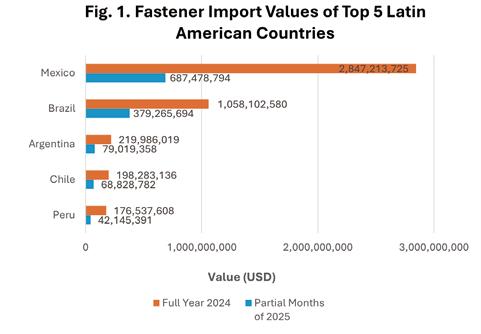

Taiwan’s fastener, tool, and component industries have faced rising operational costs and intense low-price competition from overseas in recent years, resulting in a significant drop in revenue. Specifically, the fastener industry in Taiwan, which was originally already dealing with a 25% tariff on steel and aluminum, has seen that tariff increase to 50%. This has led to an overall revenue decline of roughly 10% for the fastener industry. Meanwhile, across different other industries, some products are currently subject to steel and aluminum tariffs of 50%, while others face the reciprocal tariff (pegged at 20% as of August 1). At the time of writing, Taiwan and the United States were engaged in new negotiations

following the 20% reciprocal tariff announcement. Because many negotiation details remain undisclosed, the outlook is still uncertain. It is too early to definitively assess the long-term impact of these developments.

These three industries largely depend on exports and have built an integrated supply chain, making them an economic driver that Taiwan takes pride in and a model for industrial development. However, there have been multiple challenges in recent years. Industry players now stand on the precipice of history. Beyond monitoring economic trends closely, it would be wise to remember this: times of drastic change in the global business environment often present the best opportunities for companies to outpace their competitors.

Looking ahead, four key challenges threaten the livelihoods of Taiwan’s fastener, tool, and component industries. First is the “Trump tariff”. Since these tariffs were announced, Taiwanese companies have been struggling and are now thinking about exploring markets beyond the United States. The era of large-volume inventories and mass orders is over; the new reality demands smaller, more diversified, agile production with quick turnaround times and rush orders. With rising tariff costs, U.S. importers are reducing their purchase volumes, inventory levels, and orders placed on Taiwan to maintain cash flow and sustain normal business operations to cope with future tariff changes. For Taiwanese suppliers, “make-to-order” production is set to become the future standard going forward.

At this moment, Taiwanese companies should avoid focusing heavily on cross-field, cross-regional, or cross-industry transformations. These approaches comparatively consume considerable time, labor, and resources—luxurious in today’s volatile environment. For example, industry insiders have told Fastener World that investing in manufacturing facilities in Southeast Asia requires at least 1 billion New Taiwan dollars—a significant cost. In such an unpredictable era, pursuing overseas diversification is not an easy path. A more advantageous approach for Taiwanese companies now is to upgrade and optimize their most competitive products, processes, business structures, and services. The current market environment favors steady, well-focused investments rather than high-risk ventures.

Second is the “exchange rate.” Over the recent years, the New Taiwan Dollar (NTD) has been one of the strongest and most rapidly appreciating currencies globally. On July 4, it briefly reached 28.8 NTD to 1 USD. Profit margins in Taiwan’s hardware component sector generally range from 10% to 15%, while the fastener industry averages around 15%. When the NTD appreciates from 32 NTD to 30 NTD per USD, it eats up a large portion of these thin margins when it comes to exporting from Taiwan. If the NTD continues to appreciate past critical levels like 30, 29, or even 27 without timely adjustment, it could trigger a wave of massive temporary business closures.

Industry players shared with Fastener World their hope that the USD/NTD exchange rate will hold steady near 32 by the year-end to help sustain operations in these three industries

Third is “CBAM” (Carbon Border Adjustment Mechanism). For the fastener industry, if the EU begins imposing carbon taxes starting in 2026, Taiwanese businesses could see their wire material costs increase by 10% to 20%. This EU carbon tax may prompt other countries to follow suit, creating even greater challenges that will be difficult to avoid. However, there is still a glimmer of hope: companies need to closely watch whether the EU will announce exemptions for downstream fastener processes from the carbon tax in the third quarter of this year.

Fourth is the “Economic Climate.” Statistics signal a global economic slowdown. Tariffs and wars have heightened economic uncertainty, dampening investment and consumer demand. Meanwhile, climate change has led to frequent natural disasters, forcing governments to redirect budgets from economic stimulus to disaster relief, further slowing growth. In the automotive market, the declining sales of gasoline-fueled vehicles have reduced demand for fasteners, tools, and components. Additionally, the shift from internal combustion engines to electric vehicles dramatically cuts the use of higher-margin fasteners used in engines, impacting fastener industry revenues.

The most effective way to revive economic growth would be through a new round of global quantitative easing—similar to what the U.S., Japan, and the EU successively implemented from 2008 to 2015—to stimulate investment and procurement across global industries.

Furthermore, while TSMC has become the frontrunner driving Taiwan’s economic growth, a key challenge for these three industries is finding ways to break into hightech supply chains—such as those for AI robotics, robotic arms, and electric vehicles—and leverage these “giants’ shoulders” to uncover new business opportunities.

Taiwan’s fastener, tool, and component industries have been exporting worldwide for over 50 years. Many companies have successfully weathered global economic downturns including the financial crisis, SARS, trade wars, the COVID-19 pandemic, and the Russia-Ukraine conflict. There is no need to view the current challenges for Taiwanese industries too pessimistically. Fasteners, tools, and components, being essential goods critical to everyday life, still have opportunities to find a turning point and thrive anew.

