All together at a new edition of the world’s leading organic food trade fair. It’s a pleasure to be here and feel part of this social, cultural and business movement. Producers, processors, distributors, journalists, politicians, activists, certifiers, all in a shared space and time to grow with the energy of BIOFACH.

If there’s one trade fair that transcends all the attributes we could think of, it’s BIOFACH. We come from all over the world to this leading event since its inception in 1990, drawn by its meticulous and efficient organisation, the endless variety of proposals and business opportunities, and the well-deserved interest generated by its Congress. Oh, and the opening ceremony, which demonstrates the joy and strength of the sector and is experienced as a celebration of the passion and effort that precedes and follows this shared experience.

BIOFACH 2026 is the event we’ve all been waiting for

It takes place from February 10th to 13th at the Nuremberg Exhibition Centre and is jointly organized by Nuremberg Messe, IFOAM Organics International, the membership-based organisation working to bring true sustainability to agriculture across the globe, and BÖWL, the German Federation of Organic Food Producers.

The organic movement and industry come together to meet and connect, to share ideas, and to be inspired by other exhibitors, visitors, and speakers at the Congress. These are days to experience intensely, marked by the pulse of the international organic market. It’s an opportunity to stay up to date on the latest regulations affecting the sector and to prepare actions that will help achieve objectives such as demanding fair prices that include environmental costs, adequately rewarding the environmental services provided by organic farmers, and fully aligning policies with sustainability goals, as highlighted by BÖWL.

The BIOFACH experience engages all the senses. An experience to see,

hear, smell, and taste. At each stand, and especially in the new product presentation area, we can explore the latest trends and innovations in organic food. Also, increased consumer awareness and technological development are driving the sector forward with products that meet market expectations and avoid toxins and excessive packaging.

In the halls, presentations, and at the Congress, the future of retail and out-of-home catering is being discussed, an increasingly relevant sector for transforming our diets towards sustainability and health. Keep in mind that in Germany alone, more than 17 million people eat out every day.

Once again, specifically vegan products and the world of olive oil

have their own dedicated area for offering tastings and presentations to visitors. There are approximately 2,200 exhibitors waiting for us across nine halls. Start to meet them. This year’s Country of the Year is India, recognized for its dynamic organic strategy and export growth, which make it a global partner for organic development.

Promoting the consumption of all types of vegetables and fruits, legumes, and nuts, while reducing meat consumption, is the formula that benefits everyone’s health, including the health of the planet that is our home. Protecting and regenerating soils, preventing water and air pollution, are essential principles for food security and organic agriculture, and this is the tool to achieve them, along with variations that broaden the concept, such as regenerative organic agriculture. By putting innovation and technology at the service of the organic food industry and promoting and disseminating its advantages, we contribute to the growth of conscious consumption by informed consumers.

Matthias Beuger of the Association of Organic Food Producers (AöL) highlights that: “The Planetary Health Diet provides an answer to many of the

spread or the crunchy hazelnut spread, each flavour is delicious on toast, perfect for breakfast or as a tasty twist in your favourite recipe.

crises we currently face. So, it is in its rightful place at the heart of this exhibition area. In theory, there are now enough models for keeping consumption within the limits the planet can support. But how does that actually look on our plates? Best practices are on display, from cultivating pulses and quality storytelling to the taste experience of a cooking show.”

Young people, already acting as agents of change, working simultaneously at the political and business levels, are at the heart of the Congress, as the new generation of activists is key to achieving the transformation of the food model around the world.

Dominik Dietz, director of BIOFACH, says: “By giving the Congress a focus on young voices, innovative formats, and a strong international network, we create inspiration for sustainably transforming both nutrition and agriculture.” Tina Andres, Chair of the national organic association BÖLW, adds: “A multi-generational approach is essential if we are to deal with the major questions regarding the future that we currently face. At BIOFACH 2026, the floor belongs to the young, committed people who are assuming responsibility and shaping the future right now.”

To facilitate its follow-up, the Congress has been structured around the following thematic pillars:

BIOFACH Forum, which explores trends, innovation, and future strategies for the market, focusing especially on how young activists and start-ups envision the sector.

Retail Forum, where, through presentations, the retail sector can grow with new ideas and strategies to improve its visibility and consumer trust.

Agriculture Forum, which discusses how to guarantee fair prices and access to land, as well as the importance of education, digitalization, and innovation in organic agriculture as bridges to building sustainable systems and strengthening ties between producers and consumers through better mutual knowledge.

Sustainability Forum, with the central themes of climate change mitigation in the organic food industry, the circular economy for re-

source optimization, fair trade and work, and forms of participation and justice for a better future.

Policy Forum, a platform for dialogue and debate around national and international policy and its role in the implementation of action plans, regulation, and monitoring, certification and labelling.

Science Forum, to connect research with practice and highlight the potential for change that can arise from this dialogue between science, practice, and policy.

And finally, the STADTLANDBIO Forum, aimed at policymakers and professionals from municipalities and public institutions, as well as suppliers, to promote organic food in the out-of-home market, at events and markets. We are ready to live the most important event of the year of the organic sector!

From our certified gluten-free facility in Alicante, Spain, Free Food Tech produces premium organic granolas for industrial and private label partners. Sustainable ingredients, European quality standards, and full production flexibility — from bulk to retail-ready formats.

“Critical

Lena El Sayed is the Business Development Director Food of GBA GROUP, an international life science service company with more than 3,500 employees and a broad range of analytical, logistical and specialist services in the fields of pharmaceuticals, medical products, cosmetics, chemicals, food, drinking water and environmental sustainability.

Ms El Sayed holds a Diploma in Food Science and is a certified Lead Auditor for FSSC and ISO 22000 standards, complemented by her training as an Education Officer for Sustainable Development.

With a career spanning multiple sectors, she has held key roles in Quality Management and within Educational Institutions, where she has supported capacity building and continuous improvement initiatives. Over the past ten years, she has built an extensive track record in the Testing, Inspection and Control Industry (TIC).

What responsibilities does a company have when placing a product on the market, particularly regarding food safety, labelling, and traceability?

In general, a company that places food on the market within the European Union has a duty of care

throughout the entire food supply chain. The responsibility for food safety along the entire chain, from production to processing, storage, transport and distribution, therefore lies with the food business operator

The company responsible must ensure and verify that it has reduced the risk to the lowest possible level. This may also involve reporting obligations to the competent authorities in the event of certain findings, e.g. pathogens like salmonella.

What are the most critical control points in the organic supply chain?

Critical issues can arise along the entire supply chain, from primary production to the end product. Examples include the use of pesticides during cultivation, errors in storage involving moisture, which can lead to the formation of mould toxins, and cross-contamination with allergens, for example.

Unfortunately, incorrect labelling is also a recurring problem. In addition, there are numerous residues and contaminants that require special attention as they may be found in the product.

What are the emerging pollutants and which ones pose the greatest risk?

We have been finding some residues and contaminants for decades, in varying degrees and depending on the raw material. Pesticides, heavy metals and the afore mentioned mould toxins, so called mycotoxins, are encountered regularly in our everyday laboratory work.

In recent years saturated and unsaturated or aromatic hydrocarbon mixtures from mineral oil have been the focus of attention. These so called MOSH and MOAH have several possible sources of entries, for instance

“Consumers have very high expectations when it comes to regionality and traceability of organic products”

lubricating oils from harvesting and production machinery or migration from food contact material.

A new, specific analysis using GCxGC-TOF/FID now provides an even more detailed overview of the MOAH fractions and enables toxicological evaluation and, in many cases, identification of the source of entry.

