BEYOND THE AISLES - YOUR TRUSTED INDUSTRY VOICE SINCE 1923

BEYOND THE AISLES - YOUR TRUSTED INDUSTRY VOICE SINCE 1923

Tania Walters | Publisher

Suppliers are often told that differentiation is the primary lever of growth. Stand out. Tell a better story. Sharpen your positioning. In a stable market, these ideas hold up reasonably well. When the system comes under pressure, they matter far less than many suppliers expect. Disruption changes buyer behaviour quickly. When supply falters, lead times stretch or costs shift unexpectedly, decision-making compresses. Buyers become more conservative, not more curious. The priority moves from finding the most interesting option to securing the least risky one. In these moments, buyers do not want to hunt. They default to what they already recognise. Familiarity becomes a shortcut for risk reduction. A supplier who is clearly understood, even loosely, often beats a technically superior but unfamiliar alternative. This is

not complacency. It is a rational response to uncertainty. This is where visibility does its quiet work. Visibility is not about noise or frequency. It is about mental availability. When a buyer needs to act quickly, the question is rarely “who is best?” and more often “who do I already know enough about to proceed without hesitation?”.

This behaviour explains why reference tools like the SupermarketNews Grocery Buyers Guide have endured for decades. It was never designed as a trend piece or a sales campaign. It exists because buyers need a dependable, neutral place to orient themselves when something changes. When continuity is threatened, buyers reach for what helps them move faster with confidence.

The Guide has remained relevant because the buying window is not fixed. Range reviews, gap fills, supply disruptions and internal changes happen continuously. The idea of a single annual opportunity to be seen has long passed. Buyers need an always-available snapshot of the market, not a flurry of outreach timed to a calendar.

For suppliers, this is often misunderstood. Many invest heavily in perfectly timed pitches, assuming access aligns neatly with review cycles.

In reality, some of the most meaningful opportunities emerge between those moments. The suppliers who benefit are usually those who were already visible, already credible and already easy to place into the conversation.

That is why quiet, consistent presence tends to outperform campaign-style selling over time. Being listed, referenced and accessible lowers decision friction before pressure appears. It removes the need to explain who you are at precisely the moment nobody has time to listen.

This is not an argument against differentiation. Differentiation still matters. But timing matters more. Differentiation works when attention is available. Visibility works when it is not. In volatile conditions, familiarity often wins.

The reason the Grocery Buyers Guide still matters is simple. When buyers need to act, they go where the information already lives. Being visible in those places is not marketing theatre. It is commercial insurance.

Food and Grocery Council is an industry association for grocery suppliers providing members networking, events, industry information and strong advocacy. Contact us for information on the benefits of membership: raewyn.bleakley@fgc.org.nz

Gluten-free food market trends, certifications insights, and 2026 outlook for New Zealand.

Dana Alexander, Coeliac

28 another year of plenty of veg by Antony Heywood, Vegetables NZ

30 trends, insights and growth in convenience retail by Matthew Lane, Night 'n Day

32 2026 in focus

Where New Zealand FMCG leaders can win in a valueredefined market. by Debbie Simpson-Pudney, Circana

34 global consumer trends 2026

How comfort, clarity and technology are defining consumers' new shopping behaviour. by Euromonitor International

Higgs,

36 brand trade mark fails of the year by Aparna Watal, Halfords IP

38 what matters now for nz grocery by Stewart Samuel, IGD

Black Dog BBQ

Black Dog BBQ is set to make an impact in 2026, driven by the growing success of its award-winning range of locally blended rubs and seasonings.

Refined over years of development, the lineup has earned major recognition at the NZ Artisan Awards, including a gold medal for their Pork and Chicken rub, and silver awards for both their Beef and Lamb-andVeg Seasonings.

Each rub delivers bold, reliable flavour whether used on the BBQ or in the home kitchen. The entire range is gluten-free, with two sugar-free options for added versatility.

Founded in 2017 as a competition BBQ team, Black Dog BBQ has built a strong reputation for flavour and authenticity. While their classes and catering have introduced many to American-style barbecue, it’s their seasonings that continue to define their brand. Easy to use, full of depth, and designed to help anyone create great food with minimal fuss.

With growing demand from home cooks,

NaturKidz

NaturKidz is driving rapid growth in the healthy snacking category with its fast-selling Yoghurt Meltz and 100% Veggie Meltz ranges. These freeze-dried, nutrient-rich snacks deliver fun, melt-in-the-mouth textures that kids love and parents actively seek out. With clean-label recipes, no added sugar, and strong repeat purchase, the range taps in to consumer demand and is performing exceptionally well across grocery and specialty retail. Yoghurt Meltz combine creamy yoghurt and real fruit for a probiotic, calcium-rich snack, while Veggie Meltz transform colourful vegetables into a convenient, 5-Star Health Rated format that’s redefining the Baby & Toddler snacking aisle.

With increasing consumer demand and proven category velocity, NaturKidz is a game-changing growth opportunity for retailers.

For more information contact: Bonnie Slade bonnie@ubdfood.co.nz

restaurants, and caterers, Black Dog BBQ’s rubs and seasonings are firmly positioned as products to watch in 2026.

For more information, email Clint Lindsey clint@blackdogbbq.co.nz or contact 0226238557.

Alliance Marketing

Discover a light, crispy snack that’s as wholesome as it is delicious.

Be Right Grilled Seaweed Snack Rolls are made from premium seaweed, carefully grilled to perfection for a savoury, umamirich taste. Each pack contains five twin packs (25g total), making it easy to enjoy on the go or share with friends.

Proudly New Zealand owned and operated, these rolls are crafted without artificial flavours, colours, or preservatives; just pure, natural goodness. They’re glutenfree, vegan-friendly, and contain no added MSG, making them a smart choice for health-conscious snackers.

Perfect for lunchboxes, quick bites, or pairing with your favourite dishes, Be Right Seaweed Snack Rolls deliver a satisfying crunch with every bite. Range a snack that’s simple, clean, delivers growth to the category, and is irresistibly tasty.

Please contact your Alliance Marketing representative or Jamielle Lewis, Alliance Trading, jlewis@alliancetrading.co.nz, for further information.

PURE New Zealand Ice Cream

PURE stands for purity, provenance and sustainability. Every batch is crafted, produced and packed by hand in Wānaka, without reliance on artificial emulsifiers, flavours, colours or preservatives.

Our clean labels reflect our commitment to consumer well-being, and every flavour is certified Gluten-Free and Peanut-Free.

We source only exceptional, ethically produced ingredients from New Zealand and beyond – from Belgian Barry Callebaut chocolate to oranges, lemons, limes and boysenberries grown in Aotearoa’s own fruit bowl. This care ensures every scoop delivers a uniquely intense, honest flavour experience.

PURE’s take-home range features 14 distinctive flavours available in three take-home sizes: the 1L family tub, 500mL meal tub, and 100mL single serve.

For more than a decade, PURE has been New Zealand’s leading super-premium artisan ice cream producer, earning over 100 industry awards –recognition of our unwavering dedication to crafting ice cream as it should be - real, natural and unrivalled.

Lady Alchemy

Naturally infused in New Zealand’s Bay of Plenty, Lady Alchemy crafts clean condiments for the health-conscious consumer. Her award-winning dressings, sauces, and finishing touches are 100 percent natural, allergen-friendly, free from preservatives and refined sugar, proving that flavour and nourishment can go hand in hand.

Dressings and sauces should never be the weak link in a healthy meal; elevate thoughtful food choices rather than masking them. You go to great lengths with fresh produce, balanced dishes and vibrant salads, why undo that with a sauce or dressing full of mystery ingredients?

Designed with intention, the brand’s signature spritz and dropper formats provide effortless portion control, so no more drowning.

