Swing Trading vs. Day Trading in Forex: Which

Is Better?

Introduction

Forex trading offers a variety of strategies, but two of the most popular are swing trading and day trading Both approaches have their advantages and challenges, and choosing the right one depends on your goals, risk tolerance, and lifestyle

What Is Day Trading?

Definition: Opening and closing trades within the same trading day, often holding positions for minutes to hours

● Key Features:

○ Requires constant market monitoring

○ Focuses on short-term price movements

○ Relies heavily on technical analysis and indicators

● Pros:

○ Potential for multiple small profits per day

○ No overnight risk

● Cons:

○ High stress and time-intensive

○ Can incur high transaction costs due to frequent trades

What Is Swing Trading?

Definition: Holding positions for several days to weeks to capture medium-term trends.

● Key Features:

○ Less frequent trading than day trading

○ Combines technical and fundamental analysis

○ Focuses on capturing larger market moves

● Pros:

○ Less time-intensive

○ Reduces stress from constant monitoring

○ Can generate larger profits per trade

● Cons:

○ Exposed to overnight and weekend risk

○ Requires patience and strong risk management

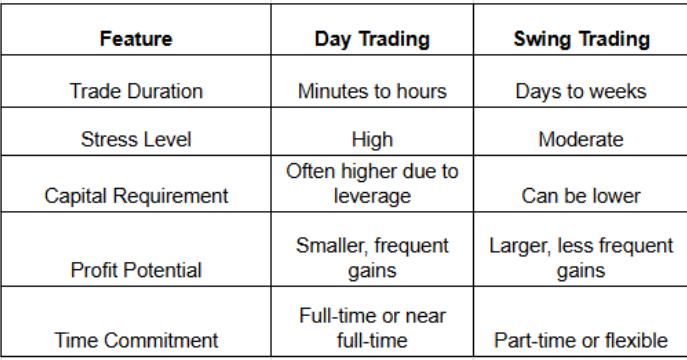

Key Differences

Which Is Better for You?

● Choose Day Trading if:

○ You can dedicate several hours per day to the market

○ You enjoy fast-paced trading and quick decision-making

○ You are comfortable managing high stress and leverage

● Choose Swing Trading if:

○ You prefer a more flexible schedule

○ You have a long-term perspective and patience

○ You want to capture larger market moves without constant monitoring

Conclusion

Neither strategy is universally “better” Your choice depends on your lifestyle, risk tolerance, and trading goals. Many successful traders even combine both approaches, using swing trades for long-term trends and day trades for short-term opportunities The key is to understand the differences, practice diligently, and stick to a strategy that aligns with your strengths.