ReThink Milling aims to disrupt the mining processing sector with its technologies

No matter how many “ings” your process has, Productivity PLCs can handle them all while providing substantial cost savings. Whether you’d prefer a single controller for complete end-to-end control or a segmented control system with multiple controllers, the scalable Productivity PLC family has what you need for less.

This family offers three series of PLCs each with different I/O capacities but all using the same FREE advanced programming software, so you can easily scale your control hardware up or down depending on the application.

NEW! More discrete and relay I/O expansion modules have been added to the Productivity PLC family for even more affordable control options.

For the Productivity1000 PLC series:

• A 4-channel, high current relay output module with up to 7A/point and four Form C contacts, perfect for applications with higher current loads

For the Productivity2000 PLC series:

• A 6-channel, high current (7A/point) relay output module with both Form A and Form C contacts

• A 16-point low voltage discrete input module and 16-point low voltage discrete output module, ideal for devices that utilize transistor-transistorlogic (TTL) and voltage levels ranging from 3.3 to 5 VDC

AutomationDirect carries a full line of AC drives, from basic micro drives to full-featured high-performance drives boasting flux vector control and built-in PLCs. So, no matter the application or environment, AutomationDirect has an affordable drive solution for you!

Micro VFDs

Starting at $119.00

With sizes as small as 55mm wide, these drives provide the needed motor speed control without taking up large amounts of panel space.

General Purpose VFDs

Starting at $147.00

General purpose drives offer great value for a wide variety of applications including conveyors, pumps, fans, HVAC systems, and elevators.

High Performance VFDs

Starting at $232.00

High-performance AC drives are top-of-the-line drives that are usually specified when a high degree of precision in speed control is required or when full torque is needed at very low or zero speeds.

Washdown VFDs

Starting at $242.00

These NEMA 4X, washdown-duty drives are built to withstand harsh environments including food and beverage processing and water treatment facilities.

$1.2 billion

The fed’s investment over 10 years to revitalize AECL’s Chalk River Laboratories to transform it into a world-class, state-of-the-art nuclear science and technology campus.

Canada’s mining sector understands the growing demand for rare earth minerals and metals, as well as other much-need resources that need to be mined to keep up with building infrastructure for a growing population and meeting decarbonization targets. The global demand for copper alone is expected to grow by 2.3 times over the next 25 years, according to Michael Stanley, mining lead for The World Bank.

While Canada has many of the much-needed resources to meet growing demands, the country’s process for getting from the concept stage to shovels in the ground is a painstaking task that can take decades, largely due to cumbersome approvals processes. But while red tape is a major hurdle for the mining sector to overcome, there is another potential issue that could hinder growth: a lack of energy infrastructure.

I imagine it comes as no surprise to anyone to hear that mining metals and minerals out of the ground requires incredible amounts of energy – the sheer size of the equipment being used serves as an obvious hint. As Canada attempts to speed up growth in the mining sector, will it have the necessary energy infrastructure in place to power these operations?

While searching the web for interesting energy-related news on the mining sector, I stumbled across a page on the website of Natural Resources Canada titled, “Small Modular Reactors (SMRs) for Mining.”

For those of you unfamiliar with SMRs, here are a few points directly from the NRCan website on the technology:

• SMRs are designed to be modular with maximum factory-construction, making them scalable to specific energy demands.

SMR designs vary in electrical output from as high as 300 MWe per module for grid-connected reactors, down to 3 MWe per module (or even smaller for micro SMRs), which could be suited for remote or industrial applications.

• SMRs are a promising technology which may be able to help mining companies and local communities in off-grid, remote, or northern areas transition away from using diesel. SMRs could also be used in hybrid energy systems to provide load-following power to enable higher penetration of intermittent renewables and help facilitate Canada’s transition to a low-carbon economy.

This last point is of particular interest since mining operations and the surrounding communities are typically located in remote regions of the country where energy costs are high, and options are more limited.

SMRs also produce energy that is free of greenhouse gas (GHG) emissions, which would be extremely beneficial to Canada’s mining sector, which is considered a major GHG emitter.

As part of Canada’s SMR Roadmap (https://smrroadmap.ca), discussions were held between the provinces, territories, utilities, and other stakeholders from Alberta, Saskatchewan, Ontario, New Brunswick, the Northwest Territories, and Nunavut. One of the other stakeholders was Canada’s mining sector. In the Roadmap, one of the SMR applications identified was for on- and off-grid heat and power for applications like mine sites, resource extraction, and mineral processing. It was recommended that mining firms explore a role for SMRs in mining operations. There were 24 current and potential mines in Canada identified as possibly being well-suited for SMR deployment. While I think this is a great concept that merits further investigation, the federal government will need to offer significant assistance to the mining sector to make this happen.

These projects require years of approvals and construction, and the mining sector needs to speed up its process towards shovels in the ground, not slow it down. If the federal and provincial governments want the mining sector to embrace this technology, Canada will need to offer another “roadmap” for getting these important metals and minerals out of the ground faster. Perhaps those that embrace SMRs for powering operations can receive fast-tracked approvals for their projects? If the feds and provinces could halve the time it takes to go from concept stage to shovels in the ground, even with the time it takes to design and build an SMR, the mining sector would likely come out ahead – a win-win for a country that needs to speed up its mining sector to meet domestic and international demand or risk getting left behind.

Reader Service

Print and digital subscription inquiries or changes, please contact Angelita Potal Customer Service Tel: 416-510-5113

Fax: (416) 510-6875

Email: apotal@annexbusinessmedia.com

Mail: 111 Gordon Baker Rd., Suite 400, Toronto, ON M2H 3R1

Audience Manager Anita Madden 416.510.5183 amadden@annexbusinessmedia.com

Brand Sales Manager Pat Lorusso 416.518.5509 plorusso@annexbusinessmedia.com

Editor Andrew Snook 416.510.6801 editor@cpecn.com

Account Coordinator Barb Vowles 416.510.5103 bvowles@annexbusinessmedia.com

Group publisher/VP Sales Martin McAnulty mmcanulty@annexbusinessmedia.com

CEO Scott Jamieson sjamieson@annexbusinessmedia.com

CPE&CN is published bi-monthly by: Annex Business Media 111 Gordon Baker Rd, Suite 400, Toronto, ON M2H 3R1 T: 416-442-5600 F: 416-442-2230

© All materials in this publication are copyright protected and the property of Annex Business Media., the publishers of Canadian Process Equipment & Control News magazine.

For permission on reprinting or reproducing any materials, e-mail your requests to cpe@cpecn.com

Canadian Postmaster send address corrections to: 111 Gordon Baker Rd., Suite 400, Toronto, ON M2H 3R1

Canadian Process Equipment & Control News assumes no responsibility for the validity of claims in items reported.

Annex Privacy Officer privacy@annexbusinessmedia.com Tel: 800-668-2384

PUBLICATION MAIL AGREEMENT #40065710

Printed in Canada ISSN 0318-0859

ANDREW SNOOK, editor editor@cpecn.com

The Province of Nova Scotia recently celebrated the opening of the Neptune BioInnovation Centre in Dartmouth, N.S.

The province is hoping that the bioinnovation centre will become a world leader in biofermentation and be a key factor in growing Nova Scotia’s bioindustrial sector. The province stated that it hopes the Neptune BioInnovation Centre will help Nova Scotia compete globally, strengthen domestic supply chains, and foster biotechnology advancements across critical sectors, including life sciences, pharmaceuticals, forestry and agriculture.

“The Neptune BioInnovation Centre is not just changing the game for bioinnovation in Nova Scotia, it is creating a whole new one,” said Colton LeBlanc, Minister of Growth and Development. “This investment will attract the best and brightest minds and companies in this sector to Nova Scotia. Their groundbreaking work will commercialize clean technologies for a more sustainable and prosperous future.”

The multi-user facility is the first of its kind in Canada and currently one of three facilities worldwide. The province estimates that the centre will generate more than 2,400 jobs; $175 million in salaries; $74 million in tax revenue; and contribute $334 million annually to Nova Scotia’s annual GDP.

“This Neptune asset and planned expansion are a game-changer for the N.S. and Canadian biomanufacturing sector, building the largest capacity in Canada. This will ensure companies scale and build commercial plants here, generating a critical domestic green supply chain for Canadian manufacturers to compete here and in Europe,” stated Beth Mason, director of the Neptune BioInnovation Centre.

The Province of Nova Scotia announced it investing $5 million towards the transformation of the 4,738-square-metre (51,000 square feet) facility into state-of-the-art wet and dry labs that will offer commercialscale precision fermentation and spray drying capacity.

