The Berkshire Innovation Center is planning a 7,000-square-foot expansion to house a new advanced optics manufacturing lab. Page 3

The Berkshire Innovation Center is planning a 7,000-square-foot expansion to house a new advanced optics manufacturing lab. Page 3

TARA MONASTESSE

Oldcastle Lawn & Garden was recently named a 2025 Mass Save Climate Leader for its commitment to sustainability, reducing emissions and lowering its energy consumption. “You don’t see a lot of environmental awards in a rock quarry,” said Brett Larmon, Oldcastle’s vice president of northeast operations, above.

BY TARA MONASTESSE

The Berkshire Eagle

LEE — Oldcastle Lawn & Garden is one of the area’s largest employers, but most local residents are only dimly aware of the fact that 150,000 tons of limestone are being harvested annually from a quarry in their neighborhood.

Until they feel a tiny shake.

About every four to six weeks, semiliquid explosives are used to blast away sections of rock at the Lee limestone quarry, fittingly located off of Marble Street. The harvested material will soon be washed, packaged and shipped from

the site, becoming the gravel and decorative stone lining the lawns and gardens of homes all over the country.

But the company isn’t just making the world more beautiful. It’s saving it, too.

The Oldcastle Lawn & Garden location in Lee — often mistakenly referred to by its old name, Oldcastle Stone Products — was recently named a 2025 Mass Save Climate Leader for its commitment to sustainability, reducing emis-

The white limestone is coveted for its decorative value, while other shades can be used for garden and soil products.

sions and lowering its energy consumption.

“You don’t see a lot of environmental awards in a rock quarry,” said Brett Larmon, Oldcastle Lawn & Garden’s vice president of northeast operations. But through a partnership with Berkshire Gas — as well as “hours of doing spreadsheets and doing numbers,” he said — the company last year reduced the rate of dekatherms (units of natural gas) used to produce each ton of stone pellets

by an estimated 25 to 30 percent.

Oldcastle Lawn & Garden — owned by CRH Americas, which is headquartered in Dublin — is now strategizing to further reduce its consumption of diesel fuels and other resources. Jonathan Pennell, site manager, said he’s gathering data from the company’s utility bills to identify areas where the site can cut down on energy usage.

Company leaders accepted the award in Boston on Oct. 15 at the Massachusetts Statehouse, a building ironically made mostly of granite. But many other historic buildings throughout the state — and

quarry FROM PAGE 1

even the country — incorporate limestone harvested from the Lee quarry.

The Lee Lime Corp., founded in 1877, formerly oversaw the quarry and specialized in dimensional stone: larger cuts used for bigger projects such as headstones and buildings. Stone harvested by Lee Lime has cropped up in historical locations throughout the country over the years, according to Pennell, including the U.S. Capitol building, headstones at Gettysburg National Cemetery and even parts of the Washington Monument. At the local level, limestone harvested from the quarry can be found in libraries, town halls and churches throughout Berkshire County.

Oldcastle Lawn & Garden today specializes in products that use smaller pieces of limestone and rock, including pond stones, decorative gravel and limestone pellets used to line gardens for better plant growth. They can be found in the garden sections of major retailers like Lowe’s and Home Depot under a variety of brand names, including KolorScape and Soil Doctor.

Despite the new name and product lines, history still lurks among the quarry’s strata. The site sometimes turns up relics from the 19th century during routine excavations, including a partially finished headstone that workers recently discovered.

Larmon said he grew up in Lee only a mile away from the quarry, but remained unaware of the full scale of its operations like many others in the area. As a youth, his only experience with the property was getting chased off for riding his dirtbike on the premises. He never imagined he’d end up overseeing the site and its stone production one day.

But now, Larmon said, “I love the rock business.” He cited its reliable nature as the main factor.

“A ton is a ton is a ton,” he said, “It doesn’t change… It makes sense in my brain.”

Now, the company hopes to make more residents aware of its history and contri-

butions to the local economy by participating in Founders Day and other nearby events. “We’re doing a lot more outreach than we ever have before,” Larmon said.

After joining as an environmental health and safety manager in 2019, Larmon climbed the ranks at the company and now oversees 13 Oldcastle Lawn & Garden sites along the East Coast. The Lee property, his “home base,” stretches across 185 acres, with the quarry taking up 50 of those.

The quarry itself appears as a deep crater in the earth, with the layers of limestone in its walls forming a gradient

between pure white and smoky gray. The white limestone is coveted for its decorative value, while other shades can be used for garden and soil products. The spring water that wells up in the quarry is additionally repurposed to wash stones.

While the quarry will one day be emptied of all its limestone, Larmon estimates that it’ll take more than 50 years to get to that point. By the time it runs out, he joked, “we’ll be dead.”

Larmon added that the company also provides the pulverized limestone used to create white lines on athletic fields, which is donated to local schools for their sports

programs. He said that several Major League Baseball teams also use the company’s products for this purpose, but declined to state which ones.

The site is currently staffed by 45 workers, 34 of whom are union members. For Pennell, his favorite part of working with Oldcastle employees is their “radical candor” on the job.

“You can tell them exactly what you need,” he said. “These are really good guys.”

Tara Monastesse can be reached at tmonastesse@berkshireeagle.com.

By M aryjane Willia Ms

PITTSFIELD — One local company is growing, while another is planting roots for the first time, both with the help of city funding.

The Pittsfield City Council recently approved a combined $700,000 in economic development funding to support the expansion of two companies, Jain Americas and Pittsfield-based Elegant Stitches.

Jain Americas, a plastics manufacturer based in Chicopee, will receive $500,000 to support its move into a new 155,000-square-foot facility at 10 Conte Drive, off Dan Fox Drive.

That site, which has been vacant for more than two years, will triple the company’s manufacturing space.

The company, which specializes in PVC shingles, siding and trim, expects to invest over $8 million in the project. That includes buying the building, making upgrades, and adding equipment.

Jain Americas expects to close on the new property in early October, with renovations and the initial move of materials beginning shortly after closing, once the building is cleared.

“I know that this is half a million dollars, but you’re going to be infusing $8 million for the local economy. So it’s good bang for our buck,” Councilor Patrick Kavey said in support. “It’s creating 30 more jobs with potential of 100 more if you move the rest of your operations here.”

The funding will be released in phases: $250,000 when Jain Americas buys 10 Conte Drive and creates at least seven full-time jobs paying $35,000 or more; $150,000 after four additional jobs are added by the end of 2026; and the final $100,000 when four more jobs are added by the end of 2027.

In total, the company must create at least 15 jobs, though its president and CEO,

The Pittsfield City Council approved $700,000 in economic development funding to support the expansion of Pittsfield-based Elegant Stitches, owned by Alfred Enchill and his son Auric, pictured here in 2020, and the expansion of Jain Americas to a new facility in the city.

Narinder Gupta, said Jain plans to hire 31 employees over the next three years.

Jobs will start at $35,000 annually, with opportunities to advance, Gupta said.

“There is a need for lower salaries when we don’t have people with skills,” Councilor Earl Persip III said. “This is a company that, to me, sounds like they’re willing to give people the skills to make a livable wage where some companies won’t even consider you at that point.”

Jain Americas lnc. is a subsidiary of India-based Jain Irrigation Systems Ltd., one of the world’s largest manufacturers of drip irrigation systems.

Elegant Stitches, a Pittsfield business specializing in embroidery, screen printing and promotional products, will receive $200,000 to support its expansion into a new 11,500-square-foot facility at 17 Downing III, in Downing Industrial Park.

Founded in 1997 by Alfred Enchill, the

company has grown from a basement operation to a supplier for local and national clients. The expansion will allow Elegant Stitches to purchase new equipment, increase production capacity and add at least six new full-time jobs, averaging $60,000 in wages, to the current eight-person team.

The company plans to keep its 237 First St. location as a retail and display space, while moving all production operations to the new facility. It’s planning to have general contractors begin improving the new space next month.

“We’ve done a good job of catering to the Berkshires market. We want to double down on that, but then also expand out into Boston [and] Albany,” said Auric Enchill, the company’s head of business development.

Funding will be released in two phases: $100,000 once the property is purchased and three new jobs are documented, and another $100,000 if three more jobs are created by the end of 2027.

“This is one of those homegrown companies, let’s make that investment. This should be a slam dunk,” Persip said.

Both agreements include safeguards following lawsuits against previous recipients who failed to meet obligations. The funding, provided as 10-year forgivable loans, will be secured by promissory notes and mortgages on the properties.

Each year, the companies must submit reports to the city and allow audits of payroll, tax and financial records. If either company shuts down within 10 years, lets employment drop below nine workers for more than 18 months or files for bankruptcy, the remaining unforgiven funds must be immediately repaid to the city.

