On behalf of Ownership, Jones Lang LaSalle America, Inc. (“JLL”) has been exclusively retained as the sales representative for the Gateway Atlanta Portfolio (the “Portfolio”). The Portfolio comprises seven (7) properties spanning 1,298,197 SF of predominantly deep-infill distribution warehouse product, anchored by a high-quality credit tenant base with long-term leases in place. Strategically positioned within Atlanta’s most sought-after institutional corridors, the Portfolio offers exceptional connectivity to the region’s transportation arteries.

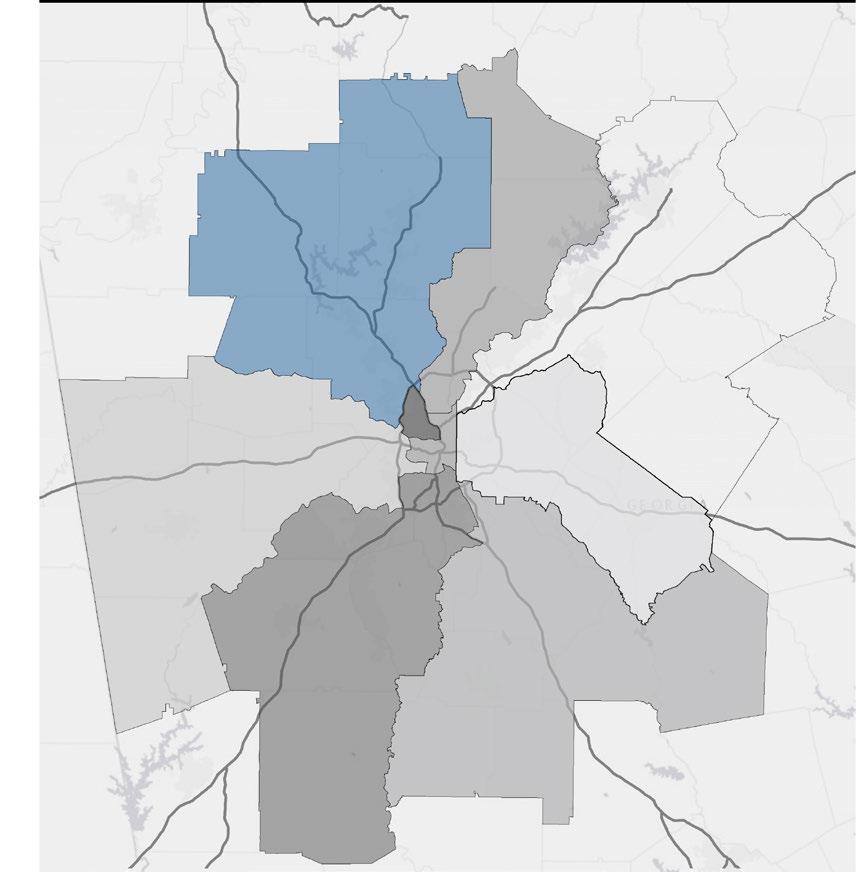

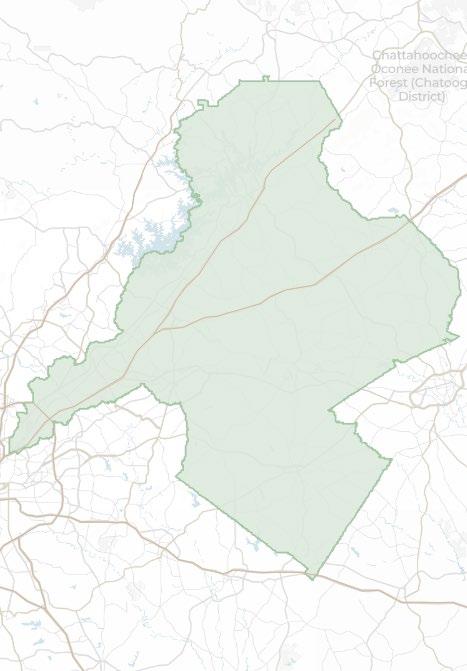

The Portfolio demonstrates exceptional stability, leveraging a tenant base with over 17 years of historical occupancy. It boasts a robust weighted average remaining lease term (WALT) of 5.7 years, complemented by an attractive average rent escalation of 3.60%. Notably, investment-grade credit-backed tenants constitute 34% of the total Gross Leasable Area (GLA). The asset distribution is strategically balanced, with 60% of the total square footage—comprising four of the seven assets—located in the I-20 West submarket. The remaining properties are positioned in the South I-75 (23%) and Northeast (17%) submarkets. Enhancing its appeal, the Portfolio’s proximity to a major interstate ensures seamless connectivity to Atlanta’s primary transportation arteries.

Atlanta’s industrial market continues to rank among the nation’s strongest, fueled by persistent demographic growth and proximity to major U.S. population centers, with 80% of Americans reachable within a two day drive. Tenant demand remains robust, with approximately 49 million square feet of active requirements, the highest level among all U.S. markets. In 2025, leasing activity exceeded 47 million SF, marking the 5th highest annual leasing volume in Atlanta’s history.

portfolio highlights

7 PROPERTIES

100% OCCUPANCY

5.7 YEARS PORTFOLIO WALT

1,298,197 SQUARE FEET

$3.60%

Average Annual Escalation

ATLANTA infill locations

• 100% leased portfolio with a 5.7-year weighted average lease term (WALT) and 3.60% average annual escalation, delivering durable and predictable cash flow for investorst

• 34% of GLA occupied by multinational, investment-grade credit-backed tenants including WestRock and Geodis (SNCF), underscoring credit quality

• Established tenant relationships with an average tenure of 17 years , reflecting long-term occupancy and renewal stability

