Copyright owned by Fastener World / Article by Gang Hao Chang, Vice Editor-in-Chief

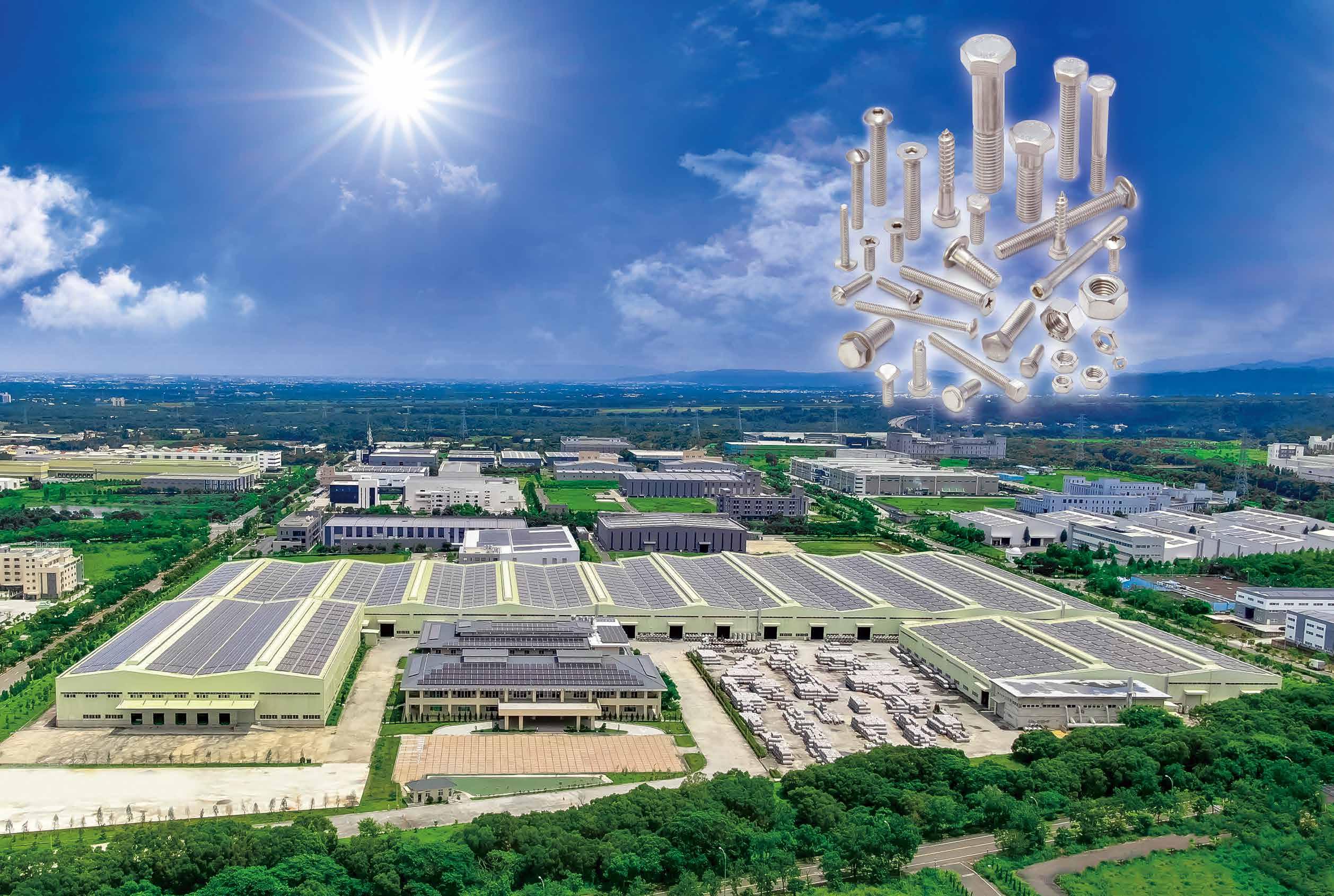

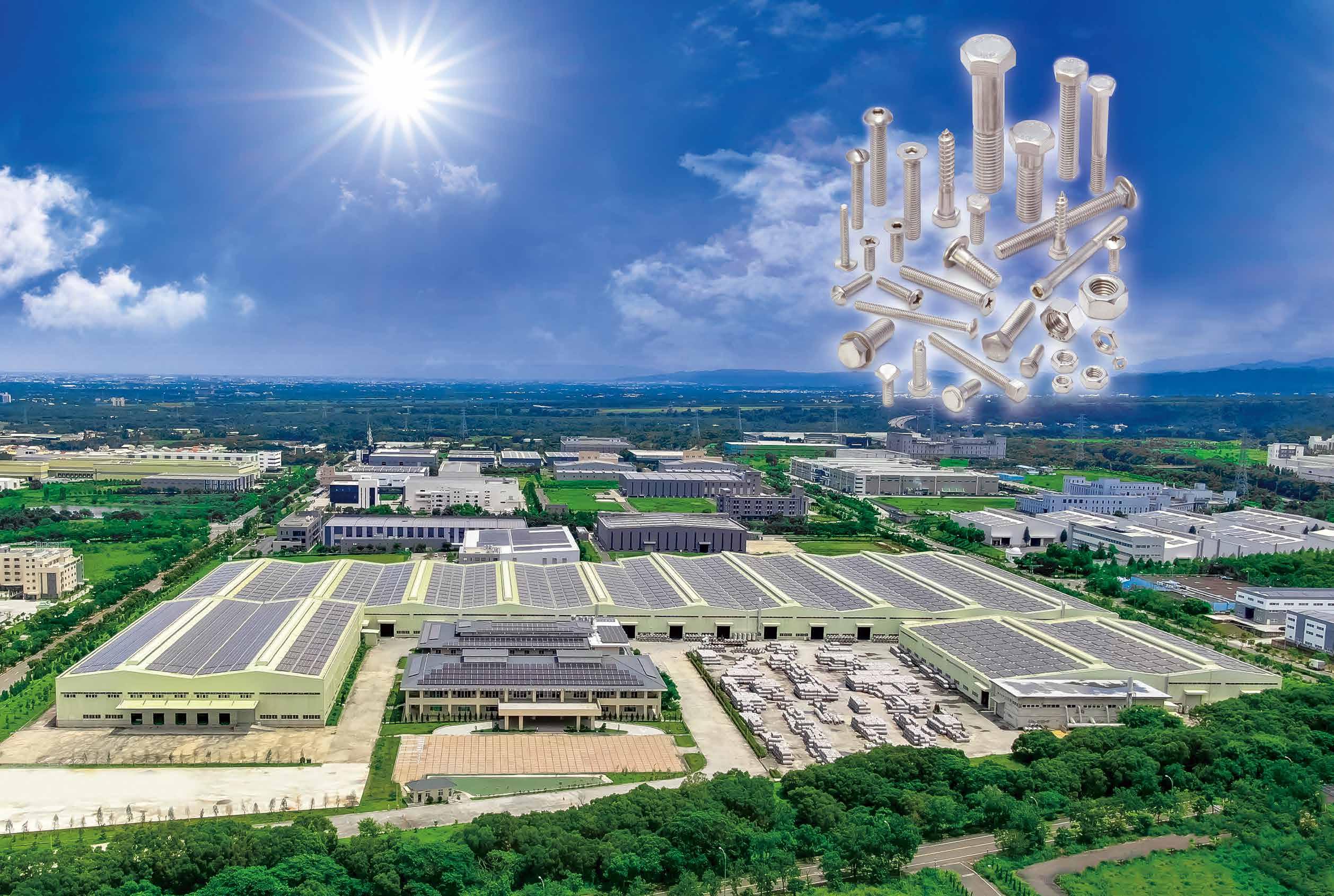

Facing the global automotive industry's push for supply chain decarbonization and digital transformation, Taiwanese fastener manufacturer, Hu Pao Industries Co., Ltd., continues to pursue dual sustainability and efficiency goals through international-level carbon footprint verification, AI implementation, and process optimization. Not only has it successfully positioned itself as a green fastener supplier with immediate competitiveness in the CBAM era, but it also sets an exemplary transformation model for other SMEs.

Hu Pao has completed the ISO 14064-1 verification and annually upgrades the quality and scope of its carbon footprint verification. To achieve visual management, its carbon emissions data has been integrated with the internal ERP system. Data verified by ARES in 2022 shows that its carbon emissions from 2,448 tons of shipped finished products reached 10,959 tons (4.47 CO2e/ton). Data verified by French AFNOR in 2024 shows the carbon emissions from 2,663 tons of shipped finished products reached 10,239 tons (3.84 tons CO2e/ton). This demonstrates remarkable performance in maintaining production capacity and quality while achieving an 8.8% increase in shipment volume and a 14.1% reduction in emissions per ton within just two years.