Copyright owned by Fastener World / Article by Dean Tseng

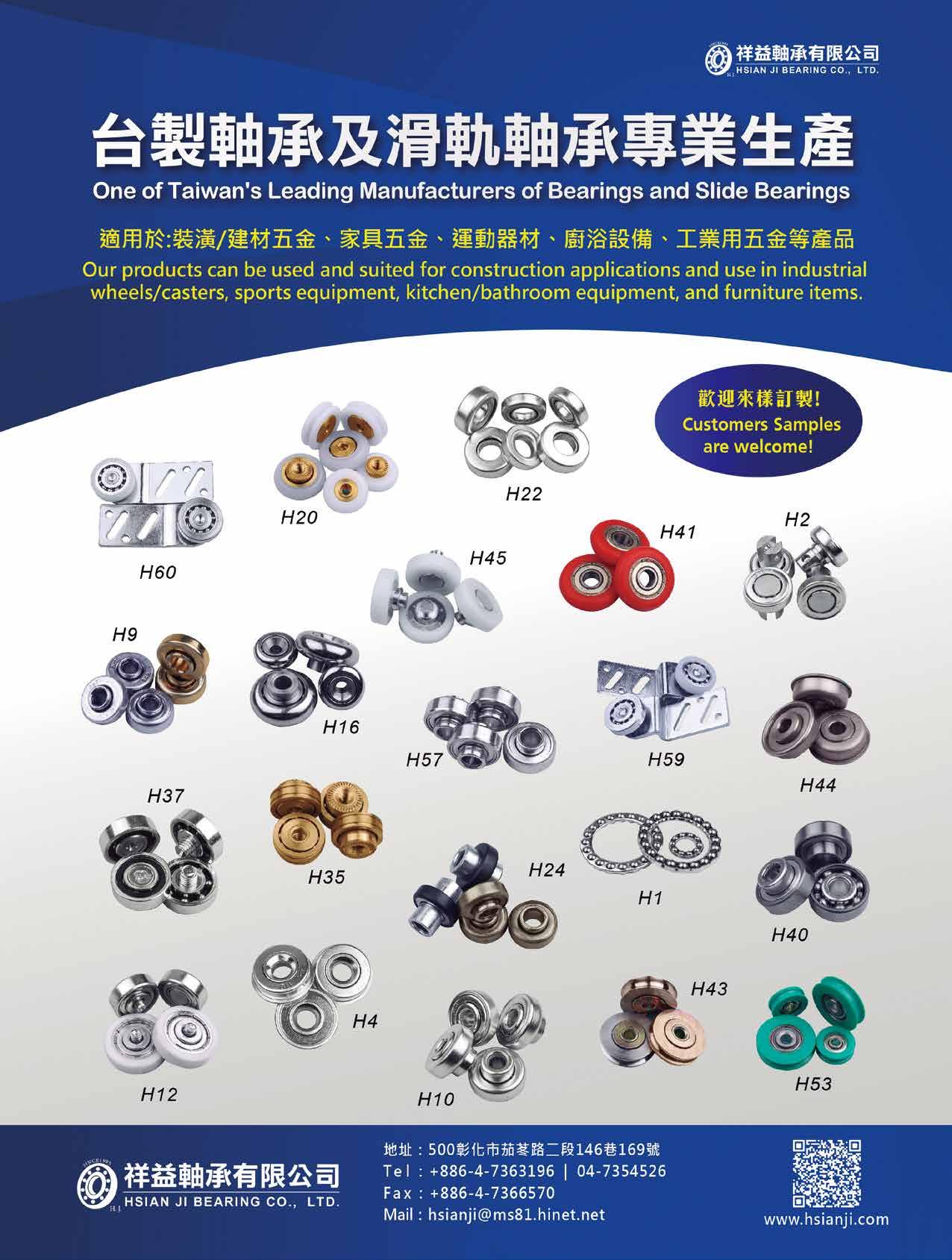

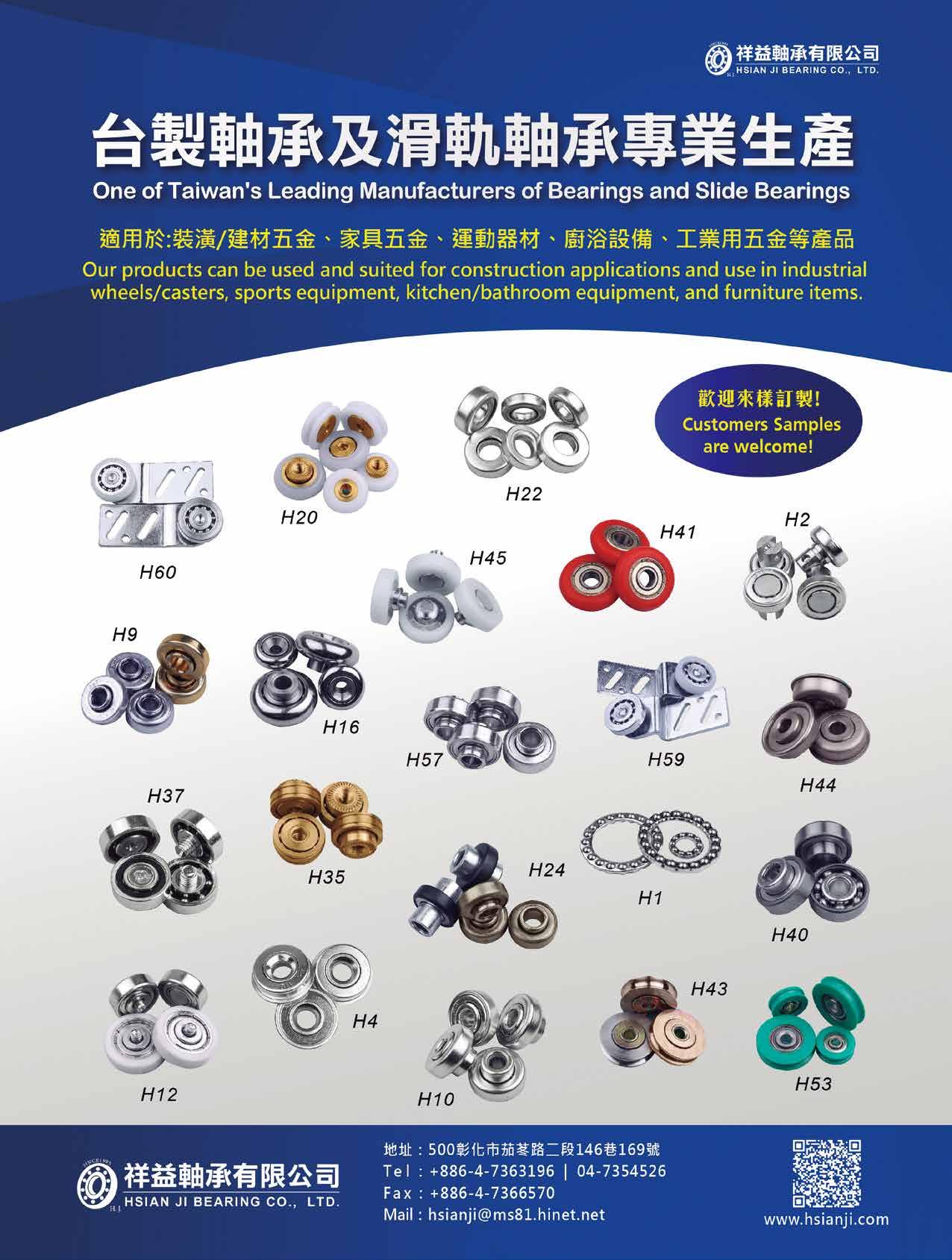

Bolt & Nut Extractor

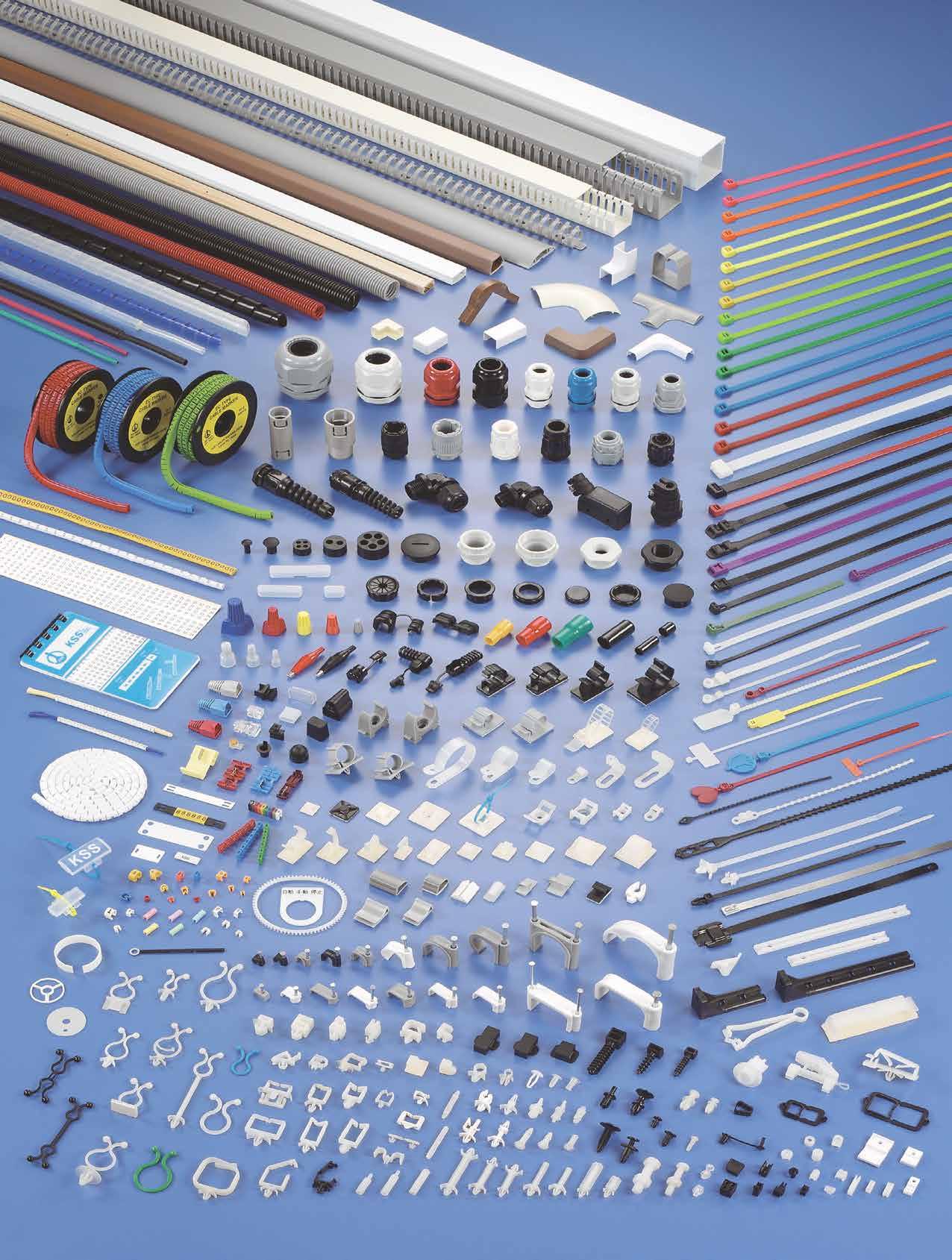

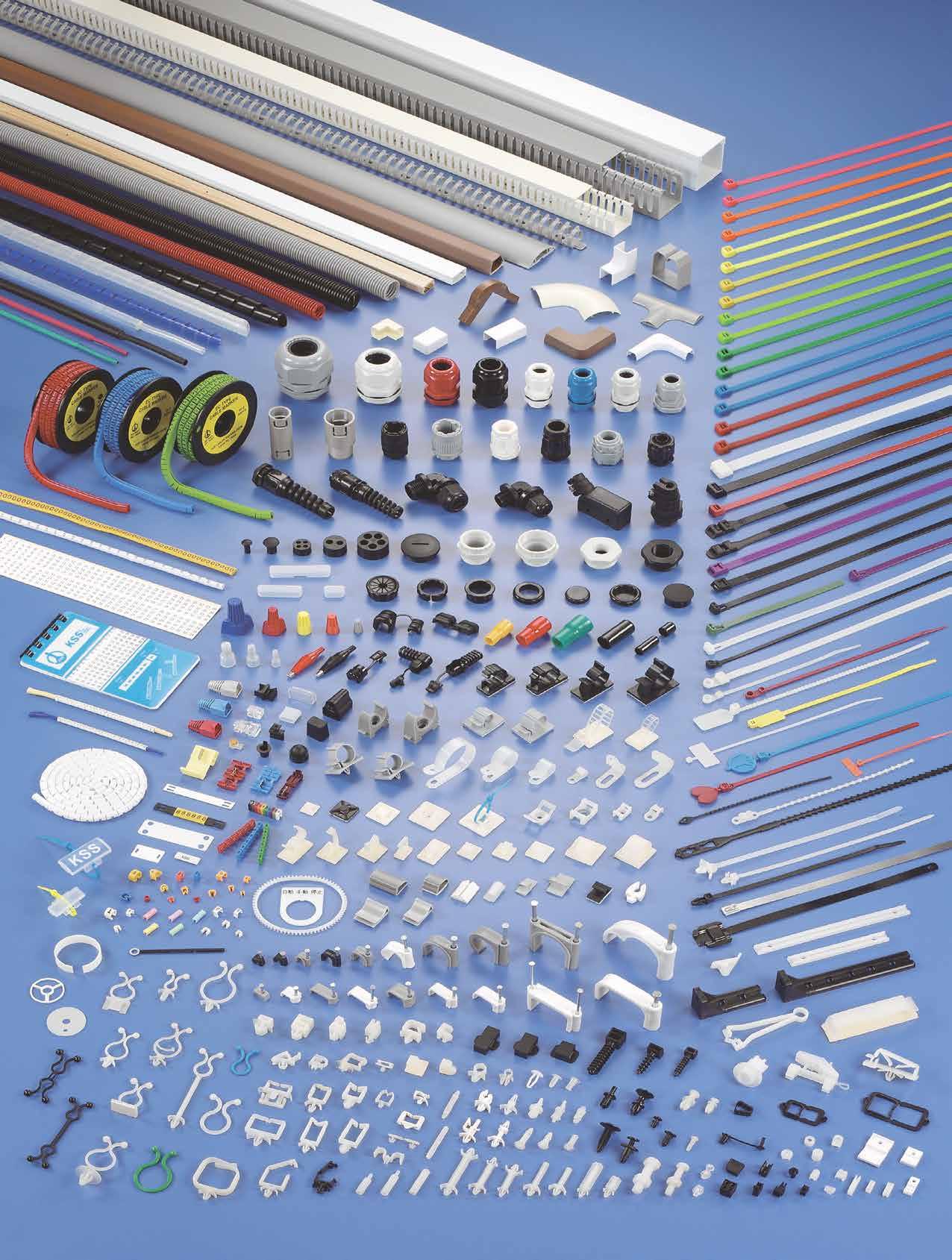

Aiming to be the trusted partner for innovative tool solutions of its customers, Way Win Tools Trade Company, established 5 years ago, has been dedicated to the production and development of professional hand/ pneumatic/electric tools, automotive repair tools, and fastener tools. It is a rising star widely noticed in many industries that require the use of professional tools for fastening.

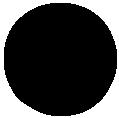

Way Win's R&D team is composed of members with more than 25 years of experience in tool manufacturing and R&D, and is able to provide the most suitable fastening tools according to the characteristics of different industrial applications and the individual needs of customers. With this highly skilled production team and a rigorous product control process, Way Win has been able to surprise the market with innovative tools every year (such as the recently launched patented Extractor Bolt & Driver Set, which can dismantle rusted and worn-out bolts and nuts). In addition to demonstrating strong product development capabilities with numerous product patents, Way Win also actively demonstrates its commitment to quality, reliability and performance to its customers.

Currently, Way Win's main products for export include sockets, wrenches, torque wrenches & accessories, vehicle maintenance tools, hexagonal wrenches & screwdrivers, pliers, vises, clamps, power tools, pneumatic tools, fasteners & accessories. With a production capacity of 20 containers per year, the company serves customers worldwide.

"We have been working hard to build our brand value through our innovation capabilities and partnerships with global customers, and to enable our customers to continue to play a leading role in the highly competitive marketplace. Meanwhile, innovation is at the core of our corporate development, enabling us to help our clients accomplish and even exceed their goals, and transform intangible ideas into endless business opportunities. On the basis of trust, innovation and success sharing, providing customers with the most complete product solutions is the ultimate mission we pursue,” said President Morris Chen.

In response to the ever-changing demands of customers, Way Win emphasizes on product quality, functionality, and the introduction of new technologies, which has enabled it to successfully penetrate into the automotive, construction, and DIY industries in critical markets such as Europe, the U.S., and South Asia. Currently, 40% of its products are sold to the U.S., 30% to Scandinavia, 20% to Israel, and 10% to India, and it looks forward to developing more customers from emerging markets in the future.

President Chen added, “Our products have not been sold to emerging markets such as the Middle East, North Africa and Central & South America at this stage, but a number of our patented power/pneumatic tools and their accessories and fasteners are well suited to the application needs of the industries in these markets, which can help local customers quickly connect with the world. In the scenario where U.S. tariffs and exchange rates continue to affect the global economy, we will endeavor to promote high quality, high performance and innovative products to customers in the global market.”

Contact: Morris Chen, President Email: waywintoolsk@gmail.com

HAI Triumphs at 2025 Association and Institute Awards, Secures Best Learning Program 愛爾蘭五金協會榮獲「2025協會與學會獎」下的「最佳學習計劃」大獎

Hardware Association Ireland (HAI) has triumphed at the Association and Institute Awards 2025, winning the prestigious Best Learning/ Professional Development Program award. The accolade recognizes the excellence and impact of HAI’s Certificate in Hardware Retail & Merchanting and its comprehensive training services that support the Irish hardware and building materials sector. These services include classroom and virtual workshops as well as customized training solutions.

The award reflects the dedication and vision of the HAI team, alongside the collaboration of member companies, trainers, and industry partners contributing to the success of HAI’s programs. The judges praised HAI’s innovative approach, highlighting the unique requirement mandating students to engage in learning reflection with active mentor and company involvement throughout the course—a model they believe could be replicated in other sectors.

In addition to this major win, HAI was shortlisted for Best Association of the Year, with judges commending its strong community connections, impressive growth, and a wide range of member services. The association’s leadership and positive impact on Ireland’s hardware sector were also recognized. HAI expressed gratitude to the awards organizers and looks forward to continuing its commitment to raising professional standards and providing accessible, high-quality training to the industry.

■

2.0 ■ Trump Tariffs Drive Up Power Tool and Fastener Prices, Impacting DIYers and Professionals

The reintroduction and escalation of tariffs under President Donald Trump’s 2025 trade policies have significantly increased the cost of imported power tools in the United States. These tariffs, ranging from 10% to as high as 50% on various imported goods including power tools, have directly contributed to price hikes imposed by major manufacturers. As a result, power drills and other common electric tools have become notably more expensive for both professional contractors and DIY enthusiasts.

Manufacturers are passing higher import duties onto consumers, making routine repairs and home improvement projects costlier. Many brands have cited the unpredictability and rapid changes in tariff policies as challenges in setting stable prices. The increased costs are compounded by supply chain disruptions already impacting the industry. Retailers warn that these price increases could curb demand and slow market growth in power tool sectors.

Experts note that tariffs aimed at reducing trade deficits have instead pushed up prices for everyday products, often accelerating inflationary pressures on consumers. The power tool industry remains on alert as ongoing trade tensions and potential new tariffs threaten further cost increases.

The tariff has also created uncertainty and pricing difficulties for the fastener wholesale industry. Craig Christensen, president of Trinity Fastener, said that although current inventory cushions the immediate impact, prices may still rise in the future. Importers have already adjusted prices in advance, causing market volatility that makes business management and forecasting very challenging. He hopes the U.S. and its trade partners can reach a stable agreement and establish a reasonable pricing standard together.

墨西哥製造商因川普關稅受益,加速供應鏈區域化轉型

Jorge H. Martínez, CEO of Micro Partes, a small manufacturer in Monterrey, Mexico, credits the Trump administration’s tariffs for boosting his business amid changing trade dynamics. While many feared tariffs would disrupt markets, Martínez saw an opportunity to thrive by supplying small plastic parts previously imported largely from Asia.