» Rail dependent tenancy from WestRock and Sunny Delight (30% of GLA) combined with scarce rail served product in Atlanta enhances tenant retention and long-term stability

• Diversified tenant mix across essential industries—packaging, logistics, and consumer goods—providing resilience and cash flow security

• All assets offer direct connectivity to Atlanta’s major logistical arteries – I -285, I -75, I - 85, and I -20 – providing seamtless access across the greater Atlanta MSA

• The Gateway Atlanta Portfolio represents a critical mass of distribution and production warehouse product located in proven infill sites within legacy industrial corridors

• The Portfolio’s strategic location provides its tenants with crucial last-mile delivery capabilities for their operations within the Atlanta MSA

• Densely built-out submarkets provide a natural competitive advantage, with minimal available land for new industrial development in surrounding areas

• The combination of scarce land availability and elevated construction costs creates a high barrier to entry, sustaining tenant demand and rent growth potential

» Completions down 56% year-over-year, marking the lowest development pipeline since 2015

• Tenant demand remains exceptionally strong with nearly 49M SF of active requirements – 1st nationally

• Absorption momentum has accelerated, rising 27% month-over-month and 13% year-over-year, closing 2025 with its strongest quarterly performance

• Leasing activity exceeds 47M SF in 2025 – Atlanta’s 5th best year on record

» 66% were new deals

» Building’s sized 100k – 250k led all leasing segments with 13M SF leased (27% of total)

• Development continues to taper off with under construction volumes down 52% since 2023

» For the first time since the pandemic, less than 10M SF or projects broke ground

• Vacancy ticked down to 9.6% in the second half of 2025

» First drop in vacancy since 2021 – signaling an inflection point in market supply and demand trends

• Rents across Atlanta have grown at an 11% CAGR over the past 5 years

» Expected supply constraints will continue to push market rents

Historical Data

Completions Absorption Vacancy

NORTHEAST SUBMARKET

• Atlanta’s largest submarket totaling 206M SF of industrial stock

• The Northeast submarket consistently generates the highest net absorption across Metro Atlanta, posting 3.2M SF in 2025 to once again lead all submarkets

• Vacancy improved to 9.4% , down from 10.2% at the start of 2025, reflecting tightening fundamentals