The Neptune BioInnovation Centre is an $18-million public-private partnership with funding committed by the Province of Nova Scotia, Atlantic Canada Opportunities Agency (ACOA), Next Generation Manufacturing Canada (NGen), and cleantech firm Dispersa.

For more information on the Neptune BioInnovation Centre, visit: https://neptunebio.ca/.

Vanessa Hellwing has been appointed to the ANDRITZ AG Executive Board. She succeeded Norbert Nettesheim as Chief Financial Officer (CFO) on March 28, 2025.

Norbert Nettesheim retired at his own request on March 27, 2025, after 36 years of a successful professional career. As a member of the ANDRITZ Executive Board and CFO since 2019, the company stated that he has been instrumental in the success of the company, consistently delivering outstanding results and providing excellent support.

Vanessa Hellwing joins ANDRITZ from the position of CFO at Viessmann Climate Solutions SE. She brings extensive and diverse financial leadership experience to her role as CFO at ANDRITZ. For more than two decades, she has successfully managed and transformed financial operations at several global companies in the engineering industry.

“I am very pleased to welcome Vanessa to the ANDRITZ team. Her broad experience in leading finance, IT, and M&A functions will be invaluable for us in achieving our ambitious goals and developing the company further. At the same time, I would like to thank Norbert for his great engagement in leading and developing ANDRITZ’s finance functions and for his contribution to the success of ANDRITZ. I wish him all the best for the future,” says Joachim Schönbeck, president and CEO of ANDRITZ.

Canada’s food and beverage manufacturers face a year of uncertainty, with opportunities tempered by economic challenges, trade disruptions and shifting consumer habits, according to the latest FCC Food and Beverage Report.

FCC Economics forecasts a modest 0.6-per-cent increase in food and beverage sales to $168.8 billion in 2025, but a 1.5-per-cent decline in sales volume, reflecting ongoing adjustments to beverage manufacturing. Profit margins are expected to improve slightly, though they will remain below pre-2019 levels, with variation across sub-sectors.

“The food and beverage industry faces ongoing pressures from economic challenges and trade disruptions,” said Amanda Norris, senior economist at FCC. “While sales growth is projected to increase slightly, manufacturers will need to carefully navigate rising costs and shifting consumer habits to maintain profitability.”

For 2025, FCC Economics forecasts a further decline in beverage sales of -2.5 per cent and -2.6 per cent in volumes. The anticipated decline is driven by a continued shift away from alcoholic beverages, particularly beer, and a slight slowdown in non-alcoholic beverage sales after four years of strong growth.

While inflation has eased and labour market pressures have relaxed,

consumer spending remains uncertain. Per capita consumption of food and nonalcoholic beverages declined for the fourth consecutive year in 2024, down 1.0 per cent from 2023 and 8.0 per cent since 2021, as household budgets remained tight. However, food and non-alcoholic beverages showed signs of recovery near the end of 2024, while alcohol consumption continued to weaken.

“Consumer behaviour is shifting, with a growing emphasis on value and products that align with individual preferences,” said Norris. “In this environment, manufacturers who adapt to changing trends and focus on meeting diverse consumer needs will be better positioned to build brand loyalty and strengthen sales.”

Another strong year for dairy product manufacturing sales is expected for 2025.

FCC Economics forecasts an 8.3-per-cent increase in sales and a 6.0-per-cent increase in volumes. Gross margins in the sector are expected to improve in 2025, to the highest level over the past two years, with support from higher sales and declining raw material costs.

Strong price growth has driven doubledigit sales increases in the sugar and confectionery sector since 2021, and 2025 is expected to bring another 10-per-cent increase in sales, with volumes rising by 6.7 per cent. While higher revenues helped offset rising expenses in 2024, margins remain under pressure from high cocoa prices and potential trade disruptions. With over 90 per cent of confectionery sales tied to exports, particularly to the U.S., the sector faces risks from shifting trade policies, though steady growth in non-U.S. markets suggests diversification opportunities.

In addition, Canada’s aging labour pool will continue to exert pressure on wages, this impact will be less pronounced than in previous years, with the decline in raw material costs helping to offset total expense.

“The food and beverage sector is at a crossroad, with both risks and opportunities ahead. Manufacturers must focus on innovation, strategic market diversification and cost management to stay competitive,” Norris noted.

The annual FCC Food and Beverage Report features insights and analysis on grain and oilseed milling; dairy, meat, sugar and confectionery, bakery and tortilla products; seafood preparation; and fruit, vegetable and specialty foods, as well as soft drinks and alcoholic beverages.

By sharing economic knowledge and forecasts, FCC provides insights and expertise to help those in the business of agriculture and food achieve their goals. For more economic insights and analysis, visit FCC Economics at fcc.ca/Economics.

Source: FCC.

Thermo-Kinetics Company Limited, a leading provider of industrial process measurement equipment, has announced the acquisition of all shares of Process Heaters Inc., a Mississauga-based company specializing in heaters, sensors and controls.

The acquisition brings together two companies with a shared commitment to customer satisfaction and high-quality products.

“This acquisition makes perfect sense for Thermo-Kinetics. Process Heaters has been a respected presence in the industry since 1995 and operates on a very similar philosophy to what has built Thermo-Kinetics – a strong focus on being customer-centric and offering a

Continued on page 8

Continued from page 7

quality product at a marketable price,” said Peter Dello, vice-president and general manager of Thermo-Kinetics Company Limited.

According to Dello, Harry Kitz, the president of Process Heaters Inc., initiated the discussions due to Thermo-Kinetics’ strong position in the marketplace. Both Dello and Kitz recognized the potential for significant synergy and expanded offerings through the unification of the two companies.

“Harry reached out to us, and it quickly became clear that our combined strengths could lead to exciting new opportunities,” Dello said. “We believe that by coming together, we can expand the offerings of both Thermo-Kinetics and Process Heaters, ultimately providing even greater value to our customers.”

Dello concluded, “I am incredibly excited to witness what the newly formed company will achieve in the marketplace. This is a significant step forward for both organizations and, more importantly, for our customers.”

The Canadian Association of Petroleum Producers (CAPP) congratulated Prime Minister Mark Carney and all the newly elected and returning Members of Parliament in a press release shortly after the federal election.

Lisa Baiton, president of CAPP, issued the following statement:

A new federal government offers an opportunity to rejuvenate Canada’s economy and its approach to natural resource development. CAPP was encouraged throughout this election by the tone set by the two leading parties on the importance of oil and natural gas to the country’s economy and national security. Canada stands at a pivotal moment in its history—caught in a trade war with our closest trading partner and facing direct challenges to our sovereignty from the President of the United States. With the global economic uncertainty being caused by actions in the United States, Canada has an opportunity to stand out as a stable, trusted trading partner.

Canada’s oil and natural gas industry is ready to work with Prime Minister Carney to support his goal of making Canada a global energy superpower. Developing our world-class oil and natural gas resources to their full potential by growing our exports to international markets will strengthen our energy security and economic sovereignty. And we can develop our resources the Canadian way—with innovation, respect

for the environment, and in partnership with Indigenous communities. We look forward to working with the new federal government. A strong oil and natural gas industry can be a key partner in growing the economy, delivering affordable and secure energy, and creating meaningful opportunities for all Canadians.

Kemira has completed the acquisition of Thatcher Group’s iron sulfate coagulant business in the East Coast region of the United States. The transaction includes certain customers and assets of the business. No employees will move to Kemira in the transaction as Kemira will serve the new customers from its existing manufacturing facilities. Annual revenue of the acquired business is less than US$10 million. Thatcher Company, Inc. is a diversified chemicals manufacturer and distributor headquartered in Salt Lake City. “The acquisition is highly synergistic with our existing operations. It is also one step towards our aim to double the revenue in water,” stated Tuija Pohjolainen-Hiltunen, EVP Water Solutions at Kemira.

Innomotics GmbH, a globally leading provider of electric motors and large drive systems and Danfoss Drives A/S, a global leader in low-voltage drives, recently announced the next phase of their strategic, non-exclusive partnership. This was announced at Hannover Messe where Michael

Reichle, Innomotics CEO, Mika Kulju, president of Danfoss Drives, attended the Innomotics booth.

This collaboration is designed to meet the growing demand for comprehensive motor and drive solutions, ensuring customers receive high-quality, efficient, and compatible products.

By joining forces, Innomotics and Danfoss offer customers the flexibility to bundle low-voltage motors from Innomotics with Danfoss low-voltage drives in a seamless package. This approach is particularly beneficial for customers seeking a specific combined motor and drive solution as part of a delivery or project.

