BUSINESS REGISTRA-

TION: NOW A JOB FOR BOTS?

If you’ve ever tried registering a business yourself, you’ll know it’s no walk in the park. Forms to fill, identities to prove, money to send – it’s a lot. Now imagine handing all of that off to an AI agent that does it for you while you sip your coffee.

That’s what we just tested. And it worked.

ANNA ran an experiment using an LLM agent acting as a human customer. The

AI navigated our entire company registration process through the web interface –collecting details, logging in securely, verifying ID, making a payment, and submitting everything to Companies House. It even got the business account up and running with a virtual card, ready to go.

"Frankly, the fact it worked first-time was extraordinary. LLM agents can struggle with something as common as checking in for a flight, yet here we saw it handle one of the most complicated and regulated sign-up

processes in the UK – endto-end, payment in full."

Boris Diakonov Co-founder and co-CEO at ANNA

Built for today, ready for tomorrow

The best part? We didn’t need to overhaul our systems to make this happen. But we’re not stopping there. ANNA is already working on a “robot-ready” version of the journey

Keep reading

Launch jobs instantly from requests, re-engagements, and onboarding — no more double handling

WE’VE ALL BEEN THERE. A CLIENT REQUEST COMES THROUGH SEAMLSS, YOU GATHER ALL THE INFORMATION, GET EVERYTHING SIGNED… THEN YOU SWITCH TO XPM TO MANUALLY CREATE THE JOB. AGAIN. AND AGAIN. FOR EVERY SINGLE CLIENT INTERACTION.

That gap between “client says yes” and “job exists in

XPM” is where profitable work goes to die. Not anymore.

Introducing XPM Job Integration

Starting today, you can launch XPM jobs directly from Seamlss — whether you’re processing a new request, running a re-engagement campaign, or onboarding a new client.

One click. Job created. Team notified. Work begins.

The Old Way Was Broken

Think about your current workflow:

• Client completes a request in Seamlss

• You review and approve it

• You open XPM in another tab

Find out more

FOR YEARS, DELIVERING ADVISORY SERVICES HAS BEEN A GOAL FOR PROGRESSIVE ACCOUNTING FIRMS, BUT DOING IT EFFICIENTLY AND AT SCALE? THAT’S THE REAL CHALLENGE.

Introducing the powerful integration between Karbon and Spotlight Reporting, where accountants and advisors can now schedule, track, and deliver high-value advisory services just as easily as they would a compliance job. This is your opportunity to scale advisory across your client base, without adding more complexity or admin.

Set Your Clients and Team Up to Win

The Karbon + Spotlight integration gives you a clear,

repeatable way to embed advisory into your workflows, so every client, not just a select few, gets the insights they need to thrive.

Automate Your Advisory Workflows

Treat advisory with the same consistency as compliance:

• Schedule your monthly, quarterly, or ad-hoc reporting work, just like you do with Financial Statements or Tax jobs.

• Allocate tasks across your team to eliminate bottlenecks, streamline delivery, and grow internal advisory capability.

Gain Unparalleled Visibility

Stop relying on memory or manual tracking. With

Karbon and Spotlight Reporting, you can:

• Instantly see which clients have advisory work scheduled.

• Identify missed opportunities - those still receiving only an Annual Accounts pack.

• Spot workflow gaps and turn them into conversations.

Unite and Empower Your Team

No more advisory bottlenecks. Distribute tasks, share context, and build confidence across your team:

• Help team members learn in real client scenarios. Find out more

KARBON, THE GLOBAL LEADER IN ACCOUNTING PRACTICE MANAGEMENT SOFTWARE, TODAY ANNOUNCED THE APPOINTMENT OF VIVEK SRIVASTAVA AS SENIOR DIRECTOR OF PRODUCT. IN THIS NEWLY CREATED ROLE, SRIVASTAVA WILL LEAD KARBON’S AI PRODUCT VISION AND STRATEGY, DRIVING THE COMPANY’S MISSION TO HELP ACCOUNTING FIRMS MODERNIZE AND OPERATE AS INTELLIGENT, CONNECTED BUSINESSES.

Srivastava brings more than 15 years of experience

XU BIWEEKLY - No. 114

Newsdesk:

If you have any news or updates that you would like us to consider for inclusion in the next edition of the XU Biweekly, please email us at: newsdesk@xumagazine.com

CEO: David Hassall

Managing Editor: Wesley Cornell

Chief Revenue Officer: Alex Newson

Account & Partnership Assistant: Robyn Consterdine

Creative Assistant: Victoria Young

Advertising: advertising@xumagazine.com

www.xumagazine.com

‘Xero’ is a trademark of Xero Limited (New Zealand). XU Biweekly and XU Magazine is collaboratively produced by an independent group of Xero users and is not affiliated in any way with Xero. All other trademarks are the property of their respective owners.

© XU Magazine Ltd 2014-2025. All rights reserved. No part of this publication may be used or reproduced without the written permission of the publisher.

XU Biweekly is published by XU Magazine Ltd (08811842), registered in England and Wales. Registered office: Office 1, Brunswick House, Brunswick Way, Liverpool, L3 4BN, United Kingdom. All information contained in this publication is for information only and is, as far as we are aware, correct at the time of going to press. XU Magazine Ltd cannot accept any responsibility for errors or inaccuracies in such information.

If you submit unsolicited material to us, you automatically grant XU Magazine Ltd a licence to publish your submission in whole or in part in all/any editions, including in any physical or digital format, throughout the world. Any material you submit is sent at your risk and, although every care is taken, neither XU Magazine Ltd nor its employees, agents or subcontractors shall be liable for loss or damage. The views expressed in this publication are not necessarily the views of XU Magazine Ltd, its editors or its contributors.

building SaaS products, with nearly a decade focused on AI. Prior to joining Karbon, he was Director of AI Product Management at Workday, where he launched several AI-powered capabilities and helped define the company’s generative AI strategy. His work has spanned document intelligence, enterprise search, and frontline AI agents, always with an emphasis on building secure, scalable technology that delivers real customer impact.

“Vivek has a proven track record of turning AI concepts into real products

that customers rely on,” said Sara Goepel, Chief Product Officer at Karbon. “His leadership will be key as we continue to build the most intelligent platform in accounting and ensure firms are ready for what’s ahead.”

At Karbon, Srivastava will focus on embedding AI across the platform, from automating complex accounting workflows to providing predictive insights that help firms work smarter and faster.

HOW MUCH TIME IS BENEFICIAL OWNERSHIP COMPLIANCE REALLY COSTING YOUR PRACTICE? UNTANGLING COMPLEX OWNERSHIP STRUCTURES AND CHASING DOWN INFORMATION FOR ANNUAL FILING TO CIPC IS A MANUAL, TIME-CONSUMING PROCESS. WITH XERO’S NEW BENEFICIAL OWNERSHIP FUNCTIONALITY, YOU CAN TURN THAT COMPLIANCE HEADACHE INTO A STREAMLINED, VISUAL, AND AUTOMATED PROCESS.

