VOL 01 | ISSUE 03 | NOVEMBER 2025

VOL 01 | ISSUE 03 | NOVEMBER 2025

Cover Page & Entire Design: SA Graphic Studio

MENTOR

Shri. Rahul Gupta, IPS

SP North & Cyber Crime

EDITOR IN CHIEF

Mr. Sahil Awasthi

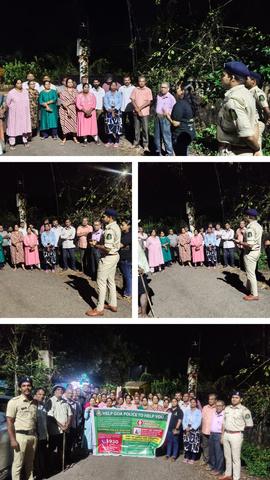

Cyber Yoddha, Goa Police

EDITOR

Ms. Neelam Prajapat

Cyber Yoddha, Goa Police

PUBLISHER

Mr Flavel Monteiro

Cyber Yoddha, Goa Police

MEMBERS

LPSI Yashika Sancoalkar

Cyber Crime Police Station, Raibander

Ms Manjari Madkaikar

Cyber Yoddha, Goa Police

Mr. Franco Caetano De Araujo

Cyber Yoddha, Goa Police

LAYOUT & DESIGN

SA Graphic Studio

Dear Readers,

Thank you for picking up this issue of Cyber Defenders Magazine. Every month, we try to bring you topics that matter in our daily digital lives, and this time we’re focusing on something many people still fall for Ponzi Schemes.

These scams usually start with big promises: “Guaranteed returns,” “Double your money,” “No risk at all.” They may look genuine, come from someone you trust, or even appear on social media with fancy videos. But behind the scenes, it’s just a cycle of taking money from new people to pay the old ones until one day it all collapses

Our aim is not to scare you, but to make you aware so that whenever a “too good to be true” offer comes your way, you know exactly what to look out for

Thank you for being a part of our growing community Stay alert, stay informed, and let’s continue building a safer digital world together

Sahil Awasthi

~ Mr. SAHIL AWASTHI Editor In Chief, Cyber Defenders

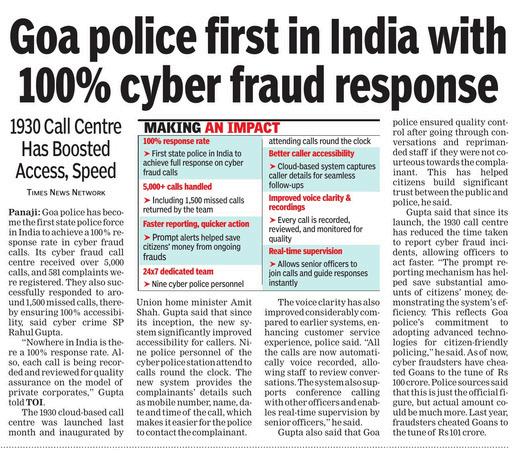

It is heartening to see Cyber Defenders continue its mission of spreading awareness about digital safety and financial responsibility. In a time when technology has made investing just a click away, understanding the risks involved and making informed decisions has become more important than ever.

This edition’s focus on Ponzi schemes highlights a serious challenge affecting individuals, families, and communities across all age groups, especially the youth Financial fraud can cause not only monetary loss but also deep emotional distress, broken trust, and lasting hardship Awareness is the strongest tool for prevention, and timely knowledge can save countless people from falling into such traps

Each of us has a responsibility to be cautious, to verify before trusting, and to guide others toward safe financial practices By staying informed and alert, we can help build a safer digital and financial environment for everyone

