Demand for strong wool springs back

PRICES for strong wool have reached 10-year highs as demand grows and buyers scramble to secure limited supply.

Prices have risen 30% in the past year, with quality full length fleece selling at the January 15 auction for $5.30/kg clean, and exporters saying prices could increase further such is the shortage and growing demand.

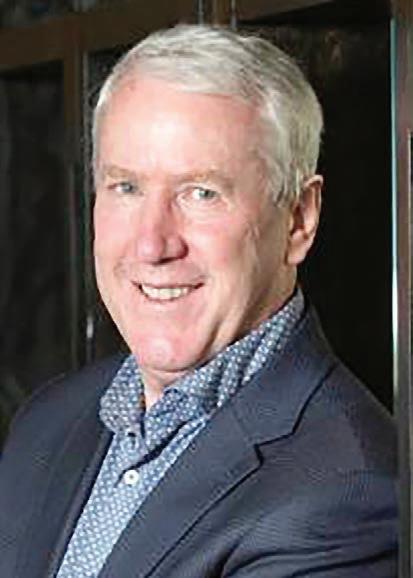

Wool Impact chief executive Andy Caughey said the sector has reached a pivotal point, and Wools of NZ chief executive John McWhirter said the sector has shifted from being oversupplied to being undersupplied.

While prices have improved, they said direct supply contracts between growers and manufacturers would ensure stable, long-term pricing.

Data collated by market analyst company Fusca shows the strong wool indicator hit 475c/kg on January 15. The last time it was at this level was August 2016, before sliding to a low of 162c/kg in January 2021.

Caughey said the resurgent price was caused by a convergence of multiple factors: reduced supply, China replenishing depleted stocks, and new demand.

“There is a whole lot more happening and we must not lose

focus of the underlying current from new and existing categories using wool.”

Those new uses include acoustic tiles and deconstructed fibre in dyes and pigments.

“We are at a point where returns are meaningful for growers and not price prohibitive for manufacturers,” he said.

This price resurgence is despite India, which traditionally takes about 20% of NZ wool exports, in effect being out of the market as it contends with a 50% import tariff imposed by the United States.

Caughey said the European Union will this year or next require the origins of natural fibres to be traceable, a process that favours direct relationships between grower and manufacturer.

There is potential for further growth in China, where consumers seek natural products and commercial property owners are concerned about the environmental impact of fossil-fuel-based office décor.

An analysis by McWhirter shows that since 2015, NZ’s wool clip has fallen 4% a year.

At that rate, he said NZ’s total clip would have halved from 2015 to 2030.

“The decline in production is a significant factor.”

He estimates an oversupply of 40,000 to 50,000 bales in

Continued page 3

Blueberries pick themselves up after floods

One blow after another left Motueka Valley blueberry growers Nicola Heckler and her husband Don fearing the worst for their crop. But, thanks to support from volunteers and local organisations, most plants survived last year’s floods and are producing early season fruit.

NEWS 4

SECTORFOCUS

Uncertainty over govt forestry policies slash expected planting.

NEWS 3

Crops lay ground for sectoral success

New Zealand cropping production is underpinning the productivity of many key primary industry sectors, according to an economic impact report.

ARABLE 18

Barley, not wheat, copped the worst of Canterbury hailstorms.

NEWS 5

Game Council says hunters sidelined on pest eradication plans.

NEWS 14

Photo: Tim Cuff

Neal Wallace MARKETS Food and fibre

Get in touch

EDITORIAL

Bryan Gibson | 06 323 1519

Managing Editor bryan.gibson@agrihq.co.nz

Craig Page | 03 470 2469 Deputy Editor craig.page@agrihq.co.nz

Claire Robertson

Sub-Editor claire.robertson@agrihq.co.nz

Neal Wallace | 03 474 9240

Journalist neal.wallace@agrihq.co.nz

Gerald Piddock | 027 486 8346 Journalist gerald.piddock@agrihq.co.nz

Annette Scott | 021 908 400 Journalist annette.scott@agrihq.co.nz

Hugh Stringleman | 027 474 4003 Journalist hugh.stringleman@agrihq.co.nz

Richard Rennie | 027 475 4256 Journalist richard.rennie@agrihq.co.nz

Nigel Stirling | 021 136 5570 Journalist nigel.g.stirling@gmail.com

Isabella Beale | 027 299 0596 Multimedia Journalist isabella.beale@agrihq.co.nz

PRODUCTION

Lana Kieselbach | 027 739 4295 production@agrihq.co.nz

ADVERTISING MATERIAL

Supply to: adcopy@agrihq.co.nz

SUBSCRIPTIONS & DELIVERY 0800 85 25 80 subs@agrihq.co.nz

PRINTER

Printed by NZME Delivered by Reach Media Ltd

Advertise

SALES CONTACTS

Andy Whitson | 027 626 2269

Sales & Marketing Manager andy.whitson@agrihq.co.nz

Janine Aish | 027 300 5990

Auckland/Northland Partnership Manager janine.aish@agrihq.co.nz

Jody Anderson | 027 474 6094

Waikato/Bay of Plenty Partnership Manager jody.anderson@agrihq.co.nz

Palak Arora | 027 474 6095

Lower North Island Partnership Manager palak.arora@agrihq.co.nz

Andy Whitson | 027 626 2269

South Island Partnership Manager andy.whitson@agrihq.co.nz

Julie Hill | 027 705 7181

Marketplace Partnership Manager classifieds@agrihq.co.nz

Andrea Mansfield | 027 602 4925 National Livestock Manager livestock@agrihq.co.nz

Real Estate | 0800 85 25 80 realestate@agrihq.co.nz

Word Only Advertising | 0800 85 25 80 Marketplace wordads@agrihq.co.nz

PUBLISHERS

Dean and Cushla Williamson Phone: 027 323 9407 dean.williamson@agrihq.co.nz cushla.williamson@agrihq.co.nz

Farmers Weekly is Published by AgriHQ PO Box 529, Feilding 4740, New Zealand Phone: 0800 85 25 80 Website: www.farmersweekly.co.nz

ISSN 2463-6002 (Print) ISSN 2463-6010 (Online)

Contents

Focus

1-15

16-17

18

Farmers . 19-22

23-26

27-28

29

30-31

32-35

36

PLANS: After a long career driven by science and ensuring NZ farming is well positioned globally, Mike Manning is stepping down from the NZ Fertiliser Association with plans to pedal around the globe.

P13

News in brief

Modest GDT rise

The second Global Dairy Trade auction for January produced a modest rise in prices for key dairy commodities and a 1.5% increase in the GDT index.

Whole milk powder was up 1% and skim milk powder up 2.2%, while anhydrous milk fat rose 3% and butter 2.1%. The market rise had been predicted by the dairy price futures market and was a welcome confirmation of the unexpected 6.3% GDT index rise on January 7.

Gas secured

Ballance Agri-Nutrients has secured another short-term gas supply contract for its Kapuni gas-to-urea plant.

It means the Taranaki plant will have enough gas supply to continue to be operational until late March. The contract replaces the short-term agreement it obtained in September last year, which provided the plant with gas until the end of 2025.

Exports grow

The value of New Zealand primary sector exports to the United Kingdom grew 25% in the second year of the free trade agreement between the two nations.

Total primary exports to the UK in the year to June 30 2025 were $1.33 billion, up from less than $1bn in 2022, following the lifting of tariffs and quotas in May 2023 as part of the free trade agreement. A report by NZ Foreign Affairs and Trade noted primary exports grew to $1.06bn in the year to June 20 2024, the first year of the FTA.

FAR directors

Three new grower directors have been appointed to the Foundation for Arable Research board in line with revised mandate to eventually have seven farmers on the board.

The appointments follow the retirement of two long-serving directors, Steve Wilkins and Guy Wigley. The new appointments are Edward White of central Hawke’s Bay, Michael Tayler of South Canterbury and Hamish Irwin of Mid Canterbury.

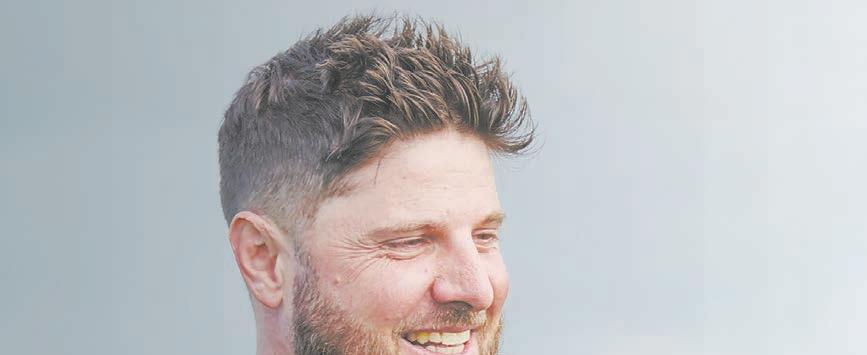

Forestry plantings set to be slashed

Neal Wallace NEWS Forestry

UNCERTAINTY over policies on climate change and forestry has cut the outlook for forecast commercial forest plantings this year by more than two-thirds.

