Business & Economy in Qatar

BANKING AND FINANCE ECONOMY

COMMERCE USEFUL NUMBERS

INVESTMENT AND TRADE

THE HYDROCARBON INDUSTRY

INFRASTRUCTURE

INTERESTING READS

BANKING AND FINANCE ECONOMY

COMMERCE USEFUL NUMBERS

INVESTMENT AND TRADE

THE HYDROCARBON INDUSTRY

INFRASTRUCTURE

INTERESTING READS

We are a non-profit community initiative dedicated to supporting and celebrating the British community in Qatar.

Whether you are new to Qatar or have called it home for years, we are here for you. From play group to padel leagues, social events for new arrivals to our winter bazaar, we offer something for everyone.

Head to our website or follow us on social media to find out more.

Banking and Finance

•Useful Numbers: Banks and Exchange Houses

•The Banking Network • Currency • The Banking Sector

•Qatar Central Bank • Qatar Credit Bureau

•Loans, Bank Charges and Interest Rates • Accounts

•Islamic Finance • Financial Services and Insurance

•Anti-Money Laundering/Combating the Financing of Terrorism

Economy

•Economic Growth and Gross Domestic Product (GDP)

•Trade Surplus • The Budget

•Inflation and Cost of Living • Employment

Commerce Useful Numbers

Investment and Trade

•Overview • Incentives • Investment Regulations

•Choosing a Business Structure

•Company Structures • Commercial Registration

•Export and Import • Taxation • Intellectual Property

•Regulatory Bodies and Government-owned Entities

•Qatar Investment Authority • Qatar Financial Centre

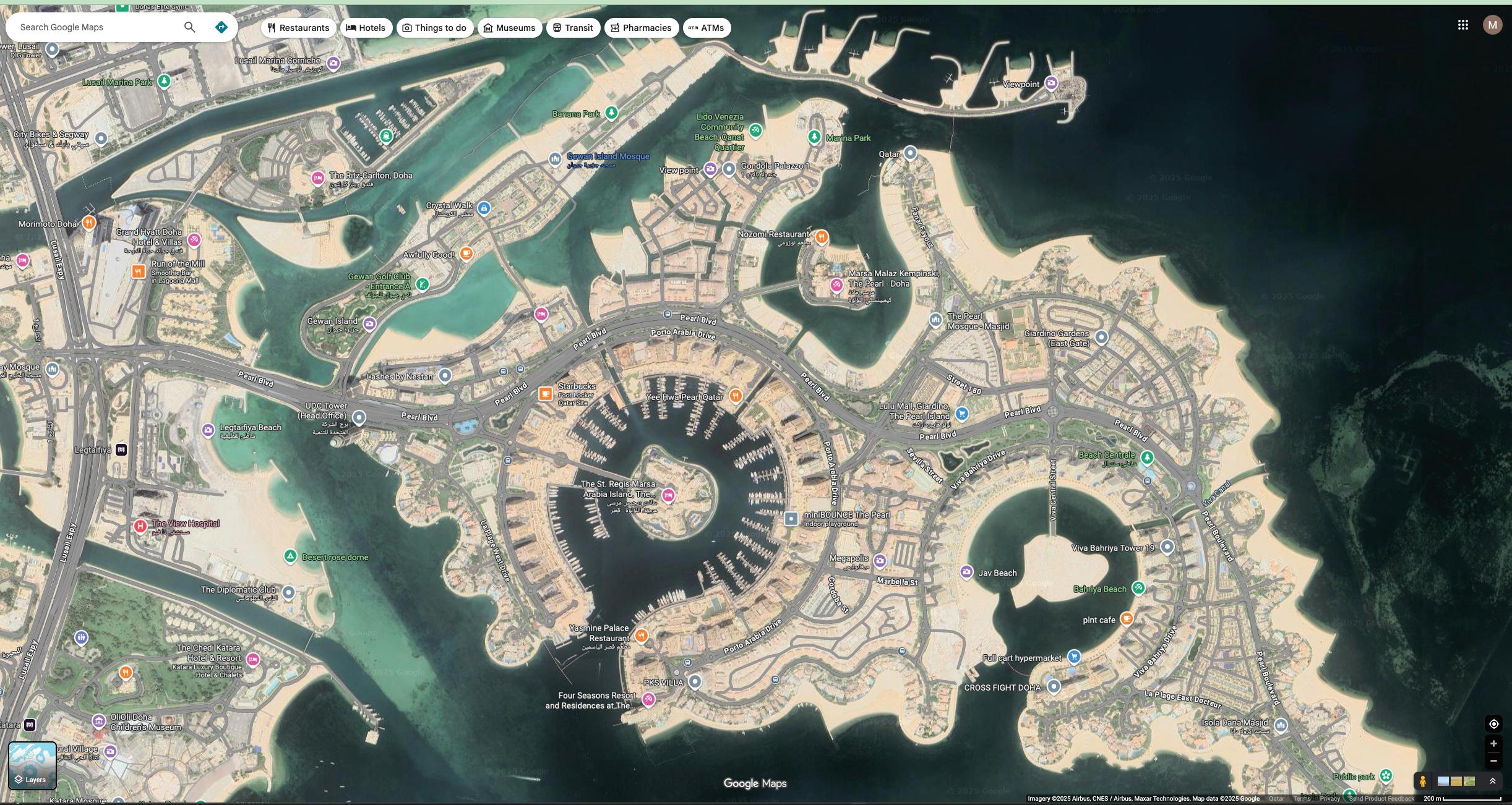

•Qatar Stock Exchange • Real Estate

•Developers and Real Estate Agents Selling Property

The Hydrocarbon Industry

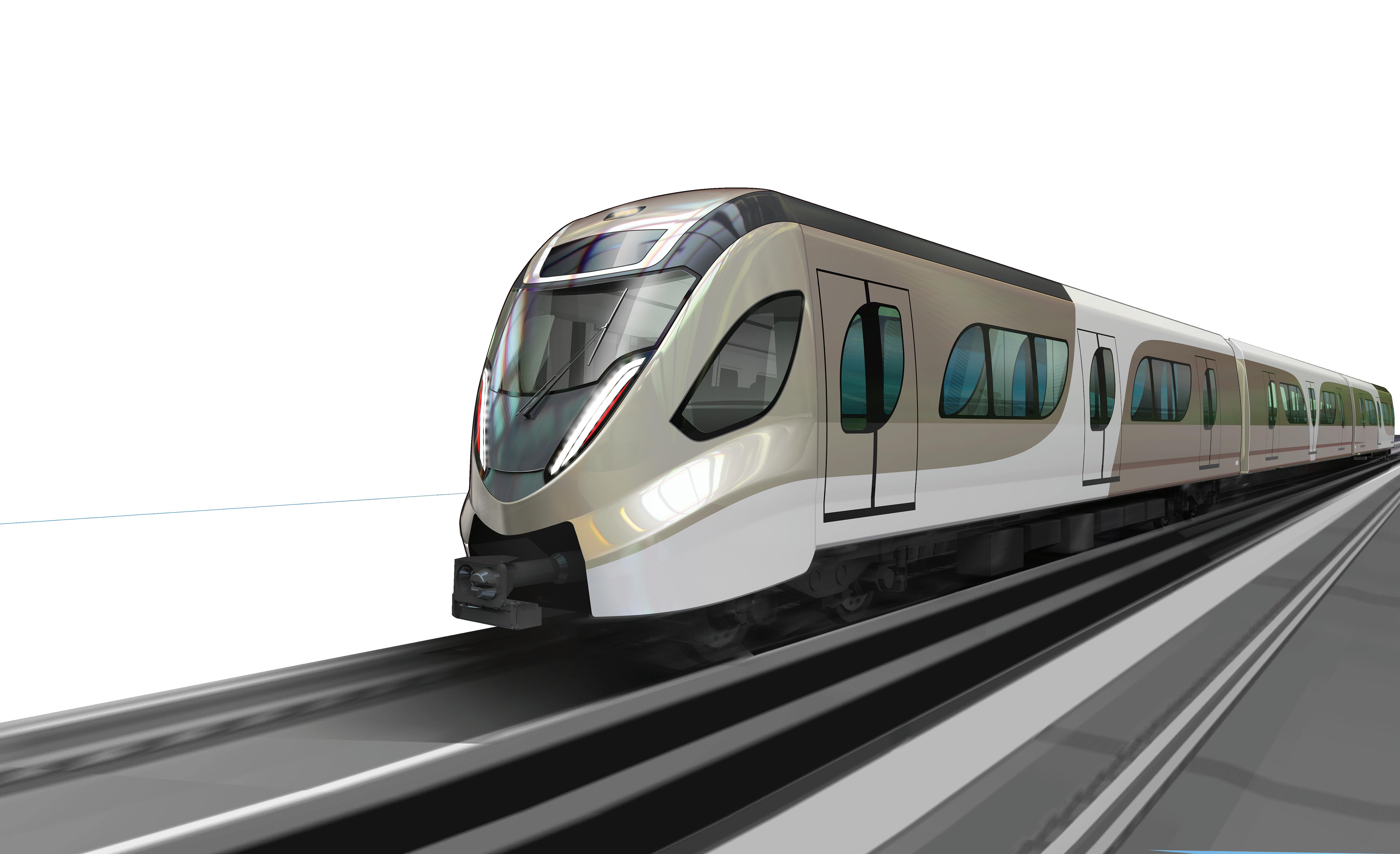

Feature – PPP Projects in Qatar

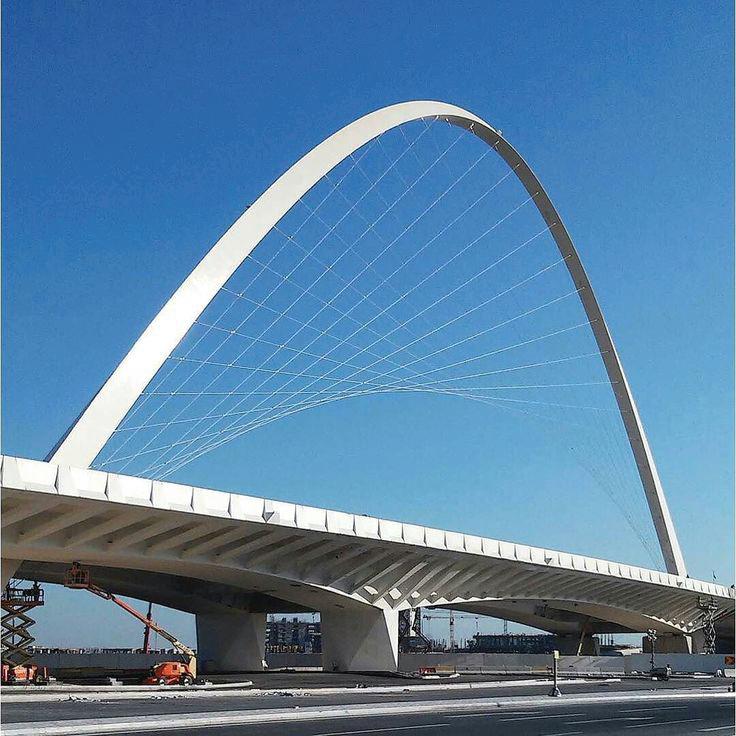

An overview of current and future

Public-Private Partnership (PPP) projects, including Sharq Crossing.

