Debuting at Accountex Manchester, the new MTD (Making Tax Digital) for Income Tax Agent transforms quarterly updates into a seamless workflow, reducing admin and ensuring compliance.

SAGE (FTSE:SGE), THE LEADER IN ACCOUNTING, FINANCIAL, HR AND PAYROLL TECHNOLOGY FOR SMALL AND MID-SIZED BUSINESSES, TODAY ANNOUNCED THE UK'S FIRST MTD FOR INCOME TAX AGENT. REVEALED AT ACCOUNTEX MANCHESTER, THE NEW AI-POWERED AGENT WILL TRANSFORM THE COMPLEXITY OF QUARTERLY UPDATES INTO A SINGLE, END-TO-END WORKFLOW, GIVING ACCOUNTANTS

AND THEIR CLIENTS CONFIDENCE THAT NOTHING HAS BEEN MISSED.

Paving the way for full automation in time for the 2026 deadline, the first release of the MTD Agent is enabled through new Sage Copilot capabilities landing in October. These features help practices prepare for quarterly updates by organising client information, reducing manual admin and making it easier to stay on top of tasks.

From April 2026, self-employed individuals and landlords earning above £50,000 will be required to keep digital records and submit quarterly updates through compatible software. More than 4 million taxpayers are expected to come into scope as MTD expands over the following years. This marks a significant shift in how accountants and their clients manage tax obligations

Keep reading

AT XEROCON BRISBANE, WE ANNOUNCED THE NEW XERO PARTNER HUB, A SIGNIFICANT STEP FORWARD IN EVOLVING THE PRACTICE EXPERIENCE FOR OUR ACCOUNTING AND BOOKKEEPING PARTNERS. BUILT WITH THE HELP OF FEEDBACK AND INSIGHTS GATHERED FROM OVER 2,000 PARTNERS ACROSS THE GLOBE, XERO PARTNER HUB HAS TRULY BEEN SHAPED WITH AND FOR YOU.

Xero Partner Hub brings

your practice tools and data together in one seamless platform, making it easier to manage your practice, clients, and compliance work. It’s designed to simplify your day-to-day work and boost team productivity by ensuring information flows smoothly — surfaced where you need it, or delivered as AI-powered insights through JAX, your AI financial superagent.

We’re building on the enhancements we’ve been making across Xero to deliver you a more intuitive

and insights-rich experience, starting with the recently announced new navigation and homepage. Now – we’re reimagining your practice experience.

Built with your feedback

We’ve already gathered insights from more than 2,000 partners, along with dozens of suggestions from your Xero Product Ideas.

Find out more

KARBON, THE GLOBAL LEADER IN PRACTICE MANAGEMENT SOFTWARE FOR ACCOUNTING, BOOKKEEPING, TAX, AND AUDIT FIRMS, TODAY ANNOUNCED ITS ACQUISITION OF AIDER, A PIONEER IN AI-POWERED ADVISORY AND REPORTING TECHNOLOGY. THE ACQUISITION ACCELERATES KARBON’S VISION TO TRANSFORM THE ACCOUNTING PROFESSION THROUGH AI.

Aider’s cutting-edge solution is already trusted by firms across the United States, Canada, Australia, and New Zealand for automating time-consuming bookkeeping and advisory workflows like reconciliations and period close, while delivering real-time client

insights and predictive reporting. By integrating Aider’s capabilities into Karbon, firms will gain powerful tools to eliminate repetitive work, expand advisory services, increase profitability, and automate period close.

“This is a defining moment for the future of accounting practice management,” said Mary Delaney, CEO of Karbon. “With Aider, we’re accelerating the shift from administration to automation—giving firms the ability to automate the mundane, scale without added overhead, and deliver richer advice to their clients.”

“Aider is incredibly proud to join Karbon,” said Brendan Roberts, CEO and Founder of Aider. “We share

a bold vision for the future where accounting is proactive, data-driven, and deeply client-centric. Karbon is the ideal partner to scale that vision and deliver even more value to our customers.”

The acquisition will deepen the recently launched integration between the two platforms, with an AI-powered period close experience built directly into Karbon’s practice management platform. This brings firms closer to intelligent, automated operations where repeatable workflows don’t just get tracked, they get completed with confidence.

Keep reading

XU BIWEEKLY - No. 115

Newsdesk:

If you have any news or updates that you would like us to consider for inclusion in the next edition of the XU Biweekly, please email us at: newsdesk@xumagazine.com

CEO: David Hassall

Managing Editor: Wesley Cornell

Chief Revenue Officer: Alex Newson

Account & Partnership Assistant: Robyn Consterdine

Creative Assistant: Victoria Young

Advertising: advertising@xumagazine.com

www.xumagazine.com

‘Xero’ is a trademark of Xero Limited (New Zealand). XU Biweekly and XU Magazine is collaboratively produced by an independent group of Xero users and is not affiliated in any way with Xero. All other trademarks are the property of their respective owners.

