Your brand can reach up to 250,000+ trade customers across 6 national publications. Download the 2025 group drinks deck.

Your brand can reach up to 250,000+ trade customers across 6 national publications. Download the 2025 group drinks deck.

Welcome to the November issue of National Liquor News – and what a month it’s been to celebrate the people, passion and progress driving Australia’s liquor retail industry.

From the Independent Liquor Group’s golden anniversary Family Reunion to the Liquor Marketing Group’s Members Conference in Prague and Munich, Liquor Legends’ Hamilton Island gathering, and Thirsty Camel Victoria’s 50-year milestone, this issue is packed with stories of legacy, leadership and evolution. They’re powerful reminders that while trends come and go, relationships, trust and community remain the heart of our trade.

Being recognised with the 2025 LSA WA Media Award last month was an incredibly proud moment – both personally and professionally. I love this industry, and to be acknowledged for doing what I love is a huge honour. I share this recognition with every retailer and supplier who has opened their doors, shared their insights, and trusted me to tell their stories with integrity.

Our cover story on Jose Cuervo Limonada captures that same spirit – celebrating innovation, authenticity and the bold ideas redefining what Australians are drinking.

As we look ahead to summer, our pages spotlight the categories and conversations shaping retail right now, from the growth of premium mixers and apéritifs, to the continued rise of agave spirits. We also celebrate the next generation of retailers, including REH Liquids’ Charlotte Smith, whose design-led approach is redefining what a bottle shop can be.

Thank you for your continued support throughout 2025. I hope these pages inspire you as we head into the busy festive trading season! And as always, a big thank you to all our contributors, readers and industry partners.

Cheers, Deb

Deb Jackson, Managing Editor 02 8586 6156 djackson@intermedia.com.au

FOOD & BEVERAGE

Tel: 02 9660 2113 Fax: 02 9660 4419

Publisher: Paul Wootton pwootton@intermedia.com.au

Managing Editor: Deb Jackson djackson@intermedia.com.au

Senior Journalist: Molly Nicholas mnicholas@intermedia.com.au

Journalist: Sienna Martyn smartyn@intermedia.com.au

General Manager Sales –Liquor & Hospitality Group: Shane T. Williams stwilliams@intermedia.com.au

Group Art Director –Liquor and Hospitality: Kea Webb-Smith kea@intermedia.com.au

Prepress: Tony Willson tony@intermedia.com.au

Production Manager: Jacqui Cooper jacqui@intermedia.com.au

Subscription Rates

1yr (11 issues) for $70.00 (inc GST) 2yrs (22 issues)for

(33

for $147.00 (inc

– Saving 30% To subscribe and to view other overseas rates visit www.intermedia.com.au or Call: 1800 651 422 (Mon – Fri 8:30-5pm AEST) Email: subscriptions@intermedia.com.au

Prosecco for every occasion

Jose Cuervo Limonada brings tequila’s vibrant spirit to light, flavour-driven RTDs perfect for summer occasions.

Jose Cuervo, the world’s first and number one tequila brand, is shaking up the RTD landscape once again with the launch of Jose Cuervo Limonada, a bright, citrus-forward blend designed for easy enjoyment and everyday refreshment.

Made with authentic Jose Cuervo Blanco, natural lemon flavours, and a splash of sparkling soda water, Limonada delivers the ultimate balance of lightness and flavour. Each 330ml can sits at five per cent ABV, 1.3 standard drinks, and only 110 calories per serve, offering consumers a better-for-you option that doesn’t compromise on taste or character.

A Proximo Spokesperson said: “Limonada is designed to recruit the next generation of tequila drinkers and trade-up light-spirit drinkers by offering them a familiar lemon flavour but a more flavourful experience.”

As the original tequila brand with more than 250 years of heritage, Jose Cuervo has built its reputation on authenticity, quality, and innovation. That same spirit of exploration now drives its evolution into a new generation of sessionable drinks that are lighter, lower in calories, and ready to crack open on any occasion.

“Tequila is the fastest-growing category in light spirits today,” the spokesperson continued. “Lemon premix variants continue to trend positively; however, consumers are looking for more flavourful options in this space, and tequila offers them that.”

Limonada arrives at the perfect time. As consumers increasingly seek convenience and sociability without sacrificing flavour, the RTD segment continues to thrive – and tequila is leading the charge. The shift toward citrus-based and authentic-tasting spirits has opened the door for tequila to take centre stage.

Jose Cuervo’s latest release captures this momentum, bringing the vibrancy of Mexico to sessionable social moments – from beach picnics and park gatherings to weekend parties and festivals.

Retailers can expect the classic 330ml can format to resonate with both male and female shoppers aged 21 to 30 who are looking for light, refreshing, and flavourful drinks in familiar serves. With a recommended retail price of $27 per four-pack, it delivers strong value and a compelling proposition onshelf – particularly as the warmer months approach.

Beyond its consumer appeal, Limonada represents an opportunity for the trade to capitalise on one of the strongest growth trends in liquor. As white spirits plateau, tequila and agave continue to surge, driven by its versatility across cocktails, premium sipping serves, and now RTDs.

Jose Cuervo Limonada is poised to be the drink of summer, expanding tequila’s reach and refreshing the RTD shelf with genuine Mexican energy.

Retailers and venue operators are encouraged to contact their local Proximo Spirits representative for more details on ranging Jose Cuervo Limonada. ■

“Limonada is designed to recruit the next generation of tequila drinkers and trade-up light-spirit drinkers by offering them a familiar lemon flavour but a more flavourful experience.”

Crafted with vibrancy and elegance, our range captures the essence of New Zealand’s most loved regions, where the curious charm of this iconic bird inspires every sip.

AVAILABLE NOW

Exclusive to IBA retailers

Meet the 21-year-old redefining Melbourne’s bottle shop culture with a female-led, designfocused, community-driven retail space.

Retail unfiltered dives behind the counter to uncover the real people of Australia’s liquor retail industry. In this issue we meet Charlotte Smith, the founder of REH Liquids, which is aiming to shake up Australia’s drinks scene with a fresh, design-led approach that is part bottle shop, part cultural hub.

Since setting up their first physical store on Smith Street at Fitzroy in Melbourne’s inner city last year, what sets REH Liquids apart is not just what’s on the shelves, but who’s behind the counter.

The brand is proudly female-founded and mother–daughter led, resulting in a dynamic that’s been key to its identity and connection with the community.

“Running a business with my mum, Joelene (Dight-Smith), has been the hardest and best thing I’ve ever done,” Smith said.

“We’re complete opposites – she’s numbers and I’m brand – but somehow that chaos works.

“She keeps me grounded when I want to blow everything up and start again, and I pull her into the creative world when she’d rather stay behind the counter.”

Starting as an experiment

REH was born out of frustration because Smith experienced every bottle shop the same way, with rows of beer, little sense of curation and nothing that spoke to women or younger drinkers who care about design.

“I’ve always been obsessed with design and architecture, especially spaces that feel intentional,” Smith said.

“I just couldn’t shake the idea that there had to be a better way to experience drinks.

“I wanted to build something that reflected the way women actually drink and connect, something design-led, inclusive, and distinctly modern.”

Smith, despite being just 21, has

forged a new approach to retail that offers customers a warmer, more welcoming atmosphere, blending music and a sense of belonging, compared to the traditionally transactional nature of bottle shops.

“REH has always been about more than selling drinks, it’s about connection and giving people something to feel,” she said.

“We do free tastings every weekend, creative collabs with local brands, fashion events, DJ nights – you name it.

“It’s not about getting drunk, it’s about celebrating how people gather, socialise and express themselves. I want people to walk in and think, ‘wait, this is a bottle shop?’”

REH has quickly gained a reputation as a space where art, design and service of Australian made products intersect, which provides a very different experience to the traditional liquor store model.

With curation central to the store’s ethos, every brand is personally tastetested, not just by the owners, but by a newly formed VIP customer group.

“I look for story and intentional founders who give a damn about what they’re creating, not just slapping a label on,” Smith said.

“I want a bottle to look as good on a dinner table as it tastes in a glass, if it feels authentic and well-made, it might earn its spot.”

As part of the whole experience instore, Smith’s focus on women – both as customers and as creators – is deeply embedded in the store’s DNA.

“Women especially have responded in a way I didn’t expect, they linger, they chat, they ask questions, we become friends,” she said.

“They finally feel like a bottle shop gets them.”

