There is no shortage of noise around the future of mobility. Trade tensions, shifting tariffs, and fragile supply chains often create a drumbeat of doom for the automotive sector. Yet beyond the static lies a horizon of opportunity—hydrogen, EVs, autonomous vehicles, and more are redefining what’s possible.

Here in Michigan, we inherit a legacy auto industry passed down through generations. Along with it come familiar challenges: fuel economy, cost pressures, and a supplier network bound by rigid, process-driven models. But that chapter is closing. The question is: how long will we try to artificially extend it—and do we have the courage to write the next one?

Automation Alley hosted its Integr8 Mobility Roundtable, recently at Michigan Central. We asked our members to confront the most pressing issues shaping this

transition. With trade tensions, tariffs, supply chain disruptions, and the ICE-to-EV shift converging, what single factor should industry focus on to navigate the complexity? How can manufacturers upskill workers for a future of fewer components and more digital sophistication? And with cost still the top barrier to EV adoption, how do we adapt production while also ensuring cybersecurity in connected vehicles?

The answers, captured in this Integr8 Playbook, reflect both urgency and optimism. They remind us that mobility’s future will not be defined by one breakthrough, but by how well we align technology, policy, and workforce readiness.

This is our invitation to think differently, act boldly, and shape the next chapter of mobility—together.

Tom Kelly Executive Director & Chief Executive Officer Automation Alley

Roundtable Attendee List:

Sponsors, Supporters and Participants

Main Feature:

Mobility: Innovative Tech Drives Mobility Solutions

Expert Insights:

Design-to-Source: Building Resilient Supply Chains for the Future of Mobility

Samsung SDS

Expert Insights:

Verizon Drives Mobility Innovation with 5G, Advancing Connected and Autonomous Vehicles

Verizon

Expert Insights:

Talent and Workforce – Divine Answers to Manufacturing’s Unseen Questions

Oakland Community College

Expert Insights:

Navigating the Mobility Shift: Strategic Imperatives for Automation in the ICE-to-EV Era

Siemens

Industry Pulse:

Ecosystem Insights at a Glance

Future Trends:

AI’s Role, Tariffs, EV Transition

Industry Insights:

Powering Michigan’s Future: Reskilling the Manufacturing Workforce for the EV Transition

Michigan Manufacturers Association

Case Study:

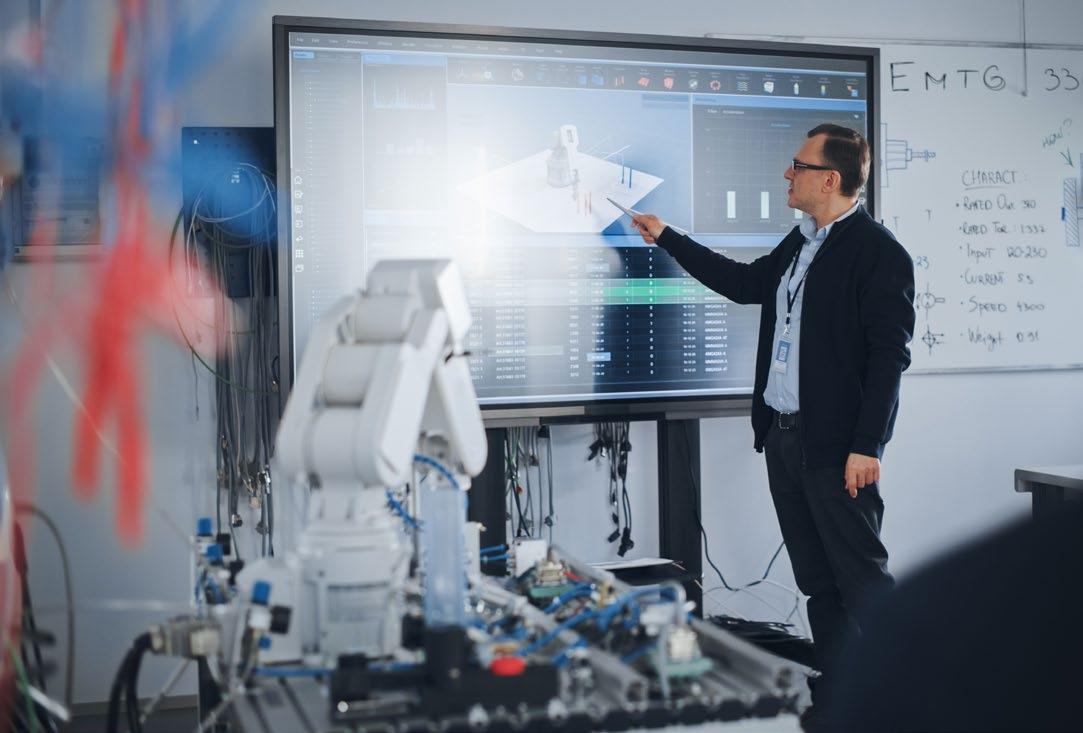

Michigan State University Offers Solutions to Challenges Facing the Mobility Industry

Key Takeaways: Policy, Workforce, Cybersecurity & More

State and National Resources: Helpful Resources for Small- and Medium-sized Manufacturers

Sources

SPONSORED BY: Siemens, Samsung SDS, Oakland Community College and Verizon

IN PARTNERSHIP WITH: Center for Automotive Research, Michigan Manufacturers Association, Michigan Economic Development Corporation and the US Center for Advanced Manufacturing

James Ellis - Business Development Manager - Battery & EV, Siemens

Kyle Veugeler - Technical Account Manager & System Engineer - Battery USA, Siemens

Timur Yaprak - Senior Transformation Consultant, Siemens

George Stasiw - Senior Account Executive, Samsung SDS

Sandra Bachert - Director of Workforce, Oakland Community College

Kristin Charlton - Business Services Manager, Oakland Community College

Dean Paczewitz - Advanced Manufacturing Trainer/Instructor, Oakland Community College

Joe Petrosky - Vice Chancellor for Economic & Workforce Development, Oakland Community College

Maggie Gallagher - Community Engagement, Verizon

John Walsh - President & CEO, Michigan Manufacturers Association

ADDITIONAL LEADERS IN INDUSTRY, ACADEMIA AND GOVERNMENT IN ATTENDANCE:

Tom Kelly - CEO & Executive Director, Automation Alley

Pavan Muzumdar - COO, Automation Alley and CEO, Project DIAMOnD

Mike Bahn - Research Executive, Global Electronics Ltd.

Niall Berkery - CEO, Neumo

Jim Brady - VP, Business Development and Partnerships, Viaduct

Mike Brooks - Market Segment Manager - E-Mobility, Phoenix Contact

Yansong Chen - CTO, ROPIX

Curt Chowanic - Senior Economic Development Specialist, Macomb County Department of Planning & Economic Development

Alice Coleman - Founder , EV love

Steven Corzyk - 3D Application Engineer - Americas Automotive Lead, HP Inc

Albert Emery - Operations Manager, J Mechatronic

John Gnotek - Communications, Media & Technology Senior Consultant, Gen AI UX DesignerCognizant Technology Solutions

Justin Goeglein - President, SwitchBox

Shlok Goel - Charging Specialist, dSPACE Inc

Jason Hamp - AI Technologist - Manufacturing, Lenovo

Judd Herzer - Mobility & Innovation Director, Michigan State University

Patrick Hillberg - Professor, Oakland University

Wesam Iwas - Managing Director, Ankercloud Inc.

