2025 CANADIAN ELECTRONICS INDUSTRY REPORT

An in depth look at the state of Canada’s electronics industry

Aluminum Electrolytic and Film Capacitors Business Group

Superior Solutions for Industrial Applications

An in depth look at the state of Canada’s electronics industry

The 2025 Canadian Electronics Industry Survey, conducted by Electronic Products & Technology (EP&T) during May and June 2024, provides a comprehensive overview of the state of the electronics sector in Canada. This year’s survey delves into various critical topics, including business challenges, employee retention, supply chain issues, and design considerations. The insights gathered from the respondents, who represent a wide range of roles and industries within the sector, offer valuable perspectives on the current and future direction of the Canadian electronics industry.

The survey saw an increase in participation from C-suite executives, who made up 24% of the respondents for our 2025 report, compared to 20% last year. This rise indicates a growing interest and engagement from top-level management in the industry’s ongoing developments. Sales personnel also saw a significant increase in representation, from 10% in 2023 to 17% in 2024. Conversely, the proportion of Engineering respondents slightly decreased, from 38% in 2023 to 34% in 2024. Notably, there was also a small rise in respondents who identified as primary decisionmakers within their organizations, growing from 39% in 2023 to 42% in 2024. This shift suggests an increasing influence of high-level executives and sales professionals in shaping the industry’s future.

The 2024 survey results indicate a shift in the business challenges faced by the Canadian electronics industry. Supply chain issues, a significant concern in previous years, were less frequently mentioned as a major challenge, with only 42% of respondents citing it as a concern in 2024, down from 57% in 2023. This decline suggests some easing of the supply chain disruptions that have plagued the industry, particularly in relation to semiconductor shortages. Similarly, challenges related to talent management (37% in 2024 vs. 41% in 2023) and the pressure to deliver short-term results (26% in 2024 vs. 32% in 2023) were less pronounced in 2024.

However, the challenge of remaining competitive and profitable was more prominent in 2024, with 40% of respondents identifying it as a major issue, compared to 33% in 2023. This highlights the ongoing pressures that companies face in maintaining their market positions in a rapidly evolving industry.

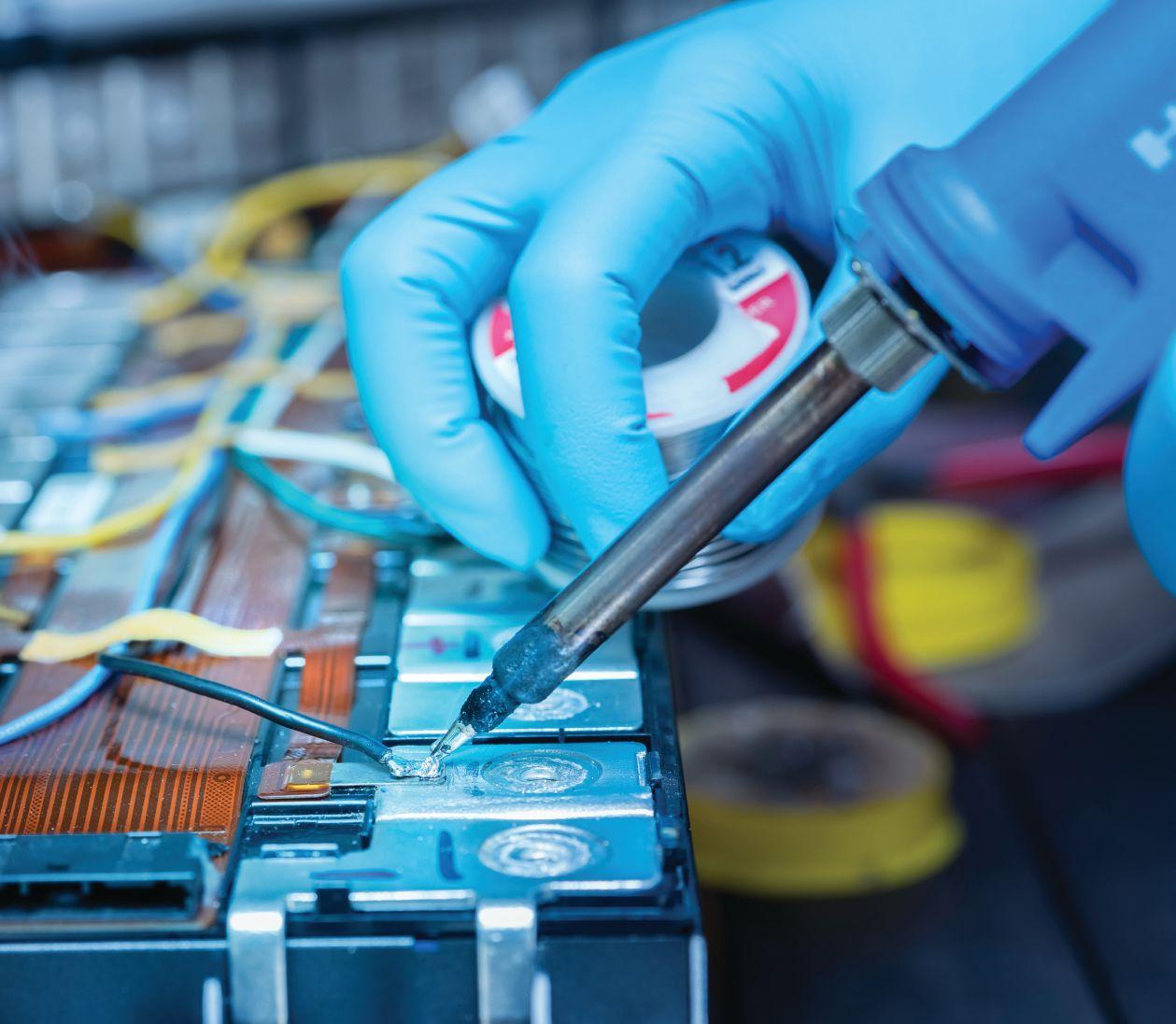

Respondents reported facing fewer challenges in areas such as alternate part sourcing, component allocation/shortages, forced redesign of schematics, and decreased production, further underscoring the industry’s progress in stabilizing supply chain operations. Employee retention remains a critical issue for the Canadian electronics industry. The 2024 survey revealed an increase in the percentage of respondents citing a toxic work environment as a reason for employee turnover, rising from 15% in

2023 to 20% in 2024. Work/life balance issues and the lack of a hybrid return-to-work option were also significant factors contributing to employee departures, particularly among respondents from firms with higher revenue.