Infrastructure in Qatar

2026 Launch Year

The British Chamber of Commerce Qatar (BCCQ) is the strategic transition of the QBBF.

The British Chamber of Commerce Qatar (BCCQ) is a member-led, Global British Chambers network and Embassy-aligned chamber, reimagined to meet the needs of a modern, connected and forward-looking business community.

Established in 1992, the Chamber empowers UK and Qatari businesses to grow, connect and lead through insight, trade and influence. BCCQ offers an in-country platform built on credibility, community and long-term commercial opportunity.

“BCCQ will redefine British–Qatari trade and business in the Middle East — positioning Qatar as a strategic gateway for regional opportunity.”

Official Partner | Global Network, British Chamber of Commerce Collaboratively working with the Department for Business & Trade

More than a membership. A gateway to growth.

BCCQ is a respected bridge between UK businesses and Qatari opportunities, embedded within the British Embassy and aligned with government and trade policy.

A modern chamber, grounded in excellence and built for long-term impact.

Strategic connections across UK–Qatar markets

High-level events, forums and working groups

Credible insight, advocacy and visibility

Access aligned to government and Embassy stakeholders

Sponsorship & Partnership Opportunities

Partnering with the British Chamber of Commerce Qatar places your organisation at the forefront of UK–Qatar commercial engagement. Sponsorship offers strategic visibility, government and Embassy access, and alignment with a trusted international platform shaping future trade and leadership.

Choose from Foundation, Platinum or Elite level sponsorship and more.

For sponsorship enquiries: info@britishchamberqatar.com

Founder & Managing Editor

Hilar y Bainbridge

Editorial

Sarah Palmer (Editor)

Ola Diab (Deputy Editor)

Terr y Sutcliffe

Adver tising

Howard Bainbridge

Marrian Magtira

Retail Sales

Ayen Molina

Online/Digital

Weslee Dizon

Patrisha Manzon

Char lotte Wright

Juggy Gill

Khaled Emad

Design and Ar twor k

Dick Tamayo

Mar Principe

Marhaba endeavours to quote accurate information and updates each of its sections ever y issue. However, the company accepts no responsibility or liability for any false, inaccurate, inappropriate or incomplete information presented, whether in print, on the website, or on social media channels.

© 2025/26 Marhaba Information Guide. All Rights Reser ved. No par t of this magazine may be reproduced, in any form, without written permission of the publishers.

Dana Public Relations PO Box 3797, Doha, Qatar Tel (+974) 4465 0083, 4465 5533

General Information

marhaba@marhaba.com.qa

Follow us

See also our maps Al Khor and the Northeast Coast

See also our maps Al Wakra, Mesaieed and the Southeast Coast

See our detailed

Bank Telephone Website Currency and Exchange

Regional Banks

Ahlibank

4420 5222 ahlibank.com.qa

Commercial Bank of Qatar 4449 0000 cbq.qa

Doha Bank 4445 6000 qa.dohabank.com

Qatar Development Bank 4430 0000 qdb.qa

Qatar National Bank 4440 7777 qnb.com

Branches of Foreign Banks

Arab Bank Qatar 4438 7777 arabbank.com.qa

Banco Santander ¥

Bank Saderat Iran 4441 4646 bsi.com.qa

BNP Paribas 4453 7115 mea.bnpparibas.com

HSBC 4442 4722 hsbc.com.qa

Mashreq Bank 4408 3333 mashreqbank.com/qatar

Standard Chartered Bank 4465 8555 sc.com/qa

United Bank Limited 4444 1314 ubldirect.com

Islamic Banks

Dukhan Bank * 800 8555 dukhanbank.com

Lesha Bank § 4448 3333 qfb.com.qa

AlRayan Bank # 4425 3333 alrayan.com

Qatar International Islamic Bank 4484 0000 qiib.com.qa

Qatar Islamic Bank 4402 0888 qib.com.qa

Investment Banks

QInvest 4405 6666 qinvest.com

* Was Barwa Bank; merged with International Bank of Qatar in 2019

# Masraf Al Rayan merged with Al Khalij Commercial Bank in 2021; name changed in 2024

§ Was Qatar First Bank; name changed in 2022

¥ Representative office incorporated in the QFC in 2024

Alfardan Exchange 4453 7777

alfardanexchange.com.qa

Al Jazeera Exchange 4449 2800 aljazeeraexchangeqatar.com

Al Mana Exchange 4442 4226 almanaexchange.com

Al Sadd Exchange 4432 3335/6 alsaddexchange.com

Arabian Exchange 4443 8300 arabianex.com

Gulf Exchange 4438 3222 gulfexchange.com.qa

Travelex Qatar 4498 1181/ 6675 8758 travelex.qa

Unimoni Qatar 4436 5252 unimoni.qa

Western Union 4453 7777 westernunion.com/qa

Bank branches and ATMs can be found extensively across the country. Visitors can usually access funds in their home accounts by using their cards here, with some ATMs allowing the withdrawal of USD and Euro – check for commission or exchange rate fees. Major credit cards are widely accepted. Exchange houses provide remittance services and foreign exchange, and are licensed by Qatar Central Bank (QCB). There are no exchange control regulations, but movement of money in and out of local accounts is monitored and a declaration of origin for large cash deposits may be required. Cash transactions above QAR50,000 are prohibited. The GCCNET system is a single ATM network linking all GCC point of sale switches – in Qatar this is NAPS (National ATM & POS Switch).

Branch opening hours: Generally Sunday – Thursday 7:30 am – 1 pm. Many banks have extended branch operations, particularly at malls; check the bank's website for timings and locations of branches and ATMs.

Digital branches and services: HSBC Msheireb Downtown Digital branch • QIB Video Banking via the QIB mobile app • Virtual assistants: Dukhan Bank (Rashid), Qatar Islamic Bank (Zaki) E-payment services: QCB has authorised digital payment services via the Qatar Mobile Payment (QMP) system, the instant national interoperable switch for mobile payments. In April 2025 QCB introduced a 'multiple wallets per mobile number' feature in the QMP system, allowing users to open two digital wallets with different payment service providers using the same mobile number. Participants: Ahli Bank • AlRayan Bank • Arab Bank • Commercial Bank of Qatar • Doha Bank • Dukhan Bank • HSBC • iPay (Vodafone Qatar) • Ooredoo Money • Qatar Islamic Bank • Qatar International Islamic Bank • Qatar National Bank. Fawran instant payment service: Fast, secure payments to individuals via Qatari mobile number or alias name. Global digital wallet services: Apple Pay, Google Pay and Samsung Pay are available and accepted in Qatar. Himyan: QCB's first national prepaid card, accepted at all ATMs, POS and online stores; Apple Pay was introduced to cardholders in June 2025, and to merchants via Qatar payment company Dibsy in July 2025.

PayPal: Goods and Services only – Friends and Family is not available.

The Ministry of Commerce and Industry mandates all commercial outlets in the country must provide an electronic payment service to customers without additional charges, nor impose charges for the use of debit/credit cards.

The unit of currency is the Qatari Riyal (QAR), divided into 100 Dirhams (Dh), issued by Qatar Central Bank (QCB). It is pegged to the US dollar at a fixed exchange rate of USD1 = QAR3.64.

The fifth series of notes were introduced in December 2020, with a new QAR200 joining the QAR1, QAR5, QAR10, QAR50, QAR100 and QAR500 notes. The old notes ceased to be legal tender on 31 December 2021, although the public can change the old notes at QCB for another 10 years. Banknotes incorporate security threads, as well as special features for recognition by the blind and visually impaired, and the new QAR500 note features a holographic security thread, the first in the Middle East to do so. Coins remain unchanged at Dh5, Dh10, Dh25 and Dh50.

The QAR1 note was changed in July 2025 (pictured) to align with laws regarding the official state emblem, Arabic numerals and date of issuance. The old QAR1 notes will remain in circulation. Changes to the other notes will be made at a later date, according to QCB.

Qatar, Saudi Arabia, Kuwait and Bahrain support the creation of a Gulf Monetary Union; the UAE and Oman have withdrawn entry. The GCC Supreme Council in 2008 approved the Monetary Union Agreement and the Statute of the Monetary Council. The Gulf Monetary Council headquarters opened in Riyadh in 2013 with monetary union proposed later that year. Qatar, Kuwait, Bahrain and Saudi Arabia subsequently agreed to establish a unified central bank with currency pegged to the USD. There has been no further action since 2013.

Overseen by Qatar Central Bank (QCB), the sector comprises local, regional, foreign and Islamic banks. State-owned Qatar Development Bank (QDB) provides financing to SMEs, while QInvest focuses on investment banking, asset management and investing its own capital.

