error in your CF-104 article in the July/ August 2008 issue of Wings. The author states the altitude record of just over 100,000 ft set by the Starfighter in 1967 “has yet to be equaled.” The Fédération Aéronautique Internationale website states otherwise.

The FAI recognizes the Mikoyan/Gurevitch E-266M (Foxbat) as holding the altitude record of 37,650 metres (123,523 ft).

Thanks very much for your time.

Jordan McGregor Engineer, Omega Aviation

Raymond Canon, Wings contributor and author of the regular feature, A Look Back, responded to McGregor’s letter:

I am the last person who would argue with the FAI on such a matter. After doing some checking on my source, it appears that the CF-104A used was a normal RCAF model stripped of all excess weight while, according to the FAI, the MiG-25 was the E-255M version especially modified for the record attempt.

But height is height and McGregor is quite right. He and I have had a very amicable discussion on the subject; he confessed to having a conspirator, Scott Delaney, in composing the letter and I thank them both for their contribution. It is nice to know that Wings has such careful readers. They are the ones who keep us journalists, aviation or otherwise, on our toes.

ExelTech Aerospace Inc. has inaugurated its regional aircraft maintenance facility at Trudeau International Airport in Montreal.

The $19-million, 153,000-sqft facility, which replaces an older building, can handle up to 10 regional jets and features advanced technical support capabilities, including the maintenance of composite materials, metallic structures, avionics and electronic systems and non-destructive testing. Once it is operating at full capacity it will employ more than 400 maintenance engineers, technicians and support staff, an increase of 100 over ExelTech’s current employment levels. It will provide maintenance for Bom-

bardier CRJ regional jets and ATR turboprops.

The building’s most unique feature is its wood beam construction. By replacing steel with wood harvested and processed in Quebec, ExelTech has built

a hangar with a smaller carbon footprint than if built with steel but which incorporates the same structural strength. The use of wood throughout the building also adds a feeling of warmth to the working environment.

Ontario’s air ambulance service, called Ornge, is purchasing six bigger and faster planes to service northern regions. The new planes, which cost about $35 million in total, will start flying in 2009 and 2010 out of Sioux Lookout, Timmins and Thunder Bay.

Ornge president and CEO, Dr. Chris Mazza, says the Swissmade Pilatus PC-12 planes will fly farther and faster than existing planes. He says they have enlarged cabins and doors and are needed because most of the current fleet is, on average, more

than 20 years old.

Ornge handles about 18,000 calls a year from accidents and on-scene trauma calls to hospital-to-hospital patient transfers.

The Webster Memorial Trophy Competition is an annual event intended to declare the “top amateur pilot in Canada.” Sandeep Nagpal, regional winner for Western Ontario, has been awarded the 2008 Webster Trophy. Sandeep flies out of Brampton Flight College, which makes this the third year in a row for a competitor from BFC to take the title.

Ornge operates 76 fixed-wing aircraft at 22 bases, and in August, it bought 10 new AgustaWestland helicopters to transfer patients in southern Ontario.

Avcorp Industries Inc. confirmed in September that it has been chosen to supply the tail assembly for Cessna’s new Citation CJ4 business jet. Avcorp estimates the contract will generate approximately $110 million US in revenue over the first 10 years, starting

in 2009. The B.C.-based company designs and builds major airframe structures for aircraft manufacturers including Boeing, Bombardier and Cessna. It currently has more than 800 employees.

Trevor Le Marquand, regional winner for Quebec, achieved the runner-up position and has been awarded the Eunice Carter Memorial Award. He is currently training at Moncton Flight College in New Brunswick. If you want to view the photos of this year’s event, please visit www.picasaweb.google.com/photomaxme/ Webster.

The 2009 Wesbster Memorial Trophy Competition has now been launched. Application forms can be accessed at www.webstertrophy.ca.

PW307A and PW308A/C are exciting additions to the Vector Aerospace Engine Services Atlantic’s PT6A, JT15D, and PW100 engine services lineup

Dallas, Texas

Atlanta, Georgia

ENGINE SERVICES FACILITIES

Summerside, Prince Edward Island

Pittsburgh, Pennsylvania

Nairobi, Kenya

Croydon, United Kingdom

Johannesburg, South Africa

Fleetlands, United Kingdom

Repair Capabilities

• Repair and Overhaul (R&O)

• Hot Section Inspection

• Engine Performance Testing

• Borescope Inspection

• Failure Analysis

• Component Repair

• Worldwide Field Service

• Service Bulletin (S/B) Compliance

• Metal In Oil (MIO) Repair

• Foreign Object Damage (FOD) Repair

• Engine and Airframe Model Conversions

Air Canada and Spafax Canada, which publishes the airline’s in-flight magazine enRoute, have launched enroute.aircanada.com to give online readers access to the magazine’s editorials, provide previews of upcoming issues and offer a summary of inflight entertainment on Air Canada flights. It will also contain travel information to help travellers plan their trips and list the top 25 new places to eat, drink and shop in Montreal, Toronto, Calgary and Vancouver. Air Canada retail partners for the site include HBC and Lonely Planet.

Air Canada plans to begin offering live internet service to customers starting next spring under an agreement announced with Aircell. The carrier intends to begin operating Gogo, Aircell’s online access, aboard Airbus A319 aircraft on selected flights to the U.S. west coast and will be accessible to customers with a standard, wi-fi equipped laptop or personal electronic devices. Initially, the Gogo system will be

powered by Aircell’s existing network and only available in the U.S. in order to make Air Canada’s rollout fast, economical and simple. Upon successful completion of the initial phase, Air Canada plans to extend the system throughout its North American and International markets as Aircell’s coverage network expands.

CHICAGO

Porter Airlines is preparing for arrival at Chicago Midway International Airport from its Toronto City Centre Airport (TCCA) base, with the first flights departing Nov. 12. Porter is the only carrier offering service between these two convenient airports. The full schedule includes six roundtrip flights every weekday, plus two Saturday and three Sunday.

Porter has converted its summer schedule between Quebec City and Toronto into year-round service. The ongoing round-trip flights will operate every weekend on Friday, Saturday and Sunday, with daily summer service resuming next year. Special holiday schedules, including

By Brian Dunn

daily flights from December 17 to January 7, are also part of the program.

Porter is also exercising existing options for two more Bombardier Q400 aircraft, representing aircraft 15 and 16 in the fleet, which are scheduled for delivery next year. The existing fleet will double to 12 aircraft by next summer.

“Operating an all-Q400 fleet is an important part of Porter’s efficiency and profitability,” said Robert Deluce, president and CEO of Porter Airlines. “The ability to save 30 to 40 per cent in fuel costs versus comparable jet aircraft is crucial given today’s oil prices.”

