Reduce your operating cost... with GL&V’s cost saving solutions

EVO2® Plastic Alloy

The latest generation of high performance material for table dewatering elements, provides long life at reduced cost.

TamPulper™ Rotor

New impeller upgrade reduces energy consumption and pulping time while still providing the same high performance.

Pulp Washer Shower Technologies

We offer many shower designs engineered to reduce operating costs.

Cleanpac® 350EZ™ Hydrocyclone

Simplifies the maintenance of your cleaner plant.

Luthi™ Rotor

Realize power savings and increased rotor and screen plate life by installing this state-of-the-art rotor.

PULP PAPER &

As one of the few segments of the paper industry forecast to grow, the tissue segment is attracting investment from many Canadian

The Quebec firm is on track to start production of lightweight linerboard on time and on budget at its Trois-Rivières

Plan for the inevitable

Cindy Macdonald

Predicting product trends can be tricky, especially now when social media can so quickly influence buying decisions. But demographics tell us that the “greying population” is inevitable, and companies must plan for this sweeping change.

In a presentation meeting of the Paper and Paperboard Packaging Environmental Council (PPEC), public opinion specialist John Wright, had these comments about Canada’s population:

• In 2016, there were more seniors than children aged 14 and under.

• By 2026, seniors will represent 21 per cent of the population, approximately the current population of Quebec.

• In 2036, just 20 years away, we will reach the highest demand level for care, with baby boomers approaching an average age of 75.

• In Toronto, by 2036, 50 per cent of the population will be over 65.

The result is that “if a product is marketed to a 50+ audience now and maintains its market share, it should increase in sales by 35 to 50 per cent in the next 20 years,” he said. There is also a significant increase coming in the number of very old people in Canada. Wright said there are currently 7,900 Canadians aged over 100. By 2061, this will climb to 78,300. So the question is: is your company developing products or doing research into this greying population?

Clearly some paper companies have considered demographic trends in their business plan. Domtar, for example, has been carving a spot in the personal care and adult incontinence segments.

But not all companies are reacting to the obvious and inevitable population shift. Wright noted that there’s not a mass market automobile designed for chauffeuring older people, even though 21 per cent of Canadians are already looking after an aging parent or grandparent.

Some analysts have argued that the extinction of newsprint is inevitable as well. Matt Elhardt of Fisher International, speaking at Specialty Papers US last fall, said demand for newsprint is still declining. “We could hit a zero number for traditional uses,” he stated. By the early 2020s, we could see the last U.S. newsprint mill, he suggested.

While not inevitable, sustainability as a consumer concept certainly seems here to stay. John Coyne, vice-president, legal and external affairs for Unilever Canada, told the audience at the aforementioned PPEC meeting that the “sustainable” brands in the Unilever business were growing faster than other Unilever brands. Ethical consumerism, he said, is gathering momentum.

For strategic planning purposes, pulp and paper companies need to accept the inevitable: the opportunities presented by an aging population, the continued decline of certain paper grades, and the need to appear sustainable.

FROM THE NEW EDITOR

It’s a pleasure to introduce myself as the new editor of Pulp & Paper Canada, starting January 2017. I’m excited to join this dynamic industry and look forward to working with you in the coming year. - Alyssa Dalton

Editor

ALYSSA DALTON 905-713-4378 adalton@annexweb.com

National Accounts Manager LAURA GOODWIN 289-928-8543 lgoodwin@annexweb.com

Contributing Editor CINDY MACDONALD

President and CEO

ANNEX BUSINESS MEDIA

MIKE FREDERICKS

Group Publisher/Director of Content and Engagement

SCOTT JAMIESON

519-429-5180 sjamieson@annexweb.com

EDITORIAL/SALES OFFICES

Annex Business Media

105 Donly Drive South Simcoe, ON, N3Y 4N5

PRODUCTION

Media Designer EMILY SUN esun@annexweb.com

News and Press Releases media@pulpandpapercanada.com

Account Coordinator TRACEY HANSON thanson@annexbizmedia.com

Circulation Manager BEATA OLECHNOWICZ bolechnowicz@annexbizmedia.com

PULP & PAPER CANADA (ISSN 0316-4004) is published by Annex Business Media 105 Donly Drive South, Simcoe, ON, N3Y 4N5

CIRCULATION

email: mchana@annexbizmedia.com Tel: 416-442-5600 ext 3539 Fax: 416-510-5170 Mail: 80 Valleybrook Drive, Toronto, ON M3B 2S9

SUBSCRIPTION RATES

Canada $55.00 per year; $88.00 for 2 years. Outside Canada (US) US$101.95 per year; (foreign) US$110.00.

From time to time, we make our subscription list available to select companies and organizations whose product or service may interest you. If you prefer not to receive this information, please contact our circulation department in any of the four ways listed above.

Annex Privacy Officer privacy@annexbizmedia.com Tel: 800-668-2374

The editors have made every reasonable effort to provide accurate and authoritative information but they assume no liability for the accuracy or completeness of the text or its fitness for any particular purpose.

No part of the editorial content of this publication may be reprinted without the publisher’s written permission. ©2017 Annex Publishing & Printing Inc. All rights reserved.

Publications Mail Agreement No. 40065710

Print edition ISSN 0316-4004

On-line edition ISSN 1923-3515

Sustaining member, Pulp and Paper Technical Association of Canada; Member, Alliance for Audited Media.

“We acknowledge the [financial] support of the Government of Canada.”

Raise The Bar

Don’t Settle for Second Best

The HOBAS history of success is based on supplying products which far exceed the minimum national standards for sewer pipe. So, do not settle for products that simply meet minimum national standards.

To achieve the successful HOBAS track record, specify HOBAS performance.

Tolko kraft mill sold, employees stay on

The paper mill in The Pas, Man., has been saved from imminent closure, and 300 jobs are no longer in jeopardy. Canadian Kraft Paper Industries Ltd., a company affiliated with American Industrial Acquisition Corp., has purchased Tolko’s Manitoba Kraft paper mill and sawmill.

As part of the agreement, all current Manitoba employees will transition to Canadian Kraft Paper Industries, and maintain operations going forward.

Announcing the sale, Brad Thorlakson, president and CEO of Tolko Industries, thanked the employees at the Manitoba operation “for their dedication and patience throughout this process,” and thanked Tolko retirees for their support of the sale.

Thorlakson added: “We also want to acknowledge the critical role that the Swampy Cree Tribal Council played in enabling this sale; and recognize the Manitoba government, the town of The Pas, and local unions for their cooperation and work towards making this sale happen.”

According to various media reports, the town of The Pas is giving the new owner a three-year break on property taxes, and provincial authorities and employees agreed to a three-year break on pension solvency payments. Also, employees agreed to a 10 per cent rollback of wages.

Tolko had announced in August it would shut down the mill on December 2.

Catalyst receives good news in SC trade dispute

The U.S. Department of Commerce has concluded its expedited review of Catalyst Paper with respect to countervailing duties applied to U.S. imports of supercalendered paper from Canada.

The preliminary results find that Catalyst received a negligible (de minimis) amount of subsidies during the applicable period of review and therefore, subject to confirmation in the DOC’s final results,

Catalyst’s exports of supercalendered paper into the U.S. market would not be subject to countervailing duties.

“Today’s decision confirms that Catalyst did not receive any material subsidies from the Government of Canada or Province of British Columbia,” said Joe Nemeth, president and CEO.

Catalyst requested the expedited review, which looked specifically at the 2014 period, after the DOC imposed countervailing duties on SC paper imports from Canada in December 2015. Without individually investigating Catalyst, the DOC assigned the company an “all-others” countervailing duties rate of 18.85 per cent, which was based on the weighted average of the rates determined for Port Hawkesbury Paper and Resolute Forest Products.

Nemeth said Catalyst has paid more than $18 million in duties and legal costs since the countervailing duties were imposed.

