Property Details

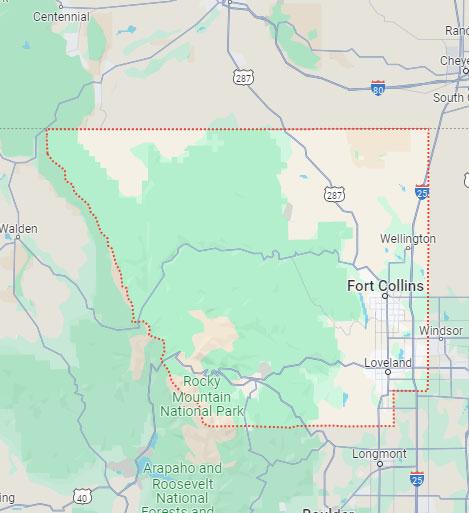

Maps

Local Schools

Community Utilities & Resources

Title & Escrow

The information contained is provided by WFG’s Customer Service Department to our customers, and while deemed reliable, is not guaranteed.

Property Details

Maps

Local Schools

Community Utilities & Resources

Title & Escrow

The information contained is provided by WFG’s Customer Service Department to our customers, and while deemed reliable, is not guaranteed.

566 SPLIT ROCK DR LOVELAND CO 80537

R1652196

LARIMER COUNTY CO

OwnerInformation

OwnerName: ONKEN LARRY L / C JANET REVOCABLE TRUST

Vesting:

MailAddress: 566 SPLIT ROCK DR LOVELAND CO 80537

OwnerStatus: OwnerOccupied

LocationInformation

LegalDesc: LOT 17, BLOCK 1, MINERAL FIRST SUB AMD LOTS 7 THRU 18, 29 AND 30 BLOCK 1, LOVELAND (20110068487)

County: LARIMER

Census/Block: 002007 / 3035

Tsp-Rng-Sec: T5N-R69W-S23

Lot/Block: Lot: 17 Block: 1

HousingTract: MINERAL FIRST SUB LastMarketSale

Date: 2013-05-20/2013-05-17

SalePrice: 391708

Document#: 2013.37661

AltParcel# 95232-14-017

SchoolDistrict: THOMPSON R-2J

Municipality: LOVELAND

Parcel#: R1652196

Lender:

Loan:

Document#:

DocType: SPECIAL WARRANTY DEED LoanType: $Sqft: $141.21

LoanTerm: PriorSaleInformation

Date: 2013-05-17/2013-05-17

Lender: Price: 427738

Document#: 2013.37536

Loan: 340800

Document#:

DocType: SPECIAL WARRANTY DEED LoanType: CONVENTIONAL

Theaboveisbelievedtobeaccurate,butisnotguaranteed. Copyright©1995-2025CDSMarketing,Inc.

566 SPLIT ROCK DR LOVELAND CO 80537

R1652196

LARIMER COUNTY CO

PropertyCharacteristics

GrossArea: 3324

LivingArea: 2774

AboveGrade: 3,324

Bedrooms: 4

Bath(F/H): 3/

Fireplace: FIREPLACE

YearBuilt: 2012

ParkingType: Garage

GarageArea:InteriorWall

RoofShape: GABLE/HIP

PorchType: OPEN SLAB

Foundation: CONCRETE PatioType: WOOD BALCONY

RoofMaterial: CLAY TILE

Construction: FRAME

HeatType: CENTRAL

CoolingType: CENTRAL

AirCond: CENTRAL

Fixtures:

Floor:

Equipment:

ExteriorWall: FRAME/STUCCO Stories: 1

Units: 1 Rooms: 9

Basement: 1360

PropertyInformation

LandUse: SFR

TaxandAssessmentInformation

Pool: No

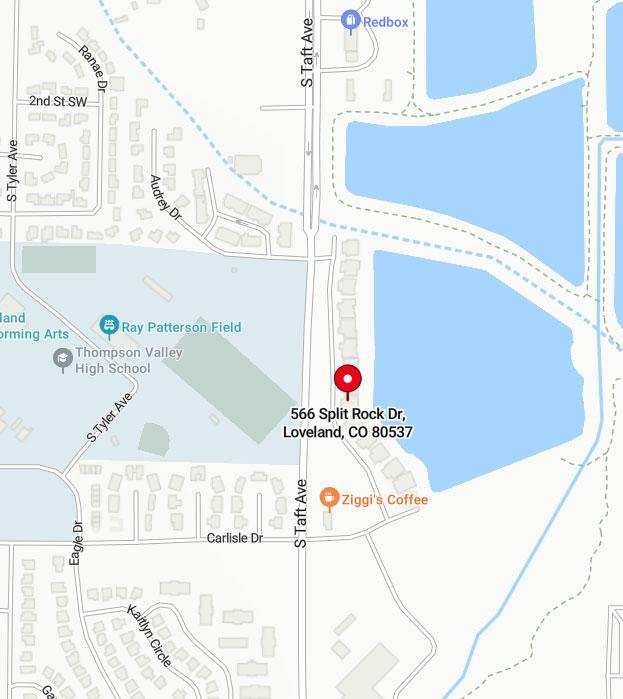

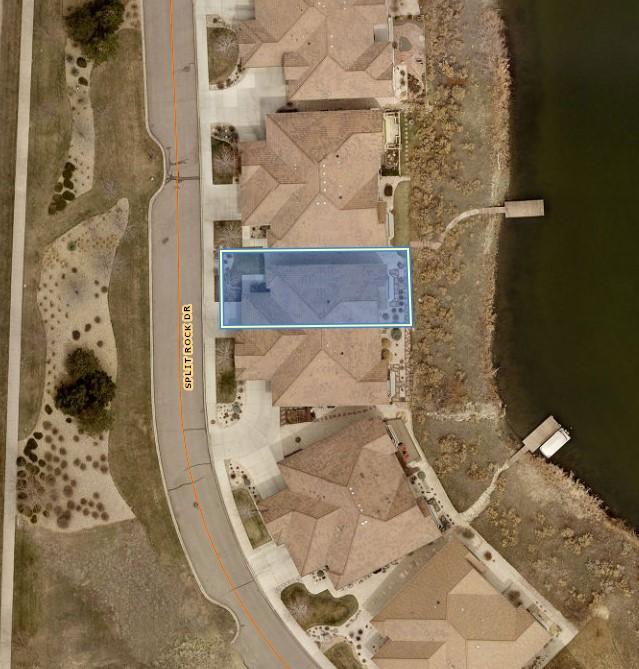

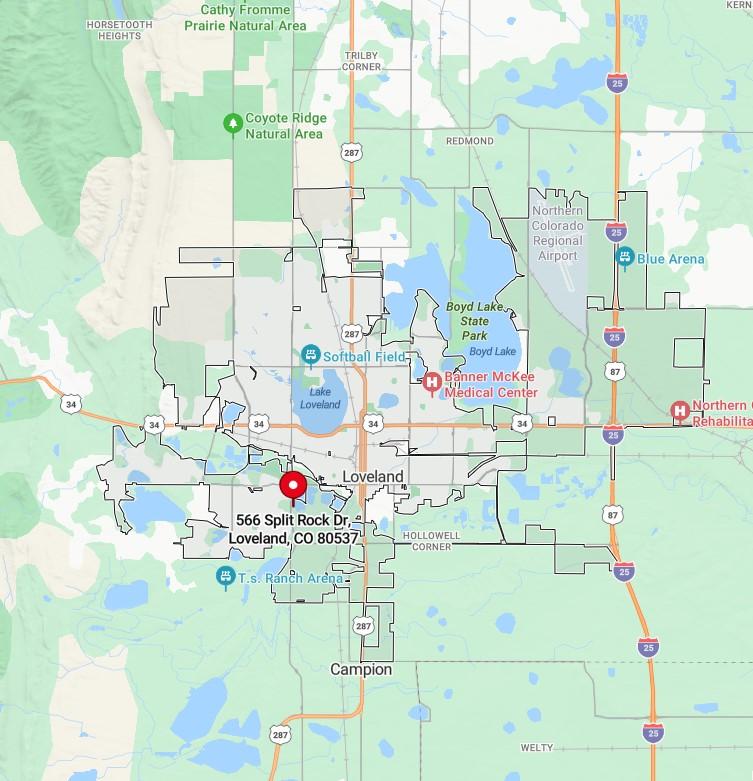

This map/plat is being furnished as an aid in locating described land in relation to adjoining streets, natural boundaries and other land, and is not a survey of the land depicted. Except to the extent a policy of title insurance is expressly modified by endorsement, if any, the company does not insure dimensions, distances, location of easements, acreage or other matters shown thereon.

This map/plat is being furnished as an aid in locating described land in relation to adjoining streets, natural boundaries and other land, and is not a survey of the land depicted. Except to the extent a policy of title insurance is expressly modified by endorsement, if any, the company does not insure dimensions, distances, location of easements, acreage or other matters shown thereon.

This map/plat is being furnished as an aid in locating described land in relation to adjoining streets, natural boundaries and other land, and is not a survey of the land depicted. Except to the extent a policy of title insurance is expressly modified by endorsement, if any, the company does not insure dimensions, distances, location of easements, acreage or other matters shown thereon.

This map/plat is being furnished as an aid in locating described land in relation to adjoining streets, natural boundaries and other land, and is not a survey of the land depicted. Except to the extent a policy of title insurance is expressly modified by endorsement, if any, the company does not insure dimensions, distances, location of easements, acreage or other matters shown thereon.

566 SPLIT ROCK DR LOVELAND CO 80537

R1652196

LARIMER COUNTY CO

ElementarySchools

Sarah Milner Elementary School970-613-6700

743 Jocelyn Drive LOVELAND CO 80537

AreaDesc:

Grades: KG to 05 Distance: 0.67 Miles

CharterSchool: N

MagnetSchool: N

TitleOne: SWP

B F Kitchen Elementary School970-613-5500

915 Deborah Drive LOVELAND CO 80537

AreaDesc:

Grades: KG to 05 Distance: 0.89 Miles

CharterSchool: N

MiddleSchools

MagnetSchool: N

TitleOne: NO

Walt Clark Middle School970-613-5400

2605 Carlisle Drive LOVELAND CO 80537

AreaDesc:

Grades: 06 to 08 Distance: 0.91 Miles

CharterSchool: N

MagnetSchool: N

TitleOne: NO

Bill Reed Middle School970-613-7200

370 West 4th Street LOVELAND CO 80537

AreaDesc:

Grades: 06 to 08 Distance: 1.00 Miles

CharterSchool: N

HighSchools

MagnetSchool: N

TitleOne: NO

Thompson Valley High School970-613-7900

1669 Eagle Drive LOVELAND CO 80537

AreaDesc:

Grades: 09 to 12 Distance: 0.23 Miles

CharterSchool: N

MagnetSchool: N

TitleOne: NO

Loveland Classical School970-670-0527

3835 Sw 14th Street LOVELAND CO 80537

AreaDesc:

Grades: KG to 12 Distance: 1.85 Miles

CharterSchool: Y

MagnetSchool: N

TitleOne: NO

Yourassignedschoolshouldbethefirstschoolineachcategory,butitisrecommendedyoucheckwiththedistrictorschool. Theaboveisbelievedtobeaccurate,butisnotguaranteed. Copyright©1995-2025CDSMarketing,Inc.

