Duke is pleased to offer a selection of high-quality, competitive benefits for you and your family’s well-being. This Benefits Decision Guide is designed to help you understand your benefit options so that you can make the selections that best meet the needs of you and your family.

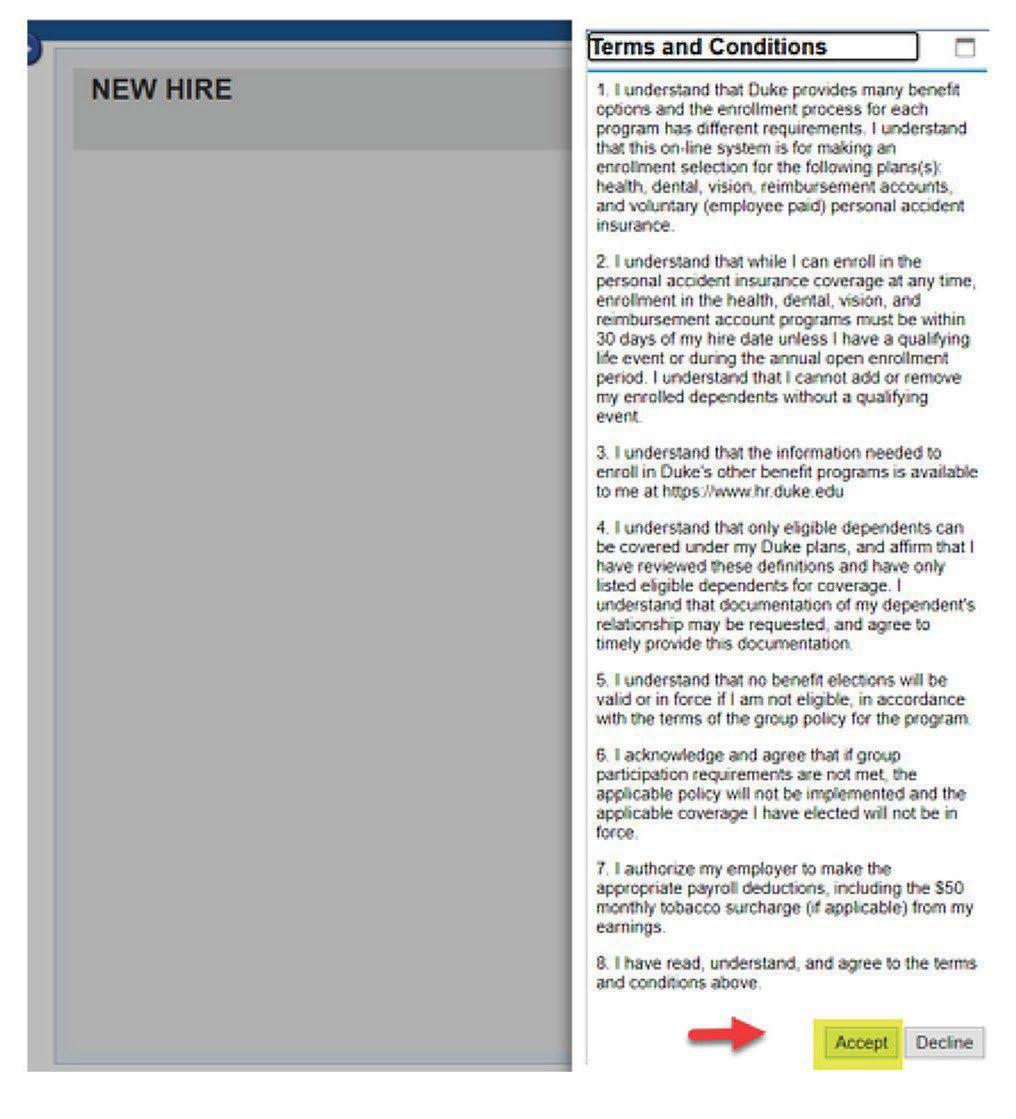

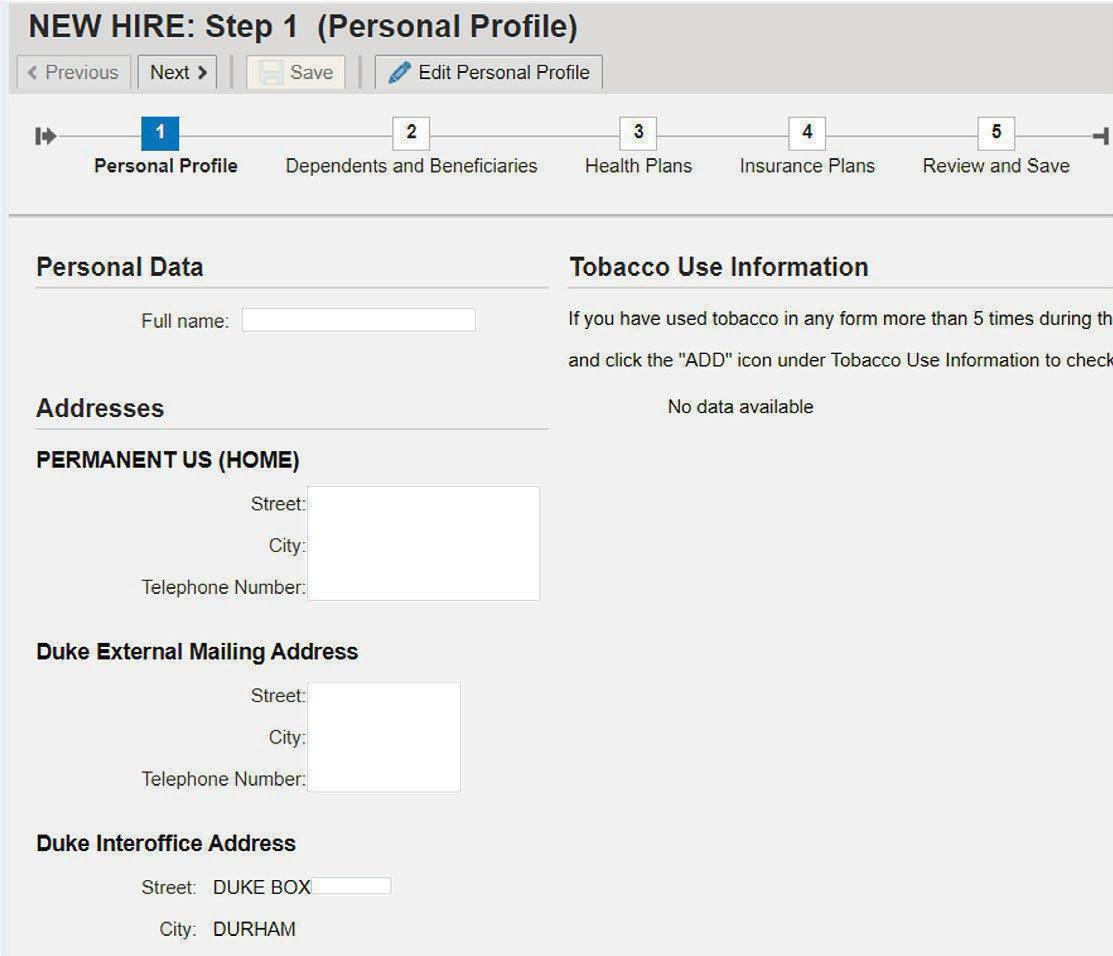

You may enroll by following the enrollment instructions within this guide. The eligibility criteria for each of these programs is described more fully in this guide.

1. You have 30 days after your date of hire or eligibility to enroll in the following benefit plans:

Medical Plan

Dental Plan

Vision Plan

Reimbursement Accounts

If you do not enroll during this 30-day period, your opportunity to enroll is limited to the annual open enrollment period or within 30 days following a qualifying life event.

2. You may apply for enrollment in the following programs at any time throughout the year; however, it is easier to enroll within the first 30 days after your new hire date or first period of eligibility because the coverage is issued under “guaranteed issue” guidelines. Guaranteed issue means coverage will be issued without regard to health status:

Supplemental Life Insurance

Voluntary Disability Programs

If you wait until after 30 days to apply for enrollment, you will have to answer health questions which may impact your enrollment in these important benefits Please review the information in this guide to determine whether these plans may fill a gap in your financial security portfolio.

3. You are automatically enrolled in the Employee Basic Life Insurance Plan which is provided to you at no cost. We encourage you to designate your beneficiary(ies) immediately since your beneficiary designation ensures that your benefit will go to whom you choose.

4. You may enroll in the Faculty and Staff Retirement Plan at any time upon commencement of your employment at Duke.

This guide presents information you will need to make your enrollment decisions. It is not intended to be a full statement of benefits provided by Duke. The official sources for the governing documents for employee benefits are available at the Human Resource Information Center and online at hr.duke.edu/benefits. The benefits that you receive are based upon the plans’ official plan documents, not this guide or any other written or oral statement. If there is a conflict between this guide and the official plan documents, the official plan documents will govern in all cases. Duke reserves the right to change or terminate these plans or your eligibility for benefits under the plans. This is not an employment contract or any type of employment guarantee.

