CStoreDecisions

Pictured: CEO Nate Brazier and Owner & Chairman

Nancy

CStoreDecisions

Solutions for Convenience Retailers

LEGENDARY FLAVORS, IRRESISTIBLE TEXTURES ARE YOUR SHELVES READY?

No matter what your customers are craving, the CORN NUTS® Brand has a flavor to satisfy.

SNAG A SAMPLE AND TASTE THE INNOVATION FOR YOURSELF

PREVENT UNDERAGE SALES

OF TOBACCO PRODUCTS

Ensure that retail remains the most trusted place to responsibly sell tobacco products.

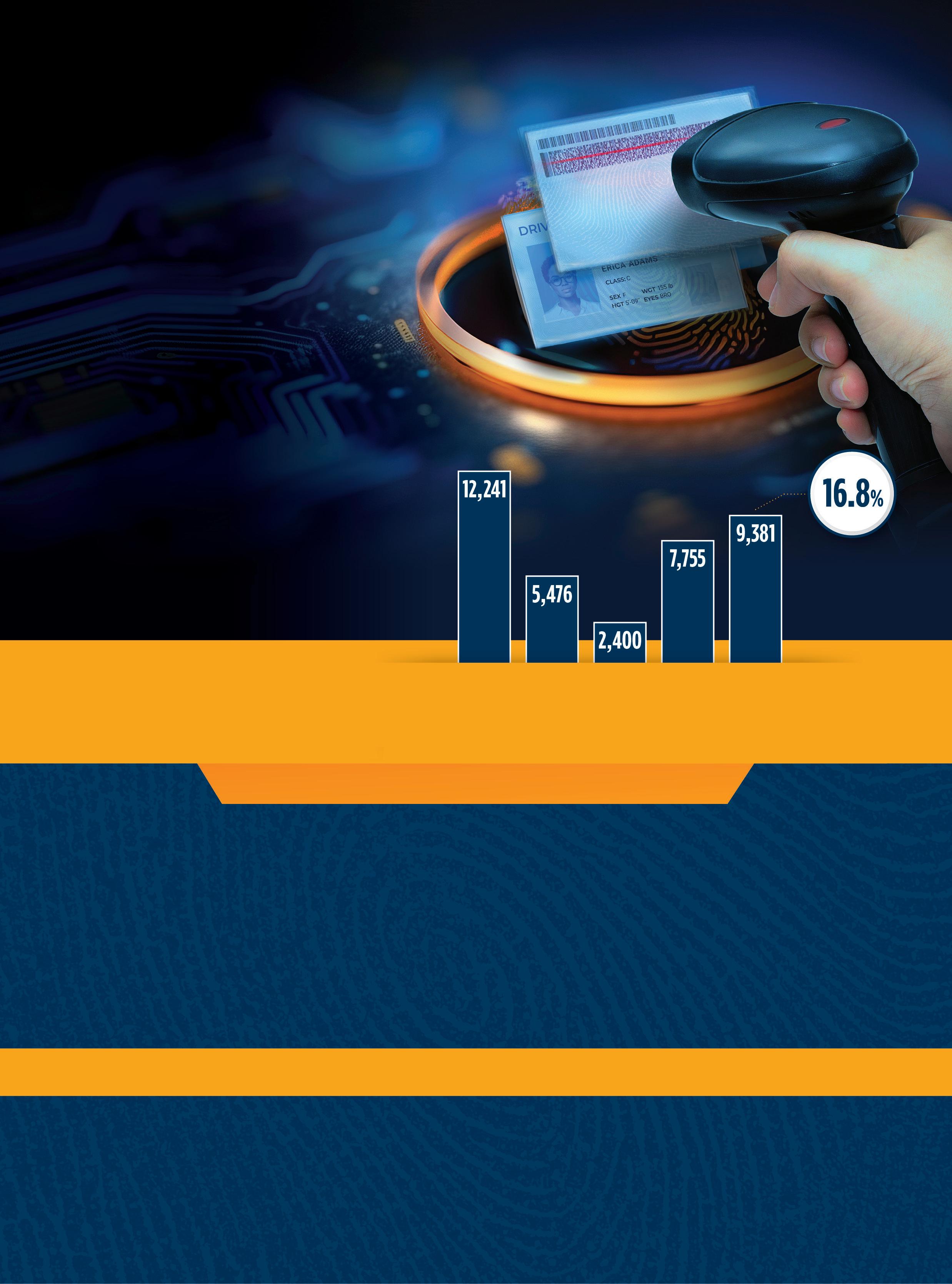

Did you know the average number of FDA compliance checks per month are approaching pre-COVID-19 levels?

In 2023, as of 9/30/23, the FDA conducted 9,381 compliance checks per month, which was an uptick from previous years.*

*Source: FDA CTP Violation Rate analysis was completed using publicly available raw data posted online at fda.gov.

Calculations of Total Compliance Checks and Violation Rates were computed by AGDC based on Decision Data published. Inspections data FFY 2019 - 2023

Modernize and simplify the ID check process with AVT, helping to reduce the likelihood of selling tobacco products to underage individuals

Improve ID check rates at a store and individual employee level, with We Card™ Training, available for Free via AGDC

State and Federal Law

Summaries and additional resources via the We Card™ resource center

Reinforce your sales associates’ understanding of ID check requirements and policies with Mystery Shop incentives

Congratulations on a game changing year

Congratulations to the team at Stinker Stores on this well-deserved honor. Being named Chain of the Year is a testament to your leadership and vision in convenience retailing. We look forward to seeing where your innovation takes the industry next.

the CSD Group

EDITORIAL

VP EDITORIAL — FOOD, RETAIL & HOSPITALITY

Danny Klein dklein@wtwhmedia.com

EDITOR-IN-CHIEF

Erin Del Conte edelconte@wtwhmedia.com

SENIOR EDITOR

Emily Boes eboes@wtwhmedia.com

ASSOCIATE EDITOR

Kevin McIntyre kmcintyre@wtwhmedia.com

EDITOR EMERITUS

John Lofstock

CONTRIBUTING EDITORS

Anne Baye Ericksen

Marilyn Odesser-Torpey

COLUMNIST

David Spross

CONTENT STUDIO

VP, CONTENT STUDIO

Peggy Carouthers pcarouthers@wtwhmedia.com

WRITER, CONTENT STUDIO

Ya’el McLoud ymcloud@wtwhmedia.com

WRITER, CONTENT STUDIO Drew Filipski dfilipski@wtwhmedia.com

SALES TEAM

SENIOR VP OF SALES & STRATEGY

Matt Waddell

mwaddell@wtwhmedia.com (774) 871-0067

KEY ACCOUNT MANAGER John Petersen jpetersen@wtwhmedia.com (216) 346-8790

SALES DIRECTOR Patrick McIntyre pmcintyre@wtwhmedia.com (216) 372-8112

SALES DIRECTOR Mike Peck mpeck@wtwhmedia.com (917) 941-1883

MARKETING MANAGER Jane Cooper jcooper@wtwhmedia.com

CUSTOMER SERVICE REPRESENTATIVE Annie Paoletta apaoletta@wtwhmedia.com

CREATIVE SERVICES VP, CREATIVE DIRECTOR Matthew Claney mclaney@wtwhmedia.com

CREATIVE DIRECTOR Erin Canetta ecanetta@wtwhmedia.com

LEADERSHIP

CHIEF EXECUTIVE OFFICER Matt Logan mlogan@wtwhmedia.com

CHIEF OPERATIONS OFFICER George Yedinak gyedinak@wtwhmedia.com

CHIEF REVENUE OFFICER Scott Kelliher skelliher@wtwhmedia.com

VP OF MARKETING Annie Wissner awissner@wtwhmedia.com

SENIOR VP, AUDIENCE GROWTH Greg Sanders gsanders@wtwhmedia.com

EVENTS VP, EVENTS Deena Rubin drubin@wtwhmedia.com

EVENT MARKETING SPECIALIST Emma Paul epaul@wtwhmedia.com

EVENTS MANAGER Jeannette Hummitsch jhummitsch@wtwhmedia.com

CStore Decisions is a three-time winner of the Neal Award, the American Business Press’ highest recognition of editorial excellence.

EDITORIAL ADVISORY BOARD

Nate Brazier, CEO

Stinker Stores • Boise, Idaho

Robert Buhler, President and CEO

Open Pantry Food Marts • Pleasant Prairie, Wis.

Herb Hargraves, Chief Operating Officer

Sprint Mart • Ridgeland, Miss.

Bill Kent, Chairman and CEO

The Kent Cos. Inc. • Midland, Texas

Nick Triantafellou, Director of Marketing & Merchandising

Weigel’s Inc. • Knoxville, Tenn.

Dyson Williams, Vice President

Dandy Mini Marts. • Sayre, Pa.

NATIONAL ADVISORY GROUP (NAG) BOARD (RETAILERS)

Greg Ehrlich, (Board Chairman) President

Beck Suppliers Inc. • Fremont, Ohio

Joy Almekies, Senior Director of Food Services

Global Partners • Waltham, Mass.

Jeff Carpenter, Director of Education and Training

Cliff’s Local Market • Marcy, N.Y.

Richard Cashion, Chief Operating Officer

Curby’s Express Market • Lubbock, Texas

Ryan Faville, Director of Purchasing

Stewart’s Shops Corp. • Saratoga Springs, N.Y.

Cole Fountain, Director of Merchandise

Gate Petroleum Co. • Jacksonville, Fla.

Kalen Frese, Director of Merchandising

Warrenton Oil Inc. • Warrenton, Mo.

Joe Hamza, Chief Operating Officer

Nouria Energy Corp. • Worcester, Mass.

Beth Hoffer, Vice President

Weigel’s • Powell, Tenn.

WTWH MEDIA, LLC

1111 Superior Ave. Suite 1120 Cleveland, OH 44114 Ph: 888-543-2447

SUBSCRIPTION INQUIRIES:

To manage current print subscription or for a new subscription: https://cstoredecisions.com/cstore-decisions-subscriptions/

SUBSCRIPTIONS: Qualified U.S. subscribers receive CStore Decisions at no charge. For others, the cost is $80 a year in the U.S. and Possessions, $95 in Canada, and $150 in all other countries. Single copies are available at $9 each in the U.S. and Possessions, $10 each in Canada and $13 in all other countries.

CStore Decisions (ISSN 1054-7797) USPS Publication #5978 is published monthly by WTWH Media, LLC., 1111 Superior Ave., Suite 1120, Cleveland, OH 44114, for petroleum company and convenience store operators, owners, managers.

Periodicals postage paid at Cleveland, OH, and additional mailing offices.

POSTMASTER: Send address changes to CStore Decisions, 1111 Superior Avenue, Suite 1120, Cleveland, OH 44114. GST #R126431964, Canadian Publication Sales Agreement No: #40026880.

CSTORE DECISIONS does not endorse any products, programs or services of advertisers or editorial contributors. Copyright© 2025 by WTWH Media, LLC. No part of this publication may be reproduced in any form or by any means, electronic or mechanical, or by recording, or by any information storage or retrieval system, without written permission from the publisher.

David Land II, Director of Marketing

The Kent Cos. Inc. • Midland, Texas

Brent Mouton, President and CEO

Hit-N-Run Food Stores • Lafayette, La.

Lenny Smith, Vice President

Crosby’s • Lockport, N.Y.

Dyson Williams, Vice President

Dandy Mini Marts • Sayre, Pa.

Hussein Yatim, Vice President

YATCO • Marlborough, Mass.

Vernon Young, President and CEO

Young Oil Co. • Piedmont, Ala.

Supplier Members

Kyle May, Director External Relations

Reynolds Marketing Services Co. • Winston-Salem, N.C.

Todd Verhoven, Vice President of Sales

Hunt Brothers Pizza • Nashville, Tenn.

Steve Yawn, Director of Sales

McLane Company Inc. • Temple, Texas

Digital Commerce for the Modern C-Store

Future-proof your store. Grow your prepared food sales. Connect every channel.

Why Altaine?

Altaine unifies loyalty, apps, kiosks, and delivery so C-stores can sell anywhere, simply.

What We Deliver

Omnichannel Ordering: Kiosk, mobile, and delivery flow seamlessly to POS and kitchen.

Loyalty Integration: Real-time rewards everywhere.

Prepared Food Growth: Smart menus, AI tips, faster sales.”

POS & Vendor Agnostic: High platform compatibility, no lock-in.

Conexxus Standards: Open APIs and compliance for scalable growth.

• Speed to Market: Deploy kiosks, mobile, and web in weeks, not months.

• Flexibility: Modular platform that grows with your business.

• Control: Own your data and customer relationship—not the aggregator.