Sunwing Travel plans to operate 15 Boeing 737-800 aircraft for its packaged vacation service this winter, up from nine aircraft last winter. It will increase flights between Canada and the Caribbean, Mexico, Central America and the U.S. Sunwing has grown to become the second-biggest tour operator in Canada after Air Transat, noted financial analyst David Newman of National bank Financial. Others in the market include Sunquest Vacations, Signature Vacations and Air Canada Vacations.

Sunwing averted a crisis by securing alternative aircraft

for the winter season following the bankruptcy of Excel Leisure Group of Britain. “It was a pain in the neck. Our airline guys were working overnight and making sure everything was coming together,” Sunwing vice-president Lawrence Elliott said.

In September, XL Leisure went into liquidation, leaving 50,000 passengers stranded.

Its collapse came two weeks after Ottawa-based budget carrier Zoom Airlines suddenly ceased operations.

XL Leisure had been slated to provide six of the projected 15 aircraft to be flown by Sunwing this winter. It has turned to three other companies for additional planes, including two that it already uses –Eurocypria and Transavia. A

third unnamed German company has been added. The new planes are the same Boeing 737-800s that Sunwing already has in its fleet.

Toronto-based Sunwing, which has 800 employees, is on a hiring spree as it prepares to deliver 700,000 seats this winter for Canadian snowbirds. It serves 33 destinations from 29 Canadian gateways, including communities such as Sault Ste. Marie, Ont., and Val d’Or, Que., that are typically ignored.

Sunwing insists that it’s in strong financial health despite the challenges of operating in a high-fuel-cost environment. Its fleet of B737-800s is young and relatively fuel-efficient.

WestJet Airlines is still looking for some sort of partnership with members of the Oneworld Alliance of international carriers to boost traffic. “There’s a lot of opportunity with Oneworld partners,” WestJet CEO Sean Durfy said during a London transportation seminar in September. “There’s a tremendous amount of opportunity left there to flow traffic onto our system in Canada.” WestJet has previously held talks with Oneworld members Cathay Pacific and British Airways.

In a separate development, WestJet has signed an agreement with GuestLogix that clears the way for WestJet customers to pay by credit card for in-flight products such as food and drinks.

www.wingsmagazine.com

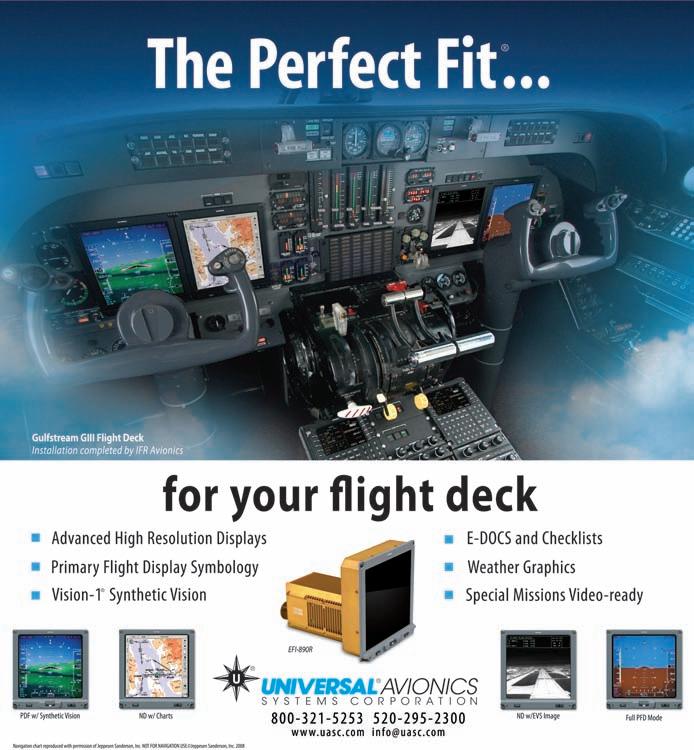

FALCON 50 UPGRADE TO FEATURE UNIVERSAL AVIONICS WAAS/SBAS-FMS AND GLASS DISPLAYS

PRATT & WHITNEY CANADA BRINGS SERVICE EXCELLENCE TO THE NEXT LEVEL

Read the full stories online at www.wingsmagazine.com

Lorne started his career early in life, leaving home at the age of 16 years to join the Canadian Army as a “boy soldier.” He started his initial technical training at the Royal Military College in Kingston, Ontario as a vehicle mechanic but soon transferred to the aviation side of maintenance.

To read more about the AME Hall of Fame inductees, visit www.wingsmagazine.com and go to the Community section.

This internationally acclaimed book by Sander Vandeth is perfect for GA and sport pilots to learn the accumulated wisdom (from over 80 years of accident investigation) on how to avoid situations that can impair the safety of a light airplane flight. Visit www.wingsmagazine.com and click on Bookstore to order a copy.

Every year, thousands of people worldwide owe their lives to the search and rescue capabilities of a Eurocopter. Just one example of the vital role that EADS technologies play in the world‘s emergency services. Navigation systems, to guide help to where it‘s needed. Satellite surveillance, to warn of natural disasters. Secure communications, to provide a lifeline between rescuers and people in need. We make the systems, we make them work together, and the survivors live to tell the tale. www.eads.com/madebyeads

The golden age of jet travel arrived 50 years ago this October. The evening Clipper America, a Pan American World Airways’ Boeing 707, roared out of New York City’s Idlewild Airport, now John F. Kennedy International, en route to Paris Le Bourget.

Pan Am and the 707 were not the first to pioneer jet air travel. British Overseas Airways Corporation (BOAC) and the de Havilland Comet were. Boeing was not the first North American manufacturer to build a passenger jet. Canada’s Avro was. But the Comet stalled two years after entering service in 1952, and Avro’s C102 Jetliner was stillborn. A refined Comet family returned to the air in 1958 and BOAC brought the jet to New York short weeks before the Pan Am inaugural. Still, the die was cast.

For the first years at least, jet travel was defined by 707s and DC8s crisscrossing the oceans, with elegant Air France Caravelles darting in and out of Paris Orly playing a supporting role. The jet set was born.

More than any other airlines, Pan Am and Trans World Airlines (TWA) defined the jet-set culture as portrayed in MGM’s 1963 film classic, The V.I.P.s, a life-altering adventure of firstclass passengers delayed in a V.I.P. lounge at fogbound London Heathrow Airport, and played by an all-star cast including Elizabeth Taylor and Richard Burton.

Other airlines made their mark in the early jet age – some louder than others. Braniff International Airways was one of the first to tap into the vibrancy and sex appeal of the sixties, with garishly painted airplanes (in seven colours) and a legendary airstrip, where stewardesses would remove pieces of a multi-layered designer uniform in-flight. As a nod to the space program, passengers were occasionally welcomed onboard by an air hostess sporting a clear plastic bubble headdress.