Many of the suppliers are female

founders who have built their brands from the ground up, usually without big investors, without a team, just a vision.

As for what’s flying off the shelves right now, readyto-drink cocktails lead the charge with 20-somethings, particularly locally made Cosmopolitans and Margaritas that Smith says, “look cute in the fridge”.

Non-alcoholic options are also booming with customers in their 30s, with Polka’s Botanical Spirit and Tula proving especially popular.

The emotional connection to the space is something the team hadn’t fully anticipated either but that doesn’t mean it has all been smooth sailing.

“It’s not just our business anymore, it’s created a family and every time someone tells me they brought their friends here ‘just to show them’, I melt,” Smith said.

“The biggest challenge has been cash flow and the constant juggle of wearing 10 hats, but those moments make the chaos worth it.”

Looking to the future, the management sees a clear shift in what customers are seeking, moving slowly away from the convenience of wanting to get a drink at a local venue to curation of an experience which tells a story and aligns with their values.

Design-led drinks, sustainability and storytelling are all set to play a bigger role in the way Australians shop and drink over the next few years and REH Liquids aims to be right at the centre of that evolution.

“I want REH to be the go-to destination for Australian-made drinks, a place people mention in the same sentence as their favourite restaurant or gallery,” Smith said.

“For me personally, it’s about building something that lasts without losing its edge and I want to stay creative, keep the store independent and keep surprising people with what a bottle shop can be.”

At the end of a long day, Smith’s go-to drink is a classic Cosmopolitan or a glass of chilled red, a fitting choice for someone reshaping what a bottle shop can mean to a new generation of drinkers.

“REH was built from scratch, bootstrapped with a lot of heart and not much else,” Smith said.

“It’s proof that young women can change the way things are done, even in an old-school industry.”

And with a growing following, a clear vision and shelves full of story-driven drinks, REH Liquids is well on its way to doing just that. ■

“REH has always been about more than selling drinks, it’s about connection and giving people something to feel.”

Charlotte Smith

With a focus on quality, value and connection, DeVine Cellars’ Managing Director Ross Tamburri reflects on the teamwork and passion that has helped the store carve out a meaningful place within the community.

Recognised for its commitment to quality and customer experience, Inglewood’s DeVine Cellars has been awarded the title of Metropolitan Retailer of the Year at the 2025 Liquor Stores Association of Western Australia (LSA WA) Awards.

This is not a first for the store that has taken home more than six major LSA WA awards in its 27-year history.

Managing Director Ross Tamburri said this year’s award has been especially humbling and an honour for the whole team.

“We’ve been in the industry for a long time, so we’re all very proud of what we have been able to achieve. Our team works so hard and it’s great for that to be recognised by our peers, industry members and our community,” he told National Liquor News.

Despite the challenges of the liquor retail environment over the past 12 months, Tamburri said the award win is a result of the team’s holistic focus on service and community.

“It’s in everything we do from our relationships with the liquor industry representatives, how we present our stores, our product range, our community participation and our focus on responsible service of alcohol.

“We’re trying to be leaders in the industry rather than followers so that means we’re really engaged in looking after our community and all while offering great products. Drinks are something to be enjoyed so I think that’s encompassing in everything we strive for,” he said.

For Tamburri a key thing that sets DeVine Cellars apart is the diverse, balanced and dynamic range of products available in-store.

“As soon as customers walk in, they are blown away by our range and how it’s presented. In my opinion, I think we have one of the most dynamic stores in the industry. We’ve even had international guests say they’ve never seen anything like it.

“Our aim is balance. That means we have top end wines in a devoted cellar along with local, interstate and international wines of all prices. Our beer and spirit categories are well covered too. What sets us apart is that those choices are always changing, we’re happy to adapt to what the community asks for –whether that’s something they’re keen to try or they discovered in a restaurant or overseas but want to enjoy at home,” he continued.

“We’re trying to be leaders in the industry rather than followers so that means we’re really engaged in looking after our community and offering great products.”

Ross Tamburri

Adaptability is something Tamburri emphasised has helped the business to stay relevant. And although that is no easy feat, its teamwork that makes it possible.

“It’s not just one person out there looking at products but all of us play our part. We’ve got a purchasing officer, but then the whole team, including, the directors and even the casual staff, they all get a chance to try a product, and say yes, we like this product or no we don’t. To us, it’s important to believe in the product and see how it fits the bigger picture.

“Having a team that backs you up really gives you an edge. It also helps us make decisions a lot quicker. If someone requests a product this week, we can have it on the shelf the next,” he said.

With 15 staff members across two stores, Tamburri said the team’s enthusiasm for the liquor industry continues to have a positive impact on the business overall.

“We really push our team, and it still amazes us that they just genuinely love working for us. They love being here and it makes a difference. I think you can train people to do anything, but it’s hard to train passion. So, when our people enjoy doing what they do, it gives us the ability to achieve more.”

After 27 years, Tamburri said DeVine Cellars' success has also been a result of the team’s ability to build community relationships through trust and consistency.

“It’s taken a lot of a lot of time to develop trust with our customers. They believe in what we do, what we say and offer. We’ve also established integrity. People in Perth know our name but that has taken time and patience to develop.”

Tamburri said it is this approach that has created a space that allows engaged and enthusiastic shoppers to explore.

“They come through and ask questions, we guide them, and they love it. We share our knowledge of food pairings or travel, and it lets people know we are approachable. We’ve got Italian heritage too, so food and wine keep us excited.

“Weaving those experiences into service is an instant way of connecting with customers. It strengthens our business because when you can relate to customers, they can relate to you, and it brings happiness to life,” he added.

With more than 3,500 Instagram followers, Tamburri says the use of social media has been an important part of the store’s marketing strategy and an extension of its service style.

“We’re engaging the local and interstate markets online, which is amazing. Our younger team is leading on content and it’s excellent. It makes things fun, brings new people in-store and shows that things don’t always have to be so serious.”

One of the most challenging parts of the industry is customer loyalty, and with many drinkers focused on value, DeVine Cellars remains focused on service and product loyalty.

“There’s a lot of competitors, but we maintain such a great range that people know they might only be able to find what they want with us. We also focus on fair pricing and specials in-store to go along with quality customer service. I think together it keeps people coming to see us.”

Looking ahead, Tamburri said the goal for DeVine Cellars is to maintain the standards already set.

“It’s just continuing to build upon our foundations and being at the front of the industry because it’s always changing, so we are always striving to be relevant.” ■

Con’s Liquor Geraldton was named WA Liquor Store of the Year at a milestone event honouring community, innovation and leadership.

Western Australia’s independent liquor retail community came together in Perth to celebrate three decades of industry excellence at the 30th annual Liquor Stores Association of Western Australia (LSA WA) Liquor Industry Awards, proudly presented by Lion at the Pan Pacific Hotel.

More than 300 guests attended the milestone event, which recognised outstanding performance, innovation, and the vital contribution local liquor stores make to their communities.

Con’s Liquor Geraldton takes top honours

The evening’s highest accolade went to Con’s Liquor Geraldton, which claimed both Regional Liquor Store of the Year and the overall WA Liquor Store of the Year titles. The double win recognised the store’s exceptional community engagement, strong business performance, and unwavering commitment to service.

In the metropolitan category, DeVine Cellars, Inglewood, Inglewood was named Metropolitan Liquor Store of the Year, highlighting its focus on quality, customer experience, and innovation in the Perth retail landscape.

Reflecting on the event’s legacy, LSA WA CEO Peter Peck said the 30th anniversary represented more than just a milestone.

“This year marks three decades of recognising the passion, hard work and

resilience that defines our members,” Peck said. “Every finalist and winner represents the best of small business and community spirit in Western Australia’s retail liquor sector.”

He added that the independent model remains the beating heart of Western Australia’s liquor trade.

“Our stores are pillars of their communities – they employ locals, support local events, and are at the frontline of responsible retailing. It’s a privilege to celebrate their contribution.”

The significance of the independent sector was reinforced by Racing and Gaming Minister Paul Papalia, who applauded the industry’s role in supporting local jobs and promoting safe, responsible retail environments.

“These stores are more than just places to buy a bottle of wine or beer – they’re part of our local fabric, employing locals and giving back to their communities,” he said.

One of the most emotional moments of the evening came with the presentation of Life Membership to Lou Spagnolo, owner of Liquor Barons Carlisle and the longestserving President of LSA WA.