The DOC’s preliminary results do not take effect until interested parties have had the opportunity to comment and the DOC issues final results, which is scheduled for February 2017.

Kruger Products to expand Trenton facilities

Kruger Products is undertaking a multimillion dollar expansion at the company’s Trenton plant.

The tissue manufacturer will install state-of-the-art equipment and set up eight new production lines. The project has a total value of up to $52 million and is expected to be completed by the end of 2019.

It is forecast to create 119 new jobs.

“We are excited about growing our Trenton plant and expanding our export opportunities. This project will significantly bolster our production capabilities and set us up for years of growth to come,” said Mario Gosselin, CEO of Kruger Products.

The company will receive a loan of up to $10 million through Ontario’s Jobs and Prosperity Fund. The loan will help the company expand its commercial division and boost its market share in the United States.

The local television station in Trenton reports that Kruger will be bringing almost 200 workers from its Mississauga plant to the Trenton location.

Fortress Paper invests in $19.7-million birch project

Fortress Paper is moving ahead with a strategic project to use birch fibre to manufacture dissolving pulp at the Fortress Specialty Cellulose Mill in Thurso, Que.

Birch trees are considered an underutilized species of tree. The company says the project will ensure a better use of the mixed forest in the local region and increase economic activity. It is also expected to result in an incremental annual production capacity increase of 8,500 ADMT in 2018 and 17,000 ADMT in 2019 compared to current production capacity.

“We are delighted with the support of the federal government. This investment highlights the innovative and transformative potential of producing dissolving pulp using birch,” said Yvon Pelletier, president and CEO of Fortress Paper.

The project is estimated to cost approximately $19.7 million in total, with $9 million to be funded by the Government of Canada through a non-repayable contribution. The remainder of the project’s total cost is expected to be financed by the company with cash on hand, operating cash-flow and other investment incentive programs, such as the Hydro Québec “Rate L” tariff.

Fortress Paper expects that the project will be completed in the first quarter of 2018.

The birch project ties in with the installation of a system to produce hemicellulose at the Thurso mill. See page 25 for details.

Neucel working towards restart of pulp mill

The Neucel Specialty Cellulose pulp mill in Port Alice, B.C., which has not produced pulp since March 2015, has begun discussions with the employees union, looking for ways to reduce production costs and restart the mill.

Neucel’s vice-president of human resources, Warren Beatty, told the local newspaper, the North Island Gazette, the mill needs to reduce fixed costs, including wages.

It has also been stated that the mill will need equipment upgrades if it does restart.

B.C. invests in new project to help manufacturers meet labour needs

The B.C. government has committed more than $45,000 for a new partnership project with manufacturers in the province’s North Central region to help identify their labour needs as well as factors that shape their workforce.

Bringing together “key organizations” from the Cariboo and Nechako economic development regions, The North Central BC Manufacturing Sector Labour Market Information Project is expected to finish in February 2017.

According to the government, B.C.’s manufacturing sector is the third-largest contributor to the economy in British Columbia and a key part of the BC Jobs Plan, generating $15 billion in revenue and supporting approximately 172,500 jobs.

“Each region in B.C. is shaped by different economic drivers and has unique labour needs,” said Coralee Oakes, MLA for Cariboo North. “In our region, the forestry industry, paper production and wood product manufacturing have been important providers of jobs and revenue for residents.”

This partnership is funded through the Sector Labour Market Partnerships program under the Canada-British Columbia Labour Market Development Agreement.

“The manufacturing sector is a key area of focus in our BC Jobs Plan and an important contributor to our province’s diverse, strong and growing economy. With the almost one million job openings projected by 2025, we want to ensure that manufacturers in B.C can meet the growing labour market demand,” added Shirley Bond, minister of jobs, tourism and skills training and responsible for labour and MLA for Prince George-Valemont.

People…

• Allen Kirkpatrick is the new executive director of the Canadian Corrugated and Containerboard Association (CCCA).

• Forest Stewardship Council (FSC) Canada has added representatives of the Haida Nation, Ontario Nature, Alberta-Pacific Forest Industries (Elston Dzus) and Unifor (Renaud Gagné) to its board of directors.

• Bob Wilson has been promoted to service manager for Indeck, while Mark Jennings moves over to focus on training and development of service technicians.

• Roger Gaudreault, formerly of Cascades, is the winner of the 2016 Canadian Green Chemistry and Engineering Award.

Papier Masson moving into wood fibre composites market

The Canadian and Quebec governments are providing $12.5 million to White Birch Paper’s Papier Masson mill to help introduce a new process to produce wood fibre for the production of wood-plastic composites. The process is the first of its kind in North America, they say.

The investment will help the Masson-Angers (Gatineau) mill produce 40 tonnes per day of densified wood fibre while reducing its energy consumption by 15 per cent. This fibre, notes Papier Masson, will replace non-renewable polymers to make wood-plastic composites for diverse products such as interior car door panels.

More than 110 local jobs will be secured as a result of the project, and new positions within mill operations will be created.

“This project is an important strategic investment that will help strengthen employment at Papier Masson, bringing positive benefits to the surrounding community,” said Stéphane Deshaies, general manager of Papier Masson WB L.P.

The Feds are providing $10 million while the Quebec government is providing $2.5 million for this project. Funding is provided through Natural Resources Canada’s Investments in Forest Industry Transformation program and Quebec’s Ministry of Forests, Wildlife and Parks.

“The new fibre that can be extracted by this process will significantly enable the company to replace fibreglass and polymers in various applications. This project will have positive impacts on the regional forestry stream, through the greater use of wood chips, as well as on the fight against climate change by replacing fossil products with products made

from renewable resources,” commented Luc Blanchette, Quebec minister of forests, wildlife and parks.

The mill currently produces approximately 240,000 tonnes of newsprint annually on its 8.4-meter-wide paper machine, and has what is described as the largest single-line thermomechanical pulping process in the world.

Twin Rivers buys specialty paper machines

Twin Rivers Paper Co. will acquire the paper manufacturing assets of the Burrows Paper Corp., which includes four specialty paper machines, located at Burrows’ facilities in New York and Mississippi.

“Twin Rivers is a nimble, high quality, integrated forest products company and we are very pleased to acquire Burrows’ paper assets and welcome its skilled associates,” said Twin Rivers CEO Bob Snyder.

The transaction will expand Twin Rivers’ geographic footprint and product offerings while strengthening its ability to serve an array of customers in the lightweight publishing, packaging, label and other technical specialty sectors.

Twin Rivers operates a paper mill in Madawaska, Maine, and a pulp mill in Edmundston, N.B.

Canadian mills have lower fibre costs than U.S.

North American wood fibre prices have trended downward for most of 2015 and 2016 with prices in the third quarter of 2016 being at their lowest levels in more than two years, according to the North American Wood Fiber Review (NAWFR).

Wood fiber costs for pulp mills in Canada and the U.S. have fallen over

the past year as a result of higher availability of residual chips from the continent’s sawmills, NAWFR reports. The biggest price declines have been in the U.S. Northwest and Northeast regions where prices have fallen between 10-15 per cent from the 3Q/15 to the 3Q/16, but prices have also fallen quite dramatically throughout Canada.

The lowest cost regions for chips are the U.S. South, British Columbia, Alberta and Quebec.

Canadian wood fiber prices, in U.S. dollar terms, have come down substantially from their record highs in 2012. Pulp mills throughout Canada have become much more competitive over the past few years and have gone from having the highest wood fibre costs in North America five years ago to currently having the lowest costs on the continent.

Kruger reduces emissions at Wayagamack mill

A new electrostatic precipitator at Kruger’s Wayagamack mill Trois-Rivières, Que., has already cut the biomass boiler’s particulate matter emissions by 85 per cent. The new equipment was installed in June at a cost of $4.5 million.

Kruger recently shared the air emissions measurement results for its Wayagamack mill, covering the period since commissioning of the new electrostatic precipitator.

