International Research Journal of Engineering and Technology (IRJET) e-ISSN:2395-0056

Volume: 12 Issue: 05| May 2025 www.irjet.net

p-ISSN:2395-0072

International Research Journal of Engineering and Technology (IRJET) e-ISSN:2395-0056

Volume: 12 Issue: 05| May 2025 www.irjet.net

p-ISSN:2395-0072

Siddhika Pokharkar1 , Bhagyashri Bhalerao2 , Pratiksha Dolas3 , Dr.Anand Khatri4

123Undergraduate Student, Department Of Computer Science And Engineering, Jaihind College of Engineering, Kuran, Pune

4Professor, Department Of Computer Science And Engineering, Jaihind College of Engineering,Kuran ,Pune

Abstract - With the increasing incidence of ATM fraud, thereisapressingneedforenhancedsecuritymeasuresin automated teller machines (ATMs). This paper presents a dual-factor authentication system that integrates face recognition and Personal Identification Number (PIN) verificationtoimproveATMtransactionsecurity.Utilizing a Convolutional Neural Network (CNN) for real-time face recognition,theproposedsystemsignificantlyreducesthe risk of unauthorized access. The implementation includes an Arduino-based cash dispenser and a web application developed using Tkinter, demonstrating a robust prototypethateffectivelymitigatesATMfraud..

Key Words: Face Recognition, CNN, Dual-factor Authentication, PIN Verification, ATM Security, Tk inter, Arduino, ATM Prototype.

INTRODUCTION-

TheriseinATMfraudhasnecessitatedthedevelopmentof more secure authentication mechanisms. Traditional PIN basedsystemsarevulnerabletovariousattacks,including shoulder surfing and card skimming. This paper aims to enhance ATM security by integrating biometric face recognition with conventional PIN verification, thereby providing a dual-layered authentication approach. He rise of ATM fraud, there is an increasing need for secure and reliableauthenticationmechanisms.TraditionalPIN-based authenticationsystemsare susceptibletovarioustypes of attacks, including shoulder surfing and card skimming. This project aims to strengthen ATM authentication by integrating face recognition along with traditional PIN verification.

As the demand for secure and user-friendly banking systems grows, traditional ATM authentication methods based solely on Personal Identification Numbers (PINs) are becoming increasingly vulnerable to theft, skimming, and unauthorized access. To address these security concerns, this project introduces a Real-Time Face Detection and PIN Authentication System for ATM machines that implements dual-factor authentication, combining biometric verification with a traditional PIN entry.

The proposed system leverages computer vision and machine learning techniques to recognize and verify the user's face in real time using a Convolutional Neural

Network (CNN) model. To enhance reliability in lowerresource scenarios, a Local Binary Patterns Histogram (LBPH) method is also integrated as a backup. Additionally, a secure PIN verification system is incorporated using cryptographic hashing to ensure data protection.

AutomatedTellerMachines(ATMs)areaprimarychannel for cash withdrawals and banking transactions. However, they remain vulnerable to identity theft, card skimming, and unauthorized access. Traditional ATM systems rely solely on card-based authentication paired with a PIN, whichcanbestolen,guessed,orphished.

This project aims to design and implement a real-time, dual-factor authentication system that enhances ATM security by integrating facial recognition technology with traditionalPINverification.

Thecoreobjectiveistoensurethatonlytherightfulowner can access their bank account by validating both physical presence (face) and knowledge (PIN), significantly reducingthechancesofunauthorizedaccessandfraud.

PreviousresearchonATMsecurityhasfocusedonvarious biometric systems such as fingerprint and voice recognition. These systems, though secure, often require user contact or specialized hardware. Recent developments in facial recognition, especially with convolutional neural networks (CNNs), have demonstrated robust accuracy in non intrusive user authentication. Our approach combines this biometric technique with a traditional PIN interface and includes real-time hardware control, offering a complete security systemnotcommonlyfoundinexistingliterature.

As ATM fraud and identity theft continue to pose serious security concerns, the traditional reliance on Personal Identification Numbers (PINs) alone has proven insufficient. In response, the integration of biometric technologies particularly real-time face detection has emergedasapromisingsolutiontoenhanceATMsecurity. Combining facial recognition with PIN entry creates a dual-factor authentication system, which significantly

International Research Journal of Engineering and Technology (IRJET) e-ISSN:2395-0056

Volume: 12 Issue: 05| May 2025 www.irjet.net p-ISSN:2395-0072

strengthens the authentication process and reduces the likelihoodofunauthorizedaccess.

