Just an update

Monday 26th January. This week's headlines:

Smartr365 – January Release

EachmonthSmartr365releaseimprovementsandresolutionstothe platform.HereisasummaryofreleasesinJanuary:

Homebuyer App document upload notifications

Smartr365haveintroducedAdvisorPortalnotificationsforclient documentuploads.

WhenaclientuploadsadocumentthroughtheHomebuyerAppandthe uploadhascompletedprocessing,theadvisorwillnowseeanotification inthebelliconwithintheAdvisorPortal.Notificationsincludetheclient nameandcaseIDforclarity.

Clickingthenotificationtakestheadvisordirectlytothecasedocument store,withthenewlyuploadeddocumenthighlighted,makingitquicker toreviewandcontinueprogressingthecase.

Homebuyer App Current Employment section fixes

Smartr365haveresolvedasetofissuesintheHomebuyerAppCurrent Employmentsectionthatcouldpreventusersfrommanagingand completingemploymentdetailssuccessfully.

Thisincludesfixesfor:

Deletingexistingcurrentemploymentrecords

ExitandSavebehaviourviatheclosebutton,whereuserscouldget stuckafterconfirmingexit

CompletingtheCurrentEmploymentsection,whereuserscouldsee agenericerrormessage

PersistingCurrentEmploymentupdatesintotheAdviserPortal, wherethesavedinformationwasnotalwaysreflectedcorrectly

Doc Drop Box document uploads restored

Smartr365havefixedanissuewheredocumentsuploadedviatheDoc DropBoxcouldfailinboththeHomebuyerjourneyandtheAdvisorPortal, preventingusersfromsuccessfullysubmittingdocuments.

DocDropBoxuploadsnowreliablycompleteusingthenewDocument API.Documentmetadataandfilescontinuetobemanagedbythenew documentserviceonlyandnodocumentdataisstoredinthemonolith database.

Halifax submit button now prevents duplicate submissions

Smartr365haveimprovedtheHalifaxFullMortgageApplication submissionexperiencetoprovideclearerfeedbackandpreventmultiple submissionattempts.

Previously,clickingSubmitFullMortgageApplicationprovidedlimited visiblefeedback,leadingsomeuserstorepeatedlyclickthebutton.

Now,whenyousubmitaFullMortgageApplicationviaHalifax:

TheSubmitbuttonisimmediatelydisabled

Aclearinprogressstateisshown(e.g.loadingspinner)whilethe submissionisprocessing

Thesystempreventsmultipleconcurrentsubmissionsforthesame case

Occupation code and job title now stay in sync across Income and Protection Fact Find

Smartr365haveimprovedhowOccupationinformationismanagedacross theplatformbyensuringtheOccupationJobTitleandSolutionBuilder (Origo)OccupationCodestayinsyncbetweentheIncomeCurrent EmploymentFactFindandtheProtectionFactFind.

ForthosefirmswithSolutionBuildercredentials,theOccupationselection isnowconsistentlyreflectedacrossbothareas,includingwhencreatingor updatingaPrimaryEmploymentrecord.WhereanOrigooccupationcode alreadyexistsintheProtectionFactFind,itwillnowbepre-populatedinto thePrimaryEmploymentwhenaCurrentEmploymentrecordisfirst added. Protection Fact Find Occupation now persists and displays correctly

Smartr365havefixedanissuewheretheOccupationfieldonthe ProtectionFactFindpagecouldappearblankorbewipedafteraddingor editingaPrimaryEmploymentrecordinCurrentEmployment.

Previously,userscouldreturntoProtectionFactFindandseethe Occupationmissinguntilthepagewasrefreshed.Insomescenarios, savingtheProtectionFactFindbeforerefreshingcouldclearthe Occupationvalueentirely.

NowwhenyouaddorupdateaPrimaryEmploymentrecord(including Occupation),thecorrectOccupationisimmediatelydisplayedon ProtectionFactFindwithoutrequiringarefreshanditwillnolongerbe clearedafternavigation,refresh,orsavingthepage.

Parenting: The Joy, the Exhaustion… and Everything In Between

DidyouknowthereisaParentMentalHealthDayon30 January? th It’sachancetopauseandacknowledgetherealityofparenting,notjust themilestones,buttheeverydaymomentsthatshapeit.Because parentingrarelylookslikethepicture-perfectversion.