Justine Johnson - Chief Mobility Officer, Michigan Economic Development Corporation

Robert Joyce - President and Founder, FibreTuff

Adam Karaien - Technical Account Manager, SwitchBox

Adam Kehela - Founder & CEO, Kehela Mobility and Engineering

Paul Kovacs - Account Executive, EOX Vantage

Brent Krahn - Sales Director for Americas, Khenda

Tom Krent - Career Pathways Coordinator, Education Planning Resources

Liliana Krynska - Business Development Manager , Bmax USA LLC

Mike Miller - VP, Orion Measurement Solutions, Inc.

Julie Oldham - Business Growth Consultant, Michigan Small Business Development Center

Phil Pertner - President, Espas Inc.

Clay Phillips - Mobility Technology Lead, Michigan Small Business Development Center

Michael Pickholz - President, CEO, and Founder, MagWerks Vision Inc.

Cody Schaub - Economic Development Director, Congresswoman Haley Stevens

John Schroeder - Partner Manager & Enterprise Account Executive, Scheer IMC Americas

Robert Scipione - Manufacturing Services Manager, Michigan Manufacturing Technology Center

Russ Senkowski - Vice President of Sales, Flex-Cable

George Singos - Business Solutions Manager - Macomb County, Michigan Manufacturing Technology Center

Thomas Sommer - Director of Corporate Partnerships, Lawrence Technological University

David Tucker - Director of Innovation, M5D

Katie Tucker - Vehicle Transformation: Customer Experience , General Motors

Ken Zalucki - Business Development Director, Bmax USA LLC

TThe final 2025 Integr8 roundtable hosted by Automation Alley concluded at Detroit’s Michigan Central, focusing on mobility. Setting the backdrop for the event was a global restructuring of the automotive industry order, with Ford relocating its global offices to the recently renovated building from its historic Glass House in Dearborn.

This theme—relocation—was felt throughout the discussion, whether it referred to onshoring production or reallocating resources for the EV transition. In 2025, the only constant is change, and 2024’s mobility landscape looks radically different from the one we inhabit today.

Despite the changes ahead, the mood was hopeful in the face of such challenges as tariffs, shifting standards, and EV mandates.

Manufacturers are navigating a constantly shifting policy environment. New tariffs, fluctuating trade policies, and evolving EV mandates are forcing companies to redesign strategies on the fly.

“There needs to be more conversation between government and industry for policy direction,” said Joe Petrosky, dean of engineering, manufacturing and industrial technologies at Oakland Community College. “It is so critical. Tier ones to tier twos are paying attention to these conversations more and more because they have to.”

Petrosky added that while tariffs can help some businesses, they’re also a struggle for others. “We need consistent policy and stability,” he said. “Innovation and stability is a sweet spot.”

With 83% of Michigan’s automotive and mobility investments now tied to EV and battery projects, the stakes are high. The uncertainty surrounding regulatory timelines, charging infrastructure requirements and consumer incentives has left many hesitant to make long-term capital investments.

As vehicles evolve into rolling data centers, manufacturers face a new set of challenges in cybersecurity, interoperability, and real-time connectivity. Integrating digital ecosystems—from suppliers to software developers—requires collaboration at a scale the industry has never attempted before.

“Ultimately, success in manufacturing comes down to flexibility,” said George Stasiw, Senior Account Executive at Samsung SDS. “Companies must diversify and expand their capabilities, invest in research and innovation, and maintain a clear, long-term vision for growth.”

“ “ There needs to be more conversation between government and industry. It is so critical. Tier ones to tier twos are paying attention to these conversations more and more because they have to.

Joe Petrosky Dean of Engineering, Manufacturing and Industrial Technologies Oakland Community College

According to CompTIA’s State of the Tech Workforce 2025, tech occupations in Michigan are projected to grow faster than the national average, yet digital integration remains uneven—especially among small and mid-sized manufacturers. “There’s a knowledge gap in our manufacturing workforce,” Stasiw said. “Before it was more mechanical knowledge, and now it’s a more technological one.”

Cybersecurity emerged as one of the top concerns.

“Security remains a critical issue in the mobility sector,” Stasiw added.

“The prevailing mindset is that our data has been compromised so extensively that identifying a single individual would take immense effort. The more pressing concern now is not theft, but the commercial sale of personal data.”

The transition to EVs and advanced mobility platforms demands new skill sets across engineering, assembly, and software. Yet the workforce pipeline is struggling to keep pace. Michigan’s strength lies in its education ecosystem—24 universities with engineering programs, 28 community colleges offering mobility-related degrees, and more than 8,200 engineering graduates annually—but aligning those credentials to the needs of a software-defined vehicle industry remains an ongoing challenge.

“We need to marry workers that have experience with the new workforce that has the technology talent to best use data,” Petrosky said. “We also need to entice more students into the pipeline with events such as MFG Day and apprenticeships.”

Kyle Veugeler, Technical Account Manager and Systems Engineer, Batteries - US, Siemens, added that AI will play a critical role in bridging workforce and data needs. “Every CTO and CEO is talking about AI right now,” he said. “There’s a lot of hype, but we need to treat it as a partner in terms of adopting it.”

Veugeler emphasized the need to prepare for multiple futures. “Whether it’s an ICE or EV push, we must consider multiple futures,” he said. “More importantly, we need to take the data we’re finding and use it to contextualize if we’re on the right track.”

He added that collaboration with education partners is essential: “Feeding this all back into academia is important. Academia is looking for a guiding light of what students should learn for this scenario. There’s a huge gap between where manufacturing is and where it’s going.”

Building a robust EV and mobility infrastructure— charging networks, grid capacity, materials logistics—remains a massive hurdle. Public and private investments are still out of sync, and the lack of cohesive planning across state and federal levels threatens to slow momentum just as global competition accelerates.

Even with 25 OEMs and 95 of North America’s top 100 suppliers located in Michigan, new infrastructure must evolve quickly to meet the demands of a digital, electrified supply chain.

Petrosky pointed to new technologies shaping that future: “We also need to talk about drones,” he said. “Vehicles and drones are opening up a new way of mobility and autonomous applications on the horizon, like Amazon deliveries.”

Meanwhile, Veugeler warned that long-term clarity is needed to support investment. “If we don’t have an understanding of where the future might be, at least some sense of guidance allows us to put money and get traction in the market,” he said. “Being able to manufacture data-driven decisions is critical.”

Michigan’s growing network of battery R&D, from solid-state breakthroughs to sustainable lithium recycling, positions the state as a leader in next-generation energy storage. With 55% of the nation’s business-funded automotive R&D occurring in Michigan, the state is uniquely positioned to drive advancements in range, charging speed and energy density—critical levers for accelerating EV adoption and securing global competitiveness.

Petrosky noted that materials innovation is gaining traction. “We talked about American battery companies using phosphate instead of cobalt,” he said. “We need to be investing in these companies for the long term.”

The reshoring and diversification of supply networks present a once-in-a-generation opportunity to strengthen domestic manufacturing. By localizing critical components—from chips to cathode materials—Michigan can reduce geopolitical risk, stabilize production and capture more value within state borders.

“Manufacturers have to diversify products and services, geographically and globally,” Petrosky said. “Automation, innovation and critical thinking are the three things you need to succeed these days.”