While both companies are aligning their go-to-market strategies for common customer approaches, they continue to provide separate quotes for its respective products, ensuring transparency and flexibility for customers. Additionally, both companies remain committed to brand independence, ensuring customers have the flexibility to choose the best motordrive combination for their needs.

“The strategic partnership with Danfoss Drives allows us to further extend our offering,” stated Reichle. “Many of our customers require very specific motor and drive combinations with the highest standards of reliability and efficiency. This applies in particular to fast-growing sectors such as the water industry. By combining our strengths, we can increase the competitiveness of both brands and conquer new markets.”

“We are excited to take this next step in our collaboration with Innomotics,” said Kulju. “By offering tailored motor and drive packages, we are delivering competitive, efficient, and convenient solutions that directly benefit our customers. Our goal is to provide the best possible solutions while giving customers the flexibility to select the right motor-drive pairing.”

The Prospectors & Developers Association of Canada (PDAC) was encouraged to see a two-year extension of the Mineral Exploration Tax Credit (METC) announced on March 2, 2025, but legislation has not materialized. Ultimately, a long-term solution is essential to provide the certainty needed to reverse the decade-long decline in equity investment in grassroots exploration across Canada.

“Since its introduction in 2000, the METC has been indispensable to

mineral exploration across the country — helping to generate billions in equity, creating jobs, supporting remote and Indigenous communities, and enabling major discoveries that feed into Canada’s broader mining ecosystem,” said PDAC president Karen Rees. “For every dollar the government forgoes, multiple dollars flow back into Canada’s economy, with rural, remote, and Indigenous communities seeing substantial benefits. Consequently, the program stands as one of the most productive federal initiatives available.”

Enacting a more permanent solution — through a ten-year extension of the METC, with an option to extend for an additional 10 years at the halfway point — will give Canadian companies a competitive edge and provide domestic investors with much-needed fiscal certainty.

PDAC is calling on the Government of Canada to prioritize this recommendation and introduce legislation as soon as the House of Commons resumes, urging all parties to support the effort so it can reach Royal Assent without delay. To see the full list of PDAC’s recommendations for parties in the 2025 federal election, visit: https://pdac.ca/ programs-and-advocacy/regulatorysubmissions/pdac-platform-roadmap. Source: PDAC.

PPG recently announced that it will invest $380 million to build a new aerospace coatings and sealants manufacturing facility in Shelby, N.C. Construction on the 62-acre site, which will initially include manufacturing and warehousing units, is set to commence in October 2025 and is expected to be completed in 2027. The 198,000-square-foot facility will enable the company to continue meeting the growing demands of the aerospace industry.

It will employ more than 110 people and produce the full line of PPG’s aerospace coatings and sealants. The additional capacity of this new plant, combined with nearby transport links that improve supply chain and shipping logistics, will help improve service levels for customers.

“PPG’s investment in this new manufacturing facility demonstrates the significant demand growth for our worldclass technologies and our continued commitment to serving our aerospace customers,” said Tim Knavish, PPG chairman and chief executive officer. “By modernizing and digitizing our facilities, PPG will continue to embody our purpose –to protect and beautify the world – while contributing to the growth and innovation of

the aerospace sector.”

“We look forward to expanding our aerospace manufacturing footprint with this new facility,” said Sam Millikin, PPG vice president, global aerospace. “This investment not only underscores our commitment to the aerospace industry and providing highquality products, but also positions us to respond more effectively to growing market needs. The Shelby, N.C. location will play a crucial role in enhancing our operational efficiency and supporting our customers. We appreciate our continued partnership with Governor Stein, local, state and federal representatives and the Shelby community as we increase our production capabilities in this region.”

“PPG knows what I know: North Carolina is the #1 state for manufacturing in the Southeast,” said Josh Stein, governor of North Carolina. “Our state’s workforce is our greatest asset, and I will continue to advocate for more training and education programs so that employees can build a career and employers have the well-trained people they need to get to work.”

The new aerospace facility will incorporate advanced manufacturing technologies and practices aimed at reducing environmental impact while maintaining the highest standards of quality and safety.

Ian Thomson recognized with Canadian Biomass

By Andrew Snook

There are few people whose names are more synonymous with biofuels in Canada than Ian Thomson. Just ask Fred Ghatala, president of Advanced Biofuels Canada.

“Ian is a pioneer leader in the development of Canada’s renewable and lowcarbon fuel sector,” he said.

Ghatala cites Thomson’s dedication to the industry since 2002, when he first focused on the potential use of biodiesel for reducing emissions from diesel fuel engines.

“The view that many of us in the clean fuels space have is there’s going to be a long road for high energy density, low carbon liquid fuels.”

“In 2002, I started looking at fuels and alternatives and zeroed in on biodiesel as something that had potential, but nobody was really doing anything with it in Western Canada,” Thomson said.

Over his impressive career, Thomson has been a key player in the establishment of the Canadian renewable fuels industry. One of his many career highlights was establishing the BC Biodiesel Association (2005) and the Alberta Biodiesel Association (2006).

“These two entities led industry development in Western Canada, eventually becoming the Western Canada Biodiesel Association in 2014. In 2015, the scope of representation expanded, and the association became Advanced Biofuels Canada Association (ABFC). ABFC is Canada’s leading renewable

fuels industry organization, promoting the production and use of sustainable, low carbon fuel alternatives to gasoline, diesel, and jet fuels,” Ghatala said.

Thomson served as president of the association from 2005 to 2024, stepping aside in 2025 to serve as past-president to assist the new executive team.

In 2005, Thomson co-founded the Canadian Bioenergy Corporation (CBEC), the first biodiesel distribution business in B.C. Ghatala said the company “quickly grew from importing 1,000 litres totes of U.S.-made biodiesel to establishing tankage at terminals in North Vancouver and Calgary, and shipping railcars as far east as Nova Scotia.”

While serving as president of CBEC, Thomson also worked on the Canadian biodiesel sector’s testing and standards work with the Canadian General Standards Board.

“The first quality standards for biodiesel and biodiesel blends were finalized around 2011, which were key to providing functional fuel assurance,” Ghatala said.

That same year, Thomson and his partners shut down CBEC to co-found Waterfall Advisors Group, which staffs ABFC’s operations and serves the Can-

While serving as president of CBEC, Thomson also worked on the Canadian biodiesel sector’s testing and standards work with the Canadian General Standards Board.

adian biofuels sector with consulting expertise and coast-to-coast coverage.

Between 2010 and 2012, Thomson led the industry associations in assisting governments with adopting the first diesel fuel RFS blending regulations in B.C., Alberta, Saskatchewan, Manitoba, and federally with the Canadian Renewable Fuel Regulations.

“In 2013, B.C. finally implemented its ground-breaking Low Carbon Fuel Standard; and Ontario followed with its hybrid (RFS/LCFS) Greener Diesel Regulation in 2014,” Ghatala notes.

Thomson has also played a key role in helping develop what eventually became Archer Daniels Midland’s biodiesel project, which commissioned Canada’s largest biodiesel facility (320MLY) in

Lloydminster, Alta. in October 2013.

“At that point we had enough demand, we reckoned, to build a plant. So, with a small group of other colleagues, put together a company that eventually co-adventured with a large global agribusiness company to build the Lloydminster biodiesel plant run by Archer Daniels Midland,” Thomson recalled.

Over the next 12 years, Thomson continued to lead the way in the growth of the renewable fuels sector with milestones such as:

• Assisting with the six-year regulatory development phase of the Clean Fuel Regulations that were finalized in June 2022, and became effective July 1, 2023;

• Helping develop the first low carbon fuel regulations in Quebec (2023); and B.C.’s new LCFS statute and regulation (2024); which is Canada’s most stringent fuel regu-

“The provinces have taken real leadership in getting regulations that give the kind of assurances that people who have capital and aspirations to build production assets need.”

lation, and includes the first SAF (sustainable aviation fuel) mandate in the Americas.

Ghatala said that these regulations were “ground-breaking achievements in Canada, and, over 2010 to 2024, they have proven to be the most successful mechanism to reduce GHGs from fossil fuel use in transportation.”

Thomson gives kudos to his colleagues of two decades including dedicated and deeply knowledgeable association staff. He also flags the indispensable work of provincial governments, especially B.C., Alberta, Ontario, Manitoba, and Quebec, and the federal government for helping create a friendlier environment.

renewable fuels sector, Thomson says to be prepared for two steps forward and one-and-ahalf steps back.

