International Research Journal of Engineering and Technology (IRJET) e-ISSN: 2395-0056

Volume: 12 Issue: 05 | May 2025 www.irjet.net p-ISSN: 2395-0072

International Research Journal of Engineering and Technology (IRJET) e-ISSN: 2395-0056

Volume: 12 Issue: 05 | May 2025 www.irjet.net p-ISSN: 2395-0072

R. John Wesley1 , Dr. S. Latha 2

1 MSC(CriminologyandForensicScience),DR.M.G.R Educational andResearchInstitute,Chennai.

2 AssistantProfessorinDepartmentof Criminology, UniversityofMadrasChennai,Tamil Nadu,India.

Abstract - Now a day, various types of online investment fraud has increased, while the number of victim became outraged and also there had so many unreported case on onlineinvestment fraud. This study based on how a people get into the online investment frauds on the perspective of victim and the role of social media platform and other online application in the online investment frauds based on the victim concern. Through the combination of survey and interview method to examine the factorthat individual gets into the investment fraud and role of the online application in the online investment fraud. This study contains 51 victims of online investment fraud in Chennai and that focusedon the quantitative analysis of the victim profile, various types of online investment fraud and comparative analysis of rate of victimization based on the gender and crime, indicating factor of individual in online investment and role of the online application in the online investment frauds, criminal activity by scammer and responseofreportbehavior.

Keyword: online investment fraud, victim profile, indicating factor, role of online application, report behavior.

1.INTRODUCTION

In 21st century, the society will be more modernize andtherehaddeveloptechnologieslikesmartphone, internet, cloud server that use in companies for storingthe employee data andcompanies’data etc. . In this century, there will be more digitize in every category of data that use in every format like companies,studymaterial,educationalinstitute,etc.. and crime also modernized and evolve in every development of technology like cybercrime, cyber frauds and other crime relate to computer. This study based on one of the cybercrime, tilted as “Online investment frauds: An Empirical study on victim perceptionin Chennai”, in this study focus on

online investment fraud based on the victim perceptive. Now a day, many people are involved in the investmentto gainthe extra moneyformaintain their comfortable life, investment platform are available in online platform to invest the money but theyhappenmanyfraudincidentinonline,theraider are target the people those are invest the money on online. Its will be easier for raider to commit the crime in online for money and also easy to escape from the investor. In this study based on victim perceptive, major finding will be demographical factorofvictimlikeageofthevictim-theireducation qualification- marital status- employment status of victim- their investment knowledge to invest the money, types of investment and platform their choose by victim, observed any criminal activity by raider through the online and report behavior like reporting the fraud – reporting platform – response from reporting platform – money recovery from raider. This finding will be analyzed with data that givenbythevictimofonlineinvestmentfrauds.

Firstofall,onlineinvestmentisprocessofinvesting themoneyorbuyingintheonlinemarket,gold,land, mutualfund,cryptocurrency,etc.throughtheonline platform. Now a day , there are so many online platform available for investment and also many startup companies are available to be a brokage for online investment to the common people. In online investment, Investors it including those new to the field,canaccessavarietyofeducationalresourceson numerous internet platforms. These resources encompassinstructionalvideos,onlineseminars,and analytical tools, enabling individuals to make wellinformed investment choices. It had some risk and may had chance to lose the money in the online investing because the financial product could be changingeverytime,itcouldhighvalueanditscould be low and also there had many fraud investing site in online platform before investing , there should verified the site or clarified the site with the expert.

International Research Journal of Engineering and Technology (IRJET) e-ISSN: 2395-0056

Volume: 12 Issue: 05 | May 2025 www.irjet.net p-ISSN: 2395-0072

And there is various type of online investment like stock, Bonde, Fixed Deposits, cryptocurrency, Trading etc.… After the industrial revolution the online investment made a huge revolution to mankind with the help of rapid technology development. Nowadays the power of technology makes a common man to investing in mutual funds, Trading, Stocks etc.. using the Investing App. The Internet plays a vital role in online investment because it teaches about the How invest, what to invest, when to invest those details help a common people to enter in online investing world. The Invention of Apps elevated the usage of online investment and makes the transition easier without any brokage support. These apps easily attract the beginners to the world of finance by providing platform as user-friendly, easy entry, easily access, various investing options etc... These apps help in reducing the cost of transactions and also we can easily monitory the real time status of the investment.TheFlexibilityofonlineinteresthelpget notifythedropandrisesofthepriceofinvestmentin themarketatanytimeandanyplaceusingthephone ordesktopwiththehelpofinternet.Theanalysistool help to predict the near match price of the investment in future. Transparency of online platforms give clear picture of fees, brokage fees, other charges, taxes etc.. which help trades to calculate the charge which involved in investment. The online platform provides the customer support for technical support and also individual assistance whichmotivatethebeginnerstoinvestinonline.The online investment is very cheaper, convivence and faster method than the traditional method. Online investment fraud is a one of the cybercrimes , its define that as a deceptive scheme that occur online, where fraudsters use various tactics to convince individuals to invest in non-existent or worthless assets.Thesescamsoftenexploittechnologyandthe internet to reach potential victims, promising high returns with little to no risk. In recent days, online investment fraud should be a recent trend crime in cybercrime in India. Frauds will be update, evolve and innovative, its will be changing in a every year. They’re had various type of online investment fraud like Ponzi scam, pyramid fraud, pump and dump scam,affinityfraudetc..,

I4Cstatedthatfirstfourmonthsofthe2024overall 740000complaintswouldregisterinIndia.Overall, 1750croresarelossesbyIndiancitizenthroughthe cyberfrauds.

