Tim Davis

The Ha mptons Luxury M arket Leader

4TH

QUARTER REPORT 2025

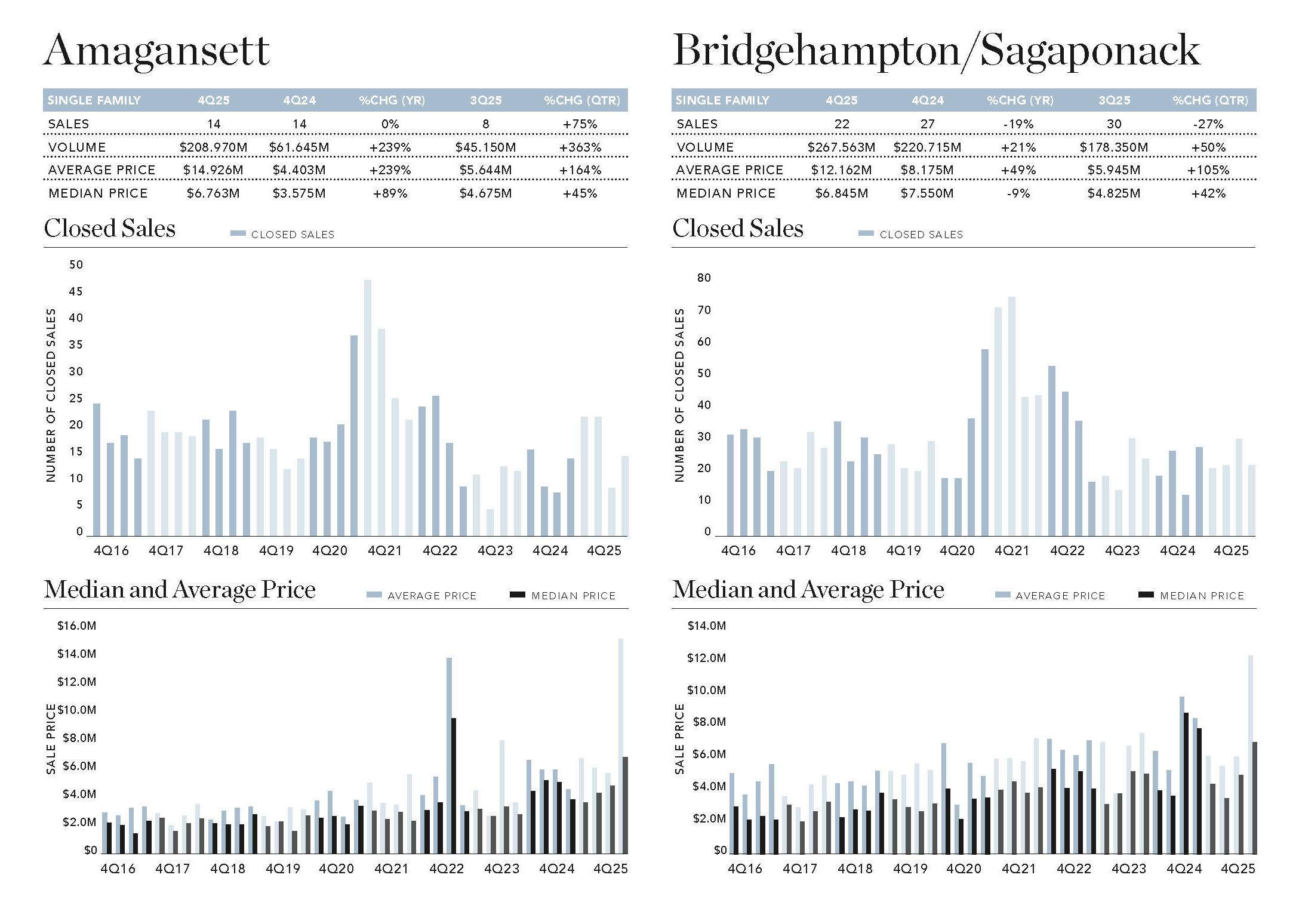

