Meet the Team

Sales team

Lesley

Panagiota Tyropolis

Sheridan

Strathfield | Bankstown | Canterbury

10 William Street, Ashfield

4 beds 3 baths

AUCTION Sunday 15 February 12.00pm

Price Guide On Request

View Saturday 11.30am - 12.00pm

Agent Grant Lee 0423 771 412

4 Hoskins Avenue, Bankstown

9 beds 4 baths 4 cars

AUCTION Saturday 21 February 11.15am

Price Guide On Request

View Saturday 3.15pm - 3.45pm

Agent David Sharma 0468 404 316

Jenny Tran 0468 867 968

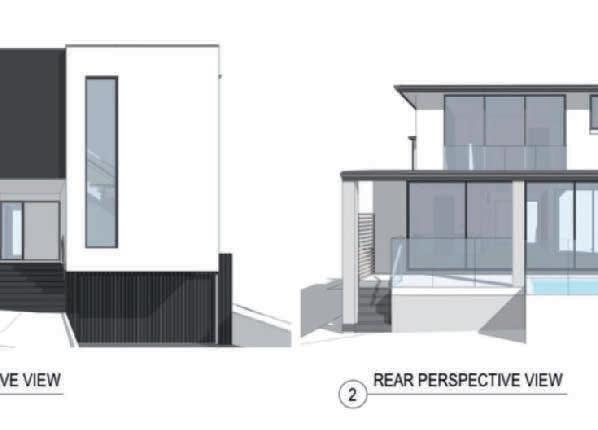

4B Varidel Avenue, Belfield

5 beds 3 baths 2 cars FOR SALE

Price Guide On Request

View By Appointment

Agent Tarun Sethi 0404 414 533

Diab Abou Haidar 0404 137 392

148 Holden Street, Ashfield

AUCTION Saturday 14 February 2.15pm

Price Guide $3,700,000

View Saturday 10.00am - 10.30am

Agent Tarun Sethi 0404 414 533

Grant Lee 0423 771 412

45 Allum Street, Bankstown

beds 2 baths 5 cars

AUCTION Saturday 31 January 12.00pm

Price Guide On Request

View By Appointment

Agent Michael Ristevski 0414 374 370

Brandon Nguyen 0431 560 560

25 Omaha Street, Belfield

5 beds 4 baths 2 cars

AUCTION Saturday 7 February 2.15pm

Price Guide On Request

View By Appointment

Agent Nina Helmy 0432 326 304

Rachel Harb 0432326492

West Street, Auburn 5 beds 3 baths 4 cars

AUCTION Saturday 7 February 4.30pm

Price Guide $2,100,000

View Saturday 10.00am - 10.30am

Agent Niki Aquino 0435 098 085

Brooke El Hakim 0412 110 023

113 Ingleburn Gardens Drive,

3 beds 2 baths 2 cars

AUCTION Saturday 31 January 9.45am

Price Guide $800,000

View Saturday 9.15am - 9.45am

Agent Olivia Karacetin 0459 988 828

George Kapos 0428 110 000

1A Persic Street, Belfield

4 beds 3 baths 6 cars FOR SALE

Price Guide $2,500,000

View Saturday 2.00pm - 2.30pm

Agent Tarun Sethi 0404 414 533

Nina Helmy 0432 326 304

Bardia

Strathfield | Bankstown | Canterbury

17A Gloucester Avenue, Burwood 3 beds 2 baths 2 cars

AUCTION Saturday 7 February 10.30am

Price Guide $1,800,000

View Saturday 1.15pm - 1.45pm

Agent Carlos Ouyang 0451 866 668

43 Walker Street, Canada Bay

5 beds 4 baths 4 cars

AUCTION Saturday 21 February 4.30pm

Price Guide On Request View By Appointment

Agent Tarun Sethi 0404 414 533

40 Lindsay Street, Burwood 5 beds 4 baths 2 cars

AUCTION Sunday 15 February 12.45pm

Price Guide On Request

View Saturday 2.00pm - 2.30pm

Agent Tarun Sethi 0404 414 533

Carlos Ouyang 0451 866 668 34 Bayview Road, Canada Bay 5 beds 5 baths 4 cars FOR SALE

