RELAY¹—THE SMALL BUSINESS BANKING AND MONEY MANAGEMENT PLATFORM ENABLING PEAK PROFITABILITY—ANNOUNCED THAT AMERICAN SMALL BUSINESSES HAVE ENTRUSTED THEM WITH MORE THAN $1 BILLION IN MANAGED CUSTOMER DEPOSITS THROUGH THREAD BANK, MEMBER FDIC. THIS MILESTONE IS A VOTE OF CONFIDENCE BY THE MORE THAN 110,000 SELF-MADE SMALL BUSINESS OWNERS USING RELAY. AS THE BANKING PLATFORM ON A MISSION TO MAKE EVERY BUSINESS GREAT WITH

MONEY, RELAY STANDS WITH THESE ENTREPRENEURS AS THEY CHART THEIR PATH TO HEALTHIER, MORE PROFITABLE BUSINESSES.

“Every dollar deposited signals the trust of the small and medium-sized businesses who bank with us,” said Yoseph West, Co-Founder and CEO of Relay. “These are tireless owners, grinding every day to build stronger businesses, and better lives for themselves and their families. For these electricians, florists, real estate agents, and many other business owners across the

U.S., reliable banking and money management tools are mission-critical. We’re honored to be part of that.”

The announcement of $1 billion in managed customer deposits comes as Relay evolves to become the financial command center for American small businesses, enabling cash flow clarity and 360 financial decision-making with products and features that put profit first. Over the past year, Relay has expanded its core offering beyond business banking accounts.

Find out more

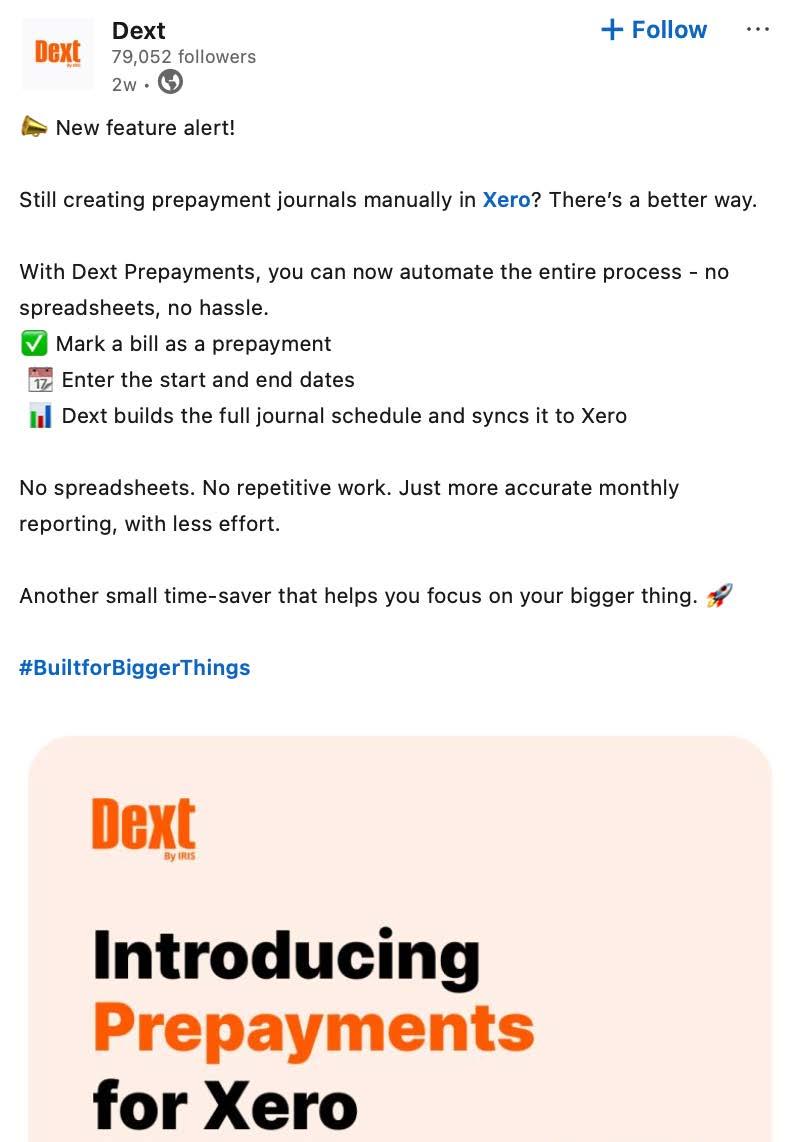

IRIS SOFTWARE GROUP (IRIS), A LEADING GLOBAL PROVIDER OF ACCOUNTANCY, EDUCATION, HR, AND PAYROLL SOFTWARE, TODAY ANNOUNCED THE APPOINTMENT OF JASON DIES AS ITS NEW CHIEF EXECUTIVE OFFICER, EFFECTIVE JULY 14, 2025. DIES SUCCEEDS GUS MALEZIS, WHO HAS SERVED AS IRIS’ INTERIM CEO AND WILL CONTINUE WITH HIS ROLE AS CHAIRMAN OF THE BOARD.

Dies is an accomplished leader with more than 30

years of experience driving transformation and growth at large, global organizations. Most recently, he served as Interim CEO of Pitney Bowes, a $3 billion technology, logistics and financial services company with over 11,000 employees, serving more than 90% of the Fortune 500 and over 500,000 medium and small businesses, globally. During his tenure, Dies drove a culture of client-centricity and innovation, while accelerating operational efficiency and performance.

“We’re thrilled to welcome Jason as our new CEO as we continue to deliver bestin-class innovative solutions for our customers and accelerate our international growth,” said Gus Malezis, Chairman of the Board at IRIS. “Jason has a proven track record of driving customer-centric performance at scale, achieving ambitious financial and operational goals, and transforming organizations through innovation.

Keep reading

WE’VE RAISED $2M AUD IN SEED FUNDING TO BUILD THE FUTURE OF AI MEETING ASSISTANTS FOR ACCOUNTING AND BOOKKEEPING FIRMS.

We’ve raised $2M AUD in seed funding to build the future of AI meeting assistants for accounting and bookkeeping firms.

Since March this year, we’re already helping hundreds of firms save hours each week by turning client meetings into structured notes, clear action items, and synced follow-ups — without the admin headache. Now, with the backing of Tidal Ventures and the founders of Dext, Ignition, and KeyPay, we’re ready to accelerate.