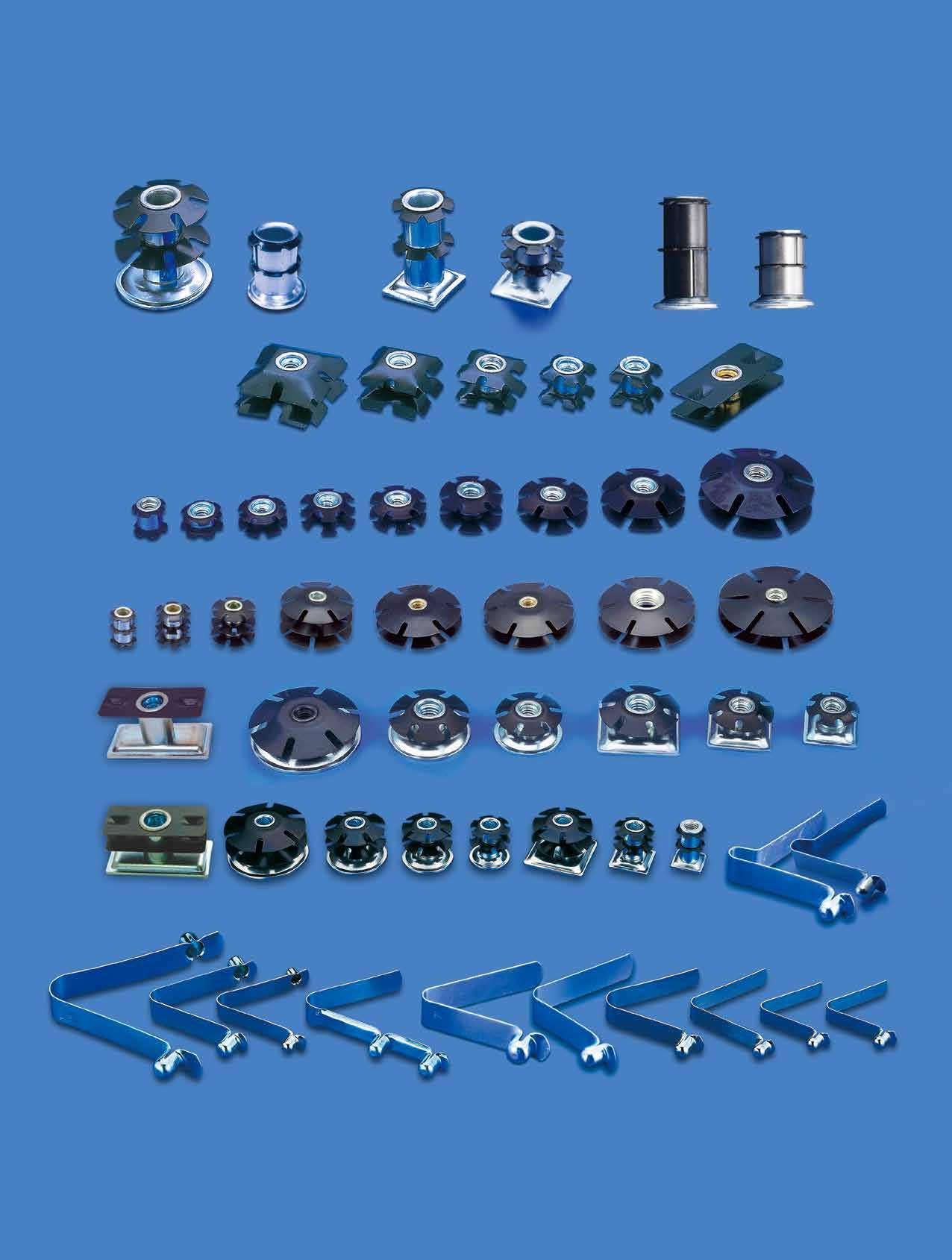

With tariffs raising costs on Asian imports, companies increasingly seek North American suppliers to comply with USMCA rules and avoid penalties. Martínez’s company produces essential industrial components like clips, fasteners, and grommets—items vital to assembly lines. To meet demand, Micro Partes invested in new machinery and local resin suppliers, expanding its production capacity.

The tariffs encouraged nearshoring, prompting many businesses to reduce reliance on Asian supply chains and favor regional sourcing. As a result, Micro Partes has seen significant growth, including orders from multinational firms such as LG and Samsung operating in Mexico. This trend underscores a broader shift to strengthen North American manufacturing networks.

川普關稅重塑全球經濟格局

Trump's high tariffs are significantly reshaping global supply chains and international trade. Since early 2025, the average U.S. import tariff has surged to about 15%, hitting an 80-year peak, forcing multinational companies to revise production and logistics. Industrial supplier Fastenal has to split imports into multiple shipments, resulting in higher supply chain costs; Nike expects to pay one billion US dollars in import taxes this year, is working on cost reduction, and plans moderate price increases.

Tariffs fuel inflation and strain U.S. trade relations, pushing Europe to seek alternative markets and bypass the U.S. Emerging supply chains are relocating from China to Southeast Asia and Mexico, marking a profound transformation in the global trade order. Although tariffs have increased U.S. government revenue, manufacturing investments and employment have not improved as expected. The long-term consequences remain uncertain amid ongoing economic shifts.

Trump Tariffs Slash GM and Stellantis Profits, Impacting the Auto

川普關稅削減通用與 Stellantis利潤 汽車產業受創

General Motors (GM) reported a significant decline in its secondquarter profits, falling over 34% compared to last year, primarily due to USD 1.1 billion in losses caused by tariffs imposed by the Trump administration. GM's net earnings dropped to USD 1.9 billion, while sales slightly increased by 7.3%. The company expects tariff-related costs to total between USD 4 billion and USD 5 billion for 2025. GM CEO Mary Barra announced plans to invest USD 4 billion in U.S. plants to increase production and shift production of key models such as pickups and SUVs back to the U.S., aiming to reduce tariff exposure.

Similarly, Stellantis, owner of brands like Chrysler, Jeep, and Dodge, revealed tariff costs of around €300 million (USD 350 million) in the first half of 2025. The tariffs have caused production halts and a 10% decline in U.S. sales for Stellantis during the second quarter. Industry experts warn these tariffs are squeezing automakers' profitability, as companies absorb costs without immediately raising vehicle prices.

Tariff Policies Reshape Hand Tool Supply Chains, Opening New Opportunities for Taiwanese Manufacturers

關稅政策重塑手工具供應鏈

In 2025, ongoing U.S. tariff policies and appreciation of the Taiwan Dollar are challenging Taiwanese hand tool makers, but also creating new opportunities from redirected orders. Major Taiwanese companies like Basso Industry, Chiu Ting Machinery, and KHgears International are witnessing order shifts due to rising tariffs on China and increased market uncertainty. The hand tool supply chain is mainly centered in China and Taiwan, with the U.S. as the primary sales target market. The recent tariff tensions have prompted American customers to reconsider their heavy reliance on Chinese suppliers. As a result, some new project models and replacement parts are being relocated to Taiwan and Vietnam.

Basso Industry sees no clear order increases yet but expects contributions from new electric tool products by year-end. KHgears International's Vietnam plant benefits from supply chain restructuring, gaining orders from Stanley Black & Decker. Chiu Ting Machinery notes that moving production from China back to Taiwan could present growth opportunities if tariffs on Taiwan remain reasonable.

中國專家表示高勞動成本阻礙工具製造業回流美國

According to Chinese executives, tool manufacturing will not return to the U.S. due to high labor costs. GreatStar Industrial's senior VP Li Feng noted U.S. labor costs are several times higher than in China or Vietnam. After acquiring U.S. hand tool company Arrow Fastener in 2017, they observed U.S. worker costs are prohibitively expensive. Chervon Holdings' CEO Pan Longquan said manufacturing in the U.S. would increase production costs by at least 50%. The U.S. lacks core component manufacturing and suitable lithium battery supply chains for power tools. Further, U.S. import tariffs on industrial materials push costs even higher. Tools made in China or Vietnam sell for tens of dollars in the U.S., while U.S.-made tools cost hundreds, making reshoring unfeasible. To cope, Chinese toolmakers like Chervon and GreatStar are expanding production in Vietnam and building inventories in the U.S. Vietnam factories aim to meet U.S. demand while China focuses on exports to Europe and other markets.

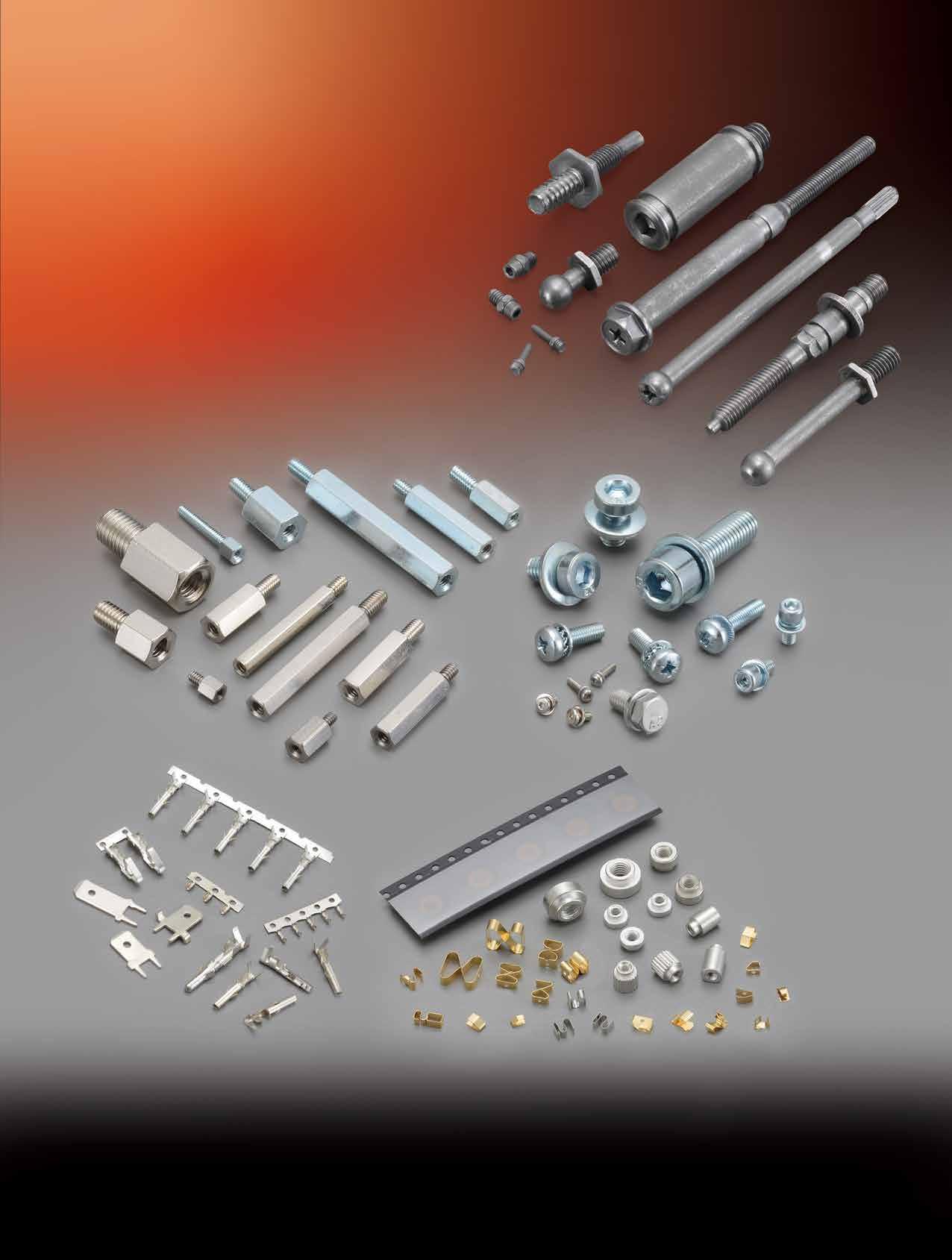

復盛應用布局手工具市場,目標營收突破百億元

Fusheng Precision, a Taiwanese golf equipment OEM, has officially acquired Proxene Tools this year and is actively expanding into the hand tool market. Leveraging Proxene Tools as a key base, the company plans to integrate group resources and aggressively pursue a hand tool business revenue exceeding NTD 10 billion. It is currently in talks with two to three major Taiwanese hand tool manufacturers for potential cooperation, with one deal expected to be finalized by the end of the year.

The company revealed it started developing titanium alloy hand tools five years ago, which now contribute nearly 10% of its revenue. By forming alliances with other industry players, Fusheng Precision aims to capture at least 10% market share in Taiwan's hand tool sector, whose annual output value exceeds NTD 100 billion. The strategy centers on resource and technology integration to scale operations and enhance global competitiveness.

崧騰手工具訂單穩定,市場環境充滿不確定性

Despite ongoing global economic uncertainties and tariff pressures, Solteam Incorporation, a notable Taiwanese manufacturer specializing in power module mechanical components, reports stable hand tool orders with a visibility of approximately 3 to 4 months. Currently, shipments slightly exceed customer orders as key clients continue to maintain steady production levels with inventories remaining at historically low levels. This cautious inventory management reflects concerns about economic volatility and fluctuating demand, leading to some variability between order and shipment volumes. Nevertheless, urgent reorder demand persists, underpinning a baseline level of activity within the hand tools segment. Solteam Incorporation's management remains attentive to market signals and continues working closely with customers to balance supply and demand effectively amid these challenges. The company's ability to sustain order stability despite macroeconomic headwinds highlights its resilient operations and solid positioning in the industrial components market.

Basso

鑽全受關稅及匯率影響短期謹慎看待

Basso Industry, a leading Taiwanese manufacturer specializing in nail guns, expressed a cautious short-term business outlook due to ongoing tariff issues and the sharp appreciation of the New Taiwan Dollar. The typical peak season effect for orders in July and August has not yet materialized. However, new development projects for electric tools continue steadily, with research and development expenses indicating an expected increase in electric tool contributions in the fourth quarter. The international tariff situation has prompted adjustments in major global manufacturers' supply chains, creating opportunities for Basso Industry to develop new products and attract new customers.

As of the end of May 2025, the company's consolidated revenue totaled NTD 1.298 billion, matching last year's level. While the company proactively converted US dollars to New Taiwan Dollar at its previous peak exchange rates (NTD 32-33), foreign exchange losses may still arise due to currency fluctuations. The recent rise of the New Taiwan Dollar exchange rate to NTD 29.5 to USD 1 may also affect gross margins, though these depend on product mix and material costs.

Acme Tools擴展版圖開設 明尼蘇達州伊根新門市

Grand Forks-based Acme Tools is expanding its footprint with the opening of a new retail location in Eagan, Minnesota. The new store aims to better serve professional contractors, industrial users, and DIY customers in the Twin Cities metropolitan area by offering a broad selection of power tools, hand tools, accessories, and tool storage solutions.

Acme Tools is recognized for its extensive inventory of quality brands and knowledgeable staff committed to customer service. The Eagan store opening marks the company’s continued growth strategy to increase accessibility and convenience for customers through physical locations in key regional markets. The company also plans to leverage this expansion to strengthen local partnerships and provide expert support for trades requiring reliable tools. This new site complements Acme Tools’ existing network and highlights its ongoing commitment to meeting the diverse needs of professional and hobbyist tool users.

Snap-on公司公布2025年第二季財報

The company reported stable net sales of US $1.179 billion, matching the previous year’s figures. However, operating earnings before financial services declined to US $259.1 million, representing 22.0% of net sales, down from 23.8% last year. Diluted earnings per share fell to US $4.72 from US $5.07 in Q2 2024.

