Non-compliance carries administrative penalties up to

Volume 54 No.1 February 2026 $15

Non-compliance carries administrative penalties up to

Volume 54 No.1 February 2026 $15

Bills C-26 (dead) and C-8 (dying?) represent Canada’s attempt to establish federal cybersecurity standards for critical infrastructure. The legislation targets telecommunications, banking, energy, transportation, and nuclear sectors — areas where many process industry operations intersect. Understanding what these bills actually do will matter for anyone involved in facilities that depend on secure networks and reliable data systems.

The official rationale centres on countering threats from Chinese state-backed telecommunications firms, particularly Huawei and ZTE (how will this change after Carney’s visit to China?). The bills give the government authority to ban these vendors from 5G networks and require removal of existing 4G equipment by 2027. The logic follows Canada’s Five Eyes intelligence partners: if network infrastructure could be compromised at the equipment level, facilities using those networks face potential vulnerabilities.

What the legislation actually establishes goes considerably further. The Minister of Industry gains authority to issue orders (including confidential ones) compelling telecommunications providers to take specific actions deemed necessary for security. This could mean installing particular equipment, terminating vendor relationships, or submitting procurement plans for approval. Notably, affected companies receive no compensation for financial losses resulting from compliance.

Bill C-8 (Critical Cyber Systems Protection Act) creates mandatory cybersecurity requirements for designated operators in vital sectors. Once designated, organizations have 90 days to establish comprehensive cybersecurity programs that must be submitted to regulators. Requirements include annual program reviews, supply chain risk management, and incident reporting to the Communications Security Establishment within 72 hours of discovery. Non-compliance carries administrative penalties up to $15 million, with potential criminal liability for directors and officers.

For process industry professionals, several practical implications emerge. First, the 90day implementation timeline is tight, particularly for complex operational technology environments. Second, supply chain risk management requirements extend compliance obligations to vendors and service providers, meaning procurement processes will likely require additional security assessments.

Third, the 72-hour incident reporting mandate demands robust detection and escalation procedures that integrate with existing safety and operational protocols.

The compliance costs deserve attention. The Citizen Lab’s analysis notes that regulatory overhead may create viability challenges for smaller providers. Organizations with mature existing cybersecurity programs receive no exemptions or recognition for prior investment; everyone starts from the same baseline regardless of current security posture.

The federal-provincial dimension adds complexity. Quebec has pushed back on aspects of the legislation, arguing that entities like Hydro-Québec already maintain cybersecurity standards meeting North American frameworks. This raises questions about whether federal standardization improves security or creates redundant compliance layers for organizations already subject to sector-specific requirements and international standards.

Implementation timing remains uncertain. Bill C-26 passed the Senate with amendments in December 2024 but died when Parliament prorogued in January 2025. Bill C-8, reintroduced in June 2025, is substantially similar but still working through the legislative process. When regulations are eventually developed, they’ll determine many operational details — incident thresholds, reporting procedures, program requirements — that will shape actual compliance obligations.

For Canadian process industries, the key takeaway is straightforward: federal cybersecurity requirements are coming for critical infrastructure sectors and adjacent operations. The framework emphasizes compliance and reporting over risk-based approaches or recognition of existing security investments. Organizations should be: assessing whether their operations might fall under “designated operator” classifications, reviewing current cybersecurity programs against anticipated requirements, and evaluating supply chain relationships for potential compliance gaps. Process industry professionals should be tracking developments and preparing for compliance obligations that will likely arrive with limited transition periods and substantial penalties for non-compliance.

JUSTIN YULE, editor jyule@annexbusinessmedia.com

Reader Service

Print and digital subscription inquiries or changes, please contact Angelita Potal

Customer Service

Tel: 416-510-5113

Fax: (416) 510-6875

Email: apotal@annexbusinessmedia.com

Mail: 111 Gordon Baker Rd., Suite 400, Toronto, ON M2H 3R1

Audience Manager Anita Madden 416.510.5183 amadden@annexbusinessmedia.com

Brand Sales Manager Pat Lorusso 416.518.5509 plorusso@annexbusinessmedia.com

Editor Justin Yule 438.483.7451 jyule@annexbusinessmedia.com

Account Coordinator Kristine Deokaran 416.510.6774 kdeokaran@annexbusinessmedia.com

Group Publisher/ Director of Production Paul Grossinger pgrossinger@annexbusinessmedia.com

CEO Scott Jamieson sjamieson@annexbusinessmedia.com

CPE&CN is published bi-monthly by: Annex Business Media 111 Gordon Baker Rd, Suite 400, Toronto, ON M2H 3R1 T: 416-442-5600 F: 416-442-2230

© All materials in this publication are copyright protected and the property of Annex Business Media., the publishers of Canadian Process Equipment & Control News magazine.

For permission on reprinting or reproducing any materials, e-mail your requests to cpe@cpecn.com

Canadian Postmaster send address corrections to: 111 Gordon Baker Rd., Suite 400, Toronto, ON M2H 3R1

Canadian Process Equipment & Control News assumes no responsibility for the validity of claims in items reported.

Annex Privacy Officer privacy@annexbusinessmedia.com Tel: 800-668-2384

PUBLICATION MAIL AGREEMENT #40065710

Printed in Canada ISSN 0318-0859

Prime Minister Carney and President Xi announced a new strategic partnership with five pillars: energy, economic cooperation, public safety, multilateralism, and cultural ties. They reached a preliminary agreement where China will lower canola seed tariffs to approximately fifteen percent by March first, while Canada will ease electric vehicle tariffs. Canadian canola meal, lobsters, crabs, and peas will avoid anti-discrimination tariffs through year-end. The agreement aims to increase Canadian exports to China by fifty percent by twenty-thirty, focusing on clean energy, agriculture, and wood products.

Energy-intensive manufacturing operations in New Brunswick are lobbying for the right to generate their own electricity, as high utility rates threaten the competitiveness of pulp and paper facilities across the province.

The province’s Natural Resources Minister John Herron is backing the initiative, which would remove current regulatory barriers preventing large industrial users from

self-generating power. Herron argues the change is essential for protecting forestry sector jobs and allowing companies to invest in their own power infrastructure.

Recent political and economic developments in Venezuela are generating targeted concerns across oil, gas and shipping sectors, though market analysts expect near-term disruption to remain limited.

According to ICIS, the London-based commodity intelligence service, any immediate reduction in Venezuelan crude exports would primarily impact flows to China rather than triggering broader market instability. “Any short-term reduction in Venezuelan crude exports would mainly affect flows to China, with minimal spillover elsewhere due to ample global supply,” the analysis noted, pointing to OPEC+ maintaining steady output through March as a stabilizing factor.

Barrick Gold Corp. has resumed operational control of its Loulo-Gounkoto mining complex in Mali following a settlement with the country’s government that resolves a two-year dispute over mining revenues and regulatory authority.

The Toronto-based company has begun restarting production at the complex, though output will resume gradually, according to an internal memo seen by Reuters. The initial phase will focus on safety and operational training for employees and contractors, according to the memo signed by Sebastiaan

Bock, Barrick’s director of operations for Africa and the Middle East.

The settlement, reached last month, followed negotiations triggered by Mali’s revised mining code. The legislation, introduced after the military junta took power, expanded the state’s share of mining revenues and increased regulatory oversight. Barrick suspended operations in January 2025 in response to the changes.

The resolution involved payment of claims by Barrick, the return of confiscated gold and the release of detained employees.

Federal procurement rules taking effect Tuesday require Canadian materials in major government projects, marking a shift toward protectionist purchasing as trade tensions persist.