INFILL I-85 MICROMARKET

• The infill portion, Chamblee, Doraville, and Norcross, has one of the highest barriers to entry in all of Atlanta’s industrial market

» Sits at the crossroad between Atlanta’s dense core and its wealthy northern suburbs, making it an irreplaceable logistical location

» Rents have grown at a strong 10.1% CAGR since 2021

» 6.7% vacancy rate – 30% below the Atlanta wide rate

I-75 SOUTH SUBMARKET

• Atlanta’s 4th largest submarket spanning 83M SF of industrial product

• 513K SF of net absorption in 2025 — extending the submarket’s decade-long trend of surpassing 500K SF annually

• SF under development has fallen nearly 4x over the past 2 years

• Average rent of $6.84 PSF, representing a 13% increase over the past two years

MCDONOUGH MICROMARKET

• McDonough serves as a key “inland port” logistics hub – efficiently connecting the Port of Savannah with the greater Atlanta area

» Home to area workforce of 1.1M+ workers and is minutes away from HartsfieldJackson Atlanta International Airport – the busiest airport in the world

» Rents have grown at an impressive 12.0% CAGR since 2021

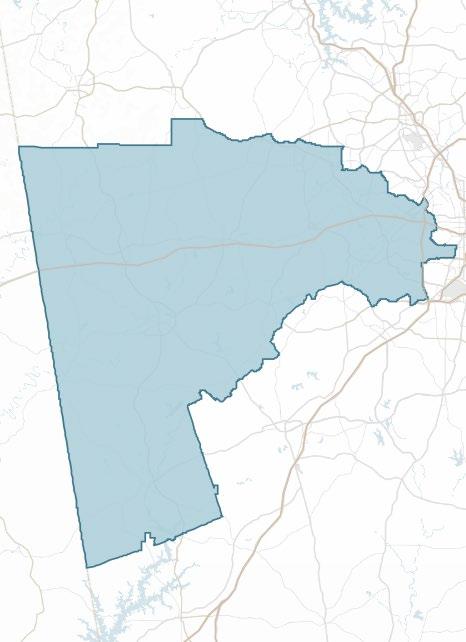

I-20 WEST SUBMARKET

• Atlanta’s 3rd largest submarket comprising 112M SF of inventory

» One of Atlanta’s most established submarkets with proximity to both I-20 and I-285

• 2nd highest net absorption of any Atlanta submarket reaching 1.2M SF in 2025

• I-20 West has one of the lowest vacancy rates of any Atlanta submarket at 7.4% (23% below Atlanta-wide rate)

• Completions fell further in 2025, dropping to 1 million SF – marking an 80% drop compared to 2023

FULTON INDUSTRIAL MICROMARKET

• Fulton Industrial District is the densest and largest industrial corridor east of the Mississippi River

» 52M+ SF of industrial product, corridor generated $31 billion of total economic output in 2023

» 7.1% vacancy rate – 26% below the Atlanta wide rate

304,400 SF 275 DECLARATION DRIVEBLDGS. A & B M c DONOUGH, GA

275 Declaration Dr - Bldg. A Geodis Logistics

302,400 SF 12/31/2029 LXD

275 Declaration DrBldg. B

Rail

Rail Doors

655 Selig Dr WestRock Paper & Packaging

133,317 SF 6/30/2030 LXD

22’ Clear Height

6” Reinforced Slab

Sprinklered Fire Protection

Iridescent Warehouse Lighting

Auto Spaces

40’x39’ Column Spacing

Front-load Configuration

Concrete Tilt-wall Construction

277/480 Volt, 3-phase Electricity

7 Drive-in Doors Truck Court

33 Dock High Doors Roof: 4-Ply BUR With Gravel Surface

Address 655 Selig Drive, Atlanta, GA 30336 Total

(Not included in total SF)