© XU Magazine Ltd 2014-2025. All rights reserved. No part of this publication may be used or reproduced without the written permission of the publisher.

XU Biweekly is published by XU Magazine Ltd (08811842), registered in England and Wales. Registered office: Office 1, Brunswick House, Brunswick Way, Liverpool, L3 4BN, United Kingdom. All information contained in this publication is for information only and is, as far as we are aware, correct at the time of going to press. XU Magazine Ltd cannot accept any responsibility for errors or inaccuracies in such information.

If you submit unsolicited material to us, you automatically grant XU Magazine Ltd a licence to publish your submission in whole or in part in all/any editions, including in any physical or digital format, throughout the world. Any material you submit is sent at your risk and, although every care is taken, neither XU Magazine Ltd nor its employees, agents or subcontractors shall be liable for loss or damage. The views expressed in this publication are not necessarily the views of XU Magazine Ltd, its editors or its contributors.

We’re excited to launch our new Ideas & Roadmap Portal!

At AccountsIQ, we believe the best products aren’t built in isolation - they’re built with the people who use them every day.

That’s why one of our core principles is Feedback is Fuel. Every idea, every vote, every comment helps us listen, learn, and improve.

Here’s what you’ll find in the new portal: Share your ideas Vote on what matters most See what’s planned, in progress, and released

It’s more than a tool - it’s our commitment to transparency, collaboration, and customer-led innovation.

VINYL, THE AI NOTETAKER BUILT FOR ACCOUNTANTS AND BOOKKEEPERS, HAS LAUNCHED A NEW INTEGRATION WITH FYI, THE LEADING DOCUMENT MANAGEMENT AND PRODUCTIVITY PLATFORM FOR ACCOUNTING FIRMS. THIS POWERFUL NEW CONNECTION BRINGS MEETING INTELLIGENCE INTO YOUR DOCUMENT WORKFLOWS, AUTOMATICALLY.

With the integration, contacts, clients, and groups

MANUAL DATA ENTRY IS THE BANE OF UK ACCOUNTANTS EVERYWHERE. THANKFULLY, MYWORKPAPERS

AUTOMATION UPDATES OFFER A ROBUST SOLUTION BY AUTOMATING THE POPULATION OF YOUR COMMONLY USED WORKPAPERS DIRECTLY FROM XERO. THIS UPDATE SLASHES THE HOURS WASTED ON COPY-PASTING AND REDUCES ERRORS, TRANSFORMING HOW UK FIRMS GET THROUGH YEAR-END COMPLIANCE.

Every accountant’s secret nemesis – manual data entry

If you’re in the UK ac-

counting world, you know the drill: Xero spits out data, then your workpapers patiently await the torturous copy-and-paste routine. Hours lost, sanity questioned, and all for the sake of compliance paperwork nobody outside the profession admires.

Cue the new MyWorkpapers automation update. No balloon animals, no gimmicks – just a sharp jolt that turns hours of manual drudgery into minutes of button clicking. Given the competition is crowded with Active Workpapers waving its template numbers like a winning lottery ticket, MyWorkpapers is taking a different approach: making

the essentials actually work better.

MyWorkpapers is delivering what UK firms actually need

Newcomers might assume automation means endless templates and tech headaches. MyWorkpapers counters this with a simple philosophy: automate the most common workpapers you actually use, with a direct, dependable plug into Xero. No smoke, no mirrors, just sensible improvements for busy accountants.

You want fewer errors and faster workflows? MyWorkpapers checks those boxes.

Find out more

OUR TEAM HAS BEEN BUSY WORKING ON A COUPLE OF BIG PROJECTS THIS YEAR, BUT THEY HAVEN’T BEEN NEGLECTING THE SMALLER, YET IMPORTANT, IMPROVEMENTS. WE’VE MADE THE TRANSFER OF SUBSCRIPTIONS MUCH SIMPLER FOR YOU AND MADE SIGNIFICANT IMPROVEMENTS TO THE PERFORMANCE OF BUDGET FORMULAS, ESPECIALLY FOR THOSE OF YOU WITH MILLIONS OF FORMULA REFERENCES. AND THERE’S MORE TO COME!

Not everyone stays in the same role for a lifetime, so you sometimes need to move your Calxa subscription to another person. Though we do still have a handful of customers who saw the very first release of Calxa in 2010!

We’ve simplified the process and now allow any owner or co-owner to transfer the subscription, so it doesn’t matter if the previous owner has moved on.

When changing the billing owner, you can now choose to keep the existing payment method if that’s still relevant. This process should now be much easier to manage when you need it.

Faster and More Reliable Saving of Budget Formulas

Those of you who are heavy users of formulas in your budgets should have noticed much improved performance in the last few weeks.

Find out more

from FYI are synced into Vinyl. After a meeting, Vinyl pushes summaries, notes, and action items directly back into FYI, creating a structured meeting record on relevant contact or client file.

