GLASS ACTS

Charting the Future

Regulation for the grape and wine sector: “The devil is in the detail”

The Federal Government has responded to the 14 recommendations of Dr Craig Emerson’s Review of regulatory options for the wine and grape sector. It agreed to seven of these 14 recommendations, which were designed to address market failure in the sector, and proposed implementation approaches. Of the remaining recommendations, the government “noted” the suggestion to review the WET (meaning it considers no “specific action” necessary), and agreed “in principle” to the other six recommendations, meaning that it was supportive of the recommendations but not necessarily the specifics. As part of this response, it was announced that a mandatory code of conduct for winegrape purchases was to be introduced, however the code itself won’t be enacted until January 2027, leaving many growers in limbo again this vintage.

Grapegrower & Winemaker reached out to Dr Emerson for this report to hear his perspective on the government response.

“The review’s central recommendation – that the existing voluntary code of conduct be made mandatory – will make a material difference to vulnerable grapegrowers in the dry inland regions of the Riverland, the Murray

Darling and Swan Hill regions and the Riverina,” said Dr Emerson. “Winemakers who had joined the voluntary code were free to leave it at any time, which was unsatisfactory and unfair.

“Grapegrowers in the dry inland regions have weak bargaining power in their dealings with winemakers and need and deserve the protection of a mandatory code,” he said. “At the same time, winemakers in these regions have weak bargaining power with wine buyers, most of whom are overseas and have options to purchase from winemakers in multiple countries.

“The approach taken in the review for winemakers in the dry inland regions was one of developing efficient, effective regulation that recognises the weak bargaining power of winemakers. Driving them to the wall with overly prescriptive regulation would not be in their interests or in the interests of their grape suppliers.

Dr Emerson also noted that the government had accepted that the mandatory code should include protection against retribution.

See the government’s responses and proposed action to each of the 14 recommendations on page 22.

In the October 2025 issue of Grapegrower & Winemaker, Winetitles presented the first of our new GrapeCheck reports. GrapeCheck will provide regular updated coverage of market conditions and grape pricing indicators and data for Australian growers wine producers and bulk traders. It will also examine policies and market factors that contribute to price outcomes.

In light of recent bushfires in Victoria, Grapegrower & Winemaker is republishing the remarkable work of Richard Hamilton and Colin Hinze on vineyard recovery from fire damage. Originally published in September 2023, this article is the first of three instalments which we will continue to make available over the coming months.

Management of vineyards after fire damage Part 1 – timing of trunk replacement

FLASHBACK

By Richard Hamilton¹ and Colin Hinze²

Background

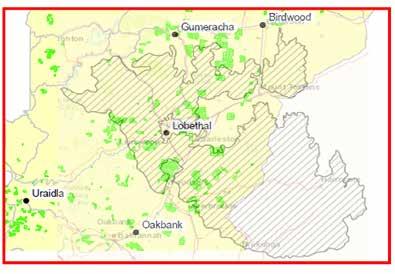

On December 20, 2019, the Cudlee Creek Bushfire burnt through 25,000ha of the Adelaide Hills. 1,200 hectares of vineyards were damaged, representing approximately 30% of the Adelaide Hills Wine Region plantings (figure 1). The fire damage to vines ranged from scorched leaves to charred trunks.

The dilemma growers faced immediately after the fire was to determine what actions should be taken to optimise vineyard recovery and which management options would be most effective based on the level of fire damage observed.

In these events, the immediate priority is to restore irrigation as soon as possible to optimise vine recovery and maximise carbohydrate reserves for dormancy. During restoration of the irrigation system, the level of damage should be thoroughly assessed (mild, moderate or severe) to inform subsequent action.

In the example shown in figure 2, variably damaged vines were pruned two weeks after the fire with the aim of promoting strong new growth. In the space of a single panel the vine in

1 Hamilton Viticulture, Ashton, South Australia. hamilton.viticulture@bigpond.com

2 Pinion Advisory, Parkside, South Australia. chinze@pinionadvisory.com

the foreground has developed vigorous water shoots, the adjacent vine has not reshot at all, and the third vine has reshot but then collapsed several weeks later. This vineyard was subsequently grubbed and replanted.

Problem to be solved

It is difficult to immediately determine the impact of fire on individual vines. Vineyard variability (e.g., slope, aspect, soil moisture status, vine age, etc.) combined with changing fire conditions (e.g., wind speed, under vine fuel loads, etc.) make it difficult to assess

the level of damage on individual vines within a vineyard. Leaf scorching is an indicator of milder damage (figure 3) but the impact of radiant heat on cordon buds and trunk vascular systems is not immediately apparent. Charring of trunks is clear evidence of severe damage to the vine’s vascular system but does not directly determine the affected vine’s root systems capacity to regenerate underground shoots.

The most pressing issue for growers in the weeks after the fire was whether to immediately replace trunks (reworking)

Figure 1: The extent of the Cudlee Creek fire. The image at right is from Vinehealth Australia and shows the Adelaide Hills Geographical Indication Reversed boundary and the vineyards within the region. The image at left shows the SA Country Fire Service Cudlee Creek fire scar map overlaid on the regional vineyard map.

