PureView French Door Fridge

Smarter

Appliance Retailer is published by

Charted Media Group Pty Ltd (a division of The Intermedia Group Pty Ltd)

ABN 47 628 473 334

41 Bridge Road, Glebe NSW 2037 Australia

P 02 9660 2113 | F 02 9660 4419 E appliance@intermedia.com.au W www.intermedia.com.au

ISSN: 1328-1852

Managing Director

Simon Grover

Publisher James Wells james@intermedia.com.au

Journalist

Celene Ignacio

Features Editor

Kymberly Martin kymberly@intermedia.com.au

National Sales Manager

Ben Curtis bcurtis@intermedia.com.au

Art Director

Alyssa Coundouris

Prepress

Tony Willson

Production Manager

Jacqui Cooper jacqui@intermedia.com.au

Subscriptions 1800 651 422 subscriptions@intermedia.com.au

Hands in pockets across the industry

At the 2007 Narta conference in San Francisco, the most memorable speaker was not one of the greatest boxers of all time Sugar Ray Leonard, but another fighter – former forensic policeman Peter Baines – who had been transferred to assist with the recovery efforts after the Boxing Day tsunami.

Baines told delegates that he had created a charity to assist with housing and caring for displaced Thai orphans who had lost their loved ones during the tsunami. The impact on the audience was so significant that by the end of the conference, Narta delegates had raised over $245,000 for the Hands Across The Water charity including cash and appliances to help build an orphanage. Hands Across The Water has just celebrated its 20th year and the organisation has now raised $40 million. The links to Narta remain with Kay Spencer performing the role of chairman and numerous appliance industry brands now supporting the organisation. The 20th anniversary dinner recently held in Sydney saw several competitors setting aside their rivalry to reach into their pockets to raise funds. Retailers including Camera House, Retravision, Betta, JB Hi-Fi and David Jones were joined by Panasonic, Electrolux, Fisher & Paykel, Smeg, Nespresso and Shark Ninja to raise another $130,000 in just a few hours.

Just days prior, the industry came together once again to support Bret Quinn – a former Smeg employee and proprietor of The Good Guys Campbelltown store in Sydney – who is suffering the debilitating Motor Neurone Disease (MND). In a rare example of industry support, representatives from both Harvey Norman

and the Narta group stood side by side to support Bret and his family and raise funds for the MonSTaR Foundation and MND research that receives no state of federal support. There were even tables purchased to support the event by individual supplier members of the appliance industry – that were paying with their own after-tax dollars – and not just their employer’s credit card.

While Winning Appliances was the only major Sydney-based retailer missing from the Bret Quinn event – it is worth remembering that John ‘Herman’ Winning, his business and his family are also significant contributors and philanthropists to industry causes as well as several artistic, sporting and cultural events – and often without requiring recognition and praise.

This industry is at its best when it parks the petty politics and point-scoring to be bigger than the sum of its individual parts. Collaborating and working together is an important part of business, but also the ability to come together for important projects that reside outside of the day-to-day fight for market share, turnover and profitability.

With the imminent excesses and financial successes for our industry from Black Friday, Christmas and Boxing Day around the corner – those with fortunes should always consider the less fortunate.

The Intermedia Group takes its corporate and social responsibilities seriously and is committed to reducing its impact on the environment. We continuously strive to improve our environmental performance and to initiate additional CSR based projects and activities. As part of our company policy we ensure that the products and services used in the manufacture of this magazine are sourced from environmentally responsible suppliers. This magazine has been printed on paper produced from sustainably sourced wood and pulp fibre and is accredited under PEFC chain of custody.

PEFC certified wood and paper products come from environmentally appropriate, socially beneficial and economically viable management of forests. PEFC/21-31-119

Scan these QR codes to make a donation to Hands Across The Water (left) or the MonSTaR Foundation (right).

MEET THE APPLIANCE RETAILER TEAM

James Wells

Ben Curtis Kymberly Martin Alyssa Coundouris

Celene Ignacio

IN THIS ISSUE

22 Harvey Norman Commercial opens new Perth showroom

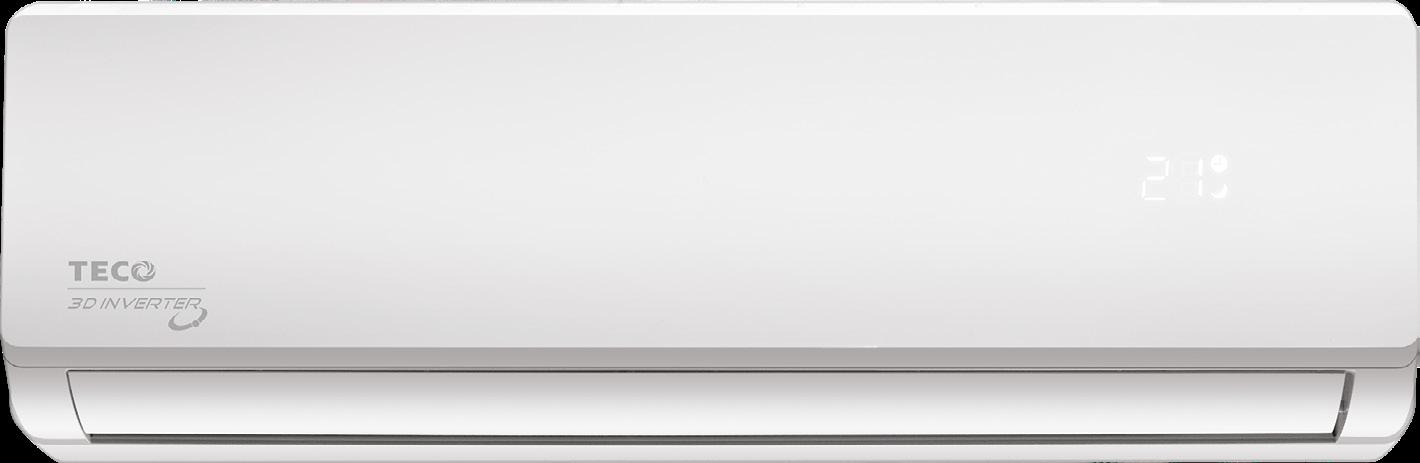

71 Cooling

With energy costs a major concern for many, it will be no surprise that energy efficiency was forefront of many consumers thinking, when it comes to their cooling product purchase. Energy efficiency and appliance quality sit high on cooling values.

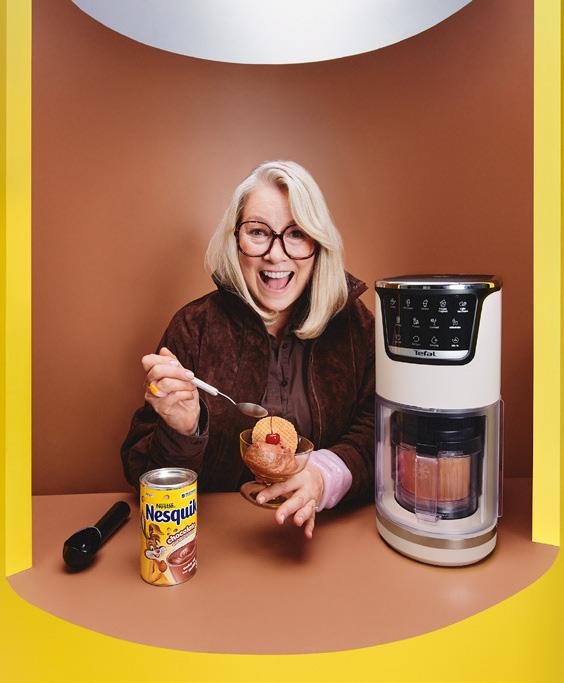

Home Café

Consumers are seeking products that offer easy maintenance, a modern aesthetic, and a compact footprint. Cold brew functionality is a growing feature, offering greater versatility and aligning with evolving consumer preferences. 47 Christmas

Consumer spending is predicted to pick up heading into Christmas, bringing some muchneeded Christmas cheer to retailers and shoppers. Those tough economic conditions, cost- of-living pressures and inflation, that put a dampener on consumer spending over the past three years, seem to have abated.

55 Floorcare

Floorcare is one of the key growth categories within small appliances, not only in Australia but globally. Functionality remains a top priority for consumers, with models that combine vacuuming and mopping.

81

Wine Cabinets & Beverage Centres

Growth in the wine cabinets and beverage centres is coming from the growing trend to entertaining outdoors as consumers enhance their outdoor living space with wine cabinets and beverage cabinets.

88 Refrigeration

A Canstar Blue survey revealed that nearly 70% of Australians prioritise energy efficiency, with a shift towards 5-star energy-rated models.

WHAT’S HOT

103

Pick of the crop

Smeg launches e-BBQ – the future of outdoor cooking, Smeg Wins Canstar Blue 2025 Award for cooktops, ECOVACS Launches DEEBOT X11 with industry-first PowerBoost Technology, V-ZUG delivers SwissMade Perfection in Cooling.