• Support: Global expertise with a personal, hands-on approach.

us:

CStoreDecisions

Industry Accolades

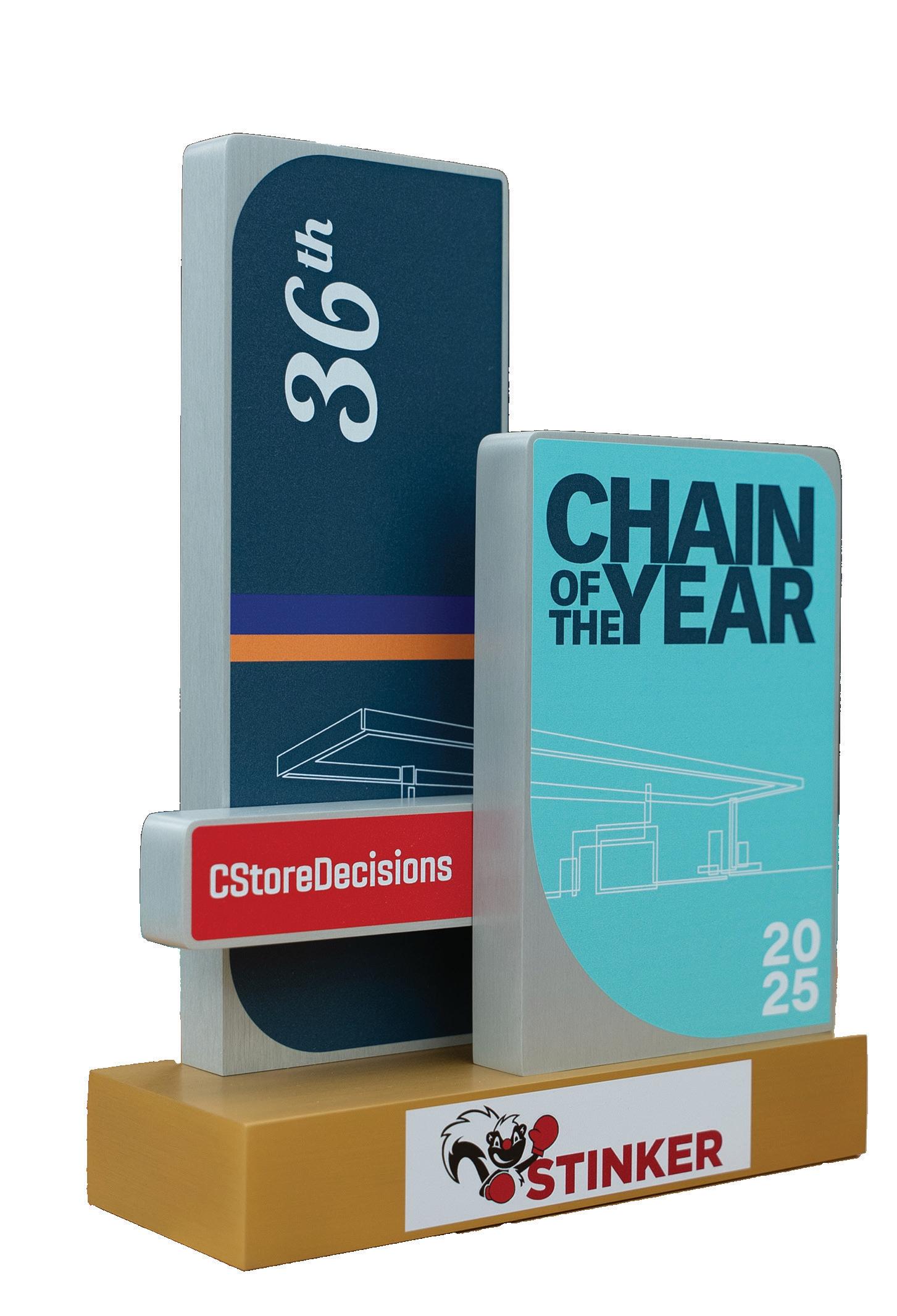

CSTORE DECISIONS’ CHAIN OF THE YEAR AWARD

turned 36 this year. As the oldest and most prestigious award in convenience retailing, the Chain of the Year Award has repeatedly recognized convenience store chains based on operational excellence, innovation and future-focused direction, starting with Wawa in 1990. The Chain of the Year Award not only celebrates excellence that inspires the entire industry, but over the years it has highlighted convenience store chains of varying sizes that are driving the evolution of convenience retail.

This year we honored our 2025 Chain of the Year, Boise, Idaho-based Stinker Stores, in a celebration at Roof on theWit in Chicago during the NACS Show on the evening of Oct. 15 (learn more in our recap on p. 16). When we were determining this year’s Chain of the Year winner, and I sought feedback from retailers in the industry about Stinker Stores, the enthusiasm was unanimous. It was evident that Stinker Stores truly embodies the spirit and purpose of the Chain of the Year Award, as you’ll see in the cover story on p. 22. It’s not only what Stinker Stores is achieving today that stood out, but also HOW the chain is doing it. One of the many things Stinker Stores has focused on is defining its vision and values: “Making the world a better place, one employee, one customer and one community at a time by being a bright spot in the lives we touch.” I’m looking forward to watching how Stinker Stores continues to build on its success in the year ahead.

MORE AWARDS…

Also during the NACS Show, CStore Decisions celebrated the winners of our Hot New Products Contest. Judged by a panel of c-store retailers, the Hot New Products Contest identifies the new product launches that retailers believe

will make the biggest impact on their customers and their business. This year, we had more than 150 entries and identified gold, silver and bronze winners across 23 categories. Learn about the winners on p. 50.