Beneficial Ownership, now available in Xero’s integrated practice management and tax solution via the Gatekeeper app, is designed to help you effortlessly manage compliance, minimise manual effort, and reclaim valuable time.

As companies cannot file their Annual Return without submitting a full trial of

ownership, there are serious consequences to non-compliance. Xero’s Beneficial Ownership solution aims to transform this process. It enables accountants and bookkeepers to effortlessly handle all required documentation with an interactive, visual approach to building organograms and powerful auditability.

Here are the key features of Xero’s Beneficial Ownership solution and what our partners are saying:

Build a visually interactive organogram

Visually build out the organogram so you can see a dynamic view of ownership structures and get a complete picture of ownership across a group. The Individual Holdings Search allows you to trace common beneficial owners and quickly find all of an individual’s holdings within a complex structure. This helps make

due diligence easier.

Instantly produce required documentation

Instantly create the required registers and documents based on the data in the organogram. This automation means you can skip the intensive manual data entry and ensure accuracy and consistency.

“The generation of Beneficial Ownership documents was really helpful and saved a lot of time.” – Dewald Taljaard, APS Africa

Historical beneficial ownership snapshots

‘Finalise’ an organogram at a specific point in time and recall that exact structure later. It ensures the data you submit to authorities is accurate for the submission date, and that you don’t lose historical information.

Find out more

SALESFORCE TODAY ANNOUNCED THE WINTER ’26 RELEASE, ROLLING OUT HUNDREDS OF POWERFUL AI, DATA, AND AUTOMATION ADVANCEMENTS, GENERALLY AVAILABLE STARTING OCTOBER 13. THIS RELEASE IS PACKED WITH INNOVATIONS DESIGNED TO HELP BUSINESSES WORK SMARTER, MOVE FASTER, AND CONNECT MORE DEEPLY WITH THEIR CUSTOMERS. FROM REIMAGINED SHOPPING EXPERIENCES TO ENHANCED DATA COLLABORATION AND INDUSTRY-SPECIFIC AI AGENTS, WINTER ’26 EXTENDS THE SALESFORCE PORTFOLIO WITH TRUSTED, ENTERPRISE-READY AI INNOVATIONS.

Top 10 updates in the Winter ’26 Release:

• Agentforce for Service: IT Service — Automate fixes, delight employees IT Service maximizes up-

time with an agentic console for managing internal IT issues, improving IT operations and team success. Agentforce accelerates issue resolution with an employee portal, native Slack integration, incident detection, and root-cause analysis wherever employees work.

• Agentic Commerce: Guided Shopping for B2C — Deliver a personal shopper experience online Guided Shopping powered by Agentforce transforms the online customer journey by offering personalized, conversational guidance from product discovery to checkout. It replicates the best in-store shopping experiences virtually, helping increase conversion and customer satisfaction.

Find out more

Introducing the new Ethical Clearance module – because client transfers shouldn’t be painful

LET’S BE HONEST ABOUT ETHICAL CLEARANCES. THEY’RE A NIGHTMARE.

You send a perfectly professional request to another firm, and then… nothing. Weeks go by. You send a follow-up. Still nothing. Your new client is getting antsy about missing filing deadlines, and you’re stuck explaining why you can’t do the work they’re paying you for.

Sound familiar? You’re not alone. One accountant on AccountingWEB put it bluntly: “Sometimes this prevented us submitting on time, causing fines. This massively damages our relationship with the new client and has the potential to damage our reputation, which is incredibly frustrating when it is out of our control.”

The Current Process Is Broken

Here’s what ethical clearances look like today:

Week 1: You send a polite email with a professional clearance letter attached. Maybe you call to confirm they received it.

Week 3: Still no response. You send a “friendly follow-up” email.

Week 5: Getting desperate. You call again. “We’ll get back to you soon,” they say.

Week 8: Your client is now asking why their tax return isn’t done yet. You’re making excuses about the “previous accountant.”

Week 12: Finally get some documents, but half the information is missing. The TFN they sent via email (hello, privacy breach!) doesn’t match what your client told you.

One firm reported sending requests to various practices over a month “and not yet had any responses.”

Find out more

THE G2 AUTUMN BADGES ARE IN, AND WE’VE ACHIEVED OUR STRONGEST SET OF RESULTS SINCE WINTER 2024. WEBEXPENSES HAS SECURED 31 BADGES IN THE FALL 2025 REPORT, SURPASSING OUR SUMMER TOTAL OF 27 AND CLAIMING THE TOP POSITION IN UK MID-MARKET EXPENSE MANAGEMENT.

The results position us as an industry leader in

DISCOVER WHAT’S NEW IN SOLDO: AUTOMATED INVOICE FIELDS, OCR-BASED VAT SPLITTING, SAVED VIEWS ACROSS THE PLATFORM, AND IMPROVED CARD DELIVERY MANAGEMENT — ALL DESIGNED TO SIMPLIFY RECONCILIATION AND REPORTING.

This quarter, we’ve focused on one big goal: making every day finance tasks less manual, more accurate, and easier to manage – especially around data, reconciliation, and reporting. Whether you’re dealing with complex VAT receipts, chasing invoice details, managing reports, or handling SAP

Concur exports, we’ve acted on your feedback. Here’s what’s new.

Invoice Fields: Reconciling invoices just got easier!

Many finance teams lose time reconciling expenses by manually entering invoice details already available on documents or known by employees. With this improvement, our users can now capture key invoice data in a structured way – manually or automatically via OCR.

Why finance teams love it:

• Invoice number

• Invoice date

• PO number

• Supplier VAT number

With OCR enabled, these fields are auto-filled from uploaded invoices, saving time and improving reconciliation accuracy.

Included in Plus & Unlimited plans

Using OCR to Split VAT rates: Complex receipts, simplified

If you’ve ever processed a fuel or hospitality receipt with more than one VAT rate, you know the headache.

Find out more

both expense and invoice management categories, with multiple first and second-place finishes based entirely on verified customer feedback.

Our Fall 2025 G2 results

G2 is one of the world’s leading software review platforms, gathering feedback from verified users to evaluate real-world performance. Once a quarter, it releases a report recognising

top-performing tools in different categories, providing a clear snapshot of which platforms are excelling.