Revised - November 2025

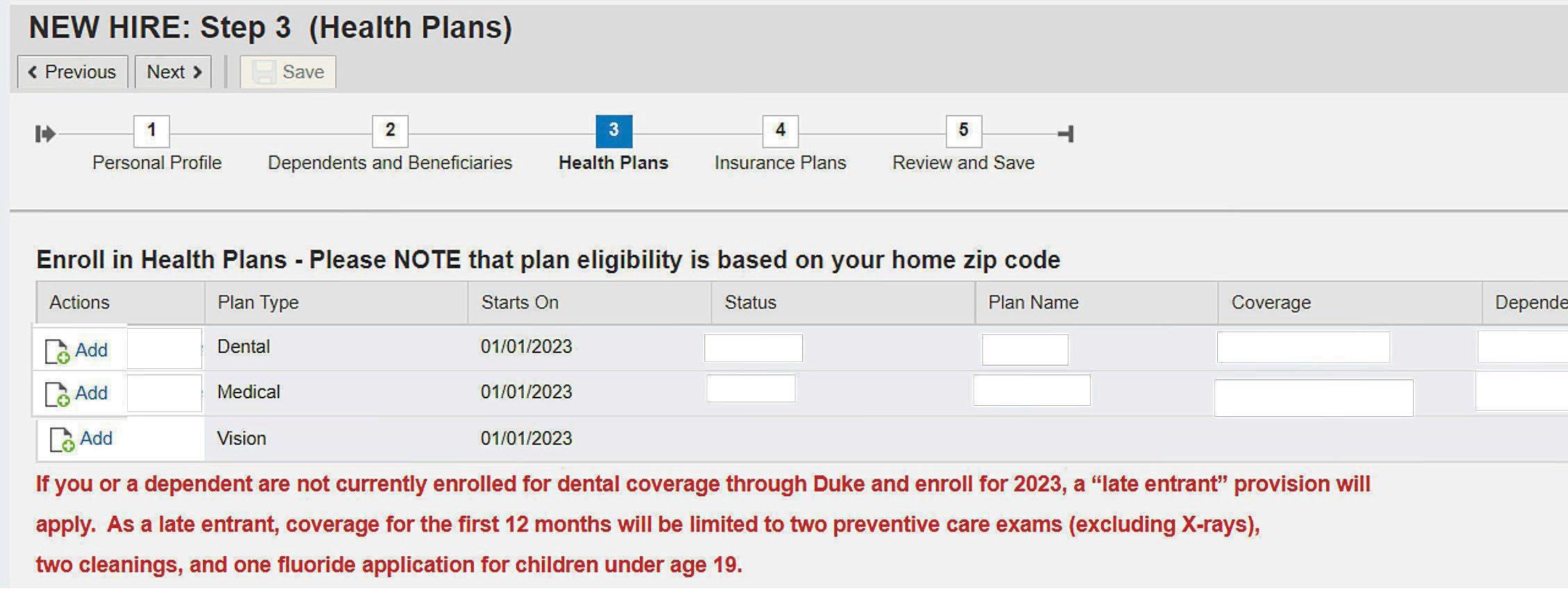

As a Duke employee, you have access to some of the world’s most advanced health care through the Duke University Health System. Duke is committed to offering employees comprehensive, high-quality insurance plans to meet their health care needs. You are eligible to participate in these plans if you are a regular employee in a benefit-eligible position scheduled to work at least 20 hours per week for at least 50 weeks during the year. When making your medical, dental, and/or vision benefit selections, you may choose from among the following levels of coverage:

Employee

Employee/Child

Employee/Children— only available for medical and/or vision care*

Employee/Spouse

Family (includes Spouse)

You have thirty (30) days after your first day of employment/eligibility to elect medical, dental, and/or vision coverage. You have two options for when your medical coverage can begin: 1) your medical coverage will automatically be effective on the first day of the month following your first day of employment/eligibility; or 2) you may contact the Human Resource Information Center to have coverage begin on your date of hire and pay the full premium for the first month of coverage. For dental and/or vision coverage, your coverage will be effective on the first day of the month following your first day of employment/eligibility. Changes made outside your initial eligibility period or annual Open Enrollment are allowed only within 30 days of a “qualifying event” such as marriage or divorce, birth or death of a dependent, or a change in insurance eligibility due to relocation of residence or work.** For more information on qualifying life events, visit hr.duke.edu/benefits/enrollment/life-events/ Your premiums for medical, dental, and vision insurance are deducted from your pay on a pre-tax basis, saving you federal income, state income, and Social Security taxes. Federal law limits when you can change your elections for these benefits.

* Dental care coverage does not include an Employee/Children option. You may cover any number of eligible children in the dental plan by choosing the Family option.

** Change in insurance eligibility due to relocation of residence or work is applicable only to medical insurance and only when network access is impacted.

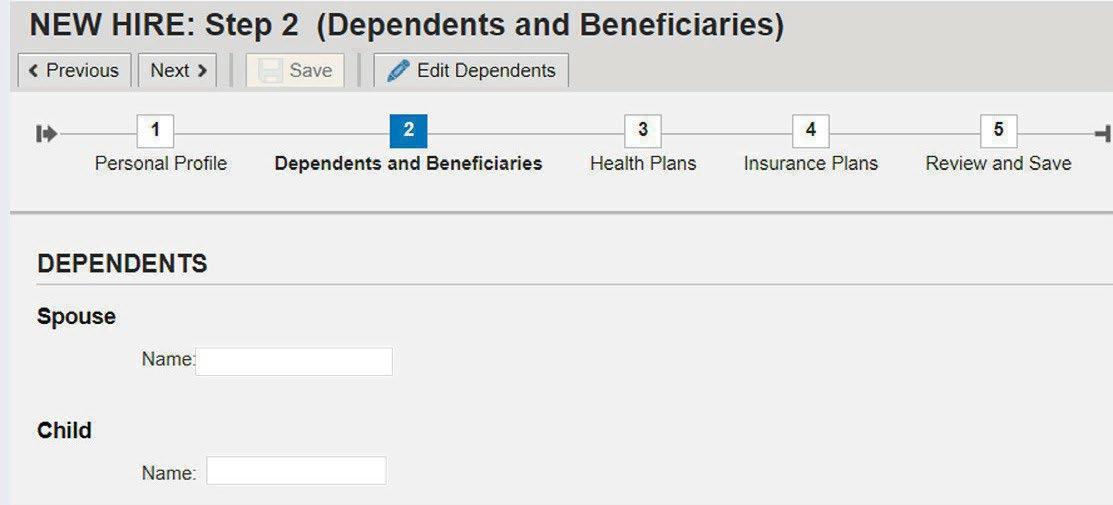

The following dependents are eligible for enrollment:

Your legal spouse.

Your children: biological children, stepchildren, adopted children, children of your registered same-sex spousal equivalent, foster children or children for whom you are the legal guardian*, up to their 26th birthday. Dependent children do not include grandchildren, siblings or other family members, or children of whom you have legal custody but not guardianship.

Your disabled children: In order to continue coverage of a mentally or physically disabled dependent child beyond his or her 26th birthday, all of the following criteria must be met:

• the child must be enrolled in a Duke health plan on his or her26th birthday;

• the parent must apply for the waiver prior to the child’s 26th birthday;

• the mental or physical disability must be significant and render the child incapable of independent living and self-sustaining employment, and must be supported by medical records;

• the condition must exist on or prior to the 26th birthday;

• the parent must remain eligible;

• the parent must provide annual evidence of continued incapacity upon request; and,

• there must not be a break in coverage under a Duke policy after the 26th birthday under the parental policy.

Under no circumstances may an employee enroll a sibling, cousin, parent, or other relative as a dependent. Duke reserves the right to verify the eligibility of dependents enrolled in the Health plans.

As part of compliance with the Patient Protection and Affordable Care Act, Duke must request all employees to provide Social Security numbers for dependents enrolled for medical coverage.

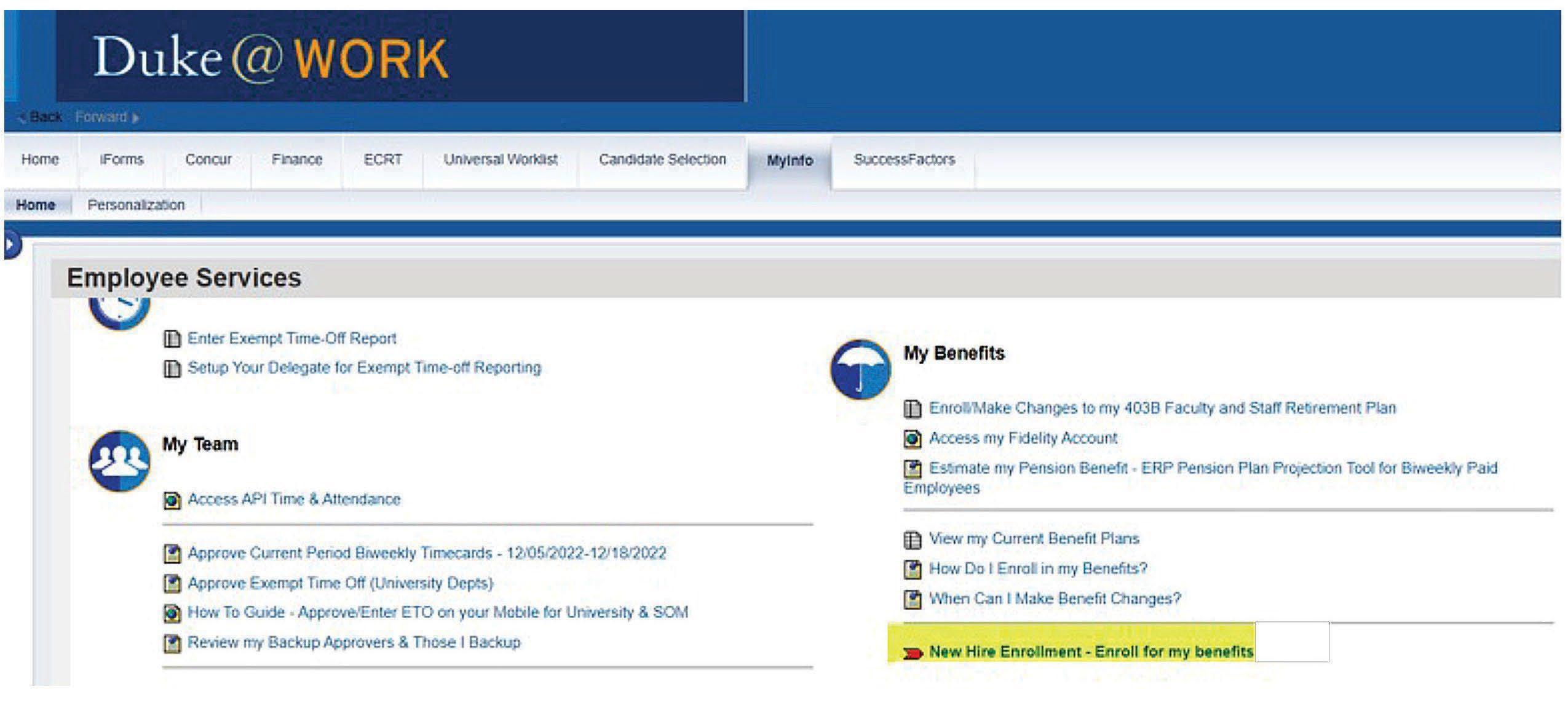

You can add the Social Security numbers for covered dependents through the enrollment process on the Duke@Workself-service website or by calling the Human Resource Information Center at (919) 684-5600.