Veugeler added that building resilient supply chains also means cross-training talent. “We need a workforce that is flexible enough to work in an industry still making up its mind,” he said. “Cross-training the existing workforce is important on both the academia and hiring sides. We need people willing to learn and respond.”

“ “ The EV transition itself is a massive digital transformation opportunity. The key is not to panic or pull back.

Alice Coleman Founder EV Love

Beyond roads and charging stations, the future of mobility depends on an infrastructure of innovation: smart factories, digital twins, simulation labs and cross-industry collaboration hubs like Michigan Central. These ecosystems connect academia, startups and OEMs, enabling rapid experimentation and deployment of new technologies.

“There is a big demand for graduates that look at things holistically,” Stasiw said. “Business and project management are in demand.”

According to Alice Coleman, Founder of EV Love, “The EV transition itself is a massive digital transformation opportunity. The key is not to panic or pull back.”

Coleman added that workforce upskilling and continuous learning will be central to success. “Programs at places like Oakland Community College and other local institutions are critical to facilitate continuous learning as technology and tools evolve,” she said. “Apprenticeships and internships can teach advanced technologies and help close the labor gap.”

Meanwhile, George Singos, Business Solutions Manager at Michigan Manufacturing Technology Center, underscored the role of small manufacturers in innovation. “The number one theme that came up was agility and flexibility,” he said. “How do we get every layer— from education to manufacturing, and from large to small organizations—to become more agile?”

Singos also pointed to Project DIAMOnD as a model for scalable innovation. “Distributed manufacturing can scale up or down depending on need,” he said. “The question is: can that same distributed model be applied to other technologies, like AI, or other products and services?”

“

“ Distributed manufacturing can scale up or down depending on need. The question is: can that same distributed model be applied to other technologies, like AI, or other products and services?

George Singos Business Solutions Manager Michigan Manufacturing Technology Center

Across the roundtable, a consistent message emerged: transformation requires unity. Michigan’s future in mobility depends not only on technological progress but also on policy stability, public–private collaboration and a shared commitment to innovation.

“Continuous innovation is essential,” Stasiw said. “Manufacturers must dedicate resources to research, embrace change, and pursue a long-term vision that ensures relevance and resilience in a rapidly evolving landscape.”

George Stasiw Senior Account Executive Samsung

The shift from internal combustion engines to electric and autonomous vehicles isn’t just a technological revolution, it’s a supply chain revolution. Automotive programs today are under intense pressure to balance innovation, cost control, and resilience while dealing with raw material shortages, shifting trade rules, and technologies evolving faster than most organizations can adapt.

And while electric vehicles (EVs) and autonomous platforms come with a new set of challenges, they’re still vehicles at their core representing complex machines made up of 25,000 to 35,000 individual components sourced from thousands of suppliers globally. Managing that level of complexity while integrating new technologies demands a fundamentally different approach.

That’s where design-to-source comes in. It’s not just a process or a tool—it’s a methodology that bridges the gaps between product engineering, manufacturing, and sourcing, creating a unified, data-driven strategy that keeps pace with change and sets the stage for sustainable competitiveness.

With many years of experience in indirect procurement managing items like office supplies and other non-production materials, I’ve seen firsthand how organizations can achieve impressive ROI by automating and integrating the procure-to-pay process. Direct materials procurement in manufacturing, however, is a very different challenge, with far greater complexity and risk.

In many organizations, procurement is invited into the conversation only after engineering has locked down the design. By then, as much as 80% of the product’s cost is already baked in, and the sourcing team is left trying to manage risks and costs with limited options.

This “handoff” model creates a chain reaction of problems:

• Last-minute changes to the bill of materials (BOM)

• RFQ cycles that stretch far beyond schedule

• Supplier constraints discovered too late to pivot

• Cost overruns that erode margins before the first unit ships

When you layer in global competition, especially from China’s vertically integrated supply chains and aggressive pricing models, the challenge becomes even more pronounced. Competing effectively now requires smarter cost insights, earlier collaboration, and greater agility than legacy processes can deliver.

Design-to-source turns the old model on its head. Instead of working in silos, engineering, sourcing, and manufacturing teams collaborate from day one. The goal is simple: design automotive products that are innovative, manufacturable, cost-competitive, and resilient.

At its core, this approach means:

Early Cost and Risk Modeling – Understanding the cost and risk implications of design decisions before they’re locked in.

Supplier Collaboration – Bringing suppliers into the design process, reducing redesigns and improving manufacturability.

Scenario Analysis – Testing how trade shifts, tariffs, or sustainability rules could affect a design before it ever hits production.

Digital Integration – Building a single thread of information that keeps every stakeholder from engineering to the plant floor working from the same data.

This integrated strategy doesn’t just help organizations move faster. It builds the resilience needed to manage disruption while maintaining competitive pricing.

Over the past year at Automation Alley, I’ve developed a genuine appreciation for just how transformative additive manufacturing can be. It’s changing the way products are designed and built, allowing manufacturers to tackle complex geometries, simplify assemblies, and even localize production to deliver faster and more cost-effectively.

But additive manufacturing also introduces new layers of complexity. It brings specialized materials that demand rigorous validation and strict compliance tracking. Manufacturers often find themselves managing sourcing relationships with highly niche suppliers, which can complicate procurement and risk management. On top of that, the rapid iteration cycles that make additive so appealing can also strain traditional processes, requiring faster decision-making, tighter integration across teams, and more agile systems to keep up with the pace of design and production changes.

Design-to-source helps manage this complexity by integrating engineering, sourcing, and manufacturing data into a single process. This allows organizations to take advantage of additive manufacturing strategically, without creating bottlenecks or cost surprises.

No other sector faces the mix of pressures that mobility does today. Here’s where an integrated design-tosource approach makes the biggest difference:

Battery and EV Supply Chains – Critical materials like lithium, cobalt, and nickel remain volatile in cost and availability. Designing with sourcing insights allows teams to develop multi-sourcing strategies and stabilize costs before production begins.

Software-Defined Vehicles – Modern vehicles are digital platforms as much as mechanical products. Connecting hardware and software sourcing through a single process reduces integration delays and creates a more predictable path to launch.

Autonomous Systems and Sensors – Technologies like LIDAR and radar have long lead times and tight compliance requirements. Identifying suppliers and validating processes early can prevent expensive redesigns and missed milestones.

Global Trade and Tariffs – With tariffs and content rules constantly shifting, scenario planning during design helps manufacturers stay compliant while optimizing for total landed cost.

Competing with Low-Cost Global Players – Chinese manufacturers benefit from vertical integration and aggressive pricing. By designing with cost intelligence and local sourcing strategies in mind, companies can close the cost gap without sacrificing quality or speed.

There’s another dimension to this conversation: people. The rapid adoption of electrification, additive manufacturing, and digital tools is widening the skills gap across the automotive workforce. In recent conversations with universities and colleges, this challenge comes up again and again: the industry is evolving faster than training programs can keep up.

Closing that gap requires a combination of skill development, cross-functional learning, and cultural transformation. Teams need to be upskilled in analytics, collaboration tools, and new manufacturing methods to keep pace with modern demands. Engineers must gain a deeper understanding of sourcing implications while procurement teams should develop an appreciation for the trade-offs inherent in design decisions.

Organizations that prioritize talent development alongside process transformation while partnering with academic institutions to shape future curricula will adapt faster and position themselves as leaders in this new era.