“I talk with people who are graduating from engineering programs or getting into them, or wanting to get into this space, and they think everything’s going to go hydrogen. They think everything is going to go electrification,” he said. “The view that many of us in the clean fuels space have is there’s going to be a long road for high energy density, low carbon liquid fuels.

Whether those are fossil fuels with significantly

lower their carbon emissions, biofuels produced out of refineries with co-processing or renewable diesel, or biofuels produced in standalone biofuel plants with low carbon intensity increasingly made from a wider range of feedstocks than just agricultural crops, the need to fuel internal combustion engines is going to be around for a long time.”

To learn more about the 2025 Canadian Biomass Awards winners, visit: https://www.canadianbiomassmagazine.ca/ canadian-biomass-awards/.

“The provinces have taken real leadership in getting regulations that give the kind of assurances that people who have capital and aspirations to build production assets need,” Thomson said. “The federal government undertaking the Clean Fuels Regulations starting in 2016, and wrapping up in 2022, was great work. It took longer than we had hoped, and ended up coming full circle back to a pretty basic local carbon fuel standard, but that was a real highlight.”

Seeing the clean fuel sectors collaborating recently has also been a highlight.

“It’s way too easy for people in the alternative fuel space to feel like they have to compete with each other,” he said. “I mean, at the end of the day, they compete. But first you’ve got to collaborate to get a market, and I think we’ve seen some really effective collaborations in Canada.”

When asked what advice he would offer the next generation looking to become active in the

Reaching a sustainable future is like kayaking. With a skilled partner, you can make the right decisions.

Reaching a sustainable future is demanding in many ways. Obstacles and change must be well anticipated to make the right decisions. We are ready to tackle these challenges with you! We will help you to improve your processes to meet specific production requirements, operational optimization, or sustainable manufacturing efforts. Let’s team up to improve!

Monitoring Solution with stainless steel pipes for ideal process water conditions and reliable conductivity values to protect your electrolyzer.

Do you want to learn more?

www.ca.endress.com

ReThink

By Andrew Snook

Many professionals in the mining process sector will tell you that grinding technologies have not changed much over time. But ReThink Milling, a startup operating out of both Ontario and Quebec, aims to change that with its Conjugate Anvil Hammer Mill (CAHM) and MonoRoll technologies. The mining sector believes there is great potential for these technologies to revolutionize the milling process. So much so that Wheaton Precious Metals Corp. (Wheaton) named ReThink Milling the winner of its inaugural Future of Mining Challenge earlier this year and awarded them the grand prize of US$1 million.

The company’s new grinding technology has the potential to improve efficiencies in milling operations while significantly lowering energy consumption, which would reduce greenhouse gas emissions and operating costs.

“Constant innovation is essential to responsibly meet the growing global demand for minerals and metals, and it is the driving force behind our Future of Mining Challenge,” stated Randy Smallwood, president and CEO of Wheaton. “ReThink Milling’s winning technology is something we believe displays this in-

novation, and we are pleased to support the company through the Future of Mining Challenge award as they advance into commercialization. Integration of new technology across global mining operations requires industry support, and ReThink Milling has demonstrated they are well on their way to moving this forward with the support of nine leading mining companies and other industry partners. We hope the Future of Mining Challenge award funds give the company a boost to propel this technology further forward.”

The CAHM machine is designed to be a significantly more efficient alternative to high pressure grinding rolls (HPGR) and semi-autogenous grinding (SAG) mills; while the MonoRoll is designed to replace or retrofit conventional ball mills and produce finer grinds.

ReThink Milling president Gillian Holcroft believes this technology has the potential to have a major impact on energy consumption in the mining sector.

“Comminution uses three per cent of the electrical energy in the entire world, so it’s a huge problem. The world needs metal for a whole bunch of different reasons, and we’re using a lot of energy to break rock. The mining industry recognizes that we have to do better,” Hol-

ReThink Milling’s 50 tph CAHM Prototype with the commissioning team and operators from Corem at their testing centre in Quebec City.

croft says. “It surprised me to learn that the design of mills hasn’t fundamentally changed over 100 years. So, if you look at a mill from 100 years ago, it’s about the same.”

The ReThink Milling technologies were based on concepts developed by inventor Lawrence Nordell that use principles for highly efficient breakage.

“Both machines are based on an inner hammer roll rotating inside of an outer shell that we refer to as the anvil, and material rotates down in that gap as the two rolls rotate together, and the pressure between the rolls is what breaks the material,” explains Steve Wilson, chief technology officer for ReThink Milling.

Randy Smallwood, president and CEO of Wheaton Precious Metals Corp.

“That process of drawing the particles underneath that roll to break them is significantly more efficient than the current tumbling mill technology that’s used where large steel balls are rotated, cascaded down, and fall randomly on particles and sometimes break them and pop them out of the way, and sometimes move them around. So, we’re looking at being way more efficient in the way the energy is used to actually create new

surfaces and broken particles.”

The potential of Nordell’s technology was recognized by a handful of key industry players, so a consortium was formed that started off with five mining companies that included Agnico Eagle Mines, Glencore, Teck Resources, Kin-

ross Gold, and Newmont.

“Everybody provided some financial input, but we also got some Canadian and provincial government support, and we started building a very largescale prototype machine – 50 tons per hour, based on a concept that used discrete

Steve Wilson, chief technology officer of ReThink

element modeling (DEM) simulation. Hundreds of simulations were done to make sure this concept would work,” Holcroft says.

After the company built its prototypes, the consortium grew from five companies to nine with additional support from other industry players including Vale, Rio Tinto, Codelco, and BHP. ReThink Milling recognizes the need for significant additional investment to be able to take their successful prototype into a mining site demonstration to showcase it scaled up at the commercialization level.

“The Wheaton Challenge funding is key in terms of getting the industry to recognize that we are here – the prestige for winning this award, the funds, but we are looking to raise additional money so that we can actually build larger demonstration units that will go into a mine site,” Holcroft says. “The ReThink Milling company was formed two years ago, but it was founded from an industry consortium that really wants this technology to work.”

The company’s prototype is currently

(Top)

L to R: ReThink Milling’s Steve Wilson and Gillian Holcroft accept Wheaton Precious Metals Corp.’s Future of Mining Challenge grand prize of US$1 million from Randy Smallwood.

(Middle)

ReThink Milling’s MonoRoll installation at Corem in Quebec City.

(Bottom)

To build the larger prototypes, ReThink Milling still requires about $15 million in additional investment.

operating in Quebec City at Corem, a research and development centre dedicated to innovation in mineral processing.

“It processes 50 tons per hour. We can take three tons of material and it’s gone in a couple of minutes. It’s massive, it weighs 27 tons. That’s the very first machine that we’ve ever built – the CAHM machine –and then we did a retrofit of an existing 1937 vintage ball mill, and we modified it to become the MonoRoll, and that’s two tons per hour,” Holcroft says.

ReThink Milling is currently in the process of raising funds so it can build a larger CAHM machine capable of processing 100 tons per hour and a MonoRoll capable of 20 tons per hour, and have those machines operate 24/7 at a mine site to prove their operability. In addition to financial support from mining companies, the company has received support from other technology suppliers in the sector.

“We’ve had significant support from the mining industry, but also from companies like and Anmar Mechanical that fabricated the machine, DRA Global, Optimize Engineering, CTTI,Rockwell Automation, which has been key. Rockwell provided us with equipment and software that’s able to sample at millisecond rates. So, the machines we build are data generators. We’re looking at every stress and how it’s performing, so that we

have all the knowledge we need to design the larger machine,” Holcroft explains.

While the technologies have gained vital industry support, there are still many challenges that lie ahead to make these technologies successful. When bringing any new technology to market, Wilson notes there are always technical and financial challenges that need to be overcome.

“I think the technical challenges have been remarkably small based on the design work and all the engineering work that went into it. We’ve had very few technical issues that we’ve had to deal with – some teething pains that always come from a first-generation prototype, but nothing that was significantly an issue in the technology or in the theory of how the technology operates,” he says. “The biggest financial challenge is that when you start to talk about prototyping large-scale equipment, you have to be able to demonstrate that you can break six-inch rock or four-inch rock. You have a significant financial obligation, so that deep tech kind of development means you’ve got to have deep pockets to be able to deliver on those machines.”

“If we’re able to raise the money this year, we could see a mine site demo happening by the end of next year.”

To date, the company has raised approximately $20 million in funding to put towards the technologies.