76,378 POPULATION

2020 Census Data

$81,149

2000 Census Data

39.6

Census Data

Loveland is the home rule municipality that is the second most populous municipality in Larimer County, Colorado, United States. Loveland is situated 46 miles (74 km) north of the Colorado State Capitol in Denver and is the 14th most populous city in Colorado. Loveland serves as a bedroom community to commuters in many direc ons, but a large percentage of occupants travel to work in Boulder, Westminster, and other parts of the Greater Denver area.

Thompson School District R2-J

2023 Census Data

63.9% of homes owner occupied

36.1% of homes rented

2000 Census Data

36.4 inhabitants per sq. mile

33,894 housing units at an average density of 931.2 per sq. mile

2010 Census Data

19.8% under age 18

8.2% between ages 18 to 24

28.1% between ages 25 to 44

22.9% between ages 45 to 64

Founded in 1877

2,100 square miles

4,997 feet eleva on

Loveland began as a hub for French Trappers in the 1700’s, later se led in 1858 with the construc on of Fort Namaqua, which was a large trading post and stage sta on, this site is now Namaqua Park. The city was o fficially founded in 1877, along the newly constructed line of the Colorado Central Railroad near its crossing at the Big Thompson River, Named a er William A.H. Loveland, President of the Colorado Cen ral Railroad.

566 SPLIT ROCK DR LOVELAND CO 80537

Animal - Services

NameAddressTelephoneDistance

E-IMedicalImaging348NJeffersonAve970-669-17931.40Mi

Gane,AmyCDVM-SouthMarch21419thStSE970-622-83811.53Mi

Cortney,ChristineDVM-Aspe3904WEisenhowerBlvd970-635-18502.32Mi

Butts,JerryLDVM-Orchard3325NGarfieldAve970-667-23832.93Mi

Smith,RandyBDVM-Worthing4212NGarfieldAve970-667-24223.47Mi

Banks

NameAddressTelephoneDistance BankofAmericaATM126STaftAve800-432-10000.36Mi

ColoradoCommunityBank1050EagleDr970-278-00400.42Mi

WashingtonMutual-BankLoca1119EagleDr970-663-37660.45Mi Shearer-RobertA1135EagleDr970-667-92200.46Mi USBank1275EagleDr970-461-01150.53Mi Credit

Coffee Shops

NameAddressTelephoneDistance

Starbucks:14thStr&TaftAv1317EagleDr970-613-86000.55Mi ColumbineAlmondToffee411NGarfieldAve970-635-27951.13Mi HisPlace103W4thSt970-461-29681.18Mi

WidowMcCoyRestaurant&Lou1011WEisenhowerBlvd970-667-04261.27Mi

CityNewsstandBookStore534ClevelandAve970-667-95081.33Mi

Theaboveisbelievedtobeaccurate,butisnotguaranteed. Copyright©1995-2025CDSMarketing,Inc.

566 SPLIT ROCK DR LOVELAND CO 80537 R1652196

Coffee Shops

NameAddressTelephoneDistance

Eating and Drinking Places

NameAddressTelephoneDistance

BearRockCafe142010thStSW970-622-84110.32Mi

CactusGrilleSouth1043EagleDr970-663-45000.42Mi

PapaMurphy'sTake'n'Bake1131EagleDr970-669-72720.46Mi

SubwaySandwiches1139EagleDr970-667-84870.46Mi

Domino'sPizza1163EagleDr970-669-85120.47Mi

Golf Courses

NameAddressTelephoneDistance

OldeCourseatLoveland2115W29thSt970-667-52562.45Mi

MarianaButteGolfCourse701ClubhouseDr970-667-83082.51Mi

SouthRidgeGolfClub5750SLemayAve970-226-28288.44Mi

PtarmiganGolf&CountryClub5416VardonWay970-226-66009.06Mi

Grocers and Supermarkets

NameAddressTelephoneDistance

AlbertsonsSupermarkets-Foo1451WEisenhowerBlvd970-593-97791.38Mi

Sam'sClub1200EEisenhowerBlvd970-461-24342.36Mi

AlbertsonsSupermarkets-Foo1325EEisenhowerBlvd970-669-00202.46Mi

Esh'sSurplusMarket4221WEisenhowerBlvd,SteB970-663-18832.57Mi

ESHDiscountGroceries4221WEisenhowerBlvd970-612-01602.57Mi

Health Clubs and Spas

NameAddressTelephoneDistance

MayChiropractic172710thStSW970-824-46500.52Mi

Theaboveisbelievedtobeaccurate,butisnotguaranteed. Copyright©1995-2025CDSMarketing,Inc.