This improvement is consistent with the results achieved with a previous electrostatic precipitator installed on the mill’s recovery boiler’s flue gas scrubbing system. That project had been completed in 2012 at a cost of $3.5 million.

Overall, the combined effect of both precipitators has resulted in a 75 per cent drop in the Wayagamack mill’s particulate emissions.

Since 2012, Kruger has invested approximately $10 million in its two paper mills in Trois-Rivières to make technological improvements that help the environment.

“Kruger continually invests in its facilities to lessen the impact of its operations on the environment, while ensuring the sustainability of its plants and therefore preserving quality jobs in the region,” said François D’Amours, senior vice-president and COO, Kruger Publication Papers Inc.

Both mills say they have significantly reduced their fossil fuel consumption by prioritizing the use of energy from renewable resources, which has led to a marked decrease in their GHG emissions, so much so that the mill on Gene H. Kruger Boulevard is no longer considered a major greenhouse gas (GHG) emitter.

According to Kruger, from 2008 to 2013, the combined GHG emissions from the Trois-Rivières and Wayagamack mills fell from 182,271 tonnes to 58,478 tonnes, which is the equivalent of taking some 26,000 cars off the road annually.

FPInnovations extends reach to U.S. mills

FPInnovations’ near-neutral brightening (NNB) technology will be introduced to the forest products industry in Alabama, and over time, to the broader U.S. Southeast, through a partnership with Auburn University.

The five-year agreement initially aims to bring NNB technology to member mills of Auburn University’s Alabama Center for Paper and Bioresource Engineering, while facilitating the transfer of FPInnovations’ technical services to Alabama and neighbouring states.

Al-Pac

will increase collaboration on cellulose nanocrystal development

Hokuetsu

Kishu Paper (HKP) says it is preparing to increase its collaboration with InnoTech Alberta and Alberta Innovates to further the development of cellulose nanocrystals (CNC), a green nanomaterial that can be a byproduct of the kraft pulping process. HKP subsidiary, Alberta-Pacific Forest Industries (Al-Pac), and InnoTech Alberta will expand their development efforts to scale up the technology and work with other partners to develop new markets for CNC.

The 100 kg/week CNC pilot plant located at InnoTech Alberta in Edmonton was commissioned in 2013 and since that time, “significant” progress has been made to refine technical processes, economic efficiencies, and approaches to develop new markets.

CNC is made by treating cellulose pulp fibres to isolate the crystalline portion of the fibre. The parties say CNC has demonstrated promise for a variety of applications, including modifying rheology in industrial fluids such as chemicals and coatings, increasing abrasion resistance, in electronics and energy storage devices, and as a composite material to improve the performance of packaging materials.

“We are very pleased with the efforts of InnoTech Alberta and the support we have received from the Government of Alberta to date,” said Sekio Kishimoto, president and CEO of HKP, who met with Deron Bilous, the minister of economic development and trade, who visited Japan on a trade mission. “We believe in the development of sustainable green products to meet growing consumer demand and believe CNC has the potential to create new and enhanced markets for HKP.”

“Alberta recognizes the importance of our forest industry and in helping that sector make transformative investments into new and non-traditional markets and products. We are very happy to be partnered with HKP and Al-Pac in the development of CNC, and the strong leadership they are showing in diversifying the forest sector,” added Bilous.

The CNC pilot plant at Alberta Innovates.

Domtar mill receives awards for sustainable forest management

Domtar’s Windsor, Que., mill picked up two accolades last fall for sustainable forest management.

Domtar received the large enterprise and institution award at the Fondation Estrienne en Environnement gala for its efforts to reduce its ecological footprint, and a Gold Award at a Quebec Quality Movement trade show celebrating best business practices.

The awards recognize 10 years of Forest Stewardship Council (FSC) certification for the Domtar forestlands in the region and the company’s innovation and engagement in sustainable forest management.

“Both awards recognize the cooperative work and the impact of the forest in the circular economy,” said André Gravel, fiber manager at the mill. “There is much more to the forest than wood, and the certification aims at a balance between the environment, social responsibility and the economy. Domtar is active in all stages, that is to say from the tree to the sheet of paper. Domtar drives, on a daily basis, the mobilization of Windsor employees and that of about 1,000 entrepreneurs, small-business owners and forest workers towards the same common objective: sustainable management of a renewable resource.”

Catalyst Paper arranges recapitalization plan

Catalyst Paper has entered into a support agreement with a majority of its security holders regarding an alternative recapitalization plan.

“The agreement with our principal noteholders confirms the support for a transaction that will improve the financial position of Catalyst,” said Joe Nemeth, president and CEO of Catalyst.

The implementation of the alternative recapitalization plan would not affect any of Catalyst’s contractual relationships with its trade vendors or any amounts owing to them. The company intends to continue to operate its business and satisfy its obligations to its service providers, suppliers, contractors and employees as it pursues the alternative recapitalization plan, it says.

A statement from Catalyst says the papermaker is still open to reaching agreement with a purchaser, such as Kejriwal Group International (KGI), who can contribute funds to enhance the continuing operations of Catalyst, or to restructure its capital in order to be able to move forward with enhanced liquidity.

Catalyst and its prospective purchaser KGI did not enter into a definitive agreement regarding the sale of the company prior to a deadline in October, but discussions are continuing regarding the KGI acquisition proposal.

Revised CSA forest standard available

The revision of the CAN/CSA Z809-16 Sustainable Forest Management standard is now complete and the standard has once again been accepted as a National Standard by the Standards Council of Canada.

“This is great news,” said John Dunford, chair of PEFC Canada. “Forest companies in Canada are excited to begin their transition to the revised standard, one that sees a new Criterion for Aboriginal Relations and one that retains the demanding requirements of public participation in developing and maintaining performance measures for sustainable forest management.”

Organizations certified to CSA Z809-08 will have two years to become certified to Z809-16.

PEFC Canada represents organizations in Canada that have certified their forestry operations to the PEFC-endorsed CSA forest management standards, as well as those certified to the PEFC International Chain of Custody Standard.

Irving mill charged with dumping into St. John River

Irving Pulp and Paper Ltd. has been charged with 15 counts of illegal dumping into the St. John River, The Canadian Press reports.

According to the news service, an Environment Canada spokesman says Irving has been charged under federal Fisheries Act provisions on the deposit of harmful substances into fish-bearing water.

The CBC is reporting the minimum penalty would be $3 million if Irving is found guilty of all 15 charges.

Irving spokeswoman Mary Keith says the charges “relate to issues that were self-reported” by the company.

Little things make a big difference.

By simply inserting one of our high-density, molded wood plugs into each roll of paper, companies can reduce damage and loss claims for just pennies per roll.

4" CENTER HOLE PLUG

• Competitively priced

• Easy-out design

• Consistently sized

• Smooth, dust- and flake-free surface

• Made of 100% recycled wood

• Built strong: 5,000lb crush strength

• No lead time, same day shipping

(603) 654-2311

Swedish delegation explores Canada’s innovation model

A delegation of Swedish executives and scientists visited Canada in September, seeking more information on the successful Canadian innovation model for the forest products industry.

The visitors were all involved with a project called Innovation in the Forest Sector, under the guidance of the Swedish Royal Academy of Engineering Sciences (IVA).

David McDonald, the Canadian facilitator for the visit, said the trip is a credit to the accomplishments of the Canadian industry over the past decade. The delegates came seeking information about the strategies the Canadian industry has employed, and the alignment of different organizations within Canada to tackle challenges in the forest sector.

The delegation consisted of several executives from companies related to the forest sector. These were Ingrid Bodin, executive vice-president, Preem AB; Olof Persson, former CEO and president at AB Volvo (now chairman of the Innovation project); and Peter Wågström, president and CEO of the NCC Group, one of the largest construction and property development groups in Northern Europe.