Our Journey So Far

Like many firms, we started with a meeting problem.

At our agency, Journey, we were meeting-heavy — clients, team, stakeholders. But all that talk led to one big issue: scattered notes, missed context, and manual follow-ups that ate up our time. We tried everything from generic notetakers like Fireflies and Fathom, to Frankensteining our own workflow using Zapier and GPT. It sort of worked — we even generated new revenue from AI-written proposals. But it wasn’t built for us.

So, we asked a simple question: Are accounting and bookkeeping firms facing the same problem?

After 12+ years working in the accounting & bookkeeping ecosystem, we took it to the community, and 276 firms answered.

What we heard was clear:

• Firms are spending 6.6 hours per week on post-meeting admin

• That’s 345 hours a year — or 43 full working days

• With the right AI help, firms could reclaim $31K+ in billable time

The biggest pain points? Remembering what was said. Capturing the right actions. Making sure follow-ups actually get done.

CREATE NEW CLIENTS AUTOMATICALLY IN XPM

Now, when a request is completed, Content Snare can automatically create new clients in Xero Practice Manager (XPM) - or you can do it manually with the click of a button.

What to know:

• First, reconnect your XPM integration in Settings > Applications.

• One request can create multiple clients at once

• Push data into any standard XPM fields (custom fields coming soon).

XU BIWEEKLY - No. 1112

Newsdesk:

If you have any news or updates that you would like us to consider for inclusion in the next edition of the XU Biweekly, please email us at: newsdesk@xumagazine.com

CEO: David Hassall

Managing Editor: Wesley Cornell

Chief Revenue Officer: Alex Newson

Account & Partnership Assistant: Robyn Consterdine

Creative Assistant: Victoria Young

Advertising: advertising@xumagazine.com

www.xumagazine.com

‘Xero’ is a trademark of Xero Limited (New Zealand). XU Biweekly and XU Magazine is collaboratively produced by an independent group of Xero users and is not affiliated in any way with Xero. All other trademarks are the property of their respective owners.

© XU Magazine Ltd 2014-2025. All rights reserved. No part of this publication may be used or reproduced without the written permission of the publisher.

XU Biweekly is published by XU Magazine Ltd (08811842), registered in England and Wales. Registered office: Office 1, Brunswick House, Brunswick Way, Liverpool, L3 4BN, United Kingdom. All information contained in this publication is for information only and is, as far as we are aware, correct at the time of going to press. XU Magazine Ltd cannot accept any responsibility for errors or inaccuracies in such information.

If you submit unsolicited material to us, you automatically grant XU Magazine Ltd a licence to publish your submission in whole or in part in all/any editions, including in any physical or digital format, throughout the world. Any material you submit is sent at your risk and, although every care is taken, neither XU Magazine Ltd nor its employees, agents or subcontractors shall be liable for loss or damage. The views expressed in this publication are not necessarily the views of XU Magazine Ltd, its editors or its contributors.

We’ll be updating templates soon to include XPM mappings out of the box.

How it works (simple version):

Think of a page or section in Content Snare becoming a client in XPM. You:

1. Map that section to a new XPM entity

2. Then map each question in that section to the right XPM field.

AI Request Builder - Now Smarter Than Ever

Build complex requests faster with our revamped AI

request builder:

• Write a simple prompt explaining what you want the request to do.

• Paste a list of questions (perfect for workpaper queries or simple Q&A lists).

• Upload PDFs and watch them transform into Content Snare questions automatically!

What it can generate:

• Every field type you need

• Clear instructions

• Conditional logic

Keep reading

WE’RE EXCITED TO ANNOUNCE THAT SINGLE SIGN-ON (SSO) WITH MICROSOFT OFFICE 365 IS ROLLING OUT. THIS NEW FEATURE WILL ALLOW YOU TO LOG INTO OCERRA USING YOUR MICROSOFT CREDENTIALS, STREAMLINING YOUR ACCESS AND ENHANCING SECURITY.

How does it work?

In a nutshell, single signon means you can use your existing Microsoft 365 login to access Ocerra. Instead of juggling multiple usernames and passwords, you’ll just sign in once with your Micro-

IT’S TIME TO TAKE YOU THROUGH OUR BRANDNEW AND MUCH REFRESHED XERO DEVELOPER WEBSITE.

A Fresh Coat of Paint and a New Sense of Direction

• New Look and Feel: First things first, we’ve given the site a beautiful new design, with a sleek, modern look that’s easier on the eyes and fast to click through.

• New Navigation: But it’s not just about aesthetics! We know you’re busy building incredible apps, so we’ve completely revamped our top-level navigation linking you straight away to the most popular pages and sections of the site.

• New Footer: And just to make sure you never get lost, we’ve given our footer a serious upgrade, with direct links to all the most-traveled destinations on our site.

New Landing Pages for Every Kind of Developer

• New Homepage: We’ve also rolled out a brandnew homepage packed with fresh content designed to get you inspired and building faster than ever. It’s the perfect launchpad for your next big idea.

• New Landing pages: We’ve created landing pages and content for wherever you are in your development journey: app developers, custom developers, or workflow automation resources for your business and practice.

• Updated FAQs: We’ve also added some new FAQs to our site.

A New AI Toolkit to Give Your AI Agents the Power of Xero’s Platform

We’re also excited to introduce our new AI Toolkit. We’ve gathered everything

soft account. This not only makes life simpler but also means fewer passwords to manage and a more secure login process overall.

Why is this beneficial?

The key advantage here is convenience paired with security. With SSO, your team can access Ocerra more quickly, reducing the time spent on login issues. It also leverages Microsoft’s trusted security standards, which means an added layer of protection for your data.

It also simplifies onboarding and offboarding - when a new team member joins,

they simply use their Microsoft 365 credentials, and when someone leaves, disabling their Microsoft account automatically removes their Ocerra access.

Additionally, because all login activity is centralised through Microsoft, it’s easier to track and audit who accessed what and when, which can help with compliance requirements.

We’re currently in the final testing stages and plan to roll this out to all users in the next couple of weeks.

you need to build the next generation of Xero integrations. Inside, you’ll find:

• The new agents Toolkit with working agent examples

• The essential MCP Server

• Prompt examples and a bunch more to get your creative gears turning.