What the Integration Does

Automatic Sync from FYI to Vinyl: Bring over all contacts, clients, and groups so you’re ready to meet

Find out more

NOW, YOU CAN TRANSFER CLIENT DATA AND FINANCIAL RECORDS DIRECTLY FROM FREEAGENT INTO ACTING OFFICE FOR MORE EFFICIENT AND ACCURATE PRACTICE MANAGEMENT.

Benefits of integrating Acting Office

The Acting Office integration with FreeAgent will bring significant efficiency and accuracy benefits by connecting the practice

software directly with the bookkeeping data. All financial information for your clients in FreeAgent is instantly available in Acting Office.

Instead of working with spreadsheets or chasing paperwork, there will be real-time access to up-to-date financial information, allowing you to focus on higher-value advisory work. All financial data is consolidated in Acting Office, ensuring a complete and accurate client profile.

This will also reduce duplication of efforts as data entered by clients in FreeAgent will flow seamlessly into the workflows, cutting down on manual entry and the risk of errors. Trial balances can be mapped and imported directly from FreeAgent, and Acting Office automatically reads and interprets FreeAgent account codes for faster processing.

Find out more

Exciting partnership news! Fathom is integrating with FreeAgent

Soon, UK accounting firms will be able to connect FreeAgent’s streamlined accounting platform with Fathom’s powerful reporting and analysis capabilities.

That means:

• Beautiful, client-ready insights without the spreadsheet grind

• Easier ways to manage and engage entire client portfolios

• More opportunities to grow and scale advisory services

Join the waitlist today and be the first to know when it's live!

NORTH WEST-BASED ACCOUNTING SOFTWARE FINTECH COCONUT HAS ANNOUNCED A FIRST-OF-ITS-KIND INTEGRATION WITH DIGITAL BUSINESS BANK ZEMPLER TO SUPPORT THE MILLIONS OF SOLE TRADERS AND LANDLORDS AFFECTED BY THE UPCOMING MAKING TAX DIGITAL FOR INCOME TAX (MTD IT) DEADLINE. THE JOINT OFFERING WILL SIMPLIFY AND STREAMLINE TAX PREPARATION

Product News for Accountants: CGT worksheets to document management, here’s what you need to know

THE LAST FEW MONTHS HAVE BEEN BUSY AT MYOB. SINCE OUR MID-YEAR UPDATE, WE’VE INTRODUCED SEVERAL NEW WORKSHEETS AND TOOLS TO MYOB PRACTICE COMPLIANCE. IT’S NOW EASIER TO CALCULATE CAPITAL GAINS TAX, CREATE SPECIALISED RETURNS, AND MANAGE COMPLIANCE WORKFLOWS IN YOUR PRACTICE.

The changes are varied, but they’re all part of our push toward a comprehensive, end-to-end accounting platform. It’s all about efficient processes that help you tick compliance boxes,

giving your people more time for intensive work and client relationships. Every update helps us move toward that goal.

Here’s a rundown of the latest changes to Tax and Client Accounting in MYOB Practice Compliance:

Specialised returns and worksheets for Tax in Practice Compliance

Tax in Practice Compliance is designed to minimise manual effort and reduce the risk of mistakes. Our latest updates reflect that, with changes to CGT worksheets, TFN reporting

and TFN withholding. Many of the updates are about building tax workflows in Practice Compliance to minimise switching between platforms and reduce your reliance on desktop software.

Look out for these changes:

Simplified CGT calculations

Calculating CGT for individual returns just got easier. MYOB Practice Compliance now has a built-in CGT worksheet for individual tax returns

Find out more

- COMPLETELY FREE OF CHARGE.

The partnership sets a new benchmark for the fintech and finance industries to collaborate to support Britain’s self-employed ahead of Government’s upcoming changes.

From April 2026, millions of self-employed individuals will no longer be able to use HMRC’s free Self Assessment service. Instead, they’ll

be required to submit quarterly digital tax updates by purchasing commercial software.

The upcoming changes will make it even more important for sole traders to open a separate business current account to keep personal and business finances separate.

As part of the partnership, customers can open a Zempler Business Bank ac-

count directly through the Coconut sign-up journey and app. Those who do will receive free access to Coconut’s HMRC-recognised accounting software for two years - a saving of up to £238.

Coconut’s mobile and desktop software is designed specifically for sole traders and landlords

Keep reading

MAUTOMATION UPDATES UK ARE TRANSFORMING HOW ACCOUNTING FIRMS CAN FINALLY RETIRE THEIR COPY-AND-PASTE MARATHONS

The tedious truth about manual data entry

Manual data entry between Xero and your workpapers is every UK accountant’s shrinking nightmare. Not only does it sap time, but it also invites errors large enough to cause client headaches or compliance penalties. In a market squeezed by regulatory evolution and competition, efficiency isn’t a nice-tohave, it’s survival.