Spagnolo’s leadership has shaped Western Australia’s independent retail landscape for more than 15 years. Presenting the honour, Peck said the award recognised an individual whose influence and integrity had strengthened the industry for decades.

“We’re here to thank someone who has gone above and beyond for this association and for the greater industry,” Peck said. “The person we are honouring tonight can only be described as visionary, diplomatic, hardworking and selfless.”

Peck noted that Spagnolo’s courage was pivotal in securing LSA WA’s independence from the national body – a decision that empowered the association to stand firmly for independents.

“It took enormous courage to say no to the chains and stand firm for the independents,” he said. “Thanks to Lou’s leadership, we now have a healthy, sustainable industry that benefits everyone in the room.”

He also praised Spagnolo’s calm leadership during the uncertainty of COVID-19, which ensured the retail liquor sector was recognised as an essential service.

Speaking to National Liquor News , Spagnolo said he was humbled to receive such recognition from his peers.

“After so many years in an industry I’m passionate about, it’s both an honour and a privilege,” he said.

Reflecting on his presidency, Spagnolo said advocacy and unity had been central to his approach.

“There have been many achievements, but what stands out most is helping to give independents a stronger voice in the regulatory and political space,” he said.

Although stepping back from formal

leadership, Spagnolo said he remains committed to supporting the next generation.

He said: “I believe in the importance of industry unity, and I’ll continue to champion the value of independent, locally-owned businesses.”

Looking to the future, he said independents must keep evolving with their customers.

“Consumer expectations are shifting rapidly toward more personalised service and specialised products,” he said. “Independents will need to keep innovating, investing in staff training, and embracing technology to stay ahead.”

The Employee of the Year award went to Victoria Williams from Greenfields Liquor Store, recognised for her exceptional leadership, customer care, and dedication to her local community.

Reflecting on her win, Williams said it came as an unexpected but deeply meaningful surprise.

“It’s been really lovely to be recognised,” she said.

With nearly three decades in the industry, Williams began her career at 18 and has spent the past six years transforming Greenfields into a thriving independent store.

“Working for an independent liquor store over the last six years has been brilliant compared to my 15 years working for a big corporation,” she said. “Being independent, we have the time to get to know our customers well, which allows us to listen to what they really want.”

Williams said the key to success lies in relationships built over time, saying: “We take the time to acknowledge our customers. A lot of our 3,000+ customers per week we know by name – we know what they drink, we speak with them about their families, pets, holidays, their jobs.”

She continued: “Look after your customers and they will look after you.”

Rounding out the major awards, the Community Service Award went to WA Police, recognised for its innovation in online retail theft reporting, which is improving collaboration and safety across the state.

As the LSA WA Liquor Industry Awards celebrated its 30th year, the evening stood as a tribute to the people, partnerships and purpose that continue to drive Western Australia’s independent liquor industry forward. ■

Life Member Award: Lou Spagnolo

Media Award:

Deborah Jackson, National Liquor News

Wine Sales Representative of the Year: Dianne Petrich – Brown Family Wine Group Spirit & RTD

Sales Representative of the Year: Dani Britz, Diageo

Beer Sales Representative of the Year: Andrew Bayley, Coopers

Corporate Wine Supplier of the Year:

Vinarchy and Samuel Smith & Sons

Corporate Spirit & RTD Supplier of the Year: Diageo

Corporate Beer Supplier of the Year: Good Drinks

Employee of the Year:

Victoria Williams, Greenfields Liquor Store

Community Service Award: Mark Twamley, WA Police

Metropolitan Liquor Store of the Year: De Vine Cellars, Inglewood

Regional Liquor Store of the Year:

Con’s Liquor, Geraldton

Overall Liquor Store of the Year: Con’s Liquor, Geraldton

National Liquor News Managing Editor Deb Jackson recognised for excellence in liquor industry journalism at the LSA WA Awards.

National Liquor News Managing Editor Deborah Jackson has been named the recipient of the 2025 Liquor Stores Association of Western Australia (LSA WA) Media Award, proudly sponsored by Lion.

The award was presented at the annual Liquor Industry Awards in Perth, celebrating Deb’s long-standing contribution to fair, factual, and people-centred reporting across the Australian liquor retail sector.

Peter Peck, CEO of the LSA WA, said Deb’s work continues to elevate the standard of industry journalism.

“Deb’s writing consistently reflects a thoughtful understanding of the broader social responsibility that comes with the industry,” said Peck. “She has championed positive conversations around harm minimisation, innovation, and leadership – including her coverage of the Banned Drinkers Register and her thoughtful reporting on industry reform and advocacy through leaders like the LSA WA’s own Steve Nicoloff and Lou Spagnolo.

“What distinguishes Deb’s journalism is her capacity to humanise the business of liquor retailing. She finds the people behind the brands – the local operators, the cooperatives, the family businesses – and tells their stories with empathy, accuracy, and respect.

“In recognising Deborah Jackson with the 2025 LSA WA Media Award, we celebrate a journalist who exemplifies the best of industry reporting – fair, factual, and fiercely committed to telling the stories that matter.”

Deb, who joined The Intermedia Group in 2015 as Editor of National Liquor News

“Winning

this award is such an incredible honour…

As Managing Editor of National Liquor News, I’ve had the privilege of writing about and working with independent liquor retailers for more than a decade. In that time, I’ve seen firsthand the passion, resilience, and innovation that make this industry so special.”

Deb Jackson

and Deputy Editor of The Shout, has since worked across several of the publisher’s key liquor and retail trade titles, including Beer & Brewer and New Zealand’s World of Wine

Following two years as Associate Publisher of Convenience & Impulse Retailing and Pet

Industry News, she returned in 2024 to her home turf in liquor as Managing Editor of National Liquor News, marking more than a decade dedicated to trade media within retail and liquor.

Reflecting on the recognition, Deb said the award was both humbling and deeply meaningful.

“Winning this award is such an incredible honour,” she said. “As Managing Editor of National Liquor News, I’ve had the privilege of writing about and working with independent liquor retailers for more than a decade. In that time, I’ve seen firsthand the passion, resilience, and innovation that make this industry so special.

“National Liquor News has always had one purpose: to help independent liquor retailers run successful businesses. But more than that, we aim to celebrate the people behind the stores – the ones who know their customers by name, who champion local products, and who keep communities connected through great hospitality.

“To Peter Peck and the LSA team, it’s always been a pleasure to work alongside you, and I’m so grateful and humbled by this award.

“And to all of the retailers that I’ve written about over the years, thank you for sharing your stories with me and letting me be a small part of your journey.”

The LSA WA Media Award celebrates outstanding journalism that promotes integrity, balance, and understanding within the liquor industry – values that have defined Deb’s editorial approach throughout her career. ■

*<0.5g Carbohydrates.

ILG marks 50 years with record results, new leadership, national growth and a milestone Family Reunion celebration.

Independent Liquor Group (ILG) marked its golden anniversary with a recordbreaking Family Reunion and Gala Dinner in Sydney, celebrating five decades of cooperative success, growth and innovation.

From 20–22 October, more than 720 members, suppliers and partners gathered across three days of events at the W Hotel, Luna Park and the ICC Sydney – the largest attendance in ILG’s history – to reflect on the cooperative’s remarkable journey and look ahead to an ambitious national future.

The celebrations capped a defining year for ILG, with the cooperative reporting solid financial results, the election of new directors to the Board, and progress on major strategic investments.

At the Annual General Meeting, members elected Tracy Hatch (Wellshot Hotel), Ripple

Parekh (Parekh Retail), Robert McGhee (Hillside Hotel), Shaughn Murphy (Lucky Star Tavern) and Doug Dalley (MacKay Northern Beaches Bowls Club), strengthening the Board with new voices from across the on- and off-premise sectors.

Chairman Damien Bottero reported that group sales revenue had climbed to $530 million, with $14.7 million returned to members in cash and non-cash rewards. While the Group recorded a modest profit, Bottero said the approach was deliberate and forward focused.

“Management has adopted a longterm approach designed to strengthen working capital and fund opportunities for sustainable growth,” Bottero said.

Among the year’s major milestones is the near completion of ILG’s new Swanbank facility in Queensland, which will deliver greater efficiency and capacity once it transitions from the Brisbane warehouse.

The Group also achieved full cyber security certification, reinforcing its commitment to operational resilience and member trust.

In his address to members, CEO Paul Esposito outlined ILG’s clear vision for the future.