Representing the Royal Swedish Academy of Engineering Sciences were Elin Vinger Elliott, Staffan Eriksson and Hampus Lindh. Carina Håkansson, director general of the Swedish Forest Industries Federation, was also among the visitors, as was Mats Johnson, project leader for the IVA’s forest industry project. Lennart Rådström, former research director at the Forestry Research Institute of Sweden, also joined the group.

The delegation attended meetings in Toronto, Montreal and Ottawa with various representatives of the Canadian industry,

government and academia.

One speaker was Jim Farrell, a former assistant deputy minister with the federal government, who explained the consolidation around Canada’s innovation strategy was industry-led and member-driven. Governments were key partners, and a collaborative research model with proprietary benefits was chosen.

McDonald described how white papers and meetings with stakeholders led to the 2007 creation of FPInnovations. Another piece of the strategy was to align universities, which culminated in the formation of FIBRE, with federal funding assistance. “Then came funding programs to help industry reduce the risk of investing in new technology. The industry on its own would never have been able to [achieve transformation],” he said. PPC

OPINION

The new challenges of the pulp and paper industry

Submitted by FPInnovations

Since the early 2000s, the pulp and paper industry has gone through very hard times with the drastic reduction in demand for paper, mostly in the newsprint and printing and writing grades. This new reality has led many mills to shift their operations toward innovative products with greater market potential, such as tissue, cardboard and biomaterials. In addition, as the skilled workforce ages and begins to retire, the industry is now facing another challenge: recruiting and maintaining the future generations of qualified professionals.

To help its member mills better position themselves in this time of rapid change, FPInnovations provides the industry with supporting tools. For example, the organization recently

offered an enhanced version of its pulp and paper course, which this year included a bioproducts component. The event offered numerous presentations and interactive demonstrations in fields as diverse as wood chemistry, paper properties, papermaking and pulping. And as the industry is evolving, new emerging applications of pulp and paper products and sub-products, such as cellulose filaments and lignin, are now included in the course as they create job opportunities in fields as unexpected as plastics, fuel, automobile components, and food additives.

Technology transfer and knowledge performance activities performed in close collaboration with member companies can help employees improve their skills

in day-to-day operations. Whether this is achieved through training sessions with mill employees or head officers, or as part of technology transfer projects (such as TX projects) with FPInnovations members, the knowledge acquired during the course of these projects are used to further develop the employee’s expertise.

FPInnovations continues its work toward helping the industry face new realities in the marketplace, and to develop strategies to be better equipped for upcoming challenges. As the future of a viable forest industry and its transformation lies in sustainable innovations, the pulp, paper, and bioproducts industry will need to turn to new job specializations to ensure product diversification and to stay on the leading edge. PPC

Committee members from Sweden’s Innovation in the Forest Sector project visited Canada in September.

Photo: Swedish delegates

Kruger’s BOLD NEW DIRECTION

Quebec firm is on track to start production of lightweight linerboard on time and on budget at its Trois-Rivières mill

By Cindy Macdonald

The rebuild of the No. 10 Paper Machine (PM10) at Kruger’s Trois-Rivières mill is proceeding on time and on budget, executives said during a press briefing in early November.

Once the project is completed in May 2017, the mill will start manufacturing 100 per cent recycled light weight and high strength linerboard, a product line that is in increasing demand in North America and around the world.

Some 200 workers are currently completing the pulp mill, which will supply the new production line with recycled fibre, while the company makes the most of each maintenance shutdown on PM10 to work on the paper machine, which continues to produce newsprint for now.

During the project’s final phase, from February 26 to May 7, PM10 will cease newsprint production and more than 350 workers will work in rotating shifts for 20 hours a day to complete the rebuild.

“We are very satisfied with the progress of work. Not only is the project on time and on budget, but it also boasts a very positive health and safety record, which is a testimony to the know-how and professionalism of everyone involved: employees, suppliers and partners alike,” said Daniel Archambault, executive vicepresident, Kruger.

Unique ultra-light product

Kruger has invested $250 million in the project to ensure optimal results; PM10 will be completely rebuilt and as efficient as a new machine, the company says. Well before work got under way, Kruger’s engineers toured numerous manufacturing plants in North America and Europe to find the best technology for manufacturing 100 per cent recycled lightweight and high-strength linerboard of the best possible quality.

Suppliers for the PM10 conversion include Valmet, Kadant and ABB.

The new linerboard grades to be manufactured at the Trois-Rivières mill will meet increasing demand for ultra-light packaging without compromising strength, performance or the environmental footprint. They will be sold under the brand name XTR.

Canadians taking the lead

Speaking at a meeting of AICC last fall, Serge Desgagnes of Kruger outlined a change of mentality in the packaging industry, a shift toward lighter weight, high performance board. In Europe, he said, about 30 new machines have been installed since 2000. North American companies did not follow that trend, but now Canadians “are in the game.”

He noted that three of the last five board machines bought or rebuilt in North America are owned by Canadian companies. And, he made the assertion that, in Canada, the newer machines were all the work of visionary entrepreneurs, bearing the family names Kruger, Lemaire (Cascades’ Greenpac mill) and Granovsky (Atlantic Packaging’s machine conversion at Whitby, Ont.).

Newer board machines are designed to build compressive strength, said Desgagnes. “That’s what converters are looking for. Weight means nothing anymore — you want your box to perform.”

He said that because the OCC furnish in North America is of good quality, “the combination of European technology with our OCC is a big win.”

Speaking of machine design, Desgagnes said a dilution headbox will maximize fibre “squareness,” a shoe press is needed for density, and a size press will give the papermaker up to 35 per cent more strength — “you have to have it.” Newer dryers aid with dimensional stability, and calenders are necessary for printing characteristics.

PM10’s annual production will total 360,000 metric tonnes of XTR linerboard, which Kruger describes as an exclusive product that it will be the first to manufacture in North America. A portion of the production will be used by Kruger’s packaging plants in LaSalle, Que., and Brampton, Ont., while the remainder will be sold to packaging manufacturers across Canada and the United States.

The new PM10 at TroisRivières will have all of these key elements, he said. It will be able to produce grades from 18 to 35 lb., he said, adding that very little 18 lb. board is now available in North America.

Adding capacity for linerboard at Trois- Rivières will give Kruger Packaging four production sites — the two packaging plants at LaSalle and Brampton, plus a containerboard mill in Montreal.

Kruger Packaging L.P. was created in partnership with Kruger and Investissement Québec, which has a 25 per cent take in its assets. PPC

Kruger’s Serge Desgagnes

TISSUE TAKES

As one of the few segments of the paper industry forecast to grow, the tissue segment is attracting investment from many Canadian producers

By Martin Fairbank, ph.d.

Canadian paper producers are very active in the tissue sector right now, investing capital and marketing efforts to expand their share of the tissue and towel market.

Tissue is a paper product that cannot easily be substituted and therefore has proven to be a good long-term investment with a stable market. According to Fisher International, the annual growth rate in the North American tissue and towel sector since 2007 has been an average of one per cent, which tracks with population growth, so the per capita consumption has not changed. By contrast, the global consumption over the same period has risen at an annual rate of 5.4 per cent, driven by increased prosperity in the developing world, especially China.

New technology opens up the market

Tissue is generally manufactured at three quality levels: premium, economy and away-from-home (AFH), although there’s a new wrinkle in this. The highest quality tissue is produced by a process known as through-air-drying or TAD. This results in very high bulk, absorption and softness. TAD was first developed in the 1960s and resulted in a number of patents by three main players in the business: Proctor & Gamble, KimberlyClark and Georgia-Pacific. These companies capitalized on TAD technology to dominate the premium market, building many new machines over the next three decades, until the patents began to expire in the late 1990s.

As explained by industry analyst Paul C. Quinn at RBC Dominion Securities,

with the expiry of these patents, the installation of TAD technology by companies, such as Kruger Products, First Quality and Clearwater, in recent years has allowed them to compete better in the private label market, by offering all levels of tissue quality to retailers to increase their market share.