For companies that have started integrating design-to-source principles, the results are striking:

Faster Time-to-Market – RFQ cycles that once took months are now measured in weeks.

Lower Costs – Early cost modeling and supplier collaboration have driven double-digit savings on key programs.

Supply Chain Resilience – Proactive scenario planning has helped organizations weather disruptions from semiconductor shortages to shipping delays.

Predictability – Procurement and production teams spend less time reacting to problems and more time driving strategic, proactive solutions.

These aren’t isolated wins. They’re a blueprint for how automotive manufacturers can thrive in the face of unprecedented change.

The EV transition is creating clear winners and losers. Companies that can unify design, sourcing, and manufacturing are gaining a decisive strategic advantage. They’re able to launch products faster into competitive markets, maintain tighter control over costs and margins, and build supply chains that can adapt quickly to disruption. Just as importantly, they are developing a workforce equipped to sustain innovation over the long term. This level of integration is no longer optional. In the coming decade, design-to-source will become the standard for how successful manufacturers not only build products but also secure their future.

The Integr8 Roundtable is more than a forum. It’s a platform that’s shaping the future of American manufacturing, one that’s powered by Automation Alley’s thought leadership alongside innovators like Samsung helping customers tackle complex challenges with proven, forward-looking solutions. The future of mobility will belong to organizations that break down silos and design for performance, resilience, and cost competitiveness all at once, turning today’s challenges into tomorrow’s opportunities. Now is the time to engage, collaborate, and lead in shaping the next era of mobility.

Samsung SDS America (SDSA) is the North American subsidiary of Samsung SDS, a global leader in cloud and digital transformation. We help organizations boost productivity, strengthen security, and make smarter decisions with enterprise-grade technologies, including secure mobility, generative AI, cloud services, and procurement solutions with full design-to-source-to-pay capabilities through platforms like Caidentia.

Serving industries from government, financial services, retail, and healthcare to manufacturing and technology, SDSA uses data-driven insights and automation to help businesses thrive in today’s connected world. As part of Samsung SDS, a globally recognized ICT leader, we deliver innovative solutions that shape the future of business across North America.

Caidentia is Samsung SDS’s AI-driven procurement platform covering the full design-to-source-to-pay process. It connects engineering, sourcing, and supplier teams to streamline collaboration and decisionmaking. The platform delivers real-time cost analysis, alternative part options, and supplier insights while using AI to automate sourcing tasks, forecast pricing, and improve contract compliance. Designed for manufacturing, high tech, automotive, and consumer electronics, Caidentia helps organizations make faster, more cost-effective sourcing decisions and strengthen supply chain resilience.

VScott Hubble

Principal Engineer Verizon Wireless

erizon is driving mobility innovation by leveraging its robust 5G network, with a strong emphasis on developing technologies for connected and autonomous vehicles. The company’s strategy revolves around several key focus areas, including the deployment of C-Band spectrum, the expansion of mobile edge computing (MEC), and the development of private 5G networks for enterprise clients.

As I, Verizon’s mobility engineering lead in Michigan, believe that connected and autonomous vehicles represent the next ‘iPhone moment’ for the wireless industry. Just as the smartphone revolutionized how our customers utilize our network, vehicles are becoming powerful, advanced mobile connected devices that require the kind of reliable, low-latency connectivity only a robust 5G network can provide. Our broad C-Band network enhancement is the critical component enabling these use cases and other innovations that will truly transform the way we live and travel.

The deployment of C-Band spectrum, a crucial midband frequency, is a fundamental component of Verizon’s 5G strategy. This spectrum provides a balance of speed and range, allowing Verizon to expand its 5G Ultra Wideband service. This expansion is critical for enabling new use cases in transportation, from

high-resolution streaming for in-vehicle entertainment to mission-critical, low-latency communication for vehicle-to-everything (V2X) applications.

The C-band (mid-band 3.7 GHz to 3.98 GHz) deployment has been a major focus for our network team and is further fortifying the reliability and capacity of our network. We see it as a critical component for enabling these advanced use cases and countless others. It’s the new foundation for the level of connectivity that allows for real-time applications like those needed for connected and autonomous vehicles.

In parallel, Verizon is advancing its Mobile Edge Computing (MEC) platform, which brings computing power closer to the end user. This low-latency capability is critical for real-time applications such as computer vision, augmented reality, and robotics—all of which are essential for autonomous and connected vehicles. Verizon has established a partner ecosystem with companies like Microsoft and NVIDIA to develop and deploy AI and other compute-intensive applications over its 5G and MEC infrastructure.

For businesses and public sector organizations, Verizon is emphasizing the creation of private 5G networks. These on-premise networks provide enhanced security and dedicated bandwidth for specific business needs. In the automotive and transportation sectors, private 5G is transformative for use cases within controlled environments like factories, shipping ports, and logistics hubs. Unlike a public network, a private 5G network ensures that a business has its own dedicated cellular infrastructure. This is crucial for autonomous machinery and robotics on the factory floor, drone operations, and autonomous transportation like automated guided vehicles (AGVs) in a warehouse. It also provides the predictive maintenance capabilities needed to monitor equipment in real time and prevent costly downtime. The high-performance, low-latency private network handles the massive data payloads from sensors and cameras, keeping sensitive operational data secure and on-premise.

Verizon is also actively involved in several programs that demonstrate and fine-tune the practical application of its technology for connected and autonomous vehicles.

Verizon Business has commercially launched its Edge Transportation Exchange, a mobile-network V2X platform that allows vehicles to communicate with other connected vehicles, road users (like pedestrians), and infrastructure in near real time. This is a key departure from traditional V2X solutions that often require expensive physical roadside units to be deployed at every intersection. By using the mobile network as the foundation, Verizon offers a more scalable and cost-effective solution for state Departments of Transportation

(DOTs) and municipalities. Partners in this initiative include the Arizona Commerce Authority, Delaware Department of Transportation (DelDOT), Rutgers University’s Center for Advanced Infrastructure and Transportation (CAIT), and Volkswagen Group of America (VW). The program is being used to study use cases like red-light warnings, vulnerable road user alerts, and weather condition warnings.

Autonomous Vehicle Testing: Verizon has partnered with Honda at the University of Michigan’s Mcity; a lab-like test track for connected and autonomous vehicles. This research collaboration is exploring how 5G and MEC can enhance safety by reducing the need for onboard AI in each vehicle.

Scenarios being tested include next-generation road alerts for emergency vehicles, pedestrian crossings, and red-light runners.

Teledriving Services: Verizon Business is providing 5G connectivity to the teledriven electric vehicle fleet of Vay Technology in Las Vegas. This partnership enables Vay’s operational model, where a “teledriver” can remotely deliver or pick up a vehicle. Verizon’s high-performance, low-latency 5G is critical for handling the massive data loads generated by the vehicles’ cameras and sensors. Verizon’s network reliability is a key factor in Vay’s ability to expand its service. This partnership is a prime example of how Verizon is leveraging its 5G network to enable a new class of mobility services that are dependent on real-time, low-latency connectivity.

Verizon Communications Inc. (NYSE, Nasdaq: VZ) powers and empowers how its millions of customers live, work and play, delivering on their demand for mobility, reliable network connectivity and security. Headquartered in New York City, serving countries worldwide and nearly all of the Fortune 500, Verizon generated revenues of $134.8 billion in 2024. Verizon’s world-class team never stops innovating to meet customers where they are today and equip them for the needs of tomorrow. For more, visit verizon.com or find a retail location at verizon.com/stores.