Barwa Bank and International Bank of Qatar (IBQ) signed a final agreement in 2018 to merge the two banks, the first in Qatar's banking history, to create a Sharia-compliant financial institution. The legal merger was completed in 2019, trading as Barwa Bank, with IBQ products converted to Shariacompliant equivalents. Barwa changed its name to Dukhan Bank in 2020.

In 2020 negotiations began for merger between Masraf Al Rayan and Al Khalij Commercial Bank (al khaliji). Masraf Al Rayan was previously involved as a third bank in the merger between Barwa Bank and IBQ. Masraf Al Rayan and al khaliji's merger agreement in 2021 was completed later that year. al khaliji's business was absorbed into Masraf Al Rayan's, with the latter becoming the remaining legal entity operating in accordance with Islamic Sharia principles. Masraf Al Rayan changed its name to AlRayan Bank in November 2024.

The Cabinet has approved resolutions allowing a non-Qatari investor to own up to 100% of the capital in AlRayan Bank, Commercial Bank of Qatar, Doha Bank, Qatar Islamic Bank, Qatar National Bank, and Qatar International Islamic Bank. A revised loan-to-deposit requirement of 100% came into effect in 2018. The adoption of International Financial Reporting Standard (IFRS) 9 by QCB has strengthened the provision coverage at Qatar’s commercial banks – under the IFRS

standard, banks and financial entities have to set aside a certain proportion of profit against losses for unseen reasons. The Supreme Emergency Committee monitors the day-to-day activities of financial institutions in the country, addressing emergency matters and easing the flow of work.

In September 2025, the IMF stated in its staff visit to Qatar that 'banks continue to demonstrate strong capitalisation, liquidity, and profitability' and that 'recent stress tests conducted by QCB suggest that banks maintain adequate buffers to withstand potential shocks'.

Under Law No 13 of 2012 Qatar Central Bank and the Regulation of Financial Services, QCB is deemed an autonomous corporate body, with a capital of QAR50 bn and under the direct control of The Amir. It is headed by a governor appointed by The Amir, and primary goals include financial stability, supporting developmental activities and strengthening the national economy. The law covers banks, insurance companies, exchange houses, Qatar Exchange and QFC-registered entities. Amiri Decision No 65 of 2021 appointed HE Sheikh Bandar bin Mohammed bin Saoud Al Thani as Governor of QCB. qcb.qa

Under Law No 13 of 2012, the Financial Stability and Risk Monitoring Committee shall study existing and future risks related to all banking, financial, insurance and stock market activities. The panel works closely with the Ministry of Finance to frame general policies.

The law provides strict penalties for anyone accepting deposits from the public without a valid licence from the banking regulator – violators can face a jail term of up to five years and/or a fine

of up to QAR5 mn. Refusing to accept the legal tender of Qatar incurs a jail term of three years and/or a fine of up to QAR5 mn, while issuing forged currency means 10 years in jail and/or a fine of QAR10 mn. Manipulating accounts incurs a prison term of up to three years and/or a fine of up to QAR200,000.

The Qatar Renminbi Centre opened in 2015, increasing financial connectivity between China, Southwest Asia and the MENA region. The centre provides access to China’s onshore RMB and foreign exchange markets to local financial institutions, facilitating trade with Chinese companies. qatarrmbcentre.com

Issued in November 2023 to create a financial and capital market that leads the region in innovation, efficiency and investor protection and positions Qatar to unlock its full economic potential in line with its National Vision 2030. The strategy is based on four fundamental pillars: the banking sector, the insurance sector, the digital financial services system, and capital markets. These pillars support five common themes:

• Governance and regulatory oversight of financial sectors.

• Enhancing the role of Islamic finance. Digital innovations and advanced technology.

• Environmental, social, institutional governance, and sustainability.

• Talent and capabilities.

ESG (environmental, social and governance) and Sustainability Strategy for the Financial Sector: Issued in June 2024 to strengthen the financial system’s capacity to support national sustainability visions and goals. There are three pillars: financial sector climate, environmental and social risk management; capital mobilisation towards sustainable finance; and embedding ESG and sustainability as part of QCB’s internal operations.

The Sustainable Finance Framework was released in April 2025, which applies to all banks operating in Qatar and establishes principles of sustainable finance in accordance with international practices to promote responsible investment and lending.

Buy Now Pay Later (BNPL): QCB gave the first licence for the BNPL service to PayLater in March 2025, one of the five approved companies in the first cohort of submitted applications in April 2024.

BNPL is a short term interest free credit facility, allowing the customer – a Qatari resident aged 18 and above – to split the transaction amount into instalments to be repaid over a maximum of 12 months, via a merchant's online and offline

store, or a BNPL Provider's digital platform that aggregates multiple merchants.

The BNPL regulations apply to any provider operating in Qatar set up under the Ministry of Commerce and Industry, Qatar Financial Centre, Qatar Science and Technology Park or any other free zone authority/commercial licensing entity, but not banks or finance companies licensed by QCB.

Fintech regulations: Noting the increasing growth and popularity of fintech, QCB has launched the Regulatory Sandbox and the Express Sandbox. Registration opened in January 2025, inviting fintech companies, startups, and innovators in the financial sector to test technological solutions in a regulated and secure environment under the supervision of QCB. sandbox.qcb.gov.qa

QCB launched the National Fintech Strategy 2023 in March 2023 to 'support and reinforce a diversified economy and investments in Qatar based on financial technology and technological innovation,' according to the QCB Governor. There are four pillars to boost Qatar's economic growth:

• Establishing infrastructure eg advanced regulatory rules and electronic platforms to develop financial technology.

• Prioritising innovation and financial technology sector growth, especially Islamic financial technology and sustainable development, as well as insurance technology.

• Empowering companies and enhancing their performance by using financial technology solutions and making the State of Qatar a financial technology hub.

• Providing a smooth mechanism and support for the transition towards cash-less transactions.

This strategy will add to the number of initiatives already in place to support the fintech sector, such as electronic wallets, instant payments and transfers, and the first local prepaid electronic payment card (Himyan).

In April 2024, QCB issued its Cloud Computing Regulations, seeking to regulate the use of cloud computing in the financial sector, protect financial data, and promote digitisation and innovation, while in September the Artificial Intelligence (AI) Guideline was issued, to regulate the use of Al within the financial sector, increase customer satisfaction and reduce costs.

Bad loans have been reduced since the Bureau started operations in 2011. The centre cannot grant credit facilities to individuals nor impose restrictions on banks. The Bureau provides

analytical data and supports banks’ use of advanced techniques in risk management, as well as support sustainable growth of credit in Qatar. It provides banks with information on customers' total exposure in the market and the loans they hold, enabling banks to choose prospective customers. cb.gov.qa

Loans: Under QCB rules, the default period for a substandard loan is three months or more, for a doubtful loan six months, and a bad loan nine months. Banks have to closely monitor loan disbursement and forward reports on customer creditworthiness to QCB. There is also a duty to track and follow defaulting customers and seek resolution – if this fails, they will take legal action. Non-payment of loans could lead to a travel ban for Qatar and possibly the GCC.

QCB has imposed ceilings on the amounts a bank can lend as a personal loan to citizens and expatriates. Banks cannot lend more than QAR400,000 to an expatriate, over a maximum repayment period of 48 months, against a max 50% of total monthly salary, and at a max 6.5% interest rate. For Qatari citizens there is a max loan of QAR2 mn over a max 72 months. Banks cannot use post-dated cheques for the loan value.

Mortgages: New rules were introduced by QCB in July 2023, to be applied by Qatari banks and subsidiaries within the country. Branches and subsidiaries of Qatari banks outside the State of Qatar should comply with the instructions and conditions of the host regulatory authorities as long as the collaterals and financed properties are outside the country.

There are three categories:

• Ready and under construction residential properties for individuals, whose repayment sources are linked to the client's own sources, salary or any other non-real estate sources:

ø For Qataris, proprieties up to QAR6 mn –maximum loan-to-value (LTV) of 80% and max tenure of 30 years; above QAR6 mn – max LTV 75%, max tenure 30 years.

ø For residents, for properties up to QAR6 mn –max LTV 75%, max tenure 25 years; above QAR6 mn max LTV 70%, max tenure 25 years.

• Financing ready properties for individuals and companies for investment and commercial purposes, with the repayment depending mainly on real estate revenues:

ø For Qatari citizens and companies, which Qatari partners own not less than 51%, for property

value up to QAR10 mn – max LTV 75%, max tenure 25 years; over QAR10mn – max LTV 70%, max tenure 25 years.

ø For residents (individuals or companies), for property value up to QAR10 mn – max LTV 70%, max tenure 25 years; over QAR10 mn – max LTV 65%, max tenure 25 years.

ø For non-residents, property value up to QAR10 mn – max LTV 60%, max tenure 20 years; over QAR10 mn – max LTV 60%, max tenure 15 years.

• Financing real estate under construction for investment and commercial purposes with the repayment depending on the property revenues in whole or in part:

ø For Qatari citizens and companies, which Qatari partners own not less than 51% – max LTV 60%, max tenure 20 years.

ø Foreigners (residents and non-resident) – max LTV 50%, max tenure 15 years.

QCB rules for granting mortgages for salary customers states the debt burden ratio should not exceed 75% of the total salary for Qataris, and 50% for expatriates. If the customer obtains permanent residence in Qatar as a result of owning the property, the mortgage providers can extend the tenure to be similar to that of residents.

The amendments also state that for underconstruction property financing, the grace period, if granted, should not exceed three years and be within the overall tenure, with regular interest payments during this period on a monthly or quarterly basis.

Documents usually required: Valuation Report from an approved real estate agent • Salary assignment letter if the home loan is the first facility with the bank • ID card for Qataris or passport and valid residence card for expatriates • Copy of the Title Deed and map • Building insurance cover. Discuss provision for life assurance against any loan amount taken and consider updating your will.

Credit cards: Max 12% annual interest rate and usually only issued when customers transfer their salary or have an adequate deposit at the bank.

Interest rates: Announced by QCB on overnight deposit and loan transactions between QCB and local banks via the Qatar Money Market Rate Standing Facility, a monetary instrument through which local banks can request access to loan and deposit facilities with QCB at daily interest rates. QCB and Bloomberg jointly launched the first Qatar interbank offer rate (QIBOR) fixing in 2012 – the interest rate charged by banks in Qatar for interbank transactions.