Sales growth was mixed across business segments. The Tools Group and Repair Systems & Information Group saw sales increases of 1.9% and 2.3% respectively, driven mainly by the U.S. market. Conversely, the Commercial & Industrial Group experienced a 7.6% sales decline due to weaker activity in Asia Pacific and Europe.

Snap-on’s CEO Nick Pinchuk remains optimistic, highlighting the company’s focus on product innovation, strengthening dealer networks, and strategic investments to drive future growth despite market challenges.

Grainger公司任命 Melanie Tinto

Grainger, a leading distributor of maintenance, repair, and operating products, has appointed Melanie Tinto as Senior Vice President and Chief Human Resources Officer, effective April 28, 2025. Melanie will join the Grainger Leadership Team and oversee all HR strategies, including talent management, succession planning, compensation, organizational performance, and benefits. Melanie brings over 30 years of human resources experience, having previously served as CHRO at WEX, where she transformed HR into a strategic partner. She also held senior roles at Medtronic, HewlettPackard, Walmart, and Bank of America. Grainger's Chairman and CEO, D.G. Macpherson, highlighted that Melanie's leadership will support Grainger's culture of engagement and development, ensuring every employee has opportunities to grow and succeed. Melanie will relocate to Chicago later in 2025 as she takes on this key leadership position.

Grainger Downgraded by Wolfe Research Amid Tariff Concerns and Slowing Momentum

因關稅壓力與動能放緩,Grainger 公司遭 Wolfe Research下調評級

Grainger was downgraded to "Underperform" by Wolfe Research in April 2025. Wolfe Research cited concerns over new U.S. tariffs that could pressure Grainger's import-heavy cost structure, potentially compressing profit margins for the full year 2025. Although Grainger attempts to offset tariff impacts through price increases and enhanced productivity, Wolfe Research remains cautious about the company achieving the higher end of its operating margin guidance of 15.1-15.5%. The downgrade reflects a tough setup ahead of Grainger's first-quarter earnings report. Despite strong fundamentals, including a gross margin of 39.36% and a long dividend streak, tariff risks and slowing momentum contributed to the rating cut, signaling investor caution amid these challenges.

Hilti Vadodara Plant Achieves India's First DGNB Gold Certification for Sustainable Industrial Construction

Hilti梵多拉工廠榮獲印度首座 DGNB

Hilti Manufacturing India's plant in Vadodara, Gujarat, has become the first industrial facility in India to receive the prestigious DGNB Gold Certification from the German Sustainable Building Council. This certification recognizes Hilti's commitment to sustainability across environmental, economic, and social dimensions throughout the building's

lifecycle—from planning and construction to operation and eventual decommissioning. The Vadodara plant features advanced energyefficient technologies such as a chilled beam and radiant floor HVAC system using water as the cooling medium, passive cooling elements, and a centralized building management system that optimizes energy usage. The site also includes a 1500 MWh photovoltaic system, rainwater harvesting with 100% water recycling, a zero-discharge policy, and a Miyawaki forest covering 25% of the campus to promote biodiversity.

Designed with inclusivity in mind, the facility offers barrier-free access, gender-sensitive amenities, excellent indoor air quality, acoustic comfort, and employee wellness zones including childcare and fitness areas. Hilti's CEO emphasized that the gold certification marks a new benchmark for sustainable industrial construction in India and reflects the company’s vision to combine performance with purpose.

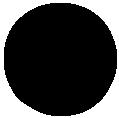

State Grid Launches Innovative Bolt Loosening Soundprint Detection Technology for Power Tower Maintenance

State Grid (China) announced the successful application of its self-developed bolt loosening soundprint detection technology for power transmission towers. This breakthrough allows accurate inspection of over 10,000

critical tower bolts within just 20 minutes, dramatically improving efficiency and safety compared to traditional manual methods.

Historically, bolt inspections on towering structures requiring 3 operators working at heights took about 2 hours for around 20,000 bolts. The new technology is based on the principle of vibration acoustic wave analysis and, combined with acoustic wave sensors, achieves high-precision detection of bolt conditions, fundamentally transforming the traditional methods. This technology promotes the intelligent and automated maintenance of power transmission lines, significantly reducing labor risks and costs while enhancing the safety and stability of power grids.

Stellar Industrial Supply, a Washington-based distributor specializing in MRO and tools, announced plans to acquire Rocky Mountain Cutting Tools (RMCT), a Colorado metalworking distributor. The acquisition will add RMCT's Frederick, Colorado location as Stellar's 18th regional hub, further strengthening Stellar's footprint in the Denver/Colorado Front Range market. John Wiborg, Stellar's President and CEO, described the deal as an important step in expanding the company's reach and enhancing customer value. He highlighted the mutual learning opportunities between the two organizations. Bryan DeAngelo, President of RMCT, expressed excitement over Stellar's expanding presence and commitment to maintaining the customer-focused values RMCT is known for across Colorado. The acquisition has been closed on June 30, 2025. Financial terms of the deal were not disclosed.

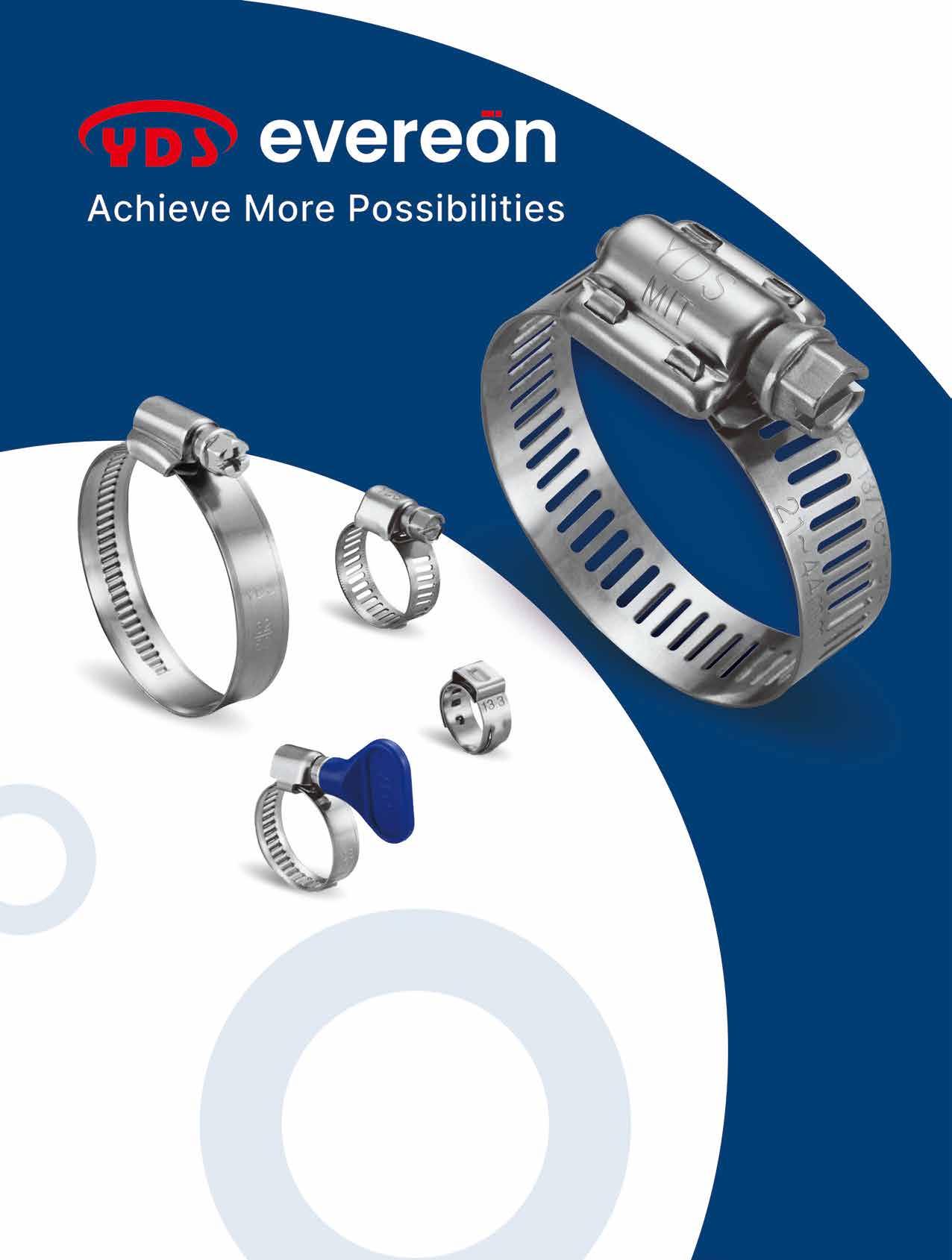

Ideal Tridon Group Acquired by Nautic Partners to Accelerate Growth

Ideal Tridon集團被 Nautic Partners收購

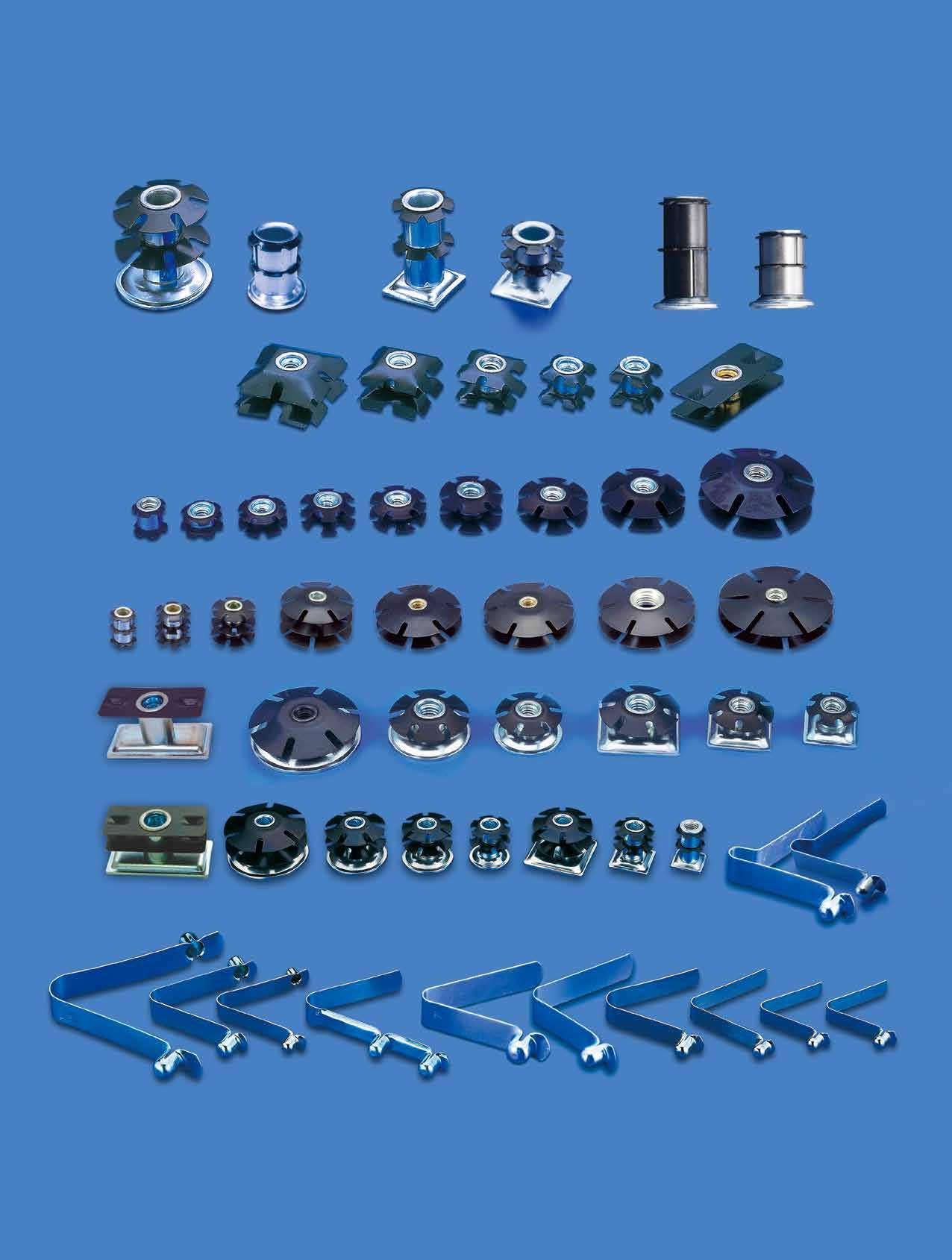

Ideal Tridon Group, a Tennessee-based engineered components supplier, has been acquired by private equity firm Nautic Partners. Nautic purchased the company from TruArc Partners for an undisclosed amount, partnering with Ideal Tridon’s management on the acquisition. Ideal Tridon produces over 60,000 SKUs of engineered components used in critical sectors such as process manufacturing, facility automation, power systems, and water management. Their product portfolio includes clamps, brackets, metal framing systems, fittings, couplings, industrial hose connections, and hygienic flow control components. CEO Rick Stepien emphasized their dedication to quality, service, and innovation, while also expanding with new products like EV battery cooling components and customized support systems. Nautic Partners expressed enthusiasm about working with the strong leadership team and supporting Ideal Tridon’s next growth phase. This acquisition is expected to enhance Ideal Tridon’s market presence and accelerate innovation across industries.