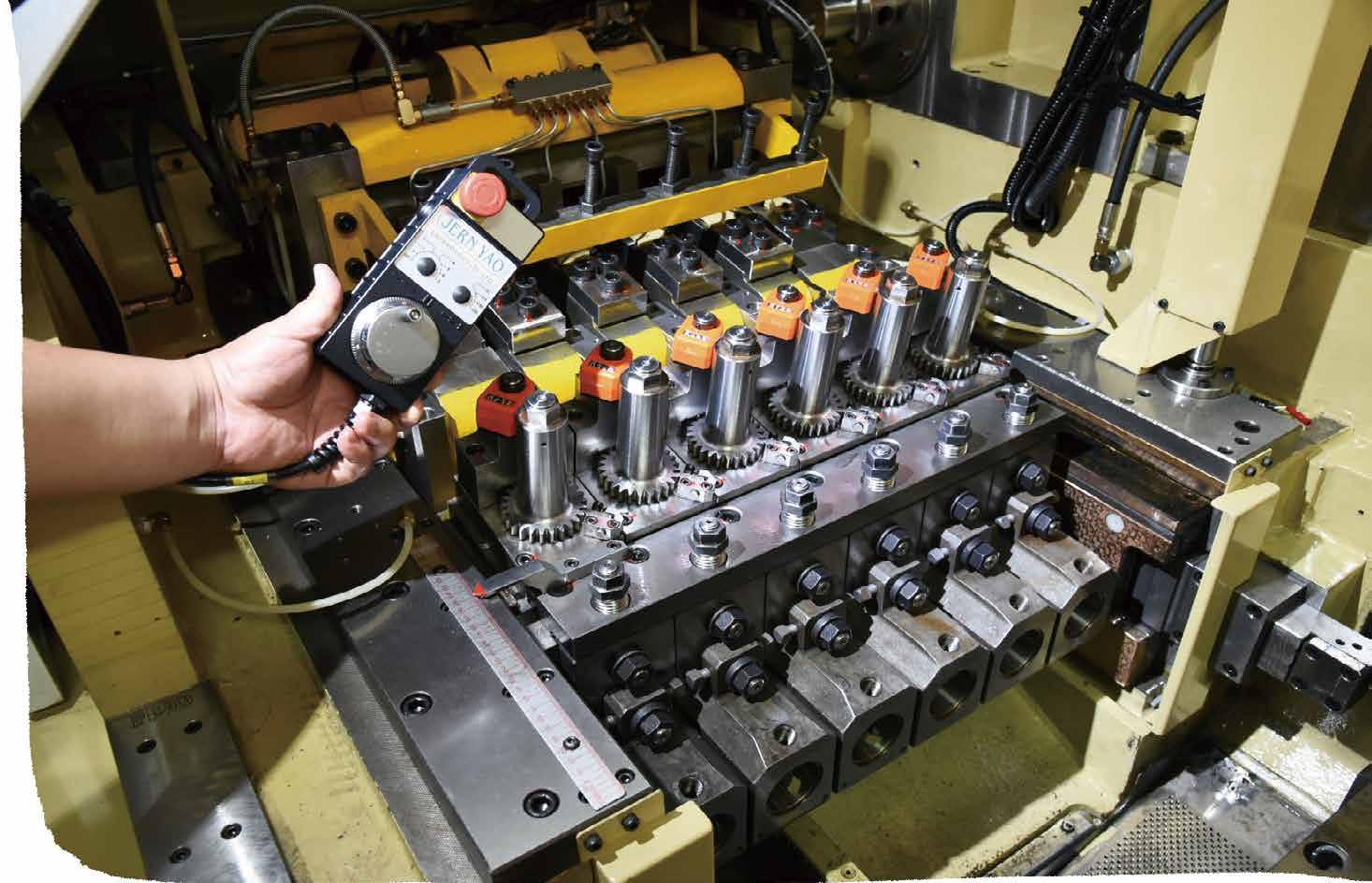

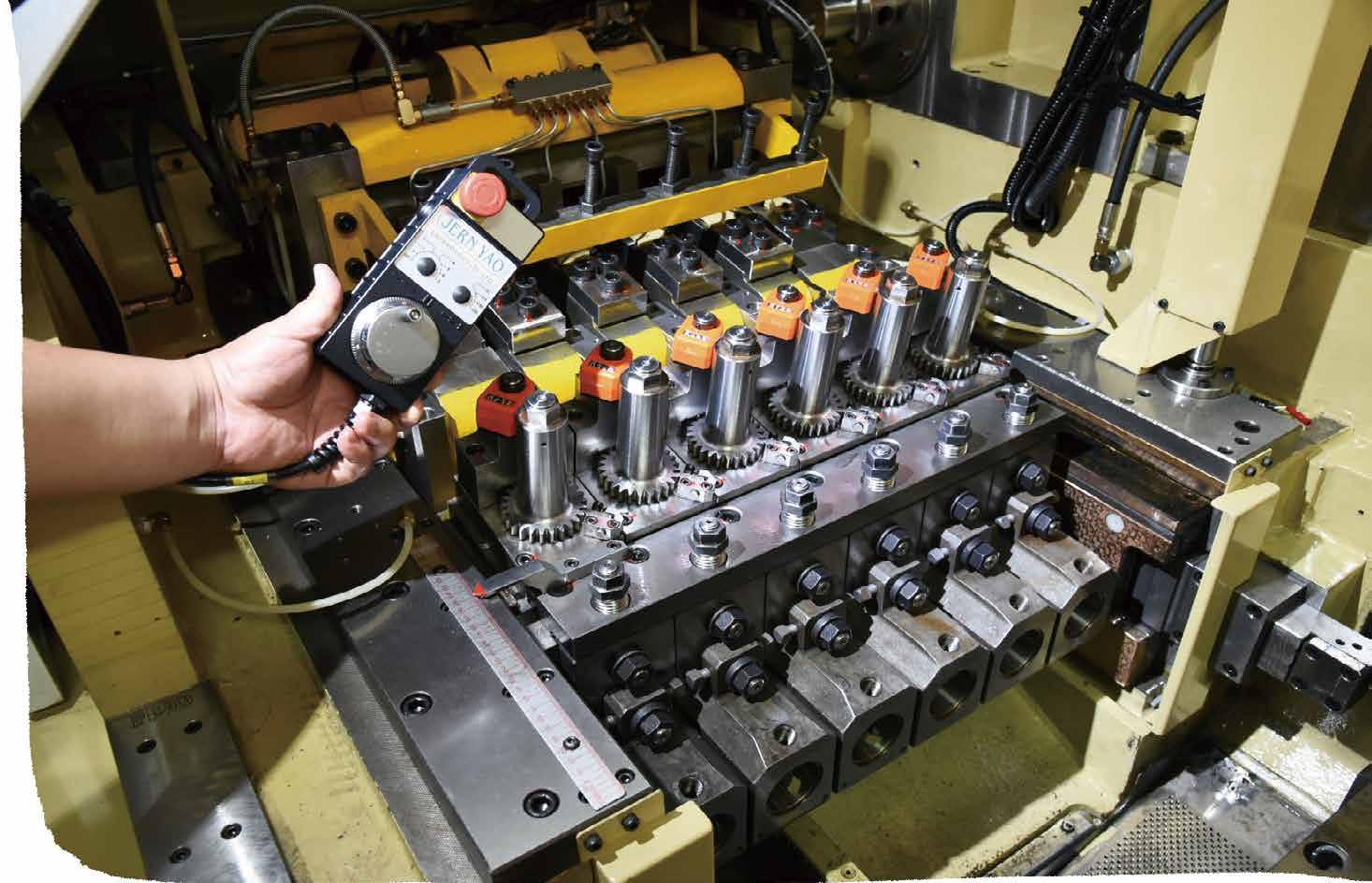

internal quality control, preventive maintenance, etc. Such as initiative also improves its delivery reliability and operational transparency as required by Tier 1 automotive supply chains. For example, the platform automatically parses customers’ RFQ documents and cross-references them with ERP cost data, significantly reducing its quoting time from 120 minutes to just 5 minutes and ensuring consistent quoting logic.

Metal forming requires substantial amounts of lubricating oil, but the environmental pollution caused by untreated waste oil discharge has long been a headache for manufacturers. To address this, Hu Pao independently developed a waste oil recycling trough that can filter and store waste oil for reuse, fully implementing green innovation in the manufacturing process. This solution reduces monthly oil consumption by 20% while also lowering workplace safety risks and eliminating unpleasant odors in the factory area, thereby improving environmental quality. Such an innovation earned Hu Pao an honor as one of Tainan City's Top 10 SBIR Outstanding Projects in 2024, establishing it as an industrial benchmark.

Achieving an 8.8% increase in shipment volume and a 14.1% reduction in emissions per ton within just two years. Vsing the Intellicon Egenthub AI platform to strengthen the management capabilities of quotation effectiveness, internal quality control, preventive maintenance, etc.

To enhance operational efficiency and reduce human error, Hu Pao introduced the Intellicon EgentHub AI platform to strengthen the management capabilities of quotation effectiveness,

Compared to thousands of Taiwanese fastener manufacturers still in the early stages of ESG implementation, Hu Pao has established a significant competitive edge through its leadership in carbon emission verification, process innovation, AI integration, and internalizing ESG/CBAM into its corporate culture. Beyond conducting annual carbon footprint verification and completing thirdparty GHG verification every 2 years, the company drives internal improvements through innovative processes like waste oil recycling and energy intensity optimization. It also leverages AI to integrate quotation documents and resolve production bottlenecks. Hu Pao’s President and its management team's deep understanding of ESG and CBAM trends has embedded sustainability as a core corporate value. “We don't just produce fasteners; we provide customers with parts backed by credible carbon data and quality traceability, helping them navigate ESG and CBAM requirements with confidence,” said General Manager Bill Wang.

Hu Pao has implemented ESG practices and leveraged AI alongside innovative green manufacturing processes to meet the regulatory requirements of global industrial buyers, successfully demonstrating its value as a technology partner capable of collaborating with the industry to co-create sustainability. For other SMEs, this serves not only as a successful model but also as a benchmark example for Taiwan's fastener industry to enhance competitiveness and advance into the next decade.