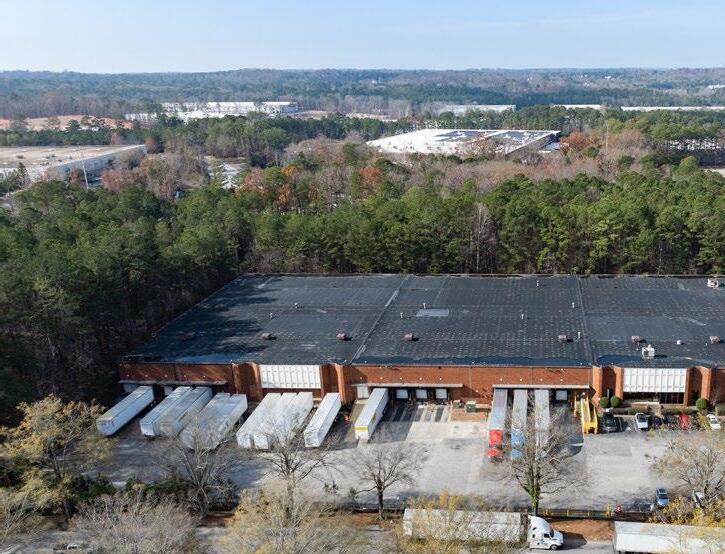

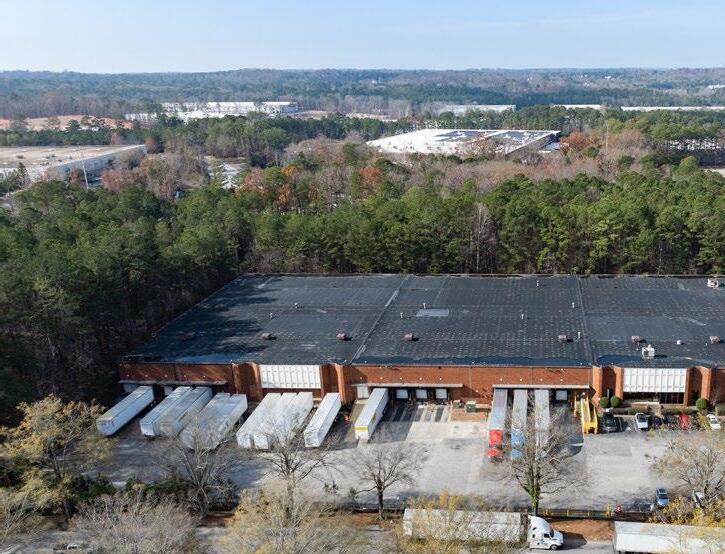

3950 Steve Reynolds Blvd

SF: 80,000

In-Place Rent: $9.19 PSF

LXD: 5/31/2031

Tenure: 2 Years

Website: https://fanmats.com/

Sports Licensing Solutions produces licensed sports-themed home and automotive décor— such as floor mats, seat covers, garage mats, wall decals, and tailgating accessories—for fans of professional and collegiate teams. In June 2025, Sports Licensing Solutions was acquired by Logo Brands, making it an operating subsidiary and expanding Logo Brands’ portfolio of licensed consumer goods. With in-house ISO-certified manufacturing capabilities and a focus on licensed products for major professional and collegiate teams, the Company combines specialized production expertise with strong distribution partnerships.

Duetz Corporation

3883 Steve Reynolds Blvd

SF: 142,073

In-Place Rent: $8.25 PSF

LXD: 10/31/2038

Tenure: 36 years

Website: https://www.deutzusa.com/home

DEUTZ Corporation is the North American arm of DEUTZ AG, a public German engine manufacturer specializing in diesel, natural gas, and emerging drive technologies. In 2024, DEUTZ AG generated $1.9 billion in revenue and employs around 5,200 people worldwide. In the U.S., DEUTZ Corporation is headquartered in Norcross, GA, serving as its primary hub for sales, service, parts distribution, and application engineering. Complementing this is a major remanufacturing facility in Pendergrass, GA, which rebuilds engines and components to OEM standards, supporting sustainability and rapid turnaround for customers. Together, these facilities anchor DEUTZ’s Southeastern U.S. operations and enable nationwide coverage through a network of service centers and field technicians.