“What was very encouraging that we heard from Wheaton is they can’t believe how much we’ve accomplished with just $20 million in terms of building these big machines and all the test work that is done,” Holcroft says. “It’s really a testament to the team we have behind us. A lot of the team has given their time for free. We meet once a week, and then the entire team once a month, for the last six years. Everyone wants to see this technology work. We’ve been able to be really effective in how all the money and time has been used to build these machines. And the inventor, Lawrence Nordell, is fully vested. He’s provided all the engineering design and all the discrete element method modeling support for free over the years. He wants to see this machine commercialized.”

To build the larger prototypes, ReThink Milling still requires about $15 million in additional investment. The company is currently in discussions with its mining company partners about additional financial support, investors and mining sites to demo the larger prototypes.

“If we’re able to raise the money this year, we could see a mine site demo happening by the end of next year. But if we’re late in raising the money, if it takes longer, then

everything gets delayed,” Holcroft says.

She adds that the recognition that the company and its technologies have received from industry to date has been incredible.

“We’re super excited because it’s often hard to get noticed. Even though we’re doing great stuff, many don’t even know our technology exists,” Holcroft says. “Winning the Wheaton Challenge has given us third-party expert validation. There are other great technologies being developed so being recognized as having

technology that has the most promise and greatest potential to be adopted in the industry is incredible. This will certainly help us raise the additional funding we need to help propel us towards commercialization.. We need a lot more money than just one million USD dollars to put it into a mine site, but we’re going to be well on our way with this recognition. The value is immeasurable.”

To learn more about ReThink Milling and its technologies, visit: www.rethinkmilling.com.

By Andrew Snook

Near the end of 2024, the Global Impact Coalition (GIC) celebrated its first anniversary since being founded at the World Economic Forum. The GIC is committed to advancing the chemical industry towards a net-zero future and a circular economy.

To learn more about the organization and its goals, Canadian Process Equipment & Control News interviewed Charlie Tan, CEO of the Global Impact Coalition.

I KNOW THE CONCEPT FOR THE GLOBAL IMPACT COALITION, OR GIC, ORIGINATED IN THE WORLD ECONOMIC FORUM. CAN YOU ELABORATE ON HOW GIC WENT FROM INITIAL CONCEPT TO THE COLLABORATION OF 100 SENIOR INDUSTRY EXPERTS?

The Global Impact Coalition started life within the World Economic Forum (WEF) in 2019, as the Low Carbon Emitting Technologies (LCET) initiative. In November 2023, we rebranded as the Global Impact Coalition, or GIC, and spun-out of the WEF as an independent non-profit association with the support of seven founding members—BASF, SABIC, Covestro, Clariant, LyondellBasell, Mitsubishi Chemical Group, and Syensqo (formerly Solvay).

The Global Impact Coalition was established to address a fundamental question: should the chemical industry pursue net-zero goals independently, or can greater progress be achieved collectively?

GIC has effectively provided a secure platform for companies to collaboratively innovate, developing business models and scale high impact technologies that might not have been feasible individually.

Since its spin-off over a year ago, GIC has experienced a positive industry response, expanding its membership by over 50% with industry leaders, representing collective annual revenues approaching half a trillion USD. Additionally, we established a clear governance structure and way of working, advancing several successful projects, including a breakthrough automotive plastic circularity pilot, an innovative R&D initiative on direct conversion, and a joint venture on sustainable olefin production. Our suc-

The Global Impact Coalition was established to address a fundamental question: Should the chemical industry pursue net-zero goals independently, or can greater progress be achieved collectively?

cess can be largely attributed to an engaged executive leadership team and a streamlined structure that swiftly transforms ideas into actionable projects, supported by a talented team from Boston Consulting Group.

Looking ahead, GIC aims to amplify its impact by continuing to expand globally and across the value chain, while continuing to develop and spin off high impact projects. Through collaboration and strategic partnerships, GIC fosters a unique environment of mutual trust within an industry that has traditionally been hesitant to collaborate on innovation. Establishing this trust is essential for achieving meaningful transformation.

HOW IS THE GIC CURRENTLY FUNDED?

GIC is a nonprofit association, funded through annual membership fees from its member companies.

WHAT DO YOU BELIEVE HAS BEEN THE BIGGEST ROADBLOCK TO DATE FOR IMPROVED RECYCLING RATES OF ELV PLASTICS? DO YOU BELIEVE THE GIC AUTOMOTIVE PLASTICS CIRCULARITY PROJECT HAS THE POTENTIAL TO HAVE A MAJOR IMPACT ON A GLOBAL SCALE, IF SUCCESSFUL?

The primary obstacle to improving re-

cycling rates of End-of-Life Vehicle (ELV) plastics has been the difficulty in efficiently sorting and processing diverse plastic materials used in vehicles. The wide variety of plastics, often bonded with other materials, complicates identification and separation, making recycling both technically challenging and economically unviable.

The Global Impact Coalition’s Automotive Plastics Circularity pilot aims to address these challenges by uniting stakeholders across the automotive value chain to develop scalable, closed-loop recycling systems. By using a new approach to ELV dismantling that groups automotive plastics into similar polymer types, facilitating the subsequent shredding and sorting plastic fractions, the pilot will address the biggest obstacles to efficient ELV plastic recycling. Ultimately, the pilot seeks to transform plastic waste into valued resources, enabling automakers to meet sustainability targets for recycled plastics.

This pilot, once scaled, will significantly reduce the environmental impact of automotive plastics, keeping plastic out of landfill and incineration, and serve as a model for global adoption, revolutionizing how ELV plastics are managed and recycled worldwide.

WHAT TYPES OF COMPOUNDS DO YOU SEE THE GIC DIRECT CONVERSION PROJECT HAVING THE POTENTIAL TO CREATE FOR THE CHEMICAL INDUSTRY?

The GIC Direct Conversion project is exploring a novel process to convert waste—whether from biomass or plastics—directly into valuable C2+ compounds for the chemical industry. Through gasification, this process generates syngas (a mixture of hydrogen and carbon monoxide) as well as higher hydrocarbons such as ethylene, acetylene, and ethane, which are essential building blocks for polymer production. If successful, this approach could provide a lowenergy, low-emission, and cost-efficient alternative to traditional fossil-based feedstocks, significantly advancing circularity in the chemical industry.

*(Learn more at: https://globalimpactcoalition.com/project/direct-conversion-gasification/)

MANY BIOENERGY AND BIOMASS PROJECTS STRUGGLE WITH THE SCALING UP PROCESS, EVEN AFTER BEING PROVEN AT THE PILOT STAGE. WHAT DO YOU SEE AS THE BIGGEST CHALLENGES FOR THE GIC DIRECT CONVERSION PROJECT TO MOVE FORWARD?

The GIC Direct Conversion project is still in the early stages of research and development, with a co-investment in an R&D collaboration with a renowned professor at ETH Zurich. This partnership is focused on assessing the environmental impact and techno-economic feasibility of the process before moving toward piloting.

Key challenges in scaling up include managing high operating costs for waste collection, sorting, and gasification infrastructure, as well as optimizing catalysts to

“We welcome new members and partners who share our commitment to accelerating the industry’s transition to net-zero emissions and circularity.”

ensure high selectivity for valuable monomers at a commercial scale. If the process proves viable, further development will require investment in integrated energy systems, lean manufacturing techniques, and revenue generation from by-products to make gasification a commercially competitive and widely adopted solution for plastic waste recycling.

ARE YOU ABLE TO ELABORATE ON THE POTENTIAL NEW LOW-EMISSIONS ROUTES TO OLEFINS THROUGH CONVERSION FROM SUSTAINABLE METHANOL SOURCES. DO YOU SEE MAJOR GROWTH POTENTIAL FOR THE GIC SUSTAINABLE OLEFINS PROJECT? WHAT WOULD BE ITS KEY MARKETS?

The GIC Sustainable Olefins project is exploring innovative methods to produce olefins—such as ethylene and propylene— through the conversion of sustainable methanol derived from waste streams. This approach offers a low-emission alternative to traditional fossil fuel-based production methods, aligning with the chemical industry’s net-zero objectives.

The project holds significant growth potential, particularly in markets seeking to reduce emissions from chemical production and reduce reliance on fossil fuels. By leveraging sustainable methanol, the project can cater to industries producing plastics, resins, and synthetic fibres, aligning with global sustainability goals.

Key markets for the GIC Sustainable Olefins project include sectors that utilize olefins as fundamental building blocks, such as packaging, automotive, and textiles. The project’s success could lead to a more sustainable chemical industry by integrating renewable feedstocks into existing production processes.

ARE THERE OTHER INITIATIVES CURRENTLY UNDERWAY BY GIC THAT YOU WOULD LIKE TO MENTION?