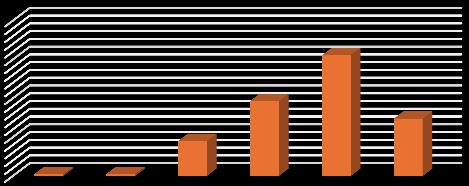

Source: Businessstandard(2025)

This data refers from the business standard news

journal, the complaint data established by the I4C under the ministry of home affair. In this report statistics, before the covid period the cyber frauds would be less reported but after 2020, the cyber frauds should be increase more that 3to 5 times higher than the before 2020. In 2024 , these cases willbereportinfirstfourmonthofthe2024.

In 2023, the I4C reported over 100,000 investment fraudincidents.Tradingscamsaccounted for 20,043 cases, leading to a loss of Rs 1,420 crore to cybercriminals during the same period. I4C stated that 222 crores are loss by people through investment scams and the report across 62687 reportedcasesfiledinfirstfourmonthin2024.

InTamilNadu, thecybercellreceived2732reported cases for cyber financial frauds and 34392 reported cases for online frauds in 2024. Overall, 771.98 crores are loss by people through the online scam and financial fraud through online and cyber cell recoveredthe83.84croresamounttothevictim.

I4Cestablishedthecyberreportof2023,TamilNadu received 59549 cases of cyber financial frauds that includealltypesoffinancialcrimes.661.2croresloss bypeopleinTamilNadu.

International Research Journal of Engineering and Technology (IRJET) e-ISSN: 2395-0056

Volume: 12 Issue: 05 | May 2025 www.irjet.net p-ISSN: 2395-0072

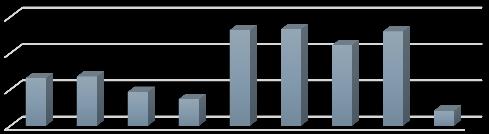

Source:Indiankanoon

In this chart show that the cases data from 2017 to present date. This data clearly explains that before 2020 investment frauds will be less reported but after2020itswillberapidlyincreaseinyearbyyear. After 2020, every year reporting rate will be increase. This data only shows that cases report in TNPIDcourtthatpresentin Madrashighcourt.

Eldad Bar Lev, Liviu-George Maha, and StefanCatalin Topliceanu (2022) in their article “Financial Frauds’ Victim Profiles in Developing Countries”,SocialandBehaviourInfluenceFinancial Frauds Victims in Emerging Countries and its offer an interesting review of the social-demographic and psychological factors underlying financial fraud perpetrators in developing countries. Through a review-types approach, the authors create both the theory and empirics to describe the traits and conditions that make certain populations vulnerable to swindles. The investigation indicates that, in different developing countries, victims of financial fraud belong to some common characteristics, as they are also male, employed, single to married, and different in their educational degrees. In countries likeChina, IndiaandNigeria,manyarecaught inthe scam and opportunistic scammers are everywhere. In places like Latin America, on the other hand, victims of the violence are motivated, certainly not by a standpoint of community solidarity or commitment, but by the search for better fiscal opportunities or the absence of an emotional imagination, potentially by reckless fantasies that corrupt invisibility can be bought like private property. Another recurring motif is the importance of connections in social networks: many victims are

urgedtoparticipateinby-nowclassicPonzischemes by their friends, family members, or acquaintances who are fully persuaded of their legitimacy, thus underscoring the relevance of social capital in the spreading of financial fraud. This study examines psychological correlates of susceptibility to fraud. Impairedcognition,reducedself-control,impulsivity, andgreater toleranceofriskisallcitedasimportant factors. Typically, victims believe themselves to be shrewdandaretoosmarttofallforsomethingofthis nature, trust a professional and are influenced into doing so by fraudsters. Such psychological predispositions, particularly in combination with situational factors such as burden of debt and social isolation, and contextual factors such as lack of financial literacy, make them more prone to fraudulent practices. Socio demographic factors are also important. For example, in India and Nigeria, younger peoplearemorelikelytobeapproached,in partbecausetheyareactiveondigitalplatformsand are interested in high-return investments, such as cryptocurrencies. Older people, especially retired people who have received little financial education, are vulnerable to scams in places like Malaysia and Bolivia, but not as easily so in Ireland or Canada though these, indeed, are many other factors to considerwhenitcomestotheolderdemographic in any given country 8. Gender relations are different, withmenbeingtheprimaryvictimsofthesescamsin India and women, who are the main providers and managers of household wealth in China, being hit moreoften.Educationallevelalonedoesnotactasa shield; in certain event, better-educated individuals are at even greater risk, perhaps because they are overconfident”or aremore exposed tosophisticated investment opportunities.Theauthorsalsohighlight the importance of tailored interventions to reduce susceptibility to financial exploitation. Recommendations include improving financial literacy programs, particularly for at‐risk populations, establishing strong regulatory frameworks to regulate financial transactions, and developing public awareness campaigns to educate people about common fraudulent schemes. By tackling the psychologically and socio-demographic factors found, policies and stakeholders can create holistic strategies to safeguard those in emerging marketsfromfinancialscams.