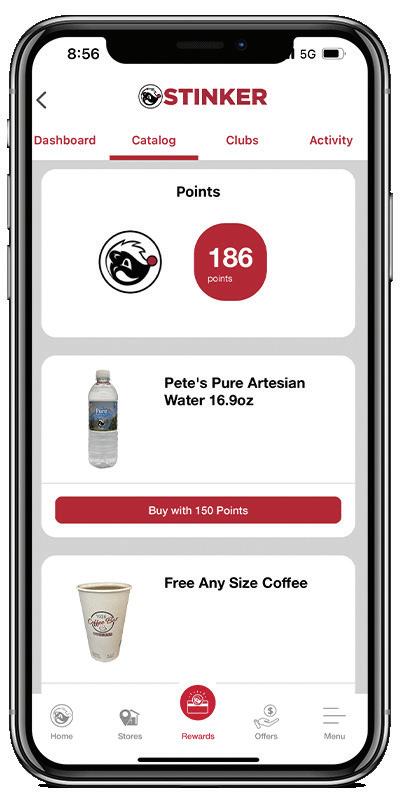

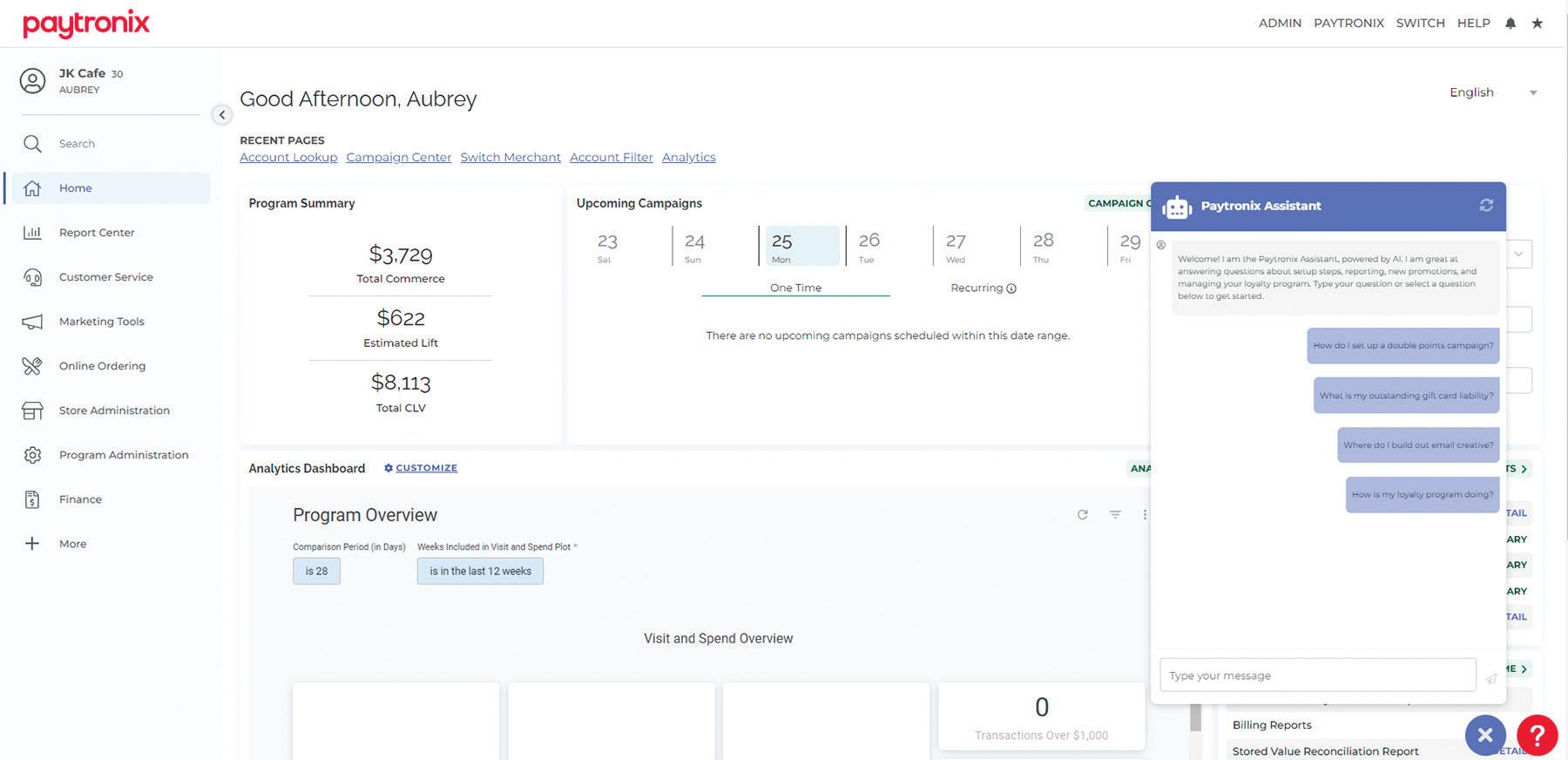

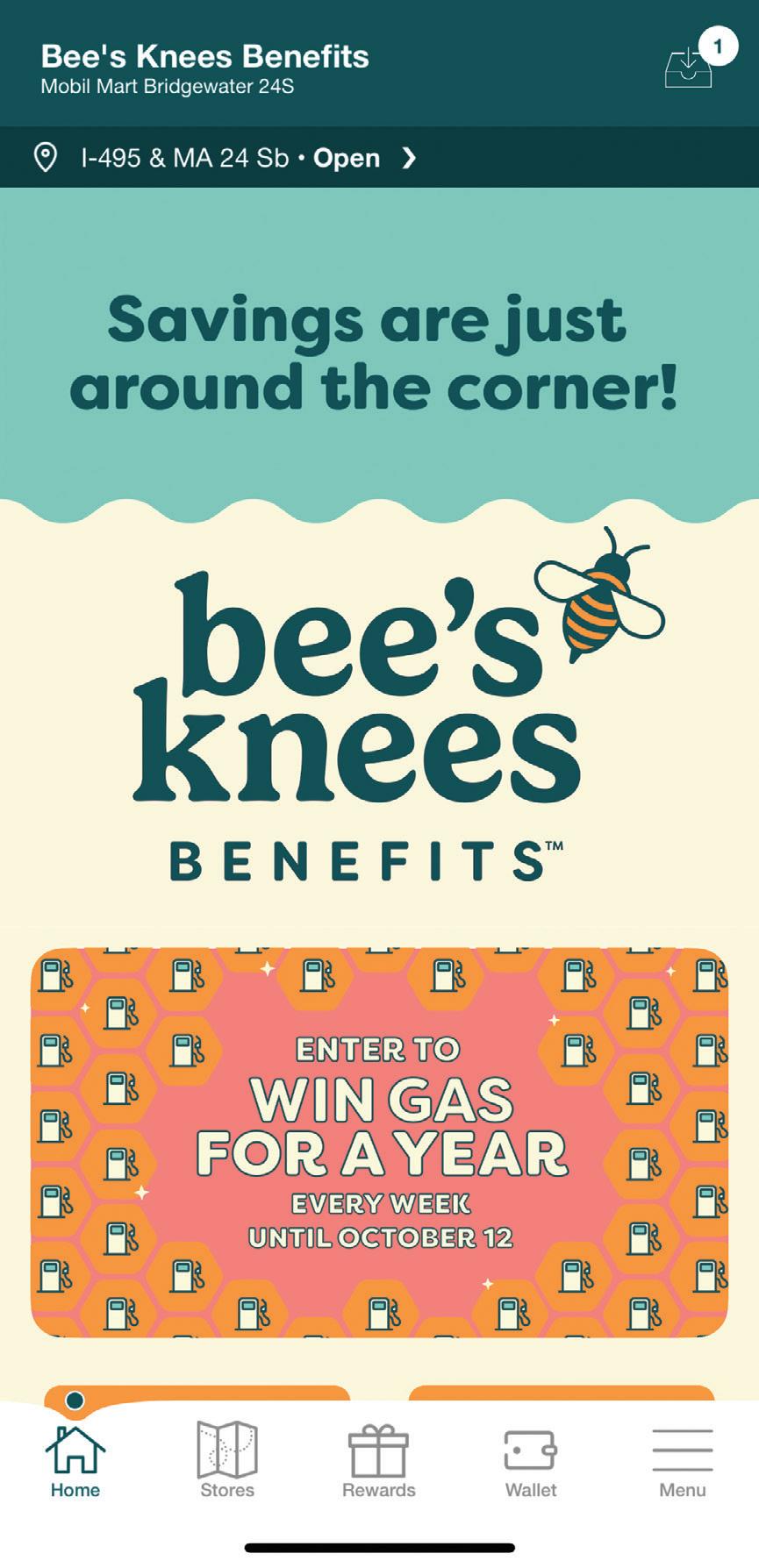

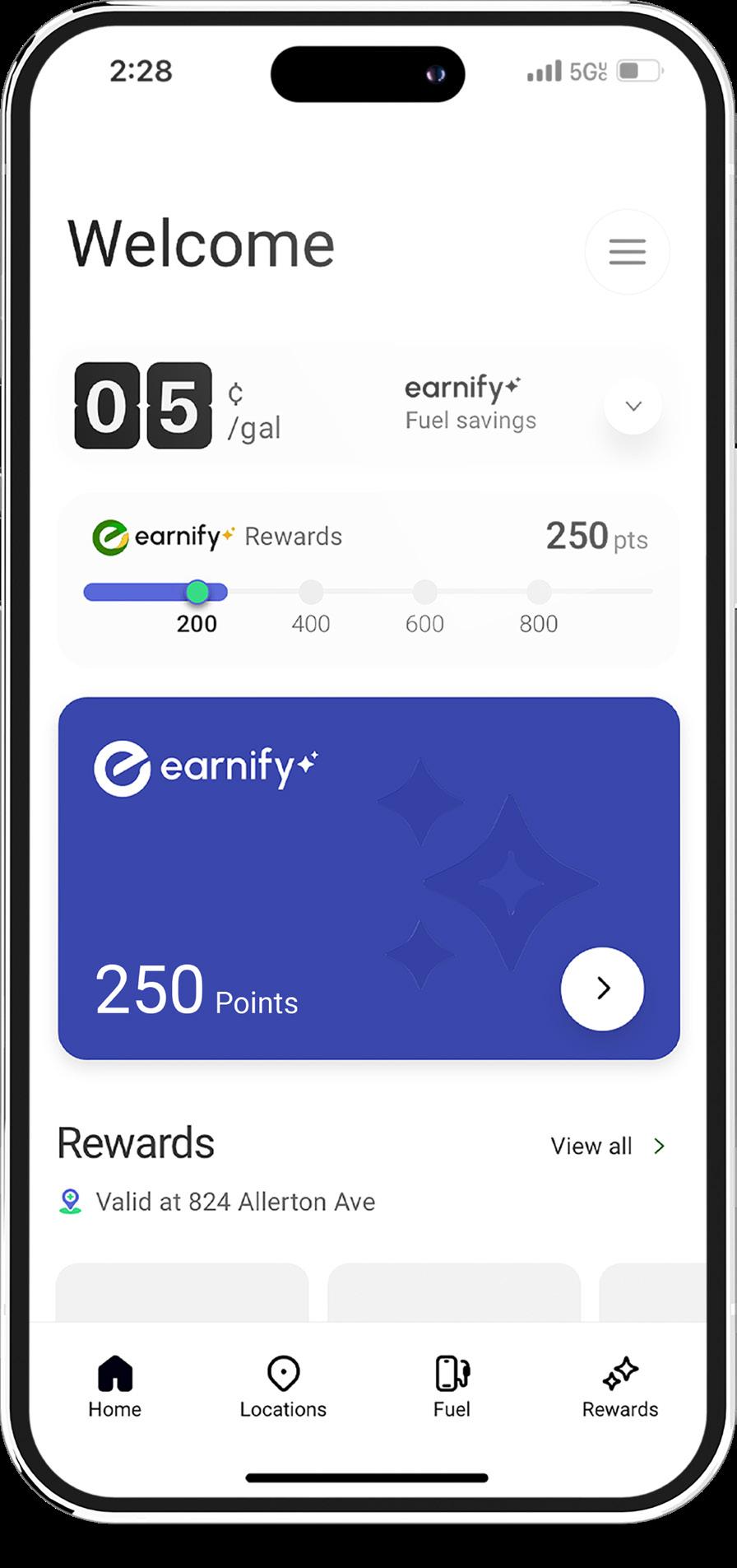

As I walked the show floor at NACS, many people asked me what stood out most among the new products and services available for c-stores. For me, it was seeing how technology is evolving to help retailers with digital integration so they can seamlessly connect their systems like point of sale, loyalty, back office, inventory management — even electronic shelf tags — and more. When I talk to retailers about burning issues, the need for better integration among systems is always high on the list. Loyalty programs and mobile app integration, in particular, are more important than ever today as retailers seek to better identify and market to their customers so they continue coming back in an increasingly competitive market. As technology advances, chains like our Chain of the Year winner Stinker Stores have relaunched their loyalty programs and mobile apps to ensure they are offering the latest technology available that can carry their chain into the future. On p. 82, CStore Decisions is recognizing two c-store chains that are standing out with new loyalty launches in 2025.

And, we’re not done recognizing the industry yet… Mark your calendars today for CStore Decisions’ annual 40 Under 40 Virtual Gala, set for Dec. 2 at 2 p.m. ET, when we will be revealing the 2025 Class of 40 Under 40 Leaders to Watch.

Erin Del Conte

WARNING: This product contains nicotine. Nicotine is an addictive chemical.

QUICKBITES

CONVENIENCE CONSUMER TRENDS

Economic and convenience factors are playing into consumer shopping changes and priorities.

CHANNEL DRIVERS

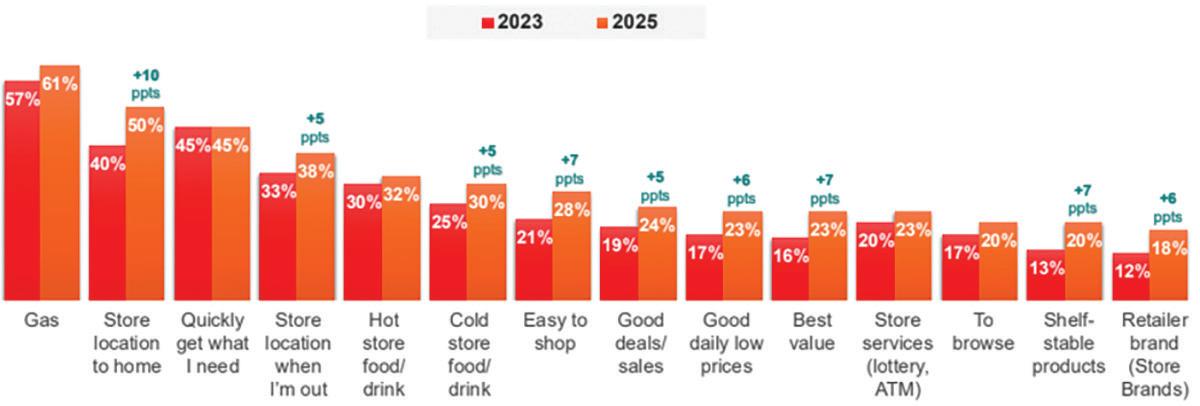

Customers who shop at convenience stores typically do so for — apart from fueling up — location and quick service. In 2025, proximity to home, easiness of shopping and best value were among traits that compelled more people to shop at c-stores compared to 2023.

PRICE WOES

When asked, “In the past six months, (in) what categories have you personally felt the most impact of price changes?” respondents said:

2026 SPENDING

Thirty-nine percent of shoppers plan to spend less in 2026, and 31% plan to spend the same in the new year. Thirty percent of shoppers plan to spend more in 2026. Generationally,

• 37% of Gen Z plans to spend more.

• 41% of millennials will spend more.

• 26% of Gen X will spend more.

• 11% of baby boomers will spend more.

Source: Salsify and Digital Shelf Institute, “Ecommerce Pulse Report: Q4 2025,” October 2025

SHOPPING FREQUENCY

Eighty percent of c-store trips are driven by fuel stops, with shoppers tending to be frequent and deliberate, according to Acosta Group.

• 63% go to a physical c-store once a week or more.

• 92% stop for food or drink.

• 72% make planned quick trips for something they need.

• 54% get snacks on the way to work.

Source: Acosta Group, “Convenience Store Shopper Insights,” August 2025

Source: Kearney Consumer Institute, “The

HISPANIC SHOPPING SHIFTS

Hispanic consumers are leaning toward food and club channels and moving away from mass and electronics. Dollar share is up for gas and convenience stores, according to Numerator.

Source: Numerator, “The

Source: Acosta Group, “Convenience Store Shopper Insights,” August 2025

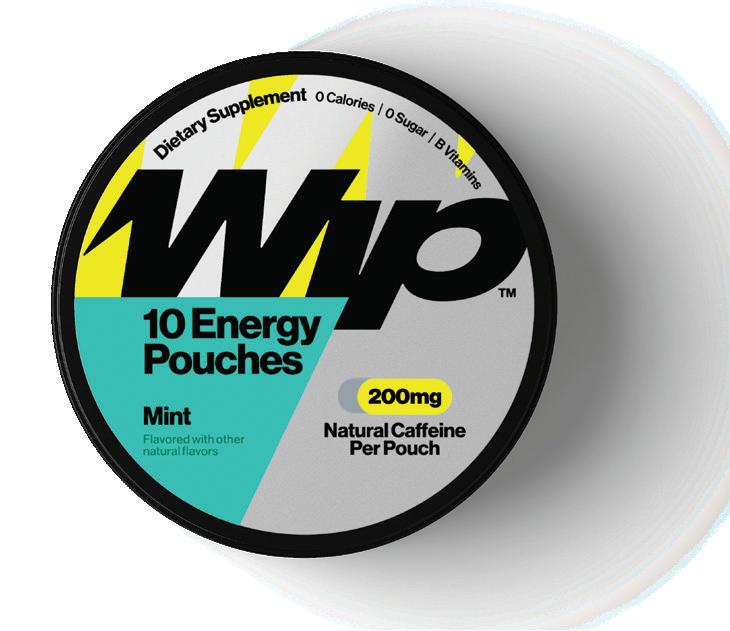

Tobacco and Nicotine Regulatory Update

The tobacco category continues to see shifts from federal changeover, state-level excise taxes and vapor product directories.

David Spross • NATO

2025 HAS PROVED to be a dynamic year in the tobacco and nicotine regulatory landscape, full of changes, court actions and legislative proposals.

After the Trump administration took office in January, there have been significant developments at the Food and Drug Administration (FDA) and the Center for Tobacco Products (CTP). There is new leadership at the Department of Health and Human Services as Secretary Robert F. Kennedy Jr. took office and Dr. Marty Makary became FDA commissioner. In late March, the administration made sweeping changes at CTP, removing Director Dr. Brian King and gutting many other departments. Since then, Bret Koplow has been temporarily filling the role of director of CTP. Koplow has worked in various roles for the FDA since 2011, including most recently as senior counselor to the commissioner.

With these developments, many see this as an opportunity for FDA/CTP to reset and streamline its operations. Rather than focus on banning certain tobacco products and with hundreds of thousands of nicotine product premarket tobacco product applications (PMTA) still pending before the agency, particularly in the vapor and nicotine pouch space, FDA has

an opportunity to provide adult cigarette consumers with more authorized product choices that potentially present less risk. Coupled with PMTA authorizations, there is also an opportunity for the agency to provide retailers with more transparency, specifically with respect to information on illicit products in the vapor and nicotine pouch categories and to increase enforcement efforts against these products.