About 60,000 hectares of new forestry were planted in each of the past two years, but the Ministry for Primary Industries expects only about 17,000ha will be planted this year and between 11,000 and 14,000ha for each of the next four years.

New Zealand Forest Owners Association chief executive Elizabeth Heeg said planting intentions have fallen since the adoption of new policies to stop whole-farm conversions to forestry and restrict planting according to land use capability, as well as changes to climate change settings and the Emissions Trading Scheme (ETS).

“While our core focus is the production of timber and value-added wood products,

Continued from page 1

recent years has dampened the market, but that has now been used up.

“We have moved from oversupply to undersupply, which is favourable to farmers.”

Wools of NZ has focused on growing carpet demand as it uses large volumes of strong wool and recently opened an office in Shanghai to service its Chinese customers and to gain insight into that market.

McWhirter said customers understand growers need to be profitable but price rises must be at a sustainable pace. That can be achieved through direct supply contracts, which provide stability and certainty for

the uncertainty around longterm climate change mitigation settings is impacting confidence in our sector,” said Heeg.

The percentage of land in commercial forestry has remained steady at around 6-8% for the past 20 years.

“The changes to the ETS are likely to see this level remain stable.”

An MPI analysis said the

both growers and customers.

“We see the future in long-term stable contracts with international customers who are keen to do that.”

PGG Wrightson South Island auction manager Dave Burridge told Farmers Weekly that the January 15 South Island sale had a 99% clearance and the South Island strong wool indicator rose 38c.

The price of good and average style full fleece were both 9% higher than earlier sales. Second shear was 12% higher and lambswool rose 5%.

Jason Everson, general manager of WoolWorks Grower Direct, said farmers are once again making money from wool.

He said Chinese manufacturers

DROPOFF: NZ Forest Owners Association chief executive Elizabeth Heeg says planting intentions have fallen since the adoption of policies on wholefarm conversions and planting according to land use capability, as well as changes to climate change settings and the ETS.

government changes were designed to redirect planting away from high- and medium-versatility farmland, not to reduce planting overall.

“New afforestation will still occur. However, we expect this to be more integrated with existing land uses, rather than whole-farm conversions.”

Patrick Murray, the owner of Murrays Nurseries at Woodville,

are developing new products and fabrics from wool and recently began using it in bedding, which traditionally used down.

Another positive move was the announcement last April that NZ government buildings will preference the use of wool carpets.

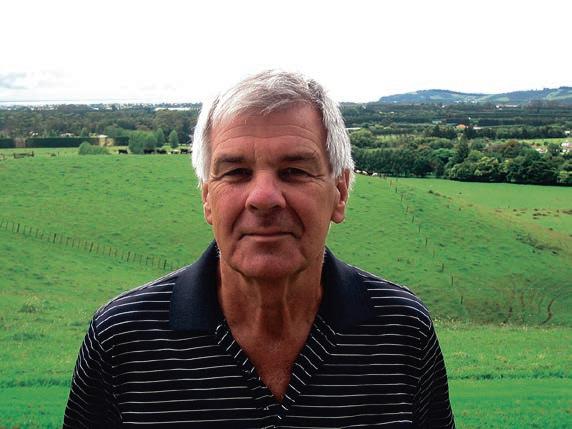

Southland grower Adrian Lawson recently received $5.22/ kg clean for his ewe fleece sold through WoolWorks, $1.41/kg more than he got last year.

It was the highest he has made in 10 years. He said he is once again making money from wool and easily covering his shearing costs.

“There’s light at the end of the tunnel and it seems prices will keep rising.”

said seedling sales this year were about 25% less than last year – which was already about 25% lower than 2023.

“At this stage most prospective investors are not doing anything for a year or two until they see how things work out.

“It’s pretty quiet.”

The price of NZ carbon units traded on the ETS has halved in the past year and is now trading at about $32/NZ Unit (equivalent to one tonne of sequestered carbon), further denting confidence.

For the past two years the government’s quarterly auction of carbon units has failed to attract any bids.

Heeg said while this low carbon price is cooling forestry investment, the full implications will take time to play out.

“More broadly, uncertainty around ETS settings is also dampening long-term investor confidence in the forestry sector.”

Nigel Brunel, the managing director of Marex NZ, describes the market as fragile.

“The regulatory risk, the Class 6 restrictions and low NZ Unit [NZUs] price are all feeding into what we are seeing happening.”

The low price could be an opportunity for forest owners to manage current risks by buying back NZU now.

“At lower price levels, buying NZUs forward to match known or expected liabilities can materially reduce long-term exposure.”

This comes as the government announced a proposed 66% reduction in the cost to forest owners of maintaining the ETS.

Forest owners took legal action against the previous government’s decision to charge them an annual fee of $30.25/ha.

Forestry Minister Todd McClay said he initially proposed a reduction to $14.90/ha but now proposes to reduce that to $10.25/ ha.

Euan Mason from the University

Most prospective investors are not doing anything for a year or two until they see how things work out.

Patrick Murray Murrays Nurseries

of Canterbury School of Forestry said the government’s wateringdown of climate change policies and reduction in planting, will make it difficult for NZ to meet its 2050 net zero greenhouse gas emission targets.

“NZ is struggling to meet its climate change commitments anyway and this certainly is not going to help.”

Carbon sequestration from forestry is a component of NZ meeting those climate change obligations.

Mason accepted wholefarm forestry conversions can negatively impact rural communities but said emission targets could be met by planting forests on low-producing farmland.

“We could do it without destroying rural communities.”

tics

Medium-large clover with ver y high total produc tivit y under a wide range of grazing managements

Blueberries bounce back after battering

Terry PEOPLE Horticulture

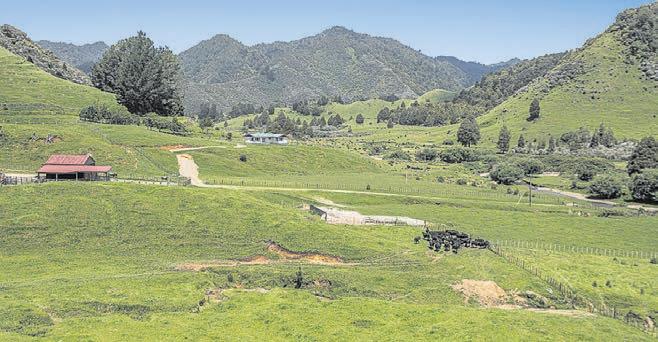

SIX months ago the future of Mill Creek Orchard looked uncertain. Two major flooding events in the Motueka Valley had not only swamped over 18 hectares of productive blueberry bushes, but had left smashed posts and thousands of tonnes of debris and silt.

Then in October, a major storm tore the plastic off more than half the owners’ 88 tunnel rows in an area unaffected by the floods, and which usually provides the early crop, from October to December. The havoc exposed the fruit to the birds the day before the first pick of the season.

“We lost that entire lot, literally overnight,” said Don Heckler, who owns the orchard along with wife Nicola.

Despite this, incredibly the couple have reported a successful season so far with the early fruit, and have just begun picking from the bushes in flood-ravaged areas, which usually fruit from January to June.

“Although productivity overall for the season will inevitably be lower than usual, it’s been a

relief to get some money coming in, rather than it going out in the recovery effort,” Heckler said.

The first heavy rain and flooding hit the Tasman region in late June last year. A state of emergency was declared.

“We were quite positive after that first event we’d still get fruit because we’d had a reasonably big event four years beforehand on 4ha, and we’d got that tidied up pretty quickly and ended up with a reasonable crop.

Everyone rallied around ... it was pretty bloody heartwarming to be perfectly honest.

“So I knew if we could get the plants cleaned off and the silt out as fast as possible, most of them would bounce back.”

Sticklers for a tidy orchard, the Hecklers had regained some semblance of normality when, at the beginning of July, the region’s second major flood event wreaked further destruction. Civil Defence declared it to be the worst flooding in almost 150 years.

“When the second flood came through it was carnage,” Heckler said.

“The Motueka River was literally roaring that night, it was deafening sometimes, so I knew it was going to be bad. After that we just didn’t know where to start.

“We’d already spent two weeks cleaning up from the first one, and the amount of debris with the second flood was incredible – whole trees, logs, baleage: you name it, it was in the orchard. Posts were broken and we lost an entire 4ha enclosed block to the river.”

To make matters worse, a slight injury Heckler endured during the initial flood became infected in the second, leading to sepsis.

“After the first flood there’d been just a bit of a wound, nothing major, and I hadn’t needed stitches or anything, but then the next flood came through and infection set it.” He was hospitalised and nearly lost his foot.