All faculty and staff, regardless of sexual orientation, must be legally married to cover a partner or partner’s child for benefits or applicable policies. Same-sex spousal equivalents who were registered with Duke Human Resources prior to January 1, 2016 are eligible for coverage, but will not be able to take advantage of federal and state tax savings for payment of benefit premiums unless legally married or able to claim one’s partner as a dependent as defined by the IRS and tax code.

* Legal guardianship obtained outside of NC must meet the NC qualifications.

Each employee’s needs are different — that’s why Duke offers four different medical plans to meet the needs of you and your family. Eligibility for each plan is based on the employee’s permanent home zip code:

Employees who live in NC with zip codes beginning with 272, 273, 275, 276, or 277…

also have the option to enroll in:

Duke Select

All employees who are in a benefits-eligible position...

…may enroll in:

■ Duke Options

■ Duke USA

■ Duke Advantage

Each medical plan covers both pharmacy and behavioral health benefits. Please refer to the plan comparison charts on pages 8 – 9 for details.

Pharmacy benefits are provided through Express Scripts. A complete description of coverage under each plan is available online at hr.duke.edu/benefits/medical. You can also compare plan choices by using the Cigna Easy Choice Tool, available online at hr.duke.edu/resource/Cigna-easy-choice-tool. All of our medical plans comply with the provisions of the Patient Protection and Affordable Care Act.

(note eligibility requirement above)

(Health Maintenance Organization)

Duke offers one HMO: Duke Select. You may, but are not required to, select a Primary Care Physician (PCP) from the plan’s list of network providers. You will pay a flat charge — or copay — for most services when you visit a network provider.

Duke Select is an open-access HMO plan. You do not need a referral from your PCP to see a network specialist. Out-of-network care is only covered for emergency or urgent care and limited to 20 visits and 20 days for behavioral health or substance use disorder when out-of-network.

Please note: Duke Select uses a healthcare provider network unique to Duke. Duke Select is only available to employees living in zip codes beginning with the following numbers: 272, 273, 275, 276, and 277. Since this network is unique, we encourage you to carefully review the provider listing at hr.duke.edu/providers.

(Preferred Provider Organization)

Duke also offers the Duke Options PPO. Duke Options provides access to a national network of physicians and hospitals through the Cigna Open Access Plus network, and provides access to full out-ofnetwork benefits, including out-of-network behavioral health and substance use disorder benefits. If you live outside of the Triangle area and need access to certain benefits, such as infertility services, and you prefer low deductibles and out-of-pocket limits, Duke Options may be a plan for you to consider.

This plan uses the same national network of health care providers and hospitals as the Duke Options and Duke Advantage plans, the Cigna Open Access Plus network. Premiums are lower than Duke Options but out-of-pocket costs (such as deductibles, coinsurance, and out-ofpocket maximums) are higher. Additionally, certain benefits covered on the Duke Options plan, such as bariatric surgery and comprehensive infertility coverage, are not covered under the Duke USA plan. If you are in need of these benefits, you should elect a different plan.

Duke Advantage is a high deductible health plan available to all benefits eligible employees. This plan is paired with a Health Savings Account (HSA) that is administered by Fidelity Investments. Duke provides an HSA contribution to offset higher deductibles. Duke Advantage offers lower monthly premiums and encourages members to make wise healthcare spending choices. The HSA allows you to save pre- tax dollars for qualified medical expenses. This plan provides access to a national network of physicians and hospitals through the Cigna Open Access Plus network, and is an option for individuals who prefer lower premium costs and are comfortable managing higher out-of-pocket expenses before the plan begins to share costs.

Members must meet the annual deductible before the plan covers most services, including office visits and prescriptions. However, preventive care provided in-network, certain preventive medications, and telehealth provided through MDLive is covered at 100%, with no deductible required.

Duke provides supplemental health insurance at no additional cost for full-time, benefits eligible employees traveling internationally for a period of time not to exceed six months. You must have health insurance from Duke or another company to be eligible for this coverage.

Cigna’s Medical Benefits Abroad (MBA) offers eligible employees and their spouses and dependents up to age 26, who are traveling with them, this supplemental medical insurance coverage for unexpected injuries and illnesses while traveling abroad. This coverage supplements Duke’s regular health insurance plans or the employee’s other health insurance coverage. The coverage also includes up to seven days of personal travel when taken in conjunction with a covered business trip.

For more information, including coverage limits and eligibility requirements, visit hr.duke.edu/abroad

Duke charges employees covered under a Duke medical insurance plan who smoke or use other forms of tobacco an extra $50 per month for Monthly paid employees and $23 per pay period for Biweekly paid employees. You will be asked about your tobacco use as part of your who use tobacco.

A “tobacco user” includes anyone who has used tobacco more than five times in the previous two months. Tobacco use includes smoking and use of snuff, e-cigarettes, or chewing tobacco. The use of a nicotine patch and nicotine gum are not subject to the surcharge.

The monthly surcharge will be removed upon completion of a tobacco cessation program through LIVE FOR LIFE, Duke’s employee wellness program. If you think you might be unable to complete the program, you may request to complete an alternative program or meet a reasonable alternative standard. Completion of an alternative activity may allow you to avoid the surcharge. Contact us at (919) 684-5600 and we will work with you (and, if you wish, with your doctor) to find the best method for achieving your best health.

Upon completion of a tobacco cessation program, the surcharge will be removed and you will receive a full refund of all tobacco surcharges paid during the current calendar year.

Visit hr.duke.edu/tobacco free for more information. 6

When comparing Duke’s medical plans, it is important to compare the cost of out-of-pocket expenses as well as premiums. Here are some questions to ask yourself in choosing a medical plan that matches the needs of you and your family. For specific coverage information, please refer to the Medical Plans Comparison Chart on https://hr.duke.edu/benefits/enrollment/oe//. You can also compare plan choices by using the Cigna Easy Choice Tool, available online at hr.duke.edu/resource/cigna-easy-choice-tool.

Can I select any doctor I wish?

Will my child's pregnancy be covered? (labor and delivery are excluded)

Prenatal care only

Will my dependent children who live in another state be covered?

Since I travel a lot, can I see doctors in other locations around the world?

Can I participate in the Duke WELL care management program?

Are there out-ofnetwork benefits?

Must I meet an annual deductible?

Do all plans cover the same services?

Emergency/urgent care only. No follow-up care

Emergency/urgent care in the US only. No follow-up care

nationwide listing of doctors

20 visits/20 days out-of-network limit for behavioral health

Emergency/urgent care out-of-network

international coverage is not provided

under out-ofnetwork benefits

of doctors

nationwide listing of doctors

What is the most I could pay for covered services in a year?

Special Services: Bariatric and Infertility

Special Services: Bariatric, Infertility Transgender surgery, Dependent pregnancy

under outof-network benefits

Special Services: Transgender surgery, Dependent pregnancy

$6,800 person/ $13,600 family

Preventative care telehealth provided through Midlives is covered at 100%

The following chart gives an overview of the differences between the four medical plans.

is access a Cigna diagnosed. Services

in-network

Duke’s coverage for outpatient and inpatient behavioral health and substance abuse benefits is provided through our Cigna medical coverage and uses the Evernorth Behavioral Health network. All of our Duke Behavioral Health providers participate in all of our medical plans. Additionally, if you elect coverage under the Duke Advantage high deductible health plan, you will be able to access behavioral telehealth services at no cost through MDLive.

For assistance with behavioral health and substance abuse benefits, contact Cigna Member Services at 400-440-DUKE (3853). Representatives will be happy to assist you with your behavioral health and substance abuse needs, as well as any questions related to these benefits.

• Pre-certification required for psychological testing, electroshock therapy, transcranial magnetic stimulation (TMS) and applied behavior analysis (ABA) therapy

• Covered in full after $20 copay for individual/ family therapy ($25 copay Duke USA)

• Must be pre-certified prior to admission

• Copay of $600 per admission

Duke also offers visits to Duke employees and their families through the Personal Assistance Services (PAS) at no cost to you. The staff of licensed professionals offer assessment, referrals and a range of other services to assist with personal, work and family matters. For information, call (919) 416-1727. pas.duke.edu

Details about behavioral health and substance abuse benefits are included in the Medical Plan Comparison chart (pages 8-9) and can also be found on each plan’s Summary of Benefits and Coverage, available online at hr.duke.edu/benefits/summaries

• Pre-certification required for psychological testing, electroshock therapy, transcranial magnetic stimulation (TMS) and applied behavior analysis (ABA) therapy (must meet the medical policy criteria of the medical carrier)

• After $650 annual deductible, you pay 30%* (you pay 40% on Duke USA)

• Limit of 20 visits per calendar year for Duke Select participants (no visit limit applies for Duke Options, Duke USA, or Duke Advantage)

• Must be pre-certified prior to admission

• After $900 per admission copay and deductible, you pay 30% (you pay 40% on Duke USA)

• Limit of 20 days per calendar year for Duke Select participants (no visit limit applies for Duke Options, Duke USA, or Duke Advantage) * All payments are based on the allowable charge. You are responsible for charges over the allowable charge when receiving out-of-network services.

Copays and deductibles vary depending on the type of medication prescribed (generic, brand, or non-formulary) the length of the prescriptions, and whether you purchase at a retail pharmacy, through the Express Scripts mail order pharmacy, or through participating onsite Duke Pharmacies.