Joe Petrosky Vice Chancellor Economic & Workforce Development Oakland Community College

Decades ago, back when Johnny Carson hosted the Tonight Show, he often played a recurring comedy skit of ‘Carnac The Magnificent’ Carnac’s costumed mystic character had the ability to divine answers to yet unseen questions in a sealed envelope he subsequently was handed and opened after announcing his answer. His responses were always on point to current issues and funny.

As I prepared for the Automation Alley Integr8 Roundtable on Mobility, I thought about Carnac and discerned the answer of ‘talent’ to what undoubtedly might be raised as a question of ‘What is one of the top issues facing Mobility companies both today and in the future?’ Unfortunately, it is not a humorous answer but rather a serious one.

The issue of talent and workforce is not unique to the mobility sector. Georgetown University’s Center on Education and the Workforce recently released a report concluding that the US economy needs 5.25 million additional workers with education and training beyond high school through 2032. This skill shortage is across the board affecting healthcare, construction, business, education and skilled trades. Their analysis was based on the projection of more retiring and exiting workers leaving the workforce than new workers entering, coupled with the addition of 685,000 new jobs over the same period.

This means that the mobility sector is competing for new workers against all these other sectors and needs to ask the question of what am I doing to make the Mobility sector and my company attractive to the next generation of workers and when and how do I engage in that challenge?

My encouragement to employers is to get involved early and often with your local schools and colleges. Research, as well as common sense, indicates that middle school students are open to exploring and trying new things and aren’t as affected by what their peers think, thus making it an ideal time to introduce thoughts about potential careers in their future.

You and your company’s involvement with educators and students at the middle school, high school, community college and university level is key to help make the Mobility sector stand out and be represented among its competition. It is required to ensure that the programs, facilities and staff are aligned to your workforce and talent needs both today and in the future.

Where I work at Oakland Community College (OCC), a large comprehensive community college in Oakland County (southeast Michigan), we value our industry relationships. We often find that while the public is aware of our academic certificate and degree programs, they know less about the great work being done in workforce development, short-term training programs and customized business training solutions for business and industry. I do predict that with the recent addition of ‘Workforce Pell’ to the federal Pell funding, those very effective short-term training programs will accelerate in recognition.

One example is the Electric Vehicle (EV) Technician Training Program at OCC designed to equip students with the knowledge and skills needed to thrive in the rapidly evolving field of electric vehicle technology. The program was designed with local employers involved at the earliest stages to identify the skills for entry level positions as the industry shifts and grapples with new technologies. Based on the input of hiring employers, not only does the training touch on EVs but also connects to its application in the automation of manufacturing with automated guided vehicles (AGV) as well as an introduction to programmable logic controllers (PLC).

Key areas for mobility employers to partner with local educational providers is through internships and apprenticeships. In a survey done by the National Association of Colleges and Employers (NACE), nearly 85% of responding employers indicated internships are the top recruiting method for their investment of time and money. And studies on apprenticeships have concluded that on average, employers realize an average return on investment of $1.47 for every $1 invested. Additionally, every $1 invested in apprenticeships leads to a public return of approximately $28 in benefits.

Other ways to get involved include joining program advisory boards, running for elected boards, offering plant tours, being a guest speaker, sponsoring educational events, or teaching a class in your field as an adjunct instructor. There are so many ways to connect and make meaningful and mutually beneficial contributions for the long-term competitiveness of the mobility sector and your local community.

So while we may never know with certainty which new challenges will appear for the mobility sector, we can be certain that with the right talent, we can address anything that comes our way. If you haven’t already taken a future focused approach for ensuring your company has the right workforce, I encourage you to make connections with your local educational providers and find a partnership that benefits you both. And I thank conveners like Automation Alley that help facilitate those introductions.

With a multi campus system throughout Oakland County, Oakland Community College (OCC) is committed to providing academic and developmental experiences that allows each student to reach their full potential and enhance the diverse communities they serve. It offers degrees and certificates in approximately 100 career fields and university transfer degrees in business, science, engineering, and the liberal arts. OCC also provides short-term workforce development programs designed in collaboration with employers for students to skill and gain employment quickly in in-demand fields. The college offers customized training solutions for businesses and works with companies to support apprenticeships in a variety of fields. More than a million students have enrolled in the college since it opened in 1965.

TKyle Veugeler

Technical Account Manager –Batteries US Siemens

he mobility sector stands at a crossroads, riddled with trade tensions, tariffs, supply chain disruptions, and the unavoidable shift from internal combustion engines (ICE) to electric vehicles (EV). These forces are reshaping manufacturing landscapes, demanding agility from industry participants. For manufacturers, machine tool builders, automation professionals, and system integrators, this transition presents both challenges and opportunities to innovate. This can be viewed as a catalyst to shape the future of manufacturing through intelligent automation. Drawing on my time as a system integrator, machine tool builder, and manufacturer, I would like to explore this navigation of complexity, addressing workforce transformations, and tackling consumer cost barriers.

In times of uncertainty, there’s a tendency to focus on short-term stability, but the true opportunity lies in forward-looking strategies that anticipate the industry’s evolution past the two-year cycle and plus five years, centered on building flexible automation and assets that remain relevant as technologies and products evolve. This means investing in modular production

lines that can pivot between platforms, chemistry, and form factors without massive overhauls. For instance, automation systems incorporating adaptive robotics and scalable software architectures allow manufacturers to reconfigure assembly processes swiftly, reducing downtime and capital expenditure.

A critical element here is AI integration. Rather than succumbing to hype, I would posit that organizations should map AI applications thoughtfully: identifying where it enables teams to make faster decisions, co-teach internally, and respond to market shifts. Digital transformation is the buzzword of the past few years, but digitizing an existing chaotic workflow is just digital insanity – you are doing what you were before, only digitally, and expecting different results. AI can optimize predictive maintenance, forecast supply chain vulnerabilities, or simulate production scenarios, but its value lies in targeted deployment and reduction of interactions and complexities.

Bridging gaps between industry, government, and academia is another priority. There’s often a disconnect where governments may lack deep understanding of automation technologies, their benefits, and expansion ramifications. Industry must proactively educate officials on strategic positioning of technologies for societal betterment, including workforce requirements proactively. This education extends to academia, ensuring curricula align with future needs.

Confusion about the industry’s trajectory is stalling investments; EVs are here to stay, and progress demands data-backed decisions over hesitation. Manufacturers should embrace market testing, iteration, and innovation. Multiple future scenario planning is key considering permutations like varying tariff impacts or EV adoption rates. Employ DMAIC (Define, Measure, Analyze, Improve, Control) closed loop thinking; identify key decision variables, monitor indicators, and adjust paths accordingly in real time transforming uncertainty into a competitive advantage. Understand critical paths for success, such as supply chain redundancy or automation scalability, and tie execution strategies to these drivers. In automation terms, this translates to systems with built-in sensors and analytics for real-time feedback, ensuring agility in uncertain times across modeled execution strategies on varied outcomes that may be likely.

As technology pivots frequently, diverse renaissance-like experts of none but high adept in many, credentials become invaluable, enabling cross-training and flexibility.