“Our purpose is clear – to grow sustainably, build a strong member culture, and position ILG for the next generation,” Esposito said. “We may not have the resources to expand rapidly, but national reach is part of our future.”

ILG’s net assets now total $27.2 million, with investments focused on technology, e-commerce, and infrastructure. The Swanbank site is leased with an option to buy, giving the Group strategic flexibility for future growth.

Key FY24 investments included $1.5 million in signage, $1.2 million in

e-commerce and marketing systems, and $1.3 million in capital and ERP projects, all designed to modernise operations and deliver member value.

The Group welcomed 280 new members and grew its retail banners by three per cent, while Victoria saw standout performance with 14.2 per cent sales growth. ILG’s sights are now set on reaching $575 million revenue in FY26 and achieving $1 billion in sales within five years.

Across liquor categories, ILG’s performance reflected resilience and opportunity. Spirits grew 12 per cent, RTDs tracked in line with market growth, and wine once again outperformed the broader market. While cider has struggled, it showed improvement in the most recent quarter.

Freight subsidies of $1.4 million ensured regional members remained competitive, while $19 million in total member benefits reinforced ILG’s commitment to returning value where it matters most – to its members.

From a trading perspective, Esposito said ILG’s future growth will come from smarter operations and stronger engagement.

“We’re building a smarter, more efficient business,” he said. “From e-commerce to logistics, every improvement is about delivering greater value to our members and ensuring ILG’s long-term strength.”

Through the ILG Foundation, the cooperative also raised $42,684 to the end of June, continuing its legacy of community giving.

Celebrating success, people and purpose

The 50th anniversary Family Reunion

celebrations combined business sessions, brand showcases and social events that captured the cooperative spirit ILG was founded on.

Esposito said the milestone was less about looking back and more about honouring the people who make ILG what it is today.

“The celebration isn’t about the past –it’s about the people, the memories, and the moments that have defined our path,” Esposito said. “Let’s walk down memory lane, reminiscing on the challenges we’ve overcome and the milestones we’ve achieved together. Thank you for your unwavering commitment and your dedication to the ILG Family. Here’s to 50 years – and to the future we will continue to build together.”

The Brands Conference provided a detailed look at category and banner performance, future retail trends and innovation opportunities.

In national trading data, New South Wales recorded growth in both value and volume, while Queensland’s revenue rose despite a slight volume dip following a large acquisition. Victoria continued its impressive trajectory, achieving 14 per cent value growth and 9.8 per cent volume growth, with further expansion planned once the Swanbank facility comes online.

ILG’s banner network remains a core pillar of its cooperative strength, with Super Cellars reporting a 4.3 per cent revenue increase nationally, Bottler growing 0.8 per cent, and Fleet Street up 2.1 per cent. Bottler’s performance in Victoria was particularly strong, rising 31.15 per cent in revenue.

Fleet Street now comprises 35 stores, Super Cellars 346, and Bottler 401, underlining ILG’s footprint across both metro and regional areas.

E-commerce has emerged as ILG’s number one marketing and operational priority, with integration through

• $530 million in total group revenue (up 1.09 per cent YoY)

• $14.7 million returned in member benefits

• 280 new members welcomed

• $1.5 million invested in signage upgrades

• $1.2 million invested in e-commerce and marketing

• $1.3 million invested in ERP and capital projects

• $42,684 raised through the ILG Foundation

• 1.4 million in freight subsidies

Myfoodlink allowing members to populate online inventories directly from POS systems. Participation has doubled in the past year, with total online orders up 228 per cent to more than 274,000, delivering $15.2 million in turnover.

The enhanced digital ecosystem now includes Afterpay, Google Pay, and Apple Pay, as well as the Instant Rewards Program and ILG Plus, which integrates directly with Meta to deliver live, trackable promotions through members’ Facebook pages.

Category sessions at the Brands Conference highlighted opportunities across ILG’s core liquor pillars.

In beer, easy-drinking and classic styles dominated, with 30-packs driving growth and cans accounting for more than half of total volume. Exclusive activations, such as the Carlsberg Christmas promotion and 4 Pines Japan campaign, generated strong engagement, while upcoming member incentives – including a USA trip for four members tied to the 2025 Christmas campaign – are set to keep momentum high.

Within spirits, lighter and easier-drinking styles such as apéritifs and tequila are driving growth, while gin’s earlier decline has begun to plateau. There’s strong demand for value products and large formats, but super-premium segments are also gaining traction. ILG is encouraging members to leverage impulse displays, bundling, and seasonal gifting to drive incremental sales.

RTD growth remains fuelled by high-ABV innovations and new flavour extensions, with Millennial and Gen Z consumers now accounting for 72 per cent of indie liquor shoppers. ILG is helping members optimise ranges, reduce slower lines like seltzers, and spotlight high-performing innovations through digital and in-store activation.

In wine, lighter styles and sparkling continue to outperform, led by Pinot Noir, Grenache, Pinot Grigio and Prosecco. Champagne has rebounded strongly, up 60 per cent MAT, and cask wine is finally returning to growth. ILG’s soon-to-launch Premium Program will include curated wine and spirits, masterclasses, events and content designed to engage higher-spending consumers.

As ILG looks to its next 50 years, its message is clear: sustainable growth, innovation, and cooperation will remain at the heart of everything it does.

Bottero summed it up best: “ILG was founded on the belief that independents are stronger together. Fifty years on, that philosophy continues to drive everything we do – supporting our members, investing in our future, and celebrating the shared success of this incredible network.” ■

Major Supplier of the Year (Overall): Vinarchy

Beer: Coopers Brewery

Wine: Vinarchy

Spirits: Pernod Ricard

RTD: Diageo

Minor Supplier of the Year (Overall): Penfolds

Beer: Good Drinks Australia

Wine: Penfolds

Spirits: Vanguard

RTD: Vok Beverages

NSW/VIC Bottle Shop: West Sunshine Drive In Liquor

NSW Hotel: Harrigan’s Cameron Park

NSW Club: St George Motor Boat Club

NSW Group: Kent Walker Group

QLD Bottle Shop: Shafston Hotel

QLD Hotel: Central Hotel Cloncurry

QLD Club: Burleigh Bears Rugby Leagues Club

QLD Group: Central Queensland Hotel Group

Trends come and go. Markets shift. But some things never changeIt’s about relationships that last, quality that endures, and a reputation you can trust!

From boardroom insights to Bavarian beer halls, LMG’s 2025 Members Conference combined strategic vision with cultural immersion, celebrating a record year and mapping out the next phase of growth for Australia’s largest independent retail liquor group, writes Paul Wootton.

The 2025 LMG Members Conference began in the heart of Europe, where 350 delegates from across Australia gathered in the fairytale city of Prague. Beneath its spired skyline and cobblestone streets, LMG set out an ambitious agenda: to build on its strong market performance, strengthen its digital edge, and reaffirm the unity of the independent sector.

CEO Gavin Saunders opened the conference with a message of confidence and challenge.

“We are going to be a much bigger, much better business,” he told delegates. “We have so many more opportunities. I think we’re an incredible business, but I also think we can be better. And we’ve got the platforms to do so.”

Saunders revealed that one in every $11 spent in Australian retail liquor now flows through LMG stores – a figure that underlines the group’s scale and momentum. Over the past four years, LMG’s likefor-like growth has outpaced both Coles and Endeavour (a difference of +8.6 per cent and +12.6 per cent respectively). The group’s top 150 stores are growing at 11.4 per cent, while the next 150 are growing at 6.9 per cent, both well ahead of the market.

“Performance, at the end of the day, is shoppers coming into your store,” Saunders said. “We’re performing better than our opposition. We’re confident that our platform is exceptional and the support we put behind it is exceptional. But our role is to challenge our members too. We want you to be bigger, we want you to be better.”

Saunders said the group’s success was underpinned by three simple but powerful goals:

1. Grow member sales and profitability.

2. Create brands and promotions that drive retail sales; and

3. Enhance retail stores, platforms and insights to make retailing easier and more effective.

“Consumer reach is core for us,” he emphasised. “To fuel reach, pricing and ranging are key.”

He announced LMG would double its pricing investment this year, supporting sharper value and stronger margins for members.

Just as importantly, the group will continue to invest in the in-store experience, reinforcing Saunders’ belief that “brand is what you experience as well as what you tell people”.

He explained: “We’ve got to make sure the experience in the retail store is of the quality we expect.”

For Damien Page, LMG’s General Manager – Merchandise and Marketing, the future is digital, and it’s already here.