The policy applies to contracts valued at $25 million or more and mandates use of Canadian steel, aluminum and wood in construction and defence projects. It covers major federal initiatives including housing, infrastructure and military procurement.

Procurement Minister Joël Lightbound said the measure prioritizes Canadian businesses and workers while strengthening domestic supply chains.

For manufacturers, the policy creates guaranteed access to a significant market segment — federal projects above the $25-million threshold must now source key materials domestically. This applies to steel, aluminum and wood products manufactured or processed in Canada.

The timing is tied to ongoing trade disputes, with Ottawa positioning the policy as support for sectors affected by U.S. tariffs.

By Justin Yule

In a speech at the Prospectors & Developers Association of Canada (PDAC) Convention in March 2025, the then-Minister of Energy and Natural Resources, Jonathan Wilkinson, got on stage and articulated to Canada’s gathered mining industry a ‘major economic opportunity’ for Canada. He stated that Canada is working to become a ‘global critical minerals superpower’. In the following article I want to provide an introduction to critical minerals and what they mean for Canada. As a top producer of key critical minerals, Canada has a major role to play. I also want to hit on this idea of ‘superpower’. Why are critical minerals so often tied up with the language of power, security, and sovereignty?

Since March, the breathless excitement around critical minerals has only grown. When Minister Wilkinson got up on the PDAC stage in March, he asserted that the global demand for critical minerals is expected to double by 2040. Subsequently, the International Energy Agency has estimated that Net-Zero by 2025 will require a six-fold increase in the critical minerals market, just for energy production. That 2050 projection has been supported in a report by the World Bank, at least for key minerals — graphite, lithium and cobalt. With a 2025 report from DataM Intelligence claiming that the global critical minerals market reached 328.19 billion USD in 2024, one realizes we are dealing in forecasts of many trillions of dollars.

Planned investment in critical mineral mining, processing and research in Canada keeps growing. The current Minister of Energy and Natural Resources, Tim Hodgson, announced in October that the government of Canada would ‘accelerate and unlock’ 6.4 billion CAD in investment. These include investments in:

• Nouveau Monde Graphite’s Matawinie Mine near Montreal, Quebec

• Rio Tinto’s Scandium Production Plant in Sorel-Tracy, Quebec

• Ucore Rare Metals Inc.’s facility in Kingston, Ontario

• Torngat Metals’ Strange Lake project in Quebec

• Vianode’s synthetic graphite facility in St. Thomas, Ontario

• Northern Graphite’s lac des Iles project near Montreal, Quebec

In addition, the government of Ontario has identified an area in the north of the province, dubbed the ‘Ring of Fire’, that putatively contains promising supplies of chromite, copper, nickel, platinum, and titanium. The provincial government is hoping to attract investment to the region by improving the mine permitting process, procuring indigenous engagement and collaboration, and securing all-season road access. The stated hope is that the Ring of Fire will generate 22 billion CAD over 30 years to ameliorate Ontario’s fiscal position.

Foreign investment is starting to pour into Canada. Most significant is the merger between the British mining company Anglo-American and Vancouver’s Teck, to create Anglo Teck — with commitments to spend 4.5 billion CAD on projects in Canada, including investments into copper projects in British Columbia, improvements in critical minerals processing at their Highland Valley Copper mine, and the establishment of a Global Institute for Critical Minerals Research and Innovation. Furthermore, Japan’s Panasonic and Mitsui, Norway’s Vianode, Italy’s ENI and Alkeemia, and Luxembourg’s Traxys have all made investment or offtake arrangements for critical minerals in Canada.

CRITICAL FOR WHAT? CRITICAL TO WHOM?

A critical mineral is a raw material deemed essential to a nation’s economic and strategic interests, and that is at risk of supply disruptions. In other words, you need it, and it might become hard to

As decision makers consider the abundant critical mineral deposits across the North Americn continent, how salient are national borders?

get. There is a lot here to break down, not least that this definition is inherently subjective. The economic and strategic interests of a nation are determined by the national government and are subject to interpretation and reinterpretation, as priorities and regimes change. Critical minerals are therefore a political project — they represent the thrusting of political questions into the economy. When Minister Wilkinson spoke at PDAC of a ‘major economic opportunity’, it must be understood that the opportunity here is for miners to better serve geostrategic priorities.

In that context, the primary critical minerals we are talking about are Lithium,

“Net-Zero by 2025 will require a six-fold increase in the critical minerals market, just for energy production.” — IEA

Cobalt, Tungsten, Alumina, Graphite, and the Rare Earth Elements. The full list is much longer; the Canadian government has identified 34 materials it deems critical, the US has a list of 50. Importantly, Rare Earth Elements (or REE), in contrast to the term ‘critical minerals’, denotes a precise group of 17 elements (see below). These minerals are a vital input in batteries for electric vehicles, in wind & solar infrastructure, in hydrogen fuel cells, in smart phones and laptops, in the construction of data centres, in fertilizers, in medical devices, in LEDs and semiconductors, and last (but most emphatically not least) in defense manufacturing.

Lithium is the cornerstone of lithium-ion batteries powering electric vehicles and stationary energy storage systems. While not particularly scarce, it occurs in low concentrations that are often uneconomic to extract. Sources include lithium-rich

Lithium, critical for the production of EV batteries, and in abundance across Canada

brines in salt flats and hard rock minerals like spodumene, with new deposits being explored following recent price increases. The mineral is processed into lithium carbonate and hydroxide forms.

Rare Earth Elements (REEs) comprise 17 specific elements that, despite being relatively abundant, are environmentally hazardous and difficult to mine. Their unique magnetic properties enable the creation of extremely powerful permanent magnets essential for electric motors, generators, wind turbines, and electric vehicles. While valuable, they are considered “nice to have” rather than critical need, and are not used in batteries. Some REEs are radioactive.

Cobalt, historically used as a blue pigment, now plays a vital role in the cathode of lithium-ion batteries. Cobalt production is uniquely controversial as over 75% of the supply comes from ‘artisanal’ (read mediaeval) mines in the Democratic Republic of the Congo, that throw miners into Dickensian squalor with a complete lack of modern tools.

Graphite is used for lubricants, valve gaskets, and foundry products, but it is its key role in the anodes of lithium-ion batteries that has caused its value to grow year on year. Canada was the eleventh-largest global producer of graphite in 2023, and Canada boasts North America’s only active graphite mine run by Graphite Nordique at Lac-des-Îles.

In addition, Canada is one of the few western nations (the importance of this qualification to be explored below) to possess an abundance of Nickel, Niobium, Indium, and the list stretches on and on of other minerals that could be profitably mined in Canada, given their characterization as critical.

The central reason for the excitement and growth around critical minerals, indeed the reason they are considered critical, is that the entire sector is so massively dominated by China. Decades ago, the Chinese government made the astute decision to begin developing production and refinement of its own critical minerals supply, and that decision has paid off enormously. Now, as we shall see, China is able to dictate the terms of critical minerals trade, and this has western governments nervous. Much of the enthusiasm about critical minerals emerges from the attitude of western governments about their future relationship with Beijing. In other words, this growth industry hinges on supposed fear of conflict with China. Because of the headstart, the economies of scale, the abundant capacity, and trained labor that China has in this space, a hypothetical lithium hydroxide plant that would cost 230 million USD in China would cost 650 million in Australia, a rough comparator nation for Canada.

That heightened cost of building in the western world is called the “strategic autonomy premium”. Investment in building out Canadian capacity has to factor in this premium.

