Diversification, flexibility, and good planning have helped Verboom Grinders succeed in the biomass business. But as the sector grows and more players join the ranks, communication and benchmarking will be essential.

A contrarian’s view of biomass fibre availability in BC and the mad rush to commit it comes from a new fibre modelling tool that looks 10 to 20 years out and asks the basic question – Is there enough fibre in the pipeline for all the projects being discussed?

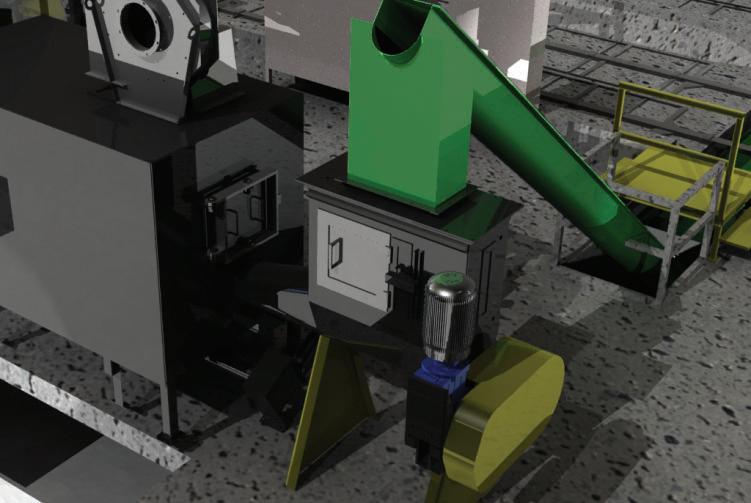

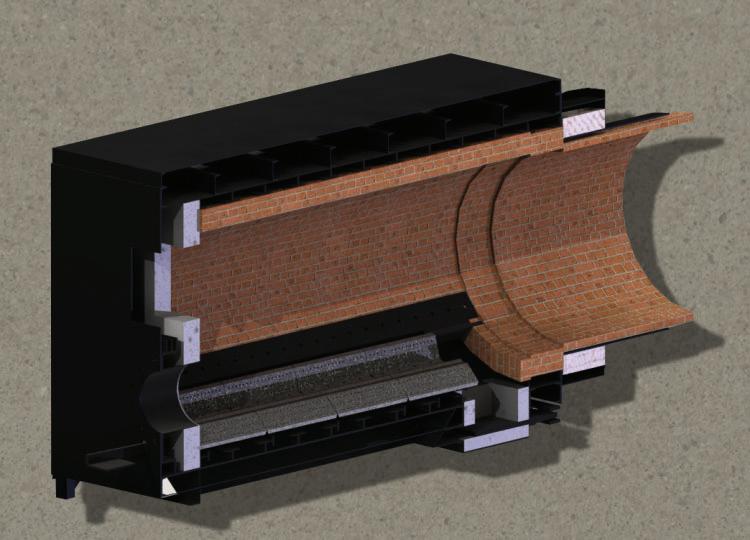

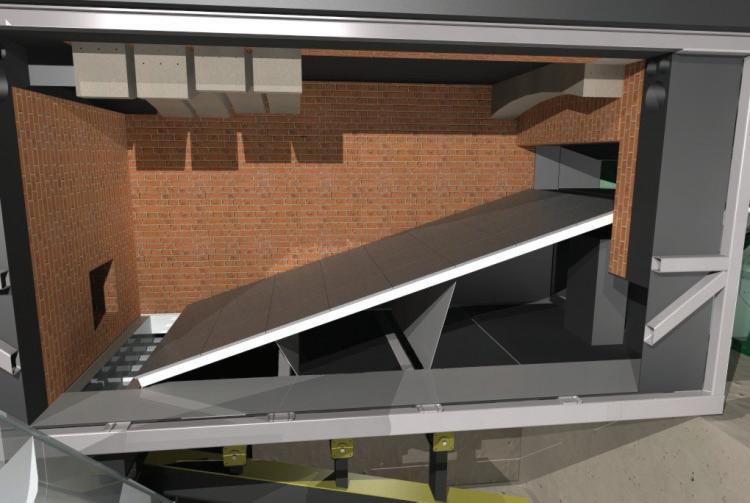

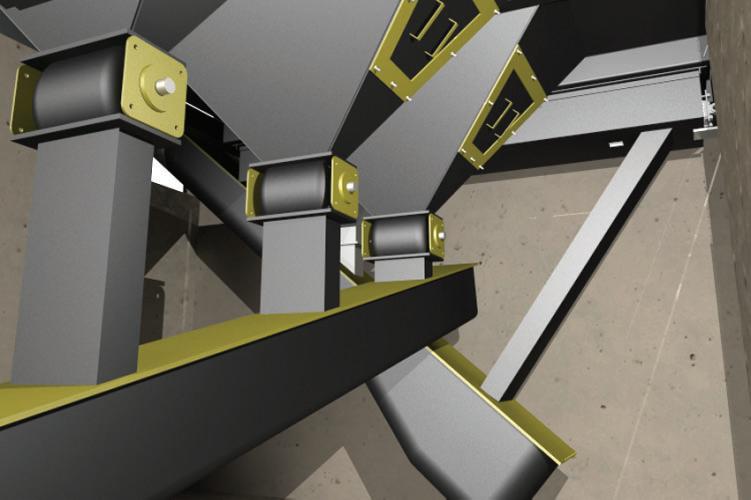

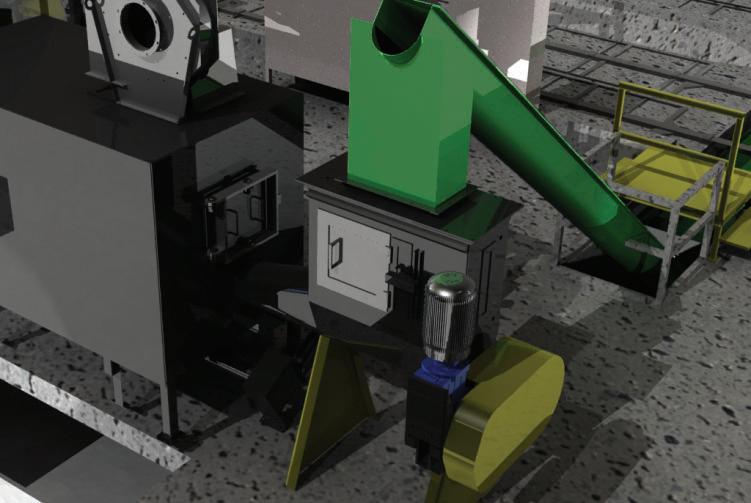

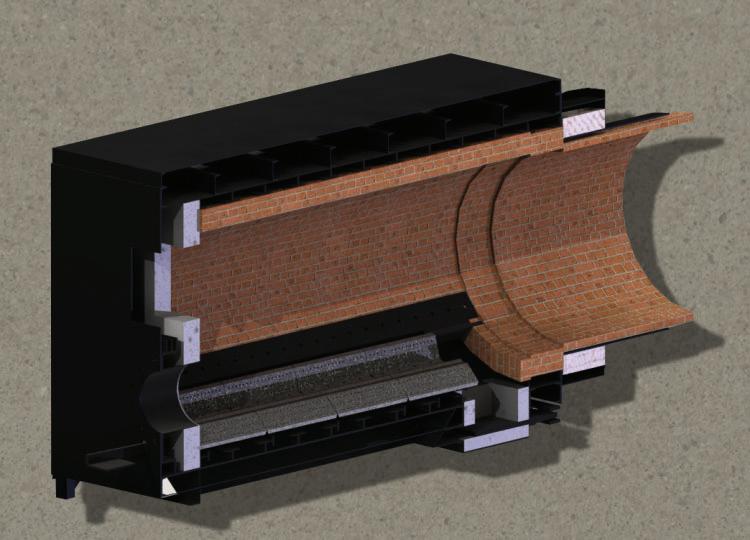

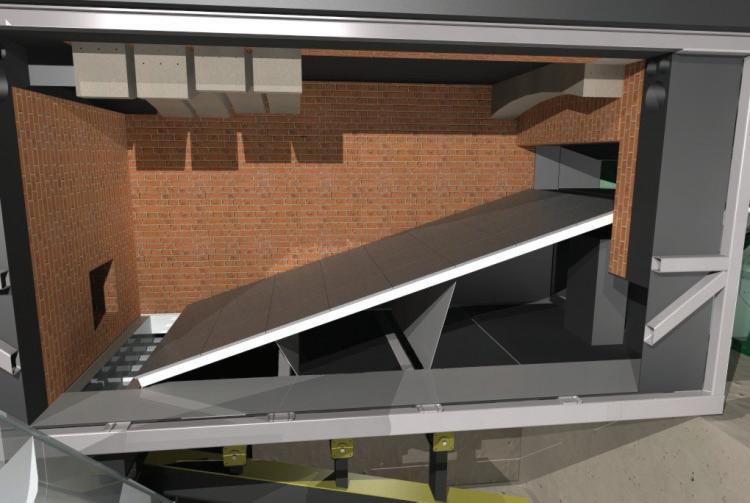

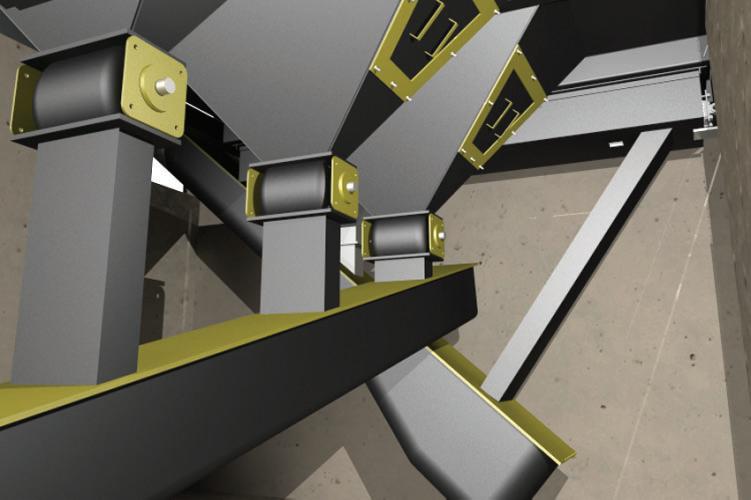

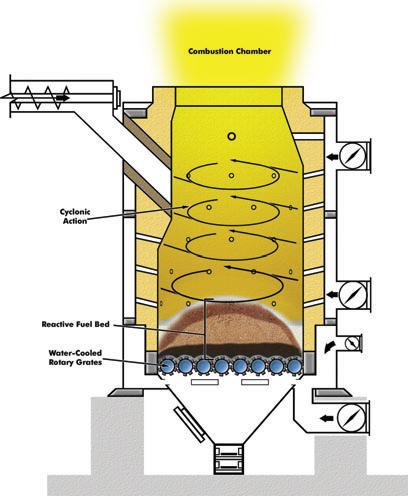

This update of available biomass combustion boilers is a follow up to our popular “Biomass Combustion 101” by Dr. Fernando Preto of CanmetENERGY. We offer an overview of technologies, specifications and applications to sawmillers, panel mills, pallet makers and other forestry professionals involved in the emerging biomass sector.