Matahiwi Estate

Matahiwi Estate’s best-selling bubbles brings a joyful blush to any shelf. This elegant Brut Rosé sparkles with strawberriesand-cream allure, a lively bead, and a refreshingly crisp finish. Crafted for pure pleasure, it delivers standout value without compromising on charm. A proven crowd-favourite at events and tastings, this is the bubbles that turns casual sippers into loyal fans. For more information, visit matahiwi.co.nz

Seeking that final flourish? A drizzle of infused finishing oil, a dollop of pickled mustard seeds, or a sprinkle of aromatic finishing salt adds instant, natural luxury. With Lady Alchemy, small touches deliver big impact, transforming everyday meals into extraordinary culinary experiences.

HANDCRAFTED IN NZ.

AND DELICIOUS

pip@littlepips.co.nz

Almighty

Almighty is proud to launch Almighty Matcha, a premium ready-to-drink matcha beverage designed for modern lifestyles. Brewed to perfection and ready when you are, it brings a globally successful format to New Zealand chillers for the first time. No whisking, no mess, just smooth, creamy matcha in a can. It’s convenience without compromise.

Available in Original, Strawberry, and plant-based White Chocolate, Almighty Matcha is vibrant, flavour-forward, and a little indulgent. It’s designed to delight the senses while supporting balance in both body and mind.

It’s matcha for people on the move design-led, flavour-first, and made to feel almighty good. Whether powering through a busy day, unwinding after yoga, or finding a spark of creativity, this new range invites you to pause and take a moment for yourself.

For more information, contact Ben Lenart on ben@drinkalmighty.com, 021 587 894, Aaron Beck on aaron@cha.co.nz, 027 410 8389.

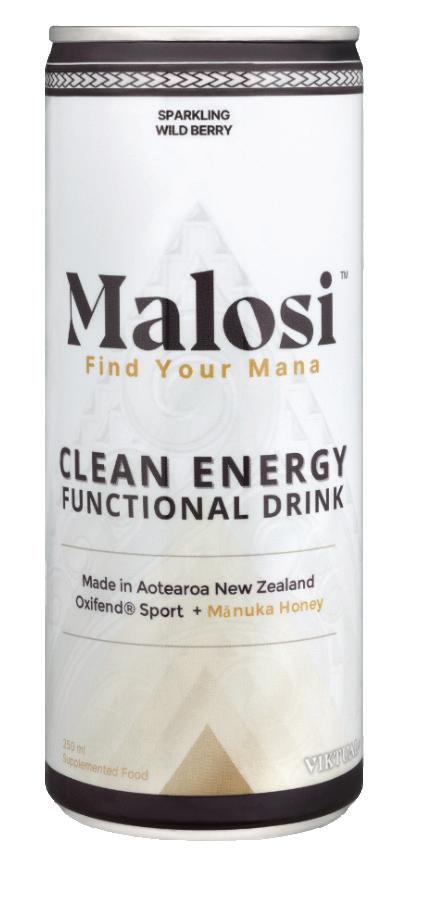

Viktual+

Made with New Zealand grown blackcurrants, sauvignon grapes and mānuka honey, Malosi is a sparkling clean energy functional drink crafted in Aotearoa New Zealand with natural flavours, low sugar and a smooth wild berry taste. Designed for everyday energy, Malosi brings together science-led ingredients for a cleaner, more balanced lift. Each can includes Oxifend® Sport, a natural polyphenol blend made in New Zealand from sauvignon blanc grapes and blackcurrants.

Malosi also features L-citrulline for performance and endurance support, magnesium and potassium for electrolyte balance, and contains caffeine. With its refreshing profile and cleaner formulation, Malosi offers a natural option for those wanting steady energy throughout the day, supported by New Zealand grown ingredients and a modern, functional blend.

Contact: rochelle@viktual.co.nz | www.viktual.co.nz

Venerdi

Venerdi Gluten Freedom is all about pushing the boundaries to create breads that offer free-from eaters true freedom at every food occasion.

By combining time-honoured sourdough fermentation with bold, dynamic flavours, the range elevates any meal and invites you to enjoy food without compromise on taste or texture.

Crafted to be vegan-friendly and free from gluten, dairy, and soy, these breads deliver such impressive taste and texture that you’d never guess they cater to specific dietary needs - and that’s

exactly the point.

They’re designed to celebrate what you can eat, not what you can’t. This is flocking good bread made for sharing, whether you’re enjoying a relaxed breakfast at home, entertaining friends, or firing up the BBQ.

Backed by a loyal fan base, the range brings confidence, creativity, and joy back to the table, making every occasion feel a little more inclusive and a lot more delicious.

For more information, contact info@venerdi.co.nz or visit www.venerdi.co.nz

Parched

Parched was founded on a genuine passion for elevating the humble garnish.

Established by industry professionals David Hawk and Olivier Rayer, the brand set out to reimagine what a modern garnish could be: natural, simple, sustainable, and finished with a touch of luxury.

Designed to meet today’s consumers' needs, these finely crafted, 100 percent natural and high-end garnishes are as tasty as they are beautiful, giving consumers access to bar-quality finishing touches at home.

Parched products make it easy to elevate

cocktails, add finesse to platters, or bring premium appeal to gourmet dishes. They also offer strong potential for gifting, hampers, and seasonal retail displays, with both a core range and tailored options available.

Parched operates with a simple belief: the perfect drink should be an experience worth celebrating and accessible to everyone.

For more information, contact Olivier Rayer on 021 0829 6676 or email oli@parched.co.nz.

Neudorf Black

Neudorf Black Garlic is New Zealand’s leading producer of premium black garlic condiments, crafted with care, 100 percent natural, and ready to inspire.

The Black Garlic Balsamic Glaze blends New Zealand black garlic with aged balsamic to deliver a tangy umami, gentle sweetness and a glossy, ready-to-use finish.

Black garlic is well established in professional kitchens; this product translates that credibility into an accessible supermarket format.

Black Garlic Balsamic Glaze is a savoury, versatile glaze that elevates everyday meals, roasted vegetables, meats, pizza, salads and cheese boards, while tapping into strong consumer interest in chefled flavour trends.

Like all Neudorf Black Garlic’s range, Black Garlic Balsamic Glaze is gluten-free and offers clear flavour differentiation and long shelf life.

Made in their solar-powered black garlic kitchen in Nelson Tasman and supported by strong provenance storytelling, Neudorf Black delivers repeat purchase, loyal customers and New Zealand differentiation.

Anthea

Anthea leads the non-alcoholic options category into the era of satisfying drinking experience. Six packs of 250ml offer satisfying cocktail ideas with best value to shoppers per can.

Anthea Blush and Blanc celebrate special moments with botanical bubbly alternatives, offering significantly less calories than de-alcoholised wine options. Each line was awarded Gold in the 2024 Inspire+ Artisan Awards.

For information on supplying your supermarket, contact your Centurian representative or alternately visit www.anthea-non-alcoholic.com

Howler Hotdogs

Cheese lovers rejoice! Howler Hotdogs have just added two popular Korean Style Corndogs to their range. Mozzarella cheese on a stick (coated in batter) and the “Half and Half” – where literally half of the sausage inside is replaced with a stick of Mozzarella cheese.

Airfryer-friendly and made using quality New Zealand ingredients, this allows consumers to enjoy this popular street food at home.

For more information, visit www.howlerhotdogs.co.nz or contact your local KML rep.

DUMPLINGS, DONE DIFFERENTLY

Pierogi Joint

As a Kiwi option rooted in rich European tradition, our pierogi introduce an exciting new flavour profile to the frozen dumpling category. The versatility of pierogi: able to be boiled, fried, or baked, and served sweet or savoury opens up extensive merchandising and meal pairing possibilities.

For more information, visit www.pierogijoint.co.nz or contact pierogijoint@gmail.com | 02102242262

The BDÉT Foam Wash has enhanced the performance of ordinary toilet paper, turning it into a luxurious, ultra-gentle wipe.

The Newanewa scent is a mix of soft notes reminiscent of freshly washed linen with aromatic hints of light woody frankincense, mint and a hint of freshly squeezed lime. The combination is both uplifting and refreshing.

For more information, visit www.b-det.com or contact bdet.company@gmail.com

In

New Zealand’s grocery sector, relationships matter — but even good partnerships come under pressure.