• Fast and easy access to the AI Automation Series: Automation Unleashed

A Place for Our People (That’s You!)

Building things is more fun with friends, and now you can officially find details on all the places to hang out with the Xero Developer team and each other via our new Community page:

• Places to Connect

• Help when you need it

• Access our socials

NTUIT, THE GLOBAL FINANCIAL TECHNOLOGY PLATFORM, HAS OFFICIALLY EXTENDED ITS PARTNERSHIP WITH THE CARLTON FOOTBALL CLUB, COMMITTING TO SUPPORTING THE AFLW SIDE UNTIL AT LEAST THE END OF 2026.

Signing a multi-year deal with the AFL program earlier this year, the Intuit QuickBooks brand will now be seen on the sleeves of the AFLW media polo, hoodie, jackets, merchandise, and media backdrop.

Intuit QuickBooks, the organisation behind QuickBooks and Mailchimp, empowers business owners by offering a unified platform to manage and streamline their operations.

As a values-led organi-

sation, Intuit QuickBooks seeks to strengthen local communities through its We Care Give Back programs, showcasing a dedication to community that is shared at the Carlton Football Club.

The partnership increases the alignment across both the AFL and AFLW, demonstrating a clear commitment to both programs.

Carlton CEO Brian Cook said the Club was thrilled Intuit QuickBooks had signed on to support the AFLW program.

“It is wonderful to see growing support for our AFLW program alongside our AFL program, and the partnership with Intuit QuickBooks truly encapsulates this,” Cook said.

Find out more

SCORO, THE ALL-INONE PROFESSIONAL SERVICES AUTOMATION PLATFORM, IS NOW LIVE ON THE XERO APP STORE. SCORO HAS SUPPORTED A NATIVE TWOWAY INTEGRATION WITH XERO FOR ALMOST A DECADE, HELPING SERVICE-BASED BUSINESSES CONNECT THEIR PROJECTS AND OPERATIONS DIRECTLY WITH ACCOUNTING.

What is Scoro?

Unlike generic project management tools, Scoro is purpose-built for businesses that bill by the hour and

need complete visibility into their team’s time usage and capacity, such as consultancies, agencies, architecture and engineering firms, IT and software companies, etc. By consolidating data around projects, resources, and finances, Scoro gives these service firms a single, real-time source of truth.

Why Scoro + Xero?

By adopting Scoro on top of Xero, businesses can close the loop between work done and money earned. Accounting data tells you what’s been billed and paid, while Scoro adds the “why” and the “how” – giving ac-

BGL CORPORATE SOLUTIONS (BGL), AUSTRALIA'S LEADING PROVIDER OF COMPANY COMPLIANCE, SELF-MANAGED SUPERANNUATION FUND (SMSF), INVESTMENT MANAGEMENT, IDENTITY VERIFICATION, AND AI-POWERED PAPER-TO-DATA SOFTWARE SOLUTIONS, IS PROUD TO ANNOUNCE THE LAUNCH OF ITS GENERATIVE AI-POWERED ASSISTANT, RONI.

Unveiled at BGL REGTECH 2025, Roni delivers real-time support and automation across BGL’s CAS 360, Simple Fund 360, and Simple In-

vest 360 solutions. Designed to streamline workflows and reduce manual effort, Roni provides fast answers with powerful and actionable insights.

From navigating BGL’s products to generating charts or summarising data, Roni helps clients work faster and make better decisions. His capabilities include:

• BGL: Guides you through the software and retrieves entity-specific information.

Find out more

countants and business leaders a shared real-time view of business performance, where every invoice line, cost item, and payment in Xero is tied back to the specific project, resource, or deliverable in Scoro that generated it.

This unified view helps professional services firms track profit margins, capacity, utilization, and revenue forecasts in real time, enabling them to standardize workflows, maximize efficiency, and ultimately boost profitability.

Find out more

STARLING GROUP HAS ENTERED INTO AN AGREEMENT TO ACQUIRE EMBER, A LEADING UK FINTECH. EMBER’S TAX AND BOOKKEEPING SOFTWARE WILL BE BUILT INTO STARLING BANK’S APP AND ONLINE BANK, PROVIDING SMALL BUSINESS OWNERS WITH AN ALL-IN-ONE SOLUTION TO MANAGE THEIR FINANCES, FROM BANK TRANSACTIONS TO TAX SUBMISSION.

Many sole traders, landlords, and other SMEs aren’t yet ready to report their tax

WE’RE EXCITED TO SHARE A MAJOR MILESTONE IN DEEL’S JOURNEY: WE’VE BEEN GRANTED AN AUSTRALIAN FINANCIAL SERVICES LICENCE (AFSL) BY THE AUSTRALIAN SECURITIES AND INVESTMENTS COMMISSION (ASIC).

This is a huge moment for Deel and our customers in Australia and across the world. It means we can now deliver regulated financial services directly through our Australian entity. We will offer a faster, more reliable service that’s fully aligned with local compliance standards.

Earning an AFSL isn’t easy. It’s the result of an intensive 12 month process, working closely with regulators to demonstrate that our compliance framework, operational processes, and expert teams meet some of the world’s strictest compliance standards.

This achievement sends a strong message to our customers and to the market that Deel is serious about building a world-class payroll and HR platform for global work.

Find out more

TALL EMU HAS BEEN NAMED THE WINNER OF THE BEST SAAS PRODUCT FOR ERP CATEGORY IN THE 2025 SAAS AWARDS.

Operated by international cloud awards body The Cloud Awards, the SaaS Awards program celebrates innovation and excellence in software-as-a-service –recognising standout solutions from around the globe across AI, process automation, and business operations.

Entries came in from organisations across the USA, Canada, UK, Europe, Middle East, and APAC.

Tall Emu, Australian owned and operated, beat some big names, including MYOB Acumatica in this category – a huge achievement for the team, and a moment of immense pride to be recognised ahead of such major players.

Find out more

online, even though HMRC will start ‘Making Tax Digital’ compulsory from April 2026. Starling Bank, which has a 9%* market share for small business banking, plans to integrate Ember’s HMRC-recognised software by the end of 2025, making it easy for those impacted to comply with the new legislation.

This integration will be part of a suite of services to enable Starling's business customers to boost productivity and efficiency. This includes Spaces, which allow business owners to put

money aside for designated purposes, Bills Manager, which helps them pay suppliers on time, and Spending Intelligence, a new feature that uses AI to help them track spending. All of these offerings make Starling market competitive.