Volatile energy costs and limited and declining fossil fuel deposits are opening the door for bioenergy, attracting attention from industry, government, the investment community and academia. Canadian Biomass reports on three recent biomass events.

“Despite a seemingly endless sea of dead pine, little work has been done to quantify how much forest-based fibre might actually be available, let alone how much it will cost.”

the full story on page 17

Verboom Grinders of Truro, NS, is a biomass harvesting and processing pioneer. Here the crew works through a pile of pellet mill residues. Story on page 12.

Photo: Heather Hager/ Canadian Biomass.

In the land of plenty, only a fool goes hungry. Will we all be starving in 10 years?

love the contrarian’s view. In almost 20 years of forestry writing I’ve even made a decent living at it. No matter how sensible a viewpoint seems, I get nervous when too many heads are nodding agreement. So when Jimmy Girvan, a fibre supply analyst from Victoria, BC, asked if I’d like to hear about a forecast model that shows a less than rosy picture of biomass availability in BC some 10 years out, I said hell yeah.

Girvan and Murray Hall tease us with some biomass availability forecasts for the central Interior starting on page 17. The future they paint is of a new subsidized biomass sector competing with the traditional forest products sector for a declining fibre supply. As sawmills shut down in the face of increasingly marginal-quality beetle-kill sawlogs, pulp and panel plants will go to the woods for their fibre supply to replace the easy money of sawmill residues. Girvan and Hall imply that emerging policies to support bioenergy may be stacking the deck against these traditional players, and not always to the benefit of local employment.

and proposed panel plants have had a tough time competing using readily available and relatively cheap sawmill residues, how will they compete when they have to go hunting for fibre in the woods?

Now before you think I’m joining a new chorus of nodding heads, here are a few words of caution to consider while reading this article.

All models are based on assumptions and specific data. I don’t know either in this case, so you’d want to explore this further before deciding biomass is not the right fit for the BC Interior.

All fibre supplies are regional, and none more so than biomass because of the economics of moving low-value wood. There may be many opportunities for local biomass entrepreneurs, regardless of how limited the big picture seems.

Given that many of BC’s pulp and existing

This is a BC Interior study. Regions like central and northeastern New Brunswick, eastern Ontario, Quebec, northern Ontario, Saskatchewan, southeastern BC, coastal BC, and many border states have seen a near collapse of their traditional pulp and panel industries. In some of these cases, it’s biomass or nothing else. Finally, when it comes to government policy, is diversity really a bad thing? Look around at some of today’s forestry ghost towns and ask yourself whether a return to a pulp and panel dominated forest sector is in the best interest of communities and the Crown. As the Internet continues to erode the demand for magazine and newsprint in North America, 10 years of market shifts becomes a long time. Will my 11-year old and her friends provide the newsprint market BC Interior mills hope for? I’m not so sure, but I’ll guarantee she’ll want heat and light.

It is likely that in most regions, biomass and bioenergy will find their places alongside traditional wood and forest products, offering loggers and mills another potential revenue stream. In some regions, pulp mills and panel plants will be better able to compete. In others, they’ve already lost the battle. Still, the fact remains that faced with a push to biomass consumption in the central BC Interior, the forecasts of Girvan and Hall should be fodder for serious debate.•

Scott Jamieson, Editor/Group Publisher sjamieson@annexweb.com

Volume 4

Editor/Group Publisher - Scott Jamieson (514) 457-2211 ext 24 sjamieson@annexweb.com

Field Editor - Heather Hager (519) 429-3966 ext 261 hhager@annexweb.com

Western Editor - Bill Tice

Market Production Manager

Josée Crevier (514) 457-2211 ext 21 jcrevier@forestcommunications.com

National Sales Managers

Tim Tolton - ttolton@forestcommunications.com 450-458-4341

Guy Fortin - gfortin@forestcommunications.com 90 Morgan Rd, Unit 14 Baie d’Urfé, Que H9X 3A8 Ph: (514) 457-2211 Fax: (514) 457-2558

Western Sales Manager

Tim Shaddick - tootall1@shaw.ca 1660 West 75th Ave Vancouver, B.C. V6P 6G2 Ph: (604) 264-1158 Fax: (604) 264-1367

Production Artist - Brooke Shaw

Canadian Biomass is published five times a year; March, June, August, October, and December. Published and printed by Annex Publishing & Printing Inc., and distributed as a supplement to Canadian Forest Industries and Canadian Wood Products magazines.

Printed in Canada ISSN 0318-4277

Circulation e-mail: cnixon@annexweb.com Tel: (514) 457-2211 Fax: (514) 457-2558

Mail: 90 Morgan Rd, Unit 14 Baie d’Urfé, Que H9X 3A8

Subscription Rates:

Canada - 1 Yr $48; 2 Yr $85; 3 Yr $115 Single Copy - $6.00 (Canadian prices do not include applicable taxes) USA – 1 Yr $44 US; 2 Yr $75 US Foreign – 1 Yr $75 US

From time to time, we at Canadian Biomass make our subscription list available to reputable companies and organizations whose products and services we believe may be of interest to you. If you do not want your name to be made available, contact our circulation department in any of the four ways listed above.

No part of the editorial content of this publication may be reprinted without the publisher’s written permission ©2009 Annex Publishing & Printing Inc. All rights reserved. Opinions expressed in this magazine are not necessarily those of the editor or publisher. No liability is assumed for errors or omissions.

All advertising is subject to the publisher’s approval. Such approval does not imply any endorsement of the products or services advertised. Publisher reserves the right to refuse advertising that does not meet the standards of the publication. www.canadianforestindustries.ca

Eugene, OR – The Seneca Sustainable Energy project, to be located on the Seneca Sawmill Company mill site north of Eugene, Oregon, will use a biomassfired CHP plant to generate up to 18.8 megawatts of electricity and provide heat for the sawmill’s dry kilns. The electricity produced by the plant will be sold to the local power grid and will meet the annual energy needs of more than 13,000 homes.

Additionally, the CHP plant will displace the annual use of 70 billion BTU’s from natural gas that is consumed to produce steam to dry lumber, eliminating 3,500 tons of carbon per year resulting from this gas combustion.

The Seneca Sustainable Energy project includes the design and installation of a Wellons 200,000 PPH wood-fired steam generation system supplying steam to an 18,000 kw electrical generation facility, with lowpressure extraction steam going to Seneca’s nearby lumber drying facility. The CHP steam generation boiler, operating at 900 PSIG and 900°F, is fired by a Wellons furnace system with six combustor cells featuring automatic ash removal. Secondary particulate emissions control is provided by a Wellons four-field modular dry electrostatic precipitator.

Electrical generation is provided by a Wellons supplied,

Vancouver – The BC Bioenergy Network (BCBN) has awarded funding of $1.82 million to Lignol Innovations Ltd. and $3 million to Nexterra Energy Corp for two biomass pilot projects. Lignol uses biorefining technology to turn wood waste into fuel-grade bioethanol and biochemicals and is commissioning a fully integrated biorefinery pilot plant. Nexterra develops gasification systems that turn wood waste into heat and power and is launching a newgeneration biomass power system for businesses, municipalities, and public institutions.

Winnipeg, MB – The province of Manitoba is providing $895,000 to programs that use crop and forestry byproducts as heat and power sources. Manitoba Agriculture, Food, and Rural Initiatives (MAFRI) will work with Manitoba Science, Technology, Energy, and Mines under the biomass energy initiatives and crop residue burning mitigation program to fund several projects. These include a feasibility study of using wood biomass for heating and power, an assessment of the feasibility of converting Assiniboine Community

the natural gas formerly used for lumber drying.

refurbished automatic extraction-condensing steam turbinegenerator set.

Wellons is also providing additional support and project services, including foundation design

and installation, mechanical installation, piping, permit assistance, extended training of plant personnel, and ongoing water treatment services provided by Wellons Water Technology.

London, UK – Argus Biomass Markets is a new weekly report that offers insight into the emerging global trade in industrial wood pellets. The report contains the Argus Biomass Index, a weekly spot price benchmark for pellets delivered CIF northwest Europe. The report also offers assessments of forward prices for up to a year ahead and spot assessments for FOB export prices from North America. Detailed market commentary will analyze fundamentals and price drivers in Europe and North America.

“Argus’ expertise in coal, gas, power, emissions, oil, and freight means that we are uniquely positioned to assess the emerging biomass markets and to aid the development of liquidity through the provision of reliable price benchmarks,” says Argus chairman and chief executive Adrian Binks.

College, the Pine Falls paper mill, and other large industries to biomass energy, development of a Manitoba biomass energy strategy, and a project to provide an alternative to burning crop residue on fields. An additional $450,000 is going to the Prairie Agricultural Machinery Institute for a prototype machine for mobile crop densification to convert very bulky crop residue into a compact, dense format more suitable for transportation to its final destination for use as a fuel source.

Nova Scotia Power is considering a power purchase agreement for renewable energy from biomass. The proposed project would involve NewPage Port Hawkesbury Corp. and Strait Bio-Gen, which would develop a 60 MW biomass-fueled electrical generation facility, taking advantage of existing infrastructure at the NewPage paper mill in Port Hawkesbury, Cape Breton.

BC Hydro and Tembec have agreed to the key commercial terms of an electricity purchase agreement that will increase BC Hydro’s purchase of wood biomass-generated electricity from Tembec’s Skookumchuck pulp mill. Tembec will enhance its power plant operation to increase the amount of electricity provided to BC Hydro from 123 to 228 GWh/year.

