They may be out of the spotlight, but location managers have a significant influence on the storytelling of films and television series. At RUBIK, we always pay close attention to everyone involved in this area, which lies between the production department and art direction—in other words, between the technical and the artistic, between logistics and narrative.

The decision of where to shoot is important not only for the film or series but also for the hosting territory. Primarily, this is due to the economic impact, but also because of secondary effects such as screen tourism. Its growing importance has led to real competition among film commissions to attract productions.

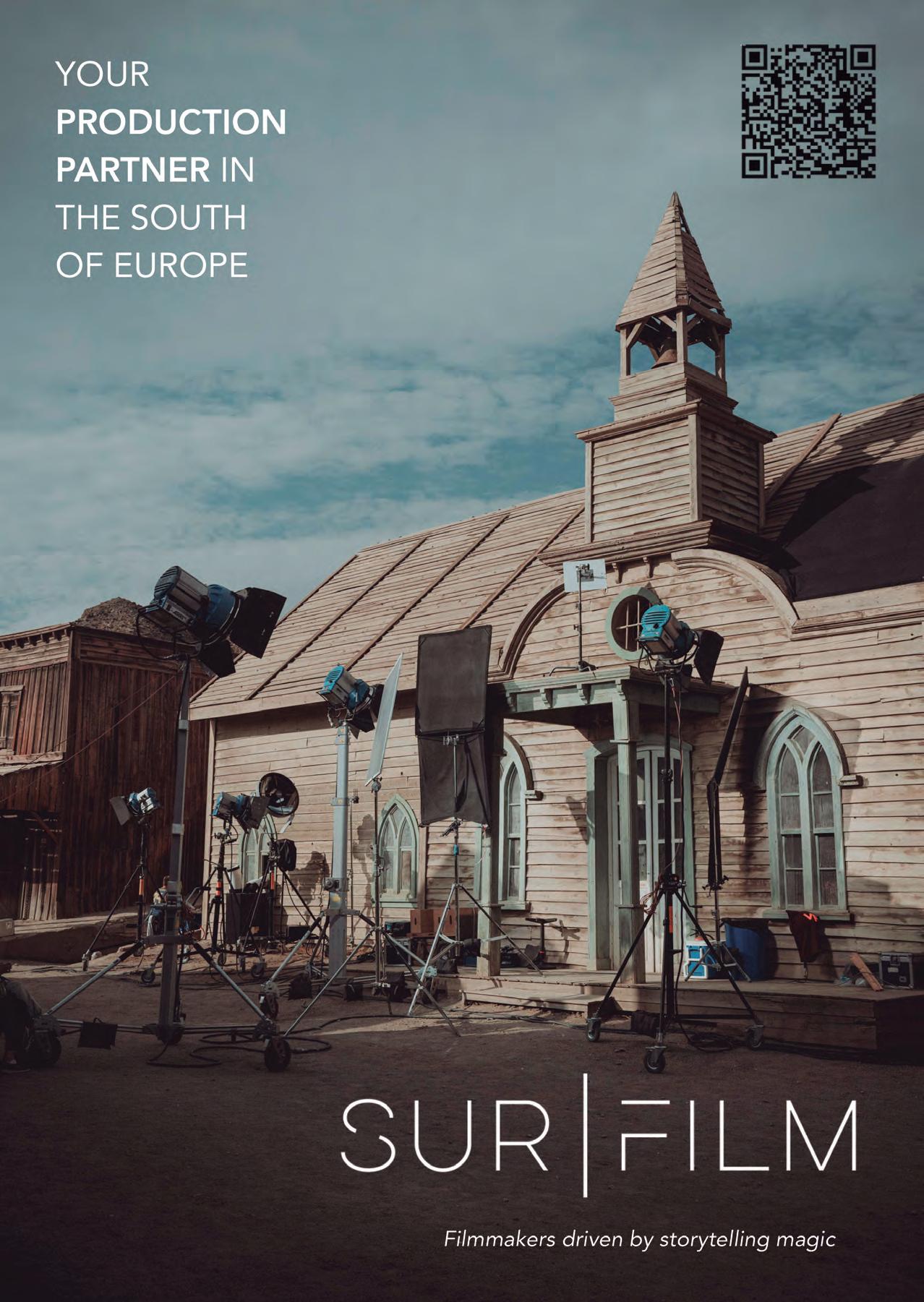

In this context, recent events like Shooting Locations Marketplace in Valladolid and FOCUS London have emerged as new meeting points. At RUBIK, we see them as highly significant, which is why we are attending them with a special international issue.

Therefore, in this edition, you’ll find extensive content on these topics, starting with articles on the latest editions of the events just mentioned.

One of the most insightful pieces for understanding the current state of the sector is our feature on the agreement between the European Film Commission Network (EUFCN) and the Location Managers

Guild International (LMGI), which includes interviews with their respective presidents: Adrian A. Mitchell and John Rakich.

Until a few months ago, Carlota Guerrero—now General Director of the Spanish producers’ federation PROA—served as co-president of the EUFCN. Drawing on her 18 years of experience as a film commissioner, she provides an article with practical advice for film offices and film commissions.

One of the main reasons for choosing a location is fiscal incentives. We’ve included an article on a study conducted by the legal firm OM-MA that examines incentives in various regions—a straightforward guide to understanding the conditions in several countries.

On a global level, we also revisit the sector’s most prestigious location awards from recent months: the LMGI Awards and the EUFCN Location Awards.

As always in our international editions, Spain takes center stage. The most in-depth feature—and the front page—is on the series The Walking Dead: Daryl Dixon, whose third season is set in Spain. It serves as a striking example of a country fully supporting a major production. The series traveled through no less than 8 regions, 22 municipalities, and 38 locations. This massive operation deserves a detailed report, split into two articles: one focusing on the production itself with insights from the service production company (Ánima Stillking) and Spanish director Paco Cabezas,

and another offering an in-depth look at the specific locations used.

Complementing this, we’ve published a piece on other ambitious international productions filmed in Spain in recent years. Many of these productions come to Spain to benefit from its incentives. These incentives— and the goal of attracting international shoots—were the driving force behind the Spain Audiovisual Hub. A recent presentation reviewed the outcomes of this initiative, and in this issue, we delve into its results and statistics.

In line with last year’s edition—where we recommended 12 mountain locations in Spain—this year we’re focusing on 12 forest locations. It’s another tool to help break the cliché of Spain as merely a land of sun and beaches.

Lastly, we don’t want to leave out the interviews. The most extensive is with Fernando Victoria de Lecea, president of Profilm (the association of the majority of spanish service production companies), and we also highlight conversations with the execs of two major production centers recently opened in Spain: the Coruña Immersive Studio and the new Toboggan sound stages in Villaverde (Madrid).

Carlos Aguilar Sambricio and Miguel Varela.

ADVERTISING CONTACT: MARKETING@RUBIK-AUDIOVISUAL.COM

SHOOTING LOCATIONS MARKETPLACE IS A TRULY UNIQUE EVENT ON THE INTERNATIONAL SCENE. WITH AN ORIGINAL FORMAT, ITS MAIN GOAL IS TO CONNECT FILMING DESTINATIONS WITH LOCATION SCOUTS AND PRODUCERS. ON OCTOBER 15 AND 16, PROFESSIONALS FROM 24 COUNTRIES WILL GATHER AT FERIA DE VALLADOLID, WHICH ORGANIZES THE EVENT IN PARTNERSHIP WITH SPAIN FILM COMMISSION.

Shooting Locations Marketplace (SLM) celebrates its fifth anniversary, and Valladolid once again stands out as the host city of a key event in the field of filming locations.

Among the key new developments is the participation, for the first time, of film commissions and location managers from Eastern regions such as Thailand, South Korea, Saudi Arabia’s AlUla region, and Kurdistan, as well as the Ibero-American Network of Film Commissions.

The event maintains strategic partnerships with major international professional associations, including Location Managers Guild International (LMGI), European Film Commissions Network (EUFCN), Crew United, and Profilm, enhancing its global scope.

“Since the project’s inception, we have emphasized the global nature of Shooting Locations Marketplace. In the previous

edition, we made a significant leap in terms of international presence, and this year that trend is being consolidated,” explains Alberto Alonso, General Director of Feria de Valladolid.

Juan Manuel Guimeráns, President of the Spain Film Commission, highlights the national industry’s support for the project, “as evidenced by the involvement of a large number of Spain Film Commission members, as well as the growing participation of private entities, including both companies that provide production services and studios.”

One of the standout features of this fifth edition is the increased presence of private companies, with 19 firms from diverse sectors such as studios, hotels, and production service providers, hailing from countries including Spain, Portugal, Jordan, Estonia, and Hungary. New additions include Stellarium Studios, based in Ciudad Rodrigo (Salamanca), and Pedralonga

Estudios from A Coruña, joining Alicante’s Ciudad de la Luz. The hotel sector will also be represented by chains such as Paradores, Radisson, MiniHollywood in Almería, THB, Blau, and Concept Group.

At the heart of the event is the business matchmaking market, where around 70

location managers and producers will meet with destinations and companies. Many of these professionals work with globally recognized studios such as Amazon, Annapurna, CBS Studios, Climax (South Korea), Focus Features, and Marvel, with participants from the U.S. and U.K. markets representing 55% of the total.

Blanca Jiménez, Councillor for Tourism, Events, and City Branding at Valladolid City Council, emphasizes that “this marketplace, unique in Spain, is part of a field that is very important both economically and socially on a global scale. The fact that SLM is being held in Valladolid is a clear example of our city’s ability to position itself through professional and distinctive events throughout the year. We are a city of film in every step of the process, from location scouting to the screening room.”

