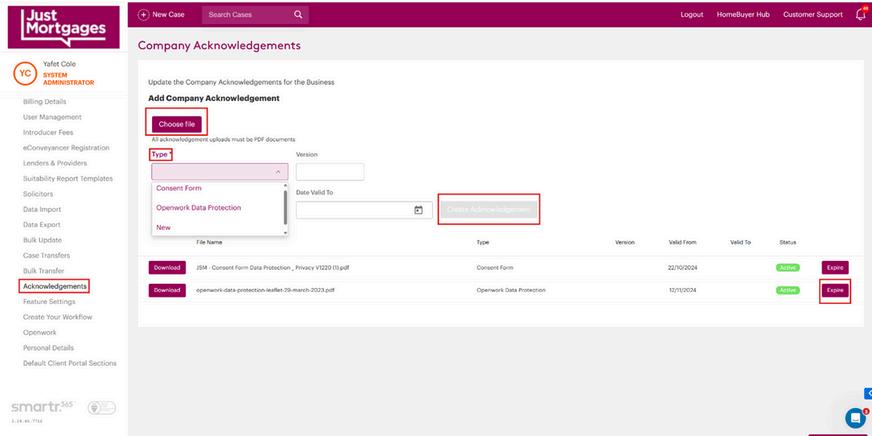

Data Protection Insert

Instructions for uploading to your

Smartr Platform:

Pleasenote-ifyouworkunderaprincipal, theywillneedtodothis,otherwisethis appliestoeveryone.

Settings>Acknowledgements>Choose File>SelectOpenworkDataProtection" fortheType>EntertheVersion>Click "CreateAcknowledgement". ThenyoujustneedtoClick"Expire"for theoldversion.

HostedbyourdedicatedSystemTrainerScarlett

McKenzie,It’stimetogetaheadofthegameandbook yourselfsomesystemswebinarsinOctober!

Don’tforget!Thesegetbookedveryquickly,sojumpon andbookassoonasyoucantoavoiddisappointment.

Note: If you book and then are unable to attend please go over to My Learning Space and cancel your place so others can have it. You do always receive a reminder one day ahead of the event.

Client Portal

Bringanewlevelofprofessionalismtoyourservicesasan AdviserbyusingtheSmartr365Portal Cutdownontime enteringdata,andupthetimespentonqualityadvice.This webinarwilltakeyouthroughthebasicsofhowtousethe clientportal,fromboththeperspectiveoftheAdviserandthe client.

Tasks, Notes and Workflows

Areyoustrugglingwithmanagingyourtasks?Doyouknow whatisgoingonwithallyourcasesandwhenclientsneedtobe contacted?Iftheanswerisno,oryouwouldliketomovefroma paperdiarysystemtomanagingonyourCRM,thenthisisthe workshopforyou!Thiswebinarwilltakeyouthroughthebasics ofhowtousetasks,notes,andworkflowssoyouareableto easilybeontopofclientcommunication.

Smartr Connect

Thiswebinarwilltakeyouthroughthebasicsofhowtoaccess SmartrConnect,theLenderswhichareavailabletoyou,and howtopushdatathroughtothem.

Mon13Oct13:00

Tue14Oct10.00

Tue21Oct13:00

Thurs23Oct10:00

Mon13Oct14:30

Tue14Oct13:30 Tue14Oct15:00

Tue21Oct11:30

Thurs23Oct13:00

Tue21Oct10:00

Thurs23Oct11:30

WorldMentalHealthDay- 20Minutes,Lasting

Support–BookNow

Beingself-employedcomeswithfreedom, flexibilityandthechancetoshapeyourown success.Butitcanalsocomewith somethingelse,theweightofresponsibility Whenyouarerunningyourownbusinessitis easytofeellikeeverythingrestsonyour shoulders,andthatcansometimesfeellike youarecarryingitalone.

Thatiswhy,forWorldMentalHealthDaythis week,weareshiningalightonthesupport thatisalwaysavailabletoyouthroughyour WellbeingAssistanceProgramme.

To mark the day, we have put together short 20-minute sessions, with our partners Health Assured, giving you an overview of:

Whoourproviderisandtheservicestheydeliver Counsellingoptionsandhowtoaccessthem Legalandfinancialsupportavailabletoyou Whathappenswhenyoupickupthephonetocall Examplesoftheissuestheycanhelpwith,fromeverydayworriestobigger challenges

Eachsessionalsoincludestimeforquestions,soyoucanwalkawaywithclarityon whatisavailable,howtoaccessit,andhowitcanmakearealdifference.

Becausehereisthetruth,beingself-employeddoesnotmeanbeingonyour own.TheWellbeingAssistanceProgrammeistheretomakesureyouhave somewheretoturn,whetheritisforpracticaladvice,emotionalsupportor simplyalisteningear.

Onadaydedicatedtoraisingawarenessaroundmentalhealth,wewantto remindyouthatsupportisnotonlyavailablebutencouraged.Havingsomeone inyourcornercanmakeallthedifference,andtheWellbeingAssistance Programmeisheretodojustthat.

Takethetimetojoinasessionbyclickingbelow,itcouldbethemost valuable20minutesyougiveyourself.

14th Oct - Session 1 - 12:00 - 13:20 14 Oct – Session 2 - 14:00 – 14:20 th 16 Oct – Session 1 - 10:00 - 10:20 th 16 Oct – Session 2 - 12:00 - 12:20 th

Afterasuccessfulpilotofits‘FirstStep’ mortgageearlierthismonth,Newcastle BuildingSocietyislaunchingFirstSteptoall ofitskeypartners,fromFriday3October.

What is First Step?

FirstStep(upto98%LTV)isalowerdepositmortgage helpingyourclientsgetintotheirfirsthomefaster.