And that’s where we come in. The fall 2025 edition placed us at the top (or near the top) of multiple competitive categories in the UK:

UK Expense Management

#1 Mid-Market Expense Management (outperform-

ing 12 competing platforms)

#2 Enterprise Expense Management (among the UK’s largest expense management providers)

UK Invoice Management

#2 Mid-Market Invoice Management (ahead of established accounting integrations)

Keep reading

OFOR SMALL BUSINESS IS XERO’S NEW PODCAST THAT SPOTLIGHTS AND CELEBRATES THE RESILIENCE, INNOVATION, AND IMPACT OF SMALL BUSINESS OWNERS ACROSS AOTEAROA NEW ZEALAND.

Hosted by Bridget Snelling, Xero Country Manager – New Zealand, the podcast dives into the real stories behind the mahi, from breakthrough moments to hard-earned lessons.

Each fortnightly episode features candid conversations with small business owners and industry experts who have carved their own paths to success.

“Small businesses are the backbone of our economy and our communities and so often their incredible mahi and positive impact gets overshadowed by conversations about how tough it can be out there,” says Snelling.

“This podcast is about providing a platform to

go behind the scenes with small business owners and really get to know what their journey has been like.

“In each episode, we dive deep into real stories of small business life. From the exhilarating highs of a breakthrough moment to the tough lessons learned in the trenches, we explore what it truly takes to build and sustain a business in today’s ever-changing landscape.

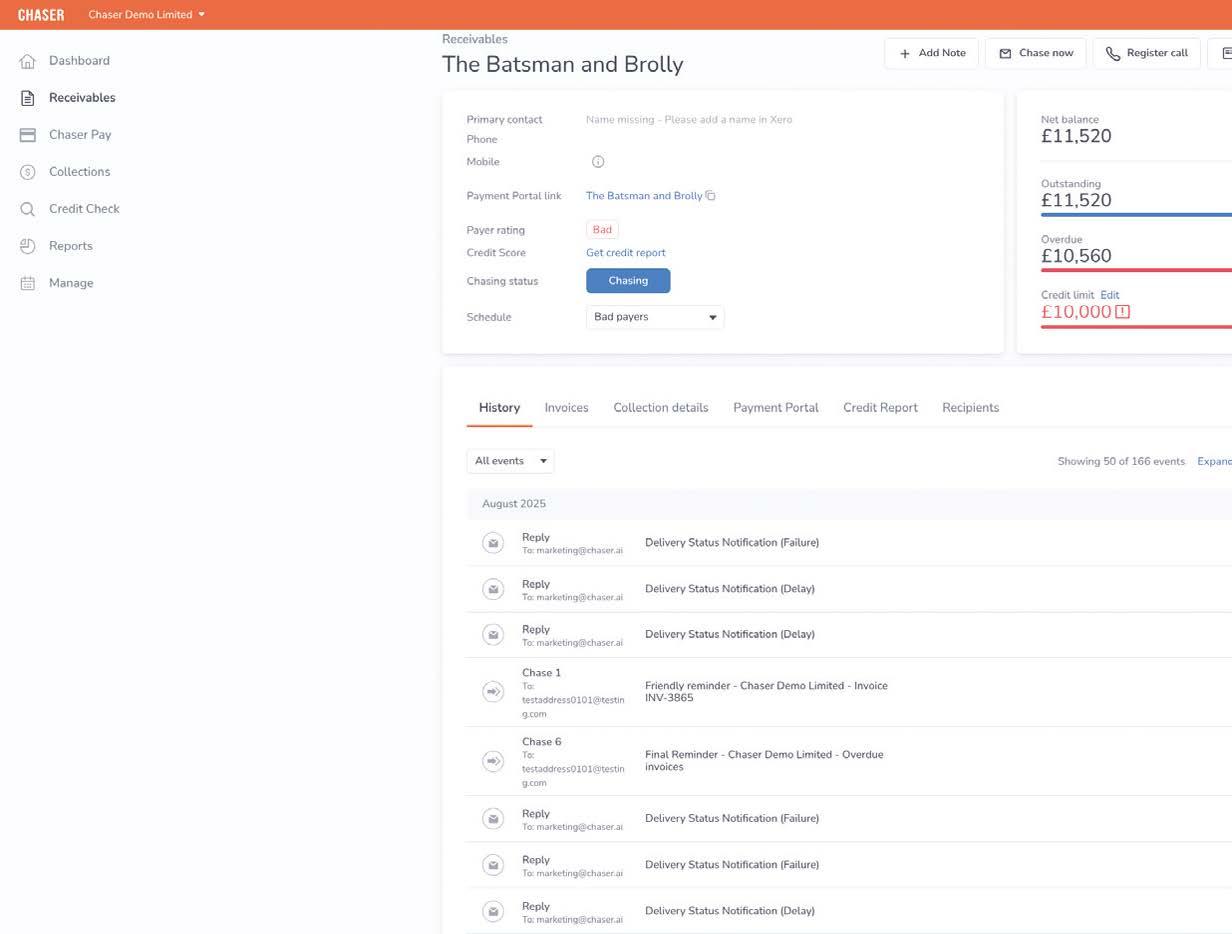

Chaser brings every debtor conversation, reminder, promised payment date, and response into one view. With CRM logging, you can now track every interaction where it matters most.

See everything. Track everything. Get paid faster.

Speak to an expert

Connect your CRM with Chaser in minutes.

DID YOU HEAR ABOUT THE NEW ZEALAND GOVERNMENT’S NEW TAX DEDUCTION? IT’S CALLED INVESTMENT BOOST, AND IT’S BEEN INTRODUCED TO HELP YOUR BUSINESS GROW WITH EARLIER DEDUCTIONS WHEN YOU BUY NEW ASSETS.

The 2025 New Zealand Budget delivered on 22 May introduced a new tax deduction for all businesses: 20% of the cost of new investment assets can be claimed immediately as an expense, with standard depreciation applied to the remaining 80%.

Now, Investment Boost is accessible via Xero: you can use Xero’s fixed asset feature to help you claim this government deduction. New assets purchased from

22 May 2025 onwards may be eligible.

We’re rolling out the update to the fixed asset feature now, and it will become available for all New Zealand Xero partners and customers over the coming weeks.

What is Investment Boost?

When your business buys a new eligible asset, you can immediately claim 20% of its cost as an expense in that year’s tax return. Then, you can claim depreciation as usual on the remaining 80%.

For example, you buy new equipment that meets the eligibility criteria for NZ$10,000.

Find out more

IWOCA, ONE OF EUROPE’S LEADING SME LENDERS, ANNOUNCES PARTNERSHIP WITH TEYA, THE GROWING ALLIN-ONE FINANCIAL SERVICES PLATFORM BUILT FOR SMALL BUSINESSES. THIS PARTNERSHIP WILL BRING IWOCA’S FLEXILOAN TO THOUSANDS MORE BUSINESS OWNERS, SEAMLESSLY INTEGRATED INTO TEYA’S DIGITAL PLATFORMS.