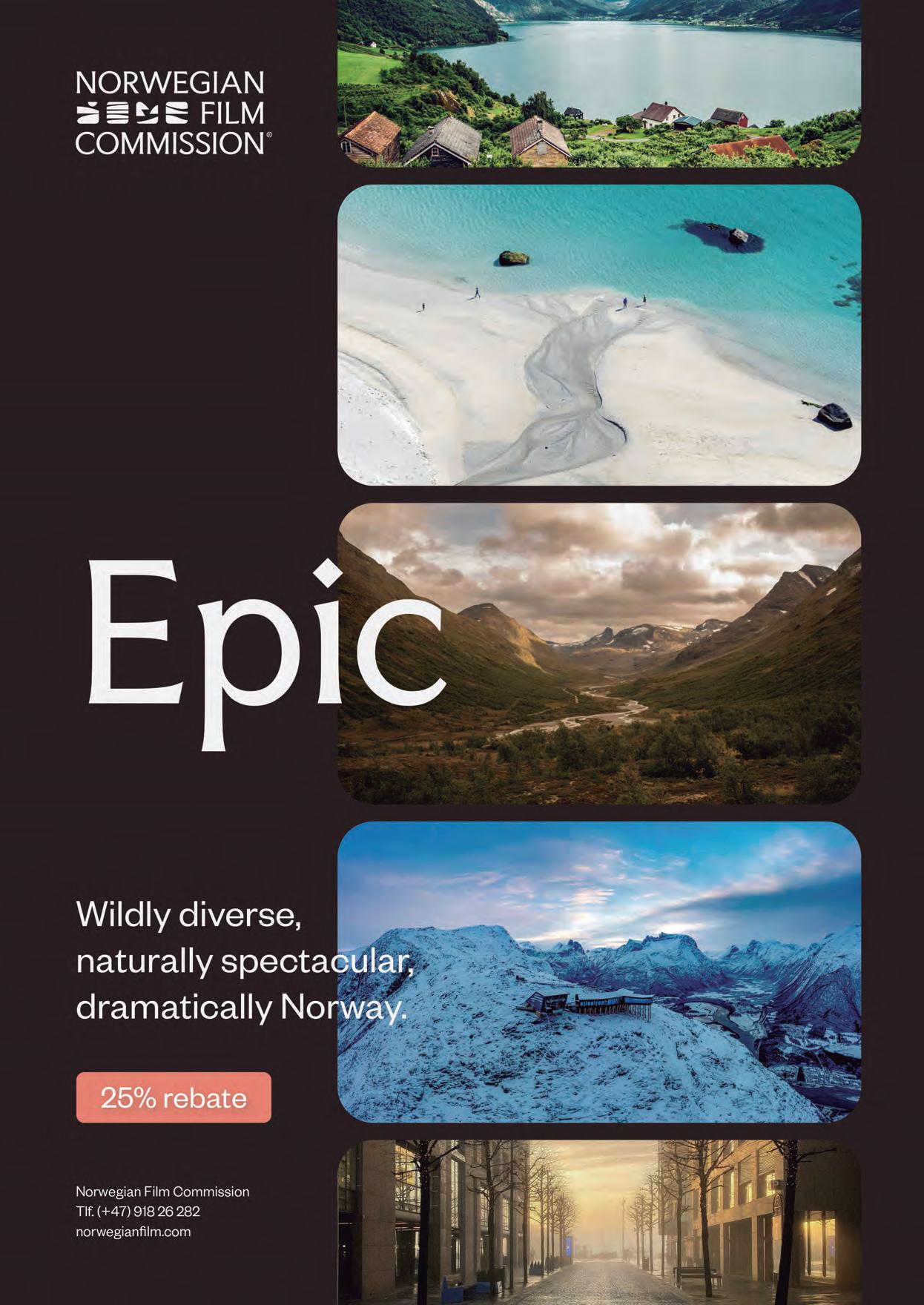

The activities of Shooting Locations Marketplace extend beyond the exhibition center, offering participants the chance to visit the destinations and filming sites discussed in the business meetings. This year, eight fam trips will depart on Friday, October 17, headed to regions such as Castilla y León, Andalusia, Rías Baixas, Asturias, Barcelona, and the Canary Islands, along with, for the first time, international destinations: Central Portugal and Norway.

In addition to the one-to-one meetings, the event features a carefully curated conference program. The opening session, titled ‘Cooperation Ties’, will take place at 12:15 p.m. on Wednesday, October 15, featuring a conversation between Juan Manuel Guimeráns and producer Anna Saura from Atrece Producciones.

That same afternoon, at 5:00 p.m., the first panel discussion, ‘Blurring Borders: The Rise of the East’, will be moderated by John Rakich, president of LMGI, and will include representatives from Thailand Film Office, Film AlUla, and South Korea’s Climax Studio.

On the second day, the morning sessions will include two panels. The first, ‘Hidden Treasures Around the World’, moderated by Kristine Guzmán of Castilla y León Film Commission, will feature speakers from the Kurdistan Film Commission, Slovakia Film Commission, Iberofic, and the Netherlands Film Commission.

The second panel, ‘Keys to Competitiveness in Global Filming’, moderated by Venia Vergou of EUFCN, will bring together professionals from production service companies such as Ready to Shoot (Portugal) or MenuFilmid (Estonia), and Pedralonga Estudios (A Coruña).

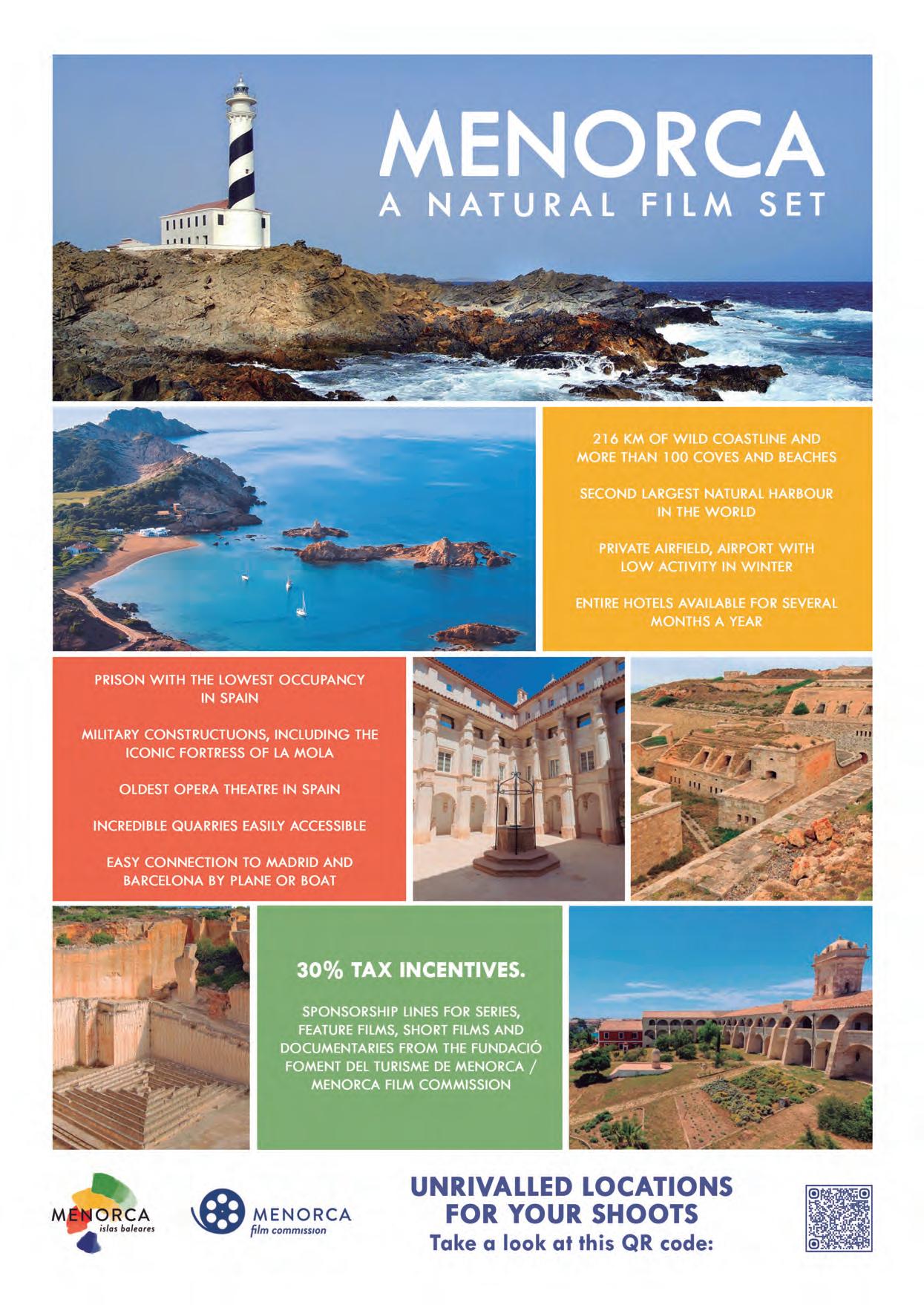

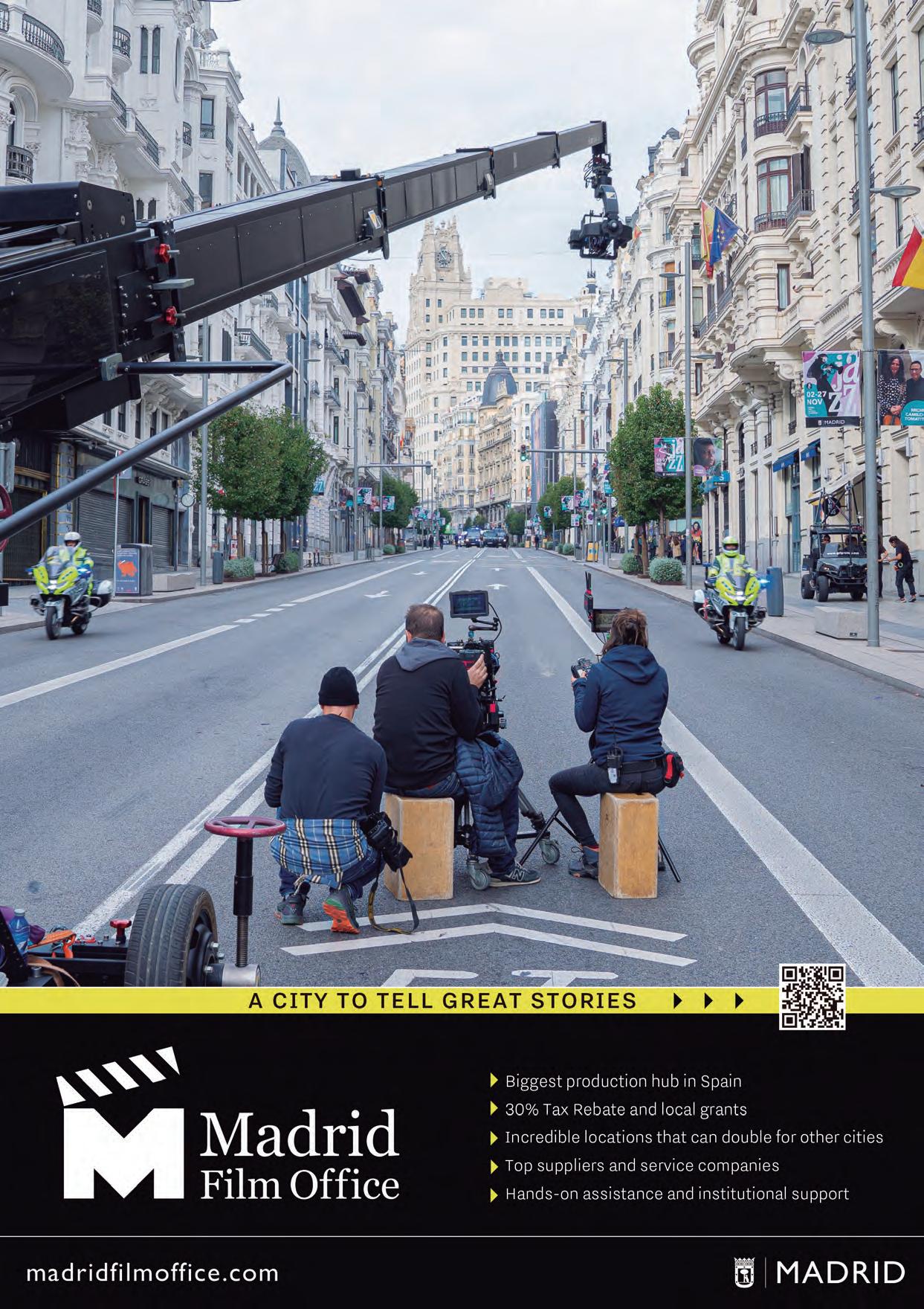

Regarding the participants, as in previous years, the event will welcome a strong presence of Spanish film commissions and film offices, representing territories from across the country: Spain Film Commission, Andalucía Film Commission, Aragón Film Commission, Asturias Paraíso Natural Film Commission, Bilbao Bizkaia Film Commission, Burgos Film Commisson, Cantabria Film Commission, Castilla y León Film Commission, Cataluña Film Commission, Costa Blanca Film Commission, Film Basque Country, Film France, Film Valencia, Galicia Film Commission, Gran Canaria Film Commission, La Palma Film Commission, Madrid Film Office, Mallorca Film Commission, Menorca Film Commission, Palencia Film Commission, Región de Murcia Film Commission, Rías Baixas Film Commission, Salamanca Film Commission, Santiago de Compostela Film Commission, Segovia Film Commission, Sevilla Film & Events, Soria Film Office, Tenerife Film Commission, Valencia Film

Office, Valladolid Film Commission and Zaragoza Film Office.