Glass acts: Innovation driving a more sustainable bottle

Glass remains at the heart of wine packaging, but how it is made, filled and transported is rapidly evolving. Writer Simone Madden-Grey recently visited a major glass manufacturing facility in the UK to explore how key innovations—from hybrid furnaces and recycled content to lightweight bottles and in-market bottling—are helping wine producers reduce emissions while meeting commercial and consumer expectations.

From vineyard to glass, sustainability underpins many a decision in the journey to market, not least of which relates to glass production and format preference.

Manufacturing glass bottles is a carbon intensive process and wine producers looking to manage their Scope 3 packaging emissions will be keen to partner with companies offering strategic carbon emissions management.

In Cheshire in north-west England, the largest glass furnaces in the world are located at the Encirc factory in Elton. The intense heat and raw power produced by the two furnaces is quite literally awe inspiring, leaving no doubt as to the energy hungry process required to shape molten glass into containers.

…the glass charge may well come down due to the better recycling rates and ease of being fully recyclable.

Mark Satchwell

To address energy efficiency, Encirc implemented a host of initiatives across the production process including the rebuilding of both furnaces, which completed in 2020. The largest furnace at Elton, EL1, was expanded by just over 10 per cent to a total of 228m² sitting alongside EL2 at 206m². The uplift from the rebuild was significant. Up to 15% less energy is used to run EL1 while output increased to 900T per day of molten glass, twice that of a standard container glass industry furnace.

As the largest glass manufacturer in the UK, being at the forefront of new technology is vital. Madalena Moreira, oenologist at Encirc said, “Delivering and accessing green energy is a strategic priority. The wine and glass industries are actively redefining efficiency, not just in output but in reducing energy

Bottles & Bottling

The largest glass furnaces in the world are located at the Encirc factory.

New Zealand Winegrowers to attend Wine Paris for the first time

New Zealand Winegrowers has announced it will be exhibiting at Wine Paris for the first time this month, ensuring the country’s winegrowing regions have “a strong presence” at the trade show.

The first-ever New Zealand Pavilion at Wine Paris will include 23 exhibitors with over 40 wineries represented, while a further 18 New Zealand wine companies are exhibiting independently. In total, there will be over 70 New Zealand wineries from across eight regions at the fair.

Known for its Sauvignon Blanc, New Zealand will also be showcasing classics such as Chardonnay and Pinot Noir, red blends and aromatic varieties, as well as lesser-planted varieties, such as Albariňo and Grüner Veltliner, along with sparkling, rosé and lower alcohol styles.

Chris Stroud, New Zealand Winegrowers’ market manager, UK Europe said the organisation was “delighted” to be attending Wine Paris for the first time.

“This is an increasingly important fair in the global trade calendar, so it is essential that New Zealand has a strong presence,” said Stroud. “Any company looking to list or find out more about New Zealand

wine, should certainly come and visit us. The New Zealand Wine Pavilion will act as an information hub for all New Zealand wineries at Wine Paris. We look forward to welcoming attendees, showcasing our distinctive wines and

supporting the growth of New Zealand wine around the world.”

The event will runs 9-11 February at the Paris Expo Porte de Versailles and the New Zealand Pavilion can be found in Hall 6, Stand D203.

Photo: Jean-Bernard Nadeau

Wine Paris 2025. Photo: Jean-Bernard Nadeau

Thinking small Reduced bottle formats a big opportunity for winemakers

Smaller wine bottles are no longer confined to airlines and niche categories, with half bottles and piccolos gaining traction across retail, hospitality and alternative packaging sets. Writer Brendan Black looks at how shifting consumer behaviour, bottling logistics, cost structures and packaging innovation are influencing producer decisions around reduced bottle formats.

Many of us will have experienced being served wine from a tiny bottle during air travel. Yet these diminutive offerings are becoming more common in other areas of wine consumption. Writer Brendan Black explores some of the pros and cons of small bottle sizes for the wine producer and consumer.

During the 19th century, the Imperial gallon was commonly used for calculating small volumes of liquid, alongside the 225L wine barrel for larger ones, which is roughly equivalent to 50 gallons. With the increased popularity of the metric system for measuring length,

weight, volume, etc., a new standard then emerged: the 750mL bottle (the reasons why is a topic for another piece or a PhD). A 225L wine barrel also equates to three hundred 750mL bottles, while a case of 12 wines, for example, is equal to around two imperial gallons.

This standardisation was helped by improvements in glass production which could create wine bottles with a more uniform shape and size, thus making it easier for wine producers and merchants to know exactly how much liquid was inside each bottle. Nevertheless, bottles of different sizes smaller to 750mL have continued to proliferate, such as

500mL (often used for tokaj, sherry and other sweet wines), and 375mL. For a time, 738mL bottles could be found in Australia, especially for fortified wines, although it’s been quite a while since these were produced.

The 375mL bottle, also known as a ‘half’ or ‘demie’, is the most common smaller size you will likely see in the retail market, although the ‘split’ or ‘piccolo’ (Italian for ‘small’), with a volume of 187mL (or 187.5mL to be precise), is regularly found on flights where soft drinks just won’t suffice and a nice glass of red, white or sparkling is called for.

Bottling & Cans

Poco Vino from Australian Vintage targets younger consumers with less emphasis on ‘regions, vintages or clones’