With the Grocery Industry Competition Act (GICA) and the Grocery Supply Code now in place, suppliers and wholesale customers have a clear, independent pathway to resolve issues with Regulated Grocery Retailers: the Grocery Industry Dispute Resolution Scheme, run by NZDRC.

The Scheme’s first adjudication isn’t just a milestone; it’s a practical example that shows that the Scheme is working as intended. A key takeaway? Engage early. Even for suppliers with limited time or resources, early support from NZDRC helps ensure everyone enters the process on equal footing and has the best chance of achieving a fair and timely outcome.

Why starting early pays off

The applicant’s submissions, witness statements, and other supporting documents should be meticulously prepared in advance as it must be submitted along with the Claim within five working days of the application. The Scheme moves fast, and suppliers or wholesale customers who understand that has an advantage.

The five-day window shapes the whole process. If you’ve already done the groundwork, you stay in control instead of scrambling. It also sets the tone for how efficiently the dispute resolution process progresses. Early preparation benefits both sides.

So does reaching out to NZDRC at the first sign of an issue . The first conversations are free, confidential, and focused on helping you understand the process and your options – giving you clarity before costs or conflict start to escalate.

Prep like a proit makes all the difference

The first adjudication made one thing clear: applicants who take time to prepare, with or without external support — are able to present their position clearly and make the most of what the Scheme offers.With all evidence required up front, there’s no room for guesswork.

Your claim is strongest when it’s anchored in the actual Code or Supply Agreement clauses at issue and backed by the commercial realities behind them. The first adjudication showed that terms like good faith, reasonable notice, and genuine commercial reasons aren’t abstract legal ideas — they’re practical standards the Scheme expects both parties to meet.

It is also important that your submissions should be well-structured and cogent, with clear reasoning and direct links to the evidence. When you connect the facts to the real commercial impact on your business, your claim becomes far stronger — whether you’re seeking damages or some other form of relief in mediation or adjudication.

The grocery sector runs on commercial relationships but when disputes and differences arise, acting early and preparing well can make all the difference. The Grocery Industry Dispute Resolution Scheme offers suppliers and wholesalers a credible and efficient way to resolve issues and move forward.

Continued from pg. 13

Picking your path: talk it out or take it to decision

A major strength of the Scheme is its flexibility. You can pursue:

• Mediation - A facilitated conversation aimed at reaching a commercial agreement. It’s collaborative, relationshipfocused, and often faster. If issues remain unresolved, you can still move to adjudication.

• Adjudication - A binding decision from an independent adjudicator. This can include compensation (up to $5 million), a declaration of rights, or practical compliance orders. The Scheme is flexible, with the adjudicator able to determine timing and details of the process, ensuring both sides can engage fairly.

Costs & timing: It’s been designed to work for you

The Scheme is intentionally accessible. Each side pays its own legal fees*, but otherwise there is no cost to the supplier or wholesale customer. The Scheme covers mediator or adjudicator fees via a levy on Regulated Grocery Retailers — a significant cost barrier is removed.

Timing is tight but manageable. Mediation aims to conclude within 25 working days of the notice of dispute being served. Adjudication runs on a structured, predictable schedule, with adjustments available for more complex matters. Speed is another advantage: the Scheme timeframes are measured in working days and weeks, rather than months and years when it comes to court proceedings. That means suppliers,

wholesale customers, and retailers can gain business and commercial clarity and move forward promptly and with certainty.

Why the Grocery Industry Disputes Scheme actually works

For suppliers and wholesale customers, this isn’t just regulatory window-dressing. It’s a practical tool with teeth. The first determination showed that the Scheme is fair, efficient, and genuinely useful.

Lowndes Jordan – who represented the supplier in the first case - captured it well:

“We consider that the Scheme is a useful tool for suppliers to enforce their rights and hold the supermarkets to their obligations … We would encourage suppliers to consider using this tool.”

If something feels off, you now have a credible avenue to seek clarity or correction — backed by an independent dispute resolution process designed to work quickly and efficiently.

The real-world play: what you should do now

Here’s the playbook:

• Call NZDRC early — free, confidential, and independent.

• Organise your documents — contracts, emails, timelines, notes.

• Clarify your goal — negotiated solution or binding decision?

• Pick the right track — mediation or adjudication.

• Budget smartly — your own costs only*; otherwise the Scheme is free to use.

*unless you act improperly or in bad faith, or you agree to a different arrangement in mediation

Final word

The grocery sector runs on commercial relationships — but when disputes and differences arise, acting early and preparing well can make all the difference. The Grocery Industry Dispute Resolution Scheme offers suppliers and wholesalers a credible and efficient way to resolve issues and move forward.

Be proactive. Be prepared. And make the Scheme work for you — on your terms.

Check out grocerydispute.co.nz for more information.

Or call 0508 347 7883 (0508 DISPUTE) and ask for the NZDRC registry team.

Contact information: Wendy Rayman Growth Strategy and Market Manager ADR Centre

Email: wendy.rayman@adrcentre.co.nz

Phone: +64 9 871 0333

The gluten-free food scene in New Zealand has continued to grow over the past year, moving from a specialty area to a major, high-value market.

For food manufacturers, distributors, and retailers, 2025 has brought tougher compliance rules, more consumer attention, and a big jump in companies getting certifiedespecially through the Crossed Grain Logo programme run by Coeliac New Zealand.

Certification as a Commercial and Compliance Imperative

The Crossed Grain Logo remains the gold standard for verified gluten-free assurance in both New Zealand and Australia. Products bearing this certification meet the Food Standards Australia New Zealand (FSANZ) definition of “no detectable gluten” (FSANZ Standard 1.2.7, 2023). Certification is verified through accredited laboratory testing ensuring compliance with the most stringent gluten-free criteria globally.

For manufactures, licensing the logo is both a commercial advantage and a compliance safeguard. Operated under annual licence agreements, the programme

scales fees to gluten-free turnover and mandates independent validation of glutenfree status via laboratory product testing. Participation has expanded steadily throughout 2025, reflecting a wider market shift toward accreditation as a prerequisite rather than a differentiator. Many new entrants to the gluten-free category are designing facilities for certification from the outset - reducing contamination risk and improving export readiness across Australia and the Asia-Pacific region.

According to the 2025 Coeliac New Zealand Member Survey, 68 percent of respondents said they actively seek out Crossed Grain Logo accredited products when shopping for gluten-free foods (Coeliac New Zealand, 2025). This strong consumer preference underscores the logo’s status as a trusted mark of safety and integrity.

Retail scan data also indicates consistent double-digit growth in certified gluten-free products, particularly within bakery, snack, and convenience-meal categories (Nielsen IQ NZ Market Data, 2025). Certified brands are outperforming uncertified competitors in both repeat-purchase rates and perceived quality - driven by coeliac consumers’ zero-tolerance for gluten contamination.

Several key developments defined the gluten-free market in 2025:

• Dedicated Gluten-Free Production Facilities: Manufacturers increasingly invested in standalone lines and purposebuilt gluten-free sites to eliminate crosscontact risks.

• Advancements in Testing Technology: The use of ELISA-based assays with lower detection thresholds has improved product verification accuracy.

• Digital Traceability and Smart Labelling: QR-coded packaging linked to certification databases allow both regulators and consumers to verify authenticity.

• Export Leverage: The Crossed Grain Logo’s recognition in Australia enhances New Zealand exporters’ competitiveness and compliance reputation.

Early gluten-free foods often had limited texture, taste, or nutritional value. However, the past five years have seen major improvements in formulation, ingredient sourcing, and manufacturing techniques. Advances in food science - such as the use of alternative flours like sorghum, buckwheat, and quinoa, combined with natural fibres and

seed-based binders such as chia gum, flaxseed mucilage, and citrus fibre to replace synthetic stabilisers - have significantly improved the texture, flavour, and stability of gluten-free products. As a result, many modern glutenfree foods are now comparable in quality to their conventional counterparts.

• Certification Expansion: More mid-tier producers and speciality producers are expected to seek Crossed Grain Logo accreditation to remain competitive.

• Tightened Regulatory Oversight: FSANZ and New Zealand Food Safety are anticipated to increase enforcement against misleading gluten-free labelling claims, aligning with global regulatory practice .

