FACULTY OF INSTRUCTION

MARTIN L. SHOTZBERGER . . Professor of Business Administration

B.S., M S., University of Richmond; Ph.D., The Ohio State University.

J AMES A. MONCURE

Associate Professor of History and Associate Dean of Liberal Arts

B.A., University of Richmond; M.A., Ph.D., Columbia University.

TALBOT R. SELBY Professor of Ancient Languages

A.B , Ph.D , University of North Carolina.

C HARLES H. WHEELER, III Professor of Mathematics

S.B ., Washington and Jefferson Colleie; Ph D , Johns Hopkins Univ ersity; D.Sc., Washingt xm and Jenerson College.

A DELBERT E. BRADLEY, JR.

Associate Professor of Speech

A.B. , Birmingham-Southern College; M.A., University of Alabama; Ph.D , Florida State University.

RO BERT C. BURTON

Associate Professor of Economics

B S., M.S., Virginia Polytechnic Institute; Ph.D., University of Virginia

RI CHARD C. CHEWNING

Assistant Professor of Finance

B S., Virginia Polytechnic Institute; M B.A., University of Virginia; D B.A , University of Washington.

GE ORGIE A. GURNEY

Assistant Professor of English

A.B. , Tufts University; M.A. Longwood College; Certificat Diplome, University of Toulouse; Harvard University; University of N orth Carolina.

JA MES K. HIGHTOWER Assistant Professor of Quantitative Method

B A., Kalamazoo College; Claremont Graduate School.

JA CK S. MULLINS

Assistant Professor of History

B.A., Furman University; M.A., Ph.D., University of South Carolina.

RICHARD s. u NDERHILL Assistant Professor of Business Administration and Director, Mana.f!.ement Development Center

B A , M.A ., University of Michigan; Indiana University

DO UGLAS w. DAVIS I nstiructor in Spanish

B.A., M A., University of Maryland; University of Maryland.

E LI ZABETH H McLAUGHLIN Part - time Instructor in Mathematics

B.A., M.A , University of West Virginia

FRA NCES D. UNDERHILL Part-time Instructor in History

B.A., M.A., University of Michigan; Indiana University

LECTURERS

.ALFREDA. ADKINS,III, B.A. Banking Assistant Vice President, State-Planters Bank of Commerce and Trusts

BENE. AMES,B.S.. . Management Personnel Manager, Thalhimer Brothers, Inc.

LINWOODM. ARON, B.A. Real Estate Appraisal

Area Supervisor General Business

Executive Vice-President, Rountrey and Associates

s. WAYNE BAZZLE, B.S., M.C. Assistant Cashier, The Bank of Virginia

ARTHUR C. BECK, JR. B.S. M.B.A. Associate, Consultant Associates

HENRY BoNo, B.S.

Assistant Chief, Technical Branch Internal Revenue Service Group Supervisor, Internal Revenue Service

DONALDBOYES,B.A., M.B.A. Traffic Management

Manager, Export-Import Division, General Traffic Department Reynolds Metals Company

WILLIAMB. BRENNAN,B.A. Office Management

General Accounting Suyervisor, The Chesapeake and Potomac Telephone Company o Va.

FRED T. BRIDGES,JR., B.S., M.S. Systems Controls Administrative Systems Analyst, Reynolds Metals Company

IRvIN L. BRITTLE,B.A., M.C., C.P.A. Accounting Partner, J. C. Wheat & Co.

HAROLDG. BROWN,JR., B.A. Banking Assistant Cashier and Branch Manager, Southern Bank •nd Trust Company

Roy S. CAYTON,B.S., C.P.A. Partner, Andrews, Burket & Company

BENJAMINT. CULLEN,JR., B.S., M.A. Personnel Director, Medical College of Virginia

WILLIAMV. DANIEL,B.A.

Vice-President, First and Merchants National Bank

MARIADEMETRIO.Doctor of Education (Cuba) Teacher, Tuckahoe Junior Hig-h School

ELLis M. DuNKUM, B.S., C.P.A.

Staff Accountant, Leach, Calkins and Scott

RIC HARD C. EDMUNDS, JR., B.A., M B.A.

Accounting

Management

President and General Manager, Richmond Materials Handling Corp.

JAM ES A. EICHNER, B.A., LL.B.

Assistant City Attorney, City of Richmond, Virginia

DON ALD M. FAULKNER, JR., B.S., M.B.A.

Associate, Whitlock-McCall, Inc.

HAR OLD D. GIBSON, B.A.

Assistant-in-Personnel, Richmond School Board

RIC HARD s. GILLIS, B A.

Executive Director, Virginia State Chamber of Commerce

J.C. HARLAN, B.A., M.A.

Business Law

Finance

English

Public Relations

Credit Administration

Assistant Vice-President, State-Planter s Bank of Commerce and Trusts

WIL LIAM M. HARRIS, A.A , B.S.

Personn el Director, Central National Bank

J AME S D HAWKINS, C.L.U.

General Ag_ent , Fidelity Bankers Life Insurance Co . President, University Life Plan, Inc

R. FRANKLIN HAWKINS, JR., B.A., M.C. Tru st Officer, Central National Bank

HAR MON HAYMES, Ph.D.

Economi st , Federal Re serve Bank

]AME S E HENDRICKS, B.B.A. Frei ght Traffic Analyst , Reynold s Metals Company

JAME S P. JACOBS, C P.C U. Assistant Mana ger, Insurance Co. of North America

WIL LIAM J. JARRETT, JR., B.S., M.B.A., C P.A. Staff Accountant, Leach, Calkins & Scott

WAL TER L. JuDD, B.A.

Area Supervisor , Retailing Personnel Manager, Sears, Roebuck and Company

WILLIA M J . KELLAM, JR., A.B., LL.B.

Attorney , Seaboard Air Line Railroad Company

ARTHU R J. KELLY, B.S ., C P.A.

Technical Advisor, Internal Revenue Service

UNIVERSITYOF RICHMOND

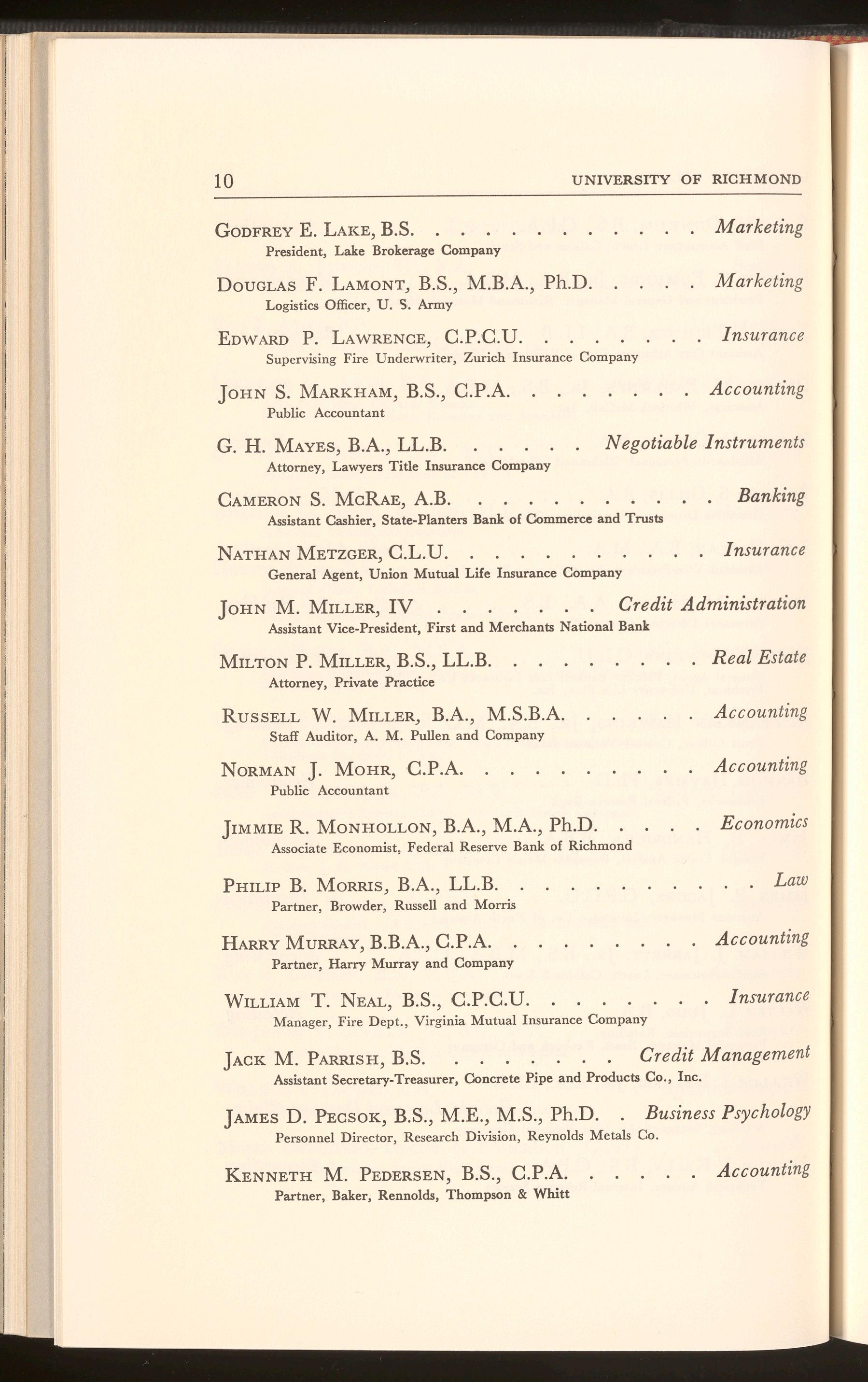

GODFREYE. LAKE,B.S. Marketing President, Lake Brokerage Company

DOUGLASF. LAMONT,B.S., M.B.A., Ph.D. Marketing Logistics Officer, U. S. Army

EDWARDP. LAWRENCE,C.P.C.U. Insurance

Supervising Fire Underwriter, Zurich Insurance Company

JOHN s. MARKHAM,B.S., C.P.A. Accounting Public Accountant

G. H. MAYES,B.A., LL.B. Negotiable Instruments Attorney, Lawyers Title Insurance Company

CAMERONS. McRAE, A.B. Banking Assistant Cashier, State-Planters Bank of Commerce and Trusts

NATHANMETZGER,C.L.U. Insurance General Agent, Union Mutual Life Insurance Company

JoHN M. MILLER,IV Credit Administration Assistant Vice-President, First and Merchants National Bank

MILTONP. MILLER,B.S., LL.B. . Real Estate Attorney, Private Practice

RussELL W. MILLER, B.A., M.S.B.A. Accounting Staff Auditor, A. M. Pullen and Company

NORMANJ. MOHR, C.P.A. Accounting Public Accountant

JIMMIE R. MoNHOLLON,B.A., M.A., Ph.D. Economics Associate Economist, Federal Reserve Bank of Richmond

PHILIP B. MORRIS,B.A., LL.B. Law Partner, Browder, Russell and Morris

HARRYMURRAY,B.B.A., C.P.A. Accounting Partner, Harry Murray and Company

WILLIAMT. NEAL, B.S., C.P.C.U. Insurance Manager, Fire Dept., Virginia Mutual Insurance Company

JACK M. PARRISH,B.S. Credit Management Assistant Secretary-Treasurer, Concrete Pipe and Products Co., Inc.

JAMESD. PEcsoK, B.S., M.E., M.S., Ph.D. Business Psychology Personnel Director, Research Division , Reynolds Metals Co.

KENNETH M. PEDERSEN,B.S., C.P.A. Accounting Partner, Baker, Rennolds, Thompson & Whitt

UNIVERSITY COLLEGE

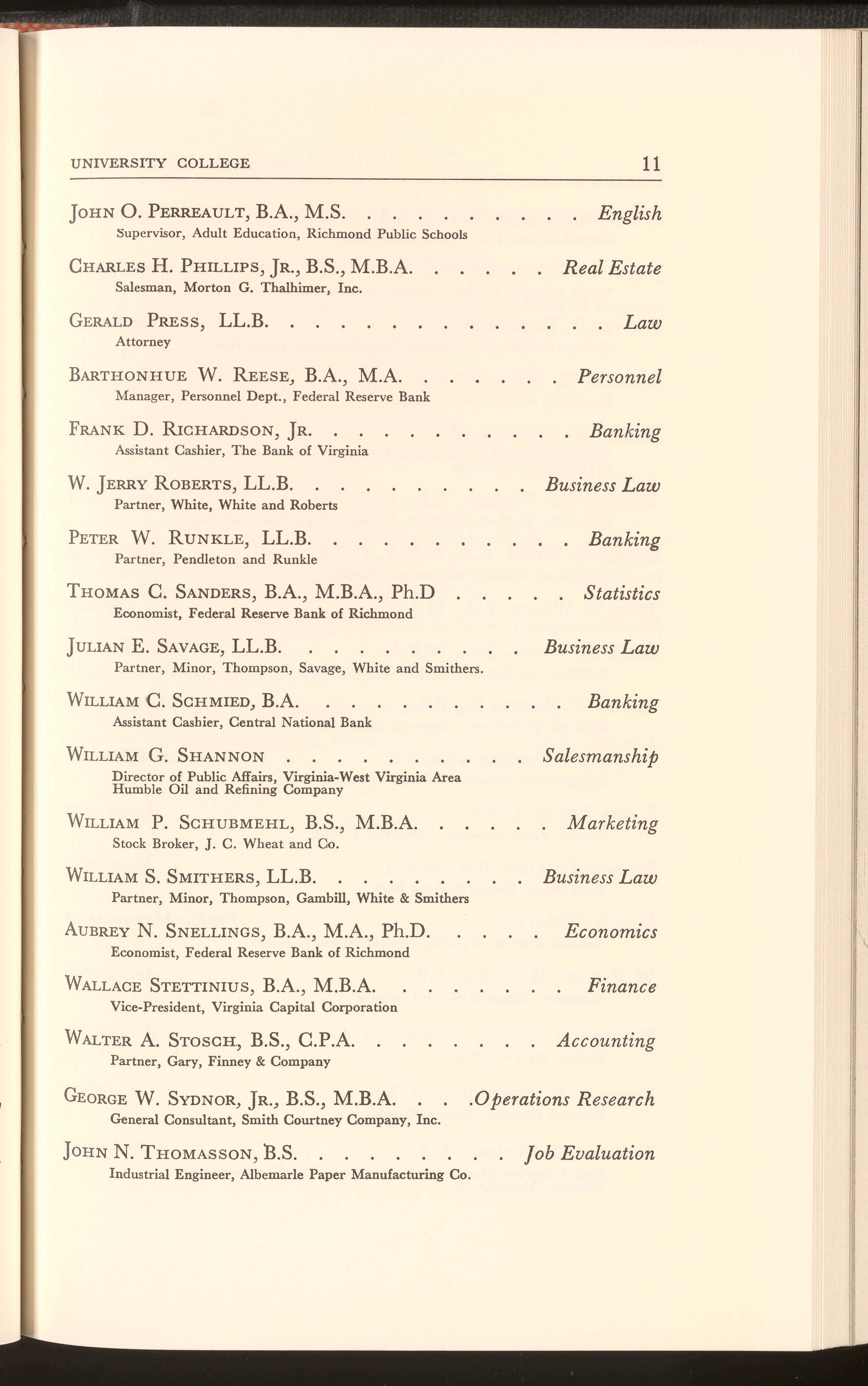

JoHN 0. PERREAULT, B.A., M.S.