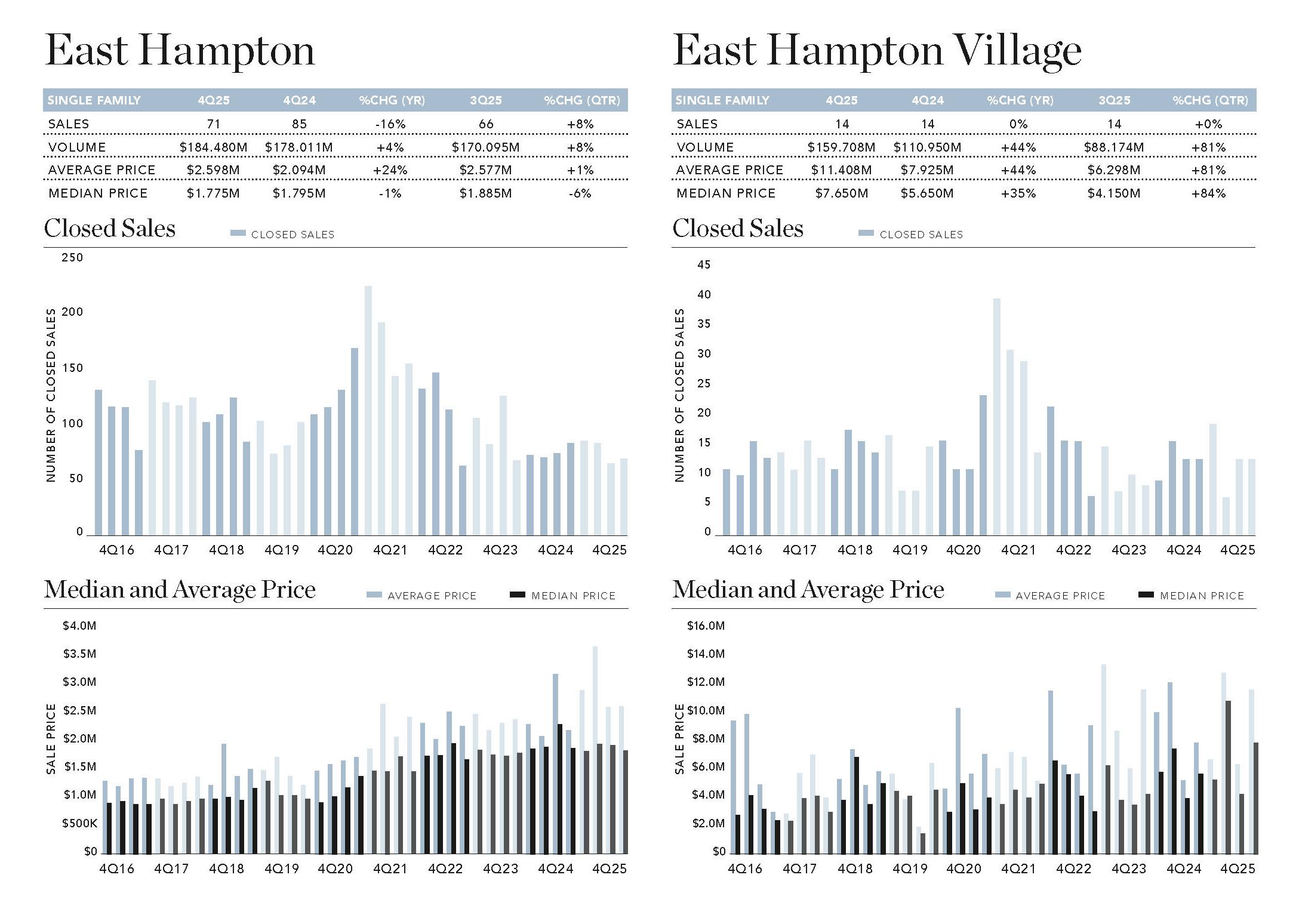

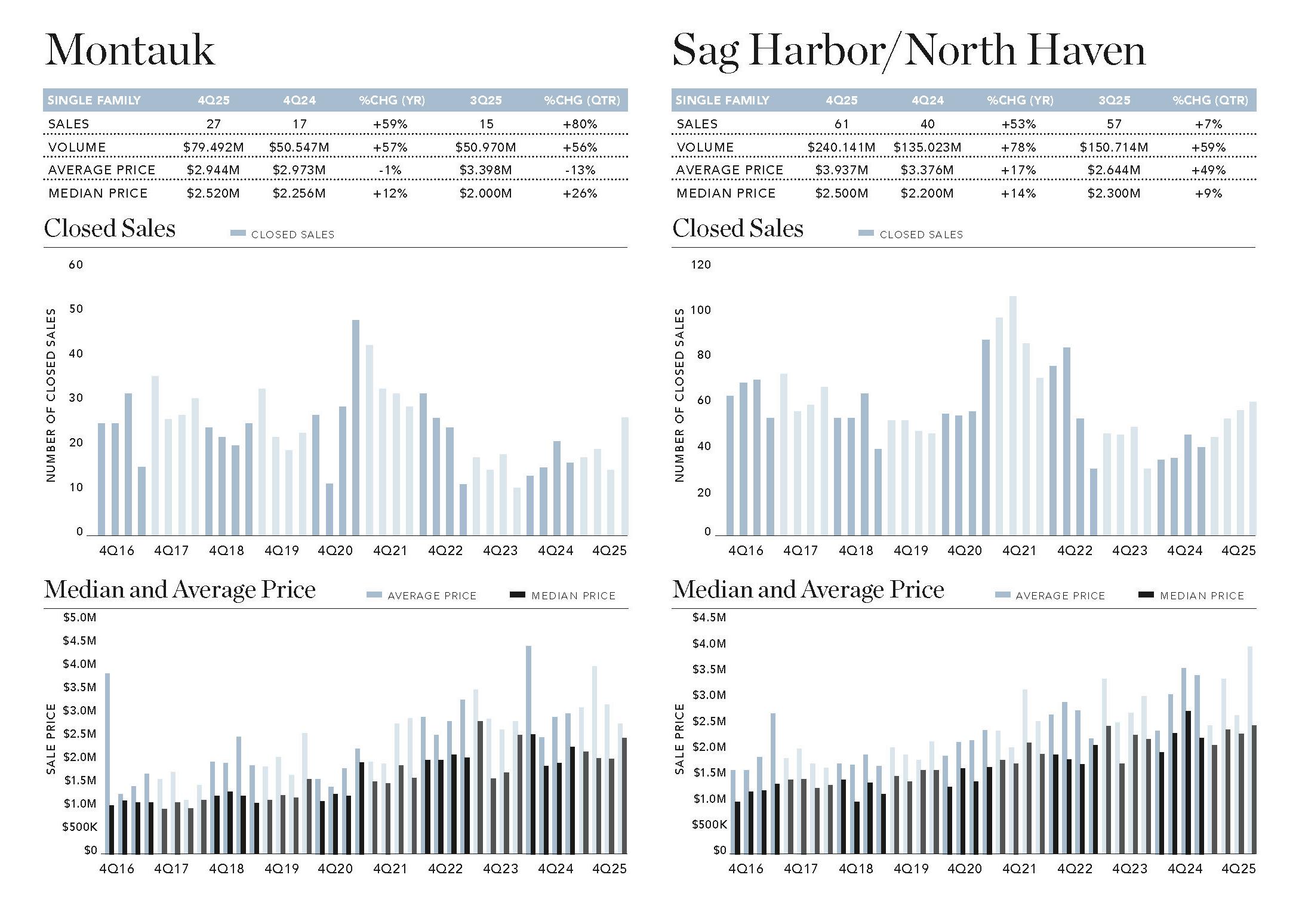