Ember currently serves the customers of companies including HSBC, Revolut, Barclays, and Lloyds; however, its software will become exclusive to Starling Bank customers in 2026.

N 2025, THE BUSINESS SHOW UK MARKS 25 YEARS AT THE CENTRE OF BRITISH BUSINESS. TAKING PLACE AT EXCEL LONDON, THIS WILL BE THE 55TH EDITION OF THE SHOW—BRINGING TOGETHER NEW FOUNDERS, SEASONED ENTREPRENEURS, AND INDUSTRY EXPERTS FOR TWO DAYS OF NEW INSIGHTS, LIVE DISCUSSION, AND REAL OPPORTUNITY.

The way we build businesses has changed. Social media drives product discovery, marketing is more personal, and the path from idea to market has become shorter and faster. The Business Show 2025 reflects that. It’s a meeting point for modern founders, but also

experienced entrepreneurs, and investors who are backing new ideas and fresh approaches.

This year’s speaker lineup features voices like Touker Suleyman, best known as a long-standing investor on BBC’s Dragons’ Den, brings decades of hands-on experience in fashion, retail, and manufacturing. He’ll share what investors are actually looking for in 2025, and how entrepreneurs can stand out in a competitive funding landscape.

Olivia Hanlon, founder of Girls in Marketing, leads the UK’s largest community-driven platform for women in the marketing industry.

Find out more

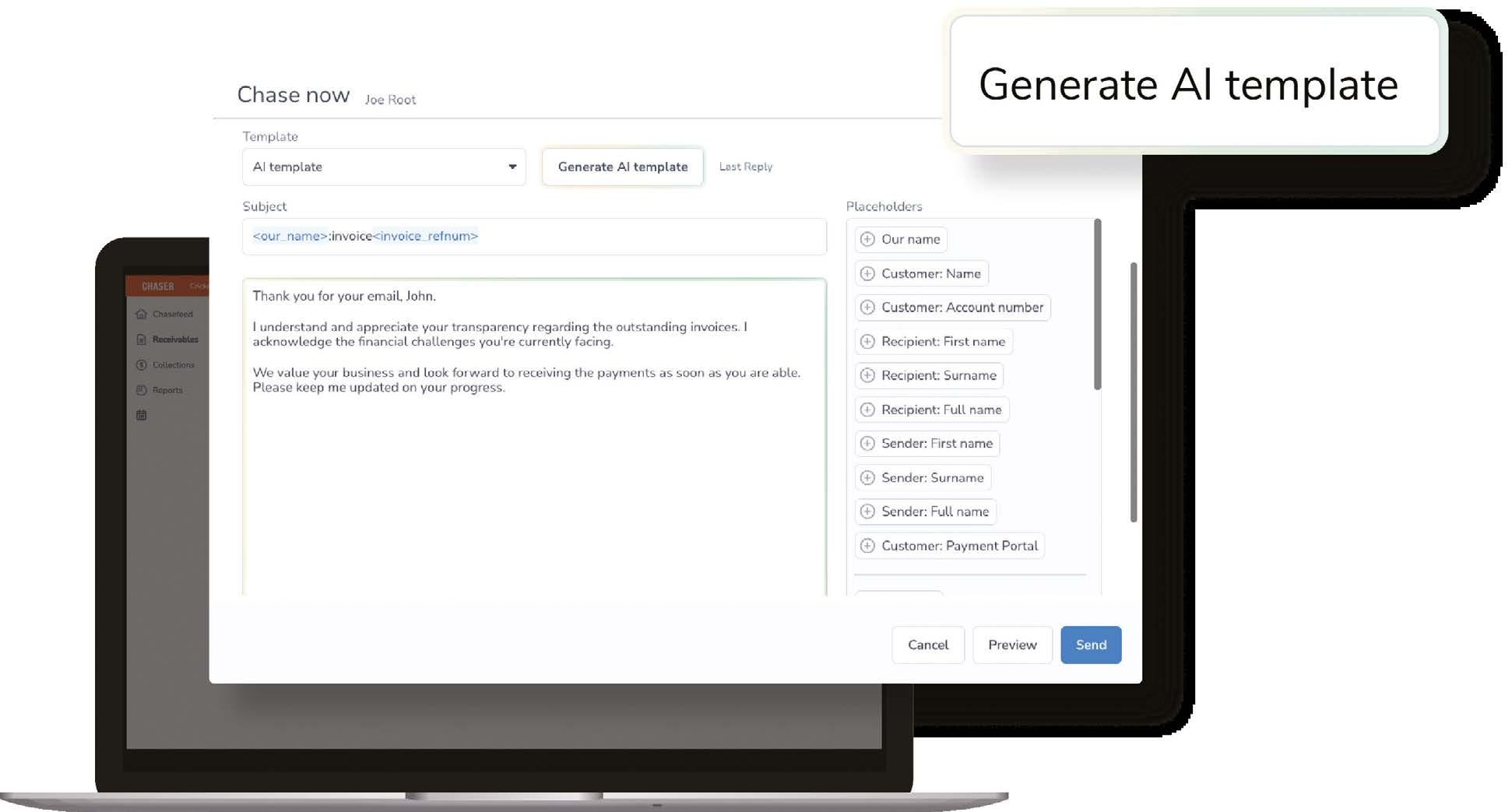

Still replying to debtor emails manually? Save hours each week with the AI email generator — send context-specific replies at the touch of a button, powered by real-time invoice data, and track every message in one place.

Reply in seconds. Stay in sync. Get paid faster.

STOCKTRIM, LEADING PROVIDER OF INVENTORY PLANNING AND DEMAND FORECASTING SOFTWARE, IS THRILLED TO ANNOUNCE ITS NEW NATIVE INTEGRATION WITH ACUMATICA CLOUD ERP, A GAME-CHANGER FOR SMALL AND MEDIUM-SIZED BUSINESSES (SMBS) LOOKING TO OPTIMIZE THEIR INVENTORY MANAGEMENT AND STREAMLINE PURCHASING PROCESSES. THIS POWERFUL INTEGRATION EMPOWERS ACUMATICA USERS WITH AI-DRIVEN FORECASTING, AUTOMATED REPLENISHMENT, AND REAL-TIME DATA SYNCHRONIZATION, ENABLING BUSINESS OWNERS AND INVENTORY PLANNERS TO MEET FUTURE DEMAND WITH PRECISION AND EFFICIENCY.

