A

new overseas plant on the horizon after its first scouting

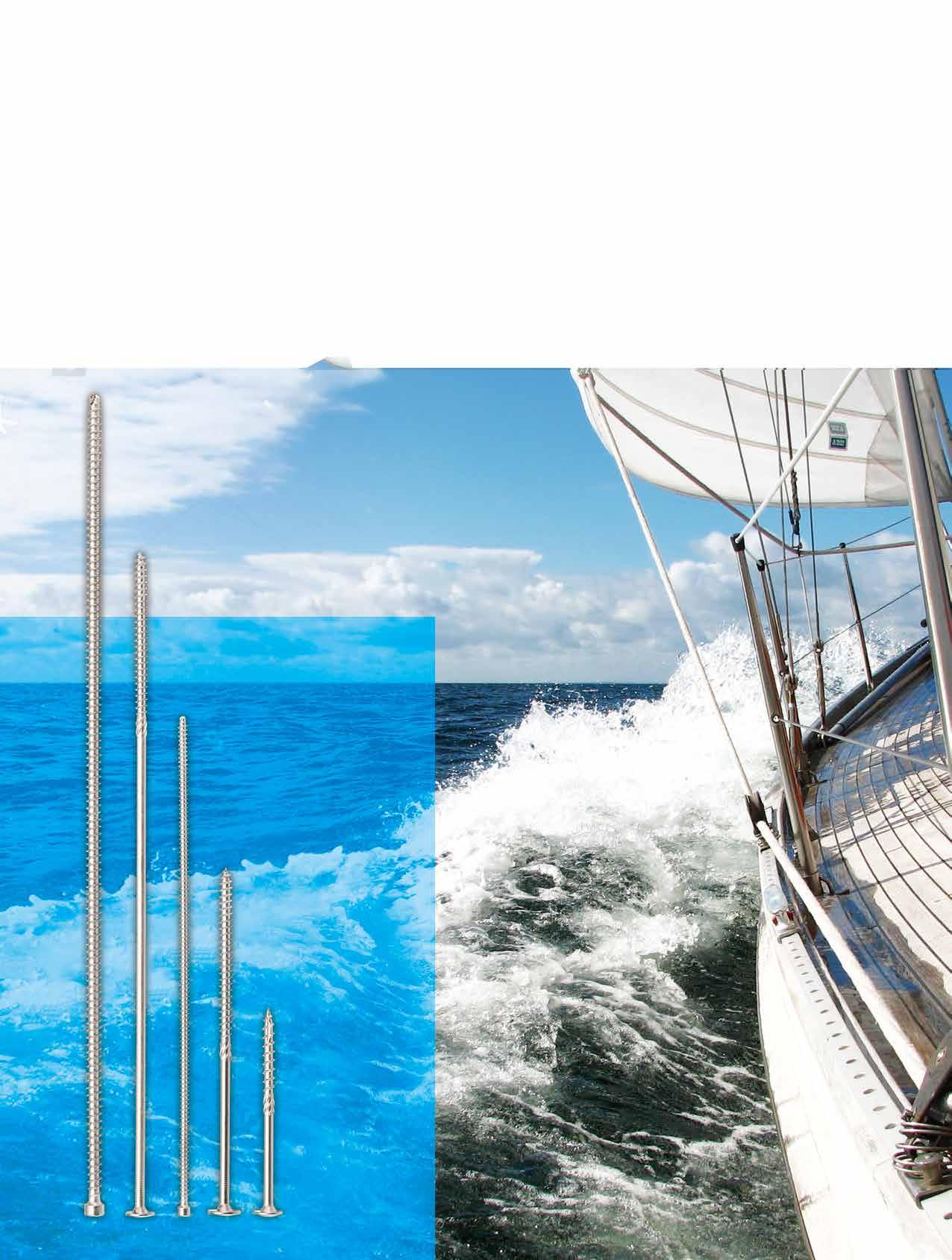

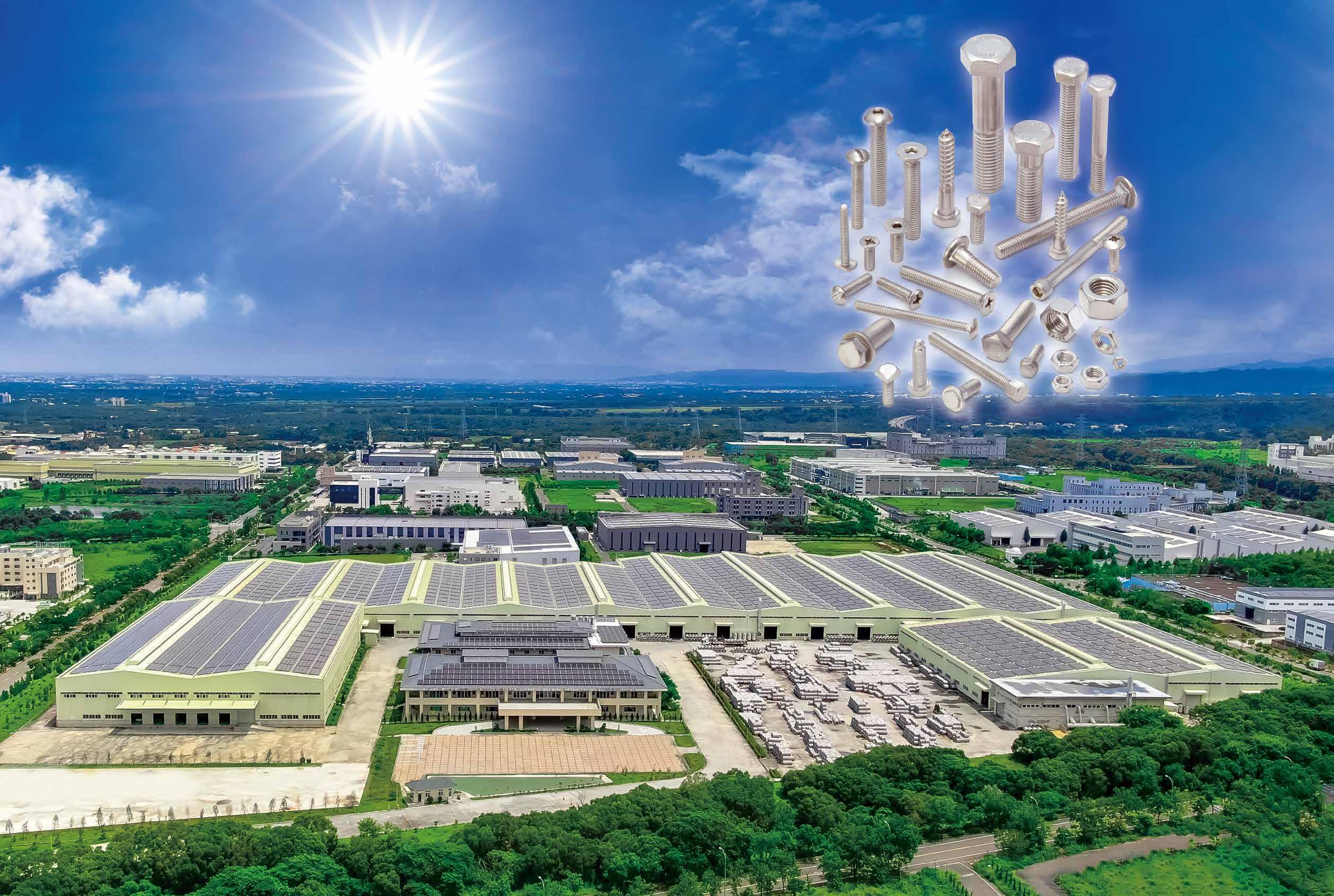

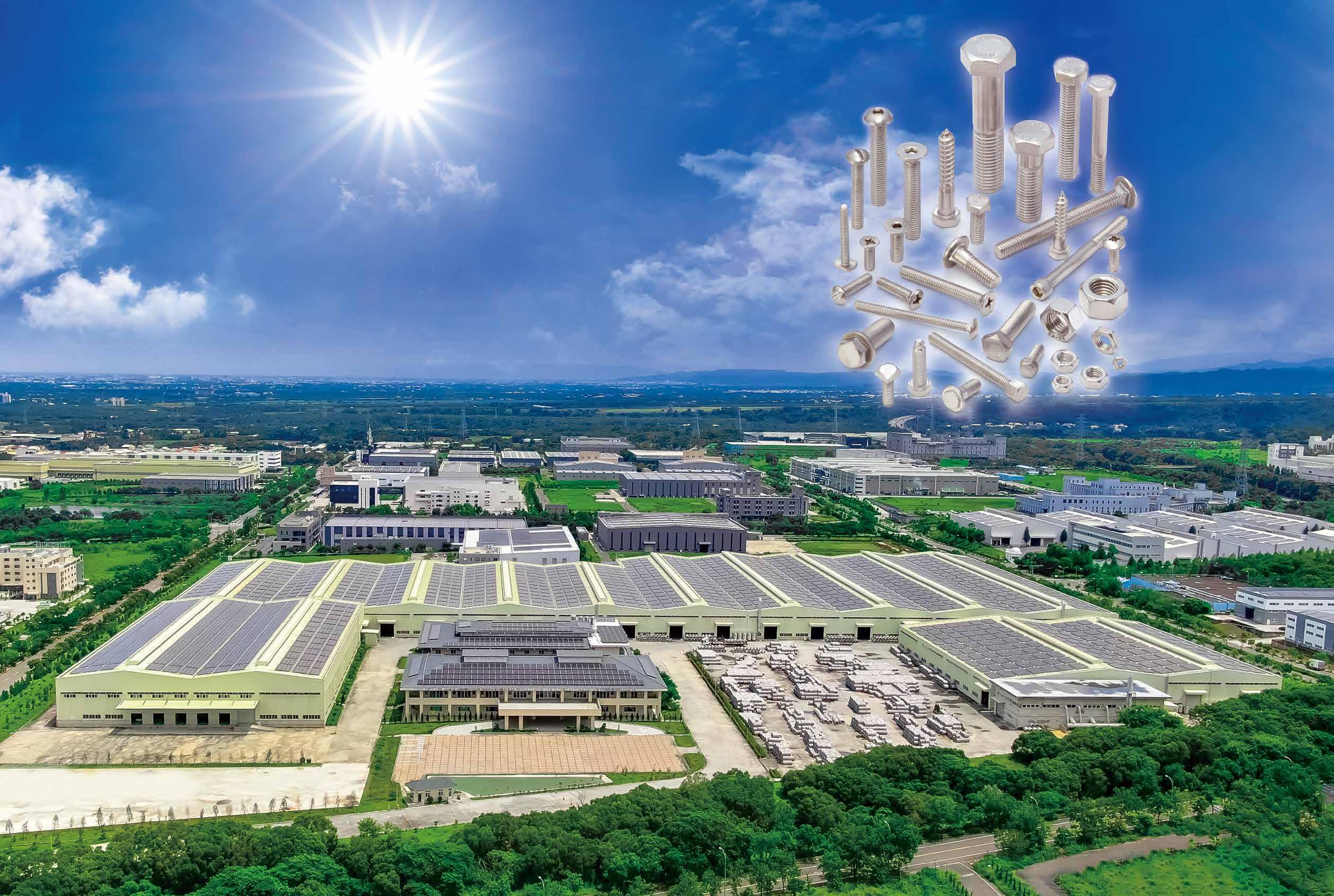

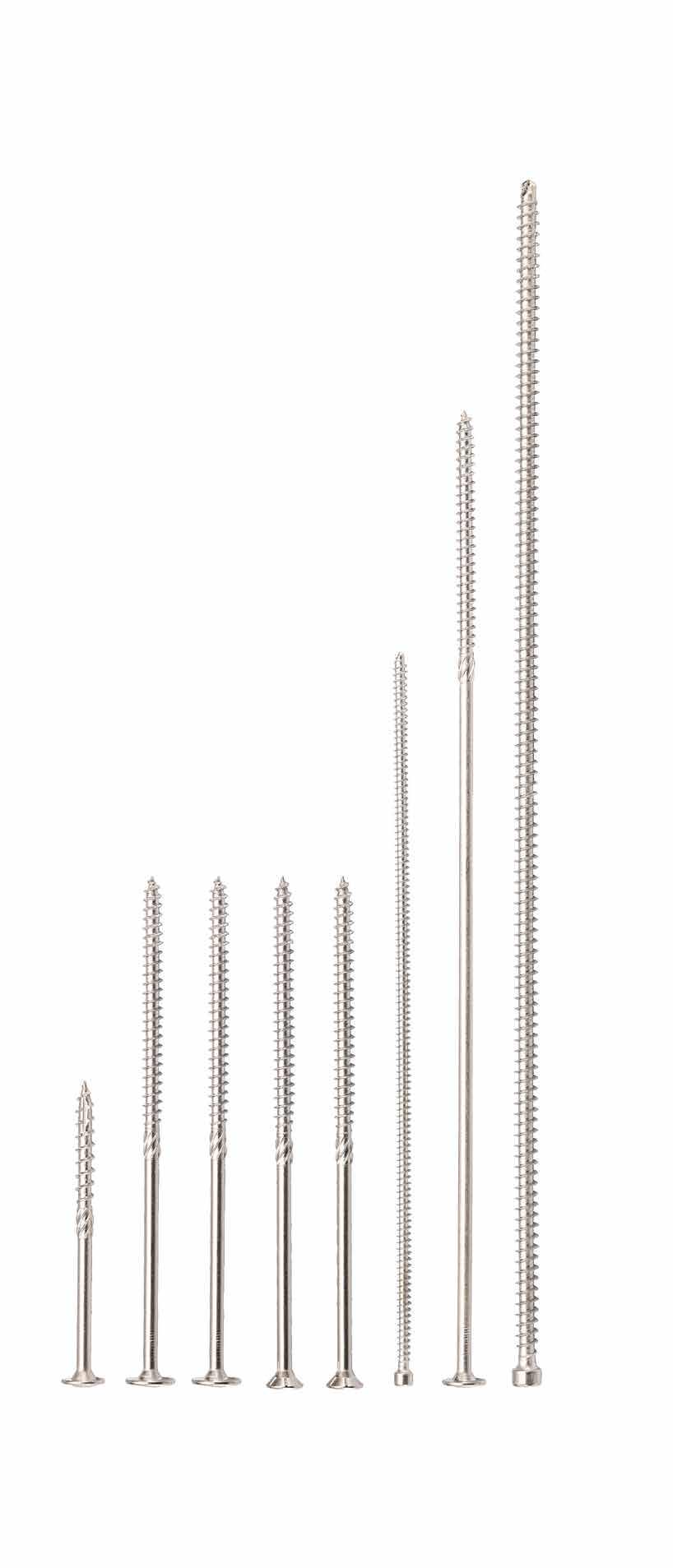

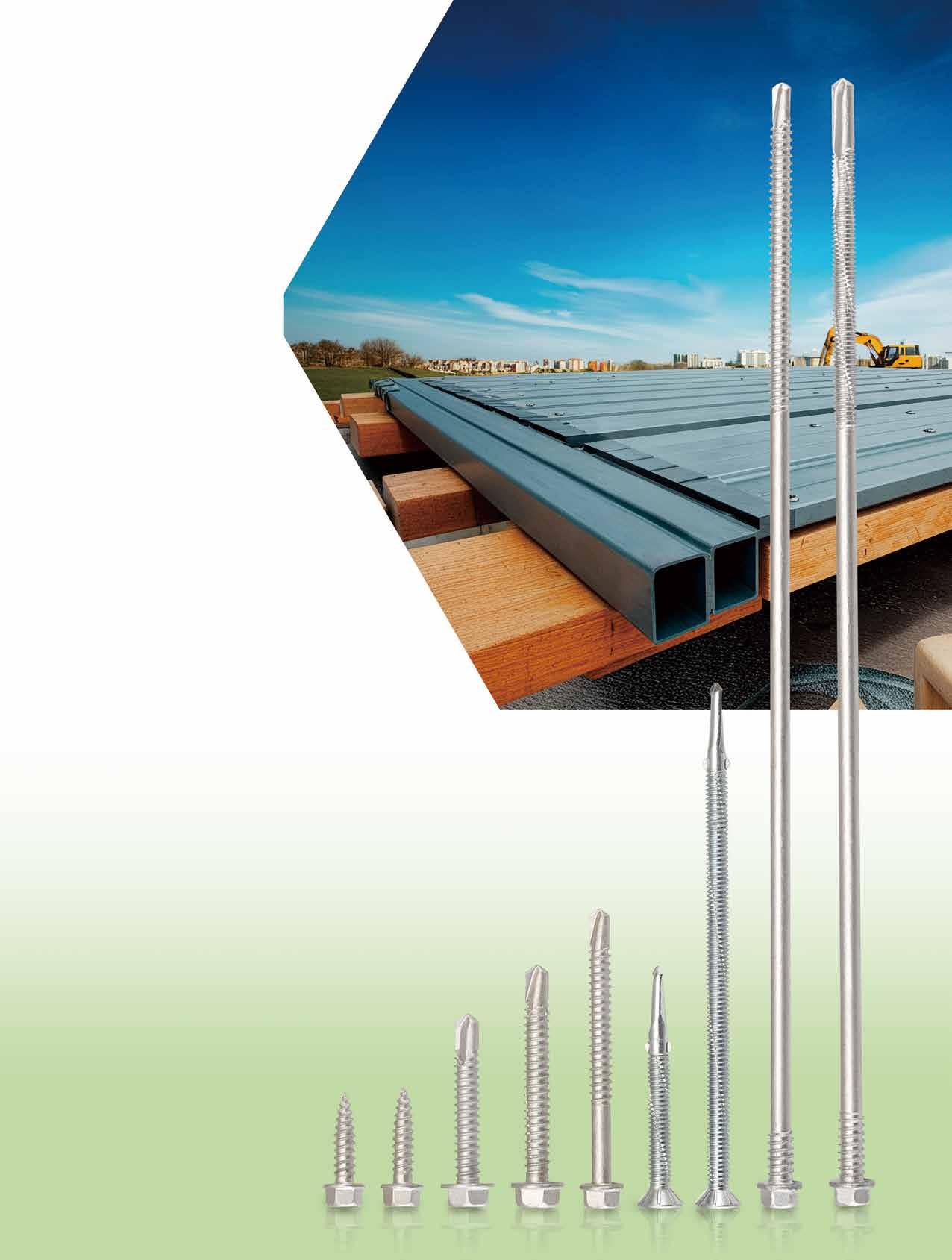

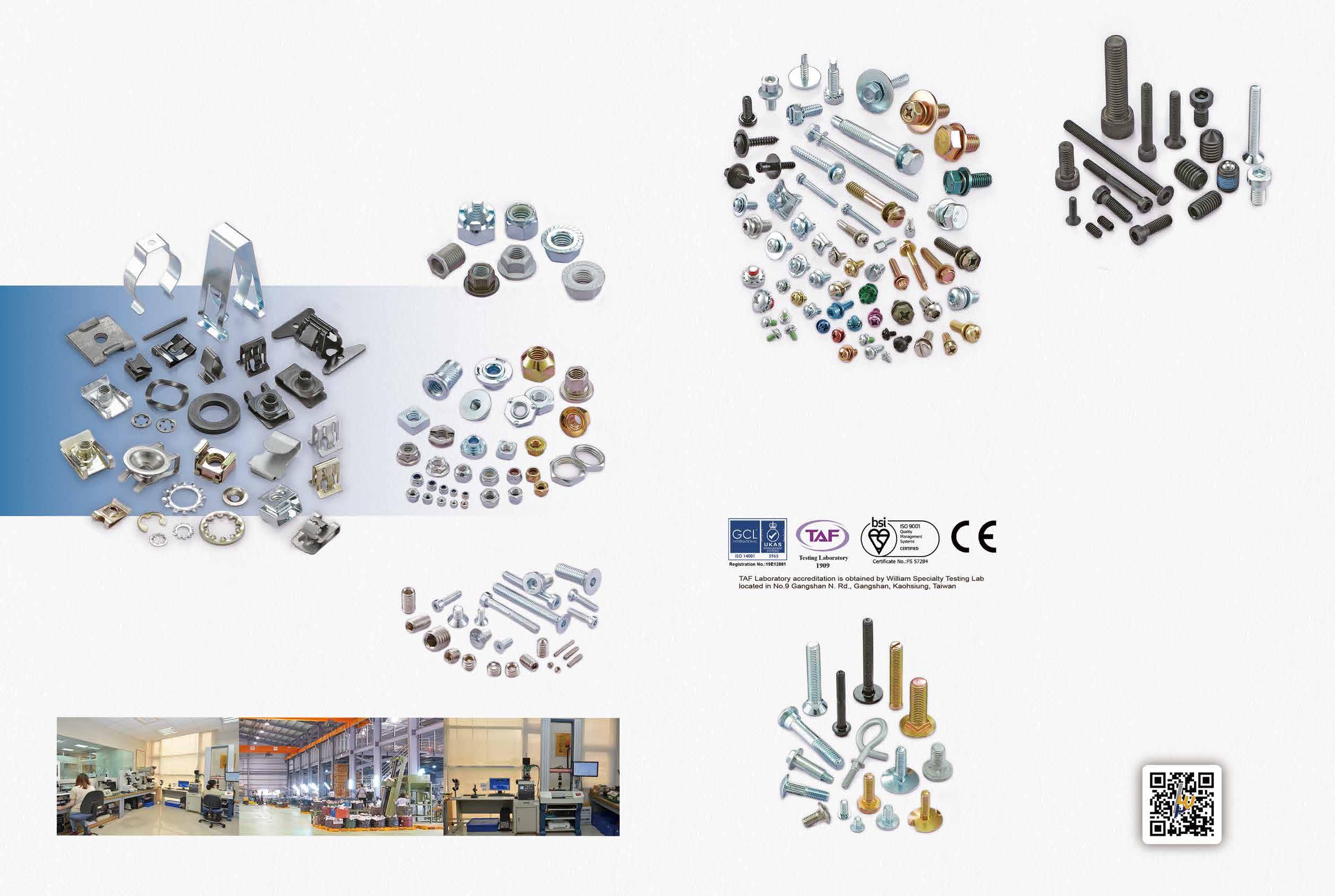

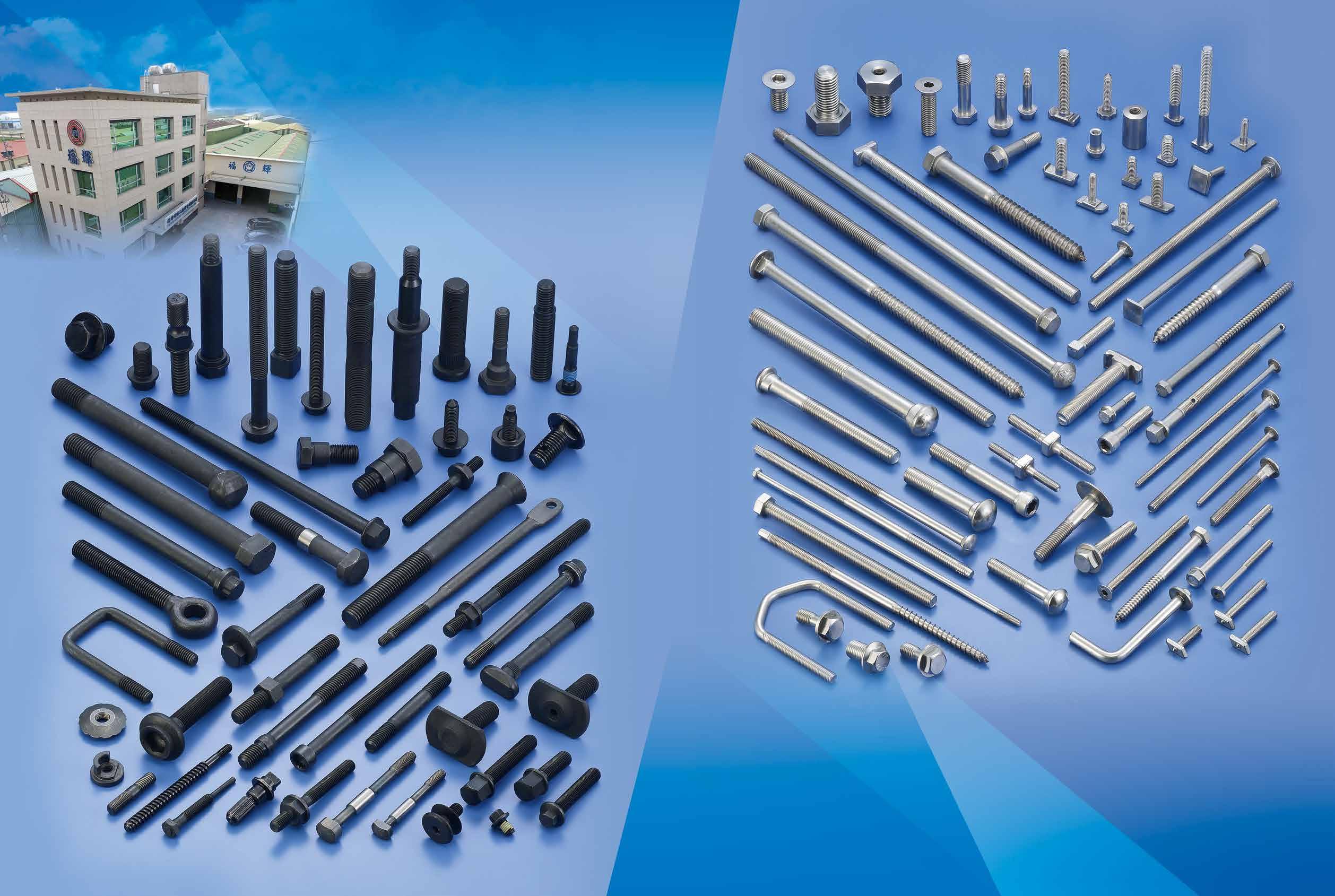

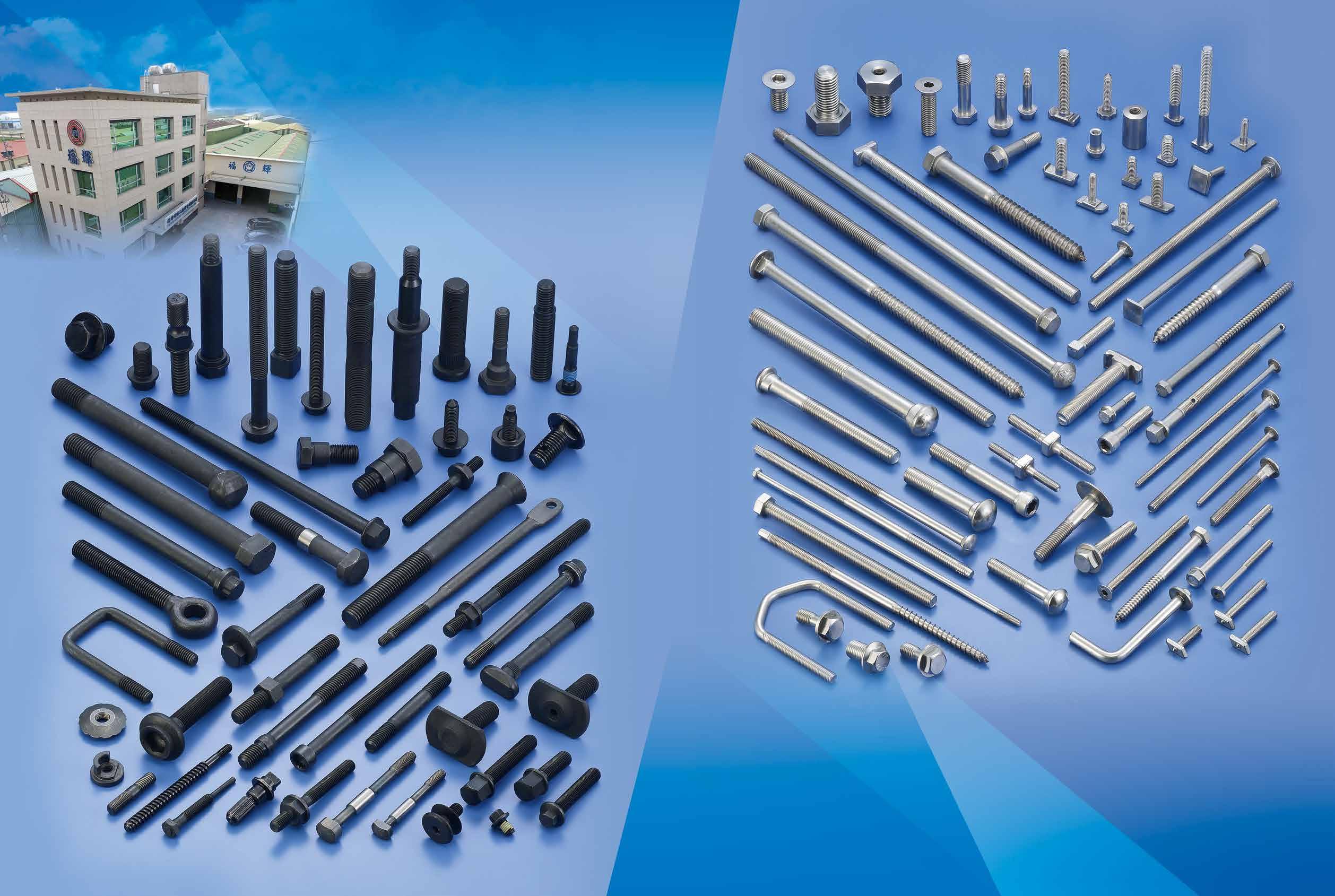

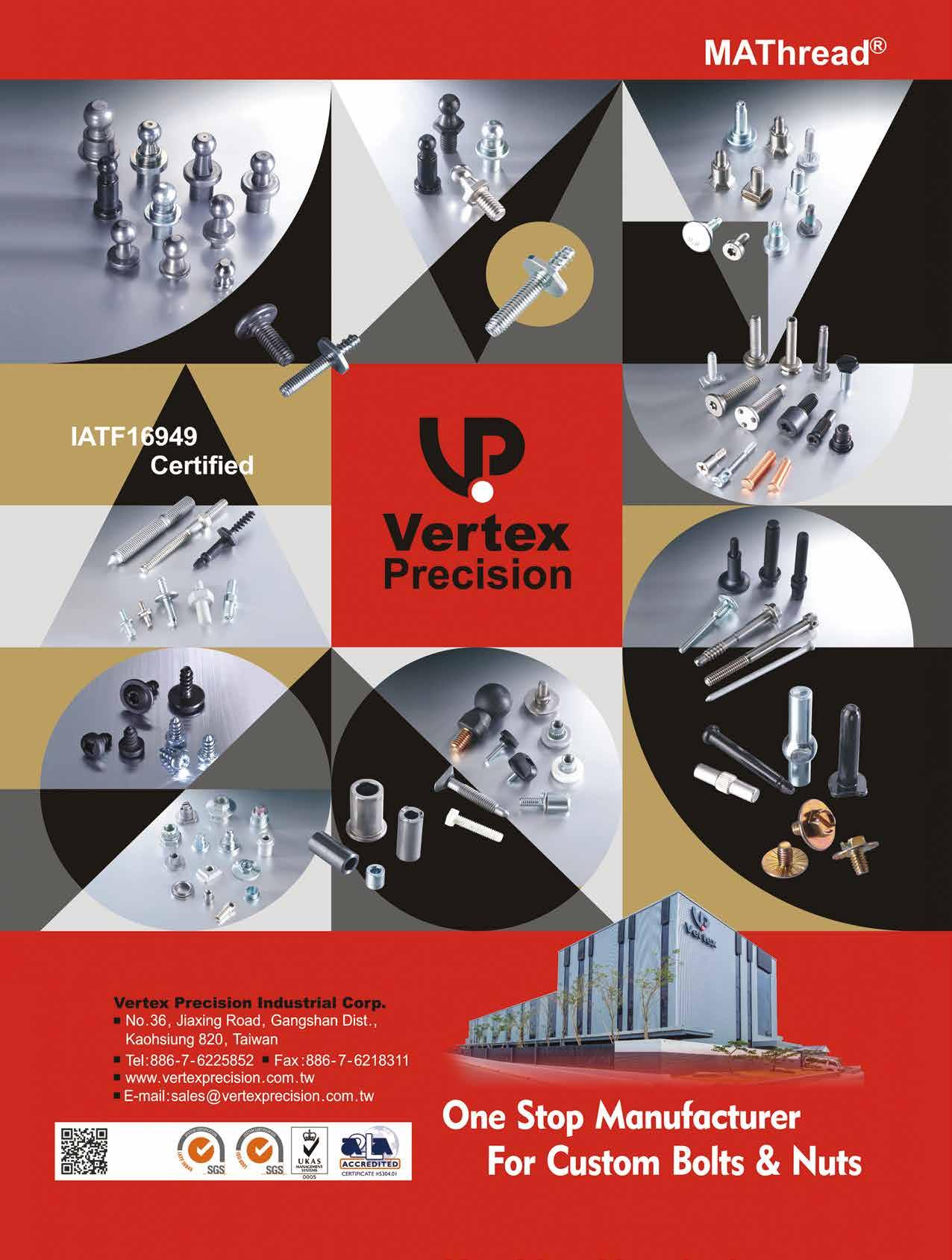

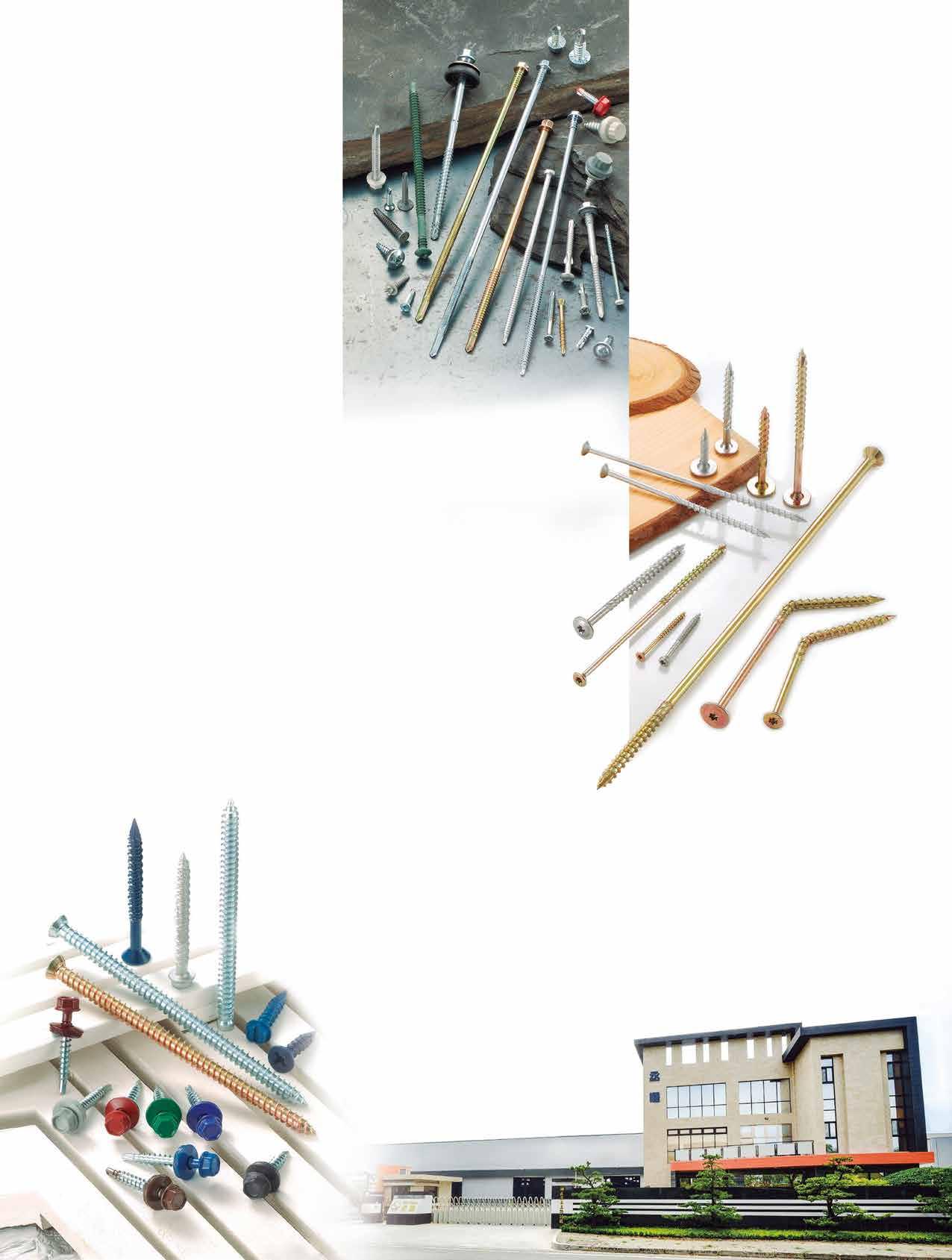

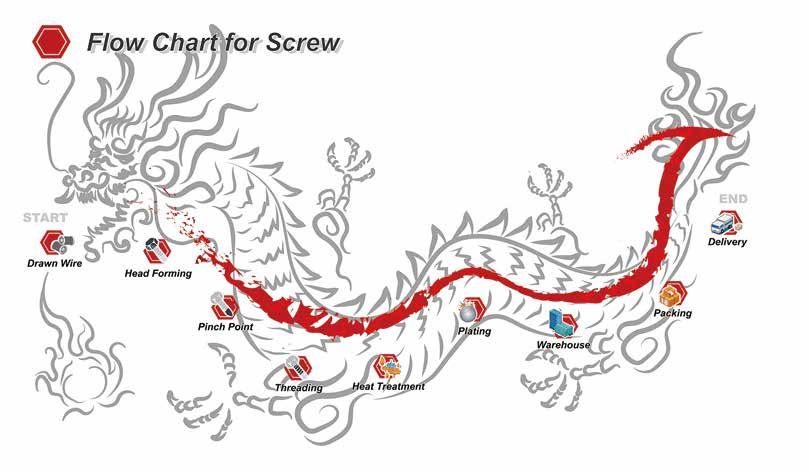

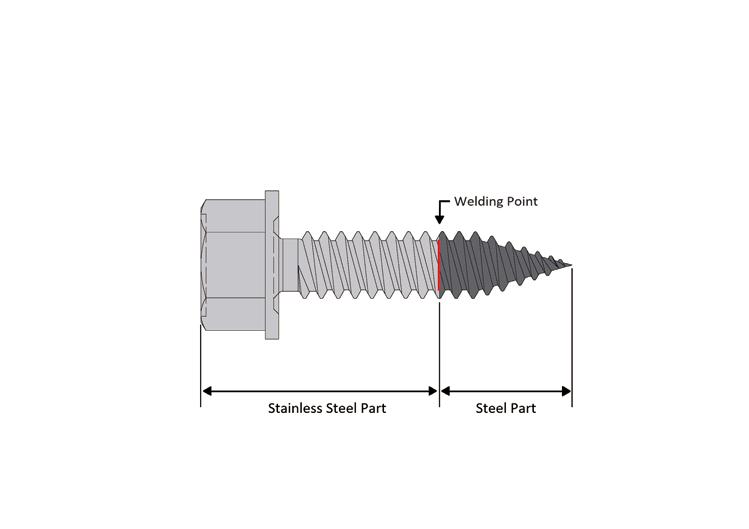

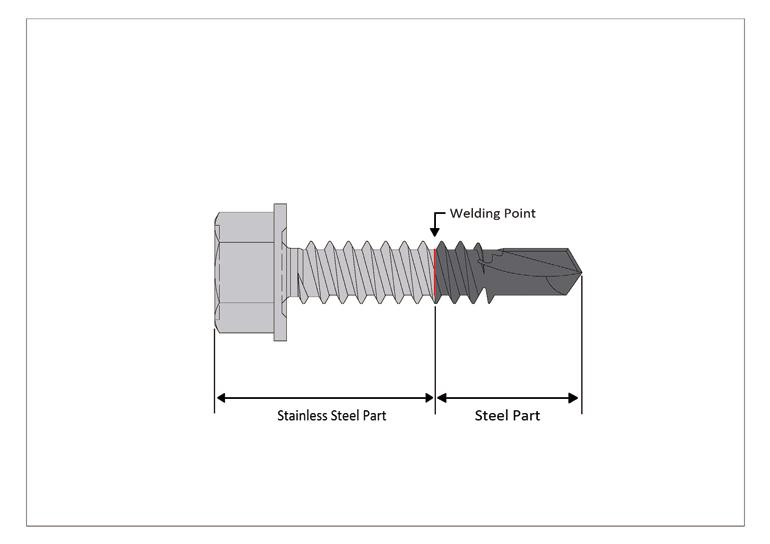

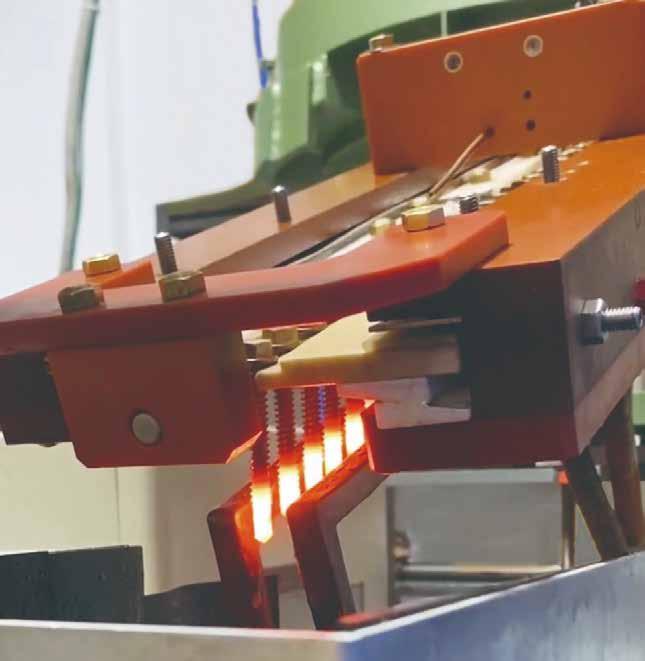

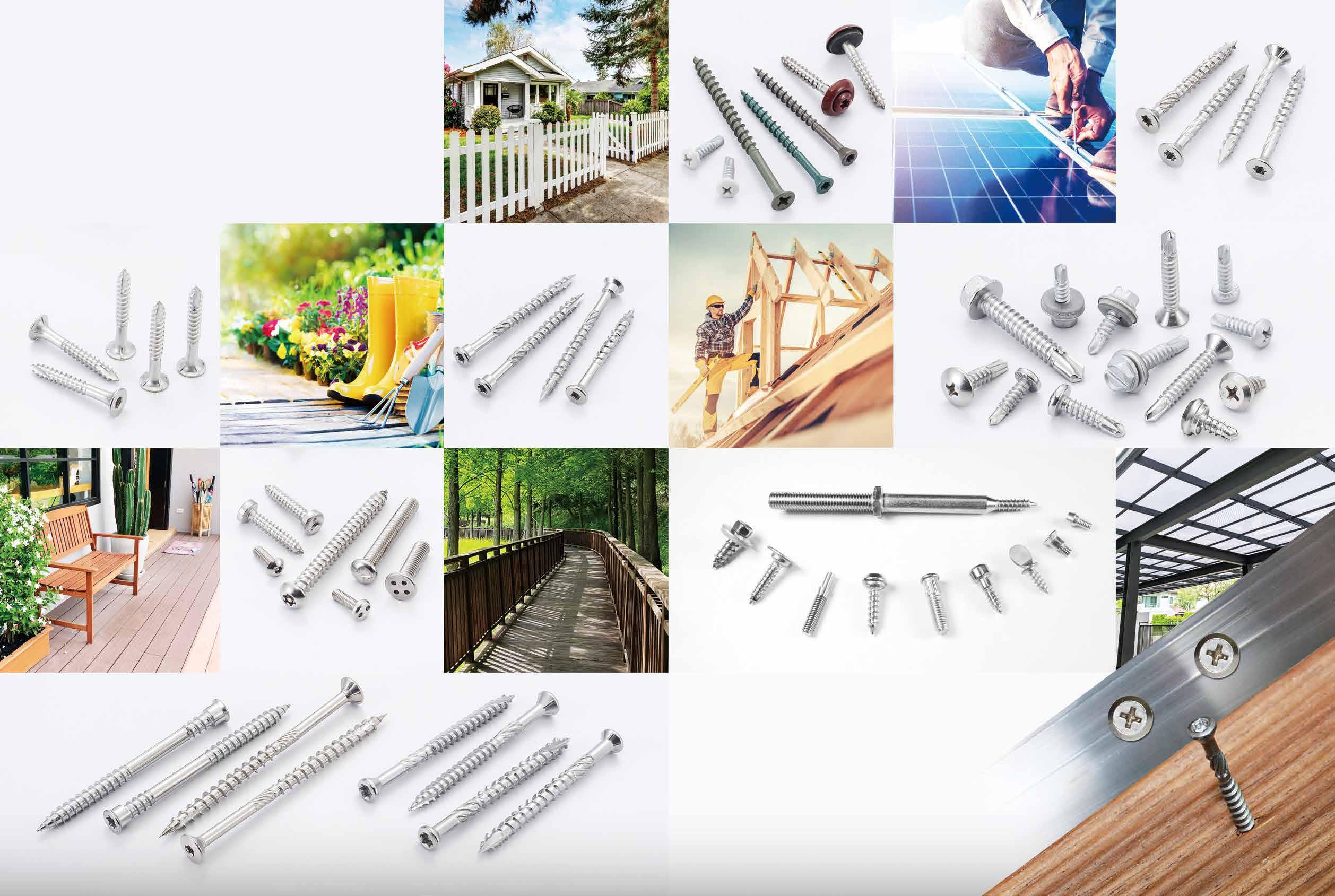

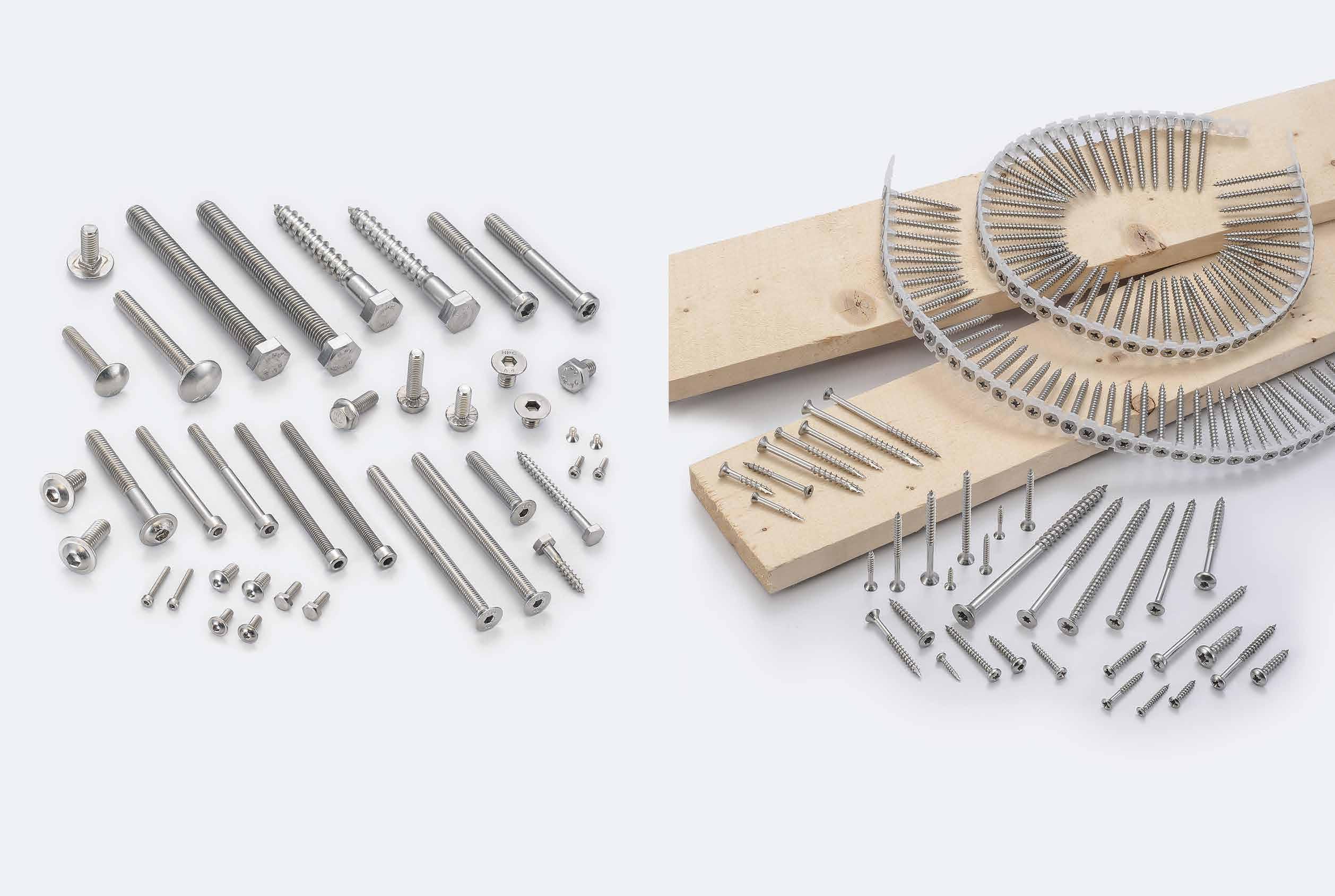