Jerrie Harris 0434 544 327 85

AUCTION Saturday 31 January 12.45pm

Price Guide $1,150,000

View Saturday 12.15pm - 12.45pm

Agent Hussein Musailem 0467 660 166

Price Guide On Request View By Appointment

Agent Patrick Heng 0412 991 495

Moe Rasool 0425719446

Price Guide On Request View By Appointment

Agent Paul Tartak 0432 328 862

Tarun Sethi 0404 414 533

Olivia Karacetin 0459 988 828 21 Lancelot Street, Concord

Price Guide On Request View By Appointment

Agent Michael Murphy 0486 123 888

Christina Heng 0423 682 901

8A Tremere Street, Concord 5 beds 4 baths 3 cars

Price Guide On Request View By Appointment

Agent Tarun Sethi 0404 414 533

Patrick Heng 0412 991 495

1a Tripod Street, Concord 3 beds 2 baths 3 cars FOR SALE

Price Guide $2,900,000

View By Appointment

Agent Tarun Sethi 0404 414 533

Matthew Selvaraju 0411 591 522

Strathfield | Bankstown | Canterbury

Price

Agent Tarun Sethi 0404 414 533

Paul Tartak 0432 328 862

5

Price Guide On Request View By Appointment

Agent Nina Helmy 0432 326 304

Diab Abou Haidar 0404 137 392

Price

Agent

Tartak 0432 328 862

Price

Agent Tarun Sethi 0404 414 533 Matthew Selvaraju 0411 591 522

Price

Agent Tarun Sethi 0404 414 533

Patrick Heng 0412 991 495

Price

Agent Paul Tartak 0432 328 862

Rachel Harb 0432326492

Price Guide On Request View By Appointment

Agent Tarun Sethi 0404 414 533

Arthur Syrios 0411 446 158

Price

View Saturday 4.15pm - 4.45pm

Agent David Sharma 0468 404 316

Nick Halmet 0477 831 387

Strathfield | Bankstown | Canterbury

25 Ayres Crescent, Georges Hall

5 beds 3 baths 3 cars

AUCTION Saturday 21 February 1.30pm

Price Guide On Request

View Saturday 12.30pm - 1.30pm

Agent Michael Hassen 0417 700 300

Price Guide On Request View By Appointment

Agent Dimi Papas 0499 808 299

Michael Ristevski 0414 374 370

beds 4 baths 4 cars

Price Guide On Request View By Appointment

Agent Tarun Sethi 0404 414 533

Michael Tringali 0408 000 100 14 Rochester Street, Homebush 4 beds 1 bath 3 cars

AUCTION Saturday 14 February 3.45pm

Price Guide On Request View By Appointment

Agent Tarun Sethi 0404 414 533

Matthew Selvaraju 0411 591 522 163 Bexley Road,

Price Guide On Request View By Appointment

Agent Carlos Ouyang 0451 866 668

23 Brooks Circuit, Lidcombe 5 beds 3 baths 2 cars

Price Guide On Request

View By Appointment

Agent James Kim 0432 326 761

Steven Choi 0412 994 900 29 Norman May Drive, Lidcombe

Michael Murphy 0486 123 888 9 Brenda Avenue,

Price Guide On Request View By Appointment

Agent Michael Murphy 0486 123 888

James Kim 0432 326 761

beds 3 baths 2 cars

Price Guide On Request View By Appointment

Agent James Kim 0432 326 761

Tarun Sethi 0404 414 533

5 Main Avenue, Lidcombe

bed 1 bath 1 car

Price Guide $780,000 - $820,000

View By Appointment

Agent James Kim 0432 326 761

Strathfield | Bankstown | Canterbury

Price Guide $2,300,000 - $2,500,000

View By Appointment

Agent Michael Murphy 0486 123 888

James Kim 0432 326 761

Price Guide $1,690,000 - $1,725,000 View Saturday 11.00am - 11.30am

Agent James Kim 0432 326 761

Moe Rasool 0425719446

Price Guide On Request View By Appointment

Agent James Kim 0432 326 761

Michael Murphy 0486 123 888 99

AUCTION Saturday 21 February 5.30pm

Price Guide On Request View By Appointment

Agent James Kim 0432 326 761

Moe Rasool 0425719446

Price Guide $1,900,000 View Saturday 12.00pm - 12.30pm

Agent James Kim 0432 326 761

Moe Rasool 0425719446

AUCTION Saturday 31 January 10.30am

Price Guide $1,200,000

View Saturday 10.00am - 10.30am

Agent David Sharma 0468 404 316 11A

Agent Rania Azzi 0433 179 397

Price Guide On Request View By Appointment

Agent Rania Azzi 0433 179 397

Dimi Papas 0499 808 299

AUCTION Saturday 7 February 3.00pm

Price Guide $2,100,000

View Saturday 11.00am - 11.30am

Agent Niki Aquino 0435 098 085

Brooke El Hakim 0412 110 023

Strathfield | Bankstown | Canterbury

3 Newington Boulevard, Newington

3 beds 2 baths 2 cars FOR SALE

Price Guide $1,800,000

View By Appointment

Agent Ania Aquino 0433 123 569

Brooke El Hakim 0412 110 023 134 George Street, North Strathfield 5 beds 2 baths 3 cars