Empowering SMBs with Advanced Inventory Management

StockTrim’s mission has always been to democratize advanced inventory forecasting for SMBs, making sophisticated tools accessible and affordable. By integrating seamlessly with Acumatica, a cloud-based ERP solution trusted by thousands of manufacturers, distributors, and retailers, StockTrim enhances Acumatica’s robust inventory management capabilities with cutting-edge AI and machine learning technology. This collaboration delivers a comprehensive solution that helps businesses reduce stockouts, minimize overstocking, and free up working capital, all while maintaining a competitive edge in today’s fast-paced market.

Find out more

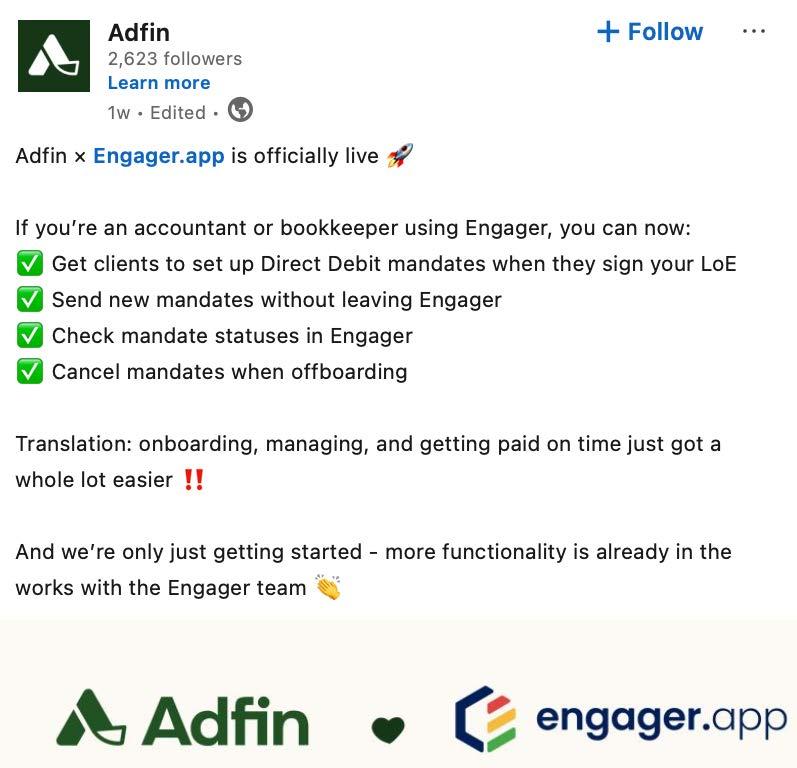

From proposal to payment to delivery, the integration helps accounting firms speed up client onboarding, improve cash flow, and reduce admin

IGNITION, THE RECURRING REVENUE AND BILLING AUTOMATION PLATFORM FOR FIRMS AND AGENCIES, TODAY UNVEILED ITS INTEGRATION WITH FINANCIAL CENTS, A TOP ACCOUNTING PRACTICE MANAGEMENT PLATFORM, TO FULLY AUTOMATE THE CLIENT ENGAGEMENT LIFECYCLE.

By combining Ignition’s proposal-to-payment automation with Financial Cents’ workflow management capabilities, firms can create a seamless handoff from signed proposals to project assignment and delivery.

“With our Financial Cents integration, we’re helping accounting firms break free from manual processes that slow them down,” said Greg Strickland, CEO of Ignition. “They can onboard clients

This month’s update is all about saving time, especially if you’re the one managing teams and keeping things running smoothly. From bulk-editing roles to faster receipt previews, these new features give workspace admins serious superpowers.

POWER FEATURES FOR ADMINS AND APPROVERS

Hover to preview receipts

No need to open each receipt. Just hover over an expense to see the attached image instantly and speed up approvals.

Create dependent tags

Cleaner data starts here. Use dependent tags so em-

ployees only see the relevant options based on prior selections like client, project, or department.

Accruals made easy

Close your books faster with one-click accruals for unapproved reimbursements and outstanding company card transactions.

Keep reading

Fand get paid faster, allowing them to refocus their energy on scaling the business instead of managing paperwork.”

Available now to customers in Canada and the US, the integration enables firms to:

• Automate proposals, billing, and payments in Ignition to improve efficiency and cash flow

• Automatically create and assign projects in Financial Cents when a client signs an Ignition proposal to kick off work

• Keep client information synced across both platforms, reducing duplicate data entry and errors

Find out more

OR THE LAST YEAR, I’VE HAD THE PRIVILEGE OF WORKING ALONGSIDE SOME BRILLIANT MINDS ON THE SME DIGITAL ADOPTION TASKFORCE, CONTRIBUTING TO THE VITAL WORK IT’S DOING TO ACCELERATE TECHNOLOGY ADOPTION AMONG UK SMALL BUSINESSES.

The SME Digital Adoption Taskforce has now published its much-anticipated full report, outlining its vision for a more digital-first future for the UK’s small- and medium-sized enterprises. The taskforce, a body originally established by a previous minister, has seen its crucial, instrumental work championed and continued by Gareth Thomas MP. Its ability to survive recent governmental changes is a testament to the widespread consensus on the transformative benefits of digital adoption.

The report lays down a sensible foundation, building on its interim recommendations to create a single point of accountability, make the most of AI, improve data access and establish standards for eInvoicing. These are all welcome and necessary steps. They reflect a fundamental truth: that digitalisation is absolutely critical for unlocking economic growth and productivity.

Throughout this whole process, it’s been clear we need truly ambitious plans and small businesses would benefit from the recommendations going even further. We need to be bolder and learn from the global leaders who are setting a formidable pace in SME digitalisation.

SEAMLESS SAUDI ARABIA, THE LEADING CONFERENCE AND EXHIBITION FOR DIGITAL COMMERCE AND PAYMENTS, HAS SIGNED A STRATEGIC MEMORANDUM OF UNDERSTANDING (MOU) WITH ACCOUNTING REFIGURED, THE REGION-BORN MOVEMENT FOR PROGRESSIVE ACCOUNTING AND FINANCE PROFESSIONALS. THE AGREEMENT WILL SEE A DEDICATED “FUTURE OF ACCOUNTING” STAGE CURATED AND DELIVERED BY ACCOUNTING REFIGURED AT SEAMLESS SAUDI ARABIA, 19 NOVEMBER 2025, RIYADH FRONT EXHIBITION & CONFERENCE CENTRE.