Dynamotive’s research facility in Waterloo, Ontario, has successfully produced significant amounts of renewable gasoline and diesel from biomass in a two-stage bio-oil upgrading process. The process involves the pyrolysis of lignocellulosic biomass to produce bio-oil, which is then hydro-reformed to a gas-oil equivalent liquid fuel. The liquid fuel can be used directly in blends with hydrocarbon fuels or can be upgraded to transportation-grade liquid gasoline or diesel.

PG Interior Waste to Energy of Prince George, British Columbia, has signed

a contract to supply electricity under phase 1 of BC Hydro’s bioenergy call for power. The plant will use beetle-killed timber and sawmill waste to produce 8 MW of electricity to start. It will also produce charcoal and bio-oil. Electricity production is expected in 2010.

Biomass Secure Power and the Lower Nicola Indian Band, both of British Columbia, signed a memorandum of understanding in April 2009 that proposes a joint venture to build a 15 MW co-generation plant and pellet mill. Biomass Secure Power is also working on two other BC proposals.

British Columbia’s Innovative Clean Energy Fund is providing more than $22.6 million to support 19 projects in rural and off-grid communities. Four of the projects use woody biomass to produce electricity and/or heat, and another will produce cellulosic ethanol and lignin. BC is also providing $10 million in funding for eight liquid biofuels projects, two of which involve the production of cellulosic ethanol from woody biomass.

A biomass heating system demonstration project is now operating at École Évangéline in Abrams Village, Prince Edward Island. The school is now using a pellet-fuel furnace as its primary heat source, with a supplemental oil heating system. The $180,000 heating unit was funded by the provincial government through the Trust Fund for Clean Air and Climate Change.

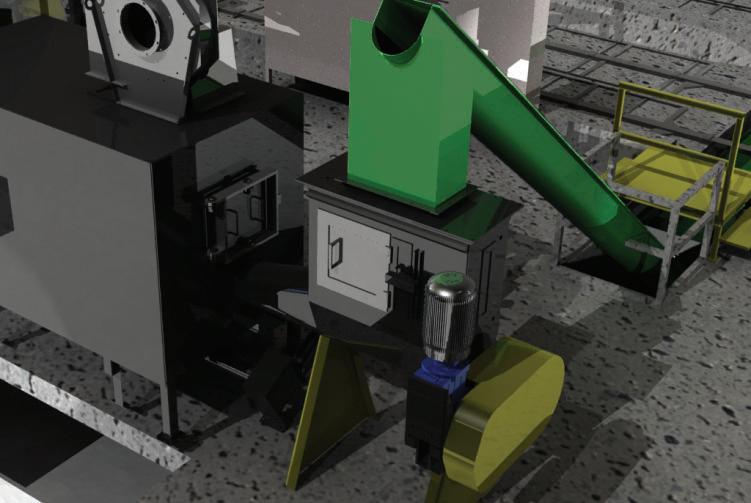

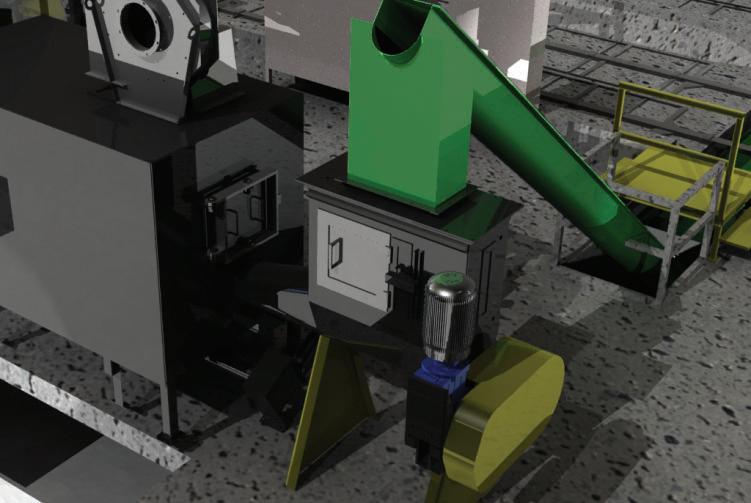

Nexterra has future plans for a 2 MWe commercial demonstration plant featuring a GE Jenbacher engine.

Vancouver – Nexterra Energy has launched a program to commercialize a new application of its biomass gasification technology to generate power and heat by directfiring syngas into high-efficiency gas engines. This initiative follows two years of work by Nexterra to upgrade the syngas made by gasifying biomass so that it meets the fuel specification of General Electric (GE) Energy’s Jenbacher internal combustion engines.

The plan is to combine the gasification technology with a Jenbacher gas engine to form small-scale, modular biomass combined heat and power (CHP) plants of 2–10 MWelectric. The new biomass CHP system is designed for on-site applications

at public institutions such as universities, hospitals, and other government facilities; industrial operations such as food and beverage plants, waste management facilities, and forest products mills; and stand-alone power for independent power producers or electric power utilities.

Nexterra and GE plan to test and demonstrate the new power application in two phases. The first-phase plans are for Nexterra’s syngas conditioning technology and a GE Jenbacher engine to be installed and tested at Nexterra’s product development center in 2009. The second-phase plans are for a commercial-scale 2 MWe plant to be demonstrated at a customer site.

Rapid City, SD – KL Energy Corporation and Prairie Green Renewable Energy have signed a letter of intent to develop a project to build a cellulosic ethanol plant near Hudson Bay, Saskatchewan, which is located northeast of Saskatoon and near the Manitoba border. The Northeast Saskatchewan Renewable Energy Facility will use KL Energy’s design and engineering to produce ethanol from wood waste. The plant would initially provide 5 million gallons of cellulosic ethanol annually to the Saskatchewan market. Plans include a second facility that would allow production to double.

Fredericton, NB – In mid-April, the New Brunswick government received proposals from parties interested in gaining access to biomass material from Crown forests, with the intent to award access by summer. “The Department of Natural Resources has developed a Crown land forest biomass harvesting policy, and in collaboration with the University of New Brunswick we have developed the assessment tools necessary to ensure that biomass material is harvested from New Brunswick’s Crown forests in a sustainable manner,” says Natural Resources Minister Wally Stiles.

Eligible applicants included individuals, corporations, and other provincial bodies with existing or proposed New Brunswick-based processing facilities. An estimated 550,000 oven-dry tonnes of biomass material will be available for allocation, depending on the amount of timber harvested.

Thunder Bay, ON – Whitesand First Nation Chief Allan Gustafson has announced a community sustainability project proposal to construct a small sawmill, wood pellet plant, and combined heat and power (CHP) biomass plant. The project

would provide electricity for Whitesand First Nation, Armstrong, and Namaygoosisagagun, located north of Thunder Bay, Ontario, near Wabakimi Provincial Park. The 4 MW CHP

Cornwall, ON – Canadian Bio Pellet Inc. has plans to build its first pellet plant in Ingleside, near Cornwall, Ontario, with a planned capacity of 450,000 tonnes/year of pellets. It cites the advantages of close proximity to feedstock from Quebec, Ontario, and the United States, as well as to major transportation networks such as

plant would replace some of the communities’ dieselgenerated power and provide heat to dry pellets and lumber. The proposed pellet plant could produce up to 88,000 tonnes of pellets

annually. Project partners include Armstrong Resource Development Corporation, Confederation College Forestry Centre, Lakehead University Faculty of Forestry and the Forest Environment, FPInnovations, and others.

CN Rail, the St. Lawrence Seaway, and a major Ontario highway. Its primary focus would likely be to supply Ontario Power Generation with pellets to replace coal. “It’s a great opportunity to establish Ingleside as a production hub,” says company vice-president Dan Stasko.

Fibre Brain Company of Sault Ste. Marie, Ontario, is planning to own and operate a wood pellet factory. It is a locally owned start-up company that will source raw material from local forests. The company is in the process of applying to the province for a wood plant operat-

ing license. Fibre Brain expects to be operating by fall 2009 and hopes to produce 32,000 tons of wood pellets per year.

A BC economic development agreement was signed with four Secwepemc First Nations: the Whispering Pines/Clinton, High

Bar, Shuswap, and Little Shuswap Indian Bands. The agreement allows the bands to apply for up to three million cubic metres of timber over 15 years to support an estimated $20 million wood pellet project. The bands’ joint company, Pelltiq’t Energy

Belledune, NB – Shaw Resources’ wood pellet plant in Belledune, New Brunswick, has received a temporary allocation of 50,000 cubic metres of birch and poplar from Crown land. “This temporary allocation will allow the company to meet its customers’ needs, and maintain all 15 jobs,” says NB Envi-

ronment Minister Roland Haché.

The plant, which began production a year ago, was designed to produce wood pellets from sawmill byproducts such as sawdust and shavings. The anticipated supply has been affected by slowdown in the sawmill industry due to the slump in

Mississauga, ON – Sustainable Development Technology Canada (SDTC) has awarded $53 million

in funding to 16 new projects that develop and demonstrate emerging clean technologies.

lumber sales to the United States. The allocation will be purchased from companies that are already carrying out harvesting operations on Crown timber licences 1 and 3 within a 100-km radius of Belledune.

“All the roundwood we’ve been buying so far is from private

Group Ltd., is working to secure construction, operating, and harvesting partnerships, and a plant site. The facility is expected to be running in the Kamloops area by the end of 2010, with targeted production of 175,000 tonnes of wood pellets.

woodlot owners, through the [North Shore Forest Products] marketing board,” said Gordon Dickie, general manager of Shaw Resources. “If I can buy all of the roundwood that I need, competitively, from the private woodlot owners, then that is our first choice.”

Four of these projects involve the use of biomass in new processes to produce clean energy. These

new investments bring SDTC’s total portfolio value to over $1.3 billion.

biorefining from plant cellulose is poised to move to mass commercial-scale production over the next few years.

By Paul Winters

anada and the United States have implemented laws promoting the use of renewable fuels and have made considerable investments in helping the industry begin to grow. Still, with the worldwide economic crisis and consequent collapse of oil prices, renewable energy companies face daunting challenges in securing a share of the more than $400 billion transportation fuel market. Currently, the industry appears unable to meet the growth targets set in government policy.