566

Health Clubs and Spas

NameAddressTelephoneDistance

FitnessForWomenLlc1325EagleDr970-663-75500.56Mi

UniquePhysique154BarberryPl970-663-40091.16Mi

ClubGenesis4188thStSE970-663-04441.31Mi

EvolutionFitnessLlc1420WEisenhowerBlvd970-613-90651.37Mi

Hospitals - Acute Care

NameAddressTelephoneDistance

MckeeMedicalCenter2000BoiseAve970-669-46402.89Mi

MedicalCenterOfTheRockies2500RockyMountainAve970-624-25005.40Mi

Nursing Homes

NameAddressTelephoneDistance

SierraVistaHealthCareCent821DuffieldCt970-669-03450.91Mi

GoodSamaritanSociety-Love2101SGarfieldAve970-669-31001.52Mi

NorthShoreHealthAndRehab1365W29thSt970-667-61112.39Mi

MckeeMedicalCenterNursing2000BoiseAve970-669-46402.89Mi

BerthoudLivingCenter855FranklinAve970-532-26835.43Mi

Offices and Clinics of Chiropractors

NameAddressTelephoneDistance

Anetrini,JaneFDC-Anetrin831W5thSt970-663-72900.76Mi Sherlock,PatrickFDC-Sher2203TaftAve970-669-59001.90Mi Mott,PPaigeDC-DiscoverL2956GinnalaDr,#102970-622-00752.81Mi

Offices and Clinics of Dentists

NameAddressTelephoneDistance

ComfortDentalOfLoveland140510thStSw970-962-99950.33Mi

Theaboveisbelievedtobeaccurate,butisnotguaranteed. Copyright©1995-2025CDSMarketing,Inc.

566 SPLIT ROCK DR LOVELAND CO 80537

Offices and Clinics of Dentists

NameAddressTelephoneDistance

DavidWilburWright200415thStSw#3970-663-21330.90Mi

SvetlanaDrozdova3332FloridaDrPreventiveDenN/A1.34Mi

Pitt,DavidGDds1524WEisenhowerBlvd970-669-39671.38Mi

NormanRyanGoding1966W15thSt#1970-669-57001.51Mi

Offices and Clinics of Medical Doctors

NameAddressTelephoneDistance

Kallio,JenniferKDDS-Comf140510thStSW970-962-99950.35Mi

BigThompsonAnimalHospital714TaftAve970-667-92300.82Mi

KanodeBradleyAMD232W4thSt970-667-35651.10Mi

IslandGroveRegionalTreatme446GarfieldAve970-669-17001.14Mi

Eckert-PetersonUrsulaDrDVM13114thStSE970-663-37621.19Mi

Pet Sitting Services

NameAddressTelephoneDistance

Wiltz,MickeyDVM-BigThomp714TaftAve970-667-92300.76Mi BlueSkyAnimalClinic2713WEisenhowerBlvd970-663-60461.70Mi

Pharmacies

NameAddressTelephoneDistance

ComfortDentalThompsonValle140510thStSW970-962-99950.33Mi

DillonCompaniesInc1275EagleDr970-663-41250.53Mi

WalgreensPharmacy130014thStSW970-818-29020.68Mi

BigThompsonMedicalGroupIn914W6thSt970-667-39760.76Mi

CentennialMedicalClinic232W4thSt970-667-35651.07Mi

Theaboveisbelievedtobeaccurate,butisnotguaranteed. Copyright©1995-2025CDSMarketing,Inc.

Theaboveisbelievedtobeaccurate,butisnotguaranteed. Copyright©1995-2025CDSMarketing,Inc.

USPS

Below is the website if you would like to change your address online or you can visit your local post office, they will provide you with the change of address packet.

h ps://moversguide.usps.com

Bene

fits you will receive when you change your address online are:

Exclusive mover savings coupons

Safe and secure with iden ty verifica on by a simple $1.00 charge to your credit or debt card

Email confirma on at the end of registra on of your change of address

Colorado Department of Transporta on

Below is the website if you would like to change your address online or have any ques ons.

Region 1 and Headquarters Denver/Central Colorado 2829 W Howard Place Denver, CO 80204 (303) 759-2368

www.codot.gov

Below is the website if you would like to change your address online or you can fill out the paperwork provided and mail it back to your County Elecons Office listed below.

sos.state.co.us/voter/pages/pub/home.xhtml

County Elec ons Office Contacts

Larimer County Elec ons 200 West Oak Street, Suite 5100, Fort Collins, CO 80522 (970) 498-7820

h ps://www.larimer.gov/clerk/elec ons

UTILITIES

Electric

NW Natural Gas

Water District

Sewer District

Garbage Provider

Cable/Satellite

Fuel (Propane)

Phone Services

Internet

FINANCIAL INSTITUTIONS

Banks and Credit Unions

Credit Card Companies

(including department store credit cards)

Lenders

(Mortgage, Home Equity, Auto, Student Loans)

Insurance Companies

(Health, Renters, Auto, Home, Medical, Dental, Disability, Life)

Re rement

(Pension plans, 401K, Social Security, Veterans Affairs)

Investments

(Investment Agencies and Brokers)

Online Bill Payer

Paypal

GOVERNMENT OFFICES

US Post Office

Department of Motor Vehicles

(Obtain your driver’s license and change vehicle registra on)

IRS

Passport Office

Veteran Affairs

Unemployment Office

(If you are currently receiving unemployment benefits)

HEALTH

Physician

Pharmacies

SERVICE PROVIDERS

Childcare

Housecleaning Services

Delivery Services

Lawn Care Services

Veterinarian

Pool Service

MEMBERSHIPS

Health Clubs

Membership Clubs (AAA or similar)

Community Groups (PTA, Neighborhood Associa ons, Civic Clubs)

Children’s Extracurricular

Ac vi es (Dance Classes, Music

Lesson, Sports Clubs)

SUBSCRIPTIONS

Newspapers

Magazine (USPS will only forward 2 months)

Movie Subscrip ons

(Ne lix, Blockbuster, etc)

Book or Music Clubs

OTHER

Friends and Family

Employers

(typically no fy the Human Resources Department)

Inventory Sheets: Create an inventory sheet of all your belongings which need to be moved

Research Moving Op ons: You ’ll need to decide if yours is a do-it-yourself move or if you’ll be using a moving company.