MyWorkpapers automation updates offer a smart solution that turns a multi-hour slog into a simple,

reliable click-to-populate process, dramatically improving speed and accuracy.

Why the copy-paste era must end for UK accounting firms

It might be tempting to think automation is just another buzzword or a gimmick only suitable for large corporations. Yet even small to mid-sized UK firms report that manual data juggling consumes nearly a third of their resource hours during year-end preparation. These hours translate into lost revenue and staff frustration.

The problem isn’t accountant expertise, it’s outdated workflows.

According to the Institute of Chartered Accountants in England and Wales (ICAEW), firms embracing automation technologies

see both time savings and quality improvements, reducing review cycles by up to 40%.

What MyWorkpapers automation updates deliver to UK firms

MyWorkpapers automation updates are designed to address exactly this pain:

• Direct Xero integration: Link your client Xero accounts once and pull data seamlessly into your workpapers.

• Automate 10 commonly used workpapers: Including bank reconciliation, payroll reconciliation, fixed asset registers, prepayments, trade debtors and creditors, and more.

Find out more

Discover why firms are embracing CAS 360 to simplify company secretarial and AML compliance.

Cloud-based and easy to use — no more spreadsheets!

Powerful automation to reduce repetitive admin tasks.

Seamless electronic filing direct to Companies House.

Integration with Xero Practice Manager, FuseSign and FYI.

Companies House compliance made easy www.bglcorp.co.uk

Watch a demo

September wrapped: What’s new at Dext

This month, we’ve rolled out some exciting updates to help you and your clients save time, stay accurate, and work smarter. Here’s what’s new: WhatsApp submission: share receipts and invoices straight from WhatsApp into Dext. No extra app needed.

Transaction clean up: improve reporting accuracy with our Data Health and Insights feature. Customisable exports: tailor cost exports per client to get exactly what you need.

…and that’s a wrap!

But we’re not stopping here. Stay tuned for more features designed to help you achieve your bigger thing.

KARBON CONTINUES TO LEAD THE WAY IN ACCOUNTING PRACTICE MANAGEMENT, RANKED AS THE #1 SOLUTION FOR THE 16TH QUARTER IN A ROW ON G2, THE WORLD’S LARGEST AND MOST TRUSTED SOFTWARE MARKETPLACE.

Each quarter, G2 releases Market Reports that feature rankings of software products and services based on the latest data, awarding badges to the highest-performing tools available. This quarter, only 3% of the tools on G2 received a Leader badge—and Karbon is in that 3%.

Karbon leads on G2 for 16 consecutive quarters

Accounting firms rank Karbon #1 in practice management.

The G2 Fall 2025 Report at a glance

• 7 x #1 rankings in the Ac-

Ignition’s latest innovation combines AI with proprietary proposal data to deliver tailored, databacked price insights at scale, enabling accounting firms to optimize pricing and revenue

counting Practice Management category

• Grid Leader in the Accounting Practice Management category

• 16 x badges in the Workflow Management category

• 31 x total new badges

• 4.8/5 stars from 678 reviews (and counting!)

What is G2?

G2 is the leading software review marketplace, built on verified customer feedback. For accounting, especially in practice management, it’s the most trusted independent benchmark, helping firms cut through marketing claims and make confident tech choices based on the real experiences of their peers.

Karbon’s Fall 2025 badges

We’re thrilled to have received 31 badges this quarter

Find out more

IGNITION, THE RECURRING REVENUE AND BILLING AUTOMATION PLATFORM FOR FIRMS AND AGENCIES, TODAY LAUNCHED PRICE INSIGHTS, THE ACCOUNTING INDUSTRY’S FIRST AI-POWERED PRICING INTELLIGENCE SOLUTION. DRAWING ON IGNITION’S ROBUST PROPOSAL DATA, IT DELIVERS TAILORED PRICING BENCHMARKS AND SUGGESTIONS THAT GIVE FIRMS THE CLARITY TO PRICE SMARTER, IMPROVE PROFITABILITY, AND OPTIMIZE REVENUE.

“The accounting industry has lacked transparent pricing benchmarks, unlike retail or software where businesses can easily shop around and compare,” said Greg Strickland, CEO of Ignition. “Firms are left in the dark, forced to guess prices, even though pricing is the most powerful revenue lever they have. Ignition’s AI-powered Price Insights changes that. By combin-

ing AI with our rich proposal dataset, we’re unlocking pricing intelligence at scale. Firms now have very tailored, data-backed guidance at their fingertips to price with confidence and clarity.”

AI-powered Price Insights are embedded directly into the Ignition proposal workflow, enabling firms to optimize pricing for services as they build client agreements. Key capabilities include:

To deliver tailored pricing guidance, Price Insights analyzes a firm’s service details and compares them to similar services from comparable firms using Ignition. Variables such as location, firm profile, and industry are factored in to tailor insights, while the underlying dataset is refreshed regularly to stay relevant.