Fast and flexible finance

Teya customers can now apply for iwoca’s Flexi-Loan directly within their Teya app or web portal, unlocking sums from £1,000 to £1

million, with flexible terms from just 1 day up to 60 months. The application is 100% paperless, with zero early repayment fees, and approved funds typically land within minutes.

As demand for speedy, hassle-free finance accelerates, iwoca’s SME Expert Index reveals that 73% of SME finance brokers say faster decisions are their clients’ top priority. iwoca’s digital lending at scale enables UK businesses to access working capital without the red tape.

HAT’S NEW?

WYou can now configure your NetSuite integration to export transactions to a ‘Weel Expenses’ vendor if no existing vendor is found in NetSuite. Alternatively, you can continue to create a new vendor upon export if no existing vendor is found.

This is to make things tidier for finance teams who don’t want a proliferation

of small, one-off vendors when reconciling their Weel expenses in NetSuite.

This is available to all customers using our NetSuite integration.

Key Features

Export transactions to a ‘Weel expenses’ vendor if no existing vendor is found in NetSuite

Find out more

HAT’S NEW?

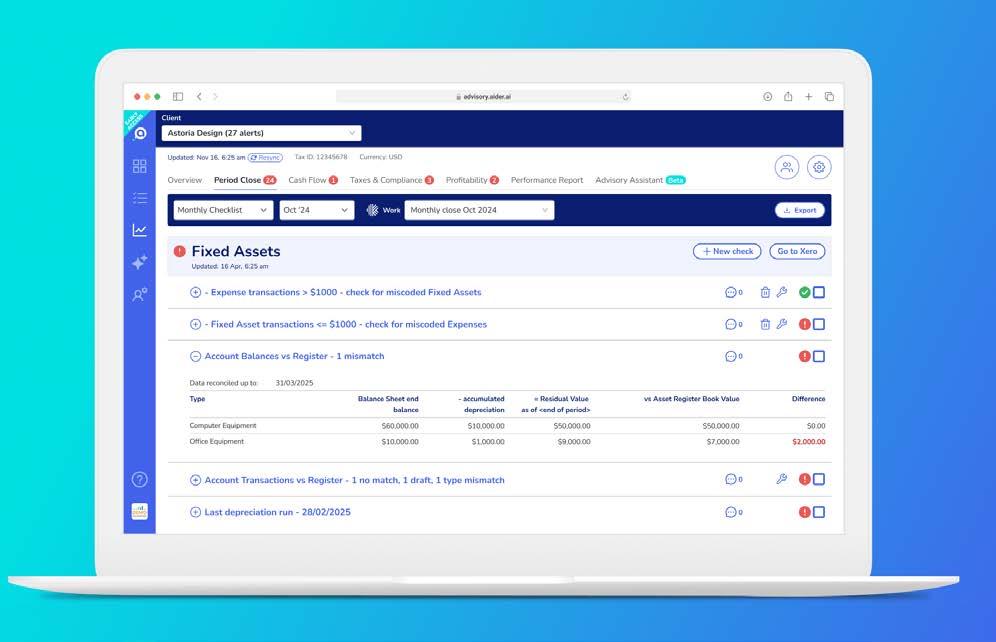

You asked and we delivered.

• There is now a dedicated section in the period close checklists for managing fixed assets and depreciations.

• More handy alerts have also been added to help you:

• Stay on top of depreciation.

• And if you are using Xero Fixed Asset Register, ensure the Register matches the general ledger.

What benefits does it have for advisors?

Stay on top of this common and complex area of

accounting easily.

• Save time & complete tasks easily: See at a glance all the relevant alerts that need fixing. Complete the task more efficiently.

• Ensure accuracy & compliance: Automated general ledger vs Fixed Asset Register alerts helps you keep both sets of financial records up to date and accurate.

How does it work?

1. The new Fixed Asset section (just above the Profit & Loss section) helps you stay focused on completing the related checks. Find out more

IDC names Soldo a Leader in AI-enabled Travel & Expense Management, proving its value today and commitment to future innovation. Catch common errors & ensure timely updates easily

SOLDO HAS BEEN NAMED A LEADER IN TWO IDC MARKETSCAPE REPORTS – IDC MARKETSCAPE: WORLDWIDE AI-ENABLED TRAVEL AND EXPENSE APPLICATIONS FOR MIDMARKET 2025 VENDOR ASSESSMENT (DOC # US53006525, AUGUST 2025) AND IDC MARKETSCAPE: WORLDWIDE AI-ENABLED TRAVEL AND EXPENSE APPLICATIONS FOR SMALL BUSINESS 2025 VENDOR ASSESSMENT (DOC # US53006625, AUGUST 2025).

What is the IDC MarketScape?

The IDC MarketScape vendor assessment model

is designed to provide an overview of the competitive fitness of technology and service suppliers in each market. The research methodology utilises a rigorous scoring methodology based on both qualitative and quantitative criteria that results in a single graphical illustration of each supplier’s position within a given market.

The report is considered one of the most respected independent technology evaluations, helping technology buyers assess vendors based on current capabilities and potential for growth.

Find out more

Companies House compliance made easy.

Simplify your compliance workflows with BGL’s cloud-based company secretarial and AML management software.

With you can:

Prepare and electronically file company changes and Confirmation Statements directly with Companies House.

Streamline AML/CFT and CDD compliance (ID verification coming soon).

Stay on top of deadlines with automated user alerts and client reminders.

Connect with apps like Xero Practice Manager, FuseSign and FYI.

Access many more powerful features and automation.

Join our webinar to see CAS 360 in action.

Live Webinar: Thursday, 25 September 2025, 11:00 - 12:00 BST Register Now

www.bglcorp.co.uk

CASEWARE™, A GLOBAL LEADER IN AI-POWERED AND CLOUD-ENABLED AUDIT, FINANCIAL REPORTING, AND DATA ANALYTICS SOLUTIONS FOR ACCOUNTING PROFESSIONALS, TODAY ANNOUNCED ITS EXECUTIVE LEADERSHIP TEAM EVOLUTION, AS THE COMPANY FURTHER ACCELERATES GROWTH IN THE RAPIDLY EVOLVING ACCOUNTING TECHNOLOGY SPACE.

The newly appointed leadership team brings deep expertise in SaaS, artificial intelligence, and accounting technology, with a strong track record of

scaling enterprise software businesses and delivering customer value.

“Great companies evolve with purpose,” said David Marquis, Caseware chief executive officer. “Caseware is positioned for its next chapter of innovation and impact. Our platform and people are aligned to our vision to power trust in the global economy.”

Assembled over the course of the calendar year, this team spans critical functions – R&D, Go-to-Market, Finance, and Operations – and represents decades of leadership in digital transformation, customer

TINSPIRATION, AND INNOVATION THAN EVER.