Spartan Fastener Acquires American Jebco to Strengthen Product and Market Presence

Spartan Fastener收購 American Jebco

Spartan Fastener, a fastener manufacturer and distributor based in southeastern Wisconsin, has acquired American Jebco, a specialty fastener and rivet supplier located in Cicero, Illinois. This acquisition immediately expands Spartan's product lineup, manufacturing capabilities, and supply chain efficiency, enhancing its position in key markets across North America. Founded in 1903, American Jebco serves various industries including automotive, construction hardware, and fire safety equipment. The company focuses on precision specialty fasteners and shifted away from high-volume rivets in 2015 to prioritize engineered, custom components. Key leadership from American Jebco, including Vice President of Sales Eddie O'Connor and Materials Manager Pete O'Connor, will remain in place to ensure operational continuity and maintain valued customer relationships. Spartan Fastener's CEO Tim Cash described the acquisition as a major milestone in the company's growth strategy, emphasizing a shared commitment to quality and service. Eddie O'Connor expressed optimism about the combined strengths positioning the companies for a strong future.

AFC Industries Acquires Cavanaugh Government Group to Expand Military and Defense Services

AFC Industries收購 Cavanaugh Government Group

AFC Industries announced the acquisition of Cavanaugh Government Group (CGG), a Chicago-based provider specializing in parts sourcing and distribution for military and defense applications. Founded in 2012, CGG offers logistics services across all government sectors, strengthening AFC’s footprint in the aerospace and defense market. AFC CEO Kevin Godin expressed enthusiasm about welcoming Mike Cavanaugh, Dina, and the CGG team into the AFC family, emphasizing that the acquisition aligns with the company's strategic focus on expanding defense capabilities. He highlighted CGG'’s expertise and customer-centric approach, which goes beyond stocking parts to partner with clients in solving problems and streamlining processes. Mike Cavanaugh, owner of CGG, stated that joining AFC provides resources and culture to accelerate growth, expressing confidence and excitement for the next chapter. Terms of the deal were not disclosed. AFC Industries is owned by private equity firm Bertram Capital and continues to expand globally with over 100 locations in eight countries. compiled by Fastener World

8,624.480

8,399.973

MobileTron's 2024 revenue was NTD 3,345.244 million, down 16.4% from NTD 4,003.635 million in 2023. The company ended the fiscal year with NTD 39.991 million in net loss in 2024, compared to NTD 124.275 million net loss in 2023. Total assets increased to NTD 8,624.480 million in 2024 from NTD 8,399.973 million in 2023.

Proxene's 2024 revenue was NTD 889.647 million, down 2.8% from NTD 915.526 million in 2023. The company ended the fiscal year with NTD 195.190 million in net profit in 2024, up 16.7% from NTD 167.321 million in 2023. Total assets increased to NTD 1,753.705 million in 2024 from NTD 1,628.572 million in 2023.

Jenn Feng Group's 2024 revenue was NTD 112.684 million, down 42.0% from NTD 194.406 million in 2023. The company ended the fiscal year with NTD 29.251 million in net loss in 2024, as compared to NTD 36.714 million net loss in 2023. Total assets decreased to NTD 271.904 million in 2024 from NTD 330.248 million in 2023.

Grainger's 2024 net sales were USD 17,168 million, up 4.2% from USD 16,478 million in 2023. The company ended the fiscal year with USD 1,909 million in net income in 2024, up 4.4% from USD 1,829 million in 2023. Total assets increased to USD 8,829 million in 2024 from USD 8,147 million in 2023.

Illinois Tool Works' 2024 net sales were USD 15,898 million, down 1.3% from USD 16,107 million in 2023. The company ended the fiscal year with USD 3,488 million in net income in 2024, up 18.0% from USD 2,957 million in 2023. Total assets decreased to USD 15,067 million in 2024 from USD 15,518 million in 2023.

Ingersoll Rand's 2024 net sales were USD 7,235.0 million, up 5.2% from USD 6,876.1 million in 2023. The company ended the fiscal year with USD 838.6 million in net income in 2024, up 7.7% from USD 778.7 million in 2023. Total assets increased to USD 18,009.8 million in 2024 from USD 15,563.5 million in 2023.

18,009.8 vs. 15,563.5

21,848.9 vs. 23,663.8

7,896.8 vs. 7,544.9

Stanley Black and Decker's 2024 net sales were USD 15,365.7 million, down 2.6% from USD 15,781.1 million in 2023. The company ended the fiscal year with USD 294.3 million in net income in 2024, compared to USD 310.5 million in net loss in 2023. Total assets decreased to USD 21,848.9 million in 2024 from USD 23,663.8 million in 2023.

Snap-on's 2024 net sales were USD 4,707.4 million, down 0.5% from USD 4,730.2 million in 2023. The company ended the fiscal year with USD 1,043.9 million in net income in 2024, up 3.2% from USD 1,011.1 million in 2023. Total assets increased to USD 7,896.8 million in 2024 from USD 7,544.9 million in 2023.

Atlas Copco's 2024 revenue was SEK 176,771 million, up 2.4% from SEK 172,664 million in 2023. The company ended the fiscal year with SEK 29,782 million in net profit in 2024, up 6.2% from SEK 28,040 million in 2023. Total assets increased to SEK 208,538 million in 2024 from SEK 182,684 million in 2023.

Einhell's 2024 revenue was EUR 1,109.699 million, up 14.2% from EUR 971.525 million in 2023. The company ended the fiscal year with EUR 65.070 million in net profit in 2024, up 28.9% from EUR 50.491 million in 2023. Total assets increased to EUR 974.813 million in 2024 from EUR 810.069 million in 2023.

Hilti’s 2024 revenue was CHF 6,429 million, down 1.4% from CHF 6,520 million in 2023. The company ended the fiscal year with CHF 558 million in net profit in 2024, up 0.2% from CHF 557 million in 2023. Total assets increased to CHF 8,055 million in 2024 from CHF 7,704 million in 2023.

Bosch’s 2024 revenue was EUR 90,345 million, down 1.4% from EUR 91,596 million in 2023. The company ended the fiscal year with EUR 786 million in net profit in 2024, down 62.6% from EUR 2,101 million in 2023. Total assets increased to EUR 112,766 million in 2024 from EUR 108,330 million in 2023.

8,611 vs. 9,284

1,106,525 vs. 1,055,808

19,941 vs. 19,241

32,970 vs. 29,649

257,256 in 2024 vs. 250,124 in 2023

Estic's 2025 revenue was JPY 7,881 million, up 10.6% from JPY 7,127 million in 2024. The company ended the fiscal year with JPY 1,181 million in net profit in 2025, up 4.3% from JPY 1,133 million in 2024. Total assets increased to JPY 12,056 million in 2025 from JPY 10,730 million in 2024.

Lobtex's 2025 revenue was JPY 5,708 million, down 3.7% from JPY 5,925 million in 2024. The company ended the fiscal year with JPY 77 million in net profit in 2025, down 72.4% from JPY 279 million in 2024. Total assets decreased to JPY 8,611 million in 2025 from JPY 9,284 million in 2024. The company forecasts 2026 revenue at JPY 5,810 million, up 1.8%.

Makita's 2025 revenue was JPY 753,130 million, up 1.6% from JPY 741,391 million in 2024. The company ended the fiscal year with JPY 79,338 million in net profit in 2025, up 81.6% from JPY 43,691 million in 2024. Total assets increased to JPY 1,106,525 million in 2025 from JPY 1,055,808 million in 2024. The company forecasts 2026 revenue at JPY 700,000 million, down 7.1%.

NS Tool's 2025 revenue was JPY 9,431 million, up 4.3% from JPY 9,040 million in 2024. The company ended the fiscal year with JPY 1,264 million in net profit in 2025, down 4.2% from JPY 1,320 million in 2024. Total assets increased to JPY 19,941 million in 2025 from JPY 19,241 million in 2024. The company forecasts 2026 revenue at JPY 9,680 million, up 2.6%.

Punch Industry's 2025 revenue was JPY 40,822 million, up 6.5% from JPY 38,344 million in 2024. The company ended the fiscal year with JPY 868 million in net profit in 2025, compared to JPY 577 million in net loss in 2024. Total assets increased to JPY 32,970 million in 2025 from JPY 29,649 million in 2024. The company forecasts 2026 revenue at JPY 39,880 million, down 2.3%.

OSG’s 2024 revenue was JPY 155,517 million, up 5.3% from JPY 147,703 million in 2023. The company ended the fiscal year with JPY 13,439 million in net profit in 2024, down 6.1% from JPY 14,307 million in 2023. Total assets increased to JPY 257,256 million in 2024 from JPY 250,124 million in 2023. The company forecasts 2025 revenue at JPY 160,000 million, up 2.9%.

