Welcome to the Q3 2025 Edition of the Aftermarket Dashboard, a quarterly information service for members of the AAAA.

This industry publication captures useful statistical and related data, as indicators of the unfolding trends and health of the automotive aftermarket industry, and has been designed to provide regular insight on our industry.

We value your suggestions for improvement or feedback regarding content.

Data is sourced from VFACTS New Car Sales Data, EVC Vehicle Sales Report, FQ SME Report September 2025, Westpac-Melbourne Institute Consumer Sentiment Index, ABS Statistics; Unemployment Rate (trend adj), Household Spending Index, Consumer Price Index, Produce Price Index, Automotive Insights Report (AIR) AutoGrab Data, Australian Institute of Petroleum, Australian Petroleum Statistics, Roy Morgan & Westpac, FQ Car Parc Forecasting, FQ Consumer Tracker, AAAA Critical Trends Survey 2025

change vs.

Business confidence increased 3 points from the previous period, returning to 2024 levels and indicating a lift in sentiment.

Consumer confidence has also improved by 12% year-on-year, despite easing slightly in September (vs. the previous month). Household spending has climbed to 147.38, reflecting resilient customer demand that continues to support the aftermarket, along with other consumer-facing sectors.

Overall, sentiment remains generally stable, with steady business optimism and consumer spending remaining resilient.

>5% change vs. YoY

Petrol prices are largely consistent with previous months, while diesel remains elevated vs year-ago levels.

Fuel sales data do however show mixed trends. Regular petrol volumes declined 6% year-on-year, while premium fuel rose to 449.2 million litres, up 3% from the previous year. Diesel sales to retailers also increased, indicating continued strength in commercial demand.

This suggests consumers are maintaining driving habits despite higher prices, with higher-income segments again maintaining their discretionary spending habits. Source: Australian Petroleum Statistics, Australian Institute of Petroleum

Source: VFACTS Reports, EVC Vehicle Sales Report, Automotive Insights Report (AIR) AutoGrab Data

Sales momentum strengthened in September, with new vehicle sales rising 7% year-on-year to 106.9K units. The Toyota Hilux led monthly sales, while the Ford Ranger remains the top model year-to-date.

EV sales nearly doubled from last year to 12.1K, reaching an 11.3% share. Hybrid and plug-in hybrid models are however still selling in higher volumes, bringing the total for Zero and Low Emission Vehicles to 29.4% of total sales, up from 22.5% a year ago.

Meanwhile, Used sales eased to 203K units, reflecting a gradual shift toward newer, more efficient models.

monthly business turnover index (5year index)*

quarterly consumer/ producer price index (5-year index)**

>5% change vs. YoY

*The ABS Business Turnover Index tracks changes in business turnover for large businesses ($20M+ annual turnover) based on monthly BAS lodgments, helping us understand trends around industry economic performance.

**The Consumer and Producer price indexes then reflect changes in the costs of parts and materials from suppliers (i.e. input costs).

Source: ABS Statistics; Monthly Business Turnover Index, Consumer Price Index, Produce Price Index

Motor vehicle & parts retail turnover held at 151.27 in August, down from the prior month but slightly above last year (149.64). Wholesale turnover was 143.29, down from 164.67 and a touch below the year-ago level.

Input costs remain elevated.

Spare parts and accessories prices increased 3.0% year-onyear while vehicle maintenance and repair costs rose 3.7%. Manufacturing prices were up 4.9%, pointing to ongoing upstream cost pressures.

Turnover has eased month-onmonth, while cost inflation persists across the supply chain. Businesses appear to be passing some costs through, but margins remain under pressure.5.69).