A recent advance in tissue-making technology has allowed quality close to TAD products at a significant energy savings. Several machines with Voith’s ATMOS and Valmet’s NTT technologies have been built in the last five years. North America’s first ATMOS tissue machine was installed in 2011 by Cascades on its PM2 at the Candiac, Que., mill. The world’s first NTT machine started up in Mexico in 2013 and the first in the U.S. started up in Natchez, Miss., in October 2016.

OFF

The emergence of these two technologies has resulted in a quality distinction between TAD-produced tissue, now often designated as “ultra-premium,” and tissue produced by these new technologies, which is just “premium.”

One reason Cascades invested in ATMOS technology in Candiac is to produce superior quality tissue paper with a majority of recycled fibres, since it is more difficult to produce bulk and absorbency with recycled content.

Among Canadian players in the tissue market are Kruger, who holds a leading position, Cascades and Irving. Another Montreal, Que.-based company, Resolute, has entered the market in the last year, but only in the U.S. to date.

Irving adds Valmet TAD machine

Irving Consumer Products recently announced the company is increasing its

capacity for household paper products by installing a new TAD tissue machine from Valmet.

“The purchase of a new TAD machine will help Irving Consumer Products continue to grow and deliver quality household paper products to our customers,” said Robert K. Irving, president of Irving Consumer Products.

Anders Björn, Valmet’s vice-president, tissue mills, commented: “This new Advantage Thru Air Drying machine will deliver ultra premium household paper products for Irving customers. It will produce very high softness and bulk for bath while delivering ultra premium performance strength and absorbency for towel.”

The delivery date will be in 2018.

Irving Consumer Products produces premium store brand paper products for many of North America’s top retailers, and produces the Scotties, Majesta and Royale brands.

Kruger adds capacity in Quebec Kruger Products (KP) is the tissue branch of Kruger Inc. It has three mills manufacturing tissue paper in Quebec (Crabtree, Gatineau and Sherbrooke), one in New Westminster, B.C., and one in Memphis, Tenn. The Memphis facility includes a modern TAD machine that started up in 2013.

KP’s Canadian capacity represents 37 per cent of total Canadian tissue manufacturing capacity. According to Steven Sage, vice-president of sustainability and inno-

Although North American growth is only forecast at one per cent, consolidation and modernization of assets make the tissue segment a very active portion of the Canadian paper industry.

vation, KP’s current strategy is to retain its leadership position in the Canadian tissue market while continuing to expand its U.S. business, in both the consumer and commercial segments.

KP’s major project in 2016 is a $55-million project to install an additional tissue machine for the AFH market in Crabtree. The machine was acquired from the bankrupt Lincoln Paper and Tissue earlier in 2016, and has been dismantled and moved out of Lincoln’s site. The building at Crabtree to house the machine is set to be completed early January 2017, with the machine scheduled to start up August 2017. This will result in a capacity increase of 20,000 tonnes at Crabtree.

KP also acquired Metro Paper’s Canadian tissue converting assets, located in Trenton, Ont., and Scarborough, Ont., in

One of Resolute’s new converting lines at Calhoun, Tenn.

North American tissue and towel market by type (FMT = finished metric tonnes).

mid-2014. Parent rolls are shipped from KP’s tissue mills in Quebec to supply these converting facilities, which serve the AFH market, allowing them to produce products near the majority of Canada’s population centres.

Resolute joins the market

Resolute Forest Products has been involved in market pulp, newsprint, specialty publication papers and lumber for many years. The company’s acquisition of Florida-based Atlas Paper Holdings in November 2015 follows a strategy of diversification away from shrinking publication paper markets. Atlas manufactures tissue products at two facilities for the AFH and private-label consumer markets, offering both virgin and recycled products in a range of grades at 57,000 tonnes of capacity. But the investment hasn’t yet produced the positive results Resolute expected; integration is taking some time.

Seth Kursman, vice-president of communications, sustainability and government affairs for Resolute, said the consolidation of the Atlas assets in progress. “We are making progress with various ongoing initiatives. Our target is $8 to $12 million in annualized EBITDA in 2017.”

Resolute’s second investment in tissue is a $270-million state-of-the-art facility in Calhoun, Tenn., to manufacture premium private-label tissue, including bath and towel, aimed at the growing retail market. The investment will include a tissue machine and three converting lines, with a total capacity of 60,000 tonnes. The machine will use Valmet’s NTT tissue production technology, and is expected to start up by the end of the first quarter of 2017. All of the converting lines should be fully operational by the end of 2016. The overall project remains on time and on budget, according to Kursman.

Oregon, as well as in the southern U.S.

In late 2014, Cascades started up a second tissue machine at its St. Helens,

Tissue basics

The principal products in the tissue market are facial and bathroom tissue, napkins and paper towels. The market can be divided into consumer (or “at-home”) and commercial (“away-from-home” or AFH).

Production of tissue requires the manufacture of the paper plus conversion and packaging. Since tissue paper is very bulky, the cost of shipping tends to limit the distance between the paper manufacturing sites and conversion facilities to about an 800 km radius, according to industry analyst Paul C. Quinn at RBC Dominion Securities.

higher quality products. One example is its 2014 investment to build a converting plant in Wagram, N.C. Another is its investment to upgrade the Candiac, Que., converting facilities in 2015 to produce high quality hand towels on equipment well-matched to the site’s 136-in. machine trim rather than selling 102-in. parent rolls, which results in poor trim efficiency.

Although North American growth is only forecast at one per cent, consolidation and modernization of assets make the tissue segment a very active portion of the Canadian paper industry. PPC

Value built in paper

Kemira’s roots are in the pulp and paper industry and we are here to stay. Working closely together with customers, we continue to invest in R&D to create value through improved process efficiency, productivity and end-product quality. Our leading portfolio and best-in-class application expertise covers the whole process from pulping to coating.

Let’s work together to build value into paper.

www.kemira.com

Attracting the NEXT GENERATION

The importance of connecting with your future pulp and paper workers

By Alyssa Dalton

The impending skills gap is not a new topic of discussion. Along with proactive succession planning and mentorship between experienced and junior workers is one way to promote knowledge transfer at pulp and paper mills, recruitment — hiring a whole lot of young people — is a significant piece to the puzzle. The industry’s current employment demographics and technological evolution means we must move quickly to attract and adopt the next generation of workers, but how and where can we find new talent to ensure the industry stays fresh, innovative and competitive?

Connecting employers with potential employees

The Forest Products Association of Canada (FPAC) says forest products companies in Canada recruited 8,000 workers between 2010 to 2012, primarily to replace retiring baby boomers. In an effort to shine a light on the industry, in February 2012, FPAC — with funding from the federal government — launched The Greenest Workforce website (thegreenestworkforce.ca) to help bring more information about the sector to Canadians. While it was successful in providing information on the different types of jobs the sector employs and the reasons to pursue a forest products career, what it was missing was a job board, says Bob Larocque, vice-president of human resources at FPAC. So in June 2016, the Job Match Tool and online labour market information (LMI) were added.

All employers in the Canadian forest products sector can post jobs, use the tool to identify candidates, and access trends

and other data to help guide company HR strategies — all for free. Meanwhile, those looking for work gain one-stop access to job openings and can post resumes and search for jobs across the country. The website also features a map of Canada that lets job seekers see how many and what types of jobs are available today, and tailor the job openings to specific provinces and regions.

Larocque says the Job Match Tool has been “very well-received,” garnering a total of 60,000 site visits and about 800 job applications since its introduction. He estimates that 50 per cent of the sector is on the site, and says FPAC is working everyday to get the rest of the industry involved.

“The fact that it’s only for the forest products sector is a very neat, innovative idea,” says Larocque. “There are lots of

different job banks in Canada but the forest products sector jobs are getting buried. With [so many] jobs getting posted daily on large [international websites], an employer could post a job today and by tomorrow, it’ll be on page 8.”