By M aryjane Willia M s

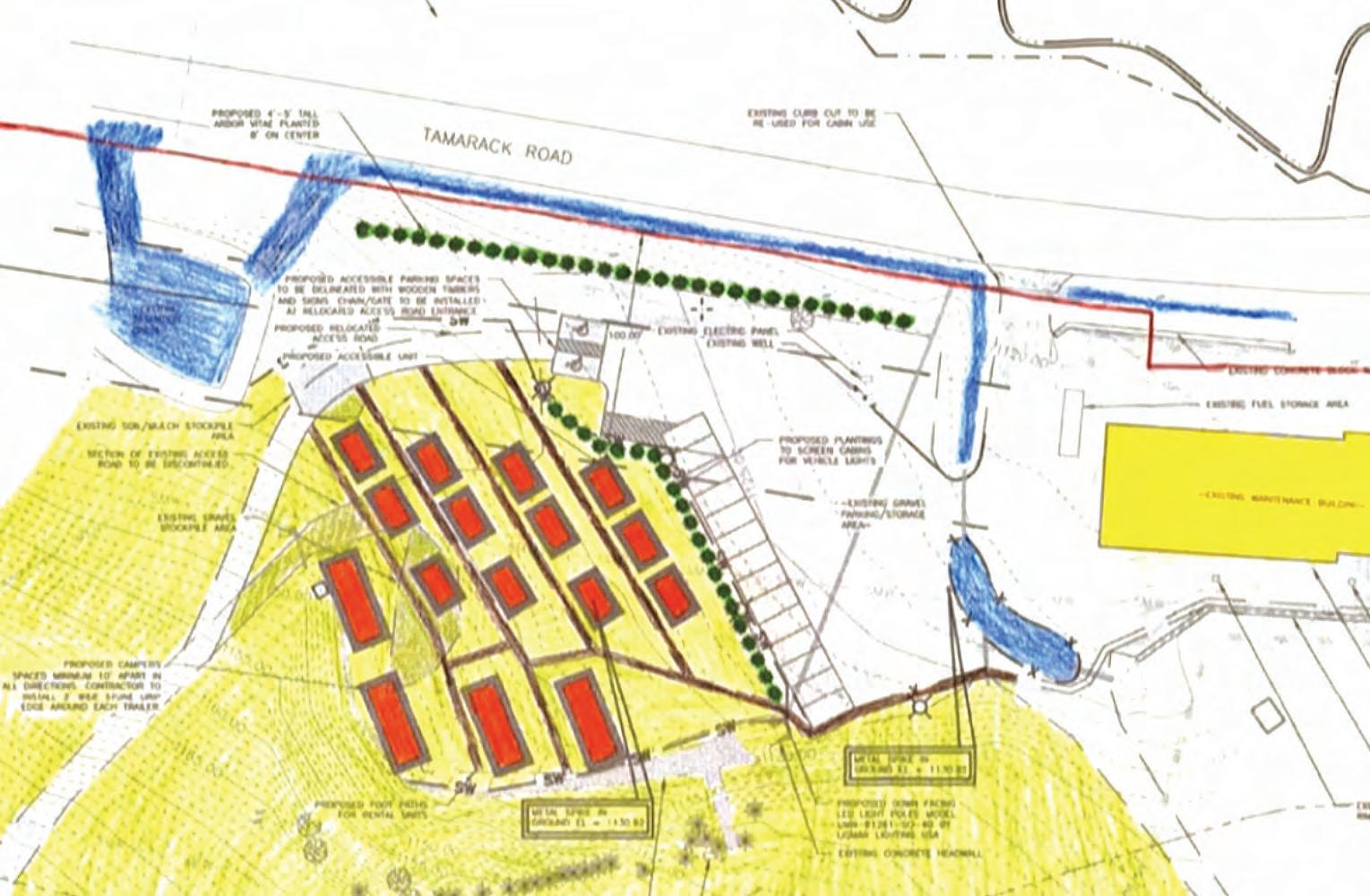

PITTSFIELD — Bousquet Mountain could soon offer year-round overnight lodging in the form of 16 “microcabins,” following the city’s approval of a new site plan for the project.

The Community Development Board voted 3–1 recently to approve plans submitted by Blue Chair Properties, which owns the ski area.

“The goal of the project is to provide a non-premises accommodation for overnight stay, really on a year-round basis,” said Brent White, a civil engineer with White Engineering, who presented the plans.

The cabins would be built on a gravel lot near the base of the ski area along Dan Fox Drive, an area currently used as a staging area for equipment. They will be manufactured by B&B Micro Manufacturing in Adams and managed by Bousquet. The plan calls for 12 one-bedroom and four two-bedroom cabins, all on wheels, available for short-term stays.

White said the project will be built in phases, beginning with three or four cabins as early as 2026 to test demand and operations before expanding further.

“We’re looking out several years before a further phase would be in the conversation,” added Tim Burke, CEO and managing director of Mill Town Capital, which owns and operates Bousquet Mountain.

Each cabin would connect to city water and sewer lines, use permeable gravel surfaces, and feature solar-powered downcast lighting that dims to 30 percent brightness after 11 p.m. and turns back on only when motion is detected.

To reduce visual impact, plans include a row of arborvitae trees along Tamarack Road to screen the project from nearby homes.

White said the team intends to preserve all mature trees on the site and improve stormwater drainage by installing stone drip edges and planting additional grass.

COURTESY OF WHITE ENGINEERING

The microcabins are planned in clusters of two to four, facing the Bousquet Sports building and stepping up the mountain slope.

site today.”

The cabins are planned in rows of two to four, facing the Bousquet Sports building and stepping up the slope of the mountain. Board members discussed whether the layout could be refined for a more natural appearance from Tamarack Road.

Each cabin would connect to city water and sewer lines, use permeable gravel surfaces, and feature solar-powered downcast lighting.

“Even though it’s an existing gravel parking lot we’re promoting any roof runoff directly back into the ground,” White said. “So ultimately, it’s our opinion that the net result of this product will improve storm water management conditions from those existing on

White said the design was shaped by existing site constraints — including a gas pipeline and access roads — but that the team is open to minor adjustments once construction begins.

Not everyone supported the plan.

Aaron Altshuler, who lives next to the proposed site, said he was in “complete objection,” citing concerns about traffic, lighting and environmental impact.

“What if that pilot program doesn’t

By Maryjane Williams

PITTSFIELD — Restaurants that currently serve beer and wine could soon be raising the bar — literally — after a new state law opened the door for them to upgrade to full liquor licenses.

The City Council recently voted to accept Massachusetts General Law Chapter 138, Section 12D allowing on-premises wine and malt beverages license holders to trade in their license for a nontransferable all alcoholic beverages license.

“I think this is going to be good for our businesses,” said Councilor Dina Lampiasi. “It allows more flexibility for them to kind of change the product that they’re providing and finding new ways to service the community, provide an experience that will call them back.”

Currently, Pittsfield is at its quota for wine and malt licenses, holding nine in total, and cannot issue additional ones unless a business closes or ceases operation.

Over four decades ago, Pittsfield turned down a one-time offer from the state to lift liquor license limits, a decision that now leaves the city unable to create any additional licenses, with none left to issue. The city is already over its population-based cap of 46

all-beverage liquor licenses.

The converted all-alcohol license cannot be sold, and if it is no longer used — if the business closes, for example — it reverts back to a wine and malt license, preserving the city’s license quota.

“It’s a benefit to the operator, and doesn’t harm the city,” said Licensing Board Chair Thomas Campoli.

Those looking to convert their licenses would have to submit an application for a change of license to the Licensing Board, per the state law.

However, the conversion is not without cost. Transitioning to an all-alcohol license would require businesses to pay an additional $530, bringing their annual fee to $1,175 versus $645 for just wine and malt.

The initial application for the wine and malt license is the same as the all-alcohol license, Campoli noted; the only difference is the cost.

“It would be my hope now that all nine wine and malt holders go for the all alcoholic license to give people more choice,” said Licensing Board member Jon Lifvergren. “I would be more apt to go somewhere that serves liquor than just beer or wine.”

work?” he asked. “How do you clean up the landscape?”

Board members acknowledged those concerns but noted that their role was limited to site plan review. The Zoning Board of Appeals will take up the required special permit for the project.

The board approved the plan with several conditions, including that all site improvements be completed before any cabins are installed and that all lighting remain downcast and shielded from neighboring properties.

Community Development Board member Matthew Herzberg cast the lone vote against the project due to the site arrangement and potential impact on neighbors.

771SouthChurchSt| NorthAdams,MA bfair.org HelpUsBuildtheFuture:OurFirstSmartHome

Thisyear,yourgifttotheHeartofBFAIRCampaignwillhelp bringassistivetechnologytolifeinournewresidentialhome— ourfirst-everSMARThome.

Thishomewillbemorethanjust aroofoversomeone’shead. Withcutting-edgeaccessibilitytechnology—suchasvoiceactivatedlighting,smartappliances,andadaptivedevices— residentswillgaingreaterindependence,safety,anddignityin theireverydaylives.

Forindividualswhohavelongbeentoldwhattheycannotdo, thishomewillrepresentpossibility,empowerment,anda futurefilledwithchoice.

LENOX

1Berkshire names winners of Trendsetter Awards

1Berkshire honored the Norman Rockwell Museum and presented the 2025 Berkshire Trendsetter Awards at its signature Celebrate the Berkshires event on Sept. 18 at the Linde Center at Tanglewood. Over 225 people attended.