But it was Pan Am and TWA that rode the glamour of the jet age. Pan Am was James Bond’s airline of choice in early 007 films, shuttled passengers to the Space Station in Stanley Kubrick’s 2001: A Space Odyssey and brought the Beatles to America in 1964 (though they would travel Back to the USSR BOAC).

In 1962, TWA cut the ribbon on its signature terminal building at Idlewild. The building’s soaring concrete roof resembled a bird in flight, although

DAVID CARR is a Wings writer and columnist.

architect Eero Saarinen modestly dismissed this as coincidence, once suggesting his design had been influenced by half a crushed breakfast grapefruit.

Here ageing Lockheed Constellations and early-model 707s nudged against an architectural masterpiece as passengers awaited their aircraft inside a modernist concrete exterior, anchored by a space-age flight display pod and accented by natural skylight and sweeping spaces. (The TWA Flight Center was shuttered in 2001. One of its futuristic tunnels was given a cameo in the 2002 movie Catch Me If You Can starring Tom Hanks and Leonardo DiCaprio.)

Indeed, both airlines built monuments to themselves and to showcase air transport’s endless horizon. Pan Am opened the world’s largest corporate headquarters. Rising 59 stories above New York’s Grand Central Station, the Pan Am building, complete with rooftop helipad to shuttle passengers between Manhattan and the airport etched the Pan Am name and famous blue globe on New York’s glittering skyline.

The jet culture inspired song (Gordon Lightfoot’s Early Morning Rain), books (Bernard Glemser’s Girl on a Wing later released as The Fly Girls and Arthur Hailey’s Airport, and theatre. Boeing Boeing, a French farce about a rich Paris lothario whose intricate use of airline timetables to juggle three flight attendant fiancées was thrown into chaos with the arrival of the jet age. The play soared in Paris where it opened in 1960, was a hit in London and crashed in New York. It was later turned into a movie with Tony Curtis and Jerry Lewis and has recently returned to both Broadway and London.

The early jet-age was vapour trails and champagne flights to exotic destinations, where a multicourse meal service was part of the in-flight experience even in economy, when passengers dressed up to fly, when BOAC Speedbirds lit up the sky in Piccadilly Circus and Times Square, and a cheap plastic travel bag slapped with an airline logo was a fashion accessory. It wouldn’t last.

On January 21, 1970, the Pan Am Worldport at JFK was the scene of another first. This time, Clipper America was a Boeing 747 on its inaugural flight to London. The DC-10 and Lockheed L1011 would follow, as would deregulation, Freddie Laker’s troubled Skytrain, the low-cost revolution and the Airbus A380. Pan Am and TWA would disappear. Supersonic air travel came and went. The jet-set culture died. The age of mass air transport had begun.

By David Carr

The predictable collapse of Zoom Airlines notwithstanding, Canadian air transport appears to have survived the great gas pains of 2008. Good news for established players and start-ups, of which there is one.

It may be too soon to fully gauge the impact the global credit meltdown will have on Canadian air transport. Passenger volume at Toronto’s Pearson International Airport is five per cent ahead of last year, but the airport authority is predicting a slight downtick in traffic for 2009, and has delayed construction of an $850-million U.S. pier scheduled to begin in 2011.

Still, neither record-high

fuel prices nor a softening economy appear to have caused lasting damage to load factors at either Air Canada or WestJet. The absence of a national low-cost competitor has helped, giving both airlines the breathing room to increase fares and pile on hefty surcharges.

Nevertheless, the tectonic plates beneath Canadian air transport are shifting. Canada’s supporting cast of smaller airlines is set for a readjustment, triggered by the collapse of Ottawa-based Zoom Airlines and the revving up of another newcomer from the west. It is unlikely that player realignments in the niche market will put

downward pressure on airfares on the scale of a Jetsgo, although it may force a shift in how the two national airlines serve smaller markets.

Zoom Airlines is one of 30 airlines that have gone bust this year, while the Alitalia deathwatch continues after a group of Italian investors turned their back on even the profitable bits of the beleagured airline. The Zoom demise surprised few. Fuel costs and the collapse of a 13thhour rescue package may have been the final cuts, but a business plan that went headto-head against established players on crowded U.K. routes and a fleet of Boeing 767-300 airplanes that lim-

ited the carrier to big markets suggests that bankruptcy was only a matter of time. As if to emphasize the point, U.K.based discounter Flyglobespan, which launched service between London/Gatwick and Hamilton, Ont. in spring 2007 had already scaled back frequency and more than doubled fares.

“There is no room in Canada for a ‘me too’ product,” explains airline analyst Jacques Kavafian of Torontobased Research Capital. “You have to be a Porter and add value,” a reference to Porter Airlines, which operates Bombardier Q400 turboprops out of Toronto’s City Centre Airport, on the doorstep of

the city’s financial district.

New York/Newark has become Porter’s most successful new destination to date, receiving more bookings ahead of the March launch than its other routes combined. The privatelyowned airline reports revenue from the route to be 80 per cent ahead of projections, and has recently ordered an additional two Q400s, bringing the fleet to 12 by the end of 2009. Porter also plans to add two new US destinations over the next 12-months, beginning with service to Chicago on November 12.

While details are sketchy, traffic on Porter’s routes is building, and the airline recently introduced a frequent flyer program, which may help to blunt a superior marketing advantage held by Air Canada and Jazz. If the highservice upstart has vulnerability it is being sole tenant at the Toronto City Centre Airport. To-date, the Toronto Port Authority, the money-losing board that operates the island airport, has been successful in shutting Jazz out, but for how long? Jazz, which is considering replacing its ageing fleet of early-generation Dash 8s with Q400s, would like to plant its flag on the island, if only long enough to drive Porter out.

bar on a few select routes just to match Porter.

With Zoom following Canada 3000, Jetsgo, CanJet’s scheduled operation and Harmony into the graveyard, the main players in Canada’s air transport industry are comfortably positioned to chase different markets. Nationally, WestJet will step up its game against Air Canada in 2009, with multi-tiered fares, a frequent flyer program and alliances with foreign airlines. Porter will continue selling convenience out of downtown Toronto, Air Transat will stimulate the leisure mar-

“The tectonic plates beneath Canadian air transport are shifting.”

But on this occasion it would be the established carrier ‘me too-ing’ the upstart, and it is not clear whether Jazz would raise the service

ket as part of the world’s fifthlargest and North America’s biggest vertically integrated tour operator and is reported to be kicking the tires of both

the Boeing 787 and Airbus A350 as a potential replacement for its fleet of Airbus A310s and A330s. Meanwhile, smaller Sunwing will expand its “bring the plane to your door” strategy of offering a limited number of sun destinations from smaller, underserved markets.