What do today’s consumers expect from an organic product in terms of safety and transparency?

Consumers expect food that is free from any harmful substances, pesticide residues, synthetic fertilisers, antibiotic residues and genetically modified organisms. In addition to ensuring food safety, consumers have very high expectations when it comes to regionality, climate friendliness and traceability of organic products. In times of international supply chains, this often poses a challenge for suppliers of organic products.

What services does GBA GROUP offer the organic sector to guarantee authenticity and traceability?

As a laboratory group, we are also adapting to these increased requirements by offering, for example, pre-shipment inspections in the country of origin or loading inspections, in order to take a representative sample at an early stage of the supply chain.

The development of audit checklists and programmes for customers,

“The goal should always be to create a shared concept of quality for which all employees in the company feel equally responsible”

with a focus on sustainability and traceability, is also part of our portfolio. It is important to train employees on the customer side accordingly, preferably as a team involving quality management, purchasing, supply chain management, and other stakeholders. The goal should always be to create a shared concept of quality for which all employees in the company feel equally responsible.

Scientifically based Analytics according to the highest Quality Standards

The GBA Group operates sites in Austria, Belgium, China, Denmark, Finland, France, Germany, Italy, the Netherlands, Poland, Romania, Sweden, Switzerland, Spain, South Africa, India and the United States.

EAT-Lancet 2.0 brings the science: We need more plant-rich diets, particularly in the Global North. But it also matters —for our health and the planet— how those plants in plantbased foods are grown! Many plantbased advocates now say “organic” loud and clear.

The plant-based movement will not embrace organic animal husbandry. And the organic movement will not embrace the whole vegan agenda. But there are many opportunities for collaboration, and some substantial sweet spots in the market and in policy that our two movements can pursue together.

In Denmark, this alliance is already racking up political wins. After decades of work for plant-rich, organic meals in schools, hospitals and all public eateries, a major breakthrough came in 2021. The Danish Climate Strategy for Agriculture launched the

Plant Food Grant (170 million EUR) where 50 percent of the fund must go to ORGANIC plant-based initiatives, from new crops and products to consumer awareness and supply chain development. The Climate Strategy also leveraged resources for a new Center for a Plant-based & Organic Future, a collaboration between Organic Denmark and Danish Vegetarian Society (DVF). Now, IFOAM Organics Europe

and DVF collaborate on getting an EU Plant-based Action Plan, based on the Danish model with a strong organic pillar. And we support organic and plant-based organizations in collaboration on national policy in more EU member states. More about Danish Plant-Based Diplomacy at the BIOFACH session Organic as a pillar of Plant-based Policy & Market Growth (Hall 9) Weds. 11 Feb. 10-10:45am.

I experience the plant-based movement as natural allies. We share a deep dedication to health, climate and respect for animals as living, sensing beings. We share high ambitions (food systems change!) and a rebellious pragmatism. We see the value of individual action but know that political and market structures and power relationships must change.

Together, we can help processors combine organic and plant-based; and help retailers set concrete goals and actions for ORGANIC plant-based sales. Consumers want this! A study in Germany, France, Portugal and The Netherlands indicated strong preference for organic when going plant-based. A US study showed the same, and organic shares of plant-based alternatives are at 25 percent. In Denmark, 73 percent of plant-based milks are organic, compared to 40 percent for cow milk. Together we can set a sustainability agenda on both farms and plates!

Despite the considerable potential of the EU Single Market, serving 450 million consumers —many of whom are driven by environmental awareness— organic companies have been slow to capitalize on the opportunities at their doorstep. Three organic companies explain the obstacles their products must overcome to reach consumers in different EU countries.

Presence of pesticides: present in some countries, absent in others

The most telling example of internal dysfunction is the handling of pesticide residues. The organic regulation sets out several obligations triggered by the “presence” of non-authorized substances, yet it does not define what “presence” means. This has led to diverging interpretations of the concept

of “presence” between Member States, creating situations that cause costly distortions in the Single Market.

“When I buy a batch of goods from an operator located in a Member State applying a different standard for ‘presence, ‘ I must block the goods in case of positive test lab, but I cannot turn to the supplier because the product is compliant with his own country›s standards, ” said Jan Groen, CEO-Founder of Green Organics Group. “To improve the Single Market, my company’s priority is to achieve consistent standards and responses to the ‘presence’ of non-authorized substances across Member States.”

Importers of organic products face serious problems due to inconsistent interpretation of customs procedures

If the EU is truly committed to safeguarding biodiversity and restoring nature, it must take concrete action to ensure that organic products are accessible to consumers in every corner of the Single Market

when non-authorized substances are found in organic products. In some Member States, organic products with residue findings—detected just before entry into the EU—are automatically decertified by customs without any investigation. Such practices are well known among EU-based importers, who, in response, seek easier ways to enter the EU market by relocating import facilities to other Member States with a less rigorous approach.

“When there are contracts to fulfil and deadlines to meet, companies cannot afford any surprises, ” said Karst Kooistra, Sourcing Development Director at Tradin Organic. “Well-trained customs officers and a clear, harmonized EU-wide procedure would greatly simplify our work. In turn, it would positively impact our suppliers in third countries and our customers in the EU.”

Food supplements: required in some countries, forbidden in others

Current EU rules about fortification of organic products result in a

patchy internal market, as supplements required in some national markets—for example, vitamin D in dairy products aimed at the Finnish market—are not allowed in others.

“Not only does this disrupt the Single Market, but it also prevents us from reaching organic consumers who need to fill a nutritional gap,” said David Care, Manager of Ecotone and President of Asobio, the Spanish association of organic processors. “We need consistent rules to reach consumers across the EU.”

As these companies demonstrate, Europe’s organic future relies on removing the invisible barriers that still fragment the market. The aim is not merely to increase sales of organic products, but to help reshape the EU’s entire food system into a more sustainable one. If the EU is truly committed to safeguarding biodiversity and restoring nature, it must take concrete action to ensure that organic products can circulate freely and be accessible to consumers in every corner of the Single Market. We are greener together.

The global demand for organic tropical oils continues to grow, driven by consumer interest in natural ingredients, functional performance and responsible sourcing. At Premium Oils, we offer a portfolio of certified organic tropical oils.

Our organic tropical oils range includes avocado oil, coconut oil, MCT, sesame oil and shea butter, each valued for its unique nutritional profile, functional properties and wide applications across food, nutrition and personal care products for the end consumer. These oils are sourced in close cooperation with partners in origin, ensuring full traceability, consistent quality and compliance with the organic standards.

Organic avocado oil is known for its mild flavor, favorable fatty acid composition and versatility in both culinary and functional applications. Organic coconut oil offers excellent stability and performance, making it a popular choice for food processing.

Organic shea butter completes the portfolio with its rich texture and functional characteristics, making it widely used in food, cosmetics, pet food and specialty applications.

Beyond individual products, Premium Oils offers the capability to develop tailor-made blends, designed to meet specific customer requirements. By combining different organic specialty oils, we can create customized solutions that align with desired functionality, nutritional profiles, processing behavior and application needs of our customers.

Quality, transparency and longterm partnerships are at the core of how we operate. From sourcing at origin to blending and delivery, we focus on consistency, food safety and on-time delivery, allowing customers to rely on Premium Oils as a longterm partner in organic specialty oils.

As we continue to expand our offering, we are pleased to do so under a refreshed brand identity, Premium Oils, which reflects our focus on healthy oils for healthier people, and our role as a proud member of the Cefetra Group.