TERRY SMART SHARES POTENTIAL NEXT MOVE AFTER JB HI-FI

JB Hi-Fi CEO Terry Smart has shared his potential next move after stepping down from the retailer on 3 October.

In an exclusive interview Terry Smart told Appliance Retailer he is “definitely retiring and hanging up the boots” and is not planning on continuing any fulltime employment after he leaves the retailer.

However, Smart remained open to possibilities when asked if he will look to join any boards as a director

“I have not ruled that out as yet,” he said.

In the interview, Smart reflected on his time in the industry and the relationships he has built.

“My time in the industry has been very positive, and we have always had great engagement with the suppliers we work closely with.”

Smart also shared his thoughts about Nick Wells – the former chief financial officer of the business that has now taken over as JB Hi-Fi CEO.

“Nick has been in the business for a very long time. He understands this business and it is in great hands. Nick is very personable and I know he will work well with the team and drive them in a positive way.”

Matt Moran leaves Philips to join Dyson

Matt Moran has ended one of the longest career lives at a single company in the industry after stepping down as managing director of Philips after 28 years with the business.

Moran has joined Dyson ANZ as managing director replacing Niall O’Leary who held the role since March 2022. When contacted by Appliance Retailer for a comment on Moran’s new role, a representative from the company said: “Dyson won’t be making an announcement or providing commentary on the appointment”.

Moran joined Philips in 1997 after graduating from a marketing degree at the University of Otago and was then relocated to work for Philips UK for four a half years.

Moran joined Philips Australia in January 2005 and became the youngest ever general manager for Philips Electronics when he was appointed in 2006 – taking over from Harry van Dyk.

Moran was appointed managing director of Philips Australia and New Zealand and general manager for health systems seven years ago. Prior to this he held the position of vice president and general manager of personal health ASEAN Pacific.

SAM ZALIN TO DEPART FISHER & PAYKEL AND RETURN TO BING LEE

Sam Zalin will return to Bing Lee in mid-November taking back his previous role within the business as Marketing and Merchandise Director.

Zalin left Bing Lee in November 2023 to take up the role of Vice President – Product at Fisher & Paykel in the USA.

Zalin previously worked at Bing Lee for over four years from 2019 to 2024 and prior to this had roles at e&s (13 months) including the opening of the e&s Preston store and Winning Appliances (almost six years).

Bing Lee general manager, Pete Harris told Appliance Retailer, he was looking forward to Zalin returning to the business.

“When Sam left Bing Lee, he left on good terms with myself, Lionel and the entire business. It was a great opportunity for him to move to the USA and experience life on the supplier side of the industry.

“We always left the door open and we are very happy for him to return to his previous role. The timing has worked out very well for Sam and for Bing Lee and we are very excited about the future,” Harris said.

In his role of Marketing and Merchandise Director, Zalin will be responsible for the marketing and buying functions for all Bing Lee stores and Bing Lee Premium Brands including La Cornue as well as the Miele Drummoyne store in Sydney.

Zalin was instrumental in the launch of the Signature Appliances store located at Willoughby in the affluent socio-economic area of the lower north shore of Sydney in March 2023 described by suppliers as premium and approachable.

Harris told Appliance Retailer that Zalin’s appointment will be an additional headcount for the business and all existing staff within both the marketing and merchandising teams are expected to remain with the business.

Bing Lee general manager Pete Harris has brought back Sam Zalin to the business.

Terry Smart

Matt Moran

Samsung confirms leadership appointments

Samsung Electronics Australia director of consumer electronics, Phil Gaut, has confirmed two leadership appointments to its Home Appliances (HA) division.

Rachel Carter joined Samsung in August as Head of Department, Home Appliances. In her role, Rachel leads the HA Division across all categories, including refrigeration, laundry, vacuum and built-in cooking.

Rachel brings extensive leadership experience in strategy, account management and sales and marketing across a variety of sectors, including Retail, FMCG and IT. Most recently, Rachel was General Manager APAC for SFI Health.

Jessica Valiukas is joining Samsung in September as Head of Product,

Home Appliances. In her role, Jessica will be responsible for leading the HA division’s Go To Market strategy for all product categories. Jessica joins Samsung from SharkNinja, where she was a Senior Product Manager. This followed earlier roles with Fisher & Paykel Appliances and Kirby HVACR.

Gaut, who was appointed earlier this year to replace Jeremy Senior, says these appointments will prepare Samsung for an exciting phase of growth.

“Samsung is excited to have Rachel and Jessica join our Home Appliances team. They are both customer focused individuals with exceptional experience, drive and a proven ability to positively disrupt,” Gaut said.

JEREMY SARGEANT APPOINTED HEAD OF RETAIL SALES AT SAMSUNG

Samsung Electronics Australia has appointed Jeremy Sargeant, Head of Retail Sales – Consumer Electronics division; a newly created role tasked with driving sustained sales growth and retail transformation across Audio Visual and Home Appliance categories.

Sargeant joins Simon Howe – Director, Audio Visual and Rachel Carter, Head of Department – Home Appliances on Samsung’s Consumer Electronics senior leadership team, headed by Phil Gaut, Director, Consumer Electronics.

Transitioning to Samsung with a strong industry pedigree,

Sargeant brings extensive retail, sales and operational experience to the role. He will focus on building and executing best-inclass cross-category retail and training experiences to highlight Samsung’s unique position as Australia’s most trusted consumer electronics brand.

Chris Kotis leaves Hisense to join V-Zug as MD

Former Hisense vice president – sales and marketing for Australia and New Zealand, Chris Kotis has joined V-Zug as the new managing director for Australia and New Zealand.

Kotis shared a comment on his new appointment with Appliance Retailer, that commenced in mid-October.

“I’m truly honoured to take on this exciting new challenge of Managing Director for V-Zug in Australia and New Zealand. I hope to leverage the experiences I have gained over the years representing some incredible brands, and I look forward to being able to lead the V-Zug business into its next phase of growth and innovation,” Kotis said.

“During my time with Hisense Australia and New Zealand, I’ve been energised by the opportunity to contribute to a business that continues to innovate, evolve and grow. I’m confident I’ve played my role in helping set the foundation for future success, and I’m proud of what we have achieved with my team and our partners. I wish the Hisense team continued success,” Kotis said.

Prior to joining Hisense in February 2024, Kotis was sales director at Miele Australia for eight years under MDs Sjaak Brower and Yves Dalcourt and has also held senior roles at Bosch and Pioneer Electronics.

Kotis replaces Nic Naes who announced his departure after seven years in the role.

“Chris brings more than 20 years of exceptional leadership experience in the premium appliance and consumer electronics industries. In his previous roles, he was instrumental in developing and executing long-range strategic plans for both retail and commercial business. We are confident that his vision and deep understanding of consumer insights will be invaluable as he leads our ANZ operations into their next phase of growth and innovation,” said V-Zug chief international officer, Alberto Bertoz.

Jessica Valiukas, Head of Product, Home Appliances, Samsung Australia.

Chris Kotis is the new MD of V-Zug ANZ.

Jeremy Sargeant has joined Samsung.

Rachel Carter, Head of Department, Home Appliances, Samsung Australia.

Narta and Harvey Norman support Bret Quinn and Motor Neurone Disease

Hundreds of people attended the Bret Quinn MND fundraising dinner including several multiple table bookings from retailers and suppliers.

Ben & Jen Whitford from Whitfords Designer Appliances at Camperdown in Sydney.

Kevin Lim (Bing Lee), Jim Kalotheos (Beko), Claudine Nakad (Bing Lee) and Ben Miller (Bing Lee).

Pui Chi-Thanghai (Narta).

Michael Doyle (Worldwide Appliances), Chris Horne (Smeg) and Evan Manolis (Worldwide Appliances).

Mark Churcher (Smeg) and Tanya Mudge (Fisher & Paykel). Steve Nesbitt and Leon Wolf (Smeg).

The appliance industry has come together in a rare display of unity to raise much-needed funds for research into Motor Neurone Disease (MND) at the Bret Quinn Gala Dinner in Sydney.

For the first time in many years, both Narta and Harvey Norman retailers were side-by-side in attendance at the same event to support with Winning Appliances the only major group missing from the room featuring hundreds of attendees. Retailers represented included multiple tables from Narta head office, Harvey Norman, The Good Guys and Bing Lee.

Among the suppliers in attendance were multiple tables costing $2,500 each booked by major companies including Smeg, Beko, Fisher & Paykel, Electrolux and Worldwide Appliances at Castle Hill RSL in Sydney on Friday 26 September.

According to Smeg channel manager, Mark Churcher, over $100,000 was raised from the generous donations and bids received from auction items on the night.