It is a good plan. Tourism patterns have changed dramatically over the last ten years, and ease of travel is one of the criteria when selecting a destination. Air Canada, WestJet and Air Transat will always offer the broadest selection of tour destinations and greater frequencies to smaller markets, but the package will likely include a layover and aircraft change at a larger hub. An airline that offers nonstop or direct service to one destination once a week may have greater appeal for consumers anxious to avoid airport and transfer hassles. “That’s what they are banking on,” says Kavafian. “People will go where it is convenient.”

Tim Morgan, president of Calgary-based Morgan Air Services, co-founder and former WestJet executive, and CEO of NewAir & Tours Group, Canada’s newest leisure airline, which will also target underserved markets, agrees. “The opportunity exists to play in those markets where nobody has played before. We won’t be stepping on anybody’s toes.”

NewAir is expected to launch in October or November 2008, using a single Boeing 737-700 and a WestJet standard of in-flight service. Otherwise, Morgan was playing his cards close to his vest at the time of writing, including the airline’s brand name, first route and whether the upstart will be based in Calgary. “We’ve not made a decision on that yet,” he added.

Both NewAir and Sunwing have the flexibility to get in and out of a market quickly. Toronto-based Sunwing has been aggressively hiring out-of-work Zoom flight and

CONTINUED ON PAGE 43

By Carroll McCormick

With Canada’s national airlines hogging most of the media limelight, it is easy to overlook the fact that there are exceptionally busy carriers of more local renown in this country. In Manitoba, the busiest “small” carrier is Perimeter Aviation, which carried 135,000 passengers in 2007; by comparison, if perhaps not entirely fairly, 79,000 passengers traveled through the Kingston/Norman Rogers Airport last year.

Perimeter has daily scheduled service to 23 destinations, all north of its home base in Winnipeg: It offers 22 scheduled flights per day out of Winnipeg and 12 scheduled daily flights out of Thompson. This kind of buzz highlights

the importance of aviation to Canada’s northern inhabitants – something they need no reminding of, but a fact us “southerners” easily forget.

Add to that 100 charter flights a month, plus 170 medevac flights a month to destination hospitals in Thompson and Winnipeg, and one begins to appreciate the importance of this company to the people of Manitoba.

Perimeter, which is headquartered at the Winnipeg James Armstrong Richardson International Airport, began offering scheduled commuter service in 1976, 16 years after it began as a flight school, then took on some bank bag runs and began to grow its operations. In 2004 Perimeter

joined the big leagues, so to speak, when the Exchange Industrial Income Fund, a Canadian business trust headquartered in Winnipeg and trading on the TSX purchased it; the trust also includes Manitobabased Keewatin Air and four manufacturing companies.

Perimeter’s Winnipeg facility includes a passenger and check-in area which, having been upgraded and doubled in size, reopened its doors this September; maintenance hangars; a new 1,142-square-metre cargo facility with two coolers and four freezers; a flight operations office building, added in 2006; and a warehouse, all of which open up onto 7,430 square metres of apron space. Since 2004, the Fund has

invested more than $25 million in Perimeter Aviation equipment and infrastructure.

Perimeter also maintains a large base in Thompson with a maintenance hangar, cargo hangar and crew residence large enough for 11 staff. Each of its four medevac bases, located in Thompson, Cross Lake, Gods Lake Narrows and Island Lake, has its own dedicated medevac-equipped aircraft, flight crew and flight nurse.

The company also maintains large stockpiles of fuel in northern Manitoba – about 3.2 million litres in all.

Perimeter Aviation’s main divisions are: Scheduled Air Services, Charter Services, Medevac Services, Flight Training, Cargo and an Approved

Maintenance Organization (AMO). As of this September there were 525 employees, distributed between Winnipeg and its other stations.

Its largest aircraft are two 37-passenger Dash 8-100s, which Perimeter purchased in 2006. Two Beech 99s, added to the fleet in 2005, serve communities with shorter runways. The rest of the 31aircraft fleet include three Beechcraft 95 Travel-Airs and two Beechcraft 55 Barons for training and courier runs, two Merlins for cargo and charters, 16 Fairchild Metro IIs and four Metro IIIs for scheduled air service. Within the next few years Perimeter will be acquiring more Metro IIIs, which will increase the capacity for all of Perimeter’s destinations.

In addition to scheduled passenger service, Perimeter operates a cargo operation that has doubled in the past three years to over five millions pounds of cargo a year. The airline delivers to 23 northern Manitoba destinations and participates in the “Food Mail” program, which is funded by Indian and Northern Affairs Canada (INAC) and administered by Canada Post. The Food Mail program provides nutritious perishable food products and other essential items to isolated northern communities at reduced postal rates, according to INAC, and at a more than 50-per-cent reduction in cost, says Dave Dunlop, chief pilot, flight operations.

Dunlop, who has been with Perimeter for nine years, is responsible for pilot training programs in the aircraft and simulator, standard operating procedures development and maintenance, Transport Canada check rides and pilot supervision.

“On the east side of Lake Winnipeg all-season roads do not go very far north. Most of the communities we service only have ice roads, which are normally only open for a few months of the year. This means that all of our services, including medevacs and cargo, are crucial for most of the year,” Dunlop says.

On the charter side, Perimeter makes available any of its aircraft for flights anywhere in North America. “A lot of our charter customers are fishermen from the U.S. going to the northern lodges. There are also lots of mining and exploration companies requiring charter services. Several businesses in town also use our charter aircraft for business trips. This type of service is very efficient and convenient for our business customers,” Dunlop says.

Aircraft medevac services are as integral a part of modern life in the North as are ambulances in areas with adequate road infrastructure. Perimeter, a medevac service provider since 2002, conducts

over 2,000 medevac flights a year as a licensed air ambulance provider with the Manitoba Health Emergency Services Branch. Perimeter uses pressurized Metro II aircraft with upwards of a 1,200-nautical-mile range, and outfitted with a wide variety of equipment ranging from oxygen tanks, cardiac units and electric winch stretchers, to extra-large rear cargo doors for wheelchairs and larger clients.

“The provincial government is responsible for our licensing for medevacs,” Dunlop says. “They require yearly aircraft inspections and individual licensing of all pilots, nurses and paramedics. The federal government is responsible for the health care of all first nations people living on reserves, which constitutes about 75 per cent of our medevac business, which is paid for by the federal government. For those non-treaty residents living north of the 53rd parallel, the provincial government maintains the financial responsibility.”