The need to hire new workers is widespread across the country, he says — no one province is unique in feeling the pressure. “There are more jobs in the bigger provinces, such as Quebec and British Columbia — because they have more mills — but everyone is looking [to hire]. In my mind, it’s based on how many mills are in the province. It’s just relative to the size of the sector in the province.”

The LMI is searchable at the national, provincial and regional levels, as well as by occupation, and lets visitors see what types of jobs the industry will need in the next year or two, or even the next three

Al-Pac offers a range of recruiting programs in an effort to attract young workers, including apprenticeship, co-op and summer placement opportunities.

Photo:

to five years.

From his perspective, the area that is the hardest to recruit for is the skilled trades, thanks to two main reasons: a knowledge gap and mobility concerns.

“[It’s very common] that someone who is in an apprenticeship or is already working in the skilled trades to not realize that we hire electricians, millwrights and pipefitters in our mills. A lot of people view the forest sector as just forestry and they are unaware that we also hire a lot of other skilled trade professions. I think there are now 55 different careers in the forest products sector [on the website] and the fact that people today still don’t know how many different jobs we hire in this industry is a big surprise to me,” says Larocque. “A second reason is that these jobs are typically in rural areas, so someone doing an apprenticeship at school will likely have to go and finish their studies in a mill, and it’s not going to be in a place like Vancouver, Calgary or Edmonton.”

But potential mill employees aren’t the only visitors targeted on The Greenest Workforce — the website also contains relocation and employment information for spouses and other family members who may also be moving.

As well, the Cost Comparison Tool allows job seekers to calculate how much time and money they could be saving by moving from a major city to a smaller community where a mill is located.

A change in the industry

Pulp and paper’s transformation to biobased products, including cellulose filaments (CF) and cellulose nanocrystals (CNC), is another factor that will change how the industry will attract and hire new talent, he says.

CF is expected to have an immediate impact on Canada’s forest industry due to their capacity to be integrated into other materials and high strength, light weight and flexibility. They can be used as a lightweight strengthening additive to produce lower cost commercial pulps, papers, packaging, tissues and towels.

Meanwhile, FPAC defines CNC as an emerging technology that is light, strong and bio-degradable, and but its “most interesting feature” is its iridescence, which the association says can make it possible to revolutionize many applica-

tions including optical films for use in specialty packaging or even to prevent counterfeiting.

“We haven’t quite felt [the effects] yet but we know [they’re] coming,” says Larocque. “This will require some different skillsets. We’re still going to need skilled trades but we are going to need people who understand that type of product. We are just building those mills now but what happens when instead of one biocrude facility, we have five? And instead of one CF plant, we have 10? As the sector transforms, we [need] to make sure we are ready for the change in regard to the skills aspect.”

Recruiting young people through targeted programs

Alberta-Pacific Forest Industries (Al-Pac) offers a variety of different programs specifically directed to hire young workers: the Registered Apprenticeship Program (RAP), a summer student program for children of team members, and a co-op program.

Since 2002, the mill has offered the RAP program to provide an apprenticeship placement for four grade 11 and 12 students for a semester, resulting in a total of eight student apprentices a year for various roles: electrician, millwright, machinist, welder, steamfitter/pipefitter, and heavy equipment technician.

“The program gives younger students a feel for what the trades look like and what they’re able to do, so if that’s where they want their path to go, by the time they graduate high school, they’ve already got that background in place before they even get started,” says Stephanie MacKeen, recruitment coordinator at Al-Pac, adding that many students from the RAP program have been hired on once they completed their studies.

Another program targets the sons and daughters of Al-Pac team members. Typically bringing in 30 or more students — depending on the need of the given year — the program matches students with the department that best suits their education studies. For example, if an engineering student would get placed with the engineering department, while an accounting student would join the finance department.

Meanwhile, the co-op program hires students for a four-month contract in the summer.

The mill also manages paid and unpaid co-op programs with Portage College for power engineering students to help them obtain the required steam time hours.

“All these programs are successful because they are tried and true. The nice thing about them is that they cover off so many different areas of study,” says MacKeen. “Since we are located in a small, rural community, these are really vital programs. We want to see the youth remain in the community. I think by giving students chances to come on board and see while we are a pulp mill, we need everybody from IT to engineering to the trades. It offers a great accompaniment of different careers for students to learn about.”

A key to maintaining the success of these programs is through continuous and early promotion, especially for the summer-based ones, says MacKeen. “We attend different career fairs and trade shows to promote what we offer and invite students to come check us out,” she says. “Word of mouth is also a big piece. If we’re looking to do an apprenticeship for a particular trade, we advertise that and through true word-of-mouth, by the next day, we have tons of interest.

I think the opportunities are there, it’s a matter of students knowing how to get at them.”

A community affair

In conjunction with recruiting programs, Al-Pac regularly hosts Career Week, a dedicated week that brings together local high school students, teachers and members of the community to spend a full day at the facility. Guided site tours, business unit information booths, givea-ways and door prizes are all part of the fun at Career Week.

“It’s a really neat, hands-on experience for the [entire] community,” says MacKeen. “We have representatives from every [department] meet and greet the students and give them a synopsis of their job functions, so students can get an A to Z view of what we offer. The programs are so important, but it’s one thing to put them in place. You need the support from all teammates within a company to make them possible.

[There is] a real value to young people coming on — the youth are the future.” PPC

Specialty papers face COMMON CHALLENGES

Producers of specialty papers are being battered by market changes, and will need to be nimble and innovative to survive, said the experts at Specialty Papers US

By Cindy Macdonald

Think of yourselves as providers of specialty products for a changing world,” Graham Moore advised the papermakers at Specialty Papers US 2016. He provided big-picture view of global trends in society, politics and economics for the audience at the two-day conference in Chicago, Ill.

Moore is a strategic consultant with Smithers Pira, which, in concert with TAPPI, produced the Specialty Papers conference.

The specialty papers sector must continue to innovate, said Moore. In terms of social influences, manufacturers should consider the aging population and the “ubiquitous” consumer, who can check prices online at any time and treats the retail shop as a showroom. The implication, said Moore, is that consumers may start to question your pricing because they can compare with other providers, and can check your price inputs. “The retail cull has only just begun,” he predicted. “I think we’ll see more and more of people trying to make their voice heard.”

A paper company looking to go beyond its own borders should consider the following political influences, he said: the growth of conservative nationalism, Brexit, the closing of borders and the growth of trade barriers.

Moore also suggested that as people are growing bored with their smartphones, tablets and laptops, perhaps paper will become a premium product, a novel way of presenting information.

On the legislative front, Moore warned that the industry will see local enactment of global directives, especially on the environmental front. “Expect continued ‘hardening’ on the use of specific chemicals in

Perkowski notes some applications and market offer more potential than others.

certain paper products,” he noted. One example would be an expected ban on the use of BPA in thermal papers in Europe.

New players push into specialty markets

Reviewing global paper industry trends, Matt Elhardt of Fisher International, confirmed that tissue and towel is still a growing segment, as is the specialty paper sector, driven by demand from Asia. Demand for printing and writing grades is flat and newsprint is declining. Packaging grades are growing rapidly, he noted.

The growth of specialty paper grades in North America and Europe is grade dependent, said Elhardt, with some increases in release papers and hygiene applications.

The question Elhardt hears frequently is, “What other grades can we make on our existing assets?” These grade con -

versions are a threat to specialty papers because they could increase supply, he said. There are now 1.7 million tonnes of specialty grades being made on printing and writing machines that were not making specialties 10 years ago.

Elhardt had a suggestion for specialty paper producers. Transportation costs are fairly low now, so there is an opportunity to find a niche offshore, he said. “Global trade is not only for the big commodities in pulp and paper.”