The special event was dedicated to raising money for research into MND which receives no state or federal funding and relies on philanthropy and donations.

The event, hosted by the MonSTaR Foundation was in honour of Bret Quinn who is currently living with MND. Quinn was previously a proprietor at The Good Guys in Campbelltown in western Sydney for 11 years and also worked at Smeg for seven years before being diagnosed with MND in late 2023.

“MND has turned my world upside down. I went from being active and independent – cooking, skiing, camping and travelling, to now needing full-time assistance. My wife Roz and I had plans to travel once our youngest finished school in 2024, but those dreams have been put on hold,” Quinn said.

“In just 16 months I have gone from walking to now being in a wheelchair full-time and reliant on equipment and support for daily life.”

Once active and independent, Bret now requires full-time assistance but continues to take part in research and clinical trials in the hope of helping others. AR

To support Bret Quinn and MND research, please donate to the MonSTaR Foundation.

Alistair Robins (Narta), Kevin Lim (Bing Lee), Peter Snowden (Abey), Ben Miller (Bing Lee) and Pete Harris (Bing Lee).

Smeg MD Wayne Campbell addressed the dinner.

Pete Harris (Bing Lee), Grant Hammond (Harvey Norman), Michael Doyle (Worldwide Appliances) and Kyle Black (Electrolux).

Michelle Silvestri (Piketech Services), Jim Kalotheos (Beko) and Kylie Bowmaker (Smeg).

Grant Knight (Harvey Norman) and Michael Doyle (Worldwide Appliances).

Haus Group promotes Matty Searle to support business growth

Haus Group, the parent company of Whispair Rangehoods, Spezialist and PITT Cooking has appointed Matty Searle as General Manager for the business in Australia and New Zealand.

Haus Group owner Dane Hocking told Appliance Retailer why Searle was selected to be promoted within the business.

“With our continual expansion both here in Australia with the additions of PITT Cooking and Spezialist along with our regional expansion in Asia and North America, has meant the time is right to hand the day-to-day reigns of our ANZ business over to Matty. He is a tremendous leader within our business and already works very closely with our retail and commercial partners.”

Searle said he was very proud to take the new leadership role within the business.

“I am incredibly grateful to Dane and Nadine for entrusting me with

this opportunity. Haus Group stands at a pivotal point in its journey – well positioned and energised for the next phase of growth. Our family-based culture means that this business is more than just work; Haus is a meaningful part of my life. I am both honoured and humbled to step into this role and help guide our team into the future.”

Haus Group has also confirmed the appointment of a new staff member to its marketing team.

“We are pleased to announce the appointment of Amy Dicarla as our Marketing Coordinator,” Hocking said.

“Amy will play a pivotal role in enhancing our marketing initiatives and elevating our portfolio of brands.”

In addition to launching Spezialist cooking surfaces in 2024, Haus has purchased part of the PITT Cooking business in Holland becoming the distributor for the brand in Australia, New Zealand and Asia.

TRISTAN PETERS REJOINS ILVE AS CEO

Tristan Peters has departed Andi-Co and has been appointed the new CEO of ILVE in Australia and New Zealand.

Prior to joining Andi-Co, Peters previously worked at Eurolinx – the former distributor of ILVE – as national sales manager.

Peters said improving the brand’s retail presence was a key priority as well as spending time to re-vitalise and strengthen the sales team including making new appointments in key areas of the business.

“This move is more than just a new chapter – it's a return to a brand I’ve had the privilege of working with for nearly two decades.”

APPLIANCES ANNOUNCES SENIOR APPOINTMENTS

Worldwide Appliances, the distributor of brands including Artusi, Fhiaba, Fulgor Milano, Steel, Everdure, Robinhood and Omega Altise, has confirmed the appointment of two senior appliance executives to the team.

Evan Manolis has joined Worldwide Appliances in a newly created role of Trade Marketing & New Product Integration.

Manolis has extensive industry experience including previous roles at Tempo Group, Etisalat, Optus, Samsung, Panasonic and Hitachi.

Worldwide Appliances CEO Michael Doyle first worked with Manolis 19 years ago at Hitachi.

“Evan has a strong track record in product marketing, brand management, category growth, and go-to-market execution across consumer electronics and home appliances,” Doyle said.

“His global perspective and proven delivery on large-scale launches will be a valuable asset to the business. Evan’s role at WWA will be driving market impact, execute the integration of new products across WWA’s categories & selling the consumer

experience as well as strengthen go-to-market execution and readiness for Artusi’s next generation of products as well as seasonal brands.”

Worldwide Appliances has also appointed Leah Demos to the newly created role of Premium Brand After Sales & Commercial Support Specialist.

“Leah brings deep industry experience across multiple roles. Her appointment strengthens our commitment to after sales experience and customer support as well as supporting our sales teams across retail and commercial,” Doyle said.

“She will play an integral role across WWA’s Premium Brands of Fhiaba, Fulgor Milano and Steel’s after sales UX. This role allows our sales teams to better focus on working with our partners to drive results and maximise opportunities.”

Doyle said he is excited to announce these two key appointments that strengthen the company’s resources across go-to-market, trade marketing, after sales and premium customer experience.

“As we continue to grow, we’re investing in people that provide a culture that allow us to provide impactful executions and a better experience to customers and partners. Evan and Leah bring the expertise and energy that will help us build the next chapter of Worldwide Appliances,” Doyle said.

Tristan Peters

Matty Searle

Evan Manolis

THE FUTURE IS ELECTRIC

Designed for discerning homeowners who value precision, safety, and style, the Smeg e-BBQ delivers the ultimate outdoor cooking experience.

LAUNCHING 1 NOVEMBER 2025

BEKO PROMOTES HODGSON TO STRENGTHEN BUSINESS

Beko has promoted Andrew Hodgson to Field Sales Manager to strengthen its sales operations and enhance support for retail partners.

Hodgson, who will continue as Key Account Manager for Bing Lee, will now lead Beko’s Australian field sales team, reporting to National Sales Manager Eddie Gaymer.

“Andrew has been with Beko for over six years and, during this time, has made a significant impact on our business and our people,” Gaymer said.

“He has consistently supported new team members, generously shared his knowledge and insights, and shown unwavering passion for the brand – a passion that has been instrumental to our growth.”

Before joining Beko, Hodgson worked at Appliances Online as an Engine Room Team Leader. He later became a Territory Manager and was appointed Key Account Manager in 2022.

Beko is currently recruiting for a new Territory Manager in Victoria as part of its strategy to bolster its sales division.

Billi promotes Nicholls to Group MD

Billi has promoted Guy Nicholls to Group Managing Director from Managing Director for Asia Pacific, a role he held for the past 10 months. Nicholls brings over 30 years of executive experience. His previous roles include CEO at RPM Automotive Group, General Manager of Oceania at Rain Bird Corporation, Interim General Manager of Commercial at REDARC Electronics Pty Ltd, CEO of Ryco Group at Amotiv, and General Manager of ANZ for Ryco Group at GUD Holdings Ltd.

Under Nicholls’ leadership, Billi relocated its Australian headquarters and manufacturing operations to a new state-of-the art facility.

“This move reflects Billi’s commitment to building the foundations needed to deliver on its purpose – helping people and workplaces tap into better living through intuitive, sustainable hydration solutions,” the company said.

“As part of this next chapter, Guy has focused on strengthening the leadership team across key regions and departments.”

Meanwhile, Billi has also appointed Christy Minutoli as Marketing Manager ANZ and Dean Cook as Director of Sales ANZ.

In the UK, the company has designated Graeme Rodger as head of marketing.

“We have a strong brand, an incredible team and a clear opportunity to grow. I’m looking forward to working with our teams around the world to build on our momentum and take Billi into its next chapter,” said Nicholls.

Zip Water announces leadership changes

Zip Water, part of the Culligan Group, has announced a series of leadership changes aimed at supporting growth and aligning its Asia-Pacific and international operations.

John Doumani, President of Culligan APAC and Zip International, has stepped down from his executive role after a decade with the business. During his tenure, Doumani oversaw strategic expansion, innovation initiatives and business transformation.

While retiring from day-to-day operations, Doumani will remain involved with the company as Chairman of Zip Global, focusing on aligning and promoting Zip’s operations across Culligan’s global network. He will continue to report to the President and Group CEO.

Mike Abbott, currently Managing Director of Zip Water ANZ, has been appointed President of Culligan ANZ and Zip International.

Abbott, who joined the business in 2020 as Marketing and Strategy Director for Zip ANZ, became Managing Director in 2022 and has overseen strategic growth and commercial performance. In his expanded role, he will lead Culligan Australia and Zip UK alongside his current responsibilities.

ILVE AUSTRALIA MARKETING DIRECTOR DEPARTS

ILVE Australia marketing coordinator Maggie McCagh has left the organisation after 19 months in the role.