The Trendsetter Awards recognize businesses, organizations and individuals whose outstanding achievements and commitment have strengthened the economy and helped the Berkshires grow.

The categories and their winners follow:

Driving Visitor Engagement: Mahaiwe Performing Arts Center.

Visionary of the Year: Kristy Edmunds, director, Mass MoCA.

The Nonprofit Collaborator: Zion Lutheran Church.

Under 40 Change-Maker: Brett Random

The Breaking the Mold: Roots & Dreams and Mustard Seeds.

Advancing the Berkshire Economy: Electro Magnetic Applications Inc.

Closing out the evening, the Norman Rockwell Museum was recognized as the special honoree for Putting the Berkshires on the Map in recognition of its strong foothold in the Berkshire tourism and creative economy clusters.

PITTSFIELD

1Berkshire welcomes Youth Leadership class

1Berkshire has selected 31 high school juniors from across the Berkshires to serve as its 14th Youth Leadership Program class.

The students were selected through a competitive application process to begin a year-long leadership development program that kicked off in late May with a three-day, two-night retreat held at Camp Becket.

The 1Berkshire Youth Leadership Program is focused on helping students develop and grow through career opportunity awareness, leadership skill development, and the design and completion of a nine-month-long collective-impact project focused on the betterment of the Berkshires.

The 2025-26 participants include Clara Janis and Sage Winkler of BART Charter Public School; Marlie Auger and Danielle Cramer of Drury High School; Olivia Silvernail of Hoosac Valley High School; Leanna Driscoll, Anna Oliva, Alanmichael Victor of Lee Middle and High School; Charlotte Culver, Greta Mathews, Brooklyn Rodriguez, and Ethan Senzel of Lenox Memorial Middle and High School; and Anna MacPherson of McCann Technical School.

Also, Shiloh Bennet of Monument Mountain Regional High School; Sunny Cart, Haydn Derby, Sara Ehle, Robyn Gregg, Sabine Guerra, Cecelia Keogh, and Gabriella Nicastro of Mount Greylock Regional High School; Reese Cook-Dubin, Armando Coreas, Benjamin Glockner, Elizabeth Klepetar, Abe Vengalil, and Gloria Williams of Pittsfield High School; Zachary Berry of Taconic High School; and Sadie Cullen, Lucy Grant and Grace Radzick of Wahconah Regional High School.

NORTH ADAMS

MCLA sets info sessions for spring M.Ed. program

Massachusetts College of Liberal Arts is accepting applications for the spring 2026 semester for its Master of Education program, a flexible and affordable graduate degree designed for working educators across Massachusetts, New York and Vermont. Information sessions will be held at 6 p.m. Thursday, Nov. 20; and 6 p.m. Wednesday, Dec. 10.

The online programs include M.Ed. with initial licensure, professional teacher licensure with M.Ed., M.Ed. with individualized plan of study

non-licensure, and accelerated 4+1 bachelor’s degree with M.Ed.

MCLA is a fully approved educator prep program through the Massachusetts Department of Elementary and Secondary Education for Initial Licensure in early childhood, elementary, middle school, secondary education, and moderate disabilities.

Applications for the Spring 2026 semester are due by Dec. 1 for priority consideration. To learn more and register for an information session, visit tinyurl.com/2p8c3c5.

LEE

The Lee Bank Foundation has awarded $73,500 in its third grant cycle of 2025 to support 11 Berkshire-based nonprofit organizations, continuing its mission to invest in programs that strengthen the local community.

Grant awards ranged from $1,000 to $25,000 and will help fund initiatives addressing key community needs.

The grant recipients include Becket Arts Center, Berkshire Community Action Council, Berkshire United Way, Childcare of the Berkshires, Community Access to the Arts, Community Development Corporation of South Berkshire, Goodwill, Kripalu, Pediatric Development Center, ServiceNet (The First), and W.E.B. Du Bois Center for Freedom & Democracy.

Nonprofit organizations interested in applying for the next round of funding, due by Dec. 1, can find application details in the Community Impact section of leebank.com.

GREAT BARRINGTON

The board of directors of Construct, the leading nonprofit housing organization in the South Berkshires, has announced a national search for the organization’s next executive director.

After the recent announcement of Jane Ralph’s decision to step down as executive director, Construct’s board of directors retained Peter Gray Executive Search to conduct a national search. The position is now posted and accepting applications. The board’s goal is to fill the position by February 2026.

Construct is seeking an executive director who is passionate about its mission and can lead the organization with excellence. The executive director is responsible for overseeing all aspects of Construct’s operations, including fundraising, program development, financial management, and staff supervision.

To learn more about the position or to apply, visit petergraysearch.com/ executive-director-construct.

PITTSFIELD

Bob Chapman of the financial services firm Edward Jones recently earned the firm’s A.F. McKenzie Achievement Award for his exceptional achievement in building client relationships.

Chapman, who works in the firm’s Pittsfield office, was one of only 1,461 Edward Jones financial advisers to receive the award.

The award is named for Al McKenzie who developed the firm’s training program, which has helped train generations of financial advisers to do what was right for clients. He served for nearly 60 years as a financial adviser, actively contributing to the well-being of his clients, colleagues and community.

Edward Jones is a North American financial services firm with more than 20,000 financial advisers.

PITTSFIELD

BMC earns four stars for quality from CMS

Berkshire Health Systems has announced that Berkshire Medical Center has been given a 4-star rating for overall quality by the Centers for Medicare & Medicaid, based on how the hospital has performed across several areas of quality.

The overall star rating is based on how well a hospital performs across different areas of quality, such as treating heart attacks and pneumonia, readmission rates, and safety of care. BMC scored at or above the national average on mortality, safety of care and readmission rates, and performed well in patient experience and timely and effective care.

To learn more, visit the CMS Hospital Compare website, tinyurl.com/ nndast76.

STOCKBRIDGE

Kripalu center reopens local membership deal

Kripalu Center for Yoga & Health is reopening its Neighbors Membership, a program designed exclusively for Berkshire locals to enjoy Kripalu in a more sustainable and accessible way.

Members gain year-round access to Kripalu’s campus through flexible weekday yoga classes, expanded access to wellness amenities, and exclusive savings on programs and dining.

Enrollment is now open, with limited spots available. The annual membership costs $1,490.

To learn more or join, visit kripalu. org/neighbors.

DALTON

LP Adams, owner earn regional industry award

LP Adams Co. and its owner, Wayne Walton, have been named the 2025 Legends of the Industry by the Home Builders & Remodelers Association of Western Massachusetts.

Celebrating 125 years in business, LP Adams is the oldest continuously operating retail business in Dalton. Under Walton’s fourth-generation leadership, the company remains a trusted source for quality building materials and exceptional service across Berkshire County.

For more than five decades, Walton has been active in the building community — helping to establish the Berkshire County Builders Association, serving multiple terms as president and supporting countless local causes, from schools and veterans’ programs to the traveling Vietnam Veterans War Memorial.

Walton and LP Adams Co. will be honored at the HBRAMA Installation Banquet on Nov. 20, at the Charter Oak Country Club in Hudson.

PITTSFIELD

BCArc names board, honorees at meeting

Berkshire County Arc elected its board of directors and presented its Employee of the Year award, selected from more than 800 employees during its annual meeting recently at the Country Club of Pittsfield.

Board Chair Michael Ferry and President and CEO Maryann Hyatt presided over the Sept. 18 meeting. State Rep. Tricia Farley-Bouvier, D-Pittsfield, delivered the keynote speech.

Shiwen “Wendy” Kanel was awarded Employee of the Year. Kanel has worked the same shift for 14 years at a house supporting a group of ladies each with a brain injury, where she arranges all their medical appointments, transports them, advocates for them, tracks their progress, and follows-up for each of them.

Blue Q received Employer of the Year. Blue Q has been working with BCArc for more than 30 years, currently employing 10 individuals through BCArc.

The Notch Insurance was awarded Innovative Business Partner of the Year. Awards were also presented to individuals with disabilities supported by

BCArc. Gus Gundlach and Bruce Stiles received work achievement awards; Jill Reed and Cesar Martinez, personal achievement awards; and Katherine Butler and Rosemarie Tessier, community achievement awards.

Staff awards were presented to Nicole Negri, the Carol Craighead Mission Award, and Sharon Johnson, the Debra Jarck Advocacy Award.

BCArc provides a range of services to 1,000-plus individuals with intellectual and developmental disabilities and brain injuries throughout Berkshire County and the Pioneer Valley.

PITTSFIELD

BCC board of trustees adds 2 new members

Berkshire Community College has announced the election of two new members to its board of trustees.

Julie Fallon Hughes, of Dalton, is president and chief executive officer of Adams Community Bank. With over 25 years of experience in the banking industry, Hughes has held senior leadership positions at several major financial institutions.

In addition to her professional accomplishments, Hughes is also active in community organizations focused on education, child advocacy and regional development.