“Companies that are able to identify opportunity and are able to leverage it, will win,” he stated. He commented that most paper companies don’t do a very good job of turning market information into market intelligence. He is also of the opinion that this industry develops robust information management systems for the back end and for manufacturing, but not

Source: Frank Perkowski, Business Development Advisory

for sales and market information.

Elhardt believes the companies that are good at rapid opportunity identification and execution and use that skill to get ahead of their competitors will be the winning specialty paper companies. He said there is space in the market for higher value packaging and retail-ready packaging. He also suggested there will be a market opportunity for papers with a small carbon footprint.

Consolidation meets diversity

The changes in the specialty papers industry over the last five years have been very dramatic, said Frank Perkowski, president of Business Development Advisory. He noted that consolidation has streamlined the product offerings from most mills, and mills which produce commodity products are still showing a tendency to shift production to specialty products.

Changing product requirements “are being driven to a large degree by increased targeting and micro-marketing,” Perkowski said. The growth in customer SKUs is still shifting demand to digital print and smaller run sizes, he added. Integrated solutions and higher performing materials are increasingly required.

The macro trends that are driving change — sustainability, food and product safety, convenience and globalization — translate to a need for more and increasingly diverse products, said Perkowski. The implication for specialty paper producers is pressure for product and process develment. “This spells doom for mills that don’t have the capabilities to respond.”

Small but nimble

John Leness, president and chairman of the board for Southworth Company, spoke about the transformation of his 175-year-old, family-owned paper company. Southworth was a manufacturer of fine writing paper, focusing on cotton fibre paper. In the last 10 years, management realized this was a declining niche and wrestled with how to reposition the company.

In 2012, there was an opportunity to sell the branded writing paper business, and so Southworth did just that. Then it needed to find new business.

Leness noted it quickly became apparent that the culture of the business was very inward-looking. Employees were not accustomed to change, or to developing or adding new products, and they were not open to new ideas and there was little emphasis on quality, he said.

Southworth is now slowly redefining who it is, explained David Mika, chief financial officer. He said the company is exploring the capabilities of its “one little paper machine” in terms of colours, materials, number of product changes in one day. “We have found there are niches that we can play in.”

The company has been renamed Turners Falls Paper, and now mostly serves business-to-business markets, performing contract manufacturing, producing art boards, engineering drawings and papers with fibre inclusions.

“We can fill our mill with small jobs,” said Leness. “If we were a machine tool company, we’d be called a job shop.”

What’s new in paper technology?

On the technical side, Specialty Papers US presented information on innovations in fibres, fillers, coatings and strength agents.

Weiguo Cheng of Nalco Water noted with the degradation of the recycled fibre supply, strength becomes an issue. When using recycled material, if a paper producer doesn’t add fresh filler, the stock can still have five to 10 per cent filler content at the headbox.

Cheng explained the efficiency of conventional strength agents, such as cationic starches, decreases at higher ash content. So Nalco aimed to develop a new strength agent that would be efficient and effective, that would not be affected by high ash content and that would not affect charge balance.

The result is Nalco’s Metrix Titan technology, a program that delivers enhanced productivity, dewatering and strength development. Cheng said the new strength agent actually improves starch efficiency.

He cited one case study in which a manufacturer of release papers was able to increase production because of the improvement in press dewatering when using Metrix Titan. The producer also experienced a significant improvement in formation.

Representatives of West Fraser Forest Products presented at Specialty Papers US, encouraging the substitution of BCTMP pulp for kraft in certain applications. Jim Stymiest, manager of North American pulp sales for West Fraser, explained that a combination of kraft and BCTMP pulps lets a papermaker “dial in properties.” Kraft contributes strength and runnability, while BCTMP offers bulk, absorption and opacity, he said.

Text and cover papers

Premium writing papers

Insulation/cover papers

backing papers Food service papers

Premium cutsize Gift/retail/tissue wrap Electrical papers

Lightweight printing papers Treated paper bags Medical/hygienic papers

Wall cover base Food packaging papers Label facestock

Security papers Retail wrapping papers Release base

Art papers Filter base stock Thermal base

Abrasive/insulation papers Digital printing paper

Growth prospects/position of major specialty paper grades.

Stymiest also noted that BCTMP has lower thermal conductivity and lower thermal diffusivity than kraft pulp, and higher heat capacity, so there may be opportunities in cup stock and cold/frozen food containers.

An oft-repeated theme at Specialty Papers US heard was that papermakers must continue to innovate, must watch for opportunities brought about by changing markets or advances in technology, and must be able to react quickly. In other words, be smart and be nimble. PPC

FOCUS ON CHEMICALS

More effective refining with enzymes

Buckman’s Maximyze fibre modification enzyme products are unique and proprietary aqueous solutions containing enzymes. They catalyze specific reactions in various components of the fiber structure, allowing mechanical refining to have a greater effect.

The company’s specialists work onsite to conduct necessary process surveys to ensure appropriate process conditions (retention time, pH, temperature, etc.) exist for the successful application of the enzymes. Application equipment is very straightforward, generally consisting of a pump and metering equipment.

According to Buckman, cellulase treatment gives papermakers many opportunities to improve operations and/or reduce total cost of operation by reductions in applied energy at refining and rationalization of fiber source. The enzyme treat may also improve drainage, boost sheet strength or increase filler content.

Enzymes, the Buckman website explains, have specific actions, so they can be selected and used to do a particular task with minimal adverse side effects. They also create high reaction rates even in small amounts and are easy to control, which makes them very efficient. Buckman, buckman.com

Case study: more accurate dosing and smarter chemical management

A paper producer wanted Kemira to develop a cost-effective solution that provides continuous control, monitoring and data collection for the customer to better understand process trends and variables. At the same time, the solution also had to provide wastewater treatment stability to continuously optimize the process with regard to costs.

Environmental aspects also contributed to the challenges. Tighter restrictions for effluent discharge and the need to better manage the wastewater have led to more challenging operational conditions.

Kemira’s solution was KemConnect, a

smart process management solution that promises to improve the customer’s costefficiency and makes performance measurable. Kemira provided a portfolio of different chemistries as well as the KemConnect platform and various smart devices to capture and connect sensor-based data to optimize chemicals in the customer’s processes, boasting greater accuracy and precision.

Increased understanding of the customer’s process and good co-operation led to a very stable process, said the company, adding that the real-time process data helped to understand the incoming load from upstream and to react to the changes accordingly.

Through the smart process management solution, the customer achieved 45 per cent overall cost savings during five years and the wastewater process has been more stable via KemConnect, and said it was “very satisfied.

The data-driven environment and “accurate” dosing enabled Kemira to provide solutions to meet tighter restrictions for effluent discharge, said the company. Kemira, www.kemira.com

Precise viscosity measurement during pulping and bleaching Dynatrol viscosity systems boast fast, precise viscosity measurement using a unique vibratory principle to provide continuous measurement at online process conditions, “eliminating the need for sampling.” The CL10-DV viscosity meter and 3000 viscosity digital converter measure the viscosity during the pulping and bleaching processes. The meters can be used for various applications: alkaline waste black liquor, black liquor, black liquor sludge and black liquor interface; as well as pulp slurry additives, resins from tissue and paperboard making, terpene resin.

Automation Products Inc., www.DynatrolUSA.com

Biobond program allows starch to be recovered

Specialty chemicals producer Solenis has received patents in both the U.S. and Europe for its Biobond technology, an innovative program that improves sustainability and productivity for manufacturers of recycled paperboard.

Solenis says the Biobond program uses exclusive Solenis biocide and cationic polymer chemistries to increase yield, improve strength and eliminate the operational issues caused by degraded starch at the source. Additionally, Solenis says the Biobond program reduces freshwater/starch consumption and chemical oxygen demand (COD) levels in the effluent discharge, improving paper sustainability.

