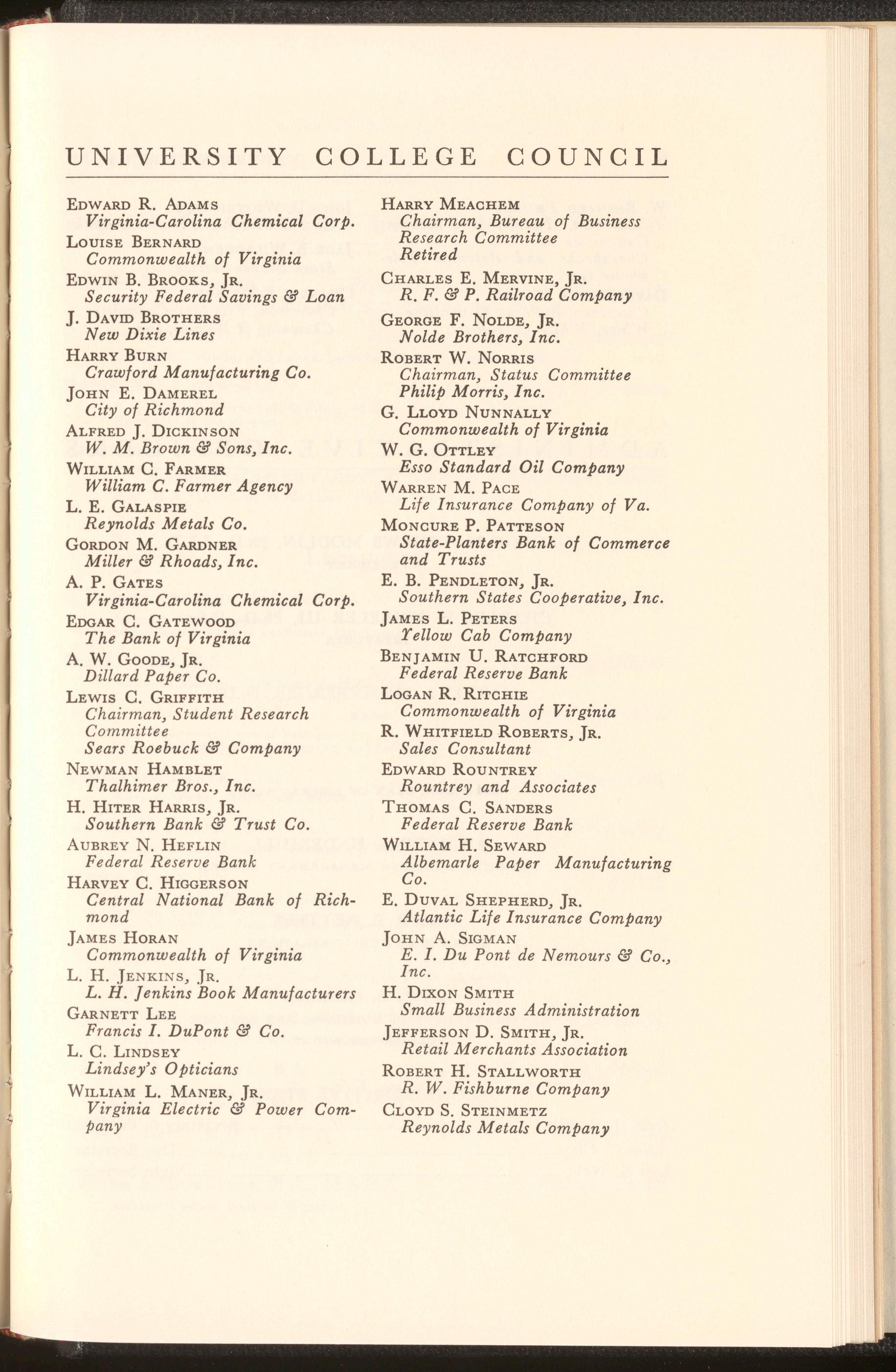

UNIVERSITY COLLEGE COUNCIL

EDWARD R. ADAMS

Virginia-Carolina Chemical Corp.

LOUISE BERNARD

Commonwealth of Virginia

EDWIN B. BROOKS, JR.

Security Federal Savings & Loan

J. DAVID BROTHERS New Dixie Lines

HARRY BURN

Crawford Manufacturing Co.

JOHN E. DAMEREL

City of Richmond

ALFRED J. DICKINSON

W. M. Brown & Sons, Inc.

WILLIAM c. FARMER

William C. Farmer Agency

L. E. GALASPIE

Reynolds Metals Co.

GORDON M. GARDNER

Miller & Rhoads, Inc.

A. P. GATES

Virginia-Carolina Chemical Corp.

EDGAR C. GATEWOOD

The Bank of Virginia

A. w. GOODE, JR. Dillard Paper Co.

LEWIS C. GRIFFITH

Chairman, Student Research Committee

Sears Roebuck & Company

NEWMAN HAMBLET

Thalhimer Bros., Inc.

H. HITER HARRIS, JR.

Southern Bank & Trust Co.

AUBREY N. HEFLIN Federal Reserve Bank

HARVEY C. HIGGERSON

Central National Bank of Richmond

JAMES HORAN

Commonwealth of Virginia

L. H. JE NKINS, JR.

L. H. Jenkins Book Manufacturers

GARNETT LEE

Francis I. DuPont & Co.

L. C. LINDSEY

Lindsey's Opticians

WILLIAM L. MANER, JR.

Virginia Electric & Power Company

HARRY MEACHEM

Chairman, Bureau of Business Research Committee Retired

CHARLES E. MERVINE, JR.

R. F. & P. Railroad Company

GEORGE F. NOLDE, JR. Nolde Brothers, Inc.

ROBERT w. NORRIS

Chairman, Status Committee Philip Morris, Inc.

G. LLOYD NUNNALLY Commonwealth of Virginia

w. G. OTTLEY Esso Standard Oil Company

WARREN M. PACE Life Insurance Company of Va.

MONCURE P. PATTESON State-Planters Bank of Commerce and Trusts

E. B. PENDLETON, JR. Southern States Cooperative, Inc.

JAMES L. PETERS Yellow Cab Company

BENJAMIN U. RATCHFORD Federal Reserve Bank

LOGAN R. RITCHIE Commonwealth of Virginia

R. WHITFIELD ROBERTS, JR. Sales Consultant

EDWARD ROUNTREY Rountrey and Associates

THOMAS C. SANDERS Federal Reserve Bank

WILLIAM H. SEWARD Albemarle Paper Manufacturing Co.

E, DUVAL SHEPHERD, JR. Atlantic Life Insurance Company

JOHN A SIGMAN

E. I. Du Pont de Nemours & Co., Inc.

H. DIXON SMITH

Small Business Administration

JEFFERSON D. SMITH, JR. Retail Merchants Association

ROBERT H. STALLWORTH R. W. Fishburne Company

CLOYD S. STEINMETZ Reynolds Metals Company

W. BERNARDTHULIN

Chairman, Faculty Procurement Committee

Chesapeake and Potomac Telephone Co.

DAVID MEADE WHITE

Chairman , Building Committee White, White & Roberts

UNIVERSITY OF RICHMOND

JOHN D. WHITEHURST First & Merchants National Bank

JACK B. WILBOURNE Stork Diaper Service

CHARLESP . WILSON Chairman, Program Committee Chewning & Wilmer, Inc.

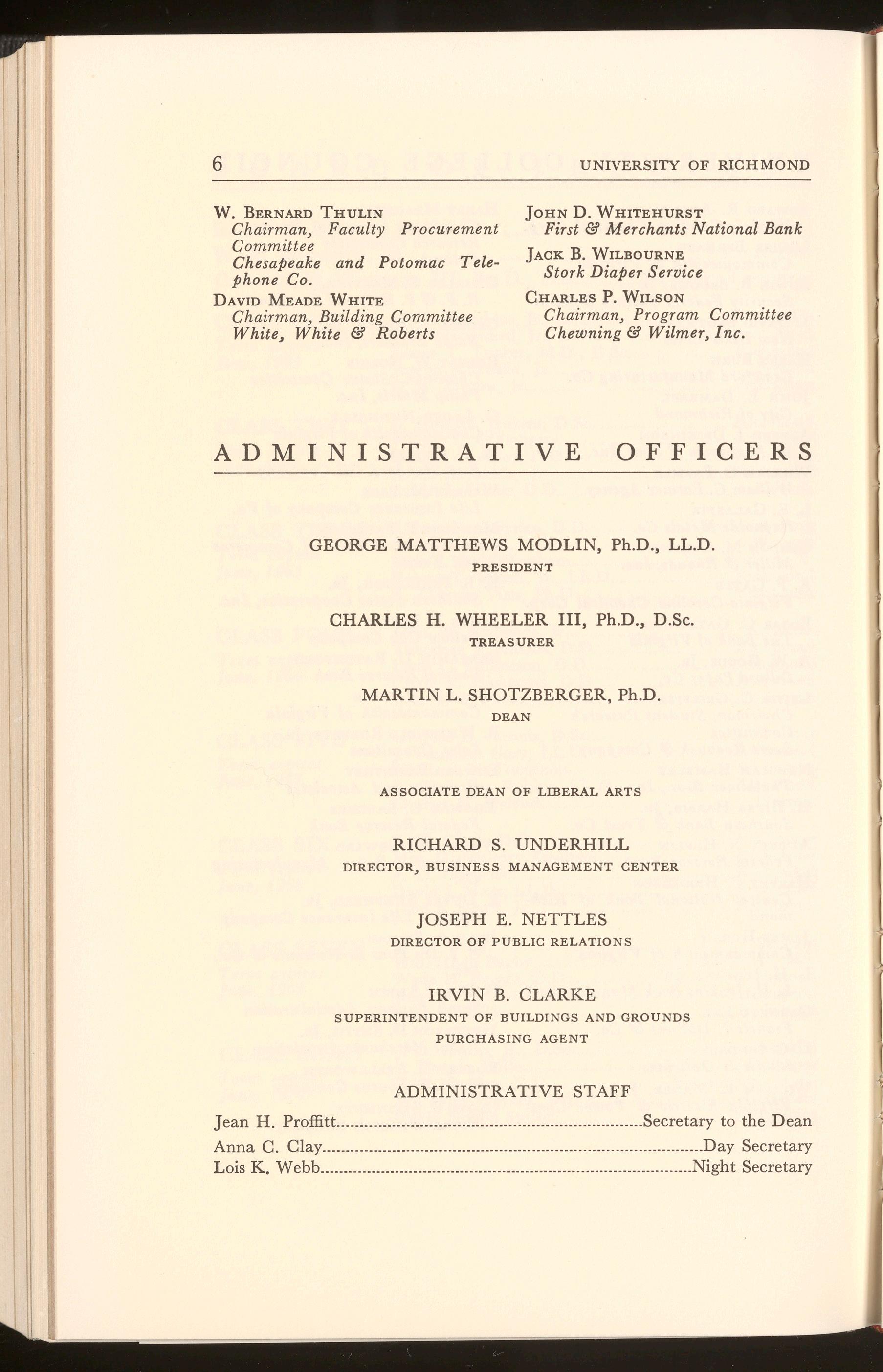

ADMINISTRATIVE OFFICERS

GEORGE MATTHEWS MODLIN, Ph.D., LL.D. PRESIDENT

CHARLES H. WHEELER III, Ph.D., D.Sc . TREASURER

MAR TIN L. SHOTZBERGER, Ph.D. DEAN

ASSOCIATEDEANOF LIBERALARTS

RICHARD S. UNDERHILL DIRECTOR,BUSINESS MANAGEMENTCENTER

JOSEPH E. NETTLES DIRECTOROF PUBLICRELATIONS

IR VIN B. CLARKE SUPERINTENDENTOF BUILDINGSANDGROUNDS PURCHASINGAGENT

ADMINISTRATIVE STAFF

Jean H Proffitt .................................................................. Secretary to the Dean

Anna C. Clay .................................................................. ................ Day Secretary

Lois K. Webb ...... ..................................................... Night Secretary i

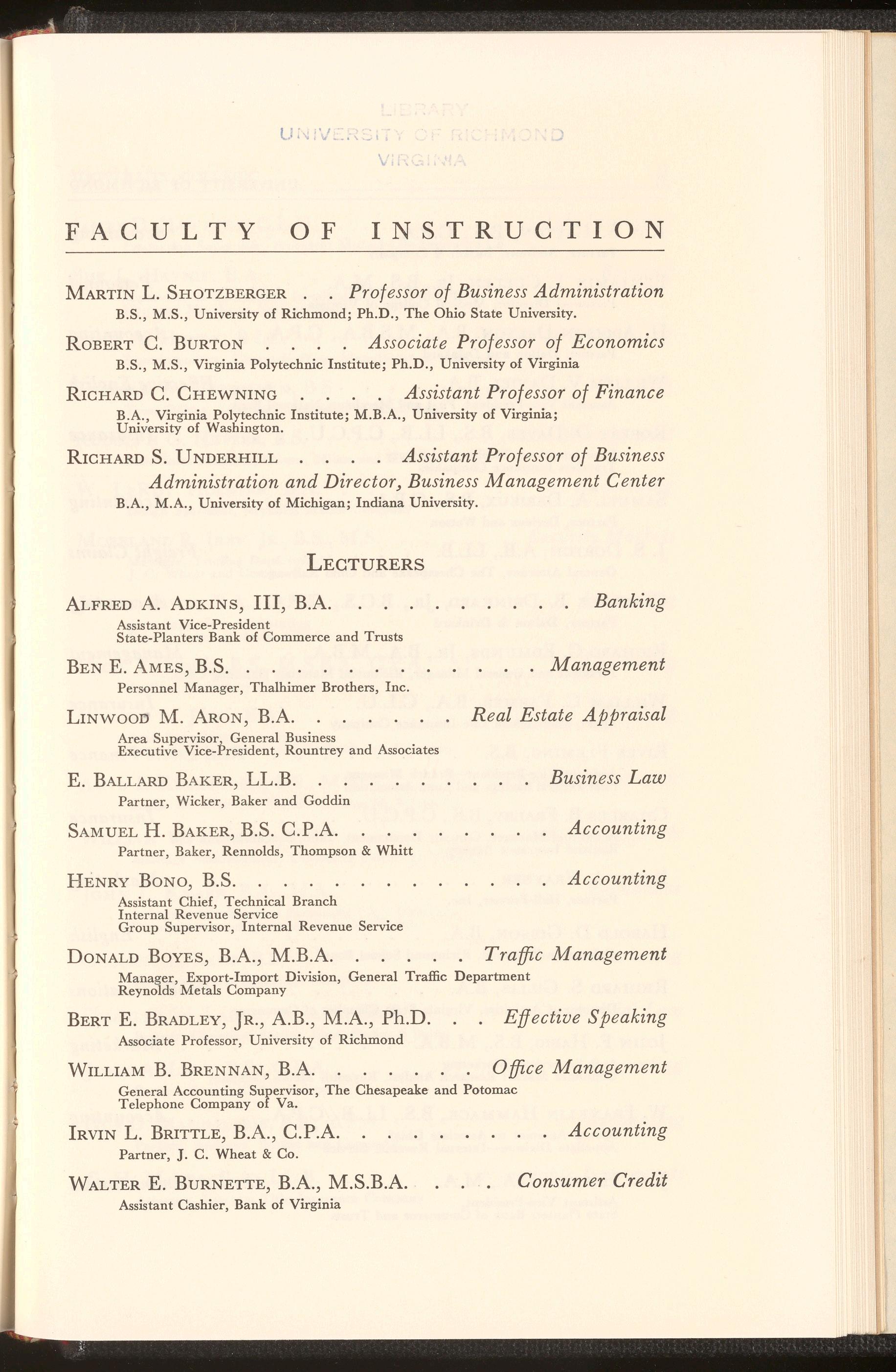

FACULTY OF INSTRUCTION

MARTIN L. SHOTZBERGER . Professor of Business Administration

B.S., M S , University of Richmond; Ph.D., The Ohio State University.

ROBERT C. BURTON Associate Professor of Economics

B.S., M S., Virginia Polytechnic Institute; Ph.D., University of Virginia

RICHARD C. CHEWNING

Assistant Professor of Finance

B.A., Vir ginia Polytechnic Institute; M.B.A., University of Virginia; University of Washington

RICHARD S. UNDERHILL

Assistant Professor of Business Administration and Director, Business Management Center

B.A , M A , University of Michigan; Indiana University.

LECTURERS

ALFRED A. ADKINS, III, B.A.

Assistant Vice-Pr esident State-Planters Bank of Commerce and Trusts

BEN E. AMES, B.S.

Personnel Mana ger, Thalhimer Brothers, Inc

LINWOOD M ARON' B.A.

Area Supervi sor General Business Executive Vice-Pr esident, Rountrey and Associates

E. BALLARD B AKER , LL.B.

Partner , Wi cker , Baker and Goddin

SAMUEL H. BAKER, B.S. C.P.A. Partn er , Ba ker, Rennolds , Thompson & Whitt

HENRY BONO , B.S.

Assistant Chief, Technical Branch Int ernal Revenue Service Group Supervi sor, Internal Revenue Service

DONALD BOYES, B.A., M.B.A. Banking Management Real Estate Appraisal Business Law Accounting Accounting Traffic Management Manager, Export-Import Division, General Traffic Department Reynolds Metals Company

BERT E. BRADLEY, JR., A.B., M.A., Ph D. Effective Speaking Associate Profe ssor, University of Richmond

WILLIAM B. BRENNAN, B.A. Office Management

General Accounting Suyervisor, The Chesapeake and Potomac Telephon e Company o Va.