This year, we’re taking the show on the road with stops in both Singapore and Malaysia. Our Singapore event will take place on 9 October at PARKROYAL COLLECTION Marina Bay, and our Malaysia stop will be held on 6 November at W Hotel Kuala Lumpur. Each event features a similar half-day

agenda packed with updates, engaging speakers, and expert exhibitors – so no matter which location you choose, you’ll enjoy the full Asia Roadshow experience.

The theme of this year’s edition is Supercharged, and fittingly, our programme is all about helping accounting and bookkeeping practices across the region elevate how they support their clients.

Find out more

engagement, and strategic execution. Sam High (CTO) and Andrew Smith (CPO) onboarded in Q1 2025, while Ericka Podesta McCoy (CMO) and Mike Jahoda (CCSO) onboarded in Q2 2025. Chris Nagy (CFO & COO) and Jason Rushforth (CRO) will onboard in Q3 2025.

Their shared focus is on driving AI-led innovation that elevates audit quality, increases accounting workflow efficiencies, accelerates auditor effectiveness, and enables exceptional client service.

Find out more

EXPENSE MANAGEMENT SHOULDN’T FEEL LIKE A SECOND JOB. THIS MONTH, WE’RE ROLLING OUT UPDATES THAT HELP ADMINS RECONCILE FASTER, EMPLOYEES STAY COMPLIANT, AND APPROVERS KEEP THINGS MOVING – EVEN WHEN THEY’RE OUT OF OFFICE.

Search smarter, not harder

Trying to find a stuck report or missing expense?

SALESFORCE, THE #1 AI CRM, TODAY ANNOUNCED PLANS TO INVEST $6 BILLION IN ITS UK BUSINESS THROUGH 2030. THIS NEW COMMITMENT FROM SALESFORCE, WHICH HAS OPERATED IN THE UK FOR 25 YEARS, WILL SUPPORT UK AND EUROPEAN COMPANIES’ TRANSFORMATION INTO AGENTIC ENTERPRISES, WITH HUMANS AND AI AGENTS WORKING TOGETHER TO DRIVE CUSTOMER SUCCESS.

The investment bolsters Salesforce’s ongoing commitment to the UK, extending a previous five-year investment of $4 billion made in 2023 and the selection of London for its first AI Center.

UK Technology Minister, Kanishka Narayan, said: “Salesforce’s decision to ex-

pand its investment in the UK underlines the strength of our economy, people and our ambition to be a global leader in technology and AI. This investment will support the UK’s mission to be a world-leading AI and data hub that creates jobs, builds AI skills and supports innovation across the country – ensuring the UK remains one of the best places to start and grow a digital business.”

“We are doubling down on our long-standing commitment to the UK with this significant investment,” said Marc Benioff, Chair and CEO, Salesforce. “We’re delighted that the UK, already a vital talent and innovation centre, will become our AI hub for Europe, driving product innovation for customers across the region.”

Find out more

We’ve added over 30 new filters to help you drill down fast, including report submission, approval, export, and paid dates. It’s now easier than ever to track every stage of the workflow.

Reconcile expenses in seconds

Bank reconciliation made easy

Credit card statement matching

Set your credit card statement cycle once, and we’ll automatically group card transactions by that timeframe.

Find out more

Use our new group-by feature to organize expenses by withdrawal date so you can match expenses against each bank transaction with zero guesswork.

CAPIUM HAS CONFIRMED THAT PRACTICES USING ITS CLOUD PLATFORM HAVE SUCCESSFULLY COMPLETED THEIR FIRST SELF-ASSESSMENT (SA) MAKING TAX DIGITAL (MTD) QUARTERLY RETURNS FOR BOTH UK PROPERTY INCOME AND SELF-EMPLOYMENT TAX AS PART OF HMRC’S LIVE PILOT.

This achievement highlights not only Capium’s technical readiness for MTD for Income Tax (MTD IT), but also the ability of its accountant and bookkeeper clients to file seamlessly under the new requirements well ahead of the April 2026 mandate.

A Defining Step Towards MTD for IT

The shift to MTD for IT is

one of the most significant changes in UK tax reporting in decades. With quarterly updates due to become mandatory, early participation in the pilot is critical. By enabling firms to make successful submissions, Capium has shown how software and practice collaboration together can reduce disruption, ensure compliance, and give clients confidence during the transition.

This early success demonstrates the strength of Capium’s integrated approach: combining tax compliance, accounts production, bookkeeping, and practice management in one platform to streamline reporting and reduce the administrative burden on firms.

Find out more

We’re happy to announce that Jody Bhagat has been appointed to lead Engine by Starling's expansion in North America, from a new regional headquarters in New York.

The appointment and office plans come as a natural addition given the significant market opportunities the Starling Group sees in North America to serve the region’s 4000+ mid-tier banks and credit unions.

Speaking at Starling Group offices in London this week, Jody (Jaideep) Bhagat, commented: “Digitalforward financial institutions are seeking a partner that can deliver technology transformation that drives real business results. Tried and tested in Europe and Australia, Engine by Starling has strong proof points demonstrating how the platform helps banks better acquire and serve customers.”

FLOAT TODAY AN-

NOUNCED THE LAUNCH OF FLOAT BUSINESS ACCOUNTS, CANADA’S FIRST FINTECH-BUILT SOLUTION WITH ZERO FEES, INSTANT LIQUIDITY, MARKET-LEADING RETURNS, AND CDIC DEPOSIT INSURANCE IN A SINGLE ACCOUNT. THIS NEW ACCOUNT COMBINES THE EVERYDAY FUNCTIONALITY OF A CHEQUING ACCOUNT WITH THE EARNING POWER OF A SAVINGS PRODUCT—ALL WITHOUT SACRIFICING SPEED, SECURITY, OR RETURNS.

With this launch, Float challenges decades of

or interest. Float delivers both—4% interest, zero fees and

banking norms that Canadian businesses have long been conditioned to accept as “just the way it is.”

“Canadian businesses have been conditioned to think banking has to be slow, costly, and restrictive. It doesn’t. With Float Business Accounts, we’re showing that Canada can have a financial system that actually works for entrepreneurs—fast, fair, and built to help them grow,” said Rob Khazzam, CEO and Co-Founder at Float. “This launch is just the beginning of rethinking what business banking should look like in this country.”

Float Business Accounts offer a combination of benefits previously unavailable in the Canadian market:

• True zero-fee banking: No monthly fees, no transaction fees on sending or receiving funds via ACH or EFT, no minimum balance requirements.

• Up to 4% interest: 2.8x higher than traditional business savings accounts—without locking in funds.

• Industry-first protection: CDIC insurance coverage up to $100,000, plus 100% of funds held in trust accounts for complete peace of mind.