First-timebuyersonly.Incaseswherethereismore thanoneapplicant,atleastoneoftheapplicantsmust beafirst-timebuyer

TheminimumLTVis95.01%andthemaximumis 98%

Theminimumpropertyvalueis£101,000.

Theminimumloanamountis£96,000

Theminimumdepositis2%or£5,000;whicheveris thehigherandmustcomefromownresources

Gifted,loanedordepositsprovidedbyathirdparty willnotbeaccepted

Availableforpurchaseapplicationsonly.

Newbuildpropertiesarenotacceptable

Themaximumloansizeis£350,000.

Theminimumtermis5yearswithamaximumof35 years.

Repaymentbasisonly

Notavailabletonon-EEAnationals.EEAnationals musthavesettledstatusorindefiniteleavetoremain Noexceptionspermitted.

Portabilityoptionavailablehowever,noadditional borrowingwillbepermittedabove95%LTV. Thismortgagecannotbecombinedwithother mortgageproductse.g.JMSP,SharedOwnershipetc.

PropertyLTVrestrictionswillstillapplye.g.max75% LTVforex-localauthority,95%convertedflats.

Barclaysarepleasedtoshareanumberofpolicyenhancements,allinareaswhereyou toldthemtheycouldimproveoutcomesforyouandyourclients.

Now accepting 100% of customer’s Profit After Tax (PAT)

WewillnowacceptfullPATinouraffordability assessments,unlockinghigherborrowingpowerfor manyofyourself-employedclients.

Wehavealsoreducedtheminimumloanthreshold forPATacceptanceto£700k WhenusingPAT income,pleaseensurethisisenteredintherelevant PATfieldwithinourapplicationsystem Seeourfull PATpolicyhere.

Greater flexibility for interest-only borrowing

Forinterestonlyapplicationswherethereisatleast£500k inequity,themaximumLTVwheretherepaymentvehicle issaleofpropertyisnow75%.

Thiswillallowmoretailoredborrowingsolutionsforyour clients.SeeBarclaysfullinterest-onlypolicyhere.

Increased maximum loans for buy to let (BTL)

BarclayshavealsoannouncedincreasestotheirmaximumloansforBTLs:

Newbuildproperties:Maximumloansizeincreasedfrom£500kto£550kat60%–75%LTV

Flats:Maximumloansizeincreasedfrom£500kto£550kat70%–75%LTV. Seedetailsonmaximumloanshere.

*We can consider lending up to age 80 on joint applications, where affordability is assessed on the younger applicant’s income. Aldermore | Helping you do more for your clients with

Aldermore have made changes to maximum age

Lendingnowavailabletocustomersuptoage75*

Previousage70capremovedforapplicationswithcustomersaged55andover Applicationswithcustomersaged55+aresubjecttoamaximum85%LTV

Concessionary purchase mortgage

Helpingclientsbuybelowmarketvalue.Here’severythingbrokersneedtoknow aboutconcessionarypurchasesincludingfamilysales,landlordtotenantcases,key criteria,documentationandhowAldermorecansupportyou.

A flexible, future focused way of helping First Time Buyers

ScottishBuildingSociety’sGuarantorMortgageisdesignedtohelpborrowers whomaynotearnasufficientsalaryorhaveabigenoughdeposittobuytheirfirst home.

UnlikeJointBorrowerSoleProprietorproducts,ScottishBuildingSociety’s Guarantorsolutiondoesn'tcomewithlifelongstringsattached.

Guarantorsprovidealimitedliabilitywhichcanbeunwoundwhentheprimary applicantisabletoaffordthemortgageintheirownright.

Ifyou'dliketocontactoneofScottishBuildingSociety’sBDMteam,youcanfind theirdetails:

With Scottish Building Society, the property must be located in Scotland and England as far South as OX postcode.

WhychooseScottishBuildingSocietyforGuarantorMortgages?

Rapidlygrowinghousepricesmeanfirsttimebuyersarestrugglingtokeeppace withthemarket.ScottishBuildingSociety’ssolutionboostsbuyingpower. Parentsoftenwanttohelpbutarekeentolimittheirliability.

ScottishBuildingSocietycansplitthetermtohelpshapethepaymentstothe client’srequirements.

ScottishBuildingSociety’sflexibleapproachtounderwritingmeansitwill considerindividualcircumstances.

Important Paymentshield Mortgage Protection (ASU) Update

FollowingtheannouncementthatPaymentshieldreintroducedtheUnemployment CoverwithintheirAccidentandSicknessproducton2ndJune,Paymentshieldhave notifiedusthattheyarecurrentlyreviewingtheirpositiontoincludeProduct TransferswithinoneoftheeligibleMortgagetransactions.

WhilstthisreviewtakesplacePaymentshieldare unabletoofferMortgageProtection(ASU)to anynewclientsforProductTransfers.Wewill provideanupdateonthispositiononcethishas beenclarifiedbyPaymentshield

Housepricesrebound:UKhousepricesrose0.5%inSeptember,markinga recoveryfromAugust’s0.1%dip,puttingyear-on-yeargrowthat~2.2%.

InternalMPCdissentoverratecuts:SwatiDhingra,aBankofEngland MonetaryPolicyCommitteemember,renewedcallsforfasterinterestrate cuts,arguinginflationpressureswereeasingandmonetarypolicyshould respond.

Ratecutslagamidinflationcaution:DespiteDhingra’sviews,markets remaincautious—expectationsforfurtherBoEcutshaveslowed,as inflationandeconomicuncertaintyweighonpolicymakers.

Mixedlenderbehaviour:Whilemanylendersheldratessteadyorevenhiked selectmortgagedealsinlateSeptember,some–notablyHSBC–made selectiveratereductions,buckingbroadertrends.