Price Guide On Request

View By Appointment

Agent Michael Murphy 0486 123 888

Christina Heng 0423 682 901 Brussels - Mena - George, North Strathfield FOR SALE

Price Guide On Request

View By Appointment

Agent Michael Murphy 0486 123 888

34 Northmead Avenue, Northmead

beds 2 baths 2 cars FOR SALE

Price Guide $1,800,000

View By Appointment

Agent David Sharma 0468 404 316 3 Gillian Place, Punchbowl

AUCTION Saturday 21 February 12.00pm

Price Guide $1,950,000

View Saturday 11.00am - 11.30am

Agent Dimi Papas 0499 808 299

Michael Ristevski 0414 374 370 2 Nicoll Street,

beds 2 baths 4 cars

AUCTION Saturday 31 January 3.45pm

Price Guide $1,500,000 View By Appointment

Agent Michael Ristevski 0414 374 370

Dimi Papas 0499 808 299

1 Sibbick Street, Russell Lea

4 beds 2 baths 2 cars

AUCTION Saturday 7 February 3.45pm

Price Guide $3,100,000

View By Appointment

Agent Tarun Sethi 0404 414 533

Angela Andrews 0412 113 722

16 Cameron Crescent, Ryde

beds 4 baths 3 cars

Price Guide $4,000,000 - $4,400,000

View By Appointment

Agent Nina Helmy 0432 326 304

Grant Lee 0423 771 412

16a Cameron Crescent, Ryde 5 beds 2 baths 2 cars

AUCTION Sunday 22 February 10.00am

Price Guide On Request

View By Appointment

Agent Nina Helmy 0432 326 304

Grant Lee 0423 771 412

Roselands

Strathfield | Bankstown | Canterbury

5 beds 2 baths 3 cars

AUCTION Saturday 21 February 12.45pm

Price Guide On Request

View Saturday 12.15pm - 12.45pm

Agent Carlos Ouyang 0451 866 668

Tarun Sethi 0404 414 533

25 Newton Road, Strathfield

7 beds 3 baths 3 cars

Price Guide On Request View By Appointment

Agent Tarun Sethi 0404 414 533

Price Guide On Request View By Appointment

Agent Michael Murphy 0486 123 888

Tarun Sethi 0404 414 533

Michael Murphy 0486 123 888 9 Birnam Grove,

AUCTION Saturday 14 February 1.30pm

Price Guide $4,500,000 - Deceased Estate View By Appointment

Agent Tarun Sethi 0404 414 533

Jerrie Harris 0434 544 327

65-69 Albert Road, Strathfield

5 beds 5 baths 3 cars

AUCTION Saturday 28 February 3.45pm

Price Guide On Request

View By Appointment

Agent Tarun Sethi 0404 414 533

Michael Murphy 0486 123 888

Price Guide On Request

View By Appointment

Agent Michael Murphy 0486 123 888

Davey Hong 0424603824

beds 1 bath 1 car

Price Guide On Request View By Appointment

Agent Carlos Ouyang 0451 866 668

Steven Choi 0412 994 900

Long Street, Strathfield

beds 2 baths 4 cars

AUCTION Saturday 21 February 1.30pm

Price Guide On Request View By Appointment

Agent Tarun Sethi 0404 414 533

Alexandra Demirjian 0432 329 026

Llandilo Avenue, Strathfield

beds 6 baths 4 cars

Price Guide $6,500,000

View By Appointment

Agent Tarun Sethi 0404 414 533

Angela Andrews 0412 113 722

Strathfield | Bankstown | Canterbury

118 Newton Road, Strathfield

4 beds 2 baths 6 cars

AUCTION Saturday 21 February 2.15pm

Price Guide $3,800,000

View Saturday 1.00pm - 1.30pm

Agent James Kim 0432 326 761

Michael Murphy 0486 123 888

19 Wallis Avenue, Strathfield

5 beds 6 baths 4 cars

AUCTION Saturday 28 February 12.45pm

Price Guide On Request

View By Appointment

Agent Tarun Sethi 0404 414 533

Jerrie Harris 0434 544 327

15-21 Manson Road, Strathfield

18 beds 7 baths

FOR SALE

Price Guide On Request

View By Appointment

Agent Michael Murphy 0486 123 888

23 Fitzgerald Crescent, Strathfield

5 beds 2 baths 4 cars

FOR SALE

Price Guide On Request

View Saturday 11.15am - 11.45am