Marguerite Deliema, Doug Shadel, Karla Pak,(2020) on their article “Profiling the Victim in

International Research Journal of Engineering and Technology (IRJET) e-ISSN: 2395-0056

Volume: 12 Issue: 05 | May 2025 www.irjet.net p-ISSN: 2395-0072

Investment Frauds: Mindsets and risk behaviour”, in its study, the researcher investigates the psychological and behavioural characteristics of individuals who are victims of investment fraud relative to those of typical investors. Given the massive financial losses and numbers of individuals victimizedbyinvestorscams,theauthorsfocusonthe psychological processes of those most at risk for fraud perpetration. Drawing on the opportunity framework of predatory victimization, an international telephone survey of 214 confirmed victimsofinvestmentfraudand813generalinvestors was conducted. Participants were selected from random digit dialling and represent a diverse and representative sample. The study intently aimed to explorevariationsthatexistininvestmentbehaviours and psychological mindsets that can lead people to the chagrinof exposure to investmentscams, as well as how potential victims may be more alluring and moreopentogainingtarget.Anumberofhighlighting differences of fraud victims can be identified in the results. Demographically, victims tend to be older and male. Psychologically, they are materially moralistic than the average investor. Victims behaviourally trade more frequently and are more likely to buy investments that have advertised through unsolicitedmeans like cold calling, emailing, TV advertising or “free lunch” seminars. Otherwise, they are not more likely to invest from social network-mates, suggesting some independence from peer adviceorapropensitytoinvestwithoutoutside validation. The results highlight the need for focused investor educationcampaigns tomitigate behaviours and mindsets such as those empirically shown here. By concentrating on decreasing materialistic attitudes, inculcating scepticism towards uninvited investment offers, and encouraging consultation of trustworthysocialgroups,suchcampaignscouldhelp toreinin theabilityofpeopletobecomeinvolvedin investment fraud. The researchers say that as increasing numbers of retirees take control of their retirement savings, they may be will be tempted by “unrealistic” investment returns offered by unprincipled brokers and urged that the life stage of beingretiredis akeytimeforteachingpeopleabout the danger involved in some investment. DeLiema, Shadel,andPak’sarticle(DeLiemaetal.,2017)offers useful information about the people who are victimized byinvestmentfraud and the research his instructive e in a number of ways, particularly the contributions to understanding the role that

psychological and behavioural factors play in determining a person’s risk for victimization. Their results support targeted education programs to promote safer investment behaviours and greater consumerprotection.

Obasanjo S. Balogun, Tomisin A. Akangbe, Olumide D. Fagbamila and Felix O. Aigbovbioisa (2024) on this article "Internet Users’ Perception of the Prevalence of Online Investment Fraud and Victimisation in Nigeria" by examines the prevalence of online investment fraud among Nigerian internet users, perceiving and experiencing itandtheimpactofsomesocio-demographicfactors. The researchers adopted a cross-sectional survey research design to elicit data from 164 participants in Ilorin, Kwara State through Google forms on the basis of convenience sampling. The study is theoretically informed by the Routine Activities Theory (RAT) whereby crime takes place when a motivatedoffenderhascontactwithasuitabletarget intheabsenceofcapableguardian.Resultsshowthat 76.3% of respondents are young people aged 18-24 who have tertiary education and, who, for the most part,arestudents,highlightingtheirfragilityinterms of financial experience and their desire for rapid financial returns. Significantly, more than 50% of those surveyed have invested online, in decisions influenced to a large extent by personal recommendations from family and friends and their searchforfinancialindependence.Alarmingly,77.3% of investors suffered from online investment scam which consists of most case of Ponzi/pyramid schemes(42.6%),cryptocurrencyfraud(26.5%)and forex trading fraud (19.1%). Monetary loss varied from less than ₦50,000 among 50% to more than ₦1,000,000 among others. The research highlights critical vulnerability factors, such as weak regulation,poverty,unemployment,andlowlevelsof training on fraud prevention. There was a strong relationship between investment experience and high returns as a cause of fraud victimisation and the importance of financial education was underscored. Also, 87.8% of respondents reported that the unregulated environment leaves Nigerians vulnerable to online investment fraud with 75.6% believingthatpovertyandunemploymentserve asa risk factor for victimisation. In conclusion, the study calls forimmediateregulationoftheonlineplatform, public awareness and educational campaigns to reduce the potential hazards of online investment

International Research Journal of Engineering and Technology (IRJET) e-ISSN: 2395-0056

Volume: 12 Issue: 05 | May 2025 www.irjet.net p-ISSN: 2395-0072

fraud in Nigeria. Recommendations have been provided with the view to implementing tougher laws on offenders, and greater consumer education to help mitigate due diligence requirements and focused initiatives on dealing with socio-economic issuewhichcausevulnerabilitytofraud.Thefindings ofthestudyareimportantforpolicymakers,financial regulators,aswellasotherstakeholderstosafeguard theinternetconsumersfromtheemergingchallenge ofonlineinvestment fraud.

These study are related to this study, most of the study would be based on the various types of finanicialfraudsandinvestmentthroughonline.

3.Methodology

This research based on the quantitative analysis research and sample will be victim of online investment fraud in Chennai. The data will be a primary data and collect by using the questionnaire with interview method. In this study, overall, 51 sample will collect by snowball technique, and analysiswithSPSSsoftware.

3.1 Objective Of Study

To explore the types of investment fraud amongthevictim.

To analyse the role of the online application intheonlineinvestmentfrauds.

To analyse the victim profile in online investmentfraud.

To observe report behaviour from the law enforcementandofficialsiteofapplication.

4. Results and Discussion

In this study, the data will analyse with 59 samples byusingSPSSsoftwareforvalidvalue.

Table1: Gender

In this table 1 show that male will be 58.8% responded and women will be 41.2% responded.

Mostoftheresponderwillbemaleandalsomalewill be victim more than women. In this study, most response that received from male so, we could not conclude that male are more vulnerable in online investment frauds. But male is more involve in investment field more than female because in our country female would be depend on family or life partner if she is a working person , her salary could be control by other so, that female could not more involveininvestmentfield.

Table2:AgeofRespondents

In this table 2 shows that 30-40 age category had highpercentage(41.2%)and41-50agecategoryhad second higher percentage(23.5%) among the respondents and above 51 age category people had low percentage (5.9%). In this analysis, worker age people had more committed in online investment and also become more victim. More respondents mention that investment is a one of the part time income, so that they invest the money on online platformbasedonotheropinionforanotherincome.