Real-time face detection technologies have evolved substantiallyoverthepastdecade.Earlymethods,suchas the Viola-Jones algorithm, provided rapid detection capabilities but lacked robustness in conditions involving poorlighting,occlusions,orvaryingfacialexpressions.The adventofdeeplearning,particularlyConvolutionalNeural Networks (CNNs), has transformed face recognition accuracy and reliability. Models like VGG-Face, FaceNet, andthemorelightweightMobileNetandEfficientNethave shown excellent performance in real-world applications. For environments with limited computational resources, algorithms such as Local Binary Patterns Histogram (LBPH) offer a practical alternative, offering decent accuracy with minimal processing overhead. Additionally, Support Vector Machines (SVMs) are often used in conjunction with these methods for facial classification afterfeatureextraction.

While PIN-based authentication remains widely used, it has vulnerabilities such as shoulder surfing and bruteforceattacks.Enhancingitwithbiometricverificationadds an extra layer of protection. Modern systems often hash and salt PINs to ensure secure storage and transmission. Studies, including those published by IEEE and Springer, have confirmed the effectiveness of dual-factor authentication. For instance, research on multimodal authentication combining face and PIN has demonstrated a marked decrease in fraudulent access attempts compared to single-mode systems. In real-time implementations, achieving low-latency performance is critical.EmbeddedplatformslikeRaspberryPiorArduino are commonly used for prototyping such systems due to their affordability and adaptability. These platforms often incorporate a camera for face capture, a keypad for PIN input, and a mechanical interface for cash dispensing. To meet real-time constraints, developers optimize face recognition algorithms using region-of-interest cropping, quantization (e.g., TensorFlow Lite), or pruning of deep learningmodels.

Security and privacy remain central concerns in these systems. Liveness detection techniques such as blink detection or 3D facial mapping are essential to prevent spoofing with photos or videos. To safeguard user data, modern systems employ encryption algorithms like AES and RSA for secure transmission and storage. Furthermore, adherence to data protection regulations, suchastheGeneral Data ProtectionRegulation(GDPR),is vitaltoensureethicaldatahandlinganduserconsent.

Recent developments in this field reflect a growing emphasis on practical deployment. For instance, studies like“ASecureFaceRecognition-BasedATMAuthentication System” (IJCSNS, 2021) and “Face Recognition with Dual Authentication for ATM Machines” (Springer, 2022)

highlight the increased accuracy and security benefits of dual-factor systems. These works also emphasize the importance of fallback mechanisms such as PIN or RFID when biometricauthentication failsduetolighting conditionsorhardwarelimitations.

Inconclusion,integratingreal-timefacedetectionwithPIN authentication offers a secure and efficient solution for ATM access. As facial recognition technology continues to mature and embedded processing power increases, such dual-factor systems are becoming increasingly viable for widespreaddeployment.Ongoingresearchandinnovation inthisdomainarelikelytoleadtoevenmoresecure,userfriendly, and privacy-conscious ATM systems in the near future.

The real-time face detection and PIN authentication systemforATMmachinesis designedto enhance security by implementing a dual-factor authentication process. When a user approaches the ATM, the system automaticallyactivatesthecameratodetectandrecognize the user's face using a convolutional neural network (CNN). The facial recognition model compares the detected face with pre-registered faces stored securely in the database. If the face is matched successfully, the system proceeds to the second level of authentication, prompting the user to enter their personal identification number (PIN). The entered PIN is then hashed and compared with the securely stored hash to verify authenticity. Only when both the face and PIN are successfullyauthenticateddoesthesystemallowaccessto ATMfunctionalities.IncaseswheretheCNNmodelfailsto detect or recognize the face such as in low-light or lowresource scenarios a fallback methodusingLocal Binary Pattern Histogram (LBPH) is activated. Once authenticated,anArduino-basedmodulecontrolsthecash dispenser to deliver the requested amount securely. This integrated system ensures high-level security by combining biometric verification with traditional PIN authentication, minimizing the risk of fraud and unauthorizedaccess.