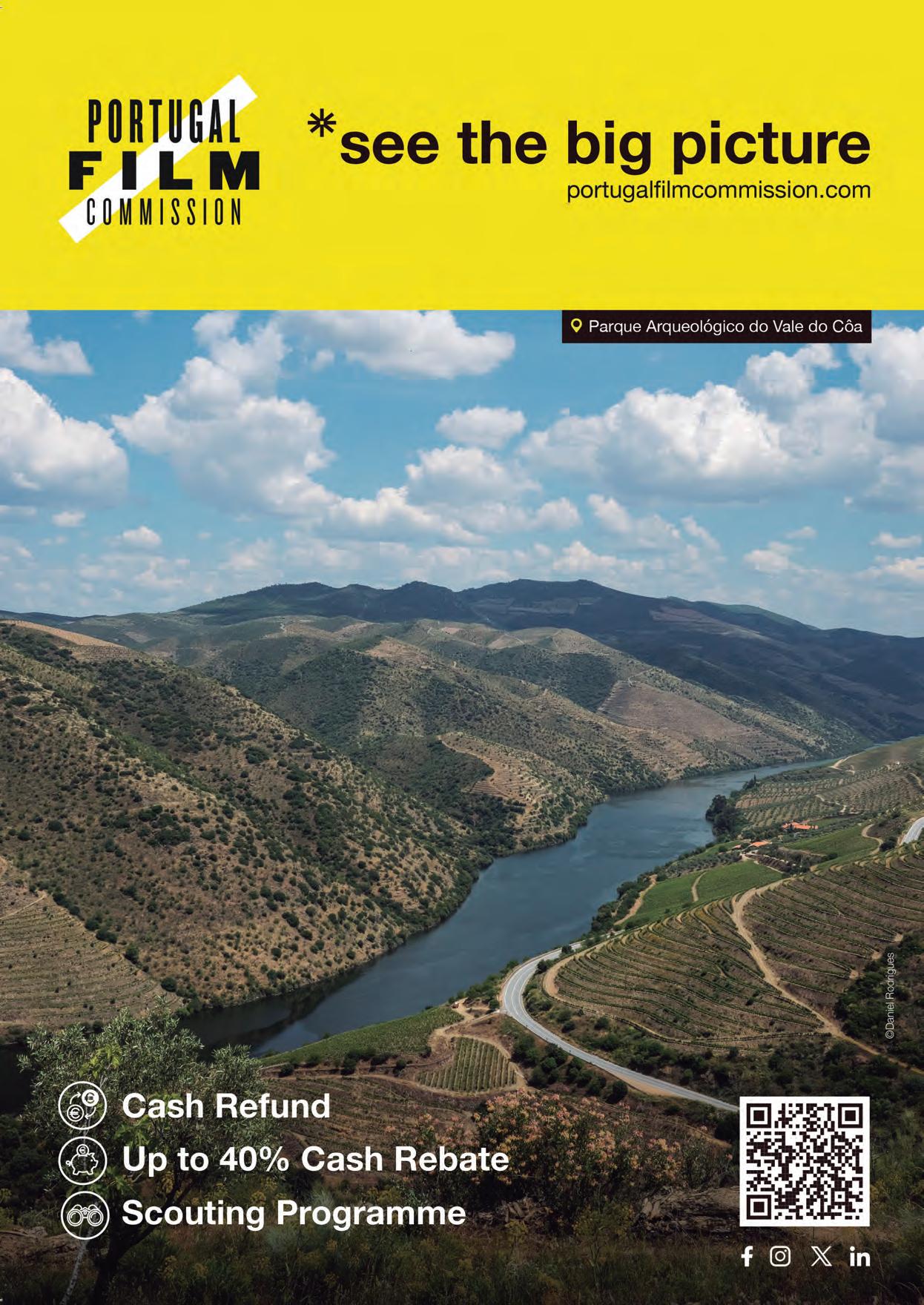

Alongside them, many European commissions will be participating, including representatives from Bayern Film Commission (Germany), BerlinBrandenburg Film Commission (Germany), Czech Film Commission, Friuli Venezia Giulia Film Commission (Italy), German Film Commissions, Netherlands Film Commission. Norwegian Film Commission, Nouvelle Aquitaine (France), Portugal Film Commission, Screen Scotland, Slovakia Film Commission, Tirol Film Commission (Austria), Viena Film Commission (Austria) and Vilnius Film Office (Lithuania).

The presence of Asian film commissions continues to grow, with this year’s attendees including Film AlUla (Saudi Arabia), Kurdistan Film Commission, and Thailand Film Office.

The event will also host service production companies, both Spanish— such as Anima Stillking, Palma Pictures,

Fresco Film, and Seven Islands Film—and international, with companies such as Zaman Productions (Jordan), Menufilmd (Estonia), The Family Project (Hungary) and Ready to Shoot (Portugal). Spanish production hubs like Ciudad de la Luz (Alicante), Pedralonga Estudios (A Coruña), and StellariumRodriwood (Salamanca) will also be taking part, alongside associations such as Crew United, EUFCN, LMGI, and Profilm.

In addition, a diverse array of organizations and institutions will participate: Aldeias do Xisto y Aldeias Históricas (Portugal), Blau Hotels (Balearic Islands), Concept Group (Balearic Islands), Fundación La Pedrera (Barcelona), Landers and Cofiño (Asturias), Ayuntamiento de Manresa (Barcelona), Minihollywood (Almería), Mont Sant Benet (Barcelona), Paradores de Turismo (Spain), Radisson Hotel Group, Red Iberofic (Latam), THB Hotels (Barcelona), The Wild Frame Locations (Madrid) and Turismo Valladolid.

90FPS 8K 16

dual sensors

stops of Dynamic Range

8K STEREO immersive

Blackmagic URSA Cine Immersive is the world’s first digital film camera for Apple Immersive Video! A fixed custom lens system and dual 8K sensors with 16 stops of dynamic range record immersive video to a single Blackmagic RAW file. This unique integrated design makes shooting 3D video simpler than ever, without the difficulty of complex multi camera 3D rigs!

Designed for Apple Immersive Video!

Apple Immersive Video is a powerful 180º media format built for Apple Vision Pro. It combines ultra-high-resolution immersive imaging and spatial audio to place viewers at the center of the action. For filmmakers, it opens up new possibilities to create scenes that unfold in every direction, giving viewers a sense of presence and realism with the freedom to explore the space around them.

Incredible RGBW Sensors

URSA Cine Immersive features revolutionary new sensors designed for incredible quality images at 8160 x 7200 resolution per eye! Using the same revolutionary RGBW sensor design as URSA Cine, the new dual sensor layout features larger photo-sites, delivering an astounding 16 stops of dynamic range! Now you can capture more detail with a wider dynamic range than ever!

While traditional digital film cameras have very basic user controls, URSA Cine has been designed with feedback from the world’s leading cinematographers so it’s loaded with controls needed for modern filmmaking. Standard connectors make it easy to use industry standard accessories and remote camera control. You also get 12G -SDI monitoring out, 10G Ethernet for network media access and more!

Includes DaVinci Resolve Studio for Immersive Video

DaVinci Resolve Studio for Mac is the world’s only solution that combines editing, color, VFX, audio post and delivery for Apple Immersive Video. New project settings bring Apple Immersive Video to every page including a new immersive video viewer that lets you view work on any monitor, an updated spatial Audio Editor as well as multiple ways to review and export Apple Immersive Video on Apple Vision Pro.

Blackmagic URSA Cine Immersive 25 825 €

CAN JOIN THOUSANDS OF FILM, TV, ADVERTISING, AND GAMES EXECS AND CREATIVES FROM OVER 100 COUNTRIES FOR TWO PACKED DAYS OF NETWORKING, KNOWLEDGE-SHARING, AND INSPIRATION.

Each passing year, FOCUS is more important for the screen industries. The organistion wants you to meet the makers shaping the future of the sector and discover global filming incentives and solutions for every stage of production.

FOCUS provides insights from expert speakers at the FOCUS Conference, developed in consultation with leading industry bodies, including Pact, BFI, BFC, UK Screen Alliance, ScreenSkills, Directors UK, Games London, and more.

At FOCUS 2024 , over 3,900 delegates, exhibitors, sponsors and international delegations, from 72 countries, enjoyed conference sessions, meetings and networking events at the Business Design Centre London. Among the new territories represented in 2024 were Nepal, Montenegro, Tunisia, South Korea, Hungary, Serbia, Barbados, Kurdistan, India, and Japan. Over 70 conference sessions and exhibitor presentations brought together more than 200 expert speakers.

If you are a working screen professional, you can claim for your free delegate pass and secure your place at this essential end-of-year gathering. There are also opportunities for Exhibitors; in this regard you have to act fast to get one of the final spaces.

This year’s there’s a record number of exhibitors (almost 300). The showfloor will include new participants from Armenia, Czech Republic, India, Georgia, Jordan, Lithuania, North Macedonia, Malaysia, and the UAE. There will be global partners from every continent — studios, film commissions, film-friendly locations, production services, and more.

In celebration of their 10th year of FOCUS, they are introducing CO:LAB: a dedicated programme featuring networking activities and workshops, designed exclusively for producers, directors and creators of on-screen content.

This specially curated, invitation-only programme includes bespoke workshops, offering expert-driven deep dives into key topics to help you level-up your knowledge: from legal and finance updates; to the latest co-production, AI and emerging technology insights. There will be speed networking sessions and informal mixers as wel.

This CO:LAB initiative is an exclusive and limited programme, and they only have 150 passes available.

It includes tailored workshops in-depth sessions, led by top-tier industry experts, covering core production areas such as Financing Strategies, Legal Essentials, Co-Production Insight, AI & Emerging Tech, Talent Management

Also, Speed Networking Sessions Facilitated networking, designed to encourage targeted business connections; Breakfast Mixer & Reception Relaxed networking opportunities; and Digital Networking Platform Access to their digital networking tool to connect and book meetings ahead of the event.

Over two days, attendees will be able to gain insights from influential voices in the industry.

There will be a Business & Leadership Stage where key topics like tax incentives, co-production, and workforce evolution will be tackled.