Victor X. Reyesthey/them of Pittsfield, a liberal arts student at Berkshire Community College, serves as a student trustee, parliamentarian and student leader within the Student Government Association.

Reyes is involved in volunteer and advocacy work, including environmental initiatives and community service projects, and has held various leadership and customer service roles.

The board is composed of area residents appointed by the governor of Massachusetts.

Afreemonthlypublicationby TheBerkshireEagle 75SouthChurchStreet, Pittsfield,MA01201

Visitberkshirebusinessjournal.comfor advertisinginformationandtosubscribe.

NEWSDEPARTMENT 413-447-7311 news@berkshireeagle.com

ADVERTISINGDEPARTMENT AMYFILIAULT,AdvertisingManager 413-496-6322 afiliault@berkshireeagle.com

CHERYLGAJEWSKI,Directorof AdvertisingSales 413-841-6789,413-496-6330 cmcclusky@berkshireeagle.com

ShareyournewswiththeBerkshire BusinessJournal. Ifyouhaveacompany promotion,anewbusinessoranewventure,let theBerkshiresknowaboutit.Rememberthe 5Wsandthatbrieferisbetter.Emailtextand photostoBBJ@newenglandnewspapers.com. ProvideyourexpertiseintheBerkshire BusinessJournal. Doyouhavetheanswer toapersistentquestionaboutbusiness andtheBerkshires?Doyouhaveideasand suggestionsonhowourbusinesscommunity cangrow?Ifyouhaveacommenttomake aboutdoingbusinessintheBerkshiresor ifyou’relookingtoraiseanissuewiththe businesscommunity,thisisthevenuefor that.Wewelcomelettersupto300wordsand commentaryupto600words.Sendtheseto BBJ@newenglandnewspapers.com

BerkshireBusinessJournalispublished monthlybyNewEnglandNewspapersInc., 75S.ChurchSt.,Pittsfield,MA01201. PeriodicalspostagepaidatPittsfield,MA01201. BerkshireBusinessJournalisdeliveredfree tobusinessesinBerkshireCountyviathird classmail.Additionaldistributionismade viadrop-offatselectareanewsstands.The publisherreservestherighttoedit,rejector cancelanyadvertisementatanytime.Only publicationofanadvertisementshallconstitute finalacceptanceofanadvertiser’sorder.All contentsarecopyrightedbyNewEngland NewspapersInc.

By M aryjane Willia Ms

PITTSFIELD — A new independent bookstore has joined the city’s downtown business community.

Indie Readery & Records, at 314 North St., opened its doors last month, offering not only new and used books, records and gifts, but also a vision of community and inclusion.

“We want people to come in and feel represented,” said co-owner Laurie Lenski. “And feel like this is a safe space and cozy, [where] they can be whoever they are when they come in.”

Coming from a family of book lovers, Emma Lenski, Laurie’s spouse and co-owner, always wanted to open a bookstore. So, when Laurie decided she wanted to phase out of construction work and pursue a new business, they decided to bring that vision to life while filling a gap in the local market.

“There’s no bookstores in Pittsfield specifically, besides Barnes & Noble, [so] we figured this was a good spot for a local indie bookstore,” Emma said. “There’s been a lot of new stores opening on North Street, and everyone’s trying to revitalize it. There’s a lot more people walking around and shopping on North Street, and so it’s exciting to become a part of that.”

Like the couple, social justice is at the heart of the store.

“We’ve both been involved with Berkshire Pride,” said Emma, who serves as the organization’s director of education and outreach. “It’s really important to us to bring that into this work as well, and just continue to advocate for marginalized people of all types.”

That mission is reflected throughout the store, which features a dedicated social justice section, along with shelves highlighting Berkshire authors, poetry, art, nonfiction, fiction, children’s, young adult and LGBTQ titles — plus gift items that align with their message of inclusion and advocacy.

Events like drag story hours, book clubs in partnership with Hot Plate, and collaborations with Berkshire Pride and local businesses already are in the works.

“We’re really trying to work with local businesses and organizations and collaborate as much as we can,” Emma said.

Beyond books and vinyl, there’s a gift section with games, candles, tarot cards, and more, plus an eco-friendly refillary stocked in collaboration with the Plant Connector, where customers can fill up on self- and home-care products.

While some downtown business owners have voiced concerns about sanitation and the unhoused community, Emma said they’re not deterred.

“They’re our neighbors,” Emma said.

“They can come in, they can look around.”

The store, which secured a grant from the Pittsfield Economic Revitalization

Corporation, will be hiring at least two part-time employees within the next year, Emma said, per the terms of receiving the funds.

Along with business consultation from the city, Emma and Laurie said the community response has been very positive and supportive.

“We made a Facebook and Instagram almost immediately after signing for the space, and there was already a lot of like traction on there for a while, and then we just kept trying to build the excitement,” Emma said. “It seems like there’s a lot of conversation online about excitement for a bookstore on North Street — or just another store on North Street.”

Laurie, a Berkshire County native, and Emma, an MCLA alumn, hope their labor of love will become a community staple.

“I really just want everybody to come in here and find themselves in something,” Laurie said.

“I’m looking forward to seeing people come in, get excited about being in a bookstore, and then tell their friends, and then come back,” Emma added. “I’m just excited to see it. … It feels really surreal.”

By Talia lissauer

GREAT BARRINGTON — A week after Darryl and Anne Peck opened Lakeville Books and Stationery in Lakeville, Conn., a customer asked them if they had heard that The Bookloft in Great Barrington was closing.

“My first thought was, ‘Oh please don’t tell me this right now, we just spent a year getting this store going,’” Darryl remembered. “My second thought was, ‘Well, Great Barrington cannot be without a bookstore,’ so I knew that we were going to have to do something.”

The Bookloft, one of South County’s oldest independent bookstores, opened 51 years ago and moved to its State Road location in 2020. It was founded by Eric and Evelyn Wilska, who owned it for 42 years until they sold it to Pamela Pescosolido in 2016. Pescosolido later sold it to Giovanni Boivin in 2022.

The Bookloft closed in July under Boivin after a long strug-

gle that included a “drastic dip” in sales and a GoFundMe that unsuccessfully tried to raise $100,000.

Since it was announced that the building was being put up for sale in April, the Pecks explored ways to save The Bookloft. Ultimately, they found that the project would turn out to be a lot more complicated and time-consuming than the couple, who have decades of experience in retail, thought it would be.

So they decided to let The Bookloft’s bankruptcy process play out before taking over the space.

The Pecks are now busy unpacking 20,000 items and transforming what was once The Bookloft into Lakeville Books and Stationery, which was set to open Nov. 7. It will be full of new merchandise, including books, cards, stationery and pens.

“It should be chock full of exciting brand new stuff when we

open,” Darryl said.

Darryl said they’ve been talking with Eric Wilska and

would like to “pick up where he left off when he sold it” in 2016.

“The Bookloft was struggling

the last couple of years. We get that,” Darryl said. “We’ve heard that from everyone, and I just want everyone to know that this is not The Bookloft, it’s Lakeville Books and I hope people give us a chance to prove to them that it can be done properly.”

This will be the couple’s third bookstore they’ve owned. They opened their first store in 2019 in Georgia, followed by Lakeville Books and Stationery, which opened in April. The Great Barrington shop will be the second Lakeville Books location.

The Georgia store was “very successful,” and they recently sold it so they can focus on their New England stores.

Darryl has been visiting South County since he was a kid in New York and had friends in Stockbridge. Now, he lives about a half hour away in northwest Connecticut, but is a very frequent visitor to the town for meals, shopping and even movies, he said.

BY M ARYJANE WILLIAMS

PITTSFIELD — Ever since she was a kid, Rachel Schwartz wanted a Victorian dollhouse.

Now, she has her own life-sized version, where everyone is welcome.

At 109 Wendell Ave., Schwartz has opened The Dollhaus, a colorful “bed and brunch” where LGBTQ+ people and allies can stay in rooms inspired by famous drag queens, surrounded by glitter, art and affirmation. But beyond its décor, her mission is clear: to create a safe, joyful place for queer travelers in the Berkshires.

“I’m creating a fun place, but also a safe space for queer travelers, [which] is really important especially in the current political climate,” Schwartz said. “I’ve had people live here who say this is the first time they’ve lived somewhere where they feel like who they are is not just tolerated, but celebrated.”

As a queer woman who’s traveled widely, Schwartz said she understands how hard it can be to find inclusive spaces on the road.

“It can be a dangerous and scary world out there, and it’s really important to have places where you feel safe, especially if you’re on vacation,” she said. “You want to relax, you want to have fun, you don’t want anybody looking at you or one of your family members.”

The 1888 Queen Anne Victorian is a tribute to drag culture and self-expression. Schwartz said drag queens often call themselves “the dolls,” a theme that inspired the home’s name — and each of its 10 rooms.

A blue, ocean-themed room honors self-proclaimed mermaid Adore Delano. Another, blanketed in red rose petals, nods to Sasha Velour’s iconic “RuPaul’s Drag Race” performance. And a pink, Barbie-esque suite celebrates Trixie Mattel, complete with a wink to her friend Katya Zamolodchikova’s darker alter ego.