After the third fill of a long-term maintenance medication at a retail pharmacy, members are encouraged to fill these medications through Express Scripts Home Delivery or Duke Pharmacies. If you continue to purchase a maintenance medication at a retail pharmacy, you will be unable to obtain a 90-day supply and you will be assessed a retail penalty of up to 50% of the cost of the drug (up to $30 for Generic, up to $165 for Brand, and up to $180 for Non-Formulary.)

Members are encouraged to use generic medications when a generic substitution is an option. Those who elect to use a brand-name medication when a generic medication is available will pay a higher cost in addition to the brand-name copay. If a generic drug is available but you request to receive the brand-name drug, you will pay the generic copay plus the difference between the cost of the two drugs, regardless of where the prescription is being filled. This applies to prescription drugs purchased at retail, through Duke pharmacies, and through Express Scripts home deliver (ma il order).

Specialty 2 must be purchased through Accredo or the Duke Specialty Pharmacy to be eligible for coverage under the plan, unless they are medications which are intended for an immediate need. See hr.duke.edu/pharmacy for a listing of "Specialty" medications.

Certain specialty pharmacy drugs are considered non-essential health benefits under the plan, and the cost of these drugs will not be applied toward a member's out-of-pocket maximum. Although the cost of these eligible specialty drugs will not be applied towards the out-of-pocket maximum, these costs will be reimbursed by the manufacturer at no cost to the member. A list of specialty medications eligible for this program is available online at hr.duke.edu/pharmacy.

Injectable fertility drugs are not reimbursed according to our standard pharmacy benefit. Only plans covering infertility services include coverage of these drugs, which must be prescribed by a Duke Fertility physician for those members residing in North Carolina. More information is available at hr.duke.edu/infertility

The medical plans’ expenses are directly related to the medical and pharmacy claims of those covered by the plans. Higher claims mean increased cost for both Duke and you. Duke covers the majority of the cost for medical care, but an increase in claims also means an increase in monthly premiums for faculty and staff. One of the best ways to reduce claims cost and the rising cost of health care is by reducing health risks and making healthy choices.

Duke offers a variety of health management programs that emphasize a proactive approach to improving health and preventing disease. These include:

This program is for participants in all our medical plans and is designed to identify risks for diseases and chronic conditions like hypertension and diabetes. It helps participants create a plan for optimal health and provides support and resources to achieve goals.

DukeWELL works closely with LIVE FOR LIFE programs. Eligible participants who engage in DukeWELL’s care plan may earn an incentive to encourage them to follow their care plans.

Website: DukeWELL.org

Phone: (919) 660-WELL (9355)

Available to all benefit eligible employees, LIVE FOR LIFE offers health assessments, fitness activities, tobacco cessation resources, gym discounts, consultations with fitness specialists and registered dietitians and run/walk clubs. LIVE FOR LIFE also organizes the farmers and mobile markets and promotes health education through programs such as Pathways to Change, Take the Stairs, and Your Weigh... Together

Website: hr.duke.edu/liveforlife

Phone: (919) 684-3136

Personal Assistance Service (PAS), the faculty/employee assistance program at Duke, offers visits at no cost for counseling. For information, call (919)416-1727. if you reside within in North Carolina. For faculty/ employees residing outside of North Carolina, services are provided through Business Health Services (BHS) at (800) 327-2251.

This program is for participants enrolled in Duke Advantage (HDHP). MDLive is offered at no cost to members, before the deductible is met. This program provides access for common, non-emergency conditions, such as the flu, sinus infections, ear pain. The program also provides support for a range of behavioral health concerns and access to wellness services. Access MDLive by logging into myCigna.com or calling MDLive at (888) 726-3171.

All of Duke’s medical plans have maternity programs focusing on providing expectant moms the tools, resources and support to stay informed every step of the way. The Cigna Healthy Pregnancy® app is designed to help you and your baby stay healthy during pregnancy. This valuable resource offers you an easy way to track and learn about your pregnancy. For those experiencing a highrisk pregnancy, Cigna has a dedicated team of nurses and doctors available to educate and guide you to ensure the best possible outcome for you and your baby. Call 800.615.2906 to learn more.

Eligible Duke employees scheduled to work at least 20 hours per week can choose from three dental options, depending on the extent of coverage you and your family may need. All options cover Type 1 (preventive), Type 2 (basic), Type 3 (major) and Type 4 (orthodontia), but differ in how they pay for covered services.

The PPO plan includes a higher maximum annual benefit than Plan A and Plan B, lower negotiated procedure rates, and your out-of-pocket costs are usually lower. However, members in the PPO plan will need to select an in-network provider. If you select the PPO plan and use an out-of-network provider, the amount the plan pays will be based on discounted network charges and you will be responsible for any amount charged over that allowance. A list of network dentists is available at explore. ameritas.com/duke or by calling Ameritas at 1-800-4875553. There is also a direct link to the Dental Plans on the Duke Benefits page that can be used to find a network provider at hr.duke.edu/benefits/medical/dental-insurance When searching for an Ameritas network provider, select the Classic Network.

If you enroll in Plan A, you can select any licensed dentist of your choice, including a network provider. Using a network provider will limit your out-of-pocket cost. Also, if you utilize a network provider, the deductible is waived. Plan B provides a very basic benefit and payments are based on a fixed schedule of fees. The allowed benefit for all covered services under Plan B can be found in the certificate document and is available on the Ameritas website at explore.ameritas.com/duke You should review the fixed schedule before selecting Plan B.

All three plans have an annual maximum benefit. If you reach this annual maximum benefit, Ameritas will not reimburse any additional services for the remainder of the calendar year. However, your Ameritas benefits include Dental Rewards. Dental plan members who have at least one covered dental claim filed in calendar year 2026, with less than $500 in claims payments, will be able to carry over $250 of their unused annual maximum for future use. This Dental Rewards accumulation can continue to grow each year (until a maximum accumulation

of $1,000 is met) if the member continues to have at least one covered service per year and paid claims in that year do not exceed

$500. The Dental Rewards carryover is in addition to the annual maximum available under each dental plan option. If a member has a year when they have allowed dental services to go above their annual maximum, Ameritas will automatically pull from any Dental Rewards carryover that the member has accumulated.

NOTE: The Dental Rewards dollars cannot be applied to Orthodontia benefits.

If you do not enroll within 30 days after your date of hire or eligibility, and enroll instead during the open enrollment period in the fall, you will be considered a “late entrant.”

As a late entrant, your benefits during the first months of coverage will be limited to preventive services: two preventive routine care exams (not including X-rays), two routine cleanings, and one fluoride application for children under age 19. No other dental or orthodontia procedure or services will be covered during the first 12 months, if a member is enrolled as a late entrant.

Periodontal procedures, including maintenance/cleanings, will not be covered during this 12-month period.

Once you have been enrolled in a Duke dental insurance plan for at least 12 months, the late entrant provisions no longer apply, and your insurance will also cover basic and major procedures such as fillings, extractions, crowns, root canals, and periodontal treatment (including periodontal maintenance, which applies toward cleaning frequency).

This 12-month waiting period does not apply:

if you are switching from one Duke dental plan to another Duke dental plan,

if you add a child during an open enrollment period prior tohis/her second birthday, or

if you enroll an eligible dependent within 30 days of a qualifying event such as marriage or adoption.

When comparing Duke’s dental plans, it is important to compare out-of-pocket expenses as well as premiums. Here are some questions to ask yourself when choosing a dental plan that matches the needs of you and your family. For specific coverage information, please refer to the Dental Plans Comparison Chart at hr.duke.edu/benefits/enrollment/oe/dental/chart

Can I visit any dentist? No, you must use a network dentist Yes, you may choose any licensed dentist or use a network dentist

If I don’t enroll within 30 days after my date of hire or eligibility and enroll in the future, will I be a “late entrant”?

Will my dependent children who live in a different location be covered?

Is there a dental deductible before the insurance will pay for covered services?

Yes, please see page 15 for more details

Yes, please see page 15 for more details

Yes, you may choose any licensed dentist or use a network dentist

Yes, please see page 15 for more details

Will I have out-of-pocket costs for preventive services?

I need an existing filling replaced. Will it be covered if I enroll in a Duke dental plan?

Yes, they may choose a dentist within a nationwide network

Yes, an annual $50 deductible for “major” services

No

Yes, if the filling is at least 6 months old

Are teeth whitening services covered under dental coverage? No

Is a pre-treatment estimate required?

We strongly suggest you ask your provider to submit a pre-treatment estimate prior to expensive procedures such as crowns, bridges, root canals, etc.

Yes, a $100 lifetime deductible for “basic” services and an annual $75 deductible for “major” services; the deductibles are waived if you use a network provider

Yes, cost sharing may be required if you visit a non-network dentist that charges above U&C

Yes, if the filling is at least 6 months old

Yes, a combined annual $50 deductible for “basic” and “major” services; the deductibles are waived if you use a network provider

Yes

Yes, if the filling is at least 6 months old

We strongly suggest you ask your provider to submit a pre-treatment estimate prior to expensive procedures such as crowns, bridges, root canals, etc.

We strongly suggest you ask your provider to submit a pre-treatment estimate prior to expensive procedures such as crowns, bridges, root canals, etc.

Late Entrant Provision

Preventive: All three plans cover:

■ 2routine exams per year

■ 2routine prophylaxis (cleanings) per year

■ Space maintainers

■ X-rays

■ Fluoride treatments for children under age 19

Basic: All three plans cover:

■ Fillings

■ Sealants

■ Full or partial denture repair

■ Anesthesia for oral surgery Removal of teeth

deductible

Reimbursement at:

■ 80% of MAC1 during first year of coverage

■ 90% of MAC1 during second year of coverage if a covered procedure is received during the first year

■ 100% of MAC1 during third year of coverage and thereafter, if a covered procedure is received in the second and following years.

After a $100 lifetime deductible per person:

Reimbursement at:

■ 80% of U&C2 during first year of coverage

■ 90% of U&C2 during second year of coverage if a covered procedure is received during the first year

100% of U&C2 during third year of coverage and thereafter, if a covered procedure is received in the second and following years.

After a combined basic and major annual deductible of $50 per person, the plan pays a pre-determined fixed amount3 based on the procedure received.