Request Moving Quote: Solicit moving quotes from as many moving companies and movers as possible. There can be a large difference between rates and services within moving companies.

Discard Unnecessary Items: Moving is a great me for ridding yourself of unnecessary items. Have a yard sale or donate unnecessary items to charity.

Packing Material: Gather moving boxes and packing material for your move.

Contact Insurance Companies: You’ll need to contact your insurance agent to cancel/transfer your insurance policy.

Start Packing: Begin packing all things des ned for your new loca on.

Obtain Your Medical Records: Contact your doctor, physician, den st and other medical specialists who may currently be retaining any of your family’s medical records. Obtain these records or make plans for them to be delivered to your new medical facili es if changing. Security is cri cal of personal records.

Note Food Inventory Levels: Check your cupboards, refrigerator and freezer. Use up as much of your perishable food as possible.

Small Engines: Service small engines for your move by extrac ng gas and oil from the machines. This will reduce that chance to catch fire during your move.

Protect Jewelry and Valuables: Transfer your jewelry and valuables to a safety deposit box; you don’t want them to be lost or stolen during your move.

Borrowed and Rented Items: Return items which you may have borrowed or rented. Collect items borrowed to others.

Your Change of Address: Change your address with the USPS, DMV, Financial Ins tu ons, U li es, Government Offices, Health Care Service Providers, Memberships, Subscrip ons and Insurance Provisions.

Bank Accounts: Transfer or close bank accounts if changing banks. Make sure to have a money order for paying the moving company.

Service Automobiles: If automobiles are to be driven long distance, you’ll want to have them serviced so you have a trouble-free drive.

Cancel Services: No fy any remaining service providers (newspapers, lawn services, etc.) of your move.

Travel Items: Set aside all items you ’ll need while traveling. Make sure these are not packed on the moving truck..

Contact U lity Companies: Set u lity turnoff date, seek refunds and deposits and no fy them of your new address.

Plan Your I nerary: Make plans to spend the en re day at the house or at least un l the movers are on their way. Someone will need to be around to make decisions. Make plans for kids and pets to be at a si ers for the day.

Review the House: Once the house is empty, check the en re house (closets, a c, basement, etc.) to ensure no items are le or no home issues exist.

Double Check With Your Mover: Ensure the mover has the new property address and all of your most recent contact informa on, should they have any ques ons during your move.

Vacate Your Home: Make sure u li es are off , doors and windows are locked and no fy your real estate agent you’ve vacated the property.

Ques ons To Ask: Where is the garage door opener?

AIRPORT

Denver Interna onal Airport (720) 730-4359

www.flydenver.com

AUTO & DRIVER REGISTRATION

Fort Collins DMV; (970) 498-7878

h ps://www.larimer.gov/clerk/ vehiclelicensing

Loveland DMV; (970) 619-4521

h ps://www.larimer.gov/clerk/ vehiclelicensing

BUS SERVICE

Larimer County Bus Services; h ps://www.larimer.gov/ sustainability/transporta on/Publictransit

Greyhound (970) 668-9290 www.greyhound.com

CABLE TV, INTERNET, PHONE & SATELLITE

Century Link (866) 963-6665

www.centurylink.com

Dish Network (800) 318-0572

www.dish.com

DIRECT TV (800) 531-5000

www.direc v.com

XFINITY

(800) 266-2278

www.xfinity.com

CITY CONTACTS

Fort Collins (970) 482-3746

Loveland (970) 962-2000

Wellington (970) 568-3381

COUNTY CONTACTS

Larimer County

200 W. Oak Street, Fort Collins, CO 80521 (970) 498-7000

h ps://www.larimer.gov/

EDUCATION

Thompson School District (970) 613-5000

h ps://www.tsd.org/

Poudre School District (970) 482-7420

h ps://www.psdschools.org/

GARBAGE

Republic Services (970) 484-5556

h ps://www.republicservices.com/ municipality/fort-collins-co

City of Loveland Disposal (970) 962-2000

h ps://www.lovgov.org/services/ public-works/trash-recycling

Waste Management

h ps://www.wm.com/us/en/ loca on/co/fort-collins/trash-pickup -fort-collins-co

Canyon U li es (970) 881-2262

h p://www.canyonu li es.com/

Fort Collins & Loveland City Water (970) 226-3104 www.fclwd.com

City of Fort Collins Water (970) 212-2900

www.fcgov.com/u li es/what-wedo/water?key=water

East Larimer County Water (970) 493-2044 www.elcowater.org

NATURAL GAS & ENERGY

Xcel Energy (800) 895-4999

co.my.xcelenergy.com

Loveland City Water & Power (970) 962-2000

h ps://www.lovgov.org/services/ finance/u lity-billing

NEWSPAPERS

Fort Colins—Coloradoan h ps://www.coloradoan.com/

Loveland Reporter-Herald h ps://www.reporterherald.com/

RECREATION

Carter Lake Big Thompson Parks

SEWER

City of Fort Collins Sewer (970) 212-2900

www.fcgov.com/u li es/what-wedo/wastewater

Loveland City Water & Power (970) 962-2000

h ps://www.lovgov.org/services/ finance/u lity-billing

Because of you… we obsess over

Cyber fraud and email hacking is on the rise. Fraudsters may access individual email accounts and monitor the life of your transaction. At the time funds are due to the escrow, fraudsters intercept the information for wiring funds and the fraudsters change the information without the knowledge of the sender or recipient, resulting in the funds being sent to an outside account and never credited to the intended party.