Table3:Educationalqualification

International Research Journal of Engineering and Technology (IRJET) e-ISSN: 2395-0056

Volume: 12 Issue: 05 | May 2025 www.irjet.net p-ISSN: 2395-0072

In this analysis, the most of the respondent will be under age of 30-40 (41.2%) and also most of victim well educated and also most of responder finish the graduated, Under Graduated (52.9%) and Post graduated(39.2%). Most of the respondents will be educatedpersonandalsomostofvictimhashesitate to give sample, they had shame to talk about their delude because Others claimed that "someone trickedordeludededucatedpeople."

Table4:Profession

Inthistable5showthatmostofrespondentlossthe amountunderthe1000-50000(52.9%)and1lakhsto more than 10 lakhs(43.2%). Some people get scammed inbeginningstage andotherget scammed aftertheyextendtheamountofinvestment.

Table6:Firsttimesucceedinonlineinvestment

In this table 6 shows that more than 40% of respondentssucceedintheirinvestment,nearly60% respondents get scammed in their first investment. In this analysis, most of respondents said that they gainthemoneyinonlineinvestmentwhentheinvest the minimum amount, but when the upgrade the investment amount, and when people invest the large amount of money in online, they get scam in firsttime.

Table7:Investmentknowledge

In this table 4 shows that profession among the respondents, 68.6% of respondent working in the private sector and 23.5% of respondent work at Government sector. Very less percentage of Daily wages employee among the respondents. Most of IT employeeareinvestingtheonlineplatform.

Table5:Amountofloss

In this table 7 show that more than 80% of respondents doesn’t investment knowledge. Most of victim doesn’t have investment knowledge when they invest the money, they invest the money based on the other indicating factor like advertisement, friendsetc..

Table8:Idea

International Research Journal of Engineering and Technology (IRJET) e-ISSN: 2395-0056

Volume: 12 Issue: 05 | May 2025 www.irjet.net p-ISSN: 2395-0072

In this table 8 shows that 52.9% of respondents invest the money in online based on friend’s idea, and43.1%ofrespondentsinvestthemoneybasedon social media and advertisement. Mostly of respondents doesn’t have investment knowledge thatshowintable7,theyinvestthemoneyononline platform based on the social media’s advertisement and other people opinion. They believe that when they invest the moneyinonline platform to gainthe amount that show in advertisement like jackpot, instantprofitetc..andalso,theyinvestthemoneyin online that refer by their friend or relative without any hesitation and also they didn’t verify the site or stockvalueinthemarketwhentheyinvested.

Table9:Typeofonlineinvestment

In this table 9 shows that 43.1% of respondents invest the money on stock market and 41.2% of respondents invest the money on scheme. In this analysis, the stock value will be depended on the company and product value in the market, sometimes its will be increase the value or decease the value but the seller or third app or company promote the low value stock to buyer to sell it in higher price, most of the respondents get scam like that.Incryptocurrencyinvestment,thecurrencywill be same value for all region, but the currency value maybe up and down in sometime, that why cryptocurrency fraud had low rate among the sample.

Table10:Specifictypeofonlineinvestment

Inthistable10showsthat29.4%ofrespondentswill be delude in provident fund and 27.5% of respondents will be scam in trading. In this data, respondentsgetscambyvarioustypeoftradingand stocks, more than 15% of various type of stocks fraud that got by respondents like income stocks, phone stocks, value stocks etc.., and also some respondentsgetscambyvariousjobscheme(14%).

In this table 11 show that 72.5% of respondents realize the fraud due to the no response, 7.8% respondentsrealizethefraudwhenthelinkdisables aftertheydepositthemoney.Inonlineplatform,they easilyridofftheircontactfromthepeople,whenthe respondent deposit the large-scale amount in the online investment, they lost the contact from the receiver and also when they invest the money through the third-party link, it will disable after receivingthelargeamount.

Table12:FamilyKnownAboutVictimization

The table 12 shows that 60.8% of victims’ families were aware of the online investment fraud victimization, while 39.2% were not informed. This indicates that a significant number of victims were openabouttheirexperience,althoughaconsiderable portionstillpreferredtokeepitprivate,likelydueto shame, guilt, or fear of judgment. Among those who didsharetheirexperience,reactionsvaried.Themost commonresponseswasscolding,followedbyfeeling bad,expressionsofsadness,andanger.Anotable of familieshadnoreaction,whichmayreflectemotional detachment or a lack of understanding of the issue. Othersrespondedwithadvice,raisedfamilyissues,or simply acknowledged the situation without strong emotional responses. This range of reactions

highlights the emotional and psychological toll on victims, who may face additional stress from family dynamics.Negativefamilyresponsessuchasscolding orangercandeepenthevictim’ssenseofshame and discourage reporting, while supportive reactions can help in coping and recovery. This underscores the importance of awareness andsensitizationprograms for families to foster empathy and constructive supportwhensuchincidentsoccur.

Table13:onlineinvestmentaftervictimization

In this table 13 shows that 86.3% of respondents does not invest again in online platform, 13.7% of respondents invest the money again in online platform. More than 85% of respondents don’t investmentmoney inonline platforms because most of respondents had some psychological problems due to the victimization, and their family reaction leads to a burden on them. Most of the respondent had stress, when they loss the money in the online investment, and others had hypertension and pressure

Table14:Advertisementplatform

In this table 14 shows that social media had high level of advertisement related to the online investment among respondents 56.9%, and 23.5% respondents frequently watch the advertisement of online investment in video games and also they received the advertisement and promotion in telegrambot17.6%.somerespondentsmentionthat

International Research Journal of Engineering and Technology (IRJET) e-ISSN: 2395-0056

Volume: 12 Issue: 05 | May 2025 www.irjet.net p-ISSN: 2395-0072

, they received message from social media like telegram, WhatsApp, Instagram for promoting the investment company and also brainwash the respondentstoinvesttheircompanyorproduct.Few respondents received call from investor to promote theircompanyandproduct.