The couple were grateful for the help of their seven fulltime employees, as well as many volunteers, and the support from organisations such as Enhanced Taskforce Green, MG Group, Foodstuffs South Island and Farmlands.

“Everyone rallied around. The community was incredible. We had 70 to 80 people here cleaning off the plants. We even had food donations. It was pretty bloody heartwarming to be perfectly honest.”

Thankfully, like a large proportion of the blueberry bushes, Heckler’s foot recovered over time.

When the couple bought the property in 2011 it had just 1ha of blueberries planted out. They

picked 6 tonnes in their first season. Last year, having expanded since that time to just over 28ha and 17 varieties, they picked 356 tonnes and, during that summer, employed nearly 150 additional staff.

This year it’s likely they’ll need only 100 extra workers due to the reduced productivity after the floods.

As well as the loss of 4ha entirely, some buds were knocked off in cleaning off the grass and debris to enable the bushes to flower, Heckler said.

“Where we’d usually have big trusses of fruit, up to 30 centimetres long, they’ve all got gaps in them this year.

“Also, some of the bushes got cracked in the crown, and although it wasn’t noticeable initially, they can get an infection. Certain varieties can handle it, certain varieties can’t.

“The full extent of damage and productivity is only just really becoming evident, although we know we’ve lost about 20% of the bushes so far. But given the amount of devastation, it’s wonderful that so many of the plants are bouncing back!”

Fiona

RESILIENT: Don and Nicola Heckler at their blueberry farm Mill Creek Orchard in the Motueka River Valley. The farm has been hit by major flooding events.

Photos: Tim Cuff

IMPACT: Don Heckler among plants that were washed sideways by last year’s floodwaters at the blueberry farm he owns with wife Nicola.

PROTECT: Hail netting covers bushes at Don and Nicola Heckler’s blueberry farm.

Don Heckler Mill Creek Orchard

Cleanup underway after wild summer weather

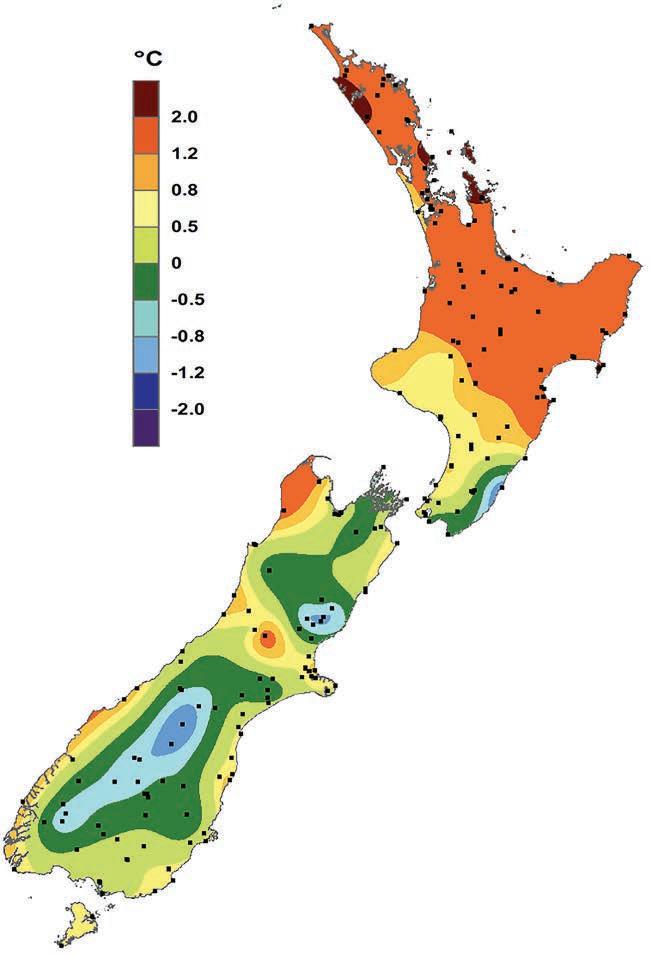

Gerald Piddock NEWS Weather

FARMERS across much of the central and upper North Island are assessing damage and cleaning up after heavy rain caused flooding in Northland, Coromandel and Hawke’s Bay-east coast.

Late last week heavy rain warnings were also in place for parts of the South Island.

Over 300mm fell in many North Island regions, flooding paddocks and rivers, leaving many without power and causing slips that blocked roads as well as other damage.

The flooding has left staff with a major cleanup job at the awardwinning Whangaroa Ngaiotonga Trust’s farm at Whangaruru, north of Whangārei.

They are using a kayak to access one part of the farm to move stock.

Morris Pita Whangaroa Ngaiotonga Trust

The flooding at the bullfinishing farm took out several culverts, creating challenges with farm access. Farm tracks have been blocked and slips occurred on some of the higher country. Around 2km of fencing was lost.

All of the staff members and livestock on the farm are safe, Whangaroa Ngaiotonga Trust cochair Morris Pita said.

The 1100 hectare farm was last year’s Ahuwhenua Trophy winner for the top Māori sheep and beef farm.

Pita said it looked like the district was the epicentre for much of the damage.

They will have a lot of work once

the rain stops to assess and repair the damage.

“We’ll let it dry out and then we’ll crack on, roll up the sleeves and get on with the process of repairing the damage.

“In one part of the farm, farm manager Matt Payne – who is doing an amazing job along with his 2IC – they are using a kayak to access one part of the farm to move stock.”

Pita said the flooding is affecting the entire surrounding community.

“As a community and as a hapū we’ll come out of this stronger.

The people in the north have a real resilience to them and we’ll come shoulder to shoulder, roll up our sleeves and get on with the cleanup and move forward from here.”

Northland Federated Farmers president Colin Hannah said it was now a waiting game for the water to reside so there can be a proper assessment of the damage.

Fonterra Farm Source regional head for the upper North Island Debra Kells said the road closures have delayed collections from some parts of Northland.

Hauraki-Coromandel president Robert Craw said the region had a lot of road closures from slips and surface floods.

There were reports of a couple of farmers with large portions of their farm being flooded. They were being assisted by the Rural Support Trust.

Most farmers had been proactive and moved stock to higher ground and there are no feed shortages.

“The only issue that we’re going to have now is that there’s a lot of supplementary feed floating away. That could pose a problem later on.”

The power was back on for most farmers but, while dairy farmers could milk their cows, tanker access was an issue and some

farmers may have to dump milk, he said.

“There are areas that have had more rain and more damage than Cyclone Gabrielle.”

The weather led to states of emergency being declared by Whangārei District Council, Thames-Coromandel District Council, in Bay of Plenty, Hauraki District and Tairāwhiti.

Hail carnage a bitter pill for beer

Annette

Scott NEWS Arable

THE hailstorms that pummelled Canterbury cereal crops look to have had more of an impact on barley for beer than on wheat for bread.

Two weeks on and as assessments continue, United Wheatgrowers chair Michael Tayler said wheat crops are not looking so bad as initially expected.

“We do have 75 claims for more than 4500 hectares – that is unprecedented – but overall

looking at a 5% loss. Across the 430,000ha grown around the country, it won’t impact supply to the extent we initially thought.

“The 75 farms hit are across Canterbury, in particular many farms along the top of Mid Canterbury up near the Rakaia River, with one of two in North Otago.

“It does appear now that barley crops are looking to be more affected; I don’t think millers will be affected too much.”

Tayler said once all assessments are complete and reports are tallied up, they will go to FMG and it will be another two to three

weeks before the real impact is known.

Federated Farmers arable sector chair David Birkett said outside the cereal crops, essentially all crops affected have been highvalue crops, vegetable seeds and winter feed crops.

“We are trying to understand now how much damage has been done, what that means for winter feed and what affect that will have to feed livestock over the winter.”

Birkett said the shorter-term effect is being felt in crops such as seed peas.

“They are not going to recover now so it’s time to get inventive. There have been peas harvested just for forage that couldn’t be taken through to seed.

“There will be an impact on export contracts where crops have been completely written off, but we don’t know the full outcome yet.”

Meanwhile it’s a wait with bated breath as cropping farmers look to the skies for every available window of harvest weather.

“We are more worried about the weather now. We need to see the sun, there’s ryegrass and cereal crops very close, there’s grass cut and this rain will be on top of that.

“We just need good weather to get started.”

CULVERT: A washed-out farm road and culvert at the Whangaroa Ngaiotonga Trust’s A3 farm near Whangaruru, which was extensively damaged by flooding.

INVENTIVE: David Birkett says it’s been about getting inventive with crops that won’t recover now.

You’re Welcome.

Great outcomes happen when farmers stand together – building scale, reputation, and value that reaches far beyond the farm gate

As we strive to set the bar for what farmers can expect from a processor, we want you to know that when it comes to joining the Co-op, you’re welcome.