Besides, in the Craft & Innovation Stage , professionals will take a look at the creative minds and technologies that are driving the future of screen production.

On Monday December 8th , we can highlight some panels related to creativity and business like ‘Human Intelligence v. AI in Film Creation’, ‘Paying for Ideas: What’s Creativity Worth Now?’ and ‘Building the

Next Generation of Leaders in Film and Television’.

Many countries take advantage of this event to promote their regions as filming destinations, both for their locations and for other reasons such as infrastructure, film crews, or tax incentives.

This year there will panels such as ‘A UK Location Filming Masterclass’, ‘The Philippines - Where Stories Find Support’, ‘Cyprus, A Natural Film Studio’ and ‘Understanding the French Tax Rebate for International Productions (TRIP)’.

On Tuesday December 9th, there will some other interesting roundtables. For instance, ‘The Global Language of Locations: Building Partnerships that Power Production’, ‘The Art of Collaboration: Blending Effects and Design for ‘Warfare’’, ‘From Scroll to Screen: The New Hollywood Pipeline’, ‘Discover the UK’s incentives for VFX and Post Production’, ‘New Tools, New Rules: AI’s Impact on Film Craft’, ‘Disrupted Distribution: How Tech Reshaped Film Financing - and What We Missed’ and ‘Authenticity Sells: What the Creator Economy Can Teach Film and TV.

BY CARLOS AGUILAR SAMBRICIO

DURING LAST MARCHÉ DU FILM – FESTIVAL DE CANNES, THE EUROPEAN FILM COMMISSIONS NETWORK (EUFCN) AND THE LOCATION MANAGERS GUILD INTERNATIONAL (LMGI) SIGNED A MEMORANDUM OF UNDERSTANDING (MOU) IN ORDER TO HAVE A FRAMEWORK FOR COOPERATION BETWEEN THEM. RUBIK WANTED TO HAVE A GOOD GRASP

ON WHAT THIS AGREEMENT MIGHT LEAD TO, SO WE HAVE REACHED THE PRESIDENTS OF BOTH ASSOCIATIONS, WHO ALSO GAVE US SOME INSIGHTS ON THE CHALLENGES IN THE CURRENT LANDSCAPE.

The Memorandum of Understanding was signed in Cannes by EUFCN President Adrian A. Mitchell and LMGI President John Rakich. This MoU aims to promote broader accessibility to resources, foster professional development, and encourage the exchange of knowledge among film commissioners, location managers, and production

professionals globally, with a focus on Europe and international markets.

We wanted to know in what ways can it be useful for both. Adrian A. Mitchell, European Film Commissions Network’s president think that “a collaborative relation between members of the EUFCN and the LMGI will genuinely benefit both networks in a pursuit of crafting opportunities for local commissions and local location professionals in the industry.”

“We wish to broaden the scope of awareness of the vast and spectacular European locations and contribute to a sustainable and professional partnership on all levels,” adds Mitchell, stating that “there is great potential in promotion, professionalism and facilitation that would benefit all.”

For John Rakich, Location Managers Guild International’s president, the point is that they see “real value in building stronger

their creative toolkit and gives productions more options when Europe is being considered as a filming destination.”

Mitchell notes EUFCN does its best “to promote all the areas and regions of all our members”. He believes that, if the work they do will reach and make an impact on location managers and scouts in the US, working on AV productions looking for locations internationally, then “we have succeeded in many ways”.

He thinks LMGI members have been across the whole of Europe, mentioning Iceland, Norway, Finland in the north to Spain, France, Italy, Germany in south and central Europe, adding Czech Republic, Greece, UK and more: “The main objective of this collaboration is to gain more knowledge, to shed the light on the diversity of locations in Europe and to find the best ways to expand on both our objectives, namely to find the best locations, in the best possible way and attract positive activity in our regions.”

To broaden the scope of the agreement and put it into the context of the current landscape, I wanted to ask what they believe

are the main challenges facing European film commissions today.

“One of the biggest challenges for European filming destinations today is competition on a global scale. Productions are looking not only at creative value but also at incentives, infrastructure, and cost efficiency. Regions like North America, the Middle East, and parts of Asia have invested heavily in competitive rebates, purposebuilt studios, and streamlined permitting, so Europe has to work harder to stand out,” comments Rakich.

“Some European countries have robust support systems and choose to invest in the creative industries, while others struggle with inconsistency and fragmented policies”.

Adrian A. Mitchell

Another challenge is “logistics and consistency”, according to LMGI’s president: “Europe’s strength is its diversity, but it also

means navigating different regulatory frameworks, labor rules, and permitting systems from country to country. That can be daunting for productions trying to move quickly and keep budgets under control”.

He also points out the issue of capacity and sustainability: “With the boom in global production, many popular European hubs are stretched—crew shortages, infrastructure bottlenecks, and concerns about overuse of locations all come into play. At the same time, the industry is increasingly looking at environmental responsibility, so locations need to show they can support sustainable production practices.”

But challenges also create opportunities and Rakich states that, “ with the right incentives, better coordination between commissions, and continued investment in both talent and infrastructure , Europe can leverage its incredible range of locations and cultural depth to remain one of the most attractive regions for international filmmaking.”

Mitchell mentions the cultural heritage , Europe’s own film legacy: “How to maintain our industry, there are environmental issues and there are other issues that, at the moment, are argued to

be more important than others. So, which to choose, and how to address them all?”

Also, he says “some European countries have robust support systems and choose to invest in the creative industries, while others struggle with inconsistency and fragmented policies. ” Considering Europe has a tradition of co-production, sometimes it´s complicated by differing regulations and priorities.

“I think we need to face these issues and seek opportunities in finding a balance between attracting international investment and how we cater for local screen productions. The international (huge) productions opens up for crew development and their financial spend often opens up for new investments locally in terms of new equipment and infrastructure. This will further give local productions accessibility to competence and equipment in the aftermath of these productions. This could, and often do, raise the bar of local productions on many levels,” he adds

Mitchell refers to sustainability as another challenge, that’s why “we need to discuss how we can find ways and manage to produce with less negative and more positive footprint.”

Regarding tax incentives, some people say it´s all about them when picking a filming destination. “Tax incentives are important, but they’re only one part of the equation. Producers and location managers are equally looking for ease, reliability, and creativity in a filming destination,’ claims Rakich.

He adds that, what really makes a difference is “when film commissions and regions can start with streamlined access and permitting”. So, “simplified, transparent, and predictable permitting systems save productions both time and money”, which is something producers value “immensely”.

Other strong points could be “providing local expertise and solutions in having well-connected, proactive commissions who can anticipate challenges—whether it’s finding crew, navigating regulations, or unlocking unique locations. Also, a commission that can give fast answers, adapt to last-minute changes, and connect us directly with decision-makers will always stand out.”

Rakich insists as well on infrastructure and crew: “Incentives won’t mean much

if there aren’t enough trained crews, equipment houses, or facilities on the ground. Building local capacity gives producers confidence they can deliver at scale.”

“Producers want that their investment is safe, their creative vision is possible, and their production will run smoothly. Tax credits may get them in the door, but it’s the overall package of support, talent, and trust that convinces them to stay”

John Rakich

At the end of the day, producers want reassurance, according to Rakich: “They want that their investment is safe, their creative vision is possible, and their production will run smoothly. Tax credits may get them in the door, but it’s the overall package of support, talent, and trust that convinces them to stay.”

Mitchell also argues that the conversation shouldn’t revolve solely around tax incentives: “There are many ways of being creative in terms of attracting screen production, and not all of them are necessarily linked to tax incentives. An incentive is what it is; an initiative brought forward to attract wanted activity. If this is services, accessibility, rebates or other - it is up to each and every country or region to find and decide.”

According to him, what matters is “screen value”. This may seem “naive”, but when one only looks at numbers, “you will be missing out on several aspects that give value to crew, creatives and in the end the audience.”

MANAGING DIRECTOR OF PEDRALONGA ESTUDIOS

PEDRALONGA ESTUDIOS INAUGURATES THE CORUÑA ESTUDIO INMERSIVO (CEI), A

AND IBERSERIES & PLATINO INDUSTRIA. WE TOOK THE OPPORTUNITY TO LEARN MORE ABOUT THE PROJECT AND INTERVIEW ITS MANAGING DIRECTOR.

MIGUEL VARELA

CEI

Rubik: How did Pedralonga Estudios come about and what is the goal of the project?

José Manuel Deus: This project started at the end of 2020, following the pandemic. Several relevant Galician production companies belonging to the Galician Audiovisual Cluster came together over the need to have spaces in the region capable of accommodating major productions. In Galicia, traditionally much filming is done outdoors due to its very attractive landscapes. But many national and international producers, after shooting those exteriors, found themselves lacking notable interior spaces to finalize filming.

That’s why the project arose to build large sound stages in Galicia where all types of film and series projects could be hosted. That idea evolved over the years until it materialized as the Coruña Estudio Inmersivo (CEI), thanks to the impetus of the Next Generation European Funds. We submitted a very ambitious project, it was well rated, it was granted, and that’s when we put it into motion.

“WE WANTED TO PROVIDE NOT JUST A STAGE, BUT A FULLY INTEGRATED SERVICE FOR THE INDUSTRY”

Rubik: So, could it be defined as a joint project of the Galician industry?

J. M. D.: Indeed, it is a project that brings together the entire Galician audiovisual sector because it is promoted by the Cluster. The ten main Galician production companies are involved as participants in the corporate entity. And also part of it is the Galician Audiovisual Cluster itself and the University of A Coruña, because we understand that this investment in studios and technology must go hand in hand with appropriate training for future generations.

We are in a privileged environment on the outskirts of A Coruña, in what is known as the Cidade das TIC. And the project is still growing, it’s very ambitious, because apart from what we are presenting now (at San Sebastián and Iberseries & Platino Industria), which is the immersive studio, there are two more large sound stages currently under construction, of 2,000 and 2,500 square meters respectively. Another benefit to highlight, in addition to good connections, location, proximity to the airport… is that we are surrounded by the entire technological

sector of A Coruña, in constant evolution. In that sense, we believe that new technologies like Artificial Intelligence will generate many development opportunities for the sector.

“Although driven by Galician industry players, Pedralonga Estudios follows a transparent, open model, offering equal conditions to national and international productions alike”

Rubik: Speaking of technology. How would you define the CEI’s technological equipment?

J. M. D.: All the technological equipment has been designed at the forefront, to be the most advanced in the country. It comprises 2,000 square meters, 1,200 of installations and 800 of sound stage. This stage features a unique LED screen, with a 1.9 pixel pitch,

measuring 28 × 6 meters. It also features a ceiling screen of 100 square meters, divided into three sectors, with totem systems for lighting.

More than simply building a stage, the objective was to provide an integral service to the industry. We have screening and viewing rooms, parking, VFX rooms, editing rooms… We can provide a partial service or a full one, adapting to the demands of the sector.

Regarding Virtual Production, we work with the Pixotope system, but if a professional comes with another system of their preference, they could also implement it. If the client arrives with specific equipment or specific needs, we are not a closed ecosystem; we can provide ad hoc services at any time.

Not only in the realm of virtual production, we can also provide everything related to lighting equipment, sound… that can respond to your needs without leaving the studio. Also, the companies that are part of the Cluster can provide those services and help develop the projects as a service.