McCagh joined ILVE Australia in March 2024 following the decision by the parent company to create a dedicated subsidiary in January 2024.

In July this year, ILVE Australia confirmed it is committed to the local market with a series of new staff appointments as well as the fitout of a new head office in Sydney.

The new ILVE Australia showroom will be located on Moore St in Leichhardt – the same street as the former distributor of the brand Eurolinx.

John Doumani and Mike Abbott.

Maggie McCagh has left ILVE.

Andrew Hodgson

Guy Nicholls

ABOVE: BSR held its 2025 national conference at Crown Perth with over 350 retailers and suppliers in attendance.

BSR ‘Better Together’ at 2025 conference in Perth

Over 350 delegates gathered for the Betta Stores Retail (BSR) 2025 Conference & Buying Expo at Crown Perth with the theme ‘Better Together’.

“As the business landscape continues to evolve, it’s important that we come together to share how our group will continue to define its future and embrace the opportunities ahead,” said BSR CEO Gavin Carter.

“Over the coming days, you will experience a comprehensive agenda featuring engaging guest speakers, informative management presentations, and valuable networking with fellow members and suppliers. This year also brings the opportunity to participate in exclusive meetings during the Buying Expo and Showcase – designed to help you secure competitive deals for the months to come,” Carter said.

BSR Executive Chairman of the Board, Graeme Cunningham reflected on the theme of resilience from the group’s conference at Singapore in 2024 and how the local and global conditions have changed over the last 12 months with green shoots now appearing.

“Going forward we have a very solid plan being led by Gavin Carter and the team,” Cunningham said.

“There will be a lot of talk this week about Artificial Intelligence and how it affects our lives and affects our businesses as well as the importance of data and accurate data and we will reinforce this over the coming days.”

KEYNOTE SPEAKER – STEVEN KOUKOULAS

Stephen Koukoulas, managing director of Market Economics, addressed delegates with some good news in an optimistic presentation titled “The Consumer Come Back – It’s On!”. In his presentation, Koukoulas said there are several turning points with higher retail spending and consumer confidence while the global economy remains fragile with tariff wars, geopolitics and concerns over government debt levels. He said inflation is now on target with interest rates forecast to decrease by up to 1% over the next 12 months. He also said Western Australia, Victoria and Queensland lead retail spending growth while wage growth is feeding into a steady recovery into household incomes.

KEYNOTE SPEAKER – JASON ROSS

Generative AI expert Jason Ross and co-founder of consultancy Time Under Tension provided delegates with an eye-opening presentation.

Ross discussed AI-driven technology that will change how we conduct our personal and business lives including pilotless drone taxis, Tesla robotaxis that will not only change how products and people move about but may also earn additional revenue for owners while they are asleep.

“THE VALUE OF DATA IS DECREASING IF WE ALL HAVE ACCESS TO THE SAME THING, IT THEN BECOMES ABOUT HOW YOU USE IT.”

– Jason Ross, Time Under Tension

Worrying some retailers in the room were buying agents that monitor and track online shopping sites to activate a purchase when certain pricepoints are hit – without any human interaction using transactions with pre-approved credit cards.

“We are optimistic with where AI is taking us,” Ross said.

Generative AI has evolved to now provide assistance using agents across text generation, image generation, audio generation, video generation and code generation.

Ross demonstrated the power of Generative AI with the creation of a BSR Conference song that was produced within minutes and outlined the features of the newly released ChatGPT5 and how it is able to search for products for consumers with AI shopping agents.

“Search is changing – consumers are shifting their browsing habits to ChatGPT. This is changing how customers research products and new ways that customers can browse products and also make things better and easier for employees,” Ross said.

ChatGPT is now the fastest growing app in history with nine million ChatGPT monthly visitors in Australia compared to 7.9 million Amazon Australia customers in 2024.

Ross also discussed the importance of data analysis and the creation of deep research reports.

“The value of data is decreasing if we all have access to the same thing, so then it becomes not about getting the data it is about how you use it.”

Ross also discussed the Agentic Workforce and agents entering the workforce and what the impact will be on workforce of the future and confirmed that 2027 will be the year AI is predicted to achieve superhuman abilities.

BSR TO EXCEED $1 BILLION IN RETAIL SALES BY 2030

BSR CEO Gavin Carter outlined a five-year retail growth plan for the group at the 2025 national conference.

In an exclusive interview with Appliance Retailer, Carter shared an overall aspiration to exceed $1 billion of retail sales in the near future as well as a five-year retail growth plan. →

Generative AI expert Jason Ross - co-founder of Time Under Tension.

Gavin Carter presenting at BSR Group Conference in Perth.

Chris, Brody and Tegan Clugson from Ulladulla Betta with Shane George from Bega Betta.

Conference MC Andrew Klein interviewed Olympic swimming coach Dean Boxall in one of the highlights of the conference.

Over 350 delegates have assembled for the BSR Conference at Crown Perth.

“BSR is back – bigger and stronger,” Carter said.

“We have remained undercover for some time while we have restructured the business foundations as well as our systems and processes, but together with my team we have put together a solid plan for the next five years.

“Our retail growth plan will see 25 new stores opened over the next five years nationally in specific strategic locations that we have already identified with a mix of franchised stores as well as joint partnership businesses similar to the arrangement we have in place with Whitfords Designer Appliances in Sydney.

“Our overall aspiration is to exceed $1 billion of retail sales in the near future led by our multi-brand retail offering including Betta, Designer Appliances and Furniture Zone as well as Stan Cash and Billy Guyatts. To achieve this goal we have implemented new systems across our business to become a much more efficient operation with an emphasis on investment within retail management, software systems, logistics and AI integration across all touchpoints.

“We are also looking to double our commercial business across the entire store network. We know this a huge growth opportunity for our business with increased commercial demand from new builds and our unique ability to service this part of the market with a broad significant geographical footprint.

“We have also developed a plan to double the online share of our total business – which will capitalise

on fulfilling customers in metropolitan areas while retaining our strength across regional Australia.”

Carter shared current business results for the business over the 12 months to 30 June – with units and value up year on year.

“Standout categories in the business were cooking, portable appliances, floorcare, furniture as well as IT and mobile.”

One of the highlights of the conference was an uplifting and motivational speech from Australian swimming coach Dean Boxall during dinner held at the Optus Stadium in Perth. Boxall – the coach of Olympic Gold Medallists Ariarne Titmus and Mollie O’Callaghan – shared the sacrifices, determination, discipline and commitment required to become a champion athlete.

Carter also discussed the importance of the buying expo for BSR suppliers held during the final two days of the conference.

“Our buying expo takes place twice a year to capitalise on key trading periods. Our stores have been enthusiastically securing key inventory for the upcoming trade period through to the end of the year including Black Friday and Christmas. We would like to thank our suppliers for partnering with us along this journey of change and growth.

“Overall this has been a very positive conference and the feedback from members and suppliers has been it is one of the best yet – the theme Betta Together perfectly represents the future of our group.” AR

Social researcher Dr Claire Madden.

Graeme Cunningham - Executive Chairman of the Board - BSR Group. Alison Riley from BSR.

Gavin Nuss from BSR.

BSR Store of the Year Awards

The winners of the BSR Store of the Year Awards for the 2024 calendar year were:

Club Betta Store of the Year 2024

Winner: Pimpama Betta

TopGun Warranty Salesperson of the Year 2024

Winner: Kennedy’s Betta

Community Spirit Award 2024

Winner: Kempsey Betta

National Furniture & Bedding

Retailer of the Year 2024

Winner: Townsville Betta

National Designer Appliances

Retailer of the Year 2024

Winner: Adelaide Designer Appliances

Betta - State Retailer of the Year 2024 (QLD)

Winner: Balonne Betta

Betta - State Retailer of the Year 2024 (NSW)

Winner: Ulladulla Betta

Betta - State Retailer of the Year 2024 (VIC/TAS)

Winner: Ciavarellas Betta

Betta - State Retailer of the Year 2024 (SA/NT)

Winner: Berri Betta

Betta - State Retailer of the Year 2024 (WA)

Winner: Narrogin Betta

Betta - National Retailer of the Year 2024

Winner: Balonne Betta

The 2025 BSR Conference wrapped up with a gala dinner attended by over 350 guests to celebrate its Store of the Year Awards.

Addressing the attendees at the dinner held within the Crown Perth Ballroom, BSR CEO Gavin Carter reflected on the importance of bringing together the industry for conferences and the opportunity to network with industry colleagues and connect with fellow retailers away from their day-to-day businesses.

“During the conference we have had some great keynote speakers and tonight is about letting our hair down – those that have hair,” Carter said.

“We have had a lot of fun and a lot of laughs together and also enjoyed the Supplier Expo and Showcase bringing everyone together as we head into this busy trading period of Black Friday and Christmas.