Supervisor, Adult Education, Richmond Public Schools

CHARLES H. PHILLIPS, JR., B.S., M.B.A. Salesman, Morton G. Thalhimer, Inc.

GERALD PRESS, LL.B. Attorney

BARTHONHUE w. REESE, B.A., M.A. Manager, Personnel Dept., Federal Reserve Bank

FRANK D. RICHARDSON, JR.

Assistant Cashier, The Bank of Virginia

w. JERRY ROBERTS, LL.B.

Partner, White, White and Roberts

PETER w. RUNKLE, LL.B.

Partner, Pendleton and Runkle

THOMAS C. SANDERS, B.A., M.B.A., Ph.D Economist, Federal Reserve Bank of Richmond

JULIAN E. SAVAGE, LL.B.

Partner, Minor, Thompson, Savage, White and Smithers.

WILLIAM C. SCHMIED, B.A.

Assistant Cashier, Central National Bank

WILLIAM G. SHANNON

Director of Public Affairs, Virginia-West Virginia Area Humble Oil and Refining Company

WILLIAM P. SCHUBMEHL, B.S., M.B.A. Stock Broker, J. C. Wheat and Co.

WILLIAM S. SMITHERS, LL.B. Partner, Minor, Thompson, Gambill, White & Smithers

AUBREY N. SNELLINGS, B.A., M.A., Ph.D. Economist, Federal Reserve Bank of Richmond

WALLACE STETTINIUS, B.A., M.B.A. Vice-President, Virginia Capital Corporation

WALTER A. STOSCH, B.S., C.P.A. Partner, Gary, Finney & Company

GEORGE w. SYDNOR, JR., B.S., M.B.A.

General Consultant, Smith Courtney Company, Inc.

JOHN N. THOMASSON, :S.S.

Industrial Engineer, Albemarle Paper Manufacturing Co.

UNIVERSITY OF RICHMOND

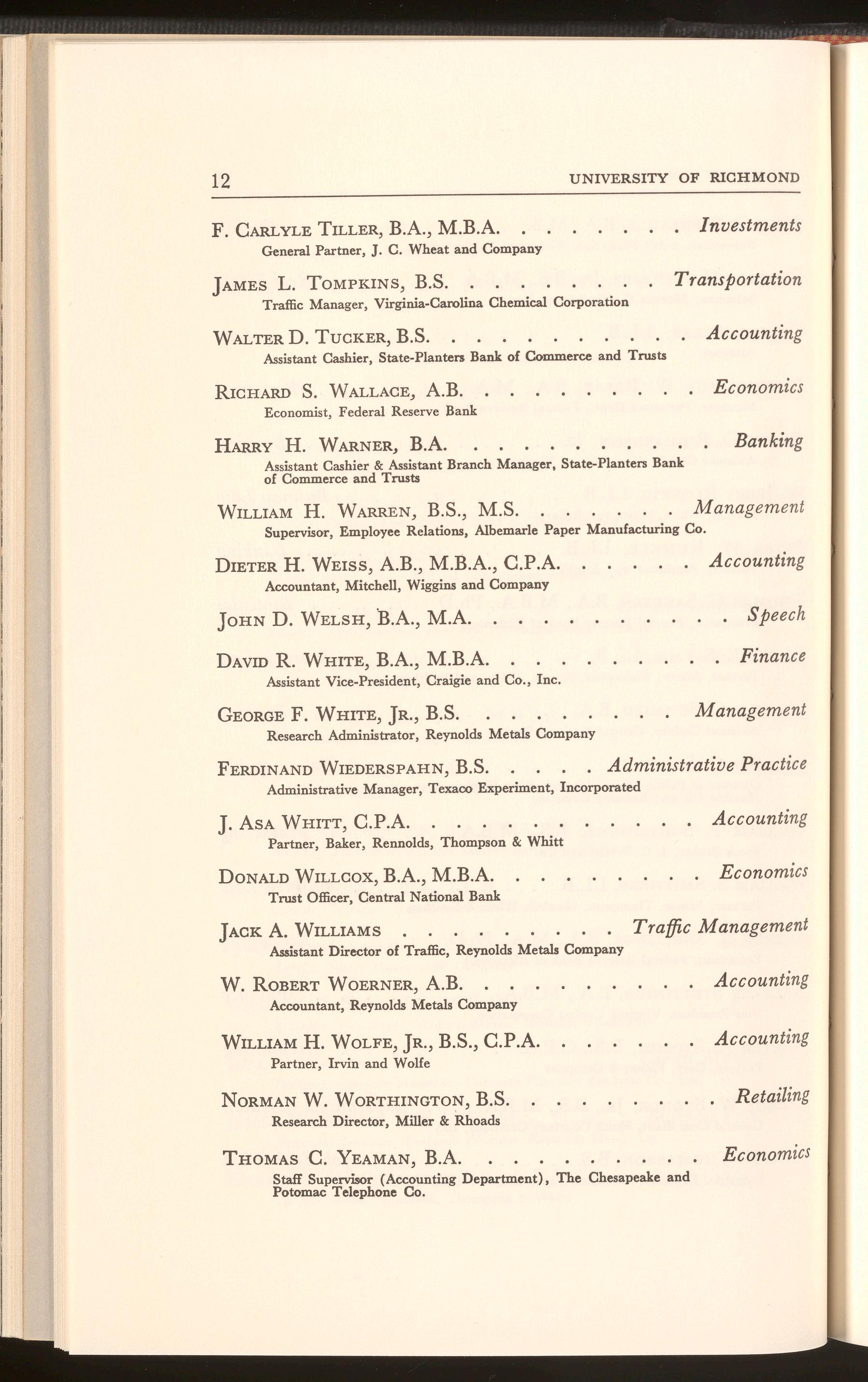

F. CARLYLE TILLER, B.A., M.B.A. Investments General Partner, J. C. Wheat and Company

JAMES L. TOMPKINS, B.S. Transportation Traffic Manager, Virginia-Carolina Chemical Corporation

WALTERD. TUCKER, B.S. Assistant Cashier, State-Planten Bank of Commerce and Trusts

RICHARD S. WALLACE, A.B. Economist, Federal Reserve Bank

HARRY H. w ARNER, B.A. Assistant Cashier & Assistant Branch Manager, State-Planters Bank of Commerce and Trusts

WILLIAM H. WARREN, B.S., M.S. Management Supervisor, Employee Relations, Albemarle Paper Manufacturing Co.

DIETER H. WEISS, A.B., M.B.A., C.P.A. Accountant, Mitchell, Wiggins and Company

JOHN D. WELSH, B.A., M.A.

DAVID R. WHITE, B.A., M.B.A. Assistant Vice-President, Craigie and Co., Inc.

GEORGE F. WHITE, JR., B . S. Research Administrator, Reynolds Metals Company

FERDINAND WIEDERSPAHN, B.S. Administrative Practice Administrative Manager, Texaoo Experiment, Incorporated

J. AsA WHITT, C.P.A. Accounting Partner, Baker, Rennolds, Thompson & Whitt

DONALD WILLCOX, B.A., M.B.A. Economics Trust Officer, Central National Bank

JACK A. WILLIAMS Traffic Management Assistant Director of Traffic, Reynolds Metals Company

W. ROBERT WOERNER, A.B. Accounting Accountant, Reynolds Metals Company

WILLIAM H. WoLFE, JR., B.S., C.P.A. Partner, Irvin and Wolfe

NORMAN w. WORTHINGTON, B.S. Research Director, Miller & Rhoads

THOMAS C. YEAMAN, B.A. Staff Supervisor (Accounting Department), The Chesapeake and Potomac Telephone Co.

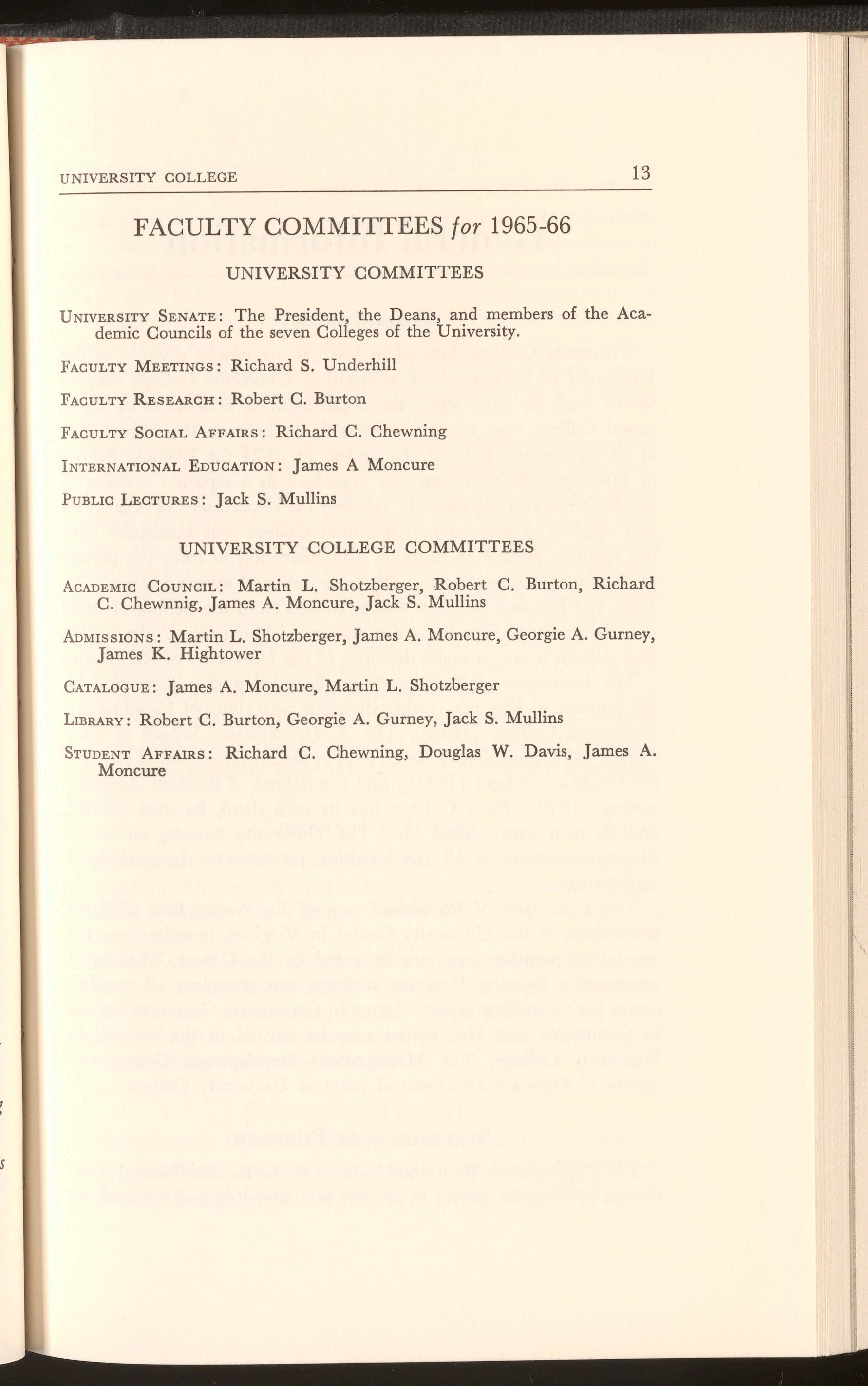

FACULTY COMMITTEES for 1965-66

UNIVERSITY COMMITTEES

UNIVERSITYSENATE: The President, the Deans, and members of the Academic Councils of the seven Colleges of the University.

FACULTYMEETINGS: Richard S. Underhill

FACULTYRESEARCH: Robert C. Burton

FACULTYSocIAL AFFAIRS: Richard C. Chewning

INTERNATIONALEDUCATION:James A Moncure

PUBLICLECTURES: Jack S. Mullins

UNIVERSITY COLLEGE COMMITTEES

ACADEMICCouNCIL: Martin L. Shotzberger, Robert C. Burton, Richard C. Chewnnig, James A. Moncure, Jack S. Mullins

ADMISSIONS:Martin L. Shotzberger, James A. Moncure, Georgie A. Gurney, James K. Hightower

CATALOGUE:James A. Moncure, Martin L. Shotzberger

LIBRARY:Robert C. Burton, Georgie A. Gurney, Jack S. Mullins

STUDENTAFFAIRS: Richard C. Chewning, Douglas W. Davis, James A. Moncure

General Information

ORGANIZATION

University College, formed in 1962, is the newest division of the University of Richmond. The origin of University College may be traced back to 1920 when the department of economics of Richmond College was created, eventually to become the department of economics and applied economics. In 1924 the Evening School of Business Administration was organized as a separate division of the University of Richmond. In 1949 the department of economics and applied economics in Richmond College was combined with the Evening School of Business Administration to form the School of Business Administration with both day and evening classes. In 1962, the Evening Division was separated from the School of Business Administration to form the nucleus of University College. This new college is one of seven divisions of the University of Richmond

The University of Richmond was founded and is supported by the Baptists of Virginia. Other divisions with dates of founding are Richmond College ( 1830) ; The T. C. Williams School of Law (1870); Westhampton College (1914); the Summer School (1920); the Graduate School ( 1921) ; and the School of Business Administration ( 1949). Each College has its own dean, its own faculty , and its own institutional life. The University Senate, on which sit representatives of all the faculties, provides for intercollegiate cooperation.