To that end, the FDA issued PMTA marketing granted orders (MGO) for JUUL pods and device, which included JUUL pods Virginia Tobacco 3.0% and 5.0%, JUUL pods Menthol 3.0% and 5.0%, and JUUL device. In authorizing MGOs, the FDA has determined that these products “are appropriate for the protection of public health.” Further, the FDA has launched a pilot program that aims to increase efficiency and streamline the review process for PMTAs for nicotine pouch products. The FDA said it would use tobacco harm reduction and the continuum of risk in reviewing applications since there is evidence that nicotine pouches can help some adults switch away from more harmful tobacco products.

On the enforcement front, in September, Secretary Kennedy and Attorney General Pam Bondi announced

the seizure of 4.7 million units of unauthorized e-cigarette products with an estimated retail value of $86.5 million — the largest-ever seizure of this kind. This was part of a joint federal operation where shipments were uncovered of various illegal e-cigarette products, almost all of which originated in China. The FDA is also focused on education, as recently they sent information to increase voluntary compliance from all U.S. tobacco and nicotine retailers.

STATE LEVEL CHANGES

Within state legislatures, most states have wrapped up their sessions. Some states turned to increased tobacco and nicotine taxes for varying reasons, including to fill budget deficits, to fund programs and to capture new revenue sources from nicotine pouches.

In total, 10 states have hiked tobacco or nicotine excise taxes. To follow are some of these increases and why the states acted:

• Indiana: In April, with only a few weeks remaining in their legislative session, legislators realized they were facing a $2.4 billion deficit. To help address this, lawmakers turned to tobacco and nicotine and applied a significant “across the board” approach, increasing the cigarette

This is Stinkin’ Awesome!

Congratulations to Stinker Stores for being named CStore Decisions’ Chain of the Year.

tax from $1 to $3 per pack; other tobacco products from 24% to 30% of the wholesale price; moist snuff from 40 cents to 50 cents per ounce; nicotine pouches from 40 cents to 50 cents per ounce; closed system vapor cartridges from 15% to 30% of the wholesale price and vapor consumable material (open systems) from 15% to 30% at retail.

• Oregon: Looking to provide funding for a wildlife prevention program, legislators enacted a new tax on oral nicotine products — for packages with 20 consumable units or less, an excise tax of 65 cents per can and for packages with more than 20 consumable units, a tax of 3.25 cents per consumable unit.

• Tennessee: Coming into this year, Tennessee was one of 18 states that did not have an excise tax on vapor products. As of July 1, the state now taxes these products at 10% of the wholesale price.

A continuing emerging issue in the states is the creation of state vapor product directories. After last year’s state sessions, 10 states are in the process of creating state vapor directories, and 20 additional states considered legislation in 2025, with Arkansas, Mississippi and Tennessee passing directories. The introduction of these bills has been in response to the uncertainty around the FDA PMTA process and the proliferation of illicit flavored dispos -

able e-cigarettes on the market. The FDA has not completed processing applications for thousands of e-cigarettes and has only approved the marketing of 39 vapor products, making it unclear to retailers and the public of the regulatory status of a large number of products, such as those for which a PMTA was never filed, those for which a PMTA was timely filed and the application is awaiting an order, and those for which a PMTA was denied but the application remains pending for legal reasons. These bills create a state-based directory that requires e-cigarette manufacturers to submit information to state tobacco regulators demonstrating that any e-cigarette being sold in the state is in compliance with FDA regulations and guidance.

Also, Massachusetts and Nevada considered bills that would create a “nicotine-free generation.” This issue first appeared on the local level where several Massachusetts towns have banned the sale of tobacco and nicotine products to anyone born after a certain date. The National Association of Tobacco Outlets (NATO) has been leading engagement efforts to inform stakeholders that these misinformed policies are not about youth; they instead target adults 21 and older who should have the right to choose which legal products they purchase and use.

David Spross is the executive director of the National Association of Tobacco Outlets, a national retail trade association that represents more than 66,000 stores throughout the country.

Stinker Stores Honored at Chain of the Year Event

Convenience retail industry members celebrated Stinker Stores as the chain accepted the Chain of the Year Award in Chicago.

Emily Boes • Senior Editor

CSTORE DECISIONS HONORED STINKER STORES on the evening of Oct. 15 at Roof on theWit as its 2025 Chain of the Year and 36th winner of the prestigious award. Celebrated on the second night of the NACS Show in Chicago, industry members gathered to mingle, enjoy the views and mark the occasion.

“Over the past 36 years, CStore Decisions has consistently honored retailing excellence. While many organizations across our industry have focused awards on chain size and store count, CStore

The Stinker team poses with the Chain of the Year Award.

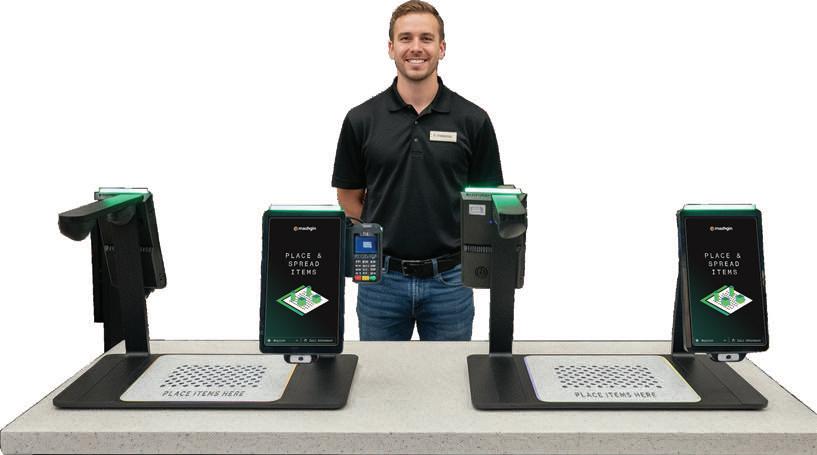

Capture every customer with Mashgin’s Power Counter. Using cameras and AI, Mashgin visually identifies items and instantly rings them up all at once - resulting in more sales and happier customers.

Decisions focuses simply on honoring operational excellence, a commitment to innovation and a future-focused direction,” said Erin Del Conte, editor-in-chief of CStore Decisions.

“We are so proud to honor Stinker Stores with the 2025 Chain of the Year Award,” Del Conte continued.

PRESENTING THE AWARD

As per tradition, 2024’s Chain of the Year Award winner, Pilot Co., presented the award to Stinker Stores.

Derek Panfil, VP, chief merchant of Pilot, represented the chain for the passing of the torch.

“The stories that we hear out on the road about what our team members do, in terms of people who are breaking down and driving across the country or who are coming across hard times, I think that is something that is lost on people who are not in the industry but something that Stinker Stores certainly exemplifies. They are (part of the) fabric of the community, and they really care about their people, and they make a difference in people’s lives every day,” he said.

Stinker Stores CEO Nate Brazier gives an exceptance speech and gives credit to Stinker Stores’ team members.

CStore Decisions Editor-in-Chief Erin Del Conte gives an overview of why Stinker Stores was selected as Chain of the Year.

Stinker Stores Owner/Chairman Nancy Jones, gives a toast to her late husband Charley Jones, former owner of Stinker Stores.

Pilot Co. VP, Chief Merchant Derek Panfil, says a few words as he presents the award to Stinker Stores.

Pilot Co. VP, Chief Merchant Derek Panfil; Stinker Stores Owner/Chairman Nancy Jones; Stinker Stores CEO Nate Brazier; and CStore Decisions Editorin-Chief Erin Del Conte celebrate with the Chain of the Year Award.

Guests at the Chain of the Year event at Roof on theWit listen to the speeches given in celebration of the 2025 Chain of the Year.

CELEBRATING STINKER

Stinker Stores CEO Nate Brazier and Owner/Chairman Nancy Jones accepted the award on behalf of the chain.

“As first-generation business owners, we have weathered and experienced the ups and downs of the American dream,” said Nancy Jones. She continued with a note of gratitude to those who have made the journey with them and gave a toast to her late husband, Charley Jones, former CEO, who passed away last year.

Brazier also said a few words in honor of the recognition.

“When we first received the news that Stinker was being named CStore Decisions’ 2025 Chain of the Year, I honestly had to take a few deep breaths,” he said. “Because it isn’t just a recognition of a company; it’s a celebration of people, of heart, of a lot of perseverance, of a stinkin’ awesome team that absolutely refused to stop believing in what we could do and build together.”

Like Jones, he mentioned thanks to those who have impacted the chain.

“This industry is the best. It is an industry full of some of the most resilient, some of the most creative and hard-working leaders that I have ever met,” he said.

“This award is not about being perfect. It’s about showing up every single day with grit, with heart and humility. It’s a reminder that culture isn’t a poster. It’s not a sign you can hang on a wall. It’s not something you write once a year and then forget what it is. It’s what you live in every store, every shift, every day,” Brazier continued.

YOU TO OUR 2025 SPON SORS!

CEO Nate Brazier, Owner/Chairman Nancy Jones and Nancy’s son Charley hold the Chain of the Year Award.

Guests mingle at the Chain of the Year event as they enjoy a cocktail hour, buffet dinner and the award ceremony.

INVESTED IN OUR PARTNERS

Congratulations to Stinker Stores on being named of the Year . At PMI U.S., we’re proud to stand alongside incredible partners like Stinker Stores—invested in driving innovation, responsibility, and a smoke-free future together.

Learn more at USPMI.com

“PMI” refers to the Philip Morris International family of companies globally. “PMI U.S.,” “we,” “our,” and “us” refer to one or more of PMI’s U.S. businesses.

CELEBRATING STINKER STORES

Stinker has earned 2025 Chain of the Year honors for its innovative mindset, focus on operational excellence, people-first culture and future-focused direction.

Erin Del Conte • Editor-in-Chief

Boise, Idaho-based Stinker Stores has taken its place as the 2025 Chain of the Year and the 36th winner of the award that recognizes operational excellence, culture, innovation and strategic direction. While Stinker Stores shines with best-in-class, new-to-industry (NTI) stores; a revamped loyalty program and mobile app; a commitment to a peoplefirst culture; foodservice excellence; and future-focused growth, what truly sets Stinker Stores apart is its unwavering commitment to continuous improvement, consistently upgrading and refining its systems and programs. Refusing to settle for “good enough,” the chain remains focused on modernizing and adapting to meet the needs of tomorrow.

“THE ORIGINAL STINKER”

Stinker Stores was founded in 1936 by Farris Lind. The first store was a service station in Twin Falls, Idaho. Today, the Boise, Idahobased chain operates 104 stores in Idaho, Wyoming and Colorado. Stinker Stores CEO Nate Brazier called Lind “the original Stinker.” “He was an expert in marketing — very creative. And his mentality, we call it ‘the moxie,’ still continues because we keep it alive,” Brazier said. “That bold, witty spirit is a significant piece of our brand, so we make sure to carry that Farris moxie forward by embracing the wit and fun — never crossing the line — but always pushing the line.”

In 2002, Charley Jones, along with his wife, Nancy Jones, and business partner, Shawn Davis, bought Stinker Stores. A certified public accountant by trade, Charley brought a financial mindset to the company and worked to elevate operational excellence and expand the chain’s footprint, while Shawn handled the retail side of the business. Stinker grew through several small acquisitions and the 2011 purchase of 14 Albertsons gas stations.

Then, in 2012, Charley and Nancy bought out Shawn and became the sole owners of Stinker Stores. As CEO, Charley began to grow Stinker Stores’ footprint outside of Idaho, while Nancy focused on the real estate and store design side of the business. In 2017, Stinker Stores acquired Bradley Petroleum and its 40 Sav-O-Mat c-stores, moving into the Colorado market. In 2019, Stinker Stores entered Wyoming with the purchase of J.H. Kasper Oil Co.

Brazier, who was the executive director of retail operations at Maverik at the time, joined Stinker in 2020 as VP of operations. He went on to serve as president and chief operating officer before taking the helm as CEO of the company in May 2024 following Charley’s retirement.

Nancy Jones, chairman of Stinker Stores, and Nate Brazier, CEO of the chain, are growing the company and committing to culture in order to be a destination of choice for its customers and employer of choice for its employees.

“One of the great things that Charley and I had was a great level of trust,” Brazier said. “So becoming president and CEO, there wasn’t much of a shift. There was definitely a shift in my responsibility, as far as — I’ll just say it, the weight that you carry. It’s a different weight,” Brazier said. “But as far as the strategy, I’ve been working on that since 2021 … and it’s evolved over time. Obviously, every year we have our strategy and planning. … If you’re looking at a five-year plan, you’ve got to look three years out because our industry changes so fast, but we’re staying in that same direction, the vision.”