“I would like to thank all of our members and corporate store managers – you all run your own businesses and are very successful retailers and we could not be more proud of what you have achieved and what you do every single day for our customers out there and our brands.

“And to my team, you are my rock and we could not have achieved this without you – we have a lot of things coming ahead which is incredibly exciting and I couldn’t do it without the team that I have.”

Carter confirmed the BSR Conference will be held at Twin Waters Resort on the Sunshine Coast from 17-21 August 2026.

Winners of the BSR awards received additional prizes including Visa Gift Cards, marketing contributions up to $5,000 for their store as well as complementary registrations to next year’s conference. AR

Balonne Betta won the award for State Retailer of the Year 2024 - QLD and National Retailer of the Year.

Pimpama Betta won the award for Club Betta Store of the Year 2024.

Kennedy’s Betta won the award for TopGun Warranty Salesperson of the Year 2024.

Adelaide Designer Appliances won National Designer Appliances Retailer of the Year 2024.

Narrogin Betta won the award for State Retailer of the Year 2024 – WA.

Kempsey Betta won the Community Spirit Award 2024 for their generosity with donations to the local community during the flood events earlier this year.

Ciavarellas Betta won the award for Betta – State Retailer of the Year 2024 – VIC/TAS.

Harvey Norman hosts inaugural Major Domestic Appliance Expo

Over 240 Harvey Norman floor staff attended the inaugural Major Domestic Appliance Expo held in the last week of September at Rosehill Racecourse in Sydney.

The Major Domestic Appliance Expo included a showcase from the top Harvey Norman suppliers in four product categories – refrigeration, laundry, dishwashers and air conditioning.

Representing all Harvey Norman stores nationally, the floor staff were selected to attend by store proprietors and represented the lead salesperson in the categories on display at the Expo.

The two-day event was the first event of its kind and based on feedback is expected to become an annual event.

The format of the Major Domestic Appliance Expo followed the successful Harvey Norman Cooking Expo held in July which ran for the second time this year growing from 180 floor staff in attendance in 2024 to over 400 floor staff in 2025.

Harvey Norman general manager of major domestic appliances, Chris Coen, told Appliance Retailer these training events provide floor staff with knowledge that will translate into improved sales for the business.

“This is an experiential and hands-on opportunity for our floor staff to understand innovation within each of these major appliance categories. This will provide our teams with the information required to help us achieve our goals in the business over the next six months including the key sales periods across Black Friday and Boxing Day.

“Our suppliers have come prepared with information about their innovation pipeline and product stories to help drive ASPs which is our advantage when it comes to the assisted sales model.

“We would like to say a huge thank you to the suppliers. We had an overwhelming response to the Cooking Expo and a number of these suppliers were the first to say that they were in for this event and wanted the biggest stand possible. We believe with these events we have created a reputation for being able to deliver value for supplier partners and they are supporting this strategy which is fantastic.

“In my presentation to the sales staff, I mentioned that they are the key to our business executing and achieving the higher than market ASPs that we have been able to achieve consistently over time.

“We feel the next 18-24 months is critical for selling these appliances in packages to those consumers trading up as well as those in the renovation market. We are predicting there will be a cycling through of the large volume of purchases made during Covid and this is a huge opportunity for our sales staff in major appliances.

“The replacement market will always be there, but we see greater consumer confidence emerging and economists are all indicating the next move on interest rates will be down – and this will bring further discretionary funds into the wallets of consumers,” Coen said.

Harvey Norman business development manager – major domestic appliances, Iain Tennant told Appliance Retailer he was impressed by the investment made by suppliers in the Expo.

Iain Tennant and Chris Coen from Harvey Norman.

Iain Tennant (Harvey Norman), Jeff Punzalan (Haier), Naomi Scesny (Haier), Suzanne Suleman (Haier), Steven Fry (Haier) and Chris Coen (Harvey Norman).

“THE TWO-DAY EVENT WAS THE FIRST EVENT OF ITS KIND AND BASED ON FEEDBACK IS EXPECTED TO BECOME AN ANNUAL EVENT.”

“Our suppliers have created a lot of excitement for our sales staff – it feels like a mini IFA exhibition. We have timed this event to coincide with the launch of refrigeration season and air conditioning season as well as new models in the laundry category.

“This Expo is about bringing together our key suppliers as we approach the biggest trading period of the year and setting the tone for our business by getting our team match fit for this crucial retail sales period. We know we have the best salespeople in the industry, and we are making sure that we are investing in product knowledge going into these key selling periods.” →

Jacky Glading and Tyson Osewald from Samsung.

Kimberley Myers, Hale Mehmet and Claudia Henriquez from Mitsubishi Electric.

Josh Hall (Asko) and Adam Evans (Harvey Norman).

The Asko team – Troy Grech, Josh Hall, Mark Murphy and Ben Pitchers.

Iain Tennant (Harvey Norman), Mark Churcher (Smeg) and Chris Coen (Harvey Norman).

Suppliers had this to say about the 2025 Harvey Norman Major Domestic Appliance Expo…

“There is no training event like this in the industry. We are using this Expo to spend time with the floorstaff – particularly the regional stores that we don’t have conversations with as frequently as the metro stores. We have introduced our new Diamond dishwashers under an agency system that will be coming to market shortly and we are using this opportunity to explain the features, benefits and patented technology. We don’t have Smeg dishwashers on every shop floor at Harvey Norman – so this is a good opportunity to educate the floor staff that can then go back to their proprietor and make a recommendation to include our product on the floor of their store.”

– Smeg Australia, national channel manager, Mark Churcher

“It has been great to be a part of the Harvey Norman Major Domestic Appliance Expo. Product training on Mitsubishi Electric products equips staff to deliver expert advice, boost sales, and confidence on the retail floor.”

– Mitsubishi Electric marketing and communications manager, Hale Mehmet

“The Harvey Norman Expo has given LG a great opportunity to connect with all the key salespeople who are in front of our customers every day. This event not only gives us an opportunity to showcase the key benefits of our products but also can give us an insight into our customers, what they are asking for and what they look for in our brand and products directly from the shop floors. We value the opportunity greatly to continue to build stronger partnerships with the Harvey Norman family.”

– LG sales director, Frank Malcaus

“This has been a great opportunity to demonstrate to the Harvey Norman floor staff our new freestanding dishwashers in stainless steel and black steel as well as our current laundry range.”

– Asko national sales manager – retail, Josh Hall

“We have been able to present our brand to the Harvey Norman floor staff and explain the evolution of our products. We have received a lot of good feedback from the audience to our refrigeration range – quad door, French door and side by side as well as our dishwashers matching the refrigeration.”

– Haier national key account manager – Harvey Norman, Jeff Punzalan

“This has been a great opportunity to speak with both experienced staff as well as new staff that have recently entered retailing for these categories. It has allowed us to discuss our technology and how artificial intelligence can be used to remotely update our products including the Bespoke AI washer and dryer and heat pump combo.”

– Samsung national product specialist, Jacky Glading

Samsung stand.

Bosch stand.

Hisense stand.

LG stand.

Electrolux stand.

Asko stand.

Bi-Rite Home Appliances hosts 2025 conference in Cairns

Bi-Rite Home Appliances brought together store owners, suppliers, and partners from across Australia for its 2025 National Conference, held at the Shangri-La The Marina in Cairns from August 23 to 25.

The event opened with a Welcome Dinner at Backyard, followed by Sunday’s plenary session themed Resilient By Nature.

CEO Abdul Kayum Sacur welcomed members and trading partners, addressing market conditions and industry challenges. Category Manager Tristan Ansley shared whitegoods and cooking insights, while Marketing Specialist Megan Holden-Wells and Marketing Manager Alayna Bullock outlined the expansion of Bi-Rite’s marketing program.

COO Hamza Hussein introduced Bi-Rite’s new electronic shelf label (ESL) initiative in partnership with Solum. Jason Busuttil of NARTA also presented The Rite Skills, a new online training platform for store teams.

The supplier showcase featured product launches and updates across major categories. Beko presented its nextgeneration front loaders with energy and water savings. Bissell unveiled the PowerClean Stick Vac range, while Breville highlighted growth in coffee and air treatment. CHiQ introduced unique refrigeration models, including a fridge drawer, alongside new washers.

Dreame made its debut in the Bi-Rite network with floor care and hair care technology. Electus highlighted 3D printing and mobile accessories.

Haier unveiled new French door fridges and laundry models with UltraFresh. LG showcased new TVs, audio products, and its A9L CordZero Stick Vacuums.

Mitsubishi focused on its glass-door fridges, while Panasonic demonstrated innovations across small appliances, air-conditioning, and personal care. Sunbeam presented its Origins espresso range and French Riviera Breakfast Series.

Spectrum Brands highlighted new products from Russell Hobbs and Remington, including SatisFry air fryers and AIRvive hair care.