The University of Richmond, one of the twenty-four affiliated institutions of the University Center in Virginia, benefits from the several cooperative programs operated by the Center. Through a cooperative Evening Program students can complete all requirements for an undergraduate degree in Commerce. Graduate degrees in Commerce and Humanities may be earned in the evening in University College. The Management Development Center and Junior College are also integral parts of University College

STATEMENT OF PURPOSE

The University of Richmond, related to the Baptist General Association of Virginia, strives to provide a challenging and comprehen-

sive academic program in a Christian atmosphere in which students of all faiths may apply themselves individually and collectively to developing their intellectual, spiritual, social, and physical potentialities. It seeks to give each student an intellectual experience that will widen his vision, deepen his faith, strengthen his character, and equip him to think and act rationally in our complex society. It fosters intellectual understanding, it defends freedom of discussion, and it p romotes an objective search for truth; for without these conditions true education does not exist.

In pursuing these general purposes the University recognizes specific areas of obligation and opportunity. Primarily a teaching institution in the liberal arts tradition, it seeks to provide a basis of sound learning and teaching and opportunities in research for the intellectual and cultural development of its students and faculty; as a church-related institution, it must prepare some students for fulltime Christian vocation and must provide for all students opportunities for the development of a satisfying personal faith, ethical maturity, and morally responsible leadership; as a privately endowed and privately controlled institution, it should develop human personality for its fullest expression through individual freedom without political pressures and control; and as an urban institution, it recognizes its obligation to prepare responsible citizens not only for useful car eers in the City and State but also for leadership in a democratic society.

LIBRARY FAGILITIES

The libraries of the University contain over 163,500 volumes. The main collection is housed in the Boatwright Memorial Library. U niversity College has a library facility designed to augment the m ain library.

Special collections of books, pamphlets and research materials are ma intained by the Richmond Chapter of the Virginia Society of Certified Public Accountants, the Richmond Chapter of the National Office Management Association, and the Richmond Chapter of the American Institute of Banking.

CLASSROOM FAGILITIES

Most classes in University College are held in the Columbia Building at Lombardy and Grace Streets and the Lombardy Building at Lombardy and Broad Streets. Some classes are offered in the

School of Business Administration building on the main campus of the University.

ACCREDITATION

University College is part of the University of Richmond which is fully accredited by the Southern Association of Colleges and Schools.

ADMISSION REQUIREMENTS To UNIVERSITY COLLEGE

Four classifications of students, both men and women, are admitted to University College evening classes.

( 1) Special students. Adults over twenty-one years of age who are not high school graduates may be admitted as special students.

(2) High school graduates. Young men and women who have graduated from high school with at least fifteen approved units are eligible to enter.

(3) Present or former college students. To those young people who have attended college a year or more without graduating, University College offers an opportunity to continue their university training while being employed.

NOTE: A student who has been dropped from another college or university may not be admitted to any evening division program even with unclassified status until a minimum of one semester has elapsed. Official transcripts from all institutions previously attended by such a student must be filed in the Office of the Dean.

(4) College graduates. Many students enrolled in University College are college and university graduates. Graduates of liberal arts colleges who wish to extend their general education, graduates of engineering colleges who wish to supplement their technical knowledge, and graduates of university schools of commerce who wish to specialize further in particular fields of activity, have found benefit in the training provided. College graduates can also obtain credits leading to the degrees Master of Commerce, and Master of Humanities.

Veterans of the armed services, whether high school graduates or not, who demonstrate their ability to undertake college work may enter University College.

ADVANCED CREDIT FOR VETERANS

In accord with the recommendations of the American Council on Ed u cation, the following advanced credit will be allowed veterans:

( 1) The veteran who has served at least six months, but less than one year, shall receive credit for two hours in military science.

(2 ) The veteran who has served one or more years shall receive credit for two hours in physical exercise, two hours in human biology, and four hours in military science.

( 3 ) Frequently a veteran may secure additional credit for specialized training courses taken from standard colleges under the auspices of the U. S. Armed Forces Institute. A veteran desiring such credit should present his record either on the transcript form of the college in which the work was taken or on the form prepared for such purposes by the U.S. Armed Forces Institute. The Academic Coun cil will determine the amount of credit, if any, to be granted in eac h case.

(4 ) In allowing further advanced credit for educational experience in the armed services the Ac a demic Council will be guided largely by the recommendations of the American Council on Educ ation.

PROGRAMS OF STUDY

Degree Programs-University College offers evening work on the the college level leading to the undergraduate degree Bachelor of Commerce and the graduate degrees Master of Commerce and Master of Humanities.

Req uirements for these degrees may b e found on pages 18, 20 and 21 r espectiv ely.

Associate Award s-Students completing prescribed courses may earn an Associate of Commerce or an Associate of Arts award in the evening . The Associate of Arts award is also available in the day Junio r College. Students interested in the associate awards in the evenin g should confer with the Dean. Those interested in the Junior College should request a Junior College catalogue and confer with the De an or Associate D ean of Liberal Arts

Cer tificat es-A Certificate in Commerce will be awarded to any student who has successfully complet ed, with a grad e of no less

UNIVERSITY OF RICHMOND

than C in each course, 36 to 43 semester hours-depending on the program----of which at least 24 semester h'ours must have been completed in University College of the University of Richmond. Each program must be approved, prior to its completion, by the Dean of University College. Several certificate programs are offered. See page 23 of the catalogue for certificate requirements.

MANAGEMENT DEVELOPMENT CENTER

The Management Development Center, established in 1963, is a non-profit service of University College to the Richmond area business community. The objective of the Center is to provide Richmond area industry with professional management training and services which are unique and of high quality. This objective is accomplished by: professional courses, on-campus and in-plant; conferences; attitude surveys; consultation; and individual development programs. Through an affiliation with the Industrial Relations Center of the University of Chicago, the Management Development Center makes available vast resources in program, research, library and materials. Activities of the Center are financed by membership fees and tuition fees paid, in whole or in part, by participating companies, as well as by fees for other services. Such an approach is in keeping with the highest tradition of the American Free Enterprise System: Private Education and Private Industry cooperating in individual and personal development.

Inquiries about the Management Development Center should be sent to: Director, Management Development Center, 601 North Lombardy Street, Richmond, Virginia, 23220.

BACHELOR OF COMMERCE

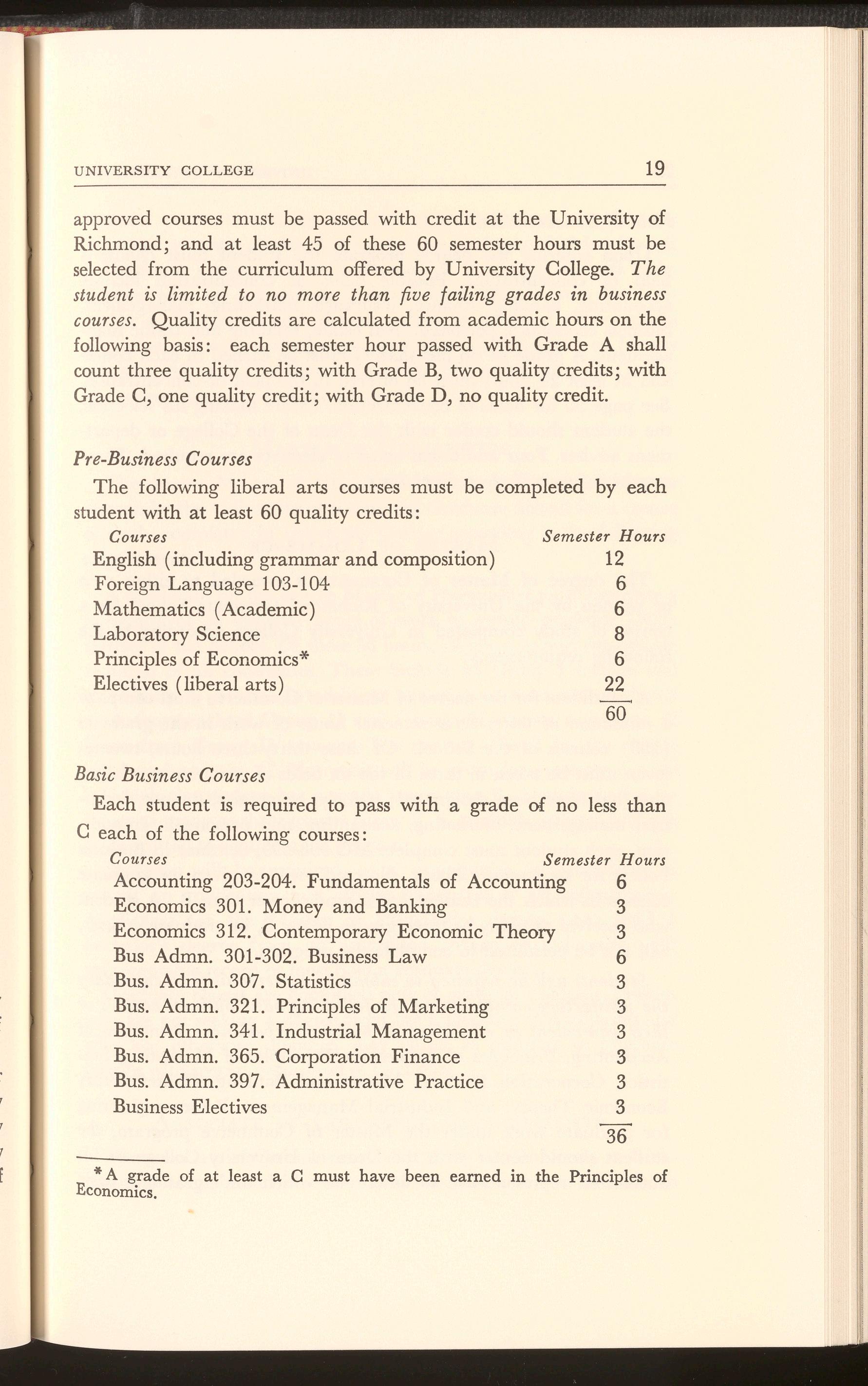

The Bachelor of Commerce degree is awarded by the University of Richmond to either men or women who complete a course of study in University College according to the following requirements: The student may become a candidate for the degree of Bachelor of Commerce by making application to the Dean of University College after he has completed 45 semester hours with 45 quality credits. A total of 124 semester hours of work and 120 quality credits are required for the degree. At least 60 semester hours of

approved courses must be passed with credit at the University of Richmond; and at least 45 of these 60 semester hours must be selected from the curriculum offered by University College. The student is limited to no more than five failing grades in business courses. Quality credits are calculated from academic hours on the following basis: each semester hour passed with Grade A shall count three quality credits; with Grade B, two quality credits; with Grade C, one quality credit; with Grade D, no quality credit.

Pre-Business Courses

The following liberal arts courses must be completed by each student with at least 60 quality credits: Courses

English (including grammar and composition)

Foreign Language 103-104

Mathematics (Academic)

Laboratory Science

Each student is required to pass with a grade of no less than C each of the following courses:

* A grade of at least a C must have been earned in the Principles of Economics.

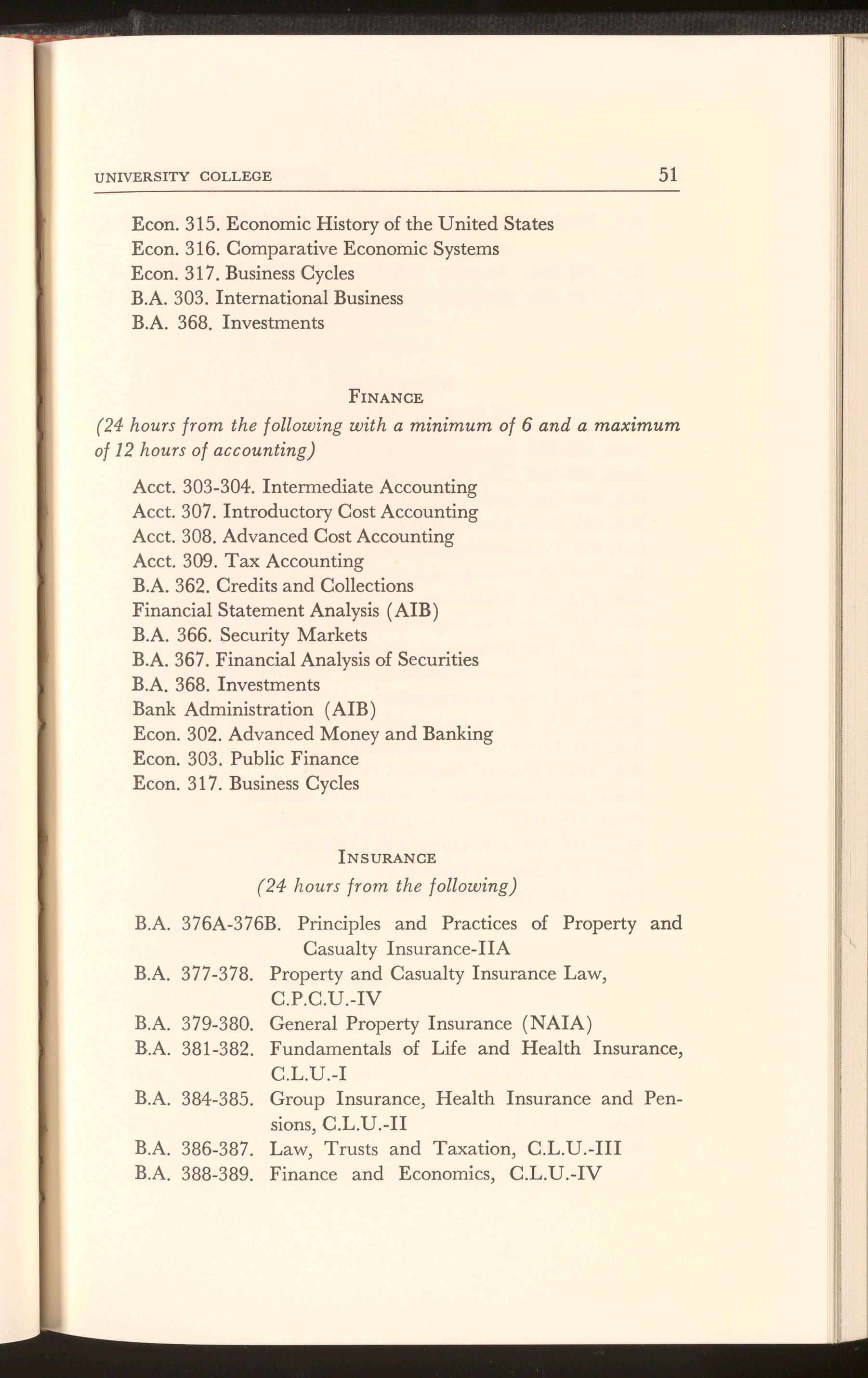

Field of Concentration

Upon entering the degree program the student must choose a field of concentration. Possible fields of concentration include accounting, banking, finance, insurance, marketing, managemen t, business economics, personnel, real estate, retailing and traffic management. A grade of no less than C must be earned in each course and at least 24 hours must be offered in the field of concentration . See page 50 for fields of concentration. Before makin g his selecti on, the student should confer with the Dean of the College or department adviser. Four additional hours of electives are required. These may be in any college credit courses.