IRvrn L. BRITTLE, B.A., C.P A. Accounting Partner, J. C. Wheat & Co.

WALTER E. BURNETTE, B.A., M.S.B.A. Consumer Credit Assistant Cashier, Bank of Virginia

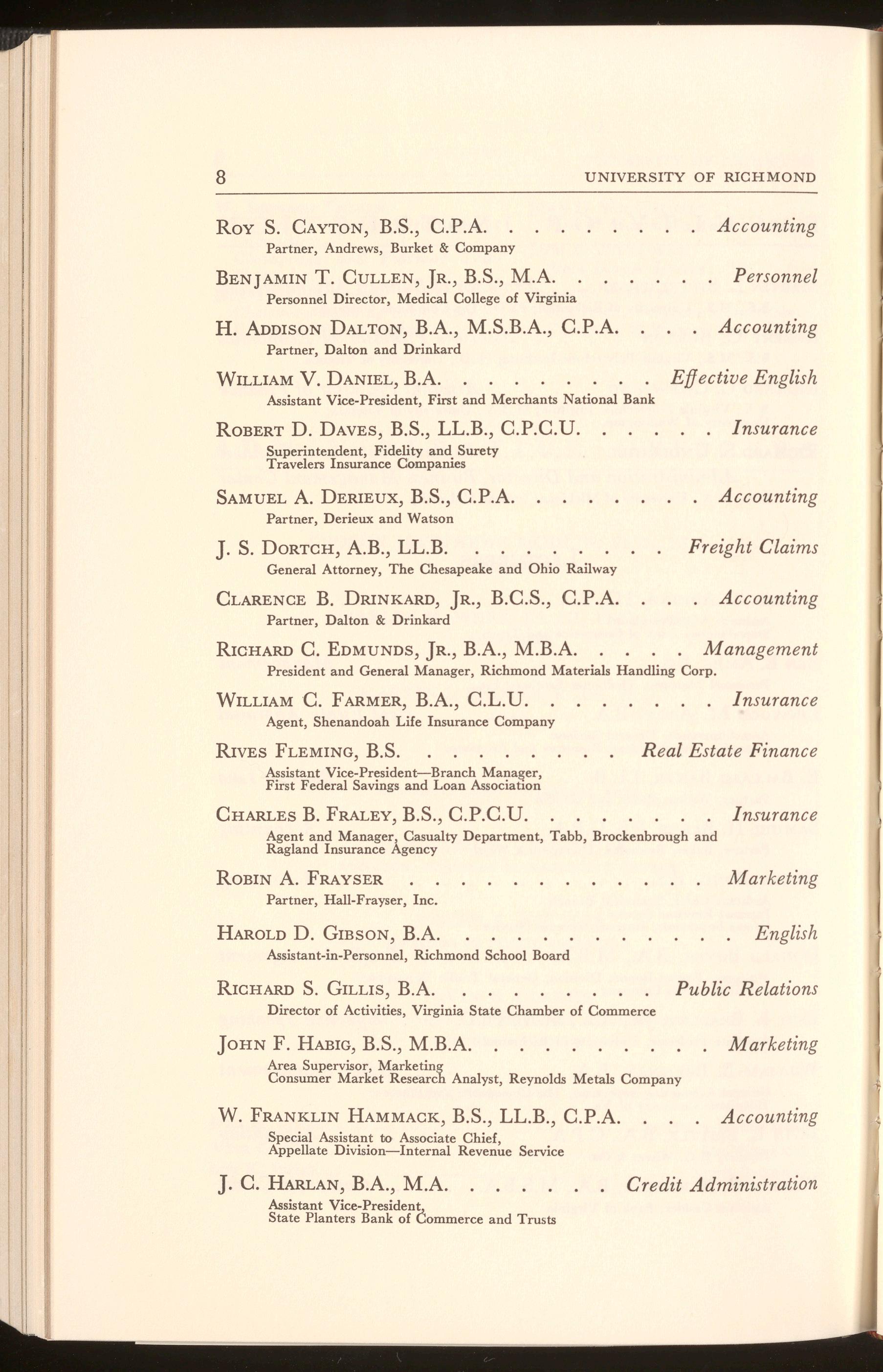

RoY S. CAYTON,B.S., C.P.A. Accounting Partner, Andrews, Burket & Company

BENJAMINT. CULLEN,JR., B.S., M.A. P ersonnel Personnel Director, Medical College of Virginia

H. ADDISONDALTON,B.A., M.S.B.A., C.P.A. Accounting Partner, Dalton and Drinkard

WILLIAMV. DANIEL,B.A. Effective English

Assistant Vice-President, First and Merchants National Bank

ROBERTD. DAVES,B.S., LL.B., C.P.C.U.

Superintendent, Fidelity and Surety Travelers Insurance Companies

SAMUELA. DERIEUX,B.S., C.P.A. Partner, Derieux and Watson

e Accounting

J. s. DORTCH,A.B., LL.B. Freight Claims

General Attorney, The Chesapeake and Ohio Railway

CLARENCEB. DRINKARD,JR., B.C.S., C.P.A. Accounting Partner, Dalton & Drinkard

RICHARDC. EDMUNDS,JR., B.A., M.B.A. Management President and General Manager, Richmond Materials Handling Corp.

WILLIAMC. FARMER,B.A., C.L.U. In surance Agent, Shenandoah Life Insurance Company

RIVESFLEMING,B.S. R eal Estate Finance

Assistant Vice-President-Branch Mana!l'er, First Federal Savings and Loan Association

CHARLESB. FRALEY,B.S., C.P.C.U.

Agent and ManagerACasualty Department, Tabb, Brockenbrough and Ragland Insurance gency

ROBINA. FRAYSER Partner, Hall-Frayser, Inc.

HAROLDD. GIBSON,B.A. Assistant-in-Personnel, Richmond School Board

English

RICHARDS. GILLIS,B.A. Public Relations Director of Activities, Virginia State Chamber of Commerce

JOHN F. HABIG,B.S., M.B.A. Marketing

Area Supervisor, Marketing Consumer Market Research Analyst, Reynolds Metals Company

w. FRANKLINHAMMACK,B.S., LL.B., C.P.A. Accounting

Special Assistant to Associate Chief, Appellate Division-Internal Revenue Service

J.C. HARLAN,B.A., M.A. Credit Administration

Assistant Vice-President State Planters Bank of Commerce and Trusts

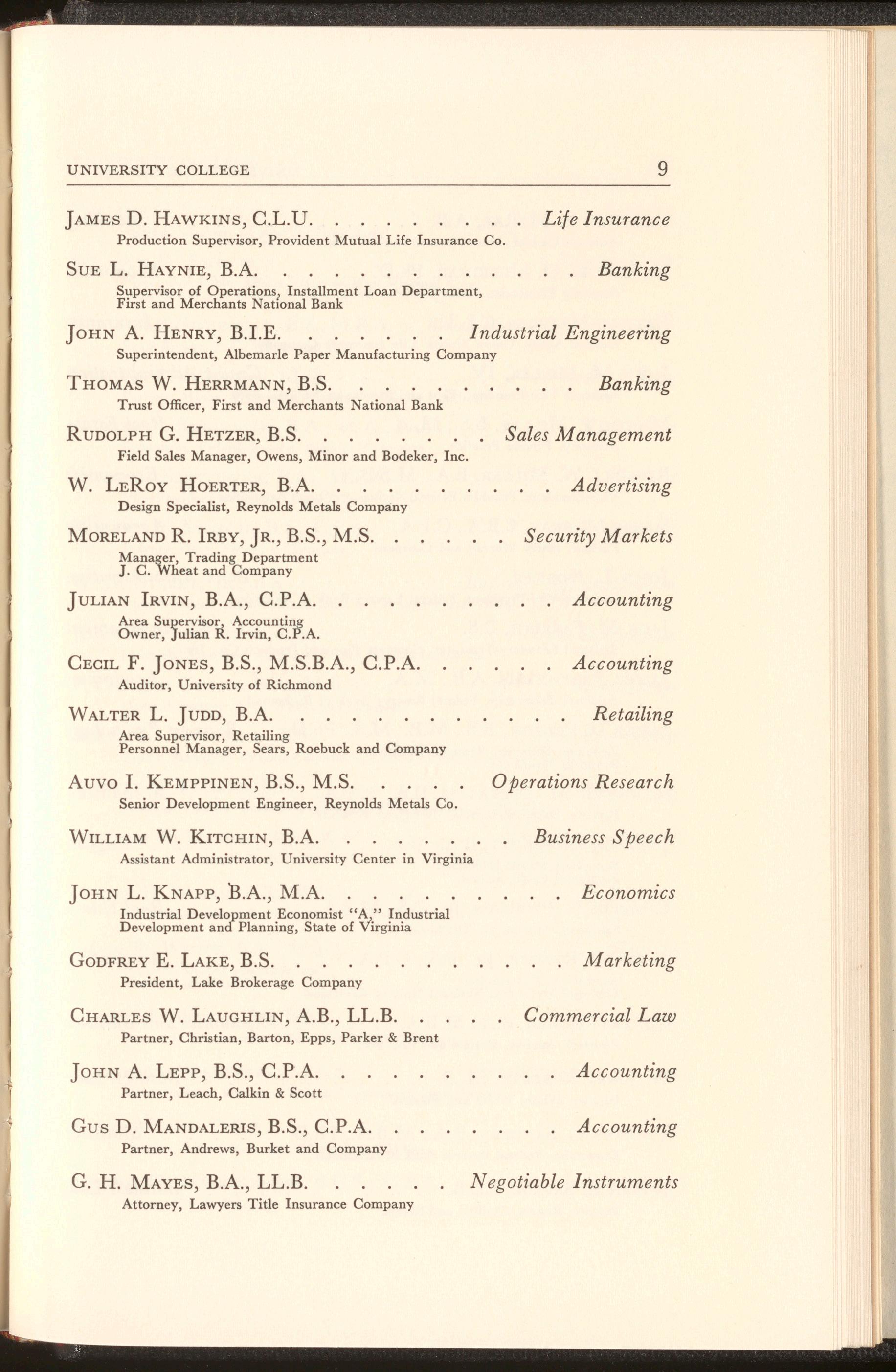

JAMESD. HAWKINS,C.L.U.

Production Supervisor, Provident Mutual Life Insurance Co.

SuE L. HAYNIE,B.A.

Supervisor of Operations, Installment Loan Department, First and Merchants National Bank

JOHN A. HENRY, B.I.E.

Industrial Engineering

Superintendent, Albemarle Paper Manufacturing Company

THOMASw. HERRMANN,B.S.

Trust Officer, First and Merchants National Bank

RUDOLPHG. HETZER,B.S.

Field Sales Manager, Owens, Minor and Bodeker, Inc.

w. LEROY HOERTER,B.A.

Design Specialist, Reynolds Metals Company

MORELANDR. IRBY,JR., B.S., M.S.

Manager, Trading Department J. C. Wheat and Company

JuLIAN lRvIN, B.A., C.P.A.

Area Su:eervisor Accountin_g Owner, Julian il. Irvin, C.P.A.

CECILF. JONES, B.S., M.S.B.A., C.P.A.

Auditor, University of Richmond

WALTERL. JUDD, B.A.

Area Supervisor, Retailing Personnel Manager, Sears, Roebuck and Company

Auvo I. KEMPPINEN,B.S., M.S.

Senior Development Engineer, Reynolds Metals Co.

WILLIAMw. KITCHIN, B.A.

Assistant Administrator, University Center in Virginia

JOHN L. KNAPP, :S.A., M.A.

Industrial Develo_pment Economist "~/' Industrial Development and Planning, State of Virginia

GODFREYE. LAKE,B.S.

President, Lake Brokerage Company

CHARLESw. LAUGHLIN,A.B., LL.B.

Partner, Christian, Barton, Epps, Parker & Brent

JOHN A. LEPP, B.S., C.P.A.

Partner, Leach, Calkin & Scott

Gus D. MANDALERIS,B.S., C.P.A.

Partner, Andrews, Burket and Company

G. H. MAYES,B.A., LL.B.

Attorney, Lawyers Title Insurance Company

Banking

Sales Management

Advertising

Security Markets

Accounting

Accounting

Retailing

Operations Research

Business Speech

Economics

Marketing

Commercial Law

Accounting

Accounting

Negotiable Instruments

UNIVERSITYOF RICHMOND

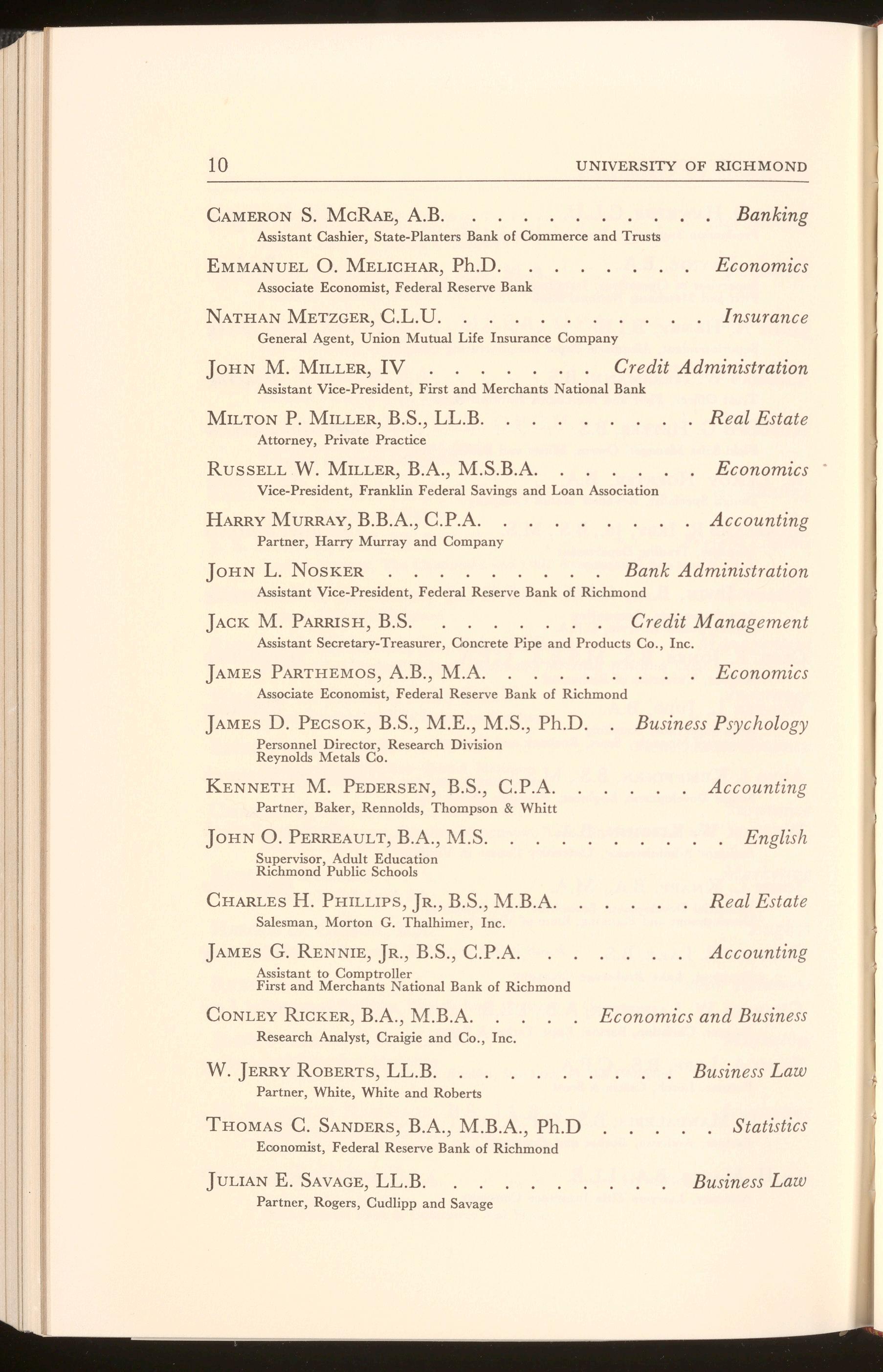

CAMERONS. McRAE, A.B. Banking

Assistant Cashier, State-Planters Bank of Commerce and Trusts

EMMANUEL0. MELICHAR,Ph.D. Economics

Associate Economist, Federal Reserve Bank

NATHANMETZGER,C.L.U. Insuranc e General Agent, Union Mutual Life Insurance Company

JoHN M. MILLER, IV

Credit Administration

Assistant Vice-President, First and Merchants National Bank

MILTONP. MILLER,B.S., LL.B.

Attorney, Private Practice

RUSSELLw. MILLER,B.A., M.S.B.A.

Vice-President, Franklin Federal Savings and Loan Association

HARRYMURRAY,B.B.A., C.P.A. Partner, Harry Murray and Company

JoHN L. NosKER

Bank Administration

Assistant Vice-President, Federal Reserve Bank of Richmond

JACK M. PARRISH,B.S.