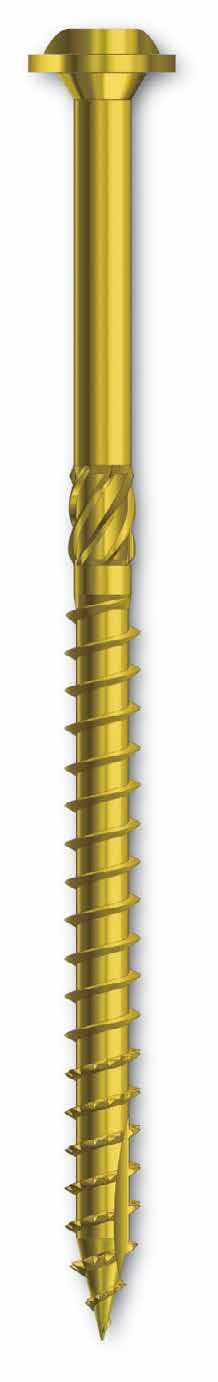

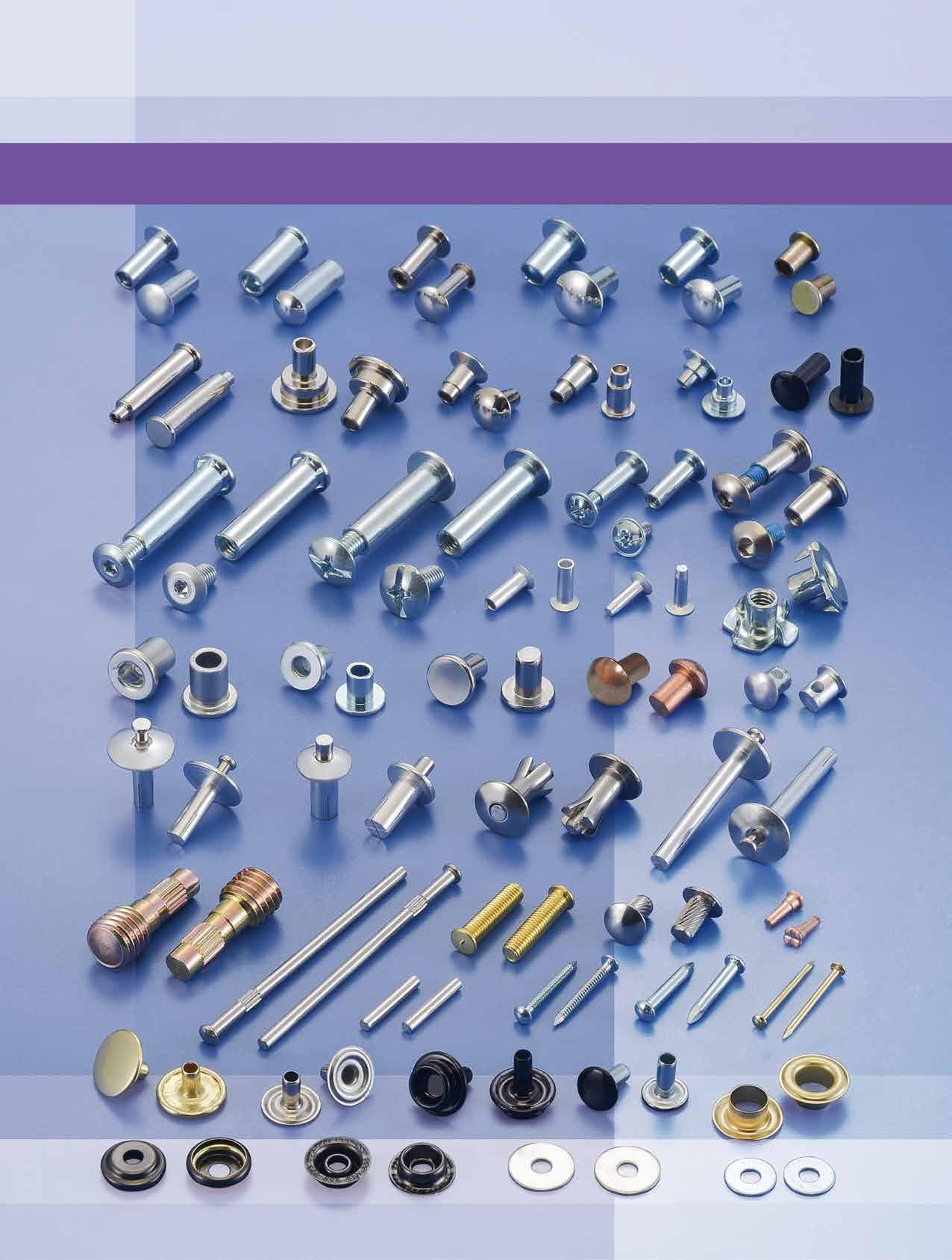

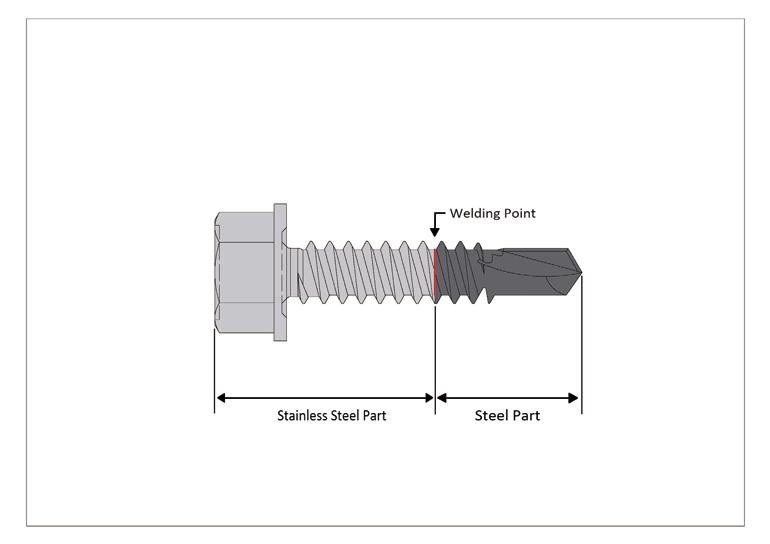

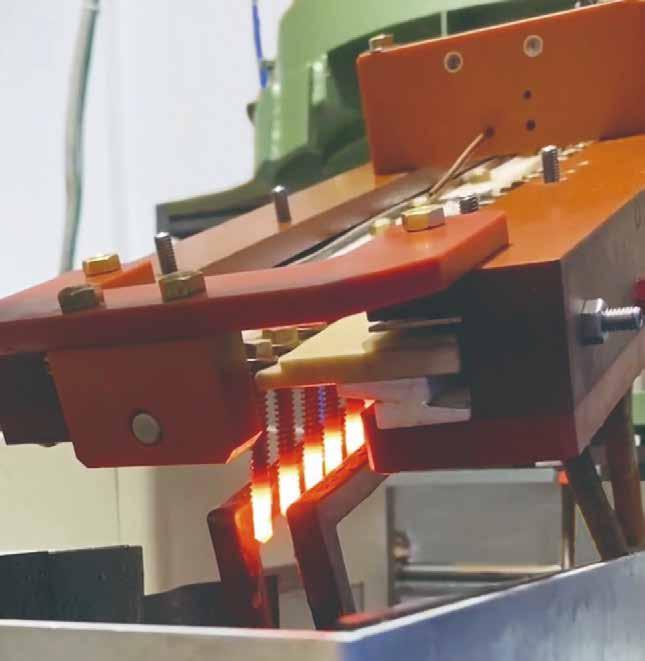

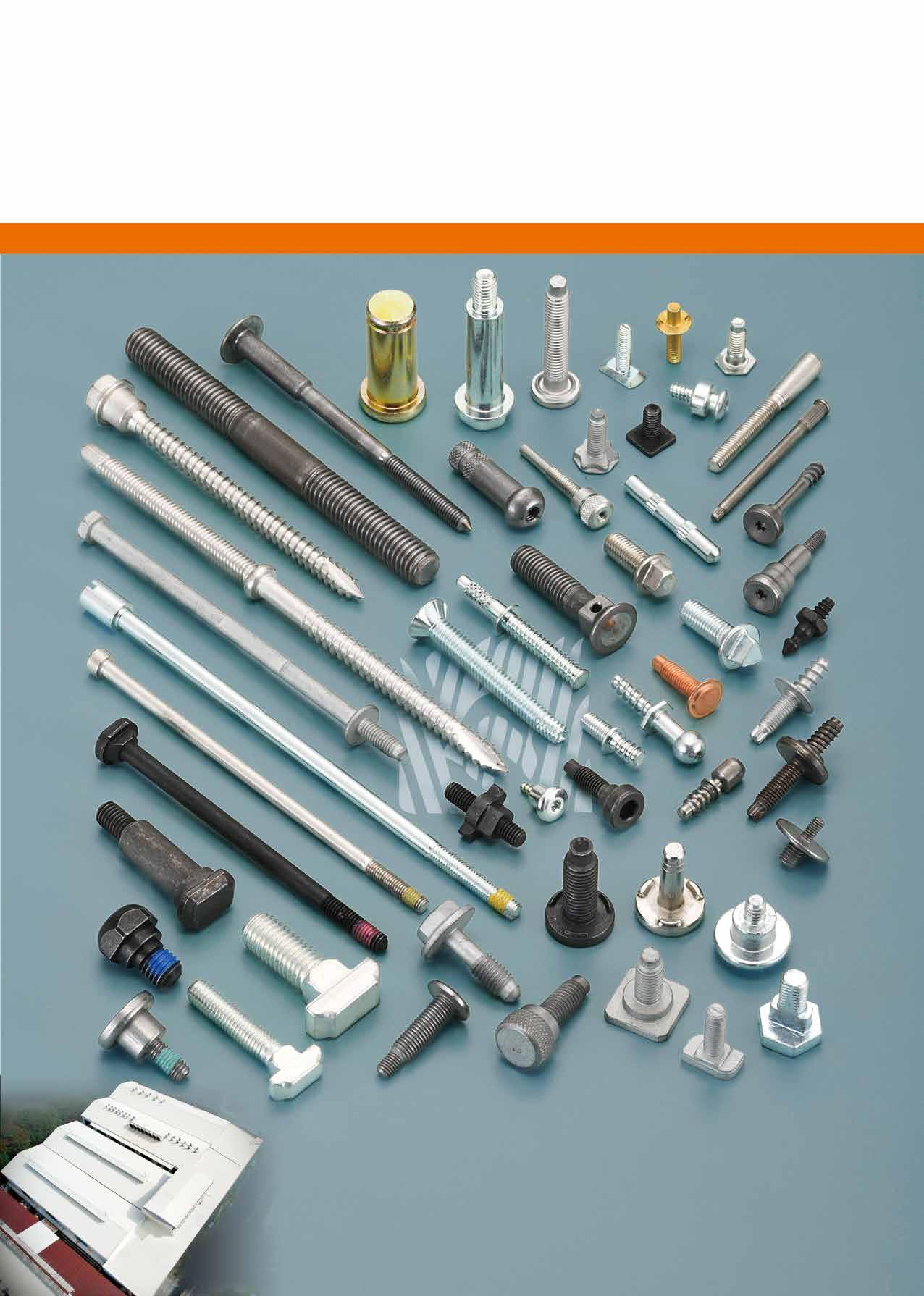

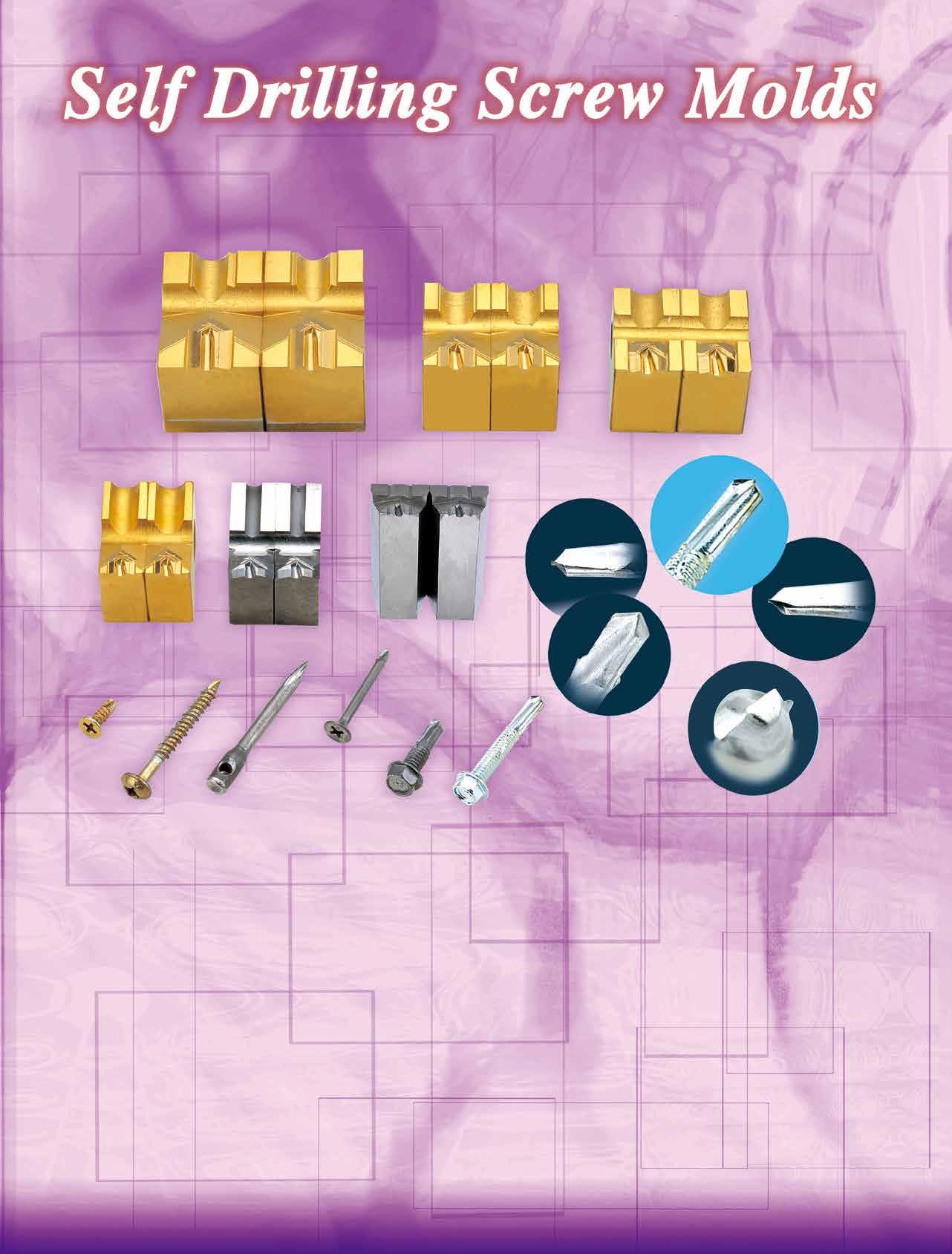

"If you're looking for unreleased leading products and technologies, look no further than Kwantex in Taiwan!" This statement from an overseas customer not only highlights Kwantex's successful investment over the past 30 years, transforming from packaging & wire drawing to R&D in fasteners, but also demonstrates its long-established leadership at a different level among its Taiwanese counterparts in terms of product development, technological innovation, and brand positioning.

Kwantex contact: Ms. Tracy Lin

Email: kwantex@ms18.hinet.net

In recent years, Kwantex has consistently conveyed its focus on R&D and its strong R&D capabilities to the international market. Its outstanding innovation is reflected in its annual product development, with many products receiving recognition such as the German Red Dot Design Award, the Fastener Innovation Award from U.S. Worldwide Fastener Sources, the Best Booth Award at IFE 2025, etc. Furthermore, Kwantex actively keeps pace with environmental protection and carbon reduction trends, such as achieving ESG certification in 2024 and planning to release its latest ESG report in 2026, demonstrating its significant commitment and responsibility to environmental friendliness and sustainable development.

"To turn the market around, there's no chance without innovation," Kwantex President Jack Lin said. Kwantex develops over 100 improved, innovative, and patented products annually, with R&D and patent maintenance costs reaching tens of millions NTD For Kwantex, a product's ability to revolutionize the market requires a balance of functional and aesthetic innovation, along with optimal adjustments to meet customer needs. President Lin believes, "Only innovative products can give us pricing power." Therefore, since securing its 1st European customer order, Kwantex has been working at full speed. Through continuous development, testing, and product refinement, an average of 1 new product is adopted by customers every 5 years, with some new products already surpassing the design and functionality of many well-known European and U.S. brands.

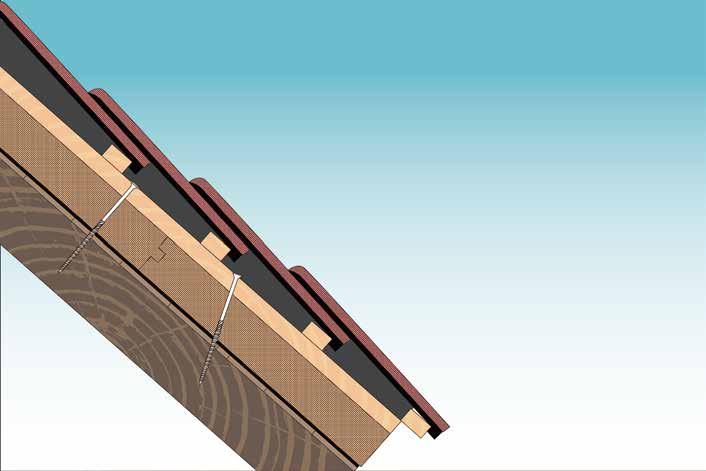

The relatively poor rust and deformation resistance of traditional industrial steel beams has led markets in Europe, USA, and Japan to shift towards Cross Laminated Timber (CLT) construction, thereby driving demand for wood screws. Coupled with rising labor costs, the demand for wood screws that can meet automated & rapid fastening requirements without cracking or insufficient anti-loosening force, as well as industrial assembly and construction screw sets with high clamping force and easy maintenance & reuse, is also increasing daily. These needs can now be met through Kwantex's full-size and high-performance product offerings, such as wood screws that offer quick & easy fastening and anti-split performance while maintaining a clean and aesthetical finish; the TTX® Drive & Bit series, which fasten securely when turned (including the patented TTX® Drive with its 6-lobe hook design to prevent slippage and which won the Worldwide Fastener Sources Fastener Innovation Award in 2022); the Cutters series, a leading brand in the Nordic and N. American furniture/construction markets, known for its ease of use and crack resistance; and the Torpedo series, which allows for quick tapping (including the KTX-Torpedo Plastic Decking Screw, which fastens wood surfaces without cracking edges and features reverse threads to prevent mushrooming); the 3rd-generation Archimedes’ Secret Threads (AS’) series (the best alternative to the TY-17, double cut design and Torpedo thread) that can prevent wood cracking without damaging the wood fibers and reducing driving torque, and maintain high pull-out force; the KTX Convex (VK) Head that can replace traditional hex washer heads and prevent slippage and wear after installation (suitable for various steel structure, wood structure, and concrete screws and bolts, which are easy to use with VN nuts); the KTX-Jig (for Hidden Decking Screw System) that can create a clean, fastener-free surface by side fastening, which won the Worldwide Fastener Sources Fastener Innovation Award in 2025; and the stainless steel KTX Terrace (IPE) Screw that can drill into extremely hard wood without predrilling and snapping-off.