The new stage will bring together firm owners, CFOs, regulators, and technology providers to tackle the King-

dom’s most pressing financial topics, including e-invoicing roll-out, AI-powered advisory services, and SME digital transformation, aligning with Vision 2030’s drive for a competitive, knowledge-based economy.

“This collaboration will bring a fresh dimension to Seamless, aligning with the Kingdom’s digital transformation goals and Vision 2030,” said Joseph Ridley, General Manager at Terrapinn Middle East, organiser of Seamless. “Attendees can expect expert-led discussions, workshops, and networking opportunities centred around accounting innovation, VAT compliance, the future of corporation tax, and regulatory transformation.

CBELEBRATING MILESTONES AND ‘MADE IT MOMENTS’ CAN SUPERCHARGE SMALL BUSINESS SUCCESS, YET THEY OFTEN GO UNRECOGNIZED.

Xero, the global small business platform, has today published new independent research revealing the impact of celebrating business milestones and ‘made-it moments’. The study, which surveyed U.S. small business owners as part of a broader seven-country report of 2,300 small businesses,

found that acknowledging wins, whether big or small, is associated with improved business outcomes and revenue.

Of the 85% of U.S. small business owners who celebrate, a majority report that it improves morale (81%), strengthens performance (78%), and increases motivation (77%). However, these celebrations are often hindered by economic challenges

Find out more

BGL CORPORATE SOLUTIONS (BGL), AUSTRALIA'S LEADING PROVIDER OF COMPANY COMPLIANCE, SELF-MANAGED SUPERANNUATION FUND (SMSF), INVESTMENT MANAGEMENT, IDENTITY VERIFICATION, AND AI-POWERED PAPER-TO-DATA SOFTWARE SOLUTIONS, IS PROUD TO ANNOUNCE THE RELEASE OF GENERATIVE AI IN ITS CAS 360 SOFTWARE.

Unveiled at BGL REGTECH 2025, the new feature allows CAS 360 clients to generate contextual, personalised email content using Roni, BGL’s AI Assistant.

“We are so excited to bring powerful and useful generative AI features to CAS 360,” said Warren Renden, General Manager - CAS 360, BGLiD and UK at BGL.

“We have focused on building AI into our core workflows. With one click, AI can be used to create beautiful and powerful emails.”

“BGL clients currently send over 4 million emails through CAS 360 each year using fully customisable templates,” continued Renden. “These templates rely on a limited number of merge fields, offering little context.”

“With the introduction of Roni, CAS 360 can now automatically generate email content that reflects the specific company and the transaction(s) the documents relate to. This creates a more personalised experience for clients and removes the need for firms to customise every template manually.”

Find out more

GL CORPORATE SOLUTIONS (BGL), AUSTRALIA'S LEADING PROVIDER OF COMPANY COMPLIANCE, SELF-MANAGED SUPERANNUATION FUND (SMSF), INVESTMENT MANAGEMENT, IDENTITY VERIFICATION, AND AI-POWERED PAPER-TO-DATA SOFTWARE SOLUTIONS, IS PROUD TO ANNOUNCE INTEGRATION WITH COINSTASH TO SIMPLIFY CRYPTOCURRENCY TRANSACTION DATA PROCESSING FOR CLIENTS.

Coinstash is one of Australia’s leading cryptocurrency SMSF investment platforms. This new inte-

gration automates the flow of cryptocurrency transaction data from Coinstash to BGL’s SMSF administration solution, Simple Fund 360, and accounting, investment, and tax solution, Simple Invest 360.

"We’re incredibly excited to partner with Coinstash, a platform trusted by thousands of SMSF investors,” said BGL's Chief Executive Officer, Daniel Tramontana. “This integration simplifies digital asset administration for our clients by eliminating the need for manual crypto data entry.”

Find out more

Lessn raises $1M+ to supercharge growth — could we be Australia’s next Melio?

IT’S OFFICIAL — OUR PRE-SERIES-A RAISE HAS CLOSED, AND THE MEDIA IS ALREADY ALL OVER IT.

Headlines are calling Lessn “the next Melio,” and we’ll admit, that’s not a label we take lightly.

If you’re in fintech, you know what that means. Melio is one of the most talked-about B2B payments platforms of the last decade — a company that took something small businesses dreaded (paying bills, managing approvals, juggling cash flow) and turned it into something fast, simple, and even rewarding.

They didn’t just solve one

pain point. They streamlined cash flow, stripped out admin, and embedded payments where business owners were already working. That combination was so powerful it caught the attention of Xero, who recently acquired Melio for $3.9 billion.

That’s the kind of impact we’re aiming for.

At Lessn, we’re building the same category-defining experience — not by copying Melio, but by applying the same focus and ambition to the Australian market first.

Find out more

ET READY FOR XERO’S NEW NAVIGATION AND HOMEPAGE, WHICH WILL BE AVAILABLE TO ALL XERO CUSTOMERS SOON. WE’VE BEEN BUSY TALKING TO OUR 30,000 BETA TESTERS TO FIND OUT WHAT THEY LOVE ABOUT THE NEW EXPERIENCE (AND WHAT THEY THINK WE CAN IMPROVE).

We’re not just listening, we’re putting your feedback into action. Feedback from

Melio is joining forces with Mastercard to offer eligible business cardholders up to $100 in automatic fee credits when they pay bills via Melio.

WE’VE GOT AN EXCITING NEW PARTNERSHIP THAT COMES WITH REWARDS FOR YOUR BUSINESS. STARTING AUGUST 1, 2025, MELIO IS JOINING FORCES WITH MASTERCARD TO OFFER ELIGIBLE BUSINESS CARDHOLDERS UP TO $100 IN AUTOMATIC FEE CREDITS WHEN THEY PAY BILLS VIA MELIO.

What’s this all about?

If you have a World Mastercard for Business, World Elite Mastercard for Business, or World Legend Business Mastercard® credit card, this promotion is for you. Use your eligible Mas-

tercard to pay business expenses through Melio for the first time, and we’ll automatically credit up to $100 toward your credit card processing fees at checkout.