Find out more

Karbon recognised as one of the UK’s 2025

in Tech™ by Great Place to Work® UK, for the second year in a row

KARBON, THE GLOBAL LEADER IN PRACTICE MANAGEMENT SOFTWARE FOR ACCOUNTING FIRMS, ANNOUNCED TODAY IT HAS BEEN NAMED IN THE UK’S BEST WORKPLACES IN TECH™ LIST BY GREAT PLACE TO WORK® UK IN THE SMALL & MEDIUM CATEGORY FOR THE SECOND YEAR IN A ROW.

With 100% of the Karbon UK team reporting that Karbon is a great place to work, the results speak for themselves.

One Karbon employee shared in the latest Trust Index™ survey that: “Despite being a global, remote workforce, there is a great, tight-knit culture and everyone feels part of the team.” Another shared: “Every single team member is highly skilled and truly great to

work with. That's rare to find.”

Karbon’s core values include a deep focus on championing connectivity and being good to each other. These, amongst the other values, are at the heart of everything each Karbon team member does.

In recent years, these values have been consolidated and further intentionally integrated into day-to-day practices at Karbon, including dedicated avenues to acknowledge behaviour that embodies Karbon values, as well as informal channels for sharing personal interests and wins beyond the workplace.

Each month, the Diversity, Equity, Inclusion, & Belonging Council presents events and resources that educate and celebrate all Karbon-

ites, advancing Karbon’s commitment to trust, pride, camaraderie, and wellbeing in the workplace.

Great Place To Work®

UK administered their research-backed Trust Index™ employee survey and analysed the responses of UKbased tech employees to determine the Best Workplaces™ list. The surveys asked employees to comment on how their company supports their work-life balance, sense of fulfilment, job satisfaction, psychological safety and financial security. Evaluations also included an assessment of how well the organisation was able to deliver consistency of their employee experience across all departments and seniority levels.

Find out more

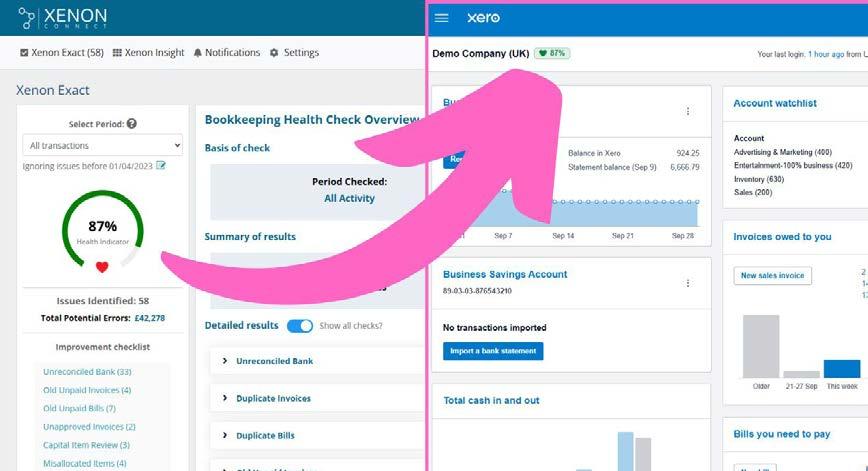

Xenon Connect Chrome Browser Extension Now Live!

View health scores directly inside Xero Deep link back into Xenon Connect in new tab 1-click install No setup required

How it works: When you are logged into Xenon Connect in the background (also in the same Chrome browser) the organsiation's health score will show next to the organisation's name in Xero.

Notes:

- Health score will be based upon the default period that is selected on the Advisor Dashboard > Settings > Xenon Exact page

- If you have not connected the specific Xero organisation to your Xenon Connect account, then nothing will show.

(More features and FreeAgent, QBO & Sage support coming soon)

We’re excited to share that Dext has been recognised by CNBC and Statista as one of the UK’s Top Fintech Companies 2025.

The list highlights the top 150 fintechs across seven market segments, and we’re proud to be named in the Enterprise Fintech category.

This recognition is a testament to the dedication of our teams and the trust of our accountancy and bookkeeping partners, as well as the SMBs we support every day.

Thank you for being part of our journey. Together we’re hashtag#BuiltforBiggerThings

EXPANDLY, THE ALLIN-ONE ECOMMERCE PLATFORM THAT SIMPLIFIES GLOBAL EXPANSION FOR ONLINE RETAILERS, TODAY ANNOUNCED THE APPOINTMENT OF KEVIN MORRIS AS BUSINESS DEVELOPMENT MANAGER, COVERING THE UNITED STATES AND CANADA. THIS STRATEGIC HIRE ENHANCES EXPANDLY’S GLOBAL SALES

REACH AND REINFORCES ITS COMMITMENT TO SUPPORTING MERCHANTS ACROSS NORTH AMERICA.