Solenis’ Biobond technology allows the high amounts of starch present in wastepaper furnish to be recovered and recycled along with the fiber. The company says this has always been a sizeable problem and continues to be a concern for the paperboard industry.

Solenis gives the example that within the global paper industry approximately 8 million tonnes of starch are lost each year as wastepaper is converted to new paper. The Biobond program helps ensure that the majority of starch is preserved, recycled and reused as a raw material.

In addition to improved environmental performance, Biobond enables paperboard manufacturers to run at higher capacities to maximize their paper production, according to Solenis. Solenis, Solenis.com/Biobond2

NIR technology can now measure Kappa number of kraft pulp FPInnovations, in partnership with FITNIR Analyzers Inc., has announced the successful commercialization of an innovative product using near infrared technology (NIR) to quickly and efficiently analyze the kappa number of kraft pulp.

The two organizations say this costeffective approach could save mills up to $150,000 in chemical costs.

The unique approach determines kappa number in less than four minutes and eliminates the need for all associated chemicals. The kappa analyzer also does not rely on other parameters for measurement (such as sample weight) thereby promising to reduce measurement error.

While NIR technology has been used in many industries, FPInnovations developed specialized expertise to apply this technology to the pulp and paper industry. Easy and quick kappa number measurement allows mills to monitor and control pulp production from the beginning of the process to the final product. Quicker adjustments improve mill efficiency, while reductions in chemical consumption lead to cost savings.

“This is a great example of how research and development leads to innovation and commercially viable products that benefit industry,” stated Pierre Lapointe, president and CEO of FPInnovations.

“We pride ourselves on listening to the needs of the market and responding appropriately,” said FITNIR Analyzers’ president, Tom Sands. “Mills were wanting another means for reducing variability and standardizing kappa measurements across sites and now we are able to offer FITNIR Kappa.”

NIR technology uses a broad spec-

trum of infrared light to illuminate a pulp sample. The resulting unique spectral frequencies are then recorded by the spectrometer and computer. A proprietary algorithm, developed by FPInnovations’ researchers and further fine-tuned by FITNIR, analyzes and determines the lignin content of the sample to ascertain the kappa number.

FITNIR Analyzers, www.fitnir.com

Resolute chooses Greycon trim optimization integrated with SAP Greycon and Resolute Forest Products are in the midst of a global rollout of Greycon’s X-Trim solution as the company’s standard trim optimization system. On July 4, Greycon successfully completed the second stage of a five-wave implementation at Resolute Forest Products.

“We are very happy with the progress so far of Resolute’s rollout campaign. Establishing a new system in a company can always be challenging, especially when you have multiple sites that need to be aligned. This is why we are so pleased with the X-Trim solution, it integrates seamlessly with SAP, showing Resolute a significant difference almost instantaneously,” said Jay Jordan, Greycon sales manager for North America.

Greycon’s X-Trim solution has been implemented at eight Resolute pulp and paper mills, and by September 2017, the campaign will be complete. In the end, 16 mills will have X-Trim integrated with Resolute’s SAP/APO (advanced planning and optimization) system.

According to Greycon, X-Trim has provided many benefits to Resolute since its implementation, including superior waste reduction. The system is also said to have an easy-to-use interface.

Greycon’s certified “Interface for Indus-

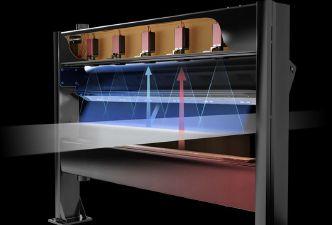

OCC system with no coarse screening: GL&V

An OCC system with no coarse screening has begun successful operation at a large paperboard and tissue mill in Ukraine.

Kyiv Cardboard and Paper Mill reports that the upgrades to its OCC system completed in cooperation with GL&V in August have achieved the 25 t/h design capacity and end product quality requirements. The system also minimizes power utilization.

According to the mill, the improvements to the screening and reject removal system equipment, and the controls update, provide almost fibre-free rejects and improved operational stability.

GL&V Pulp and Paper Group, www.glvpulppaper.com

try-Specific Optimizers” for APO allows Resolute quick configuration and deployment throughout each wave of the project.

Greycon is a provider of production planning, scheduling and manufacturing execution systems that have been designed specifically for roll-based and flat sheet industries.

Greycon, www.greycon.com

Voith offers new generation of paper machines

Voith says it has improved and refined its paper machines for all paper grades. According to the company, the machines from the new XcelLine offer fast and easy start-up, excellent value for money, pioneering technologies, ease of use and integrated solutions.

The company says the design presents decisive advantages for paper manufacturers — optimized individual components, combined with improved interfaces and process flows, resulting in a “significant” reduction in project and start-up times.

In recent months, successful start-ups of XcelLine paper machines have been achieved. One example is the installation of two packaging paper machines, Zoucheng PM 31 and PM 32, for Sun Paper. Voith reports that just a few hours after start-up, the PM 31 was producing several hundred tonnes of marketable paper. Since then, it has been running smoothly and stably at a high production level. One month later, PM 32 was also successfully commissioned.

An example of a successful XcelLine tissue machine is the Cheng Loong TM 16 in Taiwan. It is particularly energyefficient, as the Yankee dryer hood is heated with steam instead of gas, while the combination with the NipcoFlex T shoe press reduces running costs. With an operating speed of 2,001 m/min, the TM 16 is regarded as the world’s fastest tissue machine with steam-heated Yankee dryer hood.

Voith Paper, www.voith.com

Procemex invests in North American operations

A Finnish supplier of pulp and paper web monitoring and web inspection system solutions is investing strongly in its North American operations with the establishment of new company in the United States. Wesley Sweeny has been appointed vice-president of operations for the North Ameican business of Procemex Inc.

Sweeny will lead all aspects of Procemex’s businesses based in North America. He has previous experience in the web inspection, monitoring and machine vision market as the director of sales at Cognex.

Jim Haza continues to support Procemex’s North American customers as technical support and services manager.

Founded in 2000, Procemex is now a global designer and manufacturer of paper and pulp mill web monitoring and web inspection systems with smart camera solutions. Procemex, www.procemex.com

SKF Canada integrates Kaydon, Cooper brands

SKF Canada has taken on sales and technical support responsibility for Kaydon and Cooper bearing brands.

Kaydon and Cooper bearing operations were acquired by SKF Group in 2013. Until now, the sales in the Canadian market had been managed by the master distributor Cooper-Grainger Canada Inc./Technical Bearing Sales Ltd.

The Kaydon brand provides problem-solving, application-specific custom and standard thin section ball bearings and slewing ring bearings.

The Cooper niche brand, focusing on split to the shaft bearings, is uniquely suited to a variety of applications and industries where standard bearing product ranges may not be suitable. SKF Canada, www.skf.com

NA mills embrace Valmet’s automated testing

Valmet has recently received nine orders for its automated paper testing laboratory from paper mills around the world. Three of the Valmet Paper Lab units will be delivered to North America, four to Europe and two to Asia. The deliveries took place in 2016.

“Valmet Paper Lab provides papermakers with tools to manage quality and optimize the papermaking process. In addition to laboratories, today paper testing is increasingly carried out by operators, right next to the production line. By receiving rapid, reliable test results, operators are able to quickly make necessary adjustments and get back to running paper production on-spec. This is directly linked to optimal raw material and energy utilization as well as minimized environmental impact,” said Jukka Nokelainen, business manager, Valmet Paper Analyzers.

“An increasing number of papermakers have been convinced of the ability of the Valmet Paper Lab to match their needs and requirements in today’s paper making. Our solution gives papermakers freedom to move — from the lab right out next to the line — to give them the instant interactivity and real-time communications they need for faster results,” Nokelainen added.

Valmet says the unit is easy to use, all the way from sample cutting, measurements through to getting the analyses.

To present the system in action and enable paper and board makers test its performance in their own mills, Valmet has a trial lab unit available for test use.