“Failure to invest in your digital future is the path to failure,” he warned. “Shoppers have changed. Sixty per cent of people shopping in-store are doing some form of research online first, checking prices, promotions, or even just stock availability. Your digital presence is your shopfront.”

“Failure to invest in your digital future is the path to failure.”

Damien Page, LMG

LMG’s investment in digital infrastructure continues to pay off. In the past 12 months, the group’s online platform attracted one million more unique visitors, a 32 per cent increase, the equivalent of around 7,000 extra potential customers per store.

Page described the group’s loyalty platform as its most powerful differentiator.

“The Achilles’ heel of independents has always been connection. Loyalty solves that,” he said. “It’s not just about recruitment; it has to be valued by the shopper. Shoppers have to be integrated with our platform and using it. That’s the difference between us and the chains.”

LMG’s success is also being fuelled by innovation. Eight per cent of all LMG sales now come from products that didn’t exist three years ago, yet those products account for about 40 per cent of total growth.

“People are looking for new news,” Page said. “Whether that’s 10-packs of beer, premium spirits or new formats, our programs are designed to bring those innovations to shoppers, and they’re working.”

To stay ahead, he said, LMG’s strategy was built on long-term thinking rather than short-term gimmicks.

“Everything we invest in has to be sustainable. Short-term programs don’t last. Our goal is to give members the tools and insights to compete, and to grow sales and profitability.”

Page closed his session with a simple mantra that captured the spirit of the conference: “We just want to make sure we are better than yesterday. Get one more shopper, one more visit, one more sale. That’s how we grow.”

While LMG leaders set the strategic tone, the supplier sessions gave delegates a broader view of changing consumer behaviour across beer, wine and spirits.

Brad Madigan, Vice President and Managing Director ANZ at Brown-Forman, described a liquor market in flux, where moderation and indulgence coexist.

“On the one hand we’re seeing moderation, wellbeing and zero sugar growing strongly. On the other hand, eight to nine per cent ABV dark RTDs are among the fastest-growing segments,” he said.

Cost-of-living pressures are influencing how people drink, leading to growth in smaller formats such as 250ml cans.

“We’ve got a responsibility to try new things,” Madigan said. “We’re not always going to be right. You’re going to see more products come and go. They might have a two-year life cycle, as the younger generations move through drinks faster than ever before. What they’re drinking this year, they might have moved on from next year.”

Madigan also spoke about the ongoing importance of recruiting new consumers, describing the process as a “leaky bucket” that must constantly be refilled.

“There are two ways to grow a brand: get more people drinking it, or get the people you’ve got drinking more,” he said. “Recruitment is continuous.”

Kerry Appathurai, Sales Director at Lion, said beer remains one of the most dynamic and competitive categories, but it is being reshaped by consumer trends that value moderation, variety and quality.

“Australia is now the biggest market for midstrength in the world,” she said, noting the continuing shift toward sessionable, lower-ABV beers. At the same time, Guinness has enjoyed a major resurgence, up 70 per cent MAT, thanks to renewed interest in classic brands and the success of the sponsorship of the recent Lions rugby tour.

For Lion, success lies in understanding what shoppers want next – and staying agile.

he said. “There’s a big risk in wine, so we’re working hard to understand which brand vehicles can drive innovation with relevance.”

For wine, that means a focus on lifestyle positioning, adding sparkling wines to ranges that are already successful, and exclusive launches into the independent sector such as Y Series Prosecco.

“If we can innovate, recruit, and be brave about the choices we make, there’s enormous opportunity ahead.”

Brad Madigan, Brown-Forman

“If it’s about recruitment, we need to keep people excited. We need to understand what the next trend is, get ahead of it, and execute well. That’s the hardest part, but we’re getting better at it.”

Appathurai also echoed the need for range discipline.

“There are still stores where I see bays and bays of beers, probably more from the craft portfolio, where we need to ask how much of this is actually selling. We need to be brave and decide what craft products we don’t need anymore, and how we allocate the space to the right categories.”

She added: “The challenge is balancing the big brands consumers love and trust today with the ones of tomorrow. It’s about defining the core that delivers results and ensuring a continuous flow of innovation to excite shoppers.”

From the world of wine, Ty Menzies, Executive Director – Sales ANZ at Samuel Smith & Son, outlined the particular challenges of innovation in a category where product development cycles can stretch over years rather than months.

“We don’t have the good fortune of bringing new products to market as quickly as other categories,”

“It’s about small steps,” he said. “So lighter, fresher styles, promoting chilled reds, and sparkling extensions. We want innovation that shifts perceptions, and marketing that goes beyond just varietals and food matching.”

The goal, he added, is to make innovation meaningful and measured.

“Small steps matter. It’s about moving quickly where we can, but making sure that when innovation lands, it’s relevant and helps grow the category overall.”

The common thread: Bravery and balance

Across every presentation, one message resonated: growth in a volatile market demands both courage and focus.

The consensus was that independents, backed by the LMG platform, are well placed to lead the next phase of category growth, provided they remain nimble, adapt and keep recruiting.

“The market is moving fast, and the best operators are moving fast with it,” Madigan concluded. “If we can innovate, recruit, and be brave about the choices we make, there’s enormous opportunity ahead.”

From Prague to Munich: Culture, connection and celebration

When the business sessions wrapped up, the

“Australia is now the biggest market for mid-strength beer in the world.”

Kerry Appathurai, Lion

conference shifted from strategy to sightseeing, and from data to dancing.

The setting could not have been more spectacular. Prague, the ‘City of a Hundred Spires’, offered a perfect backdrop for reconnecting after another year of record growth. Delegates explored the Old Town Square, wandered across Charles Bridge, and toured the magnificent Prague Castle complex, the largest in the world.

Evenings were spent sampling the Czech Republic’s proud brewing tradition, with Pilsner Urquell, Staropramen and Budweiser Budvar flowing freely, complemented by local wines and traditional dishes such as roast suckling pig.

LMG’s welcome reception at the Art Nouveau cellar restaurant beneath Prague’s Municipal House set the tone for the week: warm, communal, and celebratory. There was live music, folk dancing, and a buffet that reflected the city’s mix of history and hospitality.

After three days of business sessions and exploration, the conference moved south to Germany, and into an entirely different kind of cultural experience.

In Munich, delegates swapped their usual attire for lederhosen and dirndls as the conference culminated at the world’s biggest beer festival: Oktoberfest.

The event took place in the Wildstuben tent, one of the festival’s most traditional venues, known for its rustic timber interiors, exceptional food and convivial atmosphere. Delegates enjoyed Bavarian favourites such as roast pork, Wiener schnitzel and pretzels, washed down with Oktoberfestbier, brewed exclusively by Munich’s six historic breweries, each around six per cent ABV and served in one-litre steins.

Every year, more than six million litres of beer are poured during Oktoberfest, which has been running since 1810, when it began as a celebration of Crown Prince Ludwig’s marriage.

As the music played and the crowd swayed, delegates toasted a successful week, a mix of hard-earned insight and shared enjoyment that reflects the unique spirit of LMG. ■

Founded: 1810 to celebrate the wedding of Crown Prince Ludwig and Princess Therese of Bavaria

Duration: 16 to 18 days, running from late September to early October each year

Beer: Only six Munich breweries may produce official Oktoberfestbier

Strength of beer: Around six per cent ABV

Consumption: More than seven million litres poured annually

Servings: Every beer is served in a one-litre glass stein

Food favourites: Pretzels, roast pork, sausages, and half roast chickens (Hendl)

Attendance: Roughly six million visitors each year

United Innkeeper, the group that ultimately formed the Thirsty Camel bottle shop banner, has marked its 50-year milestone.

United Innkeeper celebrated its 50th anniversary with a special event in Melbourne last month, attended by 230 people including founding members, past board representatives, suppliers, and partners.

The association, established in 1974, went on to form the Thirsty Camel bottle shop banner in 2007 – a milestone that redefined independent retailing across Victoria and beyond.

Adrian Moelands, General Manager of Thirsty Camel Victoria, said the anniversary was an opportunity to reflect on both the cooperative’s history and its enduring community spirit.

“It was incredibly powerful to see the community that United Innkeeper has built over the past 50 years – a network of passionate publicans, partners, and people who have shaped this industry. To celebrate that legacy together, and to hear the stories of how it all began directly from the founders themselves, was a reminder of what makes our business so unique.”