Given the fixed parity between the Qatari riyal (QAR) and the US dollar (USD), QCB short term interest rates policies are subordinated to the fixed exchange rate policy, making QCB overnight interest rates closely related to its USD counterpart, the Fed Funds Rate. As of November 2025, the QCB Deposit Rate rate is 4.10%, the Lending Rate is 4.60%, and the Repo Rate is 4.35%.

Standard bank facilities: Debit/credit cards, standing orders, money transfers, personal loans, vehicle loans, and mortgages on current and savings accounts (including joint accounts). Some accounts offer longer terms, higher interest and the option to save in USD, GBP and Euros.

24/7 telephone and internet banking services and apps offer additional options, while some services such as ordering a cheque book can be accessed via the bank's ATM network. With mobile banking a customer relations officer can visit you at home or work to assist with banking requirements. Most banks offer premium banking services.

The Wage Protection Scheme (WPS) is an electronic salary transfer system that ensures workers are paid as per their employment agreement, initiated by the Ministry of Labour and QCB. Employees therefore need a local bank account in order to receive their wages from the employer.

International bank account number (IBAN): Adopted in 2014 as a standard for identifying and numbering all bank accounts in Qatar. The system applies to all accounts in banks operating in the country, and can be found on bank statements or online in account details. The existing account number is not replaced; additional characters appear in front of the account number to form a 29‑character IBAN. All incoming and outgoing transfers to and from banks and financial institutions must use IBAN.

Opening an account: Documents usually required:

• A valid residence permit or work visa. A worker’s dependants (eg spouse and family) can open an account but may require his permission as he is their sponsor (check with the individual bank).

• Valid passport.

• For current accounts, a letter from the employer/ sponsor confirming the total monthly salary, with the company’s official stamp. You may have to transfer your salary to the new account.

• Some banks may ask to see your tenancy agreement to establish your residential address.

• Take copies of these documents, along with identity photographs. Ask for photocopies of any documents signed.

Closing an account: Start closing bank accounts 30 45 days before your last salary payment, and ensure your accounts have sufficient credit to cover loan and credit card payments (including any cancellation fees), as well as any utiility bills or traffic violation fines.

All outstanding bank loans and credit card balances must be paid off before you leave Qatar. Any end of service benefit payments will be withheld until the loans are cleared. You will then be given a signed and stamped letter to give to your employer/sponsor for payment of the gratuity. Leaving the country without paying off your loans could incur a fine or prison term if you wish to re enter.

Cheques: A chequebook can be issued with a current account. They are not widely accepted for instant payment; post‑dated cheques are commonly used for house rental payments. The onus of responsibility is on the banks not to encash cheques before the designated date. Issuing a cheque without the necessary funds in your account is a serious criminal offence and the bank or creditor may notify the police, leading to possible prosecution. Punishment for causing a cheque to bounce due to insufficient funds can be severe: jail terms of between three months and three years, and/or fines of between QAR3,000 and QAR10,000. The Capital Security Department records all cases electronically to speed up the process.

Under QCB instructions, the Qatar Credit Bureau lists individuals and companies who have issued at least one bounced cheque. Banks are not obligated to issue new cheque books to these customers unless the amount has been settled and their name removed. Banks must also report any customer who has issued a bounced cheque.

Credit cards: Available with all the usual privileges, with the credit limit determined by the cardholder's salary or savings balance. Family members may also be eligible for a card. Check at the time of applying for issuance and renewal fees, conversion charges, and payment options.

Since 2014 all card transactions made using the magnetic stripe inside and outside of Qatar will be declined. However, as certain countries (eg the US, India and the Philippines) still use the magstripe for transactions, customers should activate their card before travelling.

Offshore banking: Offshore banking can be a secure anchor for an expat's finances while out of their home country. Check with local banks for availability of international bank accounts in USD, GBP, or Euros.

Complaints: Unresolved consumer complaints can be made online to QCB's Consumer Protection Department. qcb.gov.qa

There are a number of Islamic banks in Qatar, the largest of which is Qatar Islamic Bank. Lesha Bank, regulated by the QFC Regulatory Authority, is the first independent, Sharia compliant investment bank.

Banks were required by QCB to separate their Islamic and conventional lending operations in 2011. Islamic banking by other conventional banks is barred from Qatar's market. QCB took this action due to certain supervisory and monetary issues, namely that holding both Islamic and non-Islamic deposits incurs different risks and reporting methods.

Law No 13 of 2012 requires that Islamic banks must have a Sharia board with at least three qualified members approved by the shareholders. Neither they nor members of their family may be employed or hold shares in the entity.

Institutions and services must abide by regulations set out in the holy Quran and Sharia (Islamic Law). Charging riba (interest) is haram (forbidden). Islamic banks charge fees for services and engage in profit sharing, enabling them to offer comparable facilities to those of conventional banks. Under a mudharabah (profit sharing) contract, the rabbul maal (owner of the money) authorises the bank to invest funds as per Sharia to make justifiable returns. Other concepts of Islamic banking include wadiah (safekeeping), musharakah (joint venture), and ijarah (leasing). Bai (saving) is halal (allowed).

QCB is the supreme authority with overall control, regulatory responsibility and supervisory powers for all financial services providers in Qatar, including banks, Islamic financial institutions, insurance and reinsurance companies and other financial institutions. The provision of any financial service or the conduct of any financial activity or business (including insurance and reinsurance) is prohibited unless a licence is granted by QCB.

Financial services are provided by entities registered with the Qatar Financial Centre (QFC). Insurance products are widely available from local and international companies (see Living in Qatar).

Under Law No 13 of 2012 QCB and the Regulation of Financial Services, only local insurance providers are permitted to underwrite any kind of risk against

properties in Qatar. Decision No 1 of 2016 issued by the Governor of QCB provides instructions related to licensing, regulation and controls, risk management, accounting, and other requirements. Decision No 7 of 2019 has further instructions for licensing, organising and supervising the services of supporting insurance providers. It set out the competencies and expertise, the nature of the work, areas of responsibility and functions, and the establishment of professional and ethical codes of conduct.

QCB continues to regulate and develop the insurance market under the National Fintech Strategy 2023 launched in March 2023.

the Financing of Terrorism (AML/CFT)

Qatar is a founding member of the Middle East and North Africa Financial Action Task Force (MENAFATF), and also a member of the Financial Action Task Force (FATF).

Law No 20 of 2019 on Combating Money Laundering and Terrorism Financing was issued in September 2019, replacing Law No 4 of 2010, with implementing regulations following in December. The law is in accordance with the latest standards adopted by major international organisations including FATF, highlighting Qatar's regional role in setting standards in its legal and regulatory framework for AML/CFT.

The Qatar Financial Information Unit (QFIU) is a government regulatory agency responsible for financial intelligence efforts to combat money laundering and financing terrorism. Banks, investment companies, insurers and other financial institutions must report suspicious financial transactions, which are analysed by the QFIU and disseminated to law enforcement authorities for further investigation and action. qfiu.gov.qa

The QFIU is part of the National Anti-Money Laundering and Terrorist Financing Committee (NAMLC), which works closely with financial regulators and other authorities in Qatar, alongside international bodies, to ensure the effective implementation of Law No 20 of 2019, as well as other legislation. The NAMLC is chaired by the Deputy Governor of QCB. namlc.gov.qa

In 2023, the FATF report on Qatar’s initiatives for anti-money laundering claimed that Qatar has made substantive improvements to its system to combat money laundering and terrorism financing and its technical compliance with FATF requirements is strong. m

By Sarah Palmer

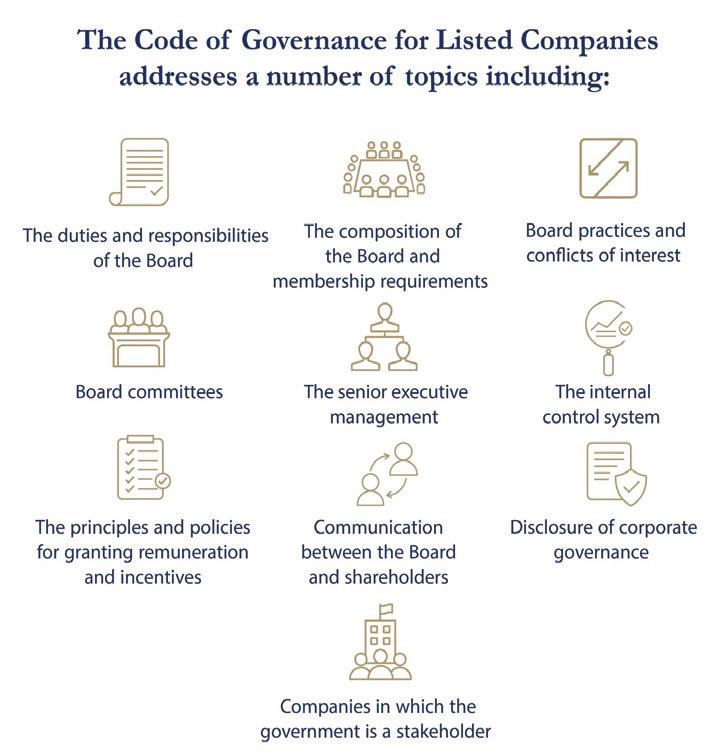

The Qatar Financial Markets Authority (QFMA) recently announced the issuance of the Code of Governance for Listed Companies, known as the New Code, replacing the previous 2016 framework.

In accordance with the Board of Directors Resolution No 5 of 2025, all parties covered by this system are required to ensure compliance with its provisions within one year from the date of its publication in the Official Gazette. This means that companies who are still applying to convert into a Qatari Public Shareholding Company (QSPC) and be listed on the Qatar Stock Exchange (QSE) may have to make adjustments in order to comply with the New Code.

QFMA has been working on a new Governance Code since 2022, with the draft having been published online for public consultation. Preparation of the draft came after conducting studies and comparisons with many other financial markets in order to adhere to the best international practices and standards.