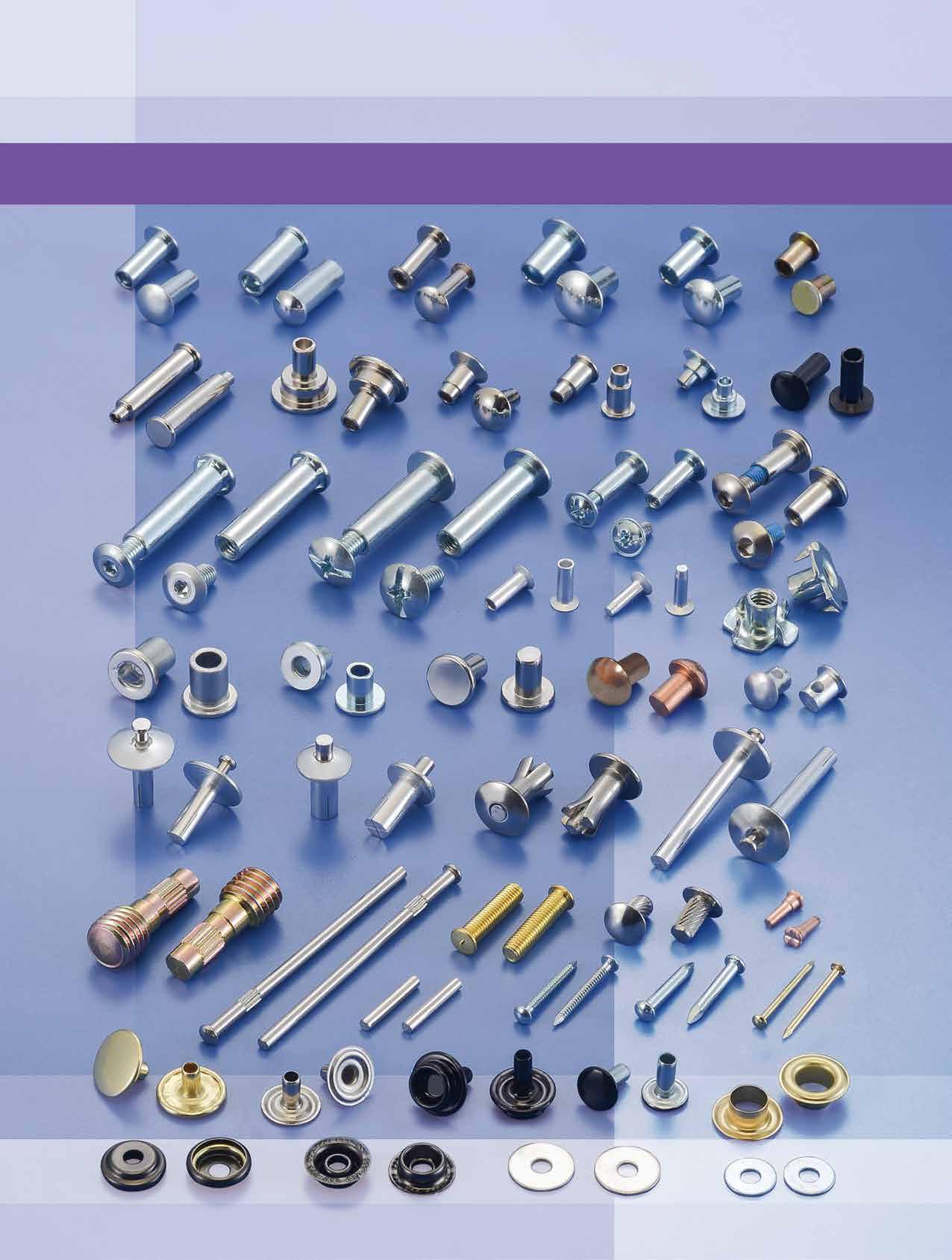

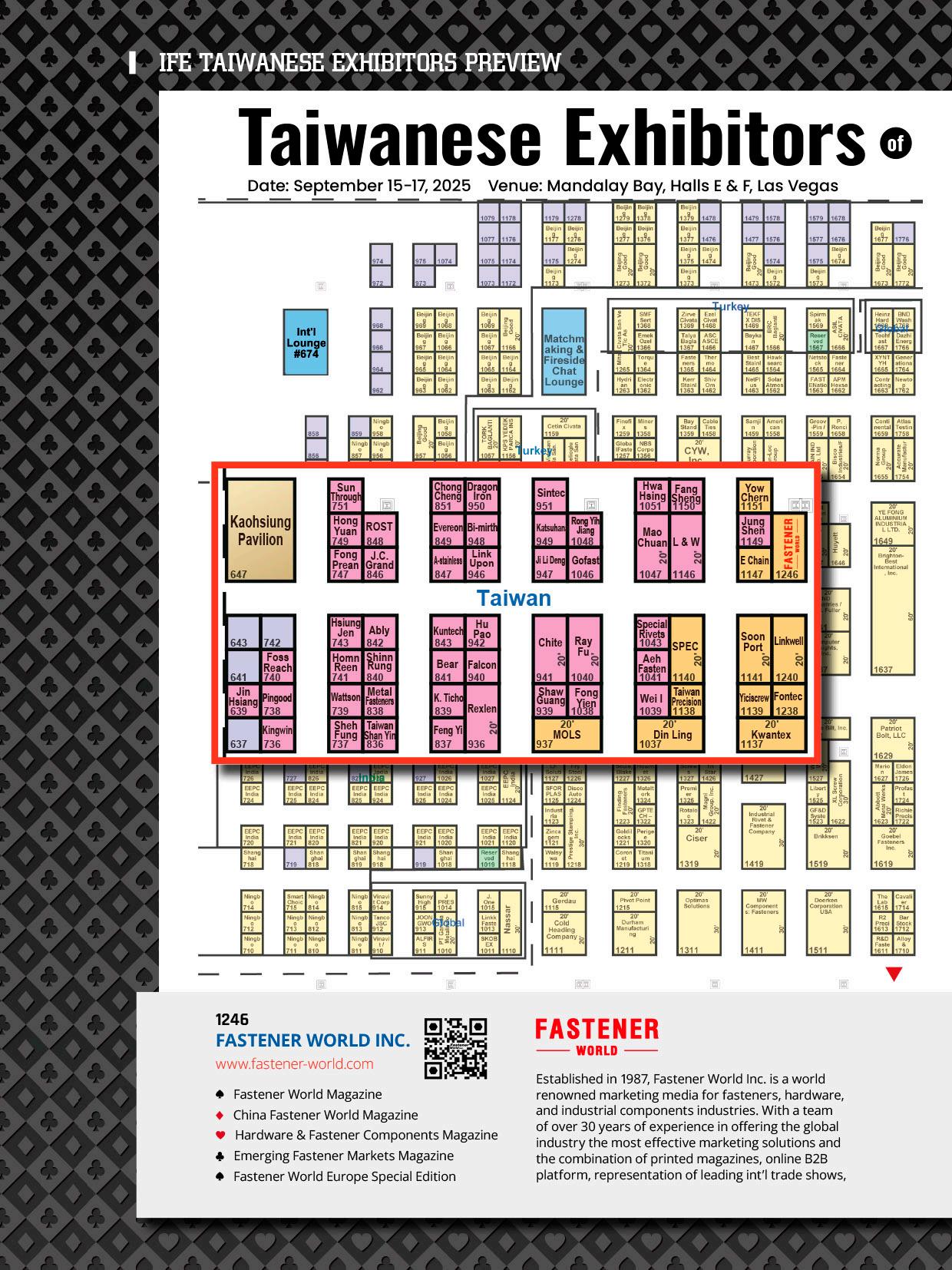

On May 22-24, roughly one thousand Chinese and a few overseas fastener-related exhibitors gathered at the Shanghai World Expo Exhibition & Convention Center (SWEECC) to participate in the annual IFS China. This year, two halls were open (one for raw materials, equipment, molds/dies, and consumables, and the other for finished fasteners) with the total exhibition area of about 40,000 square meters.

The exhibitors this year were mainly Chinese companies focusing on domestic sales, but there were also a few European and U.S. machinery-related companies (e.g. SACMA and National Machinery) wishing to expand their domestic sales in China. In addition, about 10 well-known Taiwanese machinery and equipment brands, such as Chun Zu, Jiancai, Tong Ming, and Jern Yao, as well as some punch/die/wire suppliers also participated in this year's show to enhance their exposure.

According to the observation of Fastener World’s staff on-site, the visitors this year, facing the influence of new regulations and tariff barriers from the EU and the U.S., were mainly buyers from China, India and Russia (not many from the EU and the U.S.), and most of them were buyers focusing on domestic sales in China. Visitors came mainly on the first day of the three-day exhibition, and the second day's crowd was less because of heavy rain.

Some local manufacturers revealed to Fastener World’s staff onsite that the turmoil in the global market over the past few months has caused a great impact on the export performance of Chinese suppliers, so many of them have turned to strengthen domestic sales and shifted to India, Brazil, Central and South America, and other emerging markets to cope with it. One Chinese manufacturer mentioned that as Russia recently put out a lot of post-war reconstruction programs ushering in increased demand for fasteners, many Chinese companies received a lot of inquiries and orders from Russian buyers, many of which could not even be handled by a single manufacturer and had to be divided into separate orders to be processed by 2-3 downstream factories in order to ensure punctual delivery. While the EU and the U.S. continue to exert economic pressure on China at the time, such orders do bring a ray of hope to Chinese manufacturers having encountered significantly decreased orders from Europe and the U.S. and ease the cost pressure on their operation. In addition, a number of industry experts were invited to hold trend seminars and industry summits focusing on CBAM and U.S. tariffs. They mentioned that although CBAM and U.S. tariffs had increased the short-term pressure on Chinese enterprises, the layout of export sales should be continuously strengthened in order to mitigate the involution of the Chinese market.

As there was also another international fastener expo in Shanghai this June, some exhibitors said that, considering the scale of both big shows, they would actively participate in one of these industry events or both on the premise of expanding market opportunities. However, they suggested that with the dates of both shows being so close to each other, it might be better to combine them into one bigger show, thereby attracting more visiting overseas buyers and expanding the benefits of participation.

The organizer has announced that the next show will be held on May 20-22, 2026 at SWEECC.

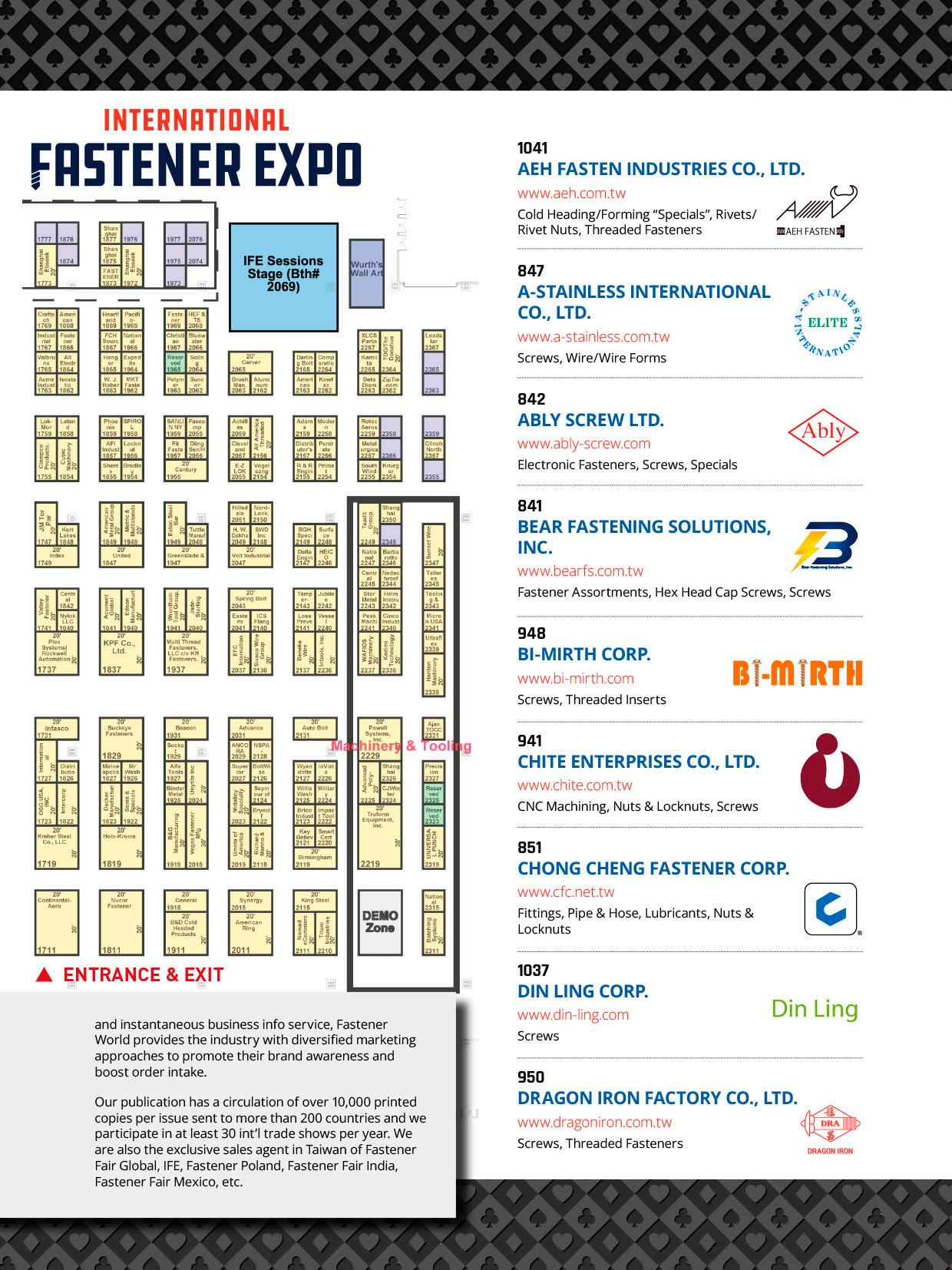

The annual Fastener Fair USA was held on May 28-29 in Hall C of the Music City Center in Nashville, the 4th largest city in the Southeastern United States. It is one of the international professional trade fairs in North America dedicated to creating networking and collaboration opportunities among manufacturers, distributors, equipment suppliers, processors, and end-users in the fastener manufacturing supply chain.

This year, there were 206 exhibitors, mainly from the fields of construction, automotive, aerospace, furniture, electronics, heavy machinery, home appliances, marine, railway, medical, military, energy, etc. The exhibits included a wide range of industrial fasteners, construction fasteners, assembly and installation systems, and fastener manufacturing technologies. Fastener World also joined many Taiwanese exhibitors to interact with local buyers from the U.S. market this time.

According to Fastener World's staff’s observation on-site, there were several visitors coming to Taiwan Pavilion on the first day of the show, and some exhibitors who also exhibited last year even said that the number of visitors was higher than last year’s record, which might be attributed to various new tariff policies in the U.S. announced this year, exchange rate fluctuations, freight cost hike, and rising raw material costs and other uncertainties, forcing more local buyers to visit the show to look for more alternative new opportunities. Some visitors also expressed high interest in sourcing from Southeast Asian and Taiwanese suppliers. Many of the visitors visiting Fastener World’s stand showed a high interest in purchasing construction-related products.

Although this show attracted many local U.S.-based exhibitors focusing on regional businesses to participate, it also attracted a number of international exhibitors from outside the U.S. looking for local importers and distributors to expand their collaboration. Some Chinese exhibitors noted that their U.S. customers still need to rely on Chinese suppliers for specific items that are not adequately supplied by the local market. On the other hand, Taiwanese suppliers also have fewer competitors in the U.S. market for certain higher value-added items, which are also attractive to local U.S. buyers, but they still need to pay attention to the possible impact of fluctuations in the exchange rate of NTD on their export competitiveness.

The organizer has announced that the next edition will be held on May 5-6, 2026 at the Charlotte Convention Center in Charlotte, the 2nd largest city in the Southeastern United States. As the city is known for its major furniture manufacturing hub, it may also attract more buyers of furniture fasteners when FF USA is open next year.

Less than a month after IFS China ended at the end of this May, the 15th Fastener Expo Shanghai was successfully held at the National Exhibition and Convention Center (Shanghai) from June 17 to 19.

Called the “Global Innovation Platform for the High-end Fastener Industry”, Fastener Expo Shanghai is often regarded as one of the barometers for observing Chinese fastener industry. This year, Halls 1.1, 2.1, and 3 were opened, attracting more than 1,200 local and overseas exhibitors to display a wide range of standard/non-standard fasteners, automotive connectors, riveting products & technologies, metal formed parts, made of carbon steel, stainless steel, and special alloys, as well as cold heading equipment, heat treatment equipment, surface treatment, molds & dies, inspection equipment & lab instruments, etc on the 70,000 sq. m. of exhibition space. A few Taiwanese machinery and equipment companies also attended the exhibition in the hope of increasing orders from local fastener manufacturers in China.

The visitors this year were mainly from domestic China and not many from overseas. According to Fastener World's on-site staffs, there were overseas buyers from Kazakhstan, Turkey, Malaysia and Peru coming to Fastener World's booth, and Japanese visitors were also seen sometimes, probably due to the dates of two similar shows (one in May and the other in June) being too close to each other.

During the exhibition, many exhibitors and visitors also seized the time to exchange views on the recent US tariffs, EU anti-dumping, currency exchange rates, market challenges, business opportunities in emerging markets and other issues. Some Chinese exhibitors told Fastener World’s staffs that "many Chinese enterprises are facing tough challenges in their business operations due to the anti-dumping duty from the EU, which is over 90%, and the uncertainty of U.S. tariffs, as well as the lack of subsidies from the Chinese government". However, some exhibitors said that "many Chinese companies have already turned to nonEuropean and non-U.S. markets", and are now doing well in the Middle East and Southeast Asia. In terms of domestic sales, some exhibitors said that "the market is still in the doldrums, and the strategy of price cutting in China is still a difficult problem for many companies to deal with."

The organizer held more than 10 industry forums, the fastener gala night and the B2B matchmaking event during the exhibition. The next Fastener Expo Shanghai will be held on June 24-26, 2026 at the National Exhibition and Convention Center (Shanghai), which will continue to provide an important business platform to promote view exchange, industrial learning, and business opportunities matchmaking.

泰國曼谷國際工業製造展

The show held from June 18 to 21 at the Bangkok International Trade & Exhibition Centre (BITEC) saw visitor numbers fill up within just half an hour of opening each day, clearly surpassing the attendance of the previous edition. This year’s event featured several notable new characteristics compared to last year’s.

In addition to the China and Taiwan pavilions, this year the Expo included pavilions from Singapore and South Korea, along with a dedicated section for industrial tools and tooling. A highlight was the Taiwan Excellence Award pavilion, which not only promoted award-winning Taiwanese companies but also hosted keynote presentations on Taiwan’s manufacturing technologies.

Japanese companies have increased their investments in Thailand in recent years. Many Japanese exhibitors seen at the show either have local factories or joint ventures with Thai firms. They employed local Thai staff to provide on-site supply services. Most of these Japanese companies were from machinery and materials sectors outside the fastener industry.

Unlike other country pavilions, there was not just one but multiple China pavilions in the different areas of the venue. By including numerous smaller Chinese booths, exhibitors with Chinese backgrounds accounted for over 50% of the total exhibitors. Fastener World talked with a Chinese exhibitor who even estimated this share to exceed 70%. This exhibitor explained that intense involution in China has suppressed domestic sales, prompting many to target Thailand for export growth. To him, the surge in Chinese presence in this show came as no surprise.