Chinese dominance cannot be understated. It accounts for 63% of the global REE supply and over three quarters of the supply of graphite, with smaller contributions in other minerals. However, it is in refinement that China now truly dominates. China accounts for 85% of REE refinement, 68% for Cobalt, 65% for Nickel, 60% for Lithium. China accounts for more than 50% of refinement for 14 key critical minerals and is a lead refiner in many more.

China’s control over the critical minerals sector has had real-world implications. Starting in August 2024, and then on four more occasions up until October of 2025, the Chinese government imposed export controls on a range of critical minerals, citing dual-use issues. Dual-use is the capacity for critical minerals to be used in both civilian and military production. The specific language used by Beijing stated that these controls were imposed “in order to safeguard national security and interests and fulfill international obligations such as non-proliferation.” In one of China’s strongest moves, the Ministry of Com-

merce determined that “export of all dual-use items to U.S. military users or for U.S. military end uses is prohibited; and license application for export to the United States of dual-use items related to gallium, germanium, antimony and superhard materials would not be approved as a principle, and stricter end-user and end-use reviews will be conducted for export of dual-use graphite

items to the United States.”

Just as western countries fear Chinese domination, Beijing fears supplying the United States military with the key inputs for the most cutting-edge military equipment. I leave it to the reader to determine which of these powers poses the most credible threat to global peace.

Negotiation with the Trump administration in the summer of 2025 temporarily

paused these controls in exchange for reduced tariffs on Chinese goods, but the stakes and methods of the contest have been set.

Critical minerals are present in over 80,000 components across nearly 1,900 U.S. military weapons systems, with major platforms like F-35 fighter jets requiring over 900 pounds of rare earth elements, destroyers using about 2,600 kg, and submarines requiring 4,600 kg. The materials enable high-performance combat capabilities in precision-guided munitions, military aircraft, ammunition, and naval vessels, with no equivalent substitutes that perform at the same level. Thus, to the extent that China fears the continued growth and development of the worlds largest military, China’s actions form a coherent policy.

Here is the predicament for Canada: as a major producer of important minerals, and as a nation tightly bound up in the US-led ‘western alliance’, Canada is not free to recuse itself from the sabre rattling around critical minerals. For better or worse, the major economic opportunity on Canada’s doorstep is the mining and processing of materials key to the production of the latest generation of fighter jets and precision-guided munitions. Canada finds itself a piece on the chess board between the two major powers, subject to strategic manoeuvring from Washington. A question rising from this — is Canada a pawn or something more?

In a recent piece for Policy Options titled “Redefining Sovereignty in the Critical Minerals Era”, Jeffery Tobin of Pan-American Strategic Advisors wrote:

Critical minerals form the backbone of North America’s energy transition. The question is whether Canada can influence the terms of that transition — or simply react to decisions made in boardrooms around the world.

The piece discusses the move by the British mining company Anglo-American to acquire the Canadian giant, Teck (which has proceeded as a merger of equals, but the point still stands). In effect, the Canadian government has lost unilateral regulatory discretion over a major player in the critical minerals market. The deal was subject to review under the Investment Canada Act, but the scope for action was limited.

Tobin’s argument is that Canadians should nuance its understanding of resource sovereignty. He writes, “in a world of cross-border supply chains, sovereignty is negotiated — continuously and deliberately.” In theory, by subjecting oneself to an international agreement and governance framework, one can influence policy beyond your own borders and be part of regional standards. In practice, this means that the upcoming 2026 renegotiation of CUSMA has very high stakes for Canada. CUSMA, or USMCA, is the trade agreement that establishes non-discrimination, transparency and investment standards across the region, and keeps the entire North American critical minerals supply-chain working as a coherent whole. There is no clause to the agreement that allows Ottawa

to block multinational mergers with Canada’s own mining companies, or to dispose of its own minerals in a way determined by Canadians. There is only the upcoming renegotiation with a Washington administration that has shown itself uninterested in balanced and coherent engagement with long-standing partners.

Trump was willing to take violent and extraordinary action against Venezuela to put that country’s resources at American disposal, the second most important of which after oil is critic-

al minerals. Greenland, a territory of Nato-ally Denmark, possesses 43 of the 50 critical minerals prioritized by Washington. To this very day, the president has not taken military action off the table against Denmark, at the risk of the whole NATO alliance. So, Canadians have to ask themselves what critical minerals mean for our country. Certainly, they present a major economic opportunity. But to what degree can we shape the industry so that it remains our economic opportunity? Let us see how the renegotiation of CUSMA goes.

By Claudiu Popa

n mining, scale is everything. Haul-trucks the size of homes, conveyors that span valleys, and crushers that turn mountains into raw material, these are all part of daily operations. Every piece of equipment, every process, is engineered for endurance and output. But behind this brawn lies a new kind of vulnerability. Not in the bolts or bearings, but in the data and devices that keep it all humming.

Over the past two decades, I have audited mining operations on three

continents. From the nickel-rich regions of Ontario to copper mines in the Andes and iron ore sites in Australia, I have seen firsthand the disciplined approach that defines this industry. Safety is sacred, financial reporting is exacting, maintenance is ritualized. And yet, even in these highly controlled environments, a subtle but dangerous risk has emerged. One that is often overlooked or misunderstood: cybersecurity.

Mining companies, particularly those with global footprints, have embraced digital transformation in stages. Predictive maintenance tools, remote diagnostics, automated fleet management, and cloud-connected sensors have become standard. These innovations are welcome. They save money, reduce downtime, and improve safety. But they also create new pathways into systems that were never designed to be connected in the first place.

Here lies the paradox. The older the system, the more critical it often is to production. These legacy systems are rugged, reliable, and familiar. But they are also outdated, unpatched, and un-

supported. And when connected to modern networks or accessed remotely during routine maintenance, they can become open doors to attackers.

I have seen field laptops used to update haul truck software that had not been patched in years. I have watched technicians plug in USB sticks containing configuration files pulled from other sites without a second thought. In one case, a condition monitoring server had not been restarted in over 1,000 days. When it finally crashed, it revealed a long-standing vulnerability that could have been exploited at any time.

The danger here is not theoretical. In recent years, without naming names, we have observed real-world incidents where mining operations have been disrupted by ransomware, data corruption, and unauthorized access. Sometimes the

Networked systems create potential entry points for cyber threats.

“Let us be clear. Maintenance is not just a safety or reliability issue anymore. It is a cybersecurity issue.”

threat enters through IT systems and makes its way into operational networks. Other times, it comes directly through an innocuous maintenance task.

Let us be clear. Maintenance is not just a safety or reliability issue anymore. It is a cybersecurity issue. And that changes the game, because it is something that decision makers and operational leaders need to get familiar with.

Some companies believe that air-gapping critical systems — the practice of disconnecting computers from the Internet – is still a viable strategy. It is not. The moment you collect diagnostics using a laptop or transmit performance data over a satellite uplink, you are connected. The illusion of isolation can lead to dangerous complacency.

What can be done?

PENETRATION

First, visibility. You cannot protect what you do not know is there. Many mining operators lack a comprehensive inventory of their digital assets. They might know every bolt on a loader but have no idea what version of firmware it is running, or who last accessed its control system.

Maintenance teams, IT departments, and cybersecurity professionals need to speak the same language. Too often, these groups operate in silos. The result is patching delays, overlooked vulnerabilities, and duplicated efforts. Cybersecurity needs to be part of the maintenance conversation, not an afterthought.

Third, standards. While Bill C-26 may have faded from headlines after Parliament was prorogued, its successor, Bill C-8, is very much alive. It aims to regulate cybersecurity across Canada’s critical infrastructure sectors, including mining. Even before it becomes law, the intent is clear. Companies would be wise to align with its expectations now, rather than wait for enforcement.