The U.S. Renewable Fuel Standard calls for the production and use of 100 million gallons of “advanced biofuels”—any biofuel not made from corn—beginning in 2010, 1 billion gallons by 2013, and 21 billion gallons by 2022. To meet this rapidly escalating annual production goal, companies would have to begin building facilities today, at a cost that could reach $500 million each. With the current price of petroleum gasoline, that cost may not seem a risky investment.

Right now, 36 cellulosic ethanol biorefineries are in the planning, construction, or initial operating stage across the United States, with at least six more in Canada, including Iogen’s facility in Ottawa, the world’s first operating cellulosic ethanol biorefinery. Most of these biorefineries are pilot-scale facilities producing fewer than 2 million gallons annually. They are designed to test and prove a wide variety of technological solutions for turning cellulosic crops and waste streams into fuels. A recent BusinessWeek article points out that there could be a “glut of innovative biofuel technologies,” meaning that the sheer number of startups will cause some to fail, allowing large energy companies to snap up the technology and use their size to crowd out competing companies.

To date, the U.S. government, private companies, and venture investors have poured more than $3 billion into the research, development, and deployment of advanced

biofuels, particularly the nearest-term secondgeneration biofuel, cellulosic ethanol. Canada’s government and private sector have made a similar-sized investment. A few companies are moving ahead with commercial facilities.

Among the companies that have formed public-private partnerships with state and federal governments in the United States and Canada to try to commercialize biofuel projects are DuPont Danisco Cellulosic Ethanol (DDCE) of Itasca, Illinois, Lignol of Vancouver, B.C., and Mascoma of Lebanon, New Hampshire.

DDCE is a joint venture of DuPont and Genencor, a division of Danisco. DDCE and the University of Tennessee, through Genera Energy, broke ground in October 2008 for a pilotscale biorefinery in Vonore, Tennessee. The University invested state research dollars to develop switchgrass as a dedicated cellulosic energy crop, employing 16 area farmers and a combined 723 acres as part of the supply chain for the biorefinery. The pilot plant is also designed to convert corn stover to ethanol. The facility is expected to produce cellulosic ethanol by the end of 2009, with an annual capacity of 250,000 gallons.

Canada. Lignol began operation of a fully integrated industrial-scale biorefinery pilot plant in Burnaby, B.C., in April 2009, with a rated production capacity of 100,000 litres/year of cellulosic ethanol, together with industrial testing quantities of high-purity lignin and other biochemical co-products.

Other companies have pursued private partnerships with large energy companies to take lessons learned from pilot or demonstration projects to commercial-scale cellulosic ethanol production. In May 2008, Verenium of Cambridge, Massachusetts, commissioned the United States’ first demonstration-scale facility in Jennings, Louisiana. In early 2009, Verenium and BP announced the formation of a joint venture company that will scale up Verenium’s

The World Congress on Industrial Biotechnology and Bioprocessing takes place in Montréal, July 19-22 to discuss the state of the industry.

technology in a 36 million gallon/year facility in Highlands County, Florida.

Mascoma Corporation has received several state and federal grants, including a $14.8 million state grant for the establishment of a demonstration plant in Rome, New York, which began full-scale operation in 2009. Mascoma is currently developing a commercial-scale production facility in Kinross, Michigan, with construction expected to begin in 2010.

Lignol has been awarded $3.4 million to produce cellulosic ethanol and other biochemical products from underused forest resources, including lodgepole pine killed by mountain pine beetle. It recently received up to $1.82 million in additional contributions from Sustainable Development Technology

In March 2009, Codexis of Redwood City, California, announced a partnership with Royal Dutch Shell. Codexis will provide technology to enhance the Iogen facility in Ottawa and expects to have a commercial-scale project up and running by 2013. Codexis is also working to use its technology in to produce cleaner, more efficient and cost-effective alternatives to traditional chemical manufacturing processes that use petroleum-based, non-renewable materials. •

Paul Winters is the Biotechnology Industry Organization’s director of communications for industrial and environmental biotechnology. He wrote this ‘state of the cellulosic ethanol industry’ review for Canadian Biomass. www.bio.org.

Diversification, flexibility, and good planning have helped Verboom Grinders succeed in the biomass business.

By Heather Hager

Itseems an unlikely location, but just inside the town limits of Truro, Nova Scotia, is the Verboom family’s small sawmill and home base to a substantial biomass grinding operation. Here, Verboom Grinders processes multiple source streams of non-timber-quality wood to supply two biomass markets: wood fuel and landscaping mulch.

“We started Verboom Grinders in 1992,” states Jim Verboom, who began the business with his father Cees, who is now “retired,” but can still be found trimming roundwood fence posts in the sawmill. Jim’s son Luke is now a partner in the business and is the resident mechanical guru. “Our first objective with grinding was for our bark mulch business. When we bought our first grinder, it was with the intention of working about three weeks per year,” says Verboom. “By 1993, we got our first biomass fuel job.”

That first grinder was a 1992 Duratech HD-10 tub grinder with 300 hp Cat engine, which worked more than 10,000 hours during its lifetime. “We started out with a tub grinder because we were processing bark sawmill residue,” says Verboom. “We had to make it a consistent size to encourage the landscape industry to use bark. It had to be easy to shovel.” The 1992 Duratech was eventually scrapped to maintain the second grinder, a 1994 model, which is still running today.

The grinding business grew quite slowly during the 1990s, in part because the low cost of oil dampened interest in alternative energy sources. However, because they owned

The growing popularity of coloured mulch has provided another business opportunity for Verboom Grinders. The company has added a Rotochopper unit to fill this need.

an industrial grinder, the Verbooms began to pick up biomass fuel jobs, industrial and commercial land-clearing work, and wood waste volume reduction work at local landfill sites.

Then Hurricane Juan hit Atlantic Canada, toppling thousands of trees and leaving behind a terrible mess.

“When Hurricane Juan hit in late September 2003, we had the existing contract with the city of Halifax to supply grinding services on demand. What that meant was 20 or 30 hours a year,” explains Verboom. The additional work created by the hurricane allowed a second grinder to be added to the fleet: a Duratech 3010 with 450 hp Cat engine.

When the time came to choose additional machines for the fleet of grinders, the Verbooms considered the emerging range of fibre supply. “As the demand for biomass

started to grow, we saw that we couldn’t supply it economically by taking long trees and cutting them up into short pieces and throwing them in the tub grinder,” says Verboom. “The next step had to be a machine capable of turning full-length trees into fuel.” This left chippers or horizontal grinders.

“A grinder can handle a broader range of fuel [feedstock] than a chipper can, especially fuel that has a little bit of dirt on it,” explains Verboom. At the time, their competitors were already using chippers. So, the Verbooms went with horizontal grinders, acquiring first a Bandit Beast 3680 with 700 hp Cummins engine and then a Peterson Pacific 5710C with 1050 hp Cat engine. Along the way, they also acquired various excavators, a 53-foot trailer with walking floor for transporting processed biomass, and last year, a Rotochopper CP118 grinder with 110 hp John Deere engine to produce coloured landscaping mulch.

Verboom Grinders is just one of the family’s three wood products businesses. “For biomass to work for us as one of the first companies into it in Nova Scotia, we had to be quite diversified,” explains Verboom. “We had to have other related products because, when you’re the first one in, it’s very rare to have steady work.” This diversity allows the company to stay busy, and viable, even when one area experiences a slowdown.

To name a few examples, tree seed collecting for the seed supply business begins when the landscape industry slows in early fall. The small sawmill produces various products, including roundwood fencing and landscaping timbers. The slab wood and other mill waste is used for biomass fuel, landscaping mulch, or animal bedding. “If somebody comes to me with a new idea, I hardly ever say no,” says Verboom. “We’ll figure out how to do it.”

In addition to its mill waste, Verboom Grinders receives used unpainted/untreated wood pallets, clean brush trimmings, Christmas trees, and cardboard at the site in Truro. However, this only amounts to 10 or 20 truckloads of biomass fuel per year. “Probably 90 to 95% of our grinding is away from the shop,” says Verboom. “And that could be anywhere from Yarmouth to Sydney to Prince Edward Island.” The company has even worked in Newfoundland.

Most clients are companies with biomass boilers or municipalities looking to reduce landfill volume. Biomass fuel customers include paper mills, combined heat and power

(CHP) plants, greenhouses, and institutional buildings. Some customers buy the alreadyground fuel, but many buy undesirable species or wood that is of too low quality to be used for pulpwood and have it ground for fuel at the boiler site.

To see a grinder in action, we dropped in at a local wood pellet plant, where one of Verboom’s tub grinders was about halfway through a two-week job. “What he’s digging into right now is actually bark that came from a sawmill, and it’s too stringy,” says Verboom, indicating the excavator operator. “It’s probably 90% stuff they can handle, but there’s just enough that’s not that it’ll plug up their system. Because the tub grinder is so fast and efficient with this material, it doesn’t cost them very many dollars per ton to make it into a form that they can readily use.”

This particular bark is also quite wet and contains frozen lumps, which will plug the pellet plant’s infeed system and associated electric grinder. “Grinders behave differently with different types of feedstock, and they [the pellet plant] just can’t change their grinder every time the feedstock changes. That’s the inefficiency of running a grinder in an infeed system,” explains Verboom. “We can set up for bark, and then if we hit the dry wood and it starts behaving a little differently, we can stop and change screens a lot easier than they can change them in their grinder.” For most of Verboom’s machines, it takes 30–45 minutes to change the screens.

Municipal work is another matter; it can be quite rough on the machines. “Although it

looks like there’s good money in municipal work, in most municipalities, people have trouble telling the difference between wood and steel, and as a result, you end up breaking your machinery quite often,” says Verboom, with a shake of his head. In the past, they have recovered up to 100 pounds of steel from a grinder during one week of work. “Some of them are potential meltdowns—when you have a major breakdown that puts your machine out of operation for a while.” Meltdowns can cost anywhere from $10,000 to $25,000 in repairs, plus lost time.

Verboom anticipates at least one meltdown per year doing municipal volume-reduction work. “We keep a couple of old tub grinders around for handling that work so that when we do break something, the repair bill’s a lot

smaller.” He says that the older machines tend to be a bit more durable, simply because they have fewer computer controls and electronics and less wiring that might chafe and short out.

A lot of the unpredictability in the business has to do with the fact that only about 5% of the biomass grinding work is pre-contracted. The remainder is supply on demand. The demand is dependent on various external factors, including the availability of mill residues, the cost of alternative fuels such as oil or natural gas, and the demand for electricity.