Credit Management

Assistant Secretary-Treasurer, Concrete Pipe and Products Co., Inc

JAMES PARTHEMos,A.B., M.A. Economics

Associate Economist, Federal Reserve Bank of Richmond

JAMESD. PEcsoK, B.S., M.E., M.S., Ph.D. Business Psychology Personnel Director, Research Division Reynolds Metals Co.

KENNETH M. PEDERSEN,B.S., C.P.A.

Partner , Baker, Rennolds, Thompson & Whitt

JOHN 0. PERREAULT,B.A., M.S.

Supervisor, Adult Education Richmond Public Schools

CHARLESH. PHILLIPS,JR., B.S., M.B.A. Salesman, Morton G. Thalhimer , Inc.

JAMESG. RENNIE, JR., B.S., C.P.A.

Assistant to Comptroller First and Merchants National Bank of Richmond

CONLEYRICKER,B.A., M .B.A. Research Analyst, Craigie and Co., Inc.

w. JERRYROBERTS,LL.B.

Partner, White, White and Roberts

THOMASC. SANDERS,B.A., M.B.A., Ph.D Economist, Federal Reserve Bank of Richmond

JULIANE. SAVAGE,LL.B.

Partner, Rogers, Cudlipp and Savage

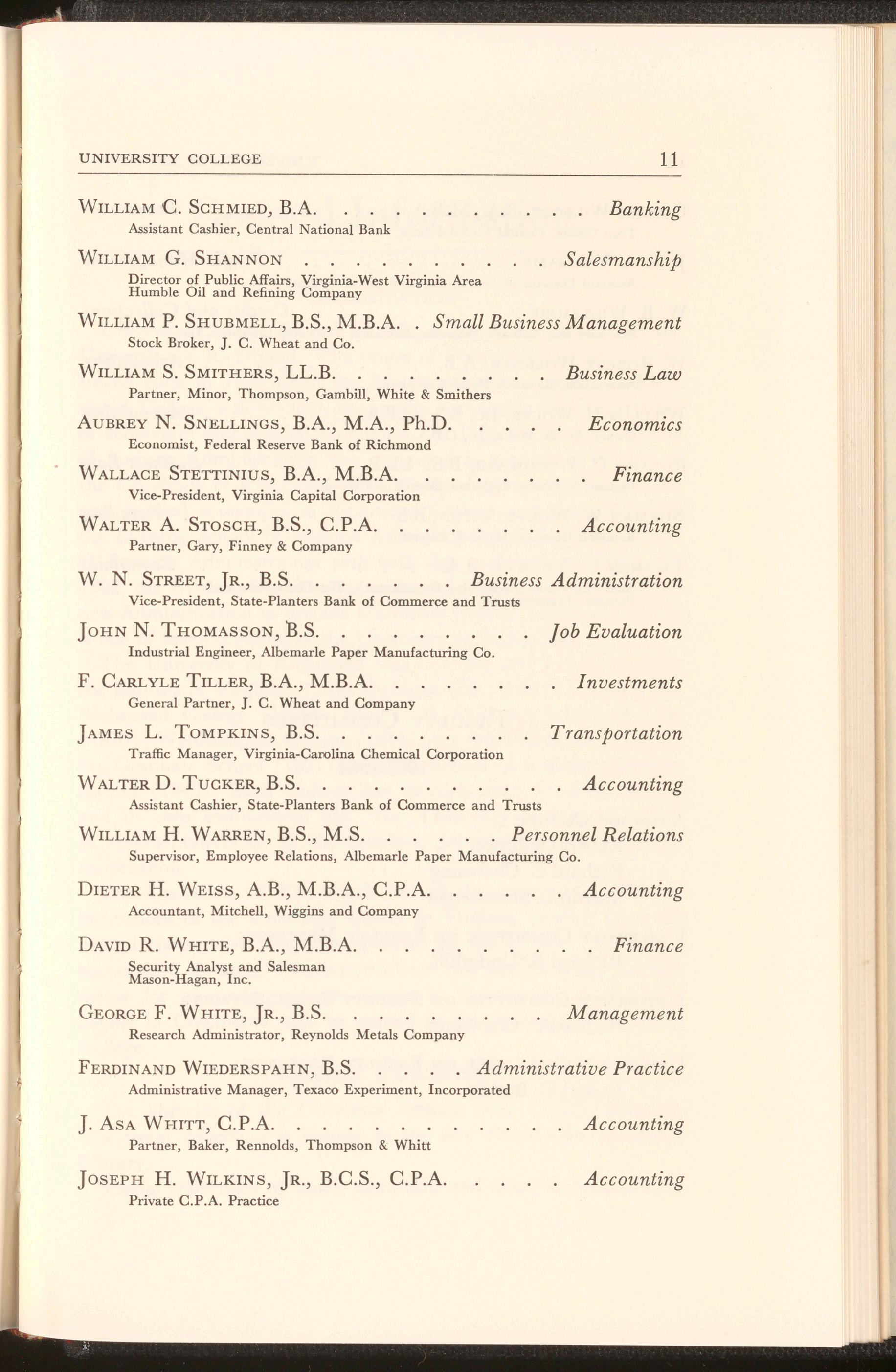

WILLIAMC. SCHMIED,B.A.

Assistant Cashier, Central National Bank

WILLIAMG. SHANNON

Director of Public Affairs, Virginia-West Virginia Arca Humble Oil and Refining Company

WILLIAMP. SHUBMELL,B.S., M.B.A. Small Business Management

Stock Broker, J C. Wheat and Co.

WILLIAMS. SMITHERS,LL.B.

Partner, Minor, Thompson, Gambill, White & Smithers

AUBREYN. SNELLINGS,B.A., M.A., Ph.D.

Economist, Federal Reserve Bank of Richmond

WALLACESTETTINIUS,B.A., M.B.A.

Vice-President, Virginia Capital Corporation

WALTERA. STOSCH, B.S., C.P.A.

Business Law

Economics

Finance

Accounting Partner, Gary, Finney & Company

w. N. STREET,JR., B.S.

Business Administration

Vice-President, State-Planters Bank of Commerce and Trusts

JOHN N. THOMASSON,'.B.S.

Industrial Engineer, Albemarle Paper Manufacturing Co.

F. CARLYLETILLER,B.A., M.B.A.

General Partner, J. C. Wheat and Company

JAMES L. TOMPKINS, B.S.

Traffic Manager, Virginia-Carolina Chemical Corporation

WALTERD. TUCKER,B.S.

Assistant Cashier, State-Planters Bank of Commerce and Trusts

Job Evaluation Investments Transportation Accounting

WILLIAMH. WARREN,B.S., M.S. . P ersonne l Relations Supervisor, Employee Relations, Albemarle Paper Manufacturing Co.

DIETERH. WEISS, A.B., M.B.A., C.P.A. Accountant, Mitchell, Wiggins and Company

DAVIDR. WHITE, B.A., M.B.A. Security_Analyst and Salesman Mason-Hagan, Inc.

GEORGEF. WHITE, JR., B.S.

Research Administrator, Reynolds Metals Company

FERDINANDWIEDERSPAHN,B.S. Accounting Finance Management Administrative Practice

Administrative Manager, Texaco Experiment, Incorporated

J. AsA WHITT, C.P.A. Accounting Partner, Baker, Rennolds, Thompson & Whitt

JOSEPH H. WILKINS, JR., B.C.S., C.P.A. Accounting

Private C.P.A. Practice

UNIVERSITY OF RICHMOND

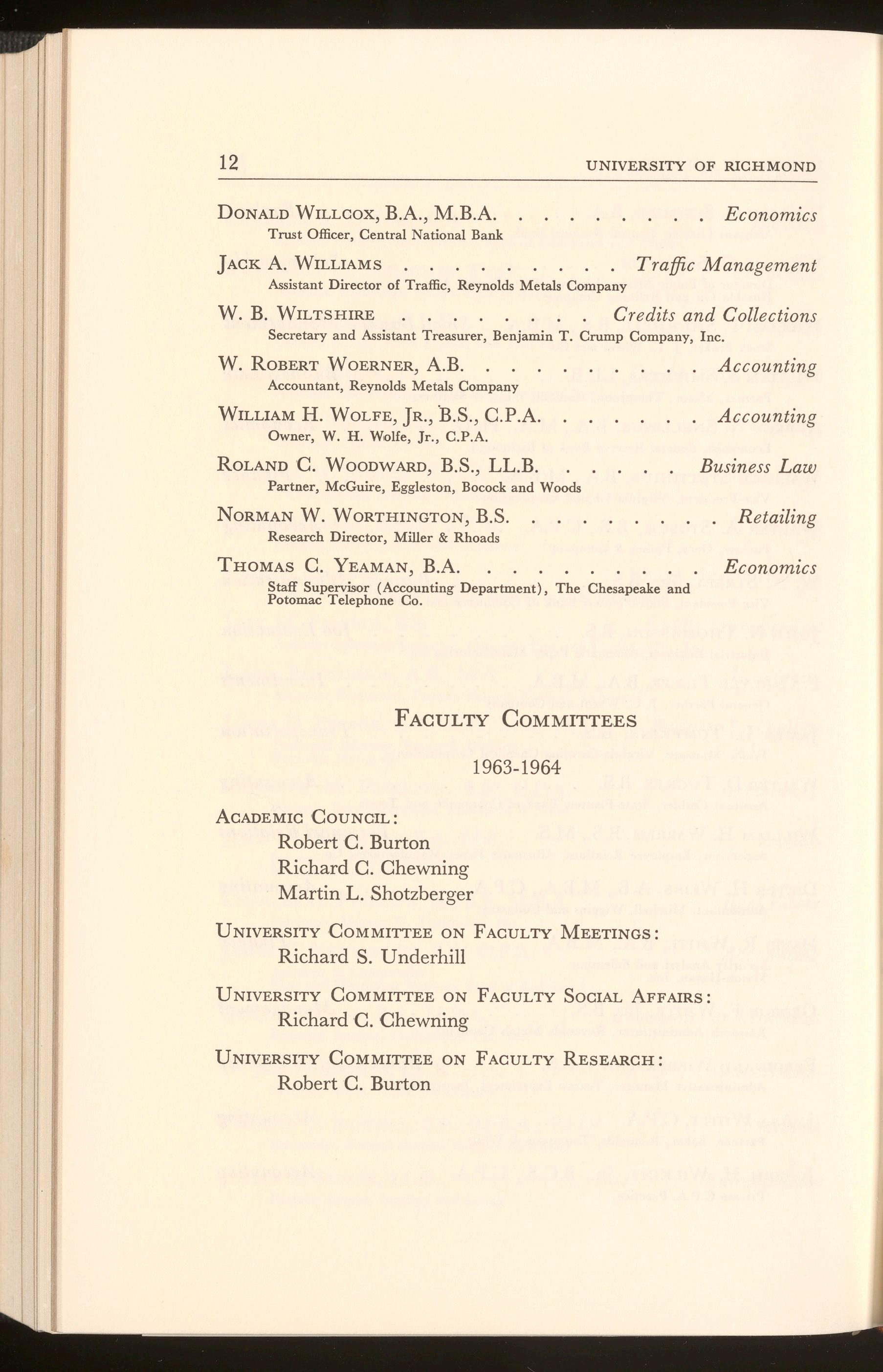

DONALD WILLCOX, B.A., M.B.A. Economics Trust Officer, Central National Bank

JACK A. WILLIAMS Traffic Management Assistant Director of Traffic, Reynolds Metals Company

w. B. WILTSHIRE Cr edits and Collections Secretary and Assistant Treasurer, Benjamin T. Crump Company, Inc.

w. ROBERT WOERNER, A.B. Accountant, Reynolds Metals Company

WILLIAM H. WoLFE, JR., B.S., C.P.A. Owner, W. H. Wolfe, Jr , C.P A.

ROLAND C. WOODWARD, B.S., LL.B. Partner, McGuire, Eggleston, Bocock and Woods

NORMAN w. WORTHINGTON, B.S. Research Director, Miller & Rhoads

THOMAS C. YEAMAN, B.A. Staff Supervisor (Accounting Department), The Chesapeake and Potomac Telephone Co

FACULTY COMMITTEES

1963-1964

ACADEMIC COUNCIL:

Robert C. Burton

Richard C. Chewning

Martin L. Shotzberger

UNIVERSITY COMMITTEE ON FACULTY MEETINGS:

Richard S. Underhill

UNIVERSITY CoMMITTEE ON FACULTY SocIAL AFFAIRS: Richard C. Chewning

UNIVERSITY COMMITTEE ON FACULTY RESEARCH:

Robert C. Burton

General Information

ORGANIZATION

University College, formed in 1962, is the newest division of the University of Richmond. The origin of University College may be traced back to 1920 when the department of economics of Richmond College was created, eventually to become the department of economics and applied economics. In 1924 the Evening School of Business Administration was organized as a separate division of the University of Richmond. In 1949 the department of economics and applied economics in Richmond College was combined with the Evening School of Business Administration to form the School of Business Administration with both day and evening classes In 1962, the Ev ening Division was separated from the School of Business Administration to become University College. This new college is one of seven divisions of the University of Richmond.

The University of Richmond was founded and is supported by the Baptists of Virginia . Other divisions with dates of founding are Richmond College ( 1830) ; The T. C. Williams School of Law (1870); Westhampton College (1914); the Summer School (1920); the Graduate School ( 1921); and the School of Business Administration ( 1949). Each College has its own dean, its own faculty, and its own institutional life. The University Senate, on which sit representatives of all the faculties, provides for intercollegiate cooperation.

The University of Richmond, one of the twenty-two affiliated institutions of the University Center in Virginia, benefits from the several cooperative programs operated by the Center . Through a cooperative Evening Program students can complete all requirements for an undergraduate degree in Commerce. A graduate degree in Commerce may be earned in the evening in University College.

LIBRARY FAGILITIES

The libraries of the University contain over 153,000 volumes. The main collection is housed in the new Boatwright Memorial Library.

Special collections of books, pamphlets and research materials are

maintained by the Richmond Chapter of the Virginia Society of Certified Public Accountants, the Richmond Chapter of the National Office Management Association, and the Richmond Chapter of the American Institute of Banking

CLASSROOM FACILITIES

Most classes in University College are held m the Columbia Building, located at 601 N. Lombardy Street. Many classes are offered in the new building of the School of Business Administration on the main campus of the University.

ACCREDITATION

University College is part of The University of Richmond which is fully accredited by the Southern Association of Colleges and Schools.

AnM1ss10N REQUIREMENTS To UNIVERSITY COLLEGE

Four classifications of students, both men and women, are admitted to University College evening classes.

( 1) Special students. Adults over twenty-one years of age who are not high school graduates may be admitted as special students.

(2) High school graduates. Young men and women who have graduated from high school with at least fifteen approved units are eligible to enter.

(3) Present or former college students. To those young people who have attended college a year or more without graduating, University College offers an opportunity to continue their university training while being employed.

(4) C allege graduates. Many students enrolled in University College are college and university graduates. Graduates of liberal arts colleges who wish to extend their general education, graduates of engineering colleges who wish to supplement their technical knowledge, and graduates of university schools of commerce who wish to specialize further in particular fields of activity, have found benefit in the training provided. College graduates can also obtain credits leading to the degree Master of Commerce Veterans of the armed services, whether high school graduates or not, who demonstrate their ability to undertake college work may enter University College. Most veterans will be eligible for educational benefits under the G. I. Bill.

ADVANCED CREDIT FOR VETERANS

In accord with the recommendations of the American Council on Education, the following advanced credit will be allowed veterans:

( 1) The veteran who has served at least six months, but less than one year, shall receive credit for two hours in military science.

(2) The veteran who has served one or more years shall receive credit for two hours in physical exercise, two hours in human biology, and four hours in military science.

( 3) Frequently a veteran may secure additional credit for specialized training courses and for correspondence courses taken from standard colleges under the auspices of the U. S. Armed Forces Institute. A veteran desiring such credit should present his record either on the transcript form of the college in which the work was taken or on the form prepared for such purposes by the U. S. Armed Forces Institute. The Academic Council will determine the amount of credit to be granted in each case.

( 4) In allowing further advanced credit for educational experience in the armed services the Academic Council will be guided largely by the recommendations of the American Council on Education.

PROGRAM s OF STUDY

Degree Programs-University College offers work on the college level leading to the undergraduate degree Bachelor of Commerce and the graduate degree Master of Commerce.

Requirements for these degrees may be found on pages 16 and 18 respectively.

Beginning in 1964-1965, University College plans to offer work leading to the degree Master of Humanities . Students interested in this program should confer with the Dean of University College.

Associate Awards-Students completing a prescribed course of study may earn an Associate of Commerce award. In 1964 an Associate of Arts award will be available through a junior college. Those interested in the Associate Award in Commerce should consult page 19 of the catalogue. Students seeking further information about the Associate in Arts should confer with the Dean of the College.

UNIVERSITY OF RICHMOND

Certificates-A certificate in Business Administration will be awarded to any student who has successfully completed, with a grade of no less than C in each course, 36 to 43 semester hours-depending on the program-of which at least 24 semester hours must have been completed in University College of the University of Richmond. Each program must be approved, prior to its completion, by the Dean of University College. Several certificate programs are offered. See page 20 of the catalogue for certificate requirements.