Similarly, financial controls under Ontario’s Bill 198 remain in force. Public mining companies must certify their internal controls quarterly and annually. A cybersecurity failure that affects production or data integrity could have serious regulatory consequences. Compliance is not just about paperwork. It is about resilience.

to protect the invisible systems that make those outcomes possible. The next breach may not come through a phishing email or a corporate laptop. It may come through a trusted techni-

cian performing routine maintenance on a legacy control system.

It is time to treat that risk with the seriousness it deserves.

CLAUDIU POPA is a published author, industrial cybersecurity auditor and speaker, and leader at OT Security Canada, where his work spans digital infrastructure, industrial policy, and critical systems. As CEO of Informatica he advises on risk, policy and compliance, particularly where operations at scale meet emerging risk. Feedback and commentary are always welcomed at SecurityandPrivacy.ca and www.OTSEC.ca.

Global standards like IEC 62443 and NIST SP 800-82 offer practical frameworks for securing industrial systems. They may not be required by law, but they are increasingly used by insurers, investors, and supply chain partners to assess risk.

Ultimately, mining operations do not need more technology. They need smarter, safer systems. That begins with recognizing that every maintenance action, from a firmware update to a calibration, is also a potential security event.

In mining, we measure success by tonnes moved and downtime avoided. But in today’s world, we must also measure it by our ability

Process improvement is like skydiving. With a dependable partner, you can reach the next level.

Just as skydivers rely on their jumping partners, we know that partnering with our customers brings the same level of support and dependability in the area of manufacturing productivity. Together, we can overcome challenges and achieve a shared goal, optimizing processes with regards to economic efficiency, safety, and environmental protection. Let’s improve together.

Do you want to learn more?

www.ca.endress.com

By Ryan Kershaw

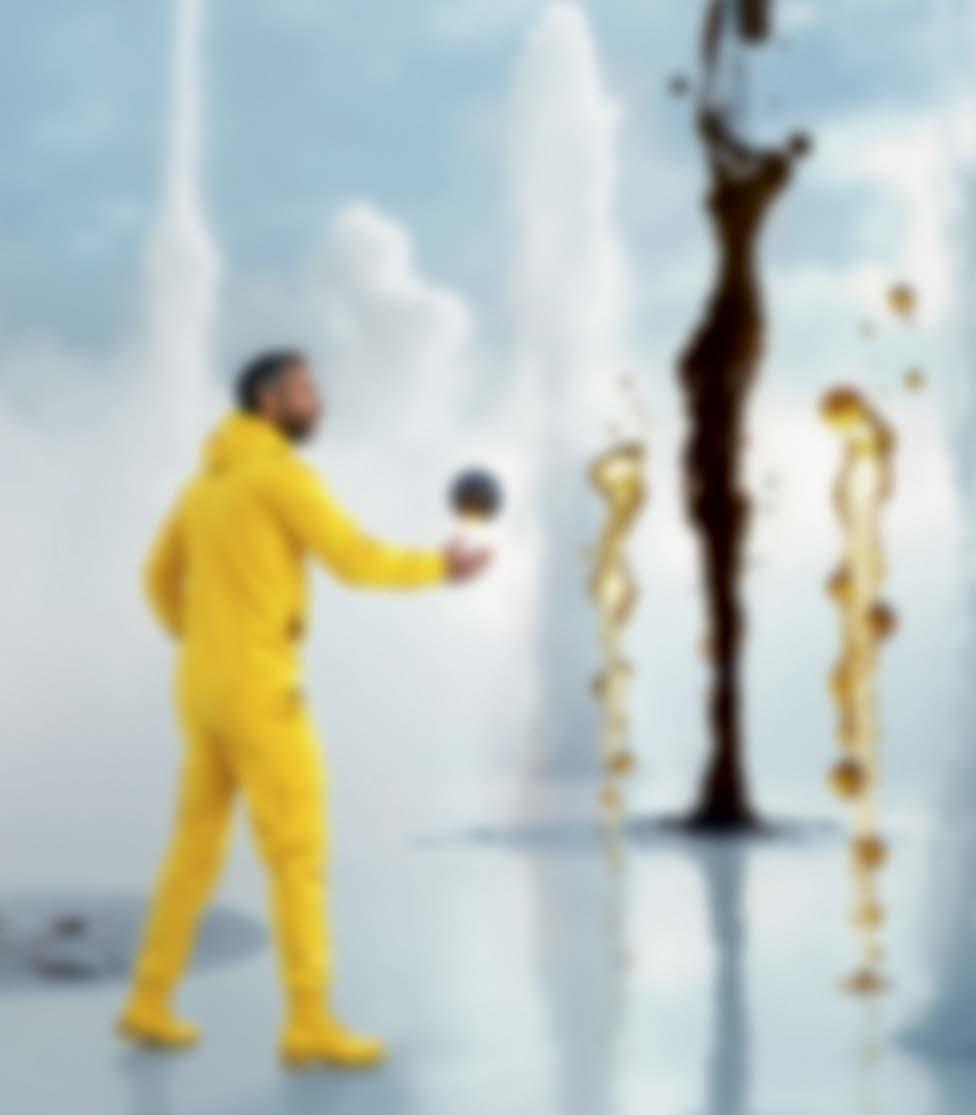

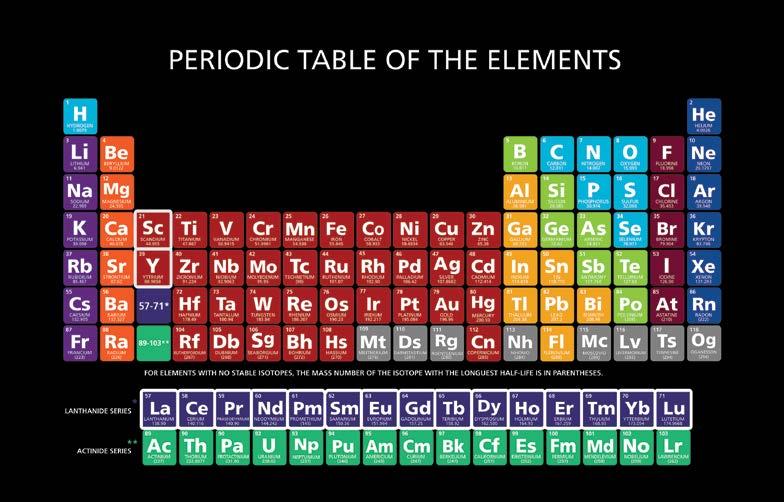

Digital transformation is not a flip of a switch, but an epic journey — a long, winding one at that. In addition, manufacturing organizations are extremely complicated. Put this together, and manufacturers have their work cut out for them when trying to figure out what work to prioritize. Fortunately, with the blossoming of digital transformation, there has also been a rise in Digital Transformation Maturity Analyses (DTMAs), which are there to help. What are DTMAs? Let us dive in.

As the name suggests, a DTMA is an assessment method, and while there are differences between different models, they all focus on how far along the organization is in its digital transformation journey. However, while the name suggests the assessment, most do not stop there.

One of the first, most well-known and widely used DTMA is the Smart Industry Readiness Index (SIRI) which, full disclosure, is the one I am involved with. SIRI started its life out in Singapore and was developed in conjunction with the local

government, industry associations, manufacturing companies, and academic institutions. The reason why it was started? Singapore had essentially run out of land to put its manufacturers and decided the best way to grow the manufacturing base was to make them more efficient. It came up with SIRI to help guide them along the way. Since then, different governments and private companies have worked to develop their own DTMAs. Some like SIRI take a holistic approach, looking at the entire organization, while others focus on specific areas or pieces of technology. Organizations like CESMII in the US have developed their own DTMA to address specific geographical areas and industries.