To protect and reduce your risk, WFG has implemented the following procedures for outgoing and incoming wires:

In the escrow paperwork provided you will be asked to provide written instructions on how you want funds dispersed at the close of escrow. If you choose to have the funds sent via wire transfer, WFG will contact you by phone to con rm the wire information provided.

For funds that are to be wired to WFG for your transaction, we will send speci c wire instructions to the remitting person via an encrypted email. We recommend you reach out to your WFG contact to con rm the wire instructions prior to remittance.

We look forward to processing your escrow transaction for you. We know that this can be a stressful time and we are here to assist you in any way we can to make this a good experience.

http://national.wfgnationaltitle.com/2016/04/05/obsess-cyber-security/

Every day, hackers try to steal your money by emailing fake wire instructions. Criminals will use a similar email address and steal a logo and other info to make it look like the email came from your real estate agent or title company. You can protect yourself and your money by following the steps below.

Don’t send sensitive nancial information via email.

Call, don’t email. Con rm your wiring instructions by phone using a known number before transferring funds.

We will never email wiring instructions to you nor change WFG account information after it’s been provided to you by our sta .

Keep your email account clean, remove any stale messages. Hackers can watch your business patterns and use this information against you.

Ask your bank to con rm the name on the account before sending a wire.

Call your title company or real estate agent within four to eight hours to con rm they have received your money.

This is for informational purposes only and should not be considered legal advice.

The purchase of a home is likely going to be one of the most expensive and important purchases you will ever make. You and your mortgage lender want to make sure the property is indeed yours and that no individual or government entity has any right, lien, claim, or encumbrance to your property.

The title insurance company’s function is to make sure your rights and interests to the property are clear, that transfer of title takes place e ciently, and correctly, and your interests as a homebuyer are protected. Title insurance companies provide services to buyers, sellers, real estate developers and builders, mortgage lenders, and others who have an interest in the real estate transfer. Title companies issue two types of policies - “Owners Policy” (which covers the homebuyer) and “Lenders Policy” (which covers the bank, savings and loan, or other lending institution over the life of a loan). Both are issued at the time of purchase for a one-time premium.

The title company conducts an extensive search of public records to determine if anyone other than you has an interest in the property before issuing a policy. The search may be performed by title company personnel using either public records, or more likely, information gathered, reorganized, and indexed in the company’s title “plant”. With such a thorough examination of records, title problems can usually be found and cleared up prior to purchase of the property. Once a title policy is issued, if for some reason any claim, which is covered under your title policy, is ever led against your property, the title company will pay the legal fees involved in defense of your rights as well as any covered loss arising from a valid claim. That protection, which is in e ect as long as you or your heirs own the property, is yours for a one-time premium paid at the time of purchase.

The title company works to eliminate risks before they develop. This makes title insurance di erent from other types of insurance. Most forms of insurance assume risks by providing nancial protection through a pooling of risks or losses arising from unforeseen events, like re, theft, or accident. The purpose of title insurance, on the other hand, is to eliminate risks and prevent losses caused by defects in title that happened in the past. Risks are examined and mitigated before property changes hands. Eliminating risk has bene ts to both of you, the home buyer, as well as the title company. It reduces the chance adverse claims might be raised, and by doing so reduces the number of claims that have to be defended or satis ed. This keeps costs down for the title company and your title premiums low. With title insurance you are assured that any valid claim against your property will be taken on by the title company, and that the odds of a claim being led is slim.

When your o er has been accepted and conveyed, escrow is opened. An escrow is an arrangement made under contract between a buyer and seller. As the neutral third party, escrow is responsible for receiving and disbursing money and/ or documents. Both the buyer and seller expect the escrow agent to carry out their written instructions associated with the transaction and also to advise them if any of their instructions are not being met, or cannot be met. If the instructions from all parties to an escrow are clearly set out, the escrow o cer can proceed on behalf of the buyer and seller without further consultation.

The Seller/Agent

• Delivers Purchase Sale Agreement to the escrow agent

• Prepares the paperwork necessary to close the transaction

• Approves the commitment for title insurance, or other items as called for by the Purchase Sale Agreement

The Buyer/Agent

• Deposits funds required to close with the escrow agent

• Executes the paperwork and loan documents necessary to close the transaction

The Lender

• Deposits loan documents to be provided by the buyer

• Deposits the loan funds

• Informs the escrow agent of the conditions under which the loan funds may be used

• Clears Title

• Obtains title insurance

• Obtains payo s and release documents for underlying loans on the property

• Receives funds from the buyer and/or lender

• Prepares vesting document a davit on seller’s behalf

• Prorates insurance, taxes, rents, etc.

• Prepares a nal statement (often referred to as the Closing Disclosure or CD) for each party, indicating amounts paid in conjunction with the closing of your transaction

• Forwards deed to the county for recording

• Once the proper documents have been recorded, the escrow agent will distribute funds to the proper parties

Escrow is the process that gathers and processes many of the components of a real estate transaction. The escrow agent is a neutral third party acting on behalf of the buyer and seller.