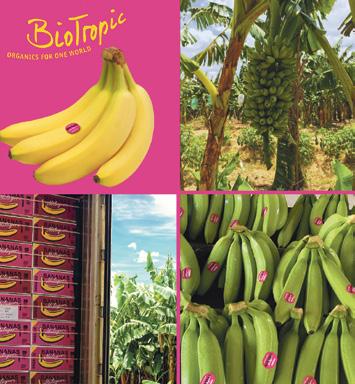

F ounded in 1997, BioTropic connects producers of fresh and dried organic fruits and vegetables from South America, Africa, Asia, Oceania, and Europe with the leading markets across Europe. With more than 10,000 m² of storage capacity and our own ripening chambers for bananas and mangoes, we ensure optimal quality and freshness from field to customer

Beyond trade, we are directly involved in production. BioTropic operates its own banana farms in Mao, Dominican Republic, cultivated according to Organic and Demeter standards. An in-house agronomist oversees every step, from planting to harvest, guaranteeing high quality, transparency, and sustainable farming methods

We also develop our own organic project in Côte d’Ivoire, where we work with local smallholder farmers to produce and dry pineapples and mangos. Through sustainable practices and certified on-site processing, we preserve natural flavor, reduce waste, and strengthen resilient local value chains

BioTropic offers one of the widest selections of organic fruits and vegetables from all six continents, available year-round to meet the needs of Europe’s organic market. Our long-standing partnerships, some maintained since our beginnings, form the basis of strong, transparent, and reliable supply chains. In addition, our international team collaborates closely with producer associations and local authorities worldwide, strengthening both product quality and social responsibility

Our global approach includes direct collaboration with agricul-

BioTropic connects producers of fresh and dried organic fruits and vegetables from South America, Africa, Asia, Oceania, and Europe

tural communities cultivating traditional crops. We help improve productivity through sustainable innovations that preserve the natural quality of the products and maintain environmental balance. We also focus on maintaining a stable and responsible production cycle, enabling agricultural communities to plan for the future. Traceability systems are implemented across the entire supply chain, ensuring transparency for suppliers, clients, and end consumers while guaranteeing continuous supply

We provide a broad range of sustainable packaging options, including flow packs, cotton nets, cardboard or polystyrene trays (recyclable and CFC-free), as well as natural branding. These solutions support our mission to combine freshness, reduced environmental impact, and customer convenience

BioTropic manages several own brands, such as BioTropic, Milagros, Vida Feliz Wein, Heisszeit Pizza,

and Green Organics Green Organics is our entry-level brand designed to make certified organic food accessible to everyone. Supported by 11 regional wholesalers in Germany with decades of experience, the brand offers essential organic products such as cereals, legumes, oils, coffees, and other dry goods, combining fair pricing, transparency, and responsible supply chains

With more than two decades of experience in marketing and producing organic fruits and vegetables, BioTropic believes that the agriculture of our ancestors is the foundation for the food of the future

Our sales team will be present at BIOFACH and looks forward to connecting with you. To arrange a meeting, please contact us at info@biotropic.com

Care is one of the four pillars of organic. When we talk about this to audiences unacquainted with organic, we tend to talk about the stewardship imperative and how we are borrowing the land from our children and our grandchildren. The organic way is to ensure that at the end of our tenure, we hand over the land under our feet in a fit state. No surprise really, given that not compromising the future in the pursuit of the present was one of the cornerstones of sustainable development when the concept emerged in the UN in the early 70s.

As the organic movement fast approaches its 80th year, it's clear that we have inherited a largely dysfunctional food and farming system, where high yielding industrial agriculture makes us pay with pollution, destruction of nature and a dietary related disease epidemic in developed countries. As the Danish Finance Minister proclaimed at last summer's Organic Summit in Copenhagen, the world

needs the organic movement now more than ever. This need for organic to continue to step up and the challenges it could face in future has led many to rethink the Care pillar.

What if it's about more than the condition of the land in 50 years? What if it's also about ensuring there are people willing and able to work that land?

made only with organic, fresh and natural ingredients

We buy vegetables from community service groups to make a positive impact and provide opportunities for at-risk youth.

It's a shocking reality that the average age of a farmer in the UK is currently 59. Not only is that close to the point when many of us might want to spend a lot more time at the golf course, but a large segment of the farming community is older still, with around 40% of farmers in the UK are cruising towards 70. But's is that a problem in itself? When you consider that older people can tend to be more risk-averse and less embracing of the kind of new thinking we need to shift our food systems, it's not ideal. Much more concerning is the reality that fewer young people are entering the farming profession. A future with less farmers, and even fewer younger farmers could be a significant threat to continuity of supply and food security.

The European Commission recently took some tentative steps toward addressing this big future challenge. No doubt motivated by elements of the EU's Strategic Dialogue of the future of sustainable agriculture (a report that received significant input from the organic sector) which highlighted the need to consider intergenerational renewal, the Commission has presented a strategy for generational renewal in wider agriculture. It aims to support young farmers and attract more people to farming and to do this it recognises that keeping farming resilient and attractive requires young people to have the right conditions to build their lives and careers. This new strategy sets a clear roadmap for how to get there, identifying five key areas for action: access to land, finance, skills, fair living standards in rural areas, and support for succession.

Initiatives identified include a lump sum of up to €300,000, to get young farmers started, facilitation of access to finance, a European Land Observatory (to help farmers access available land, support farm succession, inform policy, and prevent land speculation) and co-funding farm relief services to replace farmers during illness, holidays, or caregiving, to improve their work-life balance.

Being less about the status quo and more about our future, the organic movement already attracts a more youthful farmer, but they are not exempt from the wider challenge–there is still work to do to ensure organic farming remains an attractive proposition for the next generation.

Our very own Farmer Ambassador Liv James spoke at our annual UK Organic Trade Conference in November, and the audience were clearly moved. Liv was visibly upset as she recounted how she and her husband had been reluctantly forced to give up on growing food. As hard as Liv and he partner tried to make their modest horticulture operation viable, they simply couldn't make ends meet. This heart wrenching story of a dream to bring value to land, nature and people stopped in its tracks really brought it home for our audience just how hard it can be for young people to access land and bring healthy, sustainable food to local markets.

As Josefine van Marlen of the Dutch Organic Youth Network observed at a recent conference: 'We need to keep the knowledge alive–and we aren't doing enough to carry through' . According to Josefine, connection is key 'We need networks, and they need young people'. With many farming youth movements emerging in Europe right now, it is as important as ever to ask young people what they want and what they think and to follow through into action, so it's not seen as placating them. It's also recognised that organic needs to look to other farming movements such as regenerative–which have arguably less definition, but a better online presence – and ask how we can engage youth better.

The good news is that not only are we in the UK, exploring entrepreneurs scheme to support younger farmers, but not so far away an Organics Europe Youth Network is being es-

tablished. Organisations such as Junges Bioland (the German organic youth movement) and its many members are making real progress toward generational renewal. We were fortunate to have Lennart Bertels of the German young organic farmers movement, Junges Bioland, at our conference to share some heartening news about progress on the continent. Whether teaming up young organic horticulturalists with larger, established dairy farms so they can share costs, or creating a blueprint for other youth movements that wish to follow suit, there is no shortage of ideas coming out of the EU’s largest organic market.