Despite these challenges, fewer respondents in 2024 felt that they could earn more with a different employer, or that their current employer provided ample opportunities for career advancement. Additionally, there was a decline in the percentage of respondents who reported that one of their direct reports had resigned in the past 12 months. This data suggests some improvement in employee satisfaction and retention strategies, although challenges remain, particularly regarding workplace environment and flexibility.

The survey indicates a slight increase in the number of respondents working remotely in 2024 (59%), compared to 2023. Managementlevel respondents were particularly likely to work remotely, with 67% indicating they did so, compared to 59% for the overall category. The flexibility offered by remote work was seen as a potential driver of increased creativity, with 59% of respondents in 2024 believing it could enhance creativity, up from 54% in 2023.

However, certain tasks, such as brainstorming, circuit design/ simulation, and administrative tasks, were identified as challenging to perform remotely. While fewer respondents felt that collaboration was difficult to manage remotely in 2024 (40% vs. 46% in 2023), this issue was still significant, particularly for respondents from larger firms.

Environmental considerations in design processes saw a slight decline in 2024, with only 16% of respondents including product recyclability in their designs, down from 25% in 2023. The challenges of incorporating environmental considerations into design remained consistent, with increased costs, resistance to change, and a lack of resources/skills being the top concerns.

Supply chain resilience remains a critical concern for the Canadian electronics industry. Respondents from firms with revenues over $10 million emphasized the importance of re-shoring semiconductor fabrication in Canada, particularly to reduce supply chain risk and enhance sustainability. Establishing redundant supplier relationships was identified as the most effective resilience mechanism, with 30% of respondents endorsing this approach.

You will see plenty more detail on these findings, along with perspectives from our roundtable panel discussion here - within EP&T’s third annual Canadian Electronics Industry Report.

Stephen Law Editor, EP&T Magazine

In recent years, the electronics industry has been navigating a complex and challenging landscape marked by numerous disruptions and uncertainties. From the impacts of the Covid-19 pandemic, which led to severe supply chain interruptions and significant staffing shortages, to the broader economic instability affecting global markets, the sector has faced unprecedented challenges. These issues were compounded by a prolonged period of component shortages that halted production across various industries, creating a ripple effect that extended far beyond the electronics sector. However, as we emerge from these turbulent times, inventory levels have stabilized, bringing some much-needed relief and a glimpse of normalcy to the market.

In this dynamic environment, maintaining a leadership position within the industry requires a robust and resilient electronic component supply chain capable of meeting global demands. This ongoing evolution in the market ensures that companies must remain vigilant and adaptable, constantly innovating and improving to avoid complacency and stay ahead of emerging trends and challenges.

Celebrating its 60th anniversary this year, Mouser Electronics stands as a testament to six decades of unwavering commitment to innovation and growth. Since its founding in 1964, the company has established itself as a leader in the distribution of semiconductors and electronic components. With 28 locations across the globe, Mouser operates in 23 languages and 34 currencies, effectively catering to a diverse and international customer base. Despite the myriad challenges encountered in recent years, Mouser’s dedication to its core mission remains steadfast. The company continues to focus on the rapid introduction of cutting-edge products and technologies, ensuring that its customers can bring their solutions to market quickly and efficiently.

In response to the allocation issues that have plagued the industry, Mouser Electronics has adopted a proactive approach. The company has steadily expanded its inventory to include one of the most extensive selections of semiconductors and electronic components available worldwide. The central warehouse in Texas is a key component of this strategy, designed to meet the diverse needs of engineers and prototyping projects across the globe. This extensive inventory enables Mouser to maintain a stable supply chain and provide reliable service, even during periods of market volatility.

As a factory-authorized distributor, Mouser Electronics is at the forefront of technological advancements. Every component that Mouser stocks and ships comes straight from the original manufacturer. The company excels in rapidly introducing the latest products from over 1,200 leading manufacturers, ensuring that it remains at the cutting edge of industry developments. Additionally, Mouser’s industry-leading NPI position is augmented with the

immediate availability of well over a million different electronic components ready for prototyping and design. Through strategic collaborations with manufacturer partners and continuous inventory expansion, Mouser reinforces the stability of its supply chain, allowing it to support its customers effectively and adapt to fluctuating market conditions. This proactive approach not only enhances supply chain resilience but also ensures that Mouser can consistently meet a wide range of customer needs.

Quality and control are cornerstones of Mouser’s operations. The company adheres to the highest industry standards, providing customers with confidence that the components they order are sourced directly from original manufacturers. This rigorous approach helps prevent the introduction of counterfeit components into the supply chain, safeguarding the integrity of customer projects and ensuring reliable performance.

In the realm of e-commerce, Mouser Electronics offers a comprehensive suite of tools on mouser.com designed to streamline the sourcing and procurement process. These resources make it easier for buyers to access and manage inventory, even as experienced procurement professionals increasingly rely on mouser.com for their needs. The tools available facilitate the efficient identification of in-stock components, enable rapid quote requests for entire spreadsheets and Bills of Materials (BOMs), and provide valuable insights into end-of-life parts, further enhancing the procurement process.