With most of these DTMAs, the assess-

ment part is only the first part of the process. While knowing where the organization is along the journey is great, knowing how to get to the next stage is even better. This is usually done by looking at other metrics within the organization, such as how the company spends its money, some of the existing KPIs within the organization, and how it compares against other organizations. These parameters are meant to help identify which areas should be prioritized based on potential ROI, alignment with current goals, and competitive pressures. With all of this information, the DTMA will provide the organization with a list of areas on which they should focus to help move them forward. Looking at it another way, if digital transformation is a journey, the DTMA is the GPS system. It can tell you where you currently are, where you want to go and a couple routes that you can take to get there.

So, why should companies go through this exercise? As mentioned, digital transformation is difficult. A DTMA will help simplify things. Depending on the specific DTMA, it may provide exact answers or it may provide a general direction to pursue. Those companies that provide a DTMA as part of their consulting services may use the information generated from the exercise to provide some specific projects to work on, while those that provide it as a one-off service may be a bit more generic. The latter may be used as a base for the company to build on, while the former might be used to help identify a specific project to pursue in a certain area.

It should be noted that the goal of a DTMA is not to take an organization from nothing to fully transformed. A DTMA can help identify the steps to take to get to the next level. Digital transformation cannot be done all at once; there is simply too much to do, both in scope and scale. Being able to identify areas that should be prioritized can allow companies to take a structured approach to this journey. With this in mind, a DTMA is not meant to be a one-time exercise. Performing a DTMA on a regular basis, which can be anything from once every couple of years to every six months, can help companies track their process and adjust their plans when their priorities change as they move along their journey.

Some organizations shy away from these types of exercises due to their cost, both in terms of money and time. Many DTMAs developed with these concerns in mind. Typically, the assessment requires 2 – 3 calls and a day or two on site. Typically, one or two of the calls take place before the on-site session and one takes place afterwards. The pre-visit call(s) focus on ensuring that the right people will be at the onsite meeting, and that they also know what areas will be looked at so they can be prepared to have a good conversation when the time comes. The call after the on-site visit is the debrief where the results are presented and discussed. During this time, next steps may be suggested, especially if the DTMA was delivered ahead of a potential consulting engagement.

At the heart of the engagement is the on-site meeting. Since this is an assessment, part of the visit will involve touring the facility to see firsthand how the organization is performing. Most of the visit typically involves a discussion between the assessor and the organization. DTMAs typically have well-defined levels so, during the assessment, a discussion about where the company feels it is can be had, rather than having just the assessor determine the level of the company. That said, the facility tour does act as a “trust but verify” system, allowing the assessor to determine if the company was accurate in its own assessment.

All in all, the investment of time from the company is less than a week total, spread over about a month or two depending on how fast the organization wants to move forward. What about cost? Most DTMAs are fairly inexpensive due to their highly structured method and design, which allows the assessor to complete the DTMA relatively quickly. The SIRI assessment is only a four-figure engagement, which is fairly inexpensive, especially when it could end up saving the organization from spending millions of dollars on a failed initiative.

With all that in mind, how do you decide which DTMA to go for? Here are a few things to look for:

• Identify which stage you are at: do you need to decide between a few projects, or do you need to figure out which direction to take?

• Ensure the DTMA is based on a set framework so it can scale.

• The more data a DMTA has built up, the better it can compare the organization against industry peers.

• Ensure that the assessment takes account of other holistic parameters when making recommendations.

• Ask if there is a quality control system for the DTMA. For instance, are assessors certified in some way?

Once you have decided on a DTMA, remember it is a process, not just a single engagement. Use repeated DTMAs to track you transform

tion progress and make adjustments as your organization changes over time. Remember, the assessment is just one part of the transformation process, the rest is up to you!

RYAN KERSHAW is the Regional Ambassador – Canada, with the International Centre for Industrial Transformation (INCIT) and is based in Maple, ON. Ryan is a regular CPECN contributor.

By Michael Wright

In my last column I helped you identify a common source of problems with industrial motor bearings. “The single most common failure with any motor is its bearings. And although this is usually blamed on “old age”, it is more typically the result of one or more of the following issues: improper application, improper installation, substandard maintenance, or failure to manage external forces.” In this column, we focus on installation. I will discuss how proper installation practices are critical to the success of any proactive maintenance program which you hope to employ.

Most maintenance programs try to fit motor failures into some kind of a statistical curve. However, these statistics are based both on the particular motor having been installed as per proper millwright practices, and on the assumption that it fails because it has simply ‘worn out’. However, consider the following scenario:

“Mechanic A” installs 20 motors and they all last about a year, while “Mechanic B” installs another 20 motors and they all last 10 years. Based on the appropriate calculations, the Mean-TimeBetween-Failures (MTBF) for all 40 motors is a bit over 5 years.

If your maintenance program is “preventative”, you would change all the motors installed by Mechanic A when they failed and motors installed by Mechanic B long before they needed to be.

If your maintenance program is “predictive”, and if your sampling frequency was high enough to catch motors installed by Mechanic A before they were severely damaged, you could start monitoring them on a frequent basis and then change them just before they fail. And of course, at least you would not be wasting money needlessly changing the motors installed by Mechanic B.

Finally, if your maintenance program is truly “proactive”, you would take initial condition readings on every motor and, should you find a high vibration at the 7200 cpm frequency (with or with-

Root cause failure analysis a critical part of any kind of proactive maintenance program.

out side bands), you would be able to get Mechanic B to come and do a proper alignment, soft foot correction and, if applicable, check for sheave wear and set the belt tension to spec.

The three most common installation related causes of premature motor bearing failure: misalignment, “soft

“a proactive maintenance program should look at the root cause of the belts being overtightened.”

— Wright

foot”, and excess belt tension.

Shaft misalignment in a direct drive application is the easiest issue to visualize. So, I will discuss it first.

Flexible drive couplings are a wonderful invention because they can tolerate a significant amount of misalignment without failing. However, motor bearings cannot. So, where a Dodge Paraflex coupling of a given size can tolerate 0.012 inch of misalignment, the motor connected to it probably will not last a year if the misalignment exceeds 0.005”, and will not last 10 years if it any more than about 0.002”.

Misalignment puts a high radial load on the drive end bearing of a motor and

this will result in the bearing failing prematurely.

This also applies to belt drive applications, although the tolerance for misalignment in the sheaves is buffered somewhat by the flexibility of the drive belts. However, it is still advisable to line up the sheaves with either a straight edge or with one of the various laser alignment systems available.

“Soft foot” is a little harder to visualize than is misalignment, but it basically boils down to the fact that the feet on motors are not perfectly “flattened” (planar). Even if the motor base is brand new and was planed, shimmed, and grouted perfectly, when you sit the motor on it, there will always be a slight air gap under one or two of its feet.

“every motor should be properly shimmed so that any gaps under the feet have been corrected without causing distortion to the motor body.”

— Wright

If Mechanic A is doing the installation, he will “fix” that with a big impact wrench. And yes, you can close the gap under the motor feet if you tighten the mounting bolts enough. However, this will actually distort the “roundness” of the bearing journals in the motor, causing the outer races of the bearings to become distorted so that the rolling elements fail prematurely due to the lack of proper clearances for lubrication.

As “Mechanic B” could tell you, every motor should be properly shimmed so that any gaps under the feet have been corrected without causing distortion to the motor body.