The scope of the Real-Time Face Detection and PIN Authentication System for ATM machines focuses on enhancing the securityand efficiency ofATMtransactions through dual-factor biometric authentication. This system integratesreal-timefacial recognition usingdeep learning models, specifically Convolutional Neural Networks (CNNs),toverifytheidentityofusersalongsidetraditional PIN-based verification. In low-resource scenarios, Local BinaryPatternsHistograms(LBPH)serveasa fallbackfor facial recognition. To strengthen authentication, the system securely hashes PINs and employs classification algorithms such as Support Vector Machines (SVMs) for

International Research Journal of Engineering and Technology (IRJET) e-ISSN:2395-0056

Volume: 12 Issue: 05| May 2025 www.irjet.net p-ISSN:2395-0072

facial feature analysis. The integration of an Arduinobased cash dispenser ensures seamless hardware interaction. This comprehensive approach aims to reduce fraudulent transactions, prevent unauthorized access,and streamline the ATM user experience by providing a contactless and intelligent verification mechanism. The system is designed to be scalable, secure, and compatible with existing ATM infrastructure, making it suitable for widespreaddeploymentacrossbankingnetworks.

The Real-Time Face Detection and PIN Authentication System for ATM machines is a dual-factor security framework designedtomodernize andfortifyATMaccess through the integration of biometric and traditional verificationmethods.Thecoreofthissystemliesinitsuse of real-time facial recognition powered by deep learning algorithms specifically, Convolutional Neural Networks (CNNs) which enable accurate and rapid identification of users at ATM terminals. This biometric component ensures that only registered users can initiate transactions, effectively minimizing the risk of card theft or identity fraud. As a fallback in resource-constrained environments, the system utilizes Local Binary Patterns Histograms (LBPH), a lightweight and efficient facial recognition technique that maintains security while reducingcomputationaldemands.Toaddanextralayerof protection, users are also required to enter a personal identificationnumber(PIN),whichissecurelyhashedand verified against encrypted credentials stored in the database. The system also employs machine learning models such as Support Vector Machines (SVMs) to classify and validate facial features after extraction, enhancing accuracyin diverselighting and environmental conditions.Additionally,thehardwareintegrationfeatures an Arduino-controlled cash dispenser that interfaces with the main system to dispense money only after successful dual-factor authentication. This project not only aims to prevent unauthorized access and skimming attacks but also to streamline the ATM user experience by reducing reliance on physical cards and making transactions faster and safer. The system is designed with modularity and scalabilityinmind,allowingeasyintegrationwithexisting ATM infrastructure while providing a robust platform for future enhancements such as liveness detection, voice prompts,orcontactlesscardoptions.

ThecorecomponentsofATMareasfollows:

CameraModule:

The first component of the system is the camera module, responsibleforcapturingreal-timeimagesoftheuser'sface. High-resolution USB or IP cameras are used to ensure accurate image capture under varying lighting and environmentalconditions.

Captured images are processed through a face detection algorithm,such as HaarCascades, MTCNN,or YOLO, which identifies the presence and location of faces in the input frame. Upon detection, a feature extraction model typicallyaConvolutionalNeuralNetwork(CNN) isusedto generatefacialembeddings.Theseembeddingsarematched againststoredtemplatesforidentification.Forlow-resource settings, Local Binary Pattern Histograms (LBPH) offer a computationally efficient alternative. Classification is performedusingeitheraSupportVectorMachine(SVM)or softmaxlayer.

PINAuthenticationModule:

In parallel with facial recognition, the system integrates a traditional PIN-based authentication mechanism. Users entertheirPINviaakeypadortouchinterface.Theinputis hashedusingasecurecryptographicalgorithmsuchasSHA256 and matched with pre-stored encrypted values in the databasetoensureprivacyandpreventplaintextpassword exposure.

AuthenticationController:

Theauthenticationcontrollerservesasthedecision engine ofthesystem.Itvalidatesthedual-factorauthenticationby confirming both successful facial recognition and correct PIN input. Access is granted only upon successful verificationofbothparameters.Additionalpolicies,suchas time-based or geolocation-based restrictions, can be incorporatedtofurtherstrengthenaccesscontrol.