Charley passed away in August of 2024 after a battle with cancer. Today, Nancy continues to serve as chairman of the company or “chief skunk in charge.”

As CEO, Brazier has worked to emphasize and enhance the chain’s people-first culture. He strengthened Stinker Stores’ leadership team,

revamped its new-hire training program, and appointed a dedicated training and development manager to ensure consistent onboarding. Stinker has also defined and emphasized its vision and values — “to make the world a better place by being a bright spot in customers’ day” — reinforcing its purpose. The chain has seen a noticeable decrease in turnover thanks to its commitment to culture.

OPERATING WITH EXCELLENCE

Stinker Stores’ commitment to operational excellence is visible through its best-in-class, NTI locations, including a 10,000-square-foot truck stop that opened in Caldwell, Idaho, in September, which it calls its Black Canyon store.

The chain has introduced a prototype store design that showcases its proprietary Pete’s Eats food program at the front of the store, features an open-kitchen concept and incorporates

community seating, which the Black Canyon store showcases.

The store is trucker friendly with a roomy full-shower bathroom and laundry facilities. The outdoor setting features a park area with big trees, tables and a dog run. With more people traveling with dogs and other pets, it allows a place for the whole family to relax and enjoy a meal. The forecourt features six highflow diesel pumps and 12 traditional gas pumps. Stinker Stores features Sinclairbranded gas.

Stinker Stores has four recent NTI stores. The store design aspires to ensure customers feel comfortable and invited into the space.

“When we started designing those stores three to four years ago, we wanted to match our brand,” Brazier said. “We designed it as if a customer was coming into our (skunk) mascot Pete’s home. The textures, colors and lighting we use speak to all of that. We use a lot of

CSD CHAIN OF THE YEAR

Congratulations to Stinker Stores on being named CSD Chain of the Year. Thank you for consistently raising the bar in the C-Store industry with your commitment to continuous improvement and future-focused innovation.

Recent new-to-industry stores are designed to look as though you’re entering Stinker mascot Pete’s home, with bricks, metals and hardwoods. Pete’s Eats is directly in the customer’s line of sight when they enter, with no obstructions.

hardwoods, bricks and metals as some of the aesthetics that fit our brand.”

When customers walk in, the first thing in their line of sight is food.

“Not only just line of sight, but line of physical walking path,” Brazier said. “There are no obstructions to the food, and so the food is front and center. So that’s the biggest change in this prototype.”

The store is split in half — left and right — with one side containing convenience items and the other side dedicated to foodservice, including cold and hot dispensed beverages, grab-and-go items, and the open kitchen. “And then, like I mentioned, the community table is right there in front as a space for people to sit, enjoy and dwell,” Brazier said.

Stinker has been actively refreshing and remodeling its locations to incorporate this modern design. In 2023 and 2024, it completed a dozen remodels that included moving walls and cabinets and 18 store refreshes that consisted of more aesthetic changes in terms of paint, signage and branding elements.

Having grown through acquisitions, Stinker’s 104 stores feature numerous different layout styles.

“The purpose of why we do the refreshes is to make sure that people get the brand feel when they walk in here. They know what to expect. When they walk into a Stinker (convenience store) over here in Idaho versus one in Colorado, they’re going to get the same feel. It’s a different size building, but they’re going to get the same feel. That’s where the elements of the branding come into play,” Brazier said.

The stores feature a red, black and white color scheme. Remodeled and refreshed stores feature a flashing sign surrounded by lightbulbs that says, “Eat Here,” that hangs from the ceiling above

the Pete’s Eats food program and ties into the brand while putting the focus on the food.

In 2025, the chain paused store expansion and remodels to turn its focus to internal upgrades.

“We want to be the best. The best isn’t necessarily a number of stores. It’s how profitable and how well run each one of those stores are. We’ve taken 2025, and we said, ‘We’ve implemented all of this tech, and we’ve implemented a lot of other changes. Let’s make sure that we’re solidifying the foundation, so that in 2026 and beyond, we scale,’ because you’ve got to have the systems in place and everything in the foundation solid before you start going again. And that’s what we spent 2025 doing,” Brazier said.

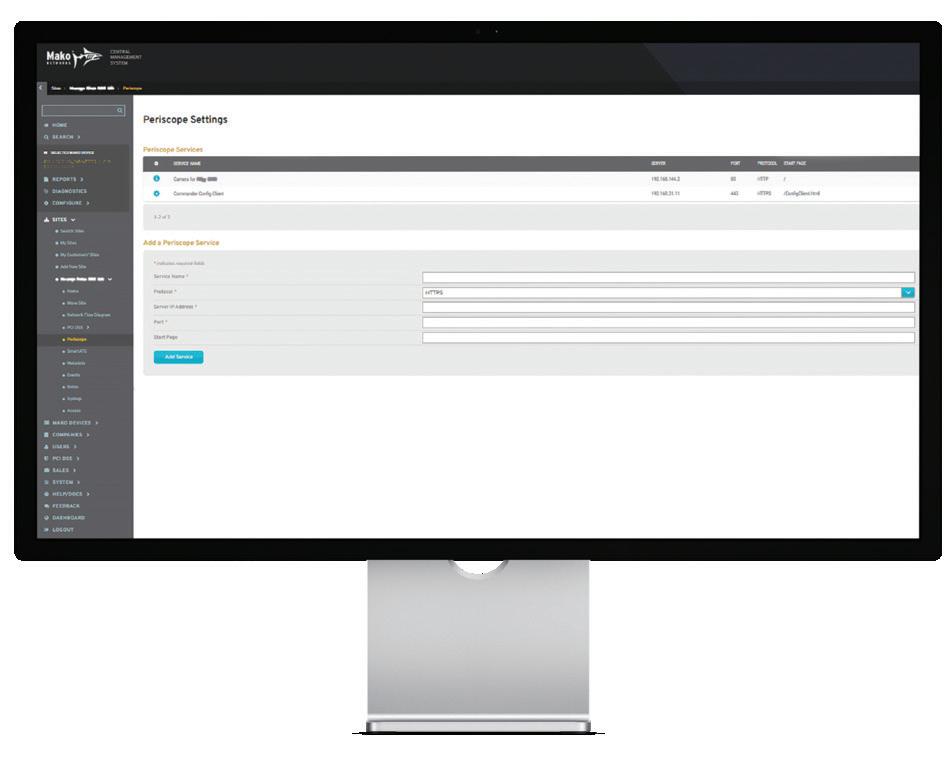

That has included enhancements to its systems and processes. Recently, it upgraded its point-of-sale (POS) system, back-office platform and human resources management system across its entire fleet of stores as it remains focused on continuous improvement and operational excellence.

“We had a very antiquated system, and to do the things we wanted to do (such as roll out a new app) we needed to upgrade both the POS and the back office as well as to gain the efficiencies we wanted in our support center, which

we call ‘the den’ or ‘den support teams,’” he said.

The chain wanted to take advantage of all the efficiencies and automation available with a move to PDI and NCR.

“As we scale forward, the system is in place, and it’s — I’m oversimplifying — it’s a plug and play, but you have to have the system and the processes first to be able to scale forward like we want to,” Brazier explained.

“When I think about operation excellence, I think about our people, and we empower our people to live our purpose every single day, and like I mentioned before, that is to make our world a better place, one employee, one customer, one community at a time by being a bright spot. We empower our people, our leaders in the stores, to do exactly that. And there’s many ways to do that, but it starts with clean, well-organized, well-stocked stores and friendly greetings,” he said.

Each month, Stinker does a “Pete’s Perennial Walk” at every store, evaluating everything from the outside and inside of the stores to the controls.

“That helps us provide the highest level of what we call ‘the exceptional customer experience’ as well as the exceptional employee experience,” Brazier said. “At our core is we operate at a very high level because we focus

on the customer/ employee experience.”

PETE GETS A MAKEOVER

In April, the chain introduced a new logo and brand identity.

“We’ve had Pete, a full-body, older-looking skunk, and (we decided) we wanted to update Pete. I joke we took Pete, and we gave him a personal trainer. We sent him to the gym and gave him a nutrition plan, and he came back, and now he’s strong and he’s fit. He’s ready to run with us as we go on this journey,” Brazier said.

As it tested logo designs, at first, the chain put Pete’s head in a circle, but then it decided it wanted Pete to be more prominent as the face of the brand, so if one were to strip away the word “Stinker” he would still be instantly recognizable.

“We played with different concepts, and where we landed was Pete waving as a more of a ‘welcome to Stinker’ type concept,” he said. The team solicited

much feedback during the process to ensure it was taking Pete in the right direction. “The brand is an emotional connection, and if our people can’t connect with it, then our customers aren’t going to connect with it,” he said. “It was a serious decision and change, and we feel really good about where we landed with the new logo.”

PETE’S EATS

Stinker Stores debuted its Pete’s Eats foodservice program in 2021, which includes proprietary grab-and-go food in both hot and cold varieties with a focus on freshness and high-quality ingredients. In just 3.5 years, Pete’s Eats has experienced significant growth, and the company is now enhancing its menu with innovative offerings and limitedtime promotions.

Customers can find burgers, chicken tenders, burritos, pizza, wraps, salads and breakfast sandwiches on the menu.

“Our breakfast sandwiches, people love them. They’re a popular item. We use brioche buns. We use fresh cracked eggs with … fresh cracked salt and pepper,” Brazier said. “Our burgers are 100% Angus beef; they’re quality. We

don’t use a bunch of fillers.”

Idaho is known for its finger steaks. “There’s chicken fingers, and then these are finger steaks, and they’re strips of steak that are battered and fried,” he said.

Stinker Stores added fryers to its busier “tier one” stores with large kitchens and began making its own finger steaks in those locations.

When it comes to the food program, ”we’re always innovating and trying to stay ahead,” Brazier said. “One of the recent changes we just made was in our doughnuts.” Stinker Stores partnered with a local Idaho vendor on doughnuts, and sales went “through the roof.”

With its baseline food program established, Stinker is now working with a local vendor on a commissary concept to ensure the right items with the bestquality ingredients and consistency reach stores that aren’t large enough to feature kitchens or carry as many items.

“But now they can because of the commissary. So that’s something that we’re right in the middle of right now, is evolving the Pete’s Eats program to commissary. We’re working with a local vendor here with an experienced chef. Our food team at Stinker partners with

Left: Pete’s Eats offers grab-and-go hot and cold food including burgers, chicken tenders, burritos, pizza, wraps, salads and breakfast sandwiches. The breakfast sandwiches are one of the most popular items, made with brioche buns and fresh cracked eggs.

Above: Stinker added fryers to its busier stores with large kitchens where it makes its own finger steaks, a popular dish in Idaho.

(this vendor) to develop the menu and limited-time offers,” Brazier said. “We handle the menu innovation, and then they produce (the products).”

For example, the vendor produces the chain’s burritos in its kitchen and packs them, and then Stinker’s logistics team delivers those fresh items to what it calls its receiving commissary stores.

INNOVATION UNLEASHED

Innovation remains a key focus at Stinker. Despite being already ahead of many c-store chains on the loyalty program and mobile app front, Stinker wasn’t satisfied. It went back to the drawing board in search of the features and functionality that would help carry it into the future. Last fall, it launched a new mobile app, complete with orderahead functionality, delivery options and gamification elements, plus an enhanced loyalty program. It plans to add geofencing capabilities to the app soon.

Left: Stinker Stores launched a new mobile app last fall, complete with order-ahead functionality, delivery options and gamification elements as well as an enhanced loyalty program. Geofencing capabilities are planned for the app soon.

Above: Stinker Stores uses Sinclair-branded fuel. Its Black Canyon store features six high-flow diesel pumps and 12 traditional gas pumps.

The relaunch not only gave the app a facelift but encourages customers to stay engaged with the chain through push notifications and gamification. It also incorporates a way for customers to earn points and then have the freedom to spend the points how they want, whether it’s on fuel discounts or in-store items. Stinker also launched a line of Stinker merchandise, which is available for purchase within the app.

“We don’t want an app just to say we have an app,” Brazier said. “We are truly providing value to the customer so much so that they want to come back to one of our stores — like member-only pricing in the app (through partnerships) with a lot of our vendor partners. … Member-only offers is a big deal and a new capability.”

Since launching the new app, Stinker doubled both the total number of app users and the number of active users.

Overall, Stinker has been focused on engaging customers through digital media, whether that’s through its app, its social media reach or a newly redesigned

website, which is coming soon. It also added TV screens with Direct TV to select locations. Now, the chain is turning its attention to retail media possibilities.