Appealing to youth as consumers too

We were also thrilled to also have Sustainability expert, Solitaire Townsend speak at out UK Trade conference. Solitaire's own experience has been formative in her work in sustainability marketing, cementing a belief that as brands and marketers we must connect with people and address their needs as individuals. Her message was clear - if we want to grow the organic

market, we must stop preaching and start connecting. With an appreciation that doing business ethically can be tough, she issued a bold challenge to organic brands: “change your story and make the consumer the hero”. Not only did Solitaire give us much to reflect on regards connecting with consumers, be they Gen-X or Alpha, or be they 'green' or 'gold' (the latter being much more led by trends and aspiration than worldviews or ethics), but she also shared much that will be relevant to those attempting to connect with younger people as consumers rather than land workers. Solitaire warns against repeating the same green claims and attempting to recruit “every single person with the same values in terms of biodiversity, animal welfare, the future of farming.

Gen-Alpha may perhaps be the first generation to take a lead from the previous generation in wanting a healthier, fairer planet. Whilst a good cross section of Gen-Alpha could be more motivated than the previous generation to actualise this ambition, Solitaire warns us that we, as marketers of organic, need to “get out of our

It's a shocking reality that the average age of a farmer in the UK is currently 59

bubble”. Whilst organic markets all over Europe are back in growth again, realising our full potential will mean reaching beyond the 'deep-green' segment who are already on-side, and that means selling benefits, not just our own values.

Should you choose to read Solitaire's bestselling book 'The Solutionists' you'll find it provides some specific insights on intergenerational collaboration. The chapter: Young and Old, being hugely relevant to the topic of intergenerational renewal, reminding us of the benefits youth can bring to any business serious about sustainably. She encourages us to harness the en-

ergy, the divergent thinking, and the commitment youth brings by virtue of younger people simply being more invested in the future. We are asked in the book to consider how we bring that energy and approach into to not just the workforce, but our governance structures too. When it comes to change, yes, we need the experience, networks and resources the older generation can command, but we need youth in the mix too.

Without appealing to the next generation of shoppers, who will buy organic food in 25 years from now? Without young organic farmers, who will grow our organic food 25 years from now? Who will continue to underpin and feed the growing consumer demand for climate, people and wildlife friendly food? Intergenerational renewal may not be a new concept, but right now the organic movement is fast gearing up to address the challenges. Whether a farmer, manufacturer or a related sector, if you represent a business, I urge you to ask what more you could do to invest in the next generation and with it, a better future for all.

As every year, Murcia will once again take part in BIOFACH, the most important international event for the organic sector, held from 10 to 13 February in Nuremberg, Germany.

Germany, the host country, is the main destination for the organic products produced by our operators, which makes this event particularly significant for our region.

With more than 50,000 professional visitors expected and around 3,500 exhibitors, BIOFACH confirms the growing global commitment to sustainability and the continued expansion of the organic food market.

At the stand of Murcia and the Ministry of Agriculture of Spain (Hall 5, Stand 371) five companies are taking part: Citromil, specialising in juices, essential oils, pulps and citrus peels; Bela Vizago Ingredientes Naturales, offering vegetable and essential oils, absolutes and floral hydrolates, resins and oleoresins, dried plants, seaweed and seeds, salts and clays; Riverbend España, which produces organic juices, concentrates, pulps and essential oils from citrus fruits (lemon, orange, clementine and grapefruit); Universal Iberland, a manufacturer of juices, concentrates and essential oils; and Almonds Cremades, producers

of organic almonds and processed organic almonds.

Murcia’s Organic Agriculture in Figures

In 2024, Murcia reached over 116,000 hectares of certified organic farmland. Of this total, 5,547 hectares correspond to citrus crops mainly lemons—4,433 to vegetables (including a broad range of products such as lettuce, broccoli, cauliflower, celery, pepper, tomato, etc.), and 1,143 to fruit trees, with apricots, table grapes and plums standing out.

Almost all of the 445 companies in Murcia that distribute organic prod-

Mand Organic Production

Murcia will once again take part in BIOFACH, the most important international event for the organic sector —Hall 5, Stand 371

ucts export them to the EU, mainly to Germany. Agriculture remains a key

urcia has a long tradition of organic farming and has been a pioneer in the production of fruits, vegetables, rice, grapes, almonds, and cereals. These practices began to be implemented on some plots as early as the 1970s.

The excellent climate we enjoy and the quality of our soils, combined with the expertise of our farmers, make our region an ideal place for developing organic production.

economic pillar for our region, and organic products continue to gain ground, generating more than 2.5 billion euros in turnover

In line with our commitment to promoting organic consumption, CAERM is preparing a full programme of events and activities for 2026.

This month, in addition to BIOFACH 2026, where five companies are exhibiting at the CAERM stand, we are launching our charity initiative “Enamorados de las buenas causas” (www.buenospornaturaleza.com).

In April, we will participate in Salón Gourmet in Madrid at the Murcia stand, alongside regional companies showcasing the excellence of their products. We will also host a meeting in Calasparra bringing together operators and chefs to highlight the qualities of organic ingredients.

We will also be present at Fruit Attraction 2026 at the Murcia stand. We remain committed to consumers of organic products and will continue to develop initiatives that bring organic food and its benefits closer to the general public.

Visit us 10-13 February 2026, Hall: 7, Stand: 361

300 farmers from South Tyrol have been dedicated to the cultivation of organic apples for generationsa lasting commitment to quality and a guaranteed year-round availability.

Once again, the Committee of Organic Agriculture of the Valencian Community (CAECV) returns to the leading international trade fair for the organic sector. This year it does so accompanied by a broad representation of organic companies and with the backing of the public administration, in a firm commitment to organic production, internationalization, and the promotion of the work carried out by farmers, livestock breeders, and operators in this Mediterranean region of Spain.

The sector is strengthening and maturing

The Valencian Community is Spain's fourth autonomous community in terms of operators and certified area. With 134,728 certified hectares, the utilized agricultural area (UAA) reaches 20.1%, a figure that is above the national average and very close to European targets.

The main crops are nuts, vineyards, and olive groves for oil production. The strong territorial presence in the region is noteworthy: organic production is present in 478 municipalities, representing 88.5% of the region's territory.

The average age of operators is 58, although there has been a notable increase in the number of young peo-

ple joining the sector, bringing with them the perspective of new generations. Seven percent of the operators of the CAECV agricultural census are young people aged under 35 years old.

The data also confirms that organic production provides solutions to the problem of generational renewal. It is also worth mentioning the leadership of women in the sector: 33% Valencian organic farms are run by women.

The region's organic sector is demonstrating its commitment to professionalization and profitability. Proof of this is the record turnover achieved in the last financial year, which closed with €832.8 million.

Valencia's organic production combines sustainability, profitability, and strong regional roots

This represents a 13% increase compared to the previous year. The EU is the main destination market for the region's organic products (50%), followed by the domestic market.

Since its foundation in 1994, CAECV has maintained its commitment to supporting and advising local organic farmers, livestock breeders, and operators in inspection, certification, and international representation. With more than 30 years of experience, the organization continues to work to defend the value of organic products, strengthen the guarantees of public organic certification, and uphold a model that positions the Valencian Community as a benchmark.

In this context, 21 Valencian organic companies travel to Nuremberg to showcase the value and potential of the region’s organic products to key players in the European and international markets. With the support of the Regional Ministry of Agriculture of the Generalitat Valenciana, a wide range of representative products from the region will be presented by companies such as L’Olivateria Bio Olives, La Casella, Unión REXI SL, Señoríos de Relleu, Nutxes Organic, Campomar Nature, Herbes del Molí, Bodegas Francisco Gómez, Organic Boosting, Bernal, Naranjas de Cullera, Vegan Milker® Bernal (Valencia), Ecoferti SL, Free Food Tech, Agrícola Marvic SLU, Fundación Oxfam Intermón, Chufas Bou, Excel Food, and GA Torres.