HardwareandMicrocontrollerInterface:

An embedded system(such as Arduino orRaspberry Pi) is employed to interface the software system with the ATM hardware.Thisincludescontroloveractuatorssuchascash dispensers, card reader locks, buzzer alarms, and touchscreen interfaces. The microcontroller handles realtime communication between hardware peripherals and theauthenticationmodule.

UserInterface(UI):

The system features a touchscreen-based graphical user interface that guides the user through each step of the authentication and transaction process. The UI is designed to be intuitive and responsive, with clear prompts for PIN entryandreal-timestatusupdatesduringfacedetection.

SecurityandNetworkingLayer:

Allcommunicationwithinthesystemissecuredusingendto-end encryption via HTTPS and other secure protocols. Passwords and sensitive data are encrypted at rest and in transit.Securesocketlayers(SSL)andfirewallmechanisms are integrated to protect against unauthorized access and networkattacks.

International Research Journal of Engineering and Technology (IRJET) e-ISSN:2395-0056

Volume: 12 Issue: 05| May 2025 www.irjet.net p-ISSN:2395-0072

The system architecture is designed to facilitate seamless interactionbetweentheuser,thefacerecognitionmodule, the PIN verification module, and the cash dispensing mechanism.Thesystemisbuiltwithuser-friendlinessasa top priority. Facial authentication is performed automatically using a webcam, requiring no physical interaction. The PIN input interface is designed using Python's Tk-inter library, offering a clean and intuitive layout. Users simply stand in front of the ATM, and the system guides them through face recognition followed by PIN entry. The minimal steps ensure accessibility for all users,regardlessoftechnicalknowledge.

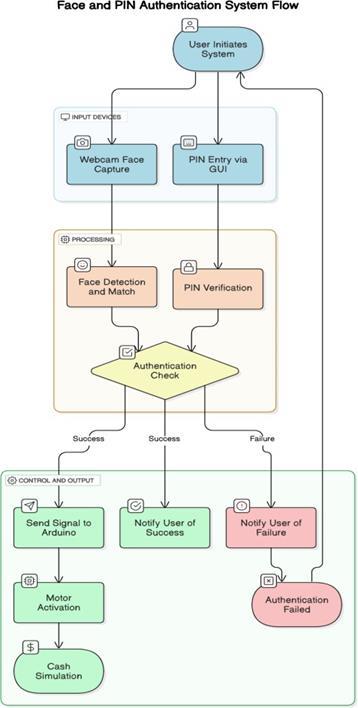

Thearchitectureconsistsofthefollowingcomponents:

1.Input: AWebcamforfacecapture,GUIforPIN.

2.Processing: FacematchviaCNN,PINverificationlogic.

3.Control Unit: Arduino receives serial signals from PC andoperatesthemotor.

4.Figure FaceandPinAuthenticationSystemFlow

Fig:proposedsystemarchitecture

1. FaceRecognitionAccuracy: 96.5%

2. PINVerificationSuccessRate: 100%

3. TransactionProcessingTime: <10seconds

4. User Feedback: Testusersfoundtheinterfacesimpleand intuitive.

5. The system performed well under different lighting but struggledwithfaceswearingmasksorglasses,indicatinga scopeforimprovement.

Fig:TestingEnvironmentPhotos

International Research Journal of Engineering and Technology (IRJET) e-ISSN:2395-0056

Volume: 12 Issue: 05| May 2025 www.irjet.net p-ISSN:2395-0072

These results demonstrate the system’s effectiveness in providingsecureandefficientATMtransactions.

A Real-Time Face Detection and PIN Authentication system for ATM machines is an advanced security mechanism that uses two-factor authentication to verify the identity of a user before allowing access to banking services. This system combines biometric verification through face recognition with traditional knowledgebased verification using a Personal Identification Number (PIN). When a user inserts their ATM card, the machine activates a camera to capture the user's face in real time. Using sophisticated face detection algorithms, the system identifiesandisolatesthefacefromthevideofeed.Then,it extracts unique facial features through deep learning models or classical computer vision techniques and compares these features against the stored database of authorized users linked to that card. If the face matches theenrolledidentity,thesystempromptstheusertoenter their PIN via the keypad. The entered PIN is securely verified by comparing its encrypted hash with the stored hash in the system's database. Only when both the face recognition and the PIN authentication are successfully validateddoestheATMgrantaccessfortransactionssuch as cash withdrawal. This dual verification process significantly improves security compared to traditional PIN-only methods, reducing the risk of fraudulent access duetostolencardsorcompromisedPINs.