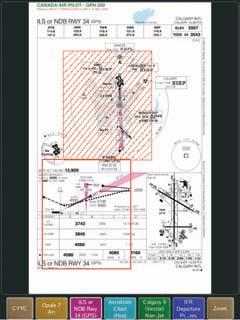

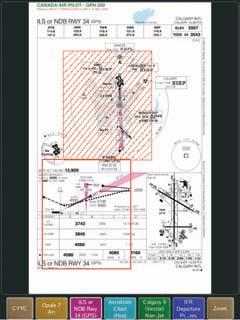

All of the 703/704 aircraft

are outfitted with certified GPS installations approved for GPS approaches. All medevac aircraft are equipped with integrated hazard avoidance systems (IHAS). “IHAS is a flight display unit that integrates Traffic Avoidance, GPS, Ground Proximity Warning System and Weather Radar in one display,” Dunlop notes.

Perimeter has never lost touch with flight training, the roots of its business: Its flight training academy, with a staff of five instructors, a flight school coordinator, chief flying instructor and an assistant chief flying instructor, accounts for about 100 training flights per month. Airline pilot training is done by a separate department and accounts for 30 training flights per month.

Jeppeson FS200 and PFC Elite simulators, which simulate a Beechcraft Baron, are used to introduce instrument flight rule (IFR) skills to pilots-in-training and allow new students to hone their skills before climbing into an actual aircraft. Perimeter

consistently trains about 150 multi-IFR pilots a year (some are international students, but most are Canadian) but with the acquisition and Transport Canada certification of a Metro simulator earlier in the year, built by flight simulator designer and manufacturer Mechtronix Systems Inc. in Montreal, Perimeter expects to increase quality of training for its pilots at a reduced cost.

Dunlop shares the excitement of having this new machine at his disposal. “Our new Metro simulator was built inside of an actual retired Metro III cockpit. It is a convertible Level III flight training device (FTD) for the Metro II and Metro III, both of which it simulates in terms of systems and flight models.

shop, electrical component shop, structures shop, component overhaul shop and a large turbine shop. The department also includes line maintenance services, longer term or heavy maintenance services and repair capabilities on many different aircraft types.

equipment installations, engine upgrades and GPS asset tracking installations.

Perimeter is particularly adept at improving its own Metros. Dunlop mentions a couple of examples: “A few years back we converted our Metro II fleet to four-bladed propellers. This has reduced the noise in the cabin for our customers and reduced the wear and tear on our propellers. We also recently developed an internal fuel tank system for hauling fuel in our long-body cargo-configured Merlin which is capable of hauling 1,600 litres of fuel.

“The realism it offers is spectacular: over 95 per cent of the systems and switches are operational, it uses 11 computers, five high-definition projectors deliver graphics to a 220x60-degree screen and it has pneumatic controls and real recorded sounds. It provides us with the opportunity to train well above and beyond the Transport Canada requirements. We use it primarily in-house to train our own pilots, but we are planning to roll out a multi-turbine training course and IFR renewal course for student pilots in the near future.”

Perimeter’s AMO comprises several specialized shops, including an avionics shop, engineering and design department, non-destructive testing

“We are definitely unique, as nearly all of our aircraft maintenance is done in-house. Not many other operators can say that,” says Dunlop. “Our company has an incredible team of maintenance engineers that keep our aircraft in top shape. Keeping aircraft away from the main base requires pro-active maintenance and having the capability to repair problems in a timely manner improves service to our customers.”

The design department, which opened in 2001, is responsible for most of the modification and repair data packages on Perimeter’s planes. It also provides design services for other aviation companies and aircraft owners.

The department has a design approval representative (DAR), who is an expert appointed by Transport Canada to expedite approval of data packages, which define any changes made to aircraft; since 2001 the department has carried out over 500 modifications and repairs on its own aircraft and for clients as far away as Montreal, Vancouver and Texas. They include bulk fuel tankers, geo-survey

To date the design department has mostly specialized in smaller aircraft – under 12,500 pounds. However, Transport Canada recently granted Perimeter’s DAR delegation for heavy-aircraft approvals, which permits the design team to approve modifications on nearly any type of aircraft.

To facilitate the ongoing training of its employees, Perimeter offers a wide assortment of online training, says Dunlop. “We have about 95 per cent of our company training online. Employees log in to our training site and complete their training videos, presentations and exams. It is all automated and can be done from the comfort of the employees’ homes.”

In addition to its day-today objective of operating a safe service for its customers, Dunlop says that Perimeter has its eye on growth opportunities. “I hope that we will continue to expand our services and grow with the northern communities. As a flight department leader I would like to see us expand our simulator fleet and pioneer the use of these FTDs at the air taxi and commuter level.”

Take a regional jet, add the industry leader in executive aircraft conversions, then add your imagination. The result is the CRJ ExecLiner from Flying Colours Corporation.

We’ve stripped away the standard high-density interior and regional range and transformed the CRJ into a luxuriously appointed executive jet equipped with a certified auxiliary fuel system that offers maximized performance and range - comparable to aircraft costing literally millions more.

Contact Flying Colours to learn the full story on the CRJ ExecLiner,

By Drew McCarthy

Multimillion-dollar purchases are well worth keeping an eye on. Buying an aircraft in the Global Express or Challenger category is, after all, not an off-the-shelf proposition. And, if you happen to be in the oil business, the high-tech sector, manufacturing, or the sports and entertainment industry, then aircraft completions are not likely your area of expertise. It’s probably a good idea to talk to someone who knows about finishing or managing an aircraft completion project. Your aircraft is your business tool; you need it as soon as possible and you need it the way you want it. That’s where

companies such as Montrealbased BJAC Services can play an important role.

BJAC, now in its 10th year of operation, is currently making its mark in the aviation community by guiding aircraft owners through the intricacies of turning a green aircraft into a finished product; or assisting prospective owners in choosing an aircraft in the first place. A full-service business jet enterprise, BJAC caters to its customers from the moment they decide to purchase an aircraft, to the continued maintenance and systems integration throughout the aircraft’s life.

The company was founded by its current president and CEO Bryan Landry, an aviation engineer who has worked in the aerospace industry for more than 24 years. Landry began his career at Lucas Aerospace and later worked with companies such as Aircraft Parts and Supply, Pole Air, and Bombardier.

At Bombardier, Landry established and managed the night shift for the production Mod Line of the Global Express and also held positions as production supervisor and pre-flight supervisor, where he assisted in delivering more than 28 Green Certificates of Airworthiness.

Over its history, BJAC has focused primarily on Bom-

bardier products, specifically, the Global XRS, Global 5000, Challenger 300, Challenger 604, and Challenger 605, although recently it has started to work on Dassault’s Falcon 7X, Boeing 777 and BBJs.