Organic companies have long shown that agriculture can work in harmony with nature. The next step is to scale regeneration in a way that is measurable, transparent and grounded in collaboration from farm to fork. This is the purpose of Tradin Organic’s Nature Positive Plan: a structured approach that links commercial continuity with concrete improvements in biodiversity, soil health, water management and community resilience.

At the core of the plan is the impact growth cycle, a model that illustrates how stable demand and committed sourcing partnerships can accelerate the transition to regenerative practices. When customers commit to volume, it becomes possible to invest in practices that improve farm resilience, such as farmer training, agroforestry, composting systems and habitat restoration. As soils improve and ecosystems become more resilient, supply chains strengthen in return. It is a cycle where ecological progress and supply reliability reinforce one another

ic movement: biodiversity, climate, water and people.

• Biodiversity: Supporting ecosystem services, diversified farming systems, such as agroforestry, and the restoration of natural vegetation around farms.

• Climate: Reducing emissions in our operations and developing carbon insetting pathways across supply chains, based on recognised methodologies.

• Water: Promoting practices that protect water quality, improve access and ensure efficient use, particularly in water-stressed regions. People: Strengthening farmer livelihoods, safeguarding labour rights and supporting community development.

To make regenerative progress visible, Tradin Organic created the RegenerEight tool. It assesses supply chains across eight dimensions that cover soil health, biodiversity, water management, climate impact, community benefits and farm-level practices. Each ingredient receives a score that reflects its current regenerative status and the improvements underway. This allows customers to compare sourcing options and identify where collaboration can create the most impact.

through volume-based mechanisms or support specific initiatives such as agroforestry corridors, composting hubs or community programs.

With sourcing teams and agronomists active in origin countries, Tradin Organic can engage directly with farmers, cooperatives and local partners. This close presence helps ensure that regenerative practices are adapted to local contexts and that improvements are both practical and long-lasting. It also means that regenerative ambition can be paired with secure, scalable and traceable supply. From cocoa to tropical fruits, oils and grains, this model allows organic supply chains to evolve into regenerative organic systems without compromising reliability.

The organic sector has already shown what is possible. The challenge now is to deepen our impact and accelerate regenerative outcomes at scale. Tradin Organic’s Nature Positive Plan offers a clear pathway for companies that want to advance regeneration while strengthening longterm supply relationships.

The tool also enables joint investment models. Companies can co-finance multi-year projects, contribute

Want to learn more? Come visit us at our booth 5-311 at BIOFACH.

France's organic market finds itself at a crossroads: structurally strong and innovation-driven, yet subject to short-term headwinds that invite prudent realism alongside constructive optimism.

After two decades of sustained expansion, the sector has experienced a moderation in recent years. National statistics published by Agence BIO show that France remains one of the world's largest organic markets, with turnover in the low-double billions and a market share measured in single digits of total food sales, but the pace of growth has eased and some indicators have contracted. In particular, 2023 and 2024 saw a slowdown in the expansion of organic farmland and a reshaping of distribution patterns. Structural themes explain the current profile and will determine the near-term trajectory.

Consumption of organic products in France remains broad and culturally embedded, yet inflation and reduced food budgets have compressed the organic share of consumers' baskets. Analysts report a slight dip in the share of organic in household food spending even as organic price inflation has been, in some periods, lower than that of conventional products. This dynamic points to resilience rather than collapse, and it favours mid-to-premium propositions that

After two decades of sustained expansion, the sector has experienced a moderation in recent years

clearly communicate provenance, seasonality and nutritional benefit.

The specialized retail (Biocoop and La Vie Claire, among other groups, independents and farmer direct channels) have shown relative strength, while parts of the mass retail channel and some branded specialist chains

have faced retrenchment and restructuring. Events and trade hubs such as NATEXPO continue to act as crucibles for repositioning: they spotlight innovation (product reformulation, sustainable packaging, plant-based alternatives and organic cosmetics) and encourage strategic partnerships between manufacturers and distributors.

Recent data published by PLAN BIO further support this differentiated channel performance. According to its 2025 assessment of specialist organic retailers -based on responses from 19 out of 22 major specialist chains- the specialised organic retail network recorded average sales growth of 8.2% year-on-year, broadly in line with 2024. For the first time, cumulative turnover across specialist chains has exceeded the €4 billion

threshold, confirming their central role in sustaining the French organic market during a period of wider consumption pressure. Growth has been driven primarily by leading cooperative and franchise models, while network rationalisation continues among smaller or structurally weaker players in a sign of consolidation.

The observed reduction of organic cultivated area in 2024, concentrated in some arable categories, signals that conversion economics and climatic variability are placing pressure on farmers' margins. At the same time, policy uncertainty (debates around institutional roles and funding mechanisms) could materially affect the funding available for conversion incentives and promotion programmes.

Why be moderately optimistic? Because the fundamentals that distinguished French organic for decades remain intact: consumer awareness, a dense specialised retail network, strong artisanal and regional supply chains, and a steady stream of product innovation. The French organic market is undergoing a selective consolidation that rewards agility, trustworthiness and value clarity, and with coordinated industry action and prudent public support, the coming seasons can restore momentum by building a sturdier, more resilient value chain for the next decade.

The global organic ingredients market has entered a phase of consolidation and professional maturity. After years of sustained expansion driven by consumer awareness and retail demand, the sector is now shaped by operational discipline, transparency and the ability to deliver consistency across complex international supply chains. Organic ingredients have become core inputs for food manufacturers in categories including plant-based foods, infant nutrition, functional products and clean-label formulations. For many buyers, organic certification is no longer optional or a premium, it is a prerequisite aligned with regulatory expectations and long-term brand positioning across multiple markets.

This evolution has placed new demands on sourcing models. Reliable supply at scale requires structured relationships at origin, particularly in regions where organic farming remains

fragmented and exposed to climate and price volatility. Leading ingredient operators increasingly rely on longterm partnerships with certified organic farmers, combining agronomic support, certification management and predictable procurement frameworks.

Traceability has become central to this model. European buyers expect full visibility across the supply chain,

supported by digital systems that connect farm-level data with processing and logistics. Integrated traceability platforms developed by global operators such as Nature Bio Foods reflect this shift. With more than three decades of experience and long-standing relationships with tens of thousands of organic farming families, these integrated models combine large-scale sourcing across certified organic

land with farm-to-fork traceability through proprietary digital tools. This enables buyers to verify origin at farm level while ensuring consistent processing volumes and supply continuity across markets.

Sustainability expectations are also evolving. Organic certification addresses agricultural practices, while broader environmental impact is gaining attention across the sector. Initiatives focused on soil regeneration, land restoration and carbon management are beginning to complement traditional organic frameworks, signalling a more comprehensive approach to sustainability. The organic ingredients market is entering a phase where long-term thinking, investment at origin and operational coherence determine resilience. Those capable of aligning farmers, technology, infrastructure and environmental responsibility will set the benchmarks for the next decade.

“Organic saffron – taking Afghanistan’s certified saffron value chain to scale”, is an innovative project which has supported two saffron producers in Herat to convert to organic. In May 2025, one of our parters Afghan Royal Saffron Company received their full EU certification and our other partner, Afghan Red Gold, is nearly there.

In summer 2021, when we were in the early stages of inception, Afghanistan was thrown into political and social turmoil. So getting this far is not only a tribute to the determination and resilience of our partners, but also a testament to our main donor DANIDA, who has never swerved in its commitment to this project or Afghanistan.

End of story? Au contraire.