BUSINESS MANAGEMENT CENTER

The Business Management Center, established in 1963,, is a nonprofit service of University College to the Richmond area business community. The objective of the Center is to provide Richmond area industry with professional management training and services which are unique and of high quality. This objective is accomplished by: professional courses, on-campus and in-plant; conferences; attitude surveys; consultation; and individual development programs. Through an affiliation with the Industrial Relation Center of the University of Chicago, the Business Management Center makes available vast resources in program, research, library and materials. Activities of the Center are financed by membership fees and tuition fees paid, in whole or in part, by participating companies, as well as by fees for other services. Such an approach is in keeping with the highest tradition of the American Free Enterprise System: Private Education and Private Industry cooperating in individual and personal development.

Inquiries about the Business Management Center should be sent to: Director, Business Management Center, 601 North Lombardy Street, Richmond 20, Virginia.

BACHELOR OF COMMERCE

The Bachelor of Commerce degree is awarded by the University of Richmond to either men or women who complete a course of study in University College according to the following requirements: The student may become a candidate for the degree of Bachelor of Commerce by making application to the Dean of University College after he has completed 45 semester hours with 45 quality credits. A total of 124 semester hours of work and 120 quality

credits are required for the degree. At least 60 semester hours of approved courses must be passed with credit at the University of Richmond; and at least 45 of these 60 semester hours must be selected from the curriculum offered by University College. The student is limited to no more than five failing grades in business courses. Quality credits are calculated from academic hours on the following basis: each semester hour passed with Grade A shall count three quality credits; with Grade B, two quality credits; with Grade C, one quality credit; with Grade D, no quality credit.

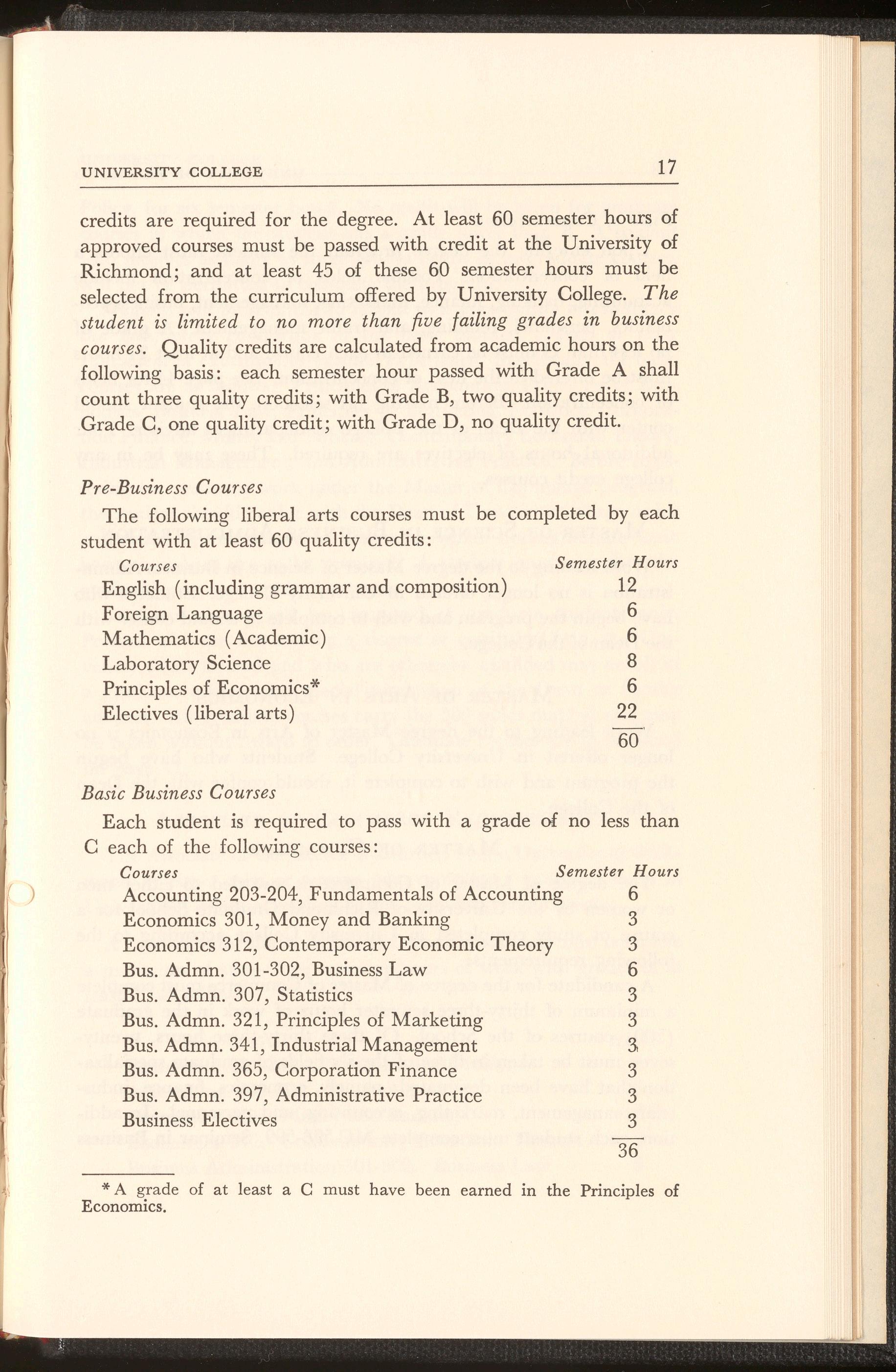

Pre-Business Courses

The following liberal arts courses must be completed by each student with at least 60 quality credits:

(including grammar and composition)

Each student is required to pass with a grade of no less than C each of the following courses:

Field of Concentration

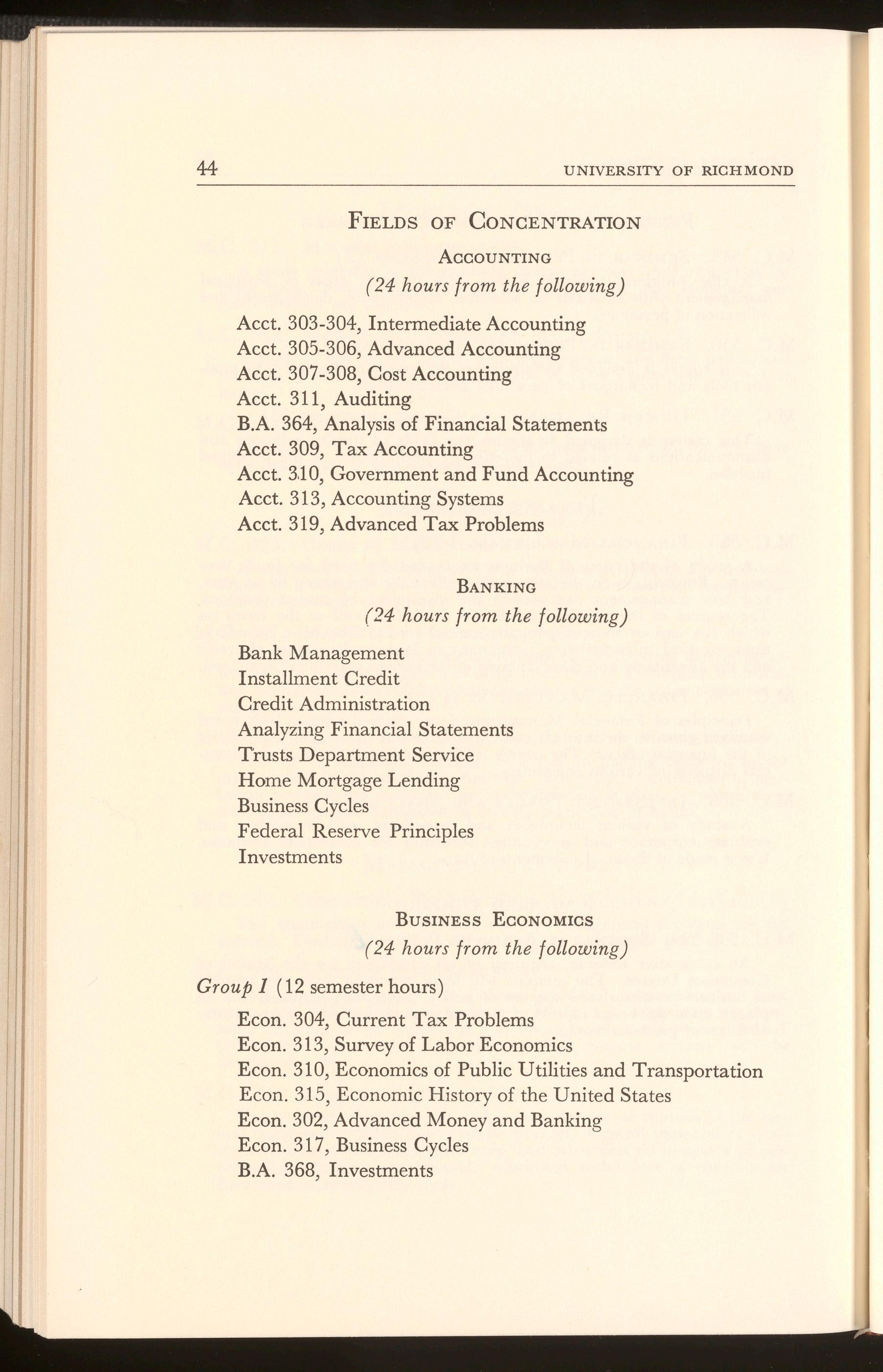

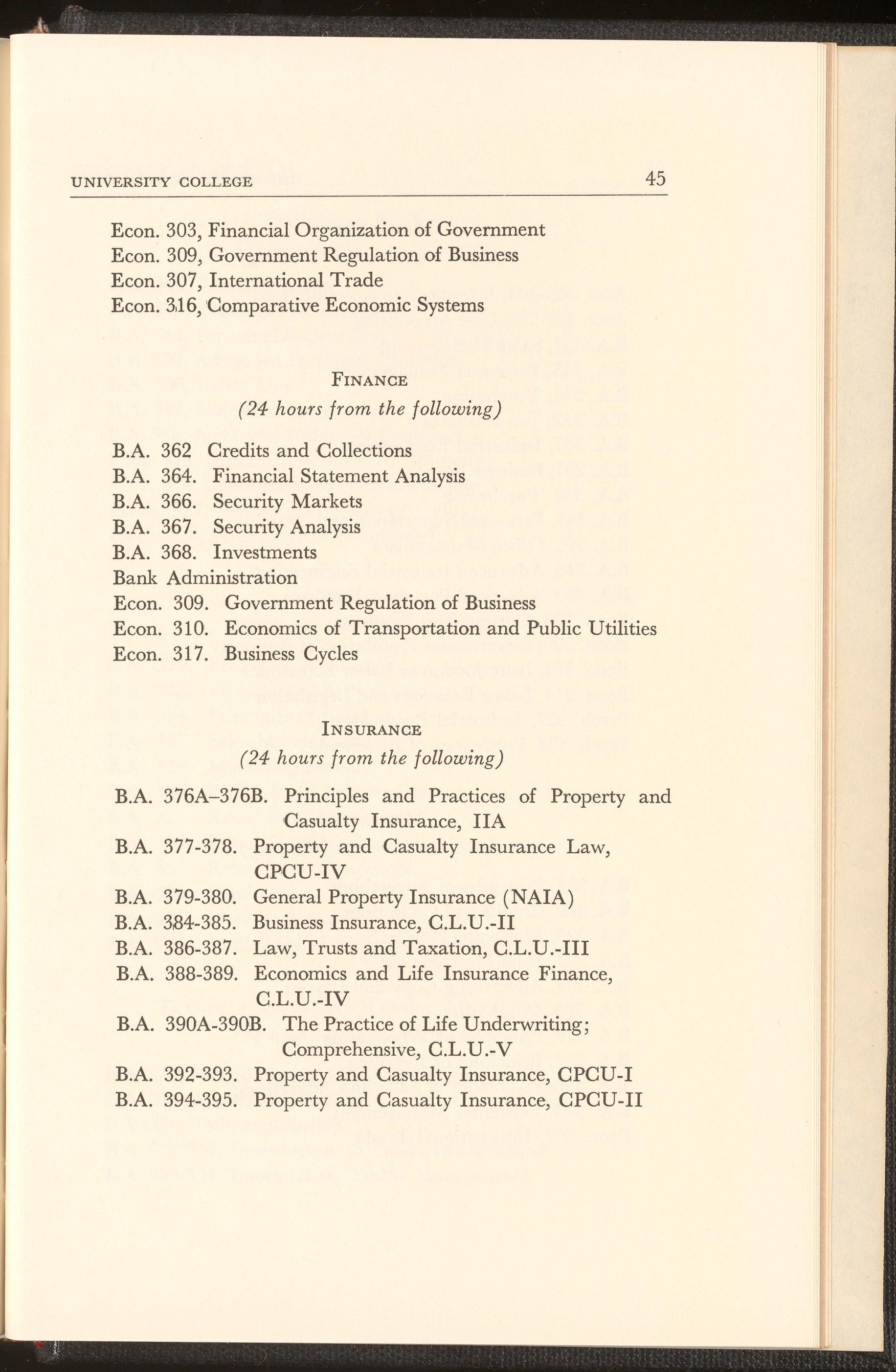

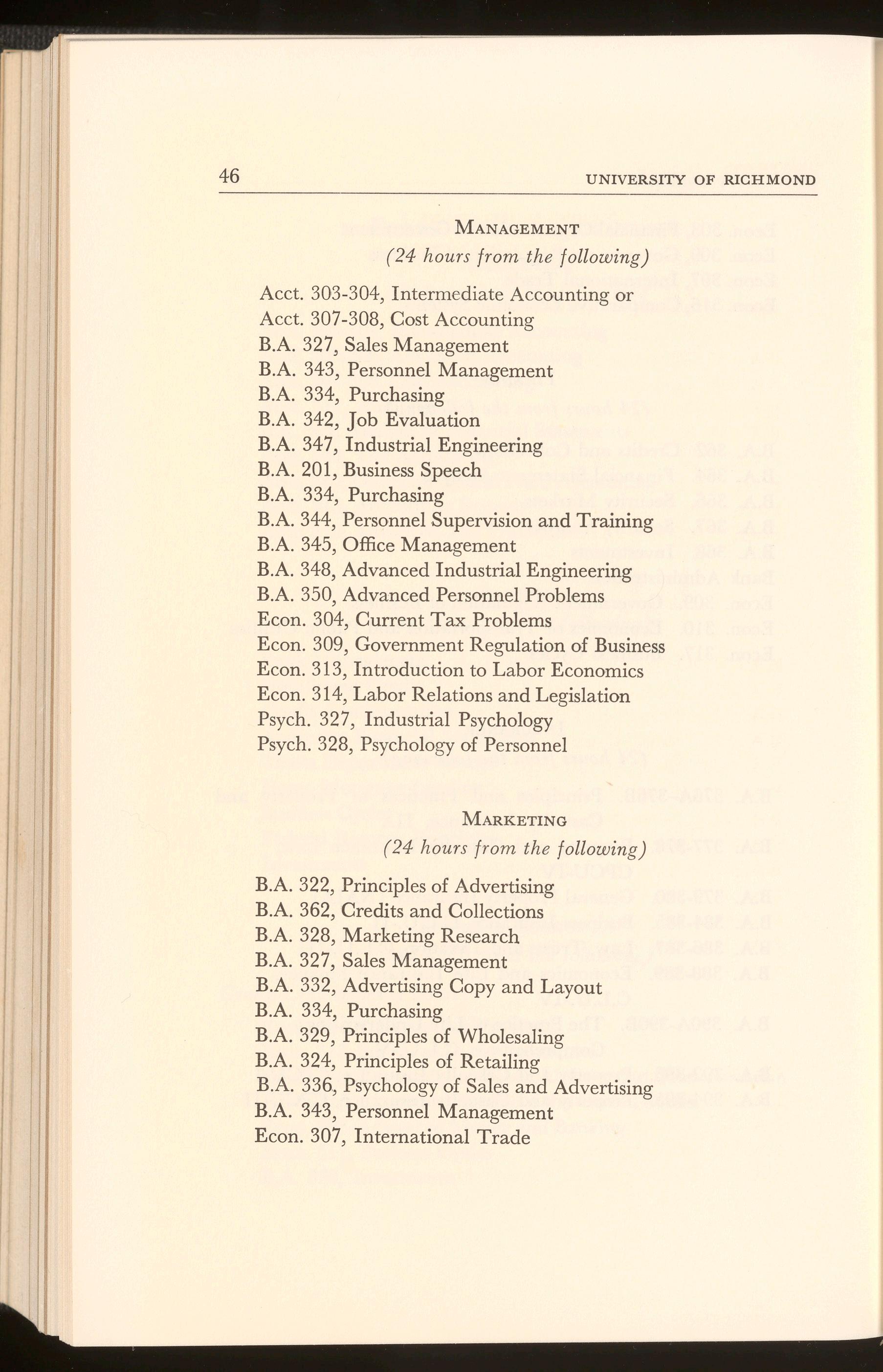

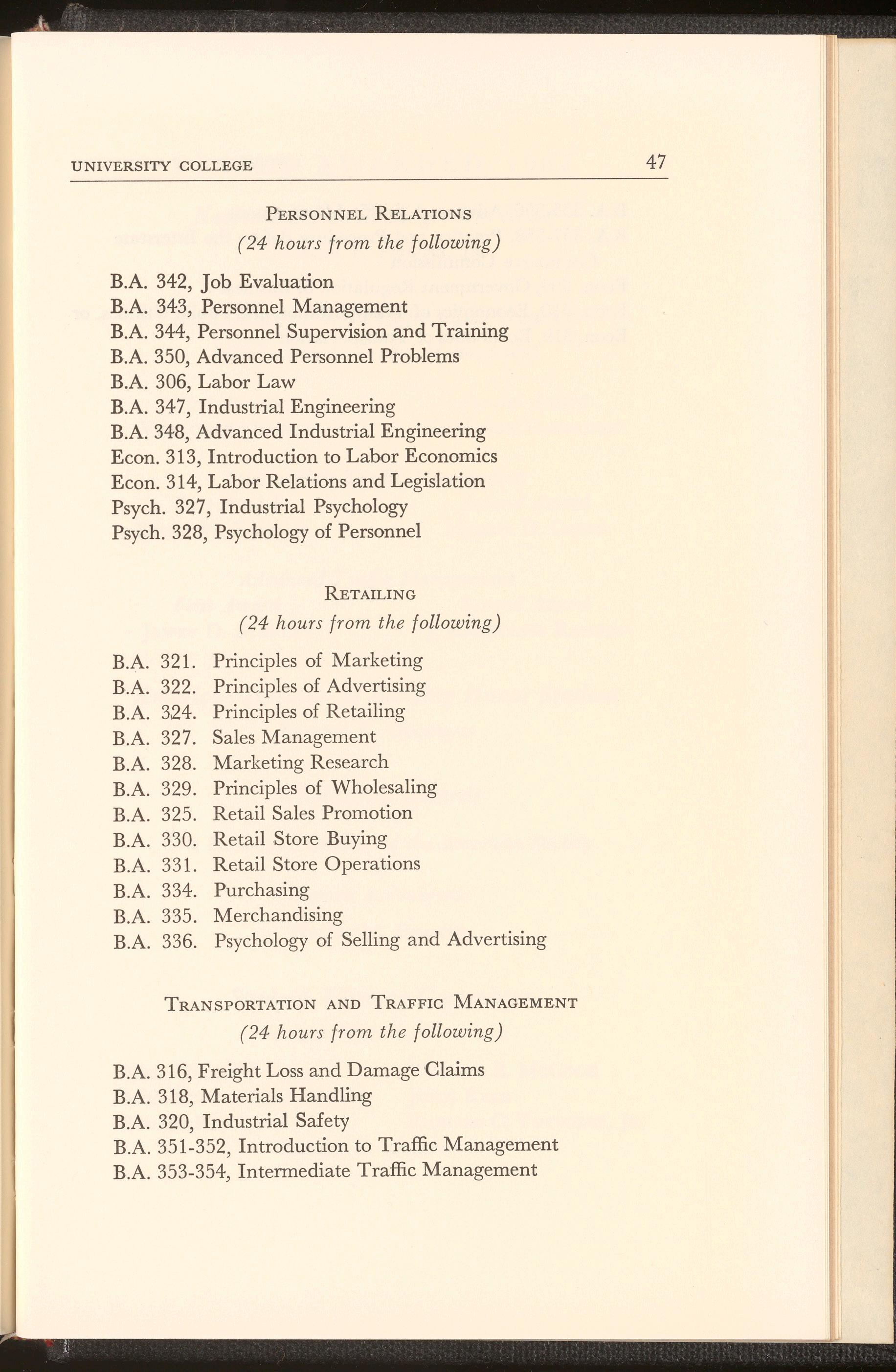

Upon entering the degree program the student must choose a field of concentration. Possible fields of concentration include accounting, banking, finance, marketing, management, business economics, personnel, retailing, and traffic management. A grade of no less than C must be earned in each course and at least 24 hours must be offered in the field of concentration. See page 44 for fields of concentration. Before making his selection, the student should confer with the Dean of the College or department adviser. Four additional hours of electives are required. These may be in any college credit courses.

l\1ASTER OF SCIENCE IN BUSINESS ADMINISTRATION

Work leading to the degree Master of Science in Business Administration is no longer offered in University College. Students who have begun the program and wish to complete it, should confer with the Dean of the College.

MASTER OF ARTS IN ECONOMICS

Work leading to the degree Master of Arts in Economics is no longer offered in University College. Students who have begun the program and wish to complete it, should confer with the Dean of the College.

MASTER OF COMMERCE

The degree of Master of Commerce is awarded to either men or women by the University of Richmond Graduate School for a course of study completed in University College according to the following requirements:

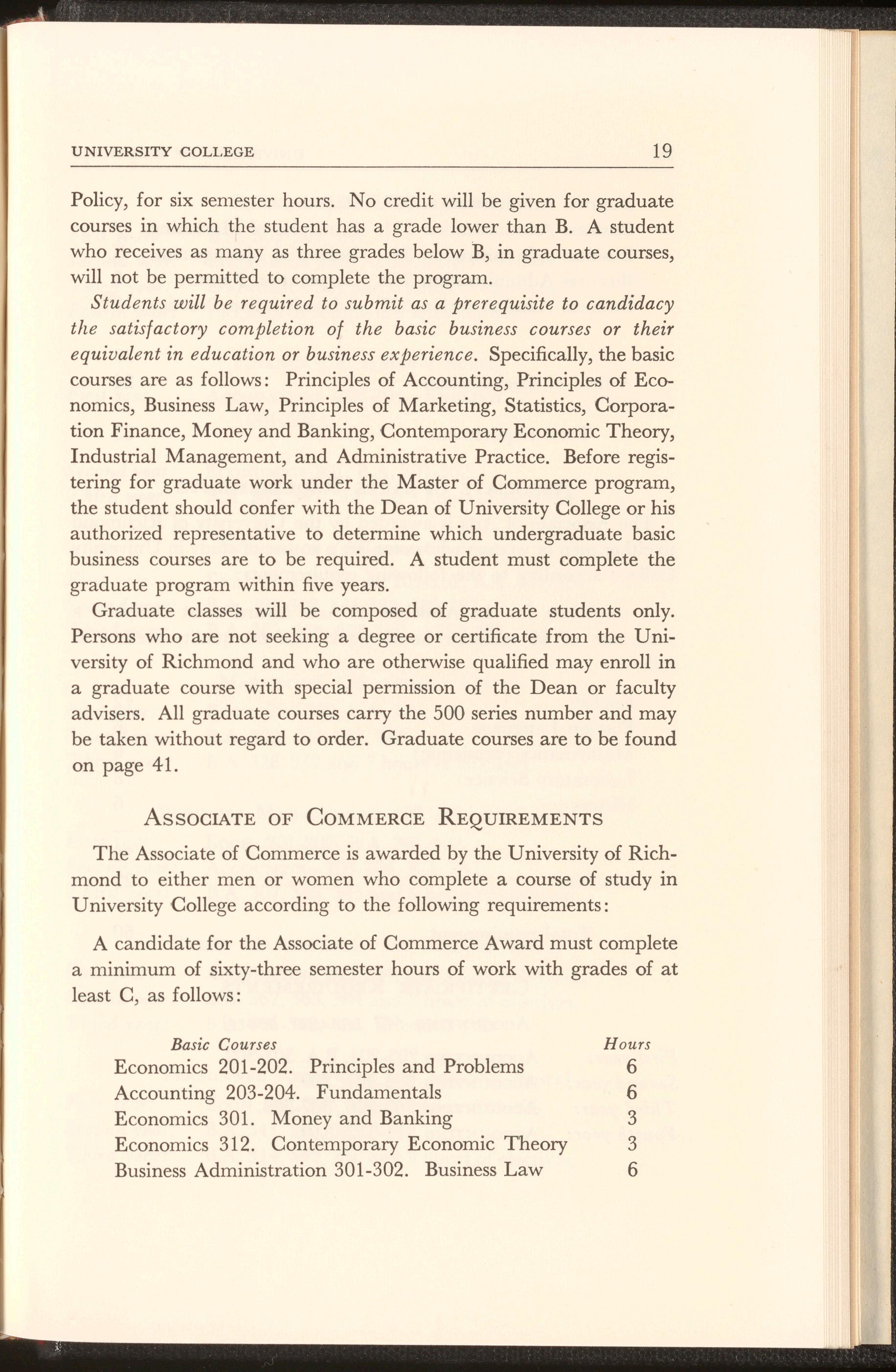

A candidate for the degree of Master of Commerce must complete a minimum of thirty-three semester hours of work in the graduate ( 500) courses of the School. Of these thirty-three hours, twentyseven must be taken in three of the six fields of graduate specialization that have been designated; namely, economics, finance, industrial management, marketing, accounting, and personnel. In addition, each student must complete MC 598-599, Seminar in Business

Policy, for six semester hours. No credit will be given for graduate courses in which the student has a grade lower than B. A student who receives as many as three grades below B, in graduate courses, will not be permitted to complete the program.

Stud ents will be required to submit as a prerequisite to candidacy the satisfactory completion of the basic business courses or their equivalent in education or business experience. Specifically, the basic courses are as follows: Principles of Accounting, Principles of Economics, Business Law, Principles of Marketing, Statistics, Corporation Finance, Money and Banking, Contemporary Economic Theory, Industrial Management, and Administrative Practice. Before registering for graduate work under the Master of Commerce program, the student should confer with the Dean of University College or his authorized representative to determine which undergraduate basic business courses are to be required. A student must complete the graduate program within five years .

Graduate classes will be composed of graduate students only. Persons who are not seeking a degree or certificate from the University of Richmond and who are otherwise qualified may enroll in a graduate course with special permission of the Dean or faculty advisers. All graduate courses carry the 500 series number and may be taken without regard to order. Graduate courses are to be found on page 41.

ASSOCIATE OF COMMERCE REQUIREMENTS

The Associate of Commerce is awarded by the University of Richmond to either men or women who complete a course of study in University College according to the following requirements:

A candidate for the Associate of Commerce Award must complete a minimum of sixty-three semester hours of work with grades of at least C, as follows:

Basic Courses

Economics 201-202. Principles and Problems

Accounting 203-204. Fundamentals

Economics 301. Money and Banking

Economics 312. Contemporary Economic Theory

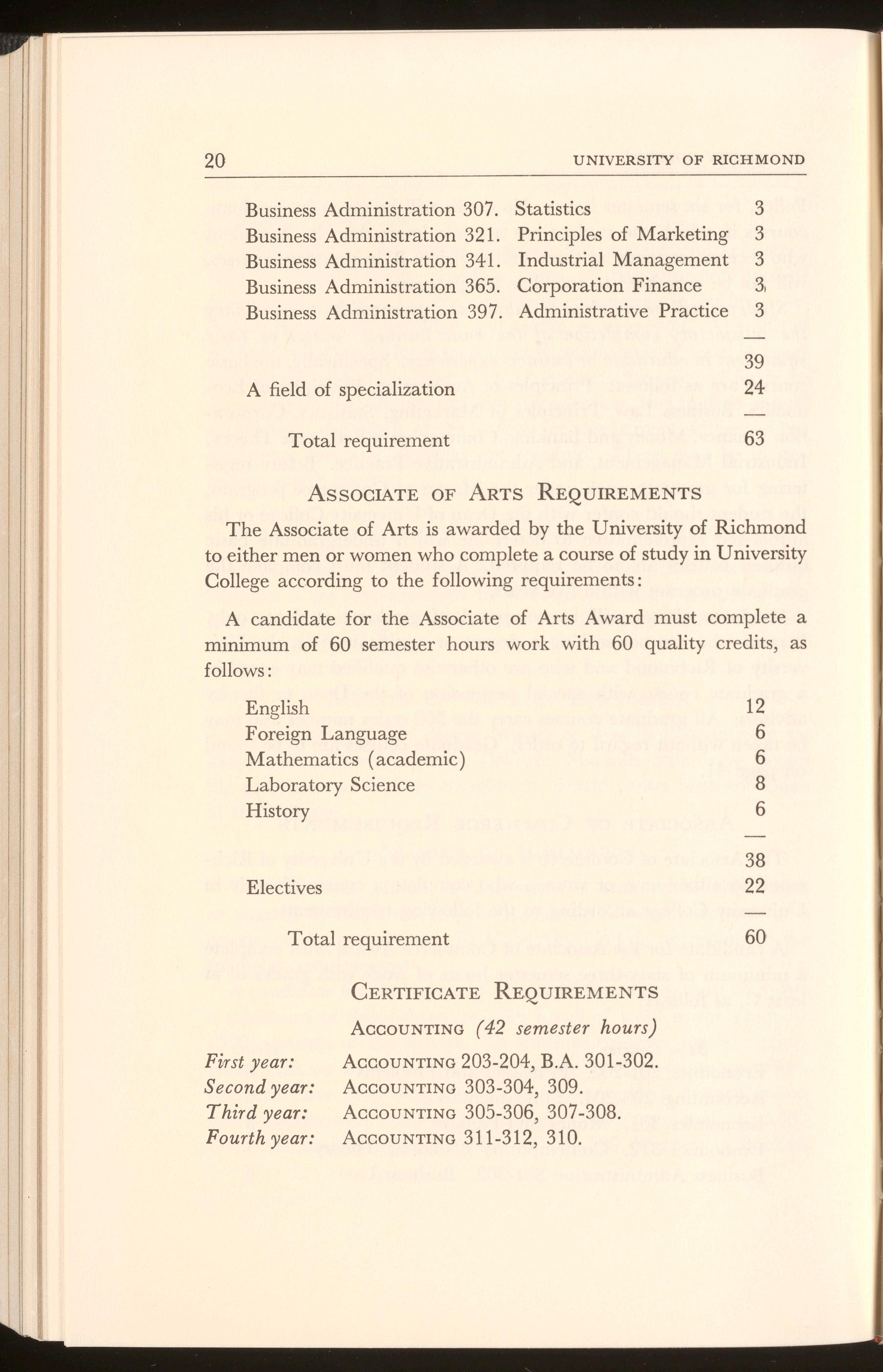

The Associate of Arts is awarded by the University of Richmond to either men or women who complete a course of study in University College according to the following requirements:

A candidate for the Associate of Arts Award must complete a minimum of 60 semester hours work with 60 quality credits, as follows:

English Foreign Language Mathematics (academic)

Laboratory Science History

Electives

Total requirement

CERTIFICATE REQUIREMENTS

AccoUNTING (42 semester hours)

First year: Second year: Third year: Fourth year:

AccouNTING 203-204, B.A. 301-302. AccouNTING 303-304, 309. ACCOUNTING 305-306, 307-308. ACCOUNTING 311-312, 310.

UNIVERSITYCOLLEGE

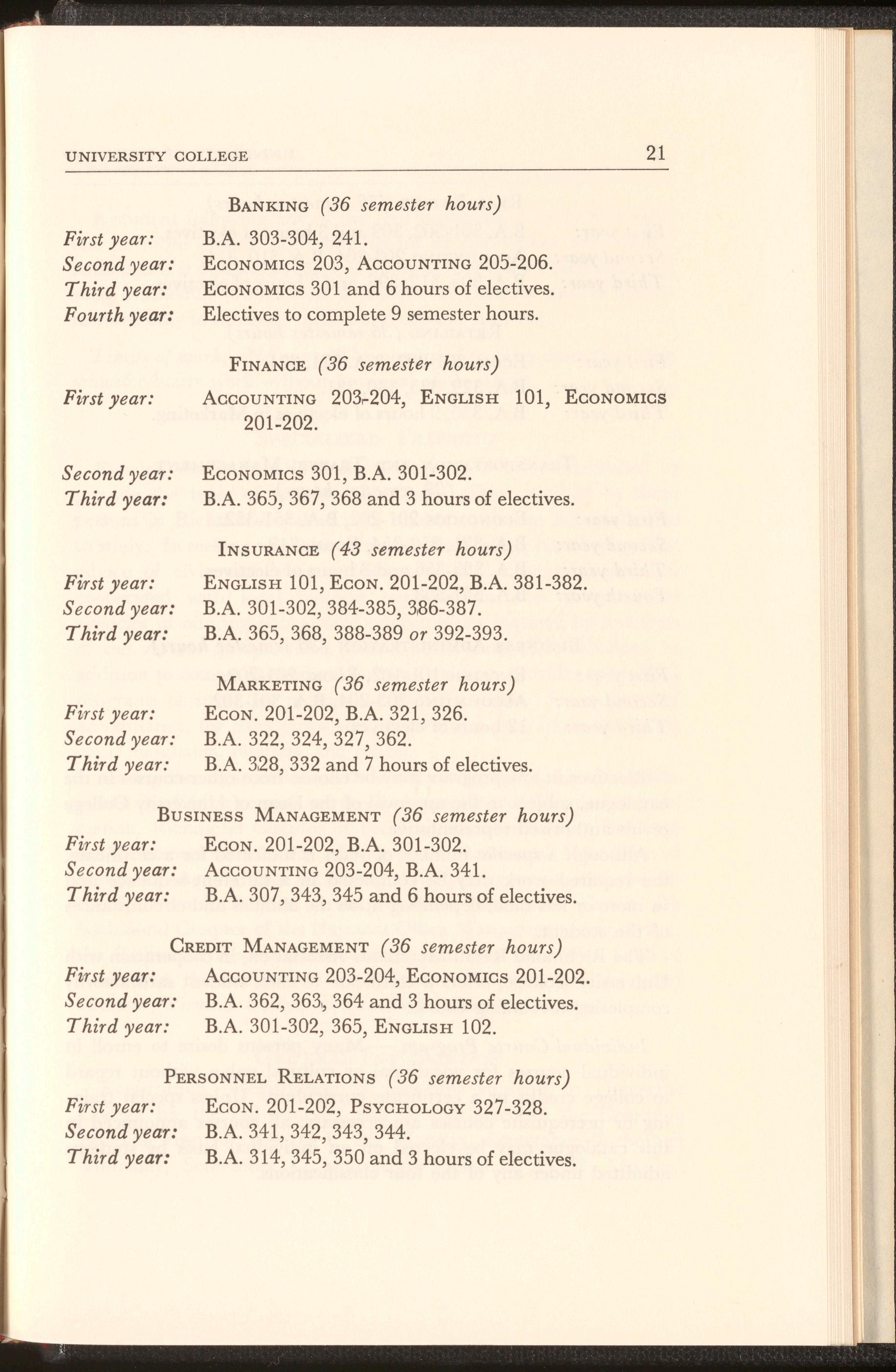

BANKING (36 semester hours)

First year: Second year: Third year: Fourth year:

B.A. 303-304, 241.