"Kwantex products have consistently achieved positive results in each market. A high percentage of customers who have used our products become our agents or use our patents for private label sales. When customers are experiencing economic downturns or excessive market competition and shift towards product upgrades, it presents an opportunity for us to leap forward. With hundreds of product improvements and innovations every year, we still achieved growth of over 20% in 2025." President Lin said. Kwantex's innovation extends from product design to subsequent packaging and logistics, and it aims to integrate concepts such as environmental protection, storage, and reuse with users' home life. Kwantex will celebrate its 30th anniversary in 2026. President Lin also announced that in the 2nd half of 2026 the company will present more groundbreaking innovations to global customers in product design, packaging, and logistics, showcasing Kwantex's world-class R&D capabilities and quality strength on par with international giants. "When Kwantex received the Best Booth Award at IFE 2025, the judges praised us as 'an industry leader and a model of innovation in Taiwan.' I believe that a large part of the reason we won this award is based on our consistent efforts to demonstrate the core value of our products and our forward-looking vision of future market trends," President Lin said.

In addition to its commitment to product innovation, Kwantex also values environmental protection and carbon reduction. The company's representative color “purple” conveys Kwantex's aspiration to maintain its business development while striving to reduce pollution in the screw manufacturing process and coexist sustainably with the Nature, because screws are not just products, but an integral part of everyone's life. "Kwantex products are certified by the EU CE/ETA, US ICC, and SGS quality management systems. They can be reused in various fields such as industrial assembly, civil engineering, bridges, vehicles, ships, and aviation, eliminating the problem of needing to scrap a large number of screws due to failure. This perfectly aligns with the spirit of ESG environmental protection and carbon reduction," President Lin said. Regarding corporate responsibility, Kwantex creates a safe workplace for its employees. In addition to professional safety and fitness managers stationed at the factory, there are also dedicated factory nurses and external occupational physicians providing employees with regular medical check-ups and assistance.

On the occasion of the company's 30th anniversary, President Lin said, "We will continue to focus on product innovation and corporate sustainability, so that our employees can work with peace of mind and we can attract more customers from more countries to adopt Kwantex products or our brand."

Copyright owned by Fastener World / Article by Gang Hao Chang, Vice Editor-in-Chief

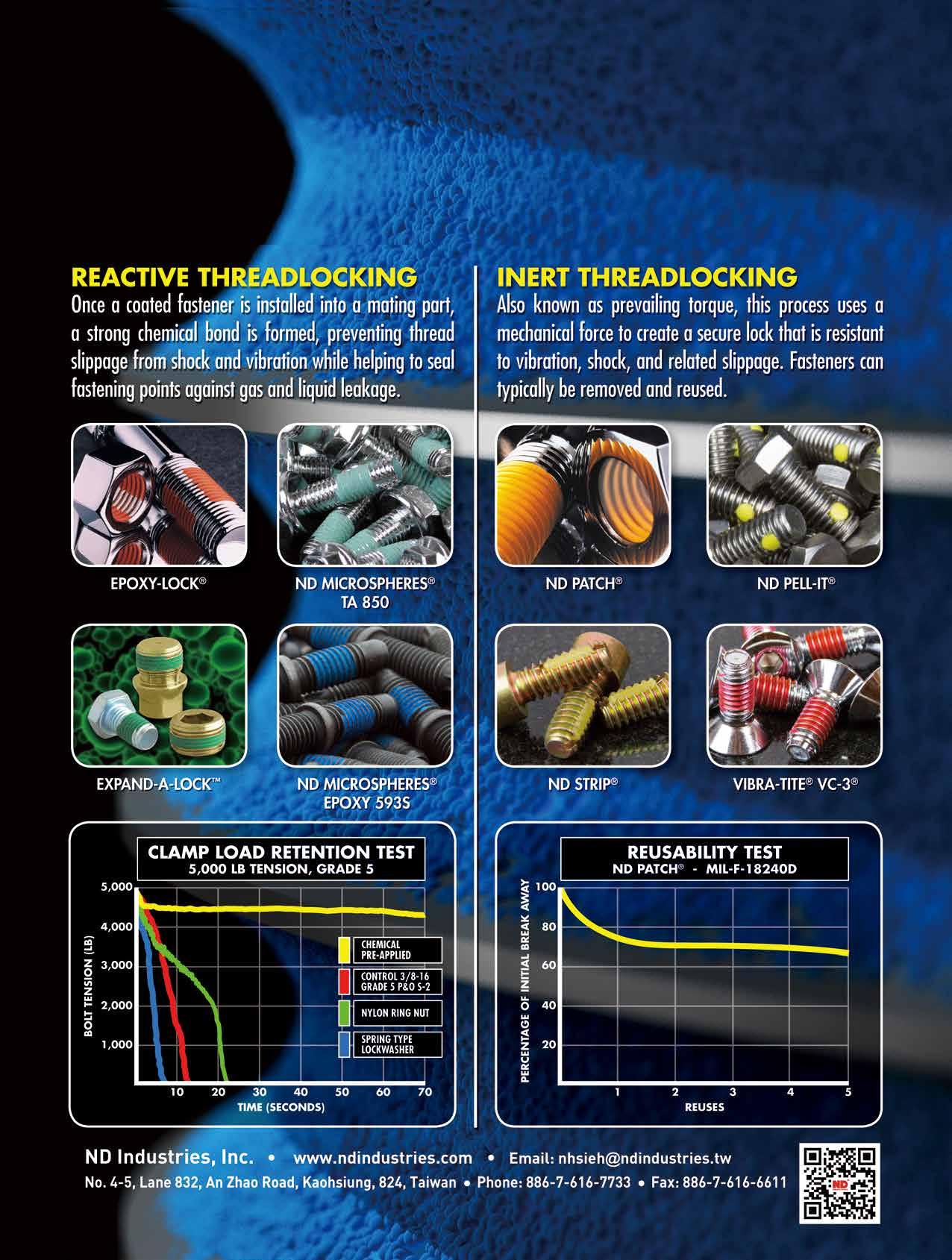

TSLG耐落是全球扣件預塗膠首選品牌

高雄廠: 高雄市湖內區中山路二段二巷53弄9號

TEL: 886-7-6996777 / FAX: 886-7-6998999 / E-mail:tslg.kh@tslg.com.tw

耐落系台灣耐落股份有限公司註冊商標 precot e®系德國 omniTECHNIK 公司註冊商標 NYLO K®系美國NYLOK公司註冊商標

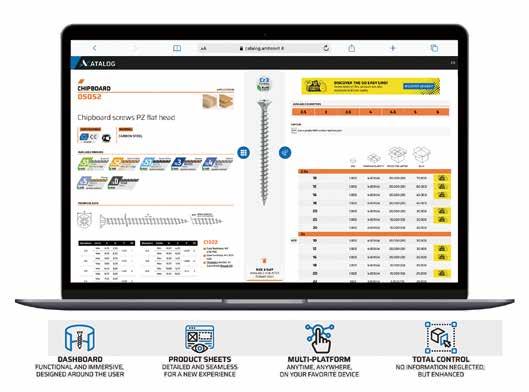

In recent years, Ambrovit has embarked on a path of profound transformation, focusing on technological innovation, logistical efficiency and environmental sustainability. Among the most significant projects is the Proxima automated warehouse, a state-of-the-art infrastructure that has revolutionized internal management, optimizing time and processes while reducing environmental impact. More than simply a technological investment, Proxima is a clear statement of responsibility toward the planet. Thanks to advanced automation systems, it enables a significant reduction in energy consumption and contributes to a more sustainable workflow.

In parallel, Ambrovit has overhauled its digital presence with the launch of a completely revamped online catalog. This smart, intuitive, and highly functional tool has been designed to provide a simple and personalized navigation experience that can guide both industry professionals and end customers through the process of selecting high-quality screws, bolts, and fastening systems. The new digital catalog is not simply a technical update: it is a true support tool for daily work, accessible from any device, loaded with informative content, and designed to meet the needs of an increasingly dynamic and complex market.

www.catalog.ambrovit.it

In addition to the “GoEasy!” retail project, which marked a major breakthrough in product distribution, Ambrovit continues to invest in innovation to strengthen its leading position in Europe. The company is recognized for its ability to anticipate industry challenges and for its ongoing commitment to supporting customers by providing integrated solutions and dedicated consulting. In a context of rising operating costs, stricter environmental regulations, and increasingly fierce industrial competition, Ambrovit stands out as a reliable and strategic partner. Through personalized services, ongoing support and cutting-edge technology, the company helps its customers to improve operational efficiency, reduce waste, and adopt more sustainable practices.

Looking ahead, Ambrovit's vision for 2026 focuses on significantly evolving its brand and communication approach. The concept for the new ADV campaign is based on one key innovative idea: to lock in on social issues and informative visuals as levers to effectively communicate the company's services, activities, and products. This represents a clear departure from classic self-referential campaigns, to embrace communication that is more authentic, engaging, and relevant to the true dynamics of the market and society in general.

Through this new language, Ambrovit intends to emphasize its central role in the direct and indirect markets in which it operates, reinforcing its image as a brand that is attentive to and participates in social and industrial transformations. The 2026 campaign will therefore serve as a tool to not only share news about products and technical solutions, but also talk about human value, social commitment, and responsibility toward a more sustainable and innovative future. Because behind every product delivered is the careful and meticulous work of a team of “hidden heroes” who ensure quality, safety, and strict control: core values that maintain Ambrovit's impeccable reputation.

This new communication strategy perfectly complements the company's philosophy, which has always focused on excellent quality and reliability and constant care for people: customers, employees, and business partners. As such, Ambrovit aims to consolidate its positioning as a global benchmark in the industrial supply sector, anticipating new market needs and building value in a sustainable and lasting way.

In summary, Ambrovit closed 2025 with a clear and concrete vision: to continue to innovate in order to simplify processes, to grow with the determination to be closer to its customers, and to communicate with authenticity and responsibility. 2026 will be the year in which this vision will take shape through more direct and meaningful dialogue with the market, making Ambrovit not only a supplier of excellence, but also a key player in the challenges and opportunities of the future of industry and society as a whole.

Denmark is often underestimated when you look only at its population (≈5.9 million) and think “small market.” That’s the wrong lens for fasteners. The right lens is: what industries in Denmark consume high-spec fasteners?

The country hosts leading offshore wind developers and turbine OEMs (Vestas, Ørsted as project developers and integrators), a strong maritime and ship-repair cluster, advanced food and pharmaceutical equipment manufacturing, and a sophisticated construction sector focused on durable and sustainable solutions. These sectors need premium fasteners — stainless, duplex/super-duplex, high-strength bolts, and coated corrosion-resistant solutions — often in traceable, certified formats (EN/ISO standards, material certificates, and batch traces). The offshore wind pipeline — new tenders and maintenance for existing farms — alone creates longterm predictable demand for millions of specialized fasteners and structural bolting systems. 1

Denmark’s imports of bolts and screws are substantial. In 2024, the country imported USD 321.5 million worth of fasteners, totalling 64.5 thousand tons. In the same year, Denmark exported more than 33 thousand tons of fasteners, valued at USD 239 million. That reflects a steady reliance on foreign suppliers for many fastener types. Denmark is not a low-margin bulk screws market. Success hinges on technical differentiation, certification, and supply reliability.

Industry analysts project a steady growth path for Denmark’s industrial fasteners market (cited forecasts show CAGR estimates in the 4–6% range until 2030 driven largely by renewables, construction refurbishment, and manufacturing upgrades). These forecasts reflect higher-end fastener demand (special alloys, coated products) rather than commodity low-cost screws alone.

Denmark imported USD 321.5 million worth of fasteners in 2024.

Now look at the distribution:

• Germany: 113,115 thousand USD → 35.2% of Denmark’s total imports.

• China: 33,617 thousand USD → 10.5% of Denmark’s total imports.

• United Kingdom: 25,972 thousand USD → 8.1% of Denmark’s total imports.

• Sweden: 22,697 thousand USD → 7.1% of Denmark’s total imports.

• Taiwan: 22,560 thousand USD → 7.0% of Denmark’s total imports.

These five suppliers alone accounted for 68% of Denmark’s fastener imports.

2024 Denmark’s Fastener Import/Export Values

▓ Import: 321.5 million USD

▓ Export: 239 million USD

Denmark’s Import Market Structure

321.5 million USD

▓ Germany: 35.2%

▓ China: 10.5%

▓ United Kingdom: 8.1%

▓ Sweden: 7.1%

▓ Taiwan: 7.0%

▓ Other countries: 32.1%

Germany supplies over one-third of Denmark’s total fastener imports. That only happens when:

√ Proximity and delivery time matter more than price.

√ Industrial customers require strict certification.

√ Supply chain reliability is critical.

√ Long-term purchasing contracts dominate the category.

If any country is planning to compete with German suppliers, they need an argument beyond cost.

China supplies 10.5% of Denmark’s market. Given China’s role as the global low-cost producer, the number is lower than what one might expect.

This means:

√ Denmark is cautious with quality-critical imports.

√ There may be EU tariffs, standards, or buyer preferences holding China back.

√ Lead times and reliability still matter in this industry.