Eyes on beef as Mercosur deal advances

BNigel Stirling MARKETS Sheep and beef

EEF exporters are hopeful the fallout from a mega trade deal involving their highestpaying market will be limited.

An agreement between the European Union and the Mercosur group of South American countries, including beef exporting powerhouse Brazil, was signed last weekend after two decades of negotiations.

The agreement with Mercosur – Mercado Común del Sur, or Southern Common Market –still needs to pass through the European Parliament before it can enter into force and tariff reductions commence.

Small quotas negotiated as part of the EU-New Zealand FTA – 3333 tonnes annually, rising to 10,000 tonnes by 2034 – limit how much beef NZ can sell to the EU’s 450 million consumers.

When the agreement was signed in 2022 the Meat Industry Association said in-quota tariffs of 7.5% meant they were likely to

be largely unused by exporters.

However, a director of one major exporter told Farmers Weekly a lot has changed since then.

“The price of beef has probably gone up 40% since, so those tariffs are not as painful.

“The EU has become this phenomenally high-paying market and that quota is gold,” the director said.

Industry statistics show the EU was NZ’s highest paying market for most of 2025, rising from $9 per kg FOB in November 2024 to $13 per kg last November.

While the EU still only accounts for 3% of NZ’s beef exports, these jumped 101% year-onyear, bettered only by the United Kingdom market’s 530% annual increase.

Taylor Preston’s beef marketing manager, Cameron Kyle, said the possibility of a new 99,000 tonne EU quota for Mercosur countries is timely for Brazil as it faces being cut back in the Chinese market following Beijing’s recent investigation into beef imports.

“Definitely ... they would be looking to place some of their

higher-value steak cuts in the EU where they have got access.

“They do already have quite an established presence in the EU and the UK and there is no doubt they will be looking to utilise that.”

ANZCO’s general manager of sales and marketing, Rick Walker, previously worked in Brussels for Fonterra. That background makes him sceptical that the deal will

progress.

Longstanding opposition from European farmers claiming they will be swamped by a deluge of cheap Brazilian beef has not gone away.

European parliamentarians are also likely to be unnerved by estimates of a 25% increase in deforestation that could occur in Mercosur countries as ranchers

The EU has become this phenomenally highpaying market and that quota is gold.

Exporter

clear more rainforest to cash in on increased access to European consumers.

“This deal has been circulating around Europe for years and the Parliament has never been keen so I am not sure why suddenly they would be open to signing it off now.

“The same issues pop up every time,” Walker said.

Walker said he expects the Brazilian beef recently shut out of China will be “scattered” around southeast Asia and North America mostly.

“And remember the projections are that [Brazilian] volumes are going to decrease in 2026 just like in the US and Australia.

“So beef markets are going to be relatively tight.”

MORE: See page 10

Fonterra greenlights South Island organic uptake

FONTERRA is expanding its organic collection to the South Island, where it will take organic milk supply for the first time starting from the 2028-2029 season.

The co-operative has been considering the move for about a year.

Over that time it has engaged farmers to see if they have both the assets and milk volumes to make it possible, Fonterra’s general manager of organics Andrew Henderson said.

“We addressed all of the

questions and got the tick of support to move ahead.”

There is also a group of South Island farmers who have been asking the co-operative to collect organic milk through informal engagement, he said.

The expansion will come on the back of strong global demand over the past few seasons for organic dairy.

“We have a number of customers that would really like us to grow faster and we haven’t been able to keep up with that growth through North Island recruitment.

“We are still very much focused on growing the North Island but we see that to meet that demand in the market growth

requirements, we need to expand into the South Island.”

Some of these farmers are well underway with the organic conversion process and are farming regeneratively, while others are starting at the beginning.

Henderson said he expects that these farmers will meet Fonterra’s certification process by the time they start collecting.

“The milk will be processed at Fonterra’s Stirling plant in South Otago and the co-op will be focusing on recruiting farmers in Southland, Otago and up into Canterbury.

Fonterra’s organic business has been running since 2002, with

Hautapu, Morrinsville and Waitoa UHT producing the majority of the co-op’s organic dairy products. Record highs have been set for the past three years on the back of

SUPPLY: The South Island organic expansion is a result of demand both in the market and from farmers wanting to convert to supply organic milk to the dairy co-operative.

growing demand, culminating in a final payout of $12.35/kg MS last season.

The current forecast for the 2025/26 season is $13.10/kg MS.

SWAMPED: Longstanding opposition from European farmers claiming they will be swamped by cheap Brazilian beef has not gone away.

Photo: Pexels

Gerald Piddock NEWS Fonterra

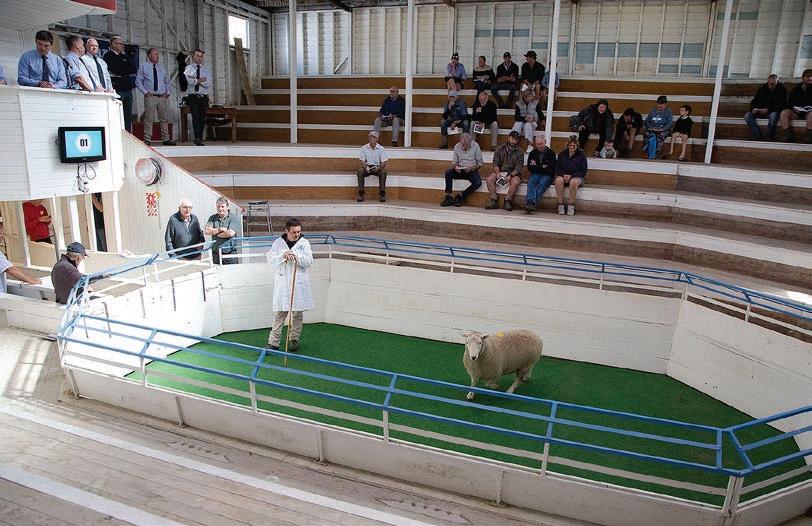

Perendale ram fetches top dollar at Gore fair

Gerhard Uys MARKETS

Livestock

APERENDALE ram took top spot at the Ram Fair in Gore.

Annabel Tripp, from Snowdon Station near Rakaia Gorge, sold Lot 1 Snowdon E337/24 for $14,000 to John Henrickson from Wairarapa.

Last year Henrickson paid the top price at the Ram Fair when he laid out $19,000 for another one of the Snowdon rams.

Henrickson said he paid top price both years because he believes both rams were the top rams on the day and will do well on his farm.

Both years, the highest selling ram also walked away with the people’s choice award.

Tripp said E337 is “quite a correct ram, with a lovely jacket of wool. [He’s] a deep ram, with good data, and is well put together.”

She said sheep and beef farmers have had it tough and it’s good to see positivity in the market, particularly as many farmers are

carrying debt to some degree. It’s good to see sheep farmers rewarded for the work they are doing, she said.

Callum McDonald, genetics manager for PGG Wrightson, said bidders chased the top quality rams.

Though the Ram Fair is a stud sale, he said, commercial on-farm sales have been tracking well with buyers wanting the best genetics that will put meat on lambs. They are “wanting rams that will make money”.

It’s nice to see sheep farmers having a good run, he said.

Fraser Darling, chair of the Perendale Ram Fair committee, said although the highest price was lower than last year, the average sale price was up by $500 to $4042.

He said this year proved commercial buyers can buy good rams for decent prices.

There’s buoyancy in the sheep industry that he hasn’t seen for a while, with high lamb prices and crossbred wool making a comeback.

There are more rams going north

E337 is quite a correct ram, with a lovely jacket of wool. [He’s] a deep ram, with good data, and is well put together.

Annabel Tripp Snowdon Station

from the South Island than vice versa, he said.

Other notable Perendales on the day were Lot 4 Mount Guardian 131/24 selling for $8500 and Lot 24, also from Mount Guardian, going for $8000. Lot 14 Gowan Braes sold for $7000.

Romney Lot 127 from Ian Caird

sold for $4758, Southern Texel Lot 125 from Dodd Farming sold for $5800 and Lot 130 From Blacksdale Stud sold for $5400.

HortNZ backs better planning on land use

Neal Wallace NEWS Regulation

HORTICULTURE New Zealand supports government changes to the Resource Management Act that include the selective opening up of some high-class soils for housing development, quarrying and mining.

The proposal, contained in the first tranche of a wholesale rewrite of the RMA, will allow urban development and rezoning on land use capability (LUC) Class 3 land.

The timeframes for councils to map and identify high-class soils so they can be appropriately managed have been extended until the end of 2027, to align with the replacement of the RMA.

HortNZ chief executive Kate Scott said it is sensible to delay the introduction of Special Agricultural Areas until new

resource management systems are in place.

“We also welcome the government’s intent to better balance the continued use of land for multiple purposes, including highly productive land, while still meeting New Zealand’s growing demand for housing.