The shift from ICE to EV production introduces unique workforce hurdles, primarily due to a limited understanding of battery production processes and quality controls and the regions these lines are being built in. Many customers I speak to are highly machine tool builder reliant on these factors, where understanding the problem themselves is key before they may train others on the production floor. Manufacturers are taking steps like articulating multiple future scenarios with academia to define required skills across pathways. This informs curriculum prioritization, addressing incongruencies where academic outputs misalign with industry’s rapid advancements. As technology pivots frequently, diverse renaissance-like experts of none but high adept in many, credentials become invaluable, enabling cross-training and flexibility. A striking statistic: 65% of current STEM graduates enter careers that didn’t exist during their schooling, underscoring the need for adaptive education. Smart production measurement can further aid this by distilling critical data to decision-makers, even those lacking specialized knowledge.

Safety remains paramount in manufacturing environments. To train workers on high-voltage EV systems or automated lines, companies are adopting AR/VR mechanisms. These tools simulate dangerous scenarios without risk, but implementation requires deep process understanding, digital assets, and software integration. Much like AI adoption, case-driven assessments of what “digital twin” you want to establish to create value are markers for successful adoption.

Regional disparities complicate staffing. Areas like the Great Lakes and Northeast boast ingrained industrial automation knowledge, facilitating quicker ramps. Elsewhere, higher compensation or relocation may be needed, or timelines extended for local training. Overall, the EV shift may reduce workforce numbers in mechanical assembly but increases demand for software, data analytics, and automation expertise, potentially optimizing capacity through higher efficiency.

Consumer cost is a chief barrier to EV adoption, yet focusing solely on sticker price overlooks total ownership costs, including energy savings and whatever incentives are in vogue that year. Manufacturers must challenge this narrow view, emphasizing holistic value. Infrastructure support is crucial; while EVs promise efficiency, adoption falters without widespread charging networks. Only a few players invest heavily here, but collaborative efforts could, and arguably are, accelerating progress.

Production strategies can adapt by leveraging EVs’ simplicity for adaptable, modular, and standardized methods, potentially lowering costs through economies of scale. Shared platforms—fleets, buses, or transit— amplify cost savings over individual ownership, distributing expenses across users.

Producing near design centers speeds time-to-market, enabling rapid iterations for better product-market fit and broader consumer alignment. In a maturing but dynamic and agile industry this is paramount as you adopt future scenario planning as I depicted above. If you are planning out multiple scenarios, putting in place a mechanism to monitor those indicators, and rapidly adjusting production and your workforce to solve these challenges, time to communicate and deploy plays a major role in your execution strategy.

Customization helps close the gap: they offer redacted versions of high-end models, stripping unnecessary features. Early EV adopters were tech enthusiasts craving bells and whistles, but as markets expand to diverse users, say your friendly farmer down the road, needs shift to reliable, efficient, safe platforms without excess. Manufacturers must recognize this evolving consumer base, tailoring options to avoid over-engineering.

In conclusion, the ICE-to-EV transition demands foresight in automation. By prioritizing flexible systems, AI-enabled decisions, workforce upskilling, and cost-effective strategies, the industry can thrive. As we move forward, ongoing dialogue and adaptation will be key.

Siemens is the technology company for industry, infrastructure, and transportation, and we provide the operating system for digitally transforming OT.

Everywhere you look, the expertise underpinning our technologies—electrification, automation, software, and financing—is helping customers be more productive, profitable, and sustainable.

Siemens continues to ensure we have the capacity to serve our U.S. customers by investing more than $650 million in new plants and factory expansions, strengthening our domestic manufacturing.

We are now leading the way in bringing platforms to industry and infrastructure that make it easier and faster for customers to harness AI and digitally transform.

About Kyle: He holds a degree in Electrical Engineering and has been in the automation industry for 19 years, having held positions in hardware design, controls software development, field service commissioning, program management, R&D, and controls engineering management.

His experience ranges from combustion systems, agrochemical, pulp & paper, aerospace, life sciences, consumer electronics, food & beverage, logistics, robotics, and most significantly in automotive and battery automation. He has worked for Mathews Company, ABB, and most recently at Tesla in Fremont, CA and Austin, TX where he acted as a Controls Engineering Manager for the Advanced Automation Engineering team in Cell Manufacturing turning pilot machines into mass production operations. Kyle is also a Volta Foundation contributing member in their annual Battery Report.

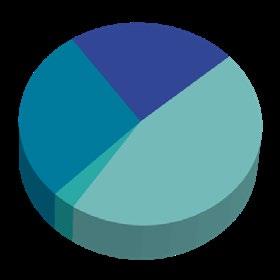

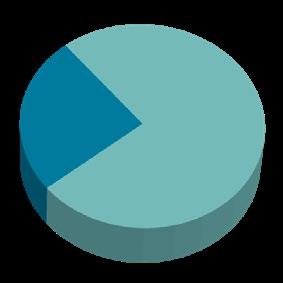

We polled leaders in industry, academia and government for their input on these questions many face. Here’s what they said:

In today’s business climate, how motivated is your company to switch from ICE component production to EV

Do you drive an EV?

in producing parts for the EV industry?

AI helps improve batteries with material simulations, and real-time charging/discharging algorithms. The technology helps cut the time and cost of finding and implementing new resources.

AI is key to the mobility industry’s battery design and optimization goals. However, digital and physical technology are not advancing at the same pace. AI technology doubles every seven months, while EV battery energy capacity typically improves by 5% per year.

Trade uncertainty has been affecting all mobility industries due to ever-changing global tariff policies. Leaders must watch, assess inventory, production, and keep supply chains strong for ongoing output.

How do self-driving EVs fit into a product line? Leaders in the field should consider the upfront costs, the running costs, and subscriptions. Accidents and injuries also raise liability concerns. Will autonomous vehicles also appeal to drivers used to traditional cars?

Switching from gas to electric vehicle production has pros and cons. Positive aspects include existing supply chains, capital, customer base, and facilities. Downsides involve factory renovations, new equipment, and assessing worker abilities. This change is a huge cultural shift and demands careful restructuring.

The transition from internal combustion engine (ICE) vehicles to electric vehicles (EVs) represents one of the most significant industrial shifts in modern history. While the shift is driven by consumer demand, environmental policy, and global competitiveness, its success will ultimately be determined by the people on the factory floor — the men and women whose skills, knowledge, and innovation keep Michigan’s automotive leadership alive. For Michigan manufacturers, this transformation is both a challenge and an opportunity. The state’s workforce is deeply rooted in the traditions of ICE production, but the future will require new skills, new approaches, and new ways of thinking about manufacturing. We must work together to ensure that this transition strengthens Michigan’s position as the nation’s manufacturing leader, while also preparing workers to thrive in the EV era.

One of the clearest workforce implications of the ICEto-EV transition is the scale of reskilling required. An electric vehicle contains fewer mechanical parts than an ICE vehicle but relies heavily on advanced systems: battery packs, electric motors, inverters, software controls, and thermal management systems.

This means that many workers who historically built engines, transmissions, and exhaust systems will need to pivot toward:

Electronics and software integration — EVs are computers on wheels, requiring assembly workers, technicians, and engineers who understand wiring, sensors, and digital diagnostics.

Battery chemistry and safety protocols —

Lithium-ion, solid state, and other battery technologies production involves unique chemical processes, quality standards, and hazard awareness, all of which are different from the skillsets needed for ICE components.

Advanced assembly techniques — EVs demand precision assembly of components that combine electronics, cooling systems, and new lightweight materials.