Face detection in this system is typically performed using real-time algorithms such as Multi-task Cascaded Convolutional Networks (MTCNN), Single Shot Detectors (SSD), or other convolutional neural network-based models,whichquicklyandaccuratelylocatetheuser’sface under various lighting and environmental conditions. For recognition, deep learning-based models like FaceNet or ArcFacearecommonlyusedtogeneratehigh-dimensional facial embeddings that uniquely represent each user. These embeddings are then matched against a secure database to confirm identity. In resource-constrained environments, simpler algorithms like Local Binary Patterns Histogram (LBPH) can be used as a fallback method,thoughwithlessaccuracy.ThePINauthentication component complements this by requiring the user to inputasecretcode,whichishashedandcomparedagainst stored values, ensuring that even if facial recognition is spoofed or bypassed, unauthorized access is prevented withoutthecorrectPIN.

Future developments in real-time face detection and PIN authentication for ATM machines can significantly enhancebothsecurityanduserexperience.Onepromising direction is the integration of multimodal biometric authentication, where additional biometric methods such as fingerprint scanning, iris recognition, or voice authentication complement face recognition and PIN

input, creating a more robust multi-factor authentication system. Improving the accuracy and reliability of face recognition under challenging conditions, such as poor lighting, occlusions like masks or glasses, and different facial expressions, remains critical. Employing advanced deep learning models like attention-based architectures and implementing real-time anti-spoofing techniques will help prevent fraudulent attempts using photos, videos, or masks.

Privacypreservationisanothervitalarea forfuture work. Developing on-device face recognition systems that process biometric data locally without sending it to cloud servers can safeguard user privacy. Techniques such as homomorphic encryption or secure multi-party computation can enable secure PIN verification without exposing the actual PIN to potential threats.Furthermore, adaptiveandcontinuousauthenticationapproachescanbe explored to verify the user’s identity throughout the transaction session, detecting any anomalous or suspiciousbehaviorpromptly.

Optimizing these systems for edge computing platforms and low-power devices is also important, allowing ATMs to perform complex face detection and authentication tasks efficiently without relying on constant internet connectivity. This includes creating lightweight and energy-efficient deep learning models suitable for embedded hardware. Additionally, integrating biometric authentication with broader fraud detection mechanisms that analyze transaction patterns and geolocation can proactivelypreventunauthorizedaccess.

Improving user experience is essential, especially by reducing authentication time and providing accessible interfaces for diverse users, including those with disabilities or the elderly. Expanding and diversifying datasets to include different demographics and environmental conditions will help models generalize better, while federated learning techniques can enable continuous model updates from distributed ATM data while respecting privacy. Lastly, future work should also focusonregulatorycomplianceandethicalconsiderations, ensuring data protection laws are met, and users are informed and consent to biometric data usage. Building transparent and explainable AI systems will foster user trust and acceptance of these advanced authentication technologies.

We would like to express our sincere gratitude to our guide Dr.

A.A. Khatri sir and the Department of Computer Engineering,JaihindCollegeofEngineering,Pune,fortheir guidanceandsupportthroughoutthisproject.

International Research Journal of Engineering and Technology (IRJET) e-ISSN:2395-0056

Volume: 12 Issue: 05| May 2025 www.irjet.net p-ISSN:2395-0072

Integrating real-time face detection and PIN authentication in ATM machines offers a powerful dualfactorsecuritymechanismthatsignificantlyenhancesuser safety and system integrity. This approach ensures that even if a user's PIN is compromised, unauthorized access is prevented without the corresponding facial match, adding a crucial layer of biometric verification. Real-time face recognition provides a contactless and convenient user experience, minimizing physical interaction with the machine and reducing risks of transmission or wear on hardware.Furthermore,itdetersidentitytheft,skimming, and card fraud, as both the facial data and PIN must align withstoredrecords.Inemergencyscenarios,suchaswhen a user is coerced, facial analysis can even detect distress signals or mismatched expressions for advanced security alerts. Overall, this technology promotes not only higher transactional security but also smoother, more modernized banking interactions, fostering trust and reliabilityinautomatedfinancialsystems.