“Many of our key horticultural regions face both production and housing pressures, and it is critical the system does not treat these needs as mutually exclusive,” she said.

“We believe that if land is to be set aside or recognised for a specific purpose, such as highly productive land, there must be a corresponding and explicit enablement of its use for that purpose.”

Planning needs to enable the growing of food on that land.

That includes access to water, infrastructure, responding to climate and market pressures and giving growers confidence to make

long-term business decisions.

RMA Reform Minister Chris Bishop said the changes would be made to the National Policy Statements (NPS) for indigenous biodiversity, freshwater management, highly productive land and the NZ coastal zone.

These would make it easier to access gravel and rock for infrastructure, do more in the coastal marine area and increase land available for housing.

The current RMA makes it too difficult to get consent for quarrying and mining.

“It is an unavoidable fact that to build more infrastructure and grow our economy, we need quarries and mines,” Bishop said.

The current NPS for highly productive land was gazetted in 2022 to protect NZ’s most valuable soil, about 15% of the country’s land mass, for food and fibre production.

It predominantly protects LUC classes 1, 2 and 3.

Olivia Smith, Commercial Manager, Spring Sheep Milk Co., 2025 Scholar

DEMAND: Fraser Darling, chair of the Perendale Ram Fair committee, said although the highest price was lower than last year, the average sale price was up by $500 to $4042.

TOP PRICE: From left, John Henrickson, Annabel Tripp, her daughter Georgie and PGG Wrightson auctioneer Ben Mckerchar. Henrickson bought Perendale Lot1 Snowdon E337/24 for $14,000 from Tripp. The ram fetched the highest price at Ram Fair in Gore.

Weirdness, wellness and beer soup on menu

Richard Rennie NEWS Food and fibre

BEER-flavoured soup, the rise of fibre, and the importance of TikTok are all on the radar of food marketers heading into the new year.

Global food market platform

Food Dive has identified a raft of trends for 2026 that include often contradictory consumer expectations, where convenience and indulgence are being sought out in less processed, “cleaner” food products.

Dr Victoria Hatton, head of food research hub Food HQ, said few of the trends identified by Food Dive surprise her as a greater number of younger consumers take more note of their health.

“They want food that gives them a boost, whether it is their brain, their gut or their general health, while some of these products also have a high level of indulgence associated with them.”

While “zero sugar” was a key feature several years ago, the market has moved more towards additives that enhance those health functions.

An example is PepsiCo launching its namesake soda with prebiotics, and Cheetos and Doritos marketed without artificial dyes in them.

MOVING ON: While

‘zero sugar’ was a key feature several years ago, the market has moved more towards additives that promise to enhance health functions, with PepsiCo launching its namesake soda with prebiotics.

milk proteins by a scientist at the Riddett Institute.

“It’s a type of green-washing when, as a consumer, you pick up an oat milk high in protein. You assume all protein is the same. He is unpacking what proteins are better than others.”

She also agreed with Food Dive that “weird is winning” when it comes to getting products across to younger consumers fully engaged with TikTok.

The result is more food companies collaborating with other producers to come up with unexpected combinations, including Campbell’s Company with lager company Pabst Blue Ribbon, for a beer soup.

“Often the longevity is short, but they will be picked up by TikTokkers.

“And if we are going to successfully sell to those consumers, that is where we have to be.”

The continued increase in the use of the GLP-1 type weight loss drug is also driving shifts in food portions and components.

Food HQ’s own work indicates that when the drugs come off patent in China and Canada this year, use is forecast to explode, estimated to reduce grocery spending by 10% per household or $8 billion annually.

No one will be cured of anything by drinking a can of Pepsi with prebiotics in it, but they will feel better about it.

Dr Victoria Hatton Food HQ

She cautioned that NZ exporters may have to seriously consider retooling processing equipment to produce smaller portions and cuts, because of GLP use.

New Zealand dairy is riding a wave of “proteinification” of foodstuffs at present, with many Asian food producers adding protein to multiple food products and touting its health benefits. “No one will be cured of anything by drinking a can of Pepsi with prebiotics in it, but they will feel better about it,” Hatton said. She described this trend of introducing outwardly healthy compounds and ingredients as akin to “dietary green-washing”. It is an aspect of food marketing currently being studied in oat

Food Dive points to fibre as the component coming hard on the heels of protein as the next big functional ingredient.

“Fibre is particularly important when on GLP drugs. Kiwifruit are an example of a NZ-sourced fruit that has enzymes that boost fibre levels in food.”

The upside for NZ food exporters is survey results that have found protein consumption has increased by users of GLPs by as much as 65%, along with an almost 80% increase in fruit and vegetable consumption.

Fast food meals are looking particularly vulnerable to consumption declines.

There is also work being done to develop food-grade bioactives that stimulate GLP-1 production, coming from pulses and vegetables particularly.

High-tech traps tackle northern pests

Hugh Stringleman TECHNOLOGY Pests

TARGET recognition and automatic trap resetting are improving the effectiveness of pest control in two Northland regions.

The high-tech NZ AutoTraps AT520-AI traps are activated when target possums and rats are attracted to baits – and turn themselves off when curious kiwi come along.

The new traps have been deployed for a year in the Whangārei Heads and Pēwhairangi Whānui (Bay of Islands) regions along with earlier AT220 models and trail cameras which send back images, as part of the Predator Free project.

Successful pest control is now considered to be elimination of the target species in districts rather than just suppression,

BALANCE SHEET: Trap life, saving labour and data collection are all positives, NZ AutoTrap operations manager Haydn Steel says.

Northland Regional Council (NRC) biosecurity manager Sam Johnson said.

In the southern, harbourside end of the Whangārei Heads zone, no possums have been detected or caught for the past two months, he said.

Biodiversity has increased with native tree and plant growth and very noticeable increases in bird populations.

NRC is delivering the Predator Free project in the Whangārei Heads with its own staff members on the ground.

In the Bay of Islands, three contract delivery entities on three peninsulas – Russell, Rakaumangamanga (Cape Brett) and Purerua-Mataroa– have recruited and trained local staff.

The three-year projects work with local landcare groups, Kiwi Coast, private home owners, farms and forests, public conservation land (Department of Conservation) reserves, Māori ownership, lifestyle blocks and baches.

Predator Free funding will cease in June this year in the Bay of Islands and next year for the Whangārei Heads project.

Work is underway on a means of alternative funding, encouraged by support from ratepayers, councillors and senior managers, Johnson said.

“We have the new proven technology, excellent results and really strong community buy-in,” he said.

“Look at Te Rāwhiti 3B2 Trust on Cape Brett, for example, where whānau have stepped into field work and administrative roles that flow over to other work the trust is doing.”

NZ AutoTraps 520s have solar panels to power the trap mechanisms, release bait and electron-

Five trade hotspots to watch this year

MARKETS Food and fibre

IF LAST year was the year of the tariff, what will the world of trade look like in 2026? There are five things to watch out for:

• It wasn’t just exporters to the United States who cried foul over President Donald Trump’s Liberation Day global tariff attack. US importers – ultimately the ones footing the bill – were also in an uproar, kicking off multiple legal challenges to the US president’s authority to impose them without congressional approval.

The US Supreme Court, where the cases have ended up, is due to issue a ruling before July. While a negative ruling wouldn’t completely shut down Trump’s ability to unilaterally impose tariffs, it could slow him down. Refunds of tariffs already collected are also a possibility. Large NZ exporters, including Fonterra, Zespri and the Lamb Company, also own importing

We have the new proven technology, excellent results and really strong community buy-in.

Sam Johnson Northland Regional Council

ically report daily activities on a yarn mesh network to the owners’ representatives.

The auto-resetting functions mean much longer intervals between trap monitoring and therefore less disturbance to livestock on farms during calving and lambing.

The battery powered AT220 auto-resetting traps are about $500 each and the AT520-AI twice that price.

NRC has 100 of the AT220s and 52 of the AT520s in service, along with eight artificial intelligenceenabled trail cameras, from Cacophony and Sentinel, that relay

images and classify the species captured.

NZ AutoTraps operations manager Haydn Steel said over 1000 of the AT520s are now working around the country, including on the West Coast, Southern Lakes, Bluff, Otago Peninsula and Northland.

In the Southern Alps the AI selectivity is protecting kea while killing pests like possums, rodents, mustelids and cats, he said.

The standard AT220 numbers have now reached 40,000 traps, here and overseas. Production from the NZ AutoTrap plant in Whakatane is up to 13,000 annually and the company has 30 employees, some part-time.

Exporting accounts for 15% of sales, in Hawaii, the Caribbean and the Pacific Islands, where mongoose is the main target species.

Traps are waterproof and very durable and are connected to the network, a cell tower or satellite. Any notified maintenance or lure

businesses in the US, and could receive refunds directly from the US Treasury.