MASTER OF COMMERCE

The degree of Master of Commerce is awarded to either men or women by the University of Richmond Graduate School for a course of study completed in University College according to the following requirements:

A candidate for the degree of Master of Commerce must complete a minimum of thirty-three semester hours of work in the gradu ate (500) courses of the School. Of these thirty-three hours, twent yseven must be taken in three of the six fields of graduate speciali zation that have been designated; namely, economics, finance, indu strial management, marketing, accounting, and personnel. In addition, each student must complete MC 598-599, Seminar in Busin ess Policy, for six semester hours. No credit will be given for graduate courses in which the student has a grade lower than B. A student who receives as many as three grades below B, in graduate courses, will not be permitted to complete the program.

Students will be required t'o submit as a prerequisite to candidacy the satisfactory completion of the fallowing basic business cours es or their equival ent in education or busin ess experi enc e : Principl es of Accounting, Principles of Economics, Principles of Marketing, Statistics, Corporation Finance, Money and Banking, Contempo rary Economic Theory, and Industrial Management. Before register ing for graduate work under the Master of Commerce program, the student should confer with the Dean of University College or his authorized representative to determine which undergraduate basic

business courses are to be required. A student must complete the graduate program within five years after he begins 500 level work.

Graduate classes will be composed of graduate students only. Persons who are not seeking a degree or certificate from the University of Richmond and who are otherwise qualified may enroll in a gra duate course with special permission of the Dean or faculty advisers. All graduate courses carry the 500 series number. Graduate courses are to be found on page 45.

MASTER OF HUMANITIES

The degree Master of Humanities is awarded to either men or women by the University of Richmond Graduate School for a course of study completed in University College according to the following requirements:

A candidate for the degree Master of Humanities must complete a minimum of 36 semester hours of work in certain graduate ( 500) courses of the School. Of these 36 hours, 12 hours in four courses are required of all candidates. These include all Group I courses and the Group V course. In addition, the student must elect 6 hours work from each of Group II and Group III courses as well as 12 hours from Group IV courses. The courses offered for the degree are found on page 47. No credit will be given for graduate courses in which the student has a grade lower than B. A student who receives as many as three grades below B, in graduate courses, will not be permitted to complete the program.

Students will be required, as a prerequisite to candidacy, to submit an application and official transcripts of all college work. Applicants for the Master of Humanities degree must hold a bachelor's degree from an accredited college or university with an acceptable record or must hold a graduate degree.

Graduate classes are composed only of graduate students. Persons who are not seeking a degree from the University of Richmond and who are otherwise qualified may enroll as auditors in graduate courses with special permission of the Dean.

ASSOCIATE OF COMMERCE REQUIREMENTS

The Associate of Commerce is awarded by the University of Richmond to either men or women who complete a course of study in

University College evening classes according to the following requirements:

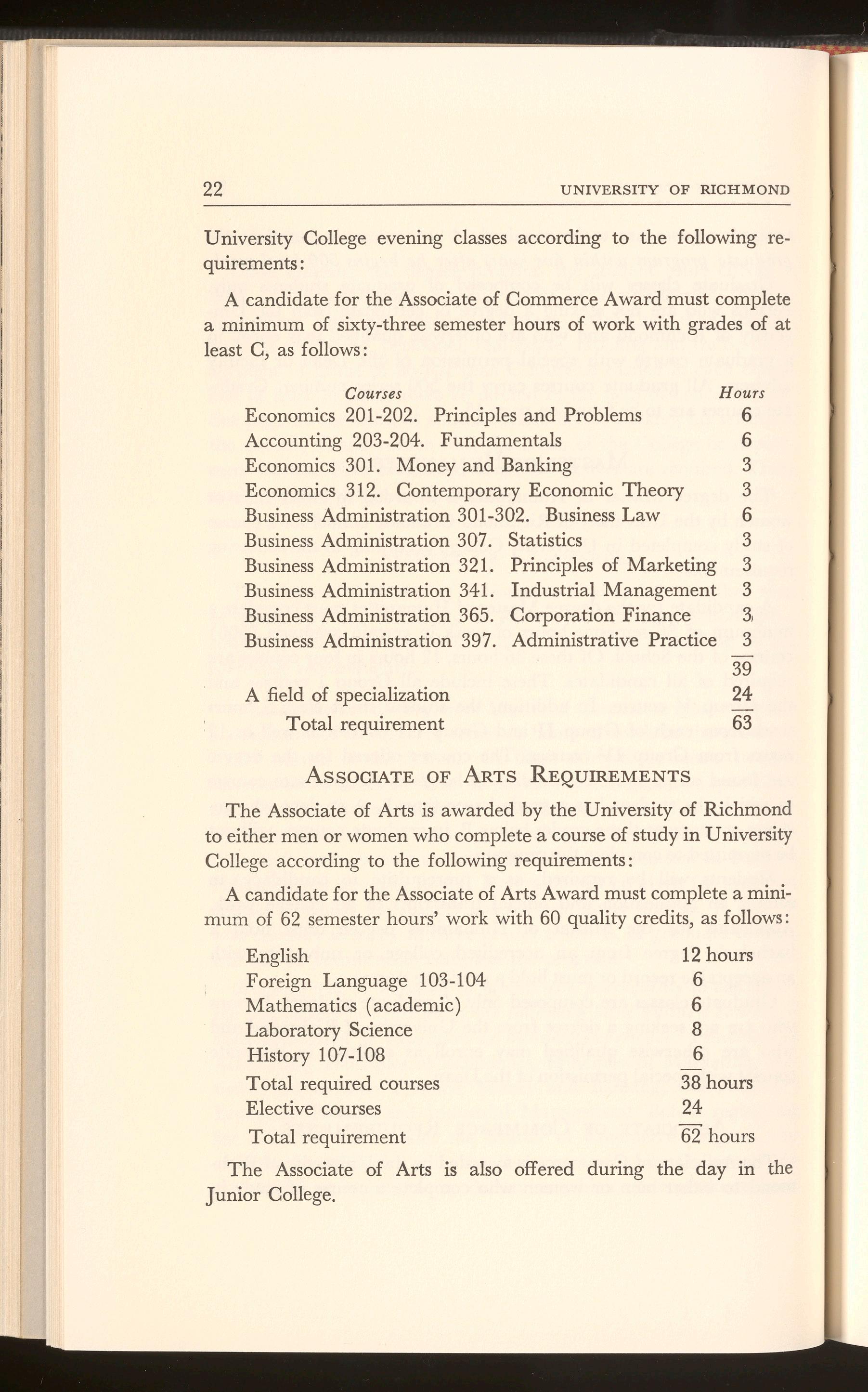

A candidate for the Associate of Commerce Award must complete a minimum of sixty-three semester hours of work with grades of at least C, as follows:

AssocIATE OF ARTS REQUIREMENTS

The Associate of Arts is awarded by the University of Richmond to either men or women who complete a course of study in University College according to the following requirements:

A candidate for the Associate of Arts Award must complete a minimum of 62 semester hours' work with 60 quality credits, as follows:

The Associate of Arts is also offered during the day in the Junior College.

UNIVERSITY COLLEGE 23

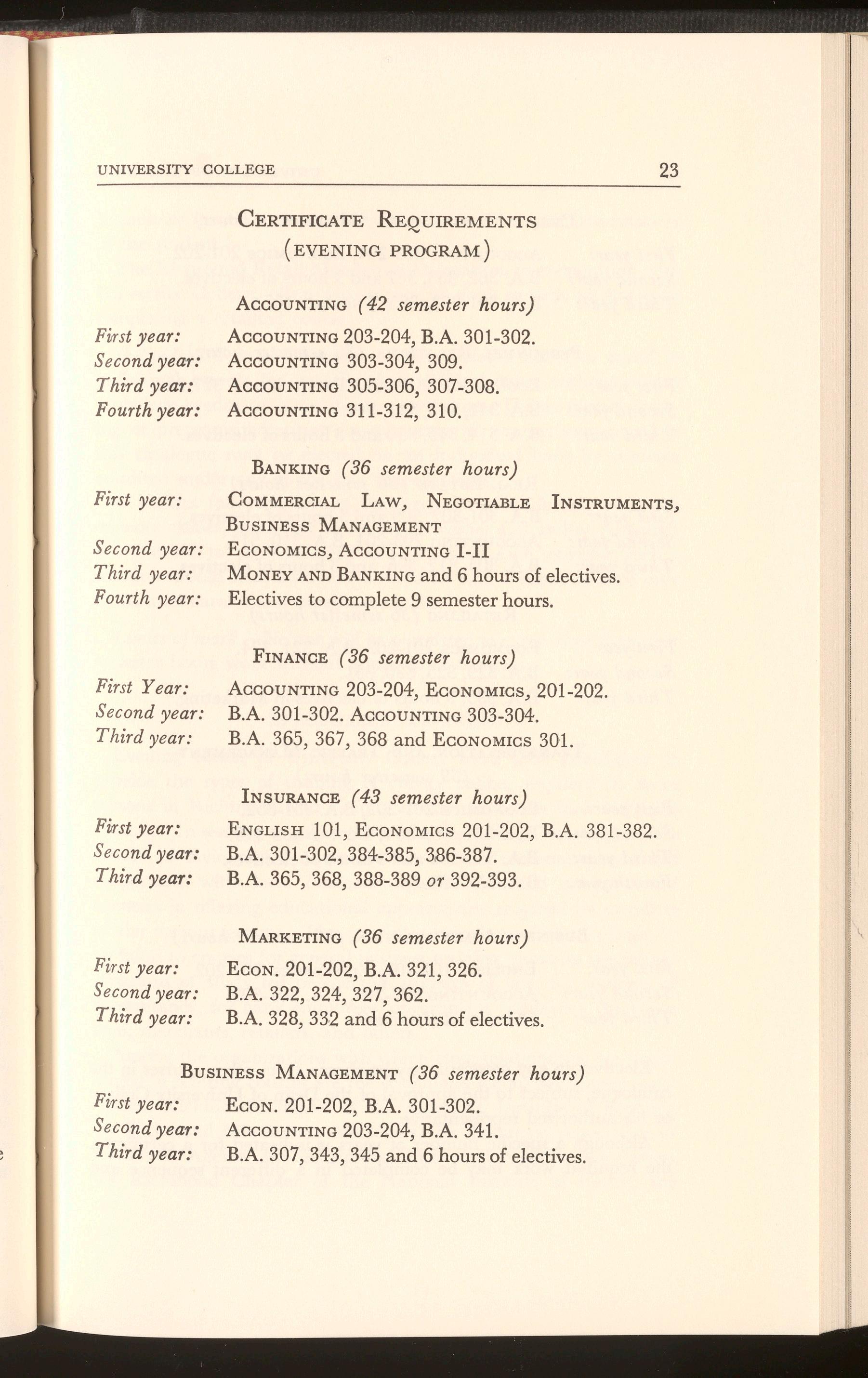

CERTIFICATE REQUIREMENTS

( EVENING PROGRAM)

AccouNTING (42 semester hours)

First year: Second year: Thi rd year: Fou rth year:

First year:

Seco nd y ear: Thi rd year:

Fourth year:

ACCOUNTING 203-204, B.A. 301-302.

ACCOUNTING 303-304, 309.

ACCOUNTING 305-306, 307-308 .

AccouNTINo 311-312, 310 .

BANKING (36 semester hours)

COMMERCIAL LAW, NEGOTIABLE INSTRUMENTS, BUSINESS MANAGEMENT

EcoNoM1cs, AccouNTING I-II

MoNEY AND BANKING and 6 hours of electives.

Electives to complete 9 semester hours.

FINANCE (36 semester hours)

First Year:

Seco nd year: Thi rd year:

First year: Second year: Thir d year:

ACCOUNTING 203-204, ECONOMICS, 201-202.

B.A. 301-302 ACCOUNTING 303-304.

B.A 365, 367, 368 and EcoNoM1cs 301.

INSURANCE (43 semester hours)

ENGLISH 101, ECONOMICS 201-202 , B A. 381-382

B.A. 301-302, 384-385, 386-387 .

B.A. 365, 368, 388-389 or 392-393.

MARKETING (36 semester hours)

First year: Second year: Thir d year:

EcoN. 201-202, B.A. 321, 326.

B.A. 322, 324, 327, 362.

B.A. 328, 33,2 and 6 hours of electives

BusINESS MANAGEMENT (36 semester hours)

First year: Second year: Th ird year:

EcoN. 201-202, B.A. 301-302.

ACCOUNTING 203-204, B.A. 341.