Rubik: From what you have publicized, in addition to the technological design, special care has been taken so that CEI offers an integral service to productions. How does this objective translate in practice?

J.M. D.: We have designed the facilities not only thinking that they will come to film on the stage and that’s it. The center has its own cameras (Arri Alexa Mini LF), sets of optics that we put at the service of directors of photography, an integrated calibrated tracking system, all rendering machines and AR / VR systems, all processors. Everything is integrated in the system, to make only the minimal aesthetic adjustments required for each production. When a crew arrives, it is only a matter of placing the set in front of the screen for the ambiance, making small adjustments, and starting to film immediately.

Beyond the technical side, the facilities also include all the basic ancillary installations for any shoot: dressing rooms, extras rooms, wardrobes… any need that a studio shoot might imply is covered.

Rubik: When one speaks of cuttingedge technology, virtual production… one automatically thinks of large-scale productions. Is the CEI intended to host big productions or also low-budget independents?

J.M. D.: It is designed to cover all kinds of productions in the sector, even beyond film and series fiction. We also want to encompass advertising, events, videogames… The facilities are prepared to respond to all types of productions. It is possible to carry out from large to small shoots depending on the needs of each project. From full productions to shooting a single scene.

Furthermore, although Galician companies and the Cluster are involved in the project, because the entity has received public funding, we are bound by a policy of absolute transparency. In other words, the production companies that are part of the society have no advantage over those that come from other regions. We are open to free competition and provision of services in a uniform and universal manner.

And I stress “universal,” because we understand we are in a great geographical position for international companies to come to shoot. In addition to proximity to any other Spanish region, we are two hours by plane from London, we have a great connection with Portugal…

Rubik: The creation of Coruña Estudio Inmersivo is a response to an increasingly mature and ambitious Galician audiovisual industry. How would you define its current state compared to neighboring industries?

J.M. D.: I believe we are at a very good level, bringing together immense creative and technical talent, of the highest level by national and international standards. Proof of this is all the Galician series currently airing on TV

and streaming platforms, with international success. And many more to come.

This is the result of great industry growth, boosted by outstanding human talent. Also by the push generated in recent years by the regional TV, which has strongly committed to creating original fiction. Also by all the academic plans launched by various formative entities, which have allowed significant training of technical staff. Universities have been driving elements of this sector.

“In A Coruña we have a saying: “the city in which no one is a stranger.” We at Pedralonga Estudios apply that philosophy to our facilities. No client will just be a client, but a partner whom we will accompany in all phases of their project”

All these factors have allowed over the years to create an ecosystem that makes it easier to work a lot. When those factors combine with talent, with the region’s idiosyncrasy, with the marvelous landscapes available for filming… it gives rise to an audiovisual region as cutting-edge as any other, capable of undertaking major international projects.

Rubik: For a Rubik reader who still doesn’t know Coruña Estudio Inmersivo, what would you tell them to come and discover it?

J.M. D.: I would tell them to come and discover new facilities, with cutting-edge technology of all kinds. We have a network of services around all that technology that is highly important, and professionals that are giving very good responses, so a wonderful ecosystem is generated to shoot under magnificent conditions and develop any type of project.

In A Coruña we have a saying: “the city in which no one is a stranger.” We at Pedralonga Estudios apply that saying to our facilities. No client will just be a client, but a partner whom we will accompany in all phases of their project.

Rubik: Can the studio already be booked for filming? What is the process to follow?

J.M. D.: The studio is now operational. The reservation process is universal and can be done via the website or by phone. It is a simple, transparent process open to anyone. Rates are already set and public because they are established in the agreement we have with the Diputación de A Coruña. We cannot yet disclose concrete project names already in the pipeline… but we can say we are very happy and excited about everything that is to come because it is very promising. There is a clear future vision, a firm commitment to a project that we want to continue evolving until it becomes an international benchmark.

FOUNDERS OF TOBOGGAN

WITH FIVE SOUND STAGES UP TO 14 METERS HIGH AND A TOTAL SURFACE AREA OF 30,000 M², TOBOGGAN’S NEW AUDIOVISUAL HUB IN VILLAVERDE (MADRID) HAS BEEN DESIGNED TO OFFER COMPREHENSIVE SERVICES TO PRODUCTIONS AND ADAPT TO ALL TYPES OF SHOOTS—FROM LARGE-SCALE FORMATS TO STANDARD PROJECTS. TO DELVE INTO THE DETAILS OF THESE NEW FACILITIES, WE SPOKE WITH JUAN PEDRO RODRÍGUEZ DE LA OSSA, CEO, PARTNER AND FOUNDER, AND DAVID GONZÁLEZ OLMO, COMMERCIAL DIRECTOR, PARTNER AND FOUNDER OF TOBOGGAN.

POR SARA RODRÍGUEZ MARTÍN

Rubik: I’d like to ask about the ambitious construction of the five new stages in Villaverde. What was the objective, and how has the project evolved?

David González: It’s a project we had been planning for quite some time. When we were looking for locations, we saw that Madrid was the most suitable place to build the studios.

With this location, we’re right in the capital, just a few commuter train stops from Atocha station. The layout of Madrid allowed us to build the studios with a maximum height of 20 meters.

As a result, we were able to create sound stages with 14 meters of clear height up to the catwalks. The conditions also changed in our favor, as we had a fast-track construction process without needing a lengthy permitting process. Everything was already well advanced, which allowed us to complete

construction in just 12 months and become operational.

Rubik: One of your key advantages is offering end-to-end services to your clients, right?

D.G.: Exactly. Toboggan was founded to provide end-to-end services for both fiction and entertainment. In addition to the sound stages, we also have production centers with prop and costume warehouses, production offices—we provide producers with all the facilities and real estate they need, whether they’re shooting in-studio or on location.

And we complement that with camera equipment, camera trucks, postproduction suites, cranes…

In other words, we offer a full-service package for fiction productions—and the same goes for entertainment. When a TV show from RTVE, a streaming platform, or any other client comes in, we provide all the technical services with our own in-house staff. That includes mobile units, screens, sound, postproduction, cranes…

“IT’S ESSENTIAL FOR A COMPANY TO TELL YOU

WHAT WORKS AND WHAT DOESN’T, SO THAT, WHEN YOU SHOW UP, NO TIME IS WASTED”

All our technicians support the project: technical directors, CCUs, vision mixers, sound engineers… We deliver a full-service production experience.

Rubik: What features or services set the new Villaverde facilities apart from other studios in Spain?

D.G.: The big difference is that these studios were built from scratch with a workflow in mind for every department. We have extensive facilities and a lot of space for work and production.

There are large pre-assembly storage areas, wardrobe zones connected via freight elevators for people and materials, climate control, on-site carpentry for each stage, 17 dressing rooms including VIP suites, spacious makeup and hair rooms—all on one floor. Then we have the catering area on the third floor, next to the production offices.

Each sound stage includes space for 60 workstations, five private offices, and meeting rooms. It’s fully separated and independent.

“The difference we bring is that these are studios built from the ground up, designed with a workflow in mind for every department. We have extensive facilities and workspaces for production.”

In

terms of the stages themselves, each one has a 14-meter height, all with technical catwalks. For soundproofing, we’ve installed

acoustic curtains to manage sound isolation, technical catwalks, climate control, and every stage is fully independent. We have a block with a 2,300 m² stage and its corresponding facilities, plus a block with four stages measuring 1,500, 1,200, 1,200, and 1,500 m².

Each of those stages is constructed independently. They’re separated by safety corridors and insulated to prevent sound transmission. We’ve even implemented a flooring system to avoid sound traveling through the ground. Besides the individual safety corridors for each stage, we added another 1.5 meters between each wall.

Each stage is a standalone box. So in terms of soundproofing, climate control, facilities, height, and catwalks, it’s a complete production setup—right in central Madrid.

We also have a large parking area with space for around 200 vehicles. It’s a closed and secured facility. People can park right at

the studio lot, and we offer 24/7 surveillance. That sets us apart from other studios across Spain.

Rubik: In terms of sustainability or technological innovation aspects, what did you do in the design and management of the space?

Juan Pedro Rodríguez: The design of the Villaverde sound stages is based on 30 years of experience working with all types of production companies. These stages are meant to respect the budgets of national producers and respond to everything we’ve learned over the years about what a production needs from a studio.

They’re also designed to be highly versatile—suitable for fiction, entertainment, and advertising. The design aims to meet the needs of any kind of production.

I believe that’s why they’re so different from what’s currently available. That’s the consistent feedback we’re getting from every production company that visits during our commercial outreach. To our delight, the most common phrase we hear is: “Finally, a set of studios in this country designed professionally and built to meet the real needs of producers.”

Rubik: With this launch, you now have 18 stages across Spain. How do you assess your current market position?

D.G.: We believe we’ve positioned ourselves as one of the leading service providers in Spain, both in terms of studios and technical facilities. Our customer service is personalized and hands-on. But we don’t claim to be the top player—we humbly

consider ourselves one of the key players, wellpositioned and differentiated.

Rubik: Your goal is to continue expanding. What are your plans for growing your facilities?

D.G.: We have two additional phases currently in development. I can’t share many details yet, but I can say the goal is to expand further within Madrid.

“The sound stages are designed to be highly versatile—suitable for fiction, entertainment, and advertising. The design aims to meet the needs of any kind of production.”

Rubik: You’ve incorporated a virtual stage and immersive production technologies. What opportunities does this open up for national or international producers?

J.P.R.: I think that, while virtual production has been around for quite a few years, it requires many technical disciplines to make it work properly. In Spain, there wasn’t a company offering a truly end-to-end solution.

What do we mean by an end-to-end solution? A company that can step in from the pre-production stage to assess shooting needs, map out what’s feasible and what’s

not, adapt and create content from 2D to 3D to Unreal, and then go into production with all the guarantees of that prior work. And even continue supporting in postproduction.

What we had until now was a scattered setup—a bunch of freelancers. A production company had to know exactly who to call during pre-production. It was complicated. There wasn’t a single company offering all of this under one roof, especially with the honesty to say what’s truly possible and what isn’t.

One of the biggest issues is we’ve come across production companies, and we expected this, that have already gone through the frustration of working with virtual production—either wasting time or finding they couldn’t achieve many of the things they had been promised.

It’s essential for a company to tell you what’s doable, what works and what doesn’t— so that, when you show up, no time is wasted.

Rubik: Who are your technology partners in developing the virtual stage?

J.P.R.: What Toboggan does is bring together all the disciplines. And we do this with reliable companies. In this case, we’ve partnered with Visualmax as technology experts.

APPIA, which has years of experience across Europe in this type of production, ensures you’re not relying on freelancers but on a company you can contact directly to provide the service. We also count Lavinia among our partners.

It’s a partnership between four companies, joining forces to provide a fully guaranteed service.