This new code is necessary to keep up with the advancement of the capital market's regulatory framework to meet the highest international standards, and has been drafted to also suit the characteristics of Qatar's financial market. It aims to reinforce transparency and integrity while also safeguarding shareholders' rights.

In a conversation with Qatar News Agency, Khalid Saif Al Sulaiti, Director of the Governance and Disclosure Department at QFMA, said that the code introduces disclosures on companies' adherence to sustainability, corporate social responsibility, and climate-related standards, requiring listed companies to publish periodic reports, as well as material news and financial statements. A guidance manual will be available from the ministry to assist companies in complying with these standards.

He further stated that the code also sets out a clear and detailed mechanism for the nomination and election process and includes an annex explaining the procedures from the opening of nominations through the formation of the board and its committees, specifying the types of members, whether independent, non-independent, executive, or non-executive, as well as the mandatory committees that must be established.

He commended listed Qatari companies for adhering to governance standards, as it maintains their standing both domestically and internationally and provides confidence to clients and suppliers. The regulations play an important role in enhancing investor confidence, particularly in allowing foreign investors to assess the regulatory environment before entering the market.

What the New Code covers and its key amendments

The rules and provisions of the code are based on recommendations by international institutions in connection with corporate governance, with additional best regional and international practices. Each company is required to develop a policy, approved by the board, for disclosure and transparency as per the relevant international principle, that benefits the company, its stakeholders, and relevant authorities.

Board of directors:

• The minimum number of board members has been raised from five to seven, with a maximum of eleven.

• A minimum of three independent board members is required; this was previously one-third of the board.

• The majority of the board must be non-executive members.

• New eligibility criteria and restrictions on shareholding, employment, and term limits (maximum of two consecutive terms) now apply to independent board members.

• The code has a clear, detailed process for nominations and elections, defining the roles of independent, nonindependent, executive, and non-executive members.

Enhanced disclosure and reporting:

• Listed companies must now disclose their adherence to standards concerning environmental, social, and corporate governance (ESG), along with sustainability, social responsibility, and climate-related practices.

• Companies must publish periodic reports of ESG efforts and standard financial statements.

• Boards must adopt and publish a board-approved policy on disclosure and transparency.

Shareholder rights and equality:

• The code reinforces the 'one-share, one-vote' principle for all shareholders, regardless of the number of shares they hold.

• It requires shareholder approval for significant transactions such as capital changes, mergers, acquisitions, and buyouts.

Other significant updates:

• The new code applies to companies on both the Main Market and the Venture Market, unlike previous regulations that focused only on the Main Market.

• Companies have a one-year grace period, ie until August 2026, to fully comply with the new provisions. The QFMA may grant extensions, for one or more additional one-year periods.

• The code is designed to align Qatar's regulatory framework with international best practices from organisations like the International Organization of Securities Commissions (IOSCO), the Organisation for Economic Co-operation and Development (OECD), and the International Sustainability Standards Board (ISSB). A set of principles were observed in drafting the provisions of this Code, including transparency and clarity, justice and equality, and responsibility, oversight, and accountability.

Companies going through the listing application process should check with the QFMA to confirm whether they may proceed with their current applications.

The QFMA was established under Law No 33 of 2005 to regulate and supervise the financial markets in Qatar as an independent regulatory body. Law No 8 of 2012 gave wider responsibilities due to developments in the financial markets.

Key roles and functions include:

• Oversight and supervision to ensure fairness, transparency and efficiency, and enforcement powers over capital market activities, including combating financial crimes related to the market.

• Investor protection to maintain confidence in the securities market.

• Regulation and licensing of financial service companies, brokers, auditors, and other participants.

• Development of financial services to improve products available to investors.

The QFMA announced in September 2025 that it was changing its official logo, 20 years after its establishment. The QFMA has now joined the collective governmental visual identity of the State of Qatar after adopting the official emblem of the State in its new logo. This move reflects the well-established connection between the QFMA and the national identity, and also increases its presence locally and internationally.

For more information about the QFMA and its activities and regulations, visit qfma.org.qa m

The economy successfully weathered both the COVID-19 pandemic and the blockade imposed on 5 June 2017, with positivity after borders reopened following the AlUla Declaration in January 2021.

An International Monetary Fund (IMF) staff visit in September 2025 stated that 'Qatar’s economy continues to demonstrate resilience, supported by forward-looking policies and large hydrocarbon wealth. The government is actively advancing reforms under its ambitious Third National Development Strategy (NDS3), which focuses on accelerating diversification, enhancing competitiveness, boosting productivity, and promoting climate sustainability'. imf.org

According to the National Planning Council (NPC), in Q2 2025 the economy showed real GDP growth of 1.9% year-on-year (y-o-y), reaching QAR181.8 bn at constant prices. This growth was driven primarily by non-hydrocarbon activities, which grew by 3.4%, and accounted for 65.6% of real GDP, reflecting the effectiveness of diversification policies outlined in the NDS3 and Qatar National Vision 2030 (QNV2030). npc.qa

According to the NPC, in Q2 2025 there was a merchandise trade balance surplus of QAR48.1 bn, a decrease from QAR54.5 bn y-o-y. Total exports amounted to QAR80.7 bn, down 5.1% y-o-y and down 8.4% against Q1 2025. Imports totalled QAR32.6 bn, an increase of 6.9% y-o-y and up 0.1% against Q1 2025. Asia was the principal destination for Qatar's exports and imports, at 74.1% and 71.7% respectively. The EU represented 8.7% of exports and 24.4% of imports, and the GCC accounted for 12.5% of imports.

The State Budget for 2025, announced in December 2024, projects total revenues of QAR197 bn. HE Ali bin Ahmed Al Kuwari, the Minister of Finance, stated that Qatar continues its conservative approach in estimating oil and gas revenues, adopting an average oil price of USD60 per barrel to ensure financial flexibility and sustainable spending patterns.

existing ones, and construct new buildings for the College of Dentistry and the College of Nursing. The health sector is allocated QAR22 bn, to complete the construction of new hospitals and develop existing facilities for Hamad Medical Corporation and the Primary Health Care Corporation. Allocations for these sectors represent around 20% of the total budget.

Allocation for the municipality and environment sector is QAR21.9 bn, for projects like the establishment of a shelter and care centre for wildlife, development and rehabilitation of the Al Maha Wildlife Reserve in Al Sheehaniya, rehabilitation and maintenance of the central veterinary laboratories building, development of farm complexes, and expansion of the Aquatic Research Center.

The sports sector is allocated QAR6.6 bn to upgrade and develop facilities at Aspire Zone, the Qatar Racing and Equestrian Club, the Qatar Equestrian Federation, and the Al Uqda Equestrian Complex, as well as the development of covered sports halls and facilities under the Ministry of Sports and Youth.

Commercial affairs are allocated QAR3.9 bn, transportation QAR3.9 bn, tourism and culture QAR3.6 bn, telecommunications QAR3 bn, social services QAR2.7 bn, and research and development QAR1.1 bn. Allocations for salaries and wages have increased to QAR67.5 bn, up 5.5%.

The IMF in September 2025 reported that moderate inflation is expected despite robust economic growth. Qatar’s consumer prices would rise by 1.2% in 2025. It is expected to stabilise at around 2% over the medium term, due to LNG expansion, public investment, and a strengthening tourism sector. The NPC states that consumer prices remain stable, with inflation largely contained within expected levels.

Projected oil and gas revenue is QAR154 bn, down 3.1% compared to 2024, while non-oil revenues remain unchanged at QAR43 bn. The budget's total expenditure is QAR210.2 bn, up 4.6%.

The education sector is allocated QAR19.4 bn, with plans to construct 11 new schools, renovate seven m

The World Bank states Qatar has one of the lowest percentages of unemployed people, declining from 0.81% in 1991 to 0.1% in 2024. Qatar has been a member of the International Labour Organization (ILO) since 1972 and has ratified six conventions including five of the fundamental conventions. In 2018, Qatar and the ILO started the first phase of a technical cooperation programme (TCP) to carry out extensive labour reforms with Phase 2 from 2021 to 2024. Phase 3 will run from 2024 to 2028 and aligns with the Third National Development Strategy (NDS3) and Qatar National Vision 2030.

Qatar is a member of the World Trade Organisation and its trade policies create a competitive international trading market. The government supports the growth and success of businesses in a bid to diversify the economy. Qatar is a member of the Gulf Cooperation Council (GCC), which also includes Bahrain, Kuwait, Oman, Saudi Arabia and the United Arab Emirates. Following the ending of the blockade in 2021, Qatar has resumed trade with Saudi Arabia, the UAE, Bahrain and Egypt, and has continued to strengthen relations with a number of other countries such as Turkey, Oman, Kuwait, India, China, the UK and the US.

Embassies can provide valuable information on commercial activities and can connect you with their business council/chamber of commerce – see the Discovering Qatar section for contact details. Translation services can be found in Day-to-Day Qatar in the Living in Qatar section.

Mubadara for Social Impact is a pioneer in the field of Corporate Social Responsibility (CSR) consultancy and management. Mubadara leverages a proactive and innovative approach to CSR that prioritizes sustainable growth and measurable social impact.

Mubadara for Social Impact is a great platform to get involved in various social initiatives.

Initiate a legacy that trenscends beyond your business into your community

AQBA was launched in September 2024 by the Australian community and business leaders in Qatar, connecting two leading nations through networking opportunities, educational resources, and exclusive benefits. By strengthening bilateral and trade relations, AQBA works to support the long-term economic vision of each country.

Membership Benefits:

Access to the Australian business community in Qatar

Access to a wide range of networking events

Exclusive membership discounts

To register your interest, please contact info@aqba.qa

Qatar has one of the fastest growing global economies thanks to the world's third largest concentration of natural gas reserves. Recent legal liberalisation, economic diversification and an expanding economy provide many investment opportunities for non-Qataris. Investors have unrivalled world connectivity via Hamad Port, one of the largest in the region, and the world’s best airport, airline and air cargo carrier. Profits can be repatriated as can proceeds of sale and capital on liquidation. Major investment sectors are hydrocarbons, education, and financial and legal services, alongside ICT, sport, leisure and healthcare.