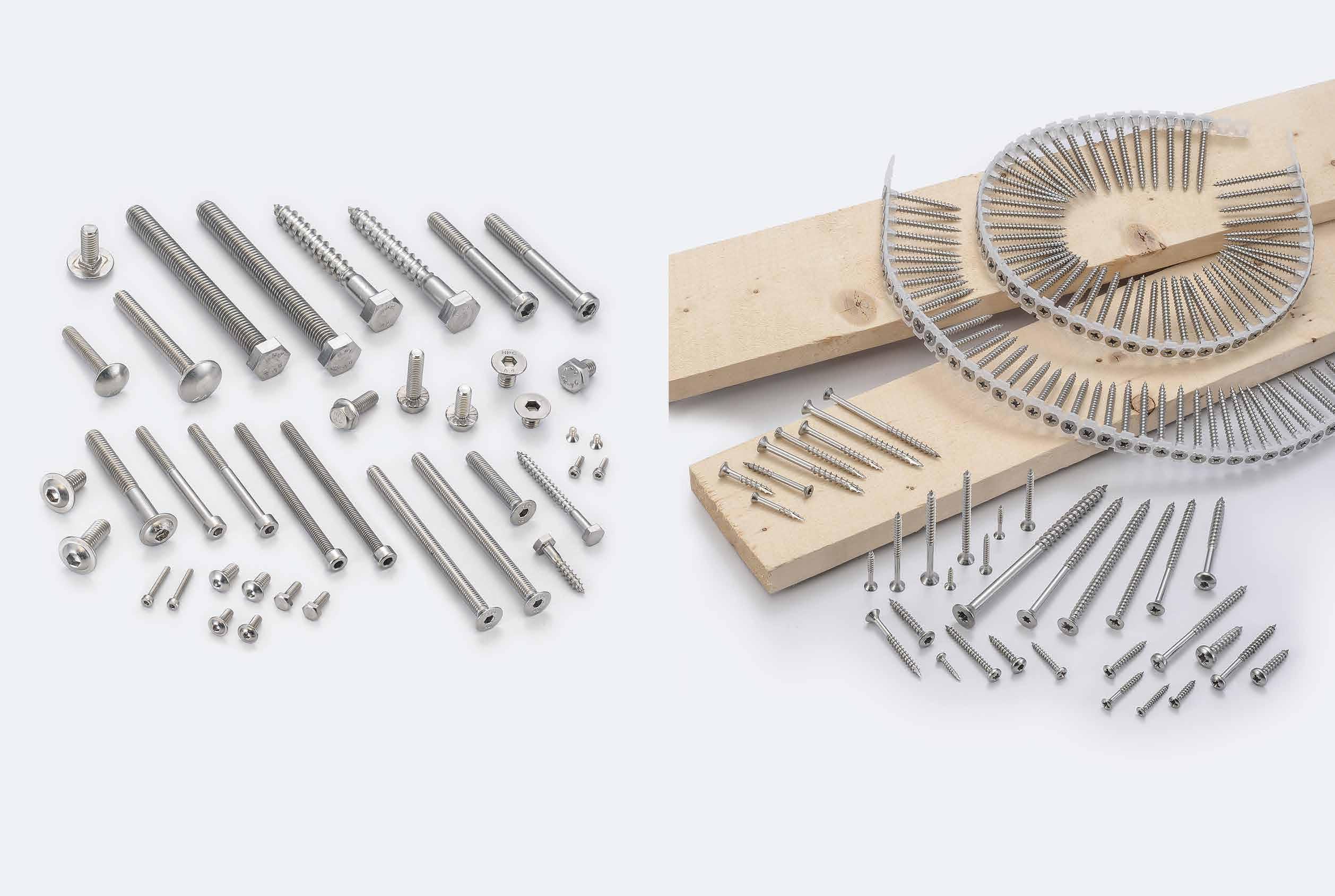

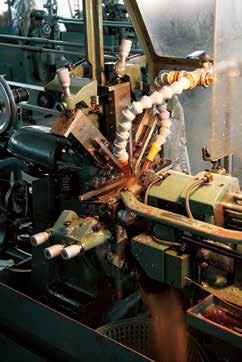

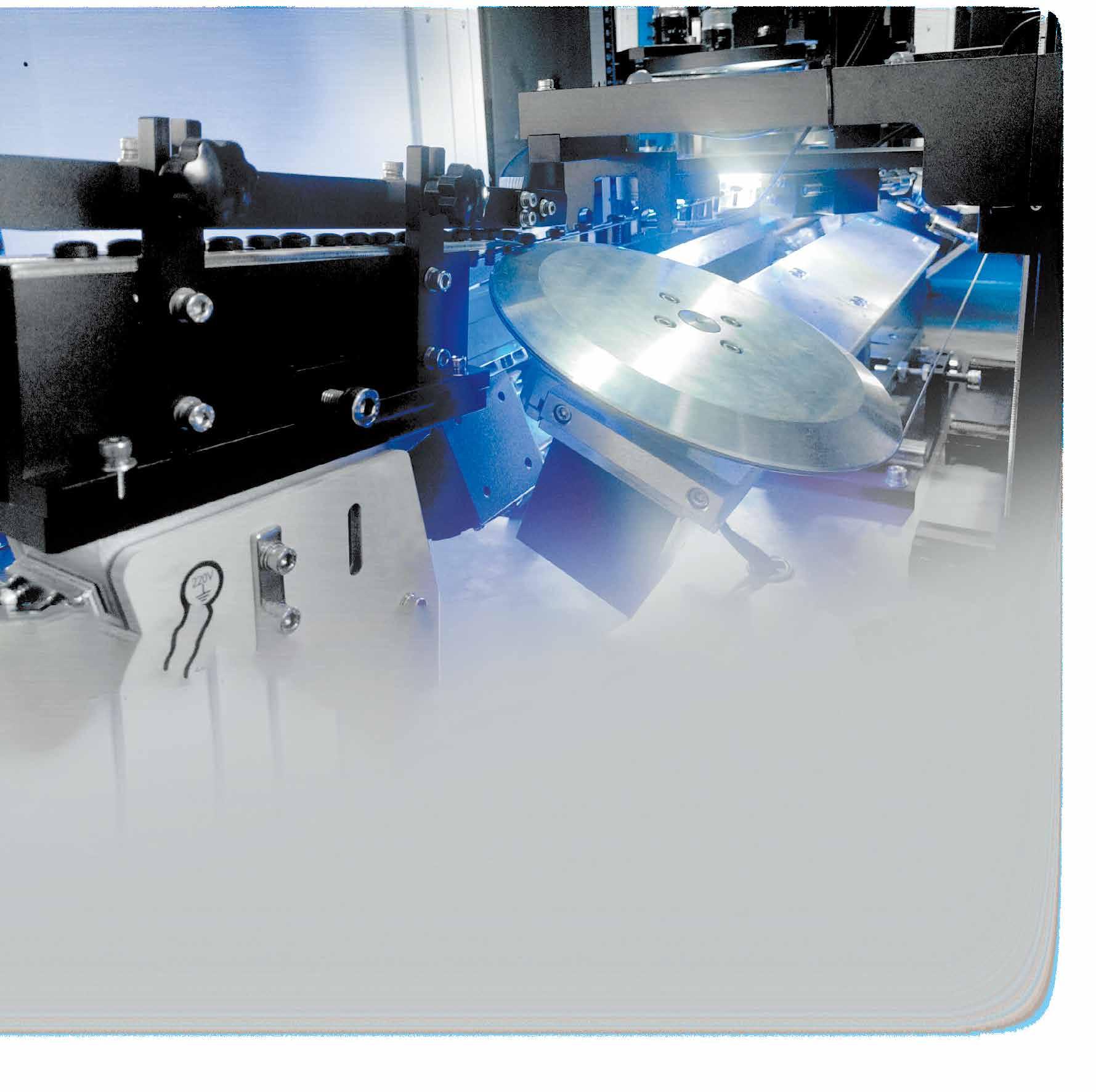

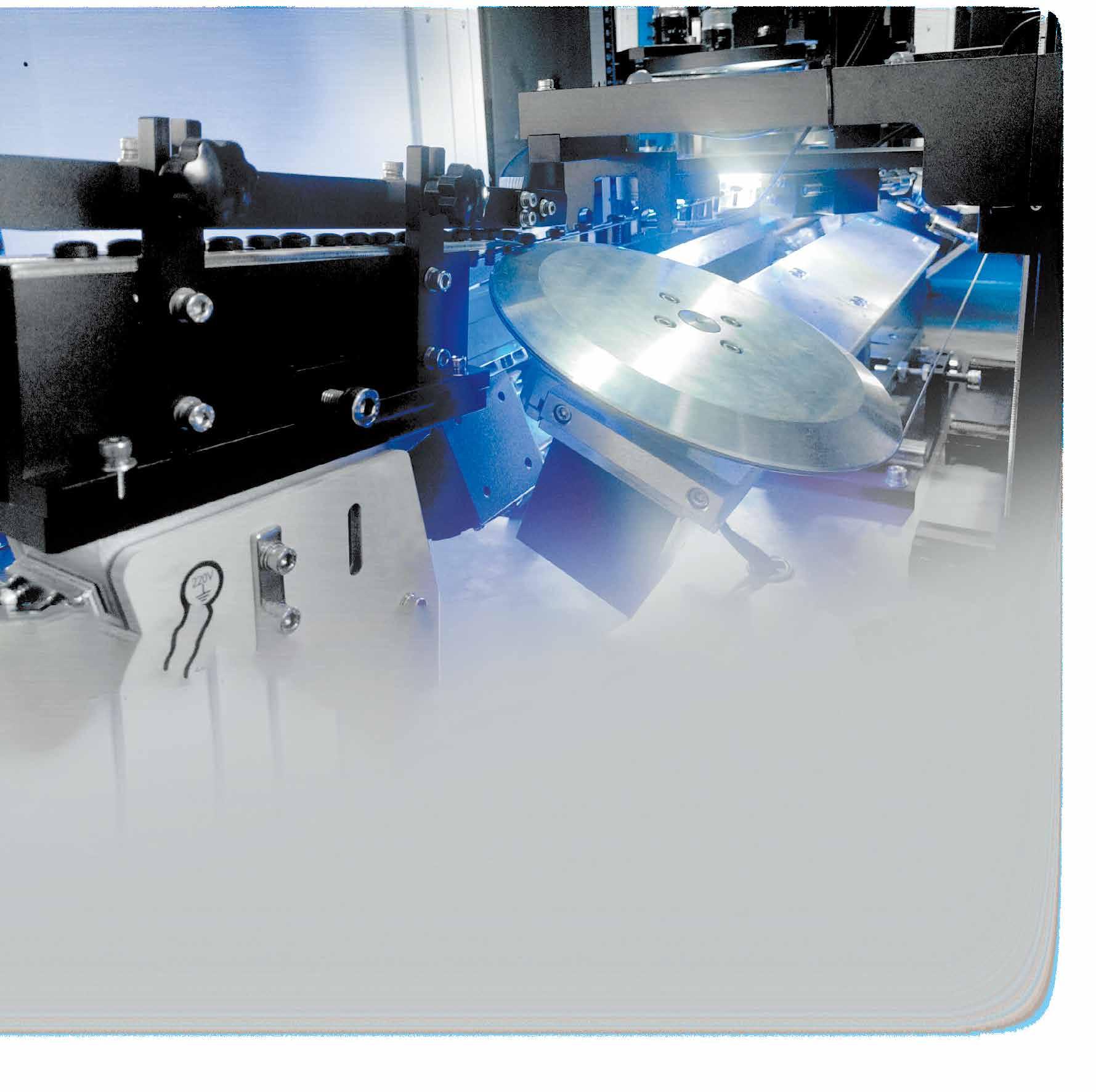

With low-carbon manufacturing, green environmental protection, and sustainability becoming crucial factors for European and American clients in evaluating potential partners, Bi-Mirth Corp. — an expert in Bi-metal, stainless steel, carbon steel, and long-size self-drilling, self-tapping, wood construction, and cement construction screws — has been actively ramping up R&D as well as production of low-carbon, high value-added products in recent years, while expanding its presence in advanced markets such as Europe and the U.S.