“The idea is to make the rooms beautiful for anyone, but then if you know the queen that it’s inspired by, it makes it extra special,” she said.

The house currently offers three rooms for short-term rentals, while others are reserved for long-term ten-

ants — including visiting artists and performers. Schwartz said she envisions the house full of “young, creative queer people,” such as the members of Barrington Stage Company who rented several rooms during their summer season.

Schwartz purchased the property in November 2023 for $470,000. After years working in entertainment production, she said transforming the home herself — from painting to decorating — became a personal creative release.

“I spent a lot of my working life in gray and beige … it was a very toxic place … so this is like a gift to myself, I get to live a simpler life here,” Schwartz said. “It’s been this really freeing, really fun, creative exercise.”

She hopes to secure funding to paint the home’s exterior in pastel tones and install an ADA-compliant sprinkler system, which would allow her to operate as a full inn. However, the system costs hundreds of thousands of dollars. Since relocating from California, Schwartz said she’s been “embraced” by the Pittsfield community.

She’s received grants from the Massachusetts LGBT Chamber of Commerce and the Pittsfield Economic Revitalization Corp. and joined the Entrepreneurship for All program, where she was mentored by Robin Helfand, former owner of Robin’s Candy in Great Barrington, where Schwartz works during the day.

“I found such an amazing community here, and the support that I’ve gotten has really made me go back and double down on my investment in the community,” Schwartz said. “It’s made my business plan maybe take a little bit longer, but I think it’s worth it, because I’m not singularly focused on profit.”

The Dollhaus has already hosted drag story hours and LGBTQ+ business mixers, and Schwartz plans to expand into workshops, community gatherings and live performances.

Schwartz hopes to add a new dimension to the Berkshires’ vibrant culture of creativity, music and art.

“What we don’t have a lot of is silliness, or if it’s here, it’s just not as visible,” she said. “So I do think that there’s a niche that I can fill.”

Her long-term vision includes making the property ADA-compliant, cre-

ating affordable accommodations for long-term tenants and hikers and establishing the Dollhaus as a regional landmark for queer culture.

“I really want this to be a place where creativity and queerness are celebrated,” Schwartz said. “Not just for queer people, but for allies too.”

By C larenCe Fanto

LENOX — After 43 years as owner of Nejaime’s Wine Cellars, the family enterprise opened by his parents in Stockbridge in 1970, Joe Nejaime, 67, is selling the business.

But it’ll stay in the family.

By the end of this year, he’s selling it to his daughter Lily Nejaime, 29, who will take over the business’s Lenox and Stockbridge locations. To ensure a seamless transition, Joe will help his daughter as a close adviser and consultant.

Lily graduated from Lenox Memorial Middle and High School and UMass-Amherst Isenberg School of Management in 2014 and 2018 respectively.

She has been full-time manager of the Lenox store for the past three years, while Jim Wallace oversees the Stockbridge location on Elm Street. From 2018 to 2022, she worked in Boston as an assistant front-office manager at the Godfrey Hotel.

“She came back with a bank of knowledge and experience, I would see it,” Joe said. “I didn’t teach it to her, she learned it on her own. I may have taught her what not to do.”

While “Lily has decided to acquire the Lenox and Stockbridge businesses,” Joe said, he’s not retiring — just stepping back.

“I’m going to work for her in a supporting role, with a reduced schedule to fill in or troubleshoot, because I love doing it,” he said. “It kind of works out that way now, though we haven’t yet formalized anything.”

“Behind the scenes, I’ll have a lot more responsibility, liability,” Lily acknowledged. “But it won’t be too much of a noticeable change for our customers because I still do things the way he taught me. We’re not making some big, drastic change, but more constant little

After 45 years operating Neijame’s Wine Cellars in Lenox and Stockbridge, Joe Nejaime, 67, is selling the stores to his daughter, Lily, 29, by the end of this year when financial details are finalized. “I won’t be driving a hard bargain,” he said.

changes to evolve in the way our customers want.”

The financial details about the value of the corporation, Stockbridge Wine Cellar Inc., are being worked out with the help of an attorney and an accoun-

tant, and should be completed by the end of this year. Since the buyer is his daughter, Joe said he does not intend to drive a hard bargain.

The Nejaimes’ building in the Village Plaza complex at 68 Main St. is leased long

term from real estate investor Drew Davis. Father and daughter are on the same page, Joe said. “I think I can contribute, even though she has new ideas, a lot of energy, and great organizational skills

and management.”

“I do make a lot of the decisions,” Lily noted, “but I’m lucky enough to be able to discuss them with my dad. Why would I make an important decision without referring to his many years of experience?”

The changeover was inevitable, he said, since Lily Nejaime is “interested, willing and able to assume the reins and the responsibility, and buy me out.”

“It does feel natural,” Lily agreed, citing “progressive changes and preparations” made in both stores. She aims to emulate her father’s relationships in the community.

“At Nejaime’s, we celebrate wine not simply as a product, but as an experience,” she said. “It’s a journey through geography and time, and I’m proud to continue my family’s tradition of sharing that journey with others through curated selections and personal service.”

Joe Nejaime, a member of the Lenox Chamber of Commerce board of directors, served previously on the Lenox Finance Committee during two different stints for 24 years.

Cultivating conversation with many customers “adds so much enjoyment to the work,” he said. “The work is always evolving and adapting; you have to anticipate that people’s interests change and develop.”

Starting with a section devoted to cheese and then expanding to other food selections, gift baskets, stemware and accessories, and picnics to go, the store recently added a wide selection of “mocktails” and other non-alcoholic beverages that are in high demand.

The store also offers beverage service for weddings as well as other special events and parties.

The wine selection is curated — “we and members of our team hand-select and taste all of the wines we bring in,” Lily said. The store holds wine seminars at Chesterwood in the summer and at Ventfort Hall the rest of

the year, and it hosts wine dinners at several area restaurants such as Cafe Triskele in Lee and Old Inn on the Green in New Marlborough.

Lily is engaged to be married next September at Chesterwood to Conor Raftery, sales manager at the Pittsfield branch of Girardi Distributors.

“We’re grateful for the people who walk through our doors and the relationships we have with this community,” she said.

rich world of wine, not just as a business, but as a way of life. Wine has always been more than just a beverage to me. It is a living expression of history, culture and place.

“I’m going to work for her in a supporting role, with a reduced schedule to fill in or troubleshoot, because I love doing it.”

Joe NeJaime, owner of Nejaime’s Wine Cellars

“When people come in, it’s a great compliment,” Joe dded.

Lily describes her immersion “in the

“Every bottle tells a story of the land it came from, the hands that tended the vines, and the traditions passed down through generations,” she said. “What draws me most to wine is its ability to connect people. It brings us to the table, sparks conversation and invites us to savor the moment. Pairing beautifully with food, wine transforms meals into memories.”

The Nejaimes have been prominent local retailers in Lenox and Stockbridge since the 1960s, when family patriarch Nabih Nejaime, who died in January 2024, opened the Stockbridge Market on Main Street.

He had emigrated from Lebanon to Torrington in 1955 to work in the grocery business after meeting his wife, Marilyn, a native of the Connecticut town, during her visit to Beirut.

The couple had met at the American University of Beirut, where Nabih trained in hospitality and culinary arts. In 1964, they moved to Stockbridge, where they set up shop as proprietors of the town’s full-service grocery store, Nejaime’s Market.

In 1970, Nabih and Marilyn bought the Stockbridge Wine Cellar on Elm Street in Stockbridge, still operated today by Joe and Lily Nejaime. In the early 80s, Nabih Nejaime opened a Lebanese flatbread national distribution business, Nejaime’s Lavash.

Sons Joe and Jim opened a second wine shop in Lenox, starting on Franklin Street in 1982, then moving to Church Street before settling into the current location opposite the post office in the Village Center on Main Street in 1999, with a major expansion in 2012.

The project involved a new wing on the east side of the existing building, formerly Yetz Amoco before it became the Lemon Tree gift shop in the 1970s and Cheesecake Charlie’s for 22 years starting in 1984. The Nejaime’s expansion added 1,880 square feet to the existing 3,024-square-foot store.

The brothers had opened a third location north of downtown at the intersection of Pittsfield and Holmes roads in 1988, eventually renamed Spirited under Jim’s sole ownership in 2012 until he sold it to Vishal Patel and retired in August 2024.

BY M ARYJANE WILLIAMS

PITTSFIELD — As an early ‘90s kid, Robert Williams used to go to the arcade to hang out with his friends in the afternoons.

Now he’s hoping to bring that same sense of fun and safety for local kids to Pittsfield’s Tyler Street.

Williams is opening Tyler Street Arcade, a family-friendly game center at 214 Tyler St., in the former Fin and Feather building. After two years of renovations, the arcade opened its doors in October.

“It’s about giving kids something to do besides wandering around the street,” Williams said. “It has a lot to do with, you know, giving back to a neighborhood that doesn’t really get much.