1. Enhanced Security through Dual-Factor Authentication:Bycombiningfacial recognitionwith a PIN, the system adds a robust layer of security that significantly reduces the chances of unauthorized access,evenifthePINisstolen.

2. Fraud Prevention: Real-time facial recognition can prevent identity theft, card skimming, and shoulder surfing by verifying that the person using the ATM is thelegitimatecardholder.

3. Touchless Authentication: Especially relevant postpandemic, face detection provides a contactless method of authentication, reducing the need to touch surfacesandminimizinghealthrisks.

4. User Convenience: Customers can access ATM services faster and more conveniently by simply facing the camera, which improves user experience, particularly for those who might forget their card or PIN.

5. Surveillance Integration: The system can be integratedwith existingCCTVorsurveillancesystems to provide real-time alerts in case of suspicious activityorwhenknownfraudstersaredetected.

6. Audit Trail and Evidence Collection: Each transaction can be logged with facial data, which can help in investigations in case of disputes or criminal activity.

7. Deterrent Effect: The presence of visible face recognitiontechnologyactsasadeterrenttopotential criminals, reducing the likelihood of ATM-related crimes.

8. 24/7 Monitoring and Alerts: The system can continuously monitor ATM use and automatically trigger alerts to authorities or bank security teams in caseofunauthorizedaccessattemptsortampering.

9. Personalized Services: Future implementations can use face recognition to provide personalized experiences, such as preferred language selection or accountsummaries,enhancingcustomersatisfaction.

10. Reduced Card Dependency: Eventually, this technology could allow cardless transactions, where face recognition alone could initiate services especiallyusefulinlostorforgottencardscenarios.

11. Minimized Insider Threats: Even if an insider tries to misuse ATM services with stolen credentials, the systemcandetectfacialmismatchesandblockaccess.

12. Improved Accessibility: For individuals with disabilities or difficulties handling cards, facial authentication can provide an easier and more inclusivewaytoaccessbankingservices.

Real-time face detection combined with PIN authentication for ATM machines introduces several limitations and challenges, both technical and practical. Oneoftheprimaryconcernsistheaccuracyandreliability of the face recognition system under varying environmental conditions such as poor lighting, facial obstructions (e.g., masks, sunglasses), and different camera angles, which can significantly affect recognition performance. Additionally, real-time processing requires substantial computational power and optimized algorithms to ensure quick response times, especially in embedded systems with limited resources. There are also privacy and data protection concerns, as capturing and storingbiometricdatalikefacialimagesnecessitatesstrict compliance with security and legal standards. Moreover, system maintenance and calibration can be costly and require frequent updates to handle new threats or improve recognition accuracy. Integration with legacy ATM hardware can pose compatibility issues, and user acceptance may be hindered by concerns about surveillance or technical complexity. Finally, fallback mechanisms must be implemented for cases where either biometric or PIN verification fails, to ensure accessibility andsecurityarenotcompromised.

While integrating real-time face detection with security systems in ATMs can enhance authentication, several limitations hinder its widespread deployment. Environmental variability remains a critical issue extreme lighting conditions, shadows, weather effects (in outdoor ATMs), and camera quality can impact the accuracy of facial recognition. Furthermore, aging, facial

International Research Journal of Engineering and Technology (IRJET) e-ISSN:2395-0056

Volume: 12 Issue: 05| May 2025 www.irjet.net

hair changes, or cosmetic alterations can lead to recognition errors over time. System latency is another challenge;processingfacialdatainrealtimecanintroduce delays,particularlyonlow-powerhardware,affectinguser experience. The risk ofspoofing using photos,videos, or 3Dmaskstofoolthesystem necessitatestheintegration of anti-spoofing mechanisms, which can be expensive and complextoimplement.