Table15:Frequencylevelofadvertisement

In this table 15 shows that 49% respondents had moderate level of advertisement and promotion receive in their social media feed and other application but 29.4% respondents had high level of advertisement and promotion in their social media feed and other application. Now a day, the investment related advertisements telecast in the television and there promote the private and also third-party companies for investment with disclaimer, but it will be indicating factor to individual for online investment and also increase the greediness of individual to gain more money. It built the trust without hesitation while their watching the advertisement in television and social media, but it led to misuse the trust or using their trustforcommittingthefraud.

Table16:Investmentbasedonpromotionvideo

suggests that although promotional videos have someinfluence,themajorityofindividualsareeither cautious or rely on other sources for making investment decisions. It reflects a degree of scepticism among investors toward promotional content and may indicate growing awareness of potential online scams. However, the 19.6% who were influenced by such videos still represents a notable vulnerability, highlighting the need for stricter regulation and awareness campaigns targeting misleading promotional material in digital platforms

Table17:Thirdpartyapporcompany

S.no Investmentin Thirdpartyappor company

Table 16 shows that only 19.6% of respondents made investment decisions based on promotional videos, while a significant 80.4% did not. This

In this table 17 shows that 56.9% of respondent invest the money on third party app or link and 43.1% of respondent didn’t invest their money on third party app or link. Many respondent mention the third-party links and companies but most of the respondents doesn’t remember the link and few respondentsmentionthewhatsappandtelegramfor received the message related online investment by unknowncontact.Manywellknowbanksareinvolve in online investment fraud, these banks are well famous in overall India. These types of third party app,fewareavailableinofficailsiteorappandother link and app suggest by social media through the unknown link in their site.These data based on the sampleperceptive

S.no Report Percent

International Research Journal of Engineering and Technology (IRJET)

Volume: 12 Issue: 05 | May 2025 www.irjet.net

In this table 18 shows reporting the fraud, most of the responders report the fraud 68.6% and other of doesn’treportthefraud31.4%.Inthisanalysis,most of the respondents doesn’t know the helpline numberofcybercell

Table19:Reasonfornon-reportbehavior

Mostofthevictimdoesn’tknowabouthowtoreport thefraudincybercell.Inthistable19thatresaonfor respondents doesn’t report the fraud.17.6% of respondentsdoesn’tknowhowtoreportthefraudin cybercellandtheparticularsite,7.8%ofrespondents mentionthattheyrealizethefraudaftermanydayso they didn’t report the fraud. 3.9% of respondent mention that they had no proof against the raiders. This table shows the many reasons for not cooperating in the report system, the reason for not reporting whether it may be personal, it shows that most of the people about 50percent of the people reported the incident and still many people are not aware how to report the incident to police or cyber cell, they are unaware of the incident to report and some have responded about the days passed by ,which shows the people of Chennai in a small percentageareleastbotheredaboutreporting,while manyofthemdonothaveaprooftoreport,andthey think without proof their report won’t last long, so people are hesitant to report if they don’t have a properprooforproperreason,theycannotsimplygo behind each door to door for reporting so the government should provide a system for reporting and other complaint cell which is friendly to people ofChennaifortheonlineinvestmentfraud.

Table20:Reportedplatform

Table 20 provides crucial insights on the response habits of victims of online investment scam by highlighting their reporting activity. The fact that a sizable majority of respondents roughly 71.4% reported the occurrence to the cyber cell suggests that formal cybercrime reporting procedures are becoming more widely recognized and trusted. This pattern is a reflection of the growing public awareness that cybercrime is a significant problem that needs government action. However, 20% of victims decided to report the scam exclusively through the specific website or platform wRemarkably, 8.6% of respondents reported the fraud to both the cyber unit and the particular website, indicating a two-pronged response mechanism meant to guarantee maximum accountability and traceability. This conduct implies that a small percentage of victims have a proactive mindset, which may be impacted by prior experiences or increaseddigital literacy. Overall, the data highlights the need for more comprehensive awareness campaigns and efficient, user-friendly reporting mechanisms that encourage more victims tousemultiplechannelsforfasterandmoreeffective redressal of online fraud, even though the high percentage of cyber cell reporting is encouraging.here it happened, perhaps because it was convenient, available right away, or they were unawareofofficialreportingchannelsliketheCyber cell..

International Research Journal of Engineering and Technology (IRJET) e-ISSN: 2395-0056

Volume: 12 Issue: 05 | May 2025 www.irjet.net p-ISSN: 2395-0072

Table21:Response

Inthisbothtable20and21showthat71%ofvictim report the fraud in cybercell and they get 76% response from cybercell, and other report the fraud in particular site(20%) and they get response from 16.7% in particular site. More than 75% of respondent state that there had no report option in thirdpartyappandsiteorlink.

Table22:Moneyrecovery

Thistableshowswhetherthepeoplerecoveredtheir lostmoney,butfromtheresponseitisseenthatlost money was recovered by people in only a small numberthisshowsthatwhenthereisafinancialloss it is very difficult to recover the money lost, and overall it is seen that this leads to huge pressure about 63 percent of the people didn’t get money which means that a large number of respondents didn’t get their financial loss and it leads to huge problemandthosegotmoneyhavecorrectproofand reported to the cyber cell , as of all the online investment case study shows that people involved online investment fraud when they are investing in an online investment it is hard to get back their money ,even after reporting .a small portion of 37 percent got their money back which is only a small percentage of money, and this online investment scams if not reported correctly and if used with protection can lead to money loss and financial loss

leading to problems in getting back the money or recovery the money mainly in the field of online investmentfraud.