• Sustainability Integration: Environmental accountability will complement foodsafety compliance, with manufacturers expected to demonstrate responsible sourcing and packaging practices.

• Hospitality Sector Inclusion: a greater focus on Gluten Free Food Safety practises is predicted to extend beyond packaged goods into institutional catering, cafés, restaurants, led by Coeliac NZ’s Dining out Programme and GF Food Safety training and masterclass

• Coeliac Awareness Week – 15-21st June is more than a calendar event – it’s a celebration of shared progress for every New Zealander living gluten-free. The theme in 2026 is “Together We Can Thrive Gluten-Free.”

For manufacturers, certified gluten-free production is now both a commercial necessity and a regulatory expectation. The trust associated with the Crossed Grain Logo represents tangible brand equity. As consumer education and diagnostic awareness of coeliac disease continue to grow, the demand for certified products will intensify. In this evolving environment, certification delivers not only compliance assurance but also measurable market advantage.

With the Crossed Grain Logo as its benchmark for credibility and safety, the market in 2026 is set to expand through continued innovation and the importance of delivering uncompromising consumer trust.

Dana Alexander Sales and Marketing Manager

Charting some of the major leaps in loyalty technology and looking at what’s to come.

The past year has marked a turning point for loyalty programs in Australian and New Zealand food and beverage retail. What was once a transaction-based relationship between brands and customers has transformed into something far more dynamic, driven by artificial intelligence, real-time engagement, and genuinely personalised experiences.

The shift towards hyperpersonalisation has been the defining trend of 2025. Previously, this level of customisation was reserved for businesses with substantial resources and dedicated data science teams. AI has changed that equation entirely.

AI now handles the complex data analysis that once required significant investment, making hyperpersonalisation accessible to businesses of all sizes. This means offers can be tailored not just to what product suits a customer, but what reward motivates them and what action they need to take to earn it. The entire experience becomes individualised in ways that were impractical just a few years ago.

This development has democratised sophisticated loyalty strategies. Smaller retailers can now compete with major chains on personalisation, creating offers that resonate with individual shopping patterns and preferences without prohibitive costs.

The most significant challenge for omnichannel retailers has always been creating meaningful digital connections with customers in physical stores. Online engagement is straightforward, but replicating that connection when customers walk through your doors requires different thinking.

The solution emerging across the region centres on real-time, in-store digital engagement. Walk into any Woolworths and you'll see customers checking their phones, opening the app, and activating

boosted offers before reaching the checkout. The retailer has successfully encouraged this behaviour through clear in-store signage and strategic timing.

This real-time engagement changes shopping behaviour. Customers reconsider purchases, remember offers they might have overlooked, and actively participate in their own savings. The physical and digital experiences merge naturally rather than existing as separate channels.

Gamification has moved from experimental tactic to mainstream strategy throughout 2025. The transformation stems from a simple insight: people enjoy games, and that enjoyment creates emotional engagement beyond transactional relationships.

UK grocery chain Asda, operating in a market that often leads trends eventually adopted in the APAC region, has demonstrated the power of this approach. Prize draws triggered by spending thresholds and instant-win mechanics have generated strong customer response. The immediate gratification of instant results, rather than waiting days or weeks for draw outcomes, proves particularly effective.

Australian retailers have begun adopting these strategies with positive results. The approach works because it adds an element of anticipation and reward to routine shopping trips. Customers aren't simply collecting points, they're participating in an experience that makes shopping more engaging.

The trajectory for 2026 points clearly towards even more sophisticated real-time experiences. AI will continue enabling in-the-moment loyalty interactions as customers shop and browse. The technology now exists to respond dynamically to customer behaviour, creating opportunities that simply weren't possible in traditional loyalty structures.

Several developments appear likely to

accelerate. First, the integration of AI-driven personalisation will deepen, moving beyond offers to encompass the entire customer journey.

Second, real-time engagement will become the expectation rather than the exception, particularly as younger consumers accustomed to instant digital experiences represent a larger portion of the market.

Third, gamification mechanics will evolve beyond simple draws and instant wins to more sophisticated challenge structures that maintain long-term engagement.

The businesses that will thrive are those that recognise loyalty programs are no longer about points and discounts alone. They're about creating ongoing relationships through experiences that feel personal, timely, and engaging. The technology now exists to deliver this at scale. The question for 2026 is which retailers will use it most effectively to transform how customers experience shopping in food and beverage retail.

Jonathan Reeve Regional Sales Director ANZ Eagle Eye

At Fruit World, we’re proud to keep growing, adapting, and delivering the freshest, highest-quality produce to our customers, at great prices.

Freshness is what sets us apart. You’ll always find a balance of affordable everyday produce and premium picks, from large, juicy pineapples and crisp broccoli to delicious summer fruits and vibrant seasonal vegetables.

Because we only buy what we need, our stock never sits around. That means fresher produce, better value, and less waste.

Every item is hand-selected by our expert buyers, each with more than 25 years of experience (one with over 50!). Their expertise and our lean model ensure great value without unnecessary costs.

We’re continuing to expand, opening new stores, improving existing ones, and growing our online service at www.fruitworld.co.nz

We’re also teaming up with local retailers and suppliers in selected locations to bring you even more convenience, combining fresh produce with quality butchery, bakery, and grocery options all under one roof.

Supply wise weather extremes through the year affected some field greens, leading to limited planting and harvesting in certain areas. Meanwhile, strong export demand has influenced prices and local availability for some fruit lines.

Through it all, our agile team continued to adapt, ensuring you’ll always find a fantastic selection of the freshest, bestvalue produce in store, and as produce

specialists, you’ll spot plenty of the weird and wonderful fruits and vegetables.

Competition across the produce sector remains strong, which is great news for shoppers!

Summer is shaping up well, with good berry supplies and a positive outlook for stone fruit heading into 2026.

We know our customers are busy, so we keep shopping simple, quick stop, walk in, walk out.

We’re proud to be local, family-run businesses serving our communities with the freshest produce possible.

We appreciate the support of all our customers. Come in and experience the Fruit World difference,it’s worth it!

When I review the year that is 2025, the clear message to me is that we are not going back to the good old days. The changes that have occurred this year are game changers.

Across our clients in manufacturing, retail, and FMCG supply chains, several key trends have been apparent:

1. The age of global cooperation is behind us

Things are not going back to the way they were. For supply chains, this is a confronting realisation. We are seeing market leaders re-examine their existing networks to design more robust and resilient structures, that are better prepared for supply shocks and hostile events. This allows rapid reorientation and rebalance.

2. The next productivity leap lies in the supply chain

For too long, the supply chain has been seen as a cost centre to be squeezed dry in order to extract cost savings for the broader business. The tide is turning, and

I am seeing more businesses looking to their supply chains as enablers for growth and productivity gain. Relative to much of the world, New Zealand and Australia are at all-time low productivity growth rates. We are genuine laggards. Significant productivity gains are possible with focus and investment. The considered and accurate application of AI tools in inventory and demand planning, as well as in fulfilment operations optimisation, is yielding positive results that can be rapidly applied to many operations. This will accelerate into 2026 and create gaps between the movers and the waiters.

3. Increasing accessibility to automation and robotics

Even three years ago, you needed to be a substantial market player to secure an acceptable ROI for automation and robotics deployments. This year we have seen the cost of amazing systems fall

significantly as the global manufacturer market for automation and robotics continues to get more competitive. Now, we have very modest size organisations securing extremely short payback periods on these investments. When coupled with high labour and property costs, applying automation and robotics to warehouse operations is a “when, not if” for most businesses. The next 2 to 3 years will bring greater competition, and thus consolidation, in the automation and robotics industry. This will further enhance the attractiveness of business cases and the reallocation of labour.

4. The need to understand the real ‘cost to serve’ to enable smarter investment decisions

Undoubtedly, I have seen a shift in businesses seeking to understand their true ‘cost to serve’. As cost-of-living pressures continue to rise, manufacturers and retailers simply cannot continue to pass these price hikes onto consumers. As a result, the need to understand the exact profitability of a particular market segment, channel, customer, or SKU is critical. With this knowledge, accurate investment decisions can be made about where businesses apply their focus and scarce resources for the greatest impact.