The birth of the camel

In a video tribute played on the night, Former General Manager Heidi Solterbeck and founding partner Darryl Washington reflected on the rebrand that evolved into Thirsty Camel – one of Australia’s most distinctive and successful bottle shop brands.

Solterbeck recalled the process began with extensive research and creative development.

“We started exploring new names and briefed two agencies. Sitting behind the screens in the focus groups, you could see the

reactions firsthand – when something was boring, people would just switch off. But when something caught their attention, you’d hear, ‘Oh, that’s interesting. That’s different.’”

Washington added: “The development process took two years, and as Heidi mentioned, we ran focus groups to test everything, including the colours. Almost as much effort went into the colour as into the brand itself. When we finally settled on the name, logo, and colours, not only me, but the rest of the board were 100 per cent confident it was the right direction.”

United Innkeeper’s first conference was meant to be a one-off – a simple thank you for members. But as founding partners, Washington and Warwick Hunter recalled, it soon became a defining tradition.

“When we first started running conferences, we didn’t realise how important they’d become – 50 years later, it’s clear how valuable they are to our members,” said Hunter.

Over the years, conferences became both educational and inspirational.

“You could use that as an incentive – what a great opportunity to learn how to run a hospitality business,” said Solterbeck. “We spent our time visiting hospitality venues overseas, and they were so receptive to what we were doing.”

Former board member Ray Dodd added: “The principle of the board was always to take members somewhere they wouldn’t think

to go themselves. We went to Brussels, Paris, and many other places that hoteliers and retailers had never been to before. Whatever we did, it had to be memorable.”

The strike that started it all

The seeds of United Innkeeper were planted during a beer strike in the early 1970s.

“Carlton & United Breweries had quite a number of unions, and it was a constant thing for them to go out on strike,” recalled Hunter. “Usually, the stoppages only lasted a week or two, but this particular one went for nearly three months – and we were desperate.”

Hunter joined forces with Washington and Lou Steinfort, pooling stock and resources to keep their pubs afloat and helping others do the same.

“We started supplying other hoteliers to keep them going because we had more than what we needed,” said Hunter.

Washington remembered: “We realised we had the bones of something bigger. We thought, if we can do it with beer, why can’t we do it with wines and spirits too?”

That meeting led to the first official gathering at the Croxton Park Hotel, where 28 hoteliers became founding members of United Innkeeper.

“One of the first things I remember,” said Hunter, “was going out to Wynns and saying, ‘We want 20 casks – what would your price be?’ Then I said, ‘What if I made that half a truckload?’ Suddenly, the price dropped. That’s when we realised if three of us could do this, imagine what 33 of us could achieve.”

Reflecting on 50 years of friendship and success

In a final video played on the night, founding members and past leaders reflected on five decades of collaboration, growth and friendship.

“In those early days, we were very reactive,” said Washington. “It was only when Heidi came on board that everything changed. She shifted the focus from being reactive to being forward-thinking –painting a long-term vision and introducing initiatives with real, lasting benefits.”

Hunter added: “Something I remember from those early days was wondering, how long can this last? Once we got behind the business of wines and spirits, we started to understand that we were important to the suppliers. Once we began to consolidate volume, it started to grow.”

For Dodd, the enduring success came down to unity: “We came at things from four or five directions, but we generally ended up in one – where we should have been.”

For Solterbeck, the strength of United Innkeeper was always about its people.

“You need to have relationships with your members and your

suppliers – and to know when to put your foot down. Don’t forget your members, don’t forget your suppliers. But in the end, we’re really here to serve our members. Members are number one,” she said.

Reflecting on five decades of connection, Washington added: “This has been a great part of my life for 50 years. The camaraderie, the interchange of knowledge – we all learned from each other. It’s been a great learning experience, and we’ve made friendships that have lasted through that entire time.”

Dodd added: “Just the variety of people – all the members, the board, the suppliers – it’s been absolutely fantastic. It’s been such a pleasure to be involved.”

Hunter closed the reflections, saying: “The satisfaction of having been involved in something that has been so successful is enormous. I don’t think we’ve ever had a cross word in all the time I’ve been involved. It’s such a pleasure to have been part of it.”

Editor’s note: Ray Dodd who was featured in the videos on the evening sadly passed away just days before the United Innkeeper 50th anniversary celebration. National Liquor News extends heartfelt condolences to his family and friends. ■

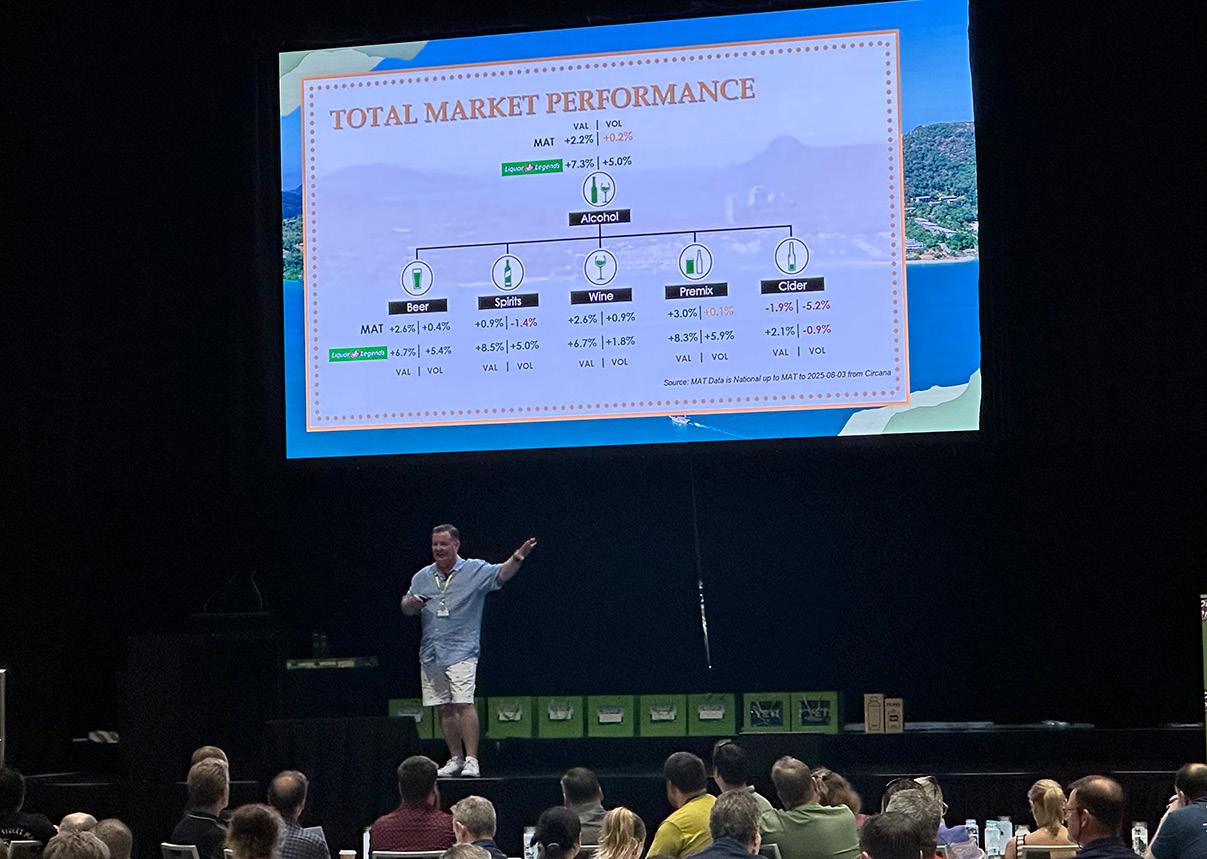

Despite the challenges of an evolving liquor retail space, Liquor Legends celebrates a year of success rooted in growth and innovation and provides a positive outlook for 2026.

Liquor Legends has celebrated another year of strong performance at its national conference held on Queensland’s Hamilton Island.

With a key message of “simplify, focus and grow,” Samantha Nicol, Wine Category Manager for Liquor Legends said this year’s conference focused on strategic innovation.

“Every session reinforced the same core message: less clutter, more clarity, and stronger execution. From the performance update and FY26 strategic objectives, to the category deep dives, the focus was on data led decision making, sustainable growth, and reinforcing the strength of the Liquor Legends model.

“Innovation was also a major talking point, with our guest speaker Nick Abrahams sharing thought provoking insights on AI in retail and how technology and human connection can coexist to create even stronger businesses,” she said.