Kevin brings over a decade of experience in eCommerce, digital marketing, and Amazon growth strategies. He co-founded and scaled multiple private-label Amazon brands to six-figure revenues, successfully exited two eCommerce

MOULA HAS EXPANDED ITS NATIONAL PARTNER SALES TEAM WITH THE APPOINTMENT OF TWO NEW BUSINESS DEVELOPMENT MANAGERS (BDMS): JESSE BARLING IN QUEENSLAND AND SHEEBA KAPOOR IN VICTORIA.

Jesse brings more than a decade of experience in financial services, having held BDM roles at Great Southern Bank and Athena. With extensive broker channel expertise and a strong focus on unsecured business lending, he will support brokers and their clients across Queensland.

Sheeba joins from NAB, where she worked as a Small Business Banker. With a background in fintech and experience spanning cash flow lending, asset and equipment finance, and property-backed facilities, she brings both fintech insight and banking experience to her new role supporting brokers across Victoria.

“We’re thrilled to welcome Jesse and Sheeba to the team,” said Sam Sfeir, Head of Sales at Moula.

Find out more

businesses, and founded an Amazon agency with a team of 16 virtual assistants. His track record also includes coaching thousands of entrepreneurs through major international eCommerce training programs, helping businesses launch, scale, and succeed online.

"I’m incredibly excited to join Expandly at such an important stage in its

global growth," said Kevin Morris. "Expandly’s mission to make global eCommerce expansion simple for retailers aligns perfectly with my passion for helping businesses grow. I look forward to working with the team and supporting clients across the US and Canada as they expand their reach worldwide."

Find out more

WE’RE EXCITED TO ANNOUNCE A NEW FEATURE IN MYDOCSAFE: ACCOUNT TEMPLATES – READYMADE, PROFESSION-SPECIFIC SETUPS DESIGNED TO HELP YOU ONBOARD CLIENTS FASTER, DELIVER SERVICES MORE EFFICIENTLY, AND GET PAID SOONER.

What are Account Templates?

Account Templates are pre-configured MyDocSafe workspaces tailored to the needs of specific professions. We’ve started with three of the most popular groups using MyDocSafe:

• Wealth planners / Financial Advisors

• Tax Advisors

• Accountants

Each template is designed to save you hours of setup time by providing:

• Service lists: Example services commonly offered in your profession, with descriptions and sample prices.

• Client portals: Profession-specific onboarding workflows that make it easy to welcome and manage new clients.

Find out more

WHILE THE SAVINGS MARKET IS AT A TIPPING POINT, FINARY HAS TAKEN AN INNOVATIVE APPROACH TO FINANCIAL MANAGEMENT TO BECOME THE LEADING INVESTMENT APP IN FRANCE AND EUROPE, TARGETING €5 BILLION IN ASSETS UNDER MANAGEMENT WITHIN THREE YEARS.

Today, Finary, a wealth management platform in hypergrowth and profitable since 2024, announced a €25 million Series B funding round led by PayPal Ventures, with participation from LocalGlobe, Hedosophia, Shapers, and existing investors Y Combinator and Speedinvest. Axel Weber

(former president of the German central bank and former chairman of UBS) and Harsh Sinha (CTO of Wise) also joined the round.

To date, Finary has raised a total of €38 million, and this new round will accelerate five strategic pillars:

Launch of innovative new financial products;

• Expand Finary One, its private-wealth offering;

• Enhance its wealth management tools using AI;

• Strengthen its position in the European market;

• Hire more than 50 talented team members to support growth.

Co-founded in 2021 by Mounir Laggoune, CEO and

best-selling author, Finary has established itself as the go-to wealth management app for democratizing investing and helping French people take back control of their money. With its all-inone platform, Finary enables everyone—regardless of their level of financial knowledge—to centralize their investments, optimize them with AI, learn, and invest in high-performing solutions with some of the lowest fees in the market. With its transparency-led approach, Finary has already transformed the financial lives of more than half a million French households seeking financial freedom.

This new phase comes

amid a shifting market and changing customer behaviors:

• Around €13.9 trillion of Europeans savings is invested in accounts yielding less than inflation

• Pay-as-you-go pension systems are running deficits across all major economies, putting further pressure on governments to scale them back

• An unprecedented wealth transfer from baby boomers to millennials and Gen Z, reaching €450 billion per year globally by 2030;

• 87% of these heirs plan to change their financial adviser by 2030.2

Find out more

Partnership includes both the women’s and men’s teams, with Starling customers offered exclusive perks

STARLING HAS ANNOUNCED A MULTI-YEAR PARTNERSHIP WITH ARSENAL, WITH THE BANK BECOMING THE CLUB’S OFFICIAL RETAIL BANKING PARTNER. TO KICK OFF THE PARTNERSHIP, STARLING HAS LAUNCHED A NEW FINANCIAL LITERACY CAMPAIGN THAT USES FOOTBALL TERMINOLOGY TO EXPLAIN KEY FINANCIAL SKILLS, AFTER THE BANK’S RESEARCH REVEALED THAT TWO-FIFTHS OF BRITS (44%) WOULD LIKE TO LEARN HOW TO MANAGE THEIR MONEY BETTER.