The company currently operates 4 locations in Taiwan offering comprehensive one-stop production lines including forming, electroplating, coating, and packaging, enabling quick fulfillment of diverse global client needs. Popular products for the European and American markets in recent years include non-standard

Copyright owned by Fastener World / Article by Gang Hao Chang, Vice Editor-in-Chief

Bi-Mirth's Contact: Tom Shih, Vice President Email: tom@bimirth.com.tw

screws, solar panel screws, chipboard screws, and long-size bi-metal self-drilling screws. Facing increasing global industrial challenges, the company is seriously considering overseas expansion and the possibility of setting up factories abroad to provide clients with high-quality products and efficient services more adaptable to market changes.

The opportunity for overseas expansion mainly arises from many European and American clients’ strong desire for Bi-Mirth to establish overseas factories on the prerequisite of maintaining competitive edges while reducing supply chain risks, aligning better with clients’ expectations. Therefore, to gain deeper insights into the pros and cons of overseas setups and evaluate the potential that ensues, Bi-Mirth’s management flew abroad and spent 5 days in mid-August scouting in Chonburi Province, southern Thailand — one of Southeast Asia’s manufacturing hubs — visiting the specifically chosen Pinthong Industrial Estate and Amata Chonburi Industrial Estate, where numerous Taiwanese fastener peers have already invested. The inspection tour included visits to Dura Fasteners of the Rodex Group, Apex International (Thailand) of Special Rivets Corp., and Domma International (Thailand), as well as meetings with reps from local industrial zones, providing Bi-Mirth with deeper insights into the region's investment landscape and market conditions.

“Due to factors like the US-China trade war and a short-term downturn in the European economy, some of our big clients strongly suggest having our own overseas factories to meet unforeseen challenges,” said Vice President Tom Shih, “Thailand allows free import of wire rods needed for fastener production at relatively low prices. Land acquisition and factory building have no joint venture requirements as in some countries, and full land ownership rights are possible — all factors that make regulations relatively foreign-investor friendly. The proximity of the industrial parks to ports is also beneficial for export, making Thailand a favorable choice. The main purpose of this trip was to comprehensively gather insights from Taiwanese-owned companies in Thailand and understand Thailand’s foreign investment regulations and policies, especially focusing on electroplating — a critical step in fastener manufacturing — to determine the entry into Thailand. We had to confirm whether electroplating is permitted within the industrial estates and find out if there are any rules about electroplating quotas imposed on manufacturers. If all conditions prove feasible, we do not rule out establishing our own factory in Thailand and even inviting European or American partners for joint ventures.”

ISO14064-1 and ISO14001 certified

Besides dedicating 20% of production capacity to the US market and 5% to emerging markets, the company exports as much as 75% of its products to the EU market. This makes compliance with European environmental regulations and CBAM highly valued in the eyes of Bi-Mirth. It has implemented noise reduction, electrostatic dust removal, waste oil recycling & treatment, water purification, and installed solar panels to save energy and reduce carbon footprint. They have also completed carbon inventory for all 4 factories and obtained ISO 14064-1 and ISO 14001 certifications. Although significant revisions to CBAM reporting targets and penalties may take effect by the end of the year, the company is fully prepared to provide carbon emission data at any time per client requests. “Transparent carbon emission data is now a necessary prerequisite to do business with European clients. We conduct annual carbon footprint inventory to ensure data accuracy, which will greatly support our future efforts to develop more European clients,” said Tom.

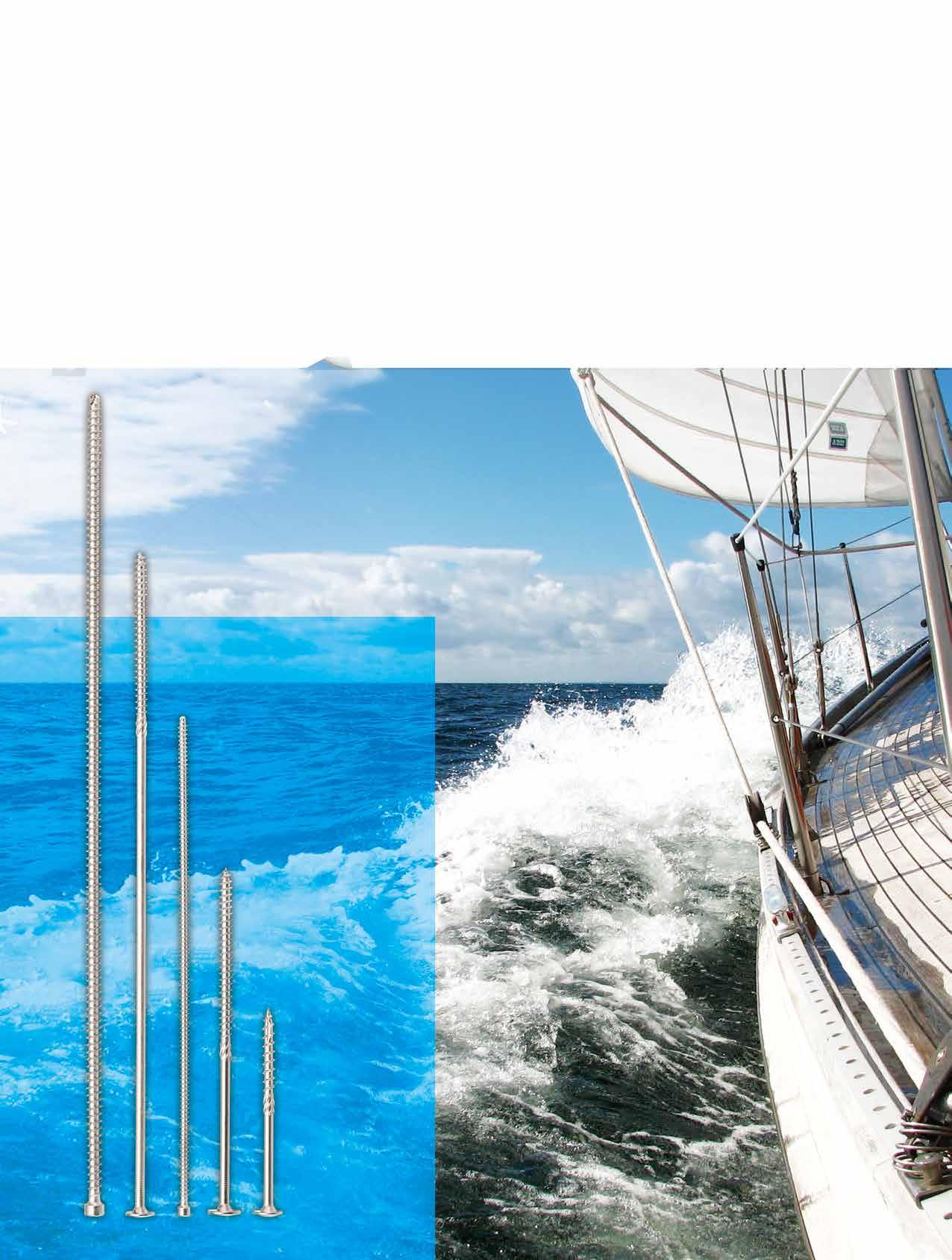

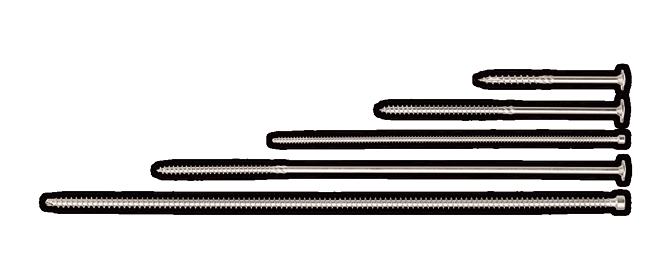

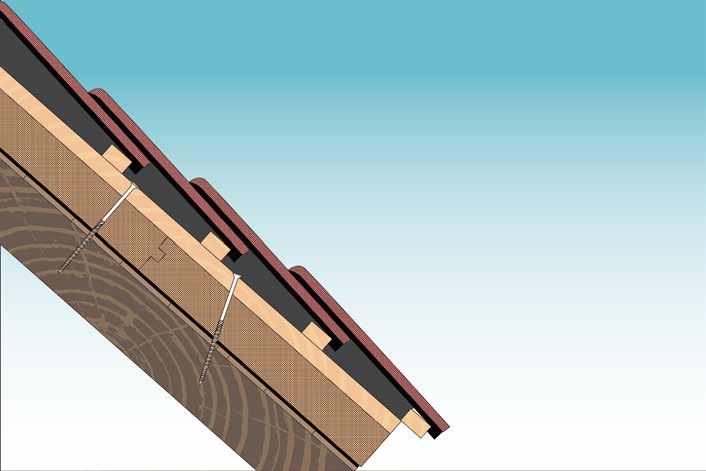

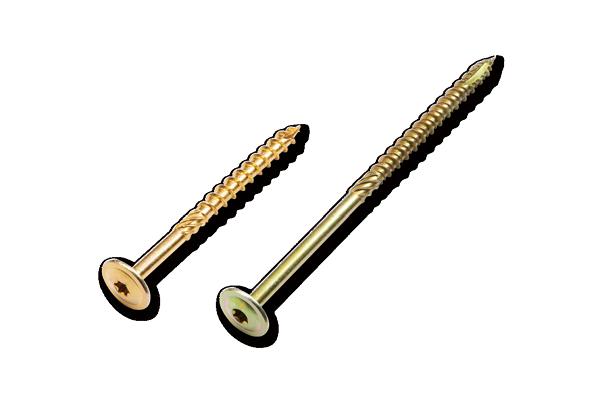

Green sustainable construction has become a hot topic in recent years in European, American, and Taiwanese construction markets. All-wood buildings are no longer a fantasy. Such constructions highly require insulation, using larger insulating boards and soundproofing cotton for assembly, which boosts demand for screws that contribute to energy-saving and carbon reduction effects in buildings. Bi-Mirth has identified the huge market potential for screws used in sustainable green architecture and invested actively in developing wood screws and long-size screws, leveraging proprietary technology to expand possibilities for low-carbon green building solutions.

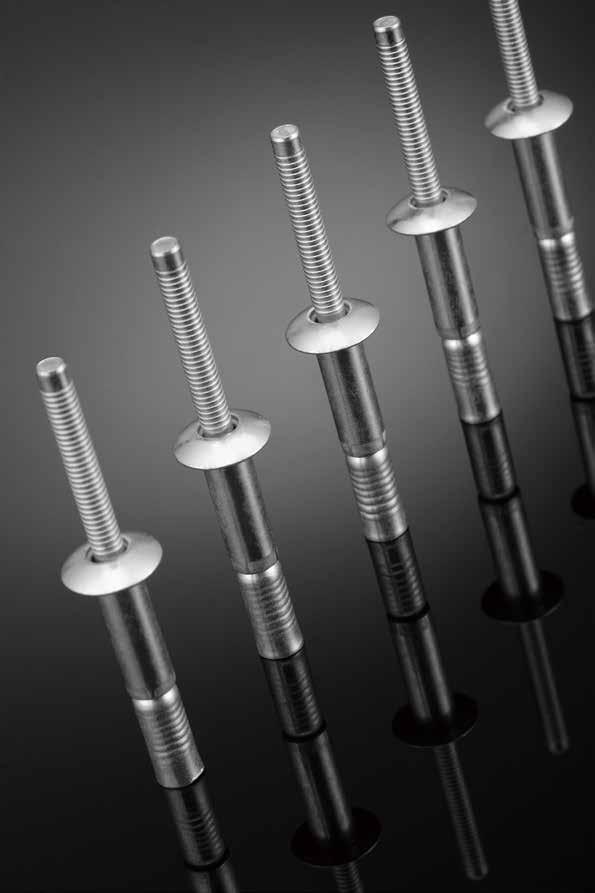

“We can offer many screw products suited for green construction. For example, our recently developed highly corrosion-resistant long stainless steel screws provide sufficient torque and smooth fastening without heat treatment. They perfectly meet today’s market demand for low carbon and have been widely adopted in many construction projects,” stated Tom.

This year, global markets have experienced uncertainties due to factors such as 50% steel and aluminum tariffs imposed by the US, reciprocal tariffs, and currency fluctuations. Many European and American clients already placed early orders before tariff implementation to hedge risks. Despite market volatility and expectations that it is not until the first half of next year that things may clear up in the market, Bi-Mirth’s growth pace remains undeterred. “Besides closely monitoring market changes, we are optimizing internal management and continuously launching new product development projects. Our goal is to introduce new products when the market stabilizes, fulfilling clients’ expectations for advanced, high-performance screws,” said Tom.

201 310EXPRESS COMPANY (SAIMA) (Japan)

Security, Tamper Proof, Anti-theft Screws...

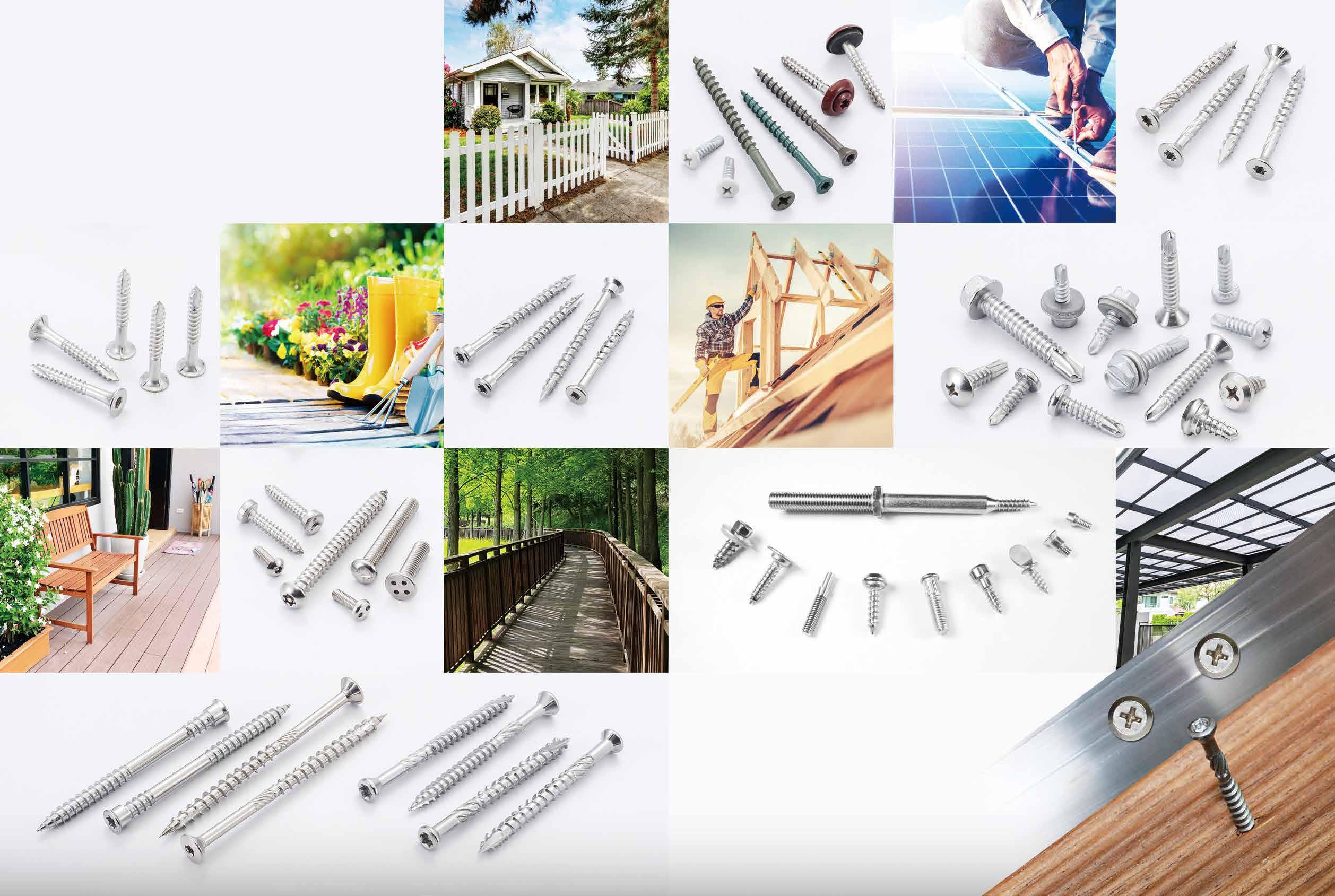

140 A-PLUS SCREWS INC.

Chipboard Screws, Customized Special Screws / Bolts...

298 ABC FASTENERS CO., LTD. 聯欣

Drop-in Anchors, Expansion Anchors, Wire Anchors...

66 AEH FASTEN INDUSTRIES CO., LTD. 鉞昌

Clevis Pins, Dowel Pins, Hollow Rivets...

79 ALEX SCREW INDUSTRIAL CO., LTD. 禾億

Button Head Cap Screws, Button Head Socket Cap Screws...

88 AMBROVIT S.P.A. (Italy)

Chipboard Screws, Combined Screws, Machine Screws...

308 ANCHOR FASTENERS INDUSTRIAL CO., LTD. 安拓

ETA Series, Anchor Bolts, Anchor Nuts, Automotive Parts...

51 APEX FASTENER INTERNATIONAL CO., LTD. 嵿峰

Nuts, Wing Nuts & Bolts, Turning Parts, Stamping Parts

80 ARUN CO., LTD.

Bi-metal Screws, Chipboard Screws, Drywall Screws...

鉅耕

122 AUTOLINK INTERNATIONAL CO., LTD. 浤爵

Automotive Screws, Machine Bolts, Flange Nuts...

93 BCR INC.

Automotive Screws, Piston Pins, Weld Bolts (Studs)...

必鋮

247 BEAR FASTENING SOLUTIONS, INC. 雄益

IFI, DIN, ISO, JIS standard, Drywall Screws, Decking Screws

26 BI-MIRTH CORP. 吉瞬

Stainless Steel Screws, Chipboard Screws, Timber Screws...

2 BOLTUN CORPORATION 恒耀工業

Automotive Screws, Nuts, Bolts, Special Parts...

191 CANATEX INDUSTRIAL CO., LTD. 保力德

Nuts, Turning Parts, Bolts, Plastic Injection Parts...

230 CHANG BING ENTERPRISE CO., LTD. 彰濱

Hook Bolts, Holders / Hooks / Rings, Dowel Screws...

235 CHARNG JIH ENTERPRISE CO., LTD. 長驥

Bonded Washers, Cotter Pins, Quick Release Pins...

137 CHEN SHIN ENTERPRISE FACTORY 成興

Professional Plastic Container Manufacturer

76 CHIAN YUNG CORPORATION 將運

SEMS Screws

81 CHIN LIH HSING PRECISION ENTERPRISE (CLH) 金利興

Automotive Nuts, Brass Inserts, Bushes, Bushings...

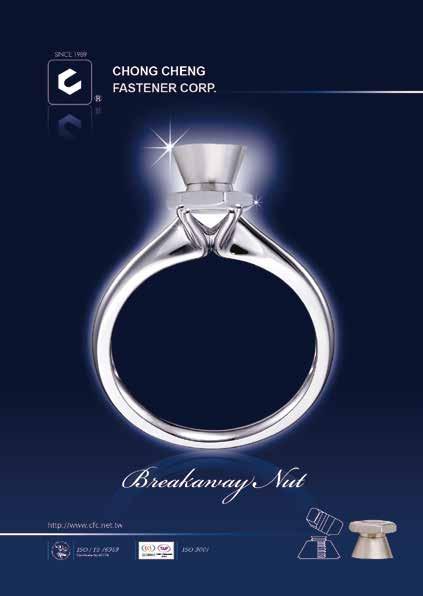

42 CHONG CHENG FASTENER CORP. 宗鉦

Cap Nuts, Coupling Nuts, Conical Washer Nuts...

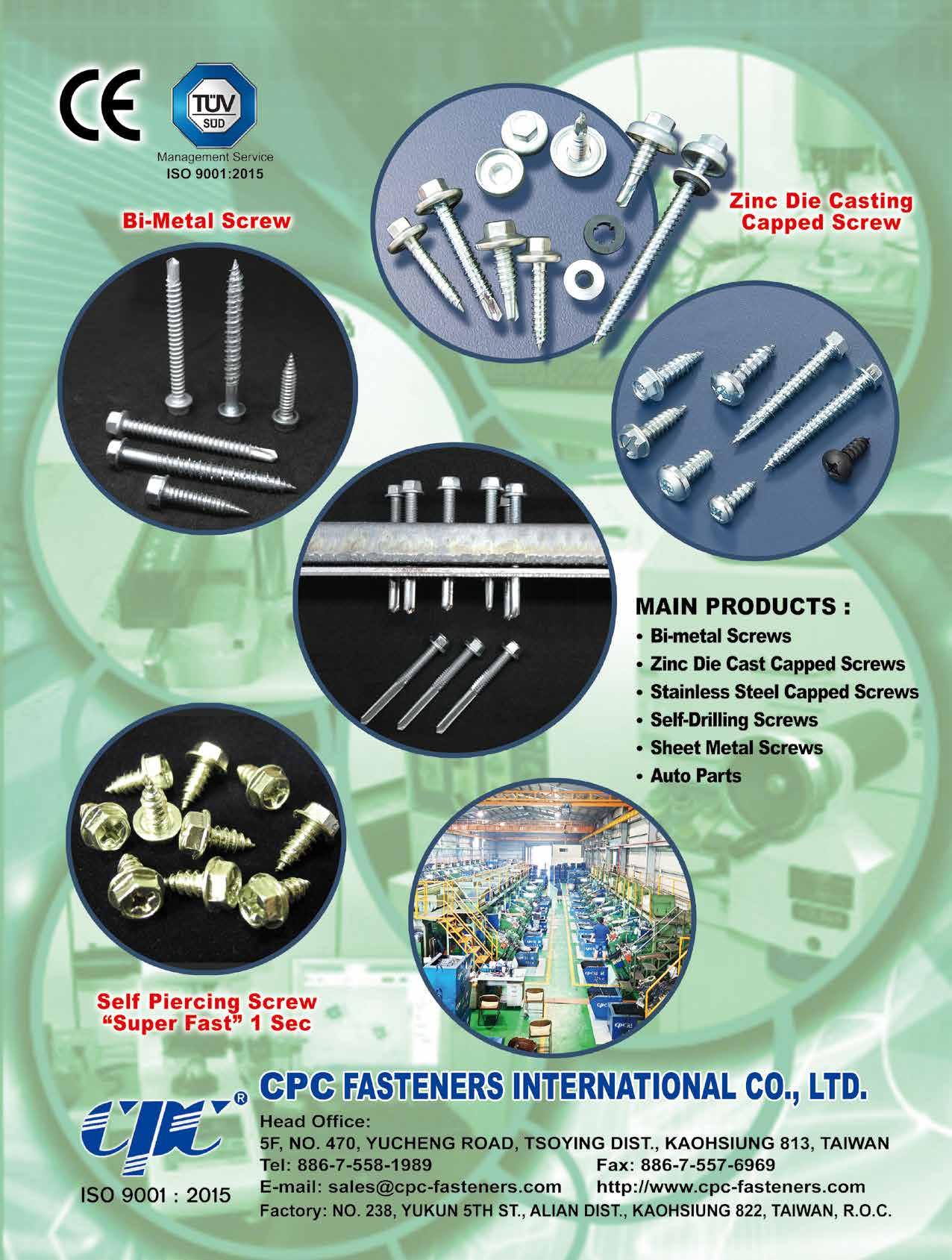

74 CPC FASTENERS INTERNATIONAL CO., LTD. 冠誠

Stainless Steel, Bi-metal Self-drilling Screws...

37 DA YANG ENTERPRISE CO., LTD. 大楊

Special Automotive Nuts, Special Weld Nuts...

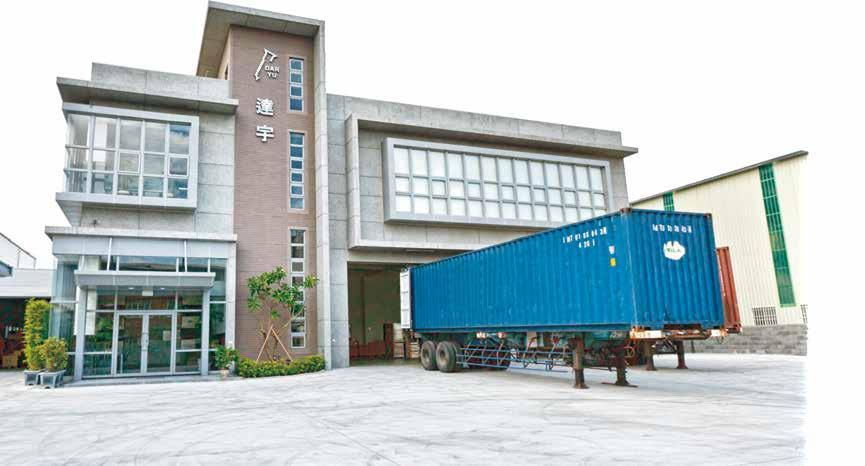

68 DAR YU ENTERPRISE CO., LTD. 達宇

Chipboard Screws, Drywall Screws, Screw Nails...

105 DE HUI SCREW INDUSTRY CO., LTD. 德慧

Drywall Screws, Decking Screws, Self-drilling Screws, Roofing Screws...

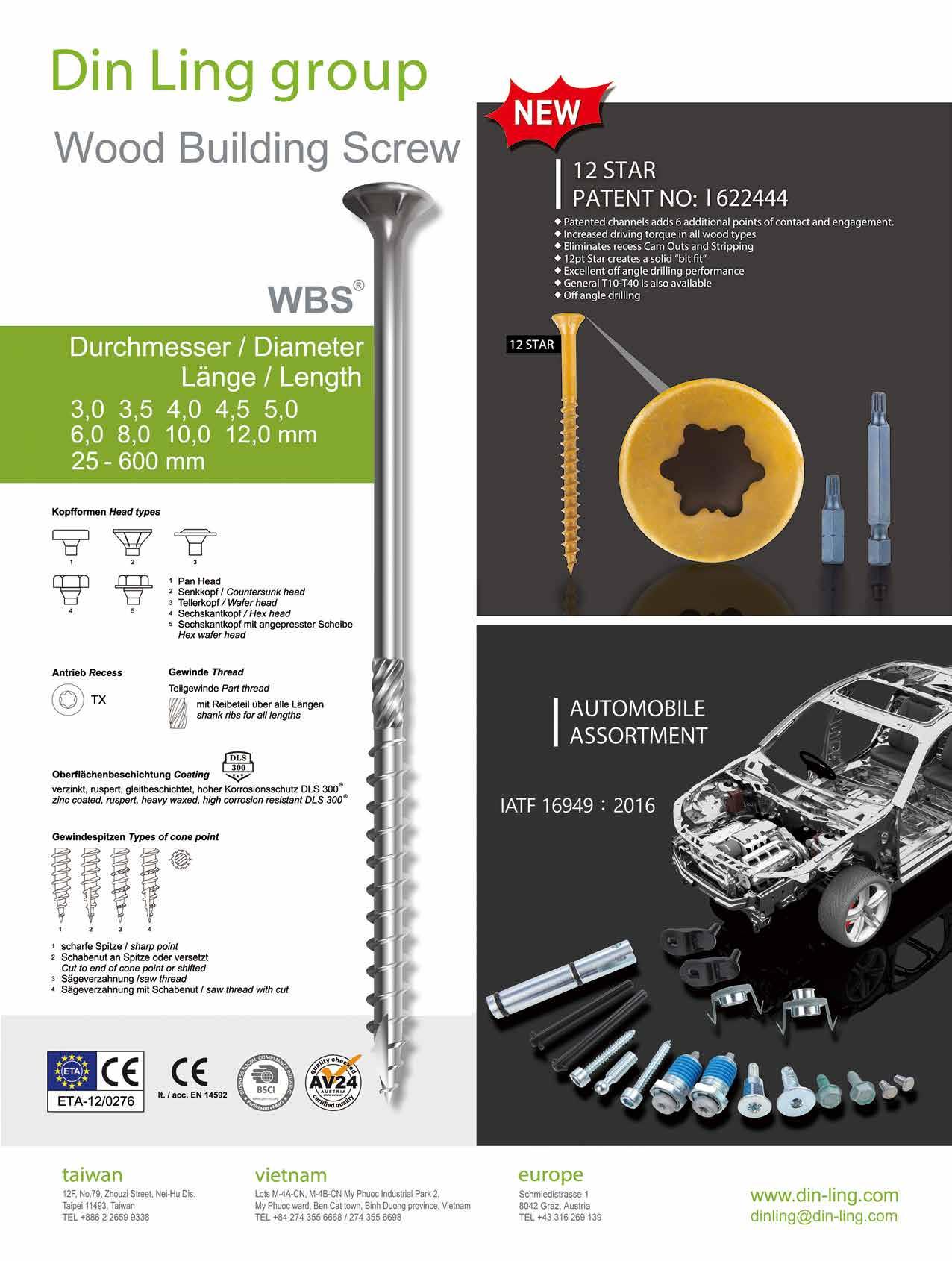

47 DIN LING CORP. 登琳

Chipboard Screws, Drywall Screws, Furniture Screws...

67 DRA-GOON FASTENERS CO., LTD.

Chipboard Screws, Phillips Head Screws, TEK Screws...

86 DUNFA INTERNATIONAL CO., LTD.

Bushes, Spacers, Automotive Parts, Tubes, Turning Parts...

104 EASYLINK INDUSTRIAL CO., LTD.

Automotive Nuts, Thread Forming Screws...

129 FAITHFUL ENGINEERING PRODUCTS CO., LTD.

Anchors, Box Nails, Door/Window Accessories...

62 FALCON FASTENER CO., LTD.

Automotive & Motorcycle Special Screws / Bolts...