• Section 201 of the US Trade Act is one avenue available to Trump to continue his global tariff attack should the Supreme Court rule against him. Last October American sheep farmers filed a Section 201 petition to Trump’s Trade Representative, calling for tariffs against Australian and New Zealand lamb imports. However, tariffs would only be possible should imports be found by the US International Trade Commission to be causing “serious injury” to US sheep farmers.

The American Sheep Industry Association followed the petition up last month, urging its 100,000 farmers to write to their congressional representatives to pressure Trump to initiate just such an investigation into Australian and NZ lamb imports.

• NZ Trade Minister Todd McClay and Labour MP and trade spokesperson Damien O’Connor will attend the 14th

biennial meeting of World Trade Organisation trade ministers in Cameroon in March. The last time such a meeting yielded a result for NZ agriculture was in 2015, when the membership banned export subsidies.

And while expectations are low this time around the stakes have never been higher. On the agenda for NZ negotiators are remaining agriculture subsidies currently ticking over at more than a trillion dollars a year and agricultural

tariffs left over after the Uruguay round of global trade talks in the 1990s now costing NZ’s dairy industry alone $1 billion a year.

• Without a breakthrough in global trade talks, NZ will continue with its strategy of bilateral and regional trade agreements to reduce tariffs. Exporters will be waiting for ratification of last year’s trade agreement with the oil-rich states of the Gulf Cooperation Council.

NZ’s FTA with India also needs

EFFECTIVE: The NZ AutoTraps AT520-AI trap has selective pest control and remote monitoring.

recharging needed on one trap in a line can be delayed until more must be retrieved, in the interests of operator efficiency.

Lifespan is five to 10 years or more and a trap will stay productive for months, Steel said.

Each trap has two kill zones, the first one to crush smaller animals like rats, mongoose and snakes, and the second to strangle the larger possums.

The traps meet the mandatory New Zealand National Animal Welfare Advisory Committee regulations ensuring the humane dispatch of target species.

The intervals of lure releases can be changed by trap owners through an app.

“The AT traps are more expensive but when you work out the labour saving, data collection and trap life those prices look more reasonable,” Steel said.

Northland holds a record kill rate of 12 possums a night on an AT220 and NRC reported 28 caught in 14 days in an AT520.

With global tensions rising, could 2026 be the year NZ exporters are caught in the crossfire?

to be passed by both countries’ parliaments before tariffs reductions can commence. Beyond that exporters will be asking what’s next for the government’s trade negotiators now that deals have been concluded with countries buying more than 80% of NZ exports.

• With global tensions rising, could 2026 be the year NZ exporters are caught in the crossfire? Meat exporters experienced the chilling effects of so-called secondary sanctions by the US when it effectively shut them out of the Iranian market a decade ago.

By scaring the Australian banks into refusing to repatriate export receipts out of fear they would lose their US banking licences, a hoped-for revival of the meat trade with Iran was nipped in the bud. Would Trump go as far again with countries dealing with China should Beijing follow through on its threats against Taiwan?

ANGRY: US importers were in an uproar over President Donald Trump’s Liberation Day global tariff attack.

Nigel Stirling

Beyond the Farm Gate: Diversi cation or Expansion for NZ Farmers?

Lower Rates, Higher Potential: The Rural Opportunity in 2026

In recent issues of this publication, we have discussed the potential value of adding diversification to your investment portfolio through off-farm investment.

A generational shift is occurring which could see over $150 billion in rural assets change hands, making the question of how best to invest farm capital more valuable than ever. Succession, risk management, and business resilience are top-of-mind for some of New Zealand’s farming families.

There are a range of investment opportunities available, each with their own set of risks and returns. Over the years, we have seen high investor interest in rural commercial property investments, particularly from investors looking for regular income.

As for all investments, returns from property can fluctuate over time as interest rates, market forces and other factors interact. In this article, we will discuss this investment cycle, what we have learnt from investing in this sector, and why MyFarm sees 2026 as an opportune time to consider an investment in rural commercial property.

What we mean by “rural commercial property”

As we know, farming is a cyclical business. At present, we have the bene t of a low exchange rate, reasonable commodity prices, falling interest rates and farm values which are probably trending up, all of which is good. But farming families with foresight are looking through these good times and planning for the long term.

Rural commercial property sits inside the agricultural value chain: think cool stores, distribution hubs, specialist processing and storage facilities, Recognised Seasonal Employer (RSE) accommodation, farm supply outlets, laboratories and genetics facilities that enable the sector to function. As investments, these properties can typically be leased long-term to operating companies, often with regular CPI adjustments and market rent reviews, with most property outgoings passed on to the tenant. In plain English: you receive rent for the tenant’s permitted use of the premises under the lease—not for taking production or price risk. Farmland and rural commercial properties are two types of assets, each offering distinct financial returns.

With more than half of all farm and orchard owners to reach retirement age in the next decade, according to the Rabobank’s 2025 white paper, Changing of the Guard –Stepping up the Succession Conversation in New Zealand Farming, it makes sense that now is the time to plan and prepare. Traditionally, many farmers have chosen to expand their businesses during good times by buying more land. This approach o ers scale, operational control, and a sense of legacy. However, investment considerations are changing, some farmers are contemplating diversi cation through o -farm investments, allocating capital into assets outside the core farm business, such as equities or land-based investments. So, this raises the question, where to from here?

The right answer will depend on your goals, risk tolerance, family

Farmland income depends on production and commodity prices; rural commercial property converts the same agri-demand into lease-backed, often inflationlinked rental income. Returns on the farm often have little correlation with lease income from rural commercial assets—useful

circumstances, and appetite for change. Below, we compare the two approaches, drawing on sector commentary, research, and specialist practical experience.

Diversi cation via O -Farm Investment

in diversifying your investments when you want stability for retirement or intergenerational planning. If you already own or operate an economic farming unit and want more certainty in your off-farm income stream, rural commercial property can help to deliver it.

Why we believe 2026 is a good time to invest

O -farm investment diversi cation means allocating capital into assets beyond the farm gate. This could include

There are several reasons why we consider 2026 an opportune time to invest in rural commercial property.

Lower OCR rates mean lower debt servicing payments: Debt costs have fallen over the past 18-months and are considered by many to be near the trough (or as low as many analysts expect them to go).

Still-recovering property prices provide potential for attractive cap rates and investor returns. Property prices, whilst recovering in places, remain well below their previous highs, providing the ability for attractive cap rates (the comparison of the return you get from lease income compared to purchase price). Based on previous cycles, a period of lower interest rates could lead to further recovery of asset prices in the coming years. Indicators would suggest that the market is closer to the start of an upswing in property prices than the end, meaning now is a good time to buy.

O -farm investments may also help with succession planning, allowing liquid assets to be more easily split among family members or their income used to support Mum and Dad’s retirement independently from the farm business. Certain investment structures may o er tax e ciencies which are complimentary to taxable farm income.

Investing outside the farm gives access to growth sectors like

over 7.5% per annum cash yields, subject to asset, tenant covenant and financing terms.

period benefited most from cheaper debt and firming (increasing) asset values.

Comparative table: O -farm investment vs. buying another farm

Factor O -Farm Investment Diversi cation

Risk

Liquidity

Succession

Returns

Tax

Emotional Value

Resilience

Capital Requirement

In short, we are seeing a favourable balance of market forces for new property acquisitions in 2026: lower debt costs and still-competitive asset prices. This combination provides the opportunity for higher “carry” (rent yield minus cost of debt) and investor returns.

Our experience and learnings As with any investment class, rural commercial property comes with its own set of opportunities, challenges and risks that can affect potential returns. Experience, insight and resilience are all important to help uncover the best opportunities and overcome challenges when they arise.

Spread (multiple sectors, less correlated)

Higher (managed funds, shares, property syndicates)

Flexible (liquid assets, easier to allocate)

management, simpli es decisions, and supports technology adoption. If the farming business grows large enough this can, of itself, provide for family succession.

What ultimately distinguishes an investment manager is not the absence of these challenges, but the capability to navigate them— calmly, methodically, and always with investors’ interests at the forefront.

However, challenges arise when concentrating risk, as income and asset values become dependent upon the risks applying to a single commodity or sector, from market uctuations, climate change, or disease. Liquidity presents another issue, with land periodically being di cult to sell or divide. The complexity of succession is heightened if heirs lack either the interest or the capability to take over the family business. Capital demands may be considerable, requiring substantial initial investment as well as ongoing debt servicing.

As a recent example that reflects MyFarm’s commitment to active management, following Cyclone Gabrielle and the resulting drop in local apple production, a group of cool stores became untenanted. We worked closely with the bank and investors to protect asset value, drew on our networks to secure a new long-term tenant, and, with the support of investors, established a development plan that positions the asset for future growth.

The point is, despite detailed planning and active management, things don’t always unfold as intended and unexpected issues can arise in any asset class. What matters most is having the tenacity to identify solutions quickly and to execute them well.