SINCE 2010, AMC’S SERIES HAS TOLD THE STORY OF A GROUP OF PEOPLE TRYING TO SURVIVE A ZOMBIE APOCALYPSE, WHERE THE UNDEAD ARE KNOWN AS WALKERS. FOR ITS THIRD SEASON, SPAIN HAS TAKEN CENTER STAGE. THE LOCAL TEAM INCLUDED MÁLAGA-BASED PRODUCTION COMPANY ÁNIMA STILLKING, WITH SILVIA ARÁEZ AS EXECUTIVE PRODUCER, AND SPANISH FILMMAKER PACO CABEZAS, WHO DIRECTED TWO EPISODES. AT RUBIK, WE SPOKE WITH BOTH TO LEARN WHAT IT WAS LIKE TO FILM THE APOCALYPSE ON THE IBERIAN PENINSULA.

Filming the third season of The Walking Dead: Daryl Dixon in Spain had a touch of Apocalypse Now—not just because of the apocalyptic setting, but also due to the specter of war, in this case the Spanish Civil War, looming over one of the locations.

“It was a pretty intense shoot—very guerrilla-style, with handheld cameras. One of the action scenes involved 300 extras, 100 stunt performers, cranes, hydraulic jacks...,” recalls Paco Cabezas,

who directed the fourth and fifth episodes of this season.

The directing opportunity came about casually and organically. The Seville-born director had just wrapped filming season two of Wednesday for Netflix when several producer friends mentioned that AMC+ was bringing the show to Spain. After a few conversations with showrunner David Zabel, Cabezas landed a two-episode block.

The first time he met actor and executive producer Norman Reedus,

Cabezas was wearing sweatpants and socks, “taping photos and drawings all over the office walls like the killer from Seven,” as he describes it. Although Reedus was surprised by the scene, Cabezas took it in stride.

“I admire Sam Raimi or Hitchcock, sure, but dressing up in a blazer just feels unnatural to me. A director doesn’t have to look good—they need to be the one moving the most around set, rolling on the floor, running everywhere… That’s why I live in tracksuits,” explains Cabezas.

Spanish village, close to where Daryl and Carol’s boat crashes, and a place where people from all over could believably coexist.

Sepúlveda, in Castile and León, turned out to be the perfect fit—meeting all the narrative requirements and inspiring Cabezas creatively.

“Sepúlveda is an incredible town, with a stunning color palette—those browns and oranges of the buildings,” says Cabezas. “It was like filming in a medieval Disneyland,” he adds.

Another key location was the historic site of Belchite. Both the producer and director recall that it presented several challenges, including for the shooting schedule. Filming coincided with a cold drop storm (DANA) that hit Zaragoza in October 2024. “You could really feel the chill on set those days,” Aráez recalls.

In episode five, Daryl follows the trail of a convoy to Barcelona in search of Justina. Along the way, he encounters a new group of survivors desperate for water. Belchite was chosen for its arid landscapes, but the storm changed everything.

“It was supposed to be the desert, but it rained a lot. Rivers of water were running through Belchite and we had to dodge them. We kept moving locations, hiding under

cover, and as soon as the rain stopped, we started throwing dirt and sand over the mud to make it look dry,” says Cabezas.

“I wanted everything to be as real as possible, without digital effects. In action scenes with so many extras, a drone, cranes, and a thousand other things, you have to be incredibly efficient. Any mistake or hesitation could hold up the whole production team.”

“It was like fine craftsmanship. On screen, it looks like a desert—but if you turned the camera just one centimeter to the left, everything was flooded.”

For Aráez, those days were so intense they could “feel the war”—not just because they were shooting in a Civil War landmark, but because of how hard the shoot was.

Just as challenging was filming an action scene in episode four. Cabezas and

Greg Nicotero—who has previously directed action for Tarantino and Raimi—designed the practical special effects for the season.

“I remember a conversation where we both agreed that zombies had become more of a nuisance than a real threat,” recalls Cabezas.

The showrunners suggested a zombie fireball, and Cabezas and Nicotero ran with the idea. There had been flaming walkers in The Walking Dead before, but never ones raining from the sky, catapulted like fireballs.

“I wanted everything to be as real as possible—no digital effects,” says Cabezas.

For example, in a scene where a fireball hits a truck, they installed mechanical hydraulic jacks to move the vehicle upon impact.

Cabezas, who has shot many battle scenes in his career—such as in Into the Badlands—says he’s learned that the eye sees in layers, focusing on what’s closest to the camera. “Everything happening in the background is choreography you can repeat without anyone noticing—it’s like a mechanical dance,” he explains.

No matter how complex a scene is, Cabezas insists that “everything starts with strong planning and a well-organized war.” He even says it’s the shoot where he’s felt the most like Napoleon.

“In action scenes with this many extras, drones, cranes, and a thousand other

things, you have to be incredibly efficient. Any mistake or hesitation could hold up the whole production team.” he says. “You have to know exactly where you’re going so your troops, in a way, can conquer the hill,” he adds.

Despite the shoot’s complexity, Cabezas says the experience was also very freeing: “Coming from something like Wednesday, where everything was so geometrically composed, this felt like throwing a camera on your shoulder and filming a zombie documentary.”

And while they faced some dangerous situations, they always managed to stay safe: “It’s not just about doing the most spectacular magic trick—it’s also about doing it safely for the crew,” he emphasizes.

For Ánima Stillking, the experience was equally rewarding. We’re proud to be part of the Daryl Dixon family in Spain,” the team says.

In terms of economic and labor impact, the data is significant: 322 jobs were created in Spain with contracts over four months, employing locals from all the cities where filming took place.

Of the cast—70 actors and 123 stunt performers—93% were Spanish, as were 98% of the stunt team. Extras were hired nationwide, totaling 2,491 people. The

region providing the most extras was Castile and León (27%), followed by Madrid (26%) and Andalusia (24%).

Providers also came from all over Spain. While Madrid supplied the most (47% of all providers), Andalusia was second with 11%.

In total, season 3 of Daryl Dixon filmed for 93 days across the Iberian Peninsula. Castile and León and Madrid had the most shoot days—38 and 13 respectively. Galicia and Aragón, also central to the story, hosted the crew for 11 and 12 days respectively.

Andalusia served as a location for seven days, followed by Catalonia with five. The Valencian Community, where Ciudad de la Luz was used, hosted filming for three days. Castilla-La Mancha hosted the team for a single day in early February.

THE THIRD SEASON OF THE SPIN-OFF THE WALKING DEAD: DARYL DIXON, WHICH RECENTLY

CONCLUDED ITS BROADCAST, WAS FILMED IN VARIOUS LOCATIONS ACROSS SPAIN. THE PRODUCTION TRAVELED THROUGH EIGHT AUTONOMOUS COMMUNITIES, 22 MUNICIPALITIES, AND 38 FILMING LOCATIONS OVER THE COURSE OF 10 MONTHS.

Daryl Dixon (Norman Reedus) and Carol Peletier (Melissa McBride) were last seen crossing the Eurotunnel from France to England, and indeed, at the beginning of Season 3, they are shown walking through English soil with landmarks like Big Ben and Tower Bridge in the background.

However, their goal is to return to the United States to reunite with their friends, and their time in England is shortlived. Aboard a small boat captained by Julian Chamberlain (Stephen Merchant), nicknamed “the last Brit on the island,” they set course for North America. With no

zombies able to reach them at sea, it seems the pair will cross the Atlantic without trouble—until a storm abruptly changes the sailboat’s direction.

At the end of 2024, AMC’s fictional universe —based on the comic series of the same name by Robert Kirkman, Tony Moore, and Charlie Adlard— chose the Galician coast as one of the main settings for the third season. A 300-person film crew, including technicians, actors, stunt performers, and extras, traveled to the area.

La Coruña provided several landscapes to depict the shipwreck scene: Boca do Río beach in Carnota; the beach and old whaling factory of Caneliñas in Cee; and the coastline of Camariñas.

Several aerial shots were also filmed showing the surroundings of the Punta Nariga Lighthouse in Malpica

Galicia appears not only geographically, but culturally: the show features traditional Galician costumes and masks from the Ourense region’s carnival, such as the felos of Maceda, cigarróns of Verín, and peliqueiros of Laza.

Linguistically, besides Spanish and English, the original version also includes dialogues in Galician and Catalan.

Both viewers and the characters Daryl and Carol discover they are in Spain at the end of the first episode, when they come across a hiking map of the Costa da Morte. In reality, Spain’s geography had already been on display from the start—even scenes supposedly set in London were largely filmed in Madrid.

Transporting the entire production crew and resources to the UK for just a few days wasn’t efficient, so the team searched for locations in Madrid that, with the help of set design, visual effects, costumes, and other artistic resources, could double as the British capital.

Thus, streets like Arbalán, Madrazo, and Cedaceros stood in for London, filled with zombie hordes, wrecked cars, overgrown vegetation, and signature red phone booths and double-decker buses.

The Palacio de la Trinidad on Francisco Silvela Street was another filming location. In the first episode, Daryl and Carol are seen escaping a mass of walkers by breaking into the abandoned mansion, after a tense moment spent forcing the iron gate open. Subsequent scenes show the double-height central hall, a corridor, and several rooms of the palace.

Other Madrid locations included the Madrid Stock Exchange, the Ritz Hotel, areas of Vicálvaro, and the Colonia del Pico del Pañuelo in the Arganzuela district. In fact, the latter replaced a key action scene originally set in Barcelona. The filming also took the crew to locations even farther from the city center, such as Las Rozas, El Escorial, Lozoya, and Rascafría, which mainly provided forested atmospheres.

The show also played tricks with locations in other ways. The Castilian town of Sepúlveda (province of Segovia) was transformed into the fictional Galician village of Solaz del Mar, home to new main characters played by Óscar Jaenada (Federico), Eduardo Noriega (Antonio), and Alexandra Masangkay (Paz).

To convincingly portray a coastal Galician village, the production team added fishing nets, harpoons, and boats to the set. Preparations began in late August, filming took place in October, and the crew stayed through December. They used various parts of Sepúlveda, such as the town’s Plaza

de España, its historic buildings, and the Pucherillas neighborhood. Additionally, new sets were built specifically for the spin-off, including a stone wall, battlements along a roadside parapet, and an arch constructed next to the Puerta del Río—one of the seven gates of Sepúlveda’s walled enclosure.

Segovia was another location visited, specifically El Espinar and the Abbey of Párraces, where the homes of the characters Antonio and Federico were set.

Meanwhile, Navaluenga, a village in Ávila province, offered the Alberche River and its 16th-century Romanesque bridge for the show’s medieval-like setting.

To support a production of this scale— not only geographically—several film camps and sets were installed in different locations. Between October and November, the crew headed to Aragon in search of desert landscapes featured in the fifth episode, which carries a distinctive spaghetti western aesthetic.

Scenes were filmed in the Old Village of Belchite, Zaragoza, including the main entrance to the town and the historic church of San Martín de Tours, whose facade was even used in promotional material for the

season. The team also spent time in the El Planerón steppe, where Daryl is seen riding a motorcycle.

Another key filming location for the episode was Teruel, where a scene was shot showing the protagonist riding a horse along a railway line. For this, a disused 10-kilometer stretch of track between Híjar and Samper de Calanda had to be restored. The task was completed with the help of the Friends of the Railroad and Trams Association (AZAFT), which also rehabilitated and prepared a train for the set.

Andalusia, in the southern Spain, wasn’t spared from the apocalypse either. Granada’s Albaicín neighborhood appears on the map of filming locations, including its famous Mirador de San Nicolás and its views of the Alhambra. In the nearby town of Monachil, the Purche road provided a mountainous setting representing the Granada Highlands.