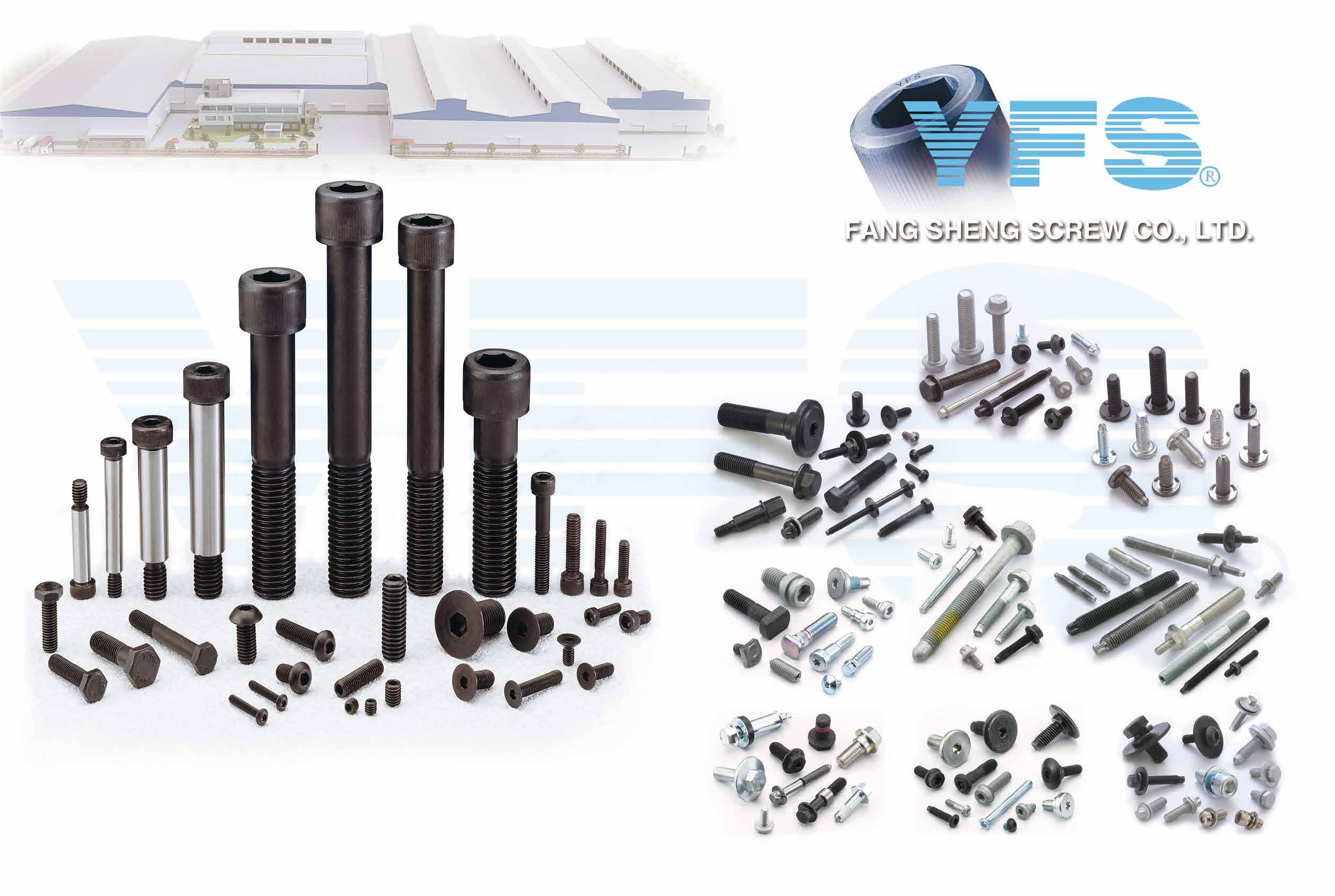

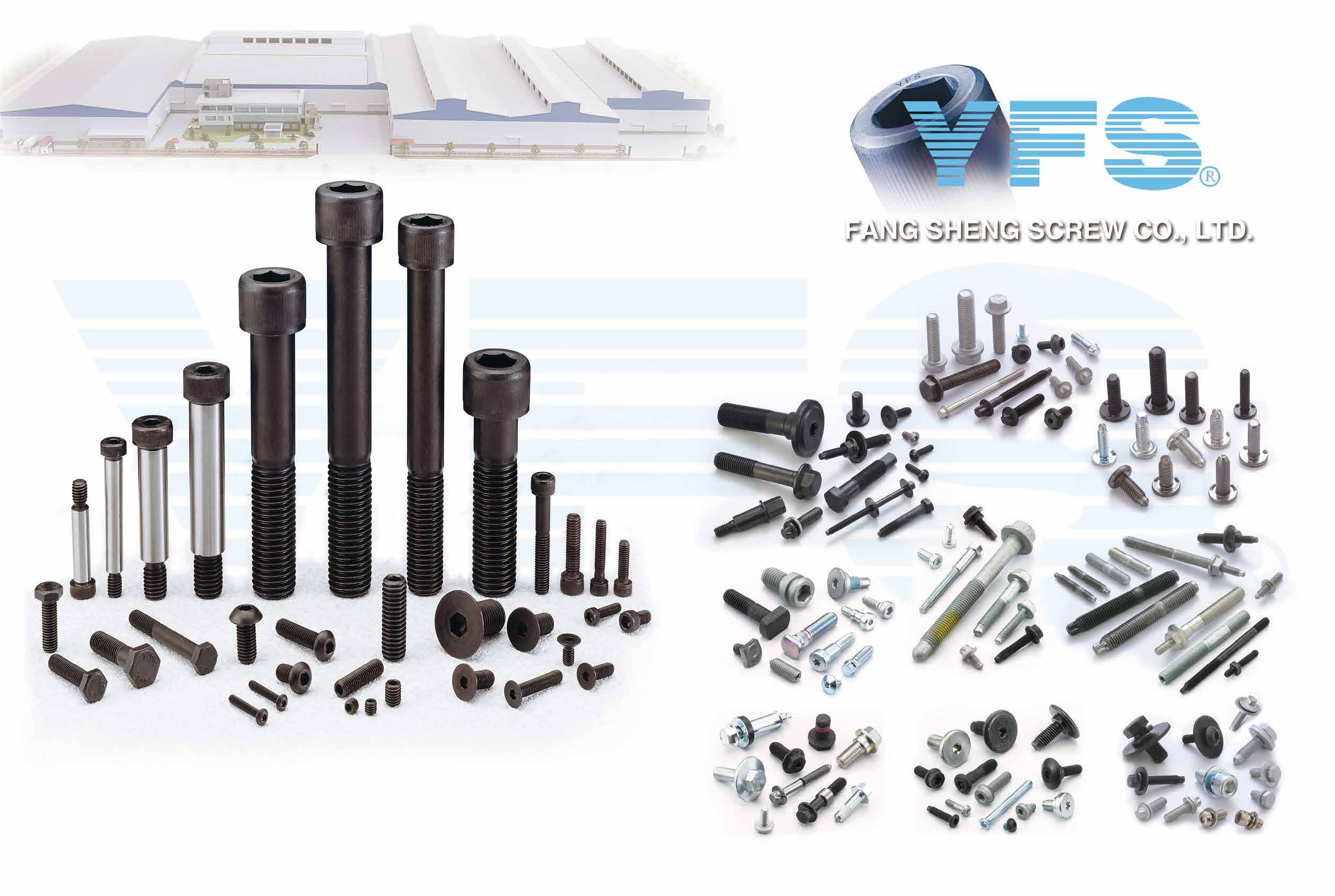

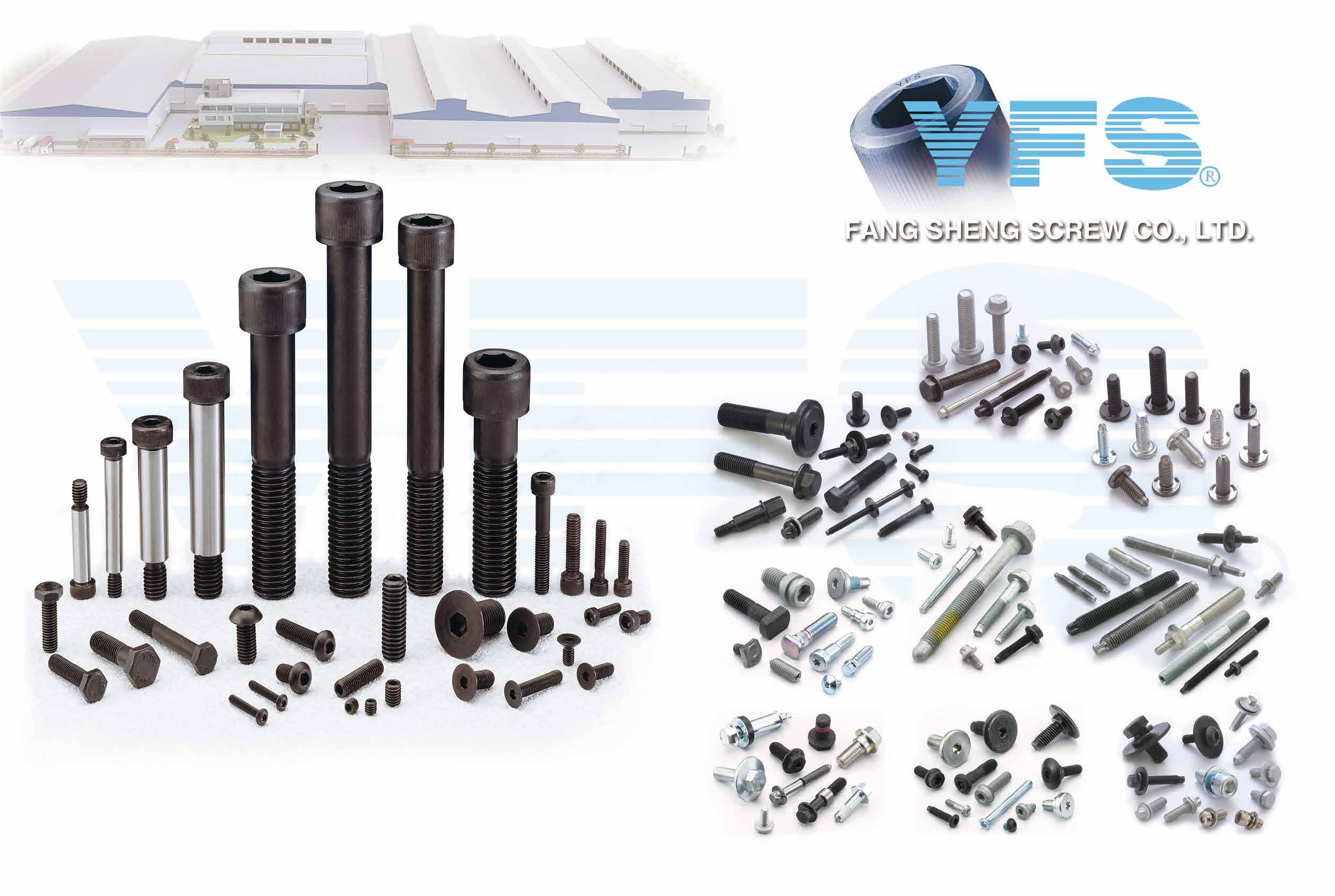

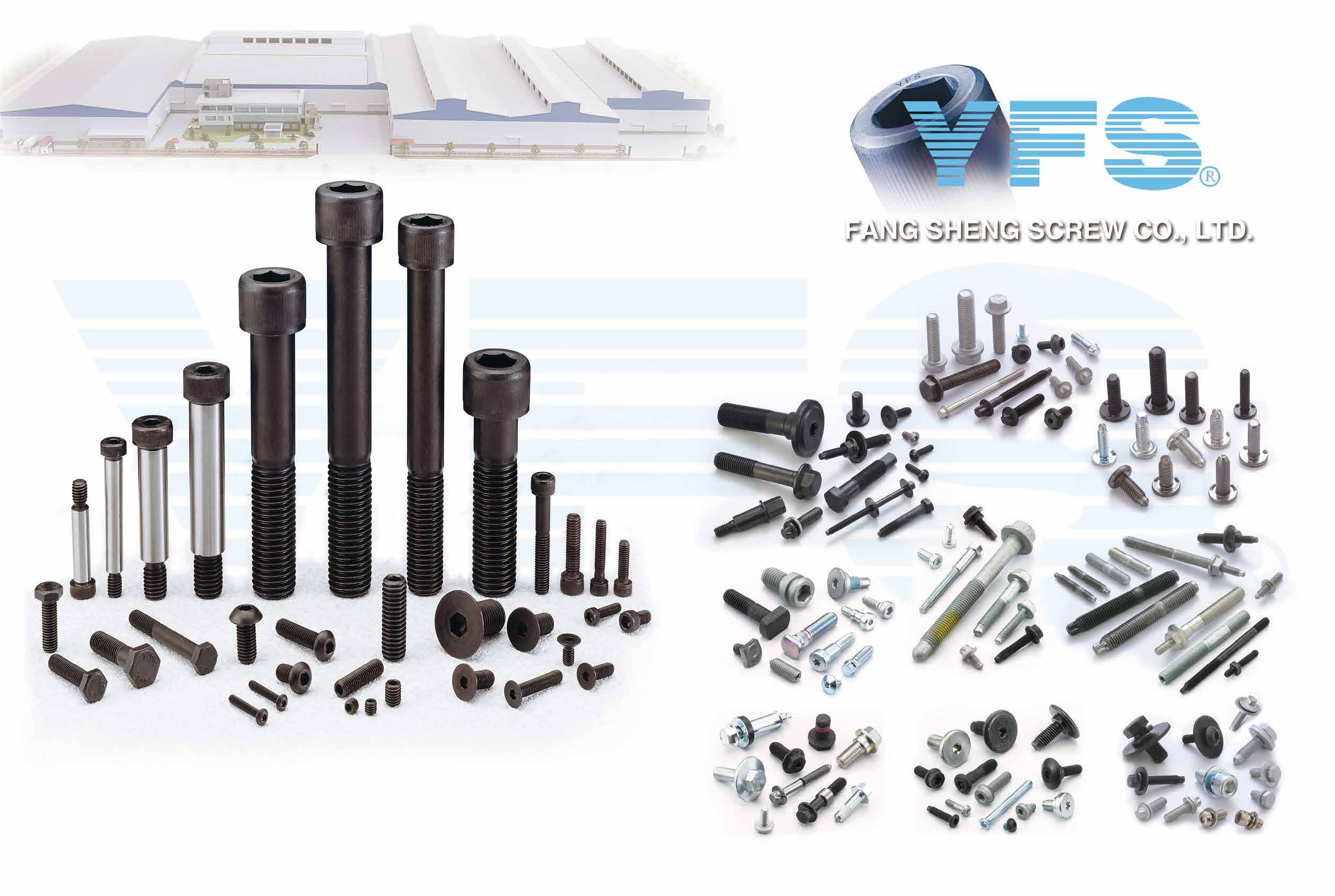

4 FANG SHENG SCREW CO., LTD.

Shoulder Bolts, Button Head Socket Cap Screws..

90 FASTENER JAMHER TAIWAN INC.

Automotive Nuts, Blind Nuts / Rivet Nuts, Bushings...

40 FASTNET CORP. 俊鉞

Dowel Pins, Flange Nuts, Weld Nuts, 4 Pronged T Nuts...

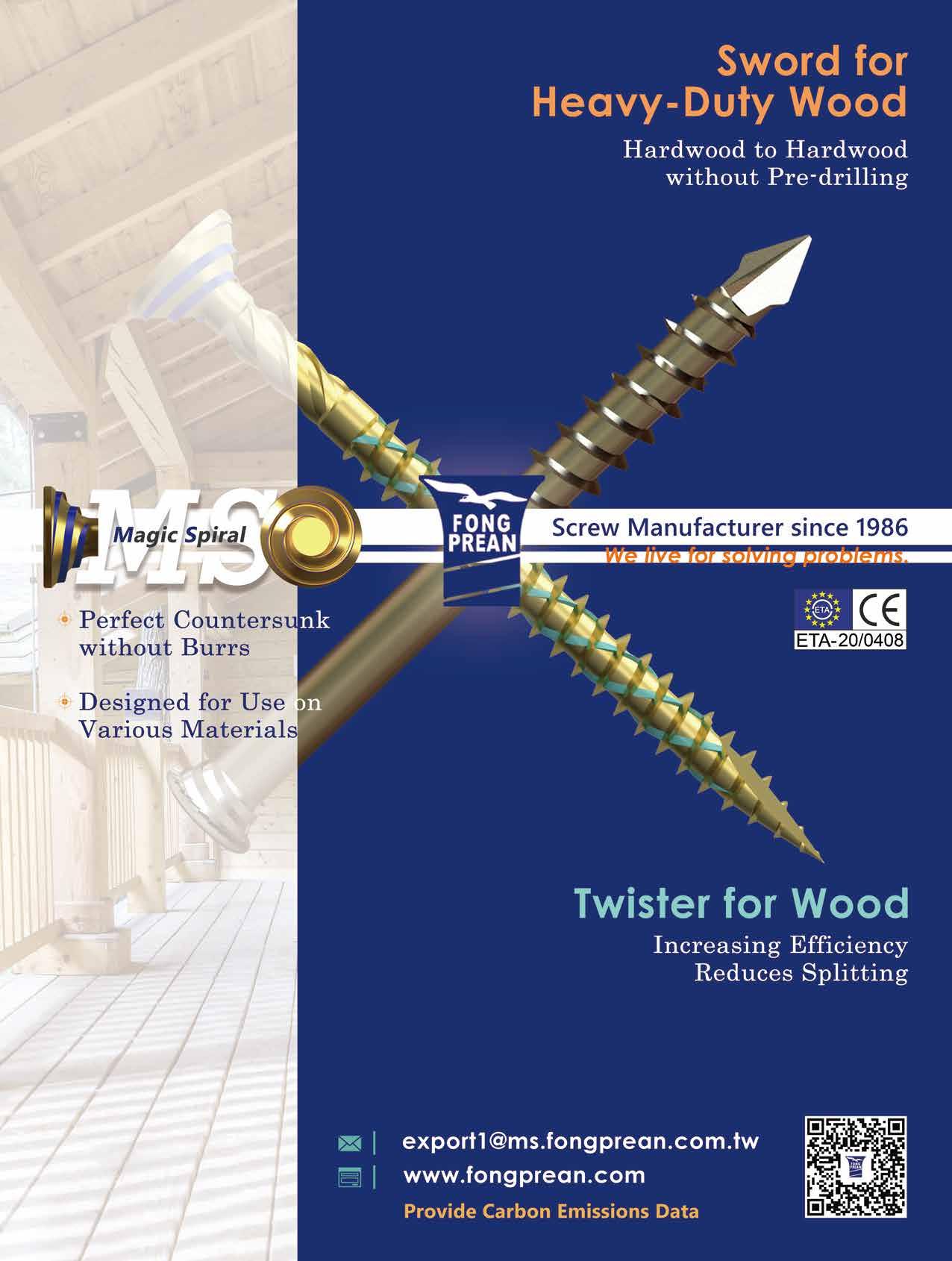

163 FONG PREAN INDUSTRIAL CO., LTD. 豐鵬

Automotive Screws, Bi-metal Screws, Brass & Bronze Screws...

70 FORTUNE BRIGHT INDUSTRIAL CO., LTD. 鋒沐

Cap Nuts, Dome Nuts, Nylon Cap Insert Lock Nuts...

60 FU HUI SCREW INDUSTRY CO., LTD.

Automotive & Motorcycle Special Screws / Bolts...

126 FU KAI FASTENER ENTERPRISE CO., LTD.

Precision Electronic Screws, Special Screws, Weld Screws...

82 FUSHANG CO., LTD.

Carbon Steel Screws, Chipboard Screws, Concrete Screws...

228 GINFA WORLD CO., LTD.

Chipboard Screws, Countersunk Screws, Drywall Screws...

198 GUANGZHE ENTERPRISE CO., LTD.

Collated Washer Paper Tape, Collated Screw Tape...

69 HAO CHENG PLASTIC CO., LTD.

PP Boxes, PET Jars, ABS Boxes, PC Boxes..

132 HARVILLE FASTENERS LTD. 豪威爾

Special Screws and Bolts, Sems Screws, Stainless Steel Fasteners...

142 HEADER PLAN CO. INC.

Chipboard Screws, Collated Screws, Deck Screws...

217 HEY YO TECHNOLOGY CO., LTD.

Precision Pins, Rollers, Dowel Pins...

219 HISENER INDUSTRIAL CO., LTD.

Wood Construction Screws, Chipboard Screws, Drywall Screws...

120 HO HONG SCREWS CO., LTD.

Alloy Steel Screws, Button Head Cap Screws, Chipboard Screws...

146 HOME SOON ENTERPRISE CO., LTD.

Bit, Bit Holder, Magnetic Nut Setter, Spring Nut Driver...

78 HOSHENG PRECISION HARDWARE CO., LTD.

Auto Parts, CNC Machined Parts, Bolts...

65 HSIN JUI HARDWARE ENTERPRISE CO., LTD.

Bushes, Construction Bolts, Special Cold / Hot Forming Parts...

41 HU PAO INDUSTRIES CO., LTD.

Automotive Nuts, Flange Nuts, Hexagon Nuts...

100 HWALLY PRODUCTS CO., LTD.

Drop-in Anchors, Chipboard Screws, Anchors...

189 INDUSTRIAL TECHNOLOGY RESEARCH INSTITUTE (ITRI)

INNTECH INTERNATIONAL CO., LTD.

All Kinds of Nuts, All Kinds of Screws, Automotive Special Screws... 10 J.C. GRAND CORPORATION

All Kinds of Screws, Chipboard Screws...

71 JAU YEOU INDUSTRY CO., LTD.

Chipboard Screws, Drywall Screws, High Low Thread Screws... 36 JET FAST COMPANY LIMITED

Blind Nuts / Rivet Nuts, Aircraft & Aerospace Washers... 269 JIAXING KINFAST HARDWARE CO., LTD.

Stainless Steel Screws, Fasteners, Anchors...

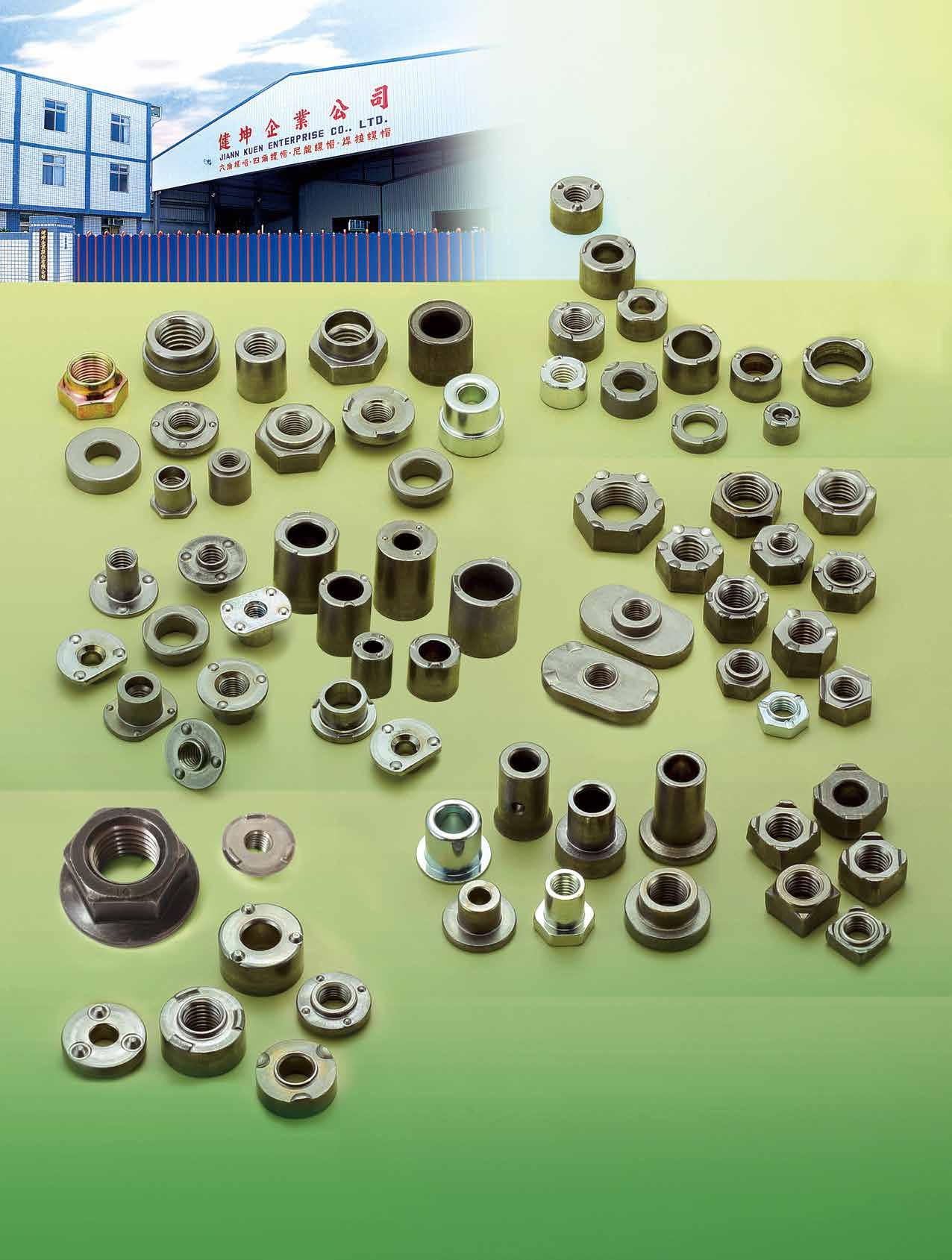

JIEN KUEN ENTERPRISE CO., LTD.

Hexagon Nuts, Nylon Cap Insert Lock Nuts, Square Nuts... 238 JINGFONG INDUSTRY CO., LTD.

Hex Nylon Insert Lock Nuts, Wing Nuts with Nylon Insert...

233

JOINTECH FASTENERS INDUSTRIAL CO., LTD.

Customized Parts, Bolts, Screws, Nuts, Automotive Parts...

77 JOKER INDUSTRIAL CO., LTD. 久可

Hollow Wall Anchors, Concrete Screws, Jack Nuts...

130 JUNG SHEN TECHNOLOGY CO., LTD. 榮燊

Bi-metal Screws, Automatic Welding & Automatic Inspection...

117 KAN GOOD ENTERPRISE CO., LTD. 鋼固

Fastener, Hardware, Plastic, Instruction Booklet Package in Bags...

121 KEY-USE INDUSTRIAL WORKS CO., LTD. 凱雍

Flanged Head Bolts, Milled Bolts, Rim Bolts, Round Head Bolts...

116 KING CENTURY GROUP CO., LTD.

Drop-in Anchors, Self-drilling Anchors, Sleeve Anchors...

58 KWANTEX RESEARCH INC.

Chipboard Screws, Wood Construction Screws, Deck Screws...

108 L & W FASTENERS COMPANY

Construction Fasteners, Flat Washers, Heavy Nuts...

139 LIAN CHUAN SHING INTERNATIONAL CO., LTD.

Weld Nuts, Special Parts, Special Washers, Flat Washers...

310 LINKWELL INDUSTRY CO., LTD.

All Kinds of Screws, Automotive & Motorcycle Special Screws...