So it’s nice for [kids] to see, ‘hey, someone’s interested in investing in us.’ That may change a mindset.”

The arcade will feature a mix of vintage and modern games, rotated regularly to keep things fresh. Williams sourced the machines from across New England, and the store owns them all.

“We pretty much got, like, the best of the different genres,” Williams said. “There’s fighting games … ‘Mortal Kombat,’ and ‘Street Fighter.’ Sports games we have ‘NBA Jam,’ ‘Big Buck Hunter’; driving games … ‘California Speed’ and and ‘Fast & Furious’; [and] redemption machines like ‘Cyclone’ and ‘Ball Drop.’”

Game tickets will be redeemable for prizes as big as an Xbox Series S.

The Licensing Board approved the arcade’s Family Center License earlier this week, and Williams said he’s waiting on a few final machines before officially opening in mid-October.

Hours will run 11 a.m. to 11 p.m., and Williams said he plans to hire 10 to 12 part-time employees.

The building itself was purchased in May 2023 for $115,000 by Krzysztof Properties LLC. The owner, who grew up in

The Tyler Street Arcade in Pittsfield opened last month with General Manager Robert Williams at the helm.

Pittsfield but prefers to remain anonymous, partnered with Williams to bring new life to the long-vacant property.

“He wanted to invest back in the city where he grew up,” Williams said about the owner. “So we were trying to think what would be a positive thing for the community, this neighborhood, because it’s very neglected.”

While the arcade is designed to be welcoming to people of all ages, Williams emphasized structure. School-aged kids won’t be allowed in during school hours

in accordance with state law, and he’s considering requiring anyone under 16 to be accompanied by an adult after 10 p.m.

“So instead of having that group of kids hanging out on the corner at 10 p.m., they could be here, where there’s adults, there’s no alcohol,” Williams said. “I’m pretty big [on] how to deal with those kind of kids … if you treat him with respect, they’ll treat you back with respect.”

But Williams made it clear that the arcade is for game lovers of all ages.

“It’s not just for kids,” he said, adding that they have darts and coin pushers. “It

brings back a lot of nostalgia for a lot of older people, too.”

Williams said the community response has been overwhelmingly positive. Neighbors regularly stop in to check on progress and ask when the arcade will open. One mom even brought him a plate of food while he was working late.

“Ever since we started working on here, the neighbors have been coming up,” Williams said. “About 10 [kids] ran over from across the street to help me bring the carpet in. I got three of them that are going to apply here.”

By C larenCe Fanto

LENOX — A landmark local restaurant, formerly the popular Trattoria il Vesuvio, has reopened under new owners as the town’s first Indian dining destination.

Sofia Christinat and her husband, Dev Khansali, who’s formerly of Delhi, India, offer “a blend of vibrant traditional flavors with the flair of creative contemporary cuisine.” Indra is the Hindu god of weather, specifically rain, thunder and lightning, and of war.

The menu is primarily Indian fusion cuisine, with several Korean and Mediterranean offerings.

“This will be a space where you want to come and have an experience, rather than eat quickly,” Christinat said last month, shortly before the opening. “There are a lot of influences from other parts of the world on the menu, but it’s 80 to 90 percent Indian food.”

Menu highlights for the 100-seat restaurant include a wide variety of appetizers and skewered meats from the tandoori oven, such as chicken kebabs with a smoky flavor, a chicken or paneer (vegetarian) tikka sandwich, mango prawn curry, and saag, vindaloo, tikka masala and other traditional plates with several naan options. There will be specials, revised weekly.

“Pricing is on par for most of Lenox, kind of mid-level, with excellent hospitality,” Christinat said. “We’re hoping to get a lot of repeat business.” Appetizers range from $12 to $18, while entrees are priced from $22 to $30, with a top of $40 (for lobster). Vegetarian and gluten-free options are plentiful.

She expects her clientele to be split 50-50 between locals and visitors or second-home owners.

Khansali has been senior sous-chef at 1894, the high-end French fine-dining restaurant in the Wyndhurst Manor at the Miraval Berkshires Resort and Spa off Lee Road (Route 20).

Christinat was a barista and manager at Wander, the Pittsfield cafe at 34 Depot St. and has worked at Pizzeria Boema and Chocolate Springs in Lenox during the six years she and her husband have lived in the Berkshires. A native of Canaan, Conn., she started as a teacher at the Montessori School of the Berkshires in Lenox Dale.

sali noted. “With Indian food, there are so many things people haven’t tried, because the first thing that comes to mind is spicy, and this is not true. It can be well-seasoned, but mild.”

What: Indra Indian fusion cuisine

Where: 242 Pittsfield Road (Route 7/20), Lenox (former Trattoria il Vesuvio).

When: Open for dinner, 4 to 9 p.m., daily except Thursdays.

Menu: Traditional Indian plates with contemporary flair, as well as several Korean and Mediterranean offerings.

Prices: Appetizers, $12-$18; Main courses, mostly $20-$30 ($40 for specials such as lobster).

Reservations: Accepted online or by phone (phone only for 10 or more); walk-ins welcome.

Information: 413-551-7033.

“We’re a team, a partnership, and we’ve been waiting for the right space to become available,” Christinat said, adding that they had been eying the former Trattoria il Vesuvio location since it closed. The couple lives next door, literally, at the Lennox Heights condominiums. They have hired a staff of 10 to 15 employees, several full time and the rest part time.

“I’ve worked in many different restaurant, Italian, French and Asian,” Khan-

The self-financed couple has a fouryear lease for the site at 242 Pittsfield Road (Route 7/20) from property owners Qi X. Chen and Qiao Y. “Jenny” Chen, who purchased the location from Dina Perkins and Ester Arace Coppola of Lenox last February for $550,000, according to the Central Berkshire Registry of Deeds. Trattoria il Vesuvio closed in September 2023, after 28 years in business “with heavy hearts, after an amazing journey,” family operator Ester Arace Rino Coppola said at the time. The property had been on and off the market for several years because of staff departures and shortages, as well as rising costs.

Until a liquor license is secured from the town and the state’s Alcoholic Beverages Control Commission, Indra will offer an extensive list of craft “mocktails” infused with Indian spices, house-made syrups, mango lassi and house-made Chai, Christinat said.

“Our mission is to add a bold and contemporary voice with classic and reimagined Indian dishes, including tandoori-grilled meats and aromatic curries, along with inventive appetizers and vegetarian specialties,” they said.

Offering dine-in and takeout, the restau-

rant will be open for dinner only, daily except Thursdays from 4 to 9 p.m. Eventually, the plan is to operate seven days. “We didn’t want to close on Sunday, Monday or Tuesday because so many other restaurants are closed on one of those days,” Christinat said.

When we talk about the Berkshire Innovation Center’s motto — ”Do More Together” — we often mean collaboration between institutions, companies and educators. The truth is, there are certain individuals that embody that spirit all on their own.

One such person is Rich Peters — a former long-haul truck driver turned chief scientist, now retired but busier than ever. Today, he’s one of our most dedicated instructors, teaching in both the BIC Manufacturing Academy’s STAT Program and the MIT Tech AMP (Technologist Advanced Manufacturing Program).

His journey from the Catskills to the cab of an 18-wheeler to the lab bench and now the classroom is, in many ways, the story of what the BIC is all about: curiosity, community, and the power of lifelong learning.

Rich grew up in the foothills of the Catskills, the youngest of four in a family where everyone worked with their hands. His mother drove a school bus, his father drove an oil truck, and “education wasn’t really emphasized,” he recalls. He left high school early, got a job moving tractor-trailers around a truck yard, and by 21 was driving his own rig cross-country.

Over four and a half years, he logged 650,000 miles hauling freight coast to coast. He loved the solitude of the open road and the sense of accomplishment that came with keeping his rig running and his business afloat. But somewhere between deliveries, a different kind of spark caught his attention.

“I had a little black-and-white TV in my sleeper cab,” he said recently on our “My Story Vault” podcast with Dennis Rebelo. “One night I caught Cosmos on PBS. Carl Sagan completely blew my mind.”

The series awakened something in him — a fascination with science, perspective and possibility. Soon after, while delivering desks to Miami University of Ohio, he found himself wandering that red-brick campus and feeling, as he put it, “smarter just standing there.” It was the beginning of an unexpected transformation.

STARTING OVER

When engine trouble finally forced him off the road, Rich decided to rebuild something else — his education. He enrolled at Berkshire Community College, took an aptitude test, and discovered he was performing at a thirdgrade math level.

Rather than discouraging him, it ignited his determination. He powered through self-paced math courses, earned straight A’s, transferred to Hudson Valley Community College, and eventually landed a scholarship to Rensselaer Polytechnic Institute (RPI), where he earned his engineering degree.

“I realized I was a lifelong learner,” he said. “I just didn’t know it yet.”

ENGINEERING NIRVANA

That drive carried him into a long career at SABIC, formerly GE Plastics, at the Polymer Process Development Center in Pittsfield. There he helped pioneer high-performance thermoplastics and composite materials used in aerospace and automotive industries — innovations that made products stronger, lighter and more recyclable.