Ready to learn more?

Whether you choose to expand your farm business or diversify through o -farm investments, the key is to match your strategy to your family’s needs, risk appetite, and long-term vision. As New Zealand’s farming sector faces its largest-ever intergenerational transfer of

Expanding Farm Business (Buying Another Farm)

If 2026 is your year to consider new income streams, or to diversify, we believe rural commercial property deserves a place on the list of considerations.

Concentrated (commodity, climate, sector)

Lower (land can be illiquid, slow to sell)

Complex (hard to split, may force sale)

Management Requires nancial literacy, external advice Requires operational expertise, time, and focus

kiwifruit, solar, forestry, rural commercial property (the o ers that MyFarm have available), or more broadly, managed funds, or equities. The aim is to create income streams that are less correlated with farm returns, reduce exposure to commodity cycles, and provide cash and assets (and liquidity) for succession and retirement.

What we’re targeting in 2026

We’re pragmatic about liquidity: unlisted commercial property should pay a margin over “money in the bank.” With deposits sitting around the low to mid 3% range in late 2025/early 2026 and debt costs aligned to a ~2.25–2.5% OCR, we’re aiming to bring new syndicates that deliver around or

If in the right structure, these assets can provide better liquidity than farms, making cash more accessible for emergencies or new opportunities.

Variable, collectively often more stable and predictable Potentially high in strong years, capital appreciation, can uctuate based on point in cycle.

Passive income, potential tax advantages

Lower (less direct involvement)

Variable, often lower

• Period 2 (2023 to 2025), we saw the cycle turn: interest rates rose sharply, meaning higher debt servicing costs for new acquisitions and slimmer free cashflow. As fixed debt rolled off lower rates, servicing costs rose. Property values fell and cap rates increased. This was hard on existing owners, but better for new acquisitions. Some of our acquisitions during this period benefitted from (and continue to benefit from) investor distributions in the 9-10% p.a. range.

More resilient to downturns in any one sector

kiwifruit, renewables, and commercial property, without the need for direct management.

MyFarm has invested across the rural commercial property sector for close to a decade, with a portfolio that includes large scale poultry facilities, RSE accommodation, a modern food distribution centre, and specialist cool store assets. We work alongside nationally recognised partners including Hortus, Southern Cross Horticulture, and Tegel.

Expanding the Farm Business

Active income, need to manage tax

High (connection to land, legacy)

Vulnerable to sector shocks

• Period 3 (2026 onwards), this period is currently characterised by lower debt costs and still-competitive asset prices.

High (land purchase, debt servicing)

MyFarm offers a range of offfarm investment opportunities to wholesale investors, including our current offer, Duncannon Horticulture LP: a lease-based rural commercial property investment, forecast to pay monthly distributions of 7.5% p.a. Visit our website www.myfarm.co.nz to find out more.

Open to wholesale investors only.

wealth, the question is not just how to grow, but how to secure the future.

Disclaimer:

Our experience across multiple market cycles has enabled us to continually adapt to shifting conditions and enhance our strategies. Over the past decade, the investment cycle can be segmented into three distinct periods:

On the ip side, investing o the farm can present several challenges. One is the loss of control, as there is less direct in uence over how these investments perform compared to managing your own farm. This change requires a trust in external managers or advisers to make sound decisions on your behalf.

• Period 1 (2018 to 2022), falling interest rates lead to rising property prices. Our acquisitions early in this

This could be through buying another farm, with the extra land either complimenting the core operation ( nishing block, runo ) or expanding it. This approach is familiar, tangible, often emotionally satisfying, and does provide advantages. Larger scale can lower costs, boost bargaining strength, and improve machinery and labour e ciency. Focusing on one enterprise sharpens

Acquiring a property at a good price is only the beginning of the investment journey. Unless you are purchasing rural commercial property outright and managing it yourself, your long-term outcomes rely heavily on your investment manager’s ability to steer the asset through changing circumstances. Over time, markets evolve, tenant needs shift, and operational issues arise—and no asset is immune from challenge.

Disclaimer:

The information contained in this article is for general information purposes only. Any reliance you place on such information is strictly at your own risk. It is not intended to constitute legal or nancial advice and does not take your individual circumstances and nancial situation into account. We encourage you to seek assistance from a trusted nancial adviser, legal or other professional advice.

The information contained in this article is for general information purposes only. Any reliance you place on such information is strictly at your own risk. It is not intended to constitute legal or financial advice and does not take your individual circumstances and financial situation into account. We encourage you to seek assistance from a trusted financial adviser, legal or other professional advice.

Load up with every thing you need for autumn.

The Ravensdown team has all the tools you ne e d to set up a year of grow th Loc al agronomy advice, 70+ exp er t agri manager s, top - qualit y nutrient s, and the game - changing HawkEye Pro are just par t of the package Together, we’ll help you farm smar ter and make ever y dollar count

C all 0800 100 123 o r talk to you r ag ri ma nage r to day.

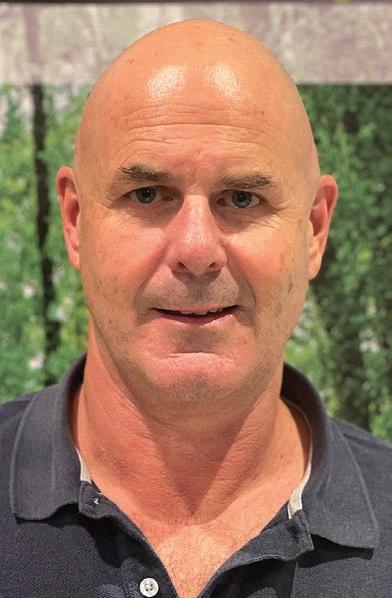

Looking back on an enriching career in fert

Annette Scott PEOPLE Fertiliser

ALMOST 40 years with the New Zealand Fertiliser Association have come to an end for Mike Manning as he looks ahead to retirement – and cycling the globe.

Manning’s journey with the NZFA started in 1998 and since his early days, rumoured to include horseback soil testing in remote hill country, he consistently championed smarter, sciencedriven approaches to industry development through education, research and innovation.

Joining the association board as a representative of Ravensdown and Southfert, Manning quickly became a driving force behind key initiatives.

He supported the development of the Fertiliser Code of Practice, recognising early the need to align industry standards with both farmer needs and regulatory expectations in a post-Resource Management Act world.

He played a pivotal role in backing the Sustainable Nutrient Management Courses at Massey and Lincoln universities and the Certified Nutrient Management Adviser Programme, helping establish robust training, qualifications and career pathways, and was a strong advocate for audited standards like Fertmark.

In its citation, the NZFA said that throughout his tenure Manning navigated evolving challenges with clarity, courage and a long-term view. His calm leadership, strategic insight, and commitment to doing what’s right, not just what’s easy, had shaped both the association and the wider agricultural sector, it said.

“Mike’s legacy is one of integrity, wisdom, and tireless support for farmers and the industry.

“His influence is deeply respected, and his contributions will continue to guide us well into the future.”

Manning’s career in the industry started in 1981 when he joined Ravensdown, going on to join the national association board in 1998.

He said his 37 years, many as cochair of the technical board, have been a privilege, “and I don’t say that lightly”.

“As an industry good organisation, the fertiliser association, when compared to what you might see in overseas countries, is generally regarded very highly for the work we do and the development of the likes of the industry Code of Practice.”

The fertiliser association promotes and encourages responsible and scientifically based nutrient management.

Manning said managing nutrients well is in all New Zealanders’ interests, both for economic benefit and environmental management.

“To promote good management practices, the association develops training programmes, funds research, participates in government and local body working groups, and works closely with other organisations in the agricultural sector.

“The Code of Practice is a big part of NZ’s reputation.

“It’s been tremendously valuable engaging with regional councils, with Federated Farmers , DairyNZ, the beef and lamb sector.

“It’s a foundation document that’s an example of the sort of work the association has done to make sure NZ uses the allimportant nutrients really well.

“When you talk to counterparts overseas, they don’t have much to the level we have in NZ and they look at that with a degree of envy.”

Manning’s key driver for his dedication to the industry is, he said “is the obvious – globally, if the world didn’t use fertilisers, food production would quickly halve; nobody would contest that we simply can’t have half the world starving.

“So how do we go about ensuring that we use it as well as we possibly can; not undersupply because there’s a yield effect; not oversupply because it’s an environmental implication.

“That is the motive that drives me. The fertiliser industry is driven by science and to make sure that we have advice and knowledge, so our approaches are science-based,

many continents of the world but now I enjoy cycling.

Globally, if the world didn’t use fertilisers, food production would quickly halve; nobody would contest that we simply can’t have half the world starving.

Mike Manning Ravensdown

available to help NZ Inc to make sure that farming and its advisers are well positioned globally, personally gives me a sense of pride and satisfaction.