Innovation extends beyond product offerings to include advancements in procurement processes. Forward-thinking procurement teams are increasingly adopting APIs and automation to optimize their operations. While user interfaces (UIs) that connect people to technology remain essential, Application Programming Interfaces (APIs) are becoming more prevalent. APIs allow for the automation of routine tasks such as inventory searches and pricing updates, freeing up procurement professionals to focus on strategic decision-making and more complex challenges.

Mouser Electronics is proud to support this research that aligns with its mission to deliver the latest products and technologies to design engineers and procurement teams. We believe that this research provides valuable insights and stimulate meaningful discussions about current and future trends in purchasing, as well as the development of innovative solutions in the electronics industry. We value the continued trust and partnership of our customers and look forward to advancing together in this ever-evolving field.

Mauro Salomão Marketing and Business Development Manager, Latin America and Canada

Mouser Electronics

Mauro Salomão is an international executive with a 35-year career spanning the Americas, Europe, and Asia, specializing in sales, business development and marketing.

By Stephen Law, Editor, EP&T magazine

After a prolonged period of shortages that disrupted production across industries, global inventory levels of electronic components are finally showing signs of recovery. However, supply chain issues continue to challenge manufacturers, with lingering bottlenecks and unpredictable demand patterns keeping the industry on edge. As companies work to rebuild their stockpiles, the question remains whether this fragile balance can withstand the next wave of market fluctuations.

Driven by the allocation problems the industry suffered through a few years ago, most component distributors, such as Mouser Electronics, have been diligent in building inventory.

“We have invested heavily on inventory, said Mauro Salomão of Mouser Electronics who is based at the firm’s headquarters in Mansfield, Texas, which also ships directly to customers around the world.

“One of the things that has really been key for us is that we keep receiving products from vendors - even doubling our inventory quantities. As a result, we don’t have shortages today. We stand in a good position with semiconductors, microcontrollers and ICs. Our customers, however, have spent the past few years stockpiling, due to the allocation issues. We are waiting for sales to really pick up,” Salomão added.

Industry veteran of 48 years, Robert Miozzo of Montreal-based distributor Diverse Electronics concurs with the observations related to industry-wide inventory levels

“The inventory is available today, and I know that the lead times from the factories are pretty much normal. But, I just don’t think that demand is very strong right now,” he noted. Miozzo mentioned a few indicators that could be contributing to a slower turnaround – such as high interest rates, weak market conditions, and a pending presidential election in the U.S.

“Many of the forecasts were indicating that things should pick-up by the end of this year. Frankly, we are heading into the fall and I don’t think much is going to change until we turn the calendar over to 2025,” stated Miozzo.

These sentiments were also echoed by Normand Bourbonnais, CEO of Technum Quebec, an innovation hub based in Bromont, Quebec.

“Based on all the discussions I’ve been having with our (Technum) partners, they have not been experiencing any problems in procuring specific part numbers – with one exception - high bandwidth memory chips produced for AI design applications,” said Bourbonnais. “Things are nothing like we experienced back in 2021 and 2022, where we were missing a lot of part numbers. Shortage wise, things are very manageable right now.”

Titu Botos, CEO and co-founder of NeuronicWorks, a Toronto-based design house compared the component supply conundrum between years 2023 and 2024 to be ‘like night and day’.

“It’s not always a very bright day – but, it’s we are better off today,” mused Botos, who’s firm expanded its service levels to deliver fully integrated, turnkey, custom box build assembly & SMT pcba services – including prototyping and full production runs.

“Yes, we still pay attention to what parts are specified. It is important to do your due diligence - to make sure that when we are working with a project in production, we don’t have any surprises.”

According to the industry report survey results, 42% of respondents identified supply chain as being the most significant business issue they faced. Following closely behind in the survey results was the issue of remaining competitive and/or profitable – with 40% of respondents indicating this.

“We are not free of problems here and there. But you look at the situation logistically, and things seem to be smoothing out, getting to normalcy,” observed Salomao. “We are just waiting for the market to catch up. This will likely be driven by some of the new technologies that are emerging within the industry.”

“Many of the forecasts were indicating that things should pick-up by the end of this year.

Frankly, we are heading into the fall and I don’t think much is going to change until we turn the calendar over to 2025 ”

– Robert Miozzo, Diverse Electronics

Industry report survey results also showed that 57% of respondents indicated that they had to conduct some sort of alternate component sourcing, due to supply chain challenges through the past year. These results were closely followed (45%) by component allocation and part shortages.

“There’s no question that there is now inventory out there – unlike that period during 2022 where inventory was very difficult to come by. It’s well documented that many players over-purchased parts, and they are still eating into some of that inventory,” noted Miozzo.

There is one component category that has been experiencing some levels of volatility these days, and it is memory chips, according to Adam Grigor, president of Tech Trek Inc., a Mississauga-based manufacturers’ representative firm, with offices across Canada.

“It’s a cycle correction that started between nine to 12 months ago. I’ve seen pricing increase in those areas pretty much month-tomonth,” stated Grigor, who identified RAM generations DDR4 and DDR5 as the most troublesome. He identified an additional area of concern when it comes to allocation, and that involves automotive sensors and even MOSFETs, depending on the device.

“In some cases, we see business booked out into 2026 - even in today’s marketplace. So, without a doubt, it’s far different than it was than it was a year ago. There’s no doubt about that,” Grigor said. Not everything is dark and ominous in the component world, as Grigor added that demand from some of his firm’s tier-one industrial customers is just starting to come back now.