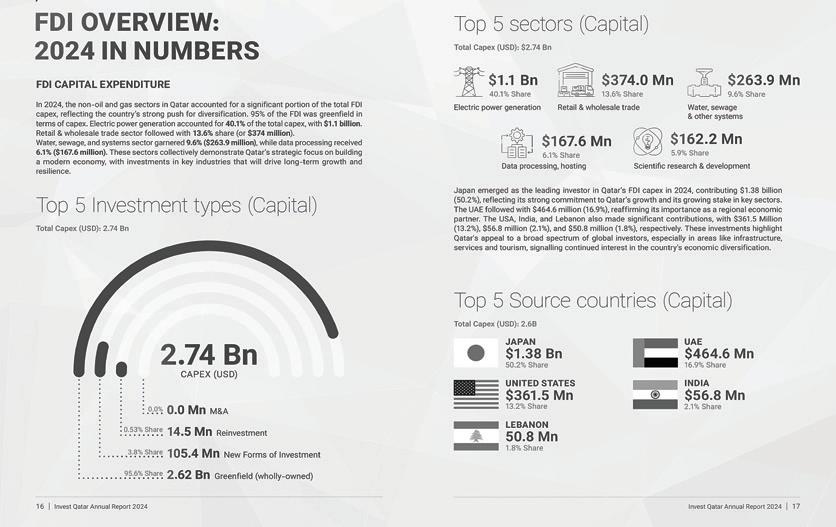

Under Qatar National Vision 2030 (QNV2030), several initiatives have been launched to diversify the economy and attract foreign direct investment. The Third National Development Strategy (NDS3) unveiled in 2024 states that Qatar is aiming for a 4% growth in non-hydrocarbon gross domestic product (GDP). As noted by the Investment Promotion Agency Qatar (IPA Qatar), the State ranks among the world’s top destinations for foreign direct investment (FDI), due to strong economic and investment momentum. There are even more opportunities due to the Ministry of Commerce and Industry reducing fees by up to 90% for certain services.

The government welcomes foreign participation in joint ventures, with a number of incentives:

• A developed infrastructure and ICT network.

• Easy access to world markets with good sea and air connections, continuously being upgraded.

• Natural gas, electricity, water and petroleum at subsidised rates.

• Land for development in the Industrial Area near Doha for nominal fees – companies can submit a request to the Ministry of Municipality for a lease contract of a plot under the Doha, Al Khor, Al Thakhira and Al Shamal Municipalities.

• Loans available from Qatar Development Bank.

• Fixed parity between the Qatari riyal and US dollar (USD1 = QAR3.64).

• No customs duty on the import of plant machinery; exemption from export duty.

• Five-year renewable tax holidays (based on government approval).

• No income tax on the salaries of expatriates.

• Tax on the profits of foreign-owned stakes in Qatari companies applied at a flat rate of 10%.

• Employment and immigration rules enabling the import of skilled and unskilled labour.

There are primarily two regulatory jurisdictions for foreign investors seeking to conduct commercial business in Qatar: the regulations of the State of Qatar, and the rules and regulations of the Qatar Financial Centre (discussed in more detail below).

Qatar also recently introduced new free zones designed to encourage certain bespoke investment vehicles to bring their businesses to the region.

Non-Qatari investors may only invest in Qatar in accordance with Foreign Investment Law No 1 of 2019:

• In January 2019 the Amir promulgated the new foreign investment law of 2019. According to

the new law, foreign investors are permitted to hold more than 49% in commercial companies with special permission from the Minister of Commerce and Industry (MoCI) (subject to some prohibitions set out below). Under the former law such increased ownership was limited to those businesses operating in a specific set of sectors.

• Non-Qatari investors are prohibited from being appointed as commercial agents under Commercial Agencies Law No 8 of 2002, but the former prohibition preventing foreigners from investing in real estate businesses has been removed under the new Foreign Investment Law. Approval from the Council of Ministers is required for foreign investment in banking and insurance.

• Foreign capital is protected against expropriation (although the State may acquire assets for public benefit on a non-discriminatory basis, provided the full economic value is paid for the asset).

• Subject to Ministerial approval, a foreign company performing a specific contract in Qatar may set up a branch office if the project facilitates the performance of a public service or utility.

• A non-Qatari company operating in Qatar under a Qatari government concession to extract, exploit or manage the State's national resources is exempt from the Foreign Investment Law. In practice this covers all large oil and gas companies.

• A company formed by a non-Qatari entity with the government or a government entity ('Article 207 Company') may be subject to special rules and exemptions from the Commercial Companies Law No 11 of 2015.

• All international companies securing mega infrastructure development work must share at least 30% of the contract with local entities.

• Law No 7 of 1987 governs the practice of commercial activity by GCC citizens in Qatar, and was amended in April 2017 under Law No

6 of 2017. GCC citizens as individuals or legal personalities can practise retail and wholesale trade in Qatar. However, the GCC citizen engaging in the activity must be directly responsible for it. Those undertaking retail business must do so via direct sale to customers in a shop, and those in wholesale trading are required to import and export the goods. NB: following the signing of AlUla Declaration regarding the blockade against Qatar, legal advice is recommended for this type of commercial activity.

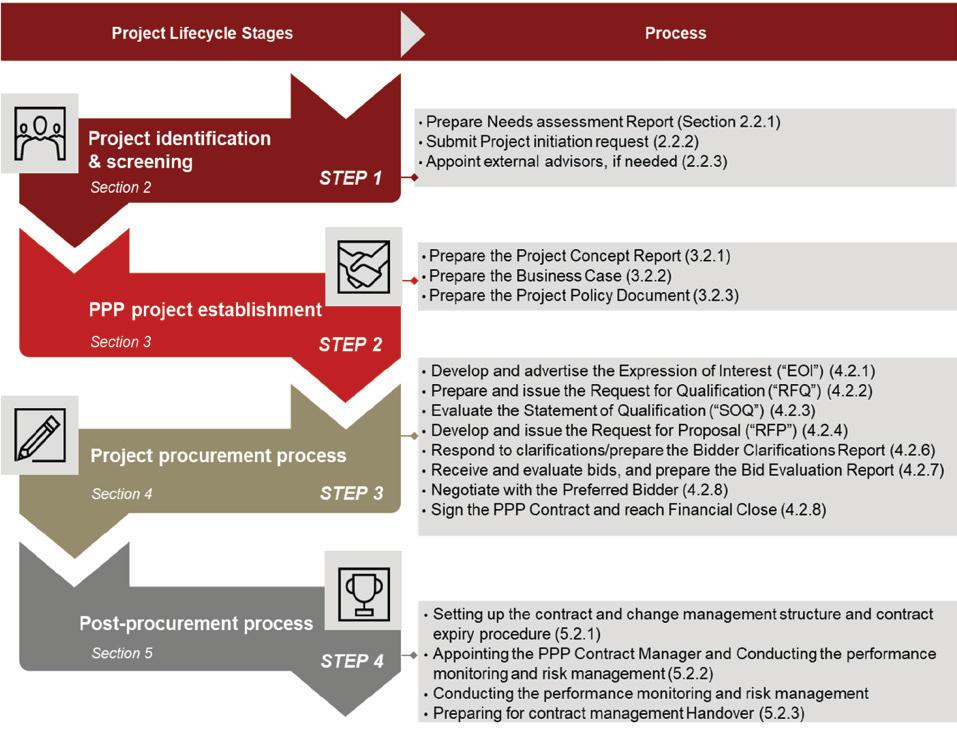

• Law No 12 of 2020 regulating the partnership between the public and the private sector became law in July 2020, as per one of the following regulations: Allocation of land through a rental or usage licence, for development by the private sector; build-operate-transfer (BOT); buildtransfer-operate (BTO); build-own-operate-transfer (BOOT); operations and maintenance (OM); or any other form adopted by the Prime Minister, upon the proposal of the relevant minister. The Government or other administration may, on its own initiative or at the suggestion of the private sector, identify a project for its implementation through partnership.

To conduct business in Qatar on a regular basis, foreign investors are required to establish or register a legal presence from the following options:

• Incorporating as a company under the Commercial Companies Law which allows full access to Qatar's market and to work on an unlimited number of projects. A Qatari partner is required to own 51% of the capital of the company, except in the circumstances mentioned above. Various exemptions are available to attract foreign capital.

• Obtaining a licence for a branch office or trade representation office which does not require a Qatari partner. The licence for a branch is granted in respect of a specific project for a government client. The existence of the branch office is dependent on the duration of a particular project: once the project is completed, the branch office must close unless it has secured additional qualifying projects. Branch offices are only permitted to perform a specific contract and may not engage in general commercial activities with the larger local market. The branch will be fully taxable unless granted a special exemption. Trade representation offices are only permitted to market goods and services; they are not permitted to engage in commercial activities.

• Under Law No 7 of 2017 companies in GCC states can now establish companies in Qatar, subject to having had a commercial registration in one of the GCC states for at least three years, and be fully owned and managed by a GCC citizen. Refer to the preceding caveat in Investment Regulations regarding the blockade.

• Appointing a commercial agent means a nonQatari company does not establish a presence in Qatar; instead a 100% owned Qatari entity or Qatari national is appointed as an agent to market the relevant goods and services. Commercial agencies must be exclusive and registered in order to be afforded the protections provided under the Commercial Agents Law No 8 of 2002; non-registered distributorships are subject to the Commercial Law No 27 of 2006.

• There is a separate regime for establishing an entity in the Qatar Financial Centre (QFC). This allows 100% foreign ownership and aims to attract international financial services companies and some professional support companies to invest in Qatar. The number of permitted activities in which a QFC firm may engage has been increased to include a broader spectrum of investment options.

• The Qatar Science and Technology Park (qstp.qa), a free zone in Education City, allows companies to engage in research and development, again with full foreign ownership.