B.A. 307, 343, 345 and 6 hours of electives

First year:

Second year: Third year:

UNIVERSITYOF RICHMOND

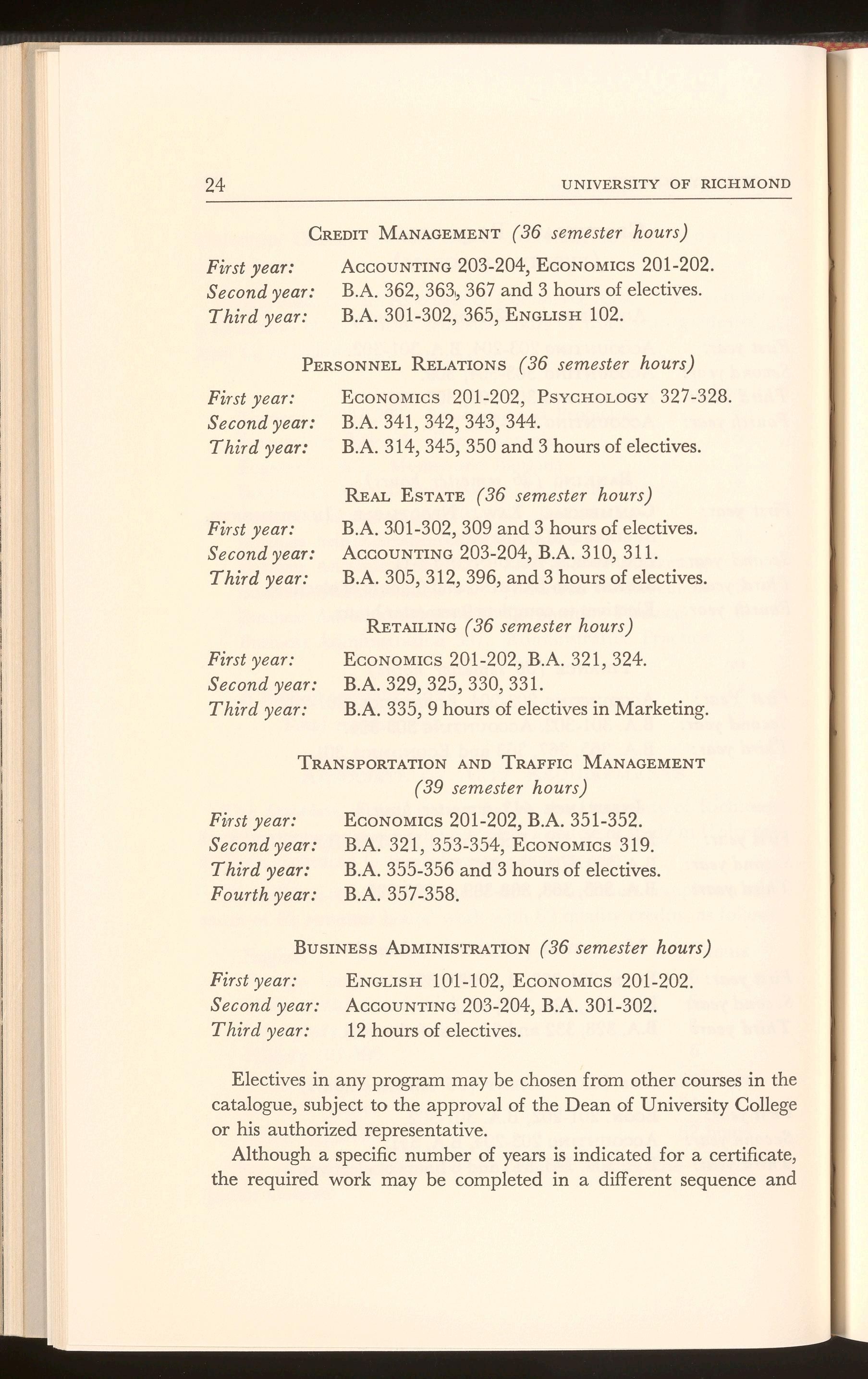

CREDIT MANAGEMENT(36 semester hours)

ACCOUNTING203-204, ECONOMICS201-202.

B.A 362, 363 ,, 367 and 3 hours of electives.

B.A. 301-302, 365, ENGLISH 102.

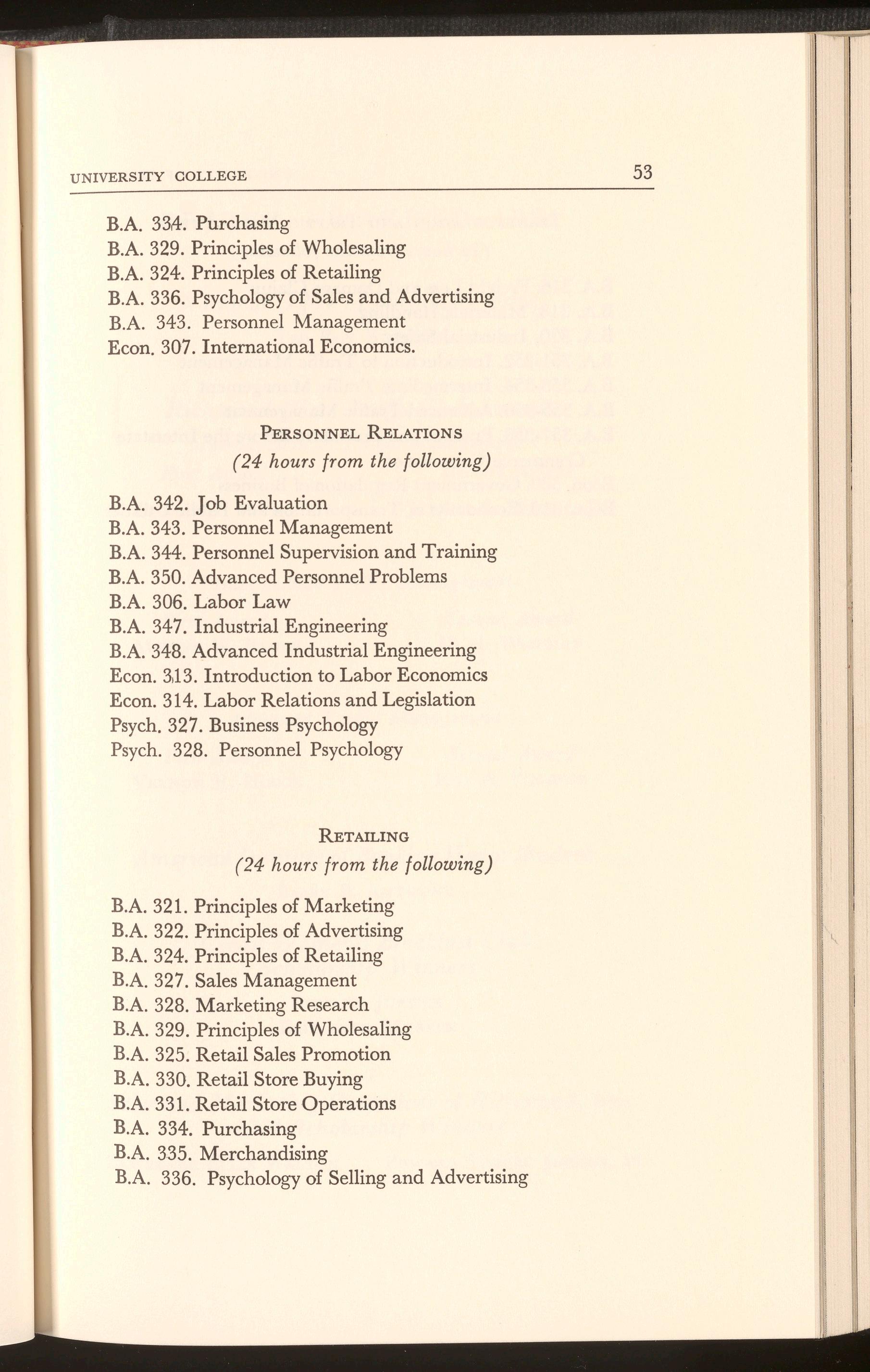

PERSONNEL RELATIONS (36 semester hours)

First year:

Second year: Third year:

First year: Second year: Third year:

First year: Second year: Third year:

ECONOMICS 201-202, PSYCHOLOGY327-328.

B.A.341,342,343,344.

B.A. 314, 345, 350 and 3 hours of electives.

REAL ESTATE (36 semester hours)

B.A. 301-302, 309 and 3 hours of electives.

ACCOUNTING203-204, B.A. 310, 311.

B.A. 305,312, 396, and 3 hours of electives.

RETAILING(36 semester hours)

ECONOMICS201-202, B.A. 321, 324.

B.A 329, 325, 330, 331.

B.A. 335, 9 hours of electives in Marketing.

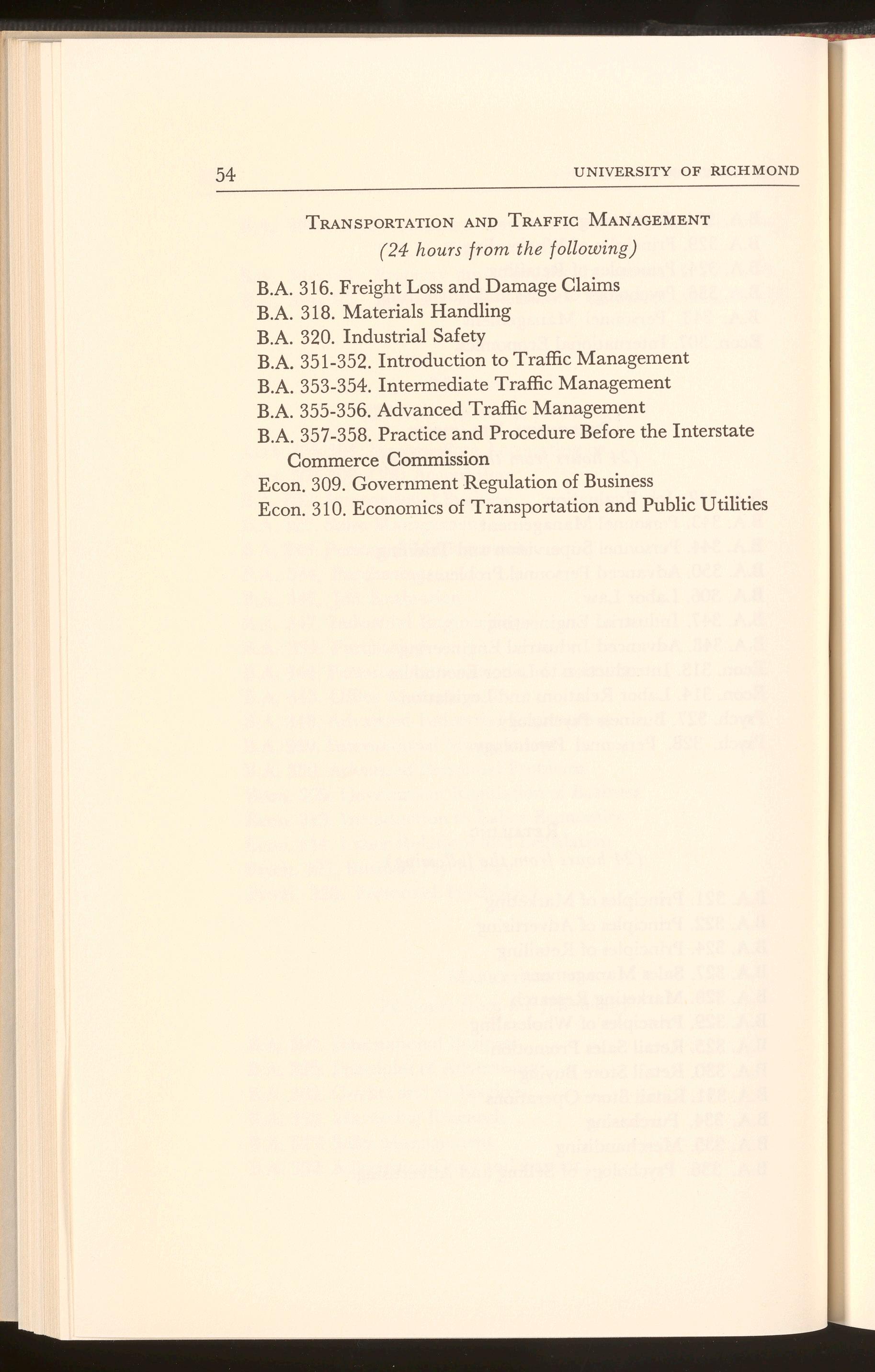

TRANSPORTATIONAND TRAFFIC MANAGEMENT

First year: Second year: Third year: Fourth year: (39 semester hours)

ECONOMICS201-202, B.A. 351-352.

B.A. 321, 353-354, ECONOMICS319 .

B.A. 355-356 and 3 hours of electives.

B.A. 35 7-358.

BusINEss ADMINISTRATION(36 semester hours)

First year: Second year: Third year:

ENGLISH 101-102, ECONOMICS201-202.

ACCOUNTING203-204, B.A. 301-302. 12 hours of electives.

Electives in any program may be chosen from other courses in the catalogue, subject to the approval of the Dean of University College or his authorized representative. Although a specific number of years is indicated for a certificate, the required work may be completed in a different sequence and

in more or less time, depending upon the abilities and circumstances of the student.

The Richmond Retail Merchants Association, in cooperation with University College, offers a certificate to each student satisfactorily completing a retailing course.

Individual-Course Program. - Many persons desire to enroll in individual courses for vocational or cultural value without regard to college credits or a certificate curriculum. Unless special training or prerequisite courses are necessary, all courses announced in this catalogue may be elected on an individual basis by students admitted under any of the four classifications.

A student following any of the programs of study may elect one or more classes, according to his or her wishes and ability. Although it is possible to carry as many as four classes each semester, such a schedule would load a student to capacity and is recommended only to the most earnest and capable students.

Limits of work.-No one will be permitted to carry more than nine semester hours work without approval of the Dean.

SPECIALIZED TRAINING

Evening classes of University College have been established to provide the types of training of college caliber required by those persons in Richmond and vicinity unable to devote their full time to study. In seeking to achieve this end, the College has obtained the advice of civic and business leaders of the community and has cooperated with local business organizations and governmental agencies in offering educational opportunities required by members of the various groups. The present curriculum of the College, in addition to courses for general business training, provides specialized programs of study for prospective students of law, for students of accountancy, for bank employees, government employees, insurance men, merchants, retailers, and others.