In general, every motor should have shims under at least one of its feet, or it will have a reduced operating life due to improper installation. This is something which can easily be observed during any kind of initial inspection.

Lastly, premature motor failure due to overtightening of drive belts is very easy to visualize. It simply puts a large radial load on the drive end motor bearing and will cause it to prematurely fail.

However, a proactive maintenance program should look at the root cause of the belts being overtightened. There is a very high probability that the belt adjustment mechanism (usually a sliding base section under the motor) is seized so the mechanic put the belts on with a pry bar, or the sheaves are worn out and the mechanic overtightened the belts so they would not slip as badly.

Either way, root cause failure analysis is a critical part of any kind of proactive maintenance program. And it may even allow you to train all of your “Mechanic A’s” to become craftsperson worthy of the title “millwright”.

MICHAEL WRIGHT is an electrical engineer with more than 50 years of experience in heavy industry. Although he has done an extensive amount of PLC/DCS programming and upgrading of power systems, he is a very strong generalist with a broad knowledge of hydraulics, pneumatics, power transfer, welding practices, mining equipment, mobile equipment, process control strategies, pumping systems, rock mechanics monitoring, mechanical maintenance practices, MRO procurement contracts, energy management, and cost control. As such, he specializes in problem prevention as a subject matter expert (or as a fixer on “problem projects”). It is his belief that safety is not a “priority” but is a way of life; that good engineering makes life simpler and easier for others; and that the best ideas come from those with calloused hands and dirty coveralls. He can be reached at: mawright@sasktel.net.

By Brandon Spencer

In climate conversations, we often do not put enough emphasis on the role that industrial activity plays in contributing to greenhouse gas emissions; the industrial sector after all accounts for nearly one-third of global emissions. This is significant. Against this backdrop, 45 percent of the world’s electricity consumption is converted by industrial electric motors into motion, which presents the industrial sector with a pivotal challenge: how to meet rising energy demand while reducing emissions and operating a resilient business. The answer: energy efficiency.

Just two years ago delegates attending COP28 in Dubai sought to double global

energy efficiency progress to 4 percent by 2030, yet according to the recent IEA Energy Efficiency 2025 Report, the world is on track to miss this key milestone. Energy efficiency is expected to improve by 1.8 percent in 2025, up from 1 percent in 2024. This target is a critical milestone to deliver on net-zero by mid-century. As a result, the modernisation of the industrial sector presents a real opportunity: nearly

Energy efficiency upgrades are not just “green” projects; they are strategic investments with concrete financial returns and competitive benefits.

one-quarter of the world’s active drives operating within the industrial sector are over twenty years old, and one-half are ten years old. What we need are modern drives that can reduce energy consumption, emissions and operating costs in one single swoop.

MODERN MOTORS — MAJOR SAVINGS

It is easy to think that such a challenge can be daunting; the global industrial sector is by no means small. However, there are already proven and scalable solutions that are readily available to improve industrial energy consumption and efficiency.

A prime example of this can be found in upgrading twenty- and ten-year-old legacy motors, to modern high-efficiency motors paired with variable speed drives (VSDs). Upgrading these motors to the latest IE (International Efficiency) class motors, from IE1 (standard efficiency) up to IE5 (ultra-premium efficiency), maximises energy savings and immediately cuts electricity use and operating costs. By adopting high-efficiency motors and drives to combat climate change,

global electricity consumption can be reduced by 10 percent.

Crucially, when industry evaluates such upgrades with a total cost of ownership mindset, considering both long-term energy and maintenance savings, efficiency upgrades are proven to boost the bottom line. The benefits do not end there, as high efficiency motors can also reduce the demand on the grid — a win-win for business and society. For example, by investing more in a higher efficiency motor paired with a drive, a U.S.-based customer would save $1.3 million on electricity costs over 25 years with a ROI of 9 months. This saving is equivalent to removing over 950 passenger cars from the road for the year.

“By adopting highefficiency motors and drives to combat climate change, global electricity consumption can be reduced by 10 percent.”

— Spencer

It is true that integrating modern motors into the industrial sector will contribute towards narrowing the energy efficiency gap. However, it is only a single part of the wider challenge within industrial energy consumption. To address the whole problem, we need to also consider the role of variable speed drives (VSDs). Investing in a variable speed drive to run alongside a modern motor means that intelligent controls can monitor the motor’s speed to process real-time demand. This allows companies to avoid wasting energy when full power is not needed.

For example, in fluid flow applications like pumps and fans, smart motor-drive systems can cut energy use by up to 50 percent, all while improving operational control. This reduces mechanical stress on equipment, extends motor lifespan, and improves reliability, all while lowering electricity bills and emissions. Despite these undeniable benefits, only about 1 in 4 industrial motors are equipped with a variable speed drive.

For industrial business leaders, the message could not be clearer. Energy efficiency upgrades are not just “green” projects. They are strategic investments with concrete financial returns and competitive benefits. At ABB, we recently broke a new world-record with a 99.13% efficient motor, which is expected to save around $5.9 million in electricity costs over a 25-year lifespan in India. It demonstrates how lower energy consumption directly translates to cost savings and carbon reductions.

On a macro scale, the efficiency prize for industry is enormous. The Energy Efficiency Movement, a coalition of companies focused on

sustainability goals, estimates that by deploying ten mature, readily available efficiency measures, the industrial sector could save roughly $437 billion annually by 2030 — and avoid vast amounts of CO₂ emissions.

Doubling energy efficiency by 2030 is still within reach, but only if industries around the world step up. The technologies are mature, the economics make sense, and the stakes for our planet are enormous. It is not as an optional upgrade, but as an essential business strategy, seizing a win-win opportunity.

BRANDON SPENCER is president of ABB Energy Industries division, part of ABB Group, a leading global technology company that energizes the transformation of society and industry to achieve a more productive, sustainable future. He oversees the delivery of solutions and services that digitize, automate and electrify industry to ensure a safer, smarter and more sustainable use of resources across the oil and gas, power, water, chemicals and life science sectors.

By Steve Knauth

When EW Packaging switched to a Rotary Batch Mixer, the Los Angeles contract manufacturer cut blending time in half and slashed ingredient overages from 10 percent to just 2-3 percent. The gentle, efficient mixing action eliminated dead zones and product damage while delivering perfect HPLC tests every time — transforming powder blending from a bottleneck into the company’s most profitable operation.

EW Packaging contract manufactures and packages powder, tablet and capsule products, protein powders, energy drink mixes, and sports nutrition products. Customers include national warehouse clubs and dietary supplement retailers.

Founded in 2001 as EW Trading, dba EW Packaging, CEO Rob Lonas renamed it EW Packaging when he brought the company’s packaging and printing services in house. Today EW operates six blister-filling lines and four bottle-filling lines, and uses flexographic printers to customize pouch and blister foils. It also machines its own tooling, which shortens turnaround times and reduces costs.

In 2016, the company began blending dietary supplement and food powders and manufacturing tablets and capsules, but the company’s V-cone blender proved inefficient. “The machine was a lot of work and there was a lot of downtime,” Lonas says. “It took at least 30 minutes to get a load in and out, plus another 15 to 20 minutes of actual mixing.”

Next, he tried a ribbon blender, which reduced loading and unloading times but it compromised blend quality. “The ribbon blender has corners, dead zones, where the powder is not mixed,” he says. Sometimes EW added as much as 10 percent more active ingredient to the products than required for HPLC testing to confirm that the product met the label claim. In addition, the ribbon blender’s

impeller put product quality at risk, Lonas says. “It chops up the ingredients and damages the product at the same time.”