Seville contributed locations such as Plaza de España, María Luisa Park, Palacio de la Motilla, Casa de Pilatos, and the Royal Alcazar.

The journey also brought the walkers to northeastern Spain, specifically Badalona (Catalonia). Scenes were filmed combining the city’s coastal landscape with its old industrial buildings. Shooting took place in the Mora neighborhood, near Marina Beach, with the iconic Three Chimneys of Sant Adrià del Besòs as a backdrop. The team also spent a few days filming at Barcelona’s Tibidabo amusement park. They also traveled to the town of Marganell, where a road leading to Montserrat was captured.

Not all Spanish locations were rural or urban. For instance, the storm-at-sea scene in the first episode was filmed in the water tank at Ciudad de la Luz. Around 250 people

worked on that shoot over 3 days at the Alicante film complex.

Lastly, although it only hosted one day of filming, the brief visit to Castilla-La Mancha is also worth mentioning. A stunt performer was scheduled to ride a motorcycle across the San Pablo Bridge in Cuenca, but the plan was called off due to rain in the forecast. In the end, the shoot was carried out using a drone that flew over various roads in the city and around the Hanging Houses to provide footage for the VFX (visual effects) department.

All the locations mentioned above form part of the ambitious filming map designed for this third season.

Last February, AMC+ announced the completion of filming, which involved 322 Spanish technicians, 2,491 local extras, 123 stunt professionals, and a total of 70 actors—93% of whom were Spanish

The apocalypse in Spain isn’t over yet, as the fourth season is also being filmed in the country. This time, the locations include Toledo and Bilbao, with Segovia returning— this time featuring the bullring of El Espinar.

So, for a few more months, zombies will continue to roam freely across the Iberian Peninsula.

BY FER S. CARRASCOSA

OVER THE PAST TWO DECADES, SPAIN HAS FIRMLY ESTABLISHED ITSELF AS A TOP DESTINATION FOR THE INTERNATIONAL SCREEN INDUSTRY—PARTICULARLY FOR MAJOR HOLLYWOOD PRODUCTIONS AND ENGLISHLANGUAGE TELEVISION—THANKS TO A COMBINATION OF FACTORS THAT GO FAR BEYOND ITS STUNNING LANDSCAPES OR RICH HISTORICAL HERITAGE, THOUGH THOSE ARE CERTAINLY NOT TO BE OVERLOOKED.

What truly makes producers and location scouts prioritize Spain is the set of conditions that streamline and reduce the cost of filming. These include attractive tax incentives, the remarkable efficiency of regional film commissions, a wide variety of natural and urban settings located close to one another, and a technical infrastructure that has consistently improved with every major production that has chosen Spain as a filming location.

In terms of tax incentives, Spain has progressively updated its legislation to compete with the most attractive filming

destinations in Europe. As a result, a foreign shoot investing at least one million euros in Spain—or 200,000 euros in the case of series—can benefit from substantial tax deductions that significantly reduce production costs. These benefits are even more generous in specific regions such as the Canary Islands, Navarre, or the Basque Country.

To access these advantages, it’s essential to partner with a Spanish service company as the local production provider, and to obtain a cultural certificate from the ICAA (Spain’s Film and Audiovisual Arts Institute), verifying the project’s eligibility. This requirement ensures that the Spanish industry also reaps the benefits of international productions.

This fiscal model is reinforced by a robust institutional ecosystem in which film commissions play a key role. Each autonomous community—and many provincial capitals—have established organizations dedicated to facilitating the permit process for filming in public spaces, coordinating with local authorities to manage traffic control or provide police presence when needed, and ensuring that shoots are compatible with everyday life.

In regions with a rich historical heritage, film commissions also serve as a liaison with monument managers and regional cultural departments, which must authorize any interventions involving protected buildings. In practice, this

means that a foreign production aiming to shoot in a historic city or a landmark such as the Royal Alcázar of Seville can rely on the local film commission as a central point of contact—streamlining what would otherwise be a complex web of separate bureaucratic procedures.

Spain’s geographical diversity is yet another undeniable advantage. Within just a few hours’ travel, one can find desert landscapes like those in Almería, lush green forests in the Basque Country, perfectly preserved medieval architecture in Castile and León or Extremadura, volcanic beaches in the Canary Islands, and modern urban environments in cities like Barcelona or Madrid.

This concentration of contrasting landscapes allows productions to access a wide variety of settings while minimizing long-distance travel, saving both time and money. Taking all these factors into account, it’s worth analyzing how they’ve been put into practice over the past decades in high-profile productions easily recognizable to the average viewer.

One prominent example is the highprofile series Game of Thrones, created by David Benioff and D. B. Weiss, which became a global phenomenon during the previous decade. Starting with its fifth season, the show incorporated numerous Spanish locations that became a distinctive part of its visual identity. For instance, the Royal Alcázar of Seville was transformed into the Water Gardens of Dorne, one of the series’ most recognizable locations.

Bringing this to life required a significant number of permits, including municipal authorizations and coordination with the Alcázar’s governing board and the regional government of Andalusia to ensure heritage preservation. Usage fees for the monument, time restrictions to avoid interfering with tourist visits, and the obligation to work with conservation specialists all influenced the production schedule and budget.

Similarly, the bullring in the Sevillian town of Osuna was used to represent the fighting pits of Meereen. For this, the local government temporarily closed the venue, allocated areas for the production team, and organized the participation of hundreds of local extras, selected through a large open casting call. The economic impact on the town was significant—not only through payments to extras, but also due to hotel bookings, expenditure in restaurants, and the long-term boost in tourism thanks to the show’s global visibility.

The production also moved to Almería, filming scenes in the Alcazaba and other historic locations, generating additional economic benefits and requiring careful heritage management plans to ensure the protection of these historic sites.

In Girona, the cathedral and old town were used to recreate King’s Landing and Braavos. This involved closing off several streets and removing modern urban elements that clashed with the medieval setting. As in previous cases, coordination with local authorities included traffic management plans, compensation for affected businesses, and collaboration with security services.

Another notable location was the islet of Gaztelugatxe in Bermeo (Biscay), which served as Dragonstone, the ancestral home of House Targaryen. This required a complex and costly logistical setup to transport crew and equipment to the remote,

environmentally sensitive site—alongside specific environmental protection measures to preserve its ecological and tourist value.

The prequel series House of the Dragon, created by Ryan Condal and Miguel Sapochnik, expanded even further on the use of Spanish locations. The cities of Cáceres and Trujillo became key filming hubs for both the first and subsequent seasons.

Spain’s

geographical diversity

is yet another undeniable advantage. Within just a few

hours’ travel,

one can

find desert landscapes like those in Almería, lush green forests in the Basque Country, perfectly preserved medieval architecture in Castile and León or Extremadura, volcanic beaches in the Canary Islands, and modern urban environments in cities like Barcelona or Madrid.

In Cáceres, various sites in the old town—including Plaza de San Jorge, Plaza de Santa María, Arco de la Estrella, Cuesta de la Compañía, and Calle Amargura— underwent temporary transformations. Modern signs and wires were concealed, anachronistic features removed, and temporary structures installed to recreate a medieval atmosphere.

The collaboration between the city council and the production team helped plan pedestrian and vehicle access restrictions during specific time windows, with local police assigned to secure the perimeter and manage public safety. A particularly interesting aspect was the negotiation around which set pieces could remain after filming as permanent attractions—such as a fountain built for the show that the city requested to keep—demonstrating how filming can leave behind lasting symbolic or material traces that enhance a city’s cultural heritage.

In the case of Trujillo, the Plaza Mayor was fenced off and exclusively reserved for filming over several days. Facades were

adapted with specific set designs, and a fictional marketplace was constructed. This required close coordination with the city council and local residents. Hospitality businesses forced to close during shooting were compensated, reportedly receiving around €1,000 per establishment, according to local press.

The key takeaway from both Game of Thrones and House of the Dragon is the vital importance of conducting thorough studies that account for a location’s aesthetic, accessibility, heritage protection requirements, costs associated with urban transformation, compensation for local communities, and scheduling that aligns with daily life. Spain offers unparalleled locations—but making the most of them demands detailed planning and fluid cooperation with local and regional authorities.

Beyond these two productions, the British series The Crown, created by Peter Morgan, is another standout example. Its use of Spanish locations illustrates perfectly why international productions often choose Spain to “double” for foreign settings.

In this case, various sites across Andalusia and Mallorca were used to represent a wide range of locations, from Caribbean islands to Australian ports and Mediterranean coastlines. For some of these scenes, the production worked with the Andalucía Film Commission and the city councils of Cádiz and San Fernando to film in locations such as the Port of Cádiz and the University of Río San Pedro, as well as coastal areas in the province.

These shoots required road closures, space modifications, and civil liability insurance policies covering both damage to property and potential risks to the public and extras.

All these permits are processed through regional and local film commissions. According to regional guidelines, applications typically must include a technical intervention plan, a safety plan, and—when protected

Film commissions, financial incentives, the technical skills of local professionals, and the proactive support of municipal and regional authorities have made Spain an ideal location where even the most ambitious productions can find both creative and operational solutions to their needs.

heritage sites are involved—a heritage impact assessment. All documentation must be submitted weeks in advance to obtain the necessary approvals.

Another notable case is the film Exodus: Gods and Kings (2014), directed by Ridley Scott, which serves as a classic example of how Almería’s natural resources have been leveraged for major international productions. Filming days were held in the Tabernas Desert as well as the Sierra Alhamilla.

it’s

clear that Spain’s accumulated experience with large-scale international productions demonstrates not only the country’s exceptional natural and cultural heritage, but also its robust institutional, fiscal, and logistical framework—making it a strong competitor among Europe’s top filming destinations.

In this instance, the beaches of Fuerteventura were chosen to depict the Red Sea scenes. As with other large-scale

productions, this required specific permits from the town councils of Tabernas and the regional environmental authorities when filming near protected areas. The production also had to secure aviation authorizations for aerial shots using helicopters and drones, as well as customs and logistical permits for the temporary importation of filming equipment. The shoot began in October 2013 in Tabernas, extended to Fuerteventura, and was completed on soundstages in the UK. Altogether, it was a 75-day operation combining extensive location work with a visual effects plan that included the postproduction creation of massive digital elements. Today, this case is often cited when evaluating the balance between practical location shooting and VFX in terms of both budgeting and production timelines.

The practice of building temporary towns and full-scale sets on rural land presents a different type of operational challenge—one that particularly concerns producers. A recent example is Asteroid City (2023) by Wes Anderson, which constructed an entire fictional town on agricultural land near Chinchón, in the Madrid region. This setup required permits for occupying rural land, lease agreements with landowners, coordination with the local council, and a strict schedule for both construction

and dismantling that guaranteed the land would be returned to its original condition post-filming.

In this case, every creative decision made by the director and art department resulted in a large-scale deployment of carpentry, props, and set design. Due to the scale, the production relied on local hiring of carpenters, heavy transport logistics, and accommodation arrangements for hundreds of crew members in nearby towns. The entire operation was overseen

by Film Madrid Region and included the standard contractual clause ensuring the return of the land and compensation for any damages, along with a written restoration plan.