Title insurance insures against nancial loss from defects in title, liens, or other matters. It protects both purchasers and lenders against loss by the issuance of a title insurance policy. Usually, during a purchase transaction the lender requests a policy (commonly referred to as the Lender’s Policy) while the buyers receive their own policy (commonly referred to as an Owner’s Policy).

It will protect against lawsuits if the status of the title to a parcel or real property is other than as represented, and if the insured (either the owner or lender) su ers a loss as a result of a title defect. The insurer will reimburse the insured for that loss and any related legal expenses.

While the purpose of most other types of insurance is to assume risk through the pooling of monies for losses happening because of unforeseen future events (like sickness or accidents), the primary purpose of title insurance is to eliminate risks and prevent losses caused by defects in title arising out of events that have happened in the past. To achieve this, title insurers perform a thorough search and examination of the public records to determine whether there are any adverse claims (title defects) attached to the subject property. These defects/claims are either eliminated prior to the issuance of a title policy or their existence is excepted from coverage. The policy is issued after the closing of your new home, for a one time nominal fee, and is good for as long as you own the property.

A title search is made up of three separate searches:

• Chain of Title – History of the ownership of the subject property

• Lien & Encumbrance Search – Discloses liens and encumbrances on the subject property

• Exceptions from Coverage Search –Includes Easements, Covenants, Conditions and Restrictions, etc.

After the three searches have been completed, the le is reviewed by an examiner who determines:

• If the Chain of Title shows that the party selling the property has the rights to do so.

• Whether there are any unsatis ed judgments on the Judgment and Name Search against the previous owners, sellers, or/and purchasers.

Rights established by judgment decrees, unpaid federal income taxes, and mechanics liens all may be prior claims on the property, ahead of the buyer’s or lender’s rights. The title search will only uncover issues in title that are of public record and therefore allowing the title company to work with the seller to clear up these issues and provide the new buyer with title insurance.

Once the searches have been examined, the title company will issue a commitment, stating the conditions under which it will insure title. The buyer, seller, and the mortgage lender will proceed with the closing of the transaction after clearing up any defects in the title that have been uncovered by the search and examination.

The examples below are typical. However, the real estate purchase agreement will ultimately determine who is paying for what expenses.

• Real Estate Commission

• Document preparation fee for Deed

• Payo of all loans in the seller’s name (or existing loan balance if being assumed by Buyer)

• Interest accrued to lender being paid o

• Statement Fees, Reconveyance Fees, and any prepayment penalties to Payo Lender

• Home Warranty (according to contract)

• Any judgments, tax liens, etc. against the seller

• Tax proration (for any taxes unpaid at time of transfer of title)

• Any unpaid Homeowners’ Association dues

• Recording charges to clear documents of record against seller

• Any bonds or assessments (according to contract)

• Any and all delinquent taxes

• Notary Fees

• Title Insurance Premium for Lender’s Policy

• Escrow Fee (one half)

• Document preparation (if applicable)

• Notary fees

• Recording charges for all documents in Buyers’ names

• Tax proration (from date of acquisition)

• Homeowners’ Association transfer fee

• HOA proration (from date of acquisition)

• All new loan charges (except those required by lender for seller to pay

• Interest on new loan from date of funding to 30 days prior to rst payment date

• Assumption/Change of Record fees for takeover of existing loan (if applicable)

• Bene ciary Statement Fee for assumption of existing loan (if applicable)

• Inspection Fees (roo ng, property inspection, geological)

• Home Warranty (according to contract)

• Fire Insurance Premium for rst year

• Any bonds or assessments (according to contract)

The distinction between personal property and real property can be the source of di culties in a real estate transaction. A purchase contract is normally written to include all real property; that is, all aspects of the property that are fastened down or which are an integral part of the structure. For example, this would include light xtures, drapery rods, attached mirrors, and trees and shrubs in the ground. It would not include potted plants, free-standing refrigerators, washer/dryer, microwave, bookcases, lamps, etc. If there is any uncertainty whether an item is included in the sale or not, it is best to be sure that the particular item is mentioned in the purchase agreement as being included or excluded.

DISCLAIMER:

This information is provided for informational purposes only and no warranties are made.

Ownership of property vested in one person rather than held jointly with another.

Parties need not be married; may be more than two persons.

Parties need not be married; may be more than two persons.

Also called sole tenancy.

The sole owner may use, encumber, rent, sell, and convey at their discretion.

The owner may transfer the property via a Will, Trust, or a Bene ciary Deed upon their death.

Each joint tenant holds an equal and undivided interest in the estate, unity of interest.

Upon death, the estate of the decedent must be “cleared” through probate or adjudication.

One joint tenant can partition the property by selling his or her joint interest.

Each joint tenant holds an undivided fractional interest in the estate. May be disproportionate interest e.g. 20% and 80%; 40% and 60%; etc.

Each tenant’s share can be conveyed, mortgaged, or devised to a third party.

Requires signatures of all joint tenants to convey or encumber the whole.

Requires signatures of all to convey or encumber the whole.

Estate passes to surviving joint tenants outside of probate.

No court action required to “clear” title upon the death of joint tenant(s).

Upon death, the tenant’s proportionate share passes to his or her heirs by will or intestacy.

Upon death, the estate of the decedent must be “cleared” through probate or adjudication.