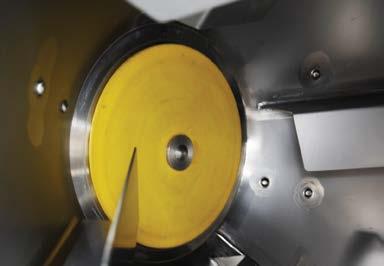

To improve EW’s blending operation, Lonas purchased a 425 L (15 cu ft) Rotary Batch Mixer (this one from Munson Machinery) that loads, blends, and discharges in about 15 minutes — half the time of the previous blenders. The unit’s

The 425 L (15 cu ft) capacity Rotary Batch Mixer discharges to a screw conveyer which transfers mixed powder products to an auger filling machine.

horizontal vessel rotates on external trunnion rings located at each end, handling ingredients gently because it has no agitators. Instead, the vessel has internal flights that create a four-way tumble-turn-cutfold mixing action, producing homogenous blends without generating heat, shear or stratification. Lacking internal shafts, the mixer has no seals that are in contact with the product.

To initiate a blending cycle, operators hand-weigh ingredients into a drum. A plant-based protein product may contain up to eight ingredients, while a flavored creatine product may contain up to four. The drum containing the weighed batch is then lifted onto a mezzanine and dumped through a security screen into a hopper that discharges into the mixer’s stationary inlet. A collection hood contains fugitive dust during the loading process, while a single external seal prevents the escape of dust during vessel rotation.

Lonas highlights the Rotary Batch Mixer’s gentle mixing action in his business conversations. “It is part of my sales pitch for whatever the job is — encapsulation, tableting or just blending a powder,” he says. “This mixer just folds in the in-

gredients. It is not smashing them or pounding them together.”

Blends are discharged from the mixer through a stationary outlet. Batches destined for encapsulation or tableting flow into mobile hoppers that are rolled into the adjacent room for those processes. Powder products are discharged into a screw conveyor that transports the batch

to the feed hopper of an auger filling machine, which dispenses it by weight into bottles, canisters, tubs, or most any container.

The vessel leaves almost no residue following discharge. “There are not any corners or pockets that can collect powder,” Lonas says. Between blending campaigns and when switching products, operators

wash, rinse, and swab-test the vessel interior in accordance with Good Manufacturing Practices.

Lonas says that the blends are always on-spec, and overages range between 2 percent and 3 percent instead of 10 percent previously. “I sold my V-blender and my ribbon blender. The Rotary Batch Mixer gives us a perfect HPLC test every time.”

Despite its modest volumetric capacity, the mixer outputs high volumes because it loads and discharges quickly and blend times are short, as little as 3 to 6 minutes, Lonas says. “When we started getting bigger orders, we got nervous at first thinking our mixer was not big enough, but we ran some big orders with no problems.” In one case, EW Packaging blended some 80 batches of a protein powder over four days, filling all of it into 2.3 kg (5 lb) tubs.

“The future for us is growing the powder business because we have our powder lines so dialed in. It is a profitable and a fast way to fill bottles.” The company’s fastest line fills as many as 50,000 bottles a day, which includes capping, induction sealing, metal detecting, check-weighing, labelling, lot coding, and neck banding.

“We seldom tell customers ‘No’ unless they come in with a liquid,” Lonas says. “If we do not have the right machinery, we buy it. Our niche is getting new products going for people and cranking it out, getting them into the market fast. We get a lot of business because of our blister capabilities and because we can do short-run stuff. There are not many other places on the West Coast that can do that.”

Lonas calls the mixer his workhorse. “I think we changed a seal once. There is not much maintenance to do on it. It is one our most reliable machines.”

STEVE KNAUTH is the marketing and technical manager for Munson Machinery Co., Inc. Established in 1823, Munson Machinery is a world leader in mixers, blenders and size reduction equipment for bulk solids materials.

By Jeff Elliott

WWhen Canadian manufacturers seek to leverage specialized expertise, advanced processing capabilities, or proprietary technologies without assuming the financial burden of acquiring and maintaining dedicated equipment or facilities, they often turn to toll processing.

Toll processing (or toll manufacturing) involves a manufacturer processing customer-supplied materials or parts for a predetermined fee. The customer retains ownership of the materials, while the toll provider applies specialized technologies, equipment, and expertise to deliver the finished components.

From a strategic perspective, toll processing provides the best of both worlds. Canadian manufacturers in high-value, innovation-driven sectors such as medical devices, aerospace, and electronics can significantly enhance the performance, functionality, and market appeal of their products through the integration of specialty materials, precision surface treatments, or other advanced processing features. This can be achieved without the capital expenditure and operational complexities associated with in-house production.

The result is often a meaningful increase in product value, enabling companies to command substantially higher price points in the marketplace. It is also a particularly cost-effective approach, particularly for small or intermittent volumes.

When

These benefits are further amplified when manufacturers engage in toll processing directly with the Original Equipment Manufacturer (OEM) of the processing equipment. While it is relatively uncommon simply because most toll processing is performed by independent third parties that use equipment purchased from OEMs, this approach offers significant value.

Third-party providers often lack the in-depth knowledge of the equipment’s design, capabilities, and operational limits, which only the original equipment manufacturer (OEM) possesses. This specialized expertise allows the OEM to deliver superior customization, optimized process performance, and tighter quality control.

When working directly with the OEM, Canadian manufacturers also gain access to engineering resources, equipment modifications, and technical support that third parties simply cannot offer. This is particularly critical in scenarios involving cutting-edge materials or novel surface modifications, where process flex-

ibility and rapid technical responsiveness are essential.

An excellent case-study of the value of advanced processing technologies is the plasma treatment systems and diffusion bonding services offered by a company like PVA TePla. The company (one of a handful that do this) serves as both an original equipment manufacturer (OEM) and a toll processor for plasma treatment and diffusion bonding technologies throughout Canada.

While these two processes differ significantly in function and application, both provide substantial performance and quality benefits across a range of high-tech industries. Plasma treatments enhance bonding and adhesion and enable a variety of critical surface modifications. Diffusion bonding, on the other hand, facilitates the joining of similar or dissimilar metals to achieve superior thermal performance, mechanical strength, and structural integrity.

Given the distinct requirements, substrates, and material combinations involved, however, each customer application is inherently unique. As a result, successful out-

comes depend on carefully tailored process development customized to the specific demands of each use case.

“A single recipe or standardized process cannot be universally applied. Each application requires a tailored approach to ensure optimal performance and compatibility,” according to Suraiya Nafis, Director Research and Development at PVA TePla.

In manufacturing, plasma treatments are often utilized to solve problems that cannot be resolved by other methods. Whether attempting to improve adhesion of dissimilar materials, depositing coatings, cleaning surfaces, applying a protective coating that repels water for example or biological fluids or enhancing surface wettability or functional coating, plasma treatments often add significant value to products.

Nafis says one of the most common applications for toll processing includes plasma treatments to improve the bonding of chemical adhesives, coatings, and inks to parts.

Adhesion promotion can be

achieved by increasing the surface free energy through several mechanisms, including precision cleaning, chemically or physically modifying the surface, increasing surface area by roughening and primer coatings. Materials that can benefit from this process include metal to plastic, silicon to glass, polymer-to-polymer interfaces, biological content to microtiter plates, and even non-stick materials like PTFE.

The net effect is a tremendous improvement in bonding. In some cases, up to 50 times bond strength improvement can be achieved.

Due to the wide range of materials, chemistries, and application-specific requirements, a significant portion of toll processing work involves developing customized processes for each customer.