“We’re right in the middle of (deciding) which way to go with retail media networks,” Brazier said. “There’s so many opportunities. You know, we have TV screens and all that in our stores, so we’re looking at, ‘How do we monetize that space, but also provide value?’”

Also on the innovation front, Stinker is using artificial intelligence (AI) to monitor freshness at its roller grills, and it launched a central fuel pricing system using AI in November.

Stinker is also testing Mashgin selfcheckout systems in select locations to enhance customer convenience. The selfcheckout units are up near the cash wrap so cashiers are nearby to greet customers and address any issues.

Stinker has seen good usage of the self-checkout system at the majority of its test stores. Educating customers on how to use self-checkout has been key. For Brazier, the point of self-checkout is to

Stinker Stores has defined and emphasized its vision and values. Its people are the most important part of the business, according to CEO Nate Brazier, and with its commitment to culture, the chain has seen a noticeable decrease in turnover.

offer an alternate checkout avenue that some people prefer, as well as labor efficiency in terms of reallocating employees to focus on other tasks, but not labor replacement.

Brazier noted that for some customers, however, human interaction is key.

“There’s some people that don’t want to talk at all, but they want to have that human interaction, which is great for us, because part of our purpose is to make our world a better place, and we do that by being a bright spot,” Brazier said. “Sometimes a customer is having a horrible day, and they come into our store, and I could share several stories that customers have shared with us about our people literally turning their day completely around because of the experience they had communicating, talking with our folks.”

The retailer recently introduced a retail intelligence program focused on signage, store layouts and customer engagement.

FUTURE-FOCUSED GROWTH

Looking ahead, Stinker Stores has its eye on potential growth opportunities both within its core footprint, as well as outside of its current operating area. The company plans to explore expansion through both new builds and acquisitions, ensuring its continued success in the competitive convenience retail landscape.

“Stinker went through a period of rapid growth that meant there was a bit of a drinking from a firehose phase for a few years as we adapted to being a multistate operator and all the nuances that go with that,” Brazier explained. “The work we have been doing the last five years is making sure that we are set to scale when the time is right. We don’t want to operate as ready, fire, aim. We’re taking our time to do it right when the time comes.”

“We should always be focused on being better tomorrow than we were today,” Brazier said. “Right now, I’m focused on keeping that idea at the

forefront and making sure that the people I surround myself with are going to share that same importance of growth, curiosity and positivity. It isn’t always easy. I’ve learned to be comfortable with being uncomfortable because it isn’t just a goal, it’s a daily practice I’ve committed to show up for.”

Stinker wants to continue to be an employer of choice for employees, a destination of choice for its customers and a “steady gathering spot” for its communities. Its people are “hands down the most important part of our business, and I’m lucky to have the best team there is,” Brazier said. “Our brand allows us the flexibility to have fun, not take ourselves too seriously and roll with whatever comes next. This has translated into a culture where people want to stay.”

Stinker’s people initiatives center around ensuring it adapts and changes proactively, keeping its focus not only on what it needs right now, but what it is going to need “five, 10, even 20 years from now,” he said.

“We are truly honored and excited to be named Chain of the Year,” said Brazier. “Of course, you know I’m going to say it feels Stinkin’ Awesome! We are coming off a year when our teams worked so hard on so many different initiatives and special projects. This is a great way to celebrate all of those successes. It’s always great to know that others see and appreciate all that hard work, too.”

Brazier noted that the recognition is not only a reflection of the chain’s achievements, but “a celebration of the Stinkin’ awesome people who make up our team — our amazing employees, loyal customers and supportive partners.”

“It’s their hard work, passion and commitment to making our world a better place that drive our success and elevate us in this competitive industry,” he added. “It’s a testament to the trust and relationships we’ve built with our communities, and it motivates us to continue innovating and improving. We are committed to continuously getting better every day for employees and customers, and we will continue to have a lot of fun doing it!” CSD

*See nutrition facts panel for saturated fat content. Does not contain OREO Cookies.

Understanding the Ever-Changing Candy Customer

AS CONVENIENCE STORE

CUSTOMERS increasingly seek out health-conscious products and offerings with nutritional benefits, the fact remains — there is still overwhelming demand for the candy, gum and mint offerings that the c-store industry has long been known for. Retailers can certainly capitalize on growing trends within the category, however, consumers are still seeking out indulgent favorites.

Historically, chocolate candy has dominated the category, and that remains the same today. Non-chocolate candy, however, continues to close the gap year after year.

“Chocolate continues to lead the candy category and remains a go-to indulgence, even in the face of economic pressures. Its enduring popularity is fueled by strong brand recognition, emotional appeal and seasonal relevance,” said Sean Carroll, director

Chocolate continues to dominate the candy category, however, non-chocolate is closing the gap and protein-based products are making their presence known.

Kevin McIntyre • Associate Editor

of category management for Good 2 Go, which operates more than 80 stores across Idaho, Wyoming, Utah, Colorado, Arizona and New Mexico.

Its market share, however, according to Carroll, is being gradually challenged by the rise of alternative protein snacks.

“These protein-rich options — often positioned as better-for-you treats — are drawing attention from shoppers who might otherwise reach for traditional confections,” he said.

According to Circana, chocolate candy sales were flat (up 0.8%) for the 52 weeks ending Oct. 3, with total sales reaching $3.63 billion in the convenience store channel. Non-chocolate sales dipped 2.1%, however, the segment brought in a staggering $3.29 billion in sales for the same time period.

Gum sales increased 1.3% to reach $1.21 billion, while mint sales remained relatively flat at $300 million.

CHOCOLATE HOLDS STEADY, NOVELTY DIPS

At Good 2 Go, candy sales are growing year over year, despite a few hurdles within the non-chocolate and gum segments.

“Chocolate continues to perform strongly across our locations, maintaining its appeal and driving consistent sales,” said Carroll. “In contrast, non-chocolate candy has experienced a modest dip in dollar sales. Within the breath freshening category, gum sales are slightly down, while mints have shown a small but notable increase.”

These results mirror those of the industry at large, with the National Confectioners Association’s (NCA) Director of Public Affairs and Communications Carly Schildhaus noting that consumer behavior is shifting as a result of the increased price of groceries.

“While overall confectionery sales in 2024 topped $54 billion, confectionery purchases at c-stores experienced a

Overall chocolate sales rolled in flat (up 0.8%) while novelty saw the biggest drop (down 47.4%).

Source: Circana, Total U.S. Convenenience Data for the 52 weeks ending Oct. 3

NON-CHOCOLATE SEGMENTS RING IN FLAT TO DOWN

Non-chocolate chewy and novelty candies rolled in flat, while licorice and specialty nut/coconut dropped.

Source: Circana, Total U.S. Convenenience Data for the 52 weeks ending Oct. 3

slight decline, falling 1.1% to $8.3 billion last year, according to NCA’s 2025 State of Treating report,” said Schildhaus. “At the same time, shoppers continue to leave room in their budgets for chocolate and candy, with 98% reporting that they made a confectionery purchase at some point in 2024.”

Consumers view chocolate and candy differently from other foods, according to Schildhaus, with people in the U.S. enjoying chocolate and candy two or three times per week.

“(Consumers) understand that confectionery products are treats, not centerof-the-plate foods, and appreciate the role that confectionery plays in sweetening special occasions and seasonal celebrations,”Schildhaus continued.

“As such, 62% of all confectionery sales in 2024 were generated during the big four candy seasons, (Valentine’s Day, Easter, Halloween and the winter holidays) and a new NCA survey found that 94% of consumers planned to share chocolate and candy with friends and family for Halloween this year,” Schildhaus added.

Since 2019, sales of non-chocolate products have grown by nearly $5 billion — an increase of almost 70%.

“Non-chocolate candy sales were boosted by the popularity of sour candy, and nearly 11% of sales came from innovation,” Schildhaus said. “This trend is driven by Gen Z and millennial consumers who report loving exploration of all things sour, flavor mashups, different textures and flavor experiences.”

LOOKING AHEAD

As we finish out 2025, retailers can take advantage of the new trends within the candy, gum and mint space as consumers continue to demand innovation, bold flavors and new experiences.

One trend that Good 2 Go embraced is freeze-dried candy, which is “captivating customers with its unique texture and intensified flavor,” Carroll said.

“Skittles Pop’d, a standout in this space, has surged in popularity and now holds the top spot in our sales rankings, surpassing even long-time favorite Nerds,” Carroll continued.

Lemonhead Ropes also saw strong performance due to its nostalgic citrus flavor and fun format.

Aside from freeze-dried offerings, Carroll is also noticing increased demand for health-focused products that offer both indulgence and functionality.

“While traditional favorites like chocolate remain strong, consumers are exploring more adventurous options and limited-time releases, suggesting a growing appetite for discovery and variety in the candy aisle,” he said.

Good 2 Go’s ability to identify consumer trends and adapt on the fly has led to increased basket sizes, even while overall shopping trips have declined. Much of this success was driven by strategic customer deals and marketing efforts, in addition to diligent category management.

“Consumers are leaning into valuedriven strategies — responding well to multiunit promotions and linked offers between complementary brands,” said Carroll. “These bundled deals encourage

larger purchases per visit. That said, economic uncertainty has introduced a cautious undertone, slightly muting the full impact of these promotional efforts. Shoppers are still indulging, but with a more calculated approach to spending.”

To stay on top of consumer trends, Good 2 Go closely monitors its customers’ preferences through a combination of sales data analysis, shopper feedback and trend tracking across social media and industry reports.

“This helps us stay agile and responsive to emerging interests — whether it’s a surge in freeze-dried candy or growing demand for alternative protein snacks,” Carroll continued. “In response, we adjust our assortments regularly, prioritize high-performing SKUs and lean into promotional strategies that reflect current buying behaviors. Flexibility in merchandising and a willingness to test new formats allow us to meet shoppers where they are and keep our offerings fresh and relevant.”

C-store retailers are uniquely positioned to cash in on an evolving and demanding consumer base. By stocking trending products like protein-focused offerings, freeze-dried candy and nonchocolate newcomers, while keeping indulgent chocolate favorites on shelves, c-stores can cash in on a reliable and lucrative category.

“Looking ahead, projections for the future of the confectionery industry are promising. U.S. confectionery sales are expected to grow over the next five years, exceeding $70 billion in all outlets by 2029,” NCA’s Schildhaus concluded. CSD

Take Center Stage.

High-profit candy, snacks and healthy food options achieve superstar status on the Royston Gondola Shelving Unit with LED Backlit Graphics. Customers are drawn to vibrant, engaging signage from multiple angles and heights. Efficient design provides 138* linear feet of adjustable shelving in a compact footprint. Durable steel construction, powder coat paint and customized graphics from SignResource (a Royston Group company) deliver a seamless solution that performs proficiently for years. Entertain greater center-store sales, visit roystonllc.com for more.

Developing Tastes for Adult Beverages

Ready-to-drink cocktails and non-alcoholic varieties attract greater interest among younger consumers, mixing things up for c-stores’ beer, wine and adult beverage selections.

Anne Baye Ericksen • Contributing Editor

IT’S INTERESTING TO LOOK at how consumer trends have evolved postpandemic. Five years out from the height of lockdowns, some sales patterns have changed long term. For example, within the beer, wine and adult beverage category, there’s been a sizable shift in what is being purchased at c-stores and who is doing the purchasing.

In 2020, beer sales at convenience

stores benefited from people staying home and buying off-premise. Circana (known as IRI at the time) reported a boost of over 13% in beer dollar sales by year’s end. In the intervening years, the sector has fallen a bit flat. Between September 2024 and September 2025, Circana data shows dollar sales slipped by 1.6% and unit sales fell almost 4%, including both domestic and imports.

Brian Sudano, CEO of S&D Insights, suggested part of the current lag in import sales may be tied to recent events. “By (themselves), the tariffs on imports only impact around 15% of the imported beer market, as the major Mexican players are still operating under the USMCA (U.S.-Mexico-Canada Agreement) aside from tariffs on the aluminum portion of imported products

packaged in cans,” he explained. “The larger impact is around economic and immigration pressures on Hispanic consumers, which over-index as users of Mexican imported beer.”

Still, brews are pouring out the biggest alcohol beverage sales for c-stores, registering more than $25.2 billion in the 52 weeks ending Sept. 7, per Circana.

“While sales and volume are normalizing to pre-COVID levels, beer continues to be a critical category that influences overall store performance. With its strong appeal during the evening and dinner hours, there’s a significant opportunity

ON TAP

for Casey’s to strengthen its position as the official pizza and beer headquarters,” said Lee Wilburn Sr., director, packaged beverages, Casey’s. The Ankeny, Iowabased chain owns and operates more than 2,900 sites throughout 19 states.