“After about four or even five quarters of zero business in that segment, we are seeing some relatively good demand. It’s not back to historical levels, but it’s a positive development,” Grigor added.

Dealing primarily with start-ups and/or scale-up companies on a regular basis, Avinash Persaud, vice-president of Hardware Catalyst Initiative (HCI) at ventureLAB in Markham, clearly recalls the ‘kneejerk’ reaction within the industry when component inventory shortages occurred.

“It was like people stock-piling toilet paper during the pandemic. Everybody bought way more than they needed, because they were scared as heck that they won’t be able to fabricate their final product,” noted Persaud. “We noticed when trying to assist some of the smaller players access inventory – that there are a lot of gray market components which ended up in the inventory streams. Some still remain in the ecosystem causing problems for the integrity of the supply chain.”

With all the question marks surrounding other components of late, Bourbonnais has witnessed impressive things for semiconductors, as the procurement for chip use in designs has been growing 15% on a quarter-to-quarter basis. Over the past few years, he has played a significant role in advocating for the reshoring of semiconductor production to Canada.

Grigor says that heightened demand for memory devices may be skewing the data as reported this summer by the Semiconductor Industry Association (SIA). Hot design sectors, such artificial intelligence (AI) and data centres have been driving the surge in memory products through early in 2024.

Automotive/ Transportation

“When trying to assist some of the smaller players access inventory – there are a lot of gray market components that ended up in the inventory streams. Some still remain in the ecosystem, causing problems for the integrity of the supply chain.” – Avinash Persaud, Hardware Catalyst Initiative ventureLAB

“I think we almost need to take a closer look at this type of situation. Is it the volume of components being fabricated, or the value of these parts. Certainly, the value these chips in AI designs is skewing the numbers a bit,” noted Persaud.

As governments tighten environmental regulations and consumers ponder their ‘green’ purchasing priorities, electronic engineers across the country face mounting challenges in their design processes. The new laws, aimed at reducing the environmental footprint of the electronics industry, require more stringent documentation and adherence to eco-friendly standards. Designers are now grappling with the need to balance innovation with sustainability, as they navigate complex compliance requirements that could reshape the future of electronics manufacturing in Canada.

“It brings another layer on top of every other challenge or complication or stress that a new product introduction implies,” says

Titu Botos of NeuronicWorks, a Toronto-based design house and production facility. “We want to think about the environment. We want to design products that are recyclable. We want to think from end-toend - from the first moment to the last time you use that product. What will happen with it, and where’s it’s going. It’s very challenging, because at the end of the day everything comes at a cost.”

Avinash Persaud, VP Hardware Catalyst Initiative, says that there needs to be more collaboration between government, as well as education for companies within the ecosystem. Pointing to some examples of success in Europe, whereby some governments have taxed players for what they don’t want to see in an electronic device, while incentivizing engineers for elements of design that are good for the environment.

“From a global perspective, I see corporations pushing to get a product that is environmentally friendly, and somehow the pressure will be to get the same product at the same price.”

– Normand Bourbonnais, Technum Québec

“For OEMs that are looking to have some environmental offering in this space – they need to be sure it’s an asset or a selling point to the product they’re looking to sell to the consumer,” noted Persaud. “If it’s just environmental value for its own sake, I don’t think there’s going to be enough incentive for it to succeed. There must be some value that makes their product more sellable.”

Persaud says if that ‘greener’ products deliver more value to the customer, such as waste reduction, then somebody’s going to be willing to pay for it.

“Unless you can put value in or reduce cost, it’s just not going to be important - in and of itself, regardless of the moral value to it,” he added.

Companies in the electronics sector must source materials responsibly, avoiding rare earth elements tied to environmental degradation or human rights abuses. This shifts design priorities

towards sustainable materials and recycling-friendly components. As a result, new governmental laws have emerged, such as Environmental, Social and Governance (ESG) requirements, which are a set of standards used to evaluate a company’s operations and their impact on society, the environment and how it is governed.

As a global distributor, Mauro Salomão of Mouser Electronics says his firm has taken steps to pay heed to ESG requirements, such as implement automation into its systems, along with reducing packaging in shipments sent to end-customers. Added ESG documentation on components has increased the amount of time it takes to process orders, thus it has contributed to price increases.

“This added documentation has required a lot more human resources to get everything together and to get the sale completed. In the end, this increases cost, for everyone,” Salomão stated.

ESG requires electronics manufacturers to focus on energyefficient designs, both in the production process and the end products. Devices must be more energy-efficient, which can lead to innovations in semiconductor and circuit design to meet lower energy consumption goals.

“I’d say the demand from our customers is all tied around regulation. As a rep, we really don’t have a competitive advantage by marketing any environmental rewards, outside of upcoming new regulations, such as DOE Level 7,” said Adam Grigor of manufacturers’ representatives Tech-Trek. “We certainly expect a whole new level of ESG requirements going into 2025. So, it will really be on our suppliers to ensure completed ESG audits. There will be a much higher level of scrutiny from our customers than in the past.”

Robert Miozzo of Diverse Electronics says that as a distributor, the issue of ESG doesn’t often come up during the customer purchase procedure, as part pricing and lead-times take precedent.

“It’s great if you pass that test and end up getting an order. However, once most of these customers finish their end-product, and determine that they will be exporting to Europe - that’s where the regulation-related paperwork poses as a possible problem. At that point, it’s too late, as the product design has been manufactured, and it may not be suitable for their particular application,” mused Miozzo. “Frankly, as a distributor, we provided the customer with what he wanted, because at that point in time the customer didn’t bring up all these other considerations.”