“Most of the larger consumers of biomass in the province like to use mill residue, but there’s not enough mill residue around to keep everybody going,” explains Verboom. To top up their biomass supply, these consumers will buy from other sources such as Verboom Grinders, but

only if they have to, because of the additional expense of the grinding service. “The mill closures were giving us extra work because there were no mill residues to supply the places that usually took them.”

Other grinding work has disappeared, however. “In one case, the price of natural gas dropped so much that a paper mill found it cheaper to burn natural gas for now than burning biomass,” notes Verboom. Another paper mill shut down, reducing its demand for power. This caused a chain reaction in which the province’s power company didn’t require as much electricity supplied to the grid from a biomasspowered CHP plant.

Just as important as markets is communication. Verboom thinks that information sharing is critical to developing the biomass industry. Locally, he says that people can be reluctant to share information. “We eye very suspiciously anybody down the street that’s using wood to make anything anywhere close to resembling what we make. Of course, you never figure out enough on your own. I haven’t lost the ability to share information with other people because I learned that lesson pretty quick.” He finds that once people explore outside their local region, they tend to become more open about what they are doing, and in return, learn more.

Back in Nova Scotia, the biomass industry seems to be gaining momentum. “In 2008, two guys bought grinders to compete against

ODo forests need to be cleaned of biomass? The answer is not as simple as many believe.

By Evelyne Thiffault

ver the past year, I have been touring Canada to talk about the consequences on the ecosystem of removing too much biomass, presentations mostly given to industry and biomass promoters. Afterwards, I was often pressed about the consequences of NOT removing biomass from the forests. “Forests need to be cleaned of biomass; we are helping the ecosystem by removing it.” But how much scientific support is there for such common perceptions?

Harvest residues left on site will decompose and emit CO2; we might as well harvest

ent from the burning of biomass: over a long period of time vs. now.

Harvest residues produce methane, a greenhouse gas even more damaging than CO2

“ There is no need to argue that forest ecosystems need us to grow and thrive, because most often they do just fine on their own.”

them and emit carbon producing energy.

This is partly correct. In forest ecosystems under temperate and warm climates, the carbon in harvest residues is gradually degraded by soil organisms and respired as CO2; after some years very little carbon is thus incorporated into the soil, as most is lost to the atmosphere. Under wetter and cooler conditions such as those found in boreal coniferous ecosystems decomposition of harvest residues and respiration of CO2 likely occur too, but at a rate so slow it is difficult to detect it, and more carbon is likely integrated into the soil (although this remains a challenging question among scientists). Yet even if the fate of carbon in residues may ultimately be its emission to the atmosphere, the timing is quite differ-

This is likely not true. Methane is indeed a very potent GHG, with a global warming potential higher than CO2. However, methane is produced from organic material under anaerobic conditions (i.e., without oxygen), which do not occur in most harvest slash conditions. If there are tightly packed piles of rapidly decomposing residues, or buried piles, this might generate anaerobic conditions for a small period of the year, but this phenomenon should be pretty rare and of little consequence. On the other hand, methane is produced in considerable quantities from the decaying organic waste of waste landfills.

Decomposition of harvest residues leads to the production of nitrates that leach through soils and to lakes, causing eutrophication.

Again, this is likely not true. Eutrophication is an increase in nutrients, mostly nitrogen (such as nitrates) and phosphorus compounds, which overloads the nutrient processing capacity of the ecosystem, and happens usually when nutrients are introduced from outside of the ecosystem. This causes excessive plant growth and decay, depleting oxygen in the water. For example, increased inputs of nutrients from the Mississippi and Atchafalaya rivers, which drain the U.S. fertilizer-rich agricultural heartland, cause ‘dead zones’ in the Gulf of Mexico, large areas of water in which oxygen levels are too low for most fish to survive.

However, harvest residues contain nutri-

ents already in the ecosystem. Natural disturbances also transfer large amounts of nutrients to the ground. This flush of nutrients in soils following forest disturbance (both natural and man-made) causes a rise in soil nutrient availability, but not eutrophication. Studies have shown that the presence of harvest residues on some forest sites does increase nitrate leaching compared with whole-tree harvested sites. However, absolute increases in leaching are generally small and disappear after three to five years.

So, do forests need to be cleaned of biomass for their own sake? Natural disturbance such as forest fires, windthrows, insect attacks and self thinning produce great loads of slash, usually much more than harvesting, and have been doing so for millennia. Forests don’t need to be cleaned other than may be necessary to achieve some human-desired condition. For example, we may need to remove slash to lower risks of fires that threaten human safety or wood supplies for industries (wildfire by itself being part of the natural cycle of many ecosystems). Slash removal may help to meet other silvicultural goals, such as clearing the way for the establishment of natural regeneration or to facilitate site preparation and plantation. Harvesting of biomass in the form of unmerchantable trees can also help enhance the quality of the stand. Removing biomass as part of a forest management strategy to meet human needs is legitimate. There is no need to argue that forest ecosystems need us to grow and thrive, because, well, most often they don’t.

Want to know the best science-based reason to remove biomass? It’s a renewable energy source to substitute for planet-damaging fossil fuels and coal (but you already knew that). •

Dr. Evelyne Thiffault of Natural Resources Canada contributes thoughts on biomass harvesting sustainability to Canadian Biomass on behalf of the Canadian Research Group on Ecosystem Sustainability.

A contrarian’s view of biomass fibre availability in BC and the mad rush to commit it.

By Jim Girvan and Murray Hall

in Canada is the buzz about forest biomass and its use for energy production heard more often than in British Columbia. In 2007, the BC Government announced the BC Energy Plan (the Plan), a key component of which was the development of the BC Bioenergy Strategy. The latter will take advantage of the province’s notionally abundant sources of renewable energy, such as mountain pine beetle (MPB) killed timber, wood wastes and agricultural residues to produce power.

On the heels of the Bioenergy Strategy, BC Hydro, the provincial regulator for power purchase and distribution, launched its Phase I Call for Power. Phase I focused on bio-energy projects that were immediately viable and did not need any allocation of new harvesting tenure from the Ministry of Forests and Range.

Then on March 5, 2009, BC Hydro launched the second phase of the Bioenergy Call for Power. Phase II will involve two separate streams, with the first targeting larger-scale biomass projects, and the second focusing on smaller-scale, innovative, community-level energy solutions using biomass.

In April of 2008, the BC Bioenergy Network was established with a $25 million grant from the BC government. This industry-led initiative will act as a catalyst for deploying near-term bioenergy technologies and

will organize mission-driven research for the development and demonstration of new bioenergy technologies that are environmentally sustainable. Notably missing from their mandate, however, was any attention to biomass inventory or availability.

Despite a seemingly endless sea of dead pine at its doorstep and strong BC government support for the development of new bioenergy-based initiatives, little work has been done to quantify how much forest-based fibre might actually be available to support a new biomass industry, let alone to determine the delivered cost of that fibre supply.

By their nature, biomass-based projects are long-term and require sustainable fibre supplies for at least 10 to 15 years to support the amortization of investment capital. While at first glance the immense destruction of BC’s interior forests by the MPB would suggest a limitless supply, closer inspection reveals the need for caution.

As some BC Interior sawmills face volume reductions from ageing beetle-kill wood supplies, they’ll make less lumber, and thus fewer residuals. The result will be more competition for low-grade fibre in the woods.

The BC Fibre Model is a proprietary fibre forecasting tool developed by Jim Girvan and Murray Hall, two independent fibre practitioners from Vancouver Island. The model is essentially a snapshot of the entire BC forest industry including AAC and sawlog availability, industrial sawlog demand, residual chip output, pulp and paper consumption and minor residual balances, including an assessment of available biomass.

It allows users to input assumptions related to the operation of the BC forest sector, such as mill operating rates in the face of changing (improving) economic indicators, allowable cut partitions to MPB killed timber, shelf-life forecasts, mill closures and forecasts of new biomass

demand. The model then provides forecasts, out to 2022, of the regional balances (or deficits) for sawlogs, residual wood chips, sawdust and shavings, hog fuel, and of course available residual biomass. The first four years of data are benchmarked to known industry performance, thereby making forecasts more credible.

“The model puts a lot of data into an easy to read and understandable format. It has helped us understand fibre issues as part of our strategic planning work,” notes Craig Garratt, general manager of fibre supply for Canfor Pulp Limited Partnership in Prince George.

With the biomass forecast, we are trying to determine what volume of biomass is forecast to

exist within the framework of the AAC that will not be consumed by the existing forest industry over time, and so could potentially be available for other, new biomass consumers.

By definition, annual biomass accumulations in the model are:

Surplus coniferous saw logs.

• Harvest (and waste) of dead pine not con-

• sumed by the existing forest sector.

• coniferous harvest” not consumed.

The non-sawlog component of any “green

All unharvested AAC.

• Surplus hog fuel.

• So what does the forecast of available biomass in BC suggest? Let’s look regionally.

With the epicenter of the MPB epidemic in the central interior, regions like the Cariboo and Kamloops have a significant pine component to their forests and have elevated allowable harvest levels designated to support the auspicious recovery of the dead timber. They are thus seemingly good candidates for the supply of forest-based biomass to support new biomass based initiatives.

However, before we start handing out forest licenses to provide fibre for new power, pellet or cogeneration plants, we must look realistically at the available supply of dead timber, the likely allowable harvest levels over time, and just what fibre the existing industries in those regions will require.

Chart 1 shows the forecast of aggregated regional AAC within the Cariboo and Kamloops regions, with corresponding sawlog availability estimates based on the application of current shelf-life thinking to the dead MPB impacted timber. As can be seen, both regions will have their AAC reduced as the limits of salvage in the MPB are reached. In addition, sawlog availability will fall as the shelf-life of MPB killed timber yields less and less sawlog material over time.

The implications of these charts are twofold. First, as the AAC falls to the mid-term sustainable level, the resulting level of allowable harvest will simply yield less wood fibre to be available to support new or existing industries. Second, reductions in sawlog availability over time will likely trigger capacity closures by regional sawlog consumers, primarily sawmills.

