Smartr365 Improvement updates

TakealookatthelatestinnovativeimprovementsreleasedtoyourSmartr365 Platform:

Document Doc Dropbox

Followingsuccessfulbetatesting,theDocumentDropBoxisnowliveforall users.

Thispowerfulnewfeatureallowsadvisersandclientstouploaddocuments quickly,securely,andinbulk.Simplydraganddrophundredsoffiles,andourAI powereddocumentintelligencelayertakescareoftherest.

The system automatically:

Matcheseachfiletothecorrect caseandclient

Identifiesthedocumenttype anditspurpose

Filesitintothedocumentstore intherightlocation

Renamesitautomaticallyusinga consistentnamingconvention, client-name-documenttype.file-extension

Alluploadsappearinstantlyinthe relevantcaserecord,ensuringa smarter,faster,andmoreorganised waytomanagedocumentation.

Email History Tab Refresh

We’veimprovedtheEmailHistory experiencetomaketrackingsent emailssmootherandmore immediate.Whenanadvisersends anemail,theEmailHistorytabnow refreshesautomatically,sothenewly sentmessageappearsinstantly.No needtorefreshthepageorclick awayandbackagain.

Onceanemailissuccessfullysent, theEmailHistorytabupdates automatically.Themostrecently sentemailwillappearinthelistright away,withoutrequiringanymanual refresh.

Resolved

Theissueoffeesbeingaddedtothe loanonthepushthroughfrom SmartrtoConcertHubhasbeen resolvedinthelatestrelease.

Introducing Maia

WehavelaunchedMaia(MortgageAI Agent)bringingthesamepowerful AItechnologythatpowersSmart SearchandDocDropBox. What’s changed?

Ourchatbeaconintherighthand sideofthescreenisnowpoweredby Maiareadytobringyouexcitingnew features.Wewillbeaddingmore overthecomingweeksandmonths toMaia,bringingyouincredibly powerfulfeatures.

Refer your client for a free legal review

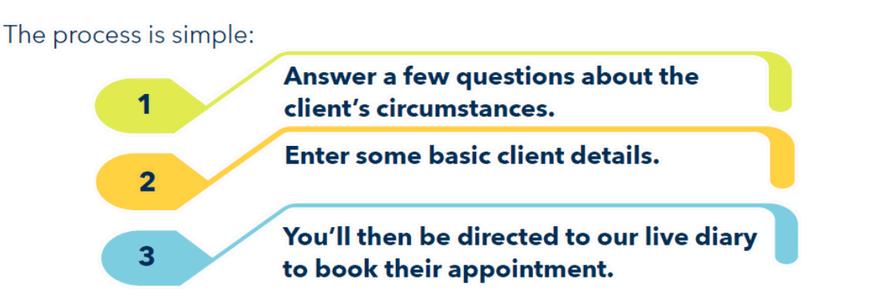

Referringyourclientisquickandeasy.Youcanreferyourclientforafreelegal reviewviatheJust/WealthMortgagesReferralHubHERE

Werecommenddoingthiswhileyou'rewiththeclient,soyoucanbooktheir appointmentdirectly.

During the meeting they will cover the following:

Tomaketheverymostoftheservice,pleasenotethefollowing:

Contact details

Ensurethatcustomerdetailsareenteredintherightformattoensureour communicationsarepresentedcorrectlyi.e.MrJohnSmithvsmrJOHNSMITH

Refer couples together

Ensurecouplesarereferredtogetherratherthanseparatelyasourservicesare usuallydeliveredinjointplanning

Contact methods

Providemultiplecontactmethods–mobileandhometelephonenumber,plus emailaddress.Weusecalls,SMSandemailtoengagewithyourclient

Online appointment bookings

Usetheonlinedirectbookingfacilitywherepossible,toprovideoptimalclient experience.

Mortgage News

MPowered to stop accepting new mortgage applications

MortgagelenderMPoweredhas announcedthatitisclosingitslending operationandwillnolongeraccept newmortgageapplications.

MPoweredwillnolongeracceptnew mortgageapplicationsafter5:30pm onTuesday28October2025andall MPowered’sproducts,including producttransfers,willbewithdrawn.

Allexistingmortgagecustomersand MPoweredbroker-partnerswill continuetobefullysupportedand MPoweredareproactivelycontacting customerstokeeptheminformed.

MQube,thepioneeringAIfintech businessfoundedin2019to revolutioniseloanoriginationthrough artificialintelligence,hasannounceda majorgrouprestructuringfollowinga strategicreview.Thecompanyisto decoupleitstechnologyandlending armsandfocussolelyonitscore technologybusiness,positioningits proprietaryAI-nativeplatformfor expansionacrossglobalmarkets.The grouphasbeenexploringdivestment optionstosupportthefuturegrowth ofitslendingarmMPoweredandwillbe appointingacorporateadvisorto implementthis.