Extended sessions were led by EHP, TCL, and Hisense. EHP showcased its new vacuum cleaners, refrigeration, and laundry models, including 3D Sense Heat Pump Dryers. TCL presented its 2025 Mini-LED TV range, energy-efficient appliances, and air-conditioning systems.

Hisense highlighted opportunities in largescreen TVs, refrigeration, and laundry, including its Side-by-Side refrigerator with ConnectLife Hub and 8i series front-load washer.

Sunday evening’s Gala Dinner, sponsored by Electrolux, saw Sacur and EHP’s Phil Russell announce that five stores would receive a year’s subscription and setup for ESL ticketing. Delegates also enjoyed networking and entertainment at The Sugar Shed in Yorkey’s Knob.

The conference concluded Monday with further trade show activity and closed workshops led by Bi-Rite’s category and marketing teams. Delegates praised the mix of industry insights, hands-on product engagement, and networking opportunities.

“The event was a good blend of industry insights, hands-on product experiences, networking and of course letting the hair down a bit at the Gala Dinner which was a highlight for me,” said Travis Wiley of Bi-Rite Wangaratta.

“The GOAT of Bi-Rite conferences! Really useful deep dive into market trends and stats and marketing initiatives. Good fun membership interactions and excellent content and presentations from suppliers. Loved seeing all the new models. And, in beautiful Cairns,” added Chantal Mortimer of Bi-Rite Boonah. AR

ABOVE: Phil O'Shea from Bi-Rite Goondiwindi on the guitar at the gala dinner.

Alayna Bullock and Megan Holden-Wells from the Bi-Rite team.

Hamza Hussein and AK Sacur with Bi-Rite store owners from Stawell, Wangaratta, Lismore and Yamba.

Harvey Norman Commercial opens new Perth showroom

Harvey Norman Commercial has opened a newly created showroom in Perth at Osborne Park.

The showroom features 1120 square metres of space across two floors with a third level providing 830 square metres of office space. A huge warehouse with 2550 square metres of space and 10 metre ceilings is the only commercial warehouse of its kind in the appliance industry in Perth.

Harvey Norman Commercial Perth proprietor, Shylo Goodman, told Appliance Retailer the new showroom represents one of the best fitouts across the entire company network.

“We are re-launching the Harvey Norman Commercial brand and we are looking to elevate our position in the WA market. Previously we didn’t have the right space to appeal to a premium and luxury market for builders, specifiers and architects.

The new showroom, also known as the Harvey Norman Commercial Selection Centre, is based around the corner from the former premises on O’Malley St that were operational for over 20 years. Despite being closed for almost eight months since the end of 2024, Goodman expects the lost trade to be made up quickly with several commercial customers already enthusiastically visiting the showroom even prior to its official opening.

Born and raised in New South Wales, Goodman started working in the Harvey Norman NSW Commercial warehouse in 1999 and worked his way up through the organisation before swapping offices with the former head of Harvey Norman Commercial in Perth David Cramond in 2023, when he took over from Alan Stephenson at Taren Point in Sydney.

Harvey Norman Commercial Perth proprietor, Shylo Goodman.

Fisher & Paykel display.

Siemens display.

THE ENTRANCE

“When visitors enter the showroom, we want visitors to immediately see best in class brands as well as experience a feeling of luxury. This is a space I am extremely proud of and represents years of cumulative effort from the team,” Goodman said.

“There has been a lot of thought that has gone into the small details such as the natural light coming into the front of showroom as well as strip lights to guide you along your journey. One of the design features is a circular Barrisol light fitting which a lot of consumers may not recognise – but interior designers will and that is our target market.”

For those that don’t know – a Barrisol light fitting features over 2000 LED lights covered in stretched fabric to deliver a flat even light.

Other effects that have been used to appeal to the interior designers and builders is the use of the labour-intensive French Wash painting technique that delivers a marble-effect on the walls as well as intriguing glimpses of other displays to allow you to see through to other locations in the showroom.

“These are design features that some people may not notice, but the designers that we are targeting will absolutely understand.”

THE RECEPTION

The by-appointment showroom features a reception counter with a La Pavoni coffee machine waiting to welcome guests to start their journey.

“We try and discourage people arriving without an appointment as we want to manage the number of people on site at one time. This is not a space for consumers to walk-in off the street – if a consumer is here they are only here because they are building or designing with one of our clients.

“All the showroom consultants are baristatrained so when they arrive at reception the consultant makes them a coffee as they qualify the client and find out whether they are aligned to a specific brand so they can be taken directly to the space rather than just roaming the showroom.”

THE JOURNEY

The showroom is split between two main floors with kitchen and laundry appliances located on the ground floor complemented by the second floor offering the best brands in bathroomware, water filtration and heating & cooling.

“We have maintained a strong focus on the customer journey right down to small details such as carpeting the staircase and installing a nice semi-frameless balustrade and warm lighting making these probably the best-looking fire stairs in Perth. We commissioned a well-known local street artist – Rachelle Dusting – to paint native flora and fauna murals in the staircase that are also carried through to our board rooms and working spaces on the third level.”

The top and bottom of the building are bookended with murals of NSW floral emblem – the Waratah – to represent the East Coast origins of the Harvey Norman business as well as the birthplace of its proprietor. →

Miele display.

Electrolux display.

La Pavoni coffee machine at reception.

THE GROUND FLOOR

One of the main features of the ground floor appliance area is a full demonstration kitchen located behind reception.

“Our demonstration kitchen features completely interchangeable cooking appliances with ovens and cooktops that can be swapped out using a captive plug system. This allows us to have different brands participating in different trade nights without having to constantly have tradespeople come in to change the products.”

One of the biggest differences between this Selection Centre and the nearby Harvey Norman retail store is the lack of signage or branding for each brand’s area.

“We have deliberately ensured there is minimal branding throughout particularly across pelmets and look-at-me style signage listing all of the features and benefits. The whole showroom is unguided differentiating itself from the type of displays in a traditional Harvey Norman store. Our customers are here because they are renovating or building a house – or two –or maybe even an entire block of apartments.

“We have tried to keep manufacturers with multiple brands together – such as Bosch, Siemens, Neff and Gaggenau; Fisher & Paykel and Haier as well as Electrolux, AEG, Westinghouse and Vintec – to help tell their stories.

“Unlike a retail store, it is not product heavy – it has been designed around the designer with a good representation of product without flooding it with every model in the range.

“A lot of effort has gone into the product selection with the manufacturers. Smeg is a good example as this is a brand that has so many different products – but here we have been able to show a strong representation of the brand portfolio with all of their design themes without actually showing all of the products.

“When it came to the displays, we designed the reception and demonstration kitchen, but the remainder of the branded areas we collaborated closely with the manufacturers. Some brands have very specific colour branding guidelines, while others such as Miele that are normally very strict with their execution decided to create an entirely unique palette for this showroom which has been very exciting.

“As a result we have delivered what we believe to be a very premium feel that is unlike a typical retail showroom. Our customers are not coming to purchase a builders pack with products between $400-$800 and as a result we start our product range at the mid-market. A good example is our rangehood display where all of our brands with off-board motors have a working model that we are able to demonstrate to customers. When you compare a rangehood with an off-board motor with an on-board motor and you explain they are both extracting the same 1600 cubic metres of air and ask which one would you rather have in your home – it is an easy upsell.

“Our specialist areas showcase rangehoods from Schweigen and Whispair as well as Sirius and Falmec. We also have brands from the Haus Group including Pitt and Spezialist, Haier, Omega and Technika.”

THE SECOND FLOOR

Bathroom fixtures including taps, basins and toilets are located on the second floor alongside room heating, underfloor heating, water filtration and even audio products. Key brands include Villeroy & Boch, Gessi as well as Zip taps, Kalfire, Rinnai, Real Flame and Planika heating systems.

Sinks and taps on the second floor.

Gessi tap display.

Vintec display.

Goodman also emphasises the importance of “thought-starters” with emerging categories such as home water filtration for every drop of water in the house being offered to customers who are looking for the latest technology to install during their renovation.

A large number of companies in the bathroomware category also offer Australian made products including taps and basins which also provides some customers with additional reassurance when it comes to warranties and fewer supply chain delays.

“People will pay more for Australian-made product if it is a quality product with designs that are unique,” Goodman said.

THE THIRD FLOOR

A large office area is located on the top floor of the building. “We have a beautiful office on the top floor that is probably one of the nicest working spaces within the Harvey Norman business and staff also enjoy basement car parking as well.

“It is important to me that the staff have somewhere nice to work. If you have a beautiful showroom there is no point having a tiny back office that is horrible for people to work in. The back office is very important for a commercial business as there is a lot of processing to support the salespeople out the front. The admin team is much bigger than a retail store with several coordinators working with site supervisors to ensure stock arrives directly to the building site.