Rich called it his “engineering playground — really, engineering nirvana.” His work turned complex chemistry into practical, scalable solutions. And though he eventually rose to the rank of chief scientist, he never lost the humility of a man who once changed oil in truck stops across America.

He retired from SABIC a few years ago, but as he likes to admit, “I’m really bad at retirement.”

BACK TO THE LAB — THIS TIME AS A TEACHER

Fortunately for us, the BIC benefits from that particular shortcoming. When the BIC Manufacturing Academy launched its STAT Program (Systems Thinking or the Application of Technology), we recruited Rich as an instructor. He quickly became a cornerstone of the program — equal parts scientist, mentor and storyteller — bridging the gap between classroom theory and shop-floor practice.

More recently, Rich has taken on another teaching role with our new MIT TechAM program, which trains “technologists” — those who bridge the critical space between engineers and technicians. It’s a role he was born to fill.

At a recent session, he was seen patiently walking participants through a lab module developed at MIT’s LEAP Group, then relating it to something every machinist in the room would recognize. “Applied learning is everything,” he told them. “You can read about how something works, but until you touch it, build it, break it and fix it, you don’t really know it.”

A LIFE OF SERVICE

Outside the classroom, Rich devotes much of his time to STRIDE Adaptive Sports, a nonprofit he helped found more than 40 years ago that teaches skiing to people with disabilities. Each winter at Jiminy Peak, you’ll find him bundled in a bright instructor’s jacket, guiding children and adults — some on sit-skis, some blind, some relearning movement after an injury — down the slopes with patience and joy.

“I’m selfish,” he likes to say. “I get more out of it than my students do.” His children grew up volunteering alongside him, learning what service looks like not as a slogan but as a habit of life.

THE LESSON BEYOND THE LAB

Rich’s story reminds us that innovation is not confined to technology or research — it lives in people who choose to keep learning, to keep giving, to stay curious. When he steps into a classroom at the BIC, our students see someone who has literally rebuilt his own path, from the cab of a truck to the heart of a global materials lab.

They see that it’s never too late to learn. For those of us lucky enough to work with him, Rich represents the best of the BIC community — brilliant but humble,

endlessly curious and always willing to lend his time and wisdom to others.

As I often tell our partners, the BIC’s greatest strength lies in our people — our collective wisdom. Rich Peters embodies that idea. He reminds us that doing more together starts with individuals who believe that learning never stops.

And if you want to hear more of Rich’s story — in his own words — tune in

to his

along with inspiring stories from other remarkable people shaping the BIC

Because behind every innovation in the Berkshires, there’s a human story worth telling — and “My Story

is where we tell them.

The Nonprofit Center of the Berkshires is celebrating the 10th anniversary of the Giving Back guide with 80 glossy pages chock full of information people need to make decisions about volunteering and donating.

Giving season is upon us with a glorious way of warming our hearts during the coldest time of year.

The word “philanthropy” has Ancient Greek roots translating literally into “love of humanity.” I’ve always felt that philanthropy is strong in Berkshire County and those who find themselves grateful for living here enjoy giving back and paying it forward.

Liana Toscanini Nonprofit Notes

This year the Nonprofit Center of the Berkshires is celebrating the 10th anniversary of the Giving Back guide with 80 glossy pages chock full of information people need to make decisions about volunteering and donating. Getting this free publication into the right hands increases community engagement, a core tenet of our strategy to leverage local assets to help nonprofits.

The guide has become an indispensable tool for helping people navigate the crowded sector and find a nonprofit to support.

The Giving Back guide contains a handy directory of over 1,000 Berkshire nonprofits organized by category. This is helpful to those who have already identified their passions and interests.

Categories include animal welfare, arts & culture, emergency services, environment & nature, food pantries, health & healthcare, housing, human rights, human services, libraries, philanthropy, religious organizations, and youth & education. There is even an “other” category for organizations like Berkshire Innovation Center, EforAll, and 1Berkshire.

The food pantry section is new, and includes meal sites. According to the Food Bank of Western Mass, there has been an 86 percent increase in the food insecurity rate in Berkshire County since 2021. Berkshire Bounty reveals that, “Food insecurity rates remain historically high and rising due to inflation, the end of Federal stimulus programs, and the influx of refugees resettling in our community.”

We hope that giving food pantries their own category will encourage people to support not only the pantry in their neighborhood, but also some of the larger outfits such as Pittsfield Community Food Pantry currently serving 1,550 families per month.

Readers of the Giving Back guide will also find full-page profiles of 100 nonprofits, which makes interesting reading and more concretely, describes ways people can help. For Flying Cloud Institute, stating a need for help with human resources resulted in a match to a highly qualified HR executive who eventually became a board member. These types of connections are not uncommon once you have the information in front of you.

The Giving Back guide is used in myriad ways:

• A giving circle uses it to make quarterly donations to nonprofits.

• An artist whose policy is to donate

the proceeds from the sale of one painting every quarter uses it to identify the recipients of his philanthropy.

• A church provides the book to interviewees for the post of pastor in the hopes of showing how vibrant the charitable sector is in our community.

• A retiree who wants to give back to the community studies the book to get an overview of the nonprofit landscape and some possible volunteer gigs.

• Camps and schools use the Giving Back guide to help youth identify community service projects.

• A couple peruses the book to identify nonprofits for year-end giving.

• Civic groups use the book as a tool to focus their giving and community service projects.

• Leadership programs, adult learning and senior groups provide copies to participants to facilitate community engagement.

• Elder Services uses it to place eligible seniors in federally funded employment situations.

It’s no small feat printing and distributing 16,500 copies to the Berkshire Community, but we have willing and enthusiastic partners in this endeavor. The Berkshire Eagle kindly bundles the Giving Back guide into an October weekend edition of the paper, which has a wide readership.

Additional copies make their way to coffee shops, doctor’s offices, bank lobbies, town halls, libraries, and other community gathering spaces. The Giving Back guide is also available online as a PDF for anyone to download at npcberkshires.org.

Sponsors help us pay for the printing which is done locally. We couldn’t do it without them. This year our sponsors are Berkshire Bank, Berkshire Taconic Community Foundation, Blackrock/ Donald C. McGraw Foundation, Canna Provisions, Feigenbaum Foundation, NBT Bank, Red Lion Inn, Dr. Robert C. & Tina Sohn Foundation, Warrior Trading, and Liz & Mark Williams.

Business advertisers are also partners in this large annual project. We’re grateful for this generous support and the opportunity to provide a really practical service to the community.

How will you give back? What motivates you this year? Is this the year to think small in terms of gifts for friends and family members, and go large in donations to your favorite nonprofits, perhaps even in honor of someone you love?

If you need additional insight or connections, do not hesitate to reach out to the Nonprofit Center of the Berkshires. Our connector role extends beyond print publications and networking events to individual referrals and consultations. Just email info@npcberkshires.org or call (413) 441-9542 for assistance.

To quote my late neighbor Bill Cohn, “Give till it hurts!”

Liana Toscanini is the founder of Nonprofit Center of the Berkshires, helping nonprofits connect, learn and grow since 2016.

One of the wonderful benefits of living and working here in the Berkshires is that there are many things that we as local denizens and local businesses can all get behind and support.

I have really enjoyed moments that have led to me meeting other business owners and realizing how much we have in common in that regard. Take for instance the fact that I’m a big Subaru fan. Not long ago, I was looking to trade my current Subaru in for a new one, and I went to a very specific dealer — Haddad Suburu in Pittsfield.

As a consumer, I don’t need to be sold on the car or brand itself. But when it came to where I chose to get my new car, I intentionally voted with my dollars by patronizing a like-minded business that I have come to respect for being as passionate about a cause I am passionate about — the Berkshire Humane Society.

For those that don’t know, every year Haddad donates and gives away a Subaru to the Berkshire Humane Society, so it, and various other entities, sells the tickets for the giveaway to raise much-needed funds for the nonprofit, to then hold a drawing and give away a car.

The 2025 “Choose Your Subaru” raffle, which concluded with a drawing on Oct. 25, 2025, raised $72,000 through ticket sales and a related clinic. This was the 13th year for the annual event, which is described as the organization’s biggest fundraiser of the year. Which brings me to another business we were interested in working with, which had a similar approach to giving back and supporting local causes as us, and that was enough to get us to discuss working together. Because it knew we were passionate about the same thing, it got me in front of a decision maker at that business much faster. They told me: “I researched you, and what I love about your company is that you do a lot of work in the community, so that’s what made me want to work with you.”

Businesses sometimes treat “giving back” like garnish … nice on the plate, but not essential to the meal. In a place like the Berkshires I’ve found it’s best served as part of the main dish. The difference between a relationship and a transaction, in my experience, is whether you’ve already shown up for each other before the emails even start.