Among the organizations with which close relationships are maintained in offering courses are the Richmond Retail Merchants Association, Richmond Chapter of the American Institute of Banking, the Richmond Life Agency Managers, the Richmond Association of Insurance Agents, the Richmond Life Underwriters Association, the Richmond Chapter of the National Institute of Credit, the

Richmond Chapter of the National Office Management Association, the Richmond Real Estate Exchange, the Sales and Marketing Executives of Richmond, Inc., the Richmond (Va.) Traffic Club, and the Richmond Chapter, Virginia Society of Certified Public Accountants.

GENERAL INFORMATION

Registration-Registration of part-time students m University College for the fall semester will be conducted in the Columbia Building from 7: 00-9: 00 P.M. Tuesday, September 7 through Thursday, September 9, and from 7: 00-8: 00 P.M. Monday, September 13 through Thursday, September 16. Registration for the spring semester will be conducted in the Columbia Building from 7: 00-8: 00 P.M. Monday, January 24, through Thursday, January 27. Evening registrations are accepted in the ·order received until classes are filled. No one will be permitted to register for any first semester classes after September 30 or any second semester class after February 10. Students who fail to complete registration by September 16, or February 3, will be charged a late fee of $3.00. Graduate stludent registration will be held Saturday, August 28, from 9: 00 to 11: 00 A.M., the first semester and Saturday, January 22 from 9: 00 to 11 :00 A.M., the second semester.

Change of Course or Section.-After the close of formal registration, no student is permitted to add or drop a class or change his section without the approval of the Dean of University College. No change in a course of study is permitted later than one week from the opening date of the semester, except in unusual cases recommended by the Dean.

Class H ours.-Classes meet once each week, beginning at 7: 00 P.M. and continuing for 120 or 150 minutes, unless stipulated otherwise in the schedule of particular courses. This schedule is available at the beginning of each semester.

Late Afternoon and Summer Classes.-To be of further service to the community, the School is offering several classes in the late afternoon and during the summer.

Grading.-The standing of students in class work and in examinations is indicated as follows: A (95-100%) excellent work;

B (88-94%) very good work; C (80-87%) fair or average work; D (75-79%) just passing; and F (below 75%) indicates failure; I, incomplete because of excused absence from final examination or because of failure to submit required work during the semester; and FN, failure because of excessive or unexcused absences.

Removal of Incomplete Grades.-A student who has received an incomplete grade on a semester's work must complete this work by the middle of the next regular School semester, otherwise it will become an F.

Withdrawals.-Students are permitted to withdraw from a class without scholastic penalty prior to mid-semester upon submitting to the office of the Dean a request in writing for withdrawal. After mid-semester, withdrawals will carry the grade WF. Students who stop attending class without notifying the office of the Dean will receive the grade FN regardless of when attendance was stopped.

Absences.-No credit can be given for an evening course if, during a semester, the student has more than four absences, whether excused or unexcused and including those caused by entering the course late, unless the instructor indicates in writing to the dean that he believes the student is sufficiently qualified to be allowed credit for the course. Unexcused absences should result in an appropriate lowering of the student's grade, to be determined by the instructor. The grounds for excusing absences are ( 1) illness, ( 2) a personal obligation recognized as valid by the instructor, and (3) religious holidays. Students carrying as many as 12 semester hours are considered full-time and are permitted only one unexcused absence per class per semester.

The University is required to notify the Veterans' Administration when a veteran has had as many as five cuts. The Veterans' Administration will terminate the veteran's training as of the last day of attendance.

*Vocational Counseling and Placement of Students.-To help students find the vocation for which they are best suited, members of the staff of the University of Richmond will conduct vocational aptitude tests which may be taken by students registered in U niver-

* University College students taking the series of tests will be charged a testing fee.

sity College. The results of these scientific tests, combined with individual discussions with students, will be used as the basis for giving students who desire advice all possible assistance in determining the field of business they may wish to enter and for which they may be fitted.

Although no promise is made by University College to secure positions for its students, an effort is made to find places for those who inform the School authorities of their desire to obtain new positions and who have made a good record in the School. Gratifying success has attended the efforts to aid capable students in making connections with business firms.

STUDENT ACTIVITIES FEE

Students of University College are students of the University of Richmond. It is the policy of the Administration and faculty to foster any proper organization and activities that the students should undertake. A student activities fee of one dollar per student per semester is charged. This fee has been requested by the students and is used for various activities of interest and benefit to the students. Funds from the fee will be administered by student representatives.

FEES

The evening tmt10n for undergraduate courses is $14.00 per semester hour and for graduate courses $21.00 per semester hour. There is a student activity fee of one dollar per student per semester. Th ese fees are payable each semester in advance, and students are expected to settle their accounts at the time of registration.

Undergraduate degr ee and associate award candidates must pay a $5.00 diploma fee. Graduate degree candidates must pay a hood and diploma fee of $25.00. Degree and award candidates not enrolled during the session in which they graduate, are charged a $10.00 non-matriculation fee. These fees are payable 90 days prior to graduation.

The tuition for the C.P.A. Coach Class, which begins in August, is $65.00.

Junior College fees are to be found in the Junior College catalogue.

Students are matriculated for a full semester. In case of withdrawal, for whatever cause, no refund of fees or any part of fees is made.

A veteran should have his Certificate of Eligibility and Entitle ment when he registers.

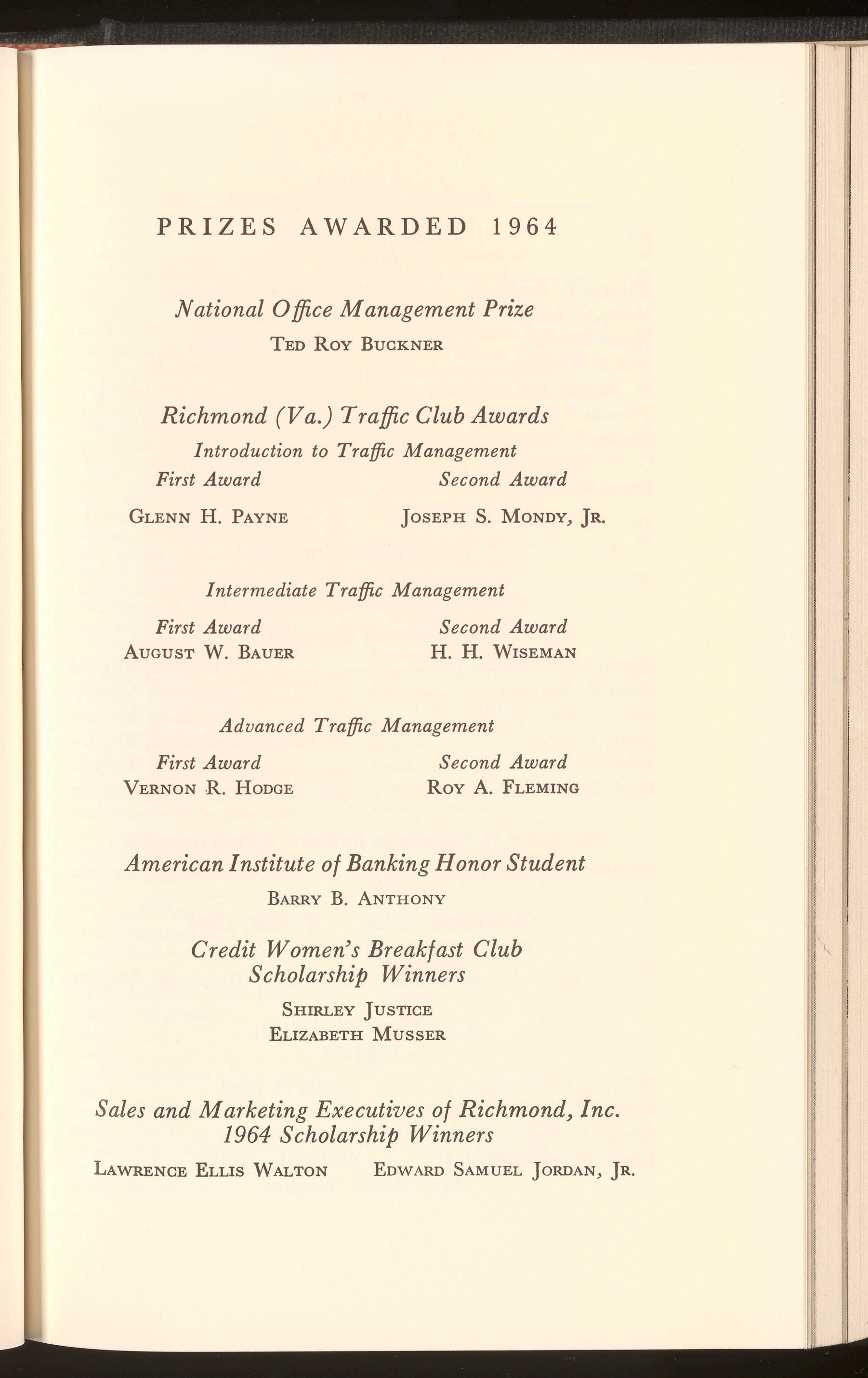

Aw ARDS AND PruzEs

1. The Richmond Chapter of the National Office Management Association awards a prize to the student receiving the highest grade in the Office Management class and the Office Methods class.

2. The Richmond (Virginia) Traffic Club awards prizes to the two best students in each of the classes in Traffic Management.

3. The Richmond Chapter of the American Society of Women Accountants gives a scholarship, for further study in accounting, to a woman student who has completed at least the first half of the Fundamentals of Accounting with a grade of B or better. This scholarship is in the form of tuition and is offered each semester.

4. The American Institute of Banking awards the Graduate Certificate winner, having the highest average grade, an appropriately engraved key and a trip to the National Convention of the Institute.

5. The Sales and Marketing Executives of Richmond, Inc., provide scholarship funds of $500.00 per year to be awarded to graduate students pursuing the Marketing curriculum. Students interested in these scholarship funds should so indicate in writing to the Dean.

SOCIETY OF ALUMNI

Alumni of the University have long been organized into the General Society of Alumni, which holds annual meetings to renew old associations, maintains a close connection with Alma Mater, and furthers the cause of higher education. The association engages the services of an alumni secretary and publishes an alumni magazine. Students who have completed a year of study in University College may join the association.

UNIVERSITY COLLEGE COURSES of STUDY FOR 1965-1966

The right is reserved to withdraw courses in which the enrollment in less than fifteen. Classes will be closed as soon as maximum enrollment is reached. The schedule of evenings on which classes meet may be secured by telephoning 358-8401 or writing to the Office.

CouRsEs IN AccouNTING

AccoUNTING 203-204. FUNDAMENTALS OF ACCOUNTING (6)

Basic accounting theory and procedures; adjusting and closing entries; working papers; ledgers; books of original entry; notes and acceptances; controlling accounts; individual proprietorships, partnerships, and corporations; voucher system; balance sheet and income statement accounts; financial statement analysis; manufacturing accounting. Fundamentals of Accounting is a prerequisite for all subsequent courses in Accounting.

AccouNTING 303-304. INTERMEDIATE AccouNTING (6)

Consideration, at the intermediate level, of accounts and transactions peculiar to corporate forms of organization; basic accounting concepts and principles; interpretation of financial statements and analysis of the principal accounts contained therein; income tax allocation; price-level impact on financial statements.

AccouNTING 305-306. ADVANCED AccoUNTING ( 3-3)

First semester: Partnerships; venture accounts; consignments; installment sales; insurance; statement of affairs; receivers' accounts; realization and liquidation reports; estates and trusts; actuarial methods. Second semester: Home office and branch accounting; parent and subsidiary corporations; consolidations and mergers; foreign exchange. Prerequisite: Accounting 303-304.

AccouNTING

307. INTRODUCTORY CosT AccouNTING (3)

Accounting for production management; principles and methods of job order and process cost accounting for managerial control of costs of production. Prerequisite: Completion of, or concurrent registration in, Accounting 303-304.

AccouNTING

308. ADVANCED CosT AccouNTING (3)

Standard costs; budgetary control; cost and profit analysis for decisionmaking purposes. Prerequisite: Accounting 307.

AccouNTING

309. TAX AccouNTING (3)

Basic discussion of broad theory and practical aspects of Federal income taxation. Prerequisite: Completion of, or concurrent registration in, Accounting 303-304.

AccouNTING

310. GovERNMENTAL AND FuND AccouNTING (3)

Accounting for institutions, municipalities, and state governments. Prerequisite: Accounting 303-304.

A CCOUNTING 311-312. AUDITING (6)

Auditing standards and procedures; programs of audit of various accounts; construction and indexing of working papers; reports to clients : professional ethics; internal audits. Prerequisite: Accounting 303-304.

A ccouNTING 3,13. AccouNTING SYSTEMS (3)

Problems and procedures connected with designing and installing accounting systems, including a brief introduction to integrated data processing. Prerequisites: Accounting 303-304; Accounting 307-308 recommended, but not required.

A ccouNTING 315. INTERNAL AUDITING AND CONTROL (3)

Review and appraisal of the internal accounting procedures of companies; verification and analysis of financial and operating reports; function and organization of internal auditing department; internal control. Prerequisite: Accounting 303-304; 307.

A CCOUNTING 319. ADVANCED TAX PROBLEMS (3)

Practical and theoretical training in the more important provisions of Federal, State, and Local tax laws; income taxes, social security taxes, estate and inheritance taxes, gift taxes, property taxes; advanced problems and tax case research and preparation. Prerequisite: Accounting 309 or equivalent experience.

A ccoUNTING 323. C.P.A. REVIEW (No Credit,)

A coach class which runs for twelve weeks beginning in August Designed to prepare students for the Nov ember C.P A. examination.

A CCOUNTING 325. BUDGETS AND MANAGERIAL ACCOUNTING (3)

Preparation of budgets and their relation to expense and cost control. Prerequisite: Accounting 307.

Ac couNTING 325-X. BUDGETS AND MANAGERIAL AccouNTING (3)

A special survey course of accounting principles and concepts for graduate students with no accounting background.

COURSES IN BANKING

The following courses are offered by University College in cooperation with the Richmond Chapter of the American Institute of Banking. Registration in these courses is limited to bank employees.