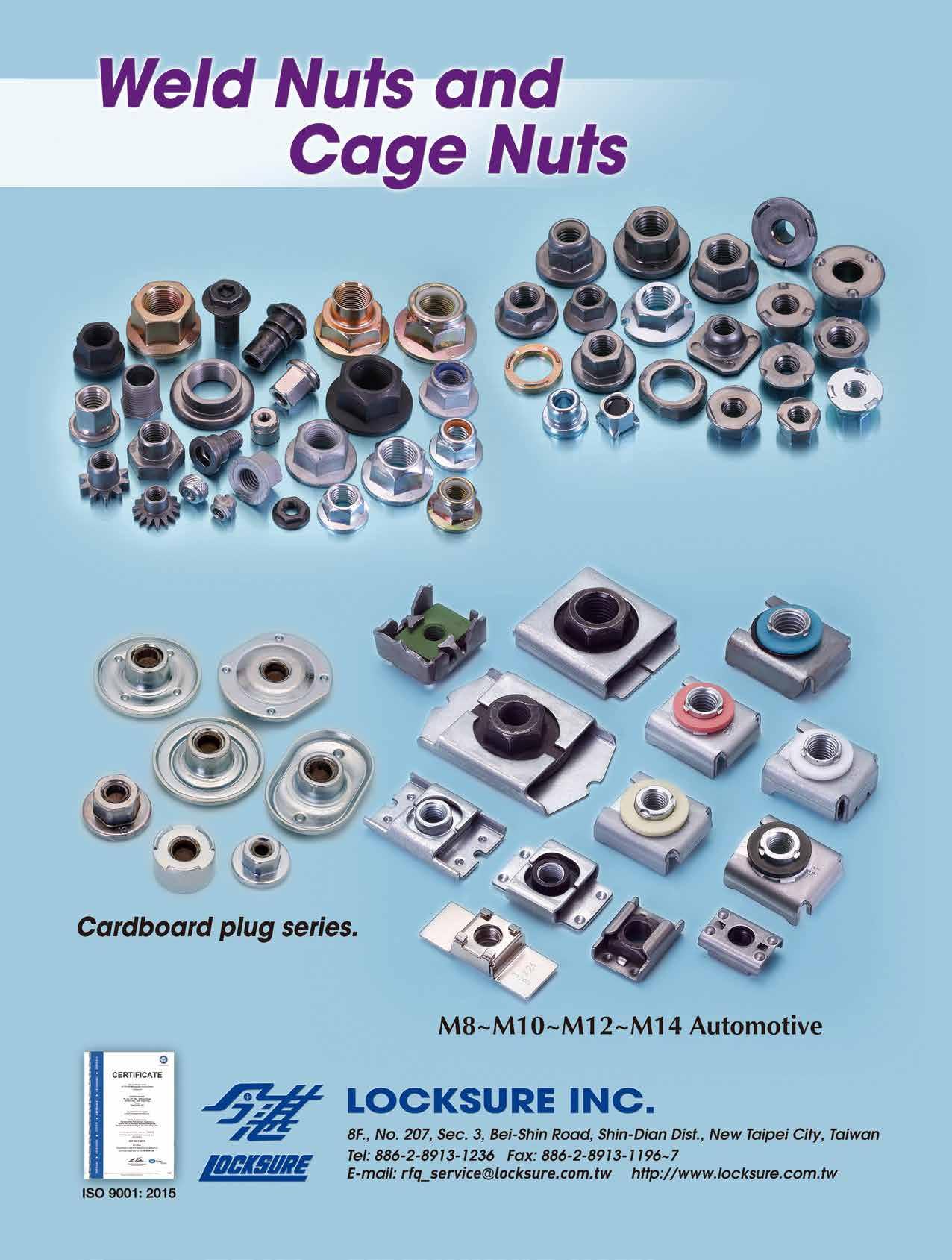

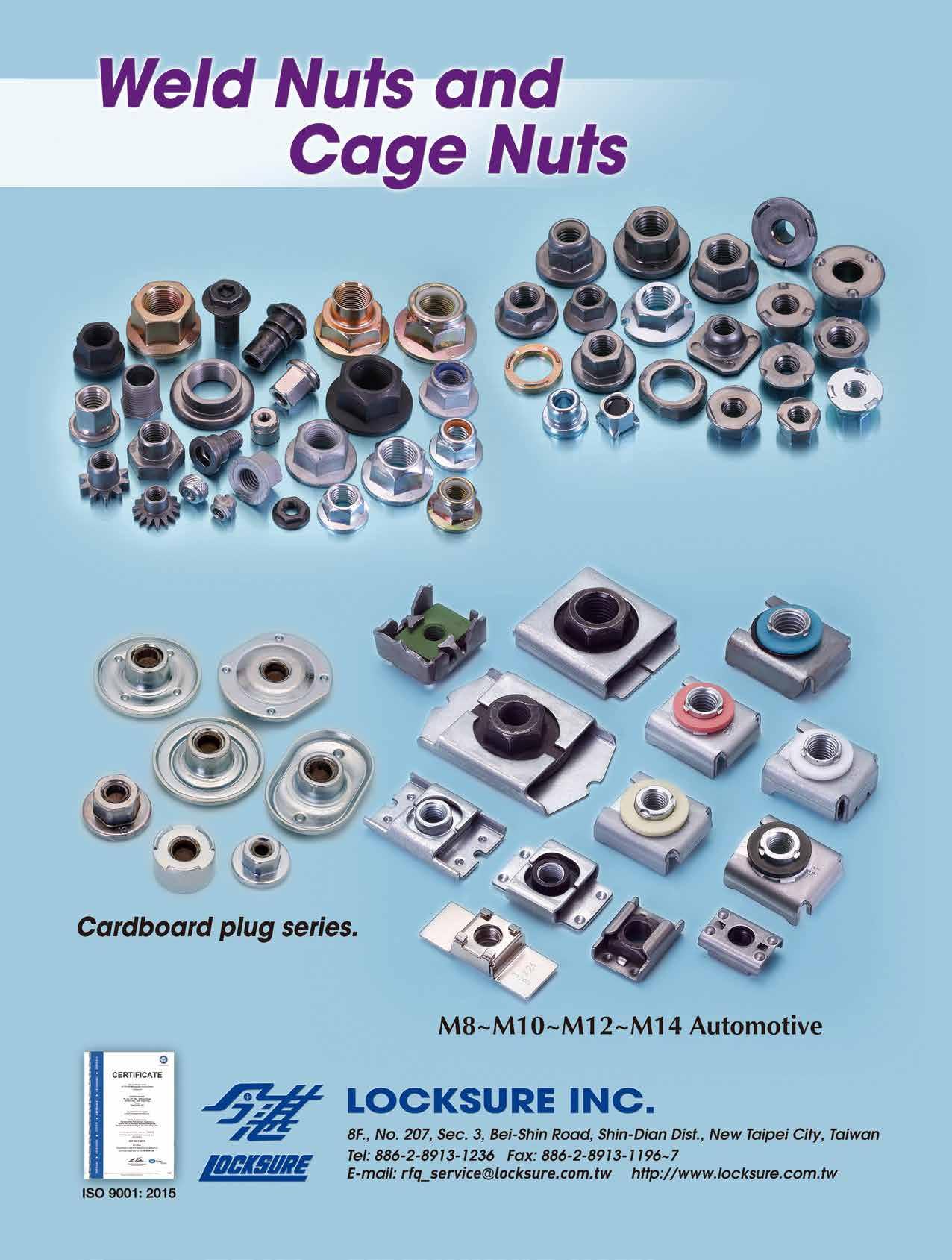

15 LOCKSURE INC.

Weld Nuts, Cage Nuts...

109 LONG THREAD FASTENERS CORP.

Bi-metal Self-drilling Screws, Chipboard Screws...

91 MAC PRECISION HARDWARE CO. 鑫瑞

Turning Parts, Precision Metal Parts, Cold Forged Nuts...

23 MASTER UNITED CORP. 永傑

Chipboard Screws, Drywall Screws, Furniture Screws...

50 MAUDLE INDUSTRIAL CO., LTD.

Button Head Socket Cap Screws, Flange Washer Head Screws...

230 MAXTOOL INDUSTRIAL CO., LTD.

Plastic Screws, Drop-in Anchors, Expansion Anchors...

215 METAL FASTENERS CO., LTD.

Self-Clinching Standoffs, Inserts, Self-clinching Nuts... M K

197 METECK ENTERPRISES CO., LTD.

Automotive Fasteners, Brass Screws (Bolts), Building Fasteners...

16 MIN HWEI ENTERPRISE CO., LTD.

Button Head Socket Cap Screws, Chipboard Screws...

商后

明徽

225 MIT INDUSTRIAL ACCESSORIES CORP. 侑威

Stamping Hardware, Bolts, Nuts, CNC Screw Machine Parts...

133 MOUNTFASCO INC.

All Kinds of Screws, Alloy Steel Screws, Automotive Screws...

118 NCG TOOLS INDUSTRY CO., LTD.

Tools for Fastening Anchors, Blind Nuts / Rivet Nuts...

崎鈺

昶彰

124 PAKWELL GROUP 開懋

Bi-metal Screws

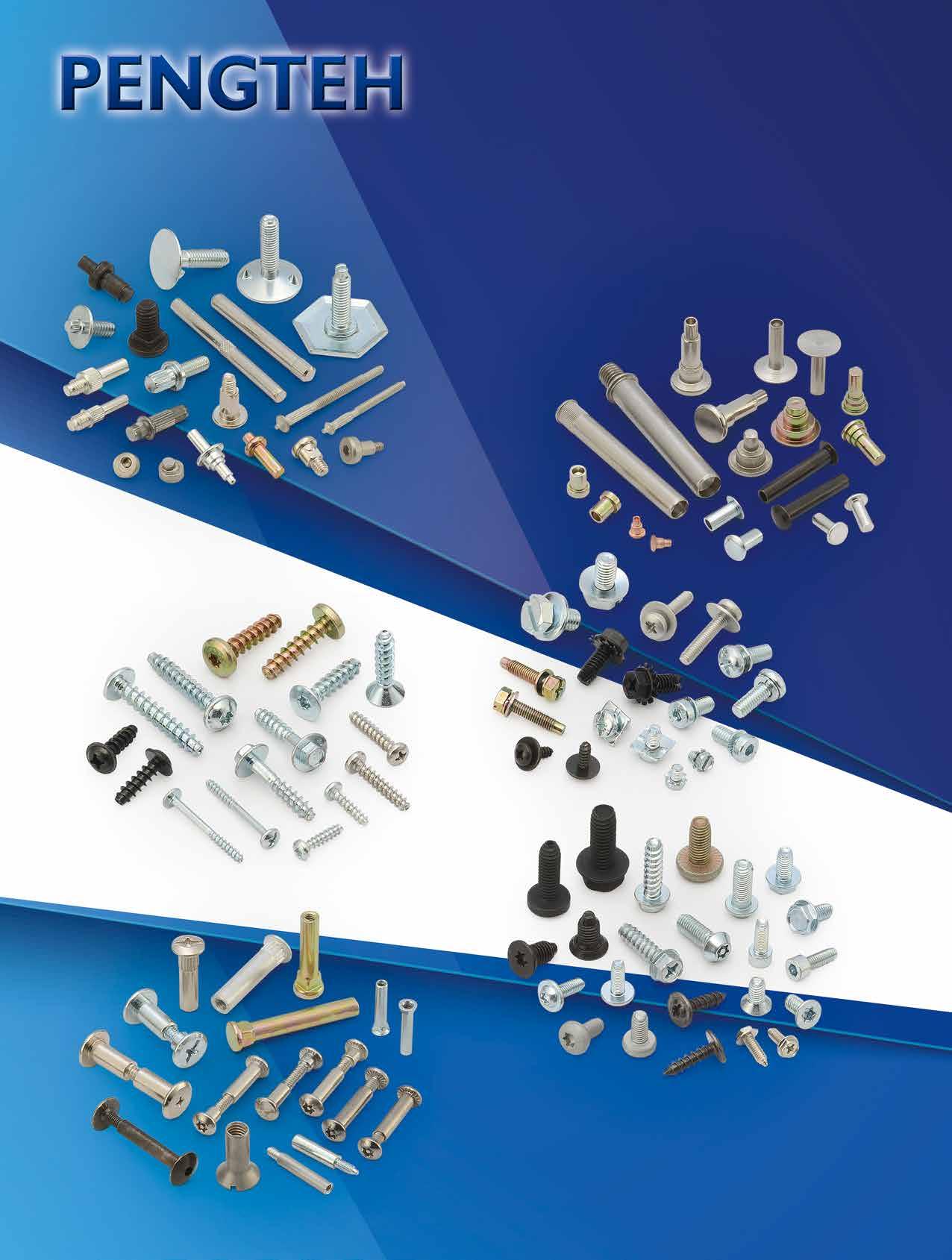

46 PENGTEH INDUSTRIAL CO., LTD. 彭特

SEMs Screws, Special Screws, Binder Screws, PT Screws...

128 PPG INDUSTRIES INTERNATIONAL INC. 美商必丕志

Chromium-free Coating, ED Coating...

175 PRO POWER CO., LTD.

鉑川 Screws, Bolts...

107 PS FASTENERS PTE LTD. (Singapore) 汎昇

Washers, Socket Set Screws, U Bolts, Alloy Steel Screws...

72 QST INTERNATIONAL CORP. 恒耀國際

Hexagon Head Bolts, Square Head Bolts, Weld Bolts (Studs)...

207 RENETSAF CO., LTD.

華鋼金

Brass, Copper, Silicon Bronze, Aluminum and Customized Parts...

12 REXLEN CORP. 連宜

Clinch Nuts, Clinch Studs, CNC Parts, Stamped Parts...

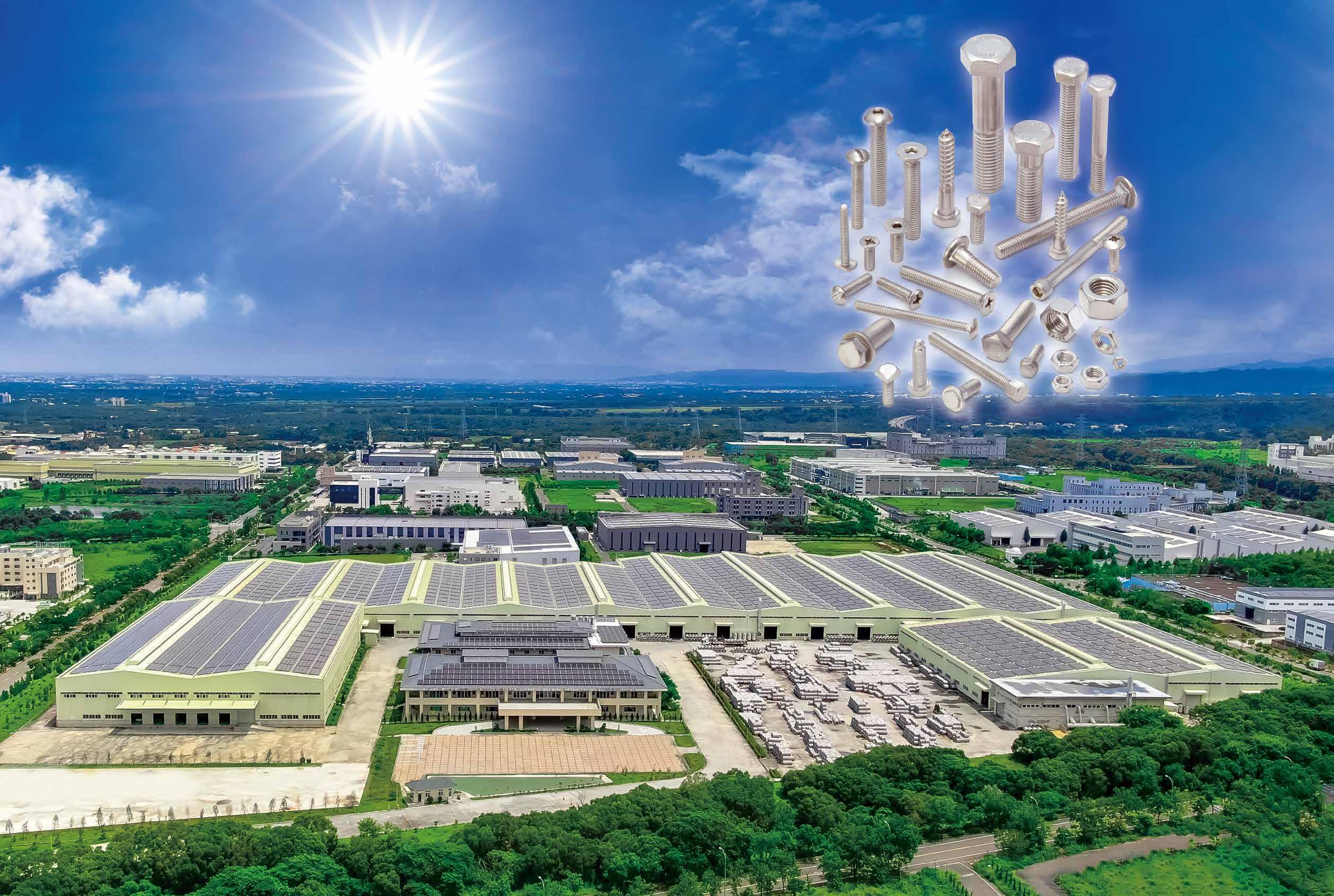

6 SAN SHING FASTECH CORP. 三星

Automotive Nuts, Automotive Parts, Carbide Dies...

115 SCREWTECH INDUSTRY CO., LTD.

Machined Parts, Thumb Screws, Micro Screws...

302 SEN CHANG INDUSTRIAL CO., LTD. 昇錩

Customized Special Screws / Bolts, Socket Head Cap Screws...

296 SHANGHAI FAST-FIX RIVET CORP. 飛可斯

Blind Rivets, High Shear Rivets, Closed End Rivets...

177 SHAW GUANG ENTERPRISE CO., LTD. 紹光

Cap Nuts, Conical Washer Nuts, Flange Nuts...

208 SHEH FUNG SCREWS CO., LTD.

Chipboard Screws, Countersunk Screws, Wood Screws...

210 SHEH KAI PRECISION CO., LTD. 世鎧

Bi-metal Concrete Screw Anchors, Bi-metal Screws...

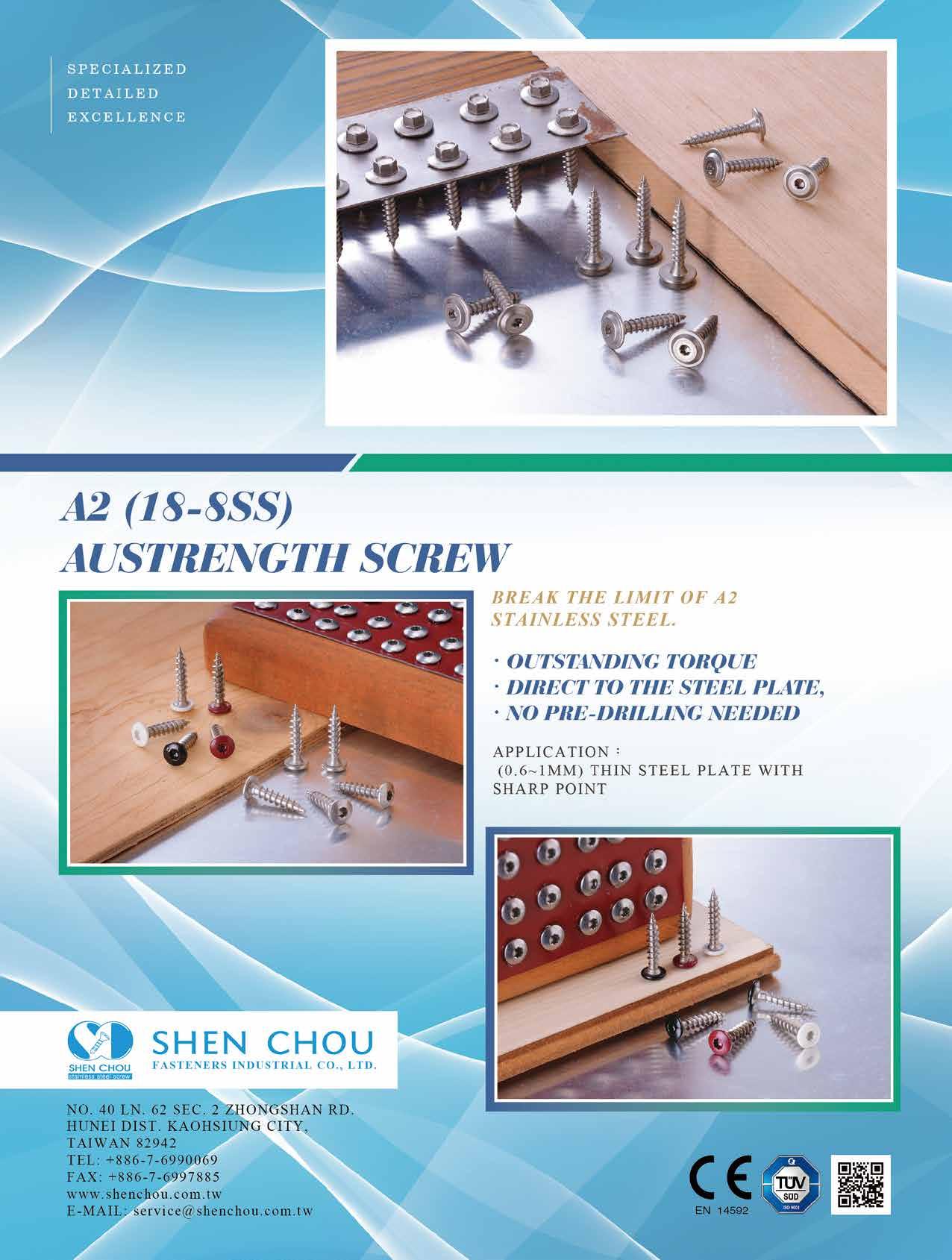

85 SHEN CHOU FASTENERS INDUSTRIAL CO., LTD.

Button Head Cap Screws, Chipboard Screws...

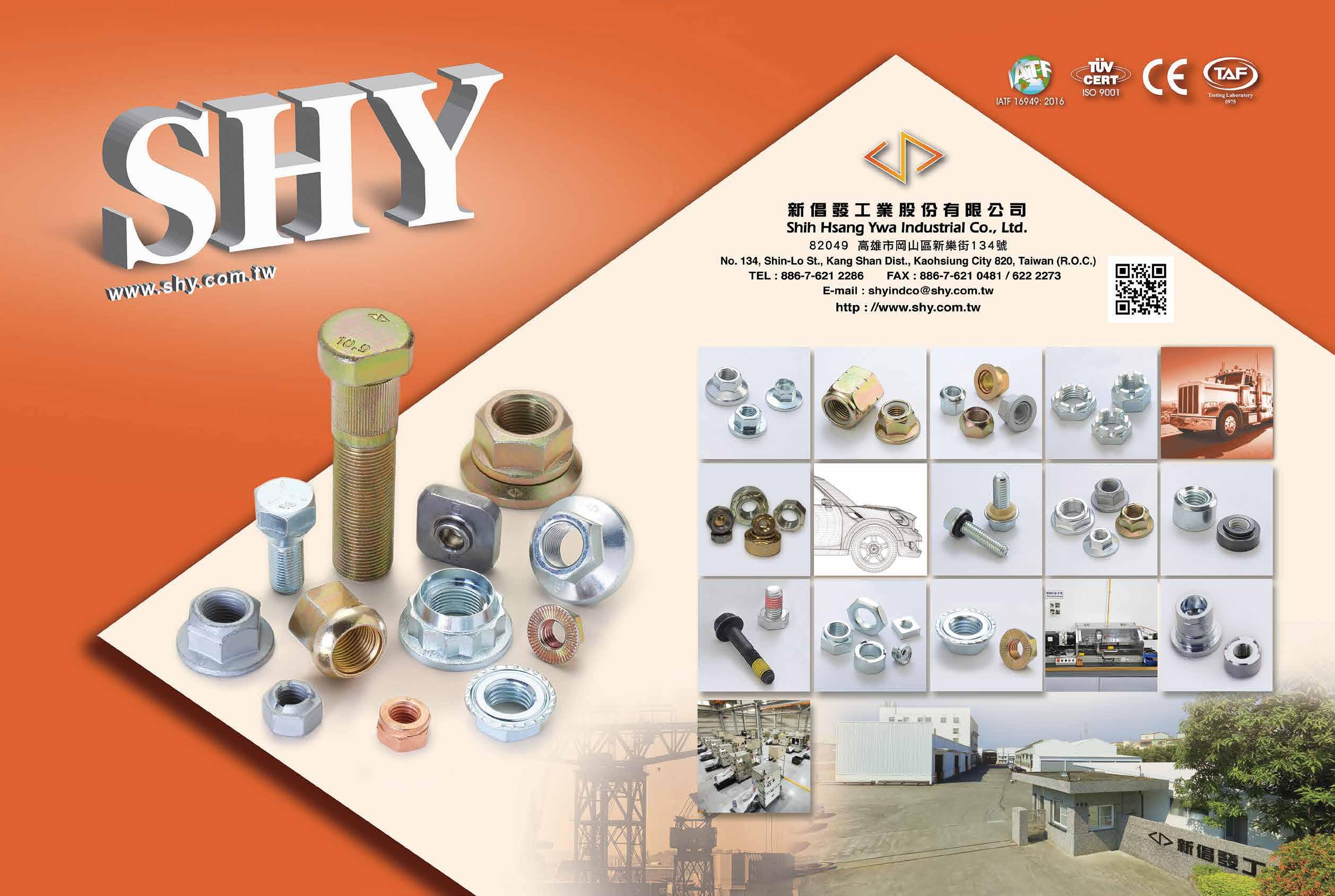

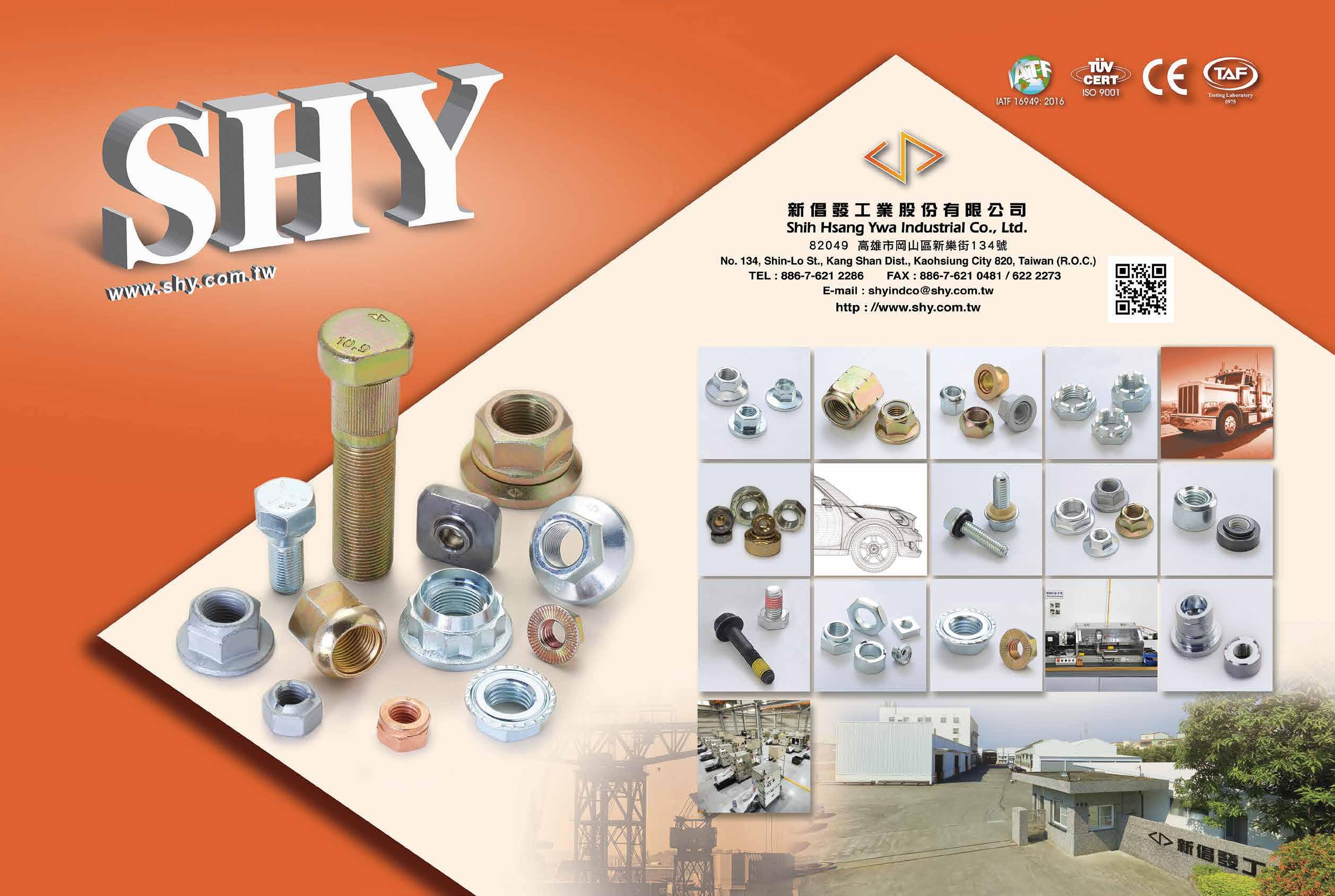

34 SHIH HSANG YWA INDUSTRIAL CO., LTD. 新倡發

Flange Nuts, Flange Nylon Nuts With Washers...

168 SHIN CHUN ENTERPRISE CO., LTD. 昕群

Automotive Screws, Chipboard Screws, Customized Screws...

205 SHUENN CHANG FA ENTERPRISE CO., LTD. 舜倡發

Long Construction Fasteners and Other Modified Fasteners...

134 SIN HONG HARDWARE PTE. LTD (Singapore) 新豐 Hexagon Nuts, Hexagon Head Bolts, Blind Rivets...

20 SPEC PRODUCTS CORP. 友鋮

Lincensee Fasteners, Turned/Machined Parts...

8 SPECIAL RIVETS CORP. 恆昭 Blind Nuts / Rivet Nuts, Blind Rivets, Air Riveters...

73 SPRING LAKE ENTERPRISE CO., LTD. 春澤 Chipboard Screws, Thread Forming Screws...

227 STRONG JOHNNY INTERNATIONAL CO., LTD. 駿愷

Automotive & Special Parts, Cold-Forged Fasteners...

101 SUNCO INDUSTRIES CO., LTD. (Japan)

Distributor Specializing in Fasteners

113 SUPER DPD CO., LTD. 三御

All Kinds of Screws, Bi-metal Screws, Carbon Steel Screws...

84 SUPERIOR QUALITY FASTENER CO., LTD. 鑫程椿

Weld Nuts, Turning Parts, Long Screws, Spring Nuts...

98 TAIWAN SELF-LOCKING CO., LTD. (TSLG) 台灣耐落

Nylok®, Precote®, Nycote®, Nyplas®, Loctite®...

199 TAIWAN SHAN YIN INTERNATIONAL CO., LTD. 慶達

Bi-metal Self-drilling Screws, Chipboard Screws...

92 TANG AN ENTERPRISE CO., LTD. 鏜安

Customized Automotive Parts and Special Fasteners

14 THREAD INDUSTRIAL CO., LTD. 英德

Chipboard Screws, Flange Nuts, Heavy Nuts...

44 TONG HEER FASTENERS (THAILAND) CO., LTD.

Hex Bolts, Stud Bolts, Socket Cap Screws, Hex Nuts...

44 TONG HEER FASTENERS CO., SDN. BHD (Malaysia)

Stainless Steel Metric Screws, Stainless Steel Screws...

18 TONG HWEI ENTERPRISE CO., LTD. 東徽

A2 Cap Screws, Button Head Socket Cap Screws...

45 TONG MING ENTERPRISE CO., LTD. 東明

Stainless Steel Fasteners, Wire Rods…

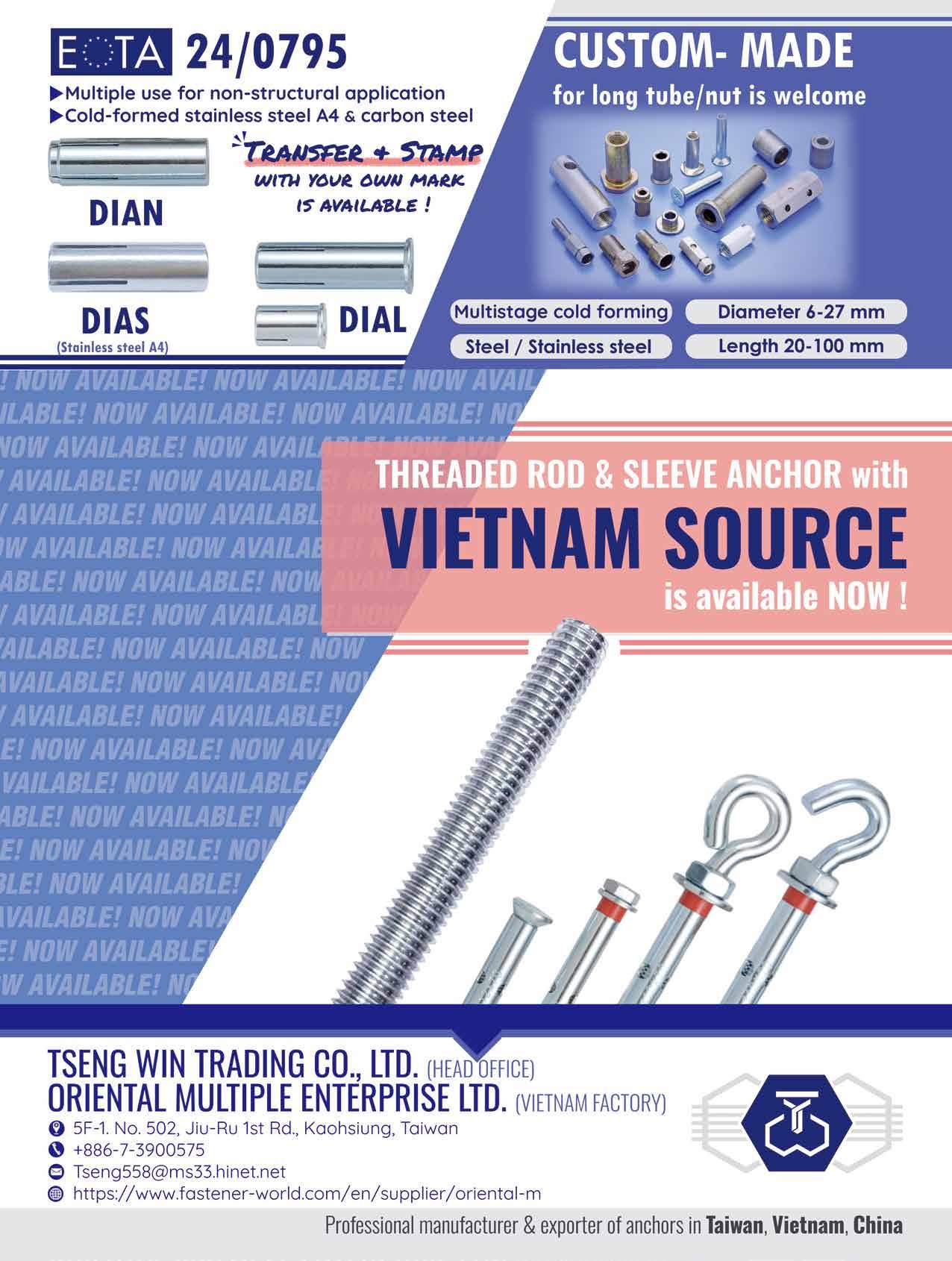

125 TSENG WIN TRADING CO., LTD. 成盈

Ceiling Anchors, Cut Anchors, Drop-in Anchors...