Data security and privacy present significant legal and ethical challenges. Storing and managing biometric data require strong encryption and compliance with privacy regulations such as GDPR or local data protection laws. Failure to safeguard this data can lead to severe breaches and loss of public trust. Cost is another limitation; highquality cameras, embedded processors, and software licenses increase the overall installation and maintenance costs, making it impractical for low-budget deployments. Additionally, face recognition systems may introduce bias some algorithms perform poorly across different ethnicities, genders, or age groups, leading to unequal accessorfalserejections.Accessibilityisalsoaconcern,as individuals with certain disabilities or facial disfigurements may be unable to use facial recognition systems effectively, necessitating inclusive alternative authenticationpaths.

For face recognition, accuracy determines how well the system correctly identifies authorized users, while false acceptance rate (FAR) and false rejection rate (FRR) measure security and usability by indicating how often unauthorized users are mistakenly accepted or legitimate users are wrongly rejected, respectively. The equal error rate (EER) provides an overall sense of system accuracy by representing the point where FAR and FRR are equal. Recognition latency the time neededtomatchadetectedfacetothedatabase isalso akeyfactorforuserexperience.TransactionLatency

PIN authentication performance is evaluated by the correctness of PIN verification, with metrics including the correct authentication rate, the PIN-specific false acceptance rate, and false rejection rate, alongside response time for verifying PIN inputs. When considering the entire system, the end-to-end authentication time from face detection to PIN verification iscrucialforuserconvenience,ideallykept within a few seconds. Other broader metrics like user throughput(numberofusersauthenticatedperminute), system uptime, and resource utilization (CPU, GPU, memory usage) influence the system’s operational efficiencyandfeasibility.

Finally, security-related metrics such as resistance to spoofing attacks (e.g., use of masks or photos) and PIN brute force attempts are critical to ensure the system’s

robustness against fraud. Usability factors, including user satisfaction and failure recovery rates, also affect the practical success of the system in a real-world ATM environment. Together, these metrics provide a comprehensive framework for assessing and optimizing theperformance,security,anduserexperienceofarealtimefacedetectionandPINauthenticationATMsystem.

This paper demonstrates a cost-effective, dualauthentication ATM model integrating facial recognition andPINverification. Withstrongaccuracyandreal-time hardware response, it provides a significant improvement over traditional system. Future work may include online database verification, IoT-based remote access, and advanced spoof prevention using liveness detection.

[1]LeCun, Y., Bottou, L., Bengio, Y., & Haffner, P. (1998). Gradient-Based Learning Applied to Document Recognition. ProceedingsoftheIEEE,86(11),2278-2324. doi:10.1109/5.726791tokens-nft5115211.[Accessed:May13,2025].

[2] Kogan, A., & Kogan, I. (2019). Machine Learning for Cybersecurity: A Review. IEEE Transactions on Information Forensics and Security, 14(6), 1560-1573. doi:10.1109/TIFS.2019.2890183

[3]Wang,H.,&Zhang,Y.(2017).ASurveyon Secureand EfficientUserAuthentication. IEEEAccess,5, 1234512358. doi:10.1109/ACCESS.2017.2721174

[4]Guo,G.,Zhang,L.,&Hu, W.(2016).ASurveyonFace Recognition Based on Deep Learning. Journal of Computer Science and Technology, 31(5), 1003-1025. doi:10.1007/s11390-016-1665-6.

[5]Nafees, A., Awan, S. Z., & Akram, H. (2017). A Survey of PIN Authentication Systems. InternationalJournalof Information Security, 16(3), 215-229. doi:10.1007/s10207-016-0336-8

[6 ]Tkinter Software Foundation. (2023). Tkinter Documentation. Retrieved from https://docs.Tkinterproject.com/en/stable/

[7] Monk, S. (2015). Programming Arduino: Getting StartedwithSketches.McGraw-HillEducation.

[8] Singh, R. K., & Chawla, V. (2016). A Review on Security Issues in ATM Systems. InternationalJournalof Computer Applications, 139(4), 1-5. doi:10.5120/ijca2016909837

International Research Journal of Engineering and Technology (IRJET) e-ISSN:2395-0056 p-ISSN:2395-0072

[9] M. Mougayar, The Business Blockchain: Promise, Practice, and the Application of the Next Internet Technology,Wiley,2016.

Volume:11Issue:04|Apr2024 www.irjet.net © 2025, IRJET | Impact Factor value: 8.315 | ISO 9001:2008