Youknowthatmomentwhenyourtoddlerhasgoneveryquiet…alittle tooquiet…andeveryinstinctinyousays,“Ohno.Whataretheyupto?”

OrthenightlynegotiationtopriseaniPad,Xboxcontrollerorphoneout ofyourchild’shands,knowingtomorrowmorningdependsentirelyon whethertheygetadecentnight’ssleep,andwhetheryoudotoo.And thenthere’shomework.

Tryingtohelpwiththenewwaymathsistaught,methodsthatdidn’t existwhenwewereatschool,diagramsthatleaveyouquestioning everythingyouthoughtyouknew,andthatfrustratingfeelingofwanting tohelpbutnotquiteknowinghow.

Thesearetheeverydaymomentsofparenting,oftenhappening alongsidework,deadlinesandeverythingelsecompetingforyour attention.

The part of parenting we don’t always talk about

Whatfeelschallengingaboutparentingoftenchangesdependingonthe stageyou’rein,buteachstagebringsitsownemotionalload.

Forthoseabouttobecomeparents,itcanstartbeforeachildeven arrives.Theexcitement,thewaiting,andthequietworryaboutwhatlife willlooklikeonceeverythingchanges.Evenwhenit’ssomethingyou’ve hopedfor,theunknowncanfeelheavy.

Fornewparents,it’softenbrokensleep,shiftingroutinesandthe constantadjustmenttocaringforatinyhumanwhodependsentirelyon you.Thatfirstdrop-off,handingthemoverandwalkingaway,canfeelfar biggerthanexpected,especiallywhenyou’rereturningtoworkandtrying tofocuswhilepartofyouiselsewhere.

Forsomeparents,thechallengeisevenbigger,adiagnosis.Tryingto understandwhatitmeans,whatcomesnext,andhowitmightchangethe futureyouimaginedforyourchild.Itcanbeoverwhelming,emotionaland isolating,anditrarelycomeswithclearanswers.We’veseenthisreflected moreopenlyrecently,includingJesyNelsonspeakingaboutnavigating herdaughter’sdiagnosisandtheemotionalweightthatcomeswithtrying tomakesenseofitallasaparent.

Aschildrengrow,thechallengeschangeagain.Schooltransitions.Exam

Support, in the middle of it all

Supportdoesn’tusuallyshowupatabreakingpoint.Moreoften,it’sthere inthemiddleofeverythingelse,whenyou’retired,jugglingalot,andnot quitesurewhatyouroptionsare.

Sometimesit’ssimplyhavingapairofears.Spacetotalkthingsthrough, makesenseofwhat’sgoingon,andthinkaboutwhatmighthelpnext. Thatmightbewhen:

You’reprocessingadiagnosisandtryingtounderstandwhatitmeans foryourchild,andforyou

Conversationsathomefeelstuckoremotionallycharged

Youwanttosupportyourchildbutaren’tsurehowbesttodothat Screen-time,routinesorco-parentingarrangementsarecreating ongoingtension

Yourteenagerisstrugglingwiththeirmentalhealth

Yourchildhasmovedawaytouniversityandfeelshomesickor overwhelmed

You’relearninghowtogiveyourchildmoreindependencewithout tyingyourselfinknotswithworry

Sometimesthatsupporthelpsyouworkthroughwhatyouneed. Sometimesitgivesthemsomeoneimpartialtotalkto.

TheWellbeingAssistanceProgrammecanbeusedby: You

Yourpartner

Anychildaged16orover

Anyoneaged16orovercanaccessitindependently,includingteenagers andyoungadultsawayatuniversity,givingthemtheoptionofsupportin themoment,withouthavingtogothroughaparentfirst.

If you need it

Ifanyofthisresonates,supportisavailable,inwhateverwayworksbestfor you.

YoucancontacttheWellbeingAssistanceProgrammebyphoneon:0800 0280199

Ifyou’dratherexplorethingsinyourowntime,therearealsopodcastsand wellbeingmodulesavailableon

MyLearningSpace:

-Parenting:ParentsinCrisis,apodcastexploringtheemotionalpressures parentscanfaceduringtimesofcrisis.