“Glass partition walls feature a different sketch from artist Rachelle Dusting on the three offices and the boardroom fitted out with Autex acoustic panels and the latest conferencing technology which is also available for Harvey Norman customers to use. “There is additional space that has been made available for future expansion as well as a larger kitchen area to provide more space for staff interaction. The balcony space features a barbecue and smoker with outdoor furniture facing an edible garden that can be used by staff as well as the demonstration kitchen.”

THE WAREHOUSE

The new warehouse attached to the Harvey Norman Commercial premises in Perth offers 2550 metres of space with 10 metre ceilings that is managed and controlled by internal staff. The previous location had 1700 square metres of space with 6 metre ceilings and a firewall down the middle of the warehouse.

“We are the only commercial division in Western Australia with our own dedicated warehousing that we control ourselves with our own staff. We have installed a wire guidance system so that our pickers can steer themselves which means we don’t have to have a bottom shelf, allowing our fast-moving products to be located on the ground. It has also reduced the amount of hand-unloading as pallets can be brought in directly from our suppliers.

We also have a three-level walk-up mezzanine with 2400 individual bay locations for all of the smaller boxes we have in stock – which is significant when you compare this to 1500 bay locations for the remainder of the warehouse.

“One of our biggest pain points was tapware and bathroom accessories – lots of small boxes on standard racking – there is nothing worse than trying to look for a 10cm x 10cm box in a 3.6m long rack – it is a like a needle in a haystack. Our new layout creates several efficiencies for picking and packing as we now have a warehouse that is more than double the storage capacity of our previous warehouse. We’ve increased our pallet storage by more than 4 times, I never thought we would fill all of the pallet space in this new warehouse, but we almost have, which is probably a good thing and shows our customers that we are here to stay.” AR

BELOW: The three-level walk-up mezzanine in the warehouse features 2400 individual bay locations.

ABOVE: There is plenty of room to expand with 830 square metres of office space on the third level.

IFA Berlin 2025

The world’s largest trade event for the appliance and consumer electronics industry did not disappoint the dozens of Australian retailers and suppliers who made the journey to Berlin in September.

Over 1900 exhibitors from 49 countries met with 222,000 visitors across 190,000 square metres.

During the event, it was announced that IFA will continue to be held annually in Berlin until at least 2034.

“Berlin offers a good trade fair infrastructure, a dynamic environment and the appeal of an international metropolis. We are delighted with the trust placed in us and are convinced that IFA in Berlin will continue to be a success story in the future,” said IFA CEO Leif Lindner.

1. Hass Mahdi

Chris Coen (Harvey Norman), Michael Keriniotou (Harvey Norman), Kurt Hegvold (Electrolux), Haydon Myers (Harvey Norman), Danielle Morrison (Electrolux), Adam Evans (Harvey Norman), Iain Tennant (Harvey Norman) and Greg Scott (Harvey Norman).

4 5 3 2

(Electrolux),

2. Darren Spencer (Narta), Chris Kotis (Hisense) and Michael Jackson (Narta).

3. Fabio Valente and Andrew Wand from Fisher & Paykel on the Haier stand.

4. The LG Team – CS Yoon, Pyungwon Han, Frank Malcaus and Josh Marshall.

5. The CHiQ team – Warren Allison, Mark Chen and David Esler.

6. Andrew Dean (Spartan), Ben Miller (Bing Lee), Lisa Saunders (Miele), Scott Kinsman (Miele) and Ben Curmi (Miele).

7. The Dreame Team – Stella Qu, Timothy Ley, James Moore and Ash Khosla.

8. The Ayonz team – Ziad Yaacoub, Darran Foster, Jerry Huang, Lukasz Szymanski and Paul English.

9. The BSH Team – Anthony Wells, Andrew Jones, Jacqui Howard and Roberto Finamore.

10. Markus Miele (Miele), Axel Kniehl (Miele) and Haydon Myers (Harvey Norman).

11. The EHP team – Himal Jenkishan, Chantelle Davy, Danielle Morrison, Aaron McNamara, Kurt Hegvold and Hass Mahdi.

12. Tristan Peters (ex-Andi-Co), Mark Meldrum (e&s), Tim Luce (Andi-Co), Rob Sinclair (e&s), Eileen Macken (Andi-Co) and Gian Paolo Glueckler (Liebherr).

13. Simon Taylor (Arisit), Tim Gaedtke (Arisit), Kevin Lim (Bing Lee), Dean Carroll (Sanus Legrand), Adam Mills (Andi-Co) and Peter Harris (Bing Lee).

AEG delivers pizza in 150 seconds and quietest ever dishwasher

Electrolux has unveiled the new PizzaExpert function at its AEG press conference at IFA in Berlin which will produce restaurantquality pizza in 150 seconds, alongside other new products including its quietest ever dishwasher.

The Pizza Expert feature is available through the AEG 7000 MealAssist oven that will be in production from 2026.

The process utilises a cast iron tray, rather than a stone, that reaches 340 degrees to produce the pizza and then takes another 150 seconds to ‘recover’ in the oven before another pizza can then be made. The cast iron tray as well as a specifically-made pizza peel will be sold as separate accessories with the oven.

AEG claims that pizza is the fourth most frequently cooked oven dish and they believe that time, appliance limitation and skill gaps are the main reasons why pizza is not made at home more frequently. Since the beginning of 2024, AEG claims it has been the fastest growing built-in kitchen brand in Europe.

“PizzaExpert features an in-app digital assistant helping consumers prepare perfect airy, chewy, and crispy pizzas,” AEG said in a statement.

“It guides users to perfect dough and flawless timing, and the EXCite Touch TFT display on the oven provides step-bystep guidance. It is approved by Scuola Italiana Pizzaioli, one of the world’s most respected institutions dedicated to the art and science of pizza making.”

Also launched at the AEG event was a new dishwasher range – Favorit that the company claims is the most silent and efficient dishwasher ever made.

Launched on a new platform, the claims the superior energy consumption with just 8.4 litres of water used and operation as

Electrolux has unveiled the new PizzaExpert function which creates pizza in its ovens in 150 seconds.

low as 37dB. With the ExtraSilent feature, noise levels can be reduced even further, reaching as low as 35 dB – making it the quietest model on the market.

Also launched at IFA 2025 was the AEG 9000 ProAssist with SteamPro oven with CamCook feature utilsing AI and integrated camera technology to recognize dishes, lean user preferences and automate cooking settings. Consumers can import online recipes via the AEG app, where AI Taste Assist – launched at IFA in 2024 –helps adapt each dish to their oven for best cooking results. Once a dish has been prepared, CamCook visually recognizes it, making it easy to recreate with the same precision next time.

MIELE ENTERS BBQ AND OUTDOOR COOKING MARKET AT IFA 2025

Miele launched the Dreams outdoor kitchen products at IFA Berlin with two barbecues – the Fire Pro BBQ (3999 Euros) and Fire Pro IQ (5999 Euros). Miele said availability will start in the northern hemisphere summer of 2026 and would be available at the earliest in Australia towards the end of next year.

Miele also launched intelligent cookware with integrated touch controls and up to three temperature sensors to permanently measure the temperature and also detect steam and control the cooktop power. Miele also announced a new 14cm steam drawer at IFA 2025, bringing with it the promise of nutritiously cooked food, plus heating and defrosting. Miele says the drawer comes with DualSteam technology and more than 100 automatic programmes on the appliance, across cooking vegetables and sous vide.

“In an increasingly complex world, our customers are looking for reliable innovations that simplify everyday life and create special moments. This is exactly what we deliver with our new products at IFA They are at the core of our Cooking Innovation Initiative and embody the highest standards in quality, design, innovation, and sustainability. In doing so, we are ushering in a new era of cooking,” said Dr Reinhard Zinkann, Executive Director and Co-Proprietor at Miele.

Dr Markus Miele, Dr Reinhard Zinkann and Dr Axel Kniehl with the new Miele Dreams outdoor kitchen.

Photo Credit: Saskia Uppenkamp.

SIEMENS LAUNCHES WORLD FIRST STEAM DRAWER AT IFA 2025

Siemens announced a worldwide first for the company, launching an intelligent steam drawer at IFA 2025, as part of a theme of “Intelligence that Delights” at its stand.

“What you see here is a fully-featured steam oven with all the known advantages and possibilities,” said BSH Vice President of Kitchen Retail in Germany, Ulrike Pesta.

“This intelligent device combines futuristic design with culinary flexibility and unlocks a universe of possibilities to cook with steam more easily and more healthily. Above all, it fits in the smallest kitchen, and with that, it is a problem-solver for all those who could not afford a steam oven before for space reasons.”

The oven, like an automatic coffee machine, has a 10L water tank that can last one hour of continuous steaming. Pesta said the smarts in the machine allow for many uses beyond direct steaming, such as proving dough. It can be operated via a colour display, the Siemens app, or voice control via an assistant like Alexa.