Agent Carlos Ouyang 0451 866 668

Tarun Sethi 0404 414 533

9 & 11 Swan Avenue, Strathfield

7 beds 4 baths 4 cars

FOR SALE

Price Guide On Request

View By Appointment

Agent Tarun Sethi 0404 414 533

Jerrie Harris 0434 544 327

51 South Street, Strathfield

5 beds 2 baths 3 cars

AUCTION Sunday 15 February 10.30am

Price Guide On Request

View By Appointment

Agent Tarun Sethi 0404 414 533

Angela Andrews 0412 113 722

4 Cameron Street, Strathfield

5 beds 3 baths 2 cars

AUCTION Sunday 15 February 11.15am

Price Guide On Request

View By Appointment

Agent Tarun Sethi 0404 414 533

Matthew Selvaraju 0411 591 522

7 Edgar Street, Strathfield 6 beds 6 baths 4 cars

FOR SALE

Price Guide $6,200,000 - $6,500,000

View By Appointment

Agent Tarun Sethi 0404 414 533

Michael Murphy 0486 123 888

1 Amaroo Avenue, Strathfield

5 beds 2 baths 3 cars

AUCTION Saturday 21 February 3.45pm

Price Guide On Request

View By Appointment

Agent Paul Tartak 0432 328 862

Tarun Sethi 0404 414 533

Strathfield | Bankstown | Canterbury

AUCTION Saturday 21 February 3.00pm

Price Guide On Request

View By Appointment

Agent Tarun Sethi 0404 414 533

Matthew Selvaraju 0411 591 522 22 Victoria Street,

145

Price Guide On Request

View By Appointment

Agent Michael Murphy 0486 123 888

Christina Heng 0423 682 901

Price Guide On Request

View By Appointment

Agent Jenny Tran 0468 867 968

AUCTION Saturday 14 February 4.30pm

Price Guide On Request View By Appointment

Agent Tarun Sethi 0404 414 533

Angela Andrews 0412 113 722

AUCTION Saturday 28 February 4.30pm

Price Guide On Request View By Appointment

Agent Tarun Sethi 0404 414 533

Jerrie Harris 0434 544 327

Price Guide $1,980,000

View Saturday 12.00pm - 12.30pm

Price Guide On Request View By Appointment

Agent Matthew Selvaraju 0411 591 522

Tarun Sethi 0404 414 533

AUCTION Saturday 31 January 2.15pm

Price Guide $1,950,000

View Saturday 1.45pm - 2.15pm

Agent David Sharma 0468 404 316

George Kapos 0428 110 000

Agent David Sharma 0468 404 316 203/1A Orchard Crescent, Ashfield

Price Guide On Request

View By Appointment

Agent Michael Murphy 0486 123 888

Mark MacKenzie 0414 950 148

Strathfield | Bankstown | Canterbury

101/1A Orchard Crescent, Ashfield 2 beds 2 baths 1 car FOR SALE

Price Guide On Request

View By Appointment

Agent Michael Murphy 0486 123 888

Mark MacKenzie 0414 950 148

604/19 Meredith Street, Bankstown

Price Guide $475,000 - $500,000

View By Appointment

Agent David Sharma 0468 404 316

G01/1A Orchard Crescent, Ashfield 3 beds 2 baths 1 car FOR SALE

Price Guide On Request

View By Appointment

Agent Michael Murphy 0486 123 888

Mark MacKenzie 0414 950 148

Price Guide $429,000 View Saturday 3.30pm - 4.00pm

Agent Hussein Musailem 0467 660 166

Price Guide $830,000 - $890,000

View By Appointment

Agent Paul Tartak 0432 328 862

Rachel Harb 0432326492

Price Guide $780,000 - $800,000 View By Appointment

Agent Rachel Harb 0432326492

5/22-30 Station Road, Auburn 2 beds 2 baths 1 car FOR SALE

Price Guide On Request

View Saturday 12.30pm - 1.00pm

Agent Christina Heng 0423 682 901

Michael Murphy 0486 123 888

Penthouse/23 George Street, Burwood 4 beds 3 baths 3 cars FOR SALE

Price Guide Burwood’s Largest Penthouse View By Appointment

Agent Michael Murphy 0486 123 888

Davey Hong 0424603824

Paul Tartak 0432 328 862 220 Georges River Road, Croydon Park 2 beds 3 baths 2 cars FOR SALE