Click Here Click here

UnderstandingAnxiety-Thismoduleaimstoprovideyouwithagreater understandingofanxietyandsteeryouintherightdirectionofsupportif youneedit.

There’splentymoretoexplore.CheckouttheWellbeingLibraryfrom HealthAssured,ourWellbeingAssistanceProgrammeprovider,withover 35modulescoveringawiderangeoftopicsdesignedtosupportyour wellbeing.

There’snorightorwrongwaytoaccesssupport.Whetheryoupickupthe phone,listentoapodcast,workthroughamodule,orsimplytakealook andcomebacktoitlater,dowhatworksforyou

Mortgage News

Nationwide extends six times lending to home movers and remortgage

NationwidehasannouncedamajorboosttotheUKhousingmarket, extendingitshighloan‑to‑income(LTI)lendingtosupportawiderrange ofborrowers.Thechangewillseehomemoversandcustomers remortgagingabletoborrowuptosixtimestheirincome.

Home movers and remortgage:

Nationwidewillnowlenduptosixtimesincometobothnewand existingcustomersmovinghomeorremortgagingupto95percent loan‑to‑value(LTV).

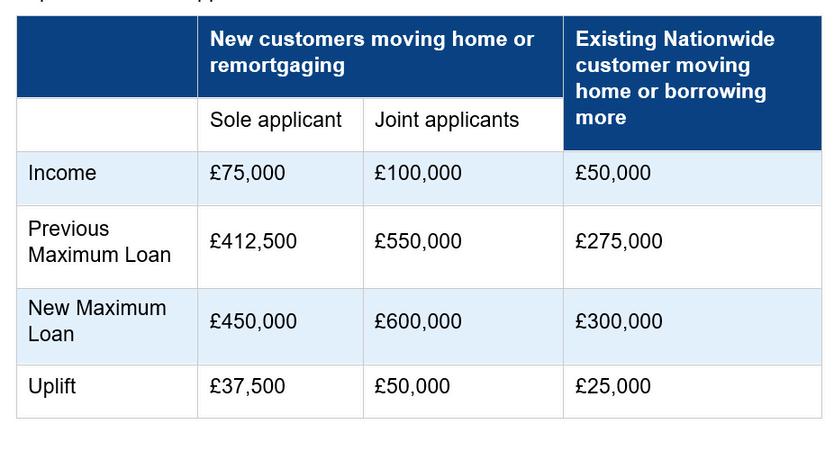

Toqualifyfortheenhancedborrowing,newcustomersmovinghomeor remortgagingtoNationwidewillneedaminimumannualincomeof £75,000forsoleapplicants,or£100,000forjointapplications.

However,tosupportexistingNationwidecustomerswantingtomove totheirnexthomein2026,suchaspreviousfirst-timebuyerswho benefittedfromHelpingHand,therewillbenominimumincome requirements.

Forallremortgageapplicationsmadethatdon’trequireanyadditional borrowing,Nationwidealreadyallowsborrowingupto6.5timesincome upto95percentLTV.

Henry Jordan, Nationwide’s Group Director of Mortgages, said:

“The government and regulatory changes last year have been a game changer for first-time buyers Alongside our Helping Hand expansion to six times income in September 2024, they’ve enabled greater support for those who need it most. Over the past year, we ’ ve seen a five-fold increase in the number of first-time buyers borrowing between 5.5 and six times income. Our latest announcement means we will provide similar support to those looking to move home or remortgage to Nationwide and shows our commitment to all parts of the market.”

How much can be borrowed?

Thefollowingareillustrativeexamples.Theamountthatcanbe borrowedwillbedependentontheapplicant’sindividualcircumstances.

£100 Discount and Green Living Rewards

HalifaxIntermediarieshaspartneredwithEffectiveHome,atrustedloft andcavitywallinsulationinstaller,andyoucanrecommendtoyourclients.

Insulatingahomeisoneofthemosteffectivewaystoimproveenergy efficiency,lowerheatingcosts,andcreateamorecomfortableliving environment.

That’swhyHalifaxIntermediarieshaspartneredwithEffectiveHome,a trustedloftandcavitywallinsulationinstaller,tomaketheprocesssimple andaffordable.