ECONOMICS203, AccOUNTING205-206.

EcoNOMICS301 and 6 hours of electives.

Electives to complete 9 semester hours.

FINANCE (36 semester hours)

First year: AccouNTING 203,...204, ENGLISH 101, EcoNOMICS 201-202.

Second year:

Third year:

First year: Second year: Third year:

First year: Second year: Third year:

EcoNoM1cs 301, B.A. 301-302.

B A. 365, 367, 368 and 3 hours of electives.

INSURANCE(43 semester hours)

ENGLISH 101, EcoN. 201-202, B.A. 381-382.

B.A. 301-302, 384-385, 386-387.

B.A. 365, 368, 388-389 or 392-393.

MARKETING(36 semester hours)

EcoN. 201-202, B.A. 321, 326.

B.A. 322, 324, 327, 362.

B.A. 3,28, 332 and 7 hours of electives.

BusINESS MANAGEMENT(36 semester hours)

First year:

EcoN. 201-202, B.A. 301-302.

AccouNTING 203-204, B.A. 341.

Second year: Third year: B.A. 307, 343, 345 and 6 hours of electives.

CREDITMANAGEMENT(36 semester hours)

First year:

Second year: Third year:

First year:

AccOUNTING203-204, ECONOMICS201-202.

B.A. 362, 363,, 364 and 3 hours of electives.

B.A. 301-302, 365, ENGLISH 102.

PERSONNELRELATIONS (36 semester hours)

EcoN. 201-202, PSYCHOLOGY327-328.

B.A. 341, 342, 343, 344. Second year: Third year: B.A. 314, 345, 350 and 3 hours of electives.

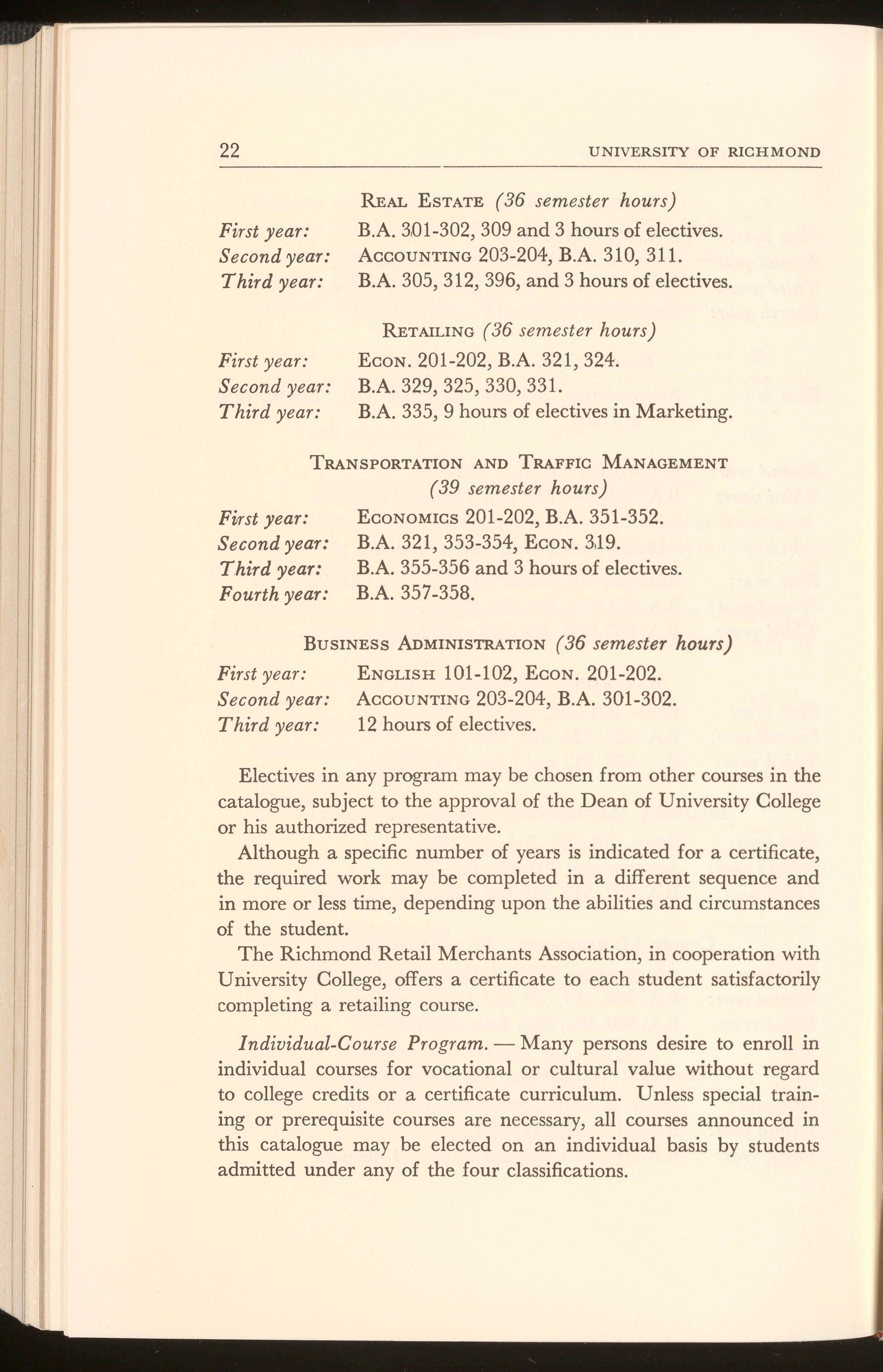

First year: Second year: Third year:

First year: Second year: Third year:

UNIVERSITYOF RICHMOND

REAL ESTATE

(36 semester hours)

B.A. 301-302, 309 and 3 hours of electives.

AccouNTING 203-204, B.A. 310, 311.

B.A. 305,312, 396, and 3 hours of electives.

RETAILING

(36 semester hours)

EcoN. 201-202, B.A. 321,324.

B.A. 329, 325, 330, 331.

B.A. 335, 9 hours of electives in Marketing.

TRANSPORTATIONAND TRAFFIC MANAGEMENT

First year: Second year: Third year: Fourth year: (39 semester hours)

ECONOMICS201-202, B.A. 351-352.

B.A. 321, 353-354, EcoN. 3,19.

B.A. 355-356 and 3 hours of electives.

B.A. 35 7-358.

BusINESS

ADMINISTRATION(36 semester hours)

First year: ENGLISH 101-102, EcoN. 201-202. Second year: AccouNTING 203-204, B.A. 301-302. Third year: 12 hours of electives.

Electives in any program may be chosen from other courses in the catalogue, subject to the approval of the Dean of University College or his authorized representative.

Although a specific number of years is indicated for a certificate, the required work may be completed in a different sequence and in more or less time, depending upon the abilities and circumstances of the student.

The Richmond Retail Merchants Association, in cooperation with University College, offers a certificate to each student satisfactorily completing a retailing course.

Individual-Course Program. -Many persons desire to enroll in individual courses for vocational or cultural value without regard to college credits or a certificate curriculum. Unless special training or prerequisite courses are necessary, all courses announced in this catalogue may be elected on an individual basis by students admitted under any of the four classifications.

A student following any of the four programs of study may elect one or more classes, according to his or her wishes and ability. Although it is possible to carry as many as four classes each semester, such a schedule would load a student to capacity and is recommended only to the most earnest and capable students.

Limits of work.-No one will be permitted to carry more than nine semester hours work without approval of the Dean.

SPECIALIZED TRAINING

Evening classes of University College have been established to provide the types of training of college caliber required by those persons in Richmond and vicinity unable to devote their full time to study. In seeking to achieve this end, the College has obtained the advice of civic and business leaders of the community and has cooperated with local business organizations and governmental agencies in offering educational opportunities required by members of the various groups. The present curriculum of the College, in addition to courses for general business training, provides specialized programs of study for prospective students of law, for students of accountancy, for bank employees, government employees, insurance men, merchants, retailers, and others.

Among the organizations with which close relationships are maintained in offering courses are the Richmond Retail Merchants Association, Richmond Chapter of the American Institute of Banking, the Richmond Life Agency Managers, the Richmond Association of Insurance Agents, the Richmond Life Underwriters Association, the Richmond Chapter of the National Institute of Credit, the Richmond Chapter of the National Office Management Association, the Richmond Real Estate Exchange, the Sales Executives Club of Richmond , the Richmond (Va.) Traffic Club, and the Richmond Chapter, Virginia Society of Certified Public Accountants.

GENERAL INFORMATION

R egistration.-Registration of part-time students in University College for the fall semester will be conducted in the Columbia Building from 7: 00-9: 00 P. M. Monday, September 9 through Thursday, September 12, and from 7:00-8:00 P. M. Monday,

September 16 through Thursday, September 19. Registration for the spring semester will be conducted in the Columbia Building from 7:00-8:00 P. M. Monday, January 27, through Thursday, January 30. Evening registrations are accepted in the order received until classes are filled. No one will be permitted to register for any first semester class after October 4, or any second semester class after February 21. Students who fail to complete registration by September 19, or February 6, will be charged an extra fee of $3.00.

Change of Course or Section.-After the close of formal registration, no student is permitted to add or drop a class or change his section without the approval of the Dean of University College. No change in a course of study is permitted later than one week from the opening date of the semester, except in unusual cases recommended by the Dean.

Class H ours.-Classes meet once each week, beginning at 7: 00 P.M. and continuing for 120 or 150 minutes, unless stipulated otherwise in the schedule of particular courses. This schedule is available at the beginning of each semester.

Late Afternoon and Summer Classes.-To be of further service to the community, the School is offering several classes in the late afternoon and during the summer.

Grading.-The standing of students in class work and in examinations is indicated as follows: A (95-100%) excellent work; B (88-94%) very good work; C (80-87%) fair or average work; D (75-79%) just passing; and F (below 75%) indicates failure; I, incomplete because of excused absence from final examination or because of failure to submit required work during the semester; and FN, failure because of excessive or unexcused absences.

Removal of Incomplete Grades.-A student who has received an incomplete grade on a semester's work must complete this work by the middle of the next regular School semester, otherwise it will become an F.

Withdrawals.-Students are permitted to withdraw from a class without scholastic penalty prior to mid-semester upon submitting to the office of the Dean a request in writing for withdrawal. After mid-semester, withdrawals will carry the grade F. Students who stop attending class without notifying the office of the Dean will receive the grade FN regardless of when attendance was stopped.

Absences.-No credit can be given for an evening course if, during a semester, the student has more than four absences, whether excused or unexcused and including those caused by entering the course late, unless the instructor indicates in writing to the dean that he believes the student is sufficiently qualified to be allowed credit for the course. Unexcused absences should result in an appropriate lowering of the student's grade, to be determined by the instructor. The grounds for excusing absences are ( 1) illness, ( 2) a personal obligation recognized as valid by the instructor, and ( 3) religious holidays. Students carrying as many as 12 semester hours are considered full-time and are permitted only one unexcused absence per class per semester.

The University is required to notify the Veterans Administration when a veteran has had as many as five cuts. The Veterans Administration will terminate the veteran's training as of the last day of attendance. In most cases, the veteran will not be permitted to reenter training under the G. I. Bill.

*Vocational Counseling and Placement of Students.-To help students find the vocation for which they are best suited, members of the staff of the University of Richmond will conduct vocational aptitude tests which may be taken by students registered in University College. The results of these scientific tests, combined with individual discussions with students, will be used as the basis for giving students who desire advice all possible assistance in determining the field of business they may wish to enter and for which they may be fitted.

Although no promise is made by University College to secure positions for its students, an effort is made to find places for those who inform the School authorities of their desire to obtain new positions and who have made a good record in the School. Gratifying success has attended the efforts to aid capable students in making connections with business firms.

STUDENT ACTIVITIES FEE

Students of University College are students of the University of Richmond. It is the policy of the Administration and faculty to foster any proper organization and activities that the students should

* University College students taking the series of tests will be charged a testing fee.

undertake. A student activities fee of one dollar per student per semester is charged . This fee has been requested by the students and is used for various activities of interest and benefit to the students. Funds from the fee will be administered by student representatives.

FEES

The tuition for undergraduate courses is $12.00 per semester hour and for graduate courses $18.00 per semester hour. The tuition for a two-hour course is $24.00 and for a three-hour course is $36.00 or $54.00 per semester. There is a student activity fee of one dollar per student per semester. These fees are payable each semester in advance, and students are expected to settle their accounts at the time of registration.

Undergraduate degree candidates must pay a $5.00 diploma fee. Graduate degree candidates must pay a hood and diploma fee of $25.00. Degree candidates not enrolled during the session in which they graduate, are charged a $10.00 non-matriculation fee. These fees are payable 90 days prior to graduation.

The tuition for the C.P.A. Coach Class, which begins in August, is $60.00.

Students are matriculated for a full semester. In case of withdrawal, for whatever cause, no refund of fees or any part of fees is made.

A veteran should have his Certificate of Eligibility and Entitlement when he registers.

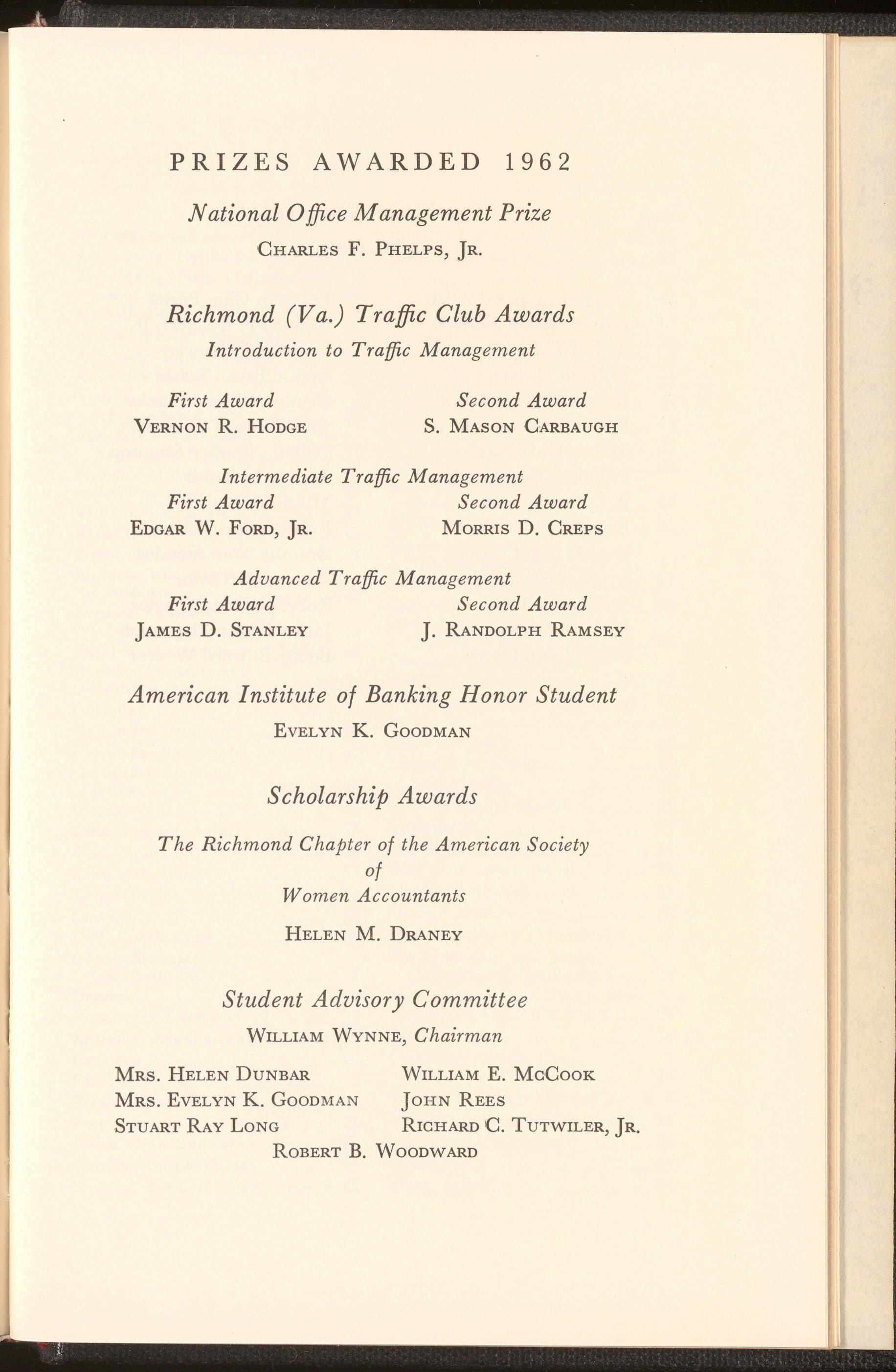

PRIZES

1. The Richmond Chapter of the National Office Management Association awards a prize to the student receiving the highest grade in the office management class and the office methods class.