Among the respondent, Male will be 58.8% responded and women will be 41.2% responded. Most of the responder will be male and also male will be victim more than women.

Themostoftherespondentwillbeunderage of 30-40 (41.2%) and also most of respondents well educated and also most of responder finish the graduated, Under Graduated (52.9%) and Post graduated(39.2%).

More than 40% of people succeed in their investment, nearly 60% people get scammed intheirfirstinvestment.

More than 80% of respondents doesn’t investment knowledge. Most of respondents doesn’t have investment knowledge when theyinvestthemoney,theyinvestthemoney based on the other indicating factor like advertisement, friends etc. 52.9% of respondentsinvestthemoneyinonlinebased on friend’s idea, and 43.1% of respondents invest the money based on social media and advertisement.

43.1% of respondents invest the money on stock market and 41.2% of respondents invest the money on scheme. 29.4% of respondentswillbedeludeinprovidentfund and 27.5% of respondents will be scam in trading. various types of trading and stocks, more than 15% of various types of stocks fraud that got by respondents like income stocks, phone stocks, value stocks etc.., and also some respondents get scam by various jobscheme(14%).

72.5%ofrespondentsrealizethefrauddueto the no response, 7.8% respondents realize the fraud when the link disables after they depositthemoney.

49% respondents had moderate level of advertisementandpromotionreceiveintheir social media feed and other application but 29.4% respondents had high level of advertisement and promotion in their social media feed and other application. social

International Research Journal of Engineering and Technology (IRJET) e-ISSN: 2395-0056

Volume: 12 Issue: 05 | May 2025 www.irjet.net p-ISSN: 2395-0072

mediahadhighlevelofadvertisementrelated to the online investment among respondents 56.9%, and 23.5% respondents frequently watchtheadvertisementofonlineinvestment in video games and also, they received the advertisementandpromotionintelegrambot 17.6%.

56.9% of respondent invest the money on third party app or link and 43.1% of respondentdidn’tinvesttheirmoneyonthird partyapporlink.Manyrespondentsmention the well know bank(29.4%) and most of respondents doesn’t remember the site or link (9.8%). 5.9% of respondent mention the whatsapp.

most of the responders report the fraud 68.6% and other of doesn’t report the fraud 31.4%. In this analysis, most of the respondents doesn’t know the helpline number of cybercell. Most of the victim doesn’t know about how to report the fraud incybercell.

71% of victim report the fraud in cybercell and they get 76% response from cybercell, and other report the fraud in particular site(20%)andtheygetresponse from 16.7% in particular site. More than 75% of respondent state that there had no report option in third party app and site or link. most of respondent 62.7% doesn’t get their money back but who are complaint in cybercell about the fraud their get money back.

DISCUSSION

Online investment fraud has become a serious menace in India targeting people from all walks of life. New data shows that 58.8% of victims are male and41.2% are female. Mostof these accesses arein the age of 30 to 40 and have higher education degrees, such as under graduation and postgraduation. Many of them have no idea what investing is, and some are victims of a series of fraud.”

Many victims claimed they had been lured into an investment by social media ads and recommendations byfriends or family. About52.9% were influenced to invest following recommendations from friends, while 43.1% were swayed by online promotions. Notably, 56.9 percent

of surveyed victims invested through third-party applicationsorthroughspear-phishinglinkswithout confirming if the platforms were authentic or not. Investment modalities comprised stock marketing (43.1%), diverse schemes (41.2%), provident fund pyramids (29.4%), and trading (27.5%). Shockingly, more than 15% fell victim to scams involving other types of stocks, likeincome, phone andvalue stocks, and14%weredupedbyquestionablejobpromises. The realisation that that money was gone came late formany–72.5%realisedthatsomethingwaswrong whentheydidn’thear backfrom the platform, while 7.8% only realised when links to trades vanished after they paid their money. In spite of the wide spread ofthesescams,atotalof68.6%reportedthe incidents; However, 31.4% didn’t and unawareness of reporting mechanism is the most reason behind. Of those who reported, 71 per cent reported to the cyber cell with a response rate of 76 per cent while 20 and a quarter per cent reported at the specific sites with of 16.7 per cent. More than 75% reported thattherewasnowaytoreportsuch scamsonthirdparty apps or websites, and 62.7% were unable to get their money back. But those who reached the cybercell’sdoor,theoddsofgettingthemoneyback weremuchbetter.

The emotional and psychological damage caused by these scams is real. Many victims were welleducated, but felt too embarrassed, or worried they would not be believed to report their experiences. Their vulnerability was additionally aggravated by the misplaced trust in familiar sources, whether friends, or known platforms, without due diligence. High-frequency commercials touting looking easy moneyalsoledmanytobelievethattheycouldeasily earnbigfromthesescams.

In order to fight this rising threat, it is importantto increase financial literacy. The introduction of financialliteracyprogramsthatconcentrateonbasic investment and risk assessment may help people to have a greater control over their lives. One should ensure that whatever platform you are putting your money into is for real especially if it is from a recommendation of a friend or from some random ads from online. In the events of fraudulent transaction, timely reporting to the cyber cell helpline 1930 or on the National Cyber Crime Reporting Portal could lead to fund recovery. When it comes to advertisements, specifically ones with guaranteedreturns,itisimperativetobecarefuland

International Research Journal of Engineering and Technology (IRJET) e-ISSN: 2395-0056

Volume: 12 Issue: 05 | May 2025 www.irjet.net p-ISSN: 2395-0072

not invest in unsolicited third-party apps or links beforedoing properduediligence.