Price Guide $1,550,000

View By Appointment

Agent James Kim 0432 326 761

Patrick Heng 0412 991 495

Strathfield | Bankstown | Canterbury

A904/10 Court Road, Fairfield

2 beds 2 baths 1 car FOR SALE

Price Guide $688,000 View By Appointment

Agent Brandon Nguyen 0431 560 560

Michael Ristevski 0414 374 370

1008/6 East Street, Granville 2 beds 2 baths 1 car

Price Guide $480,000 - $528,000 View By Appointment

Agent Jerrie Harris 0434 544 327

Moe Rasool 0425719446 4/36 Hawthorne Parade, Haberfield

Price Guide $1,200,000 View By Appointment

Agent James Kim 0432 326 761

Price Guide $500,000 - $520,000 View By Appointment

Agent James Kim 0432 326 761 1204/153

Price Guide On Request View By Appointment

Agent Matthew Selvaraju 0411 591 522

Tarun Sethi 0404 414 533 15/6 Station Street, Homebush

Price Guide On Request

View Saturday 10.15am - 10.45am

Agent Carlos Ouyang 0451 866 668

2305/9 Nipper Street, Homebush

AUCTION Saturday 7 February 12.45pm

Price Guide Auction $1,100,000 View By Appointment

Agent Matthew Selvaraju 0411 591 522

Paul Tartak 0432 328 862

Price Guide On Request

View Saturday 10.00am - 10.30am

Agent Moe Rasool 0425719446

Price Guide On Request

View By Appointment

Agent James Kim 0432 326 761

James Kim 0432 326 761 3/1-3 Mary Street, Lidcombe 3 beds 3 baths 2 cars

Strathfield | Bankstown | Canterbury

441/11 Canning Street, Lidcombe

3 beds 2 baths 2 cars

Price Guide On Request

View By Appointment

Agent James Kim 0432 326 761

1/17-19 Robilliard Street, Mays Hill

1 bed 1 bath 1 car FOR SALE

Price Guide $479,000

View Saturday 11.15am - 11.45am

Agent David Sharma 0468 404 316

13/17 Robilliard Street, Mays Hill

2 beds 2 baths 1 car

Price Guide $599,000

View Saturday 11.15am - 11.30am

Agent Olivia Karacetin 0459 988 828

George Kapos 0428 110 000

208/6A Atkinson Street, Liverpool 2 beds 2 baths 1 car

Price Guide On Request

View By Appointment

Agent James Kim 0432 326 761

Moe Rasool 0425719446

Price Guide On Request

View Saturday 11.15am - 11.45am

Agent Jenny Tran 0468 867 968 Bill Delimitros 0415 988 831

Price Guide $645,000 - $680,000 View By Appointment

Agent David Sharma 0468 404 316

Price Guide $550,000 - $570,000

View By Appointment

Agent James Kim 0432 326 761

AUCTION Saturday 31 January 4.45pm

Price Guide On Request View Saturday 4.15pm - 4.45pm

Agent David Sharma 0468 404 316

Moe Rasool 0425719446 23/4 Peace Lane, Parramatta

Price Guide $530,000 - $560,000

View Saturday 9.30am - 10.00am

Agent David Sharma 0468 404 316

Strathfield | Bankstown | Canterbury

62/20 Matthews Street, Punchbowl

2 beds 2 baths 1 car FOR SALE

Price Guide On Request

View By Appointment

Agent Michael Ristevski 0414 374 370

Natasha Ristevski 0410 412 354

605/3 Jean Wailes Avenue, Rhodes

2 beds 2 baths 1 car FOR SALE

Price Guide On Request

View Saturday 10.30am - 11.00am