GE NERAL AccouNTING 1-11 (6)

Course content is similar to Accounting 203-204, but designed to meet needs of banking students. Not open to degree candidates

PR INCIPLES OF BANK OPERATIONS (No Credit)

This is a special course designed for bank employees who wish to begin a program of study leading to the pre-standard certificate awarded by the American Institute of Banking.

AGRICULTURAL CREDIT (3)

This course is concerned with the role of credit in modern agriculture and covers the methods employed in making, servicing and collecting farm loans. The approach to this course is from the commodity standpoint.

ECONOMICS (3)

Course content is similar to Economics 201-202, but designed to meet the needs of banking students. Not open to degree candidates.

MONEY AND BANKING (3,)

An introduction to the field of money and monetary systems; credit; and the banking system of the United States.

BANK LETTERS AND REPORTS (3)

This course is designed to achieve clearness, accuracy and conciseness characteristic of effective expression essential to bank employees.

BUSINESS ADMINISTRATION ( 3)

An introductory course designed for banking students which covers the organization, functions and operations of a business enterprise. Each phase of business activity is examined. Not open to degree candidates.

COMMERCIAL LAW (3)

A study of the fundamental principles of law from the standpoint of banking and commerce. Subjects covered are contracts, agency, partnerships, corporations, sales, estates, trusts, etcetera. Not open to degree candidates.

NEGOTIABLE INSTRUMENTS (3)

A continuation of Commercial Law, which covers the form and interpretation of negotiable paper, the right of a holder in due course, negotiation, liability, acceptances, etcetera. Not open to degree candidates.

BANK MANAGEMENT (3)

An advanced course for banking personnel which covers personnel policies, budgetary control, audits and examinations, insurance and taxation, business development and advertising policies.

INSTALLMENT CREDIT (3)

The various phases of installment financing and personal loans, types of lending agencies and their techniques of operations. Special emphasis is placed on bank policies regarding consumer credit.

CREDIT ADMINISTRATION ( 3)

A study of the procedures and problems involved in effective credit management with emphasis on forms of credit, term loans, real estate loans, sources of information, and a general approach to loan policy.

ANALYZING FINANCIAL STATEMENTS (3)

The origin and nature of the items on a financial statement, their proper segregation, analysis, significance and relationships, together with several methods of analysis and secondary test methods. Prerequisite: Accounting 203-204 or 205-206.

SUPERVISION AND PERSONNEL ADMINISTRATION ( 3)

This course deals with the management functions at the supervisory level. Special emphasis is placed upon planning, action and control. The supervisor's role as a manager is analyzed as related to his responsibility for the management function.

TRUST DEPARTMENT SERVICE

TRUST DEPARTMENT ORGANIZATION } (6)

Description and explanation of trust institutions and departments. Various types of trusts, human and legal responsibilities are discussed.

TRUST INVESTMENTS AND SECURITY ANALYSIS I-II (6)

This course gives the trust investments officer a broad background on which to base portfolio decisions and a sound knowledge of investment management. The first semester deals with the types of investment risks and their relative importance, the different types of investments, the supply and demand for investment funds, the principles of bond and stock investment, the mathematics of investment, investment markets, and the timing of security transactions. The second semester is devoted to security analysis, including U. S. Governments, municipals, and the various categories of corporate issues.

Ho ME MORTGAGE LENDING ( 3)

This course covers the basic principles involved in home mortgage lending with special emphasis upon credit examination, appraisal of property, types of mortgages, and various regulations.

EFFECTIVE SPEAKING (3)

The course presents the basic principles involved in orgamzmg and presenting a speech, and for developing skill, self-confidence, and poise in speaking.

PUBLIC RELATIONS (3)

This course is designed to give a basis for public relations, both internal and external. Research methods for analyzing public opinion are given. Advertising and publicity techniques are described and illustrated. Relations with customers, schools, the community, associations, and the Government are reviewed. The primary objective of this course is practical, its aim being for students to learn the reason for their own behavior and how to improve their own and their bank's public relations.

EFFECTIVE ENGLISH ( 3)

This course is concerned with the mastery of language through wide reading, an interest in words, and practice in writing of all kinds. In addition to discussing the principles of grammar, punctuation, spelling, and effective writing, the course illustrates banking situations in which there is a definite correlation between competency in written and oral communication and career success.

COURSES IN ECONOMICS

ECONOMICS 103. EVOLUTION OF INDUSTRY (3)

A survey of the origin and development of our modern economic institutions. Agricultural feudalism; guilds; mercantile capitalism; industrial capitalism; finance capitalism.

UNIVERSITY OF RICHMOND

ECONOMICS 201-202. PRINCIPLES OF ECONOMICS (6)

Fundamental economic principles. Production; value; price; distri- bution; wage.s; rent; interest; profits; business cycles; consumption eco- nomics ; national income; labor; transportation; money and banking; pub- lic finance; public utilities; and economic systems. Not open to freshmen. This course is a prerequisite for all advanced courses in economics.

ECONOMICS

301. MONEY AND BANKING (3)

An introduction to the field of money and monetary systems; credit ; and the banking system of the United States. Required of all degree candidates.

ECONOMICS

302. ADVANCED MONEY AND BANKING (3)

An intensive study of current problems in the field of money and the commercial and central banking systems; a critical examination of con- temporary monetary theory and policy.

ECONOMICS

303. PUBLIC FINANCE (3)

A study of the theory and problems of the finances of government, with emphasis on revenues, expenditures, and debt management at the Federal Government level.

ECONOMICS

307. INTERNATIONAL ECONOMICS (3)

A study of the role of economic theory in world trade; examination of principles and practices of international economic organization and discussion of international economic institutions and agencies and forms of international cooperation.

ECONOMICS

309. GOVERNMENT REGULATION OF BUSINESS (3)

A study of the economic bases for government regulation of private business; critical examination of the development of Federal regulation of industry; discussion of sound public policy toward business.

ECONOMICS

310. ECONOMICS OF TRANSPORTATION AND PUBLIC UTILITIES (3)

Analysis of the major economic characteristics of the transportation sys- tem of the United States and of the principal utilities industrie.s, including methods of regulation, valuation and rate making with special emphasis on problems of public policy.

EcoNOMICs

312. CoNTEMPORARY EcoNOMIC THEORY (3)

An analysis of current economic theory and its policy implications; study includes Twentieth Century developments in micro and macroeconomic theory.

EcoNoM1cs

313. EcoNOMics OF LABOR RELATIONS (3)

A study of labor and the labor movement as a basic factor in our economy. Special emphasis is placed upon union organization, collective bargaining, and labor legislation and their effect upon wages, hours, and employment.

EcoNoMICs

314. LABOR RELATIONS AND LEGISLATION (3)

A study of the industrial conflict; collective bargaining; labor legisla- tion; agencies and methods of prompting industrial peace.

EcoNoMICS 315. EcoNOMIC HISTORY OF THE UNITED STATES (3)

A survey of the economic development of the U. S. from Colonial times to present. Topics include development of industry, economic expansion, technological development, economic growth since World War II.

ECONOMICS 316. COMPARATIVE ECONOMIC SYSTEMS (3)

A study of the world's major economic systems; critical evaluation of the solution to economic problems of production and distribution under socialism, communism, and capitalism as they exist today.

ECONOMICS 317. BUSINESS CYCLES (3)

A review of the characteristics of the business cycle and various theories attempting to explain recurrent periods of prosperity and depression. Prerequisite: Economics 301 or equivalent experience.

COURSES IN GENERAL BUSINESS

B.A. 201. BUSINESS SPEECH (3)

A course designed to develop poise and self-confidence in speaking through the effective use of the principles of organization, content, and delivery. Practice in the use of these principles is stressed.

B.A. 301-302. BUSINESS LAW (6)

Introduction to nature and source of law; fundamentals of the law of contracts, property, sales, negotiable instruments, agency partnerships, corporations; application of law fundamentals to business practice. Required of all degree candidates.

B.A. 303. INTERNATIONAL BUSINESS (3)

Balance of payments problems; tariffs and trade controls, U. S. Foreign Trade Policies and the foreign environments of the multi-national business. Stress is placed on the differences met by firms operating abroad.

B.A. 305. LAW OF REAL AND PERSONAL PROPERTY (3)

Methods of acquiring property-deeds, wills, inheritance, etc.; estates created-fee simple, life, term of years, etc.; co-tenancy-joint, in common; liens--common law, mechanics, etc.; incorporeal interests in landprofit and easements; licenses; landlord and tenant; examination of title.

B.A. 306. LABOR LA w ( 3)

Federal and state statutory law and common law governing relations between employer and employee. Special emphasis is placed on current laws.

B.A. 307. STATISTICS (3)

Construction, use and interpretation of statistical tables, charts, diagrams, indexes, deviation curves and correlation with special emphasis on uses in business. Required of all degree candidates. Prerequisite: college algebra, or permission of the instructor.

B.A. 308. BUSINESS MATHEMATICS (3)

Mathematics of business finance with special emphasis on annuities, amortizations, sinking funds, depreciation, bonds, and actuarial mathematics. Prerequisite: college algebra, or permission of the instructor.

UNIVERSITY OF RICHMOND

B.A. 309. PRINCIPLES OF REAL ESTATE (3)

A course covering the fundamental factors, procedures, and instruments which are basic to selling, managing, and appraising real estate.

B.A. 310. REAL ESTATE BROKERAGE AND MANAGEMENT (3)

A course covering selling, prospects, listings, and settlements. Also a study of the management of business and residential properties.

B.A. 311. REAL ESTATE APPRAISAL (3)

Theory, principles, and procedures used by the professional real estate appraiser. This course is of value to attorneys, trust officers, mortgage lenders, real estate brokers, and investors. For those training as professional appraisers, the course prepares for required Examination I, American Institute of Real Estate Appraisers.

B.A. 312. ADVANCED REAL ESTATE APPRAISAL (3)

Practical application of the fundamental appraisal procedures. The solution of typical appraisal problems encountered by practicing appraisers. This course will assist in preparation for Examination II, American Institute of Real Estate Appraisers.

B.A. 314. PRINCIPLES OF PUBLIC RELATIONS (3)

The basic principles and procedures involved in a sound public relations program with emphasis on selection of media and proper preparation of publicity releases.

B.A. 316. FREIGHT Loss AND DAMAGE CLAIMS (3,)

This course is designed to furnish the student with the technical aspects of handling loss and damage claims. Covers the Transportation contract; carrier liability; measure of damages; filing of claims; carrier claim regulations.

B.A. 317. HUMAN RELATIONS IN INDUSTRY (3)

A study of working people-their place in the industrial social system and the factors which influence their morale and ultimately determine their efficiency. Readings in several acknowledged authoritative sources.

B.A. 318. MATERIALS HANDLING (2)

This course covers the basic principles in materials handling including the functions of processing, storing and internal transportation.

B.A. 320. INDUSTRIAL SAFETY (3)

Organization and operation of an industrial safety program; accident investigation and prevention, physical safeguards, lighting, ventilation, sanitation and other specific problems of an industrial safety program.

COURSES IN MARKETING

B.A. 225. RETAIL SELLING

A study of the sales process in retail selling, sales training techniques, and sales supervision methods.

B.A. 321. PRINCIPLES OF MARKETING (3)

A study of the institutions involved, functions performed, and problems encountered in getting goods and services from producers to consumers. Required of all degree candidates.

B.A. 322. PRINCIPLES OF ADVERTISING (3)

Course covers modern principles of advertising as they relate to local and national advertising. All classes of advertising media are treated.

B.A. 324. PRINCIPLES OF RETAILING (3)

This course is designed to give the student a knowledge of the various aspects of retail store organization and management.

B.A. 325. RETAIL SALES PROMOTION (3)

A study of the advertising and sales promotion activ1ties of retailing, including sales promotion planning and budgeting, advertising media, non-advertising sales promotion activities, and evaluation of sales promotion. Prerequisite: B.A. 324 or equivalent experience.

B.A. 326. SALESMANSHIP (3,)

A study of the principles involved in personal selling. Special emphasis on developing territories, prospecting, buying motives, presentations, sales work, closing the sale, etcetera.

B.A. 327. SALES MANAGEMENT (3)

This course covers organization of the sales function; recruiting, selection and training salesmen; compensation, supervision, control, territories, expenses, forecasting, quotas, budgeting, etcetera. Prerequisite: B.A. 321.

B.A. 328. MARKETING RESEARCH (3)

This course is designed to familiarize the student with the various techniques of market and marketing research. Emphasis is placed upon actual research problems. Prerequisites: B.A. 307 and B.A. 321.

B.A. 329. PRINCIPLES OF WHOLESALING (3)

The nature and evolution of wholesaling. The wholesaling structure. Operation and management of a wholesale business, and the economic and governing aspects of wholesaling.

B.A. 330. RETAIL STORE BUYING (3)

A study of what, where, when to buy merchandise for the retail store, including buying techniques, buying plans, and methods of determining customer wants. Prerequisite: B.A. 324, or equivalent experience.

B.A. 331. RETAIL STORE OPERATIONS (3)

A study of the operating activities of a retail store, including organization, materials handling, location and layout, and service. Prerequisite: B.A. 324 or equivalent experience.

B.A. 332. ADVERTISING COPY AND LAYOUT (3)

Practical workshop methods and techniques in writing copy and developing layouts. Prerequisite: B.A. 322, or equivalent experience.

B.A. 3,34. PURCHASING (3)

Purchasing procedures including quality and quantity control, sources of supply, inspection, and price policies. Special emphasis is placed on purchasing problems. Prerequisite: B.A. 324 or B.A. 329, or equivalent experience.

B.A. 335. MERCHANDISING ( 3)

A study of the techniques of unit control and dollar control of mer• chandise for retail stores. The course includes stock planning and analysis, problems of turnover and maintenance of proper margins. Prerequisites: B.A. 321 and B.A. 324, or equivalent experience.

B.A. 336. PSYCHOLOGY OF SELLING AND ADVERTISING (3)

A practical application of basic principles of psychology to retail and wholesale selling, sales promotion, market research and advertising.

COURSES IN MANAGEMENT

B.A. 101. INTRODUCTION TO BUSINESS (3)

A survey course offered for beginning students of Richmond College to give the student a perspective of the various phases of business. The student is introduced to such activities as finance, marketing, management, statistics, accounting, labor, transportation, and insurance.