The sudden spike in online investment scams highlight the importance of joint vigilance and the obligation to take precocious action to protect a personfrompotentialfinancialscams. Self-victimization define that the person exaggeratedly expresses the feeling as a victim or their victim hood to seek other attention or play victim role for some benefits or manipulating other. Cybervictimalsowillbeundertheself-victimization because there are voluntarily went to the trap of scammer, there gave all data and money for their individualbenefit,buttheyarewillinglygivingallthe personal detail and money to stranger without any verification. In this study, few people became selfvictimizationlikereceivedsomemessagefromsocial media about investment related their business, withoutanyverificationtheycontacttostrangerand investmentsomeamountafterthatstrangemadeup the fake success investment report to the investor, and put some words to investor to invested more money. Investor invested the money several time to the strange , that amount came around 1.4 crores, afterthatthestrangedidn’tresponsetotheinvestor after the amount received. In this incident, the investor gave all their savings to the scammer voluntarily but they blame the scammer, they didn’t accept their mistake. In this research, most of the respondent become the victim like this. Most of the scammer used the pig butcher scam method to the people for gain their trust to invest more money in theirfakeproductorstocks.

InthisresearchofONLINEINVESTMENTFRAUD:AN EMPIRICAL STUDY OF VICTIM PERCEPTION IN CHENNAI, we cansee thatmostof the victim will be educated and also working person but there had no knowledge about online investment while investing becausethereareinvestingtheirmoneybasedonthe social media advertisement and their friend. And also, there had no criminal activity in online investment fraud but some sample say that online loan app involves in crime activity like threating, videomorphingthreatetc.

Inreportbehaviour,mostofthevictimdoesn’tknow about the complaint process and helpline number andalsogoldenhourincybercell,whoallreportthe

fraud in cyber cell, they get money recovered from the raiders. In India , our government took many precautions measure and create the awareness throughadvertisementand caller tonesetc.., butour people successful ignored the cyber awareness from Government and fell into the fraud traps in online. People should aware before investing the money in onlineandgaintheinvestmentknowledgeandverify thecompanyorsiteorproductbeforeinvesting.

Reference

Ansar,S.A.,Yadav,J.,Dwivedi,S.K.,Pandey,A., Srivastava, S. P., Ishrat, M., ... & Khan, R. A. (2021).Acriticalanalysisoffraudcasesonthe Internet.Turkish Journal of Computer and MathematicsEducation,12(12),2164-2186.

Aqib, M. S., & Sukiati. (2024). Crime of Fraud (Pig Butchering Scam) Through Social Media in the Perspective of Islamic Criminal Law. Journal Equity of Law and Governance, 4(2), 231–237.

https://doi.org/10.55637/elg.4.2.10013.231237

Baker, H.K.andPuttonen, V.(2017), "Trap 2: Being Deceived by Other Investment Frauds",Investment Traps Exposed, Emerald Publishing Limited, Leeds, pp. 183226.https://doi.org/10.1108/978-1-78714252-720171006

Baker, H.K.andPuttonen, V.(2019), "Trap 2: Becoming a Victim of Investment Frauds and Scams",Navigating the Investment Minefield, Emerald Publishing Limited, Leeds, pp. 79103.https://doi.org/10.1108/978-1-78769053-020191005

Balachandar, A. (2022). Financial Frauds in India:AnAnalysis.JusCorpusLJ,3,213.

Balakrishnan, V., Ahhmed, U., & Basheer, F. (2025). Personal, environmental and behavioural predictors associated with online fraud victimization among adults. PLOS ONE, 20(1), e0317232. https://doi.org/10.1371/journal.pone.031723 2

Balogun,O.S.,Akangbe,T.A.,Fagbamila,O.D., & Aigbovbioisa, F. O. (2024). Internet users’ perception of the prevalence of online investmentfraudandvictimisationinNigeria. Gusau Journal of Sociology, 4(2), 169–181. https://doi.org/10.57233/gujos.v4i2.13

International Research Journal of Engineering and Technology (IRJET) e-ISSN: 2395-0056

Bar Lev, E., Maha, L.-G., & Topliceanu, S.-C. (2022). Financial frauds’ victim profiles in developing countries. Frontiers in Psychology, 13, 999053. https://doi.org/10.3389/fpsyg.2022.999053

Bartels, K. C. (2000). “Click Here to Buy the NextMicrosoft”:ThePennyStockRules,Online Microcap Fraud, and the Unwary Investor. Indiana Law Journal, 75(1), 353–377. Retrieved from https://www.repository.law.indiana.edu/ilj/vo l75/iss1/18/

Bele,J.L.(2020).FinancialScams,Frauds,and ThreatsintheDigitalAge.ModernApproaches toKnowledgeManagementDevelopment,39.

Bharne, S., & Bhaladhare, P. (2023). Comprehensive Analysis of Online Social Network Frauds. In Advances in Data-Driven Computing and Intelligent Systems (pp. 23–40). Springer. https://doi.org/10.1007/978981-99-3250-4_3Ebin.pub+2

Button,M.,McNaughtonNicholls,C.,Kerr,J.,& Owen,R.(2014).Onlinefrauds:Learningfrom victims why they fall for these scams. The Australian and New Zealand Journal of Criminology, 47(3), 391–408. https://doi.org/10.1177/0004865814521224

Cross, C., Richards, K., & Smith, R. G. (2016). The reporting experiences and support needs ofvictimsofonlinefraud.TrendsandIssuesin Crime and Criminal Justice [Electronic Resource], (518), 1–14. https://search.informit.org/doi/10.3316/infor mit.300566903591621

Cyber, I., & Coordination, C. (2024). Recent Cybercrime Trends in Financial Frauds CybercrimeTrends.August.