Regional sawmill closures will mean less residual wood chips, sawdust, shavings and hog fuel to support existing pulp, paper, power and pellet production. This reality will trigger the need for these industries to turn to the accumulation of forest biomass to support their

operations. And while the AAC forecast presented above is scary to say the least, the fact that the fall is predicted to happen within 10 years suggests that to support growing bioenergy businesses within BC, some of the current users of forest-based biomass may have to close. Can pulp and paper mills compete with new biomass based industry for the same wood? Will new biomass industries be supported by government to the detriment of the existing

ones? Will the levels of employment in a biomass energy plant for example, be the same as for a pulp and paper mill? These are all important questions that need to be considered when we look at the reality of a declining regional and provincial fibre basket.

So if we assume that the AAC and sawlog availability will follow the trend predicted above, and then further assume that existing pulp, paper, power and pellet industries will

not close in the face of falling residual fibre availability, what does the forecast for residual forest-based biomass look like?

Chart 2 shows the forecast of the annual and accumulated forest-based biomass in the Cariboo and Kamloops forest regions. As can be seen in both regions, biomass accumulates annually over time until the point where sawmill capacity closures are expected to occur.

In the Cariboo, accumulated biomass totals as much as 50 million cubic metres and the Kamloops region suggests 25 million cubic metres. However, as capacity closures occur, the existing pulp, paper, pellet, power and board plants reliant on residual fibre from regional sawmills will be forced to turn to the inventory of unused forest-based biomass to supplement their need for fibre.

By as early as 2020, at the point where the AAC has been reduced to the mid-term sustainable level and sawmill capacity has been rationalized in the face of falling sawlog supply, biomass is no longer accumulating within the forest and the inventory is being drawn down. In the Cariboo, annual demand for forest-based biomass is forecast to exceed 1 million cubic metres per year, whereas in Kamloops, it is closer to 500,000 cubic metres annually.

While the accumulation of biomass appears large and suggests a significant accumulation opportunity within the forest, the million dollar question is how long will the accumulated biomass in the forest last if so many existing industries are going to be reliant upon it?

As indicated above, the forecast is an accumulation of available biomass, within the framework of the AAC that is, in essence, not forecast to be used by any other consumer. The accumulation assumes that if wood fibre is not used in a single year, that it then becomes available for use (i.e., accumulated as biomass) in subsequent years. There are three cautionary notes in this regard, however:

The forecast does not include biomass- 1. based industries that are planned to start up in the near future. In the Cariboo, an OSB plant that consumes as much as 1 million cubic metres per year is required to support an existing harvesting licence there. That plant alone, if it were to come on line before 2020, would reduce the available biomass within the region by close to half. In the Kamloops region, announcements of new pellet plants that will be supported by a 3 million cubic metre licence were made recently.

In this forecast, unharvested AAC con- 2. tributes to biomass. This is essentially

The accumulated surplus of biomass in the field will depend on how much is left to accumulate, and how much is burned.

undercut that is assumed to be carried forward. Forest policy may dictate that this volume may not available for future use but will remain as a contributor to future AAC calculations.

The accumulation of biomass assumes no 3. fire hazard abatement. In these forecasts we are assuming that waste piles created by the harvest and subsequent piling of non-sawlog material remains available for use over the planning horizon. In practice, firms will move to reduce the hazard

by burning waste piles, effectively removing the accumulation from the biomass inventory,

In application, the combination of these factors would suggest the gross forecast of accumulated forest-based biomass within both of these regions shown above is optimistic at best. Could the actual level of available biomass be one-half or one-third? If so, then within 15 years none of the existing biomass-based industries will be able to exist, let alone any new industry that will be competing for this very same material, as a result of a lack of fibre.

The volume of fibre available and the cost of that fibre is a critical question to be resolved if we are to move forward with significant investments in new technology to consume biomass within BC. These forecasts suggest caution, or at least a discussion about who should close down and who should start up in the face of a limited supply of biomass. Is closing a pulp mill in favour of opening a power plant in BC the answer? Can existing board and pellet plants compete with government-supported new biomass technology?

We should have the discussion and consider the analysis before we pit them against each other in the BC fibre market. •

Jim Girvan, RPF MBA, is the principal of MDT Management Decision and Technology of Ladysmith, BC, where he provides consulting support in the areas of timber supply and fibre flow modeling and analysis, industry forecasting, statistical analysis, licence acquisition and forest policy. Murray Hall, BComm, is the principal of Murray Hall Consulting Ltd. of Duncan, BC, where he provides consulting support in the areas of residual fibre analysis, fibre quality and strategic assessments of wood supply.

JUNE 29-JULY 3, 2009 • 17TH EUROPEAN BIOMASS CONFERENCE AND EXHIBITION Hamburg, Germany www.conference-biomass.com

JULY 19-22, 2009 • WORLD CONGRESS ON INDUSTRIAL BIOTECHNOLOGY AND BIOPROCESSING Montreal, QC 202-962-6630 or 202-962-9204 www.bio.org/worldcongress

JULY 26-28, 2009 • PELLET FUELS INSTITUTE ANNUAL CONFERENCE Ponte Vedra Beach, FL 703-522-6788 www.pelletheat.org

AUGUST 4-5, 2009 • INTERNATIONAL CONFERENCE ON WOODY BIOMASS UTILIzATION

Starkville, MI 662-325-8454 www.forestprod.org/confbiomass09. html

AUGUST 31-SEPTEMBER 4, 2009 • BIOENERGY 2009 – SUSTAINABLE BIOENERGY BUSINESS CONFERENCE & EXHIBIT

Jyvaskyla, Finland www.bioenergy2009.finbioenergy.fi

Continued on page 25

By Jamie Bakos

he theme song of a popular prairie-based sitcom, called Corner Gas, is Not a Lot Goin’On. It naturally included a line about the opportunity to watch your dog run away for three days. The tongue-in-cheek theme song set the stage for each episode that set out to dispel this “nothing going on” myth by humorously demonstrating a lot of prairie talent and sophistication that would rival any place in the world.

So why is there “not a lot goin’ on” with bioenergy and bioproducts in the prairies, a region that is saturated with both forestry and agricultural biomass? Indeed, the bioeconomy is so far off the radar of government and industry that the two hottest topics in the prairie province of Saskatchewan are clean coal technology and nuclear power. There is only fleeting mention of biomass in its energy plans.

The answer is scale. The biomass industry needs to demonstrate the scale of the biomass business opportunity.

Two respective envisioned clean coal and nuclear projects are currently in the prairie spotlight: Up to two 1000 MW nuclear reactors at 1. a cost of $8–10 billion each. The plant would offset on the order of six million tons of CO2 per reactor compared to the status quo of coal-fired generation.

One $1.5 billion clean coal project pro- 2. ducing 100 MW of electricity and storing around 1 million tons of CO2 by ground injection to enhance oil recovery.

These are two big-ticket items, both in their capacity to deliver power and to reduce greenhouse gas emissions. They are projects that could shake up a province of just one million people.

So what could you do with the money from one nuclear reactor and one clean coal project and access to Saskatchewan’s biomass? Could biomass deliver scale?

The potential alternatives:

A combined heat and power (CHP) plant: 1.

one plant could produce 2000 MW of power, or a number of smaller distributed facilities could produce power and heat for industry. These would offset a similar amount of CO2 as a nuclear power plant.

Slow pyrolysis: a recent 10 ton/day demo 2. in Saskatchewan showed that 1000 MW of power could be generated by smaller 2 MW distributed biorefinery facilities. These projects would have the added benefit of producing 15,000 tons/day of biochar, potentially worth more than $2 billion per year, approaching the value of all unprocessed crops.

The biomass projects would require between 16 and 20 million bone-dry tons/year for either project. Approximately six million acres of land would be needed to grow this biomass at an estimated three bonedry tons of biomass per acre. Since Saskatchewan has 64 million acres of cropland, entrepreneurs (i.e., farmers) would need to convert 10% of Saskatchewan’s land into energy crops. That should do the trick, but they might as well use some of the wheat and barley straw, totaling around 20 million tons/year, and seed some of the 37 million acres of cropland and commercial forests that are not currently in production.

equals subsidies and trade issues, or more simply put, significant complications.

But look at the opportunities. The biomass alternatives yield these possibilities:

For the CHP option, Saskatchewan could

• get almost twice as much power from biomass, and similar or better environmental benefits, for the same price as clean coal and nuclear. More jobs would be created by the CHP option, resulting in higher operating costs, but this is a reasonable price to pay for sustainability. With the per-capita usage of electricity at approximately 48 kWh/day, 2000 MW will provide electricity for everyone.

For the slow pyrolysis option, the prov- • ince would get about the same amount of power, but also 19 million more tons/year

To join the debate, attend the CANBIO Annual Bioenergy Conference on the Prairies, 20–21 October 2009, Edmonton, AB.

The Canadian prairies have been particularly slow on the uptake of bioenergy and bioproducts for a reason. Biomass faces its share of issues ranging from access to financing, long transportation distances, pests, and water availability.

Coal, oil, natural gas, uranium, gold, and potash are shining, and rightfully so, as there is much money being made. For many in government and the public, forestry and agriculture

of CO2 sequestration and the same CO2 offsets by not burning coal. Another added benefit is that biochar from slow pyrolysis can improve biomass yields and reduce nitrous oxide emissions. Moreover, Canada might even become a player in the emerging U.S. carbon trading market.

There are advantages and disadvantages with any alternatives, and the debate will continue. The discussion will require much more discussion and scientific, third-party comparisons.•

Jamie Bakos is a professional environmental engineer, a member of the board of CANBIO, and chair of the Prairie Committee of CANBIO, Canada’s national bioenergy organization.