Major: All three plans cover:

■ Crowns

■ Bridgework

■ Partial or full dentures

■ Dentures, prosthodontics and inlays

■ Periodontal maintenance (periodontal cleaning) and gum treatment

■ Endodontic procedures (root canals, etc.)

Orthodontia:

All three plans cover orthodontia only if treatment begins after the participant becomes covered by a Duke Dental Plan.

After a $50 calendar year

After a $75calendaryear deductible per person: deductible per person:

Reimbursement at:

■ 50% of MAC1

■ 65% of MAC1 for

Reimbursement at:

■ 50% of U&C2

■ 65% of U&C2 for periodontic or gum periodontic or gum treatment treatment

65% of MAC1 for

■ 65% of U&C2 for endodontic procedures endodontic procedures

$1,000 lifetime orthodontia maximum benefit per person (adults and children)

$1,000 lifetime orthodontia maximum benefit per person (adults and children)

After a combined basic and major annual deductible of $50 per person, the plan pays a predetermined fixed amount3 based on the procedure received.

$750 lifetime orthodontia maximum benefit per person (adults and children)

1 All payments are based on the Maximum Allowable Charges (MAC). PPO dentists have agreed to accept the contracted fee (MAC) as the maximum charge.

2 All payments are based on the usual and customary (U&C) allowable charge. You are responsible for charges over U&C.

3 The fee schedule, or

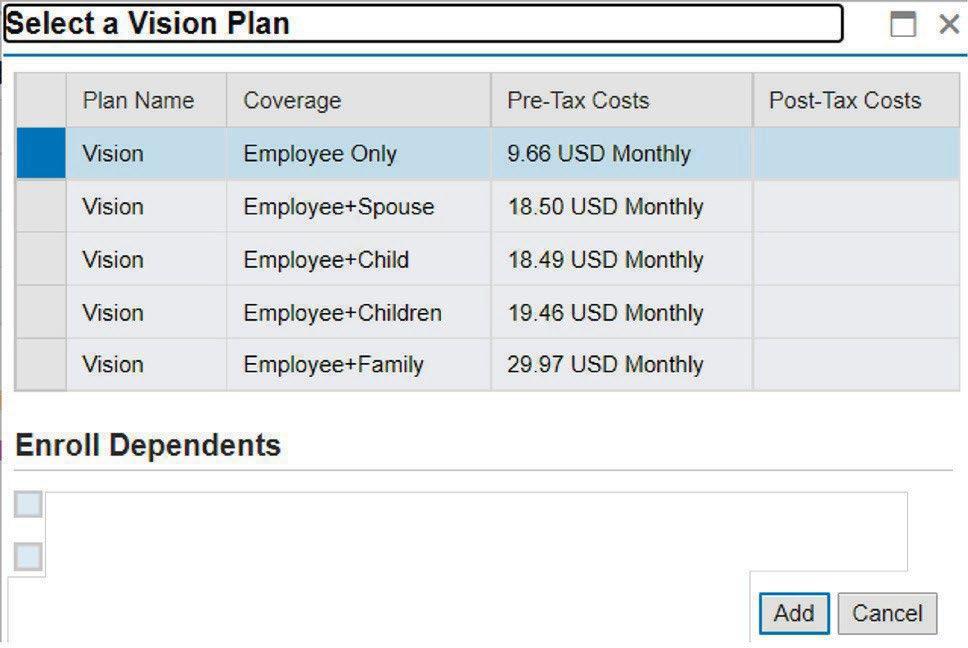

While Duke’s medical plans provide coverage for annual eye exams, Duke also offers eligible employees a nationwide vision plan to manage the cost of eyeglasses and contact lenses, as well as eye examinations. The vision plan, administered by UnitedHealthcare Vision, allows you to pay for vision premiums on a pre-tax basis. You are eligible to participate in the vision plan if you are a regular employee scheduled to work at least 20 hours per week. You do not need to be enrolled in a Duke medical plan to participate in the vision plan.

The vision care plan provides coverage for prescription lenses and frames, contact lenses (in lieu of eyeglasses), and a complete annual eye exam for a low monthly premium. Under the plan, you can visit an optometrist or ophthalmologist within the

UnitedHealthcare Vision network or you may choose to visit an out-of-network provider, which may result in higher out-ofpocket costs. If you visit an out-of-network provider, you must submit a claim to be reimbursed.

Further details about the vision plan are outlined on the next page.

If you have questions about the vision care plan or would like to find a network provider, you may visit myuhcvision.com or call 1-800-638-3120.

Please note: UnitedHealthcare Vision does not issue identification cards to enrolled members. However, you may print a personalized ID card by completing the User information at myuhcvision.com and selecting “Print ID card” from the Member Web Portal page.

Anyone enrolled in one of Duke’s medical plans can continue to receive coverage for an annual eye exam with the medical plan’s copay, including out-of-network physicians. If you enroll in the vision plan, UnitedHealthcare Vision will reimburse you up to $40 when you submit a claim for your medical plan’s vision examination copay if you visit a provider outside of UnitedHealthcare Vision’s network.

Note: The Duke Eye Center is not a participating member of the UnitedHealthcare Vision network for eye exams. However, your Duke medical plan may provide coverage for an annual eye exam at the Duke Eye Center and you are able to use the vision plan with outof-network providers. Additionally, the NCEENT (NC Eye, Ear, Nose & Throat) office located near the Duke Eye Center is a network provider and accepts the vision insurance for the purchase of frames and lenses.

Below is an at-a-glance comparison of how your out-of-pocket expenses may vary depending on whether you have vision care coverage.

Exam1 (once per calendar year)

Materials Copay2

Frames1 (once every two calendar years)

copay

copay

Up to a $150 allowance towards the purchase of frames

30% discount applied to frame allowance overage

Eyeglass Lenses1 per pair (once per calendar year)

Single Vision

Lined Bifocal

Lined Trifocal

Lenticular

Lens Options

Photochromic Lenses, Tints, Standard Anti-Reflective Coating, Standard Scratch-resistant Coating, Ultraviolet Coating, Standard Progressive Lenses, Deluxe Progressive Lenses, Premium Progressive Lenses, Platinum Progressive Lenses, Polycarbonate Lenses for Adults, Polycarbonate Lenses for Dependent Children

Non-covered Lens options

Price Protection available for non-covered lens options ranging from 20-60% off retail pricing at participating providers (except where not permitted by state law)

Contact Lenses1,3 - in lieu of eyeglasses (once per calendar year)

Elective

Covered-in-full contact selection list

Additional Elective Contact Options

Covered-in-full after copay (up to 6 boxes)3 including evaluation, fitting, and up to two follow-up visits

Up to $150 towards the purchase of contacts (materials copay does not apply); does not include fitting fee

1 Usage during prior periods of employment during the same calendar year count towards the 12-month/24-month benefit period.

2 Materials copay is a single payment that applies to the purchase of eyeglass lenses and frames or contact lenses (in lieu of eyeglasses). All contact lenses must be purchased at one time.

3 All 6 boxes of contact lenses must be purchased at one time in order to receive the full $150 in-network allowance. There is only one annual service authorization for this benefit.

4 Determined at the provider’s discretion for one or more of the following conditions: following post-cataract surgery without intraocular lens implant; to correct extreme vision problems that cannot be treated with spectacle lenses; with certain conditions of anisometropia; with certain conditions of keratoconus. If your provider considers your contacts necessary, you should ask your provider to contact UnitedHealthcare Vision confirming how much of a reimbursement you can expect to receive before you purchase such contacts.

Note: The following services and materials are excluded from coverage under the vision care plan: post cataract lenses; non-prescription items; medical or surgical treatment for eye disease that requires the services of a physician; Workers’ Compensation services or materials; services or materials that the patient, without cost, obtains from any governmental organization or program; services or materials that are not specifically covered by the policy; replacement or repair of lenses and/or frames that have been lost or broken; and cosmetic extras, except as stated in the policy.

Premiums

Total premium includes both the Duke and the full-time employee contribution.

Do

You have thirty (30) days after your first day of employment/eligibility to enroll in medical, dental, and/or vision coverage Does My Coverage Begin?

For medical coverage, with enrollment, your coverage will be effective on the first day of the month following your first day of employment/eligibility unless you elect to have medical coverage begin on your date of hire and pay the full premium for the first month of coverage.

For dental and/or vision coverage, with enrollment, your coverage will be effective on the first day of the month following your first day of employment/eligibility. You must be a full-time employee working at least 30 hours per week to be eligible for the Duke contribution towards medical insurance. Part-time staff who work at least 20 hours per week, but less than 30 hours per week, are eligible for medical insurance, however, they must pay the total premium. Seepage 2 for additional eligibility requirements.

Tobacco Use Surcharge: Duke charges employees covered under a Duke medical insurance plan who smoke or use other forms of tobacco an extra $50 per month for Monthly paid employees and $23 per pay period for Biweekly paid employees. The surcharge doesn’t apply to dependents who use tobacco. 18

Tax-advantaged Accounts

Health Savings Account (HSA)

Limited Purpose Flexible Spending Account (LPFSA)

Healthcare Flexible Spending Account (FSA-HCRA)

Dependent Care Flexible Spending Account (FSA-DCRA)

Duke Advantage

Duke Advantage

Duke Select, Duke Options, Duke USA

Dependent care expenses for children under 13 or disabled spouses or parents in elder care

Duke Advantage is Duke’s new High Deductible Health Plan that can be paired with a Health Savings Account (HSA). An HSA-eligible high deductible health plan (HDHP) satisfies certain IRS requirements with respect to deductibles and out-of-pocket expenses. You must elect coverage in the Duke Advantage HDHP in order to be eligible to open and contribute to the Duke HSA.

An HSA is an individual account used in conjunction with an HSA-eligible health plan to cover out-of-pocket qualified medical expenses on a tax-advantaged basis. Your HSA belongs entirely to you, which means it is yours to keep even if you change employers. HSAs can be used to pay for both current and future qualified medical expenses for you and your eligible dependents. You can contribute to your account, withdraw money to pay for qualified medical expenses, and potentially grow your account on a tax-free basis by investing your savings in a wide array of investment options.