If you make community involvement part of your cannabis businesses operating system, instead of a side program, you change the energy in every room you enter. Which helps make the trust show up early. The deal, if

there is one, finds its pace. There is a sentiment which I think about a lot: “Service is the rent we pay for being. It is the very purpose of life, and not something you do in your spare time,” is most famously attributed to Marian Wright Edelman, the founder of the Children’s Defense Fund. Her full, original quote is slightly different but carries the same powerful message, and it’s also very similar to a well-known quote from Muhammad Ali, who said, “Service to others is the rent you pay for your room here on earth.”

At Canna Provisions, we take that to heart and we want to encourage other businesses to consider what causes you are supporting, and why. And make sure others know about it. It’s less about virtue signaling, and more about business signaling to bring in like-minded people from your community to also vote with their dollars, just like we do. If I didn’t know about Haddad’s dedication to the Berkshire Humane Society, I likely would have chosen any number of other dealerships to find my next Subaru.

I’ve built cannabis operations and retail businesses across the U.S., through booms and busts. The constant I’ve found in every state is that generosity clarifies values, which is helpful when you don’t want to waste time with partners who want something you can’t give. It also clarifies strategy,

because commitments to real organizations require real planning. And it clarifies reputation (which is just the slow accumulation of what people say about you when you’re not in the room). In small markets like the Berkshires, reputation tends to arrive before you do, so develop and protect it and let it do some lifting for you.

You may be asking, does giving back “pay off”? I’d say that’s the wrong scoreboard, but I understand the question. There’s a temptation, especially in regulated and competitive industries like cannabis, to become purely transactional. But what I have personally seen, especially right here in Lee where Canna Provisions has been thriving since opening in 2019, is it changes the texture of everything.

Recruiting gets easier because talented people want meaning with their paycheck. Partnerships deepen because your word is backed by years of visible follow-through. We became an employee-owned company last year and many of our partners have echoed one another in stating what that move signals about our company ethos.

Even tough conversations go better; grace is more abundant when folks have gotten to your character by your devotion to giving back and serving the community. And yes, sometimes a landlord or a new business partner says, “I want you in that space because you make this region better.”

That’s an outcome of living your values of giving back as a business out loud, consistently, without calculation.

There’s another piece that matters to me as a leader: giving back steadies you. Business ownership requires never-ending decisions and bombards you with lots of noise. Community work is grounding, as it shrinks the ego and widens the view. When you’ve spent your morning loading boxes at the Lee food pantry, a supply chain hiccup at 3 p.m. is still a hiccup but not not an existential crisis. Perspective is fuel for business survival, in cannabis, in the Berkshires, and beyond.

That’s how I want to do business. That’s the culture I’m committed to building and protecting. Not because it’s a neat trick to close deals, but because it’s the only way I know to make the numbers mean anything.

The spreadsheets have to work. But the story has to work, too — the story we tell ourselves about why we’re here, and the story our neighbors tell about what it’s like to share a town with our business, our staff, our customers, and us.

Over time, that becomes its own reward. And every once in a while, in a quiet office on an ordinary work day, it can even open a door you’ve been knocking on for years.

Meg Sanders is CEO and co-founder of Canna Provisions.

I recently spoke with a couple who want to sell their home. Their Realtor told them the market was a little soft but added that interest rates were likely to come down this year.

The suggestion was that falling rates would boost home prices. That’s a common assumption, but it left me wondering whether it is always true.

Luke Delorme Money Talk

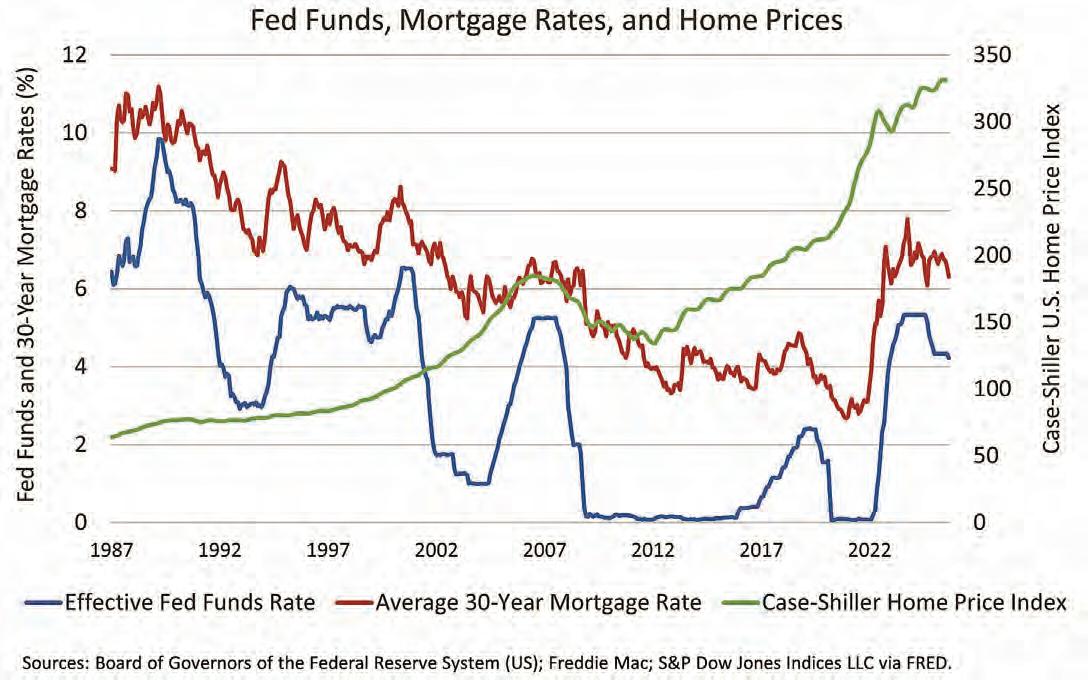

There are two key questions worth asking. First, do mortgage rates always go down when the Federal Reserve (“Fed”) cuts interest rates? And second, even if mortgage rates decline, should we expect home values to rise as a result?

To explore this, I spoke with Eric Steuernagle, owner of Fairground Real Estate in Great Barrington and a housing expert. I also looked back at decades of data on interest rates and home prices.

FED FUNDS AND MORTGAGE RATES

The Fed directly controls a shortterm interest rate known as the “federal funds rate.” This is the rate banks charge one another for overnight loans. It plays an important role in the economy, but it’s not the same as the interest you’d pay on a 30-year mortgage. Mortgage rates are tied more closely to longterm rates, which are influenced by inflation, investor expectations, housing demand and even global events.

Still, historical data show that shortterm rates (like the federal funds rate) and long-term rates (like 30-year mortgage rates) generally move in the same direction. Since the late 1980s, the average spread between the Fed’s target rate and the 30-year mortgage rate has been about 3 percentage points (see chart). So, if the Fed’s rate lands near 3.5 percent, mortgage rates might settle at around 6.5 percent — roughly where they are today.

This is one reason Steuernagle is skeptical that housing will become dramatically more affordable. He says that home prices would likely increase “if you think interest rates are going back to 2.75 percent, but that may have been once in a lifetime.”

The Fed cut the fed funds rate by 0.25 percentage points each in September and October. The market still expects one more 0.25 percentage point cut this year, although it’s uncertain. The goal is to stimulate the economy as signs of labor market weakness emerge. So, while Fed cuts may bring mortgage rates down

slightly, there’s no guarantee they will fall by a huge amount.

The historical data suggest that longer-term interest rates, including mortgage rates, may decline slightly if the Fed lowers the overnight lending rate. But to Steuernagle’s point, mortgage rates between 5 and 6 percent are much less enticing for buyers than the 3 percent rates we saw a few years ago.

MORTGAGE RATES AND HOME VALUES

Even if mortgage rates do decline, the bigger question is what that means for home prices. In theory, lower mortgage rates make monthly payments more affordable for buyers, which should support higher home values. But history shows the connection is far from consistent.

Consider four major rate-cutting cycles in recent decades:

• Early 1990s (Gulf War recession): Mortgage rates fell from about 10 percent to 7 percent between 1990 and 1993. Yet home values barely budged, rising just 2 percent over four years.

• Early 2000s (dot-com bust): Rates fell from around 8 percent to 6 percent between 1999 and 2003. This time, home prices surged, rising by about 40 per-

cent nationally.

• 2007–2008 (global financial crisis): Rates declined from about 6 percent to 5 percent, but home prices cratered, falling 17 percent as the housing market collapsed.

• 2019–2020 (COVID-19 pandemic): Mortgage rates dropped from roughly 4.5 percent to a record-low 2.7 percent. Home prices spiked 14 percent and kept climbing afterward.

The takeaway from these past rate-cutting episodes is that economic factors like unemployment, stock market performance, and financial crises can overwhelm the impact of falling rates. Lower borrowing costs are helpful, but they don’t guarantee rising prices.

Steuernagle notes that current rates have been stifling sales. Many homeowners refinanced when rates were near 3 percent, and they are now understandably reluctant to give up those mortgages. Meanwhile, buyers may continue to face affordability challenges even if rates fall to 5 or 6 percent. A move down into the 5 percent range could provide some relief for buyers, but it’s unlikely to spark the kind of frenzy we saw during the pandemic.