The UK, Sweden, and Taiwan Form the

Each contributes 7–8% of the market. They are not dominant, but they are not marginal either.

They likely serve:

√ Specialized fasteners

√ Niche certifications

√ Automotive or machinery-specific components

The market is fragmented at the technical level even though the top supplier dominates volume.

Total exports: USD 239.4 million (M).

Top destinations:

• Germany: 52.5M (21.9%)

• United States: 27.2M (11.3%)

• United Kingdom: 20.4M (8.5%)

• Sweden: 16.9M (7.1%)

• Norway: 16.4M (6.9%)

• China: 14.5M (6.1%)

These six countries together make up 62% of Denmark’s fastener exports.

Germany is Denmark’s largest export destination and the largest supplier to Denmark.

This usually means:

√ The supply chain between Denmark and Germany is deeply integrated.

√ Companies on both sides are part of the same manufacturing networks.

√ There may be reprocessing or value-added steps (import → refine → re-export)

This pattern is typical in precision engineering, automotive parts, and machinery.

The U.S. buying USD 27M from Denmark is meaningful. The U.S. does NOT import high-value fasteners from everyone. They buy when:

√ The product is highly specialized.

√ Certification requirements are stringent.

√ Supply reliability is essential.

√ The supplier has strong reputation.

This indicates Denmark isn’t just trading commodities.

There is a niche, value-added manufacturing capability inside the country.

239.4 million USD

▓ Germany: 21.9%

▓ United States: 11.3%

▓ United Kingdom: 8.5%

▓ Sweden : 7.1%

▓ Norway: 6.9%

▓ China: 6.1%

▓ Other countries: 38.2%

Sweden and Norway together imported USD 33.4M, about 14% of Denmark’s exports.

This is expected because:

√ These markets are geographically close.

√ They share industrial standards.

√ They have machinery, maritime, and construction sectors with similar needs

Proximity alone doesn’t guarantee this level of trade, but Denmark’s producers are trusted in the region. Quality over price.

China is the world’s biggest producer of fasteners, yet it imported USD 14.5M from Denmark.

That doesn’t happen unless Denmark makes things China cannot easily produce.

Denmark holds technological or certification advantages in selected segments.

Possible reasons:

√ Aerospace or defense-certified fasteners

√ High-spec, corrosion-resistant marine fasteners

√ Custom precision-engineered components

√ Niche production for European OEMs operating in China

Denmark is a global leader in offshore wind development and continues to open large tenders: the Danish Energy Agency recently announced tenders for three offshore areas totalling at least 2.8 GW (Contracts-for-Difference model). This kind of pipeline produces large, concentrated demand for heavy structural components.2

Denmark’s maritime cluster (shipowners, repair yards, and marine equipment manufacturers) relies on corrosion-resistant fasteners and custom bolting solutions (e.g., for retrofits, deck machinery, hull joints). In 2024, Denmark was a top-ten global maritime nation with 740 ships flying the Danish flag and a fleet tonnage of 60.5 million tons. While its traditional shipbuilding capacity has decreased, the industry's overall size is strong due to its leading position in maritime equipment manufacturing, design, and repair services.

Denmark stands out as a high-value fastener market not because of its size, but because of the industries that anchor its economy. Offshore wind, maritime engineering, pharmaceutical machinery, and advanced construction collectively create a level of technical demand that few countries of similar population can match. These sectors require certified, traceable, corrosion-resistant, and highstrength fasteners — the kinds of products that reward capability, not low-cost competition. The country’s import profile, dominated by Germany and other European producers, reinforces that buyers prioritize reliability, standards compliance, and consistent delivery over price alone.

The pharmaceutical market in Denmark is expected to reach a projected revenue of US$ 19,029 million by 2030 3. A compound annual growth rate of 6.5% is expected of Denmark's pharmaceutical market from 2025 to 2030. The combined market for food and pharmaceutical machinery in Denmark was estimated to be around US$3.78 billion in 2025. This figure is based on the 2025 projection for the broader "Industrial Machinery Manufacturing" market, as specific, up-to-date data for just food and pharmaceutical machinery is not readily available for 2024. This broader market is expected to have a compound annual growth rate of 0.18% through 2029. 4

Denmark’s construction sector is focused on renovation, sustainable materials, and quality builds. Indices and statistical series from Statistics Denmark point to active construction indices (residential, civil engineering, maintenance/renovation) that sustain demand for structural bolts, anchors, and specialty fasteners used in façade systems, bridges, and public infrastructure.

The Danish construction and civil engineering market was valued at approximately US$46.19 billion in 2024. The market was predicted to grow to US$51.97 billion by 2025 and is supported by government initiatives and green development projects.

At the same time, Denmark’s export structure reveals a deeper layer of opportunity. The country not only imports premium fasteners but also produces specialized components trusted by top-tier markets such as the United States, China, and the Nordic region. This confirms the presence of high technical standards within Denmark’s industrial ecosystem and positions the country as a strategic gateway to the broader Northern European market. For fastener suppliers capable of meeting stringent specifications, Denmark represents a stable, growing, and technically sophisticated market where strong positioning and certification can translate to long-term, defensible business.

1. https://www.iea-wind.org/wp-content/uploads/2024/11/Denmark_2023.pdf

2. https://ens.dk/en/press/danish-energy-agency-opens-tenders-three-new-danish-offshore-wind-farms

3. https://www.grandviewresearch.com/horizon/outlook/pharmaceutical-market/denmark

4. https://www.statista.com/outlook/io/manufacturing/industrial-machinery-manufacturing/denmark

Copyright owned by Fastener World / Article by Behrooz Lotfian

Sweden, as one of Europe’s most industrialized nations with a diversified manufacturing base, offers a fertile ground to examine demand potential for fasteners. By analyzing Sweden’s industry structure, output, and key industrial segments, we can identify where fastener demand likely concentrates — which may offer useful signals for suppliers, traders, or exporters.

According to a recent sector breakdown, the industrial sector (which includes manufacturing, mining, energy, construction) contributed about 22.6% of GDP in 2024. More narrowly, manufacturing value added reached US$ 84.15 billion in 2024. Historically, manufacturing has accounted for nearly 20% of GDP.

Within manufacturing, traditional heavy industry segments, such as steel (basic metals and metal products), automotive, industrial machinery, and metal fabrication, remain substantial contributors. Sweden’s “advanced manufacturing/industrial engineering” sector is estimated to be about US$ 40 billion, contributing significantly to exports. Around 75% of Swedish exports reportedly come from manufacturing/industrial engineering.

The manufacturing sector also provides employment to a large workforce — many hundreds of thousands: some sources estimate around 700,000–800,000 people employed in manufacturing in recent years. This broad industrial base implies that Sweden remains heavily reliant on production sectors where mechanical joining (fasteners) is essential.

Sweden’s industrial profile is broad and heavy duty — exactly the kind that generates sustained demand for fasteners across many use cases. Sweden’s industrial diversity spans:

• Metals and Basic Metal Products:

Every metal fabrication job, whether building a steel structure, frame, machine casing, sheet metal housing, or heavy-duty structural parts, requires fasteners or welded assemblies, including steel production, metal processing, and metal fabricated goods. In 2024, Sweden's metals and basic metal products industry had revenues of approximately US$9.2 billion, with a 0.9% contraction in the industry. Ore production was just over 80 million tonnes, a 5% decrease from 2023, though the number of active mines increased to thirteen. Despite production declines, Sweden remains a leader in sustainable and fossil-free advanced metallic material production, supported by its natural resources and energy system. 1

• Automotive and Transport Equipment Manufacturing (vehicles, trailers, semi trailers, heavy vehicles): It is part of “motor vehicles and transport equipment” classification within manufacturing. In 2024, Sweden's automotive and transport equipment manufacturing industry had an estimated revenue of US$5.2 billion and produced 270,500 units, representing a decline from previous years due to the transition to electric vehicles. The sector employed approximately 60,400 full-time equivalent employees in 2023, with a significant export value of approximately 14% of total Swedish goods exports in 2022, notes Sharing Sweden. 2

Metals and Basic Metal Products

Automotive and Transport Equipment Manufacturing Construction and Infrastructure

Sweden’s Diversified Heavy-duty Industries Aerospace Industry

Forest based Industries Industrial Machinery & Equipment, Mechanical Engineering, Automation Equipment, Metalworking

• Industrial Machinery & Equipment, Mechanical Engineering, Automation Equipment, Metalworking: The Sweden Industrial Process Automation Market size was valued at US$390.6 million in 2024 and was projected to grow to US$407.9 million by 2025. Additionally, the industry is expected to continue its growth trajectory, reaching US$ 446.4 million by 2030, at a CAGR of 2.25% from 2025 to 2030. 3

• Forest based Industries, Including Timber, Pulp/Paper, Wood Products, and Wooden Building Materials: In 2024, Sweden's forest-based industry was a major economic force, with exports valued at US$19.6 billion, representing about 85% of its products. The industry is a significant employer,

1 https://www.sgu.se/en/about-sgu/news-from-sgu/2025/june/swedish-mining-industry-continues-togrow--despite-decreased-ore-production-in-2024/#:~:text=The%20ore%20production%20in%20 Sweden,extending%20the%20lifespan%20of%20mines.

supporting 140,000 jobs, and consumes approximately 15% of Sweden's total electricity for its operations, which are largely powered by bioenergy. The sector has also invested billions, with US$ 6.9 billion invested between 2020-2024. 4

• Aerospace Industry: In 2024, Sweden's aerospace industry was valued at approximately US$14 billion (Market Cap) and had a 2021 sales revenue of about US$2.586 billion, with projections to reach US$5.24 billion by 2033. The sector is driven by a strong focus on defense, with companies like Saab experiencing significant order growth. It also has a leading role in the development of electric aviation technology, with initiatives like ELISE (Electric Aviation in Sweden).

• Construction and Infrastructure: It is especially given the importance of construction in complementing industrial activity and urban development. In 2024, the Swedish construction industry's value was around US$ 49.30 billion, with a notable but shrinking transportation infrastructure sector valued at approximately US$ 16.86 billion. While residential construction declined significantly due to high interest rates, investments in transportation and energy are expected to provide some support to the overall market, which is projected to shrink by about 3.9% in real terms for the year. 5

Quantitative Perspective:

Sweden’s import profile in 2024 shows a sharply concentrated sourcing pattern. Out of a total of US$ 525.2 million, Germany accounted for more than a quarter with US$ 142.4 million. The reasons may be: Germany sits close, offers stable logistics, and holds a strong reputation for industrial reliability.

More interesting is the second tier. Taiwan, at US$ 79.9 million, has secured a position far beyond what its size suggests. This isn’t an accident; it reflects specialization, consistency, and the kind of high-precision manufacturing that buyers can rely on. China, despite its global manufacturing scale, trailed at US$ 46.7 million. This gap points to a purchasing environment where quality, trust, and technical standards matter as much as price—areas where Taiwan tends to outperform.

Italy’s US$ 41.9 million formed the tail of the top exporters, reinforcing a pattern: Sweden relies on partners that deliver engineering quality, predictable supply chains, and regulatory alignment. The hierarchy isn’t driven by sheer production capacity but by assurance, precision, and consistency.

Sweden’s Fastener Export Reach (USD)

Importers

Sweden’s outward trade flows in 2024, totalling US$ 399.8 million, reveal a pattern that is anything but random. The country’s export footprint is broad, yet its commercial gravity remains firmly regional.

Norway led with US$ 57.4 million, a familiar result given tightly integrated Nordic supply chains and low logistical friction. But notice the next positions: the United States at US$ 41.3 million, followed closely by Germany at US$ 33.1 million. This mix tells you Sweden succeeds where established trust, regulatory compatibility, and demand for advanced, reliable goods converge.

The presence of Denmark (US$ 29.6 million) and the United Kingdom (US$ 25.2 million) reinforce the point: Sweden’s strongest markets are countries that value quality over scale and place a premium on dependable long-term partners. These are not markets won by price competition alone; they’re shaped by technical standards, cultural proximity, and industrial alignment.

In short, the numbers expose a highly stable export ecosystem—broad internationally, but with undeniable concentration among Sweden’s closest economic and regulatory allies.

Taken together, Sweden’s industrial structure and its trade patterns point to a market where fastener demand is anchored in long-standing, technically demanding sectors rather than speculative growth pockets. Heavy industries such as metals, automotive, machinery, and forest-based manufacturing continue to dominate both output and employment, ensuring a consistent baseline need for mechanical joining solutions. Even in segments facing cyclical pressure— construction, vehicle production, or basic metals—the underlying engineering intensity remains high. These industries cannot function without reliable fastening systems, meaning suppliers who match Sweden’s expectations for precision, certification, and supply-chain stability will remain relevant despite short-term fluctuations.

The country’s import and export dynamics reinforce this industrial profile. Sweden relies on partners known for quality and engineering standards, not cheap volume, and its outward trade is the strongest with regions where industrial expectations mirror its own. This alignment suggests that the Swedish fastener market is not simply large—it is selective. For foreign suppliers or exporters, the opportunity is real but contingent on meeting the technical, regulatory, and reliability thresholds that Swedish industries treat as non-negotiable. In essence, the data describes a market where demand is robust, but access must be earned through capability rather than price.