We have some massive challenges and issues to resolve: the main one being that organic yields are still significantly lower than non-organic yields. We are collaborating with the Swiss-based organic institute FiBL to address this directly. STOP PRESS thanks in part to FiBL’s recommenda-

“Saffron production employs and supports women in Afghanistan with an income”

tions in Sept 2025, the harvest yield in December 2025 was significantly better than originally predicted.

Looking forward, there are many reasons to be cheerful about Afghanistan’s saffron sector’s conversion to organic.

We have been approached by more than 40 companies who want to convert. The genie is out of the bottle – they know it makes sense to convert to organic.

Afghan saffron is extremely high quality and the annual harvest production employs and supports women in Afghanistan with an income

And we have recently started collaborating with ASEEL as a commercial partner in order to help our partners reach high value markets.

“The genie is out of the bottle: they know it makes sense to go organic”

Thanks to all our partners, we are sowing the seeds (or rather corms) of a quiet, inspiring and gentle innovation in agricultural practices in western Afghanistan. Who knows, you might see us at a stand in Biofach 2027.

For more information please contact: Kathryn Kelly kkelly@hihinternational.org

www.organicseurope.bio

Eduardo Cuoco, IFOAM Organics Europe Director www.organicseurope.bio|info@organicseurope.bio

As global politics make the world a more uncertain place, the importance of having a good representation of the organic sector in Brussels cannot be overstated. In 2026 the European Union will decide on its new budget for the next seven years (20282034), and we need to ensure that EU policies will contribute to the growth of the sector and will secure stable relations with our trade partners.

This is the mission of IFOAM Organics Europe, which represents more than 200 organic associations and companies across Europe, and which ensures that the organic community is heard by the European institutions.

One of our core missions is to ensure that European policy instruments and budgets contribute to expanding organic production and markets, and to the development of the sector through research and innovation. This starts with making sure that the EU Organic Regulation is implementable and adapted to the practical realities of operators on the ground. It is with this objective in mind, and to avoid any trade disruption, that European Commissioner for Agriculture and Food Christophe Hansen announced on 23 September a targeted review of the organic regulation, accompanied by a roadmap to simplify the implementation of some aspects of the regulation, as well as an update of the celebrated EU Organic Action Plan. The primary aim is to make the EU organic regulatory framework more efficient, easier to implement and more competitive, while ensuring stable rules for trade in organic products.

A central motivation for this targeted review is the need to provide legal clarity following the ruling of the European Court of Justice in the renown “Herbaria case”, particularly regarding the import of organic products under the equivalence scheme. The Commission also stressed the importance of preserving the credibility of the EU organic logo, so that it reliably reflects production rules for products placed on the EU market.

We also highlighted the risk of trade disruption if current equivalency recognitions with eleven non-

One of our core missions is to ensure that European policy instruments and budgets contribute to expanding organic production and market

EU countries expire on 31 December 2026. The Commission therefore underlined the necessity of extending this deadline to prevent the discontinuation of recognition systems that underpin a significant share of EU organic trade, and plans to extend the recognition of all current equivalency agreements with third countries from 2026 to 2036. This would safeguard trade flows with key partners such as the United States, Japan and South Korea, which together account for an estimated €12-15 billion in organic exports.

The proposed targeted review also introduces several technical clarifications and adjustments. These include clearer rules on the use of organic terms and the EU organic logo in labelling and advertising processed foods containing imported ingredients, addressing loopholes exposed by the Herbaria ruling.

Further changes concern livestock production, notably specific rules for quail production, adjustments to poultry housing and outdoor access for young birds, and revised withdrawal periods following the use of allopathic veterinary medicines.

Long-standing difficulties around establishing a positive list of products for cleaning and disinfection in processing and storage facilities are also addressed. In addition, Member States may be allowed to exempt certain small sellers of unpacked organic products from certification requirements based on a simpler, single criterion. At the same time, groups of operators that have faced difficulties complying with existing eligibility rules for establishing or maintaining a group may benefit from higher thresholds and more flexible conditions.

The targeted revision was presented on 16 December as part of a broader “Organic Package”, alongside a roadmap for simplifying secondary legislation and an updated EU Organic Action Plan expected in 2026. While the proposed amendments to the Basic Act remain technical and broadly supported by key stakeholders, attention is increasingly focused on the accompanying roadmap. If it fails to deliver meaningful simplification, pressure from national governments and the European Parliament for wider legislative changes is likely to grow. Importantly, the revised Basic Act of the organic regulation must be adopted before the end of 2026 to avoid regulatory gaps and potential trade disruption.

Revising the EU Organic Action Plan offers scope to further develop collaboration across the organic value chain, address constraints related to processing capacity and encourage the uptake of skills, innovation and digital solutions. Such measures can enhance competitiveness and help the sector respond to changing market conditions and societal ex-

pectations. Approaches like biodistricts can support more integrated value chains by connecting organic production with local development initiatives, tourism, gastronomy and public catering, while contributing to value creation and quality employment in rural areas.

IFOAM Organics Europe is also active in many other policy areas beyond the organic regulation that affect the operations of organic farmers and companies, such as the Common Agricultural Policy, biocontrol, research policy and seed legislation, all of which are up for review in 2026.

There are different ways to gain an edge on legislative developments at EU level that will impact your business.

To get to know us, you could consider joining one of our events, such as our Business Day on 10 February, which provides a creative space for business leaders to address pressing challenges and share best practices. Another event, the Policy Day, will bring together high-level policy-makers and organic leaders to discuss current challenges and future prospects.

If you are not at BIOFACH, you have another chance to meet us at the European Organic Congress (EOC), our flagship event and the leading event for organic food and farming in Europe, which will take place this year in Ireland.

If you would like to get your company in the know, benefit from networking opportunities and services, or simply support our work, you can consider becoming a member or a sponsor.

IFOAM Organics Europe is the European umbrella organisation for organic food and farming. With almost 200 members in 34 European countries, our work spans the entire organic food chain and beyond: from farmers and processors organisations, retailers, certifiers, consultants, traders and researchers. Visit www.organiceurope.bio for more information or contact info@organicseurope.bio.

There is a spiralling global demand for organic products. Data from the Research Institute of Organic Agriculture showed that global organic markets totalled 136.4 billion euros in 2023, a sharp surge from 15.1 billion euros in 2000.

However, in the three major organic markets in the world – the United States (59 billion euros), Germany (16.1 billion euros), and China (12.6 billion euros) – rising demand does not always translate into rising trust in organic products or a positive perception of organic practices.

The gap between market expansion and consumer confidence highlights a critical challenge for the organic sector: the need for clearer, more consistent, and more compelling communication to help consumers understand what “organic” truly stands for

How is organic perceived in the three biggest markets? A Thünen Institute policy brief (2025) identified a loss of trust in organic products among German consumers. Across the Atlantic, data from the Organic Trade

Association suggested that the USDA Organic seal is the most trusted agriculture label in the country. In China, a study published in Sustainability (2023) found that the growing interest in organic food was undermined by a confidence crisis. Those mixed perceptions underscore the importance of examining the underlying

factors that reinforce or undermine trust in organic – a closer look that is essential for understanding where communication must improve.

Studies suggested that most respondents chose organic for health reasons. German consumers prefer organic products for the absence of antibiotics in animal husbandry and of synthetic pesticides in crop cultivation. Likewise, U.S. shoppers see value in certified organic food as being free from toxins, synthetic pesticides, hormones or genetically modified organisms. To Chinese consumers, organically certified products, which follow internationally approved standards, are safer and more trustworthy.