Agent Michael Murphy 0486 123 888

Christina Heng 0423 682 901

17/1-4 The Crescent, Strathfield

3 beds 2 baths 2 cars

Price Guide On Request

View By Appointment

Agent Patrick Heng 0412 991 495

Tarun Sethi 0404 414 533

601/36 Walker Street, Rhodes 3 beds 2 baths 1 car FOR SALE

Price Guide On Request

View By Appointment

Agent Niki Aquino 0435 098 085

Ania Aquino 0433 123 569

31/22-26 Cotswold Road, Strathfield

Price Guide On Request

View By Appointment

Agent Tarun Sethi 0404 414 533

Patrick Heng 0412 991 495

604/5 Albert Road, Strathfield 3 beds 2 baths 1 car

Price Guide On Request

View By Appointment

Agent Michael Murphy 0486 123 888

Christina Heng 0423 682 901

3004/36 Walker Street, Rhodes 2 beds 2 baths 1 car FOR SALE

Price Guide $1,160,000 - $1,200,000 View By Appointment

Agent Jerrie Harris 0434 544 327

Moe Rasool 0425719446

43/17 Everton Road, Strathfield

bed 1 bath 1 car FOR SALE

Price Guide On Request View By Appointment

Agent Michael Murphy 0486 123 888

Christina Heng 0423 682 901

A305/86 Centenary Drive, Strathfield 2 beds 2 baths 2 cars

SALE

Price Guide On Request

View By Appointment

Agent Carlos Ouyang 0451 866 668

Steven Choi 0412 994 900

Strathfield | Bankstown | Canterbury

14/57 Manson Road, Strathfield 1 bed 1 bath 1 car FOR SALE

Price Guide $510,000 - $530,000 View Saturday 11.30am - 12.00pm

Agent Christina Heng 0423 682 901

Michael Murphy 0486 123 888

303/23-25

Price Guide On Request View Saturday 3.00pm - 3.30pm

A204/86 Centenary Drive, Strathfield 2 beds 2 baths 1 car

Price Guide On Request View By Appointment

Agent Alexandra Demirjian 0432 329 026

Matthew Selvaraju 0411 591 522

901/9-13 Parnell Street, Strathfield 2 beds 2 baths 1 car FOR SALE

Price Guide On Request View By Appointment

Agent Angela Andrews 0412 113 722

Tarun Sethi 0404 414 533

Price Guide $800,000 - $830,000

View By Appointment

Agent Angela Andrews 0412 113 722

Agent Carlos Ouyang 0451 866 668 6/64 The Boulevarde, Strathfield

Tarun Sethi 0404 414 533

2103/11 Australia Ave, Sydney Olympic Park

3 beds 2 baths 2 cars FOR SALE

Price Guide $1,260,000

View By Appointment

Agent Ania Aquino 0433 123 569

Brooke El Hakim 0412 110 023

43/333 Bulwara Road, Ultimo

2 beds 1 bath 1 car

FOR SALE

Price Guide On Request

View By Appointment

Agent Jenny Tran 0468 867 968

Bill Delimitros 0415 988 831

4/432-434 Liverpool Road, Strathfield South 3 beds 2 baths 1 car

FOR SALE

Price Guide On Request View By Appointment

Agent Nina Helmy 0432 326 304

Jerrie Harris 0434 544 327

105/5 Stromboli Strait, Wentworth Point

3 beds 2 baths 2 cars

FOR SALE

Price Guide $1,400,000 - $1,500,000

View By Appointment

Agent Ania Aquino 0433 123 569

Niki Aquino 0435 098 085

Strathfield | Bankstown | Canterbury

1902/11 Wentworth Place, Wentworth Point

2 beds 2 baths 1 car

FOR SALE