2 https://sharingsweden.se/app/uploads/2024/11/SI_IP_Transport_Overview_241101.pdf

3 https://www.nextmsc.com/report/sweden-industrial-process-automation-market

4 https://www.nextmsc.com/report/sweden-industrial-process-automation-market

5 https://www.nextmsc.com/report/sweden-construction-market#:~:text=Sweden%20 Construction%20Industry%20Overview%20The%20Sweden%20 Construction,CAGR%20of%206.6%25%20from%202025%20to%202030.

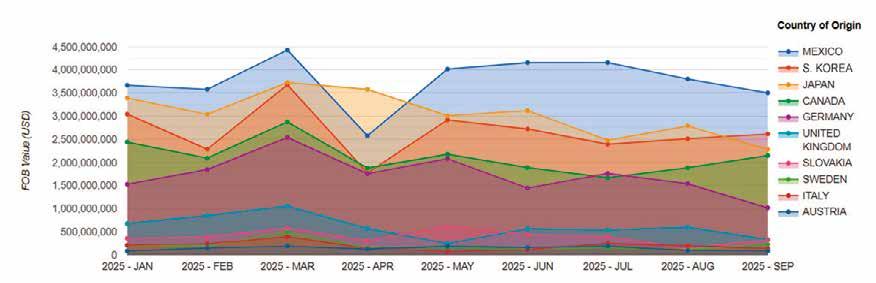

As Taiwan's largest fastener export destination, the U.S. since 2025 has undergone structural changes in its external fastener procurement amid intensifying international political, economic, and trade competition. This poses unprecedented challenges to Taiwanese fastener makers' overseas orders and profit margins. As China’s tensions against the U.S. and relations become the new norm, the restructuring of global fastener supply chains is now firmly established and becoming long-term and frequent, requiring Taiwanese businesses to accelerate their transformation to adapt to it.

In his address, Chairman Tsai stated: "Facing challenges like U.S. tariffs and the EU's CBAM, businesses must stay united, accelerate transformation, and grit their teeth to push through. Over the past two years, the industry has faced unprecedented volatility in costs, order demand, and exchange rates. We must consolidate domestic team strength, regain our footing, and seize the initiative in the next wave of opportunities. I call on fastener industry veterans and second-generation successors to join hands and fight for Taiwan's future!"

To assist Taiwanese fasteners industry to compete through a group model, TIFI will once again form the Team Taiwan, continuing the success made in the IFE show. Again, TIFI will establish "Taiwan Quality Fastener Pavilion" at Taiwan International Fastener Show, IFE (Phoenix, U.S.), and Fastener Fair Global (Stuttgart, Germany) in 2026. TIFI will also organize a group to exhibit at FASTENER POLAND®, promoting Taiwan's high-value fastener businesses, products, and services to visitors and buyers worldwide. All TIFI members have been invited to join and participate.

The event drew a distinguished gathering, including Kaohsiung Mayor Chen Chi-Mai, Economic Development Bureau Director Liao Tai-Hsiang, Metal Division Chief Guo Yan-Yun from the Industrial Development Bureau, and Secretary-General Chiang Tsung-Yi of Taiwan Steel Wire & Wire Rope Industries Association. Mayor Chen delivered remarks to boost morale, instructing the Economic Development Bureau to provide full administrative and resource support to help businesses overcome obstacles—even amid turbulent waves—with government backing. Chairman Tsai expressed gratitude to members for not giving up amid challenges and firmly breaking through, while specially thanking the government for supporting Taiwan's fastener industry development. He wished everyone prosperity at the end of the journey and a new peak ahead.

Additionally, the Assembly featured a lecture on "Corporate Resilience and R&D Transformation Guidance," covering key areas members need to know: "Dual-Axis Transformation" (green design, energy-saving and carbon reduction), "Technology Value-Add" (new processes, new materials, high-precision products), "Cross-Boundary Integration," and "Marketing Deployment" (product certification, channel development). Businesses facing client demands to absorb tariffs, cargo returns, order cancellations, or delays—even without export operations—can apply for related assistance.

Amid international economic and trade challenges, TIFI leads members forward steadily. Through the united power of the Team Taiwan, it helps businesses seize new export opportunities and jointly forge a stable future for the fastener industry.

TIFI (Taiwan Industrial Fasteners Institute) Member Assembly was grandly held on December 18, 2025, at the "Enjoy Your Life Banquet Hall" in Gangshan, Kaohsiung City. TIFI Chairman Mr. Yung-Yu Tsai emphasized the TIFI role in helping Taiwanese businesses turn the tide in this critical survival battle. Since taking office, he has actively linked TIFI with the Ministry of the Interior, Ministry of Economic Affairs, Kaohsiung City Government, and others, articulating the export challenges faced by fastener businesses to various government agencies and securing their support. This has enabled TIFI to lead numerous Taiwanese fastener companies in forming a "Team Taiwan," realizing the vision of creating "Taiwan Quality Fastener Pavilion" to unite Taiwanese exhibitors under one roof and shine at major global trade shows. Copyright owned by

TIFI and Taiwan CSC held the final year-end production & sales networking event for the fastener industry on Dec./05 2025 at the Taiwan CSC Headquarters in Kaohsiung. TIFI Chairman Yung-Yu Tsai and Vice Chairman Simon Lin, along with Taiwan CSC Vice President of Sales Tung-Chieh Chuang and Sales Department Director Po-Han Chen, were present to discuss current domestic and international industry conditions and shared positive developments for enhancing competitiveness and expanding future international marketing amid the current market downturn with over 100 fastener industry representatives.

Chairman Yung-Yu Tsai stated that 2025 has been the most challenging year for Taiwanese fastener industry, but he believes this is not necessarily a bad thing, as such competition will enable the industry to build greater resilience to tackle market challenges. He emphasized that business owners have no time for lamentation and they must adjust their mindset to steer companies toward positive growth. Over the past few years, as Chinese and Vietnamese competitors vied for market share and rivals from India and elsewhere pressed closer, some domestic Taiwanese factories indeed succumbed to the pressure and closed down. However, those who have survived must now seize the moment to assess whether their production, delivery, and overall capabilities are sufficient to meet future market order demands.“Don't wait until the Russia-Ukraine War truly concludes to realize your delivery lead times have stretched beyond a year!”

Taiwan CSC reps noted that external pressures this year including U.S. reciprocal tariffs, steel & aluminum duties pursuant to Section 232, and the sharp short-term appreciation of New Taiwan Dollar (NTD) have sent shockwaves through the industry, with occasional reports of poor order intake and factory closures. Not only have tariff issues caused customer orders to freeze and shrink, but profits generated earlier in 2025 from overseas customers shifting orders have also been eroded by the rapid NTD appreciation. Although the fastener market has been sluggish for 3 years, signs of urgent orders showing gradual

replenishments in the market are now visible. Pressure from the NTD appreciation is also easing. Additionally, the Bank of Japan's potential consideration of yen appreciation could boost the competitiveness of Taiwanese exports. A market turnaround and recovery can be anticipated in the future. Taiwanese downstream steel-related industries possess strong management capabilities and sufficient competitiveness, just awaiting the right timing to flourish. It is believed that as long as the Russia-Ukraine War and Middle East conflicts could be resolved swiftly, and the international situation could stabilize 2026, the performance of the steel market and related industries should improve progressively.

Speaking of the widespread lamentations of the market, where companies are desperately waiting for orders, Chairman Tsai emphasized, “Market crises are no excuse. The real problem lies in lacking self-confidence!” He believes that making profits during good times is expected, but demonstrating resilience during downturns is what truly reflects the strength of Taiwanese industries. At this stage, companies should not focus on fiercely competing for orders. Looking at factories in the US, Japan, the UK, and Germany, they also face market challenges yet thrive. How dire could the crisis be for Taiwanese factories? Instead, this wave of challenges should be seized as an opportunity to thoroughly refine and strengthen corporate fundamentals.

Chairman Tsai also announced plans to expand marketing efforts for Taiwanese fastener industry at the Taiwan International Fastener Show in April 2026 and the IFE in October 2026. He encouraged companies to abandon the practice of undercutting prices to capture market share, urging them instead to collectively showcase at int’l exhibitions how Taiwanese superior fastener enterprises are advancing with the times, which involves demonstrating their robust capabilities in carbon reduction and environmental protection, highlighting their close integration with global corporations, etc. Chairman Tsai stated that TIFI's stands at the Taiwan International Fastener Show 2026 will be even bigger. TIFI will also select 4 companies for enhancing their promotion. At the IFE, the number of stands booked by TIFI will also expand to 12 booths, and TIFI will exclusively select 8 companies to feature their fasteners for more brand awareness. Specially arranged staff will be on-site to provide introductions. TIFI’ s stands at both shows will also allow non-exhibiting companies to apply for catalog placement. Companies may directly register to engage with clients through assistance from TAITRA personnel. Additionally, the Metal Industries Research & Development Centre (MIRDC) team will be present to offer technical consultations. Additionally, in response to China's market expansion, TIFI is actively coordinating with MIRDC to share resources and guide Taiwanese manufacturers in developing high-value products like SEMS screws to expand into the U.S. market. Chairman Tsai emphasized that with the U.S. actively promoting manufacturing reshoring, the next two years present the optimal timing for Taiwanese fastener industry to gain more market share. Companies must seize this opportunity to consolidate their market positions. Particularly as Taiwanese government has offered various resources available for application, businesses should leverage these resources to enhance competitiveness through initiatives like energy saving, carbon reduction, and advanced equipment upgrades.

Regarding the wire rod & coil pricing for Q1 2026, which is the primary concern for industry players in attendance, Chairman Tsai stated that Taiwan CSC holds significant influence among global steel mills and possesses a far clearer understanding of global steel market trends than any individual company. Based on past experience, if CSC reduced its price, Chinese steel mills would follow suit. Given that some Chinese screw prices in the market are already as low as Taiwan CSC's wire rod quotations, Taiwan CSC should have the wisdom to set optimal pricing that allows long-term supporters to sustain their operational momentum.

Taiwan CSC reps stated that they understand many manufacturers continue to enhance competitiveness and create more favorable conditions by refining personnel training and upgrading/maintaining equipment. Taiwan CSC is also striving toward equipment renewal and material development, with more tangible results expected by 2026. Although current market signals remain mixed, China's wire rod trends remain a key influencing factor. However, positive developments are increasingly prevalent, including sustained inventory reduction and the emergence of urgent orders in the market. Should the Russia-Ukraine War conclude, raw material supply and demand begin to balance, and Taiwan-U.S. tariff negotiations yield clearer positive outcomes, the industry should witness improved prospects.

Copyright owned by Fastener World / Article by Gang Hao Chang, Vice Editor-in-Chief

The Overseas Information Committee of Fasteners Cooperative Association of Kansai (Western Japan) led a delegation of 7 members on a tour to Manila, Philippines, from October 22 to 24, 2025. The purpose was to gain insights into local market dynamics and business environment while exploring potential future collaboration opportunities.

The group departed from Kansai International Airport and, upon arriving in Manila, they toured the historic Intramuros district first to experience remnants of the Philippine colonial era. The following day, the delegation visited Yamaguchi Nut Philippines Corporation (affiliated with Japan's Yamaguchi Nut Company), where they received a company overview and details on future development plans. Discussions focused on Philippine market trends and business challenges, followed by a tour of the nut factory to examine production processes. The group then proceeded to Philippines Ogami Corporation (affiliated with Japan's Ogami Co.), listened to a company briefing, and conducted a tour of the mold factory to gain a deeper understanding of local operations.

After concluding the tour, the delegation returned home from Manila. This activity not only gathered valuable overseas information but also strengthened ties between Japanese and Philippine companies, contributing to the association's future internationalization efforts.

According to the 2025 Overseas Activities of Japanese Companies in North America survey, released by the Japan External Trade Organization, the study indicates that under Trump’s tariff policies, the profitability structure and supply chain configurations of Japanese companies in North America are at a major turning point. The survey highlights the high volatility of the North American business environment, with firms reconfiguring supply chains and business strategies to cope with new tariffs and market risk.

The survey notes that while about 66.5% of Japanese companies in the U.S. still expect to achieve operating profits in 2025, the proportion of improved profit prospects has declined compared with 2024. This reflects how tariff-driven cost

increases and market demand uncertainty are eroding profitability. Firms are more inclined to source materials and components locally in the U.S. to alleviate cost pressures, a shift that has doubled compared with 2024. In terms of the supply chain, an increasing number of companies are considering relocating production bases to the U.S. By 2025, 34 firms stated they are reviewing such adjustments—the highest figure since 2019. This move is driven not only by tariff pressures but also by strategic aims to bolster North American competitiveness and shorten supply chains.