Maintaining a good relationship with the OEMs is an indispensable part of what BJAC does. “The relationships that BJAC has established with major OEMs is an important element of our business,” says Maurice Varin, vice-president, corporate sales and account management. “We have very positive and cooperative dealings with the major OEMs.”

Because of these good relationships, BJAC is able to effectively manage projects on behalf of its customers. Says Varin, “Our job is to ensure that purchasers get their aircraft delivered on time and with the right specifications.”

To make sure that happens, the process ideally begins with the aircraft sale, which can often be up to two years before delivery. BJAC initiates the process by undertaking a technical procedure called the green aircraft acceptance. The procedure includes an in-depth review of the OEM’s functional and ground

test procedures as well as the detailed inspection of the interior and exterior elements of the aircraft.

Once the BJAC team has completed the green aircraft acceptance of a client’s aircraft, they are then prepared to suggest the aircraft systems best suited to the client’s needs and to ensure optimal integration throughout the aircraft.

The next step is to work with the client to ensure that the interior of the aircraft meets both the functional and aesthetic needs of the client. The numerous details that comprise the interior need to be clearly delineated at the earliest possible stage – while reconciling personal tastes with aeronautical regulations.

Clients will next work with their own designer or a designer from the completion centre to decide on the details of the aircraft. At this point, a written interior specification is developed. This document becomes the foundation on which the interior of the aircraft is built.

The BJAC team verifies the drawings for the aircraft to ensure that they mirror the specification so that at the end of the completion process there are no anomalies in the documentation, which could cause a problem with the regulatory authorities and delay the delivery of the aircraft. Depending on a multitude of factors, the process can last several months.

Throughout the completion process, BJAC project managers track and verify the status of the work. These project managers provide regular reports to owners keeping them abreast of the work’s progress. Customer reports can be done weekly, bi-weekly or monthly depending on the

specifics of the job. If something seems to have gone awry, they will first contact the customer.

“If something doesn’t look right, we usually get in touch with the owner and just ask if there has been a change in plans,” says Varin. “We will then report what is being done and work with the client to make sure the project is on the right track.” Varin points out that while their first loyalty is to the customer, they are certainly not there to fight with the OEMs. The goal is to facilitate the process so that all parties are satisfied at the end of the project.

Once the completion is finished, BJAC assists with the final acceptance and delivery. A final inspection of the aircraft on the ground and in flight is conducted to make certain it meets the customer’s specifications. Further tests are also performed to ascertain that all aircraft systems are integrated harmoniously. BJAC ensures all documentation and loose equipment are delivered as per the purchase agreement.

Varin says that about 50 per cent of BJAC’s projects are green-to-completion jobs, but they are able to start working with clients either before or after the green stage. One of the services offered by BJAC is pre-purchase consulting. The company works with

prospective buyers by examining their budgets and flying requirements. They can also provide assistance in identifying an aircraft broker.

BJAC will oversee the construction of an aircraft on behalf of a purchaser. Its team ascertains if the regulatory requirements are being met. Daily meetings are held with the OEM delivery team and daily reports are submitted to the customer outlining the progress made and what possible contentious issues were uncovered. Once all of the issues are addressed and resolved with the OEM, the aircraft is then moved into a completion centre for installation of the interior and integration of optional aircraft systems.

The company can also provide appraisal for pre-owned aircraft purchases. It performs pre-purchase inspections, which include a complete review to ensure all pertinent OEM service bulletins are installed and that the aircraft is current with the latest OEM modification status and regulatory requirements. It will undertake ground and flight test procedures, taking into account the OEM manuals and maintenance programs, and review the logbooks to deter-

mine if they are compliant with all requirements and that no major damage has occurred.

In addition to its completions management and prepurchase services, BJAC has also partnered with Air Data to provide a bio-protection system for the Bombardier Global series aircraft, and with Goodrich to offer the BJAC PilotsEdge electronic flight bag for all business aircraft.

The bio-protection system, called The Jet Air BPS, destroys almost all bio-contaminants and 90-95 per cent of residual cabin ozone present in recirculated cabin air for improved protection of passengers and crew.

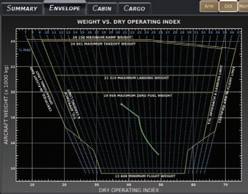

The PilotsEdge electronic flight bag is a Class 3 EFB platform built to commercial airline avionics standards. It has recently received Canadian and FAA certification and EASA/JAA certification is still pending.

BJAC has recently opened its new and expanded facilities on Cote de Liesse in Montreal, across the street from the Bombardier Training Facility. It also maintains offices in St. Louis, Mo. and Portsmouth, N.H. and will soon be opening a location in Dallas.

by James Careless

In January 1994, Captain Emil St. Hilaire founded A ‘Corporate Aviation Support Service company’ in Canada; ACASS for short. His goal was to help corporate aircraft owners/operators find skilled pilots and crew. “We saw a need for contract crewings, in situations where pilots and crew were needed for a week or two,” says St Hilaire. “Say that one of the regular crew was on leave or short-handed. There was a clear need for a company who could make up this shortfall, by providing trained, experienced personnel to fill the gap on a contractual basis.”

Today, ACASS is still providing crew support and pilot placement services for Boeing BBJ/727, Bombardier, HawkerBeechcraft, Cessna, Dassault and Gulfstream jet aircraft. Under the leadership of president/CEO Andre Khury and St Hilaire, ACASS has grown from a handful of people to almost 60, and now offers a wide range of services to corporate owners/operators. These include aircraft management, aircraft sales and acquisitions, charter services, interim lift and access to ACASS’ own fleet of private aircraft. Today, more than 80 per

cent of ACASS’ business is conducted outside of Canada, for people such as heads of state, VIPs and Fortune 500 executives. Judging by its library of testimonials, they’re pretty happy with its service. “ACASS is a supremely professional company, with the all-important knowledge required in the aviation industry to provide first-class service to aircraft owners and operators alike,” says Mohammad Safadi, Lebanon’s minister of public works and transport. “ACASS has always been there for us when we needed last minute or continuing support,” adds

Robert Wells, CEO of TAG Aviation Europe.

PILOT PLACEMENT:

ACASS’ BREAD-AND-BUTTER

Even today, finding the right pilots and crews for corporate clients is at the centre of ACASS’ business, which is not an easy challenge: The growing popularity of corporate aviation in Asia, Russia and the Middle East is eating into the pool of potential employees, as is the retirement of ‘Baby Boomer’ pilots.

To deal with this challenge, “we have full-time staff inhouse whose only purpose is

Add your labour market data to CAMC’s new LMIS database and help create an accurate picture of our sector.

CAMC is now collecting labour market data from aviation companies and MROs, aerospace and manufacturing companies, and training organizations. Up-to-date data helps ensure that generated reports are both accurate and current — and, therefore, useful to corporate and individual members.