64 VERTEX PRECISION INDUSTRIAL CORP. 緯紘

6 Cuts/ 8 Cuts Self Drilling Screws, Barrel Nuts, Cap Screws

48 WE POWER INDUSTRY CO., LTD. 威力寶

Chipboard Screws, Concrete Screws, Drywall Screws...

Standard / Customized Parts, Machining Parts, Stamping Parts...

Rivets, Bifurcated Rivets...

Open-Die Parts, Automotive Parts...

YI CHUN ENTERPRISE CO., LTD.

Cap Screws, Socket Set Screws, Cage Nuts, Automotive Parts...

YI HUNG WASHER CO., LTD.

Rubber Washers, Plastic Screws, Custom Washers...

Automotive & Motorcycle Special Screws / Bolts...

YOUR CHOICE FASTENERS & TOOLS CO., LTD.

A2 Cap Screws, Bits & Bit Sets, Chipboard Screws...

YOW CHERN CO., LTD.

Flanged Head Bolts, Chipboard Screws, Floorboard Screws...

YUH CHYANG HARDWARE INDUSTRIAL CO., LTD.

Automotive & Motorcycle Special Screws / Bolts...

280 CHI NING CO., LTD.

Machine, Nuts, Tooling...

Hot Forming Tools, Punches & Sleeves, Dies, Machinery Accssories...

GIAN-YEH INDUSTRIAL CO.,

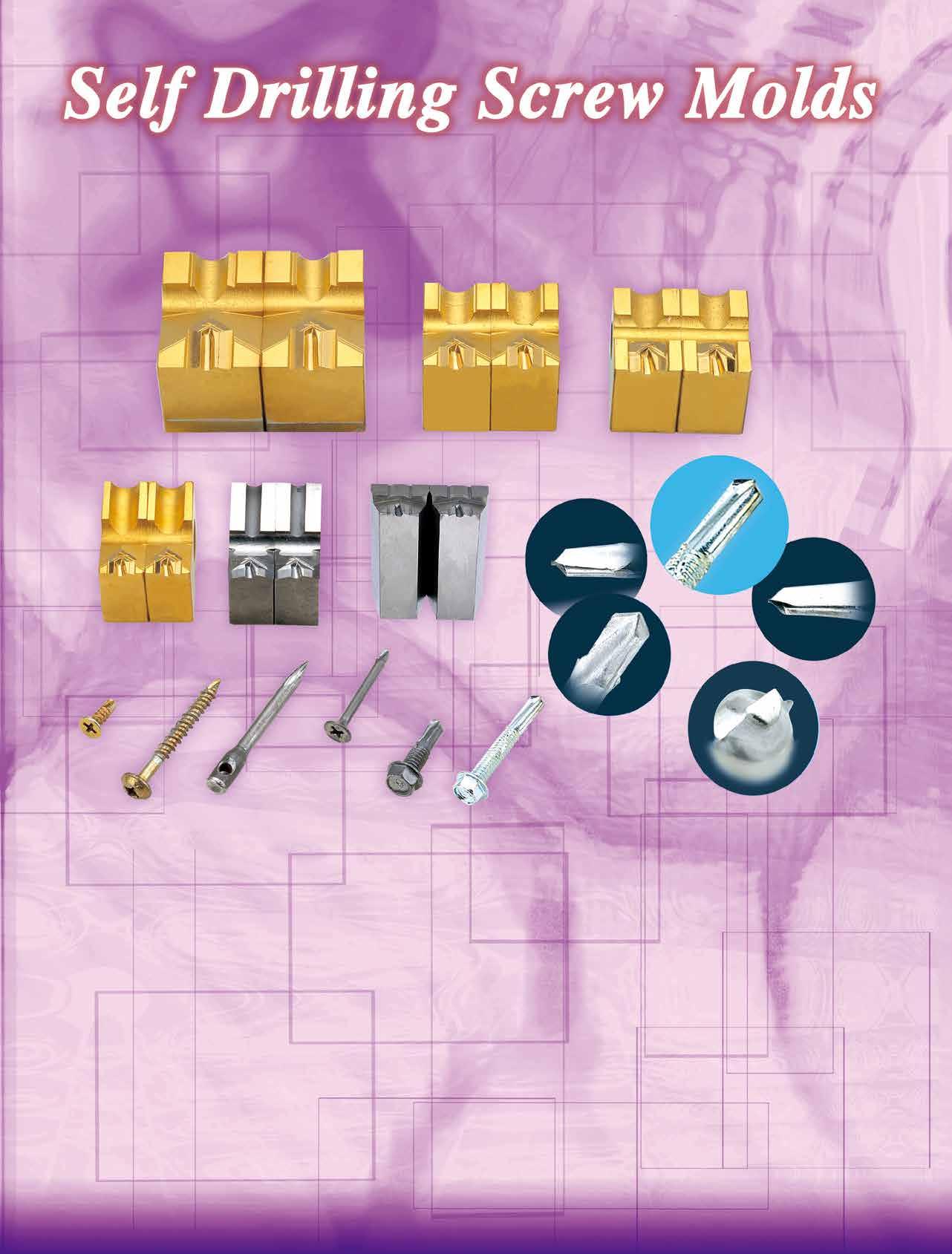

Rivet Dies, Self-drilling Screw Dies, Screw Tip Dies...

INFINIX PRECISION CORP.

Customized Punches and Dies

WAN IUAN ENTERPRISE CO.,

279 BIING FENG ENTERPRISE CO., LTD.

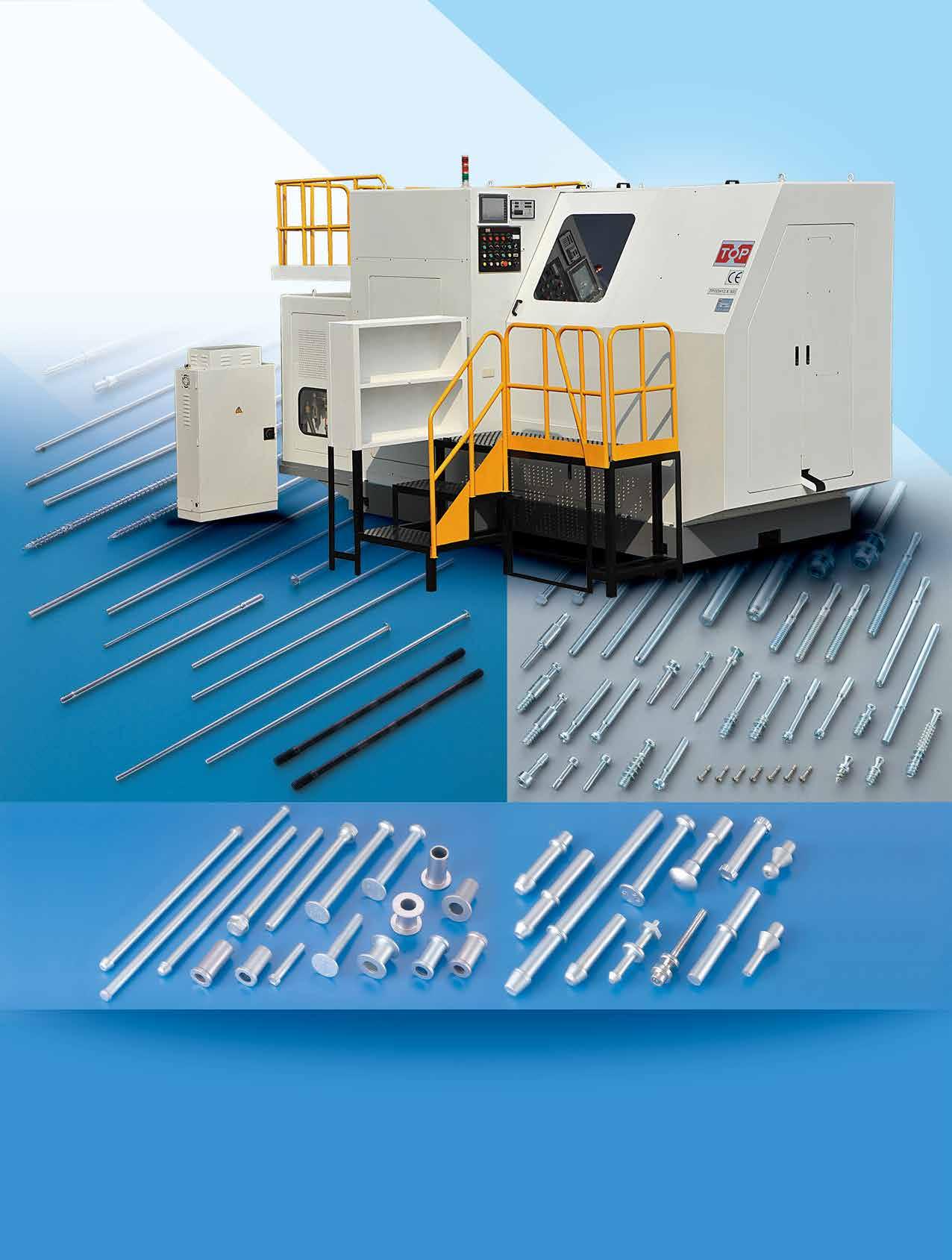

Blind Nut Formers, Multi-station Cold Forming Machines...

278 CHIEN TSAI MACHINERY ENTERPRISE CO., LTD.

Thread Rolling Machines

276 CHING CHAN OPTICAL TECHNOLOGY CO., LTD.

Eddy Current Sorting Machines, Fastener Makers...

291 GREENSLADE & COMPANY, INC. (USA)

Concentricity, Ring Gage, Plug Gage Calibration, Gages...

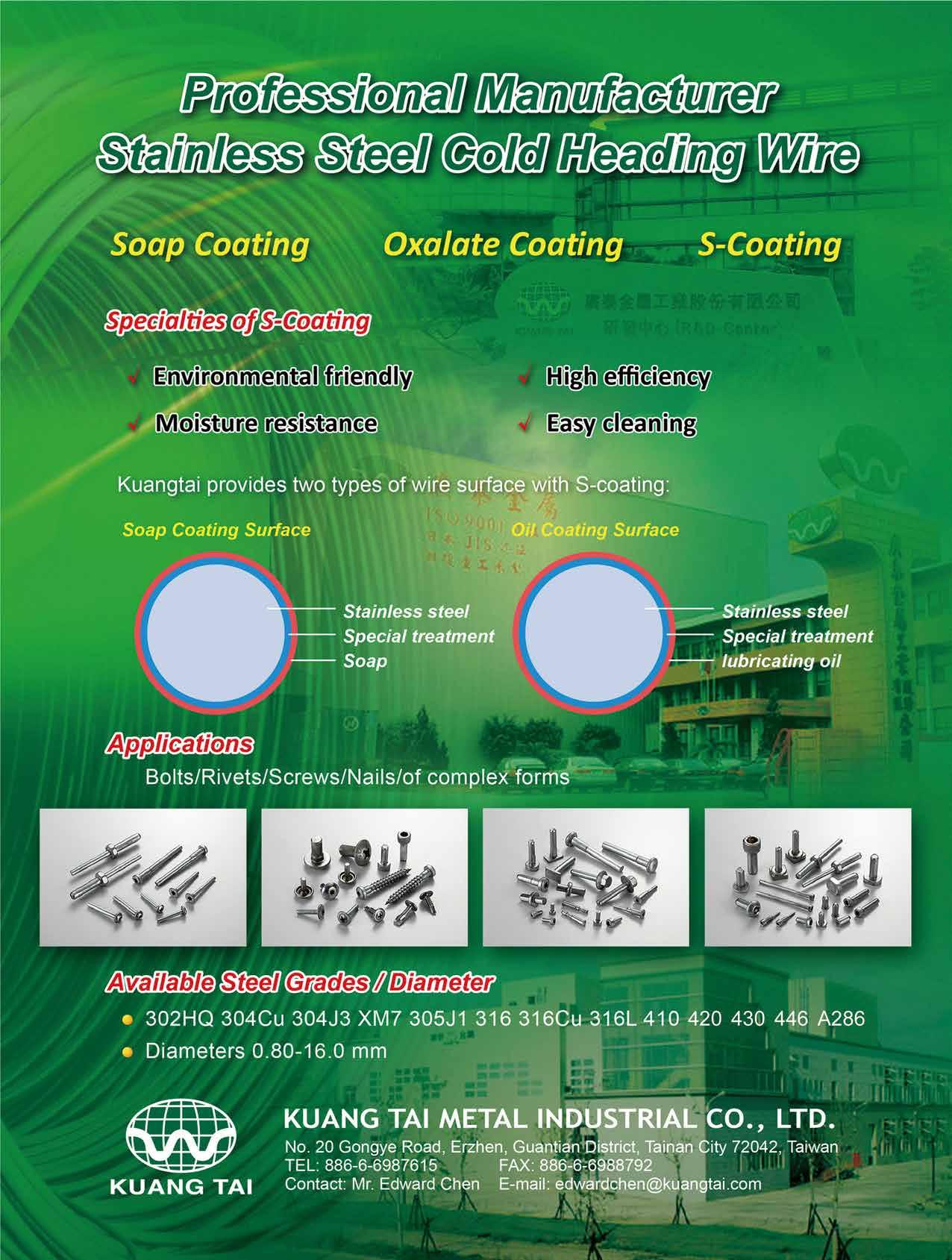

286 KUANG TAI METAL INDUSTRIAL CO., LTD.

Stainless Steel Cold Heading Wire

289 HONG TAY YUE ENTERPRISE CO., LTD.

Wire Straighteners, Hydraulic Clamping Machines...

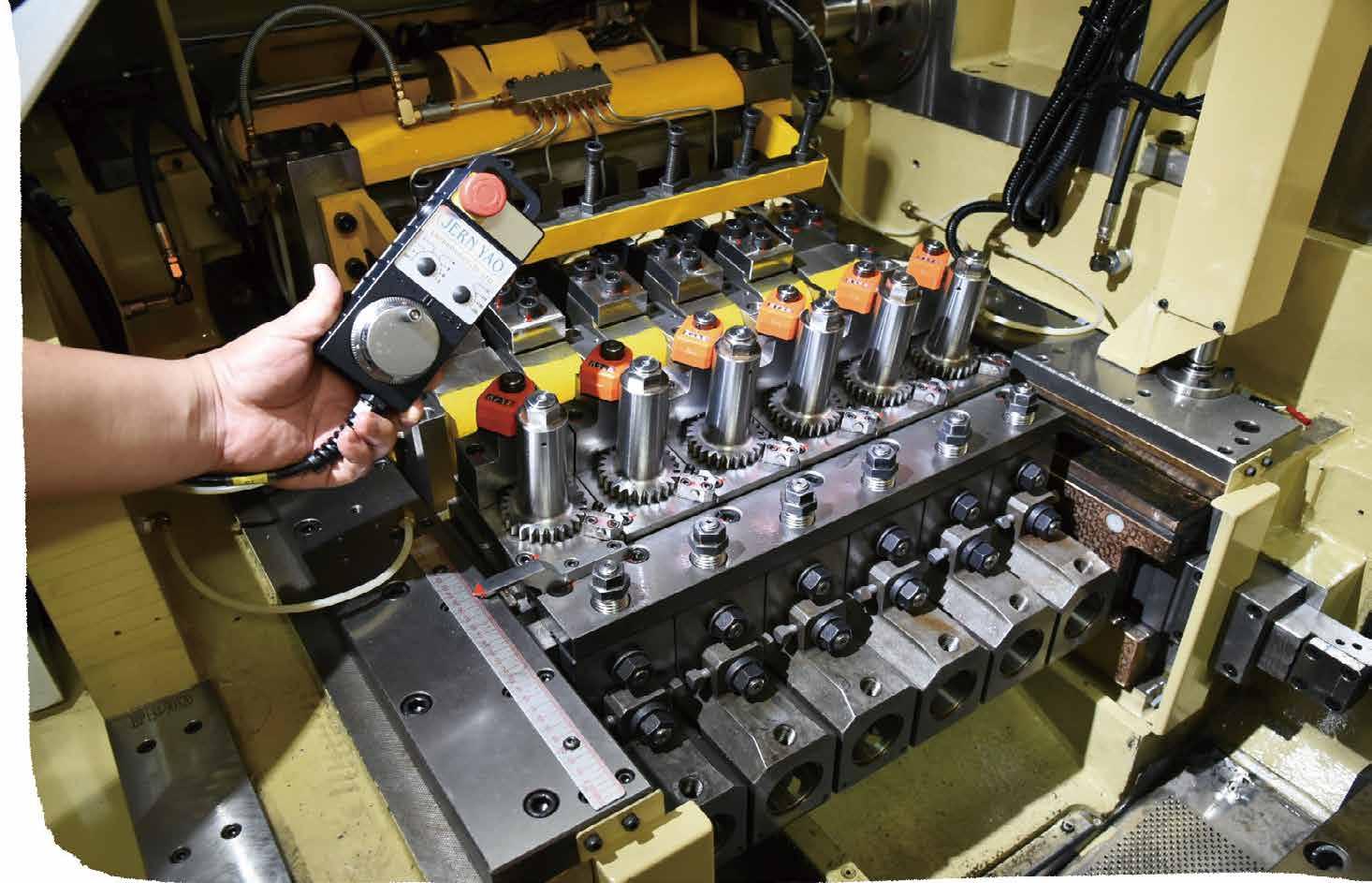

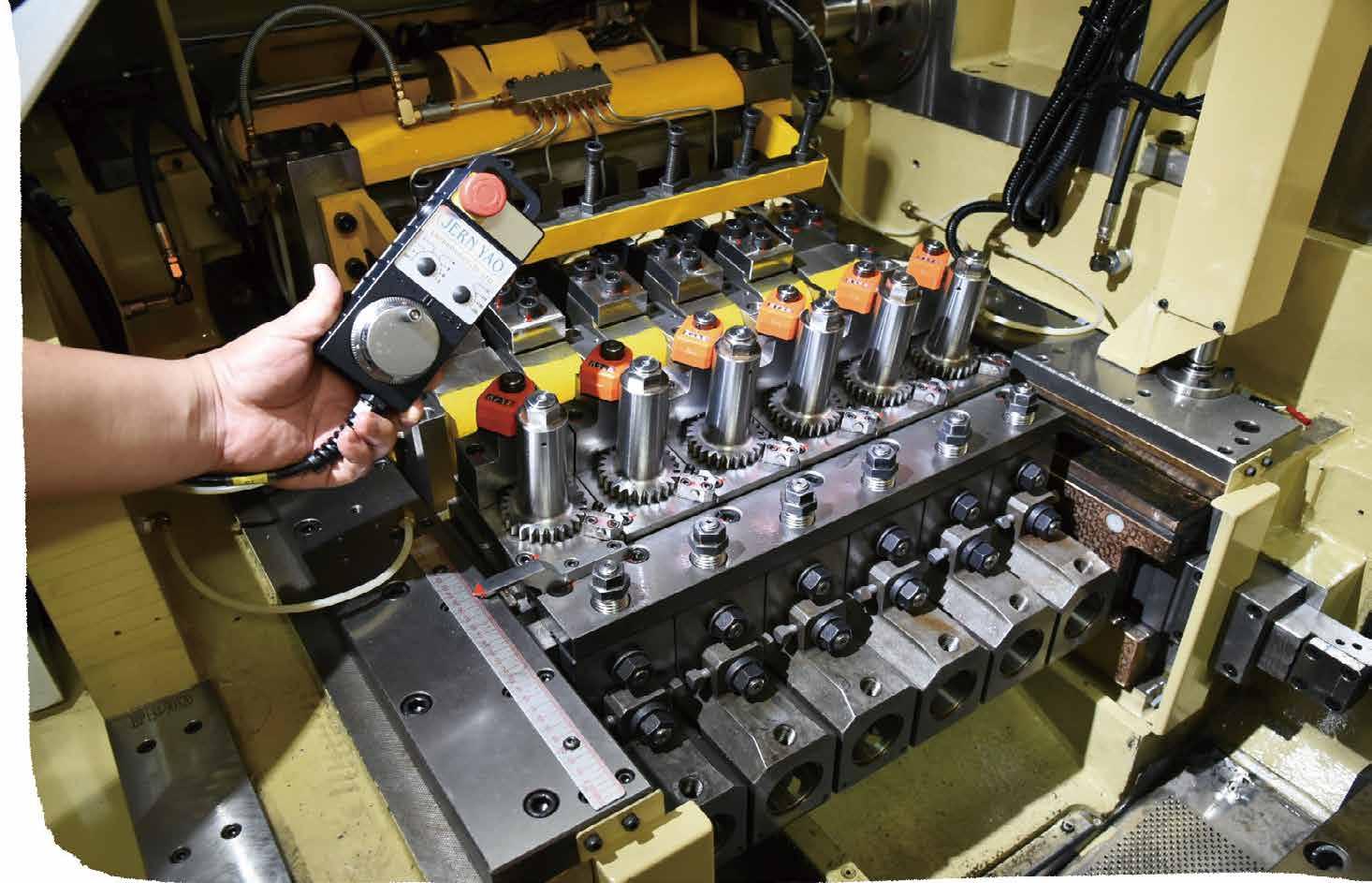

306 JERN YAO ENTERPRISES CO., LTD.

Multi-station Cold Forming, Parts Forming Machines...

273 JIE LE MACHINERY CO., LTD.

Consolidation of Artificial Intelligence Equipment

287 KING SHANG YUAN MACHINERY CO., LTD.

Hydraulic Press for Lock Nut Notches & Fasteners Assembly

300 LIAN SHYANG INDUSTRIES CO., LTD. 連翔 Automatic Cold Former, Nut Tapping Machines...

281 SHEEN TZAR CO., LTD.

Self-Drilling Screw Machines & Dies

193 SONG YI MACHINERY CO., LTD.

Spindle Tapping Machine, Thread Gauge Checking Machine...

SUN FAME MANUFACTURING CO., LTD.

Shank Slotting Machines, Screw Point Cutting Machine...

283 TZE PING PRECISION MACHINERY CO., LTD. 智品 Open Die Machines, Cold Headers, Cold Forming Machines...

301 YESWIN MACHINERY CO., LTD. 友信 Bolt Formers, Multi-station Cold Forging Machines...

Provided by Sunco Industries

SUNCO exhibited at EXPO 2025, which is being held in Osaka from April 13 through October 13, 2025, under the theme “Designing Future Society for Our Lives.” This international event brings together people and innovations from around the world to address global challenges. Countries from across the globe are participating by presenting their own unique pavilions.

As a related event, the 3rd Japan International Art Festival/Osaka-Kansai EXPO Exhibition was held from July 2 to July 6 at EXPO Messe “WASSE.” SUNCO joined the exhibition through the introduction of the Mayor of Higashiosaka. Its booth, which fused fasteners and art, stood out and captured the attention of many visitors.

Following the opening ceremony of the 3rd Japan International Art Festival/Osaka-Kansai EXPO Exhibition, President Mr. Yoshihide Okuyama gave a greeting at the SUNCO booth. He noted that final products using screws can be found all over the world in industrial goods, automobiles, motorcycles, and more, many of which use JIS-standard screws. Based in Higashiosaka, Osaka Prefecture, home to the largest concentration of screw manufacturers in Japan, SUNCO is committed to delivering JIS screws to the world.

Despite having less than two months to prepare after confirmation, SUNCO’s booth was packed with creative

ideas. From meticulously designed booth walls to a screw-themed original keychain-making event, SUNCO’s display overflowed with originality and attracted a constant stream of visitors throughout the day. The highlight was a diorama art piece of the EXPO 2025 ’ s symbolic “ Grand Ring.” This iconic structure was recreated using screws and became a topic of conversation on TV and online news.

Including preliminary meetings, the diorama took over a month to complete. Approximately 1,500 to 1,600 screws, all SUNCO products, were used. Selected from SUNCO’s extensive catalog of over 2.01 million items, the screws added depth and realism to the artwork. The production team stated, “The actual Grand Ring is constructed without any nails or screws. That’s why recreating it with screws carries significant meaning and appeal.” Screws, typically behind-the-scenes structural components, took center stage in this piece. The natural weight and luster of metal gave the work a strong presence. The team hopes visitors will enjoy discovering and being surprised by the screws, saying things like, “ What is this screw normally used for?” or “I can’ t believe this is a screw!”

The booth welcomed a wide range of visitors, from school groups and families to elderly guests, creating a lively and unexpectedly large turnout. Many visitors from Higashiosaka commented, “I’ve seen the penguin logo before,” “I’ve heard the name on train announcements,” and “I saw the TV commercial.” Although most visitors were Japanese, somewhat off from SUNCO’s original aim of promoting JIS screws internationally, the event offered a valuable opportunity to connect with the general public and raised awareness of SUNCO’ s name beyond the industry.

During JAPAN DAY on July 3, a vibrant parade was held, with SUNCO’ s original character “ Socket Boy ” leading the way. As various Japanese mascot characters walked in line, many attendees called out “Hey, Socket Boy!” and waved in support.

Within the booth, SUNCO actively distributed its magazine “ SOCKET BOY ” to share its efforts and highlight the appeal of the screw industry. Although the audience turned out to be predominantly Japanese, limiting the reach to overseas readers, the team remarked that today, anyone can become a media outlet through social media. They believe that spreading the word online can serve as effective marketing. Even simply raising awareness that such an actively PR-driven company exists in Higashiosaka made the exhibition worthwhile.

The collaborative efforts leading up to SUNCO’s participation in EXPO 2025 marked a major achievement for the company. The opportunity to exhibit came just as employees began to develop a global mindset, making it a potential catalyst for future international expansion. Looking forward, SUNCO plans to promote young talent and aims to increase global brand recognition and boost overseas sales. With its mission of delivering Japanese (JIS) screws to the world, SUNCO remains committed to taking on new challenges.