German consumers also treasured the higher transparency in the origin of food and farming practices, especially at farm shops or weekly markets where they have personal interaction with growers.

The reasons behind scepticism against organic products are manifold. The most notable factor is price While U.S. consumers justify the price premiums of organic products, German shoppers saw the higher price as a major barrier. This stems from the lack of clarity about where the price difference lies compared with conventional food, and how organic differs from conventional alternatives. Many German consumers also preferred regionality to organic. Similarly, Chinese consumers showed hesitation towards the higher prices due to limited awareness of the reasons leading to price differences.

Another factor inviting mixed perception from consumers is the organic labels. German shoppers claimed multiple organic labels caused confusion about the guidelines behind respective labels. In China, consumers’ willingness to pay varied widely depending on the organic label – the EU organic label ranked highest, followed by the Brazilian, Japanese and Chinese labels.

Mixed consumer perceptions pinpoint three areas where stronger communication is essential. First, consumers need a deeper understanding of what organic truly encompasses beyond the absence of synthetic pesticides, and in contrast to “organic alternatives”. Second, the reasons behind price differences between organic and conventional products must be communicated more clearly. Third, the global landscape of numerous standards and labels requires clearer explanation to reduce confusion.

As part of our presence at international and local events, we constantly raise awareness of the need to imple-

ment full cost accounting (FCA) in food production. Through our guidelines on FCA, policymakers and organic advocates get access to full cost arguments to steer the narrative related to agriculture and food.

The advocacy and communications work of IFOAM – Organics International continues to address many aspects of the above knowledge gaps. In 2025, our webinar series covered topics ranging from seed rights and organic adaptation to extreme heat, to farmer-led organic enterprises and the relationship between organic and regenerative agriculture These topics tap into the aspects of organic agriculture less well known to the public. In 2026, we will continue to follow this path, beginning with a webinar that explores the core of organic and debunks the common misconceptions related to it.

To address the confusion about the labels on products, we support our members and organic trade associations in conducting awareness campaigns for consumers. As a catalyst, we bring international experience and our convening power to ensure the exchange of best practices.

We remain committed to deepening our connection with organic communities through direct dialogue at international events. At the BIOFACH Congress 2026, we will host a communication-focused panel, drawing on insights from our panellists, our own experiences, and the stories shared by participants as we explore generational differences in the perception of organic values, the challenges of crafting inclusive messages, and practical strategies to strengthen trust in the organic movement. The exchange there will not only enrich our collective understanding, but it will also serve as a cornerstone for shaping our communication efforts in the year ahead.

A recent calculation of the costbenefit difference between conventional and organic agriculture in the Netherlands demonstrates the failure of the primary “industrial” agriculture. The annual revenues of €13.3 billion do not outweigh the €18.6 billion in social costs. A negative balance of €5.3 billion remains due to damage to biodiversity, the degradation of nature, and the negative impact on the climate. Organic agriculture reduces this negative balance by €4.3 billion. Through a further transition to more plant-based production and innovations, organic agriculture could even achieve a positive balance of over €5 billion, according to the research agency Deloitte. And that doesn’t even include the difficult-to-calculate but highly

the necessary agricultural and food transition. Zutphen and the South Veluwe region declared themselves, in 2025, the first Biocity and the first Bioregion. On October 31st, 18 mu

The energy we, as Bioregion initiators, have experienced in the regions and cities over the past year is perfectly understandable. They face the problems caused by the conventional food system on a daily basis: citizens protesting pesticide use and odor nuisance in their backyards, the decline in tourism appeal, economic uncertainties, construction freezes due to exceeding nitrogen allowances by agriculture, and increasing health problems... These are not always popular topics to address in the current political atmosphere, but after all, they can’t be ignored.

And what regional and local politicians do like to profile themselves with is pride in delicious and healthy products from their own region. And that is precisely what makes Bioregions attractive to local and regional politicians. The Bioregion movement in EU countries is a powerful grassroots signal to accelerate the transition to sustainable and locally produced organic food. Dutch regions and cities are at the threshold of joining this movement and are seeking connections with the international networks of bioregions and biocities. This will start at BIOFACH on Thursday morning at around 11:00 a.m., with a presentation of the Bioregion Ambitions and Criteria and the start of the Bioregion Network Netherlands, at the orange booth of the Netherlands in Hall 5. Hope to meet you there!

Florentin stands for pure, organic flavors from the Mediterranean kitchen. We passionately prepare Falafel, Hummus, and spreads using sustainably sourced organic ingredients, completely free from artificial additives. Pure and delicious!

The Import Promotion Desk (IPD) will be showcasing the potential of small and medium-sized organic producers from Africa, Asia and South America at BIOFACH 2026. The import promotion initiative, which connects European buyers with producers from developing and emerging countries, will once again have a large stand in Nuremberg. Under the motto ‘Organic Sourcing for Development’, this year’s focus is on the African continent –on Egypt, Côte d’Ivoire, Ghana, Kenya, Madagascar, Morocco, South Africa and Tanzania.

South Africa is known for its biodiversity. The exhibitors at BIOFACH will provide a small insight into the country’s plant diversity and will present, for example, essential oils and plant extracts. In addition, companies will showcase organic macadamia nuts and macadamia oil. Madagascar is also highlighting its natural wealth, with exhibitors presenting essential oils as well as vanilla products. Other

African IPD partner countries offer a wide variety of organic goods: moringa from Ghana, spices and orange and lemon peel from Tanzania, herbs from Egypt, rose water and spices from Morocco, cashew nuts and cocoa beans from Côte d’Ivoire, as well as avocado oil and macadamia nuts from Kenya. Many companies will be present at BIOFACH to personally introduce their products and answer buyer’s questions.

The proportion of organic producers within the IPD programme is steadily increasing. Many companies recognise that organic certification is an important prerequisite for exporting many product groups. The IPD team supports this process by showing exporters the potential for organic products and advising them on certification options and the process. As a result, the organic products portfolio of IPD partner companies

has become increasingly diverse. At BIOFACH, producers from Sri Lanka and Indonesia will present Ceylon cinnamon and other spices as well as coconut blossom sugar. Brazilian companies will showcase organic guarana, acerola, and hibiscus extracts. And Ecuador –known for its cocoa– will be represented with cocoa beans and derivatives. The IPD stand at BIOFACH will therefore cover a wide range of organic products. However, if you still can’t find what you’re looking for, you should contact the IPD team directly at BIOFACH: the IPD experts will put you in touch with carefully selected organic producers from 19 IPD partner countries where IPD sources natural ingredients!

Further information: www.importpromotiondesk.de/en IPD at BIOFACH: Hall 1-261

BARCELONA 23 - 26 March 2026

Gran Via Venue

Our food crops have to be continuously adapted to new pests, diseases or changing climate conditions. Breeders invest a lot of work to improve varieties accordingly. But in recent years, a growing number of patents on plants derived from classical breeding has put them in a situation where they risk not having access to genetic material or facing patent infringement lawsuits. And all of this because big seed companies use legal loopholes and the European Patent Office keeps granting patents on classical breeding, even though this is against European patent law which says that only technical inventions are patentable, which in plant breeding means genetic engineering, but not classical breeding, such as crossing or selection.

One of the concerned breeders is Grietje Raaphorst-Travaille from Nordic Maize Breeding (Netherlands). She worked on a variety of organic maize that is adapted to colder climates. Their variety is threatened by a patent granted to the German

company KWS in 2022 (EP3380618).