Our Sustainable Methanol project is evaluating the supply-demand balance for sustainable methanol sources from waste materials. The working group is exploring the most viable sourcing options to ensure a stable, cost-competitive supply with a low carbon footprint. This work directly supports our Sustainable Olefins project, mentioned above.

In another project, we have partnered with a world leading venture creation studio, Deep Science Ventures (DSV) to explore low-emissions and energy pathways to key base chemicals and intermediates— identifying the most promising opportun-

ities to improve sustainability while ensuring industrial scalability.

We have just completed our Q1 ideation session with all our members to identify the next round of projects to focus on in the coming months – so stay tuned for more information.

HOW CAN CANADA’S AUTOMOTIVE, PLASTICS AND CHEMICALS SECTORS PLAY A ROLE IN HELPING THE GIC INITIATIVES SUCCEED?

We welcome new members and partners who share our commitment to accelerating the industry’s transition to net-zero emissions and circularity. Companies can engage with GIC in two key ways:

• Full membership: Members actively drive the advancement of GIC projects to create tangible impact, commit resources to participate in working groups and leadership discussions, and bring internal projects that can benefit from collaborative scale-up.

• Project partnerships: Organizations—including R&D institutions, startups with innovative technologies, and key players across the chemical value chain—can collaborate with GIC on specific initiatives to advance breakthrough solutions.

By joining forces, Canada’s automotive, plastics, and chemicals sectors can play a pivotal role in shaping scalable, impactful solutions for a more sustainable future.

Chemicals are embedded in over 95 per cent of man-made products, making them a key component of Scope 3 emissions across nearly all industries. To drive meaningful change, collaboration beyond the chemical sector is essential. We see key opportunities to engage more deeply with downstream players, such as consumer packaged goods (CPG) companies and retailers, to collectively tackle emissions reduction and circularity challenges.

Our Automotive Plastics Circularity pilot is a prime example of how cross-industry collaboration can drive impact— bringing together waste collectors, dismantlers, shredders, chemical recyclers, and auto manufacturers (OEMs) to scale solutions for end-of-life vehicle plastics. Expanding these partnerships across industries will be key to unlocking systemic change.

By Michael Wright

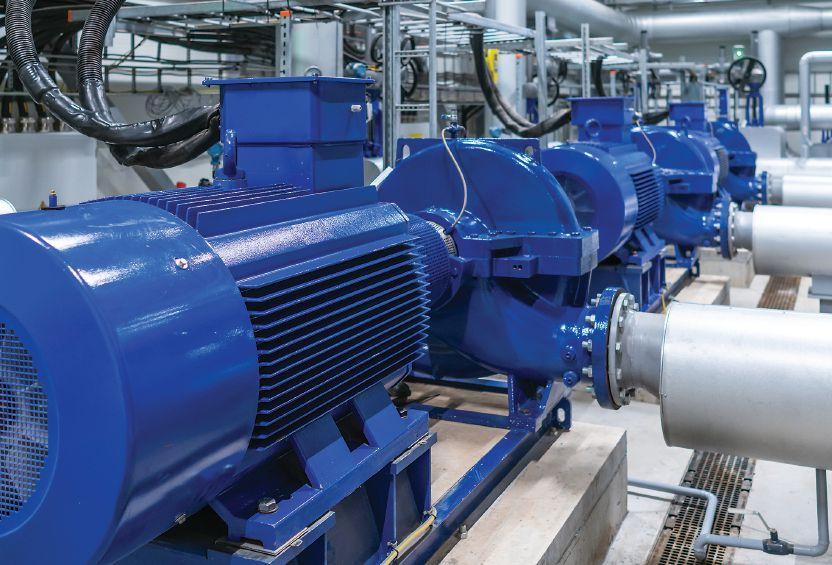

The question often comes up, “Should we rebuild or replace this failed motor?”

The answer is often more complex than it seems and the decision must not be left up to some bean counter using a standard “formula.” Instead, the decision must be made by those who have both budgetary and operational knowledge.

If your plant has a strategic alliance partner who supplies and rebuilds your motors, the answer is often purely financial: if it is cheaper to replace the motor with a new, identical one, then replacement is the typical answer.

However, if the failed motor just has a bearing issue, it is your only spare, production is at peak, and its December 23, you may want them to just slap a new set of bearings in it and get it back to you TOMORROW, so that you can operate through Christmas. Then you can decide whether you should buy a new motor after the holiday season is over.

Even in this simple case, it comes down to need, cost, availability, and reliability. And because reliability relates directly to operating costs, it may have to take precedence over the purchasing agent’s formula for when you rebuild versus replace. And don’t always assume that replacement will automatically give you more reliability than will a quality rebuild.

For example, a company for which I was working chose an alliance partner to supply and repair motors, which were not as reliable as advertised. And although the purchasing department was proud of the warranty agreement that they negotiated, warranty is meaningless when the plant is down and you are losing $100,000 per hour in production.

As it happens, the alliance partner was using smaller drive end bearings than their competition, and their motor shafts had been machined without the normal chamfers that would eliminate stress points at the steps in the shaft. As such, the motor bearings had a life expectancy of about 10 months, and if you just replaced the bearings, the shaft would break within a couple of months of service.

In this case, my solution was to rebuild the failed motors with properly ma-

If your plant has a strategic alliance partner who supplies and rebuilds your motors, the answer is often purely financial: if it is cheaper to replace the motor with a new, identical one, then replacement is the typical answer.

chined shafts and oversized bearings in spite of the fact that this upgrade cost more than the price of a new motor.

Speaking in general terms, unless there is something very special about motors under 15HP, they are usually not worth rebuilding if you want proper QAQC testing done on them to ensure that they will be reliable. And if you are in a strategic alliance with a single source motor service provider, this economic boundary moves up to about 100HP.

However, if special circumstances call for rebuilding a motor that would otherwise not be economically viable, ensure that you ask the repair shop for test data sheets so that you know what you are getting for your money. And if the motor is over 75HP, and has been around longer than you have, ask that dynamometer testing be done on it so that you will know if it can actually produce its rated power. Because, if it has a long history, there may be cracks or voids in the rotor bars or some of the previous “repairs” may have either increased the rotor air gap or have removed enough burnt spots from the laminations to prevent the motor from ever producing its rated power again.

Above all, if your plant is using special purpose motors which are old, unreliable, and “irreplaceable,” it is time that you

came up with an engineering solution to replace them with something more attainable. That could be as simple as an off-the-shelf motor fitted with an adapter plate or it could be a new motor with a custom modified shaft and an adapter so that it can be used in lieu of the original.

MICHAEL WRIGHT is an electrical engineer with more than 50 years of experience in heavy industry. Although he has done an extensive amount of PLC/DCS programming and upgrading of power systems, he is a very strong generalist with a broad knowledge of hydraulics, pneumatics, power transfer, welding practices, mining equipment, mobile equipment, process control strategies, pumping systems, rock mechanics monitoring, mechanical maintenance practices, MRO procurement contracts, energy management, and cost control. As such, he specializes in problem prevention as a subject matter expert (or as a fixer on “problem projects”). It is his belief that safety is not a “priority” but is a way of life; that good engineering makes life simpler and easier for others; and that the best ideas come from those with calloused hands and dirty coveralls. He can be reached at: mawright@sasktel.net.

Manufactured in Denmark, the new RTCt Temperature Calibrator from AMETEK JOFRA brings new and improved features, including a customizable touchscreen, real-time graphing, dual sensor inputs, Wi-Fi connectivity, automated switching and expanded temperature range. User-defined presets, stability monitoring, and an adaptable interface make the RTCt a powerful, efficient tool for modern calibration, improving usability and functionality significantly over its predecessor, the RTC. Whether you work in pharmaceuticals, energy, food and beverage, or manufacturing, the RTCt is designed to optimize your calibration process. Available through Cameron Instruments in Canada.

Cameron Instruments https://cameroninstruments.com/

Autonics miniature photoelectric sensors

AutomationDirect has added Autonics BTF, BTS, and BPS series miniature photoelectric sensors featuring ultra-compact slim or narrow housings that are easy to install in tight spaces. The lineup includes: BTF ultra-thin series with housings only 3.7mm thick (4.6mm including lens; BTS ultra-slim series with housings only 7.2mm wide; BPS compact series low-profile, flat housings only 7.5mm thick (8.1mm including lens). These miniature sensors offer sensing distances up to 3m, durable PBT thermoplastic housings, and an IP67 protection

rating. They feature highly visible red LED or light sources for reliable detection and are available in diffuse, diffuse with background suppression, retroreflective, and through-beam sensing styles. The new Autonics miniature photoelectric sensors are CE and UKCA marked and RoHS compliant. They offer a three-year warranty. AutomationDirect www.automationdirect.com

HART Tunneling for the HES HART to Ethernet Gateway System

Moore Industries announces a significant feature update for the HES HART to Ethernet Gateway System, introducing HART

Tunneling which enables remote communication with HART field devices. This new feature allows seamless bi-directional HART data transmission between PC-based HART software applications and HES connected field devices over Ethernet.