Geodis Logistics

275 Declaration Dr - Bldg. A & B

SF: 302,400

In-Place Rent: $6.71 PSF

LXD: 12/31/2029

Tenure: 18 Years

Website: https://geodis.com/us-en

Parent Entity: SNCF Group | S&P: A+

Geodis Logistics is a global third-party logistics leader and a wholly owned subsidiary of the French state-owned SNCF Group (S&P: A+).

In 2024, GEODIS reported $12.3 billion USD in revenue, reflecting it’s strong financial position and global scale. To that end, the company operates in 166 countries with over 49,000 employees and nearly 1,080 sites worldwide, including a significant North American presence. Geodis provides comprehensive supply chain solutions to approximately 91,000 clients worldwide including freight forwarding, contract logistics, distribution, and transportation management, serving major industries such as retail, automotive, and technology.

SF: 133,317 | In-Place Rent: $7.08 PSF

LXD: 6/30/2030

Tenure: 46 Years

Website: https://www.smurfitwestrock.com

Credit Rating: BBB

Smurfit WestRock is a global leader in sustainable paper and packaging solutions, formed in July 2024 through the $12.7 billion merger of Smurfit Kappa and WestRock. Headquartered in Dublin with significant North American operations based in Atlanta, GA, the company reported approximately $34 billion in combined annual revenue and employs around 100,000 people worldwide. Its operations span 63 paper mills and over 500 converting facilities across 40+ countries, delivering corrugated packaging, containerboard, consumer packaging, and recycling solutions to major industries including food & beverage, retail, and e-commerce. Smurfit WestRock is publicly listed on the NYSE (SW) and maintains an investment-grade credit rating BBB.

SF: 260,000

In-Place Rent: $5.12 PSF

LXD: 12/31/2033

Tenure: 19 Years

Website: https://sunnyd.com

Sunny Delight (“SunnyD”) is a leading beverage manufacturer best known for its iconic fruit-flavored drinks. The company operates under Harvest Hill Beverage Company –recently purchased by Castillo Hermanos for $1.5 billion in April of 2025, which manages a portfolio of well-recognized brands including SunnyD, Fruit2O, and Veryfine. The Company employs approximately 615 people, and operates five U.S. manufacturing facilities, ensuring robust production and distribution capabilities. SunnyD maintains strategic partnerships with major distributors such as Keurig Dr Pepper (U.S.) and Saputo (Canada), while its products are sold through top-tier retailers including Walmart, Kroger, and 7- Eleven.

Czarnowski Display Service

3755 Atlanta Industrial Pkwy

SF: 380,407

In-Place Rent: $5.90 PSF

LXD: 12/31/2029

Tenure: 1 Year

Website: https://www.czarnowski.com

Czarnowski Display Service, part of the Czarnowski Collective, is a leading multinational provider of trade show exhibits and experiential marketing solutions.

Founded in 1947 and headquartered in Chicago, the company employs over 2,000 people and operates nearly 40 U.S. locations along with 20 international offices. Its global footprint spans two continents, serving 30+ countries and encompassing more than 2 million SF of production and warehouse space. Czarnowski delivers end-to-end services—including design, fabrication, installation, and program management—for world-class brands such as Toyota, Samsung, and Philips.

FINANCIAL OVERVIEW

• With nearly 49M SF of active tenant requirements, the highest of any market in the entire U.S., demand remains strong

• Development volumes continue to taper off with under construction volumes down 52% over the past two years as of year-end 2025 (lowest point since 2015). This, combined with strong tenant demand, is expected to support strong rent growth

112.0M s.f.

Existing Inventory

The I-20 West submarket maintained its momentum with 710,830 s.f. of net positive absorption in Q3, ranking second highest in absorption YTD among Atlanta submarkets. Three large move-ins drove activity, led by Cirro (633, 269 s.f.), Exhibition Hub Atlanta (114,770 s.f.), and SJ Distributors (100,111 s.f). The quarter’s largest move-out was Warner Brothers vacating 177,335 s.f While overall development activity continues to be muted with no completions this quarter, Broadstone Net Lease (BNL) broke ground on a 1.2 million s.f. build-to-suit distribution facility for Southwire in Bremen, GA. I-20 West is now one of only two submarkets with more than 1.5 m.s.f. under construction.