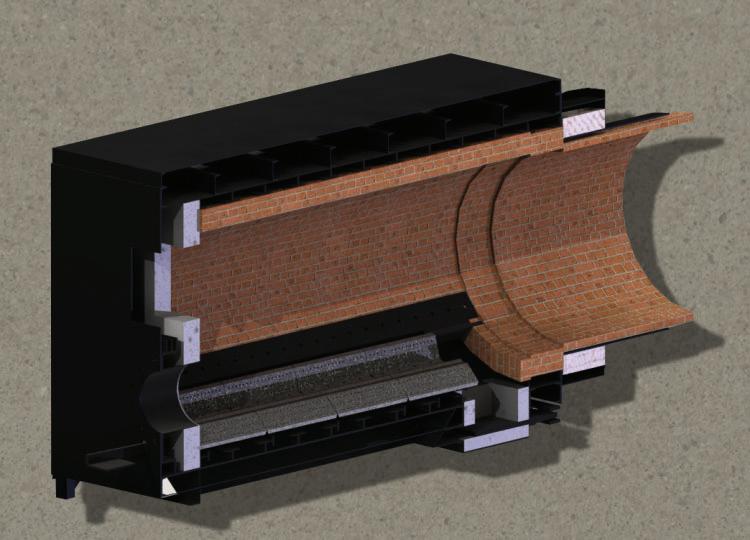

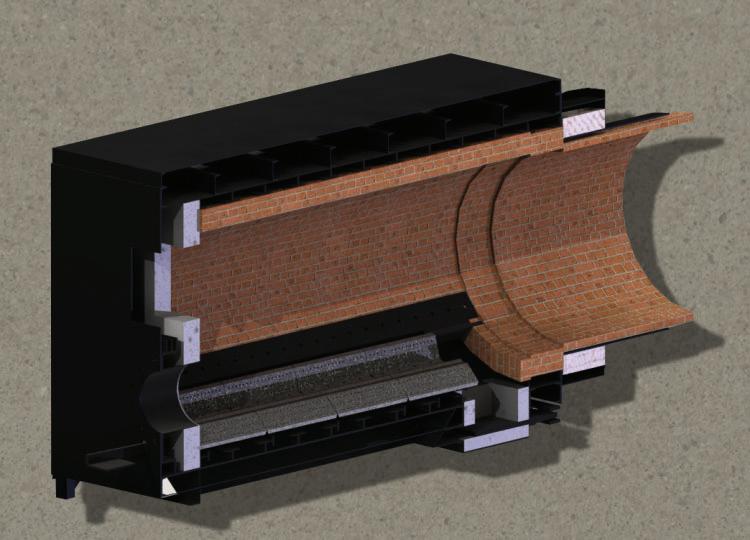

update of available biomass combustion boilers is a follow-up to our popular “Biomass Combustion 101” by Dr. Fernando Preto of CanmetENERGY. Here, we drill down through the mass of information provided by equipment suppliers to offer an overview of technologies, specifications and applications to sawmillers, panel mills, pallet makers and other forestry professionals involved in the emerging biomass sector. Compiled by Colleen Cross.

Above: The

combustor burns bark, sawdust, wood chips, wood pellets, forest residuals and agricultural biomass.

BFI (Falmac Boiler) manufactures stoker grate and bubbling fluidized bed boilers with capacities in the range of 250 kW to 20 MW, and also offers cogeneration (thermal plus electricity). The boilers, which suit small commercial and industrial applications, burn wood chips, wood pellets, agricultural waste and municipal solid waste. BFI manufactures fluidized bed biomass power plants and offers turnkey biomass power plants that produce thermal and, optionally, electrical energy (cogeneration); these systems are fully automated and fabricated in modules for easy transportation and installation. They can burn biomass with higher levels of moisture, even buried biomass. BFI also offers custom designs of its own systems according to client specifications. www.biomasse.ca, c.asselin@falmec.qc.ca

With its moving grate, Blue Flame’s Chain Grate Stoker can burn various fuels without clinkers.

Blue Flame Stoker’s Chain Grate

Stoker is available with a capacity range from 300 kW to 6 MW for small commercial and industrial applications. The versatile Multi Fuel Stoker burns wood shavings, wood chips, wood pellets, municipal solid waste, corn stover, flax straw, agricultural waste with moisture content up to 50%, and fuel sizes from four inches down. Its overfeed system is designed for

trouble-free feeding of densified or loose biomass, and its moving grate enables it to burn various fuels without clinkering problems. A user-friendly PLC control panel manages all the stoker functions from a single touchscreen. Features include a fully modulating system with turndown ratio of 6:1 with “Hold Fire” option; Type “C” or HRT style boilers, built to ASME code and ready for hot water or steam with pressures up to 300 PSIG; a Multi cyclone dust collection system that is up to 90% efficient; an automated ash and soot removal system; and a compact design that requires minimal floor space for installation. www.blueflamestoker.com, info@ blueflamestoker.com

Combustion Expert’s thermal power units use any kind of residues – from sawdust to small logs – with up to 60% moisture content.

Combustion Expert Inc. is a manufacturer of biomass combustion systems, including watertube, firetube, hybrid, electric and thermal fluid boilers, for commercial and industrial companies. System capacities range from 1 MW (100 BHP) to 30 MW (3000 BHP). From sawdust to small logs, the thermal power units use any kind of residues with up to 60% moisture content. Either for heating or thermal process, different advanced technologies can be used according to the client requirements. The system mainly consists of the boiler, the combustion chamber and the woodfeeding system. This system is generally a combination of a hydraulic mobile rake system, shaftless screws and the feeder. Combustion Expert delivers turnkey projects as well as existing system conversion services. For more versatility, systems can also be assembled in a container to avoid building costs or in a mobile unit for temporary use. The product also features an automatic ash exhaust system and remote monitoring, and meets low emission rates while maintaining efficient combustion. www.combustionexpert.com, info@combustionexpert.com

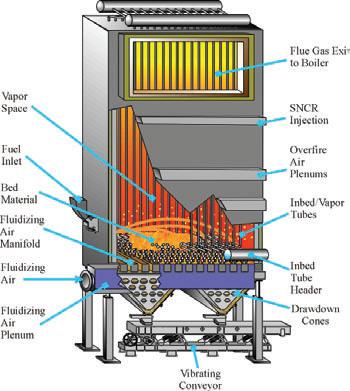

EPI’s fluidized bed boiler systems convert renewable biomass and other solid or liquid fuels into steam energy.

With nearly 35 years of operating experience and more than 80 fluidized bed energy system installations, Energy Products of Idaho (EPI) develops and implements fluidized bed gasification and combustion of biomass and waste fuels for the production of green power while reducing greenhouse gases. Early EPI systems used biomass waste to generate process steam and/or hot gas for directfired dryer applications. The company provides fluidized bed energy systems that range from 2 MWe (8 MW thermal) up to 50 MWe (200 MW thermal). Application of this state-of-the-art technology has now expanded to include independent power production facilities and utility power boiler conversions from antiquated stoker and grate technologies. EPI systems have logged more than five million hours of operating time using such diverse fuels as refuse-derived fuel, board plant waste, demolition waste, urban waste, waste paper, paper sludge, sewage sludge, coal, waste plastics, chicken litter, rice hulls, peat, lignite, cow manure, railroad ties, tires and agricultural waste products. www.energyproducts.com, epi2@energyproducts.com

Fink is the authorized sales agent for KÖB, which manufactures the Low-Particle Firing Pyrot Rotary Combustion Chamber Boiler and the Pyrtec Moving Grate Combustion Boiler. These fully automatic chip and pellet boilers are available in sizes from 80 kW to 2500 kW (270,000 to 8.5 million BTU).

The Pyrtec takes wood fuels ranging from dry pellets to moist forest wood chips, while the Pyrot uses dry woodchips, wood pellets or wood byproducts. The equipment meets commercial, institutional and/or industrial heating requirements, and the company’s specialty is installing large heating systems. Fink is experienced in biomass-based systems for district heating grids, woodchip and pellet systems for municipal buildings and local heating networks.

The Pyrot is environmentally friendly, with low emissions. The Pyrtec offers outstanding controllability of output and fully automatic de-ashing and cleaning. Unlike oil and gas, wood is CO2-neutral and renewable. When used with KÖB modulating output controllers, the burners can achieve more than 90% efficiency. www.finkmachine.com, info@finkmachine.com

KMW Energy Inc. specializes in the engineering and supply of thermal and combined thermal and power systems. Each KMW Energy system is custom designed and engineered to suit the requirements of each application, with thermal energy outputs ranging from 150 boiler hp to 4000 hp and power generation from 1 MW to more than 25 MW. Successful combustion/gasification tests have been made using KMW Energy test units installed at Ortech International in Mississauga, Ont., and CANMETEnergy Technology Centre, Ottawa, on such materials as refusederived fuel (RDF) from municipal waste, scrap tires, construction debris, waste paper, peat, chicken litter, corn stover, rice husks and mill sludge. The KMW Energy

system, designed as modules based on standard components, has been created for optimum combustion/gasification and operating efficiency, and for quick and smooth assembly. www.kmwenergy.com, info@kmwenergy.com

Hurst’s biomass steam and hot water boilers and direct-fired STAG units burn everything from wood to sludge.

Hurst Boiler & Welding Company offers a series of biomass steam boilers, hot water boilers and direct-fired STAG units for alternative solid fuel systems. The Biomass product line is available with such options as Flat Grate Stokers, Underfeed Stokers and Traveling Grate Stokers to meet all biomass system requirements. The company provides medium-sized steam and hot water boilers for the production of heating and domestic hot water, steam for process and heating as well as power generation for all sizes of industrial, commercial, and institutional/industrial applications. Steam capacity range is from 0.78 tons per hour to 57.2 tons per hour. The latest addition to Hurst’s series is the Reciprocating Grate Stoker with automated ash removal. This unit offers solid fuel combustion and allows mechanical replacement of fuel with the least number of moving parts possible. Its efficient, multi-fuel design is offered in various configurations to utilize a wide selection of solid fuels: wood, coal, bark, construction debris, nuts, shells, husks, paper, cardboard products, hog fuel, sawdust, shavings, sludge and agricultural biomass. The Hurst Biomass-ter features a CO2 Neutral Release and PLC-based total systems monitoring. All Hurst factory stokers are cast from high-quality steel alloys and mounted on a robust undercarriage system. www.hurstboiler.com, jhurst@ hurstboiler.com

Jansen Combustion and Boiler Technologies, Inc. provides engineering evaluations, CFD modelling, boiler retrofit/modifications, engineering/design and design. The company provides engineering and equipment to upgrade and modify existing biomass and waste-fuelled boilers, including stoker grate units and fluidized bed boilers. Jansen has provided upgrades on biomass and combination fuelled fossil/ biomass boilers ranging in size from 60,000 lb/hr steaming rate up to 800,000 lb/hr. Generally its work has been in the industrial and independent powerproducing industry. Its engineering includes detailed evaluation/characterization

of the boiler, design of cost-effective combustion and heat transfer solutions, and detailed design and equipment supply. Jansen’s upgrades provide increased steam production from biomass and waste fuels, improved air emissions, improved boiler efficiency, and reduction/elimination of fossil fuel co-firing. Engineering analysis includes in-house computational fluid dynamic (CFD) modelling of each individual boiler, steam/water circulation analyses that include ultrasonic flow monitoring of critical boiler circuits, design engineering, equipment supply and project management.