“Even when multiple customers request a hydrophilic surface [one that attracts water, allowing it to spread rather than bead up], the underlying process cannot be assumed to be identical,” says Nafis.

“A hydrophilic coating that works well on PEEK may not perform the same on PTFE or a polymer due to the distinct surface chemistry of each material,” adds Nafis. “Each material responds differently to plasma, and variations in substrate material, surface energy, and other factors require a customized process to achieve consistent, reliable results.”

When needed, the OEM Toll processor can tailor its equipment to meet specific customer requirements, making custom modifications to tools, hardware, or system configurations to support specialized applications and performance objectives.

Once the process is fully developed, all parameters are standardized and tightly controlled. The recipe is locked, and a formal Standard Operating Procedure (SOP) is established to ensure repeatability and consistency.

Diffusion bonding is an essential joining method used to achieve a high-purity interface when two similar or dissimilar metals require superior structural integrity. The process involves applying high temperature and pressure to metals mated together in a hot press, which causes the atoms on solid metallic surfaces to intersperse and bond.

Nafis says toll processing is often utilized because diffusion bonding equipment is exceptionally large, complex, and costly, ranging from several hundred thousand to several million dollars. These systems can be as tall as one- to two-story structures and demand significant facility space to accommodate their height, footprint, and supporting infrastructure.

Diffusion bonding is increasingly valuable for joining dissimilar metals, such as aluminum to steel or titanium. This allows engineers to design components and assemblies with the best properties of each metal.

For example, one metal might offer superior corrosion resistance while the other provides greater strength. This ‘packaging’ of dissimilar metals opens new possibilities in design, particularly for overall weight reduction of design and enhancing performance in challenging environments.

Diffusion bonding also has applications for conformal cooling. The concept is to bond layers of sheet metal that contain machined channel/microchannel structures. When combined, the channels provide a path for heat dissipation.

Today, much of the innovation involves aluminum as one or more of the layers of metals that are

bonded. Aluminum’s compatibility with diffusion bonding allows for the creation of complex cooling channels in high-power electronics, injection molds, and specialized heat exchangers—designs often impossible to achieve through conventional machining.

Whether for plasma treatments or diffusion bonding, OEM toll processors supports a wide range of customer engagement models. According to Nafis, some clients send large batches of parts once or twice a year, while others may submit only a few parts on an occasional basis. In contrast, regular customers operate on a consistent monthly schedule, often reserving tool time in advance and providing a three-month rolling forecast. This approach ensures sufficient capacity and alignment with their ongoing production requirements.

Turnaround times depend on part volume and processing requirements. With nine dedicated plasma system lines, PVA TePla can run up to three distinct jobs in

parallel, significantly improving throughput and minimizing lead times. For projects with tight deadlines, expedited services are available at an additional cost.

Process development schedules depend on the complexity of the application. Straightforward, well-defined requirements can often be addressed within days. More complex projects that involve testing protocols, validation steps, or equipment customization can take several weeks or even months to finalize.

For Canadian manufacturers looking to adopt sophisticated technologies without incurring the costs of capital investment, OEMbased toll processing delivers a scalable and technically robust solution that supports both immediate project needs and longterm strategic goals.

JEFF ELLIOTT is a Torrance, Calif.-based technical writer. He has researched and written about industrial technologies and issues for the past 20 years.

Kobold has released the PITe magnetic-inductive flow meter insertion version with U-PACE electronics for measuring volume flow of electrically conductive liquids.

The flow meter operates based on Faraday’s law of induction, in which a conductive medium flowing through a magnetic field induces voltage proportional to flow velocity. The device consists of a tube, magnetic field coil and two electrodes. The induced voltage is processed by electronics to determine volumetric flow.

www.koboldusa.com

Advance Lifts has outlined its Industrial Standard Duty Manual Turntables, designated TML and TM Series, for rotating heavy loads in industrial environments.

The manual turntables are non-powered units designed for applications requiring frequent rotation of materials. The models feature bidirectional rotation capability and low-profile construction.

www.advancelifts.com

Electromate Inc. has announced availability of the maxon HEJ 90 High-Efficiency Joint, an integrated actuator for mobile and legged robotic systems.

The Vaughan, Ont.-based company said the HEJ 90 combines a brushless motor, gearbox, encoder, servo drive and thermal monitoring in a sealed joint assembly. The unit is designed for battery-powered robots.

The actuator delivers up to 140 Nm of peak torque, with configurations available up to 180 Nm

peak torque. The joint supports speeds up to 13 radians per second and achieves efficiency of 86 per cent. The unit measures 110 mm in diameter, 90 mm in length and has a mass of approximately 1.96 kg.

According to the company, the joint is designed for applications including quadruped robots, humanoid joints, mobile manipulators and propulsion or steering joints in wheeled and tracked robots. www.electromate.ca

Marley Engineered Products Inc. has outlined its infrared radiant heater line designed for aircraft maintenance and storage facilities.

The Bennettsville, S.C.-based company said the heaters are available with multiple mounting configurations for wall, ceiling or structural integration. The units use infrared heating technology and operate without moving parts or fans.

The Thermazone series provides heat through electric infrared radiation without requiring ventilation. The heaters convert electricity to infrared radiation, which the company said eliminates combustible emissions, flames or gases. The design eliminates moving parts or bulbs for reduced maintenance requirements. www.marleymep.com

Nationwide Boiler Inc. has highlighted two trailer-mounted boilers in its rental fleet designed for chemical processing applications.

The company offers a 150,000 pounds per hour high-pressure saturated steam boiler and a 110,000 pounds per hour high-pressure superheated steam boiler. Both units are mobile watertube boilers built to meet emissions and efficiency standards.

The saturated steam boiler has a maximum allowable working pressure of 650 psig and operates from 350 to 600 psig. The superheated steam boiler has a maximum allowable working pressure of 750 psig and operates from 350 to 680 psi, producing steam at 750 F.

Both designs feature low-NOx burners with optional selective catalytic reduction technology for reduced nitrogen oxide emissions. The units include metered combustion controls.

IMAGE: nationwide.jpg www.nationwideboiler.com

Festo has released the CMMT-AS-S3 servo drive series with built-in safety functions for industrial automation applications.

The Mississauga, Ont.-based company said the drives are available in two safety configurations: Basic (S1) and Advanced (S3). All CMMT-AS servo drives support multiple communication protocols including EtherNet/IP, PROFINET, EtherCAT and Modbus TCP.

The drives integrate safety functions within the unit to reduce external components. Safety implementation can be configured through hard-wired digital input/output connections or via PROFIsafe network protocol for integration with Siemens safety programmable logic controllers.

The company’s Safety Configurator, included in the Festo Automation Suite commissioning software, is used to configure safety parameters. Users select the interface type and enter parameters to activate safety functions. www.festo.com/ca/en/

Indeeco has introduced a tubing and tube bundle product line for industrial heating applications.

The St. Louis-based company said the iHeat line includes steam traced and electric traced models designed for industrial process lines, analyzer sample lines and fluid transfer applications. The products are manufactured at a single facility using vertically integrated processes.

Kirk Mankin, director of sales at Indeeco, said the manufacturing approach is intended to reduce turnaround times for quoting, design and delivery. The product line includes light and heavy steam traced models, designated LTB and HTB, along with an electric traced bundle model called ETB. The steam traced bundles are designed for instrument impulse lines, pressure transmitters, fluid transfer lines and analyzer sample lines. Light tracers provide freeze protection while heavy tracers maintain elevated temperatures. www.indeeco.com