2. The Richmond (Virginia) Traffic Club awards prizes to the two best students in each of the classes in traffic management.

3. The Richmond Chapter of the American Society of Women Accountants gives a scholarship, for further study in accounting, to a woman student who has completed at least the first half of the Fundamentals of Accounting with a grade of B or better. This scholarship is in the form of tuition and is offered each semester.

4. The American Institute of Banking awards the Graduate

Certificate winner, having the highest average grade, an appropriately engraved key and a trip to the National Convention of the Institute.

SOCIETY OF ALUMNI

Alumni of the University have long been organized into the General Society of Alumni, which holds annual meetings to renew old associations, maintains a close connection with Alma Mater, and furthers the cause of higher education. The association engages the services of an alumni secretary and publishes an alumni magazine. Students who have completed a year of study in University College may join the association.

UNIVERSITY COLLEGE COURSES of STUDY FOR 1963-1964

The right is reserved to withdraw courses in which the enrollment is less than fifteen. Classes will be closed as soon as maximum enrollment is reached. The schedule of evenings on which classes meet may be secured by telephoning ELgin 8-9485 or writing to the Office.

AccouNTING CouRsEs

ACCOUNTING 201-202. ELEMENTARY ACCOUNTING

This course is designed for students who wish only to acquire a knowledge of bookkeeping and statement preparation, or who find the burden of assignments in Accounting 203 too heavy for their particular circumstances. This course, by itself, carries no academic credit, but those who successfully complete it will be admitted to Accounting 204. Upon successful completion of Accounting 204, Accounting 201-202 will be regarded as equivalent to Accounting 203, and 3 semester hours of academic credit will be granted therefor

ACCOUNTING 203-204. FUNDAMENTALS OF ACCOUNTING (6)

Basic accounting theory and procedures; adjusting and closing entries; working papers; ledgers; books of original entry; notes and acceptances; controlling accounts; individual proprietorships, partnerships, and corporations; voucher system; balance sheet and income statement accounts; financial statement analysis; manufacturing accounting. Fundamentals of Accounting is a prerequisite for all subsequent courses in Accounting.

ACCOUNTING 303-304. INTERMEDIATE ACCOUNTING (6)

Consideration, at the intermediate level, of accounts and transactions peculiar to corporate forms of organization; basic accounting concepts and principles; interpretation of financial statements and analysis of the principal accounts contained therein; income tax allocation; price-level impact on financial statements

ACCOUNTING 305-306. ADVANCED ACCOUNTING ( 3-3)

First semester: Partnerships; venture accounts; consignments; installment sales; insurance; statement of affairs ; receivers ' accounts; realization and liquidation reports; estates and trusts; actuarial methods. Second semester: Home office and branch accounting; parent and subsidiary corporations; consolidations and mergers; foreign exchange Prerequisite: Accounting 303-304.

AccouNTING

307. INTRODUCTORY CosT AccouNTING (3)

Accounting for production management; principles and methods of job order and process cost accounting for managerial control of costs of production. Prerequisite: Completion of, or concurrent registration in, Accounting 303-304.

AccouNTING

308. ADVANCED CosT AccouNTING (3)

Standard costs; budgetary control; cost and profit analysis for decisionmaking purposes. Prerequisite: Accounting 307.

AccouNTING 309. TAX AccouNTING (3)

Basic discussion of broad theory and practical aspects of federal income taxation . Prerequisite: Completion of, or concurrent registration in, Accounting 303-304.

ACCOUNTING 310. GOVERNMENTAL AND FUND ACCOUNTING (3)

Accounting for institutions, municipalities, and state governments. Prerequisite: Accounting 303-304.

ACCOUNTING 311-312 AUDITING (6)

Auditing standards and procedures; programs of audit of various accounts; construction and indexing of working papers; reports to clients; professional ethics; internal audits. Prerequisite: Accounting 303-304.

AccouNTING 3,13. AccouNTING SYSTEMS (3)

Problems and procedures connected with designing and installing accounting systems, including a brief introduction to integrated data processing. Prerequisites: Accounting 303-304; Accounting 307-308 recommended, but not required.

ACCOUNTING 315. INTERNAL AUDITING AND CONTROL (3)

Review and appraisal of the internal accounting procedures of companies; verification and analysis of financial and operating reports; function and organization of internal auditing department; internal control. Prerequisite: Accounting 303-304; 307.

AccouNTING 319. ADVANCED TAX PRoBLEMs (3)

Practical and theoretical training in the more important provisions of Federal, State, and Local tax laws; income taxes, social security taxes, estate and inheritance taxes, gift taxes, property taxes; advanced problems and tax case research and preparation. Prerequisite: Accounting 309 or equivalent experience.

AccouNTING 323. C P.A R.Evrnw (No Credit,)

A c oach cl a ss w hich runs for twelv e w eeks beginning in Augu st D esigned to prepare students for the N ovemb e r C.P.A. ex amination .

ACCOUNTING 325. BUDGETS AND MANAGERIAL ACCOUNTING (3)

Preparation of budgets and their relation to expense and cost control. Prerequisite: Accounting 307.

BANKING COURSES

The following courses are offered by University College in cooperation with the Richmond Chapter of the American Institute of Banking. Registration in these courses is limited to bank employees.

GENERAL ACCOUNTING 1-11 (6)

Course content is similar to Accounting 203-204, but designed to meet needs of banking students. Not open to degree candidates

PRINCIPLES OF BANK OPERATIONS (No Credit)

This is a special course designed for bank employees who wish to begin a program of study leading to the pre-standard certificate awarded by the American Institute of Banking.

AGRICULTURAL CREDIT ( 3)

This course is concerned with the role of credit in modern agriculture and covers the methods employed in making, servicing and collecting farm loans. The approach to this course is from the commodity standpoint.

ECONOMICS ( 3)

Course content is similar to Economics 201-202, but designed to meet the needs of banking students. Not open to degree candidates.

MONEY AND BANKING (3,)

An introduction to the field of money and monetary systems; credit; and the banking system of the United States.

BANK LETTERS AND REPORTS (3)

This course is designed to achieve clearness, accuracy and conciseness characteristic of effective expression essential to bank employees.

BUSINESS ADMINISTRATION ( 3)

An introductory course designed for banking students which covers the organization, functions and operations of a business enterprise. Each phase of business activity is examined. Not open to degree candidates.

COMMERCIAL LAW (3)

A study of the fundamental principles of law from the standpoint of banking and commerce. Subjects covered are contracts, agency, partnerships, corporations, sales, estates, trusts, etcetera. Not open to degree candidates.

NEGOTIABLE INSTRUMENTS (3)

A continuation of Commercial Law, which covers the form and interpretation of negotiable paper, the right of a holder in due course, negotiation, liability, acceptances, etcetera. Not open to degree candidates.

BANK MANAGEMENT (3)

An advanced course for banking personnel which covers personnel policies, budgetary control, audits and examinations, insurance and taxation, business development and advertising policies

INSTALLMENT CREDIT (3)

The various phases of installment financing and personal loans, types of lending agencies and their techniques of operations. Special emphasis is placed on bank policies regarding consumer credit.

CREDIT ADMINISTRATION (3)

A study of the procedures and problems involved in effective credit management with emphasis on forms of credit, term loans, real estate loans, sources of information, and a general approach to loan policy.

ANALYZING FINANCIAL STATEMENTS (3)

The origin and nature of the items on a financial statement, their proper segregation, analysis, significance and relationships, together with several methods of analysis and secondary test methods. Prerequisite: Accounting 203-204 or 205-206.

UNIVERSITY COLLEGE

TRUST DEPARTMENT SERVICE

TRUST DEPARTMENT ORGANIZATION ( ( 6) s

Description and explanation of trust institutions and departments. Various tYPes of trusts, human and legal responsibilities are discussed.

HOME MORTGAGE LENDING ( 3)

This course covers the basic principles involved in home mortgage lending with special emphasis upon credit examination, appraisal of property, types of mortgages, and various regulations.

EFFECTIVE SPEAKING ( 3)

The course presents the basic principles involved in orgamzmg and presenting a speech, and for developing skill, self-confidence, and poise in speaking.

PUBLIC RELATIONS (3)

This course is designed to give a basis for public relations, both internal and external. Research methods for analyzing public opinion are given Advertising and publicity techniques are described and illustrated. Relations with customers, schools, the community, associations, and the Government are reviewed. The primary objective of this course is practical, its aim being for students to learn the reason for their own behavior and how to improve their own and their bank's public relations.

EFFECTIVE ENGLISH (3)

This course is concerned with the mastery of language through wide reading, an interest in words, and practice in writing of all kinds. In addition to discussing the principles of grammar, punctuation, spelling, and effective writing, the course illustrates banking situations in which there is a definite correlation between competency in written and oral communication and career success.

ECONOMICS COURSES

EcoNOMics 103. EvoLUTION OF INDUSTRY (3)

A survey of the origin and development of our modern economic institutions. Agricultural feudalism; guilds; mercantile capitalism; industrial capitalism; finance capitalism.

ECONOMICS 201-202. PRINCIPLES OF ECONOMICS (6)

Fundamental economic principles. Production; value; price; distribution; wages; rent; interest; profits; business cycles; consumption economics; national income; labor; transportation; money and banking; public finance; public utilities; and economic systems. Not open to freshmen. This course is a prerequisite for all advanced courses in economics.

EcoNoM1cs 301. MoNEY AND BANKING (3)

An introduction to the field of money and monetary systems; credit; and the banking system of the United States. Required of all degree candidates.

ECONOMICS 303, FINANCIAL ORGANIZATION OF GOVERNMENT ( 3)

Principles of public finance; public expenditures; public finance theory; shifting and incidence of taxation; budgetary procedure; distribution of the tax burden.

UNIVERSITY OF RICHMOND

ECONOMICS 307. INTERNATIONAL TRADE (3)

History of foreign trade. Evolution of theory of trade and prices; mercantilism; colonization; tariffs; foreign investments; balance of payments; international finance; transportation and communication.

ECONOMICS 310. ECONOMICS OF TRANSPORTATION AND PUBLIC UTILITIES (3)

Analysis of the major economic characteristics of the transportation system of the United States and of the principal utilities industries, including methods of regulation, valuation and rate making with special emphasis on problems of public policy.

ECONOMICS 312. CONTEMPORARY ECONOMIC THEORY (3)

A study of the forces determining the level of, fluctuation in, and growth of National Income. Required of all degree candidates.

EcoNoMICs 313. EcoNOMICs OF LABOR RELATIONS (3)

A study of labor and the labor movement as a basic factor in our economy. Special emphasis is placed upon union organization, collective bargaining, and labor legislation and their effect upon wages, hours, and employment.

EcoNoMICS 314. LABOR RELATIONS AND LEGISLATION (3)

A study of the industrial conflict; collective bargaining; labor legislation; agencies and methods of prompting industrial peace.

EcoNoMics 317. BusINEss CYCLES (3)

A review of the characteristics of the business cycle and various theories attempting to explain recurrent periods of prosperity and depression. Prerequisite: Economics 301 or equivalent experience.

ECONOMICS 318. FEDERAL RESERVE PRINCIPLES (3)

The development of the Federal Reserve System, its operation and its contribution to our economic life. The Federal Reserve Statement is carefully analyzed.

EcoNOMICS 319. ECONOMICS OF TRANSPORTATION (3)

Analysis of the economics of the transportation system of the United States, including air, rail, water, and highway. The course also includes a study of the theory of rates, with special emphasis on legislation and agencies of control. Prerequisite: Economics 201-202, or permission of the instructor.

COURSES IN GENERAL BUSINESS

B.A. 201. BUSINESS SPEECH ( 3)

A course designed to develop poise and self-confidence in speaking through the effective use of the principles of organization, content, and delivery. Practice in the use of these principles is stressed.

B.A. 301-302. BUSINESS LAW (6)

Introduction to nature and source of law; fundamentals of the law of contracts, property, sales, negotiable instruments, agency partnerships, corporations; application of law fundamentals to business practice. Required of all degree candidates.

B.A. 305. LAW OF REAL AND PERSONAL PROPERTY (3)

Methods of acquiring property-deeds, wills, inheritance, etc.; estates created-fee simple, life, term of years, etc.; co-tenancy-joint, in common; liens-common law, mechanics, etc.; incorporeal interests in landprofit and easements; licenses; landlord and tenant; examination of title.

B.A. 3,06. LABOR LA w ( 3)

Federal and state statutory law and common law governing relations between employer and employee. Special emphasis is placed on current laws.

B.A. 307. STATISTICS (3)

Construction, use and interpretation of statistical tables, charts, diagrams, indexes, deviation curves and correlation with special emphasis on uses in business. Required of all degree candidates Prerequisite: college algebra, or permission of the instructor.

B.A. 308. BUSINESS MATHEMATICS (3)

Mathematics of business finance with special emphasis on annuities, amortizations, sinking funds, depreciation, bonds, and actuarial mathematics . Prerequisite: college algebra, or permission of the instructor .

B.A. 309. PRINCIPLES OF REAL ESTATE (3)

A course covering the fundamental factors, procedures, and instruments which are basic to selling, managing, and appraising real estate.

B.A. 310. REAL ESTATE BROKERAGE AND MANAGEMENT (3)

A course covering selling, prospects, listings, and settlements. Also a study of the management of business and residential properties.

B.A. 311. REAL ESTATE APPRAISAL (3)

Theory, principles, and procedures used by the professional real estate appraiser. This course is of value to attorneys, trust officers, mortgage lenders, r eal est a te br okers, and investors. For th ose training as professional appraisers, the course prepares for required Examination I, American Institute of Real Estate Appraisers.

B.A. 312. ADVANCED REAL ESTATE APPRAISAL (3)

Practical application of the fundamental appraisal procedures. The solution of typical appraisal problems encount ered by practicing appraisers. This course will assist in preparation for Examination II, American Institute of Real Estate Appraisers.

B.A. 314. PRINCIPLES OF PUBLIC RELATIONS (3)

The basic principles and procedures involved in a sound public relations program with emphasis on selection of media and proper preparation of publicity releases.

B.A. 316. FREIGHT Loss AND DAMAGE CLAIMS (3,)

This course is designed to furnish the student with the technical aspects of handling loss and damage claims . Covers the Transportation contract; carrier liability; measure of damages; filing of claims; carrier claim regulations.

UNIVERSITY OF RICHMOND

B.A. 317. HUMAN RELATIONS IN INDUSTRY (3)

A study of working people-their place in the industrial social system and the factors which influence their morale and ultimately det ermin e their efficiency. Readings in several acknowledged authoritative sources

B.A. 318 . MATERIALS HANDLING (2)

This course covers the basic principles in materials handling including the functions of processing, storing and internal transportati on.

B.A. 320. INDUSTRIAL SAFETY ( 3)

Organization and operation of an industrial safety program; accident investigation and prevention, physical safeguards, lighting, ventilation, sanitation and other specific problems of an industrial safety program.

COURSES IN MARKETING

B.A. 225. RETAIL SELLING

A study of the sales process in retail selling, sales training techniques, and sales supervision methods.

B.A. 321. PRINCIPLES OF MARKETING (3)

A study of the institutions involved, functions performed, and prob- lems encountered in getting goods and services from producers to consumers. Required of all degree candidates.

B.A. 322. PRINCIPLES OF ADVERTISING (3)

Course covers modern principles of advertising as they relate to local and national advertising All classes of advertising media are treated.

B.A. 324. PRINCIPLES OF RETAILING (3)

This course is designed to give the student a knowledge of the various aspects of retail store organization and management.

B.A. 325. RETAIL SALES PROMOTION ( 3)

A study of the advertising and sales promotion activities of retailing, including sales promotion planning and budgeting, advertising media, non-advertising sales promotion activities, and evaluation of sales promo- tion. Prerequisite: B.A. 324 or equivalent experience.

B.A. 326. SALESMANSHIP (3,)

A study of the principles involved in personal selling. Special emphasis on developing territories, prospecting, buying motives, presentations, sales work, closing the sale, etcetera

B.A. 327. SALES MANAGEMENT (3)

This course covers organization of the sales function; recruiting, selec- tion and training salesmen; compensation, supervision, control, territories, expenses, forecasting, quotas, budgeting, etcetera. Prerequisite: B.A. 321.

B.A. 328 . MARKETING RESEARCH (3)

This course is designed to familiarize the student with the various techniques of market and marketing research. Emphasis is placed upon actual r esea rch probl e ms. Prerequisit es: B A. 30 7 and B.A . 32 1. 321.

B.A. 329. PRINCIPLES OF WHOLESALING (3)

The nature and evolution of wholesaling. The wholesaling structure. Operation and management of a wholesale business, and the economic and governing aspects of wholesaling.