You must meet several IRS eligibility requirements in order to establish and contribute to an HSA. It is your responsibility to determine if you are eligible:

You must be enrolled in an HSA-eligible health plan on the first day of the month. For example, if your coverage is effective on May 15, you are not eligible to contribute to or take a distribution from your HSA until June 1.

You cannot be covered by any other health plan that is not an HSA-eligible health plan.

You cannot currently be enrolled in Medicare. A 6-month look-back rule may apply for Medicare enrollment. Therefore, HSA contributions should end 6 months before enrollment in Medicare.

You cannot be claimed as a dependent on another person’s tax return.

If you open an HSA and do not meet the above criteria, your contributions, any investment earnings, and distributions may be subject to income taxes, penalties, and/or excise taxes.

Additionally, in order to open and contribute to an HSA, you must have a valid U.S. address.

Distributions from an HSA used to pay for qualified medical expenses for you, your spouse, and dependents are tax-free provided they meet the IRS definition of a qualified medical expense. The good news is that a lot of expenses qualify for payment or reimbursement, such as:

• Health plan deductibles and coinsurance,

• Most medical care and services,

• Dental and vision care,

• Prescription drugs, over-the-counter medications, and insulin,

• Medicare premiums (if age 65 or older).

Note that these expenses must not already be covered by insurance and non-Medicare health insurance premiums generally do not qualify. Additional information about HSAs and qualified medical expenses can be found in IRS Publications 969 and 502 at www.irs.gov

don't use my HSA for current medical expenses, can I have it for the future?

One of the main benefits of an HSA is that it is flexible depending on your needs. You can use your HSA to save and grow your money tax-free for the future, or you can use it to save money on taxes while paying for qualified medical expenses today. The combination of HSA tax advantages and the breadth of investment options available through an HSA provides an opportunity for potential growth.

Reimbursement accounts (also known as flexible spending accounts) help you take advantage of tax savings on health care and dependent care expenses. Duke offers you three Flexible Spending Accounts (FSA):

General Purpose Health Care Reimbursement Account (Health Care FSA)

Limited Purpose Flexible Spending Account (LPFSA)

Dependent Care Reimbursement Account (Dependent Care FSA)

The General Purpose Health Care FSA is available to all benefits eligible employees not enrolled in the Duke Advantage (HDHP). If you or your spouse are enrolled in a Health Savings Account (HSA), you are not eligible to participate in a Health Care FSA. The Limited Purpose Flexible Spending Account (LPFSA) is only available to employees enrolled in Duke Advantage. The Health Care FSA is used to pay for eligible health expenses such as copays, deductibles, and medical supplies. You will be provided with a HealthEquity Healthcare card you can use to draw money from the account to pay for eligible medical, dental, and vision expenses at the point of sale. The Limited Purpose FSA is used to pay for eligible dental and vision expenses only and is a great companion to the HSA.

Dependent Care Reimbursement Account (Dependent Care FSA) (for reimbursement of day care expenses for eligible dependents). Please note the Dependent Care FSA is only for day care expenses for children up to age 13 or tax-dependent. elderly or disabled adults. The Dependent Care FSA is not for health care expenses incurred by a spouse or child.

Since your contributions are deducted from your pay before federal income, state income, and Social Security taxes have been withheld, you save on taxes.

Do you have medical, dental, vision, or prescription drug expenses that are not covered by your insurance plans, like deductibles, copays, coinsurance, or amounts in excess of usual and customary (U&C) limits?

Do you plan to buy new eyeglasses or contacts, or have your hearing tested, or do you expect orthodontia expenses* that are not covered by insurance?

Do you spend money on day care for your children up to age 13?

Do you have children up to age 13 (and both you and your spouse work, if you are married), who are enrolled in a before- or after-school program, summer day camp, or intersession day camp while you work?

Do you spend money on adult day care for an elderly parent who lives with you and whom you claim as a dependent for income tax purposes?

* If you have questions about flexible spending account orthodontia expense guidelines, please call HealthEquity at (877) 924-3967 for more information. When calling this number, please provide the last four digits of your Duke Unique ID number, when asked for the last four digits of your social security number or employee ID. Your Duke Unique ID is located on the back of your ID badge.

If your answer to any of these questions is yes, then an FSA could be right for you.

Pay directly for many eligible health care expenses by using the Duke Healthcare card provided by HealthEquity. The card deducts pre-tax money directly from an employee’s health care FSA. That means less hassle and less paperwork. More information is available on the next page.

Participating employees may contribute up to $3,400 to the Health Care FSA for the 2026 plan year. The minimum contribution is $130. Your contributions will be deducted pre-tax from your pay.

Please note that elections are effective from your benefit eligibility date until December 31 of the plan year. Deductions are based on (a) pay frequency; and (b) the number of pay periods remaining in the year (for 2026: Monthly = 12 and Biweekly = 26).

Example: If your participation date is March 1, 2026, and you elect $1,200,you will have 10 paycheck deductions in the amount of $120.00 each if you are monthly-paid, or if paid biweekly, 22 paycheck deductions in the amount of $54.55 each. This is assuming your enrollment has been processed before the payroll cycle deadline.

Please note: If you or your spouse are enrolled in a Health Savings Account (HSA), you are not eligible to participate in a Health Care FSA.

On the next page are some examples of out-of-pocket expenses eligible for reimbursement from the Health Care FSA. If you want to check whether a particular expense is eligible, contact HealthEquity, the company that manages our reimbursement accounts, at (877924-3967* or go to www.healthequity.com/fsa-qme or refer to Internal Revenue Service (IRS) Publication 502, available by calling (800) TAX-FORM or by accessing the IRS website at irs.gov Only expenses incurred during the plan year (Jan. - Dec.) and on or after the effective date of coverage will be eligible for reimbursement. Any expenses incurred prior to your participation date in the plan or after your participation in the plan ends are not eligible for reimbursement. NOTE: You have until April 15, 2027 to submit expenses incurred in 2026. However, up to $680 of unused 2026 Health Care FSA funds can be carried over to the next plan year. You must be an active employee in a benefits-eligible work status on December 31 in order to be eligible for the carryover provision.

The healthcare card, provided by HealthEquity, works similarly to a debit card. Each time you use the card, funds are withdrawn from your Health Care FSA and payment is made to the merchant/provider. Using the HealthEquity healthcare card eliminates the need to pay expenses out-of-pocket and having to wait for reimbursement from your flexible spending account. The HealthEquity healthcare card can be used at doctor and dentist offices, vision centers, pharmacies†, and other health care-related merchants who accept Visa debit cards.

You can voluntarily enroll in the Health Care FSA, as part of enrolling for your benefits, you determine how much money you want to contribute to your Health Care FSA, which essentially serves as the “spending limit” for the card. While enrolled in the Health Care FSA, you may submit paper or online claims for eligible health care expenses paid out-of-pocket, use the healthcare card at the point of service, or do a combination of both.

Please review your Health Care FSA balance and transactions monthly to ensure there isn't unauthorized use. Should you see unauthorized use, please let HealthEquity know immediately. Please treat the healthcare card like cash. HealthEquity provides some protections from loss, but only within 60 days of occurrence.

Upon receipt of your healthcare card, please activate the feature to be notified whenever a card transaction is made. This option can be selected by accessing your online reimbursement account via the Duke@Work self-service website at hr.duke.edu/selfservice. and clicking 'Preferences' under your FSA Profile.

The healthcare card cannot be used in 2026 for 2025 expenses.

* Please note: When calling HealthEquity, you will be prompted to provide the last four digits of your social security number or employee ID. You must provide the last four digits of your Duke Unique ID number instead. Your Duke Unique ID is located on the back of your ID badge.

† The easiest way to purchase prescription drugs, and other eligible health care items is to use the card at a merchant with an inventory control system referred to as “IIAS.” Local merchants in our area that are currently IIAS certified are Walgreens, Wal-Mart, Sam’s Club, Target, CVS, Rite Aid, Publix, Harris Teeter, and Kroger. Please note: A pharmacy must be certified in order for the HealthEquity Health Care Card to be accepted. An updated list of IIAS certified merchants is available at hr.duke.edu/benefits/reimbursement-accounts/health-care-account. The on-site Duke pharmacies also accept the HealthEquity Health Care Card.

We have listed below many of the medical expenses eligible for payment under the Health Care FSA, to the extent such expenses are not covered by your medical, dental, or vision insurance. This list is not meant to be all-inclusive. Other expenses not specifically mentioned may also qualify. For additional information, please refer to IRS Publication 502 Medical and Dental Expenses or refer to www.healthequity.com/fsa-qme However, the two exceptions to be aware of are: 1) Insurance premiums are not reimbursable under a Health Care FSA, and 2) The reimbursement under a Health Care FSA is based only upon when the expense was incurred, i.e., date of service, not the date paid. To be eligible, the service has to be provided in the plan year of your participation period.

In general, expenses must be medically necessary and prescribed by your physician. The following are examples of eligible expenses:

Acupuncture Alcoholism treatment

Ambulance fees

Animal trained to aid deaf person

Artificial limbs

Braille books and magazines (cost difference of common product)

Car controls for the disabled

Chiropractor fees

Christian Science practitioner fees

Contact lenses and cleaning solutions

Copays, deductibles, and coinsurance not covered by insurance

Dental fees (for non-cosmetic purposes)

Doctors’ fees

Drug addiction treatment

Eyeglasses (prescribed)

Eye surgery (e.g., LASIK and radial keratotomy)

Face masks

Feminine hygiene care

Guide dogs

Hand sanitizer

Hand sanitizing wipes

Hearing aids/exams

Hospital services

Infertility treatments

Lab fees

Lamaze classes for expectant mothers

Menstrual care products

Mileage (requires receipt from physician and distance traveled)

Nursing services

Optometrist fees

Orthodontia expenses†

Over-the-counter medications

Prescription medications

Psychotherapy for approved medical care (by approved provider)

Smoking cessation program fees and prescription drugs

Surgery (for non-cosmetic purposes)

Telephone for the hearing impaired

Therapy (medical)

Transplants

Tuition at special schools for the disabled (select circumstances only)

Varicose vein treatment

Vision exams

Vitamins (prescribed)

Wheelchairs

X-rays

† If you have questions about FSA orthodontia expense guidelines, please call HealthEquity at (877) 924-3967 or visit hr.duke.edu/benefits/reimbursement-accounts/health-care-account/orthodontia for more information. When calling HealthEquity, you will be prompted to provide the last four digits of your social security number or employee ID. You must provide the last four digits of your Duke Unique ID number instead. Your Duke Unique ID is located on the back of your ID badge.