• The I-20 West submarket maintained its momentum with 1.2M SF of net positive absorption in 2025, continuing its decade-long streak of 750K+ SF of positive absorption and ranking 2nd highest in absorption among Atlanta’s submarkets.

• Vacancy rates improved to 7.4%, down from 7.6% the previous year, as absorption gains outpaced new supply additions. With development remaining limited and absorption trends holding steady, downward pressure on vacancy is expected to continue with the overall rate forecasted to decline.

• Under development supply totaled 1.8M SF as of year-end 2025, 27% below the 10-year average and 66% below the submarket’s peak in 2022.

Leasing activity surged 48% quarter-over-quarter to 2.5 million s.f. with 55% representing new deals. Three new leases exceeded 100,000 s.f., while small-to-medium deals continued its strong performance with 1.4 million s.f. across 34 transactions up 60% year-over-year.

Vacancy rates improved to 7.0% from 7.6% in the previous quarter as absorption gains outpaced new supply additions. With development remaining limited and absorption trends holding steady, downward pressure is expected to continue and vacancy rates should continue their gradual decline

South I-75 demonstrated strong momentum in Q3 with 1.2 million s.f. of positive absorption, the highest among all Atlanta submarkets this quarter. This marked a significant turnaround from consecutive quarters of negative absorption (Q1: -497K s.f., Q2: -815K s.f.). Georgia Power’s 825K s.f. BTS anchored the quarters performance, alongside notable move-ins by GEODIS (206K s,f.) and Siemens (192K s.f.), with minimal move-out activity totaling 54K s.f.

• The I-75 South submarket extended its streak of positive net absorption for the 10th consecutive year, even as total supply nearly doubled over the same period. Construction activity has since cooled, with under-construction volumes down 72% from 2023 levels.

• Although the submarket ranks third in total construction volume, development remains heavily concentrated in its southern portion, particularly in the corridor extending from Locust Grove and farther south.

Vacancy rates declined 150 basis points QoQ to 10.6%, down from 12.1% in Q2. However, YTD vacancy of 11.0% remains elevated compared to the four-year average of 5.3%, with buildings in the 100k-500k s.f. range representing 52% of current vacant space.

• The limited industrial rezonings in McDonough has begun to constrain new supply, driving under-construction volumes 68% below the five-year average. As a result, McDonough’s vacancy rate now sits at 10% – roughly 15% lower than the submarket average.

New construction starts surged to 5.3 million s.f. across eight speculative projects, representing 39% above the 10-year quarterly average of 3.8 million s.f. and the largest development wave in the post-pandemic era. The speculative activity, combined with 6.4 million s.f. under construction, signals strong developer confidence in the submarket's long-term fundamentals despite current market conditions.

Leasing volume reached 1.6 million s.f., improving 87% from the previous quarter, with 79% representing new deals and an average deal size of 315k s.f. above the YTD average of 280k s.f. However, activity remains 16% below the five-year quarterly average, and if current trends continue, annual leasing could decline 34% YOY to the lowest levels since 2018.

The availability rate stabilized at 18.4% in Q3, representing minimal change from the prior quarter’s 18.5%. Although current availability remains above historical norms 17.9% YTD versus an 11.3% fouryear average market fundamentals are improving.

206.0M s.f.

Existing Inventory

Absorption

Northeast remained Atlanta’s absorption leader with 2.8 of positive net absorption YTD a 194% increase from Move-in activity for the quarter totaled 2.3 million s.f., the YTD quarterly average and 41% year-over-year, half concentrated in the 100k-250k s.f. range across Two deals led the quarter: Elogistek's 495k s.f. lease Highway and EDA International's 320k s.f., which represented 35% of quarterly move-ins.

• The Northeast submarket remained Atlanta’s absorption leader with 3.2M SF of positive net absorption in 2025, a 119% increase from last year.