DISCLAIMER – The foregoing contains informational examples only and is not to be construed as legal advice. Given the complexities involved in acquiring and holding legal title to real property, WFG strongly recommends that you seek legal advice from an attorney prior to doing so.

55 Madison Street, Suite 690

Denver, CO 80206 (720) 475-8325

NORTH

12050 N Pescos Street, Suite 110 Westminster, CO 80234 (720) 475-8350

8610 Explorer Drive, Suite 105

Colorado Springs, CO 80920 (719) 598-5355

7800 E Union Avenue, Suite 310 Denver, CO 80237 (720) 475-8300

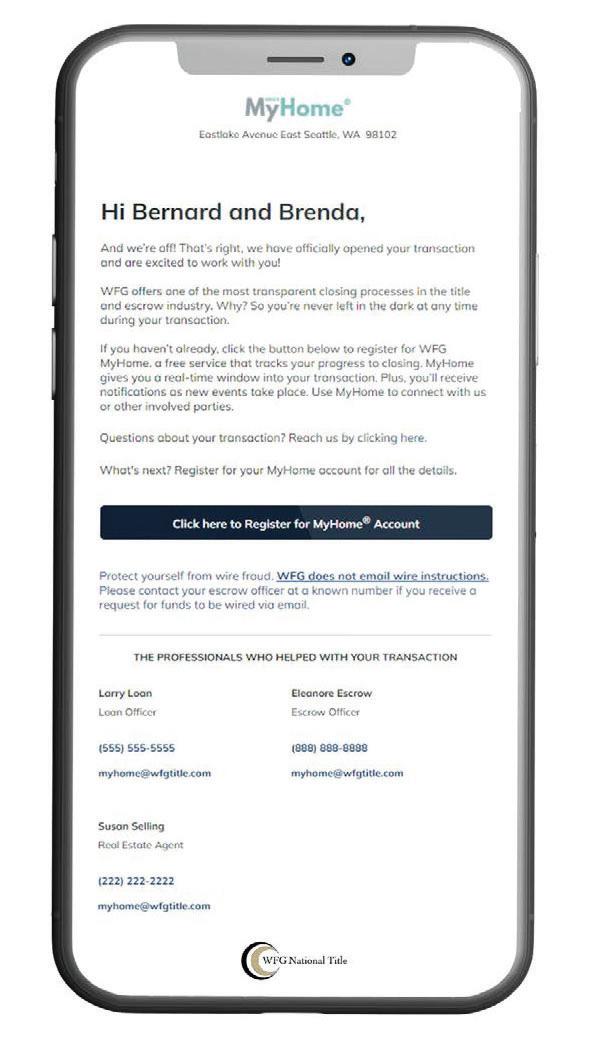

WFG’s My Home

CC&R’s (if applicable)

The information contained is provided by WFG’s Customer Service Department to our customers, and while deemed reliable, is not guaranteed.

This week the median list price for Loveland, CO 80537 is $607,500 with the market action index hovering around 49. This is an increase over last month's market action index of 48. Inventory has increased to 16.

This answers “How’s the Market?” by comparing rate of sales versus inventory.

The market continues to get hotter. More sales demand and fewer homes listed have contributed to a relatively long run of increasing prices. Current supply and demand levels show no sign of prices changing from their current trend.

Market Segments

Strong Seller's Market

Each segment below represents approximately 25% of the market ordered by price.

The market for this zip code continues its bounce again this week. We're a long way from the market's high point so watch the Market Action Index to predict how long this trend will last.

In the quartile market segments, we see prices in this zip code generally settled at a plateau, although Quartile 2 is on a bit of an up trend in recent weeks. We'll need to see a persistent shift in the Market Action Index before we see prices across the board move from these levels.

The market appears to be placing an increasing premium on homes. When list prices and price per square foot consistently increase in tandem, as they're doing now, you can often find short-term investment opportunities. Watch the Market Action Index for persistent changes as a leading indicator for these trends to flatten or drop.

Inventory has been falling in recent weeks. Note that declining inventory alone does not signal a strengthening market. Look to the Market Action Index and Days on Market trends to gauge whether buyer interest is changing with the available supply.

The market continues to get hotter. More sales demand and fewer homes listed have contributed to a relatively long run of increasing prices. Current supply and demand levels show no sign of prices changing from their current trend.

Not surprisingly, all segments in this zip code are showing high levels of demand. Watch the quartiles for changes before the whole market changes. Often one end of the market (e.g. the highend) will weaken before the rest of the market and signal a slowdown for the whole group.

The properties have been on the market for an average of 160 days. Half of the listings have come newly on the market in the past 189 or so days. Watch the 90-day DOM trend for signals of a changing market.

It is not uncommon for the higher priced homes in an area to take longer to sell than those in the lower quartiles.

Instant access to

WFG’s MyHome® provides full transparency, real-time updates, and post-closing home information in a secure built with YOU in mind.

Contact information for

Sign up for an account at https://myhome.wfgtitle.com today!

Click Register for MyHome® account on a MyHome® email to https://myhome. wfgtitle.com

Complete a brief registration form. Use your email address on immediate access.

via text, email, or

for your transaction

your escrow team

TRANSACTION CLOSED

GATHER UP

SIGNING SCHEDULED

CLOSE TO SIGNING

TITLE CLEARED

UPDATER INVITATION

TITLE REPORT DELIVERED

TRANSACTION STARTED

MIDPOINT FEEDBACK

EARNEST MONEY