In the box below are some examples of expenses that are not eligible for reimbursement under a Health Care FSA. If you want to check whether or not a particular expense is eligible for reimbursement, contact HealthEquity, the company that manages Duke’s flexible spending accounts , at (877) 924-3967 or go to www.healthequity.com/fsa-qme. When calling HealthEquity, you will be prompted to provide the last four digits of your social security number or employee ID. You must provide the last four digits of your Duke Unique ID number instead. Your Duke Unique ID is located on the back of your ID badge.

Expenses to promote general health are not reimbursable under the Health Care FSA. This list is not meant to be all-inclusive. The following are examples of ineligible expenses:

Babysitting & child care

Breast pumps*

Hair loss medication

Cancelled appointment fees Hair transplant

COBRA premiums

Contact lens insurance

Cosmetic surgery/procedures

Custom fit overs (clip-ons)

Dancing lessons

Diaper service

Discounted fees/write-offs

Electrolysis

Exercise equipment*

Eyeglass insurance

Face masks with vents and/or valves

Face shields

Fitness programs

Health club dues

Treatment program (at a health club)

Herbs & herbal medicines

Illegal operation or treatment

Insurance premium interest charge

Insurance premiums

Marriage counseling

Massage therapy**

Maternity clothes

Personal trainer

Prescription drug discount program premiums

* Eligible only with doctor’s certification identifying the medical condition and length of treatment program.

Sanitizing wipes for surfaces (e.g. Clorox Wipes & Lysol Wipes)

Special foods* (cost difference of common product)

Student health premiums

Swimming lessons*

Tattoo removal

Teeth whitening/bleaching

Toiletries, toothpaste, etc.

Veneers*

Vision discount program premiums

Vitamins (unless prescribed by physician)

Weight loss programs and/or drugs (unless prescribed by physician)

** Eligible only with doctor’s certification identifying the physical nature of the medical condition and length of treatment program. Massage therapy for the sole purpose of tension/stress relief or depression (even with a doctor’s statement) does not qualify as an eligible expense.

Eligible employees may contribute up to $7,500 per year to the Dependent Care Flexible Spending Account. The minimum contribution is $130. Your contributions will be deducted pre-tax from your pay. Please note that elections are effective from your benefit eligibility date until December 31 of the plan year. Deductions are based on (a) pay frequency; and (b) the number of pay periods remaining in the year (for 2026: Monthly = 12 and Biweekly = 26).

Example: If your participation date is March 1, 2026, and you elect $5,000, you will have 10 paycheck deductions in the amount of $500.00 each if you are monthly-paid, or if paid biweekly, 22 paycheck deductions in the amount of $227.27 each. This is assuming your enrollment has been processed before the payroll cycle deadline.

Below are some examples of out-of-pocket expenses eligible for reimbursement from the Dependent Care Flexible Spending Account. This is not a complete list. If you want to check whether a particular expense is eligible, contact HealthEquity at (877) 924-3967* or go to www.healthequity.com/dcfsa-qme or refer to IRS Publication 503, available by calling (800) TAX-FORM or by accessing the IRS website at irs.gov Only expenses incurred the first of the month following your date of hire/eligibility through the last day of the plan year (December 31, 2026), and during the participation period will be eligible for reimbursement. Use the HealthEquity calculator at www.wageworks.com/calculators/fsa- savings-calculator/ to help you decide how much to contribute.

Expenses incurred which allow you (and your spouse, if married) to work, look for work, or attend school as a full-time student are eligible and include:

For children up to age 13 -

■ Day care center or preschool (excluding transportation, lunches, and educational services)

■ Local day camp

■ Before-school and after-school day care programs

■ In-home babysitting services (during your working hours; income must be claimed by your care provider)

Household services for the care of an elderly or disabled spouse or dependent who lives with you

FICA and other taxes you pay for day care providers

Nursery school and preschool (preschool expenses are eligible if the amount you pay for schooling cannot be separated from the cost of care)

Expenses at an adult day care facility for an elderly or disabled spouse or dependent who lives with you and for whom you claim as a dependent for income tax purposes (but not expenses for overnight or nursing home facilities)

Please note: A qualifying life event (QLE) is permissible to stop a dependent care reimbursement account deduction due to a child not attending day care or a day camp, or if there is an increase in day care cost. No refunds are allowed for any monies already contributed to a dependent care flexible spending account, per Internal Revenue Code regulations.

* Please note: When calling HealthEquity, you will be prompted to provide the last four digits of your social security number or employee ID. You must provide the last four digits of your Duke Unique ID number instead. Your Duke Unique ID is located on the back of your ID badge.

Here are special federal tax guidelines you need to keep in mind if you decide to contribute to a Dependent Care FSA:

Your total contribution cannot be greater than your earned income or your spouse’s earned income, whichever is lower. This means if your spouse’s salary is $4,000 and your salary is $30,000, the most you can contribute is $4,000. In addition, your deposit to the Duke reimbursement accounts may not exceed half of your gross pay each pay period.

If your spouse has no earned income, you are not eligible for a Dependent Care FSA. However, there are special rules if your spouse is a full-time student or is disabled. Contact HealthEquity at (877) 924-3967* for more information.

You may use a combination of the Dependent Care FSA and the Dependent Care Tax Credit. However, participation in the Dependent Care FSA offsets on a dollar-for-dollar basis the allowable expenses that are used to calculate the dependent care tax credits on your income taxes. You will need to determine whether you can save more income tax through the Dependent Care FSA or through dependent care tax credits. The best approach will depend upon your eligibility for the Earned Income Tax Credit, dependent care expenses, marital status, and adjusted gross income. Before making your decision to participate, you may want to consult your tax advisor

If both you and your spouse are enrolled in a Dependent Care FSA, your household contribution limit is $7,500.

The provider’s name, service date, dependent name, and amount billed are required on the documentation/receipt when a Dependent Care FSA claim is submitted. Provider signature is NOT required, but can replace the need for other proof of service.

If you participate in the Dependent Care FSA, you must complete IRS Form 2441, “Child and Dependent Care Expenses,” along with your IRS Form 1040, “U.S. Income Tax Return.”

The Dependent Care FSA Plan is required to complete annual testing to ensure compliance with IRC regulations. One test examines the participation rates in the plan by income levels. If participation rates are not in accordance with the regulations, your contribution amount may be adjusted. The Duke Benefits Office will contact you to provide notice in advance of any adjustment.

If you are a divorced or separated parent, check with your legal or tax advisor to see if special rules apply to you that would enable your child to be claimed by the non-custodial parent or by both parents.

If two or more people want to claim the same child as their qualifying child, the person who has the right to is: (1) the child’s parent, if one person is the child’s parent and the other is not, (2) the parent with whom the child lives with longest in the year, if both people are the child’s parents, (3) the parent with the higher adjusted gross income, if both people are the child’s parents and the child lives equally with both during the year, or (4) the person with the higher adjusted gross income, if both people are not the child’s parents.

* Please note: When calling HealthEquity, you will be prompted to provide the last four digits of your social security number or employee ID. You must provide the last four digits of your Duke Unique ID number instead. Your Duke Unique ID is located on the back of your ID badge.

If you use a Duke-contracted facility, such as the Duke Children’s Campus, and receive a subsidy, the amount you can contribute to the Dependent Care FSA is reduced dollar-for-dollar. Contact the Duke Human Resource Information Center at (919) 684-5600 for more information.

Dependents are defined differently between the Health Care FSA and Dependent Care FSA.

Health Care Flexible Spending Account (HFSA) & Limited Purpose FSA (LPFSA)

Any dependent you claim on your federal income tax return — your spouse, your unmarried children, and even a dependent parent — is a dependent under the Health Care Reimbursement Account. Also, special rules allow a dependent to be eligible for the Health Care FSA even when that dependent does not qualify to be claimed as your tax dependent on your tax return form. Additionally, the person must be a U.S. citizen, U.S. national, or resident of Canada or Mexico.

Children up to age 13 or otherwise qualified individuals whom you claim as a dependent on your federal income tax return such as your spouse, parent, or child, regardless of age, who live with you more than half the year and are incapable of caring for themselves are dependents under the Dependent Care FSA.

Please note the Dependent Care FSA is only for day care expenses for children up to age 13 or tax- dependent elderly or disabled adults. The Dependent Care FSA is not for health care expenses incurred by a spouse or child.

The reimbursement account plans are governed by Internal Revenue Code guidelines that limit the reimbursement of healthcare expenses and dependent care expenses to legal dependents.

Check with your legal or tax advisor to verify that your dependents are, in fact, eligible for these plans.

Estimate your expenses carefully when deciding how much you want to contribute for the year. You may be reimbursed for eligible services incurred from the effective date of your reimbursement account through December 31, 2026. You have until April 15, 2027 to submit expenses incurred in 2026. However, up to $680 of unused Health Care FSA funds can be carried over to the next plan year. You must be an active employee in a benefits eligible work status on December 31 in order to be eligible for the carryover provision. Carryover is only available for the Health Care FSA.

Duke provides $10,000 of Basic Life (term) and $10,000 of Accidental Death and Dismemberment (AD&D) Insurance for active benefits eligible staff regularly scheduled to work at least 20 hours per week, regular rank faculty, and full-time faculty, at no cost to you. This coverage ends at retirement or termination of employment. When coverage ends, you may convert your life insurance coverage to an individual whole life policy and pay the cost of the coverage directly to the insurer. Designate your beneficiaries* online at hr.duke.edu/selfservice

In the event of your death while you are in a full-time employment status and meet plan eligibility requirements, Duke pays a benefit equal to the amount of one month’s pay for each year of continuous full-time service, up to a maximum of six months and plan limits, if applicable, to your spouse or estate only. You will be eligible for this benefit after one year of service as a full-time employee. Eligibility for this benefit ends at retirement or termination of employment.