ExclusiveOffer:ClientswhoregisterforaninsulationquoteviatheHalifax referrallinkbetween12Januaryand23February2026willreceivean introductory£100discountontheirinstallation.

From24February2026,thestandardofferofgrant-finderservicewillapply.

Toqualifyforthe£100discount,clientsmust:

RegisterthroughtheHalifaxreferrallinkby23February2026

CompleteavirtualsurveywithEffectiveHome

Paya£100depositandbookinstallationwithin6weeksofreceiving theirquote Encourageyourclientstoactnowandtakeadvantageofthislimited-time offertomaketheirhomeswarmer,greener,andmorecost-efficient.

FindoutmoreabouttheHalifaxInsulationOffer

Mortgage offers for new business are going digital for your clients and solicitors!

Greatnews!Yourclientswillnowreceivemortgageoffersfasterandmore securelyfromAccordMortgages.

WhereAccordhaveavalidemailaddress,theywillnowsendmortgage offerstoclientsandsolicitorsviaencryptedemail.Thischangegivesyour clientsasmoother,quickerexperience,helpingyoudeliverthe exceptionalservicetheyexpect.

Postaldeliverywillonlybeusedinexceptionalcasesandwherenovalid emailaddresshasbeenprovided.

What’s changing?

Youraccessstaysthesame:You’llcontinuetoviewoffersviathebroker MSOportalasusual.

Quickerturnaround:Bysendingoffersdigitallyviaemailinsteadofby post,clientsandsolicitorsreceivethemmuchfaster,helpingyoudeliver anevenbetterexperience.

Secureandreliable:Emailswillbeencryptedforaddedpeaceofmind.

What do you need to do?

Ifanemailisn’tvalidorbouncesback,Accordwillissuetheofferby postwithin48hours(postaldeliverytimesmayvary).

Pleasemakesureclientemailaddressesareaccuratewhen submittingapplications.

Working with you…

Switch now reminder

Santanderarestickingtotheirpledgein2026andcontinuingtoimprove producttransferswithyouinmind.Here’sareminderofwhatyourclients willbenefitfrom,iftheydecideto‘switchnow’.

Ifyourclientiseligibleandthenewrateislower,youandyourclientwillget tochooseifyouwantthenewdealtostartstraightaway.

Iftheychoosetoswitchnow,they’llbenefitfromlowerpaymentssooner andSantanderwillwaivetheERContheirexistingproduct.

Fixedrateshaveaproductenddate,sothenewratewillendonthesame date,regardlessofwhenitstartsontheirmortgage.

Tofindoutmoreabout‘switchnow’,visittheirproduct transferspageHERE

ICYMI: Don’t give Mortgage Fraud a chance!

StayaheadofthecurvewithHSBCUK’sCPDapprovedMortgageFraud Preventionwebinars,withabrand-newthemefor2026.

Thesesessionswillgiveyoupracticalinsightsintothelatestfraudtrends, helpyourecognisesuspiciousmortgageapplications,interpretCIFAS alerts,andspotkeyredflags.

We’llalsocoveremergingrisks,sharestrategiestoprotectyour customersandguideyouonkeepingyourbusinesssecureandcompliant.

It’sagreatchancetosharpenyourfraudpreventionskillsandboostyour confidenceintacklingfinancialcrime.

How to register

Toregisterforoneofthewebinars,pleaseclickonyourpreferredoption belowandenteryourdetails.Allwebinarswilllastapproximately45minutes.

Onceconfirmed,pleasesavetheinvitationtoyourcalendar.

Pleasenote,youmustregisterandattendthewebinarindividuallyto receiveyourCPDcertificate.

Allwebinarswilllastapproximately45minutes.

BackbypopulardemandandIncollaborationwithL&G,aseriesof ExclusiveWebinarshavebeenarrangedforyoutoexpandyour knowledgeandskills.

ThiswebinarprogrammewasfirstdeliveredinDecembertogreat successandiscomingbacktogivemoreofyouachancetoattend!

Simplyclickontherelevantlinkandcompleteashortregistration.An emailconfirmationinvitewillthenfollow.

