Algorithmic Trading: How Bots Are Changing the Forex Market

Introduction

The Forex market is evolving rapidly, and one of the biggest game-changers in recent years is algorithmic trading. Traders are increasingly relying on automated systems, or “bots,” to execute trades, manage risk, and exploit market opportunities faster than ever before But how exactly are these bots changing the way Forex is traded?

What Is Algorithmic Trading?

● Algorithmic trading uses computer programs to execute trades automatically based on predefined rules and strategies

● How It Works:

○ Bots can analyze market data in real-time

○ They can place, modify, or close trades instantly

○ Decisions are based on technical indicators, statistical models, or AI algorithms

Benefits of Using Trading Bots

1 Speed and Efficiency – Bots can process vast amounts of data and execute trades much faster than humans

2 Emotion-Free Trading – Algorithms stick to the rules, avoiding fear and greed

3. Backtesting Strategies – Traders can test strategies on historical data to see how they would perform

4 24/5 Market Coverage – Bots can monitor and trade the Forex market continuously without fatigue.

Risks and Limitations

● Technical Failures: Connectivity issues or coding errors can result in losses

● Over-Optimization: Bots may perform well on historical data but fail in live markets.

● Market Volatility: Unexpected news or events can trigger losses if the bot cannot adapt quickly

● Cost and Complexity: Developing or purchasing a reliable trading bot can be expensive

How Bots Are Changing the Forex Market

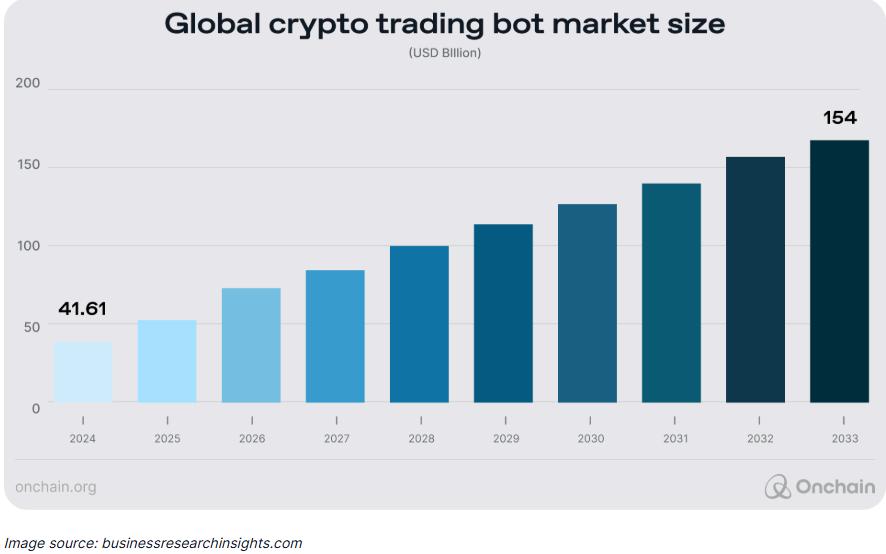

The above picture shows the bot market size of crypto trading

● Increased Competition: Human traders now compete with sophisticated algorithms, making markets more efficient

● High-Frequency Trading (HFT): Bots execute thousands of trades in seconds, affecting liquidity and spreads

● Accessibility: Retail traders now have access to automation tools once only available to institutional traders

● Strategy Innovation: New algorithmic strategies, including AI and machine learning, are constantly emerging

Tips for Traders Interested in Bots

● Start with a demo account to test any bot or algorithmic strategy.

● Learn the basics of coding or use prebuilt platforms cautiously

● Always implement risk management rules; bots are tools, not guarantees

● Monitor performance regularly, even with automated trading.

Conclusion

Algorithmic trading is revolutionizing the Forex market by bringing speed, efficiency, and accessibility to traders of all levels. While bots can offer significant advantages, they are not foolproof and require careful testing, monitoring, and risk management For traders willing to

embrace technology responsibly, algorithmic trading offers exciting opportunities to navigate the modern Forex landscape.