~ Shri RAHUL GUPTA, IPS Superintendent of Police Crime & Cyber Crime Goa Police

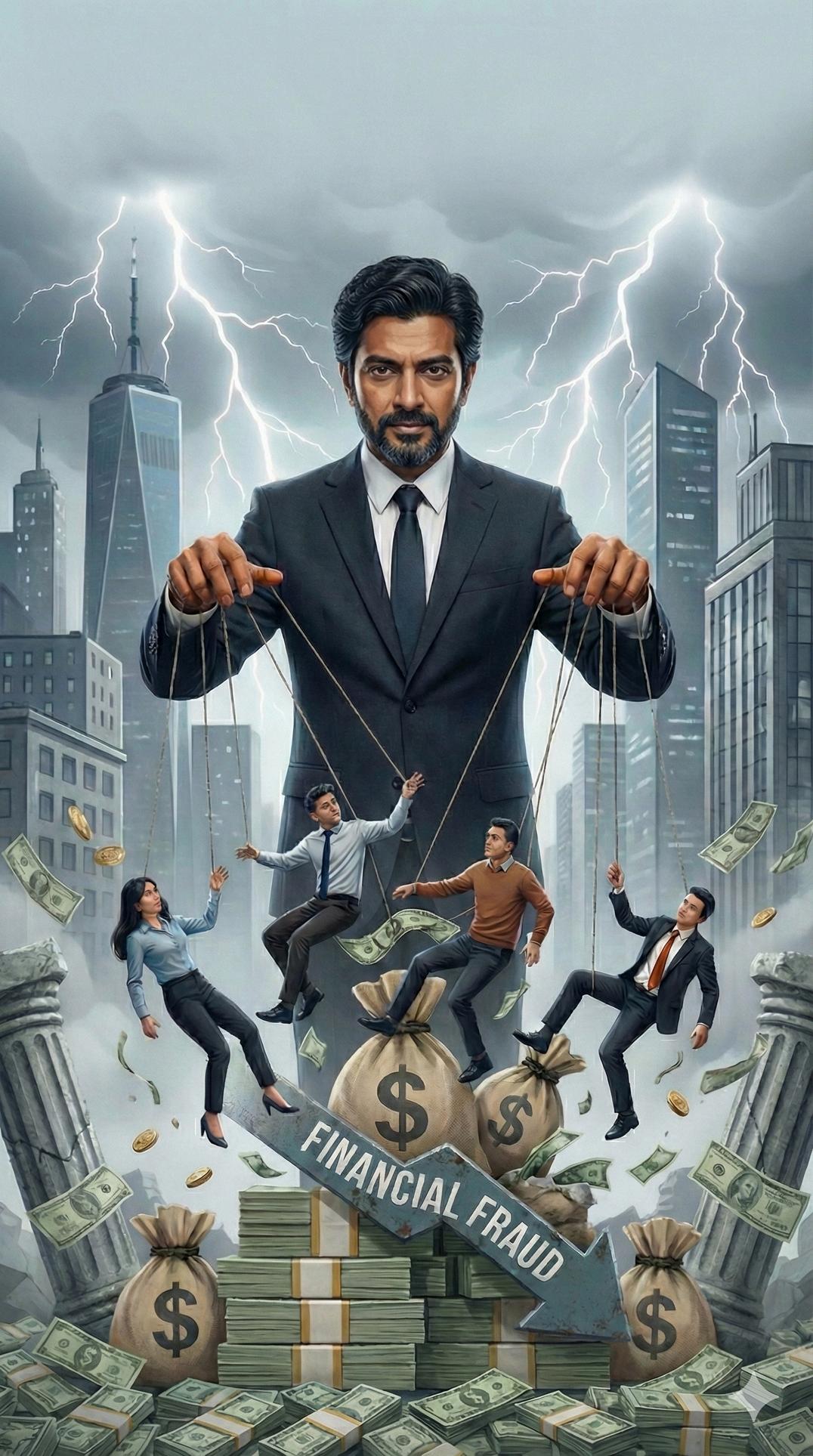

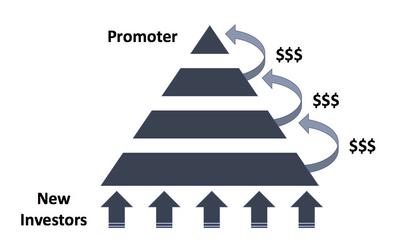

Ponzi schemes are a form of financial fraud that promise high or guaranteed returns with little or no risk These schemes operate by using the money of new investors to pay returns to earlier investors, creating a false image of profitability