Atotalof4webinartopicsareavailable,withchoicesoftimesandwill cover:

BeyondtheMortgage–howtoelevateyourprotectionadvice(2 parts)

CriticalIllnessforLife–practicalskillsandobjectiontechniques IncomeProtection–protectthelifestyle,learnvaluabletipsand techniquesincludingFamilyIncomeBenefit

When?

Monday2 Februaryat11am nd

What?

Enhancingyourprocess.This2-partworkshopisdesignedtohelp mortgageadviserselevatetheirprotectionadvicebyenhancingtheir processandsharpeningtheirskills.

InPart1,you’llexplorehowtobuildprotectionintoyourmortgage process,demonstrateyourvalueastheirtrustedadviser,andenhance yourconversationstodrivebetterclientoutcomes. Packedwithpractical ideasandproventechniques,thissessionwillshowyouhowtomakeyour processmoreefficient,moreimpactfulandmoreprofitable.

When?

Tuesday3 February11am rd

Critical illness - For life, interrupted

Thissessionexploresthetruefinancialimpactofacriticalillness, revealinghowcoverisusedinreallifetoprotectclientswhentheyneed itthemost.

You’lllearnhowtouncoveryourclients’goalsthroughbetter conversationsandtranslatetheseintotailoredsolutionsthatsupport theirlong-termplansandfinancialsecurity.

When?

Thursday5 February11am th

Leading with Income - Protecting the Lifestyle

Thissessionexplorestheimpactandneedofprotectingyourclient’s income.Understandingthatincomereplacementsolutionscanbean effectivesolutiontomaintainingyourlifestyle.

We’lllookatevolvingourmindsettoleadingwithincomeasthedriving forcebehindprotectionconversations.LookingathowbothIncome ProtectionandFamilyIncomeProtectionworktogethertocreatebetter clientoutcomes.

When?

Friday6 February11am th

Aviva – Underwriting position

Avivacontinuetoacknowledgethesignificantunderwritingdelaysthey arecurrentlyexperiencing,withturnaroundtimesforassessingGPRs averagingaround37days(94%ofcasesunder35days).Theysincerely apologisefortheinconveniencethismaycauseandwanttoreassure advisersthattheyaredoingeverythingpossibletoimprovethesituation. Severalinitiativesareunderwaytoaddressthebacklog,although unfortunatelythereisnoquickfix.

OnepositivedevelopmentisthelaunchoftheirnewgenerativeAItool. ThistoolanalysesandcondensesGPmedicalreportsintoconcise summaries,highlightingkeydetailsandremovingirrelevantinformation. Underwriterswillreviewthesesummariestomakefinaldecisions, significantlyreducingprocessingtimeswhilemaintainingaccuracyand customercare.

Thesolutionhasbeen18monthsindevelopmentandhasbeentested onmorethan1,000casestoensurerobustsupportfortheright customeroutcomes.1300'real'GPRshavenowsuccessfullygone throughthetool,andishavingapositiveimpact.

WhileAvivawillcontinuetomanageescalations,theymustalsobe mindfulthatdoingsocanfurtherimpactoverallprocessingtimes. Despitethesechallenges,straight-throughprocessingremainsstrongat 80%,andAvivaremaincommittedtomaintainingthislevelofefficiency whereverpossible.Theywouldliketothankyouforyourcontinued patienceandunderstanding.

Industry News

TheUKmortgagemarketcontinuedtoevolvethisweek,withsignificant lenderactivityMajorlenderssuchasHSBC,Nationwideandothershave beencuttingheadlinemortgagerates,withtwo-yearfixesdroppingto around3.5%inrecentre-pricingmoves,providingimprovedoptionsfor borrowersandcreatingamorecompetitiveenvironmentforadvisersto supportclientsthroughremortgageandpurchasedecisions.

IntheBTLmarket,TheMortgageWorksannouncedcutstobuy-to-let(BTL) mortgageratesofupto0.15%onselectedfixedproductsfrom17January, benefittingbothnewbusinessandexistingswitchersacrossseveralterms.

Nationwideextendedloan-to-incomeratiosupto6×forcertainpurchase andremortgageapplicationsatupto95%LTV(Seeearlierarticle),aimedat broadeningaccessforaspirationalborrowers.

Analystcommentarypointstowardplentifulmortgageproductchoicewith over7,000dealsavailable,thehighestsince2007andexpectationsof