Here’s how it works: Let’s say you need to pay a $3,500 invoice to a vendor using your eligible Mastercard through Melio. Normally, you’d pay a 2.9% credit card fee ($101.50). With this partnership promotion, you’d only pay $1.50 for that first payment— the rest is covered with your fee credits!

Find out more

Ebeta testers has already informed several upcoming improvements, including how we present third-party apps, prioritise key elements in the navigation, and surface the most relevant information in the banking widget.

The good news is you dation and homepage web page to test drive it for yourself using an interactive prototype.

Find out more

VERY YEAR, THE XERO ASIA AWARDS ARE OUR WAY OF SAYING A BIG THANK YOU TO THE AMAZING ACCOUNTING AND BOOKKEEPING PARTNERS WHO EMPOWER THE REGION’S SMALL BUSINESSES TO THRIVE. THEY ARE CATALYSTS FOR INNOVATION, ADVOCATES FOR DIGITAL-FIRST ACCOUNTING AND TRUSTED ADVISORS WHO SUPPORT ASIA’S SMES AT EVERY TURN.

This year, we evolved our award categories to better

reflect the diversity of our partner community in Asia. We also introduced a new video submission format, giving partners the opportunity to tell their stories in their own words.

To everyone who submitted a nomination, we’d like to say a huge thank you for the time and effort you put into your entries. The judges were truly blown away by the passion, creativity and heart that came through!

Find out more

UPCOMING EVENTS Tuesday 2nd September 2025

Thursday 4th September 2025

OVER THE LAST COUPLE OF DAYS, WE ROLLED OUT OUR NEW PREDICTIVE FUTURE INCOME FUNCTION TO ALL CUSTOMERS ON THE STANDARD, PREMIUM, AND BUSINESS PLANS. IN ADDITION TO THE NEW ESTIMATION FEATURE, WE HAVE ALSO INTRODUCED SEVERAL NEW FUNCTIONS TO THE FUTURE INCOME REPORT, INCLUDING THE ABILITY TO CUSTOMIZE THE COLUMN ORDER, THE ABILITY TO RESET TO THE DEFAULT COLUMN SELECTION, AND THE ABILITY TO RUN EXPORTS USING YOUR CHOSEN COLUMN SELECTIONS.

In other areas, we have continued our performance improvement work with speed enhancements to the value and line charts, as well as performance and stability improvements across our infrastructure generally.

New functionality / enhancements

• Rolled out the new predictive future income function, displaying estimated dividend income up to three years into the future to all Standard (previously called Investor), Premium (previously called Expert), and Business plan customers.

• Introduced the ability to customize the column order on the future income report, which we will introduce to additional reports over time.

• Future income report export formats now match the table customization on screen.

• Introduced the ability to reset to the default column selection in the future income report.

• Introduced a new ‘Real Estate’ investment type to our custom investment function, providing

a more accurate option than the existing ‘Property Fund’ label for those wanting to track their personal property.

• Rolled out performance improvements to the value and line charts. On large portfolios, you should see these charts load noticeably faster moving forward.

• Rolled out support for covered warrants & derivatives to all stock markets globally, excluding the EURONEXT.

• Enabled the automatic calculation of interest payments for any listed fixed interest investments on the ASX and NZX. Previously, this function had to be enabled manually per holding.

Find out more

PAYONEER (NASDAQ: PAYO), THE GLOBAL FINANCIAL TECHNOLOGY COMPANY POWERING BUSINESS GROWTH ACROSS BORDERS, TODAY ANNOUNCED A STRATEGIC PARTNERSHIP WITH PROGRAMMABLE FINANCIAL SERVICES COMPANY

STRIPE. THE COLLABORATION MARKS AN EXPANSION OF PAYONEER’S ONLINE CHECKOUT OFFERING FOR CROSS-BORDER MERCHANTS LOOKING TO SELL DIRECT-TO-CONSUMER.

Launching in key markets within the Asia Pacific

(APAC) region first, including China and Hong Kong, the upgraded Payoneer Checkout capabilities — powered by Stripe’s bestin-class technology — will empower Small and Medium-sized Businesses (SMBs) to accept a broader range of payment methods via online webstore checkout including Buy Now Pay Later (BNPL) options like Affirm and Klarna, and digital wallets such as Apple Pay and Google Pay.

In the three years since launching Payoneer Checkout, the company has scaled

SHARESIGHT AND WEBULL AUSTRALIA HAVE PARTNERED TO MAKE IT EVEN EASIER FOR AUSTRALIAN INVESTORS TO TRACK THEIR INVESTMENTS IN SHARESIGHT. BY CONNECTING THEIR WEBULL ACCOUNT TO SHARESIGHT, INVESTORS CAN AUTOMATICALLY SYNC THEIR TRADING DATA TO A SHARESIGHT PORTFOLIO, ALLOWING THEM TO TAKE ADVANTAGE OF SHARESIGHT’S AWARD-WINNING PERFORMANCE, DIVIDEND TRACKING AND TAX REPORTING. TO LEARN MORE ABOUT THE BENEFITS OF CONNECTING SHARESIGHT AND WEBULL, KEEP READING.

Who is Webull?

Webull is an award-winning CHESS-sponsored broker. It is a low-cost platform offering access to the Australian, US, Hong Kong and China-A share markets.

from zero to nearly $1 billion in run-rate annual volume, demonstrating rapid market adoption and strong customer demand. Over the last twelve months through June 30, 2025, the business has generated $30 million in revenue, representing over 100 percent year-over-year growth.

“We are committed to simplifying cross-border online trade for SMBs,” said Adam Cohen, Chief Growth Officer, Payoneer.

Find out more

Webull is known for its zero-commission ETF trading and powerful trading tools. The platform is packed with advanced charting tools, professional data and research features to help active traders implement trading strategies swiftly.

The platform is available to investors in 15 regions worldwide, such as the United States, the United Kingdom, Australia, Canada, Hong Kong and Singapore, and is continuing to expand.

Webull has partnered with

Sharesight to make your performance and tax reporting much more efficient.

Key features of Webull

Webull Australia offers a comprehensive suite of investment products and services designed to meet the diverse needs of Australian investors:

• Zero-commission ETF Trading – Trade ETFs without brokerage fees, making it cost-effective to build diversified portfolios.

• US options trading – Access sophisticated options strategies on US markets with competitive pricing and advanced trading tools to help you manage risk and enhance returns.