Instead of being generated from legitimate business activities, the profits come directly from the funds contributed by unsuspecting victims. Such schemes often collapse when new investments stop flowing in.

The core danger of a Ponzi scheme lies in deception. Fraudsters lure people by showcasing fake success stories, fabricated profit statements, and emotional manipulation. Victims are often encouraged to reinvest their earnings and bring in friends and family members. This chain continues until the system becomes unsustainable, leading to massive financial losses for the majority of participants.

WHERE DO PONZI SCHEMES OPERATE MOST?

✔ Social Media Platforms

✔ Messaging Apps & Groups

✔ Fake Investment Websites

✔ Cryptocurrency & Forex Scams

✔ Referral & Chain Marketing Networks

✔ Online Trading & App-Based Schemes

Guaranteed high returns with zero risk

Pressure to recruit new members

Lack of clear business model

No proper registration or legal documents

Delays in withdrawals

Heavy focus on commissions over real products

The implications of cyberbullying extend beyond those who are directly targeted; they can also adversely affect the reputations of the perpetrators and any bystanders who engage in or tacitly support such behaviour.

Cyberbullying is a crime in India and is punishable under various laws like the Information Technology (IT) Act, 2000, and the Indian Penal Code (IPC), so report it if you are a victim, you can either register a complaint on https://cybercrime.gov.in/ or call 1930.

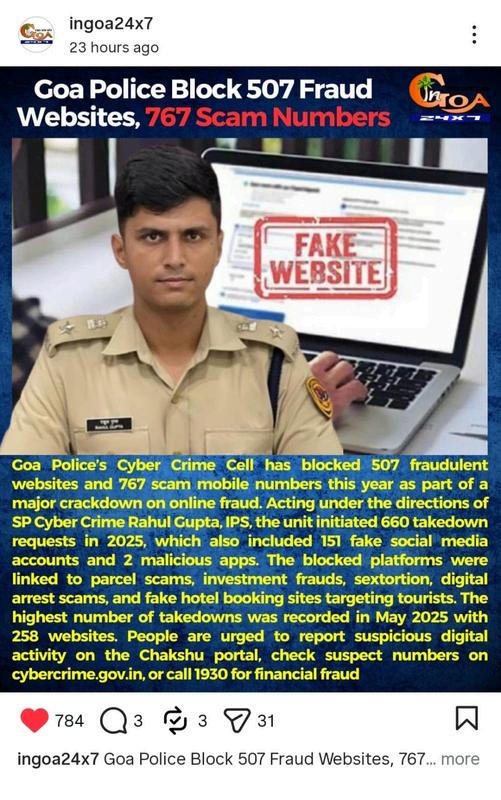

Ponzi schemes thrive on greed, fear, and lack of financial awareness. No genuine investment offers guaranteed returns without risk. Staying informed, verifying platforms, and refusing suspicious offers are the best ways to protect yourself and others. If it sounds too good to be true it probably is.

A large number of victims fall within the 18–35 age group students, young professionals, and small business owners hoping to grow their income quickly. Most victims start with small investments, see quick returns, and then invest large sums sometimes even borrowed money The scam collapses once new investors stop joining Ponzi schemes are not just about money they destroy families, friendships, and mental peace Victims often suffer in silence due to shame and fear of judgment Some hesitate to report because the person who introduced the scheme may be a close friend or relative

CYBER CRIME HELPLINE

CYBER CRIME NATIONAL

HELPLINE - WEBSITE