Also worth mentioning is Kingdom of Heaven (2005), again directed by Ridley Scott, which illustrates how a major production can alternate filming between Spain and neighboring countries to find the optimal mix of constructed sets and authentic historical locations. The film

used the Castle of Loarre in Huesca for fortress scenes, as well as other locations in Seville, Ávila, Segovia, and Palma del Río. These were complemented by shoots in international locations such as Ouarzazate, Morocco.

Filming at Loarre required negotiations with the regional government of Aragon and with the managers of the heritage site to establish strict conditions concerning anchoring equipment, the movement

of props through rooms and towers, scheduling, and oversight by professional conservators to avoid any damage.

Finally, Terminator: Dark Fate (2019), directed by Tim Miller, offers a compelling case study of how productions sometimes substitute one geographic setting for another due to safety, cost, or logistical considerations. In this case, scenes set narratively in Mexico were instead filmed in Madrid neighborhoods such as Pueblo Nuevo and Lavapiés, as well as in coastal towns of Almería like La Isleta del Moro.

This doubling allowed the production to reduce costs and minimize physical risks, but required a dedicated urban “dressing” phase and an aesthetic continuity unit to ensure visual credibility.

Thanks to all these examples, and many more, it’s clear that Spain’s accumulated experience with large-scale international productions demonstrates not only the country’s exceptional natural and cultural heritage, but also its robust institutional, fiscal, and logistical framework—making it a strong competitor among Europe’s top filming destinations.

Film commissions, financial incentives, the technical skills of local professionals, and the proactive support of municipal and regional authorities have made Spain an ideal location where even the most ambitious productions can find both creative and operational solutions to their needs.

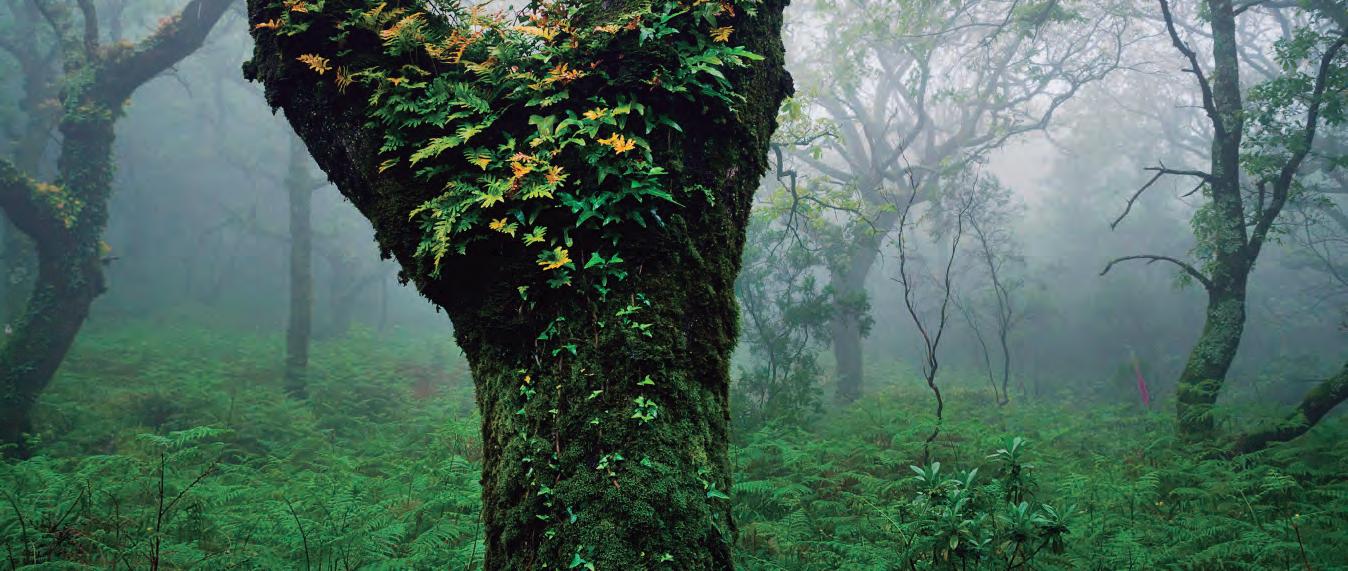

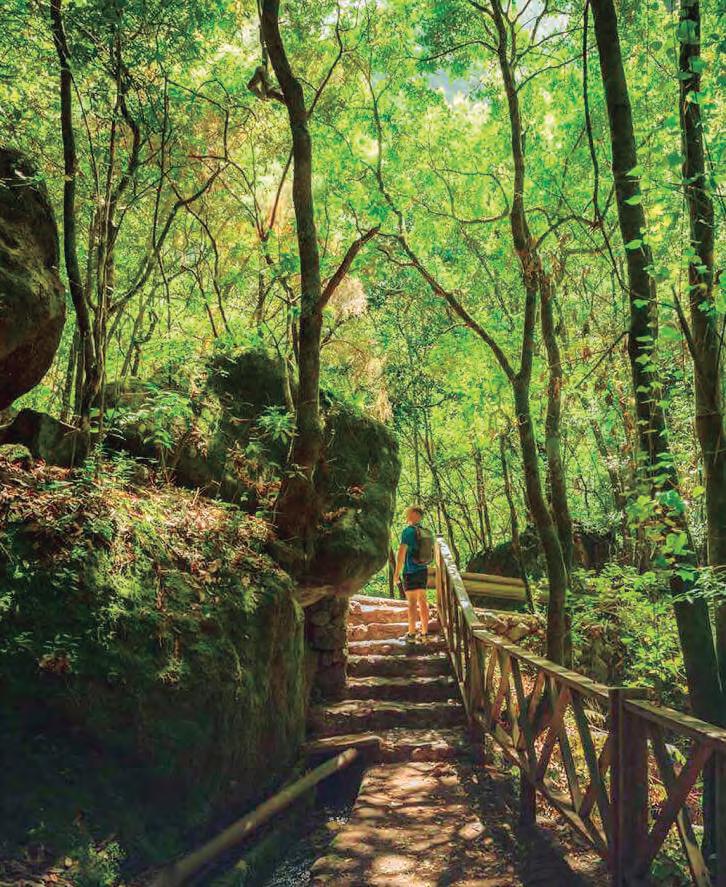

LAST YEAR AT RUBIK, WE PUBLISHED AN ARTICLE HIGHLIGHTING MOUNTAIN LOCATIONS IN SPAIN. THE IDEA WAS TO BREAK THE STEREOTYPE OF SPAIN AS MERELY A LAND OF SUN AND BEACHES. THE COUNTRY’S LANDSCAPE DIVERSITY IS ASTONISHING, AND TO REINFORCE THIS, WE ARE FOLLOWING UP THAT ARTICLE WITH THIS ONE FOCUSED ON FOREST LOCATIONS. AND THE TRUTH IS, THERE’S PLENTY TO CHOOSE FROM BECAUSE, ALTHOUGH MANY PEOPLE DON’T KNOW IT, SPAIN IS THE THIRD MOST FORESTED COUNTRY IN EUROPE—AFTER SWEDEN AND FINLAND—WITH NEARLY 28 MILLION HECTARES OF FOREST LAND. BELOW, WE HIGHLIGHT 12 FORESTS IN SPAIN THAT ARE PERFECT FOR FILM PRODUCTIONS.

FRAGAS DO EUME NATURAL PARK

A Coruña (Galicia), in the northwest of Spain

Contact: Galicia Film Commission jairo.aldana@miraveo.es

One of the best-preserved Atlantic river forests in Europe, spanning 9,000 hectares with fewer than 500 residents. The forest follows the Eume River, and the vegetation is sometimes so dense that sunlight barely penetrates. It contains more than 20 species of ferns and 200 species of lichens, as well as oaks, poplars, ash, and alders. According to legend, goblins also inhabit the forest. There are numerous streams, springs, and waterfalls, and hidden at the forest’s heart is the Caaveiro Monastery.

Cádiz (Andalusia), in the south of Spain

Contact: Andalucía Film Commission proyectos@andaluciafilm.com

Located in the Los Alcornocales Natural Park, between Tarifa and Algeciras, you’ll find the Llanos del Juncal and its Fog Forest. This is a laurel forest covering 80 hectares with vegetation including vines, ivy, mosses, ferns, and laurel trees, all shrouded in dense fog present for around 245 days a year. This forest exists thanks to the high humidity in the area, which creates a microclimate similar to tropical regions.

La Jacetania County (Huesca), in the northeast of Spain

Contact: Aragón Film Commission dlozano@aragonfilmcommission.es

A natural area within the Western Valleys Natural Park in Huesca, in the western Aragonese Pyrenees. It is traversed by the Aragón Subordán River and surrounded by mountain peaks. The forest mainly consists of fir trees, along with pines and beeches, and also contains yews, maples, and birches. Inside are three dolmens and the remnants of one of Emperor Antoninus Pius’s Roman roads.

Las Nieves Natural Park, near Santa Cruz de La Palma (Canary Islands)

Contact: La Palma Film Commission info@lapalmafilmcommission.com

A UNESCO Biosphere Reserve, this forest’s high humidity supports an extensive laurel forest, reaching 20–30 meters in height, considered the most important in the Canary Islands—and among the most important in the world. Erosion has carved a deep gorge with near-vertical walls. From the El Espigón Atravesado viewpoint, the entire ravine can be seen. A highlight is the Los Tilos Waterfall, a lush spot with a pool fed by water cascading from the cliff above.

Salazar and Aezkoa Valleys (Navarre), in the north of Spain

Contact: Navarra Film Commission navarrafilmcommission@nicdo.es

This is the largest forested area in Navarre and the second-largest beech-fir forest in Europe (only surpassed by Germany’s Black Forest), with 17,000 hectares. It lies deep in the Pyrenees. The Navarrese valleys of Aezkoa and Salazar comprise the majority of it, with smaller parts in the French valleys of Cize and Soule. It features beeches, oaks, firs, birches, willows, ferns, and mosses. Ernest Hemingway once said he loved getting lost in this forest, hoping the Basajaun, Lord of the Forest, would come out to greet him.

La Garrotxa County, near Olot (Girona Province), in the northeast of Spain

Contact: Catalunya Film Commission cfc@gencat.cat

A natural reserve comprising a beech forest growing on relatively flat terrain. It spans about 4.8 km² and its soil is formed by lava mounds—called “tossols”—that can reach over 20 meters in height. The forest is surrounded by several of the 21 volcanoes in La Garrotxa. At one end is the Can Jordà farmhouse, now a center for the conservation of cultivated plants.

Anaga Massif, northeast Tenerife (Canary Islands)

Contact: Tenerife Film Commission film@webtenerife.com

With an area of around 14,500 hectares, Anaga Rural Park is a Biosphere Reserve located just minutes by car from Santa Cruz de Tenerife. Its upper areas host Tenerife’s best examples of laurel forest. One of the park’s most iconic sights is the “sea of clouds.” In addition to fine black-sand coves, the park features dramatic geological formations such as “roques,” dikes (wall-like intrusions), cliffs, and steep ravines.

Monte de Las Navas, near Cabezón de la Sal (Cantabria), in the north of Spain

Contact: Cantabria Film Commission - cantabria.film@srecd.es