This industry-requested system depends on industry stakeholders to provide current information. You provide the data; CAMC provides the technology, the project management and a secure, web-based “data warehouse.”

The LMIS is designed to record, consolidate and sort data in order to generate reports on important topics such as human-resource demographics, trends, and supply-and-demand realities.

LMIS reports will help industry stakeholders plan strategic human-resource policies and practices. Generated reports will provide national and provincial perspectives and, where possible, regional breakouts for each province. Generated reports could include the following topics: Compensation and Incentive Plans

Human Resource Demographics

Aviation and Aerospace Labour Inventories

Aviation and Aerospace Trade Clusters

Labour Attrition and Forecasting

Current Employment and Vacancy Rates

Training Programs and Enrolment Rates

Student Demographics

Employment Growth Rates

Cost-of-Living Comparisons

To participate or for more information about this LMIS project, please contact: Theresa Davis-Woodhouse Project Manager

1-800-448-9715, ext. 247 tdavis-woodhouse@camc.ca

to locate and recruit quality pilots,” says Khury. “Their sole task is to look for talent around the world, and then convince the best to join us.” To sweeten the offer, ACASS offers competitive pay, benefits and ongoing support wherever they may be based. “Pilots want to be looked after, given how much they work away from home,” he says. “Our job is to act as their umbilical cord, ensuring that everything they need is taken care of.”

This is no small matter. As a global company, ACASS fills pilot and crew requirements worldwide. This means it needs pilots and crew who can work in other cultures, often for six to eight weeks at a stretch. In contrast to the commercial world, these employees must be willing to work in a flexible scheduling environment, where takeoffs can be pushed up and departures delayed at any time by clients. “In the Middle East or India, being booked to leave at 8 a.m. may mean that you actually leave at 2 p.m., while returning on the 15th might actually mean coming back on the 11th,” says Khury. “It is a much more volatile environment than most pilots are accustomed to, and it can make flight planning difficult.”

And that’s not all. ACASS’ pilots must be willing to act as able and courteous hosts to their passengers, rather than just as high-paid chauffeurs isolated in their cockpits. In Middle Eastern, East Indian and Asian countries, the etiquette of passenger service is also different from the North American norm, particularly if your passengers are members of Middle Eastern royal families.

All told, ACASS expects a lot from its pilots and crews, which is why it pays well, on time, all the time. Moreover, it gives them an opportunity to experience a much more fluid and potentially exciting form of work; at least when compared to going back and forth on the same route day in and day out.

Buying, maintaining and selling aircraft are not activities for the inexperienced or the faint-of-heart. With their high price

tags and operating costs, business jets can quickly become a money pit for the unwary, costing far more than they provide in convenience and personal service.

Given ACASS’ expertise in business aviation, it makes sense for the company to act as a go-between for its clients, helping them find and finance the right aircraft, maintain and house it, and eventually sell it when the time is right in the future. In doing so, “We look at what customers actually want to do with their aircraft,” Khury says.

“We consider the destinations they need to access, because this determines which aircraft are optimally appropriate in terms of range, speed and size. We analyze crewing requirements; is the customer looking at an aircraft that is widely flown by today’s pilots? We also consider interior space requirements, and how this aircraft will be taken care of. In short, we cover it all.”

ACASS didn’t start out intending to provide charter services. But in response to customer demand, the company now provides charter services for Cessna Citation, Bombardier Challenger, Dassault Falcon, Gulfstream and HawkerBeechcraft business jets. Some of these come from its own fleet while some are leased from third-party providers.

In September, ACASS officially entered the US market with the opening of an office in Atlanta with emphasis on pilot and crew placement services for U.S.-based business aviation operators. ACASS has more than 7,000 pilots in its placement database (90 per cent are FAA-certified and the majority are U.S.-based).

The new leadership team includes:

Nick Houseman, managing director, U.S.A. Prior to joining ACASS, Houseman was program director and head of new program development (for the Global XRS and Global 5000 aircraft models) at Bombardier Aerospace. From 2003 to 2007, he was director of flight operations at Bombardier Aerospace. Earlier, Houseman was general manager of Bombardier Skyjet North America, headquartered in Washington, D.C.

Kevin Rodgers, vice-president, sales, U.S.A. Before joining ACASS, Rodgers was a regional director of sales at Jet Aviation. Earlier, he served as vice president of operations and director of sales at Bombardier Aerospace’s Skyjet North America division. An active pilot and licensed dispatcher, Rodgers serves on the Board of Directors of the Georgia Business Aviation Association and is a member of the Southeast Corporate Aviation Management Association.

George Tsopeis, director of aircraft services, U.S.A. Tsopeis brings more than a dozen years of aviation experience to the ACASS team. Most recently, he was director of business development at CAMP Systems, a global provider of business aircraft maintenance tracking services. Earlier, he held several management positions with Bombardier Aerospace, including manager of business planning and performance, and manager of strategic and business development.

For clients who need the kind of on-demand service provided by owning a business jet but are waiting for one to be delivered, ACASS offers Interim Lift service. This is a leased form of dedicated corporate jet service, without the ownership element. “Interim Lift helps business people get fast access to the transportation they need,” says Khury. “Given how backed up aircraft manufacturers are these days, and the resulting lack of product in the used market, Interim Lift is a welcome bridge between charter and private ownership.”

The past 15 years have been good to ACASS. but the future, although promising, presents some real challenges.

Chief among these are finding good staff for its clients. Although the slowdown in the commercial aviation industry is putting laid-off pilots back on the market,

growing demand in Russia, the Middle East and Asia is increasing competition for their talents. ACASS’ ability to keep finding good help will hinge on offering pilots/crews a better mix of pay, benefits and working environments than other firms.

Operating costs are another consideration: As fuel and other expenses go up, ACASS has to pass these costs on to its charter and Interim Lift customers. Add the U.S. subprime credit crunch still reverberating throughout the global economy, and one has to wonder how these factors may cut into ACASS’ sales. With any luck, increases in corporate travel in the Middle East and Asia will offset any shrinkage in the North American and European markets.

This said, Khury is optimistic about the future, both for ACASS and other members of the Canadian Business Aviation Association. (Khury is chair of CBAA’s Quebec chapter.) “We will succeed by keeping one eye on the present and the other on future opportunities,” he says. “We are aggressive in nature, and have the knowledge, networks and wherewithal to keep growing and succeeding.”

By Rob Seaman

If you live in the aviation world, you would had to have slept like Rip van Winkle not to notice that aircraft sales for all types have been very good, to say the least, over the last few years. The OEMs have been doing a happy dance as their order books loaded up.