5. Supply chains increasingly define customer experience With more cost-conscious consumers, and a plethora of channels to reach these consumers, the focus on supply chains’ impact on customer brand experience has come to the forefront. Businesses are wanting to ensure they more effectively “own” their customer experience to ensure that it is consistent and positively differentiating. Late deliveries, outof-stocks, and damaged goods do not align with any customer strategy. In this environment, the supply chain has become one of the most powerful levers a business has to protect and elevate its brand.

As a result of these key trends, I am seeing more manufacturers and retailers asking the question, “is my 3PL service provider doing a better job for my brand than I could do?”. In some cases, the answer is a definite “yes”. However, we often hear the answer “perhaps not”.

The three key questions to ask yourself are:

• “Is there anyone that cares about my business and my customer experience more than I do?”

• “Do I have the bandwidth and expertise to positively change this?” or,

• “Should I focus my efforts on securing better outcomes from my existing 3PL service provider?”

With the pace of geopolitical, automation, and AI-driven change, the need for high quality leadership within supply chain operations has never been more acute. Leaders need to be able to identify, attract, and retain an increasingly different type of talent, including mechatronics engineers, data scientists, commercial dealmakers, and industrial change designers. This ensures the ability to seize full advantage of the dynamics confronting global supply chains right now.

The good old days are gone, but were they that good anyway? Perhaps what matters more is what we choose to build next.

As we look back on 2025, one thing stands out across our shared food system. Food is never just food. It is science, health, economics and culture.

Most importantly, it is trust. That trust is built every day by people across New Zealand and Australia who grow, manufacture, quality control, transport, sell and regulate food so that consumers can be confident in the safety and quality of what they eat.

The past year has highlighted how interconnected the food system has become. Global pressures such as climate impacts, trade disruption and rising costs continue to influence the food supply. At the same time, technology is advancing quickly. Novel proteins, digital tools, AI driven supply chains and new packaging materials are reshaping how food is made and sold, and how information is shared with consumers.

For regulators, this environment calls for agility. At Food Standards Australia New Zealand, our role is to safeguard public health by supporting a system that can innovate safely and efficiently. That means ensuring our processes are transparent and grounded in evidence, while supporting alignment with trusted international partners.

One of our major achievements this year has been modernising the definitions for gene technology and new breeding techniques. These updates reflect scientific progress in recent decades and ensure regulation continues to focus on the outcomes that matter for safety. The changes also align more closely with international approaches, supporting trade and creating clearer pathways for innovation. Importantly, they

maintain strong consumer protections by ensuring regulatory oversight of techniques that warrant careful assessment.

Another significant milestone was the approval of cell-cultured quail, the first cell-cultured food in our region. This involved a detailed assessment of nutrition, composition, allergens and microbiological safety. It demonstrated that our regulatory system is flexible enough to assess technologies that do not fit traditional models of production. It also provided clarity for future cell-cultured food approvals and signalled our commitment to science based, proportionate oversight of emerging food technologies.

Progress also continued across food information standards. Consumers increasingly want clear and trusted information to help them make decisions, while industry wants labelling systems that are practical and efficient. This year we introduced mandatory energy labelling on alcoholic beverages to support informed consumer choice. We also continued work on front- and back-of-pack nutrition information labelling, including preparatory work to support food ministers’ decision making in early 2026 on whether the Health Star Rating system should be mandated.

Looking ahead, we will be commencing work on digital approaches to food labelling to explore how such tools can improve the way consumers access information, while supporting efficiency for businesses.

Modernising regulation also means strengthening efficiency. Our shared scientific assessment program with Health Canada for genetically modified foods allows industry to seek approvals across three countries through a single assessment. This world-leading, collaborative model reduces duplication and supports faster access to safe and innovative products while maintaining high standards. It also helps build confidence between regulators, strengthening consistent global approaches to food safety.

Science continues to underpin all our work. The 28th Australian Total Diet Study is well underway and provides essential data on exposure to chemicals across the food supply. We also continue to monitor emerging contaminants and changes in dietary patterns. Our engagement with international agencies ensures we keep pace with global research and can respond quickly when new issues arise.

Looking ahead to 2026, we expect to see continued focus on digital information,

public health, industry innovation and international alignment. Our proposals roadmap to 2030 outlines how we will prioritise work over the next 5 years across the food regulation system goals of safe and suitable food, a healthier food supply, informed consumers and thriving food economies. It includes regular evaluation of how well standards are working in practice, helping us focus efforts where they deliver the greatest public health and economic benefit.

Our key takeaway from 2025 is that partnership and collaboration remain our strongest assets. By working together across government, science, industry, public health and consumer groups, we can navigate complexity, support innovation and maintain the trust that defines our food system. As we move into 2026, that shared commitment will be essential to ensuring that food in New Zealand and Australia remains safe, modern and ready for the future.

of Fierce Competition and Value-Driven Buying

APAC distributors in 2025 didn’t just look for “good” brands, they looked for commercial proof. With buyers pickier and shelves more competitive, exporters needed clearer value and stronger commercial discipline to break through.

APAC Still OutperformsBut Market Entry Is Harder Than Ever

The APAC region again outpaced global GDP growth, with the Philippines, Indonesia, Vietnam and Malaysia leading the way. But this economic strength hasn’t translated into easier access for exporters.

Distributor inboxes are overflowing

Incite’s 2025 annual APAC Distributor Survey showed that 13 percent of distributors are pitched to daily and

almost half receive weekly approaches, up significantly from prior years. As a result, 42 percent of distributors now onboard fewer than 10 percent of presented opportunities, a sharp rise from 33 percent last year.

According to Nada Young at Incite, this isn’t a decline in appetite, 87 percent are still reviewing new distribution opportunities, but a reflection of limited capacity and a surge of global exporters targeting the APAC region.

The bar has risen. Distributors are looking for brand support with commercially viable pricing, viable shelf life, marketing support and proven results in existing markets before committing to a new brand.

Southeast Asia Emerges as a Sourcing Powerhouse European brands continues to dominate APAC distributor portfolios, but the major story of 2025 is the rise of Southeast Asian (SEA) products now being imported into APAC markets.

Why the shift?

• Lower total landed costs due to shorter shipping distances, scaled manufacturing and regional free trade agreements.

• Cultural alignment, especially in snacking, convenience and beverage categories.

• Risk diversification, with distributors and retailers favouring stable, nearby supply over geopolitically exposed routes.

Still, provenance stories from New Zealand, especially around food safety and natural ingredients, remain powerful, particularly in markets like Taiwan where consumer trust drives purchase.

Shelf Life Now Outrank Price

For the first time in years, distributors ranked taste and quality above price when evaluating new products. This shift reflects a more discerning consumer and the importance of repeat sales.

Shelf life is a critical factor: short-dated

Cameron Gordon Founding Partner & Head of Client Growth Incite

shipments or delays can force costly write-offs, especially given strict retailer minimum imposed shelf life policies. Nada Young highlights that write-offs quickly erode margins, making shelf life discipline essential.

The formula for 2025 success has been: Win with taste and quality. Compete with value. Survive with a viable shelf life.

Marketing Expectations

Evolve: Social Media + Promotions Lead

APAC distributors and retailers increasingly require brands to invest in creating demand, not just supplying stock.

Price promotions remain the most important lever, but social media marketing has surged, offering strong ROI across the

region. However, performance varies by market. Will Gordon at Incite notes that Malaysia delivers far cheaper digital results than Singapore, highlighting the need for market-by-market planning.

Key expectations include:

• Localised content, not recycled homemarket assets.

• Local KOL and influencer partnerships to add authenticity.

• 12-month promotional calendars submitted to buyers before listings are approved.

• Joint brand–distributor investment in both trade marketing and digital reach.

Dominate, Dairy Falls, Plant Protein Shrinks

2025 reshaped category priorities across the APAC region:

• Savoury snacks topped demand from distributors, supported by high retail velocity and strong margins.