Fronted by the club’s legendary stopper, David Seaman, the first instalment of Starling’s financial literacy series, ‘Defending against Cyber Crims’, explains how best to defend your personal banking information.

Starling will release more videos on its social media

and YouTube channels in the coming months, covering topics ranging from transaction monitoring to understanding interest rates. The videos will feature past and present Arsenal players including Alessia Russo and Beth Mead, with the goal of helping people become ‘Good with Money’.

“From checking transfers to building a fantasy team, football supporters’ everyday habits translate perfectly into money management. Now, we want to empower more people to take on those habits. Together with beloved Arsenal legends, our financial literacy series will use the cultural currency of football as a platform to get people in the UK rethinking their relationship with their money,” said Michele Rousseau, Chief Marketing Officer at Starling.

Find out more

GOOGLE AND PAYPAL TODAY ANNOUNCED A MULTIYEAR STRATEGIC PARTNERSHIP FOCUSED ON ADVANCING SEVERAL COMMERCE SOLUTIONS. THE COLLABORATION WILL DELIVER INNOVATIVE SOLUTIONS THAT TRANSFORM HOW BUSINESSES AND CONSUMERS TRANSACT ACROSS PLATFORMS AND DEVICES. COMBINING THEIR EXPERTISE AND SCALE, THE COMPANIES AIM TO DELIVER FRICTIONLESS DIGITAL COMMERCE EXPERIENCES AND SET A NEW STANDARD FOR COMMERCE ECOSYSTEM INNOVATION.

"PayPal is a leader in digital commerce, and we're excited to expand our work together to make online

transactions simpler and more secure," said Sundar Pichai, CEO of Google and Alphabet. "Through this partnership, PayPal will use our industry-leading AI to enhance services and security, and we will more deeply integrate PayPal's innovative payment capabilities for a better experience across Google products and platforms."

"In this emerging world of agentic commerce, trust and innovation are key," said Alex Chriss, President and CEO of PayPal. "Together with Google, we are leading the way for digital commerce, ensuring greater opportunities for merchants and users worldwide. We are bringing PayPal's products and services to billions of Google users and redefining what's

possible at global scale."

Innovations Redefining the Future of Commerce

• Agentic Shopping and Commerce Experiences: PayPal and Google are collaborating to create new AI shopping experiences and developing standards that will help shape the future of agentic commerce across the industry. The partnership will bring together PayPal's global payment infrastructure, data-driven personalization and trusted identity solutions, alongside Google's AI expertise to deliver new AI experiences.

Find out more

TODAY, PAYPAL AN-

NOUNCED THE EXPANSION OF PAYPAL OFFSITE ADS TO GERMANY AND THE UNITED KINGDOM, BRINGING ITS INNOVATIVE TRANSACTION-BASED ADVERTISING PLATFORM TO EUROPEAN MARKETS FOR THE FIRST TIME. FOLLOWING PAYPAL ADS' RECENT LAUNCH IN THESE MARKETS, WHICH ENABLED CAMPAIGNS ON PAYPAL PROPERTIES USING THE COMPANY'S UNIQUE INSIGHTS, OFFSITE ADS LETS ADVERTISERS LEVERAGE PAYPAL'S EXTENSIVE TRANSACTION GRAPH TO REACH MILLIONS OF CONSUMERS ACROSS THE OPEN WEB THROUGH DISPLAY AND

PayPal Offsite Ads provides closed loop attribution powered by actual purchase data across millions of merchants and consumers. This enables brands to reach highly relevant audiences based on real shopping intent, not just inferred interest, and measure true impact.

"With Offsite Ads, we're transforming how brands connect with consumers in Germany and the UK by delivering commerce-driven advertising precision and relevance," said Mark Grether, SVP and General Manager, PayPal Ads. "For advertisers, this is a fundamentally

different approach from current solutions as PayPal sits horizontally across millions of merchants, allowing us to build on actual cross-merchant purchase behavior across more than just one retailer.”

PayPal Offsite Ads is built upon the company’s transaction graph, providing high precision to advertisers by making cross-merchant transaction insights available. PayPal’s transaction graph is a unique repository of real, cross-merchant purchase signals that drive relevant advertising.

Find out more

PAYPAL HOLDINGS, INC. (NASDAQ: PYPL)

TODAY ANNOUNCED A COMMITMENT TO INVEST $100 MILLION THROUGHOUT THE MIDDLE EAST AND AFRICA, FUELING INNOVATION, SUPPORTING ENTREPRENEURS, AND DRIVING INCLUSIVE ECONOMIC GROWTH IN ONE OF THE WORLD’S FASTEST-GROWING DIGITAL COMMERCE REGIONS.