Capacity range is from 5 to 100 MW (heat input) and fuel types include biomass, waste wood, hog fuel, mill sludge, TDF, OCC, MSW and/or RDF. In providing customized, engineered solutions, Jansen’s focus is to help customers improve operating performance and fuel economy of boilers that handle biomass and/or waste fuels in the areas of efficiency, fuel-burning capacity and air emissions. www.jansenboiler.com, jansen@jansenboiler.com

The Hybrid solid fuel boiler integrates a full waterwall furnace with a steam-generating firetube section and maximizes heat transfer through an extensive radiant and convective surface combining watertube and firetube steam generation. Capacity ranges from 5000 PPH to 40,000 PPH. Hybrid boilers are best used when a byproduct is readily available as an alternative fuel (wood, manure, biomass, bagasse, coal, etc.). Installations offer economic benefits in addition to the fuel savings on such expenses as disposal fees, tax incentives and environmental implications. Typical industrial applications include manufacturing and processing facilities, pulp and paper, sawmills, petrochemical, universities, hospitals, greenhouses and ethanol plants. The A-Type watertube is a symmetrical, well-balanced boiler with a large furnace volume, designed with a centred steam drum and two lower mud drums. The A-Type configuration allows increased capacities (up to 250,000 PPH) and higher operating pressures (up to 1500 PSIG) than other watertube designs. Given its large design capacities, the A-Type is well suited for cogeneration and solid fuel firing (with an open bottom furnace). Typical industrial applications include manufacturing and processing facilities, pulp and paper, chemical, and petrochemical. www.groupsimoneau.com, info@groupsimoneau.com

High efficiency, low environmental emissions, and generous sizing are the trademarks of Teaford Company biomass-fired boilers. These units are designed with multi-stage burners, and can be provided in the following sizes: field-erected boilers with up to 300,000 PPH steam output and superheated up to 1200 PSIG/1200 F, and package boilers with up to 70,000 PPH steam output and superheated up to 1200 PSIG/1200 F. Teaford’s field-erected and package boilers feature saturated or superheated steam; high- and low-pressure designs; tangent tube, tube and tile, and membrane wall designs; wet and dry fuel systems; wet fuel up to 55% moisture content wet basis; reciprocating grate; auxiliary gas or oil burners; air preheaters and economizers; pollution control including ESPs; SCR and SNCR NOx reduction systems; and high combustion efficiency systems. Package boilers feature compact low-cost firetube designs; watertube designs for high pressure; combination watertube and firetube designs; high- and low-pressure designs; and complete turnkey plants. Teaford’s custom design of boilers can include many different options to meet individual site requirements while maintaining high efficiency and low cost parameters. Most Teaford systems are for industrial operations that use steam in dry kilns, heat exchangers, dryers, for conditioning of materials and electrical generation/cogeneration. Some electrical generation users are power companies trying to get renewable energy as part of their overall electrical production, while

others are single companies (universities, mills, etc.) powered by cogen systems. www.teafordco. com, www.teafordcanada.com

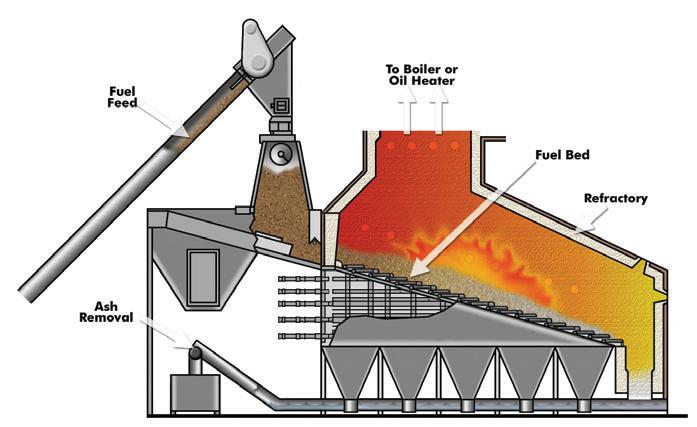

Wellons’ Combuster Cell applications include sawmill and board plant energy systems, biomass fired electrical generation and CHP systems and directfired systems. The Stepped Grate Furnace suits the medium- and large-sized district heating systems used in hospitals and university campuses.

The Wellons group of companies offers two biomass combustion technologies to satisfy customer-specific fuel and thermal energy requirements: the Stepped Grate combustor and the Combustor Cell. The Stepped Grate combustor features a hydraulically operated fuel feeder and fully automatic hydraulic rake ash extraction system. It offers a capacity of 2 to 40 MW thermal and burns bark, sawdust, wood chips, wood pellets, forest residuals and agricultural biomass. Applications include sawmill and board plant energy systems; biomass-fired electrical generation and CHP systems; district or space heating using hot water, steam or thermal fluid; and direct-fired systems to provide hot gases to dryers for pellet plants, MDF or OSB facilities. The equip -

eventS Board

Continued from page 20

SEPTEMBER 10-12, 2009 • WOOD WEEk 09 - INTERSAW, LOGFOR, CANADIAN BIOMASS & DEMO FORET 2000 CONFERENCE Quebec City, QC 506-658-0018 www.masterpromotions.ca

SEPTEMBER 16-18, 2009 • WORLD BIOENERGY – CLEAN VEHICLES & FUELS 2009 Stockholm, Sweden www.elmia.se

SEPTEMBER 17-18, 2009 • BIOMASS BOILER WORkSHOP Portland, OR 425-952-2843 or 425-952-2835 www.jansenboiler.com/workshops.html

SEPTEMBER 21-23, 2009 • ATLANTIC BIOENERGY CONFERENCE Moncton, NB 519-576-4500 www.atlanticbioenergy.ca

Optimum crushing of wood chips!

ment suits medium- and large-sized district heating systems used in such applications as hospitals and university campuses.

With the Combustor Cell you can choose either an overfeed green fuel configuration with automatic ash removal or an underfeed dry fuel configuration with manual ash removal. Modular design of the unit in two- to six-cell configurations provides gross combustion input ranging from 4 to 140 MW. With a capacity of 3 to 73 MW for steam boilers, and 6 to 30 MW for thermal oil heaters. Suitable fuel types include bark, sawdust, wood chips, wood pellets and forest residuals. Applications include sawmill and board plant energy systems; biomass-fired electrical generation and CHP systems; and direct-fired systems to provide hot gases to dryers for pellet plants, MDF or OSB facilities.

For eastern North America see www. wellonsfei.ca , and contact info@wellonsfei. ca . For western North America, and the Combuster Cell, see www.wellons.ca , and contact sales@wellons.ca.

Phone:001-905-836 5643 Fax:001-905-836 6037 rbmacarthur@sympatico.ca www.akahl.de

Volatile energy costs and limited and declining fossil fuel deposits are opening the door for bioenergy, attracting attention from industry, government, the investment community and academia.

By Bill Tice

and bioenergy are hot topics these days. There has been so much interest in the sector over the last couple of years that entire conferences are being dedicated to the topic at a breakneck pace. And even at conferences targeted at other industries, such as the ailing forest industry, biomass is stealing the show.

Just look at the Washington State University’s 43rd International Wood Composites Symposium in Seattle at the end of March. Several speakers introduced biomass and bioenergy into their presentations and even keynote speaker Wolf-Gerd Dieffenbacher, president and CEO of the German wood panel press system manufacturer Dieffenbacher, dedicated a large portion of his address to biomass. However, Dieffenbacher’s comments on biomass were not all positive. He told the audience of about 150 industry, government and academic research representatives that he is concerned about the amount of residual fibre that is being directed towards the biomass industry, but he did stress there is an opportunity to work together.

“We see governments strive to get independent from fossil fuels and therefore promote the production of energy from renewable resources,” he said. “Biomass power plants and the pellet plants buy the same raw material as the panel industry does and because of subsidies they get better prices.”

Dieffenbacher did emphasize that the production of wood based panels provides an

ideal partnership opportunity for a biomass power plant that could optimize the raw material and the heat energy usage. He concluded that governments support the production of green energy and that the panel industry can and should participate.

Jerrold Winandy, a principal at Winandy and Associates, LLC in Mazomanie, Wisconsin, followed not long after Dieffenbacher, telling the audience about integrated biomass technologies. He says this holistic view of how to achieve high-value materials with enhanced performance properties from renewable resources is an integrated concept that promotes the use of sustainable, biobased, environmentally neutral technologies to meet global demands for building and materials end uses, chemicals and energy.

Other International Wood Composites Symposium conference speakers covering biomass included Shijie Liu, the associate

director of the Biorefinery Research in Syracuse, New York. Liu and his research partner, Thomas Amidon, director of the Biorefinery Research Institute, note that biomass is a reliable source of materials, chemicals and energy that can be replenished at the rate of our needs. They say the biorefinery is a concept for the collection of processes used to convert biomass to materials, chemicals and energy and that the biorefinery is a “catch and release” way of using carbon that is beneficial to the environment and the economy.

Portland, Oregon, played host to the International Biomass Conference & Expo in late April. The three-day event that was entirely focused on biomass attracted 1,035 participants, which was a 20% increase over the 2008 show held in Minneapolis, Minnesota. Exhibitors at the “sold out” expo profiled

their products at over 130 booths, while on the main stages approximately 90 speakers presented on six different tracks.

One of the tracks was specific to the forest industry. Entitled “Forest and Wood Processing Residues,” speakers from Canada, the U.S. and overseas covered topics such as woody biomass from public and private forest lands, increasing competition for wood biomass, and the greenhouse gas emissions and energy associated with wood pellets. Another track called “Dedicated Energy Crops” included forest industry content with speakers discussing topics such as dedicated tree farms and next generation biofuel feedstocks. The other tracks were Crop Residues, Livestock and Poultry Wastes, MSW, Urban Wastes and Landfill Gas, and Food Processing Residues. Participants could customize their agenda by switching tracks at any time during the conference.

The event was kicked off with a welcome address by Oregon governor Ted Kulongoski, which was followed by the keynote address

by Robert Cleaves, president of the Biomass Power Association. The rest of the opening morning was dedicated to a discussion on how the U.S. Stimulus Bill and other federal policy developments will impact biomass, and a session on biomass project financing. Time for networking and visiting the product expo was also included in the schedule. The conference will move back to Minneapolis next year, and will be held from May 4 to 6.