• Health foods continued growing as consumers seek cleaner formulations and governments tighten sugar regulations.

• Confectionery and sweet snacks stayed resilient thanks to affordability.

• Dairy dropped from #1 to #8, with consumers seeking alternative nutrition.

• Plant protein tumbled from #7 to #16, reflecting global market recalibration.

Nada Young notes that snacks’ structural advantages, ambient storage, long shelf life and attractive price points, make them especially appealing to retailers and distributors.

The biggest theme moving into 2026? Pragmatism.

Distributors want partners who understand their realities, not just their distribution potential.

Exporters planning for 2026 should prioritise:

• Robust market preparation, category insights, competitor pricing and clear commercial models.

• Credibility, home-market proof points, retail performance, awards and consumer traction.

• Distributor support, joint marketing plans, realistic budgets and strong assets.

• Long-term commitment, not short-term sales.

APAC remains one of the world’s most promising growth regions, but brands now need sharper strategy, stronger value and deeper partnership to win. Success increasingly depends on arriving marketready, with competitive pricing, meaningful marketing investment and a clear understanding of local category dynamics. Exporters that prioritise collaboration, adapt to consumer realities and commit for the long term will be best positioned to capture sustainable growth across the region.

Avocados have long been the star of weekend brunches, but the real growth opportunity lies in everyday meals. At NZ Avocado, we want shoppers to see avocados not as a luxury or trend, but as a simple, versatile staple that fits easily into daily life.

Around 70 percent of New Zealand households already buy avocados. The next step is helping people use them more often across the week. We are focusing on ideas that feel practical and achievable. Quick breakfast pairings, lunchbox snacks, and easy dinner add-ons like salads, wraps, tacos and bowls all help families build habits that fit naturally into their week. Encouraging shoppers to buy a mix of ripe and firm fruit can also help them plan for several days at a time.

Inspire Usage at the Display

A recent Hass Avocado Board research report, Rethinking Retail: Avocado Path to Purchase, highlights how strongly shoppers rely on visual cues. Most consumers said freshness and ripeness guides influence their choices, yet many still struggle to judge ripeness by sight. Simple “Ready Now” and “Ripen Later” sections can give shoppers more confidence and prompt them to buy more than one fruit at a time.

Cross merchandising is another easy win. Placing avocados near eggs, wraps or salad kits helps shoppers picture how they might

use them. Recipe cards or fridge magnets reinforce those ideas at home. Some stores have trialled placing avocado displays in supporting aisles, such as next to Mexican ingredients, or creating small meal bundles with wraps, avocados, beans and seasoning.

Building Everyday Habits

A good in store experience leads to repeat behaviour. When shoppers have a positive result at home, they are far more likely to add avocados to their regular list. Recipe inspiration can help reinforce this, supporting avocados to become an everyday grocery item much like bananas. If your store would like display materials, ripeness guides or simple recipes to encourage everyday avocado use, get in touch with NZ Avocado.

Research commissioned by Summerfruit NZ shows that Kiwis have a love affair with summerfruit. ‘Our research partner found that consumers love and what to buy and eat the fresh summerfruit the New Zealand industry produces,’ said Summerfruit NZ Chief Executive, Dean Smith.

They love the taste, flavour and variety. They also love the novelty and anticipation, and have an emotional connection to summer and nostalgia.

However, consumers also find summerfruit a challenge, because it varies across the season, category, variety, and retailers and channels.

This is a risk for the industry because the research also shows that if a consumer has a bad experience, they will delay buying summerfruit again. This is why the industry is focusing on quality, throughout the supply chain.

Smith said like every season, 2024-2025 brought its challenges.

Hawke’s Bay had an early start with warm, dry weather that brought forward maturity and resulted in some outstanding pre-Christmas quality. However, January and February 2025 were colder than ideal, which slowed things down.

Blenheim had its best season in years, with a great crop in terms of both quality and quantity.

The season in Central Otago was more mixed with a cooler start to spring with frosts, wet and windy conditions during blossom, and some wind damage to netting. However, overall growing conditions were favourable, but grower returns were frustrated by soft post-Christmas 2024 consumer spending in the domestic market.’

During the height of the domestic season, Summerfruit NZ ran a targeted, market development campaign, “Summer for Everyone, Everyday,” across YouTube, Meta, and TVNZ on Demand.

The videos, which featured New Zealanders enjoying a taste of summerfruit wherever they are, generated more than a million views and supported Summerfruit NZ’s ongoing partnership with the 5+ A

Smith said cherry exports surpassed 5,000 tonnes for the first time in 2024-2025 – a milestone for our industry.

However, export markets remain extremely competitive, especially China, where an influx of Chilean fruit made Summerfruit NZ’s focus on quality and market diversification more important than ever. This is why collaborating with the Government and trade officials to enhance and maintain market access remains a top priority for Summerfruit NZ.

Looking ahead to the 2025-2026 season, Smith said there are no red flags on quality and quantity.

Growers are reporting that the crop looks fantastic so at this point, it looks like consumers will be well served by good

supplies of quality fruit. Shoppers should keep their eyes peeled for when the fruit starts to arrive in quantity, and make the most of what is a pretty short season.

News that Wattie’s is reducing its take of Hawke’s Bay peaches for canning is concerning

"Any significant or sudden change in demand like this for what our industry produces has a major impact," said Smith.

"But the best thing consumers can do to support local growers is buy locally canned products, as opposed to imported. Locally canned may not always be the cheapest but they will always be better."

Over the coming season, Summerfruit NZ will step up its “Summer for Everyone, Everyday,” domestic market development campaign.

"We will build on the momentum of last year’s campaign and use some new tactics. I don’t want to say too much but we will be expanding our reach and frequency to ensure more consumers get the nudge to buy and enjoy fresh New Zealand grown summerfruit, in season, while they can."

Summerfruit NZ will also continue its export market development activities in India and Asia, working closely with other fruit export industries like kiwifruit and apples, as well as New Zealand trade officials.

2025 has been another good year for growing vegetables in New Zealand. Vegetables from the main growing areas of Pukekohe, Levin, and Canterbury have been bountiful, and that’s kept supermarket shelves full and prices relatively steady.

Antony Heywood Chief Executive Vegetables NZ

That said, the current cold and unsettled Spring weather could affect supply as we head into Christmas.

Behind the scenes, growers are feeling the pressure, due to rising costs, falling consumer demand and the threat of unworkable environmental regulation. This is a reminder that the abundance of vegetables – which we all take for granted –depends on many factors, and luck with the weather.

The recent news that Wattie’s is reducing its take of beetroot, sweetcorn and tomatoes for processing has been a blow to the growers of these crops in the Hawke’s Bay. Wattie’s has citied falling demand for these products, however, New Zealanders have not been impressed.

What can shoppers do to support these growers – and other vegetable growers across the country? The answer is easy: buy locally grown, fresh or processed vegetables, without exception!

Three things to keep in mind

As a shopper, no matter the time of year, there are at least three things to keep in mind:

• Seasonality is your friend. When you buy what’s in season, you get the best value and flavour. Think corn, courgettes, lettuce and tomatoes in summer; and kūmara, pumpkin, cabbage and broccoli through autumn and the colder months.

• Expect the occasional bump. A cold snap, flood, or storm can quickly affect crops, and supply and prices. Flexibility helps; if broccoli is in short supply, try fresh silverbeet or spinach, or frozen product. Just ensure it has been grown and processed in New Zealand because while it may cost a little more, it will taste a lot better, and will have been grown to exacting standards.

• Local really means fresher. Because most of our vegetables are grown near to our major cities and towns, they spend less time in transit. That means better taste and longer shelf life once they’re home.

Looking ahead

The Resource Management Act (RMA) changes and other regulatory reforms that the current government is wanting to implement would – if put in place successfully, with regional government’s support – underpin the vegetable industry’s

success, and shore up its ability to feed New Zealanders fresh, healthy food.

Technology is also changing the game. Precision irrigation, greenhouse innovation, and low-waste packaging are helping growers do more with less.