Duke provides eligible employees a benefit of up to $200,000 in the event of your accidental death while you are out of your city of employment on Duke business and receiving travel reimbursement. The plan pays up to $5,000 for related medical expenses. Coordination of benefits may apply. The plan also provides a $5,000 benefit when a covered person suffers covered loss at any time while insured by this policy. Duke pays the entire cost for coverage. Eligibility for this benefit ends at retirement or termination of employment.

Duke offers international help through International SOS Assistance. This program provides Duke travelers the highest possible level of travel, medical and security advice and services, as well as online access to information many insurance companies do not offer. Duke requires all travelers on the University’s behalf to maintain medical insurance which covers them while abroad; the International SOS Assistance is not medical coverage. For more details regarding travel assistance, please visit the Human Resources website at https://travel.duke.edu/isos-cigna/

Duke provides long term disability coverage to eligible employees to replace 60% of your base salary, to a maximum of $35,000 per month, while you are experiencing a disabling illness or injury. You will be eligible for this program as of the first day of the month after completing three years of full-time continuous service as long you are actively at work and benefits-eligible.

If you are a full-time employee scheduled to work at least 30 hours per week, regular rank faculty, or full-time faculty of Duke University Health System, you may be eligible for long term disability benefits if you are out of work due to an illness or injury for more than 90 calendar days.

If you are a staff member working 30 or more hours per week, regular rank faculty, or full-time faculty of Duke University, you may be eligible for long term disability benefits if you are out of work due to an illness or injury for more than 120 calendar days.

Can the Duke Disability Program Waiting Period be Waived?

If you had an employer-sponsored long term disability plan within 90 days of full-time employment at Duke, you may participate in the Duke Disability Program as of the first of the month after your hire date (waiving the normal three-year waiting period). You must provide proof of your prior coverage within 90 days after your date of hire to be eligible.

If you would like to see if you are eligible for this waiver, the “Duke Disability Program–Request for Service Requirement Waiver” form is available at hr.duke.edu/disability waiver

It is your responsibility to provide proof of prior employersponsored long term disability coverage and to confirm receipt of proof by the Duke Benefits Office within 90 calendar days after your date of hire or full-time benefits eligible status.

An individual (non-group) LTD disability plan does not qualify for LTD waiver consideration.

Duke offers free, confidential professional assistance in resolving personal and family problems through the Personal Assistance Service (PAS). All Duke employees and their immediate family members are eligible to use PAS. PAS counselors provide assessment, consultation, referral, and short-term counseling for problems such as emotional distress, family and marital difficulties, alcohol or drug abuse, stress at home or work, and financial or legal concerns. All services are provided at no charge. For faculty and staff residing in North Carolina, you may reach a PAS counselor at (919) 416 -1727 between the hours of 8 a.m. and 5 p.m., Monday through Friday. Faculty and staff residing outside the state of North Carolina have services provided through Business Health Services (BHS), available by calling (800) 327-2251.

*It is the employee’s sole responsibility to ensure that your beneficiary designation is up to date and reflects any change in your life circumstances.

The benefit time-off program for which you are eligible is linked to whether your position is within Duke University or Duke University Health System. Employees within the Duke University Health System are eligible for the Paid Time Off (PTO) program, and employees with the University are eligible for traditional vacation, holiday, and sick time. Generally, employees must be scheduled to work at least 20 hours per week to be eligible to accrue time off. Time off for programs described below differs from the time below described for staff. Please refer to the applicable faculty handbook or employment agreement for details, or speak with your departmental manager to assure you have the needed information.

The Paid Time Off (PTO) program puts vacation, sick leave, and holidays into one program. This gives employees more flexibility in scheduling time off while meeting the staffing and operational needs of the Health System. DUHS employees accrue time off based on years of service and whether they are in an hourly-paid or monthly-paid position.

PTO eligible employees also have access to three days of bereavement leave to handle matters related to a death in the family. Pay for missed work due to bereavement leave is paid at base rate (with shift differential and weekend work premium not applicable).

Monthly-paid employees accrue 30 days of PTO per year during their early years of employment. This increases to 40 days after a certain number of years as illustrated below:

If Your Position is Within Duke University (including Academic, Medical and Research Units):

Holidays — There are 14 paid holidays per year

Sick Leave — Duke provides paid time off for personal illness or to care for sick members of your immediate family. University staff accrue 12 sick days per year. Unused sick leave may be accumulated without limit.

Vacation — Staff may accrue from two weeks up to four weeks of vacation per year. Accrual rates increase depending upon the level of your job, length of service, and job classification Please see charts below for accrual rates. The maximum carry-over is two times your annual accumulation. Your department head or manager will notify you of your annual vacation time accrual. hr.duke.edu/benefits/time-away/university

All monthly-paid employees accrue three weeks of vacation per year during their early years of employment. This increases to four weeks after a certain number of years as illustrated below:

* The beginning accrual rate is three weeks of vacation per year (1.25 days per month)

Biweekly-paid employees initially accrue up to two weeks of vacation per year and this increases to four weeks after a number of years as illustrated below:

In order to assist and to support new parent relationships through its leave policies and programs, Duke provides Paid Parental Leave. To be eligible for Paid Parental Leave, you must be a benefits eligible staff member working 30 or more hours per week after completing one year of employment. Paid Parental Leave provides six consecutive weeks of 100% pay following the birth or adoption of a child. If you have questions about the Paid Parental Leave program, you may visit hr.duke.edu/benefits/time-away/paid-parental-leave or contact the Staff and Labor Relations office.

Please note: This policy may not be applicable to faculty and to employees covered under a union contract. Employees covered under a union contract should refer to their respective contract.

Duke offers two different education benefits, the Employee Tuition Assistance Program (ETAP) and the Children’s Tuition Grant Program. While the ETAP program is available to employees within Duke University and Duke University Health System, the Children’s Tuition Grant Program is only available to employees within Duke University.* Please talk with your supervisor or Human Resources representative if you have any questions about whether your position is part of Duke University or Duke University Health System.

The Employee Tuition Assistance Program provides reimbursement of tuition for classes which provide academic credit and are taken at Duke or any other accredited higher educational institution. This program provides reimbursement of tuition for a maximum of three classes per semester or quarter (limit nine classes per calendar year) up to $5,250 per calendar year for full-time employees with at least 6 months of continuous full-time service.

The Children’s Tuition Grant Program provides a grant for undergraduate tuition expenses incurred by the children of eligible employees. The program provides a grant of up to 75% of Duke’s tuition, after applying a deductible. The benefit may be used for the child’s full-time study at the associate or baccalaureate level at any approved, accredited, degree-granting institution of higher education in the world, to obtain his/her first bachelor’s degree. Children up to age 26 are eligible for this benefit.

You may be eligible to participate in this program after you have completed five consecutive years of full-time service with Duke University or Medical Center.

Newly hired Duke University Health System employees are not eligible for this benefit. Please note that the Children’s Tuition Grant Program is NOT available to new employees in the Health System (e.g., working with Duke Hospital, Duke Regional, Duke Raleigh, PRMO, Duke Primary Care, Duke Cancer Center, Duke Homecare and Hospice, and all other areas/units included as Duke University Health System).

Please talk with Human Resources if you need additional information regarding whether this program may apply to you.

Duke offers severance pay benefits for employees not paid entirely from grant funds who are terminated due to Duke’s operational needs and not due to misconduct or poor performance. Benefits are equal to one week of base pay or salary multiplied by completed years of continuous service up to a maximum of 26 weeks. The minimum benefit amount is two weeks. You are eligible for this benefit if you are a part- or full-time Duke University or Duke University Health System employee scheduled to work at least 20 hours per week. Faculty are not eligible for this benefit.

*Employees represented by a union should refer to their collective bargaining agreement for educational benefit details.

Many financial experts estimate that you will need 75% to 90% of your final working income in retirement. It is unlikely that any one retirement benefit plan will replace this much of your income. However, the three sources below can work together to help you retire more comfortably.

Faculty and Staff Retirement Plan

You can voluntarily contribute to your retirement through this 403(b) plan regardless of whether you are an employee paid on a biweekly basis or an employee paid on a monthly basis. The plan allows you to make voluntary contributions on a pre-tax basis, Roth after-tax basis, or a combination of both.

Employees’ Retirement Plan

(for employees paid on an hourly or biweekly basis except for Duke Health Lake Norman employees) — A pension plan designed to provide you with a guaranteed monthly income at your retirement, paid entirely by Duke. However, there are special provisions that apply to Commissioned Police Officers which are outlined in the Employees’ Retirement Plan for Commissioned Police Officers’ Summary Plan Description. You automatically become a member of the plan if you have reached age 21 and have completed one year of employment, working at least 1,000 hours. You will be entitled to receive plan benefits after completing five years of continuous service, which is called vesting. You can retire with benefits at normal (age 65), early, or postponed retirement. If you elect early retirement, your benefit will be reduced. The benefit at retirement is based on a formula that includes years of service, average final pay, and your age at retirement.

Examples of an employee’s accrued benefit under this plan is outlined below, to illustrate how this plan can benefit you in retirement:

This Employees’ Retirement Plan benefit can be a significant supplement to employees’ voluntary pre-tax savings in the Faculty and Staff Retirement Plan and Social Security benefits. Additional information about the Employees’ Retirement Plan can be found at hr.duke.edu/erp.

Faculty and Staff Retirement Plan

(for employees paid on a salaried or monthly basis and all Duke Health Lake Norman employees paid both biweekly or monthly) — A defined contribution 403(b) retirement plan. In general, salaried employees paid monthly are eligible for the Duke contribution to the Faculty and Staff Retirement Plan after completing one year of service and reaching age 21; however, vesting rules apply. More details about Duke’s contribution are available on page 34.