An opposition filed by No patents on seeds! has been rejected in 2024. “Presumably these plants had already been used in breeding for years before the patent application was filed. Now it seems unclear whether plants with these genetic traits can be used in future breeding. We cannot even search our varieties for the specific gene sequences, as even the relevant detection methods have been patent-

ed. Such patents can pull the rug out from under conventional breeding,” Grietje Raaphorst-Travaille says.

Frans Carree from the Dutch organic breeder De Bolster faces similar challenges. For example, the growing number of patents makes it very difficult to develop new tomato varieties that are resistant to a new virus (TBRFV). Around 20 patents have already been registered by 10 different

companies. In 2025, over 40 breeders and organisations filed a joint opposition against one of these patents (EP3629711, Vilmorin). We are still waiting for a decision by the EPO. “As breeders, we are deeply concerned about these patents and consider them to be unethical,” says Frans Carree. “If the monopolisation of conventional seeds is not stopped, we and other companies, may no longer be able to afford to carry on with our traditional businesses. This would have major negative consequences for gardeners, farmers and consumers interested in having access to a broad range of food plants.”

Political solutions are urgently needed to safeguard classical breeding in Europe.

Agroecology, the new organic?

In recent years, practitioners, scientific actors, policymakers —including those from the FAO, the EU, and global forums such as the UN Food System Summit— as well as many countries, have increasingly promoted the concept of Agroecology. Feedback has been overwhelmingly positive, and representatives of Agroecology (e.g., the global Agroecology Coalition, comprising around 50 countries) have observed a progressive shift in food systems toward Agroecology principles. Although hard numbers are difficult to obtain due to the broad scope of practices, governance models, and social dimensions, the global shift is qualitatively significant and institutionally visible. Strong developments are particularly evident in Latin America and Sub-Saharan Africa, with growing momentum in Europe and Asia. Agroecology is applied in agroforestry, mixed crop–livestock systems, marginalized agroecosystems, dryland cereals, and urban and peri-urban agriculture.

Organic marketing is well-established, based on regulations, standards, certification, and labeling systems that are widely recognized and trusted. Over the decades, a structured and expanding global market has been built. Agroecology is guided by 10 elements, 13 principles, and 10 “red flags” such as the prohibition of GMOs and highly processed foods. However, it does not rely on conformity assessments, long

value chains, formal quality management systems, legal enforcement of claims, or retailer-driven promotion. Agroecology markets, if not using organic claims, primarily rely on direct sales, farmers’ markets, communitysupported agriculture (CSA), and farmto-school programs. In some cases, Participatory Guarantee Systems (PGS) are used. The agroecology claim is not widely established and works mainly where producers and consumers maintain direct, trust-based relation-

ships. Agroecology is not inspected against a standard, but its principles can be evaluated through tools, notably FAO’s TAPE and Biovision’s FACT/B-ACT. These tools assess farms, landscapes, projects, and community food systems, etc. Agroecology is oriented toward systemic transitions and continuous improvement, so repeated assessments measure both current performance and progress over time.

In Kenya, the Kilimohai organic label, managed by the Kenyan Organic Agriculture Network (KOAN), is well established. It uses a green organic label. In 2026, KOAN introduces a blue agroecology label, supported by FiBL. Unlike the green organic Kilimohai, the blue agroecology label is based on self-assessment using the Kenyan Agroecology Assessment Tool (KAAT), which is adapted from the TAPE and ACT. Operators must demonstrate compliance with “red lines” and show progress compared to previous years.

As we welcome 2026, the natural beauty market shows no signs of slowing down. Globally, it reached USD 31.4 billion in 2024 and is on track to hit USD 52.2 billion by 2030, growing at an average annual rate of 8.9%. This steady growth reflects a clear shift in consumer habits: natural cosmetics are no longer a niche, but a mainstream choice that combines performance, quality, innovation, ethics, and wellbeing. But growth isn’t just about products – it’s about people. Today’s consumers value transparency, trust, and emotional significance in their beauty routines. They want to know what goes into their products, where it comes from, and how it’s made, increasingly seeing natural beauty as part of a holistic approach to health, self-care, and emotional balance.

Understanding today’s natural beauty consumer

The modern natural beauty consumer is informed, conscious, and selective. They seek products that work,

align with their values and enhance their wellbeing. Sustainability remains a top priority, alongside transparency, ethical sourcing, and verifiable claims. Consumers are drawn to brands that tell a story, communicate openly about ingredients and production processes, and demonstrate a genuine commitment to responsible, thoughtful beauty Emotional wellbeing has also become central. Skincare is no longer only aes-

thetic; it is part of a routine that blends health, self-care, and emotional balance. Today’s consumers want highperformance products that also offer lasting value and support not just the skin, but the mind and overall sense of self. In fact, a recent study shows that 46.6% of respondents plan their selfcare routines primarily to feel good about themselves, showing that emotional wellness now takes centre stage in beauty choices.

2026 will be defined by a transformation in how beauty is understood Four conceptual shifts are leading this change: Metabolic Beauty signals a move from external aesthetics to holistic wellbeing. Consumers are no longer focused solely on improving the skin, hair, or nails; they are looking for products that support beauty from within. Personalised solutions that consider metabolism, individual biology, and overall wellbeing are increasingly in demand; Sensorial Synergy (or Neuroglow) places the full sensory experience at the centre of skincare. Textures, fragrances, colours, and even sounds all influence how a product makes the user feel. Recent studies show that many consumers now prioritise these sensory aspects even more than the product’s effectiveness; Authenticity in beauty reflects a shift away from flawless filtered images and social media retouching. With 67% of UK social media users believing that retouched posts contribute to body insecurities, brands that celebrate individuality, imperfection, and genuine stories are forging deeper emotional connections.

The rise of locally made, socially conscious cosmetics reflects a broader vision of sustainability. Consumers increasingly want transparency – where ingredients come from, who

makes the products, and the social impact of their choices. Supporting local production and shorter supply chains aligns with both environmental and community values.

Alongside these conceptual shifts, market trends are shaping the natural beauty landscape:

Sustainability remains a key driver, and the search of “greener”, low-impact alternatives is becoming increasingly visible. As consumer interest intensifies, natural cosmetics brands must demonstrate verifiable and credible sustainability claims, offering transparent, measurable attributes without compromising the performance consumers expect. This combination of proof and results is essential for building trust and longterm loyalty

Innovation continues to shape the market. Science-backed skincare, barrier-supportive formulations, and microbiome-focused routines are seeing growing interest. Consumers are looking for products that combine high performance with simplicity, offering targeted solutions alongside low-maintenance routines that fit modern lifestyles.

Inclusivity is rising. Spate’s Future of Beauty report found that inclusive beauty brands grew 1.5 times faster than less inclusive competitors in 2024, reflecting a clear shift towards diversity and representation in products and marketing.

Personalisation and proactive wellness are accelerating. AI-driven tools and diagnostic technologies are giving consumers deeper insights into their skin and overall wellbeing, enabling more precise and tailored routines. At recent industry fairs, skin-analysis devices assessing hydration, barrier condition, or specific concerns – and recommending the most suitable treatments – show how quickly personalised beauty is moving from innovation to everyday reality.

2026 will see natural beauty become more ethical, innovative, inclusive, and personalised, blending performance with purpose and meeting consumer expectations on multiple levels, from sustainability and science to diversity and emotional wellbeing.

Perfumes and artificial fragrances can be problematic for a growing number of consumers, especially for those with sensitive skin, who do not tolerate strong scents, or who are part of the group affected by Multiple Chemical Sensitivity (MCS). These products can be responsible for skin reactions and irritations or sensory discomfort in the home. Therefore, the demand for hypoallergenic and fragrance-free products is on the rise.