Price Guide On Request

View By Appointment

Agent Brooke El Hakim 0412 110 023

Ania Aquino 0433 123 569

506/8 Marine Parade, Wentworth Point

3 beds 2 baths 2 cars

AUCTION Saturday 7 February 1.30pm

Price Guide $1,350,000

View Saturday 10.00am - 10.30am

Agent Ania Aquino 0433 123 569

Brooke El Hakim 0412 110 023

319/4 Stromboli Strait, Wentworth Point

2 beds 2 baths 2 cars

FOR SALE

Price Guide $840,000

View Saturday 10.45am - 11.15am

Agent Ania Aquino 0433 123 569

Brooke El Hakim 0412 110 023

546/46 Baywater Drive, Wentworth Point 2 beds 2 baths 1 car FOR SALE

Price Guide $890,000

View By Appointment

Agent Ania Aquino 0433 123 569

Brooke El Hakim 0412 110 023

409/5 Sea Rush Street, Wentworth Point 2 beds 2 baths 1 car

FOR SALE

Price Guide On Request

View Saturday 12.00pm - 12.30pm

Agent Niki Aquino 0435 098 085

Brooke El Hakim 0412 110 023

1404/13 Verona Drive, Wentworth Point

2 beds 2 baths 1 car

AUCTION Saturday 14 February 2.15pm

Price Guide On Request

View Saturday 12.15pm - 12.45pm

Agent Ania Aquino 0433 123 569

Brooke El Hakim 0412 110 023

10001/16 Amalfi Drive, Wentworth Point 1 bed 1 bath 1 car FOR SALE

Price Guide On Request

View Saturday 1.30pm - 2.00pm

Agent Niki Aquino 0435 098 085

Brooke El Hakim 0412 110 023

206/5 Sea Rush Street, Wentworth Point 4 beds 3 baths 3 cars

FOR SALE

Price Guide On Request

View Saturday 1.00pm - 1.30pm

Agent Ania Aquino 0433 123 569

Niki Aquino 0435 098 085

303/51 Hill Road, Wentworth Point

2 beds 2 baths 2 cars

AUCTION Saturday 14 February 4.30pm

Price Guide $800,000

View Saturday 11.30am - 12.00pm

Agent Niki Aquino 0435 098 085

Brooke El Hakim 0412 110 023

Strathfield | Bankstown | Canterbury

28/203 Auburn Road, Yagoona

2 beds 2 baths 2 cars FOR SALE

Price Guide $750,000 - $800,000

View Saturday 2.45pm - 3.15pm

Agent David Sharma 0468 404 316

B18/161 Arthur Street, Homebush West 1 car FOR SALE

Price Guide On Request View By Appointment

Agent James Kim 0432 326 761

2/55 Raymond Street, Bankstown 3 cars FOR SALE

Price Guide $970,000

View By Appointment

Agent Michael Hassen 0417 700 300

24/124 Dutton Street, Yagoona 2 beds 1 bath 1 car FOR SALE

Price Guide $619,999

View Saturday 2.00pm - 2.30pm

Agent David Sharma 0468 404 316 2 Alan Street, Fairfield Land FOR SALE

97 Highland Way, Marulan 8 beds 5 baths 10 cars FOR SALE

Price Guide $2,000,000 View By Appointment

Agent Dimi Papas 0499 808 299

George Kapos 0428 110 000

Price Guide On Request View By Appointment

Agent Diab Abou Haidar 0404 137 392

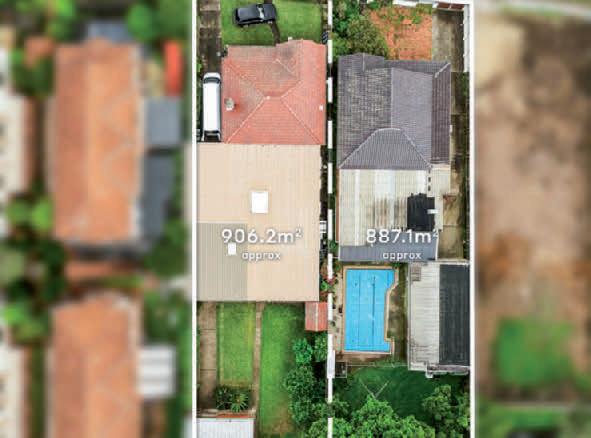

151 Wentworth Road, Strathfield Land FOR SALE

Price Guide $2,400,000 View Saturday 3.45pm - 4.00pm

Agent Michael Murphy 0486 123 888

Carlos Ouyang 0451 866 668

McGrath Estate Agents Strathfield & Concord

44 The Boulevarde, Strathfield NSW 2135

T 02 9457 9339

W mcgrath.com.au