Furthermore, facing labor shortages and rising personnel costs, firms must balance cost control with market expansion. The majority of Japanese companies in the U.S. still plan to expand their business over the next 1–2 years, indicating that the North American market remains strongly attractive in the long term despite policy pressures.

Criticize: Carbon Border Tax Too Lenient on

Starting in 2026, the EU imposes carbon fees on cement, iron, steel, aluminum, and fertilizers imported from countries with weaker emissions standards, ensuring "dirty" imports do not gain unfair advantages. EU domestic products must pay around €80 per ton of CO 2 European high-energy-intensive industries are deeply concerned that the CBAM is too soft on heavily polluting imports from China, Brazil, and the US, undermining the mechanism's original purpose.

The main challenge lies in foreign producers not providing precise emissions data, so the EU plans to use default formulas for calculations. Drafts show that default emissions values for Chinese steel products are even lower than EU equivalents, sparking industry criticism. Green steelmaker Stegra is surprised that some EU production routes have "higher emissions than China" and suggests adjusting the values.

Industry warns that low default values will weaken incentives for clean production, allowing high-emission imports to enter the market at low carbon costs, potentially backfiring. CBAM Alliance Acting Chair Leon de Graaf stresses that default values should be set high to "punish" those not reporting real data, or importers will lack motivation to comply. Incorrect values could harm EU producers for two years.

In response, Chinese media reports that these European industry figures overlook China steel sector's green transformation achievements, claiming that by 2024, China's steel industry had 660 million tons of capacity engaged in energy efficiency benchmarking, saving 105,000 tons of standard coal annually per 10 million tons of capacity—totaling 10.5 million tons saved and 27.5 million tons of carbon reduced yearly, equivalent to the annual carbon sink of 570 million trees. China's Ministry of Commerce has urged the EU to uphold fairness, transparency, WTO rules, minimize trade disruptions, and avoid protectionism and green trade barriers.

The EU will not grant the UK a CBAM exemption unless the two sides formally link their emissions trading systems. UK government estimates indicate that from 2026, this will burden British industry with around £800 million in annual carbon fees, plus heavy administrative requirements like emissions reporting, verification, and certification—similar to post-Brexit paperwork surges.

Limited relief may apply to UK electricity exports. The EU recognizes higher UK electricity generators’ carbon costs, exempting them in principle from CBAM fees, welcomed by the UK government. However, steel, cement, fertilizers, and aluminum exports remain affected. Frank Aaskov, Policy Director for UK Steel, warned that CBAM would heighten competitive disadvantage amid global trade uncertainty. Although the carbon cost for hot-rolled wire is only €13 per ton, market prices are highly sensitive (around €650 per ton), and a €5 difference can determine a purchase decision. The impact is particularly large on small and medium-sized enterprises, making it hard to compete with low-cost imports from China. A UK government spokesperson reiterated prioritizing carbon market linkage to spare £7 billion in exports from CBAM fees. Industry fears eroded competitiveness, urging swift agreement.

The Canadian government has issued an official announcement imposing a 25% surtax on specified steel derivative products effective December 26, 2025. This measure applies to steel derivatives imported from all countries worldwide, aimed at protecting the domestic steel industry. Importers must declare and pay through the Canada Border Services Agency (CBSA). Goods in transit on the effective date are exempt. Affected fastener HS codes include: 731811, 731812, 731813, 731814, 731815, 731816, 731819, 731821, 731822, 731823, 731824, 731829.

Exemptions: Goods covered by existing surtax orders (e.g., China/U.S. steel surtax orders), casual goods, Chapter 98 goods, and in-transit goods.

Temporary Exemptions: Until July 1, 2026, goods for manufacturing motor vehicles or vehicle chassis, or parts/accessories thereof; goods for aircraft, ground flight simulators, or spacecraft, or parts thereof.

Remissions: Case-by-case relief available for goods unavailable domestically or causing severe economic impact. Existing U.S. import remissions temporarily extended through January-June 2026 (depending on use).

The Executive Yuan's Office of Trade Negotiations (OTN) states that Taiwan formally requested consultations under the WTO framework on December 15, 2025, targeting Canada's unfair import restrictions on fasteners and other steel products. The WTO announced this to member states on December 18. OTN acted on appeals by request of Taiwan Steel & Iron Industries Association (TSIIA), aiming to secure a fair competitive environment for Taiwanese businesses.

OTN notes Canada imposed a 25% tariff on global steel derivatives, severely impacting Taiwan's steel interests. TSIIA estimates total annual losses exceeding NTD1.7 billion, with the fastener industry facing an extra NTD1.3 billion tariff. OTN emphasizes steel's critical role in national defense and exports, but Canada's restrictions have heavily disrupted Taiwanese shipments. Taiwan has repeatedly raised concerns through bilateral and multilateral channels; while Canada respects Taiwan's rights, it has not proactively resolved the issues.

To prompt mutual benefit discussions, Taiwan activated the WTO dispute settlement mechanism. OTN highlights Taiwan and Canada as like-minded partners with signed agreements on double taxation avoidance, investment protection, and science/technology cooperation. Both should enhance collaboration to combat low-priced steel and illegal transshipment, upholding free and fair trade order.

Despite persistently falling export prices, China's fastener industry demonstrates strong resilience. According to the latest data, China's fastener exports reached 5.107 million tons in the first 11 months of 2025, up 7.5% year-over-year. Full-year exports are projected to grow substantially for the second consecutive year, though the average price stood at just USD 1.921 per kg, down 2.7% from the previous year.

January's exports soared to 587,339 tons, setting a historical single-month record. Volumes contracted sharply to 249,243 tons in February and fell further to 411,424 tons in October—the secondlowest monthly figure of the year. November saw a rebound to 493,438 tons, up 19.93% month-over-month and 4.31% year-overyear, approaching the 500,000-ton mark and signaling demand recovery.

On pricing, August 2024 plunged to USD 1.85 per kg—the lowest in 6 and half years. This year, January dipped to USD 1.857 per kg, while March briefly rose to USD 2.008 per kg, ending nine straight months below the USD 2 threshold. October and November slid again to USD 1.893 and USD 1.874 per kg, respectively, both annual lows. By contrast, December 2022 peaked at a record USD 3.278 per kg, with March 2023 at the second-high USD 3.205 per kg.

In 2024, full-year exports totaled 5.289 million tons, up 16.66%, but prices crashed 14.3% to USD 1.97 per kg. Analysts note that low pricing remains a key competitive edge, driving volume growth amid pricevolume divergence. Historical lows, like February 2023's 190,000 tons, underscore volatility, yet the overall upward trend bolsters China's global market share.

Taiwanese wire rod leader Chun Yu emphasized at its December 24, 2025 conference that vertical integration and global operations sustain its unbeatable edge in construction and industrial fasteners, with long-term low-carbon process strategies to meet international sustainability and supply chain demands.

Despite global economic cycles pressuring the fastener industry, Chun Yu maintains solid profitability. Gross margins held 14%-16% from 2022-2024, reaching 13.8% in the first three quarters of 2025, with operating profit margins above 4%, demonstrating strong cost absorption and pricing power amid raw material fluctuations and demand shifts. Taiwan remains the core market at 35%, followed by Hong Kong/China and Southeast Asia at 23% each, with Europe and the U.S. totaling 16%—high diversification reduces single-region risks.

Looking ahead, Chun Yu anticipates short-to-medium-term rate cuts spurring infrastructure investments and steel fastener demand; long-term focus shifts to low-carbon electric arc furnace processes and products, raising entry barriers. Upon economic recovery, the company stands ready to seize opportunities and generate peak profits.

Walsin Lihwa unveils its new stainless steel cold-finished bar brand "Steeval." The AI era ushers in a new chapter for metal processing, with Taiwan entering global supply chains for automation, new energy, robotics, and aerospace. "Steeval" signals the company's transformation from material supplier to comprehensive technical service solutions provider.

Taiwan's steel industry fueled the rise of its fastener kingdom. Facing precision manufacturing upgrades, Walsin Lihwa offers full-spectrum solutions—from products and processes to services. Its cold-finished bars hold top market share globally, featuring high machinability, cleanliness, wear/corrosion resistance, heat resistance, and soft magnetic properties. They support fasteners, automotive, aerospace, semiconductors, AI servers, and automation precision needs. The new brand initially integrates Taiwan and China production lines, with plans to incorporate premium European products for higher value.

By the end of 2026, China, Taiwan, and Europe cold-finished bar output will reach 180,000 tons annually: China monthly from 3,500 to 5,000 tons, Taiwan from 4,000 to 5,000-6,000 tons. Walsin Lihwa's annual stainless steel capacity is 1.3 million tons, with cold-finished bars at 10%—primarily targeting at automotive, rising to 13.8% targeting at new energy vehicles.

Packer Fastener, a premier distributor of threaded fasteners and industrial supplies, has unveiled its latest distribution hub in Pearl, strategically positioned to support the Jackson region. This state-of-the-art facility enhances service for commercial contractors, manufacturers, and fabricators throughout Mississippi and the Southeast U.S., with a particular focus on fast-growing industries such as data centers, electric vehicle battery and automotive manufacturing, power generation, and heavy industrial construction.

The opening represents a key step in Packer Fastener's expansion plans, driven by surging customer needs and the company's dedication to superior inventory access and responsive support. Linked directly to the Atlanta distribution center, the Jackson hub ensures procurement teams, project leads, and site managers maintain seamless workflows free from delays. "Expanding our footprint brings us closer to the communities we serve," stated Terry Albrecht, CEO of Packer Fastener. "With the backing of our robust Atlanta operations, this new Pearl location reinforces our role as a dependable partner for regional construction and industrial projects— delivering the rapid, reliable service our customers expect."

U.S. anchor bolt and nonstandard construction fastener manufacturer Portland Bolt has expanded its production plant in North Augusta, South Carolina. The facility has grown from 25,000 to 62,500 square feet, significantly boosting production capacity, enhancing service levels, and shortening lead times for customers across the Eastern U.S.

The expansion features a new hot-dip galvanizing line, delivering consistent, high-quality corrosion protection for Portland Bolt's products. This system not only streamlines internal manufacturing but also offers galvanizing services to external partners in industries including construction, infrastructure, fabrication, utilities, and transportation. "This expansion underscores our commitment to supporting

customers with unmatched speed, quality, and technical expertise," said Blake Ray, CEO of Portland Bolt. "By strengthening our East Coast presence and adding new capabilities, we're improving national coverage with greater rush-order capacity, faster turnaround times, and smoother production flows—enhancing our ability to meet urgent project demands and deliver industry-leading service." Operations VP Todd McGurk added that the additional space and equipment ensure even greater efficiency in producing, galvanizing, and shipping high-quality products.

MinebeaMitsumi will manufacture two types of fasteners to support Boeing's 737 MAX and 787 Dreamliner aircraft programs. Moving forward, the company will continue strengthening quality management and supply systems, maintaining high quality standards to contribute to the aerospace industry. The MinebeaMitsumi Fujisawa Plant originated as the factory of Tokyo Screw Manufacturing Co., Ltd., founded in Minato-ku, Tokyo, in 1898, and relocated to its current site in 1921. In 1981, it was absorbed and merged into Minebea Co., Ltd. Fujisawa Plant. Current main operations span aircraft fasteners and machined parts, measurement instruments with strain gauges as core technology, and products like railway/ industrial motors and electromagnetic clutches.

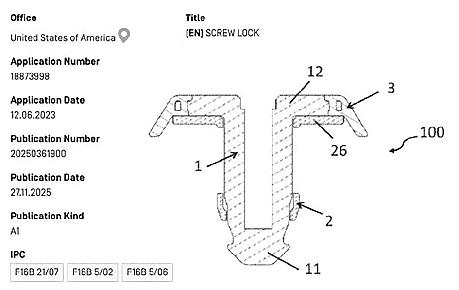

Carscoops reports BMW has publicly disclosed a patent for a custom screw head mimicking its iconic round logo. Unlike standard Phillips, hex, or Torx designs, if it goes to mass production it could mandate specialized tools for removal.

Patent illustrations show the screw head divided into four quadrants inspired by the brand emblem: two recessed, two flat or raised, creating a unique geometric profile operable only by matching bits. Documents stress conventional screws are easily manipulated by anyone; BMW aims to limit access to authorized personnel for operation, removal, or installation. The logo structure is non-replicable without permission, covering screws and tools. Primary applications target vehicle interiors: cockpitto-body connections, center console mounting, seat fasteners. Variants include half-round, countersunk, and cylindrical heads for enhanced visibility.

Carscoops notes such non-standard fasteners boost brand recognition but challenge mechanics and DIY owners—standard toolkits won't grip, requiring BMW-specific sets for critical parts. However, carmakers file many patents annually with many unrealized. This design, filed June 7, 2024, and published December 11, 2025, remains conceptual.

Whitesell Group—including Whitesell Corporation, Thread Rite Screw Products, Whitesell Supply, and Whitesell Precision Components—announces its new name “Altius Solutions, Inc.” as a North American powerhouse in engineered fasteners, components, and supply-chain management.