Reflecting on the past year’s success, Nicol says momentum, focus, and partnership has enabled Liquor Legends to continue to outperform the market across key categories.

“Despite the shifting retail landscape and ongoing economic pressures, our members have kept performing, and that’s a real credit to the partnerships that sit behind

everything we do. We’ve continued to grow both in-store and online, strengthened our loyalty base, and seen real momentum through collaborative planning with our supply partners.”

“Every session reinforced the same core message: less clutter, more clarity, and stronger execution.”

Samantha Nichol

A standout achievement for the group in 2025 was its rewards and loyalty program, which Nicol said continues to be one of Liquor Legends’ biggest strengths.

“We have made great progress modernising our systems and marketing approach, particularly with Legends Retail Media and our Swordfish automated journey, which has taken our communication and personalisation to another level.”

She added: “From a trading perspective, we’ve seen strong growth in scan out

performance across beer, RTDs, and wine, underpinned by better ranging and a focus on GP growth.”

In terms of what is driving member growth and success, Nicol explains that there are four main factors: clarity in ranging, smart loyalty marketing, partnerships that deliver, and capability through technology.

“Our ‘less is more’ approach in wine ranging proves that simplifying choice drives better rate of sales, stronger promotions, and healthier margins. And we’ve got incredible supplier relationships that are built on transparency and trust. When everyone’s aligned, everyone wins,” she says.

“We’re also investing in smarter technology and tools that connect data with real customer behaviour, as well as the upcoming Rewards App and the Legendary Automated Replenishment platform, which simplifies stock management and boosts efficiency across stores.”

Nicol acknowledged the exceptional work and success of members recognised in this year’s major awards, from standout retailers to those behind the scenes shaping the liquor industry.

“Every award reflected the power of

collaboration and shared ambition. From our Retailer of the Year, Yarrabilba Hotel (QLD), to our Supplier of the Year, Sazerac, recognised for their innovation and partnership excellence.

“We also celebrated our BDM of the Year, Gus McKellar, whose passion and leadership have played a key role in driving member engagement and results across his region. And of course, we celebrated the people behind the scenes, including Kim Edmonds, our Employee of the Year, whose dedication, professionalism, and legendary spirit capture the essence of what makes Liquor Legends truly special.”

What stood out most for Nicol about this year’s winners was a commitment to performance and community that was felt across the board.

“The 2025 award winners truly embody what it means to be legendary. Each one demonstrated outstanding performance, creativity, and consistency, but also a genuine commitment to their teams, communities, and customers. These winners don’t just deliver results; they set the standard for what success looks like across our network.”

Over the next 12 months, Liquor Legends’ focus will remain on digital transformation, efficiency, loyalty and growth.

“We’ll roll out the new Rewards App, expand our automated replenishment systems, and keep refining our ranges so members can sell smarter, not harder,” Nichol said.

“AI will continue to shape how we communicate and plan but ultimately, it’s about people. Our members, our customers, and our supply partners are what make this brand legendary.”

For the consumer, she said balance between value and experience has been a major influence on spending in liquor retail, with members continuing to adapt to the evolving market.

“Drink better, not more is driving shoppers, but they are seeking more than just price. They want value and trust, but they still want discovery and experience. Younger customers are driving RTD and flavour exploration, while established demographics are staying loyal to their go-to brands.

“Our members are adapting through smarter promotions, better space allocation, and greater agility in responding to trends.”

Nicol emphasised that Liquor Legends remains focused on working with suppliers and partners to create value for members and customers.

“Partnership sits at the centre of everything we do. We’re proud of the transparency and collaboration we have with trading partners, which allows us to make decisions that drive mutual growth. Through Legends Retail Media, trading partners can now connect directly with our customers across digital and in-store platforms creating integrated campaigns that deliver measurable results.”

After a strong year, Nicol says the group is aligned for continued growth and innovation to continue. ■

Independent Liquor Retailers (ILR) has carved out a distinctive position in Australia’s retail landscape – one that balances national buying power with deeply local relevance.

For CEO Anthony Abdallah, the group’s continued growth lies in its ability to deliver both scale and authenticity in equal measure.

“Customers choose independents because they value trust, community and choice, and our model amplifies that by backing local retailers with structured programs that drive consistency and profitability,” Abdallah said.

At the heart of ILR’s approach are programs and partnerships that strengthen its members’ competitive edge – from pricing and rebates to data-driven category strategies and digital tools.

“Competitive pricing, rebates and tailored category execution sit at the core, while initiatives like the Beer Program, loyalty and e-commerce give members a real performance edge,” he explained.

That combination of local connection and collective strength has become ILR’s hallmark.

“Our stores are deeply embedded in their local communities, yet benefit from the strength of group buying power, supplier

“Our ambition is bold: to double our market share and lead the industry in member pride, success and growth.”

Anthony Abdallah

Independent Liquor Retailers is uniting local authenticity with national scale to empower independents for sustainable growth.

partnerships and data-driven insights,” he said. “Other retailers compete on price and tech, but ILR competes on trust, agility and authenticity. In short, we deliver scale with a local soul, and that’s proving priceless in today’s retail climate.”

Abdallah said the independent liquor landscape is evolving quickly, driven by new consumption habits and social trends.

“One of the key trends reshaping the independent liquor landscape is the rise of ‘mid-tempo’ socialising – picnics, casual gatherings and the at-home 4–7pm occasions,” he said.

“These moments are changing category dynamics, driving growth in smaller wine formats, chilled RTDs and premium beers made for easy entertaining. ILR members are adapting through flexible merchandising, tailored promotions and strong supplier partnerships that ensure timely new product launches.”

While Australians may be drinking less overall, Abdallah said they’re drinking better – a shift that continues to benefit ILR stores.

“Premiumisation remains a powerful driver. Australians are drinking less but spending more, trading up to boutique wines, Japanese beers, one-litre spirits and innovative RTDs,” he said. “Our members can respond quickly with premium programs, private label ranges and small-batch brands that deliver both value and margin.”

Technology is also reshaping how independents compete, particularly as customers increasingly expect the same level of digital convenience as they do from larger chains.

“From e-commerce to loyalty and customer rewards, ILR is

working closely with individual stores to tailor solutions that suit their customers,” Abdallah said. “These tools keep independents agile, connected and competitive in an evolving retail environment.”

Abdallah said that ILR’s partnerships with suppliers are founded on transparency and collaboration.

“Trust and transparency sit at the heart of how ILR works with suppliers and partners,” he said. “We build collaborative plans, drive engagement and execute bespoke programs that deliver both collective outcomes and individual success.”

It’s a model designed to serve all stakeholders in the value chain, from shoppers looking for genuine value, to suppliers seeking meaningful engagement, to members striving to grow their businesses sustainably. Abdallah said that by keeping collaboration at the centre of every decision, ILR ensures that outcomes are fair, measurable and mutually rewarding.

“Shoppers trust independents for authenticity and fair value; suppliers trust ILR for structured collaboration and retail growth initiatives; and members trust us to deliver practical solutions that protect margins and drive growth,” he said. “In today’s retail climate, transparency is the true currency, and it’s what sets ILR apart.”

To achieve that, ILR focuses on open dialogue and joint planning that benefits both members and suppliers.

“Suppliers are seeking innovation, meaningful promotional engagement and sustainable margins. ILR delivers this through centralised supplier reviews, joint business planning, and strategic

“In short, we deliver scale with a local soul, and that’s proving priceless in today’s retail climate.”

Anthony Abdallah

marketing partnerships, offering suppliers visibility and confidence, while giving members access to the latest launches and tailored local activations.”

This balanced approach extends all the way to ILR’s retail programs, where collaboration and transparency translate into real in-store impact. Each initiative is designed to balance member profitability with shopper trust, creating a consistent and authentic retail experience across the network.

“Our strategy balances both sides of consumer demand: premium programs and targeted ranging that build margin and elevate store positioning, alongside EDLP programs and ‘Price Lock’ initiatives that reassure shoppers on everyday essentials,” Abdallah explained. “It’s about credibility, delivering affordable luxury and everyday trust, side by side, in a way only independents can.”

As ILR prepares for the year ahead, Abdallah said the group’s focus is squarely on empowering members to thrive – both commercially and culturally.