Quality control for new systems — Testing and validation must adapt to battery performance, charging systems, and digital controls, requiring new inspection methods and tools.

Even roles that appear unchanged — such as plant maintenance or materials handling — are evolving. EV facilities require new equipment, different safety systems, and greater reliance on automation. Workers who adapt to these new environments will remain in high demand, but only if training systems keep pace.

Michigan is uniquely positioned to lead this transformation. For over a century, the state has been the beating heart of the automotive industry. It has:

• Deep expertise in automotive engineering and high-volume manufacturing.

• A mature supplier network capable of pivoting toward new technologies.

• A skilled workforce already familiar with complex assembly processes.

• A strong policy environment that supports innovation and workforce development, such as MMA’s leadership on policy and workforce development.

But these advantages are not guarantees of future success. Michigan faces urgent challenges that must be addressed if it is to retain its manufacturing dominance:

1. Adapting Education and Training Systems Quickly Schools, community colleges, and training providers must rapidly adjust curricula to focus on battery technology, electronics, and digital systems. Waiting until the transition is complete risks leaving thousands of workers behind.

2. Protecting Workers from Being Left Behind

The ICE workforce includes tens of thousands of highly skilled employees. Without proactive reskilling, many could face job losses or wage reductions. Michigan must ensure these workers see clear pathways into EV-related roles.

3. Attracting and Retaining EV Investment

Michigan’s economic future depends on securing battery plants, electric motor facilities, and EV component manufacturing. If these facilities locate elsewhere, the jobs will follow. A competitive incentive and infrastructure strategy is essential.

4. Supporting the Supply Chain

Much of the EV transition will happen at the supplier level. Michigan’s vast network of small and mid-sized suppliers must be supported so they can retool and integrate into EV programs.

The pace of change in the auto industry demands rapid training models. Workers cannot afford to spend years in retraining programs; they need practical pathways measured in weeks or months.

Potential solutions include:

• Mobile training units that bring equipment and trainers directly into communities or plants.

• Industry apprenticeships that combine hands-on EV assembly with classroom learning.

• Boot camps focused on specific technical skills, such as high-voltage systems or battery pack assembly.

The MMA has already begun addressing this through its Workforce Solutions Collaborative Network, which connects manufacturers, educators, and workforce leaders to design short-term, targeted training aligned with employer needs. These efforts ensure that programs don’t just teach theory but prepare workers for the exact jobs available in Michigan plants.

Even after initial reskilling, the learning cannot stop. EV and battery technologies evolve rapidly, and today’s cutting-edge skill can be outdated within a few years. To remain competitive, Michigan’s workforce will need continuous training opportunities.

MMA envisions a system built around:

Flexible, modular training that allows workers to add skills over time while staying employed.

• Micro-credentials and certifications in emerging areas like battery technology, power electronics, and software diagnostics.

• Employer-driven partnerships with community colleges and training centers to ensure learning aligns with actual industry requirements.

This kind of continuous learning not only benefits workers but also helps employers reduce turnover, improve productivity, and maintain Michigan’s reputation for manufacturing excellence.

Reskilling workers is only half the equation — Michigan must also secure the facilities where those workers will be employed. MMA plays a critical role in advocacy, supporting policies that:

• Incentivize manufacturers to locate and stay in Michigan.

• Invest in infrastructure, from power supply to transportation networks, that make EV production viable.

• Provide grants and tax credits for suppliers to retool and modernize their operations.

By aligning training with investment, Michigan can ensure that its workers are not only ready for the EV transition but have the jobs waiting for them when the skills are acquired.

While automakers dominate headlines, suppliers form the backbone of Michigan’s manufacturing economy. The EV transition is already reshaping supply chains, creating risks for companies tied to ICE parts but opportunities for those that can pivot.

Suppliers would benefit from:

• Networking and collaborative learning, connecting small and mid-sized manufacturers with resources to retool.

• Supplier development programs, which help firms add capabilities in electronics, lightweight materials, and advanced assembly.

• Integration opportunities, linking suppliers to automakers and tier-one firms seeking local partners for EV production.

This support is vital to ensuring that Michigan’s thousands of smaller manufacturers remain competitive and retain jobs in their communities.

The transition from ICE to EV is not simply a technological evolution — it is a workforce revolution. Michigan’s future as a global manufacturing leader will depend on how quickly and effectively it can reskill workers, adapt education systems, and attract investment in EV production.

The Michigan Manufacturers Association is leading this effort with vision and purpose. Through accelerated reskilling programs, ongoing learning opportunities, supplier support, and policy advocacy, MMA is ensuring that Michigan workers are not left behind but instead become the engine driving the EV economy forward. If Michigan seizes this moment, the state can transform its century-long legacy of automotive leadership into a future defined by innovation, opportunity, and sustainable prosperity.

Advancing the mobility industry faces a couple of significant challenges.

First, there is a shortage of workers in the United States capable of developing and implementing new technologies for the general public’s use.

The Semiconductor Industry Association released a report in July 2023 stating that “the United States faces a significant shortage of technicians, computer scientists, and engineers, with a projected shortfall of 67,000 of these workers in the semiconductor industry by 2030 and a gap of 1.4 million such workers throughout the broader U.S. economy.”

The report added that jobs in the semiconductor industry alone will increase by nearly 115,000, putting that number at 460,000 by the end of the decade.

Second, technology moves at a rapid pace, potentially leaving businesses at a loss for how to create, test, and re-engineer EVs, batteries, charging stations, and other related equipment and computer programming.

“Currently, we have 7,000 (engineering students) and still not enough,” David Bertram, Director of Economic Development for the Michigan State University College of Engineering, said about the need to graduate more skilled workers into the technology and manufacturing industries. “We have people aging out of the field and leaving Michigan for other states.”

As the mobility industry faces these challenges, MSU—located in East Lansing, Michigan—has stepped up to educate the future workforce and use the campus as a proving ground for new technology.

Filling the workforce gap begins with instruction, and MSU has expanded its traditional engineering programs and introduced a new Tech Engineering Degree that incorporates the study of autonomous vehicles, EVs, Autonomous Vehicle Systems (AVS), mechatronics, and semiconductors.

“It’s a bachelor’s for a hybrid engineering degree,” Bertram said. “Most engineering degrees are for mechanical and computer science. This is aimed at the new mobility technologies. We need more engineers in technology spaces. Industry leaders are looking for engineers who can work in several of these lanes.”

MSU’s engineering students immerse themselves in practical applications of their studies by collecting data, digital twining, battery testing, researching reusable materials, and incorporating fewer metals such as cobalt and zinc into production.

They also design lighter vehicles that reduce tire wear and improve mileage between battery recharges, which makes vehicles more durable for street use and the military.

Improving technology and processes doesn’t begin and end in the College of Engineering, as several disciplines collaborate on making mobility more efficient and cost-effective in the public and private sectors.

Bertram said MSU takes an “ecosystem approach.”

“We have 17 colleges on campus, and seven of those colleges touch mobility and research, and they all take a significant role,” they explained. “We are doing the social side, law elements, agriculture. We look at the human impact. We look at what (autonomous, EVS, AVS) can do, where they can go, and how they are used.”

Pushing for innovations is “critical,” Bertram said. “That’s part of the reason why we’re using the campus as a test bed for autonomous and other types of vehicles that require simulation. When you’re game-ready, come to MSU to test in a live environment.”