HART Tunneling with the HES permits users to send read and write HART commands remotely with any HART-capable software application, such as PACTware or an asset management system, through the HES without requiring physical access to field instruments. Acting as a gateway, the HES facilitates seamless HART communication between Ethernet and twisted pair networks, simplifying the configuration, monitoring, and diagnostics of remote HART devices.

Unlike costly and complex HART multiplexer systems, the HES now offers a simple and cost-effective approach for connecting to just one or a few critical remote HART devices over your facility’s local or remote Ethernet infrastructure. Key features of HES HART Tunneling:

• Seamless Integration – Direct communication from PC-based HART software applications to field devices over Ethernet networks.

• Enhanced Accessibility – Remote configuration and diagnostics

monitoring of HART field devices from a control room or off-site location.

• Security Measures – A security jumper on the HES enables or disables HART tunneling to address cybersecurity concerns.

• No Additional Cost – All new HES units include the HART Tunneling feature at no extra charge. The firmware on previously supplied HES units can be upgraded to include the HART Tunneling feature.

To utilize HART Tunneling with the HES, a Virtual Serial Port (VSP) software application is required to create a bridge between the HART PC-based software application and the HES.

Moore Industries https://mimpage.miinet.com

Emerson enhances optimization capabilities

Emerson has released the flagship software of its Aspen Technology business. The release introduces a significant expansion of industrial AI capabilities, enhances user experience, provides new

capabilities to accelerate progress toward sustainability goals and improves operational performance. Version 15 of AspenTech’s software offers expanded industrial AI capabilities, including generative AI (GenAI), and creates a more seamless and efficient user experience with streamlined integrations, enhanced visualizations and simplified workflows. The release also includes more than 175 sample models supporting sustainability-driven use cases, empowering users to make measurable progress toward decarbonization and resource efficiency goals.

Emerson www.emerson.com

By Daniel Marshall

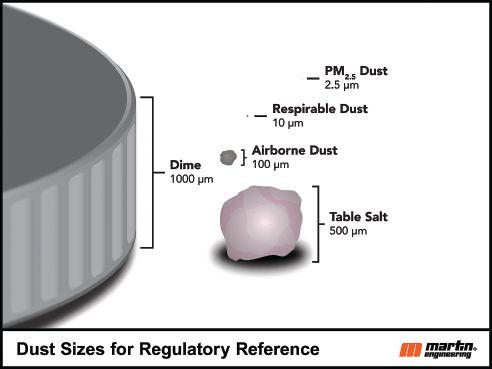

Dust emissions in the workplace have come into acute focus in Canada. Many of the regulated particulates, such as respirable crystalline silica (RCS), are invisible to the naked eye, so staff working around a conveyor system are often unaware of the danger or the level of exposure.

It may be easy for some operators to see where the dust is coming from, but some dust solutions are more complicated to solve than others. Modern conveyor equipment designs have taken dust into account and offered solutions that are easier to maintain and support workplace safety compliance.

Inspectors from provincial agencies can equip trained workers with personal dust monitors that they wear throughout their shifts. The small machines collect particulates from the air to measure RCS, heavy metals, and other regulated substances. The filters capture particulate matter (PM) smaller than 10 microns (µm) in size. In the case of RCS, the regulated measurement must be less than 50 micrograms (µg) in weight over an eight-hour, time-weighted average (TWA), i.e., a single shift.

For perspective, PM smaller than 200µm, roughly the size of sand dust, is light enough to remain airborne on ambient air currents. When PM reaches 100µm – approximately the size of a cross section of a human hair – it becomes invisible to the naked eye. At 10µm or smaller, the particulate is considered “respirable,” meaning it can surpass the body’s natural defences and enter deep into the lung causing serious damage and health issues.

Respirable dust is invisible to the naked eye, travels long distances, and is the most detrimental to worker health.

Once measured, inspectors usually order violators to address air quality. Personal protective equipment (PPE) such as respirators can be the answer in the short term, but for the long term, regulators recommend that operators

address the problem using “engineering controls.” These are equipment solutions that prevent emissions, reducing or eliminating the need for PPE. The reason for this is PPE can be hard to monitor throughout a shift, is often inadequately maintained, and the internal safety policy commonly lapses as time goes on; since respirators can be challenging to wear day in and day out throughout entire shifts.

Relevant standards:

• Alberta’s Occupational Health and Safety Code (2009) Part 36 (Mining) Section 601 (1)(2), 742 (1-5); Section 743 (1.1).

• Health, Safety and Reclamation Code for Mines in British Columbia (6.24.2).

• Province of Quebec’s Regulation respecting occupational health and safety in mines (98).

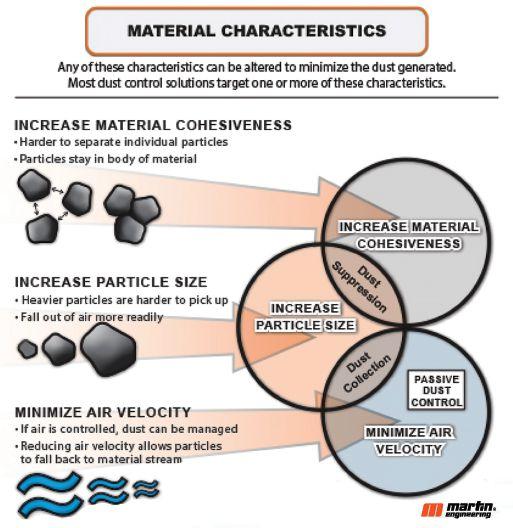

The volume of conveyor dust emissions is dependent on the conditions and the application. Operators and designers should first know the material characteristics and how they change as they pass

Dust control for operations with several conveyor transfers can be a serious challenge.

through the processing and conveying system. Examples of this can be found in most industries from cement to mining, as raw material is reduced from large to small, processed and stockpiled. Year-round weather conditions can cause dust, especially during dry seasons, which pull humidity out of the air, increasing emissions. Prevailing winds or

changes in wind patterns can suddenly shift a dust-free operation into one with several violations.

Conveyor dust emissions are also derived from many sources including transition points, material impact and cargo disruption:

• Dust at the transition happens when material falls to the belt, hitting the sides of the chute or rock boxes on the way down. As it falls, material not contained by a drop chute (such as onto a stockpile) separates, exposing the entire stream to ambient air currents allowing emissions.

• Dust on impact happens when material lands on the belt with no controls such as a rock box or curved drop chute. Depending on the height, weight, and density of the material, the impact

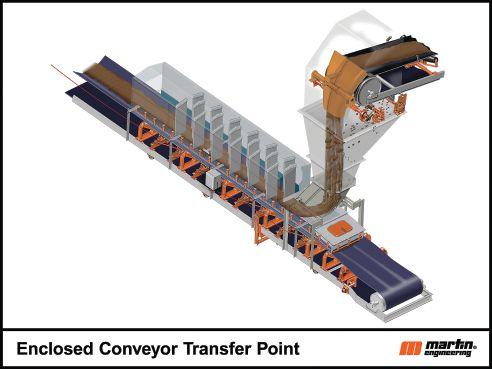

Dust suppression can be engineered controls like enclosed transfer points. Dust collection includes dust bags or mechanical air cleaners.

on the belt causes air turbulence and shifting leading to airborne emissions.

• Dust from disruption happens along the conveyor path, often between idlers where the belt slumps. This causes the cargo to shift and bounce slightly along the belt path, disrupting material, and causing dust emissions.

Loading zone design has shifted over the past decade in response to the need for dust reduction and greater efficiency and is an excellent example of an engineering control. Rather than transitions from conveyor to conveyor, or storage container to conveyor, that are straight drops from heights, chutes direct and control material flow using spoon designs. These designs ensure that material is loaded in the centre of the belt with little impact. This reduces dust, spillage, mistracking and belt damage commonly associated with conveyor transitions.

The impact of material on the belt can cause a splashing effect and produce air turbulence that seeks exit points from the chute through gaps between the skirt and the belt created by the slump between impact idlers. These rollers also tend to break under longterm pressure, causing them to seize. So, another innovation replaces impact idlers with a bed of steel angles lined by energy-absorbing impact bars with a top layer of low friction, ultra-high molecular weight (UHMW) polymer or polyurethane. The bar design helps the skirtboard sealing systems consisting of a wear liner and skirting to retain a consistent seal at the loading point to reduce the amount of spillage and dust emissions.