MODERATING TRENDS

One of the more entrenched trends that emerged during the COVID-19 pandemic appears to be the expanding popularity of ready-to-drink (RTD) cocktails. Where hard seltzers and fermented malt beverages (FMB) once dominated, RTDs have taken over.

Beer sales still cash in for c-stores, but the smaller spirits segment, boosted by premixed cocktails, shows the most growth.

Source: Circana OmniMarket Shared BWS, Total U.S. Convenience data, latest completed 52 weeks ending Sept. 7, 2025

According to Circana, beer-centric seltzers lost 1.4% in dollar sales over the past 12 months, and case sales of FMBs dropped by 4.5%. Premixed cocktails landed at a 56% gain for the 52 weeks ending Sept. 7. What’s more, RTDs grew market share by nearly 8%, and case sales went up by almost 68%.

The convenience factor continues to offer a prominent perk for RTDs — NielsenIQ revealed single-serve cans accounted for more than 30% of RTD sales for the first half of 2025. Flavorings also attract attention to this segment.

“Much of the flavor innovation is occurring across two formats: RTD cocktails and RTD teas. Berries remain popular but under fanciful names, such as Bramble … or berry-flavored margaritas. Innovation is also expanding into other segments, such as lemonade,” said Sudano.

Also lifting RTDs is the aging of Gen Z.

“Older Gen Z consumers, now of legal drinking age, are increasingly exploring RTDs and better-for-you beverage options. While they currently represent a smaller share of wallet, they are highly dynamic in their preferences — often influenced by factors like value, pack size

“Older Gen Z consumers, now of legal drinking age, are increasingly exploring RTDs and better-for-you beverage options.”

- Lee Wilburn Sr., director, packaged beverages, Casey’s

and occasion,” said Wilburn.

Sudano added that the pandemic may have shaped this demographic’s drinking choices. “Many developed a (healthier) lifestyle, and products that require an acquired taste were not consumed as often as normal among this group. As a result, lower consumption levels and gravitation toward convenience/easierto-drink offerings took place, which favored RTDs versus beer,” he added.

In addition to premixed drinks, younger shoppers still show a preference for low alcohol by volume moderation or

non-alcohol options.

Per Circana, non-alcoholic beer sales jumped over 28% year over year, and non-alcoholic wines grew by 27%. Wine in general, however, slowed further, with case sales decreasing by 7%. That could pick up now that the holiday season has arrived, since wine and spirits often are purchased as gifts.

Indeed, the adult beverage category across all segments has the potential to deliver holiday cheer to c-stores as people gather and celebrate with a variety of drink choices. CSD

FAST FACTS:

• Beer sales registered more than $25 billion in the past 12 months.

• Case sales of premixed cocktails grew by almost 68% for the year ending Sept. 7.

• Non-alcoholic wine sales increased by 27% year over year.

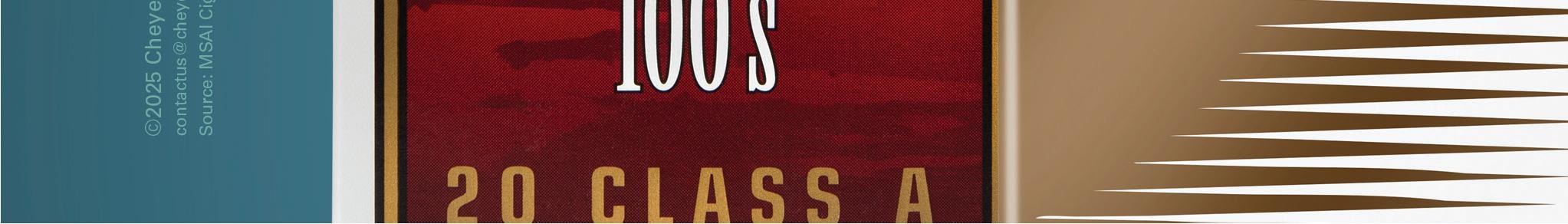

Biggest Trends and Mainstays in the Cigarette Market

Dive into insights with the most profitable sector of in-store sales.

C-stores rely on tobacco products, especially cigarettes, for sales as they continue to dominate the industry. But with OTP (other tobacco products) sales growing, operators need to be aware of what consumers are looking for. A conversation with David Brinkley, vice president of sales at Cheyenne International, shed light on what smokers want and how operators can best supply those options.

Q: With the rise of other oral nicotine products, why is it still vital for c-store operators to be offering diverse cigarette options?

A: Many long-time smokers are unwilling to give up cigarettes altogether, so they’re seeking lower-priced alternatives rather than leaving the category. By stocking a broad assortment of cigarettes, including premium, discount, and fourth-tier options, retailers ensure they’re not leaving sales on the table. At the same time, this also communicates to customers that operators understand their needs and that their store is the one-stop shop. This kind of variety builds trust and keeps customers coming back.

Q: What is downtrading, and why is it important for c-store operators to be aware of it?

A: Downtrading occurs when consumers shift from higher-priced, premium items to more affordable alternatives, such as fourth-tier cigarettes. In the tobacco space, this

behavior tends to accelerate when excise taxes increase or economic pressures rise. If a retailer doesn’t offer value options, adult smokers may walk out the door and find a store that does. Downtrading isn’t just a consumer behavior—it’s a profitgenerating opportunity if retailers position themselves correctly.

Q: What opportunities for profit and growth do c-stores have now?

A: Right now, the biggest opportunity is in the value segment. When retailers lean into that space, they’re building repeat traffic. And it’s not just about the cigarette transaction, either. Shoppers are often picking up other items, which adds to the basket size. If operators think strategically about assortment and pricing, they can turn downtrading into a real growth driver.

Q: What role does pricing play in a consumer’s decision to choose Cheyenne over other brands?

A: Pricing is absolutely central.

Today’s adult smoker is more pricesensitive than ever, but that doesn’t mean they’re willing to compromise on quality. Cheyenne delivers both. When adult consumers can find a cigarette that gives them a consistent, enjoyable experience at a fair price, the decision becomes simple.

Q: What advice would you give to a c-store operator looking to expand their tobacco product selection for maximum profitability?

A: Offer choice. That means having a balanced assortment across all tiers, especially in value. Too often, retailers lean heavily on premium or mid-tier and miss out on where a growing share of the business is happening. By giving consumers options at different price points, operators are protecting their sales and giving themselves the best chance at repeat business. Pair that with smart merchandising and competitive pricing, and they’ll maximize profitability.

-By Ya’el McLoud

Backbar

Anne Baye Ericksen • Contributing Editor

REVIEW MARKET ANALYSES of tobacco and nicotine sales in c-stores over the past few years, and it’s hard to deny the growing value of modern oral nicotine.

NielsenIQ data, as reported by Goldman Sachs, shows sales of smokeless tobacco, including nicotine pouches, for Q3 grew more than 13%, which further widens the performance gap with other products in this pivotal

category. Not even production slowdowns during Q1 and into Q2 dimmed demand this year.

“Our expansion into new brands played a key role in alleviating outof-stocks and helped drive growth within the category,” noted Tim Greene, category director for general merchandise and tobacco for Smoker Friendly. The Boulder, Colo.-based

company is owned by The Cigarette Store Group, which also runs several other brands.

As strong as pouch sales have been, several recent developments could affect sales either up or down. Goldman Sachs pointed to manufacturers’ promotional programs, such as a free can with any nicotine purchase or discounting multiple quantities in a single transaction, as a

C-stores ride the ups and downs of smokeless tobacco, vape and modern oral nicotine sales.

MARKET SHARE CHALLENGE

From September 2024 to September 2025, spitless tobacco, including nicotine pouches, gained nearly 10% of market share, closing in on snuff for the top smokeless tobacco spot.

Source: Circana OmniMarket Total Store View, Total U.S. Convenience data, latest 52 weeks ending Sept. 7, 2025

distinguishing factor driving consumer interest. On the other hand, the segment butts up against local, state and federal regulations just like other entries to the tobacco/nicotine category.

“(There have been) lots of new entrants in the modern oral space, with new flavors and higher nicotine milligram options. In our market specifically, (we’re) looking for backup options for nonflavored modern oral in preparation for statewide flavor bans,” said Jon Manuyag, director of marketing for Plaid Pantry, which owns and operates 110 retail sites in the Pacific Northwest.

Then, in early September, pouches received unexpected news: The Rutgers Institute for Nicotine and Tobacco

Studies released findings from a study of U.S. adults’ use of nicotine pouches in relationship to traditional tobacco.

Researchers concluded the greatest representation of current, daily pouch users are individuals who recently quit using tobacco, including combustible cigarettes. Although the authors issued a call for additional study into potential long-term health effects, they did suggest there could be a role for nicotine pouches to aid cessation efforts. To date, no nicotine pouch brand has received a modified risk marketing designation from the Food & Drug Administration (FDA), although applications have been submitted.

As much as that assessment possibly

explains the migration of traditional tobacco users to modern oral options, Manuyag said it’s thinned out the vaping demographic, too. “This is in part of the overall continued success we are seeing in modern oral and the transition of that consumer to that segment. Vape continues its down trend: -12% in dollars and -10% in units, performing slightly better than the market.”

& SNUFF OUTLOOK

According to Circana, vaping products slipped by more than 8% in dollar sales nationally for c-stores and 12% in unit sales. NielsenIQ data paints a similar picture for Q3: e-cigarettes/vape volume fell by 12% for the 12 weeks ending Sept. 6.

“The vape category remains challenging, largely due to slow and inconsistent regulatory enforcement.”

- Tim Greene, category director for general merchandise and tobacco, Smoker Friendly

“The vape category remains challenging, largely due to slow and inconsistent regulatory enforcement,” added Greene. “While we’ve begun to see increased action from the current administration, state-level directories have played a more immediate role in determining which products are permitted. As these directories continue to roll out, we remain agile, adjusting our assortment to stay compliant while still meeting consumer demand.”

Overall, traditional snuff and chewing tobacco sales are continuing on a steady decline. Snuff fell by nearly 4% in dollar sales for the 52 weeks ending Sept. 7

and 8.5% in units, per Circana. Chewing tobacco didn’t fare any better, with drops of almost 8% and 9%, respectively.

“In cigarettes and smokeless, we are seeing a clear consumer shift toward deep discount brands, prompting manufacturers and retailers to adjust pricing and positioning to stay competitive,” said Greene.

According to Circana, price increases over the 52-week period for chew was a mere 1% and approximately 5% for snuff. In contrast, spitless tobacco prices, including nicotine pouches, jumped more than 9%. While that may somewhat attribute to the bump in dollar sales

(44%), the subcategory simultaneously experienced a 31.5% increase in unit sales. That particular gauge emphasizes the vitality of pouches right now.

While no one can accurately predict what 2026 will deliver in terms of new regulations or FDA market orders, c-store owners and operators undoubtedly look forward to modern oral nicotine products continuing to lead the tobacco/nicotine category. CSD

FAST FACTS:

• Over a 52-week period, prices for chewing tobacco increased a mere 1%.

• Spitless tobacco experienced a 31.5% increase in unit sales over the course of one year.

• A study highlights possible pouch use as a cessation aid.

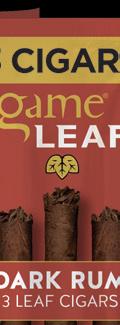

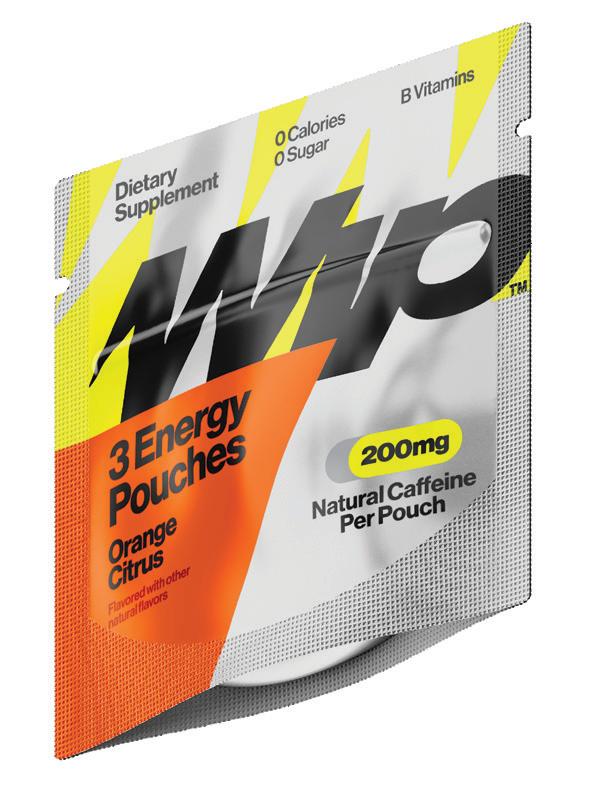

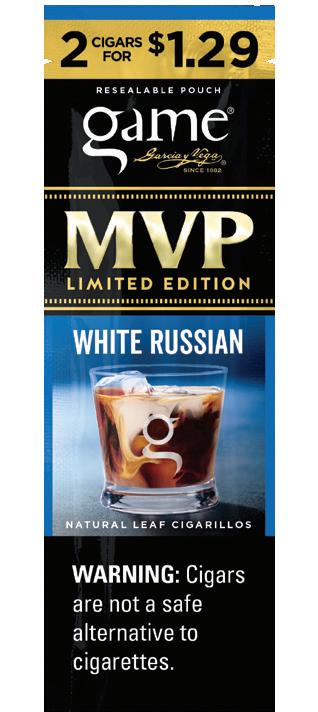

GOOD THINGS COME IN THREES

GAME® LEAF GIVES CUSTOMERS WHAT THEY WANT

In 2015 Game Leaf was introduced as part of the Garcia y Vega portfolio of cigars, revolutionizing the Rolled Leaf cigar category. Now, as part of our 10th anniversary celebration, we’re reintroducing Game Leaf with colorful, eye-catching, consumer-tested 3-cigar packaging designed to bring Rolled Leaf customers more of what they want.