• The Qatar Free Zones (qfz.gov.qa) accept applications from international investors in key sectors, at these locations:

ø Ras Bufontas, a 4 sq km site adjacent to Hamad International Airport – a technology and manufacturing hub for businesses requiring international connectivity.

ø Umm AlHoul, a 30 sq km site adjoining Hamad Port, south of Al Wakra – offers easy access to the water for maritime and logistics companies, and is a gateway for imports and exports. A port and marine cluster, 'Marsa', is able to support a wide range of marine businesses.

• The Cabinet has added some areas to the Free Zones Law, including Msheireb Downtown Doha, where Media City, established under Law No 13 of 2019, will focus on managing and developing media activities.

• Under Ministerial Decision No 242 of 2016, the MoCI will grant licences for small businesses at home conducting certain commercial activities including sewing, events services, electronic services, business services, cosmetic activities and food activities. A single licence is issued per

activity, with an annual fee, and cannot involve direct sales to the public from the residence. A further 48 activities were announced in 2024, bringing the total to 63. Applications can be made through the MoCI Single Window portal at moci.gov.qa

According to the Commercial Companies Law No 11 of 2015, the following structures are permitted:

• Limited liability companies (LLCs) – subject to the Foreign Investment Law can now be established by a single person owning the entire share capital (previously the minimum number of shareholders was two). This replaces the single person company under the old companies law. Shareholders can determine the share capital of an LLC (previously the minimum share capital was QAR200,000 divided into equal shares).

• Article 207 company – a shareholding company where the Qatari government, a government owned entity or a public corporation must own 51% of the shares, unless the Council of Ministers consents otherwise. Certain provisions of the Commercial Companies Law are excluded from the company’s Articles of Association.

• General partnership – joint partners administer the affairs of the company, and trustee partners contribute to the company's capital.

• Simple limited partnership – a local entity formed by two or more Qataris.

• Limited partnership with shares – formed by joint partners, liable for the debts, or trustee partners, whose liability is limited to the share value.

• Unincorporated joint venture – formed by two or more people pursuant to specific contractual arrangements. The unincorporated joint venture does not have a separate legal personality distinct from its partners.

• Joint stock company (public or private) – the capital is divided into shares with a minimum of five shareholders. Permissible foreign share ownership depends on the type of company and is subject to Qatar Financial Markets Authority approval.

• Holding company – incorporated as a joint stock or limited liability company. The holding company must hold at least 51% of the shares in each of the companies under its control.

Virtually all companies use a government liaison officer or facilitator to assist with establishment

formalities. Under Qatar Commercial Registration Law No 25 of 2005, companies must be approved or registered by one or more of the following entities: Ministry of Commerce and Industry (MoCI); Qatar Chamber; Ministry of Municipality; Ministry of Interior; Importers' Register/ Contractors' Register; and QFC Authority (where appropriate). Visit moci.gov.qa for details.

Amendments were made under Law No 20 of 2014 to expedite registration procedures, followed by Decisions 30 and 31 of 2019:

• The MoCI must respond to the applicant's request for registration on the same day.

• Reasons must be given for rejected applications. The Minister must accept or reject an appeal of the Ministry's decision within 15 days.

• Incorporated branches must be in the exact name of the principal company, and are not considered separate legal entities.

• Amendments have also been made to penalties for those operating commercial premises without a CR, misusing the CR, and providing false/ wrong documents.

• Renewals, trade name changes and other modifications are now online services only at investor.sw.gov.qa

According to the National Planning Council (NPC), total exports in Q2 2025 was QAR80.7 bn. There are no duties on exports. Imports in Q2 2025 was QAR32.6 bn. Asia was the principal destination for Qatar's exports and imports. See Economy in this section for more details.

Importers of goods into Qatar must sign up to the Importers' Register and be approved by Qatar Chamber (QC). Customs duty and legalisation fees are levied on all commercial shipments, irrespective of its value. All goods imported into Qatar are subject to customs duties, based on a percentage value of goods (usually 5%), or on a 'per unit' basis. Effective from 2021, incoming parcels and personal shipments with a cost, insurance and freight (CIF) value exceeding QAR1,000 is liable to 5% customs duties.

Customs duty tariffs fall under these categories:

• Personal effects and household items, imports of charitable organisations and returned goods, diplomatic and military exemptions, merchandise for ‘free zones’ and duty-free shops – Exempt. Goods in transit may be accepted at designated stations without duty.

• General cargo, eg clothing, perfumes, cars, electronic appliances and devices – 5%

• Steel – 20%

• Urea and ammonia – 30%

• Cigarettes, tobacco and its derivatives – 100% or QAR1,000 per 10,000 cigarettes, whichever is higher

Law No 25 of 2018 on Excise Tax came into effect 1 January 2019. All businesses that import, produce or store/stockpile excise goods must comply with the requirements stipulated under the law. The following goods are subject to Excise Tax:

• Tobacco products, energy drinks, special goods – 100%

• Carbonated drinks (non-flavoured aerated water excluded) – 50%

In accordance with the Gulf Cooperation Council (GCC) Customs Union, more than 800 goods are exempted from customs duties, alongside exemptions granted to certain bodies and persons under Customs Law No 40 of 2004. There are fees for the attestation of the Certificate of Origin (from QC) and a tariff for the attestation of the Commercial Invoice, based on shipment value.

Qatar implemented the World ATA Carnet Council in 2018, an international customs system with nearly 80 member countries, permitting the dutyfree and tax-free temporary import and export of goods for up to one year.

Through the Authorised Economic Operator (AEO) launched in 2019, the General Authority of Customs (GAC) aims to develop partnership and cooperation with the private sector by granting customs benefits and facilities to companies involved in the supply chain in international trade, as per the World Customs Organisation (WCO) Framework of Standards to Secure and Facilitate Trade (SAFE).

Import regulations

All commercial shipments are examined by GAC prior to clearance. The Qatar Electronic Customs Clearance Single Window (Al Nadeeb) is the one-stop e-government system to facilitate international trade. customs.gov.qa

Regulations were introduced in 2013 to prevent fake products from entering the market. All general goods must have non-removable marking of their place of manufacture to be eligible for customs clearance. This applies to both air and sea freight. The import of vehicle tyres, spare parts and electrical home appliances has to be based on a 'certificate of conformity' issued by the authority concerned. All general cargo for customs clearance

must be backed by an original commercial invoice on the shipper’s letterhead, with stamp and signature. They also require attestation by QC. The packing list of each consignment must have the number of pieces, weight and volume.

All importers must obtain an HS Code, an international system for classifying traded products. This must be linked to the trader's Commercial Registration and import licence. Following Amiri Decree No 98 of 2024, the Integrated GCC Customs Tariff was implemented on 1 January 2025. The new tariff system comprises 12-digit tariff codes (previously 8 digits), so products can be classified for purposes such as determining the customs duty rate, nontariff barriers, and statistics.

The GAC has recently completed a direct electronic integration between Al Nadeeb and the Digital TIR Carnet Service of the International Road Transport Union in association with QC, which enables the exchange of data related to the road transport of goods governed by the International Road Transport Convention, ensuring a smoother flow of shipments through land ports by enhancing tracking accuracy and increasing transparency and control.

In September 2025, the GAC launched the Customs Documents system to automate archiving and create a unified central database for customs documents. The system uses artificial intelligence (AI) to analyse document content to enhance work efficiency and facilitate access to information, while also ensuring data protection and confidentiality.

Points of entry

Imports and exports transit via Hamad International Airport, Hamad/Doha/Mesaieed/ Ruwais Ports, Ras Laffan and the Salwa Overland Terminal.

The GAC has specific exemptions and declaration requirements regarding luggage, personal belongings, gifts, household items, and the transfer of money or valuables across borders.

As per Law No 20 of 2019 on Anti-Money Laundering and Terrorism Financing, any person entering or leaving Qatar and in possession of any currency, bearer negotiable instruments, or precious metals or stones, equivalent to or exceeding QAR50,000 (or its equivalent in foreign currencies), must complete a declaration form, and provide any other information as requested.

Banned imports include alcohol, pork and e-cigarettes. The import of pets is allowed, although certain breeds are not permitted.

There are no personal taxes or statutory deductions from salaries in Qatar. Under Law No 24 of 2018 on Income Tax ('the New Tax Law') and its executive regulations, companies must pay tax on all profits at a flat rate of 10%. This is on all corporate income from sources in Qatar, whether the entity has a physical presence in Qatar or not. The share of the profits due to a Qatari or GCC partner is exempt from tax.

Tax exemption applies for certain activities, and companies listed on the Qatar Stock Exchange are also exempt, but companies are required to pay a 2.5% contribution to charitable and cultural activities. Taxpayers need to register with the Public Revenue and Taxes Department. Auditors must be a firm based in Qatar and registered with the MoCI or approved by the QFC. Services are offered by the General Tax Authority via the Dhareeba portal.

In 2016 GCC members agreed to introduce VAT in early 2018. The Qatar Value Added Tax (VAT) Law and Excise Tax Law and Executive Regulations was approved in May 2017, based on the unified GCC agreement. To date, only the Excise Tax has been implemented.

Under Law No 9 of 2002, a trademark registration is valid for 10 years from the date of filing the application, renewable for further consecutive periods of 10 years. The court may be ordered to cancel a trademark registration if the owner fails to use it in Qatar within five consecutive years from the date of the registration.

Copyright Law No 7 of 2002 gives protection to authors of original literary and artistic works. Protected works include books, lectures, musical works, photographic works and computer software. The economic rights of the author/owner are protected during the lifetime of the author/owner, and for 50 years after his death.

Patent Law No 30 of 2006 provides for the registration of inventions and foreign patents at the Qatar Patent Office; implementing regulations were issued by the Minister of Commerce and Industry under Decision No 153 of 2018.

Qatar announced its accession to the Patent Cooperation Treaty in 2011. The Law of Trademarks in the GCC Countries was promulgated under Law No 7 of 2014, and in the same year Qatar signed a cooperation agreement with the World Intellectual Property Organisation (WIPO) to jointly improve services. There is an electronic trademark

registration service on the MoCI website to expedite submissions and preserve IP rights. Law No 10 of 2020 on the protection of industrial designs was issued to offer more comprehensive protection for designs, once the implementing regulations are issued, as previously protection was sought by publishing cautionary notices in Qatari newspapers.