The majority of buyers came from four key industries: electronics, assembly, automotive, and machinery. As these buyers required fasteners in smaller quantities for assembly, their purchase requirements shared common traits: support for small-quantity supply, local manufacturing presence in Thailand, and the ability to provide customized products. These traits reflect that fastener companies able to supply locally in Thailand will be the most competitive in entering the Thai market.

Many visitors expressed difficulty finding local fastener suppliers despite strong demand. Hence, Fastener World offered them matchmaking with global suppliers and introduced to them fasteners, dies, tooling, and machinery suppliers through company reports and catalogs in Fastener World publications. Understanding the characteristics of these buyers offers interested suppliers a valuable opportunity to capture business in this Southeast Asian industrial hub.

2025越南胡志明國際工具機暨金屬加工設備展鏈接國際製造業與越南市場商機

MTA Vietnam took place at Halls A and B of Saigon Exhibition and Convention Center (SECC) in Ho Chi Minh City from July 2 to 5, attracting about 380 exhibitors from Vietnam, Asia (Taiwan, India, Japan, China, Thailand, Korea, Malaysia, Singapore, Indonesia, Israel), Europe (Germany, UK, Italy, Austria, Netherlands, France, Switzerland, Finland) and the US. Moreover, Japan, Singapore, China, etc. were presented in the form of national pavilions.

Since its inaugural edition in 2005, MTA has continued to play an important role in facilitating two-way exchanges between the global manufacturing industry and Vietnam's local market, and introducing the most advanced manufacturing products, technologies and product solutions from around the world to the Vietnamese manufacturing industry. Exhibitors in 2025 mainly came from the fields of automation, cutting tool systems, factory equipment, material handling, measurement and inspection technology, metal cutting machines, metal forming/ sheet metal cutting machines, tools & dies, software and design systems, surface treatment and heat treatment.

In order to provide exhibitors and visitors with a deeper understanding of the latest manufacturing technologies and trends, the organizer also invited associations and industry experts to hold a number of market and technology seminars on topics ranging from automation to AItomation, investment/development/collaboration opportunities in Vietnamese semiconductor industry, digital transformation, smart sustainable manufacturing, sourcing, clean energy, manufacturing technologies, raw material processing, and many other topics. There were also matchmaking meetings with German and Japanese companies for buyers.

Fastener World also went to the exhibition again this year. In addition to disseminating the latest sourcing magazines, we also introduced the optimized online product and supplier search platform to the professional buyers coming to our booth. Many buyers who read our magazines on site or scanned the QR code to enter our online B2B buying & selling platform all said that the abundant information on fasteners, hardware, components, tools, machinery and peripheral suppliers was very helpful for them to find more sources for future purchases.

The organizer has not announced the dates and venue for the next edition of the show yet. Please stay tuned to our official website at www.fastener-world.com for more information.

Manufacturing World is held in Tokyo, Osaka, Nagoya and Fukuoka by turns in different months of a year, and the edition in Tokyo is the largest of them all in terms of scale. On July 9-11 this year, Manufacturing World was grandly held at Makuhari Messe in Tokyo. The concurrent shows included Design Manufacturing Solutions Expo, Mechanical Components & Technology Expo, Medical Device Development Expo, Factory Facilities & Equipment Expo, Additive Manufacturing Expo, Manufacturing Cyber Security Expo, Smart Maintenance Expo, Measure/Test/Sensor Expo, Manufacturing DX Expo, and Industrial ODM/EMS Expo.

This year's event featured 11 pavilions and attracted 1,975 Japanese and overseas companies to exhibit the most advanced metal parts and components, facilities and equipment, manufacturing technologies, IT technologies, digital transformation and AI solutions, etc. According to the latest figures released by the organizer, the 3-day exhibition attracted a total of 55,749 visitors, mainly from the automotive, heavy industry, electronics, machinery, precision equipment and many other fields. During the exhibition period, the organizer also invited many Japanese and overseas leading business executives and renowned experts to hold a number of manufacturing-related industry trends and technology exchange seminars, which attracted many visitors interested in market trends and the latest manufacturing technologies to make appointments to listen to the seminars.

According to the observation of Fastener World's staff at the show, Tokyo located in the Kanto region of Japan is a pivotal city where many well-known manufacturers of electronic equipment, precision instruments, medical equipment, heavy industry, machinery, construction equipment, semiconductors, as well as automobiles and peripheral parts set up their factories or headquarters, which demonstrates a huge manufacturing momentum. The number of exhibitors this year was similar to that of last year. Roughly 20-30 exhibitors were related to the fastener industry and were mainly from Japan and China. There were also a few from Europe, Taiwan, and Thailand.

The organizer has announced that the next show will be held on July 1-3, 2026 at Tokyo Big Sight. For more show information, please keep following us on our official website at www.fastener-world.com.

Hungary's fasteners and fastening tools market presents a compelling case for growth and strategic investment in 2025. Situated at the heart of Central Europe, Hungary is not only a key manufacturing hub for the automotive and machinery sectors, but also plays a pivotal role in regional supply chains extending into Western Europe and the Balkans. This article offers a detailed analysis of the current state of the market, grounded in genuine forecasts and supported by credible sources, while providing practical insights and projections for stakeholders across the value chain.

As of early 2025, Hungary’s economy remains industrially resilient, with manufacturing contributing nearly 20% to its GDP. The automotive sector, driven by global OEMs with local production facilities, continues to dominate exports and industrial output. According to the Hungarian Central Statistical Office (KSH), the industrial production index rebounded in Q1 2025 by 2.1% year-over-year after contractions in late 2024. This industrial momentum fuels consistent demand for a wide array of fasteners, from standard bolts and rivets to advanced, lightweight systems tailored for electric vehicles (EVs) and automated manufacturing.

According to 6Wresearch, the Hungarian industrial fastener market is growing at a rate of 5.43% in 2025, with expectations to reach the CAGR up to 12.71% by 2029. In monetary terms, the market is projected to exceed HUF 90 billion (~EUR 230 million) by 2029. This projection signals not just expansion but a structural transformation in product sophistication and tooling demand.

Parallel to industrial growth, Hungary’s integration into EUfunded infrastructure projects is boosting demand for construction fasteners. Between 2021-2027, Hungary is expected to receive more than EUR 22 billion from the EU cohesion fund, much of which is allocated to transport, water systems, and energy efficiency infrastructure. These developments are increasing the need for high-load, corrosion-resistant fasteners, while light manufacturing and electronics are pushing demand for precision-engineered microfasteners and digitally enhanced fastening tools.

Three key industries are driving Hungary’s fastener demand: ➊ Automotive Manufacturing: Hungary remains one of Europe’s key vehicle assembly hubs. With a growing share

of EV and hybrid production, manufacturers are sourcing fasteners that meet stricter durability, weight, and thermal tolerance standards. Aluminum and high-tensile alloy fasteners are increasingly preferred, while modular vehicle platforms require more standardized fastening systems that improve speed and reduce variability on production lines.

➋ Construction and Infrastructure: The domestic construction market expanded by 4.7% in early 2025 compared to the previous year, driven by large-scale transport and residential projects. Structural fasteners, especially those with anti-corrosion coatings and compliance with seismic standards, are in high demand, particularly in transport, logistics, and renewable energy projects.

➌ Industrial Equipment and Machinery: Hungary’s machinery and components sector grew by 6.3% in 2024, and this momentum continues into 2025. Local and foreign suppliers require customized fasteners for thermal control, automation, and energy applications. Torque-controlled fastening systems, digital verification tools, and assembly optimization software are now increasingly used in precision engineering environments.

The fastening tool segment, including electric drivers, torque wrenches, pneumatic tools, and AR-guided fastening systems, is gaining significant traction across Hungary. Regulatory tightening around quality assurance and traceability in industrial assembly is driving demand for smart tools. Tool system suppliers report increased interest from both large assembly plants and SME subcontractors in:

• Electric torque tools with calibration sensors

• Battery-operated impact drivers with variable torque control

• Guided fastening solutions integrated with ERP or MES systems

Hungary’s tool distribution model is also shifting. B2B digital platforms now account for nearly 22% of tool sales, a figure expected to rise above 30% by 2026. The growth of e-commerce platforms serving industrial buyers is improving tool accessibility, particularly for remote construction and manufacturing zones.

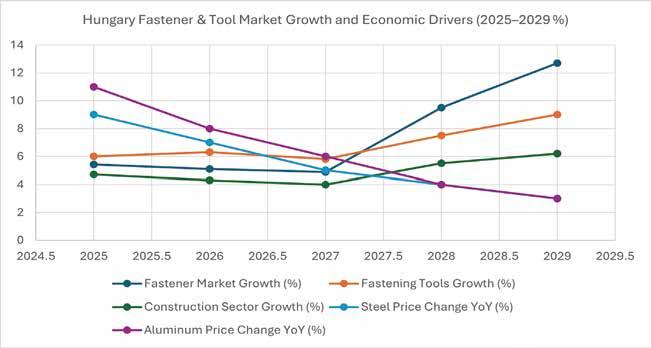

Based on current trajectories and projections from industry sources:

• 2025: Fastener market growth at 5.43%, fastening tool segment estimated at ~6.0%.

• 2026–2027: Growth moderates (~4.8–5.1%) due to anticipated EU regulatory transitions, tightening margins, and input cost volatility.

• 2028–2029: Strong recovery driven by Green Deal-linked investments and increasing exports. Fastener CAGR may reach 12.71%, with continued momentum in fastening tool demand.

Hungary’s strong export infrastructure, combined with its role in nearshoring and supply chain resilience strategies, positions it ahead of several regional peers.

The right chart presents year-over-year percentage growth estimates for Hungary’s fastening tool market, alongside related construction sector growth and raw material cost trends. These values are derived from credible regional studies and global industry research—specifically on power tools and fastening solutions in Central and Eastern Europe—tailored to Hungary’s economic and industrial profile. The slight

(2025-2029;%)

dip in 2027 likely reflects macroeconomic adjustment, followed by strong momentum through 2029. The easing of steel and aluminum price inflation further enhances the sector’s outlook.

Hungary’s geographical location and developed logistics infrastructure support its role as a fastener distribution and re-export center. According to Volza, Hungary consistently exports fasteners to Poland, Romania, Austria, and Ukraine. In 2024, the country registered over 120 distinct export shipments of fastening components, indicating strong B2B and OEM supply network activities.

Local producers are gaining traction through ISO 9001 and ISO/TS 16949 certification, while foreign investors continue to expand their fastener manufacturing capacity near Debrecen and Győr. The trend toward integrated packaging, tools and fasteners combined in tracked systems, is also helping Hungarian firms win supply contracts in electronics, defense, and construction applications.

• Material Costs and Availability: Steel prices in early 2025 rose 9% year-over-year, while aluminum input costs increased by 11%. Sourcing consistent quality materials remains a barrier to growth.

• Workforce Development: While Hungary has a strong vocational training tradition, specialized labor shortages, especially in robotics-based assembly environments, are limiting advanced tool adoption.

• Certification and Compliance Costs: Smaller firms face significant overhead to comply with EU procurement standards and environmental reporting obligations.

➊ For Manufacturers: Prioritize R&D in hybrid alloy fasteners, expand production of coated and multi-application fasteners, and invest in digital twin simulation for fastening process design.

➋ For Distributors: Focus on vertical integration, providing both fasteners and tools. Leverage ERP and inventory analytics to enhance responsiveness and customer retention.

➌ For Policymakers: Accelerate digital infrastructure in logistics parks, expand technical education subsidies, and harmonize standards across EU and non-EU supply chains to ease cross-border trade.

Hungary’s fasteners and fastening tools market in 2025 reflects a rapidly maturing industrial ecosystem that is adopting advanced technology while building on a resilient manufacturing base. With structured investment from both public and private actors, and the support of EU funding cycles, the market is poised for high-value growth across automotive, energy, infrastructure, and precision engineering. For stakeholders ready to innovate and scale, Hungary offers both competitive access to the European market and the ability to influence the fastener industry evolution over the next decade.

Copyright owned by Fastener World / Article by Dr. Sharareh Shahidi Hamedani, UNITAR International University

References

Hungary Industrial Fasteners Market, 6Wresearch (2022–2029)

Europe Industrial Fasteners Market Report, Credence Research, 2024

Grand View Research, Global Industrial Fasteners Market Outlook, 2024

MarketsandMarkets: Power Tools and Fastening Tools Forecasts, 2025–2029

Volza Export Shipment Data: Hungary, 2024

Hungarian Central Statistical Office (KSH): Industrial Production Index and Construction Output Reports, 2025

EU Cohesion Fund Budget Allocation 2021–2027 for Hungary, European Commission

2024-2025第一季波蘭扣件和緊固工具貿易統計

Poland's economy expanded by 2.9% in 2024 despite pressures from energy costs and EU Green Deal transitions. Industrial output particularly in automotive, white goods, and general machinery remains a major contributor to its GDP, accounting for nearly 22% as of late 2024 (Statistics Poland, 2025). This industrial strength supports robust demand for both basic and specialty fasteners, alongside a growing appetite for advanced fastening tools.

According to data from the Polish Agency for Enterprise Development (PARP), Poland imported approximately €214 million worth of fasteners and fastening components in 2024, marking a 4.1% year-over-year increase. At the same time, exports reached €176 million, with a strong presence in markets such as Germany, the Czech Republic, Slovakia, and Sweden. Much of this trade focuses on bolts, screws, nuts, washers, and rivets made of steel, brass, or aluminum.

The fastening tool market also registered a noticeable expansion, with total imports of powerdriven tools valued at over €96 million, supported by demand across automotive plants, construction sites, and light manufacturing facilities.