B.A. 330. RETAIL STORE BUYING (3)

A study of what, where, when to buy merchandise for the retail store, including buying techniques, buying plans, and methods of determining customer wants. Prerequisite: B.A. 324, or equivalent experience.

B.A. 331. RETAIL STORE OPERATIONS (3)

A study of the operating activities of a retail store, including organization, materials handling, location and layout, and service. Prerequisite: B.A. 324 or equivalent experience.

B.A. 332. ADVERTISING COPY AND LAYOUT (3)

Practical workshop methods and techniques in writing copy and developing layouts. Prerequisite: B.A. 322, or equivalent experience.

B.A. 3,34. PURCHASING (3)

Purchasing procedures including quality and quantity control, sources of supply, inspection, and price policies. Special emphasis is placed on purchasing problems. Prerequisite: B.A. 324 or B.A. 329, or equivalent experience.

B.A. 335. MERCHANDISING ( 3)

A study of the techniques of unit control and dollar control of merchandise for retail stores. The course includes stock planning and analysis, problems of turnover and maintenance of proper margins. Prerequisites: B.A. 321 and B.A. 324, or equivalent experience.

B.A. 336. PSYCHOLOGY OF SELLING AND ADVERTISING ( 3)

A practical application of basic principles of psychology to retail and wholesale selling, sales promotion, market research and advertising.

COURSES IN MANAGEMENT

B.A. 101. INTRODUCTION TO BUSINESS (3)

A survey course offered for beginning students of Richmond College to give the student a perspective of the various phases of business. The student is introduced to such activities as finance, marketing, management, statistics, accounting, labor, transportation, and insurance.

B.A. 242. SMALL BusINESS MANAGEMENT (3)

An analysis of the various problems involved in organizing and operating a small business with special emphasis on kind of business, location, record keeping, merchandising, personnel, legal obligations and over-all management.

B.A. 243. BUSINESS THEORY FOR SECRETARIES (2)

This course covers the basic elements of business management and is designed to prepare experienced secretaries for the CPS examinations.

UNIVERSITY

B.A. 340. INTRODUCTION TO OPERATIONS RESEARCH (3)

The quantatative procedures of industrial problem solutions are developed. Optimization of decisions based on the interaction of complex variables with opposing cost relationships is of major interest. Replacement theory, queueing theory, linear programming, scientific method, sampling theory, theory of games, and computer applications are included

B.A. 341. INDUSTRIAL MANAGEMENT (3)

Primary emphasis is on production, particularly manufacturing. The organization of a concern and the location of its plant or plants; the design of production and materials handling facilities; the design of the product; and control of personnel, production, and finances receive attention. Students may be required to spend several afternoons visiting selected plants in the Richmond area, as arranged by the instructor. Required for all degree candidates

B.A. 342. joB EVALUATION (3)

A critical study of various types of job evaluation plans with emphasis on the point system. Recent trends in wage and salary administration are reviewed . A sample evaluation requires students to spend several evenings in a Richmond manufacturing plant.

B.A. 343. PERSONNEL MANAGEMENT (3)

Practically all phases of personnel administration are touched upon in this course. It involves practices and procedures in organizing a personnel department, recruiting and training employees, and rendering staff assistance by activities such as safety programs, fringe benefits, and miscellaneous employee services.

B.A. 344. PERSONNEL SUPERVISION AND TRAINING (3)

Various techniques of supervising and training people are examined in this course by the conference method, with case materials covering widely different situations. Samples of audio-visual aids used in training supervisors are furnished.

B.A. 345. OFFICE MANAGEMENT (3)

A study of the principles, methods and general practices of office operations which are adaptable to both large and small offices with emphasis on duties and responsibilities of the manager, layout, equipment, forms, costs, budgets, selection and training of personnel, manuals, etcetera.

B.A. 3,46. OFFICE METHODS ( 3)

The development and application of work simplification techniques to the non-productive processes of the business organization; proper layout, flow of work, standard operations and procedures.

B.A. 347. INDUSTRIAL ENGINEERING (3)

A study of the improvement of methods and elimination of waste through time study, job evaluation, operator training and standard cost . ( A laboratory fee of $ 1.00 is charged for this course for materials.)

B.A. 348. ADVANCED IND U STRIAL ENGINE E RING (3)

Micromotion study, principles of motion economy, methods time measurement and determination of time standards. Prerequisite: B.A. 34 7, or equivalent experience. (A laboratory fee of $1.00 is charged for this course for materials.)

B.A. 349. INTERNATIONAL MANAGEMENT

This course is designed to develop understanding of national differences relating to domestic management of overseas operations, management of business in overseas locations and associations with foreign managers.

B.A. 350. ADVANCED PERSONNEL PROBLEMS (3)

A course designed to enlarge the understanding and broaden the outlook of supervisors, junior executives, and other administrators by examining cases drawn from everyday operations of business. Prerequisite: B.A. 343, or equivalent experience.

B.A. 351-352. INTRODUCTION TO TRAFFIC MANAGEMENT (6)

General introduction to the transportation field; history; basis governing classification of freight and freight classifications; principles of freight tariffs, and elements of rate making; shipping documents and their application; outline of special freight services; and freight claims.

Application of tariff circulars; construction and filing of tariffs; freight rates and tariffs; special freight services; demurrage and storage; reconsignment and diversion; transit; embargoes; warehousing and distribution; and materials handling.

B.A. 353-354. INTERMEDIATE TRAFFIC MANAGEMENT (6)

Application of through routes and rates; technical tariff and rate interpretation; overcharges and undercharges; loss and damage; import and export traffic; classification and rate committee procedure.

The constitutional power of Federal regulation; the original act to regulate interstate commerce; the amendatory and related acts; the transportation policy of Congress; the carriers subject to the Interstate Commerce Act; certificates, permits and licenses required by rail, motor, water, freight forwarders and brokers. Prerequisite: B.A. 351-352.

B.A. 355-356. ADVANCED TRAFFIC MANAGEMENT (6)

Construction and interpretation of the Interstate Commerce Act; duties, prohibitions and rights of carriers, shippers and the Interstate Commerce Commission; general principles and practical application of traffic law. Prerequisite: B.A. 353-354.

B.A. 357-358. PRACTICE AND PROCEDURE BEFORE I.C.C. (6)

This course is designed to prepare the student to become a practitioner before the I.C .C. Special attention is given to the nature, function and organization of the I.C.C.; practice and procedure before the Commission and the courts as provided for in the Interstate Commerce Act and the Commission's General Rules of Practice; evidence; leading Supreme Court decisions; and the Code of Ethics. Prerequisite: B.A. 355-356.

B.A. 359. STATISTICAL QUALITY CONTROL (3)

The application of statistical methods to control of quality in production and inspection; preparation of control charts; acceptance sampling. General shop problems will be used and proven statistical approaches to their solution will be demonstrated.

B.A. 397. ADMINISTRATIVE PRACTICE (3)

Administrative Practice is a capstone course which is required of all Senior students who are candidates for the degree. The course is designed to give students a broader management viewpoint through study and discussion of actual administrative problems and cases.

COURSES IN FINANCE AND CREDIT

B.A. 361. CONSUMER CREDIT (3)

The various phases of installment financing and personal loans, types of lending agencies and their techniques of operations Special emphasis is placed on bank policies regarding consumer credit.

B.A. 362. CREDITS AND COLLECTIONS ( 3)

A study of the nature and functions of credit regulations and restrictions governing credit; bank, consumer and mercantile credit methods; types of credit information; analysis of credit risks; and collection procedures and systems. Prerequisite: B .A. 321.

B.A. 363. CREDIT ADMINISTRATION (3)

A study of the procedures and problems involved in effective credit management with emphasis on forms of credit, term loans, real estate loans, sources of information, and a general approach to loan policy.

B.A. 364. ANALYSIS OF FINANCIAL STATEMENTS (3)

The origin and nature of the items on a financial statement, their proper segregation, analysis, significance and relationships, together with several methods of analysis and secondary test methods. Prerequisite: Accounting 203-204 or 205-206

B.A. 365. CORPORATION FINANCE (3)

Study of the development of the corporation, legal aspects, promotion, methods of financing, operation of the security markets, financial management and others. Required of all degree candidates Prerequisite: Accounting 203-204, or equivalent experience.

B.A. 366 . SECURITY MARKETS ( 3)

A study of methods and procedures used in marketing corporate and government securities with special emphasis on operations of the New York and other stock exchanges.

B.A. 367. SECURITY ANALYSIS (3)

A study of various techniques and procedures used to analyze and evaluate corporate and government securities for investment purposes.

B.A. 368. INVESTMENTS (3)

This course describes the various types of corporate secunt1es, the mechanics of purchase and sale, security price movements, analysis of financial page, and introduces the subject of investment management.

B.A. 371. CREDIT MANAGEMENT (3)

A study of the procedures and problems involved m effective credit management.

B.A. 372. ADVANCED CREDITS AND COLLECTIONS (3)

An advanced course in credits and collections, including financial statement interpretation, credit and collection correspondence, protection and redemption of credit. Special emphasis is placed on actual cases. Prerequisite: B.A. 362, or equivalent experience.

B.A. 374. PERSONALFINANCE(3)

This course is designed for laymen who seek to know how to secure maximum benefit from their incomes. It covers such subjects as when to rent or buy a home, use of banks, purchase of securities and basic budgeting.

B.A. 375. REAL ESTATEFINANCE(3)

A study of the financing of real estate with special emphasis upon the financial institutions and instruments

COURSES IN INSURANCE

B.A. 376A-376B. PRINCIPLESAND PRACTICESOF PROPERTYAND CASUALTYINSURANCE,IIA (6)

A survey course in Property and Casualty Insurance designed to prepare the student for the examinations for the Insurance Institute of America Certificate . It includes a study of basic insurance principles and the structure of the insurance industry, as well as an analysi"s of the more important Property and Casualty Insurance policy contracts.

B.A. 377-378. PROPERTYANDCASUALTYINSURANCELAW, CPCUIV (6)

A specialized course designed to prepare the student for the Part IV examination for the C .P.C.U. Designation. Includes a survey of business law and negligence Jaw and their specialized application to the field of Property and Casualty Insurance. Prerequisite: B.A. 376A-376B or equivalent experience in the Property and Casualty Insurance industry

B.A. 379-380. GENERALPROPERTYINSURANCE(NAIA) (6)

A comprehensive multiple-line course dealing with Fire and Allied Lines, Time Element Coverages, Inland Marine, Burglary and Glass, Automobile, Public Liability, Workmen's Compensation, Fidelity and Surety, Boiler and Machinery, and Aviation Insurance. This course prepares students for Part I of the C.P.C.U. examinations.

B.A. 381-382 . FUNDAMENTALSOF LIFE INSURANCEAND ANNUITIES, C.L.U.-I (4)

Needs and uses Types of contracts. The arithmetic of premiums and reserves Contract provisions and legal principles. Structure of the business. Fundamentals of programming and settlement options .

B.A. 383, N . PROPERTYINSURANCE(2)

Basic principles of insurance pertaining to coverage of loss due to fire, standard policies, evaluation and coinsurance.

B.A. 384-385. BUSINESS INSURANCE,C.L.U .-II (6)

Business purposes. Problems of old age, unemployment, and disability . Accident and Sickness insurance Group Insurance. Pensions and deferred compensation.

B.A. 386-387. LAW, TRUSTS ANDTAXATION,C.L.U.-III (6)

Business law and life insurance law. Estates, wills and trusts. Taxation.

UNIVERSITY OF RICHMOND

B.A. 388-389. ECONOMICS AND LIFE INSURANCE FINANCE, C.L.U.IV (6)

Economics. Family finance. Business finance.

B.A. 390A-390B. THE PRACTICE OF LIFE UNDERWRITING; COMPREHENSIVE, C.L.U.-V (6)

Human motivation. Ethics. Case studies (family, individual, business, and estate situations)

B.A. 391. INLAND MARINE INSURANCE (2)

This course covers the history of inland marine insurance, interpretation of insuring powers of marine underwriters, personal floater policies, transportation insurance, bailee's interest, commercial floaters, and other important forms coming within the scope of this subject.

B.A. 392-393. PROPERTY AND CASUALTY INSURANCE, CPCU-1 (6)

A specialized course designed to prepare the student for Part I of the examinations for the C.P C U. Designati on. Includes an advanced study of insurance principles, the structure of the insurance industry, government regulation of insurance, and a detailed analysis of Property and Casualty Insurance policy contracts. Prerequisites: B.A. 376A-376B or equivalent Property and Casualty Insurance experience.

B.A. 394-395. PROPERTY AND CASUALTY INSURANCE, CPCU-11 (6)

A specialized course designed to qualify the student for Part II of the C.P C U examinati ons Includ es a study of Pr op e rty and Casualty Insurance rate making, underwriting, loss adjustment, surveys, reinsurance, and financial statements Prerequisite: B.A. 392-393 or extensive Property and Casualty Insurance experience.

B.A. 396. BUSINESS INSURANCE ( 3)

A study of insurance policies as they apply to business operations.

RELATED COURSES

ENGLISH 101. BUSINESS ENGLISH (3)

A study of the fundamental principles of English grammar and composition with emphasis on sentence structure, punctuation, usage, vocabulary, and the organization of written work. Regular weekly written assignments and individual criticism and comment.

ENGLISH 102. BUSINESS LETTER WRITING (3)

A course in the essential types of business letters Regular weekly written assignments and individual criticism and comment Emphasis upon correctness and effective expression in both oral and written communications.

ENGLISH 104. BUSINESS REPORTS (2)

An intensive course in the various types of business reports, designed to cover the subject for all practical purposes. Regular written assignments and individual criticism and comment.

UNIVERSITY COLLEGE 41

PSYCHOLOGY 3,27. BUSINESS PSYCHOLOGY (3)

A study of the various applications of psychology to business and industrial situations, such as individual differences, training, fatigue and efficiency, advertising, use of public opinion surveys, and consumer research.

PSYCHOLOGY 328. PERSONNEL PSYCHOLOGY ( 3)

A detailed and intensive study of the psychological problems of personnel management with emphasis on tests, ratings, incentives, emotional factors, and morale. Prerequisite: Psychology 327, or equivalent experience.

LIBERAL ARTS COURSES

ENGLISH 101-102. RHETORIC AND COMPOSITION (6)

The elements of writing in theory and practice. Parallel reading. Exposition for the first semester; description and narration for the second, including a study of the short story and the novel.

HISTORY 107-108. SURVEY OF EUROPEAN CIVILIZATION (6)

FRENCH 101-102. ELEMENTARY FRENCH (6)

MATHEMATICS 101. COLLEGE ALGEBRA (3)

Simultaneous linear equations, quadratic equations, progressions, binomial theorem, theory of equations, determinants, permutations, combinations, and probability .

MATHEMATICS 102. TRIGONOMETRY (3)

Logarithms, right oblique triangles, trigonometric equations, identities, complex numbers and De Moivre's Theorem.

GRADUATE COURSES

AccouNTING CouRsEs

M.C. 501. MANAGERIAL AccouNTING AND CONTROL (3)

Emphasis is upon accounting as a tool of management. The course is designed to give the student an understanding of managerial controls, the information needed for their operation, and the manner in which accounting provides that information. Consideration of the types of accounting data relevant to managerial decisions.

M.C. 502. FINANCIAL ACCOUNTING THEORY (3)

An intensive study of the fundamental structure of financial accounting theory, including various concepts of income determination.

M.C. 503. AUDITING THEORY AND PRACTICE (3)

An advanced course in public accounting. Various topics are covered, including auditing techniques, auditing standards and principles, internal control, and developments and trends in the accounting profession.

UNIVERSITY OF RICHMOND

ECONOMICS COURSES

M.C. 511. MODERN ECONOMICS (3)

A study primarily of the national income account. Such topics as income data, interest rates, savings and investments, and monetary and credit systems are discussed.

M.C. 512. MONETARY THEORY AND FISCAL POLICY (3)

A study of the money supply, debt management, and fiscal policy, and the role of the central banking system in the creation and control of money.

M.C. 513. HISTORY OF ECONOMIC THOUGHT (3)

A study of the development of major micro-economic concepts from early beginnings to Marshallian Neo-Classicism.

MARKETING COURSES

M.C. 523. CASES IN MARKETING (3)

A case study of marketing problems and their solutions. The problems found by a company in its marketing operations are analyzed for determination of methods of solution.

M.C 527. MARKETING MANAGEMENT (3)

An analysis of the management problems of coordinating marketing activities of a company. The marketing operation of a company is scrutinized for determination of the proper marketing mix for accomplishment of the company objectives.

M.C. 528. RESEARCH AND DECISION MAKING IN MARKETING (3)

The use of marketing research as a tool in making decisions in the management of the marketing function. The modern techniques of marketing research are evaluated and consideration is given to where these techniques may be profitable in solving marketing problems.

MANAGEMENT COURSES

M.C. 540 . OPERATIONS RESEARCH FOR MANAGEMENT SYSTEMS (3)

The quantitative procedures of solving management problems are developed. Optimization of executive decisions is a major goal.

M.C. 549. SYSTEMS PROGRAMMING (3)

This course will cover the various functional relationships of sales, manpower, production, and inventory. Methods of optimizing programming decisions under both static and dynamic states will be emphasized. Quantitative procedures of programming business systems will be developed.

M.C 559. SYSTEMS CONTROLS (3)