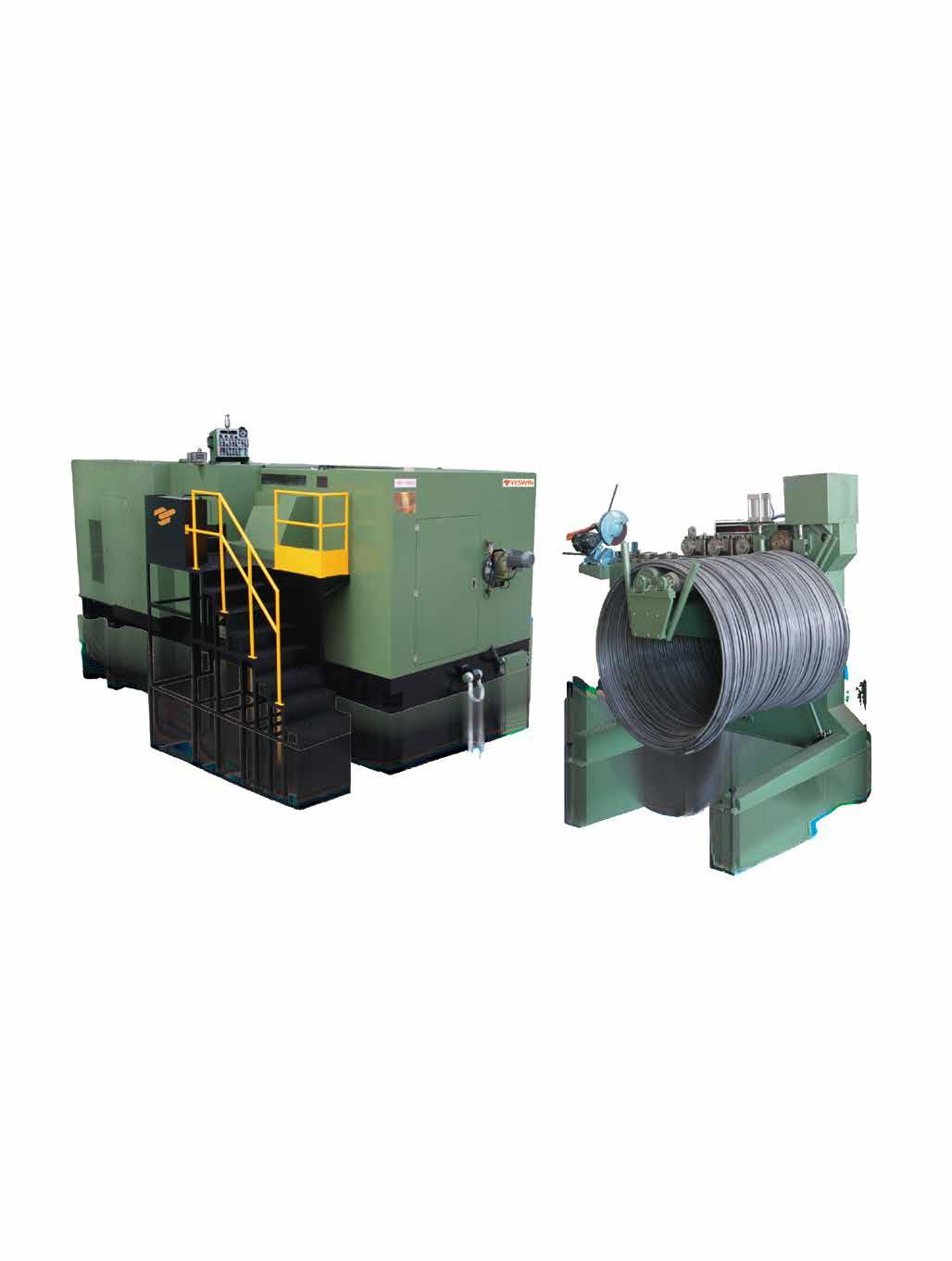

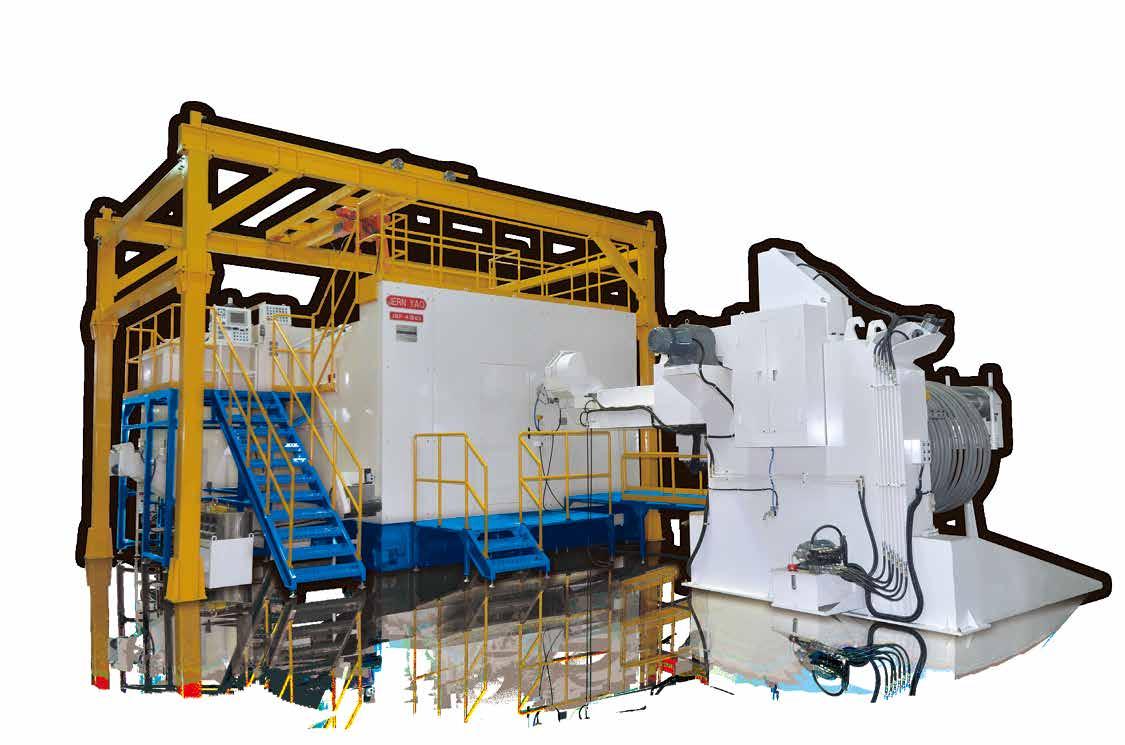

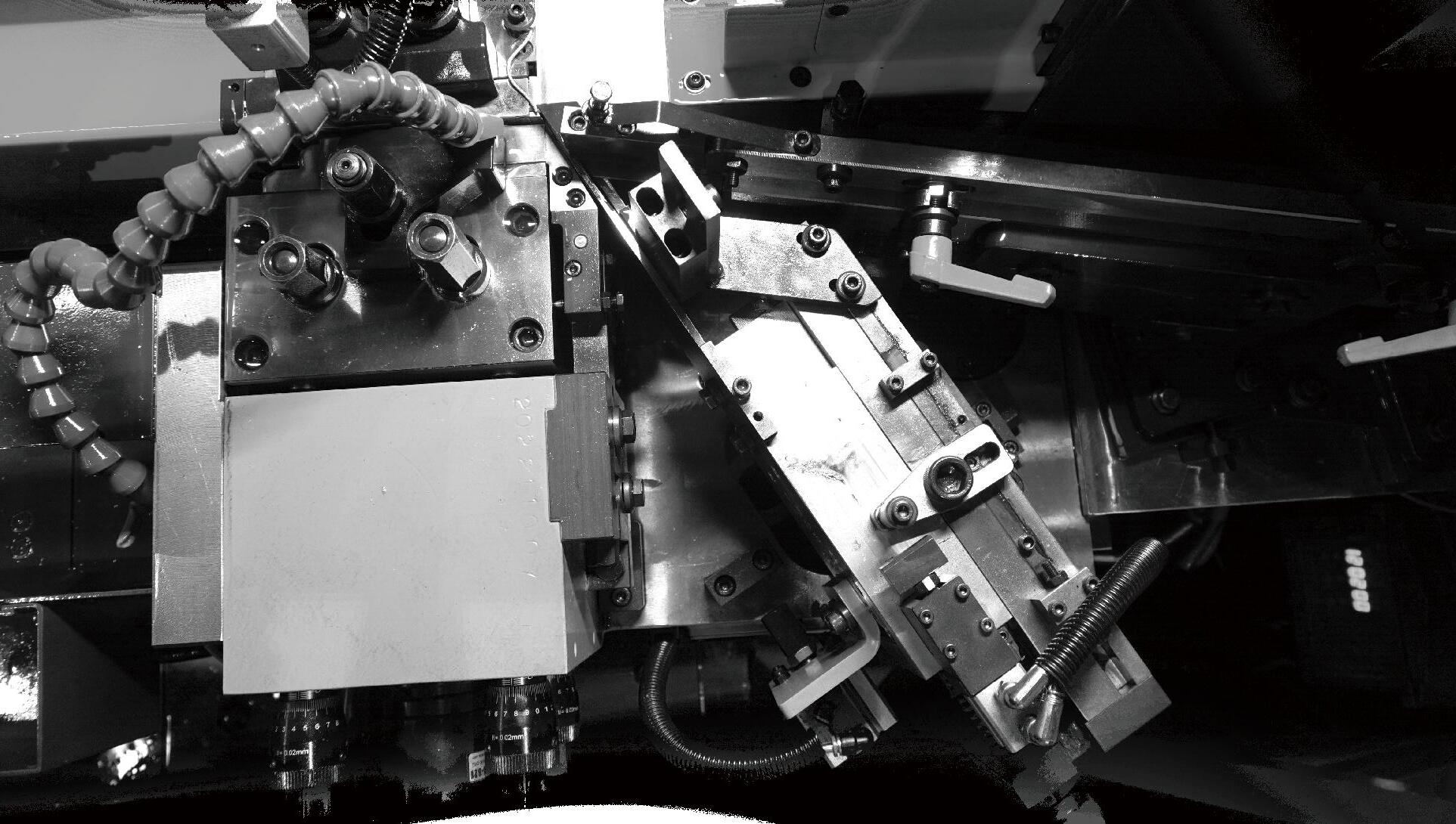

one of the world's largest manufacturers of mid-to-high-end screw, nut, and part formers, with cumulative global sales nearing 5,000 units, officially inaugurated its self-use parts processing plant in Rende (Tainan) at the end of 2024. Unlike the original Plant 1, handling assembly, outsourcing, quality assurance, warehousing, and maintenance, the primary mission of Jern Yao's 2nd new plant will be to “increase the percentage of self-use parts production” and “enhance the precision, speed, and stability of machined parts.”

The 12,560 sqm second plant dedicated to producing self-use parts represents a significant endeavor that sets Jern Yao apart from its competitors in the former manufacturing industry. The percentage of Jern Yao's self-use parts production was previously ~30%, primarily consisting of small-batch custom orders. Considering the challenges such as emerging succession gaps among partner factories, equipment upgrades, and parts lead times increasingly failing to meet the industry's stricter demands, coupled with the company's own desire to accelerate production schedules and enhance finished product precision, Jern Yao made a substantial investment in introducing 45 advanced and 4 five-face milling machines. This initiative aims to rapidly elevate Jern Yao's product precision and manufacturing capacity to a level unmatched by competitors within a short timeframe. At a time when an increasing number of former manufacturers are heard to directly source cheap yet questionable-quality parts from China and have them assembled in Taiwan to reduce their cost, Jern Yao not only refuses

to follow suit by steadfastly rejecting Chinese raw materials and parts that fail to meet its high-standard quality requirements, but also invests heavily in acquiring dozens of advanced milling machines to enhance its self-use parts production capabilities, demonstrating Jern Yao’s unwavering commitment in recent years to actively frame itself as the world's premier former brand and solidify its position as the global leader.

"Currently, few Taiwanese former manufacturers possess five-face milling machines. Unlike traditional CNC machines, the advantage of five-face machines lies in eliminating the need to flip workpieces, significantly boosting machining capacity. It can operate with only a single setup, reducing human-made errors while enabling us to execute more complex designs and achieve higher precision levels. To ensure precision for both tooling and workpieces, we even maintain our plant air conditioning at a constant 28 °C. With the introduction of five-face milling machines, we now have the opportunity to further increase our core part self-sufficiency ratio to a 5:5 split, " stated President Alec Tsai.

Jern Yao currently offers machine models ranging from 2-die to 8-die configurations. To meet customer demands for automated processing speed and efficiency, it actively integrates AI into product design (e.g., machine troubleshooting functions). It also recalibrates existing models (e.g., increasing their production from 240 pcs of M8 screws per min. to 300pcs) and accelerates die change efficiency through external adjustment of male/female dies. These measures comprehensively address increasingly stringent customer requirements for precision, speed, and stability.

“Price cutting represents Jern Yao's most significant challenge at present. However, the superior performance, the capability to produce more precise products, and the stability of our machines remain unmatched by competitors. Moving forward, we will strive to gain greater customer recognition by reducing unnecessary costs in the manufacturing process, ensuring smoother production line operations, and shortening lead times, in order to pave the way for Jern Yao's next era of successes,” added President Tsai.

Jern Yao, which has dominated the industry for 32 years with its exceptional high-performance machines, welcomed new leadership in July 2024 as Alec Tsai formally took over the helm from former President Ted Tsai. His first initiative was a sweeping overhaul of Jern Yao's corporate culture, aiming to introduce Western management philosophies emphasizing “frank communication and treating managers as partners.” While the initial implementation proved challenging, the shift in corporate atmosphere is evident today. When employees now feel comfortable addressing President Tsai directly as “Alec,” it signals a departure from the previous era where management dictated every detail.

Before assuming the role of President, Alec had served at Jern Yao for over a decade, gaining deep familiarity with all departments. His years of study, work, and life in the US and Canada also instilled in him a strong emphasis on fostering open communication between employees and management holding different viewpoints. Therefore, in his first year in

office, he vigorously promoted reforms in the company's internal management culture. He hopes to eliminate the corporate atmosphere of the older generation that overly emphasizes hierarchical systems, allowing Western management thinking that encourages bold expression of opinions and mutual growth and progress to further take root in all departments. President Tsai believes: “The invisible distance between employees and supervisors hinders corporate growth and progress. This barrier prevents employees from promptly voicing concerns or suggestions, resulting in valuable input failing to reach management and issues not being resolved through timely team brainstorming.”

To bridge the gap with employees, President Tsai himself frequently addresses staff and managers by their first names in a friendly manner at the company. He actively encourages them to speak up whenever issues arise, emphasizing that even urgent matters can be brought directly to him for discussion—there's no need to hold back simply because someone is a supervisor. He believes that eliminating the hierarchical distance that inhibits openness will enable smoother progress across all company operations.

President Tsai stated: “I aspire to build Jern Yao into a company where employees are genuinely motivated to work hard and even feel a sense of belonging, like it's their home. Traditional industries in central and southern Taiwan often adopt a management style where criticism comes first when things go wrong. I strongly dislike this leadership approach

I aspire to build Jern Yao into a company where employees are genuinely motivated to work hard and even feel a sense of belonging, like it's their home.

Jern Yao’s contact: Mike Huang, Sales Section Chief

Email: mike@jernyao.com

because over time, employees become passive. They hesitate to raise issues or offer constructive suggestions, fearing they might be held accountable for any shortcomings. Instead, I prefer a collaborative approach where we sit down together to discuss problems and find solutions, encouraging everyone to voice ideas that benefit the company's future development."

Corporate culture and employees determine a company's future trajectory. To strengthen employees' sense of identification and belonging with the company, President Tsai has actively promoted knowledge transfer and technical training across departments. His goal is to equip the company team with more robust capabilities to tackle future market challenges. Under his leadership philosophy that “new equipment demands new ways of thinking,” Jern Yao stands ready to secure a decisive victory for the next 30 years.

Taiwan’s precision manufacturing leader, Screwtech Industry, successfully obtained the international environmental management system ISO 14001 certification in 2024. This achievement is not only regarded as a major milestone toward entering global markets but also demonstrates the company’s environmental management effectiveness and commitment to continuous improvement. A senior executive emphasized that obtaining this certification is a commitment to environmental protection and a necessary strategy to enhance competitiveness in the global market.

The company revealed that they faced various challenges during the process, especially in encouraging employees to embrace and proactively integrate environmental awareness into their mindset— a key bottleneck. Screwtech promoted sustainable values among employees through internal communication and training, and also engaged upstream and downstream supply chain partners

in environmental initiatives, highlighting the integration and collaboration within the entire ecosystem. This spirit not only overcame resistance throughout the process but also was crucial to successfully passing the certification.

Screwtech has maintained a rigorous approach to environmental management since it passed the certification. Getting approved in the 2025 annual audit reaffirms its solid performance. Auditors especially praised the company for not just setting plans but also actualizing them on schedule, making environmental management a natural part of daily work rather than superficial compliance.

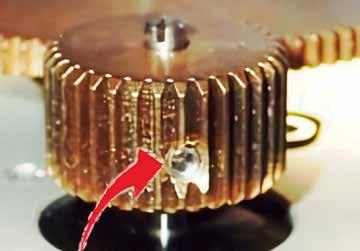

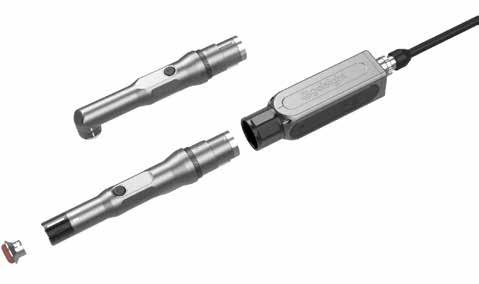

Screwtech proudly recommends its Hi-cass bolts and nuts, well-received in both domestic and global markets and closely aligned with environmental protection:

1. Meets environmental standards: Non-toxic and harmless, complying with RoHS requirements.

2. High corrosion resistance: Effectively reduces consumable losses and replacement frequency caused by rust, extending product lifespan and improving overall reliability.

3. Water-saving production: Significantly reduces water usage during production, minimizing wastewater generation to achieve energy conservation and environmental protection.

4. Innovative ceramic electroplating technology: The nano-ceramic coating differs from conventional electroplating by preventing electric potential differences, thereby stopping rust caused by electron interactions on metal surfaces, greatly improving corrosion resistance and lifespan while reducing maintenance costs.

This robust management and execution capability has enhanced Screwtech’s brand trust among international markets and clients, significantly boosting its ESG performance and establishing a corporate image willing to take responsibility for the planet and the well-being of humanity. Furthermore, it places great importance on employee health and occupational safety by integrating hygiene and safety management systems. These efforts have strengthened cohesion both inside and outside the company and earned recognition from partners for Screwtech’s sustainability spirit. It envisions “net-zero emissions” by driving energy-saving and carbonreduction initiatives, creating a green environment where humans, nature, and all forms of life coexist harmoniously.

In addition to Hi-cass, Screwtech has also been deeply involved in the precision screw sector for many years. Its products, stable and reliable, are widely used in advanced industries such as automotive, electronics, AI, and semiconductors, injecting vigor into high-tech industries. Readers are invited to visit the photonics exhibition this October to witness Screwtech’s breakthroughs in manufacturing innovation and its blueprint for green sustainable prosperity.

Copyright owned by Fastener World / Article by Laurence Claus

A: Electroplating is an electrochemical process that deposits a thin layer of one metal on another. In the case of fasteners, zinc electroplating is a common choice of customers and users and involves depositing a thin layer of zinc onto a steel substrate. The process essentially introduces an electric current into a “plating bath” resulting in zinc ions being stripped from solid zinc ingots, conducted through the plating bath and being re-deposited on the steel fasteners.

A: There are several different protection mechanisms that can be employed to protect parts from corroding. These can be a singular mode of protection or combined to provide even more protection. In the case of zinc electroplating the base zinc layer provides a sacrificial mechanism, meaning that the zinc layer behaves as an anode and sacrifices itself before the base substrate is attacked and damaged. As soon as the zinc layer has completely sacrificed itself and opened a pathway to the base substrate, corrosion will occur. Most zinc electroplates receive chromate treatment after plating. The chromate is a Chromium rich chemical that triggers a conversion at the surface of the plating layer that provides a passivation mechanism. This generates a more electrically passive layer which boosts the ability of the plating to resist corrosion. So, zinc electroplating protects parts using a combination of sacrificial and passivation protection mechanisms.

A: There are several parts to this answer, but in a nutshell, zinc electroplating can be designed to provide moderate corrosion protection in a cost-effective manner. Additionally, it is available in every industrialized region, provides an attractive surface finish (bright and smooth), is available in multiple colors, possesses good adhesion, and has a long track record of successful application on fasteners.

A: This is partially answered in the protection mechanism question above, but further explanation is warranted. As described above, zinc protects the base metal by utilizing a sacrificial protection mechanism. The sacrificial activity of just zinc is quite rapid and aggressive. Therefore, to provide greater corrosion protection, it is best to slow this mechanism down. This can be accomplished by passivating or making the surface more electrically passive. In simple terms, the passivated surface slows down the rapidity with which the anodic zinc disappears. This increases the corrosion protection by extending the time the parts can withstand accelerated corrosion testing, like the neutral salt spray test. Chromates are made up of different forms of the Chromium atom, primarily either the hexavalent chromium ion or the tri-valent chromium ion. In the old days, chromates were comprised mostly of hexavalent chromium constituents. However, in the last twenty years hexavalent chromium has been exposed to be unhealthy to humans and the environment. Therefore, the European Union banned it from automobiles about twenty years ago and now it is mostly available only in the trivalent form.

A: Yes, hexavalent chromates, in addition to possessing the passivation protection mechanism, were also self-healing. A selfhealing mechanism is a particularly effective one that is able to repair itself when damaged. Stainless steel possesses this protection mechanism, which is one of the reasons it is such a strong performer for corrosion protection. In addition to providing a real ability

to boost corrosion protection, hexavalent chromium-based chromates could be formulated to naturally produce a variety of colors. Trivalent chromium-based chromates, at least in the early days, did not possess either of these advantages. They were unable to produce the variety of colors that the market had become accustomed to and were weak in regard to adding to Zinc’s corrosion protection.

A: The simple answer is, mostly, yes. Trivalent chromates are still not as effective as their hexavalent counterparts, but they have been improved and today they are able to naturally reproduce many of colors that were previously available. Additionally, the surface finishing industry developed and added many sealer options that enhance corrosion protection by creating additional barriers to penetrating the surface.

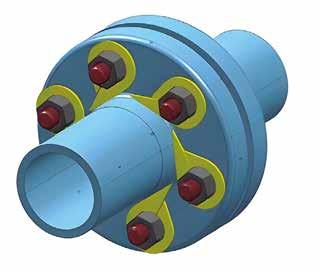

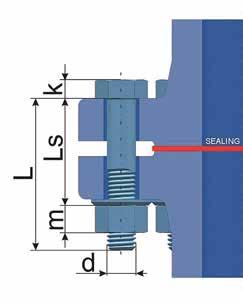

A: Yes, there are a couple of other considerations that fastener engineers need to keep in mind when specifying zinc electroplating. 1. Electric Current Density- this refers to the way that the electric current distributes itself across a part. In areas of the part where the electric current density is high, plating (the depositing of zinc on the surface of steel parts) occurs more quickly and efficiently. Conversely in areas of low current density, deposition occurs more slowly. In most instances the current density is higher at the ends of a part than it is in the middle. This makes zinc electroplating of long parts tricky because meeting the minimum required plating thickness everywhere on the parts means leaving it in the plating bath long enough for the areas of low electric current density to reach the minimum thickness. However, plating thickness continues to grow in the areas of high electric current density, giving the overall plating layer a dog bone shape. This wouldn’t be problematic except that most fasteners have threads on one or both ends, so that the maximum plating thickness occurs in the threaded region and results in potential gage or thread fit issues. 2. The ability of a plating or coating to get into recesses or hollow features on a fastener is called throw. Zinc electroplating generally has poor throwing capability, meaning that it either does not deposit at all or very minimally in recesses and hollow features. That will make fastener features like drive recesses more vulnerable than surfaces where throw is not a concern.

A: Per ASTM F2708, Hydrogen embrittlement is a permanent loss of ductility in a metal or alloy caused by hydrogen in combination with stress, either externally applied or internal residual stress. Hydrogen embrittlement failures take two forms, Internal Hydrogen Embrittlement (IHE), where the source of hydrogen comes from the manufacturing process and Environmental Hydrogen Embrittlement (EHE), where the hydrogen source is usually a by-product of Cathodic Hydrogen Absorption from localized corrosion. It is important to remember that hydrogen embrittlement does not occur unless several key factors intersect in sufficient quantity. Those factors are material susceptibility, presence of hydrogen, and tensile stress. Today we know that the most influential of these factors regarding hydrogen embrittlement risk and ultimate failure is material susceptibility. Long-term research has shown that fasteners become highly susceptible when they possess a Rockwell Hardness above HRC39. That means that all metric property class 12.9 parts and inch socket head cap screws processed to ASTM F574 are quite vulnerable. It is for this reason that metric PC12.9 and inch socket head cap screws should not be zinc plated.

The two most common and concerning sources of hydrogen for IHE are from part cleaning and electroplating. Both are parts of the electroplating process. Recent research into hydrogen embrittlement in fasteners has identified that not all platings are the same. In fact, platings that create dense, very impermeable layers are higher risk for hydrogen embrittlement than those that possess a more permeable layer. The reasoning for this is that the more permeable finishes have more pathways to allow the hydrogen to get out. Electroplated zinc happens to form a very impermeable layer. Thus, zinc plated parts are at higher risk than those possessing many other platings and coatings. It is also the reason that manufacturers and users of high strength fasteners (metric fasteners in PC 12.9 and above and inch fasteners above 150,000psi) should take great care when using zinc electroplating on these parts. In fact, the best practice would be to avoid zinc (or any other high-risk electroplating) altogether on these high strength (highly susceptible) parts. However, if a customer is resolute on using zinc electroplating on highly susceptible parts it is important that the manufacturer takes every step to minimize hydrogen embrittlement, including baking for sufficient time (like 16 to 24 hours or more), testing each lot for hydrogen embrittlement, minimizing the plating thickness, and only using applicators that employ statistically controlled plating processes.

A: Yes. As mentioned above, when hexavalent chromates were banned in favor of trivalent and non-chrome systems, it posed problems with eliminating color choices and lessening corrosion protection. Much has been accomplished in the last twenty years to reestablish some of this lost performance. Today trivalent chromated systems can be obtained with both yellow and black coloring that does not depend on dye additives. These color choices are ultimately improving in UV stability since they depend less on dyes. Sealers are now added to almost all zinc plating systems. These topcoat sealers can dramatically improve corrosion protection and usually do so without adding significant thickness to the zinc layer.

Torque tension ability (lubricity) has also become a key feature desired by many customers. Friction modifiers lessen the effort to drive fasteners, making zinc plated, friction modified fasteners desirable for ergonomic and safety reasons. Additionally, friction modified parts lessen the amount of variation in both torque and tension during installation. Even small reductions in installation variation can keep an assembly line running more smoothly.

About thirty years ago, zinc alloy platings began to emerge. These included Zinc-Nickel, Zinc-Iron, Zinc-Cobalt, and Zinc-Tin. Each of these zinc plating alternatives have strengths that make them interesting to application specific uses. However, in the last ten years Zinc-

Tariffs and the appreciation of the New Taiwan Dollar have impacted Taiwan's manufacturing industry. These two topics were the main focus during the conference held on September 4, 2025, at Taiwan CSC headquarters. In the conference, Mr. Yung-Yu Tsai, Chairman of Taiwan Industrial Fasteners Institute (TIFI), stated that due to severe involution within China, Chinese fastener products are being dumped worldwide, competing with Taiwan's fastener exporters and even causing difficulties for some Taiwanese companies with factories in China.

▲

Yung-Yu

Tsai, TIFI Chairman

Regarding the U.S. market, Chairman Tsai observed that the impact of Trump's tariff policies has not been fully reflected; and therefore, has not drastically affected the business of U.S. importers or the domestic U.S. market. However, importers are reluctant to import because they will have to bear a 50% tariff on fastener products plus an additional 5% to 7% interest, significantly increasing operating costs. In that sense, buyers prefer to purchase locally in the U.S.

Chairman Tsai extended from that phenomenon with a former example: during COVID-19, global shipping costs soared, yet buyers still placed large orders to Taiwanese fastener manufacturers despite the high costs. Even when Taiwanese fastener prices increased, record order volumes were still achieved. Now putting this example in perspective, we can tell that the decline in orders for Taiwanese companies this year is not due to pricing but rather disruptions in international supply chains and structural changes in demand.

From this perspective, Chairman Tsai said Taiwanese companies should avoid competing solely on low prices and

instead be patient. "The U.S. market still holds opportunities for us, and collaboration between American and Taiwanese manufacturers remains beneficial. For Taiwan's fastener industry, the scenario is not going to be any worse than where we are now," he emphasized, "Taiwanese fastener manufacturers aren't just ‘manufacturing’, but prioritizing ‘service’. The fasteners we sell are not just usable; they are critical fasteners that ensure life safety. We have higher quality, better service, and a stronger brand image than China and Southeast Asia!" He believes Taiwan's quality advantage is irreplaceable, so Taiwanese fastener manufacturers must have confidence in themselves amid these challenges.

After Chairman Tsai’s speech, Taiwan CSC presented an analysis of the current situation in a briefing, stating that the impact of Trump’s tariffs on global manufacturing procurement and inflation is not as severe as initially expected and predicting a high possibility of interest rate cuts before the end of the year. Taiwan CSC also noted that China's steel production cuts have helped improve global supply and demand mechanism, yet China's steel exports from January to July this year still increased by 11%. Overall, Taiwan CSC’s market outlook for the fourth quarter is positive. Uncertainties are fading, markets are seeking stability amid fluctuations, supply and demand momentum are coming back, and a peak season effect can be expected, leaving room for market growth and opportunities.

Finally, regarding the fastener industry, data provided by the Taiwan Industrial Fasteners Institute showed that Taiwan’s fastener exports reached 751,800 tons in the first seven months of 2025, a yearon-year increase of 1.58%. The average unit price was 3.47 USD per kilogram, a decline of 0.84%. Exports of wood screws, self-tapping screws, and bolts all grew slightly, but nut exports decreased. In addition, Taiwan’s fastener exports to the U.S. during the same period declined by 0.95%, while exports to Germany increased significantly by 24.75%, indicating changes in the destination structure of Taiwan’s fastener exports under current conditions.

Copyright owned by Fastener World Article by Dean Tseng

Q1:First of all, congratulations on your new appointment as NFDA president. Could you please share your thoughts on being elected as president of the association for 2025-2026? At the same time, could you please briefly talk about your professional background and past industry experience, and how these background and experience will help you play the new role?

A: Thank you, it's truly an honor to give back to an industry that has given me so much over the past 30 years. I got my start in the fastener business as a young man working in a warehouse, learning the ropes of products, operations, and everything in between. I spent nearly two decades in master distribution with Porteous Fastener Company and continued with Brighton-Best after the acquisition. For the past 10 years, I've been part of the Procurement team at Wurth Industry USA.

Having grown from warehouse roles to regional sales at Porteous, I’ve had the opportunity to work closely with a wide range of distributors and develop a strong understanding of their needs. Now, on the procurement side at Wurth, I’ve gained a new perspective on the challenges facing distributors—both large and small—and how those challenges continue to evolve.

Q2:Tariffs against all steel and aluminum imports and exchange rates are the top concerns for global fastener manufacturers in 2025. Based on your observation, what are the main impacts of these two issues on the US fastener industry (incl. manufacturers/distributors/ importers)?

A: I believe there’s still a fair amount of uncertainty when it comes to tariffs and exchange rates. Tariffs are intended to protect national security and support the revitalization of domestic manufacturing. However, rebuilding the infrastructure needed for steel production—and developing a skilled workforce for fastener manufacturing—will take years. In the meantime, market demand remains steady, and imported fasteners will continue to play an essential role. As for the impact, we’re seeing rising costs and a variety of approaches in how those increases are being passed through different distribution channels.

NFDA President Ed Smith

Compiled by Fastener World

Q3:Apart from steel and aluminum tariffs and exchange rates, what other issues and trends are also worth paying attention to in the US fastener industry at present?

A: Business acquisition and consolidation continue to be major trends in the industry. We’re seeing increased activity from private equity firms acquiring companies, as well as closures driven by a range of factors—such as owners retiring or a slowdown in demand forcing businesses to shut their doors.

Q4:(Following Q2 and Q3) Have US fastener distributors and importers responded to these challenges and trends in any way?

A: That’s a tough question, as the challenges can vary widely depending on where you are in the market. That said, given the ongoing uncertainty, I believe it’s essential for U.S. fastener distributors and importers to stay informed about tariffs, understand how they may impact their business, and be prepared to adapt accordingly.

Q5:Based on the latest market research reports and data indices, which fastenerdemanding industries in the US do you think have a potentially growing market?

A: I believe the markets will continue to be diversified with the growing segments being tied to modernization, sustainability, and high precision manufacturing – namely EV automotive, aerospace/ defense, construction/infrastructure, electronics and renewables. Demand is driven by material innovation, manufacturing automation and reshoring of key industries.

Q6:What are the main plans and goals you wish to accomplish during your tenure as president (internally and externally)?

A: It’s simple: we must stay true to our mission of helping members thrive in a global marketplace. This means continuing to grow our membership by offering fresh and meaningful learning and networking opportunities at our in-person events. We also want to provide resources that support our members in developing their teams, with a strong focus on attracting and retaining talent in the industry. Additionally, I’d like to see NFDA become more inclusive by welcoming anyone interested in what we offer, even if they feel they don’t quite fit the mold. Give NFDA a chance and let us help change your perspective.