Over five decades, Altius has mastered an uncommon blend of in-house production, value-added distribution, and a robust global sourcing network. This integration enables delivery of precision fasteners, assemblies, fabrications, and Class C components with exceptional scale, adaptability, and seamless coordination unmatched by competitors. Customers gain flexible sourcing choices: inhouse cold heading, advanced machining, and sheet-metal fabrication for rapid control, or cost-effective global vendor partnerships cultivated for decades. Parts arrive as individual items, kits, assemblies, VMI, or 3PL services tailored to exact specifications.

Altius serves expanding sectors including aerospace, automotive, HVAC, energy, heavy equipment, and specialized industrials, partnering with leading OEMs and manufacturers. "Our name 'Altius' signifies 'higher,' embodying our daily commitment to excellence," stated Jason Albro, President of Altius. "This rebranding launches our next evolution phase. Customer trust remains our foundation—we stay dedicated to dependable solutions that empower confident scaling."

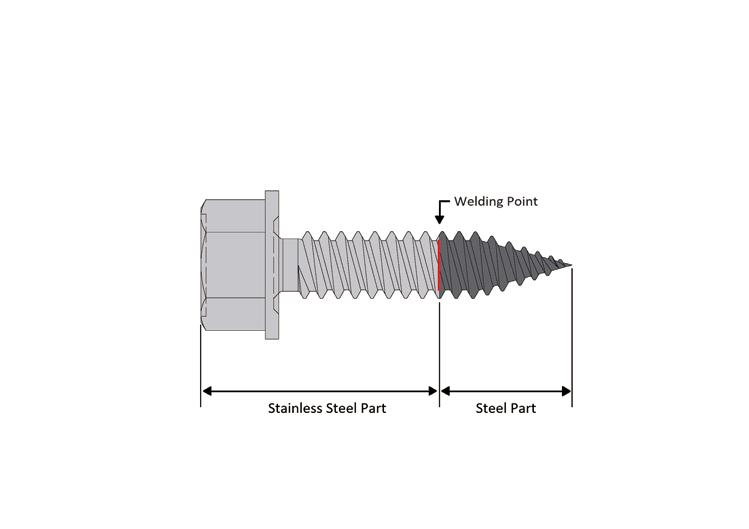

Tesla’s latest breakthrough targets a seemingly ordinary yet critical component: the fastener. This innovation not only ensures structural integrity for vehicles like Cybertruck but also transforms manufacturing processes. Combining different metals, such as stainless steel body panels with traditional fasteners, often triggers galvanic corrosion, leading to premature rust, especially in harsh environments. The Cybertruck's stainless steel exoskeleton faced this issue, as standard steel fasteners couldn't endure it, while stainless steel alternatives proved too costly and mechanically inflexible for mass production.

Tesla conceived a non-metal fastener system featuring a central rotating lock and flexible housing, completely avoiding metal corrosion problems. Through a unique mechanical leverage mechanism, these fasteners secure vehicle panels with unprecedented strength. High-strength glass fiber-reinforced polyamide polymers ensure durability, challenging the conventional belief that only metals provide reliable structural robustness. This system allows pre-assembly on parts to reduce assembly line labor and time. Snap-fit designs ensure stability during transport, optimizing logistics and processes. Though made of "plastic," these fasteners match metal endurance against high wind resistance and vibrations. Their reusable design facilitates easy removal and reinstallation, minimizing waste and demonstrating sustainability commitment. This technology supports the "Unboxed" modular manufacturing for future models like Robotaxi. Replacing metals with polymers yields major cost savings while maintaining quality and margins.

Seika Corporation announced it acquired 100% of the shares in Asahi Sunac—a manufacturer and seller of coating machines, die-casting machines, and precision cleaning equipment—on December 1, 2025, making it a subsidiary. The market has expectations of performance contributions. The two companies previously established joint ventures in Germany and Thailand. This acquisition aims to leverage Seika Corporation's expertise as a comprehensive machinery trading firm, deepening collaboration not only in sales but also in business development. The acquisition price was not disclosed.

Howmet Aerospace announced it has signed a definitive agreement with Stanley Black & Decker to acquire its subsidiary Consolidated Aerospace Manufacturing (CAM) for approximately USD1.8 billion in cash. CAM is a global leader in the design and manufacture of precision fasteners, fluid fittings, and other highly engineered products for aerospace and defense applications. The transaction qualifies for favorable federal tax treatment, delivering significant tax benefits to Howmet. Howmet expects CAM's fiscal 2026 revenue to range from USD485 million to USD495 million, with EBITDA margins exceeding 20% (excluding synergies). Including synergies and tax benefits, the transaction multiple is approximately 13x.

Howmet Executive Chairman and CEO John C. Plant stated: "The acquisition of CAM is an important step in expanding our differentiated fasteners portfolio. CAM's established brand, engineering expertise, and deep customer relationships perfectly complement this transaction, enabling us to serve aerospace and defense customers with a broader range of critical fastening solutions and create value for shareholders." The deal is expected to close in the first half of 2026. This move strengthens Howmet's leadership position in the high-demand aerospace market.

This move represents a key step in RCF's ongoing growth strategy, expanding its product range and enhancing its capacity to meet rising customer demand across multiple sectors. By integrating Lyndenway's expertise and product portfolio, RCF can now offer a broader selection of fasteners with improved efficiency and availability. Both companies share a longstanding commitment to quality, reliability, and exceptional customer service. The acquisition supports RCF's mission to invest in UK manufacturing, expand capabilities, and deliver the best possible solutions to customers.

RCF looks forward to the opportunities this deal brings, continuing to grow, strengthen its strengths, and uphold the high standards customers expect from RCF. As a key player in the UK fastener market, this transaction not only expands market share but also highlights the resurgence of domestic manufacturing, helping the company stand out in a competitive global supply chain.

Valley Fastener Group proudly announces the acquisition of Chicago Fastener, a strategic move that broadens its portfolio of companies and reinforces its dominant position in the fastener industry. For over five decades, Valley Fastener Group has earned its reputation as a reliable U.S.-based producer of semi-tubular and solid rivets, threaded components, and custom cold-formed specialties—all rooted in its renowned heritage of superior rivet solutions. The addition of Chicago Fastener enhances its ability to provide customers throughout North America with expanded production capacity, cutting-edge innovation, and unmatched value. This integration promises stronger service and growth opportunities as it continues to lead the market.

compiled by Fastener World

GameChange Solar, a leading U.S.-based provider of PV trackers and fixed-tilt racking systems from Connecticut, has unveiled an innovative twopiece rivet mounting solution compatible with its Genius series trackers. This alternative delivers faster field installation, reduced long-term costs versus bolt methods, and proven reliability through independent and internal lab testing.

The rivet system—featuring a rivet pin and tubular collar—employs a rivet gun for automatic locking and pin trimming, bypassing torque adjustments entirely. Unlike bolt connections through pre-punched holes that demand regular tightening for environmental resilience, this design ensures permanent tightness and durability. Targeted at EPC firms as a bolt replacement , the solution has passed rigorous UL 2703 testing for structural integrity, electrical grounding, and flat-type PV module performance. Certification came from third-party Intertek labs and GameChange's in-house facilities, with zero failures. Installation and removal tools were validated at the company's training center, confirming real-world deployment efficiency. This advancement streamlines solar project timelines while enhancing system longevity for developers.

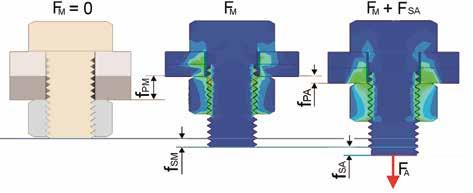

Keystone Electronics unveils an upgraded SEMS screw variant for its PCB screw terminals, designed to streamline wire connections and boost mechanical reliability in dense board assemblies. The pre-assembled SEMS screw enables secure fastening of wire leads—including bare wires—without the rotation issues common during tightening.

Rated for 15- and 30-amp applications, these terminals feature an anti-rotation, nonwobbling structure ideal for high-density PCB layouts. The SEMS screw incorporates a captive, free-spinning lock washer that preserves clamping pressure and stops wire spin under torque. Available in horizontal and vertical orientations, they suit diverse board configurations. Constructed from tin-plated brass, the terminals ship either fully assembled with SEMS hardware or as components for custom integration. Keystone distributes them via its worldwide network and e-commerce platforms, alongside its extensive interconnect solutions and custom machining, stamping, and assembly services.

Japanese YS Corporation has developed the "Tentacle® Nut", based on years of screw research that thoroughly analyzes nut loosening causes. This patented product is now expanding into the market. Designed like an octopus tentacle "firmly wrapping" bolts, it fits standard M6, M8, M10, M12, and M16 bolts, with the latest addition of M2 size for more precise applications. Loosening mainly occurs due to vibration causing cumulative thread gap shifts. "Tentacle Nut" uses a double-nut structure where the upper nut compresses the lower nut's protrusion, filling tolerance gaps to ensure axis alignment and no bolt damage. The lower nut manages torque and tension, with easy removal by reverse rotation from upper to lower. Ideal for vibrating machinery in factories, amusement rides, towers/bridges, or high-temperature sterile environments, it enhances safety and maintenance-free operation. In NAS3350 impact tests (30Hz, 30,000 vibrations) it retained over 80% tension; DIN25201 vibration tests (2,000 cycles) show no detachment with 94.3% residual tension, far surpassing standard nuts. Analysis confirms no self-rotation, achieving "never-loosening" bolt-nut combos with simple nut replacement.

World's First "Seal

Japanese Fuji Seira Company has unveiled the globally pioneering trademark-registered (No. 5757876) "Seal Up® Screw," featuring a largecontact-area flat sealing gasket automatically embedded in the seat's annular groove. This dramatically enhances waterproofing, oilproofing, and dust-proofing performance. Simply replace the screw to use immediately on existing equipment—no hole modifications needed. Key advantages include no gasket detachment: the inner thread diameter is smaller than the outer thread diameter for secure fixation. The gasket offers high adhesion volume for superior waterproofing. Even with larger pilot holes in workpieces (standard: nominal thread diameter +0.5mm Max.), it reliably compresses and deforms, enabling easy screw swaps. Performance rigorously verified: tightened in a sealed fixture under 115MPa water pressure (equivalent to 11,000m depth), confirming no leaks; withstands Mariana Trench pressure (10,994m depth), the world's deepest. Ideal for marine engineering, high-pressure environments, or precision machinery. Fuji Seira announces the addition of the Hex Socket Bolt “Seal Up Cap" variant to the series, enhancing sealing for hex socket bolts.

Key Features:

Nissen Corporation introduces the domestically pioneering titanium high-pressure blind rivet "N Valve Titanium", designed specifically for ultra-thin titanium sheets. Featuring a large-diameter back-side buckling structure, it effectively grips the parent material and significantly boosts bonding strength! Ideal not only for titanium-totitanium joining but also for areas demanding superior corrosion resistance, fully leveraging titanium's lightweight and durable advantages.

Tailored for titanium's common ultra-thin sheets, it employs a large back-side buckling shape to dramatically enhance thin-sheet joint performance. Perfect for lightweight vehicles, flying objects, aerospace fields, or medical devices, chemical equipment, and plant facilities that capitalize on titanium properties.

Japan’s First: Titanium high-pressure blind rivet, filling a market gap.

Large Back-Side Buckling Diameter: Especially effective for thin titanium sheets, with markedly improved bonding strength. Pure Titanium Material: Maximizes titanium's lightweight, high corrosion resistance, and biocompatibility advantages. The product pioneers new possibilities in high-spec titanium applications, advancing lightweight durability in aerospace, medical, and other cutting-edge sectors.

In the field of industrial equipment and machinery maintenance, bolt looseness inspection and position marking have always been crucial for ensuring safe operation. The industrial marker pen Shokue Pen, recently launched by Nejiya (Japan), enables workers to instantly determine if a bolt has loosened through clear markings. During routine patrols, simply checking if the mark has shifted allows quick assessment of equipment status, significantly reducing inspection time and the risk of human error. Additionally, during equipment repair or disassembly, the product serves as an alignment marker, helping technicians accurately realign to original positions during reassembly and ensuring the mechanism returns to its correct state. It is also suitable for confirmation marking after inspections or verifications, allowing subsequent personnel to clearly identify finished work areas.

In terms of specifications, the Shokue Pen features white ink for clear, conspicuous markings on various metal surfaces. It withstands temperatures up to 250℃ , making it ideal for highheat operating environments without degrading due to heat exposure. The pen tip produces a line width of about 2 mm, balancing precision and visibility for marking small bolts and parts.

LISI Group achieved sales of €1.44 billion for the first nine months of 2025, up 9.1% compared to the same period in 2024, with LISI AEROSPACE up 19% on the same period and LISI AUTOMOTIVE and LISI MEDICAL down 4% and 1.8% respectively.