However, sourcing and paying for energy to heat greenhouses is a real concern, and if solutions cannot be found, New Zealand will no longer have a viable greenhouse, capsicum, cucumber and tomato industry, which will further weaken the country’s ability to feed itself fresh, healthy vegetables.

Meanwhile, Vegetables NZ continues to fund food literacy in schools, encouraging young New Zealanders to cook, eat, and understand where fresh vegetables come from.

Resilient and forward-thinking

New Zealand’s vegetable industry is resilient and forward-thinking, but it’s not without challenges. Every time you buy New Zealand vegetables, you’re helping keep growers in business and ensuring fresh, healthy food stays available for all New Zealanders.

So next time you’re in the produce section, take an extra moment to admire that stack of gleaming carrots or vibrant broccoli. There’s a lot of hard work behind, and health in every bite.

As the convenience sector continues to evolve, 2025 has been a year defined by innovation, resilience, and stronger-thanever local connections. Across the industry, retailers have navigated shifting customer expectations, economic pressures, and increasing competition with a renewed focus on value, speed, and experience.

For Night ‘n Day, a standout moment was being named Retailer of the Year at The Grand Business South Awards. This recognition reflects not only the dedication of our franchisees, store teams, and support centre, but also the collective effort of local communities who continue to choose and trust convenience retail as part of their everyday routines.

Innovation continues to be one of the strongest growth drivers in convenience. New product development (NPD) has remained essential, with customers increasingly seeking variety, new flavours, and products that surprise and delight. Our most successful launches in 2025 blended creative new ideas with trusted and recognisable brands, resulting in strong double-digit contributions to their categories.

Limited Time Offers (LTOs) again proved their ability to generate excitement and fast feedback. They allow retailers and suppliers to test customer enthusiasm quickly, and in cases where demand remained high, we transitioned select products into our permanent range. This approach mirrors

wider sector trends, where speed-to-shelf and willingness to experiment continue to set successful retailers apart.

Supplier collaboration has been central to this success. Strategic partnerships allowed us to refine product presentation, coordinate promotional windows, and align marketing so launches landed at the right moment. This cooperation ensures new products reach shelves with relevance, visibility, and momentum.

One of the defining strengths of New Zealand’s convenience sector is the influence of local ownership. Franchisees bring reallife insight that data alone cannot explain. For example, data can show that a category is underperforming but not necessarily tell you why that is. Their understanding of who their customers are, when they shop, and what matters most helps shape decisions that feel genuinely relevant.

In 2025, this local connection mattered more than ever. Franchisees continued to demonstrate the value of community engagement through local employment, sponsorships, and by stocking products that reflect regional preferences. This helps convenience retailers stand apart by offering

familiarity, approachability, and a sense of belonging. When customers see a store as part of their community, not just a place to purchase essentials, loyalty grows and repeat visits strengthen.

Despite ongoing economic pressures, convenience retail has shown remarkable resilience. While customers remain priceconscious, they continue to value speed, accessibility, and the ability to make quick, low-effort decisions.

Essentials such as bread, milk, and everyday staples remain solid performers however indulgent categories such as ice creams, confectionery, and barista-made coffee have continued to grow as customers sought small, affordable treats throughout the year.

Digital convenience also shaped the landscape. Self-checkout adoption increased again, helping reduce queues and speed up transactions. Online ordering and delivery

options expanded, reflecting broader industry trends toward hybrid models where customers expect both fast physical access and digital solutions.

Operating under a supported franchise model has continued to provide important advantages. Strong backend systems, national supplier agreements, and clear operational frameworks allow franchisees to focus on people, service, and daily store operations. This support ensures consistency while still allowing stores to adapt to local needs.

Elevating the in-store experience has been a key area of focus across the industry in 2025. Customers increasingly respond to stores that feel modern, easy to navigate, and reflective of current design expectations. Our own store modernisations continued to roll out, with darker and more contemporary interior elements helping

products stand out and enhancing the overall shopping experience. Supplier collaboration on freezers, displays, and promotional units enabled us to spotlight hero products and create visually appealing merchandising areas. These updates do more than refresh the look, they improve flow, make shopping more intuitive, and support increased conversion and basket size.

The trends of 2025 highlight a sector that is dynamic, customer-focused focused and deeply rooted in innovation. As we move into 2026, our focus is on building momentum. New product development will remain central, supported by strong supplier partnerships that allow us to bring new ideas to market quickly and effectively. We will also continue expanding digital convenience, recognising that customers increasingly expect seamless access to products, whether they are in-store or ordering online.

Night ‘n Day’s success reinforces that innovation, collaboration, digital accessibility, and local connection are not just strategies but core strengths. With these foundations in place, we are well-positioned to meet the challenges and opportunities of the year ahead with confidence and optimism.

Where New Zealand FMCG leaders can win in a value-redefined market

A market turning the corner –but not evenly. New Zealand’s retail sector enters 2026 with a cautious but genuine sense of recovery. After one of the toughest trading environments in decades, the market is finally stabilising.

September quarter core retail sales showed a 1.2 percent quarterly lift in volumes and 4.6 percent lift in the actual dollar value of sales. In November Consumer Confidence lifted to its highest level since June.

Business confidence has strengthened; interest rate relief and easing loan to value ratio (LVR) restrictions are creating more certainty; agricultural performance is improving; and two global retail giants entering the market will inject competition and sharpen value strategies.

Yet, the recovery remains uneven. Some banners and channels are stabilising; others continue to feel cost pressure, soft unit growth, and shifting missions.

New Zealand grocery has quietly been

the anchor of the retail economy. While total retail has only recently returned to growth, grocery held its ground throughout the downturn. Pre-packaged grocery is now worth $19.3 billion,

For FMCG leaders, the question isn’t “Is the market improving?” It’s “Where is the improvement happening, and how fast?”

Value is being redefined – and shoppers are in control

The most important shift heading into 2026 is how New Zealanders perceive value. It’s not as simple as being defined by the lowest price. Instead, shoppers are balancing affordability, quality, experience, and personal relevance.

Private label has become the frontline

Debbie Simpson-Pudney Head of Retail Consulting and Innovation for New Zealand Circana

indicator of this shift. With 15.3 percent share of sales and 43.1 percent of FMCG value growth, it is a trusted option for everyday staples.

Shoppers are also trading up when the product feels meaningfully “worth it”, with premium growth strongest in categories such as coffee beans, champagne, premium pet food, and fine fragrance deodorants.

Snacking, indulgence and “small moments” are outperforming

Circana’s 2025 Snacking Project shows that New Zealand adults now generate more than eight million snacking moments every day, a behaviour that has shifted from incidental to deeply ingrained.

What we’re seeing across the aisle is outsized momentum in categories that speak to how people live today: warm and easy frozen snacks, fun cheese-based bites, onthe-go liquid breakfasts, energising drinks, and the growing wave of Asian-inspired snacking options.

These categories succeed because they deliver what consumers value most right now, convenience, flavour, novelty and small moments of comfort. In a cautious economy, emotion is money, and shoppers reward products that offer a quick lift without stretching the budget.

Wellbeing moves from virtue to value

Wellbeing is no longer a niche or a moral choice; it had become a premium value driver across demographics.

The highest-performing segments include protein, functional drinks, gluten-free, keto, sports nutrition, and non-alcoholic beverages.

The opportunity for buyers and suppliers lies in expanding better-for-you options, supporting credible claims, designing pack sizes and formats that align with personalised wellness goals, and balancing permissibility with indulgence.

Innovation remains resilient – and becomes a competitive necessity

New product development is holding steady, with a slight lift in the number of launches and solid performance overall. Top performing innovations are coming from beverages, snacking, indulgent treats, and convenient meal solutions, categories where shoppers are most open to trial and quick wins.

Top New Zealand launches reflect a blend of wellness, convenience and joy, demonstrating that shoppers reward both functionally smart and emotionally engaging products.

Innovation that connects with cultural moments, social sharing, or “little luxuries” will have an outsized chance of success in 2026.