Poland is one of Europe’s largest vehicle component producers, housing over 300 tier-1 and tier-2 automotive suppliers. Electric vehicle (EV) production continues to rise in Katowice and Lower Silesia, driving up the use of lightweight aluminum fasteners, blind rivets, and vibration-resistant locking systems. These trends correspond with Poland’s export of specialized automotive fasteners valued at €64 million in 2024 alone (Eurostat, 2025).

Fastener consumption in Poland’s construction sector rose by 6.3% in 2024, according to the National Association of Construction Manufacturers. EU recovery funds and public-private partnerships continue to support road, rail, and residential projects. This has significantly increased demand for anchor bolts, heavy-duty expansion plugs, and galvanized steel fasteners.

As a major production hub for appliances and consumer electronics, Poland’s manufacturing sector uses high volumes of small-diameter screws, captive fasteners, and torque-controlled assembly tools. The sector’s output grew 5.4% in 2024, according to GUS (2025), amplifying domestic consumption of highprecision fasteners and related tooling systems.

The fastening tool segment in Poland is evolving with a clear shift toward digitized and ergonomic solutions. Key trends in 2024–Q1 2025 include:

- Cordless Electric Tools: Demand surged by 8.1%, led by battery-operated torque wrenches, impact drivers, and angle grinders.

- Smart Assembly Tools: Increasingly adopted in automotive and aerospace manufacturing. These tools allow for torque verification, data logging, and MES integration.

- Growth in SME Usage: Affordable imports from Taiwan, Germany, and China have increased availability among SMEs involved in furniture, metalwork, and machine maintenance.

Retail and B2B e-commerce for fastening tools also gained momentum, now comprising roughly 27% of total sales, particularly among younger and digitally inclined buyers.

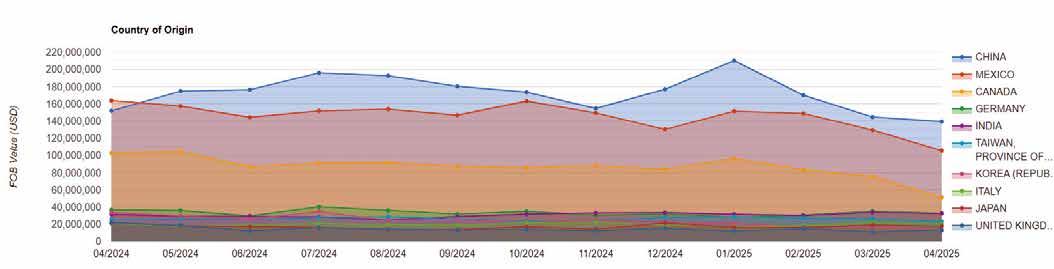

The table below summarizes Poland's key fastener-related trade figures for 2024 (source: Eurostat, UN Comtrade, 2025 ):

public infrastructure spending and industrial automation. The automotive segment maintains solid export strength due to Poland’s role as a Tier-1 supplier in Europe. Meanwhile, the industrial fastener category, though growing more modestly, still represents the highest total trade value, confirming its foundational role in Poland’s manufacturing ecosystem.

Poland remains one of Central Europe’s largest re-exporters of industrial components, acting as a logistics hub for both EU and nonEU flows. According to Volza export shipment data, Poland conducted over 140 distinct fastener export shipments in Q1 2025 alone, with consistent volumes to Hungary, the Czech Republic, Romania, and Germany.

The country’s bonded warehouse infrastructure, road-rail connectivity, and special economic zones (e.g., Katowice Special Economic Zone) enhance its appeal for multinational producers seeking just-in-time supply networks for fasteners and associated tools.

These data reflect a broadly expanding market, with construction fasteners and power tools showing the highest annual growth rates, supported by strong

Copyright owned by Fastener World / Article by Behrooz Lotfian

Fluctuating steel and aluminum prices remain a challenge. Steel input costs rose by 7.5% in late 2024, squeezing margins for smaller fastener producers and importers reliant on raw material precision.

While Poland offers a welleducated technical workforce, skill shortages in CNC machining, robotics, and digital tool operation are emerging. This poses a barrier to deeper adoption of advanced fastening technology.

Changes to EU carbon disclosure, REACH compliance, and the incoming Ecodesign requirements for tools are expected to increase costs, particularly for imported fastening systems and subcomponents.

- Invest in corrosion-resistant, weight-optimized fasteners for EV and aerospace clients.

- Embrace digital twin simulation to optimize fastening system design.

- Consider co-locating production with tool providers to create bundled offerings.

Retailers

- Expand digital catalogs and support for e-commerce platforms.

- Integrate after-sales service and tool calibration to enhance valueadded offerings.

- Target Tier-2 manufacturing firms with modular fastening tool kits.

- Promote technical education in tool calibration, automation, and mechatronics.

- Simplify certification for SMEs under new EU procurement rules.

- Strengthen bilateral trade facilitation with Baltic and Balkan markets to diversify exports.

Poland’s fastener and fastening tool sector in 2024–Q1 2025 reflects a growing, strategically vital industry aligned with national manufacturing strengths and EU industrial strategies. As automation and electrification redefine product requirements, Poland’s trade data underscores both opportunity and pressure to innovate. With continued investment in infrastructure, tooling technology, and workforce development, the country is well-positioned to become a regional leader in fastening systems over the next decade.

References

- Eurostat Trade Database (2025). EU Trade Statistics for Mechanical Fasteners.

- Statistics Poland (GUS). Industrial and Construction Output Reports, Q1 2025.

- Volza Shipment Analytics: Poland Fastener Exports, 2024–2025.

- UN Comtrade Database. HS Codes 7318 & 8467 Trade Flows – Poland, 2024.

- Polish Agency for Enterprise Development (PARP), 2024.

- MarketsandMarkets: Fastening Tools Market – Central Europe Forecasts (2024–2029).

- European Commission, EU Green Deal Implementation Roadmap, 2024–2025.

International Exhibition and Convention Centre Expo Krakow

Twodays of industry meetings, presentations of the latest technologies and products, an expert conference on topics important for the fastener industry, Meeting Zone and novelty – Surface Protection Exhibition. This is a preview of this year's edition of the International Trade Fair for Fastener and Fixing Technologies FASTENER POLAND®. The trade fair will take place on October 15th-16th at EXPO Kraków.

The previous edition of the trade fair was attended by 153 exhibitors from 18 countries, 75% of which were foreign companies. The statistics of visitors were equally international. Of the 2,856 guests, 46% came to Krakow from abroad. Europe was most represented by industrialists from Germany, the Czech Republic, Slovakia, Ukraine and Romania. The above data only emphasize the importance of the event and the fact that the FASTENER POLAND® trade fair is the most important place for business meetings in the industry in Central and Eastern Europe.

The demand for specialised fasteners, in terms of quality and standards, is constantly growing. This is probably influenced by the most technologically advanced industrial sectors. Polish suppliers have specialised in supplying high-quality fasteners. Thanks to investments in modern technologies that are friendly to the environment and the continuous improvement in the qualifications of production staff, Poland is the third largest supplier of fasteners in the European Union, after Germany and Italy. The location of Poland and well-developed transport infrastructure guarantee uninterrupted supply chains to the furthest corners of the continent. Although labour costs are also rising in the country, Poland still offers competitive prices compared to other European countries. All these factors make Poland an ideal place for investment in the fasteners industry. Exhibitors from all over the world know this, and every year at the only event dedicated to fasteners in Poland they want to establish business contacts, find an agent or investigate the potential to open a branch.

A novelty of this year's edition of the FASTENER POLAND® Trade Fair will be an exhibition devoted to the preparation and protection of the surface of fasteners. This work is carried out at every stage, both by manufacturers and distributors of fasteners. Therefore, the organizer invites manufacturers and suppliers of cleaning, degreasing, coating, varnishing and protection of metal surfaces to EXPO Kraków. Manufacturers of machines and devices, suppliers of chemicals, paints, varnishes and galvanic technologies will present their offer.

D156 BIING FENG ENTERPRISE CO., LTD. 秉鋒興業股份有限公司 www.bf-bestformer.com

D153 BOSS PRECISION WORKS CO., LTD. 伯獅精工股份有限公司 www.screwboss.com

D158 CHI NING CO., LTD. 旗林股份有限公司 www.nutformer.com.tw

D136 CHITE ENTERPRISES CO., LTD. 尚余企業股份有限公司 www.chite.com.tw

D138 DE HUI SCREW INDUSTRY CO., LTD. 德慧螺絲工業股份有限公司 www.dehuiscrew.com

D120 FENG YI TITANIUM FASTENERS (FENG YI STEEL CO., LTD.) 豐益鋼鐵企業有限公司 www.fengyi-ti.com

D152 FRATOM FASTECH CO., LTD. 福敦科技有限公司 www.fratom-fastech.com

D118 HOPLITE INDUSTRY CO., LTD. 合利國際股份有限公司 www.hoplite.com.tw

D114 INDUSTRIAL TECHNOLOGY RESEARCH INSTITUTE (ITRI) 工業技術研究院 中分院 www.itri.org.tw

D115 JOKER INDUSTRIAL CO., LTD. 久可工業股份有限公司 www.joker-fastener.com

D161 KO YING HARDWARE INDUSTRY CO., LTD. 柯穎五金企業有限公司 www.ko-ying.com.tw

The previous edition showed that B2B meetings are a very important aspect of the trade fair. Meeting Zone dedicated to companies that are beginning their adventure with participation in fairs and those that have not planned this form of promotion in this year's budget. In a dedicated area, with a small financial outlay, traders had the opportunity to present their offer and obtain orders. This project was enthusiastically received and will certainly be continued this year, too.

D117 L & W FASTENERS COMPANY 金大鼎企業股份有限公司 www.lwfasteners.com.tw

D154 MAC PRECISION HARDWARE CO. 鑫瑞精密工業有限公司 www.machardware.com.tw

D133 MAO CHUAN INDUSTRIAL CO., LTD. 貿詮實業有限公司 www.maochuan.com.tw

D155 RAY FU ENTERPRISE CO., LTD. 瑞滬企業股份有限公司 www.ray-fu.com

D135 TAI HUEI SCREW INDUSTRY CO., LTD. 台煇螺絲工業股份有限公司 www.taihuei.com

D137 TAIWAN INDUSTRIAL FASTENERS INSTITUTE 台灣螺絲工業同業公會 www.fasteners.org.tw

D176 TAIWAN PRECISION FASTENER CO., LTD. 台灣精密扣件有限公司 www.taiwan-precision-fastener.com

D160 TSUNAMI LTD. 宣大企業有限公司 www.tsunami-p.com.tw

D121 VERTEX PRECISION INDUSTRIAL CORP. 緯紘精密工業股份有限公司 www.vertexprecision.com.tw

D162 YESWIN MACHINERY CO., LTD. 友信機械股份有限公司 www.twyeswin.com

D159 YI XING SCREW CO., LTD. 億炘實業有限公司 yixing-fastener.tw/

D157 ZHISHAN XING ENTERPRISE CO., LTD. 至善行興業有限公司 www.fastener-world.com/en/supplier/zhishan

Bulgaria's industrial sector continues robust expansion, significantly influencing demand for fasteners and fastening tools in 2025. With a stable economic environment and advantageous geographic positioning in Eastern Europe, Bulgaria is emerging as an increasingly strategic market. Anticipated growth above global averages is primarily driven by thriving sectors such as automotive manufacturing, heavy machinery, construction, and infrastructure developments, boosted by European Union investment initiatives and supportive governmental policies.

By mid-2025, Bulgaria's economy is demonstrating strong resilience, maintaining a GDP growth projection of around 2.6%. The manufacturing sector, representing about 27% of Bulgaria’s GDP, remains a robust contributor to national economic stability and growth. The ongoing surge in infrastructure projects, including large-scale construction of transport corridors and residential buildings, has significantly boosted the demand for industrial-grade fasteners.

Automotive assembly, notably buoyed by the electric vehicle (EV) sector, has witnessed marked acceleration. Major European automakers have expanded their Bulgarian operations, incorporating advanced lightweight materials such as aluminium and titanium alloys and corrosion-resistant coatings. Fastening tools have seen considerable market traction, supported by industrial modernization, increased investments in precision and automation technologies, and a growing doit-yourself (DIY) culture.

Bulgaria’s industrial fastener market is forecasted to experience a steadily rising growth trajectory between 2025 and 2029. The annual growth rate is expected to start at approximately 8.8% in 2025 and gradually increase to around 9.56% by 2029. By 2027, the growth rate is projected to stabilize near 7.98%, underscoring Bulgaria’s solid performance within the European region, led predominantly by Germany, followed by the United Kingdom, France, Italy, and Russia. These figures point to a consistent upward trend, supported by Bulgaria’s expanding manufacturing capabilities, increasing foreign direct investment, and integration into pan-European supply chains.

Figure 1: The Projected Annual Growth Rates for Bulgaria’s Industrial Fastener Market from 2025 through 2029

The Bulgarian industrial fastener market is specifically projected to reach around BGN 0.65 billion (€0.33 billion) by the end of 2025. These estimates are grounded in a comprehensive analysis incorporating Bulgaria’s proportional share of Europe’s industrial output, its relative GDP standing, and sector-specific growth factors such as infrastructure development and industrial modernization.

Industrial fasteners, essential to sectors like construction, transportation, and machinery, constitute the bulk of this market. Demand is particularly strong for standard and specialized fasteners used in civil engineering, structural installations, and export-oriented equipment manufacturing.

Within this segment, the automotive fastener subsector is gaining momentum and is expected to reach approximately BGN 0.17 billion by the end of 2025. This growth is being driven by increased vehicle assembly operations, especially in electric vehicle production, and a market shift toward lightweight, durable components. Fasteners made from coated steel, aluminium, and titanium alloys are becoming increasingly favoured for their strength-to-weight advantages and enhanced corrosion resistance.

Figure 1 illustrates the projected annual growth rates for Bulgaria’s industrial fastener market from 2025 through 2029.

It highlights the country’s positive market momentum and reinforces expectations for long-term sector expansion.