Eliminating moving parts and the

requisite lubrication of rolling components drastically reduces the amount of maintenance and improves safety by promoting a tight seal between the skirting and the bar. Some manufacturers have even developed innovative designs that mount the cradles on rails, allowing slide-out removal to reduce maintenance time and improve safety.

After cargo has been loaded, the stilling and settling zones of the transfer enclosure should be properly designed to have a sealed environment that controls airflow with negligible dust emissions. This design should include closely set idlers or idlers that transition between cradles. Another important element is continuous external skirting in single strips that run the length of the enclosure on either side. Inside the enclosure, strategically placed dust curtains slow airflow enough for particulates to settle back into the cargo stream. Dust bags and compact mechanical air cleaners, when installed on the enclosure, will also capture dust and ensure a dust-free exit from the enclosure.

Once the material has left the enclosure, wind can be an issue so many operators cover exposed conveyors. However, this does not control dust from material shifting, disruption over idlers, or mistracking. These actions can cause spillage and dust to fall along the length of the conveyor. Installing tracking devices along the belt path helps reduce spillage from mistracking even if cargo shifts.

More often than not, the conveyor discharges down an open shaft with a dead drop into the transfer chute leading to

another conveyor, into a hopper or silo, or onto a storage pile. When the material leaves the belt, it separates, exposing the entire stream which allows smaller particulates to become airborne. Stacker conveyors and tripper conveyors are especially prone to this and often utilize a misting ring or specially designed sock to control the stream.

However, material often hits the back of the transfer chute or impacts on rock boxes which can result in dust blowing back up the chute. Enclosing the discharge zone and controlling the impact of material using a spoon design will mitigate blowback. Also, adding air cannons helps direct cargo and airflow, as well as prevent unscheduled downtime from buildup and blockages within the chute.

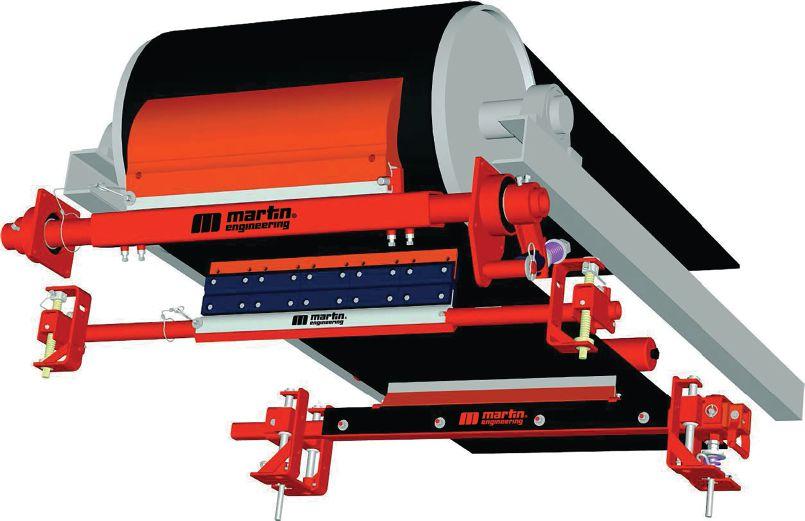

Conveyor belts across all bulk handling sectors take a tremendous amount of punishment and the single most expensive piece of equipment on the conveyor system is the belting. No matter how careful the upkeep, the belt will eventually start to show divots and cracks. The weight of the cargo can cause dry material to stick to the surface and dust and fines collect in the flaws. If not properly cleaned, the adhered material will not be discharged with the cargo flow and remain on the belt as carryback, spilling fines and emitting dust along the return path of the system.

Primary cleaners remove the most abrasive and hardest material left on the belt after discharge. Mounted at the head pulley on a tensioned assembly and the engineered polyurethane construction, many blades are in a curved configuration that allows the blade tip to fit snuggly against the belt and wear evenly throughout the blade’s life with only minor adjustments to the tensioner. One innovative primary cleaner design requires no tensioning at all after initial installation. It features a matrix of tungsten carbide scrapers installed diagonally to form a three-dimensional curve around the head pulley and typically delivers up to four times the service life of urethane cleaners without ever needing re-tensioning.

Secondary and tertiary cleaners are located immediately after the belt leaves the head pulley to address dust and fines that escape the primary cleaner. Generally equipped with spring or air tensioners that easily adjust to fluctuations in the belt, secondary and tertiary cleaners dislodge dusty carryback, adding it back into the cargo flow.

The prevailing impression that bulk handling is inherently dusty is an old

Top: The low-profile primary cleaner takes up less space than standard cleaners.

Bottom: Primary, secondary, and tertiary bladed systems ensure dust from carryback is mitigated.

idea that regulators are trying to reverse. By identifying causes of dust and retrofitting modern equipment, operators find that they can control emissions at the source and increase efficiency. Designers and engineers of high-quality conveyor accessories are constantly striving to innovate, adding ways for operators to reduce employee interactions with equipment, significantly lower dust emissions, improve workplace safety and remain compliant.

DANIEL MARSHALL received his Bachelor of Science degree in mechanical engineering from Northern Arizona University. With nearly 20 years at Martin Engineering, Dan

has been instrumental in the development and promotion of multiple belt conveyor products. He is widely known for his work in dust suppression and considered a leading expert in this area. A prolific writer, Dan has published over two dozen articles covering various topics for the belt conveyor industry; he has presented at more than fifteen conferences and is sought after for his expertise and advice. He was also one of the principal authors of Martin’s FOUNDATIONS The Practical Resource for Cleaner, Safer, and More Productive Dust & Material Control, Fourth Edition, widely used as one of the main learning textbooks for conveyor operation and maintenance.

KROHNE Coriolis flowmeter technology

KROHNE’s cutting-edge Coriolis flowmeter technolog is designed to address the most demanding process measurement challenges across various industries. With decades of experience and continuous innovation, KROHNE’s OPTIMASS Coriolis flowmeters offer accuracy, versatility, and reliability for critical flow measurement applications.

KROHNE’s Coriolis flowmeters provide mass flow accuracy of approximately 0.1%. These advanced instruments simultaneously measure mass flow, density, and temperature, offering comprehensive process insights with a single device. These meters can be installed in virtually any orientation without requiring specific flow profiles or straight pipe runs.

KROHNE distinguishes itself with its unique single straight tube design, offering benefits for challenging processes that cannot accommodate bent tube solutions. This innovative design provides advantages such as lower pressure drop, easier installation, and better handling of shearsensitive fluids. One of the most significant advancements in KROHNE’s Coriolis technology is the proprietary Entrained Gas Management (EGM) feature. This innovation allows for continued operation in two-phase flow conditions, a situation that traditionally causes most Coriolis meters to cease functioning. EGM enables the meter to continue measuring repeatably without process interruption, even when accuracy may be slightly degraded from published specifications.

KROHNE’s Coriolis flowmeters excel in various sectors, including chemical processing, food and beverage production, and oil and gas operations.

KROHNE www.us.krohne.com

Altech releases Alsense Energy Monitor for advanced industrial energy management

capabilities, including voltage measurement, current measurement, active and reactive power tracking and power factor analysis. Built for industrial environments, the Alsense operates reliably in temperatures from -25°C to +40°C and features vibration and shock resistance. With Modbus RTU/RS485 communication capabilities, it integrates seamlessly with existing SCADA systems and data logging platforms. The Alsense joins Altech’s monitoring solutions portfolio, which includes its Voltage Protection Relay,

Current Monitoring Relays and Voltage Monitoring Relay. These products provide a complete energy monitoring ecosystem that enhances efficiency, reduces costs and protects valuable equipment.

Altech www.altechcorp.com

The Alsense Energy Monitor supports both 1-phase and 3-phase systems with voltages up to 277 VAC (L - N)/ 480 VAC (L - L), delivering exceptional accuracy with voltage measurements precise to ≤0.15% and current measurements accurate to ≤0.25%. This compact DIN rail device provides comprehensive energy monitoring

From large stones to the smallest grains: Bulk solids come in all types, shapes and sizes, but choosing the right measurement technology is surprisingly easy. With our level and pressure sensors, you can effortlessly keep an eye on all your important process values – and still have time to crack the really hard rocks.

Everything is possible. With VEGA

vega.com

By Andrew Snook

estled in the heart of the B.C. Northern Interior is a joint venture ready to turn the locally-produced residuals of the wood products sector into renewable fuels.