According to the survey results for this Industry Report, low percentages of respondents in 2024 stated that the “sense of doing good, creating a marketing advantage, and meeting customer demands” were benefits in including environmental considerations into design, by comparison to the previous year. In the end, being environmentally conscious can be an added stress to the process of building an electronic device, according to Botos.

“Unfortunately, the environment draws the short-end of the stick often, because not many clients are capable of footing-the-bill when it comes

to doing the whole process properly, and get the product to where it needs to be,” Botos said. “Ultimately, as a generation, we have to understand that the process is not business as usual. We need to think about tomorrow, and about what we are leaving behind for our children.”

Normand Bourbonnais, president & CEO of Technum Quebec, deals frequently with tech start-ups and has observed that many venture capitalist (VC) investors are inquiring if an ESG roadmap is in place.

“If these VCs find out that the start-up is not working with an ESG approach to the marketplace, then they will not be investing,” added Bourbonnais added.

Overall, ESG requirements push the electronics industry towards more sustainable practices, which can spur innovation, but also

increase costs and regulatory burdens. Companies that successfully integrate ESG strategies often gain competitive advantages by appealing to environmentally conscious consumers and investors.

“From a global perspective, I see corporations pushing to get a product that is environmentally friendly, and somehow the pressure will be to get the same product at the same price. This is what I see from both sides – the people ordering product and those manufacturing it,” Bourbonnais stated.

“We need more than just environmental reasons to purchase something. Yes, we want a better world - we want a safer world. We want to use things that are not going to harm us. But, at the end of the day we all have to pay the price for them,” Salomão concluded.

In the past few years, the electronics industry has faced its share of supply chain disruptions, from semiconductor shortages to shipping delays and geopolitical tensions. To shed light on the challenges and the path forward, we asked our panel of industry experts to share their firsthand experiences grappling with these obstacles and to offer insights into how companies can better prepare for future disruptions. As supply chains become more complex and interdependent, the experts stressed the importance of diversification, local sourcing, and advanced planning to build resilience for the years ahead.

“I would say that the lesson learned is to always respect the supply chain. Prior to 2020, we were spoiled, and we took it for granted,” said Titu Botos of NeuronicWorks, a Toronto-based design house and production facility. “Today, we must do more work into verifying where the components are coming from. In the past, a quote may have been optional. But today, we have two or three alternatives in the BOMs.”

As a significant driver and proponent of re-shoring semiconductor production on Canadian soil, Normand Bourbonnais says he is excited to see the Federal government finally recognizing the impact of the electronic industry in Canada – on so many different markets. Enthused by the recent formation of the Canadian Semiconductor Council (CSC), Bourbonnais says the country now has a single voice speaking on behalf of microelectronics.

“I would love to see all members of the Canadian electronics industry become a member of CSC. This is very important, so that we develop the appropriate policies in order for us to be well positioned in the global ecosystem, and have the capability of providing services within the next new resilient supply chain in Canada and USA,” said Bourbonnais.

Avinash Persaud, VP Hardware Catalyst Initiative at VentureLAB in

Toronto, has played a pivotal role in fostering innovation within Canada’s semiconductor ecosystem. As one of the founding organizations of the CSC, ventureLAB supports and scales up startups by providing resources, mentorship, and access to strategic partnerships. Their efforts are crucial in advancing Canada’s semiconductor capabilities, helping emerging companies navigate the challenges of scaling in a competitive global market while contributing to the growth and resilience of the nation’s high-tech sector.

“We recognize that we needed a coherent voice in this sector, which is why we initiated the council,” Persaud adds. “I think we need to look at the recent chip shortage and recognize that this crisis was a blessing in disguise. It woke up governments as to what could happen - not only the semiconductor industry as a sector, but every other sector it affects - even manufacturing production. There is not a single industry of any consequence that is unaffected by semiconductors.”

Persaud says when he first joined ventureLAB in 2019, his group was knocking on Government’s door to discuss what the opportunities were. Once the chip shortages kicked-in, their roles reversed – and the government was suddenly keen to hear what strategy should be put in place.

“I think it was a rude awakening to both the challenge and the opportunity, and we can’t allow complacency to put us back where we were before the chip shortage,” noted Persaud. “This is not an issue of low-cost supply. This is an issue of resilience of supply. And, it’s going to take a lot of effort, a lot of concentration. We can’t be distracted by short term issues, whether there’s short term oversupply short term, short problems. There will be challenges in getting the right incentive for this to happen, and it’s only going to become more significant. In the years to come, we must keep the focus.”

As electronic OEMs increasingly seek to reshore their production to North American contract electronics manufacturers (CEMs) or electronics manufacturing services (EMS) providers, they are encountering an unexpected reality — significantly higher costs compared to offshore services performed in Asia. While reshoring offers benefits such as improved supply chain resilience and proximity to markets, many OEMs are recoiling at the added expenses tied to domestic labour, regulatory compliance, and material costs. This tension highlights the challenges of balancing supply chain security with the financial demands of producing closer to home.

Localized CEMs are seeing these concerns on the rise here, sometimes on a daily basis, according to Titu Botos, CEO of NeuronicWorks, a design house and production facility based in Toronto. The recent trend towards reshoring designs at home has been met, in part, by sticker price shock. This also comes at a time when OEMs are paying close attention to their bottom line, while attempting to reel-in rising costs to manufacture their products.

“A few years ago, this trend started, whereby OEMs were saying ‘let’s go back to North America’ and let’s manufacture onshore things. We were right in the thick of things and we were doing everything to make that happen,” says Botos. “Unfortunately, when the people see the prices you give them, they say ‘we cannot bear those costs’. They know what service levels and costs to expect when doing business in the Far East, but at the same time they also want all the good things that come with doing business on home turf, such as the quality, the reassurance, the service that we can provide here in Canada,” Botos explained.