StuartCheetham,CEOofMQube commented:“ThegrowthofbothMQube andMPoweredhasbeentrulyphenomenal, supportedbyafantasticteamofpeople, ourMQubeandMPoweredfamily. MPoweredhasshownwhat’spossible whencutting-edgetechnologymeets high-qualitymortgagelending.Theteam hassetnewstandardsforspeed, efficiency,andcustomerexperience.Our focusnowisonmakingthattechnology availabletolendersaroundtheworld.This movewillenablebothbusinessesto achievetheirfullpotential.”

Summary:

MPoweredwillstopacceptingnew mortgageapplicationsafter5:30pm Tuesday28October2025.

Offerswillcontinuetobeissueduntil 5:30pmMonday10November2025, afterwhichnonewofferscanbe made.

Allexistingoffersandcompletions remainunaffected.

Questionsforbrokersand distribution-partners

Renters’ Rights Bill becomes law

TheRenters’RightsBillhasbecomealawfollowingRoyalAssentonMonday 27October2025,markingthemostsignificantoverhauloftheprivaterented sectorindecades.

TheActintroducesaseriesofreformsaffectinglandlordsandlettingagents acrossEnglandandWales,withthegovernmentexpectedtoannouncethe timetableforimplementationinthecomingweeks.

Thenewlawestablishesnewrulesonrentincreases,advertising,andletting practices,aswellasaDecentHomesStandardforprivaterentals.Landlords willberequiredtosignuptoanewsectordatabaseandombudsman,with non-complianceattractingnewoffencesandcivilpenalties.

Someenforcementpowersforlocalauthoritieswillbeactivatedwithintwo months,enablingthemtodemandevidenceofcomplianceand,incertain cases,enterbusinesspremiseswithoutawarrant.Majorreforms,suchasthe endoffixed-termtenanciesandthenewpossessiongrounds,willtakeeffect onadateyettobeconfirmed.

Thegovernmenthasindicatedthatlandlordsandtenantswillreceive “sufficientnotice”beforethemainprovisionsareenacted.Industrybodies havecalledforatleastsixmonths’leadtimetoallowlandlordstopreparefor thechanges.Duringthisperiod,landlordsareadvisedtoreviewtheir documentation,inspectproperties,andensureagentsarereadyforthenew requirements.

Inthemeantime,ifyouhaveanylandlordclientscomingtoyouwith questions,theNationalResidentialLandlordsAssociation(NRLA)website hasagoodsummarythatislandlord-facing.

Renters’ Rights Bill gets Royal Assent – but what happens next? | NRLA

Join Lloyds Banking Group for an online cyber event

YouareinvitedtoattendthethirdeditionofLloydsBankingGroup'sonline cyberevent.

ThesessionwillbeledbyGarethThomasfromtheLBGSafeandSecure teamandwillfeatureaguestspeakerwhoisamortgagebroker.Theywill sharetheirpersonalexperienceofbeingthetargetofacyber-attack, offeringvaluableinsightsandlessonsforprofessionalsacrosstheindustry.

It's taking place on Friday 7 November at 10:00am to 10:30am

90%

SantanderhaveincreasedthemaximumLTVfrom85%to90%forremortgages withcapitalraising.

Thisgivesgreaterflexibilityforyourclientslookingtoreleaseequityforhome improvements,largepurchasesorotherpersonalgoals.

Important: Whereanyelementofcapitalraisingisfordebtconsolidation,the maximumLTVwillstayat85%.

Santanderhavealsoimprovedtheirdebttoincomelendingpolicy.Checkif SantandercouldlendtheamountyourclientneedsbygettinganAIP,asit’sa softcreditcheck.

Pipelinerules:AnyFMAssubmittedfrom6amonTuesday28Octoberwillbe assessedusingtheirnewlendingpolicy.Ifamaterialchangeismadetoan existingapplicationfrom6amonTuesday28October,thecasewillbe reassessedusingthenewlendingpolicy.

Santanderhaveupdatedtheiraffordabilitycalculatorandlendingcriteriaontheir websitetoreflectthischange.

Zurich Life and Pensions

Customers contact centre update

Mortgageapprovalsjumpstrongly:InSeptember,UKlenders approvedthemostmortgagessofarin2025,arisefromAugust, signallingreneweddemandandmomentuminthepurchasemarket.

Housepricesdefyheadwinds:NationwidedatashowedUKhouse pricesrose0.3%inOctober(versusSeptember),bringingannual growthto2.4%.Thisresilienceissurprisinggivenweakconsumer confidence.

CautiousbuyerbehaviouraheadoftheBudget:Analystswarnthat somebuyersareremainingonthesidelinesinanticipationoftaxor stampdutychangesintheAutumnBudget,whichmayslow transactionvolumesdespitepricestrength.

Greaterflexibilityinprotectionpolicies:Legal&Generalannounced for“increasingcover”policies(indexation)thatcustomerscanopt outofannualcoverincreasesforuptothreeconsecutiveyearswhile preservingtheoptiontoresumelater.