TODAY, PAYPAL ANNOUNCED THAT VENMO AND PAYPAL CUSTOMERS IN THE US AND SELECT GLOBAL MARKETS WILL BE ABLE TO SKIP THE WAITLIST AND RECEIVE EARLY ACCESS TO PERPLEXITY'S NEW AI-POWERED COMET BROWSER. THROUGH A NEW OFFER THAT INCLUDES A FREE 12-MONTH TRIAL OF PERPLEXITY PRO VALUED AT $200,1 CUSTOMERS WILL BE AMONG THE FIRST TO EXPERIENCE PERPLEXITY'S HIGHLY ANTICIPATED AI BROWSER BEFORE IT'S WIDELY AVAILABLE TO THE PUBLIC. COMET OFFERS A RANGE OF FEATURES LIKE AN INTEGRATED AI ASSISTANT, NATIVE AN-

SWER-FOCUSED SEARCH, PRODUCT COMPARISONS, AND MORE.

"Our partnership with Perplexity gives PayPal and Venmo customers early access to one of the most anticipated AI browsers and dynamic subscriptions," said Diego Scotti, General Manager, Consumer Group at PayPal. "It's exciting to deliver offers and tools that our customers request most, meeting their needs and helping them navigate their financial lives with greater simplicity, added convenience, and even more rewards."

"The Comet browser is like a personal shopper and

personal assistant all in one, so we're excited that PayPal users will have early access to Comet", said Ryan Foutty, VP of Business at Perplexity. "In conjunction with Perplexity Pro, we're arming PayPal and Venmo customers with powerful, accurate AI that's useful throughout their daily lives."

Perplexity Pro is one of the first offers now available to customers directly in PayPal's new subscriptions hub – a single destination to easily view and manage recurring subscription payments.

Find out more

• Seamless USD capabilities: CAD and USD accounts with market-leading FX rates for cross-border operations.

The platform provides real-time transaction visibility and integrates directly with Float’s existing corporate card and expense management tools, creating a unified financial operations system that can be set up in minutes rather than the weeks typically required for traditional business banking.

Find out more

Sam Everington, CEO, Engine by Starling, said: "Our ambition is clear: we want to become a significant partner to ambitious and customer-focused banks in the US and Canada, supporting them in replacing legacy technology constraints with revolutionary banking systems. To bring this vision to life, we need a top-class dedicated team for North America, and in Jody Bhagat we’re confident we’ve found the leader to make that happen.”

As part of an investment upwards of US$50 million in North America, Engine will operate from regional headquarters in New York, complemented by a Canadian team based in Toronto. Earlier this month, Engine also opened regional offices in the Middle East and APAC, selecting Dubai in the UAE and Sydney in Australia. These will act as further bases for the business to grow and work with clients and partners internationally.

OVER THE LAST MONTH WE’VE ROLLED OUT NEW SUPPORT FOR PRECIOUS METALS, ACHIEVED A SIGNIFICANT SECURITY CERTIFICATION, AND MADE FURTHER IMPROVEMENTS TO THE FUTURE INCOME REPORT.

We know that many of our users invest in more than just stocks. As part of our ongoing efforts to sup-

port more asset types, we've now added precious metals to Sharesight. You can now track the value and performance of your gold, silver, platinum, and palladium investments alongside the rest of your portfolio. With options for both grams and troy ounces, you can now record buy and sell trades in any currency and Sharesight will track the value in your portfolio currency.

In Ben's June update, he shared that we had secured our SOC 2 Type 1 certification and were beginning the journey toward SOC 2 Type 2. We are proud to share that we've now successfully achieved our SOC 2 Type 2 certification. This is a testament to our ongoing commitment to robust security and protecting your data.

Find out more

FOR MORE THAN A DECADE, ADYEN AND GOOGLE HAVE PARTNERED, BRINGING A SHARED VISION OF GROWTH AND INNOVATION IN PAYMENTS TO LIFE. TODAY, ADYEN IS PROUD TO TAKE OUR RELATIONSHIP A STEP FURTHER AS A COLLABORATOR ON GOOGLE’S INITIATIVE DEVELOPING THE AGENT PAYMENTS PROTOCOL, A NEW OPEN FRAMEWORK THAT ENABLES AI AGENTS TO SECURELY INITIATE AND TRANSACT PAYMENTS.

Agentic commerce is not just about a consumer-facing application like a chatbot, but about the underlying infrastructure that powers it all. Adyen’s infra-

structure, with its direct access to global banking and payment networks, ensures that as agentic commerce evolves, it works seamlessly across payment methods, regions, and customer journeys worldwide. The Adyen platform is purpose-built for this next chapter of commerce thanks to its focus on the essential building blocks: secure credential management, authentication, and fraud mitigation. On top of this, Adyen’s global risk system—trained on billions of transactions—is designed to meet the new demands of agent-initiated flows, such as mitigating fraud and ensuring better conversion rates for merchants. By helping define standards like this, we extend our approach to innovation: solving complex-

ity in payments as technology and commerce continue to evolve.

Adyen and Google have been collaborating for over ten years, and our work together has continuously evolved over the years to meet the dynamic demands of global digital commerce. This collaboration extends across a wide spectrum, encompassing payments acceptance for Google's online and in-store products and services, Google Pay, and innovative solutions like Tap to Pay on Android.

Find out more

STARLING HAS REVEALED MAJOR CHANGES TO ITS VISUAL BRAND, WITH A NEW LOGO, COLOURS, AND CARD DESIGNS SET TO ROLL OUT TO THE BANK’S APP FROM TODAY. NEW MONEY MANAGEMENT TOOLS INCLUDE SPENDING INTELLIGENCE, WHICH ALLOWS CUSTOMERS TO USE AI TO UNDERSTAND THEIR SPENDING HABITS, AS WELL AS A NEW AI-POWERED IMAGE CUSTOMISATION CAPABILITY FOR SPACES. THE BANK HAS ALSO REVEALED A FORTHCOMING REVAMPED EASY SAVER PRODUCT