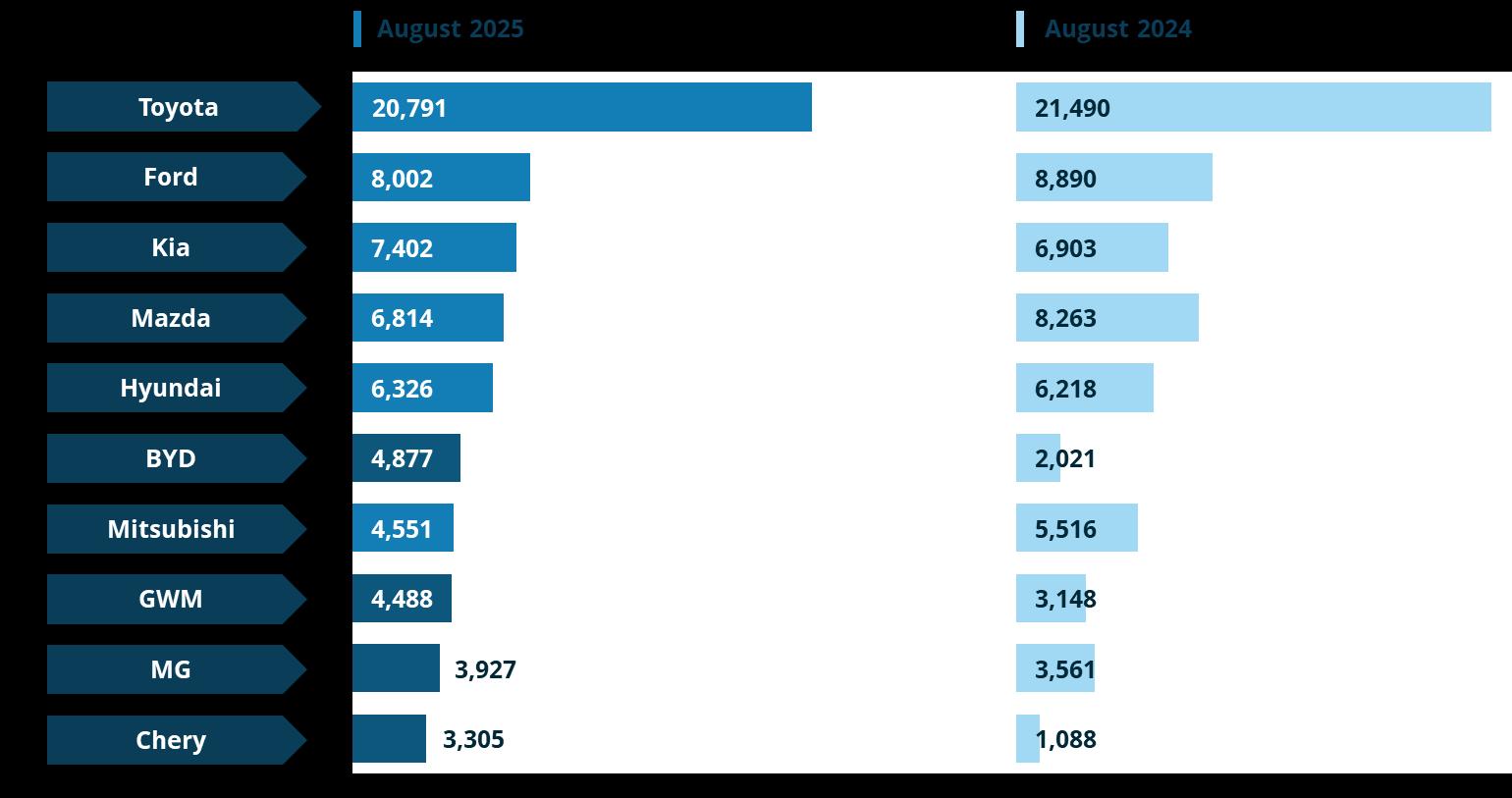

Chinese automotive manufacturers continue their rapid market penetration, with four brands now securing positions in the national top 10 for August 2025.

▪ BYD leads Chinese expansion: 4,877 units (+141% YoY), now 6th largest brand by volume

▪ Chery posts highest growth: 3,305 units represents +204% increase

▪ GWM and MG maintain momentum: GWM up 43% to 4,488 units; MG grows 10% to 3,927 units

The strategic question for aftermarket operators shifts from 'will Chinese brands succeed?' to 'are we prepared to service them?

Australia's total car parc: ~21 million vehicles (as of 2025). Chinese brands: ~314,000 vehicles (1.5% of total parc), growing from near-zero in 2019. At current rates, Chinese brand parc will exceed 500,000 vehicles by Q2 2026 and reach 1 million by late 2027.

While new vehicle sales indicate future demand, the car parc tells us what's on the road today. As at end August 2025, this includes 314,000 Chinese-branded vehicles, (about 1.5% of the ~21 million total parc). The growth is accelerating too: 161,480 vehicles more than doubles the existing base, creating significant aftermarket demand across multiple service horizons.

▪ Now-Q2 '26: Consumables (oil, filters)

▪ Q2 '26-Q4 '27: Wear items (brakes, tires)

▪ 2028+: Component repairs post-warranty Parts networks, diagnostic systems, and technician training must be ready to go by 2026 to capture the likely post-warranty service wave.

The Australian Automotive Aftermarket Association, is the national industry association representing manufacturers, distributors, wholesalers, importers and retailers of automotive parts and accessories, tools and equipment, as well as providers of vehicle service, repair and modification services in Australia.

For more information, please contact:

Lesley Yates

Director of Government Relations and Advocacy

Australian Automotive Aftermarket Association (AAAA)

Convenor: Automotive Products Manufacturers & Exporters Council (APMEC)

7-8 Bastow Place

Mulgrave VIC 3170 Australia

+61 (3) 9545 3333 | 0402 005 476 lyates@aaaa.com.au

With over 20 years of automotive experience, Fifth Quadrant has developed a detailed understanding of the automotive sector, using this market knowledge, we design and deliver research that helps our clients understand and overcome their business issues, empowering them to move forward with confidence.

For more information, please contact: Ben Selwyn Amelia McVeigh Director Account Director Fifth Quadrant Fifth Quadrant 0411 132 166 0420 248 689

ben@fifthquadrant.com.au amelia@fifthquadrant.com.au

Level 6, 54 Miller St

North Sydney NSW 2060 Australia

+61 (2) 9927 3333