Cybercrime, N., Portal, R., Cyber, I., & Coordination, C. (2024). First four months of 2024 see 7,000 online complaints per day: Investmentscams,sextortionandotherfrauds that Indians lost Rs 1,750crore to - Times of India.2023–2024.

Dalvadi, V. M., & Sharma, M. (2015). Online Investment Fraud: Nature, Pedagogy, and Remedy for Investors. Allana Management JournalofResearch,5(1),30–35.

Deb, S.andSengupta, S.(2020), "What makes the base of the pyramid susceptible to investment fraud",Journalof Financial Crime,

Vol. 27 No. 1, pp. 143154.https://doi.org/10.1108/JFC-03-20190035

Dong, W., Liao, S., & Zhang, Z. (2018). Leveraging financial social media data for corporate fraud detection. Journal of ManagementInformationSystems,35(2),461–487.

https://doi.org/10.1080/07421222.2018.1451 954

Graham,W.(2014).AQuantitativeAnalysisof Victims of Investment Crime. Financial Conduct Authority. Retrieved from https://doczz.net/doc/8434584/aquantitative-analysis-of-victims-of-investmentcrime

Graham,W.(2014).Aquantitativeanalysisof victimsofinvestmentcrime.London:Financial ConductAuthority.

Henderson, L. (2003).Crimes of Persuasion: Schemes,Scams,Frauds: howConArtistsWill Steal Your Savings and Inheritance Through TelemarketingFraud,InvestmentSchemesand ConsumerScams.CoyoteRidgePublishing

Jamuna, S. (2023). A STUDY ON MITIGATING ONLINEFINANCIALFRAUDSINDEHGAM.

January,B.(2024).HereishowmuchIndians lost to cyber frauds between Jan and Apr of 2024.2023–2024.

Kamalludin, I., Suhendar, H., Pratami, B. D., Yaqin, 'A., & Afifah, N. (2022). Criminal Law Treats for Online Gambling Performers: Investment Fraud Modes. Dialogia Iuridica: Journal Hukum, 14(1), 26–51. https://doi.org/10.28932/di.v13i2.5252

Lacey, D., Goode, S., Pawada, J., & Gibson, D. (2020). The application of scam compliance modelstoinvestmentfraudoffending.Journal of Criminological Research, Policy and Practice, 6(1), 65–81. https://doi.org/10.1108/JCRPP-12-2019-0073

Marguerite Deliema, Doug Shadel, Karla Pak, Profiling Victims of Investment Fraud: Mindsets and Risky Behaviours,Journal of Consumer Research, Volume 46, Issue 5, February 2020, Pages 904–914,https://doi.org/10.1093/jcr/ucz020

Mueller,E.A.,Wood,S.A.,Hanoch,Y.,Huang,Y., & Reed, C. L. (2020). Older and wiser: age differences in susceptibility to investment

Volume: 12 Issue: 05 | May 2025 www.irjet.net p-ISSN: 2395-0072 © 2025, IRJET | Impact Factor value: 8.315 | ISO 9001:2008

| Page1688

International Research Journal of Engineering and Technology (IRJET) e-ISSN: 2395-0056

Volume: 12 Issue: 05 | May 2025 www.irjet.net p-ISSN: 2395-0072

fraud: the protective role of emotional intelligence.Journal of elder abuse & neglect,32(2), 152–172. https://doi.org/10.1080/08946566.2020.1736 704

Nash, R., Bouchard, M., & Malm, A. (2013). Investinginpeople:Theroleofsocialnetworks in the diffusion of a large-scale fraud. Social Networks, 35(4), 686–698. https://doi.org/10.1016/j.socnet.2013.06.005

Pressman, S. (1998). On financial frauds and their causes: Investor overconfidence.AmericanJournalofeconomics andsociology,57(4),405-421.

Rusch, J. J. (1999, June). The “social engineering” of internet fraud. InInternet Society Annual Conference, http://www. isoc. org/isoc/conferences/inet/99/proceedings/3g /3g_2.htm.

Singh, K. N., & Misra, G. (2023).Victimisation of investors from fraudulent investment schemesandtheirprotectionthroughfinancial education. Journal of Financial Crime, 30(5), 1305–1322. https://doi.org/10.1108/JFC-072022-0167

Subhash, K. S., Sandhya, M., Uddhav, T. A., & Kiran, T. " The Rise of Social Media-Driven Stock Market Investment Scams: Analysing FinancialFraudinTheAgeofSocialMedia

Cyber Frauds in India: Here is how much Indians lost to cyber frauds between Jan and Aprof2024|IndiaNews - BusinessStandard

https://effectivelaws.com/economic-offenceswing-eow/

https://en.wikipedia.org/wiki/Indian_Cyber_C rime_Coordination_Centre

https://en.wikipedia.org/wiki/Information_Te chnology_Act,_2000

https://i4c.mha.gov.in/about.aspx

https://indiankanoon.org/search/?formInput =tnpid%20act&pagenum=18

https://timesofindia.indiatimes.com/technolo gy/tech-news/first-four-months-of-2024-see7000-online-fraud-complaints-per-dayinvestment-fraud-sextortion-and-other-scamsthat-indians-lost-rs-1750-croreto/articleshow/110476085.cms

Ponzi Scheme: Definition, Examples, and Origins

What Is a Pyramid Scheme? How Does It Work?.

© 2025, IRJET | Impact Factor value: 8.315 | ISO 9001:2008

| Page1689