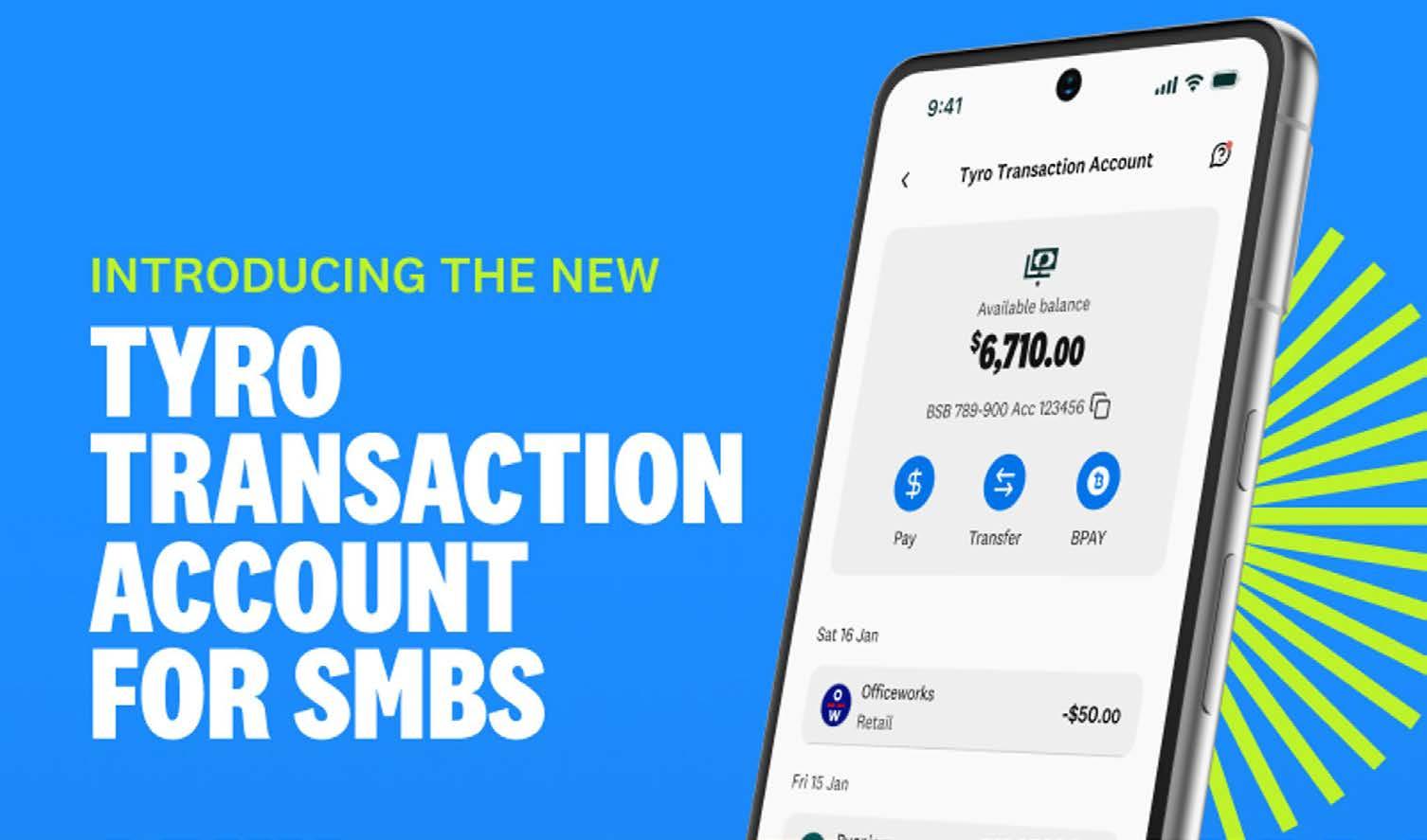

SMALL AND MEDIUM BUSINESSES ARE THE BACKBONE OF AUSTRALIA’S ECONOMY, MAKING UP MORE THAN 97% OF ALL BUSINESSES AND EMPLOYING NEARLY HALF THE WORKFORCE. YET MANY FACE CONSTANT PRESSURES FROM RISING OPERATING COSTS AND TIGHTER MARGINS, TO NAVIGATING COMPLEX BANKING PRODUCTS THAT AREN’T ALWAYS DESIGNED WITH SMBS IN MIND.

The new Tyro Transaction Account, available exclusively to Tyro EFTPOS customers, is designed to change that. It brings together the best of digital banking with practical features tailored

to the real needs of growing and established businesses.

Keep more of your money

Too often, business owners pay just to hold a business bank account. Monthly fees, minimum balances, and hidden charges take a toll, especially when margins are already tight. The Tyro Transaction Account helps you cut those costs, keeping more of your money in your business where it matters most:

Access your takings easily

• No set-up fees

• No account-keeping costs

• No minimum balance

Almost 90% of customers believe Tyro products help them manage their cash flow 3 giving them more confidence to focus on growth.

Cash flow is one of the biggest challenges for SMBs. Waiting days for EFTPOS settlements can mean scrambling to pay staff, delaying supplier invoices, or dipping into reserves to bridge the gap. The Tyro Transaction Account ensures your money is available faster, so your business keeps running smoothly without cash flow stress:

Same-day settlements, 7 days a week

Find out more

The updates support Starling’s mission to help people in the UK be ‘Good with money,’ with every aspect of the bank’s visual identity, app, and customer experience designed to encourage customers to take action over their finances, and to rethink how they budget, spend, and save.

The bank’s mission is a direct response to the lack of agency Britons feel over their finances. Over half (53%) of Britons say they find money management hard at the moment, and two-fifths (38%) worry about money daily. More than two-fifths (44%) would like to learn more money management skills, but 22% don’t know how to improve.

“Anybody, no matter their means, can be Good with money. As a bank, we believe it’s our responsibility to help our customers get

there by empowering them to embrace life-changing money management habits. Our newly refreshed look and app is the first step of many towards encouraging our customers to engage with their finances daily. We will be focussing on launching products which help our customers be smart with their money, including more AI-powered products and smart in-app features which will save our business and retail customers time and money,” said Raghu Narula, Chief Customer & Banking Officer.

Starling’s new visual identity, which draws on the colours of starling birds, includes a bold new logo and updates to the purple and teal tones the bank is known for to a more active and vibrant colour palette. Personal Account customers will be able to use the updated teal cards in their mobile wallets in the coming weeks, while Joint Account cards will switch from green to taupe, and Business and Sole Trader Account cards will switch from dark blue to aubergine. Starling’s updated physical cards will be available from February 2026 to new customers and those requiring new cards.

“The first step towards becoming ‘Good with money’ is paying active attention to your finances. Starling’s new look, with a stronger colour system, cleaner typography, and bolder graphics, has been designed to make it even easier for people to

engage with our app and to keep building those good money habits,” said Michele Rousseau, CMO at Starling.

Game-changing banking, life-changing habits

Starling’s new logo and colours are being rolled out to the bank’s refreshed app, which is set to feature new money management products and tools that help customers:

• Boss your tax-free allowance: Starling has launched a Cash ISA product to help customers make the most of their £20,000 tax-free ISA allowance. The ISA is currently being tested by some customers and will be rolled out to all in the coming months.