The supply of resale aircraft has also meant good things to the market as owners rush for first-time, trade-up and even interim aircraft. Throughout last summer and fall, if you called on a listing one day, the broker would likely have warned that an offer was in the works and it may go fast. And in many cases that became reality. Even during the traditional quiet periods like December and January, things just seemed to be running at full speed.

Growth in pricing has been a natural offshoot of the market success. Asking and actual selling prices on aircraft have been climbing steadily as demand seemed to outstrip supply. You used to able to bargain a reasonable amount between “ask” and “sell,” but increasingly “ask” became the final price. For those used to dickering a few hundred thousand off, the barter and banter in selling became a tougher go

as sellers held firm on their price. Some have walked from the deal even though the price was literally within thousands of “ask” and “offer.” From the seller’s perspective, there was another guy around the corner tomorrow who would give what was wanted.

The commodity sales strategy has taken aircraft prices to new highs and created a speculative market as holders of positions with earlier deliveries than those from the factory, have offered them for sale at what is considered to be the price for today – not what they paid when originally ordered. It has even led some to

openly offer an opinion that new aircraft orders may have become a new investors’ speculative market – that is, to buy a position today (as an investment) that you never intend to close on for your own use, and then resell it downstream to a guy who really does not want to wait four to five years for his new aircraft and is willing to pay a premium on it.

As the profits and health of the aircraft builders goes, so too does that of everyone else from avionics and maintenance folks, completion centres, oil and lube providers and yes – especially the FBOs. Even with the introduction of

new models and more types of aircraft available like revised versions of current favourites with newer avionics suites and engines through to VLJs, rotorcraft and many others, things had kept rolling along quite nicely. But like all good trends, there has to be a turning point and this industry appears to have reached it.

The talk over the summer – off the record, according to whoever was asked – was that we have hit the wall on quick sales and ever-growing prices. In fact, tracking prices on many older corporate jets on the market today has shown lowered or revised asking

“Safety is economical ... safety management is actually a method of controlling costs.” — R.H. Wood

BELOW 10 000 FT

When we consider that the change in atmospheric pressure is greater at the lower altitudes, where most of general aviation’s flying is done, we must take some time studying its effects.

The ear

To put it simply—as you go up, gas expands, and as you come down, gas contracts. In the ear there is a small air space behind the eardrum that is connected with the throat through two narrow tubes. It’s through these narrow tubes that the air behind the eardrum is equalized to the outside atmospheric pressure.

As you climb and the outside pressure decreases, the eardrum will bulge and may give a fullness sensation and pain. You may feel a “clicking” when the eardrum bounces back into place as the air is ventilated into the throat through the narrow tubes—now the pressure is equalized.

During descent, the reverse happens. However, the flutter valve at the end of the narrow tubes might not work so well. You can usually alleviate the problem by swallowing, yawning or closing your mouth, holding your nose and blowing gently (valsalva). The big problem will arise if you have a headcold, sore throat, ear infection, sinus trouble or any condition that will cause the tubes to swell. This will prevent the inner ear air pressure from equalizing with the outside, causing severe pain. A simple rule:

if you cannot “click” your eardrums by valsalva on the ground— don’t fly.

if you can clear your ears with slight difficulty on the ground, you may decide to fly—but be prepared. Assume that you will have trouble on descent.

The sinuses

Those wretched holes in the head can create serious difficulty

for some people. A blocked sinus can create visual problems, toothache, or other severe head pain. Unlike the ear, the air in the sinus is free to come and go during ascent and descent. An infection or allergy tends to close the sinus aperture; this can result in air escaping on ascent, but not being able to enter on descent. It is advisable that:

if one or both sinuses are completely blocked and will not clear by a simple sniff—don’t fly!

if one or both nostrils can be partially cleared by sniffing— proceed with caution. Sniff hard on ascent and at altitude to get the passages as clear as possible. Plan for discomfort on descent.

if the congestion is associated with any kind of fever or malaise—don’t fly!

The retina of the eye is more sensitive than any other part of the body to an insufficiency of oxygen in the blood. Night vision is especially affected as there is a reduction of 25 percent by the time you reach 8 000 ft. Breathing oxygen will alleviate the problem. But here’s more—since blood absorbs carbon monoxide more readily than oxygen, smoking three cigarettes in a row will reduce your night vision by 25 percent as well. Alcohol intake will also severely reduce night vision.

The brain

Since the brain needs oxygen for proper functioning, and alcohol reduces the amount of oxygen that the blood can carry, any ascent will further impair the brain. After some alcohol consumption if you fly at 8 000 ft, your brain may be flying at 20 000 ft—in this case you may pass out within 10 min. If you consider that your body may take up to 48 hr to recover from excessive alcohol consumption, planning a flight takes more than just looking at the weather.

Tips are intended to increase overall safety awareness and are not a substitute for compliance with regulatory guidelines.Source TP 185 – Aviation Safety Letter (ASL), issue 3/2008 - Take Five for Safety. Originally published by Transport Canada. Reproduced with permission of the Minister of Public Works and Government Services, Canada, 2008.

Bar XH Air is currently accepting applications for our Calgary and Medicine Hat operations. We offer a comprehensive group benefits program that boasts Retirement Savings Plan (RSP) & Deferred Profit Sharing Plan (DSP); with employer contribution, Extended Health Care, Dental Insurance, Vision Care, Short and Long Term Disability Insurance, Life, AD&D and Dependant Life Insurance.

The following positions are available, please send applications to the corresponding email address:

Operations Manager bphillips@barxh.com

King Air 200 Captains chiefpilot@barxh.com

Jetstream 31/32 Captains chiefpilot@barxh.com

TC licensed M1/M2 AME dbowers@barxh.com

By Raymond Canon

Today the name Cessna, as a maker of small to mediumsized piston-driven and jet aircraft, is known all over the world. At the outbreak of the Second World War, it was just another of a myriad of insignificant aircraft builders. It owes its successful beginning to a twin-engined aircraft that is all but forgotten except by the aircrew that flew it from 1939 to 1945 in the British Commonwealth Air Training Plan (BCATP). This plane was the Cessna T50 Crane. Cessna was not a wellknown company at that time. Formed in 1927 by Clyde Cessna to build monoplanes, it was forced to close for two years during the Great

Depression of the 1930s. Its first big success was, in fact, the Crane and this was due mainly to the great demand for training aircraft when it became obvious that the war was likely to be protracted.

After the outbreak of war it soon became obvious that the aircraft and aircrew in place would not do. As the aerial Battle of Britain took place, Canada was facing the immense task, through the BCATP, of producing large numbers of aircrew. Airports were rapidly built, while aircraft were acquired wherever possible to the point of setting up production lines in Canada.

It was under this category that the Cessna Crane entered