B.A. 242 SMALL BUSINESS MANAGEMENT (3)

An analysis of the various problems involved in organizing and operating a small business with special emphasis on kind of business, location, record keeping, merchandising, personnel, legal obligations and over-all management.

B.A. 243. BUSINESS THEORY FOR SECRETARIES (2)

This course covers the basic elements of business management and is designed to prepare experienced secretaries for the CPS examinations.

B.A. 340. INTRODUCTION TO OPERATIONS RESEARCH (3)

The quantitative procedures of industrial problem solutions are developed. Optimization of decisions based on the interaction of complex variables with opposing cost relationships is of major interest. Replacement theory, queing theory, linear programming, scientific method, sampling theory, theory of games, and computer applications are included .

B.A. 341. INDUSTRIAL MANAGEMENT (3)

An introduceion to the fundamentals of management, with emphasis upon the application of the scientific method to the solution of business problems. Illustrations will be drawn from various types of organizations, including manufacturing and service industries, government, charitable and other social institutions. Required of all degree candidates.

B.A, 342. JOB EVALUATION (3)

A critical study of various types of job evaluation plans with emphasis on the point system Recent trends in wage and salary administration are reviewed . A sample evaluation requires students to spend several evenings in a Richmond manufacturing plant.

B.A. 343. PERSONNEL MANAGEMENT (3)

Practically all phases of personnel administration are touched upon in this course. It involves practices and procedures in organizing a personnel department, recruiting and training employees, and rendering staff assist- ance by activities such as safety programs, fringe benefits, and miscel- laneous employee services.

B.A. 344. PERSONNEL SUPERVISION AND TRAINING (3)

Various techniques of supervising and training people are examined in this course by the conference method, with case materials covering widely different situations. Samples of audio-visual aids used in training super- visors are furnished.

B.A. 345. OFFICE MANAGEMENT (3)

A study of the principles, methods and general practices of office operations which are adaptable to both large and small offices with emphasis on duties and responsibilities of the manager, layout, equipment, forms, costs, budgets, selection and training of personnel, manuals, etcetera.

B.A. 3,46. OFFICE METHODS ( 3)

The development and application of work simplification techniques to the non-productive processes of the business organization; proper lay- out, flow of work, standard operations and procedures.

B.A. 347. INDUSTRIAL ENGINEERING (3)

A study of the improvement of methods and elimination of waste through time study, job evaluation, operator training and standard cost. (A laboratory fee of $ 1.00 is charged for this course for materials.)

B.A. 348. ADVANCED INDUSTRIAL ENGINEERING (3)

Micromotion study, principles of motion economy, methods time measurement and determination of time standards. Prerequisite: B.A. 34 7, or equivalent experience. (A laboratory fee of $1.00 is charged for this course for materials.)

B.A. 349. INTERNATIONAL MANAGEMENT

This course is designed to develop understanding of national differences relating to domestic management of overseas operations, management of business in overseas locations and associations with foreign managers.

B.A 350. ADVANCED PERSONNEL PROBLEMS (3)

A course designed to enlarge the understanding and broaden the out- look of supervisors, junior executives, and other administrators by examining cases drawn from everyday operations of business. Prerequisite: B.A. 343, or equivalent experience.

B.A. 351-352. INTRODUCTION TO TRAFFIC MANAGEMENT (6)

General introduction to the transportation field; history; basis governing classification of freight and freight classifications; principles of freight tariffs, and elements of rate making; shipping documents and their appli- cation; outline of special freight services; and freight claims. Application of tariff circulars; construction and filing of tariffs; freight rates and tariffs; special freight services; demurrage and storage i reconsignment and diversion; transit; embargoes; warehousing and distribution; and materials handling.

UNIVERSITY OF RICHMOND

B.A. 353-354. INTERMEDIATE TRAFFIC MANAGEMENT (6)

Application of through routes and rates; technical tariff and rate interpretation; overcharges and undercharges; loss and damage; import and export traffic; classification and rate committee procedure.

The constitutional power of Federal regulation; the original act to regulate interstate commerce; the amendatory and related acts; the transportation policy of Congress; the carriers subject to the Interstate Commerce Act; certificates, permits and licenses required by rail, motor, water, freight forwarders and brokers. Prerequisite: B.A. 351-352.

B.A. 355-356. ADVANCED TRAFFIC MANAGEMENT (6)

Construction and interpretation of the Interstate Commerce Act; duties, prohibitions and rights of carriers, shippers and the Interstate Commerce Commission; general principles and practical application of traffic law. Prerequisite: B.A. 353-354.

B.A. 357-358. PRACTICE AND PROCEDURE BEFORE I.C.C. (6)

This course is designed to prepare the student to become a practitioner before the I.C.C. Special attention is given to the nature, function and organization of the I.C.C.; practice and procedure before the Commission and the courts as provided for in the Interstate Commerce Act and the Commission's General Rules of Practice; evidence; leading Supreme Court decisions; and the Code of Ethics. Prerequisite: B.A. 355-356.

B.A. 359. STATISTICAL QUALITY CONTROL (3)

The application of statistical methods to control of quality in production and inspection; preparation of control charts; acceptance sampling. General shop problems will be used and proven statistical approaches to their solution will be demonstrated.

B.A. 397. ADMINISTRATIVE PRACTICE (3)

Administrative Practice is a capstone course which is required of all Senior students who are candidates for the degree. The course is designed to give students a broader management viewpoint through study and discussion of actual administrative problems and cases.

COURSES IN FINANCE AND CREDIT

B.A. 361. CONSUMER CREDIT (3)

The various phases of installment financing and personal loans, types of lending agencies and their techniques of operations. Special emphasis is placed on bank policies regarding consumer credit.

B.A. 362. CREDITS AND COLLECTIONS ( 3)

A study of the nature and functions of credit regulations and restrictions governing credit; bank, consumer and mercantile credit methods; types of credit information; analysis of credit risks; and collection procedures and systems. Prerequisite: B.A. 321.

B.A. 363. CREDIT ADMINISTRATION (3)

A study of the procedures and problems involved in effective credit management with emphasis on forms of credit, term loans, real estate loans, sources of information, and a general approach to loan policy.

B.A. 365. CORPORATION FINANCE ( 3)

Study of the development of the corporation, legal aspects, promotion, methods of financing, operation of the security markets, financial manage- ment and others. Required of all degree candidates. Prerequisite: Accounting 203-204, or equivalent experience.

B.A. 366 SECURITY MARKETS ( 3)

A study of methods and procedures used in marketing corporate and government securities with special emphasis on operations of the New York and other stock exchanges.

B A. 36i. FINANCIAL ANALYSIS OF SECURITIES (3)

A study of various techniques and procedures used to analyze and evaluate corporate and government securities. Heavy emphasis is placed on the origin and nature of the items on a financial statement, their proper segregation, analysis, significance and relationships.

B.A. 368. INVESTMENTS ( 3)

This course describes the various types of corporate securities, the mechanics of purchase and sale, security price movements, analysis of financial page, and introduces the subject of investment management.

B .A. 371. CREDIT MANAGEMENT (3)

A study of the procedures and problems involved in effective credit management.

B.A . 372. ADVANCED CREDITS AND COLLECTIONS (3)

An advanced course in credits and collections, including financial state- ment interpretation, credit and collection correspondence, protection and r edemption of credit. Special emphasis is placed on actual cases. Prerequisite: B.A. 362, or equivalent experience.

B.A. 375. REAL ESTATE FINANCE (3)

A study of the financing of real estate with special emphasis upon the financial institutions and instruments.

COURSES IN INSURANCE

B A . 376A-376B. PRINCIPLES AND PRACTICES OF PROPERTY AND CASUALTY INSURANCE, IIA (6)

A survey course in Property and Casualty Insurance designed to pre- pare the student for the examinations for the Insurance Institute of America Certificate. It includes a study of basic insurance principles and the structure of the insurance industry, as well as an analysis of the more im portant Property and Casualty Insurance policy contracts.

B.A. 3 77-378. PROPERTY ANDCAsUALTYINSURANcELAw,C.P C.U.IV (6)

A specialized course designed to prepare the student for the Part IV examination for the C.P.C.U. Designation. Includes a survey of business law and negligence law and their specialized application to the field of Property and Casualty Insurance. Prerequisite: B A . 376A-376B or equivalent experience in the Propert y and Casualty Insurance industry

42

UNIVERSITYOF RICHMOND

B.A. 379-380. GENERALPROPERTYINSURANCE(NAIA) (6)

A comprehensive multiple-line course dealing with Fire and Allied Lines, Time Element Coverages, Inland Marine, Burglary and Glass, Automobile, Public Liability, Workmen's Compensation, Fidelity and Surety, Boiler and Machinery, and Aviation Insurance. This course prepares students for Part I of the C.P.C.U. examinations.

B.A. 381-382. FUNDAMENTALSOF LIFE ANDHEALTH INSURANCE, C.L.U.-I (6)

This Part is designed to provide the C L.U. candidate with a firm foundation in: The meaning of the human life value concept; the nature and types of life insurance and annuity contracts used in insuring human life values; the various uses of life insurance and annuiti es; and the fundamental principles underlying the calculation of life insurance and annuity premiums, reserves, nonforfeiture values and dividends. The various aspects of life insurance company operations are also discussed.

B.A. 383-N. PROPERTYINSURANCE( 2)

Basic principles of insurance pertaining to coverage of loss due to fire, standard policies , evaluation and coinsurance.

B.A. 384-385. GROUP INSURANCE,HEALTH INSURANCEANDPENSIONS,C.L.U.-II (6)

This Part provides a thorough analysis of the important and rapidly growing fields of group life insurance, individual and group health insurance, and pensions. It also covers the problems of old age, unemployment and disability along with the various plans which have been developed to meet these problems.

B.A. 386-387. LAW, TRUSTS ANDTAXATION,C.L.U.-III (6)

In Part C.L.U. III the basic elements of business law and life insurance law are explained. Also, the candidate is given a broad background in the subjects of guardianship, the administration and distribution of property, and the administration of estates, wills and trusts. Finally, the federal income, estate and gift tax systems are explained with particular reference to the taxation of life insurance and annuities. State death taxation is also discussed.

B.A. 388-389. FINANCEANDECONOMICS,C.L.U.-IV (6)

This Part deals with the financial and economic system within which life and health insurance exist The different aspects of family finance are presented, including: investments in common stocks, bonds and mutual funds; bank deposits and other savings media; and property and liability insurance coverages. Next the principles of business finance are explained so that the candidate may better appreciate how life and health insurance will fit into the financial structure of a business. Finally, the subject of economics is considered.

B.A. 390-A-390-B. BUSINESS INSURANCEANDESTATE PLANNING, C.L.U.-V (6)

This is the final Part of the C.L.U. study program leading to the Chartered Life Underwriter Diploma It covers advanced subjects in life underwriting, such as: the use of settlement agreements in estate planning, business uses of life and health insurance, and estate planning in general including a section on the particular uses of life and health insurance in the estate planning process. A section on human behavior and ethics is also included.

B.A, 391. INLAND MARINE INSURANCE (2)

This course covers the history of inland marine insurance, interpreta- tion of insuring powers of marine underwriters, personal floater policies, transportation insurance, bailee's interest, commercial floaters, and other important forms coming within the scope of this subject.

B A. 392-393. PROPERTY AND CASUALTY INSURANCE, C P.C.U.-I (6)

A specialized course designed to prepare the student for Part I of the examinations for the C.P.C.U. Designation. Includes an advanced study of insurance principles, the structure of the insurance industry, govern- ment regulation of insurance, and a detailed analysis of Property and Casualty Insurance policy contracts. Prerequisites: B.A. 376A-376B or equivalent Property and Casualty Insurance experience.

B.A. 394-395. PROPERTY AND CASUALTY INSURANCE, C.P.C.U.-II (6)

A specialized course designed to qualify the student for Part II of the C.P.C.U. examinations. Includes a study of Property and Casualty In- surance rate making, underwriting, loss adjustment, surveys, reinsurance, and financial statements. Prerequisite: B A. 392-393 or extensive Prop- erty and Casualty Insurance experience.

B.A. 396. BUSINESS INSURANCE (3)

A study of insurance policies as they apply to business operations.

RELATED COURSES

ENGLISH 101B. BUSINESS ENGLISH (3)

A study of the fundamental principles of English grammar and com- position with emphasis on sentence structure, punctuation, usage, vocabu- lary, and the organization of written work Regular weekly written assign- ments and individual criticism and comment.

ENGLISH 102B BUSINESS LETTER WRITING ( 3)

A course in the essential types of business letters. Regular weekly written assignments and individual criticism and comment Emphasis upon correctness and effective expression in both oral and written communica- tions.

ENGLISH 104. BUSINESS REPORTS (2)

An intensive course in the various types of business reports, designed to cover the subject for all practical purposes. Regular written assignments and individual criticism and comment.

PSYCHOLOGY 3,27. BUSINESS PSYCHOLOGY (3)

A study of the various applications of psychology to business and industrial situations, such as individual differences, training, fatigue and efficiency, advertising, use of public opinion surveys, and consumer research

PSYCHOLOGY 328. PERSONNEL PSYCHOLOGY (3)

A detailed and intensive study of the psychological problems of personnel management with emphasis on tests, ratings, incentives, emo- tional factors, and morale. Prerequisite: Psychology 327, or equivalent experience.

LIBERAL ARTS COURSES

BIOLOGY 101-102. PRINCIPLES OF BIOLOGY (8)

The fundamental principles of biology and their application to man.

ENGLISH 101-102. RHETORIC AND COMPOSITION (6)

The elements of writing in theory and practice. Parallel reading. Exposition for the first semester; description and narration for the second, including a study of the short story and the novel.

ENGLISH 203-204. SURVEY OF ENGLISH LITERATURE (6)

English literature from the beginnings through the Nineteenth Century. Lectures, recitations, parallel reading.

FRENCH 101-102. ELEMENTARY FRENCH (6)

A course for beginners.

FRENCH 103-104. INTERMEDIATE FRENCH (6)

A review of grammar, composition, reading, and conversation. Prerequisite, French 101-102 or the equivalent.

HISTORY 107-108. SURVEY OF EUROPEAN CIVILIZATION (6)

Civilizations of the Mediterranean world and Medieval and early modern Europe to 1715 first semester. Europe and the world since 1715, second semester.