• Development activity remains muted, highlighted by under 1M SF currently under construction for the entire submarket – down 23% from last year and over 90% from the 2022 peak.

• Vacancy rates fell precipitously by 18.2% in 2025, dropping from 10.2% to 9.4%. This trend is set to continue as development activity remains muted combined with positive leasing activity that leads all of Atlanta’s submarkets.

submarket continues to lead Atlanta in leasing volumes, 11.2 million s.f. year-to-date representing 33% of activity and its highest annual volume since 2021. Quarterly totaled 4.3 million s.f. albeit flat compared to the prior year. favored larger transactions, with 250k-500k s.f. deals 27% of activity and 100k-250k s.f. transactions for 23%.

Development activity accelerated after a slow first half of the year, new speculative projects totaling 233k s.f. breaking ground Alliance Oakwood Industrial Park. Completions also with four deliveries three spec and one BTS totaling compares to just one owner-built project delivered in of the year

strong leasing and absorption, vacancy rates rose above norms, increasing 90 basis points year-over-year and the ten-year average. Properties between 100k-250k s.f. for 28% of vacancies, while Class A properties the highest share of vacant space.

Under construction and completions per quarter

s.f. (millions) Under construction Completions

Net Absorption Completions Total Vacancy

ATLANTA INTERNATIONAL AIRPORT

INVESTMENT SUMMARY MARKET OVERVIEW

PROPERTY OVERVIEW TENANT OVERVIEW

FINANCIAL OVERVIEW

7/1/28 $878,920 $5.60 3.00% 7/1/29 $905,287 $5.76 3.00% 7/1/30 $932,446 $5.94 3.00% 7/1/31 $960,419 $6.12 3.00% 7/1/32 $989,232 $6.30 3.00%

Controllable Expense Cap: 8% cap on controllable expenses on a compounded and cumulative basis.

• Tenat has two, 5-year renewal options at the greater of (i) FMR or (ii) 4% increase of base rent from prior term.

3.00%

• Rental Rates increased annually on July 1st of each year based upon CPI; the underwriting herein assumes a 3% increase annually.

• Sunny Delight pays quarterly on the first day of each fiscal quarter. However, for purposes of the cash flow table herein, rent is shown as monthly.

• Two, 7-year lease renewal options exist. First renewal option: Year 1 rent will be the greater of (i) then current rent or (ii) FMV rent. Thereafter, rent shall be increased annually by CPI. Second renewal option: Year 1 rent, and each subsequent year, shall be adjusted by CPI.

• Landlord is solely responsible for insurance costs.

• 7000 LaGrange Blvd has an active access agreement with Comcast Communications Management, LLC.

Rental Rates increased annually on July 1st of each

based upon

the underwriting herein assumes a 3% increase annually.

• Sunny Delight pays quarterly on the first day of each fiscal quarter. However, for purposes of the cash flow table herein, rent is shown as monthly.

• Two, 7-year lease renewal options exist. First renewal option: Year 1 rent will be the greater of (i) then current rent or (ii) FMV rent. Thereafter, rent shall be increased annually by CPI. Second renewal option: Year 1 rent, and each subsequent year, shall be adjusted by CPI.

• Landlord is solely responsible for insurance costs.

• Base Rent is abated for the period of 11/1/2025 to 4/30/2026 in the amount of $97,675.19 per month. Tenant nonetheless owes Additional Rent during the Abatement Period.

• Duetz Corporation recovers 4% management fee but is charged a 3% management fee.

• Tenant has one, 5-year renewal option at the greater of (i) FMR or (ii) 4% increase of base rent over prior term.

PRIMARY CONTACTS

BRITTON BURDETTE Senior Managing Director britton.burdette@jll.com 404.995.2302 JIM FREEMAN Managing Director jim.freeman@jll.com 404.995.2399

REED DAVIS, SIOR Executive Managing Director reed.davis@jll.com 404.844.9128

MAGGIE DOMINGUEZ Managing Director maggie.dominguez@jll.com 678.378.4593