The campus boasts 5,200 acres (8.1 miles) of urban (north), suburban (middle), industrial, and rural zones (south), which include agriculture and solar farms.

Other features that make MSU an ideal test site are:

• 60 miles of roads

• 20 miles of bicycle lanes

• 120 miles of pedestrian walkways and sidewalks

• Nearly 40 traffic signals, with real-time traffic control

• 70,000 students and faculty on campus daily

• 30,000 vehicles on campus daily

• 545 buildings

• 26,000 parking spaces

• Four weather season

• Spartan Mobility Village is home to MSU’s mobility labs, where roadways and parking lots can be closed to test new technologies.

“ “ When you’re game-ready, come to MSU to test in a live environment.

David

Bertram Director of Economic Development

Michigan State University College of Engineering

MSU has seen significant change over the last decade, including adding 47 EVs to its fleet over the past few years. It is on its way to putting that number at 370 by 2030.

The campus also joined the Capital Area Transportation Authority (CATA) of the greater Lansing area, which provides nine fare-free routes on campus. Part of that system is the SpartanXpress, a 28-foot autonomous bus with 22 seats that is compliant with Federal Motor Vehicle Safety, Americans with Disabilities Act, and Buy America standards. The bus has six LiDAR, six radars, eight RGB cameras, and a C-V2X (Cellular Vehicle-to-Everything) unit. The campus employs autonomous farm equipment, floor sweepers, and SnoBots for snow removal.

Engineering students developed a last-mile drone delivery system as part of a NASA-funded research project looking to improve safety, quietness, and affordability.

According to MSU’s mobility website, “the MSU Aerial Intra-City Delivery Electric Drone (AIDED) team simulated a delivery trial with a truck-drone tandem system where a drone hitches a ride atop the truck before delivering a package.

“Instead of flying directly to the end customer, this research centered around an autonomous delivery drone traveling on the roof of public transportation, where it is able to charge its battery and then launch from the platform once it is within a certain range of its destination to deliver a package.”

The drone is just part of what is possible for current and graduate engineering students. According to data collected by MSU from 2019 through 2023, engineering students had a Knowledge Rate of 91% in 2023, 83% in a five-year overall average; Placement Rate of 94% (2023), 96% (overall); Employment Rate of 79% (2023), 81% (overall); and Continuing Education Rate 14% (2023), 14% (overall). Michigan retained those graduates at a rate of 59% in 2023 and 58% overall.

Salaries jumped for all graduates from $66,926 in 2023 to $76,806 in 2023 (an overall average of $71,445).

The mobility sector’s transformation demands companies that can adapt quickly to shifting markets, technologies, and supply chains. Success will depend on manufacturers’ ability to remain flexible, invest strategically, and plan for the long term as the EV transition accelerates.

Unpredictable tariffs, evolving EV mandates, and fluctuating trade policies continue to disrupt planning cycles for automakers and suppliers. The industry needs stable, forward-looking policy frameworks that encourage investment, support innovation, and create confidence for long-term decision-making.

Data integration and analysis are becoming central to manufacturing strategy. Companies that effectively collect, interpret, and act on data will make smarter investments, optimize production, and identify opportunities faster—whether in EV, hybrid, or ICE markets.

The shift from mechanical to digital systems is widening the skills gap across manufacturing. A strong educated ecosystem provides a foundation, but continuous upskilling, cross-training, and apprenticeship programs will be critical to align workforce capabilities with emerging technologies.

As vehicles and factories become increasingly connected, cybersecurity must be built into every level of the supply chain. Small- and mid-sized manufacturers need stronger support systems to meet cybersecurity standards and protect shared data networks from growing threats.

Distributed production models, such as regional 3D-printing networks, demonstrate how flexible manufacturing can respond to market demand quickly and cost-effectively. Applying similar frameworks to AI, automation, and data-driven systems could accelerate innovation in the mobility space.

The state’s deep network of OEMs, suppliers, universities, and innovation hubs gives it a unique advantage in shaping the next era of mobility. Strengthening collaboration between academia, industry, and government will ensure Michigan remains the center of mobility innovation.

The Michigan Economic Development Corporation (Michiganbusiness.org) offers funding and testing resources. Funding includes grants for testing, development, demonstrations, and other aspects of mobility technology. MEDC provides resources to connect with testing sites and research labs throughout the state. For more information, visit https://shorturl.at/glsxJ

The Michigan Department of Transportation provides updates on statewide initiatives, programs and plans for future mobility developments, allowing industries to remain up-to-date on the implementation of the technology. For more information, visit michigan.gov/mdot/travel/mobility/initiatives

Michigan Emerging Technologies Fund expands funding opportunities for technology-based companies in the federal innovation research and development arena. The funds are available through a partnership between the Small Business Development Center (SBDC) and the Michigan Economic Development Corporation. For more information, visit https://www.mietf.org/#/

The U.S. Department of Transportation offers grants to the private sector that promote new mobility-based technology. The department also offers other information and resources. For more information, visit https://www.transportation.gov/

The U.S. Department of Energy offers technology grants and information on tax incentives for EVs and Alternative Fuel Vehicles. For more information, visit energy.gov

The U.S. offers Commercial Clean Vehicle Credit up to $40,000. For more information, visit shorturl.at/cZFxM

Automation Alley is Michigan’s Digital Transformation Insight Center — a nonprofit technology business association accelerating the growth and global competitiveness of businesses through Industry 4.0 technologies and innovation.

With a regional foundation of more than 4,000 member companies spanning all 83 Michigan counties, Automation Alley unites industry, academia, and government to build a connected ecosystem that drives technological adoption, workforce development, and economic prosperity. Over the past 25 years, our programs have engaged one in three Michigan manufacturers, helping companies of all sizes develop the skills, strategies, and partnerships needed to thrive in a rapidly changing digital landscape.

At Automation Alley, our mission is to help businesses thrive in the rapidly changing digital economy. We equip them with the knowledge, insights, and tools to develop a software-first mindset that leverages the power of automation, AI, and other cognitive technologies. We believe that by working together, we can build a stronger, more innovative, and more competitive economy for the future.

Wealth, prosperity and equality through technology.

MiAuto - Michigan is Automobility

https://michauto.org/wp-content/uploads/2025/09/Multipager_MIAM. pdf

CompTIA - State of the Tech Workforce 2025 https://www.comptia.org/en-us/resources/research/state-of-the-techworkforce-2025/

Project DIAMOnD https://www.projectdiamond.org/

Semiconductor Industry Association - America Faces Significant Shortage of Tech Workers in Semiconductor Industry and Throughout U.S. Economy https://www.semiconductors.org/america-faces-significant-shortage-of-tech-workers-in-semiconductor-industry-and-throughout-u-s-economy/

Aerial Intra-City Delivery Electric Drone https://aided-website.vercel.app/

Michigan State University - 2022-2024 Destination Report - College of Engineering https://www.careers.egr.msu.edu/_files/ugd/bc0367_ae9fb7b96ea5462f99bae2de41dfaedd.pdf

National Association of Colleges and Employers https://www.naceweb.org/

WEF Future of Jobs Report https://www.weforum.org/publications/the-future-of-jobs-report-2025/

Publication Credits

Editorial: Nicole Kampe, Dennis Burck and Joseph Gray

Graphic Design: Laura Gearhart

Photography: Corey Sims