For OEMs looking to reshore their electronic production runs to Canada, the expectation of matching the lower pricing available in Asia presents a major conflict. Manufacturing offshore often comes with

lower labour costs, fewer regulatory expenses, and economies of scale, allowing for competitive pricing that North American facilities often cannot match. As a result, Canadian manufacturers face pressure to reduce costs without compromising quality, while struggling to reconcile the financial realities of domestic operations. This disparity creates a tension between the need for supply chain resilience and the economic pressures that have driven production offshore for decades.

“Their main objective is to reduce the cost of the manufacturing. They (OEM) may be okay with the way the product works or looks, but they are not okay with the cost of producing that unit,” Botos explained. “The other half of this equation is that we, as a company, have to stay competitive and profitable. And, it’s not necessarily easy, as we are always being compared with services that are done somewhere else.”

“Their main objective is to reduce the cost of manufacturing. They (OEM) may be okay with the way the product works or looks, but they are not okay with the cost of producing that unit.”

– Titu Botos, NeuronicWorks

I

n Budget 2024, the Government of Canada had committed to launch consultations on a right to repair (RTR) policy, which has the potential to transform consumer rights and environmental sustainability. These laws, aimed at electronics manufacturers, will require companies to provide consumers and independent technicians with the tools, manuals, and replacement parts needed to fix devices themselves. The initiative is designed to reduce electronic waste and extend the life cycle of products, from smartphones to household appliances. As Canada joins the growing global push for repairability, tech companies and consumers alike are preparing for the changes that could reshape the way products are designed and maintained.

“In Europe, they have the right to repair type regulations, which we don’t have yet. This is where it’s not just contingent on the consumer or supplier - it’s also regulatory. This impacts the investor’s decisionmaking process. It’s a whole ecosystem that’s going to drive it,” noted Avinash Persaud VP Hardware Catalyst Initiative.

Life Cycle Assessment (LCA) represents a systematic method used to evaluate the environmental impacts of a product or process throughout its entire life cycle, from raw material extraction (cradle) to disposal or recycling (grave). LCA is particularly relevant in industries such as electronics, where products have complex supply chains and can generate significant environmental impacts at each stage of their life cycle.

“Because we are right there at the front-end of the design process, life cycle assessment (LCA) or the repairability has become a big part of our focus - it has become top of mind. Our customers are expecting designs that are serviceable and reparable in the field,” said Titu Botos of NeuronicWorks. “It will take more than just the will of a person or of a single group. It maybe even require political will to push us toward these ‘green’ tendencies. Ultimately, it makes things more expensive, and that is a big factor in the decision process, when it comes to design and manufacturing.”

The life cycle of electronic components is a complex journey that spans several stages, each with its own environmental and economic implications. From the extraction of rare and precious metals, to the energy-intensive semiconductor fabrication processes, and the eventual assembly into consumer electronics, the environmental footprint is significant.

During the use phase, energy efficiency becomes crucial, particularly as devices become more interconnected and powerhungry. However, the most pressing concern comes at the end-of-life, when millions of devices contribute to growing e-waste. Without proper recycling infrastructure, valuable materials are lost and toxic substances risk polluting the environment.

“When it comes to the life cycle of the components, we’re seeing that factor be much more critical in the part selection process. It’s not due to environmental. It’s due to supply chain.”

–

Adam Grigor, Tech-Trek

“When it comes to the life cycle of the components, we’re seeing that factor be much more critical in the part selection process. It’s not due to environmental. It’s due to supply chain,” said Adam Grigor of Tech Trek. “As demonstrated through the covid allocation period - the life cycle of the components has become more of a critical factor in selection. To be able to demonstrate that a component is going to be around for five to seven years is certainly a selling point.”

As businesses continue to adapt in the shadows of the COVID-19 pandemic, office work environments are undergoing a significant transformation. Employees across various sectors, including electronic engineers, are now expressing a strong preference for hybrid work models—combining the flexibility of remote work with in-office collaboration. This shift in expectations has forced companies to rethink their workplace policies, balancing productivity with employee well-being. For industries like electronics engineering, where innovation thrives on both focus and teamwork, the hybrid approach is quickly becoming the new standard.

According to those who participated in the Industry Report survey, slightly more respondents stated that they worked remotely at all (59%) in 2024, by comparison to the previous year (56%). Respondents in management positions were more likely than most to state that they worked remotely at all (67% vs 59% for the overall category).

Of course, the reactions of those surveyed depends on their particular job function. Those directly involved in engineering or design work may have migrated to a hybrid model. The survey results also showed that 66% of respondents stated that flexibility with work time would help in increasing creativity through remote work.

Those in engineering roles indicated that the tasks they found most difficult to perform remotely include: testing (48%); brainstorming (47%); prototype build and/or collaboration (both at 40%).

For some, such as for Titu Botos of NeuronicWorks, collaboration is key during the electronic design process. Thus, he stresses to all new team members that their prescence in the office is required 100% of the time.

“It

certainly is more difficult to sell and to develop new customers in this work from home environment. Such an important part of sales is developing a personal relationship and that is really difficult to do virtually.”

– Adam Grigor, Tech-Trek

“Even the young people understand that after being with us for a few weeks or months, they see that it takes four or five people to integrate the product and deliver in time. They may come with this request of working remote the first, but then they understand. You have to be here, and nothing beats the effort of a team that works together,” Botos explains. “There is no lone wolf that can do what a whole team can accomplish.”

Life was not easy for salespeople trying to get some facetime with customers during the pandemic, as most clients were sequestered within their newly designated home offices. The new normal today, however, still includes some of these hurdles, as many engineers or administrative employees have transitioned to a hybrid work model. This has made it difficult to connect with some important players in the buying cycle, according to Adam Grigor, president of Tech Trek, a Mississauga-based manufacturers’ representative.