• Superbudget – and earn interest: Starling’s popular Easy Saver product will soon evolve to include a much-requested feature: Spaces. Instead of accruing interest on funds within one Easy Saver Space, customers will be able to break down their Easy Saver into multiple Spaces, so they can separate their savings for ‘Holiday’, ‘Dream house’ and ‘Emergency fund’ while earning interest on them all.

• Perfect your payday routine: Starling will soon launch a much-requested feature; scheduled internal transfers to Easy Saver.

AIRWALLEX, A LEADING GLOBAL FINANCIAL PLATFORM FOR MODERN BUSINESSES, TODAY ANNOUNCED THE ACQUISITION OF OPENPAY, A SAN FRANCISCO-BASED BILLING PLATFORM THAT OFFERS SUBSCRIPTION MANAGEMENT, PAYMENT ORCHESTRATION, AND REVENUE ANALYTICS. THE ACQUISITION WILL BRING OPENPAY’S BILLING AND ANALYTICS CAPABILITIES INTO AIRWALLEX'S GLOBAL PLATFORM, STRENGTHENING AIRWALLEX’S POSITION AGAINST OTHER PLAYERS LIKE STRIPE BILLING AND RECURLY, AND EMPOWERING AIRWALLEX CUSTOMERS TO UNLOCK

AND AUTOMATE REVENUE GROWTH.

“Most billing systems are locked in the past, they were never designed for a global, multi-currency world. That’s the gap we’re closing,” said Jack Zhang, Co-founder and CEO of Airwallex. “By bringing OpenPay’s subscription management, orchestration, and analytics capabilities into Airwallex, we’re creating the first truly global billing platform. The OpenPay team brings deep technical strength and a shared conviction in our vision, and we’re thrilled to have them on board as we help businesses scale seamlessly across borders.”

“We started OpenPay to solve the complexity of recurring revenue management. We envisioned a smarter, more intuitive platform that empowers subscription businesses to scale without barriers,” said Lance Co Ting Keh, CEO of OpenPay. “In Airwallex, we found a partner who shares our vision, our DNA, and has the global reach to apply our work at scale. We are very proud of what we’ve built and excited for our next chapter as we partner with Airwallex to set a new standard, creating a paradigm shift in global payments.”

Find out more

GOCARDLESS, THE BANK PAYMENT COMPANY, HAS EXPANDED ITS LONG-STANDING PARTNERSHIP WITH BILLINGBOOTH, A SPECIALISED BILLING SOFTWARE DESIGNED FOR TELECOM COMPANIES. THE COLLABORATION WILL SEE GOCARDLESS’S FULL SUITE OF BANK PAYMENT SOLUTIONS INTEGRATED DIRECTLY INTO THE BILLINGBOOTH PLATFORM, HELPING TELCOS SIMPLIFY THEIR BILLING AND PAYMENTS PROCESS, AND EASILY RECOVER BAD DEBT.

ON THE HEELS OF THE PAYPAL WORLD ANNOUNCEMENT, A GLOBAL PLATFORM CONNECTING THE WORLD'S LARGEST DIGITAL PAYMENT SYSTEMS AND WALLETS, PAYPAL TODAY INTRODUCED PAYPAL LINKS, A NEW WAY TO SEND AND RECEIVE MONEY THROUGH A PERSONALIZED, ONE-TIME LINK THAT CAN BE SHARED IN ANY CONVERSATION.

PayPal users in the U.S. can begin creating personalized payment links today, with international expansion to the UK, Italy, and other markets starting later this month. By making payments this simple and universal, PayPal links helps drive new

customer acquisition and brings more users into the PayPal ecosystem.

The peer-to-peer (P2P) experience is about to go even further. Crypto will soon be directly integrated into PayPal's new P2P payment flow in the app. This will make it more convenient for PayPal users in the U.S. to send Bitcoin, Ethereum, PYUSD, and more, to PayPal, Venmo, as well as a rapidly growing number of digital wallets across the world that support crypto and stablecoins.

Expanding what people can do with PayPal also comes with reassurance around how personal payments are handled. As al-

ways, friends-and-family transfers through Venmo and PayPal are exempt from 1099-K reporting. Users won't receive tax forms for gifts, reimbursements, or splitting expenses, helping ensure that personal payments stay personal.

borders, and currencies effortless to pay your friends and family, no matter where they are or what app they're using."

"For 25 years, PayPal has revolutionized how money moves between people. Now, we're taking the next major step," said Diego Scotti, General Manager, Consumer Group at PayPal. "Whether you're texting, messaging, or emailing, now your money follows your conversations. Combined with PayPal World, it's an unbeatable value proposition, showing up where people connect, making it

P2P is a cornerstone of PayPal's consumer experience, driving engagement and bringing more users into the ecosystem. P2P and other consumer total payment volume saw solid growth in the second quarter, increasing 10% year-over-year as the company focused on improving the experience and increasing user discoverability to make it easier than ever to move money globally. Plus, Venmo saw its highest TPV growth in three years.

Keep reading

The integration now includes Instant Bank Pay, GoCardless’ open banking-powered payment solution, and Success+, its AI-driven tool to optimise and automate payment retries. The new features complement Billingbooth’s existing GoCardless Direct Debit functionality, providing an end-to-end billing and payment solution for its customers.

For telcos, especially those dealing with high volumes of low-value transactions, effective credit control is a major challenge. The integration addresses this

by enabling them to take both recurring and one-off payments within a single platform. Instant Bank Pay allows for the immediate and secure collection of outstanding payments directly from a customer’s bank account, eliminating manual processes and long waits. This speed reduces administrative overhead and late payments.

In addition, Success+ helps businesses to automatically recover two-thirds of failed payments, on average.

ADYEN, THE GLOBAL FINANCIAL TECHNOLOGY PLATFORM FOR LEADING BUSINESSES, IS SUPPORTING LVMH, THE WORLD LEADER IN LUXURY GOODS, IN A MAJOR INTERNATIONAL INITIATIVE: THE UNIFICATION OF PAYMENT SYSTEMS ACROSS ALL OF ITS MAISONS.

Adyen’s solutions are live in nearly 50 of the group’s Maisons around the world, spanning fashion and leather goods, exceptional hospitality, watches and jewelry, beauty, and department stores.

As part of a strategy to strengthen synergies, LVMH is driving the adoption of best practices across its Maisons. The objective is to leverage the group’s most effective initiatives and scale them, while preserving each

Maison’s unique identity and standards of excellence.

It was in this spirit that LVMH selected Adyen as its global payments partner in 2020, with the goal of unifying in-store and online payment infrastructures and delivering a seamless, high-end customer experience.

The implementation of Adyen’s solutions has delivered concrete benefits from the very first deployment phases, including:

• A premium, frictionless in-store experience, notably with mobile terminals and Tap to Pay technology

• A significant reduction in manual entry, saving time and minimizing errors