Pesta also announced Siemens is rolling out a bigger range of matte black appliances, expanding to 20 models, including its cooktops, ovens, and coffee machines. Next year, Siemens will prominently mark 100 years of the oven, and started early at IFA .

Bosch invests in AI and hydrogen for the future of cooking in the kitchen

The highlight of the Bosch booth was advancements for its Cookit appliance – the Thermomix-like food processor.

Bosch announced that the Cookit is getting an AI recipe converter that automatically converts online recipes from just about any website into step-by-step instructions for use with the Cookit and its various accessories.

Other key launches included a new Series 8 heat-pump dryer, which dries laundry almost half as fast as previous models, according to the manufacturer, and repeats similar claims from Siemens about being 78% more energy efficient than previous models.

Bosch also launched an XXL Series 6 air fryer, adding more capacity, while preparing dishes as much as 65% faster and using up to 70% less energy than conventional cooking methods.

One surprising unit on display was a 100% hydrogencapable cooktop – while not for sale yet, the product is in use.

A Bosch representative told Appliance Retailer that in 2025, Bosch is testing with households in Scotland that are using cooktops fully capable of running on hydrogen, which produce no carbon dioxide. They may become a real alternative to natural gas when households want to stick to direct flame.

Bosch Cookit appliance.

Siemens matte black ovens launched at IFA.

Siemens steam drawer.

Haier showcases new products and sponsorships at IFA

Haier’s European-focused event tapped into the show’s theme, Naturally Connected, to unveil its latest connected appliances, with Neil Tunstall, CEO Haier Europe, opening the show.

“There’s nothing that we make that we don’t connect now, and most importantly, the connection is not a connection of a washing machine and a tumble dryer. It’s a connection of Haier to our consumers,” he said.

He also added, when talking about Haier’s scale, “Between one in four, and one in five of all of the refrigerators all over the world is produced by Haier. Similar figures for wine coolers, freezers, and washing machines. This is a truly high-scale company, but one that values the differences of the local regions.”

The Haier Next Generation washer-dryer range, features a camera inside the drum to enable AI vision, bringing a new level of garment care and understanding of the wash cycle.

“This is a camera that is inside the drum and continuously grabs information about the washing cycle,” said Laundry Senior Marketing Director, Natalia Sellibara. “This helps to adapt parameters to make sure that we can deliver the best washing performance. It goes further, as this machine will feature nine additional sensors that will continuously grab information about the performance of the product and help or to optimise the washing cycle.”

Haier has deep ties with tennis sponsorship, sponsoring the Australian Open along with Roland Garros in Paris. At IFA 2025, the company announced new sponsorships with Paris SaintGermain and Liverpool, and had former PSG player and French international midfielder, Claude Makélélé, on hand to support the announcements, along with answering some football questions, and taking part in a photo ceremony.

HISENSE RETURNS AS FIFA WORLD CUP SPONSOR IN 2026

Hisense announced at IFA 2025 that it has again sponsored the FIFA World Cup, extending its eight-year relationship with FIFA as a second-level sponsor even further.

The 2026 FIFA World Cup will be the first three-nation event in history, expanding further to 48 teams and more than 100 matches.

Catherine Fang, VP of Hisense Group, announced the deal, saying, “Back in 2018, Hisense became the first Chinese electronics brand to sponsor the FIFA World Cup. Since then, overseas revenue has nearly doubled. “We are now the number two TV brand in the world, and number one in Europe for 100inch TVs … Our display technologies have even been used in VAR rooms, where sharpness matters most.”

Coinciding with the deal was Hisense announcing upgrades to its 116-inch RGB-MiniLED TV. First debuted at CES 2025, additional upgrades have come for the next-gen displays, now further competing with QD-OLED display technology, and surpassing it in some ways, claimed the company.

Dennys Li, CEO of Hisense Visual Technology, said, “The upgraded AI 3D colour control delivers 30,000 dimming zones, 10-bit precision, and 200% peak brightness. Traditional white backlights spill over, disrupting the picture. RGB Mini LED fundamentally overcomes this, reducing halo effects by 60% while maintaining ultra-high brightness.”

“This is the first TV in the world to support Dolby Vision 2, delivering frame-level precision.”

Hisense’s Li added, “We believe groundbreaking technology should belong to everyone, not just a select few. That’s why we’re bringing RGB Mini LED to more affordable models like the U7S Pro.”

Hisense confirmed it has extended its sponsorship of the FIFA World Cup.

Haier CEO Neil Tunstall.

Haier announced Liverpool and PSG sponsorships at IFA 2025.

ECOVACS LAUNCHES DEEBOT X11 AT IFA 2025

ECOVACS unveiled its latest flagship robotic floor cleaner, the DEEBOT X11, at IFA 2025 in Berlin.

The DEEBOT X11 introduces PowerBoost Technology, which enables uninterrupted cleaning of spaces up to 1,000 square metres per task by recharging during mop-washing breaks.

ECOVACS says this allows for a “perpetual run” without extending overall cleaning times. The system also incorporates a 100W fan, a 6,400 mAh battery, and TruePass technology to handle thresholds up to four centimetres in height.

The upgraded OZMO ROLLER 2.0 with TruEdge 3.0 Extreme Edge Cleaning is designed for edge-to-edge coverage, applying stronger pressure and continuous rinsing to tackle stains such as coffee and soy sauce in a single pass.

The company claims a 140 per cent boost in fine dust removal, a 262 per cent increase in hair removal, and a 100 percent pickup rate for large debris compared with previous models.

“As a leader in the home service robotics industry, ECOVACS has been consistently pushing the boundaries of intelligent cleaning. Our innovation is deeply rooted in real user needs, and the DEEBOT X11 Family exemplifies our product-market-fit strategy,” said Karen Powell, Regional Director ANZ for ECOVACS.

“With our most advanced technologies to date, the DEEBOT X11 delivers ‘Xtra in Every Way’ to stay ‘Ahead in Every Play,’ offering an effortless, ultra-efficient, and unmatched cleaning experience that redefines robotic vacuum cleaning.”

The DEEBOT X11 OmniCyclone introduces the world’s first bagless OmniCyclone Station, which uses PureCyclone 2.0 Auto-Empty Technology and a dual-stage cyclonic separation system to eliminate disposable bags while maintaining suction performance. The station incorporates heated mop washing at 75°C and hot-air drying at 63°C, designed to improve hygiene and reduce manual maintenance.

Tempo to distribute 3i range of robotic vacuum cleaners

Tempo Australia signed a distribution agreement for the 3i range of robotic vacuum cleaners at IFA 2025.

Tempo Australia product and marketing manager, Matt Pearce, said the range of robotic vacuum cleaners will be exclusively available through Amazon in early 2026.

“3i is redefining robotic floorcare with world-first technologies that make cleaning more effective, more sustainable, and more convenient than ever,” said Pearce.

“We are thrilled to bring this outstanding range of robotic vacuum cleaners to the Australian market in 2026. This is an innovative new brand developed by global robotic cleaning leader PICEA Corporation,” Pearce said.

“With over four million robotic vacuums shipped globally in 2024 and more than 1,100 patents, PICEA and its 3i brand bring proven leadership in robotic cleaning technology to Australian homes.

“Having debuted to strong international acclaim and media reviews, the 3i range combines intelligence, innovation, and imagination to deliver world-first cleaning solutions, with industry-leading suction power, smart AI navigation, and advanced mop technologies that set a new benchmark for home cleaning,” Pearce said.

There are two models in the initial range with pricing yet to be confirmed – but they are expected to be priced at the premium

level of the category. The S10 Ultra Robot Vacuum and Mop with WaterRecycle Station is the world’s first WaterRecycle floor washing robot vacuum featuring 18,000Pa suction, 100+ object recognition with green-light illumination, extendable roller mop, all-in-one auto station with water recycling, sanitising and drying.

The P10 Ultra Robot Vacuum and Mop with 18,000Pa suction, UltraReach mop for complete edge-to-edge coverage, all-round station with hot water mop washing & hot-air drying, DirtScan intelligence and AI-powered navigation.

ECOVACS showcased its entire product portfolio at IFA.

ECOVACS ROBOTICS CEO David Qian launched the DEEBOT X11 OmniCyclone at IFA.

Matt Pearce (Tempo), Greg Calnon (Tempo), Sunny Young (3i), Nigel Dent (Tempo) and Jesse Yang (3i).

Residentia hosts Narta retailers in Berlin during IFA

Residentia Group hosted key Narta retailers and buyers at an event on the first day of the IFA 2025 exhibition in Berlin.

Residentia co-founder, Matthew Evans welcomed guests to the Kink Bar and Restaurant in east Berlin.

“Since we have taken over Omega in 2023, we have always tried to do something a bit different, by providing insights and reflecting on the brand as well as where we are taking it into the future,” Evans said.