“It is certainly more difficult to sell and to develop new customers within the ‘work from home’ environment. Such an important part of sales is developing a personal relationship and that is really difficult to do virtually,” said Grigor. “Our sales organization has been in business for 42 years. So, our relationships with existing customers can supersede that challenge. But, as the industry welcomes new engineers into the marketplace, it adds to our challenges.”

Industry veteran of electronic distribution channels Robert Miozzo agrees.

“You know it is hard to find a customer today that’s willing to call you back. It’s not so easy. At one time it was quite simple. You picked up the phone, called and somebody answered it. That’s hasn’t been my experience for quite some time now,” Miozzo says.

The hybrid model is something that the youngest generation wants, according to Normand Bourbonnais Chairman and CEO of Technum Quebec.

“Personally, I don’t need a reason to come into work every day, because I like working at the office – I like being with people. But, the younger generation, they seem to really enjoy it if they can spend a day home doing reporting. They don’t have to travel to and from the office. They don’t have to take their car. They also do understand that if there’s a customer coming into the office on a Friday, they must be present as well. I think the expectation has to be very clear,” stated Bourbonnais, who has more than

40 years in the field of microelectronics, working in various management positions including production, quality control, engineering and product development.

While hybrid work models offer flexibility for many office-based roles, they don’t easily accommodate employees in manufacturing or production environments. Workers in these settings often rely on physical presence to operate machinery, manage production lines, or conduct hands-on quality control, making remote work impractical. Unlike office staff who can perform tasks digitally, production workers need to be on-site to ensure seamless operations, limiting the flexibility that hybrid models provide. As a result, these roles often require more traditional work arrangements, highlighting a divide in the feasibility of remote work across different job functions.

“The other challenge is with engineers supporting a manufacturing line. They too, would prefer to work remotely two or three days a week. The problem is, you cannot inspect product through a microscope when you’re at home - you have to be on the production floor - that’s part of the job,” Bourbonnais added. “I worked close to one year on night shift, and it was demanding and difficult on your metabolism. The fact of the matter is that a manufacturing line represents so much capital, you have to try and maximize that investment, which often means running two shifts per every 24-hours.

Chasm between expectations – responsibilities

The generational divide – which includes job perceptions and expectations within the electronics industry, can wreak havoc on sales organizations, such as Diverse Electronics. A veteran of the electronics distribution industry for decades, Robert Miozzo has been responsible for the hiring procedures at his Montreal-area facility. Patience may be a virtue in fulfilling a sales position, but many new hires within the younger demographic groups don’t seem to demonstrate it.

“Most people that I interview from the younger generation tend to have a higher expectation of themselves and in some cases not realistic. I tell everybody, and I’m not sure they believe me - that in the first three, even six months, they’ll probably will not make any commissions – I mean zero,” explained Miozzo. “Most applicants probably don’t believe me. They might think: ‘you know I I’m better than that.’ And, that becomes a problem, because at some point in time - when those commission dollars don’t come in - it now becomes a negative. It just takes time in this business. It takes time to understand your customers and their expectations and to know your suppliers. I would tell you that most people don’t want to put in the time and effort.”

As a result, all of these things add to the frustration for recent grads dipping their toe into the broad electronics job market and add to some of the job turnover that exists, according to Miozzo.

COULD YOU HAVE RETAINED ANY EMPLOYEES WHO LEFT YOUR COMPANY FOR A NEW OPPORTUNITY, WITH…

Raise or bonus

Continuing

HAVE EMPLOYEES LEFT YOUR ORGANIZATION FOR ANY OF THE FOLLOWING REASONS?

Early retirement = 27%

Work/ life balance issues = 26%

Toxic co-worker environment = 20%

Unmanageable workload = 19%

Lack of hybrid work option =14%

Health/safety reasons = 9%

Childcare reasons = 8%

Lack of diversity = 5%

None of the above/other = 43%

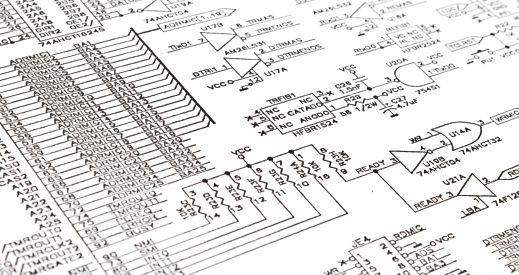

When it comes to developing and designing cutting-edge electronics, engineers rely on a few key resources to guide their decisions and ensure successful project outcomes.

EP&T’s recent Industry Report survey reveals that datasheets top the list as the most commonly used source of information, with 79% of respondents—and an overwhelming 95% of engineers in specialized roles—relying on them for crucial component details.

Following closely are technical articles and documentation (63%) and application notes/whitepapers (59%), which provide deeper insights into product capabilities and design strategies. Rounding out the top five are supplier sales/Field Application Engineers (FAEs) (36%) and trade magazines/journals (35%), offering industry insights and personalized technical support. The data highlights the increasing importance of these resources, particularly for those in engineering-specific roles, as they navigate the challenges of electronic design today.

Thus, the dominance of the data sheet makes sense—whether sourcing a new component or refining an existing design, engineers need precise and accurate specifications to ensure compatibility and performance. A datasheet provides all the technical details necessary, including voltage ratings, pin configurations, power consumption, and thermal tolerances. For engineers, these documents are indispensable because they eliminate guesswork and allow for quick decision-making when it comes to selecting components that meet specific project needs.

“For me, it’s the fastest way of finding the information on the product that you are looking for,” said Mauro Salomão of Mouser Electronics. “I think it’s a more secure, documented and adds credibility. The datasheet is the highest source of information available.”