Q7:NFDA maintains close ties with major associations in Europe, the U.S., and Asia, and many NFDA members have close partnerships with overseas fastener manufacturers. How do you plan to assist NFDA members in strengthening their collaboration with key overseas suppliers (especially those in the Taiwanese supply chain) in the future?

A: Many of our members work closely with overseas suppliers, particularly in Taiwan, a key player in the global fastener market. As an association, we aim to support these relationships through open communication and industry collaboration. It’s about giving members the tools to make informed sourcing decisions, wherever opportunity aligns with

Q8:As Taiwanese fastener manufacturers or other Asian manufacturers are part of the US fastener supply chain, what advice would you give them?

A: My advice is to stay the course and maintain open, frequent communication with your U.S. customers. While we may see shifts in certain commodity products, demand for fasteners produced in Asia and around the world will continue.

Q9: What other important activities or training courses has the NFDA planned for 2025 and 2026?

A: We have two events coming up to close out 2025: a virtual session on Fastener Certifications and Test Reports on October 1st, and our Executive Summit in Key West, FL, from October 15th to 17th. Currently, no virtual events are scheduled for 2026, but our Learning Committee is actively reviewing key industry topics and will announce the upcoming schedule soon. Looking ahead to June 2026, we’ll gather in Indianapolis, IN, for our Annual Meeting and ESPS.

Q10:What are your expectations for the market outlook for 2025-2026?

A: I expect market demand to remain steady, with moderate growth through 2026, driven by core industries such as automotive, construction, aerospace, and high-tech manufacturing. Tariffs and exchange rates will continue to be top of mind and will undoubtedly influence sourcing strategies as we adjust to what feels like a new normal.

Q11:Is there anything else you would like to share with our readers?

A: Thank you for the opportunity to participate in this interview. I’ve been a longtime reader of Fastener World Magazine, and it’s an honor to share some of my insights with fellow readers. I appreciate your time and the chance to contribute.

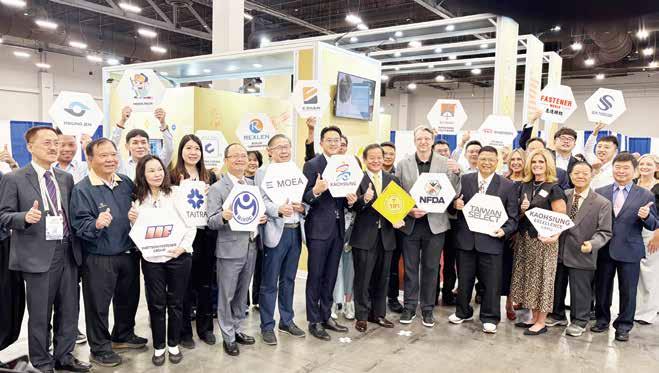

From September 16 to 17, 2025, the International Fastener Expo (IFE) grandly opened at the renowned Mandalay Bay Convention Center. As one of the largest professional fastener exhibitions in North America, the show gathered fastener products, related technologies, and peripheral service suppliers from around the world. Taiwan, Turkey, and India specially set up their own pavilions, providing an important platform for industry professionals to exchange ideas and collaborate.

This year, Taiwanese exhibitors were led to IFE by Fastener World, the sales agent for Taiwanese booths, bringing together 60 quality Taiwanese exhibitors. The exhibitors included: Ably Screw, Aeh Fasten Industries, A-Stainless International, Bear Fastening Solutions, Bi-Mirth, Chite Enterprises, Chong Cheng Fastener, Din Ling, Dragon Iron Factory, E Chain Industrial, Evereon Industries, Falcon Fastener, Fang Sheng Screw, Feng Yi Titanium Fasteners, Fong Prean Industrial, Fong Yien Industrial, Fontec Screws, Foss Reach Manufacturing, Gofast, Homn Reen Enterprise, Hong Yuan Pm, Hsiung Jen Industrial, Hu Pao Industries, Hwa Hsing Screw, J.C. Grand, Ji Li Deng, Jin Hsiang Enterprise, Jung Shen Technology, K. Ticho, Katsuhana Fasteners, Kingwin Precision, Kuntech International, Kwantex Research, L & W Fasteners, Link Upon, Linkwell Industry, Mao Chuan Industrial, Metal Fasteners, Mols Corporation, Pingood Enterprise, Ray Fu Enterprise, Rexlen, Rong Yih Jiang, Shaw Guang Enterprise, Sheh Fung Screws, Shinn Rung, Sintec, Soon Port International, Spec Products, Special Rivets Corp., Sun Through Industrial, Taiwan Industrial Fasteners Institute, Taiwan Metiz Alliance, Taiwan Precision Fastener, Taiwan Shan Yin, Wattson Fastener, Wei I Industry, Yiciscrew, and Yow Chern.

The exhibits from Taiwanese companies covered high-strength screws, nuts, special fasteners, dies, equipment, and smart manufacturing solutions, showcasing Taiwan's competitive and diversified strength in the global fastener supply chain. Meanwhile, Taiwan Industrial Fasteners Institute also organized a group to exhibit, consolidating Taiwan’s industry power and jointly promoting its brand image.

In addition to exhibitors, the show attracted strong attention from Taiwanese government officials and research units. Economic Development Bureau of Kaohsiung City Government, Taiwan Industrial Fasteners Institute, Industrial Technology Research Institute, and the International Trade Administration (MOEA) all sent representatives to demonstrate the determination of the government and industry to jointly expand international markets. In the show, Fastener World’s staff on-site actively interacted with local US importers, distributors, and end buyers to promote Taiwanese suppliers and successfully helped build multi-party collaboration bridges.

Notably, Fastener World not only served as the sales agent and communication coordinator for the Taiwan region but also facilitated in-depth exchanges between National Fastener Distributors Association and Taiwan Industrial Fasteners Institute, paving the way for future collaboration between the U.S. and Taiwan. On the evening of September 15 before the show, Fastener World held a special gala dinner titled “Fastener World Night” inviting Taiwanese exhibitors and international guests to gather. The lively atmosphere enabled industry professionals from different countries to exchange experiences and explore collaboration opportunities in a relaxed setting, making it a key highlight of the show.

Overall, IFE 2025 not only showcased the latest trends in the global fastener industry but also highlighted Taiwan's influence in the international market. Through the efforts of Fastener World and related entities, Taiwanese exhibitors not only strengthened connections with the U.S. market but also successfully expanded more potential collaboration opportunities, laying a solid foundation for future international development.

Copyright owned by Fastener World / Article by Gang Hao Chang, Vice Editor-in-Chief

resource integration to build a joint platform, thereby responding more efficiently to the U.S. market needs and providing one-stop comprehensive services.

James Lee, General Manager of Chiang Shin Fasteners Industries, also shared experience of LindFast’s long-term collaboration with Taiwan. He pointed out that the group’s brands require both imperial and metric products, applied in industries such as automotive and railway. Currently, about 40% of the group’s products come from Taiwan, with the remainder sourced from China and Southeast Asia. He emphasized that Taiwanese suppliers' advantages in special products and technical quality remain a key reason for LindFast’s continuous partnership. James further explained that previously each brand managed procurement independently, but under the current CEO’s leadership, they are moving towards centralized management, consolidating procurement forecasts for the next one to two quarters, then uploading them to a platform for purchasing managers’ use. If Taiwanese suppliers actively collaborate, it will help improve efficiency and deepen collaboration.

Addressing external concerns about geopolitical risks, James expressed optimism. He said that fasteners are a rigid demand that will not disappear due to environmental challenges but will continue to grow with the flourishing of U.S. industries such as construction, oil rigs, and automobiles, along with the promotion of the “Made in America” policy. He acknowledged that the biggest current challenge is that rising tariffs require buyers to manage cash flow more cautiously, but he still believes the market’s “explosive demand” will return soon. He stated, “I encourage Taiwanese partners not to be pessimistic during short-term market downturns. When demand recovers, everyone will be very busy again.”

Overall, this exchange highlighted the close collaboration between LindFast and Taiwanese firms. Whether it is high-quality products, precise market forecasting, or digitized integration of procurement platforms, both sides demonstrate strong complementarity and confidence in ongoing collaboration. As international market demand gradually recovers, Taiwan’s strategic position in the global fastener supply chain will continue to be recognized and strengthened.

On September 17, the newly appointed President of National Fastener Distributors Association (NFDA), Ed Smith, and Vice President Melissa Patel met with representatives from Taiwan fastener industry as well as the Kaohsiung City Government and Taiwanese trade organizations. The meeting took place at the Taiwan Pavilion specially set up by the Taiwan Industrial Fasteners Institute (TIFI) at the IFE show, where diverse exchanges were held. They discussed U.S. market demands, Taiwan-U.S. collaboration, tariff policy impacts, and prospects for future bilateral industry collaboration. Before the exchange meeting, prominent figures from Taiwan and the U.S. from government and industry— including Director Mr. Tai-Hsiang Liao of Economic Development Bureau of Kaohsiung City Government, Chairman Mr. Yung-Yu Tsai of TIFI, NFDA President Ed Smith, NFDA Vice President Melissa Patel, and IFE Executive Vice President Karalynn Sprouse—gathered in front of the Taiwan Pavilion to hold a lively ribbon-cutting ceremony. Witnessed by many exhibitors and visitors, the event underscored hopes for closer and stronger collaboration between Taiwan and U.S. fastener industries in the future.

In the post-ceremony exchange, Ed Smith expressed that domestic U.S. facilities remain insufficient for full self-supply, leading to strong dependence on the Taiwan supply chain. He emphasized Taiwan’s advantage in the U.S. market based on quality and craftsmanship. However, he also noted that under tariff policy impacts, companies must find ways to reduce production costs to offset profit losses. Melissa Patel pointed out that beyond technical advantages, U.S. partners are more concerned about how Taiwanese suppliers can shorten delivery times to improve efficiency.

Chairman Yung-Yu Tsai suggested considering establishing large warehouses in Taiwan to allow clients to place orders in advance for direct delivery, thus reducing tariff-impact costs and speeding up shipment flow. Yung-Hsiang Lai, President of MIRDC, said Taiwan is actively introducing AI to help companies improve manufacturing efficiency and reduce waste. Director Tai-Hsiang Liao noted that local governments in Taiwan help industries by expanding markets, providing financial loans, and employee training, with plans to continuously adapt strategies to meet North American market demand. He invited U.S. industry representatives to participate in the Taiwan International Fastener Show 2026 in Kaohsiung to deepen bilateral exchange and collaboration.

Future participation of Taiwan industry representatives in the NFDA annual meeting and related seminars was also discussed. Ed Smith responded that he is very willing to submit this suggestion for discussion at the next NFDA board meeting. Melissa Patel emphasized that Taiwan has always been an important partner for U.S. businesses and will remain the preferred partner going forward. Director Tai-Hsiang Liao stated that Taiwan-U.S. industry exchanges will continue to be promoted toward efficient production and innovative development. The Taiwan-U.S. bilateral exchange meeting held at the Taiwan Pavilion at IFE was an unprecedented success, not only enhancing mutual understanding between Taiwan and the U.S., but also marking a milestone for deeper collaboration in the Taiwan-U.S. fastener industry.

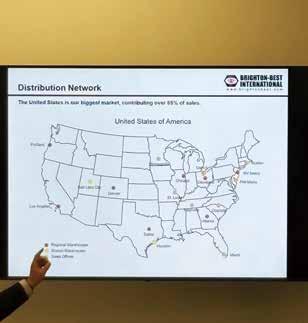

On September 18, Taiwan Industrial Fasteners Institute (TIFI), together with Fastener World and several Taiwanese fastener firms, visited the well-known U.S. fastener distributor BBI (Brighton-Best International) to deepen industrial chain exchanges and collaboration between both sides. In the morning, the delegation visited Ta Chen International’s warehouse and office in the U.S., as well as BBI’s warehouse, and attended a presentation on industry and business strategy delivered by BBI General Manager Jun Xu.

Before the presentation, remarks were given by Director TaiHsiang Liao of Kaohsiung’s Economic Development Bureau, TIFI Chairman Yung-Yu Tsai, and Jun Xu. Director Liao noted that this was the first time Kaohsiung City Government joined TIFI to participate in the IFE show and visit Ta Chen International and BBI. He expressed the government’s hope to promptly understand and assist industry players in overcoming challenges, promote the transformation and international linkage of Taiwan’s fastener industry, strengthen collaboration with distributors, and build a more diverse and stable supply chain. Chairman Tsai emphasized the significant role of Taiwanese businesses in the Asian market but pointed out that facing strong price competition from Indian firms, Taiwanese firms must break away from a mindset of going at it alone and enhance competitiveness through collaboration and

integration. Jun Xu pointed out that while manufacturers face market and customer pressures, distributors like BBI can flexibly adjust by switching suppliers and marketing channels while benefiting from U.S. tariff policies, and highlighted BBI’s competitive advantage in its large inventory.

In his presentation, Jun Xu detailed that BBI specializes in the complex and diverse socket fastener market, offering about 6,000 product specifications to meet different customer needs. After being acquired in 2008 by an investment group led by Ta Chen International, BBI expanded through acquisitions, including Porteous Fastener in 2013, Australia’s EZ Sockets in 2015, and IRONCLAD Performance Wear and Vertex Distribution in 2021, strengthening its business scale and inventory advantages. BBI operates with 80% of its business online, improving customer inquiry and service efficiency, enabling distributors to quickly respond to orders, with about 95% of orders shipped within one day. Regarding U.S. steel and aluminum tariffs, Jun Xu believes that investing in highly complex critical fasteners increases irreplaceability and competitiveness despite tariff impacts. BBI leverages this opportunity with its ample inventory and operational flexibility to maintain control in competition. Currently, BBI holds about 60-70% market share in U.S. distribution channels, with annual revenue near USD 3 billion and serving 3,000 to 4,000 customers. Its main products are medium- and low-carbon steel fasteners, with high-end fasteners maintaining a stable share.

Near midday, TIFI and BBI formally signed an MOU, symbolizing closer collaboration and concluding the visit on a high note. Director Liao pointed out that following the recent U.S. Federal Reserve rate cut, economic growth is expected to continue, and rising demand in U.S. construction, automobile, and public infrastructure will drive fastener market development. Kaohsiung Government and TIFI will jointly support industry players in expanding R&D and sales channels, further deepening Taiwan-U.S. fastener collaboration.

This trip not only strengthened industrial chain interaction but also provided forward-looking strategic insights for Taiwanese fastener firms. It demonstrated that under fierce global competition and tariff policies, enhancing channel integration and collaboration is a key objective for the industry. Taiwan’s fastener industry will continue to deepen international collaboration, strengthen brand and supply chain competitiveness, and promote stable industry growth.

In tandem with the grand launch of IFE 2025, Fastener World (the exclusive sales agent for Taiwanese exhibitors) specially held the "Fastener World Night" gala dinner the evening before the show. The event took place at the well-known Chinese cuisine restaurant Ping Pang Pong, inviting Taiwanese exhibitors to gather together and enjoy a sumptuous meal in a warm atmosphere.

Director Tai-Hsiang Liao of Kaohsiung’s Economic Development Bureau said: "This year brought many challenges, including reciprocal tariffs. The fastener industry remains a vital pillar of Kaohsiung. Recent industrial transformation and new investments, especially in electric vehicles, highlight its importance. The government will continue supporting fastener firms in advancing technology and applications. Attending this show with you all is a valuable learning experience for me, helping to better understand your needs so we can tackle challenges like tariffs and exchange rates together."

Chairman Yung-Yu Tsai of Taiwan Industrial Fasteners Institute said: "Thanks to Fastener World for hosting and the Kaohsiung City Government for their strong support. Working closely with fastener companies at this show has deepened our understanding of the difficulties U.S. clients face under Section 232 tariffs. After the event, the Institute will partner with the government to develop strategies to overcome these tariff challenges. Facing tough competition from Chinese products in global markets, we will also engage clients to consider relocating warehouses to Taiwan, boosting Taiwan's industrial capacity, strengthening Taiwan-U.S. ties, and securing Taiwan’s fastener industry's future."

Fastener World has long been dedicated to promoting Taiwan’s fastener industry. By organizing "Fastener World Night," it not only demonstrates support for the exhibitors but also hopes to unite support through this dining event, working together to enhance the image of Taiwan’s fastener industry.

Tour to Antelope Canyon & Horseshoe Bend

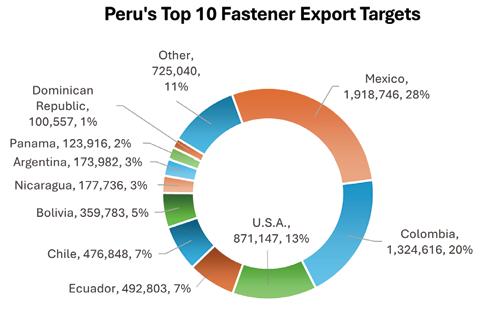

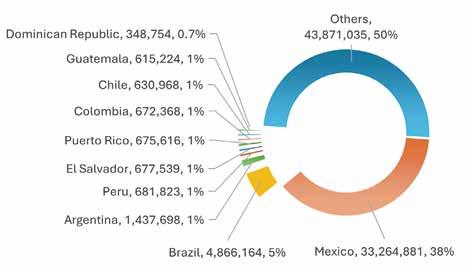

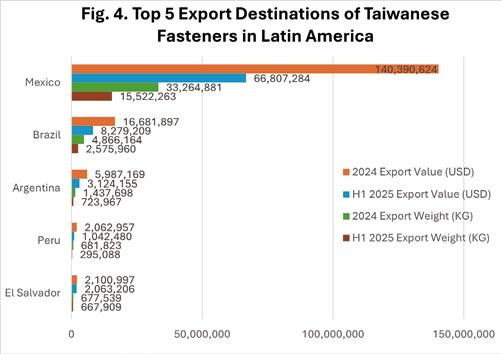

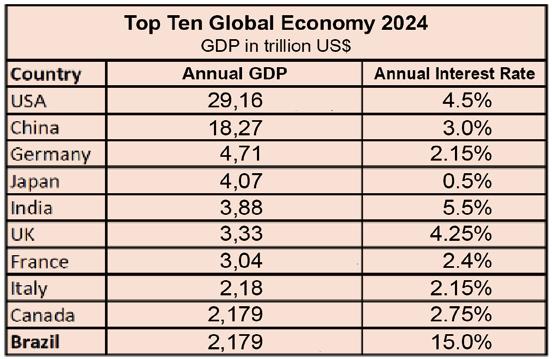

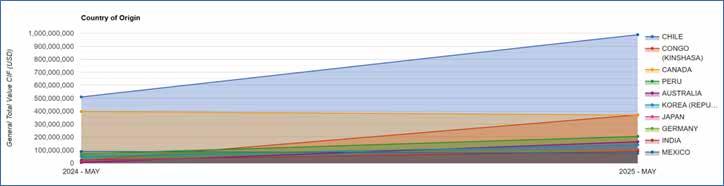

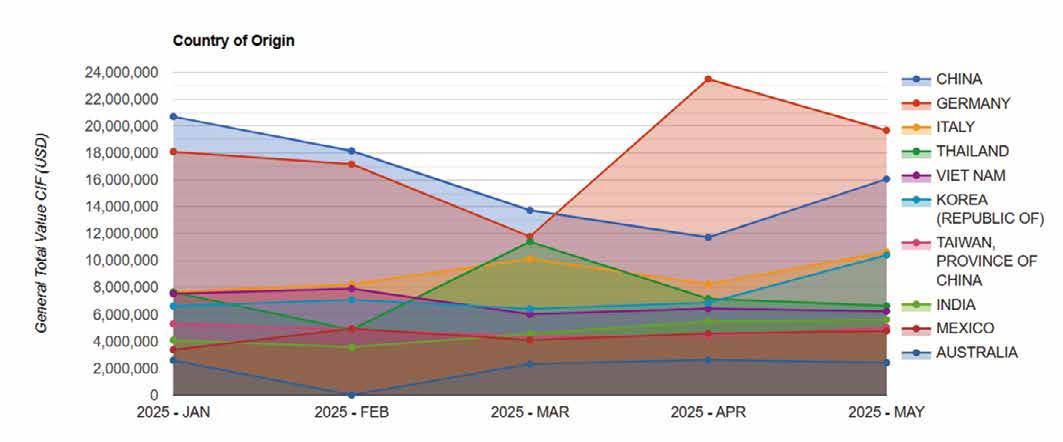

In the context of steadily growing global industrial demand, Latin America is increasingly asserting its importance as an emerging market. With ongoing development in infrastructure, automotive, and manufacturing sectors in this region, the Latin American market for fasteners is expanding steadily and showing a clear reliance on imports. Fierce competition among the United States, China, and Europe contributes to a complex and dynamic international trade environment within Latin America. Taiwan has also gradually penetrated this market, demonstrating its influence within the global industrial supply chain. This report offers an in-depth analysis of the Latin American fastener market in 2024. It examines the trade structure, key country roles, international competitive landscape, and policy risks. The aim is to provide the industry with comprehensive and forward-looking market insights to help enterprises grasp opportunities, meet challenges, and continuously optimize their deployment and strategic adjustments.

The report offers Fastener Products Analysis illustrated with charts presenting trade statistics for Latin America covering the full year of 2024 and partial months of 2025. It highlights the top 15 importing and exporting countries in the region and delves into the primary trade partners of the top 5 countries. It also features Taiwan’s top ten export destinations in the region during the same period to illustrate trade flows between Taiwan and Latin American countries.

The Latin American trade data are sourced from Inter-American Development Bank (IDB), which provides data based on trade values. Taiwan’s trade data come from the International Trade Administration of Taiwan’s Ministry of Economic Affairs, which include both trade values and weights. Given the fact that not all Latin American countries’ data for 2025 are updated to the same month, the time frames of the 2025 data for respective countries have been clearly marked in a separate table column. As for Taiwan’s trade statistics, the 2025 data are currently updated through June. Since not all Latin American countries publicly disclose data, this report focuses the analysis on countries listed by the Inter-American Development Bank.

‧ Ranking of Fastener Trading Countries in Latin America ‧

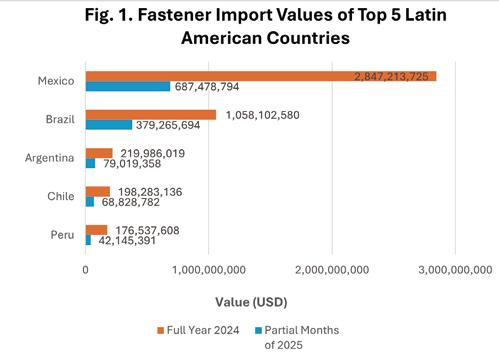

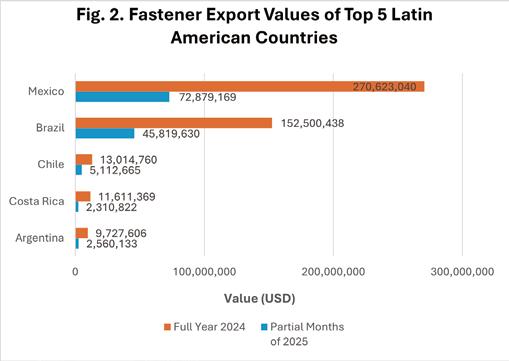

Table 1 ranks the top 15 Latin American countries by their fastener import values for 2024 from the highest to the lowest. The top five were: Mexico (imports of USD 2.8 billion, exports of USD 270.6 million), Brazil (imports of USD 1.0 billion, exports of USD 152.5 million), Argentina (imports of USD 219.9 million, exports of USD 9.7 million), Chile (imports of USD 198.2 million, exports of USD 13.0 million), Peru (imports of USD 176.5 million, exports of USD 6.7 million). Mexico’s import value accounted for about 58.5% of the combined total of these 15 countries—roughly 2.6 times (refer to Figure 1) that of Brazil (21.7%) and 12.9 times that of Argentina (4.5%).

This large gap illustrates Mexico's clear dominance over other countries in the Latin American fastener import market. In terms of exports, Mexico held about 56.6% of the total among the 15 countries, which was 1.7 times (refer to Figure 2) that of Brazil (31.9%) and 27.8 times that of Argentina (2.0%). In other words, Mexico controlled over half of both the fastener import and export markets in Latin America, while Brazil commanded around 20-30%.

The combined total of these 15 countries indicates that the fastener import market size in Latin America reached at least USD 4.8 billion in 2024, while exports totalled at least USD 477.5 million. The region’s overall fastener imports were more than 10 times its exports, revealing that Latin America had a strong dependence on imports for fastener products. For the first three to four months of 2025, import rankings largely mirrored the 2024 pattern. However, there are some changes in export rankings for this period. The combined import value of this period for these 15 countries was USD 1.3 billion, with exports totaling USD 133.2 million.

Table 1. Fastener Trade Values of Top 15 Latin American Countries

HS 7318: Screws, bolts, nuts, threaded hooks, rivets, washers (including spring washers), cotter pins and similar products of iron or steel

This article extracts and analyzes the top five Latin American countries from Table 1, analyzing their top ten import and export trading partners. The data are visually presented side-by-side as pie charts in Table 2

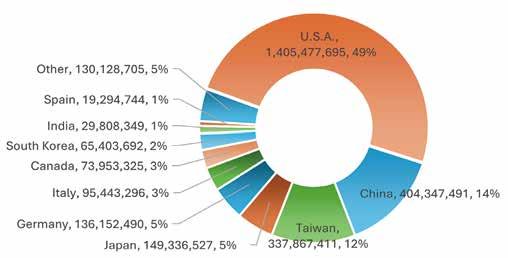

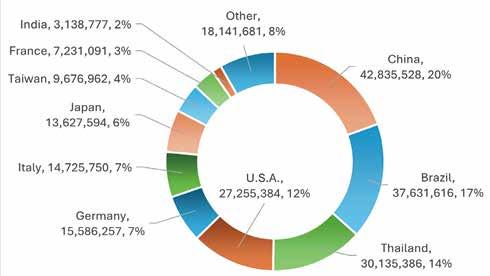

1. The largest import sources for Mexico: The United States, China, Taiwan.

2. The United States held nearly a 50% market share in Mexico.

3. The import proportions from Taiwan and China both exceeded 10%. Taiwan and China were mutual competitors in Mexico.

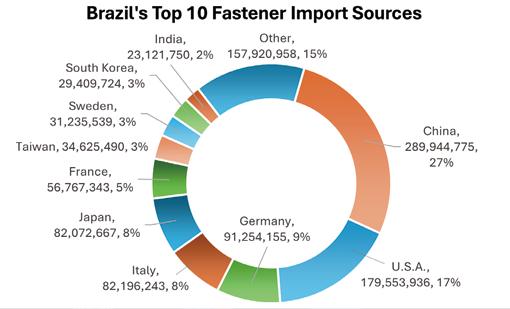

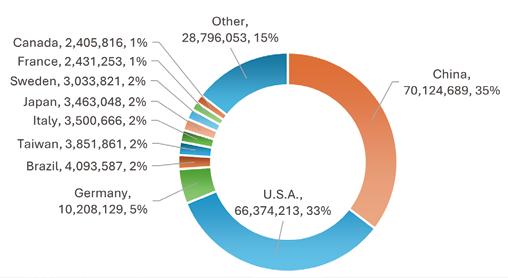

1. Brazil's largest import sources: China, The United States, Germany.

2. China and the United States were mutual major competitors in Brazil.

3. Brazil imported at least 79% from mid-to-high-end fastener manufacturing countries (The U.S., Germany, Italy, Japan, France, Taiwan, Switzerland, S. Korea), at least 25% from Europe, and at least 43% from Asia.

1. The United States dominated Mexico's fastening export market, accounting for as much as 89%.

2. The proportion of Mexico's exports to Latin American countries was at least 5.8%, with Brazil (3%) being the largest recipient.

3. Mexico’s main export destinations were the United States and Latin American countries.

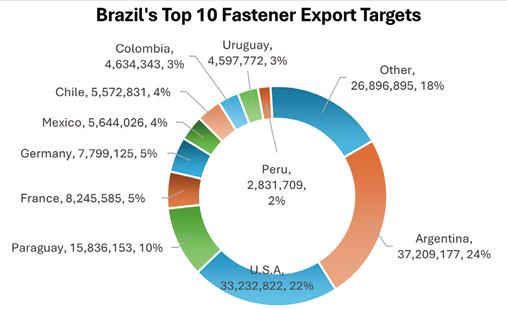

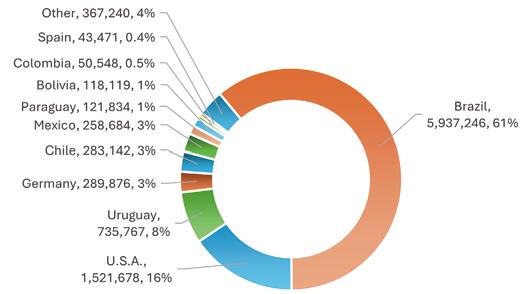

1 Argentina and the United States jointly dominated Brazil's fastener export market, each accounting for about 20%.

2. The proportion of Brazil’s exports to Latin American countries was at least 50%, exports to Europe at least 10%, and exports to mid-to-high-end fastener manufacturing countries (the U.S., France, Germany) at least 35%.

3. Brazil’s main export destinations were the United States and Latin American countries.

1. Argentina's largest import sources were China, Brazil, Thailand, and the United States. These four countries directly competed with each other.

2. Argentina imported at least 39% from mid-to-high-end fastener manufacturing countries, at least 46% from Asia, and at least 17% from Europe.

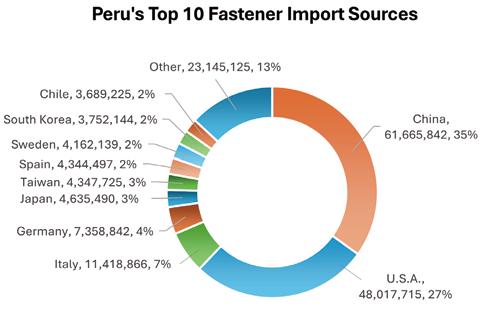

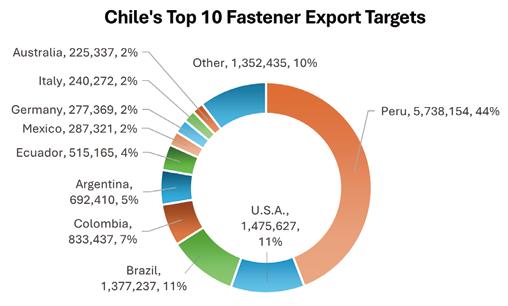

1. Chile’s largest import sources were China and the United States. These two countries directly competed with each other, each accounting for about 30%.

2. Chile imported at least 48% from mid-to-high-end fastener manufacturing countries, at least 39% from Asia, and at least 10% from Europe.