• Auto investing – Set up automated investment plans to regularly invest in your favourite shares and ETFs, making it easier to build wealth consistently over time.

• DIY portfolio – Create and manage your own diversified investment portfolio with access to thousands of shares and ETFs across multiple markets, giving you complete control over your investment strategy.

• SMSF accounts – Specialised Self-Managed Super Fund (SMSF) accounts that allow you to take control of your superannuation investments whilst maintaining compliance with Australian regulatory requirements.

• Trust accounts – Flexible

account structures for family trusts, unit trusts, and other investment entities, providing tax-efficient investment solutions for more complex financial arrangements.

• Multi-market access –Trade across Australian, US, Hong Kong, and China-A share markets from a single platform, providing global investment opportunities.

• Advanced charting and research – Professional-grade analytical tools, real-time data, and comprehensive research features to support informed investment decisions.

These features, combined with Webull's integration with Sharesight, provide Australian investors with a powerful and streamlined investment experience.

Why has Webull integrated with Sharesight?

The integration comes just in time for the upcoming tax season, addressing one of the most challenging aspects of investing for Australian traders – meeting the country's comprehensive tax reporting requirements for capital gains, dividends and foreign income.

"At Webull Australia, we're committed to removing barriers that prevent investors from maximising their potential in the markets," says Rob Talevski, CEO of Webull Australia.

BCB GROUP, A LEADING PROVIDER OF BUSINESS ACCOUNTS AND PAYMENT SERVICES FOR THE DIGITAL ASSET ECONOMY, HAS BEEN NAMED A FINALIST AT THE PRESTIGIOUS PAYMENTS AWARDS 2025, FURTHER CEMENTING ITS POSITION AS AN INNOVATOR IN THE PAYMENTS INDUSTRY.

The company is shortlisted for three categories – B2B Payments Innovation of the Year, Real-time Payments Innovation and Payments Innovation of the Year – recognising its pioneering work in bridging fiat and digital asset markets. In addition, Tim Renew, Deputy CEO of BCB Group, has been recognised individually for his leadership and contribution to the sector.

Hosted annually, the Payments Awards celebrate the organisations and individuals driving progress in one of the most dynamic areas of financial services. This year’s winners will be announced at a black-tie ceremony on 13 November 2025 at the London Marriott Grosvenor,

with industry leaders and innovators gathering to celebrate excellence in payments.

BCB Group’s nominations highlight the firm’s achievements in transforming cross-border transactions and digital asset payments for institutional clients. Central to this recognition is the BLINC Network, the company’s instant settlements infrastructure that allows clients to transfer fiat and digital currencies 24/7 with zero settlement risk.

With clients spanning crypto-native corporates, global exchanges, and fintech institutions, BCB Group has become a trusted partner to firms requiring operational resilience, regulatory confidence, and scalable infrastructure. The company’s solutions enable institutions to integrate fiat and crypto payments seamlessly, while maintaining transparency and safeguarding standards that match traditional finance.

Tim Renew, Deputy CEO of BCB Group, said: “It’s an

honour for BCB Group to be recognised by the Payments Awards – not just for our innovation, but also for the resilience and trust we bring to our clients. To be named a finalist alongside other industry leaders is a testament to the hard work and dedication of our entire team. I am particularly proud of the impact we are making through BLINC, which is reshaping the way institutions move money across borders and asset classes. This recognition reinforces our commitment to building the financial infrastructure of the future.”

Alongside BCB Group’s company nominations, Tim Renew has been recognised for his leadership in advancing payments innovation. With over two decades of experience scaling global fintech firms and raising more than $85m in funding, Renew has built a track record in payments, growth strategy, and international expansion.

Find out more

WITH AGENTIC AI EMERGING AS THE NEXT BIG SHIFT IN TECHNOLOGY, ANNA MONEY IS PROUD TO ANNOUNCE THAT IT HAS SUCCESSFULLY PROVEN ITS ABILITY TO WORK DIRECTLY WITH LARGE LANGUAGE MODEL (LLM) AGENTS TO COMPLETE ONE OF THE MOST COMPLEX, HIGHLY REGULATED ONBOARDING PROCESSES IN UK BUSINESS… COMPANY REGISTRATION WITH FULL AUTHORISATION, IDENTITY VERIFICATION AND PAYMENT.

Imagine you wanted to register your business. It can be frustrating - you’ve got

to fill in online forms, hand over information, prove your identity and make the payment. But what if an LLM could do all that work for you?

In recent tests, ANNA used an LLM agent as though it was a human customer that wanted to register a business. The LLM agent completed the entire journey through ANNA’s web interface - collecting all required details, navigating secure logins, completing identity checks, handling the payment process, and submitting the application to Companies House. It then confirmed that the new ANNA business account was

open and ready, complete with a virtual card available for immediate use.

“Frankly, the fact it worked first-time was extraordinary,” says Boris Diakonov, co-founder and coCEO at ANNA. “LLM agents can struggle with something as common as checking in for a flight, yet here we saw it handle one of the most complicated and regulated sign-up processes in the UK - end-to-end, payment included. That’s a real milestone for agentic AI in financial services.”

Find out more

KLARNA, THE GLOBAL DIGITAL BANK AND FLEXIBLE PAYMENTS

PROVIDER, TODAY ANNOUNCED THE EXECUTION OF A MULTI-YEAR FORWARD FLOW AGREEMENT WITH NELNET, A U.S.BASED FINANCIAL SERVICES AND INVESTMENT FIRM, TO SUPPORT THE CONTINUED EXPANSION OF KLARNA’S PAY IN 4 PRODUCT IN THE UNITED STATES.

The agreement enables Klarna to sell newly originat-

ed, short-term, interest-free Pay in 4 receivables to Nelnet on a rolling basis. Over the life of the program, up to $26 billion in total payment volumes are expected to be sold. The transaction delivers scalable and efficient funding to power Klarna’s U.S. growth, while enhancing balance sheet flexibility and supporting long-term capital strategy.

“This is a landmark transaction for Klarna in the U.S.” said Niclas Neglén, CFO at

Klarna. “Our partnership with Nelnet allows us to scale a core product responsibly, while continuing to deliver smooth, interest-free payment experiences to millions of consumers.”

The forward flow structure offers predictable, offbalance-sheet funding and underscores Klarna’s ability to structure and execute large-scale capital markets transactions.

Find out more