Whether a team of engineers is incorporating components into a new design or a supplier is looking to sell or distribute parts, datasheets form the foundation of decision-making. The data sheet offers insights not only on component capabilities, but also on the potential limitations and risks.

“I’m not surprised at all by these survey results, because as an engineer, the data is the most important factor in the design process. That’s the foundation - the datasheet,” said Titu Botos of NeuronicWorks. “The data sheet is the contract between the manufacturer of the component and us as the designer. We believe firmly that our

engineering team read data sheets in their entirety – regardless of length, which can be cumbersome.”

For example, a datasheet may indicate whether a microcontroller can withstand certain environmental conditions or whether an amplifier has enough bandwidth for high-frequency applications. This technical depth explains why engineers, particularly those in design-intensive roles, rank datasheets far above other resources in their toolbox.

“I can tell you that if we’re looking at new suppliers, one of the qualifications is looking at the quality of their data sheets, knowing how important they are,” said Adam Grigor, president of Tech Trek. “It’s just part of any engagement, on any design – knowing that there will be related review and dialogue around the data sheet.”

“It’s the fastest way of finding the information on the product that you are looking for. I think it’s more secure, documented and adds credibility. The datasheet is the highest source of information available.”

– Mauro Salomão, Mouser Electronics

Now that our annual industry survey is into the third year of collecting a profile perspective of our readership, it’s not surprising that there haven’t been any demographic shifts overall. The Canadian Electronics Industry Report is based off the results from EP&T’s annual survey conducted during May and June 2024. This year’s findings provided us with an in-depth look at the professionals who shape this nation’s dynamic electronics sector. Traditionally a male dominated industry, this year’s survey results delivered valuable insights into the demographic makeup of the industry, highlighting trends in roles, experience levels, age distribution and gender representation.

The survey results indicate that the Canadian electronics industry is diverse in terms of the roles that professionals occupy. A significant portion of the respondents, 34%, are engaged in engineering roles, reflecting the technical backbone of the sector. These professionals are involved in designing, developing, and improving electronic systems and components, playing a crucial role in driving innovation.

C-suite executives make up 24% of the respondents, showcasing the strategic leadership that guides the industry’s direction. These individuals are instrumental in making high-level decisions that impact the overall trajectory of their organizations and the broader industry.

Sales professionals account for 17% of the respondents, indicating the importance of business development and client relationships in the electronics sector. These individuals are key in ensuring that cuttingedge technology reaches the market and meets consumer needs. Maintenance, Repair, and Operations (MRO) professionals represent 16% of the respondents, underscoring the critical role of maintaining and optimizing existing systems. Production management, comprising 9% of respondents, highlights those who oversee the manufacturing processes, ensuring efficiency and quality in production lines.

The survey reveals an experienced workforce, with the average age of respondents being 56.4 years. This statistic points to a significant presence of seasoned professionals within the industry, many of whom have spent decades honing their skills and expertise.

A breakdown of the age groups shows that those aged 60 to 69 make up the largest segment at 33%, followed by the 50 to 59 age group at 22%. Interestingly, 15% of respondents are aged 70 or older, reflecting a commitment to the industry even past traditional retirement age. The 40 to 49 age group comprises 15% of the respondents, while those aged 30 to 39 make up 13%. Younger professionals, aged 26 to 29, represent just 3% of the respondents, and there were no participants under the age of 25.

This age distribution suggests that the industry is dominated by experienced professionals, with a wealth of knowledge accumulated over decades. However, the relatively low percentage of younger participants highlights potential challenges in attracting new talent to the field.

The survey also sheds light on the tenure of professionals within the electronics industry. A significant 44% of respondents have been in the industry for more than 30 years, indicating a strong level of commitment and deep-rooted expertise. Those with 21 to 30 years of experience account for 21% of the respondents, further emphasizing the industry’s reliance on seasoned professionals.

Respondents with 10 to 15 years of experience make up 10% of the total, while those with three to five years of experience also represent 10%. Notably, only 3% of respondents have been in the industry for one to two years, and there were no participants with less than one year of experience. This data points to a mature workforce, with a significant majority having spent a substantial portion of their careers in the electronics industry.

When it comes to decision-making power, the survey reveals that 42% of respondents are primary decision-makers within their organizations. Another 37% are involved in recommending and contributing to the decision-making process, while 14% are consulted on decisions. A smaller segment, 6%, has minimal involvement in decision-making.

The survey also highlights the gender distribution within the Canadian electronics industry. The majority of respondents, 86%, are male, while 12% are female. An additional 3% identified as ‘other.’ These figures underscore the ongoing gender disparity within the industry, pointing to the need for greater efforts to encourage diversity and inclusion.

The annual survey provides a comprehensive overview of the demographics shaping the Canadian electronics industry. While the sector benefits from a wealth of experience and expertise, the data also highlights areas where the industry could evolve, particularly in attracting younger talent and promoting gender diversity. As the industry continues to advance, these insights will be crucial in guiding future strategies and ensuring a robust, inclusive, and innovative workforce.

READER’S AGE

Primary

Recommend

Minimal

IS YOUR COMPONENT FORECAST FOR THE LAST HALF OF 2024?

BIGGEST BUSINESS CHALLENGES

% of respondents indicated these were significant business issues.

Supply Chain

Competitiveness/Profitability

Attraction and retention of staff

Delivering short-term results

Lack of Capital

Keeping pace with industry changes

Environmental awareness

SPONSORS

Marketing and Business Development Manager, Latin America and Canada Mouser Electronics Inc.

PANELISTS

and Co-Founder NeuronicWorks Inc.

Director of Sales & Operations Diverse Electronics Inc.

and General Manager Technum Québec