GLP-1: early days, but long-tail implications

While GLP-1 uptake in New Zealand is still emerging, global momentum – and Australia’s experience – signal a significant behavioural shift ahead.

GLP-1 users tend to eat smaller portions, prefer protein-first, high-fibre formats, reduce sugar, alcohol and refined carbs, value satiety overindulgence, and increase spend on health devices and self-care categories.

Even modest uptake could reshape pack architecture, reformulation strategies, portion design and new product development pipelines.

Manufacturers who plan now will be ahead of the curve when New Zealand adoption accelerates.

The rise of agentic AI and why product discoverability must evolve

New Zealand’s online retail grew exponentially faster than physical retail; a critical foundation for agentic AI, the next major disruptor in how New Zealanders shop.

Agentic AI systems anticipate needs, compare product alternatives, build baskets, automate replenishment, and convert shoppers at significantly higher rates. This shift makes product data quality a

top priority for 2026 – clean attributes, clear benefits, consistent imagery, strong nutritional and sustainability cues, and metadata optimised for algorithmic ranking. If your products aren’t readable by AI, they risk becoming invisible.

What will define FMCG success in 2026?

Circana’s analysis reveals four growth engines that will shape the next 12 months in New Zealand:

1. Value sophistication: Clear quality cues, sharper value tiers, and a smarter blend of premium and private label.

2. Targeted innovation: Purposeful, joyful, wellness-oriented innovation connected to real shopper needs.

3. Experience-led differentiation: Cultural relevance, flavour-driven indulgence, and emotionally resonant products.

4. Digital and AI-enabled commerce: Future-ready product content and omnichannel discoverability.

The path forward

New Zealand’s FMCG sector is entering a new era; one defined by smarter value, dynamic consumer expectations, and emerging disruptors that will reshape how New Zealanders shop, search and spend.

The businesses that will win in 2026 will be those who define value beyond price, innovate with intent, embrace precision over speed, prepare early for GLP-1, and optimise for AI-driven retail journeys.

Circana’s State of the Industry New Zealand provides the data, foresight and clarity to unlock these opportunities, and to help buyers, retailers and suppliers build demand with confidence in an evolving market.

The retail landscape is shifting as consumers continually assess their priorities in response to global uncertainties, economic pressures, and a growing focus on long-term wellness. To thrive, retailers and brands must align with these evolving behaviours and deliver solutions that resonate with today’s mindful shoppers.

Euromonitor International’s Global Consumer Trends 2026 report reveals trends encapsulating key shifts shaping consumer habits. The trends ‘Comfort Zone’ and ‘Rewired Wellness’ in particular, offer valuable insights for players in the FMCG space looking to stay ahead of emerging expectations.

Comfort Zone: Consumers seek stability amid uncertainty

Anxiety and uncertainty are everyday realities, and according to Euromonitor’s Voice of the Consumer: Health and Nutrition Survey, fielded February 2025 (n=21,207), 58 percent of consumers experience moderate to extreme stress daily. Additionally, Euromonitor’s Voice of the Consumer: Lifestyles Survey, fielded January to February 2025 (n=40,337), reveals that

two in five consumers feel they are under constant pressure to get things done.

This underscores how many consumers are reevaluating how they spend their time, money and energy, making efforts to consciously simplifying their lives, and this includes day-to-day activities such as grocery shopping. Shoppers are curating their consumption more intentionally, by buying fewer, higher-quality products that provide both tangible and emotional comfort.

Matthew Barry, global insight manager: Food, Cooking and Meals , shares that “Going grocery shopping has become a stressful experience after the price hikes of recent years and that is not going to change in 2026. Food brands need to be ensuring their product is not adding to that stress, whether through calming functional ingredients, nostalgic and comforting flavours, or simply attractive prices.”

When it comes to wellness categories, functional foods and adaptogenic beverages and gentle personal care are thriving. Similarly, brands that promote mental balance, minimalism, and authenticity are gaining traction. For brands, this shift demands empathy on top of innovation, to deliver personal safeguards where products and experiences help consumers feel safe, soothed and in control in today’s unpredictable world.

Key growth areas that brands can tap into, include wellbeing and mental health products such as nutritional supplements, herbal teas, and comfort foods designed to reduce stress, home-centric innovation through products that turn the home into a sanctuary, together with functional minimalism in the form of multi-purpose, sustainable products that simplify routines and reduce clutter. Overall, helping

A new era of wellness is emerging, where science and technology merge seamlessly with daily routines. Consumers are no longer satisfied with surface-level self-care and instead look for advanced precision products that are easily accessible.

consumers build resilience and regain balance can help brands achieve new loyalty and higher perceived value.

Looking ahead, the grocery and FMCG sectors will continue to evolve around the theme of emotional utility, in the form of products that do more than meet physical needs but also support mental and emotional wellbeing.

As consumers navigate uncertainty, their comfort zone becomes their control zone, and brands can align with consumers’ desire for calm and simplicity to thrive.

Rewired wellness: Leveraging technology to transform everyday health and self-care

A new era of wellness is emerging, where science and technology merge seamlessly with daily routines. Consumers are no longer satisfied with surface-level self-care and instead look for advanced precision products that are easily accessible.

This has seen the wellness market now expand into more advanced, data-driven territory where consumers are embracing clinical-level, high-tech tools as everyday essentials, marking a shift that blurs the lines between healthcare, beauty, and FMCG.

Euromonitor’s Voice of the Consumer: Health and Nutrition Survey, fielded February 2025 (n=21,207), finds that three in four consumers track their health using a device or app, monitoring everything from sleep and nutrition to exercise and mood. Meanwhile, 35 percent of consumers surveyed are seeking new prevention or treatment methods because their current approaches are not effective. This shift signals a collective move away from one-size-fits-all wellness and toward a more precise, personalised, and proactive approach towards health.

Consequentially, retailers and FMCG brands are moving from being product providers to wellness partners, in line with consumers no longer viewing their health journey as linear, but an ecosystem that blends devices, data, and daily decisions.

Euromonitor also observes this with beverages, where functionality and health outcomes are no longer abstract but the engine of growth in the industry and efficacy is increasingly measurable. Retailers need to curate ecosystems by connecting smart products, nutrition, supplements, and tech, to will win the consumers’ trust in this data-driven consumer generation.

According to Howard Telford, senior global insight manager: soft drinks, “As more consumers track things like their daily hydration or the impact of caffeine or alcohol on sleep or athletic recovery through wearable devices and apps, they’re starting to expect evidence that a drink or nutritional supplement actually does what it claims.

“The categories evolving fastest are those that align with that logic across energy, hydration, mental focus and gut health. Functional brands aren’t just selling ingredients anymore, but instead selling outcomes – and increasingly, those outcomes can be tracked, compared and shared through health data, wearables and connected devices. As a consequence, we will see more food, beverage and nutrition brands engaging with public health technologies, striving to move from marketing claims to a measurable part of someone’s daily performance routine.”

2025 was a masterclass in what happens when brand ambition outruns trade-mark discipline. Here’s what went wrong, what the courts said in some cases, and what every FMCG and supermarket buyer can fix on Monday.

Law in one line: Under section 120 of the Trade Marks Act 1995 (Cth), infringement turns on whether the marks are deceptively similar and used in relation to goods or services that are the same as, or closely related to, those covered by the registration. The infringer’s intent or awareness is not material. Do this instead: Run full availability

searches before launch. A one-hour search beats a five-figure rebrand. Avoid phonetic twins and misspellings of existing trade marks (Cinnabuns/Cinnabon; Donutime/Donut Time) are accidents waiting to happen.

Dupe culture rising: When look-alikes hit the shelves

The fail: “Dupe” products (cheaper alternatives closely mimicking premium brands) have surged in Australia. The decision in Hampden Holdings I.P. Pty Ltd v Aldi Foods Pty Ltd [2024] FCA 1452 is the clearest warning shot yet.

In that case, Aldi’s Mamia Baby Puffs were found to infringe copyright in the Baby Bellies packaging owned by Hampden Holdings. While Aldi avoided liability under trade mark law, the Federal Court held that its packaging infringed Hampden’s copyright.