This strategic investment will be deployed through a mix of minority investments, acquisitions, PayPal Ventures funding, people, and technology deployments that will help local businesses scale, unlock new oppor-

tunities for innovators, and bring millions more consumers and communities into the digital economy.

“The Middle East and Africa are home to some of the most dynamic and rapidly evolving businesses in the world,” said Alex Chriss, President and CEO, PayPal. “By dedicating a $100 million investment to this region over the coming years, we’re investing in the technologies, partnerships, and solutions that will help entrepreneurs scale faster, expand their reach beyond borders, and unlock new opportunities for growth in the digital economy.”

The announcement follows the April launch of PayPal’s first regional hub in Dubai, a gateway designed to deliver global commerce capabilities to the region by providing businesses from large enterprises to small merchants with frictionless payments, robust security, and greater access to international markets.

This new $100 million commitment also builds on PayPal Ventures’ existing investments in some of the region’s most promising startups

Find out more

BCB GROUP IS PLEASED TO ANNOUNCE THE APPOINTMENT OF TOM SQUIRE AS CHIEF REVENUE OFFICER (CRO). TOM, WHO JOINED BCB IN JUNE AS COMMERCIAL DIRECTOR, WILL NOW TAKE ON AN EXPANDED REMIT, LEADING REVENUE GENERATION ACROSS ALL PRODUCTS, SERVICES AND MARKETS, DRIVING AMBITIOUS GLOBAL GROWTH PLANS.

As a leading provider of payment solutions for the digital asset economy, BCB Group is known for its institutional-grade infrastruc-

OOREDOO FINTECH, ONE OF MENA’S LEADING DIGITAL FINANCIAL SERVICES

PROVIDERS, OPERATING IN MULTIPLE COUNTRIES

ACROSS THE REGION, TODAY ANNOUNCED THEIR INTENTION TO FORM A STRATEGIC COLLABORATION WITH PAYPAL (NASDAQ: PYPL). OOREDOO FINTECH IS SET TO JOIN PAYPAL WORLD, A GLOBAL PLATFORM CONNECTING THE WORLD’S LARGEST PAYMENT SYSTEMS AND DIGITAL WALLETS.

Ooredoo Fintech will join leading global payments systems and digital wallets in enabling nearly two billion users globally to seamlessly send money, shop online, in-store, and with AI agents across borders. Benefits will

include:

• Access to shop at millions more businesses, online, in-store, and with AI agents,

• Pay international businesses using their domestic payment system or wallet of choice and local currency,

• Seamless money transfers to users across borders.

For consumers, PayPal World can enable Ooredoo Wallet users access to millions of merchants globally and the ability to send funds abroad with unprecedented ease, reducing the usual friction and roadblocks associated with international payments.

PayPal World will connect millions of businesses to

nearly two billion consumers worldwide. Businesses will benefit from:

• Expanded reach into new markets and nearly two billion users,

• Increased payment options and sales – online, in-store, and with AI agents,

• Businesses automatically accept new digital payment options at checkout when more partners join the platform, with no additional development work required.

Mirko Giacco, CEO at Ooredoo Fintech said, “We have empowered the masses with digital finance in Qatar and taken this successful model to Oman and the Maldives. With additional markets over time to widen

access to modern cost-effective financial solutions. This partnership with PayPal fits perfectly with our mission to empower consumers and merchants with global financial access through their local wallet."

“PayPal World is a first-ofits-kind payments ecosystem that will bring together many of the world’s largest payment systems and digital wallets on a single platform. It is testament to the passion our partners share for an inclusive, global digital economy and has the potential to revolutionize cross-border commerce,” said Alex Chriss, President and CEO of PayPal.

Keep reading

ture and regulatory-first approach. As CRO, Tom will steer global sales, partnerships, client success, and commercial strategy, aligning current plans with BCB’s overarching vision for the future of digital finance and asset infrastructure.

“Tom has already proved himself a formidable force since joining us,” said Oliver Tonkin, Co-founder & CEO of BCB Group.

“His energy, commercial acumen and ambition have amplified our momentum. As CRO, he will spearhead our global expansion, deepen customer engagement,

and help bring our vision of an integrated fiat–crypto ecosystem to life.”

Tom brings a wealth of experience to the group, spanning a diverse career that includes finance, M&A, and international payments across both developed and emerging markets.

He previously led sales at NALA, an Africa-focused remittance group, where he played a key role in developing the company’s Rafiki platform

We’re excited to announce our partnership with CommSec, Australia’s leading online broker. This collaboration combines CommSec One’s exclusive program with Sharesight’s award-winning portfolio tracking and tax reporting platform, giving investors a secure, whole-of-wealth view designed to handle even the most complex portfolios.

At Sharesight, we’re focused on helping investors see the complete picture of their wealth. By bringing CommSec and Sharesight together, members gain deeper insight into performance, greater control over complexity, and the ability to manage their portfolios with ease.