“Over the next 12 months, our focus is clear – strengthening what makes ILR and its members truly Proudly Local,” he said. “Our priority is to support independents with the right balance of insight, scale and solidarity. That means turning technology and data into meaningful actions that drive member success, while continuing to deepen our supplier partnerships to deliver real value and longterm growth.”

The group will sharpen its competitive advantage on several fronts, including refining product ranges to reflect local relevance and customer needs.

“At the same time, our marketing programs will sharpen ILR’s impact in market – driving foot traffic, growing sales and amplifying the voice of the independent retailer,” Abdallah said.

“Operationally, we’re investing in practical store-level support to simplify processes and improve efficiency, freeing up members to focus on what they do best – connecting with their communities,” he continued.

And when it comes to the future, Abdallah's vision for ILR’s next chapter is ambitious.

“Our ambition is bold: to double our market share and lead the industry in member pride, success and growth,” he said. “The biggest opportunity lies in uniting local authenticity with the power of collective scale, and that’s exactly what ILR is built to deliver.”

Liquor Barons is once again inviting customers to embrace their adventurous side, launching the next chapter of its celebrated A Thirst for Discovery campaign in partnership with Perth creative agency Hypnosis.

The refreshed campaign takes The Baron beyond the bottle shop and into new territory – celebrating the joy of exploration, curiosity, and local connection. In a market still dominated by major chains chasing price competition, Liquor Barons continues to carve its own path as a proudly WA-owned cooperative where every store is independently run by locals who know their community best.

This year, The Baron embarks on a new journey ‘from celebrations that deserve a toast to discoveries waiting just off the beaten track,’ highlighting everything from ‘a lager your grandad swore by’ to ‘a tequila too good to slam’.

The message is clear – discovery can happen anywhere, and Liquor Barons is the home of it.

The campaign will roll out across Western Australia through out-of-home, online video, print, and social media, with The Baron once again serving as the witty, mischievous tour guide for drink lovers.

“We’re having fun with the campaign, but it’s also building something real for our brand and our stores. This campaign expands our creative universe and celebrates our commitment to exploration, discovery and the local expertise that defines our cooperative model,” said Lisa Hegarty, Marketing Manager at Liquor Barons.

MixIn by Endeavour Group has partnered with Amperity and Criteo to launch a first-of-its-kind retail media solution that directly connects digital campaigns to verified in-store wine sales, marking a breakthrough for closed-loop attribution in Australia.

Hayley Robinson, Head of Sales at GTM Retail Media at MixIn, said: “This changes how retail media works in Australia. For years, brands have been asking us for proof that digital campaigns drive in-store sales and now we can finally show it.”

The solution, built in just five weeks, uses Amperity’s data cloud and Criteo’s commerce platform to link verified sales to campaigns, all on privacy-safe foundations.

Bel Lloyd from Amperity said: “We’re proud to be part of a solution that’s setting a new standard in speed to value and measurement.”

Vinarchy Wines’ Meredith Lewis-Jones added: “Closedloop attribution finally means I can justify premium spend by showing deeper shopper insight.”

Honestly, only in WA would they think this is a good idea. A bunch of independents cooperating to share profits while providing customer value instead of shareholder value.

Honestly, only in WA would they think this is a good idea. A bunch of independents cooperating to share profits while providing customer value instead of shareholder value.

Spending money on creative campaigns and commercial strategy like they’ve got something to prove, when

Spending money on creative campaigns and commercial strategy like they’ve got something to prove, when

everyone knows the smarter play is just to discount harder and bleed margin.

everyone knows the smarter play is just to discount harder and bleed margin.

Building personal relationships with suppliers, topping Advantage surveys, and celebrating ALIAs as though recognition actually matters, instead of quietly filling the C-suite’s pockets.

Building personal relationships with suppliers, topping Advantage surveys, and celebrating ALIAs as though recognition actually matters, instead of quietly filling the C-suite’s pockets.

WA, a land of overpaid miners and oversized egos, somehow spawned a business that prioritises customers, nurtures small business, and keeps the lights on.

WA, a land of overpaid miners and oversized egos, somehow spawned a business that prioritises customers, nurtures small business, and keeps the lights on.

Retail Drinks Australia has raised concerns over the ACT Government’s proposed Liquor Amendment Bill 2025, which would limit delivery quantities, restrict hours to 10am–10pm, and enforce a two-hour “safety pause”.

Retail Drinks CEO Michael Waters said that while the industry supports harm minimisation, “the ACT Government has rushed this Bill that has no evidence base and without proper consultation with those it will impact the most”.

He said the Bill would create “the most restrictive framework in the country,” with excessive delivery limits, data retention requirements and meal exemptions unsupported by evidence.

Waters added that Retail Drinks’ Code of Conduct already governs 85 per cent of the market with a 94 per cent compliance rate.

“If a two-hour delivery delay was imposed, our data indicates 91 per cent of respondents would simply access alcohol by other, potentially less safe, means,” he warned.

“This is simply not good enough. It is policy on the run.”

A new player, Blue Sky Drinks Co., has entered the Australian market with the acquisition of several well-known brands, combining established spirit and RTD products.

The company has agreed to purchase the assets of Top Shelf International after it was placed into voluntary administration, including NED Australian Whisky, Grainshaker Vodka, and Act of Treason (under exclusive license). In addition, Blue Sky Drinks has also acquired Gravity Drinks Co – the better-for-you RTD brand founded in 2022 by Mick Spencer, Liam Battye and a group of professional athletes.

The Gravity Drinks team will take a leading role in Blue Sky’s development, with Spencer assuming the role of executive chair and Battye becoming head of operations. Gravity’s CEO Greg Mitchell and sales director David Ward will also move across, joined by drinks industry veteran Ray Noble who joins the board as a non-executive director.

Spencer stated: “By combining Gravity with some of Australia’s strongest spirits and RTD brands, we’re building a new kind of drinks company – one that’s proudly Australian owned, Australian made, and built for a future under a blue sky.

“We have stronger backing, bigger ambitions, and a renewed focus on what matters most: our customers, our suppliers, and keeping the energy alive behind these incredible brands.”

The combined business will continue production in partnership with IDL and maintaining strong national distribution across more than 5,000 off-premise partners.

National Liquor News would like to issue a correction to the Rosé Trade Buyer’s Guide published in our October issue. The LUC pricing and distributor information for wines supplied by Hill-Smith Family Estates were incorrect – the correct distributor is Samuel Smith & Son, and the LUC prices have been updated accordingly. We apologise for these errors and any confusion they may have caused. To view the corrected details, please scan the QR code on the following page to download the updated Rosé Buyer’s Guide.

For comprehensive category buyer’s guides, download our latest Trade Buyer’s Guide now. Scan the QR code to download the updated Rosé Buyer’s Guide.

As premium rum and Australian-made spirits gain momentum, Husk Rum continues to lead with its authentic farm-to-bottle story and awardwinning craftsmanship.

“The success of Husk Rare Blend, which is exported to France and won the 2025 Spike Dessert Trophy for Best Rum at the Melbourne Royal Australian International Spirits Awards, is proof that fine Australian-made rum is coming of age,” said Founder Paul Messenger.

Husk Rare Blend combines 80 per cent canehoney rum and 20 per cent fresh cane-juice rum, all produced and aged at the distillery’s Tweed Caldera farm in northern NSW. After a minimum of two years’ sub-tropical ageing, select barrels are blended to deliver ripe fruit and honeysuckle aromas with notes of vanilla, toasted oak, and subtle spice.

Messenger added: “Since 2012 we’ve crafted single-estate, farm-to-bottle rums on our farm, defining the spirit of our place and our people.”

With rum outperforming many other spirit categories, Husk offers a compelling local alternative for bars and retailers – premium in quality, authentic in provenance, and accessible in price. Available nationwide through leading wholesalers, Husk Rare Blend showcases the future of Australian rum craftsmanship.

Distributor: ALM, Paramount, and ILG

Cazcabel, the independent family estate tequila brand, has launched a new Tequila Blanco infused with Jalapeno extract from Mexico, giving earthy and citrus notes with a spicy finish, making it ideal for spicy margaritas.

Cazcabel is a true field to glass tequila brand, only using agave grown in their own agave fields and crafting the tequila at their own brand exclusive distillery, Hacienda Cazcabel. The additive-free Tequila Blanco contains only three ingredients – agave, water, and yeast – for a truly authentic tequila experience.

The Jalapeno infused Tequila Blanco, has natural Jalapeno extract added and is bottled at 35 per cent ABV, making it ideal for mixed drinks with a spicy kick.