AVAILABLE AT 3 FOR $2.19 TRIAL PRICING AND SAVE ON 3

3 REASONS FOR 3-PACK SALES

In 2024, the 3-pack was the only Rolled Leaf format to show volume growth, along with a 5.7% increase in share of the market.

While all other Rolled Leaf formats showed velocity declines in 2024, the velocity for 3-packs rose by 15%.

Rolled Leaf 3-packs were added to shelves in over 9,700 c-stores in 2024, an 11% increase in store count over 2023.

3 REASONS TO GO WITH GAME LEAF

Game Leaf is able to build on the tremendous brand equity of Game, the #1 selling Natural Leaf cigar in the US.

Game Leaf’s commitment to quality and stringent quality standards—from broadleaf crop selection through manufacturing—ensure the best quality Rolled Leaf cigar available.

Consumers equate the Game Leaf brand with the Garcia y Vega tradition of quality and craftsmanship, as Garcia y Vega has been making Natural Leaf cigars since 1882.

Announcing

the Winners of CStore Decisions

2025 HOT NEW PRODUCTS CONTEST

Gold, silver and bronze awards were given to winners in 23 categories.

A CStore Decions Staff Report

EVERY YEAR, THOUSANDS OF NEW PRODUCTS and services hit the convenience store market, but only a select few have what it takes to stand out in today’s competitive landscape.

CStore Decisions’ 2025 Hot New Products Contest set out to identify those standout launches. This year, nearly 150 entries poured in across multiple categories, from snacks and beverages to technology and services. A panel of retailer experts evaluated submissions using a detailed point system, weighing factors such as innovation, appearance/packaging and overall potential for success.

After careful review, we’re proud to present the 2025 CStore Decisions Hot New Products Contest winners:

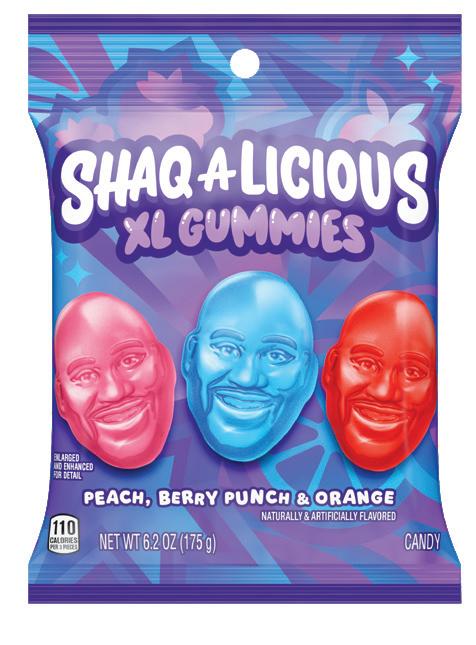

Candy

Gold: Hi-Chew Blue Raspberry Stick

by Hi-Chew

Bronze: Shaq-A-Licious XL Gummies

by The Hershey Co.

Silver: Prime Rib Style Beef Sticks

by Archer

Archer Prime Rib Style Beef

Originally a standout in HI-CHEW’s beloved Fantasy Mix, the HI-CHEW Blue Raspberry Stick has quickly become a fanfavorite flavor. This delightful treat has been thoughtfully repackaged for on-the-go convenience and sharing with friends and family. Blue Raspberry is a flavor that transcends the ordinary, inviting candy lovers on a unique and delectable adventure with each chew. The launch marked an exciting moment, as it was the first stick format release since the Sweet & Sour Watermelon flavor in 2020. With its vibrant color and tantalizing flavor profile, the HI-CHEW Blue Raspberry Stick enchants candy enthusiasts and holds a special place in the hearts of consumers everywhere.

Silver: Reese’s Chocolate Lava Big Cup

by The Hershey Co.

Reese’s Chocolate Lava Big Cup is a new dessert-inspired offering providing Reese’s fans with a rich experience in the form of an extra layer of ooey-gooey chocolatey filling inspired by the decadence of a lava cake. Now available in snack size, this treat gives a rich and gooey eating experience that complements the iconic chocolate and peanut butter combination.

Shaquille O’Neal brings his larger-thanlife personality to candy with Shaq-ALicious XL Gummies. These XL gummies, available in 6.2-ounce peg bags and 11.8-ounce pouches, come in two fun varieties: Shaq-A-Licious Original features peach, berry punch and orange flavors molded after Shaq’s face, while Shaq-ALicious Sour comes in pineapple, mixed ber ry and watermelon flavors — each piece shaped like one of Shaquille O’Neal’s iconic nicknames, such as “Diesel,” “Big Cactus,” and “Big Shamrock,” making the whole line a sweet homage to Shaq’s big personality.

Meat Snacks & Jerky

Gold: Smoky BBQ Beef

by Chomps

Chomps

Smoky BBQ Beef is seasoned with a bold smoky barbe cue spice blend and smoked with natural hardwoods. Chomps spent over a year meticulously developing this unique blend of natural spices and smoking techniques to replicate the nostalgic barbecue flavor without relying on sugar or artificial additives. Each stick is made from thoughtfully sourced, 100% grass-fed and finished beef and has 10 grams of protein. Like all of Chomps’ products, Smoky BBQ is free of artificial flavors and the top nine allergens, appealing to a broad range of health-conscious consumers and meeting the growing demand for better-for-you snacks.

Sticks deliver all the savory, gourmet flavor of a delicious prime rib steak — no grilling required — and packaged up into a convenient snack you can enjoy at home or on the go. These tasty beef sticks are a great option for staying fueled throughout the day, from postworkout snacks to busy travel days. Made with 100% grass-fed and finished beef, the one-ounce sticks contain eight grams of protein per serving, zero sugar and no preservatives and meet certified glutenfree and Paleo standards.

Bronze: Elk Jalapeño & Cheese Snack Stick Multipack

by Pearson Ranch Elk & Bison Jerky

Spice up snack time with Pearson Ranch Elk Jalapeño Cheese Snack Sticks. This four-ounce pack blends premium elk, zesty jalapeños and rich cheese for a bold, flavorful experience. Packed with protein and full of smoky goodness, these sticks are the perfect companion for your adventures.

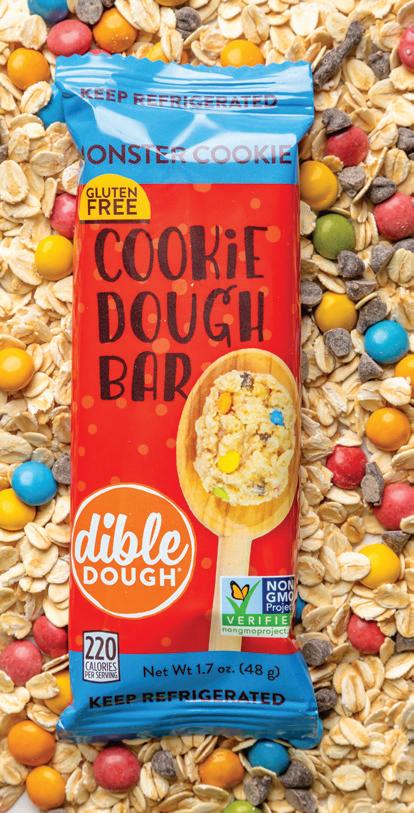

Snack Bars

Gold: Kate’s Real Food Peanut Butter Cup Protein Bar

by Kate’s Real Food

The Kate’s Real Food Peanut Butter Cup Protein Bar brings bold, nostalgic flavor to the clean snacking space. Made with organic peanut butter, rich dark chocolate and sweetened only with organic honey, this plant-based protein bar delivers the taste of a peanut butter cup in a real-food format. It’s crafted for consumers who want an indulgent flavor experience without compromising on clean ingredients. This bar is made to satisfy and sustain — whether you’re out on the trail or just need something solid between meals. It’s a go-to for people who want real ingredients and dependable energy without the artificial aftertaste, or ingredients, common in typical protein bars.

Silver: Monster Cookie Dough Bar

by Dible Dough LLC.

Dible Dough’s very first gluten-free flavor is a gamechanger, a perfect combo of all things Dough-licious — gluten-free oats, creamy peanut butter, rich chocolate chips and crunchy chocolate candies. This dough is monstrously delicious.

Bronze: Kate’s Real Food Peanut Butter Brownie Protein Bar

by Kate’s Real Food

The Kate’s Real Food Peanut Butter Brownie Protein Bar brings rich chocolate flavor together with creamy organic peanut butter for a clean snack that tastes like dessert — without the crash or compromise. Soft and chewy with just the right amount of sweetness, it delivers the comfort of a brownie in an organic format that fits into any part of your day. This bar is made for movement. It holds

up on the trail, at your desk or in your bag — no melting, no crumbling, no chalky finish. Wherever the day takes you, it’s ready when you are. And with real ingredients behind every bite, the flavor does more than satisfy — it earns its place in your routine.

Sweet Snacks

Gold: Ding Dongs 5 CT CEreal Straws

1.76 OZ

by Hilco Sweets

Ding Dongs fivecount cereal straws in 1.76 ounces are Hostess Ding Dongs-flavored light and crispy wafer rolls filled with a cream center. They work as straws for milk or anytime consumption. It is a delicious and fun snack.

Silver: Pop-Tarts x Girl Scouts

by Kellanova

Bronze: Oreo Muddy Buddies

by General Mills Convenience

General Mills Convenience is introducing an elevated new twist on its Muddy Buddies Cookies & Cream with the introduction of Oreo Cookies & Cream Muddy Buddies. The new snack includes crispy corn Chex pieces coated with a topping of real Oreo cookie wafers. Other flavors of Muddy Buddies available at convenience stores include: Cinnamon Toast Crunch, Funfetti, Peanut Butter & Chocolate, Brownie Supreme and Girl Scout Thin Mint. The 4.25-ounce bags for the warehouse salty category have a suggested retail price of $4.29.

Pop Tarts teams up with Girl Scouts to roll out two irresistible new flavors inspired by fan-favorite Girl Scout Cookies: Frosted Coconut Caramel and Frosted Thin Mints.

Spicy Snacks

Gold: Xochitl Cholula Hot Sauce Tortilla Chips

by Xochitl

Crafted with premium ingredients and authentic flair, Xochitl and Cholula bring the bold, spicy flavors of Mexico closer to you. With a commitment to quality and tradition, these iconic brands continue to elevate the snacking experience with thin and crispy chips with the right amount of heat.

Silver: Chex Mix Spicy Dill

by General Mills

Convenience

General Mills Convenience is bringing cstore consumers not one but two bold new ways to enjoy Chex Mix snack mix with the launch of Spicy Dill and Hot & Spicy flavorblasted varieties. Packed with seasoned Chex cereal, mini breadsticks, pretzels and crispy crackers, these new mixes deliver an irresistible combination of crunch and bold flavor and offer c-store retailers a high-impact snack option that satisfies consumers’ cravings for intense, salty flavors. The 4.5-ounce bags for the warehouse salty section of the c-store have a suggested retail price of $3.79.

Bronze: Pringles Hot Ones Collection

by Kellanova

The Pringles x Hot Ones collection includes two returning crisp flavors and one brand-new flavor, all inspired by Hot Ones sauces.

Bronze: Chex Mix Hot & Spicy

by General Mills Convenience