“The industry is in good shape, it’s got direction, it’s got structure, a mandate, and funding, so it’s got everything it needs to go forward; in good heart for others to pick up and carry forward.”

The future for Manning?

“I used to run marathons in

“I have cycled the length of NZ and now I want to do other parts of the world.”

At 68, Manning figures he has 10-12 years “while fitness, health and desire allow”.

The first trip is booked to France in July and while not any part of the Tour de France, Manning, accompanied by his wife Nicki, will be wheeling his way around France at the same time.

“For me it’s a combination of personal and family, and then if I can make a contribution to help NZ to stay competitive in an agricultural sense, I am only too happy to do that if opportunities arise.”

Meantime in the transition to full retirement Manning has stepped back to three days a week in his day job with Ravensdown before full retirement kicks in next year.

Molesworth Station lease applications open

Richard Rennie NEWS Conservation

THE ability to offer increased public access and greater recreational opportunities on Molesworth Station could be required for an entity taking on the station’s new lease. With the current lease ending mid-year, the Department of Conservation has made the conditions and terms of the new lease available for parties interested in takingon the operations of New Zealand’s single largest farm entity.

However, interested parties need not apply if they are considering extracting water for irrigation, or mulling game or safari park hunting, exotic forestry, or building new accommodation on the property.

The document clearly rules out all these activities from consideration under what is known as the Molesworth recreation reserve.

The document acknowledges the priority given to outdoor recreation and protection of the station environment, with extensive constraints and

conditions applying to stock grazing over the property’s recognised permissible grazing areas.

At present the current leaseholder, Pāmu, is running the equivalent of 34,000 stock units as 5100 cattle, under a lease stock limit of 6500 adult cattle.

While sheep grazing is not currently an activity, the document says it could be considered under the agreement in areas that can be fenced to avoid impacts on steeper country.

The document notes that a successful leaseholder may be

required to offer greater opportunities for public recreation.

The property currently has about 60km of road through it that is available for public use between October and Easter. The document says calls for greater access, including for year-round activities, have come from individuals and hunting-fishing groups.

RECREATE: The new lessee of Molesworth may have to offer more public access as part of their new lease conditions.

At present Molesworth has 26 concessions for guided recreational activities including cycling, walking, mountain biking, horse riding and boating. There are also three major events held each year – the Molesworth Run, Mowsworth charity ride and The Graveler cycle race.

Molesworth has a long history of struggling with wilding pine incursions and the document notes the $2.2 million spent a year on their control on Moles-worth.

This programme is expected to continue, but applicants are invited to describe any additional control they would undertake.

The document acknowledges the priority given to outdoor recreation and protection of the station environment.

VISION: Molesworth’s ex-manager, Jim Ward has laid out his vision of the station becoming a ‘station for the nation’, enshrining public access alongside a commercial farming operation.

To date the highest profile expression of interest in picking up the lease has come from Molesworth’s ex-manager, Jim Ward.

He laid out his vision of the station becoming a “station for the nation”, enshrining public access alongside a commercial farming operation, and overseen by a charitable trust.

PLANS: After a long career driven by science and ensuring NZ farming is well positioned globally, Mike Manning is stepping down from the NZ Fertiliser Association with plans to pedal around the globe.

Gisborne foresters challenge council

Richard Rennie NEWS Forestry

EAST coast foresters continue to push back against a district council they claim continues to fail to balance the region’s economic future alongside forest planting and harvesting regulations.

Eastland Wood Council (EWC) chair Julian Kohn told Farmers Weekly commercial foresters on the coast feel council is “listening to us but not hearing us”.

EWC members account for about 130,000ha of the region’s 150,000ha pine plantation estate. He said this applied to consent conditions laid out a year ago, and more recently to the council’s proposed $359 million transition fund it seeks from government to retire vast areas of erodible land in the region.

Early last year foresters had angrily responded to Gisborne District Council’s new standards for forestry operations, claiming lack of consultation, regulatory overreach, and severe curtailment of the industry’s ability to continue operations on the coast. It had come despite council claiming a new climate of closer collaboration between it and forestry companies as the region began a post-Gabrielle reset and

responded to new standards to manage forestry plantations.

But a year on, Kohn said the concerns over those regulations’ unworkability continue.

“We finally got them (council) to sit down at the table and have two meetings with them, to be told the second would be the last, despite not having locked down everything.”

Gisborne District Council (GDC) CEO Nadine Thatcher Swann said the council’s engagement with foresters since 2023 has been extensive and ongoing.

She said since the severe weather events of 2023 council has undertaken engagement including multiple workshops and hui and had a focused working group with the sector to review and refine a set of standard consent conditions.

“Through this process, council has engaged in good faith and been clear about its responsibilities as the consent authority under the Resource Management Act.

“The majority of issues raised by the sector have been addressed through amendments or clarifications. Council is currently

Hunting sector sidelined in deer control plans

GAME Animal Council CEO Corina Jordan says the hunting sector makes the largest dent in deer numbers, yet has been sidelined in a national initiative to reduce increasing numbers of the pest. In December the Ministry for Primary Industries announced a joint initiative with the Department of Conservation, Federated Farmers, Beef + Lamb New Zealand and Forest and Bird to nationally control and monitor feral pests.

John Walsh, Biosecurity

New Zealand director for pest management said the MPI is reviewing regulations to make control operations easier and improve data collection to enable better coordinated control operations.

The initiative will also run trials at catchment level to help farmers and growers manage the impacts of feral deer on their businesses.

Jordan said no one in the hunting sector has been included in the initiative, even after the council asked for a national strategy five years ago.

She said the hunting sector

awaiting further information from sector representatives on one remaining issue.”

Meantime council have applied to government for a $359 million forest transition fund to retire over 100,000ha of vulnerable land back into native bush as a response to the Gabrielle ministerial inquiry recommendations.

The council is claiming a 4:1 return on the transition spend that proposes a 10-year investment of the funds, plus regional and private contributions of a further $240 million.

Government response to the funding has so far been cool. In December a spokesperson for forestry minister Todd McClay described it to RNZ as realistic, although no decisions have been made.

One forestry insider told Farmers Weekly the council had gone about its transition project the wrong way, first seeking the funding then seeking out industry input, at which point industry “ripped apart” the plan’s principles.

Farmers Weekly understands an independent report of the council’s business case behind the $359 million application is due out very shortly, confirming flaws in the council’s assessment on the impact of retiring significant land areas from commercial forestry.

Thatcher Swann said council

The business case understates the potential risks to our region’s economy, and we believe landowners need to be considered more.

Julian Kohn Eastland Wood Council

was aware of the independent review of the business case being undertaken and remained confident it was supported by robust evidence, sound analysis and extensive local expertise.

She said assertions the business case underestimates the impact of land use changes have not been accompanied by alternative evidence-based analysis.

Kohn said he was reluctant to comment on the report pending its upcoming publication.

“But I do stand by what I said to RNZ.

“The business case understates the potential risks to our region’s economy, and we believe landowners need to be considered more.”

He said the wider economic implications of the council’s proposal for retirement demanded scrutiny, given the significant role forestry played in the region’s economy.

can use recreational hunters, management hunts, that are essentially culls, and aerial control.

Currently commercial aerial controllers focus on large animals for venison, but they need a subsidy to make culling of smaller deer financially viable.

Professor at Lincoln University and data analyst at the Game Animal Council, Geoff Kerr, said there is no national database to report deer numbers killed.

The GAC crunched numbers after a survey of almost 500 hunters in 2024, with results showing recreational hunters killed about 181,000 deer annually, about 125,000 goats and 53,000 wallabies.

The annual kills are estimated by multiplying average annual kills per hunter by the total number of hunters.

Excluded from the analysis is anyone who did any commercial hunting, or reported very high kills, Kerr said.

He said there is also no database of how many deer Wildlife Recovery Operations (WARO) processes for venison each year, but there are estimates of over 20,000.

Unlike other countries, New Zealand hunters do not need a special permit for each species or for specific animals and surveys are the best bet to gather data.

Reporting on the issue in the past by Farmers Weekly has put

some numbers to annual kills.

Founder of Trap and Trigger NZ, Jordan Munn, the largest commercial hunting team in the country, said his operators typically take 3000 - 4000 deer per year, but have shot as many as 10,000 in a year across public, private and forestry land.

Mike Perry, DOC wild animals manager said WARO recovered 3787 deer from public conservation land between July 2024 and June 2025.

DOC does not hold a consolidated national dataset of animals removed by aerial and ground control, but are implementing a new system which will hold this information, Perry said.

“DOC’s monitoring focuses on ecosystem improvements, rather than total animals removed.”

DOC’s annual goat hunting competition removed 10,134 goats in 2023, 12,935 in 2024 and 10,350 in 2025.

There are many private cullers shooting high browser numbers.