Qatar acceded to the Madrid Protocol in May 2024 and is the 115th Member of the Madrid System, a practical and efficient solution for protecting trademarks worldwide. This brings the total number of countries in which it is possible to secure trademark protection via a single application to 131.

The Madrid Protocol came into force in August 2024, and allows for the centralised filing of trademark applications across multiple countries. Companies and entrepreneurs in Qatar can now seek protection via one application in one language (English, French or Spanish). Trademark holders in any other Madrid System Member can seek overseas protection of their trademark in Qatar, while holders of existing international trademark registrations will be able to expand its geographical scope to include Qatar. Trademark holders in four of the GCC countries – Bahrain, Oman, Qatar, and the UAE – can now use the Madrid System.

Investment and Trade Court A4

The court was established under Law No 21 of 2021, specialising in investment and trade issues and increasing the pace of resolving commercial disputes. Work commenced in 2022 using a stateof-the-art electronic system, offering a range of services from registration to case management, scheduling hearings and other related procedures, up to the issuance of preliminary and appeal rulings. The court consists of primary and appellate circuits, and a circuit in the Court of Cassation that specialises in examining appeals against rulings issued by the court. A cooperation agreement was signed with WIPO in September 2025 to enhance the court's role in protecting IP rights and resolving disputes. itc.sjc.gov.qa

Investment Promotion Agency Qatar (IPA Qatar) A4

Custodian of the Invest Qatar brand, IPA Qatar was launched in 2019 and is registered at the Qatar Financial Centre (QFC). The agency provides investment solutions in Qatar, attracting foreign direct investment in the country’s priority sectors. The Startup Qatar Investment Program, provided by Qatar Development Bank, aims to attract tech

startups to establish or expand operations in Qatar, with funding and incentives. The Invest Qatar Gateway is the first digital platform for investors in Qatar providing information on partners, business opportunities and resources. invest.qa, startupqatar.qa

Ministry of Commerce and Industry (MoCI) A4

Creates commercial policy for both private and public sectors to boost regional and international trade relations and support business development. A number of services are available through the Single Window to attract local and foreign investments. In line with Law No 1 of 2020 on the Unified Economic Register, the Qatar Business Map Portal was launched, with comprehensive information related to commercial establishments. There is a new dedicated digital platform under the Public-Private Partnership (PPP) Programme, to highlight investment opportunities and projects available to the private sector.

The MoCI signed a 25-year concession agreement with the Qatari Economic Zones Company (Manateq) in January 2025 to manage the Small and Medium Industries Zone, with fees subsequently reduced in February. In September 2025, the MoCI and the Ministry of Transportation announced that companies engaged in shipping can consolidate land, sea, and air freight activities into one commercial registry. moci.gov.qa, investor.sw.gov.qa, businessmap.moci.gov.qa, manateq.qa

Ministry of Finance (MOF) C4

Prepares the State Budget and proposes objectives and tools of financial policy in line with Qatar National Vision 2030. Its Tahfeez programme enhances local services and products to strengthen the private sector. The General Authority of Customs monitors the import of goods, and the e-services of the Unified Website of State Procurement include tenders and company registration. In 2024, the Center for Fourth Industrial Revolution (C4IR Qatar) was launched, part of the World Economic Forum's C4IR Network and a step towards enhancing technological innovation in Qatar. mof.gov.qa, customs.gov.qa, monaqasat.mof.gov.qa, c4ir.qa/home

Ministry of Justice (MOJ) C4

Records legal actions and documents, registers and protects IP rights, and reviews draft contracts and agreements in accordance with the law. The Ministry has a real estate registration/ authentication office at the QFC for QFC entities.

Ministry of Municipality C4

The Foras investment portal promotes PPPs for environmental, service and sustainability projects. The Ministry's e-services cover shops and

establishments on commercial streets, agriculture and real estate. mme.gov.qa

Qatar Chamber (QC) D4

Provides services and support to local and international businesses, including QFC-licensed firms, like certificates of origin (COO) for import/ export and ATA Carnet, acting as liaison for international business delegations, and providing training courses. QC became a member of the International Federation of Freight Forwarders Associations (FIATA) in 2023.

The Qatar International Center for Conciliation & Arbitration (QICCA), established in 2006 as part of QC, acts as an efficient and swift mechanism to settle disputes between Qatari enterprises, or between national companies and foreign counterparts. qatarchamber.com, qicca.org

Qatar Development Bank (QDB) D4

Has an active role in the economic and industrial development of Qatar in the private sector by promoting and financing SMEs. The bank is 100% owned by the State of Qatar and provides a wide range of financial and advisory products, such as funding, incubation, and support services. qdb.qa

Qatar Financial Markets Authority (QFMA) C4

An independent regulatory authority supervising the financial markets and firms authorised to conduct activities related to securities in or from Qatar, and empowered to exercise regulatory oversight and enforcement over the capital markets. QFMA was granted full membership of the International Organisation of Securities Commissions in 2013. In 2023 QFMA launched the Single Window E-Portal so companies deal with just one entity, without separately involving QFMA, MoCI, Qatar Stock Exchange (QSE), and EDAA (formerly Qatar Cental Securities Depository Committee). qfma.org.qa

Qatar Science and Technology Park (QSTP) C2

A facility for international technology companies in Qatar, and an incubator of start-up technology businesses, offering premises, services and support programmes. The free zone at Qatar Foundation's Education City allows foreign companies to set up 100%-owned businesses in Qatar free of tax and duties. qstp.org.qa

Qatar Investment Authority (QIA)

The QIA A4 was established in 2005 as the sovereign wealth fund to grow and diversify Qatar's economy. QIA reports to the Supreme Council for Economic Affairs and Investments (SCAEI), the highest decision-making body concerning economy, energy, and investment of the State. The SCAEI approves QIA's investment policy and oversees QIA's performance.

QIA has two main objectives: to support the local economy; and provide liquidity when required to stabilise the local economy, supporting local economic development by investing in companies that fill market gaps. QIA is the owner or a key shareholder in domestic companies such as Qatar National Bank, Ooredoo, Qatar Airways, Mwani Qatar, Qatar Holding, Qatari Diar Real Estate Investment Company, Katara Hospitality, Barwa Group, and Qatar Sports Investments, which owns football club Paris Saint-Germain.

QIA has approximately USD557 bn in assets according to Sovereign Wealth Institute (August 2025), although the fund does not publish its holdings. Direct investments are made in real estate, healthcare, retail/consumer, technology/ media/telecoms, finance and industry. Following a restructure in 2016, USD100 bn of investments in local companies were placed in a new unit, Qatar Investments (known as QIA internationally).

QIA is a founding member of the One Planet Sovereign Wealth Fund Working Group, helping to produce a framework in 2018 to integrate climate change analysis into investment decisions. Further to this, in 2020 QIA embarked on a revised strategy promoting sustainability, with no new investments in fossil fuels.

Amiri Decision No 34 of 2023 reorganised QIA, highlighting its mandate, primary roles and responsibilities, and strategic objectives. An enhanced governance framework enables effective oversight, aligned with international best practices.

QIA announced the establishment of the Active Asset Management Initiative in 2024, with Ashmore Group its first partner. A USD1 bn investment in international and regional venture capital (VC) funds will support entrepreneurs, Qatar's first VC Fund of Funds. qia.qa

QIA Portfolio (unconfirmed): 52 Champs-Elysées, Adecoagro, Agricultural Bank of China, Asia Square Tower 1, Banyan Tree, Barclays PLC, Barwa Bank, Brookfield Property Partners, Canary Wharf Group, Claridge's/The Berkeley/The Connaught hotels, Coveo, Credit Suisse Group AG, Deutsche Bank AG, El Corte Ingles SA, Empire State Realty Trust, Fahrenheit, Glencore PLC, Grupo Santander Brasil, Harrods, Hassad Food, Heathrow Airport Holdings, Hochtief, Iberdrola SA, ISAGEN, Ivanhoe Mines, J Sainsbury PLC, Kahramaa, Kardium Inc, Lagardère, Le Brantano!, Le Tanneur, Lifestyle International Holdings Ltd, London Shard Tower, London Stock Exchange, LVMH, Masraf Al Rayan, Mowasalat, National Grid PLC, One Ocean Port Vell, Ooredoo, Oryx Midstream Services (Oryx), Pavilion, PsiQuantum, Pulkovo Airport, Qatar

Exchange, Qatar Islamic Bank, Qatar International Islamic Bank, Qatar National Bank, Reliance Retail Ventures, Rosneft PJSC, Royal Dutch Shell, Sauber Holding, Siemens, Societe Fonciere Lyonnaise SA, The Bürgenstock Selection, Total SA, Turkuvaz, Valentino Fashion Group SpA, Vente-Privée, Vivendi, Volkswagen AG, Xstrata PLC.

Ongoing projects include: Lusail City; Simaisma (Qatar) • Chelsea Barracks; Chancery Rosewood (UK) • Qatar Railways Development Company (Qatar Rail), overseeing the Qatar Rail Development Programme: the Doha Metro, the Long Distance Rail, and the Lusail Tram. qataridiar.com

The QFC C4 was established in 2005 to attract international financial institutions and firms to establish business operations in a 'best-in-class' international environment.

Firms need to be incorporated or registered by the QFC Companies Registration Office, licensed by the QFC Authority, and for regulated activities, authorised by the QFCRA. Advantages of establishment in the QFC include:

• A separate legal, regulatory, tax and business environment.

• 100% foreign ownership, 100% repatriation of profits, and 10% corporate tax on locally sourced profits.

• A double taxation avoidance agreement network with more than 80 countries.

As of August 2025, the QFC has 3,300 registered firms, with 828 new firms registered in the first half of 2025, a 64% increase in new registrations compared to the same period in 2024. Companies comprise investment and private banking entities, and (re)insurance and asset management firms (each of which is regulated); and consultancy service providers, law firms and financial services recruitment firms (which are non-regulated).