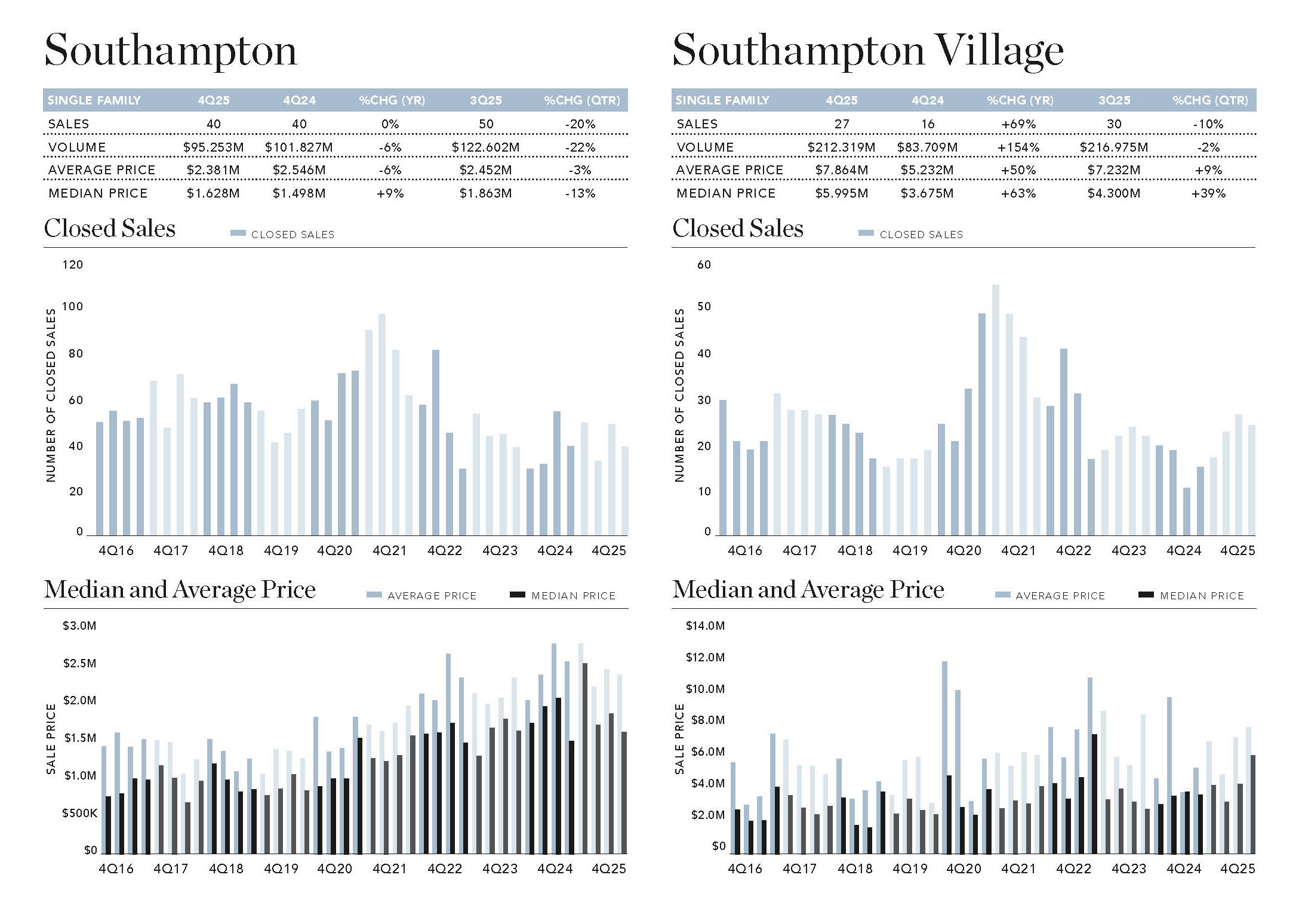

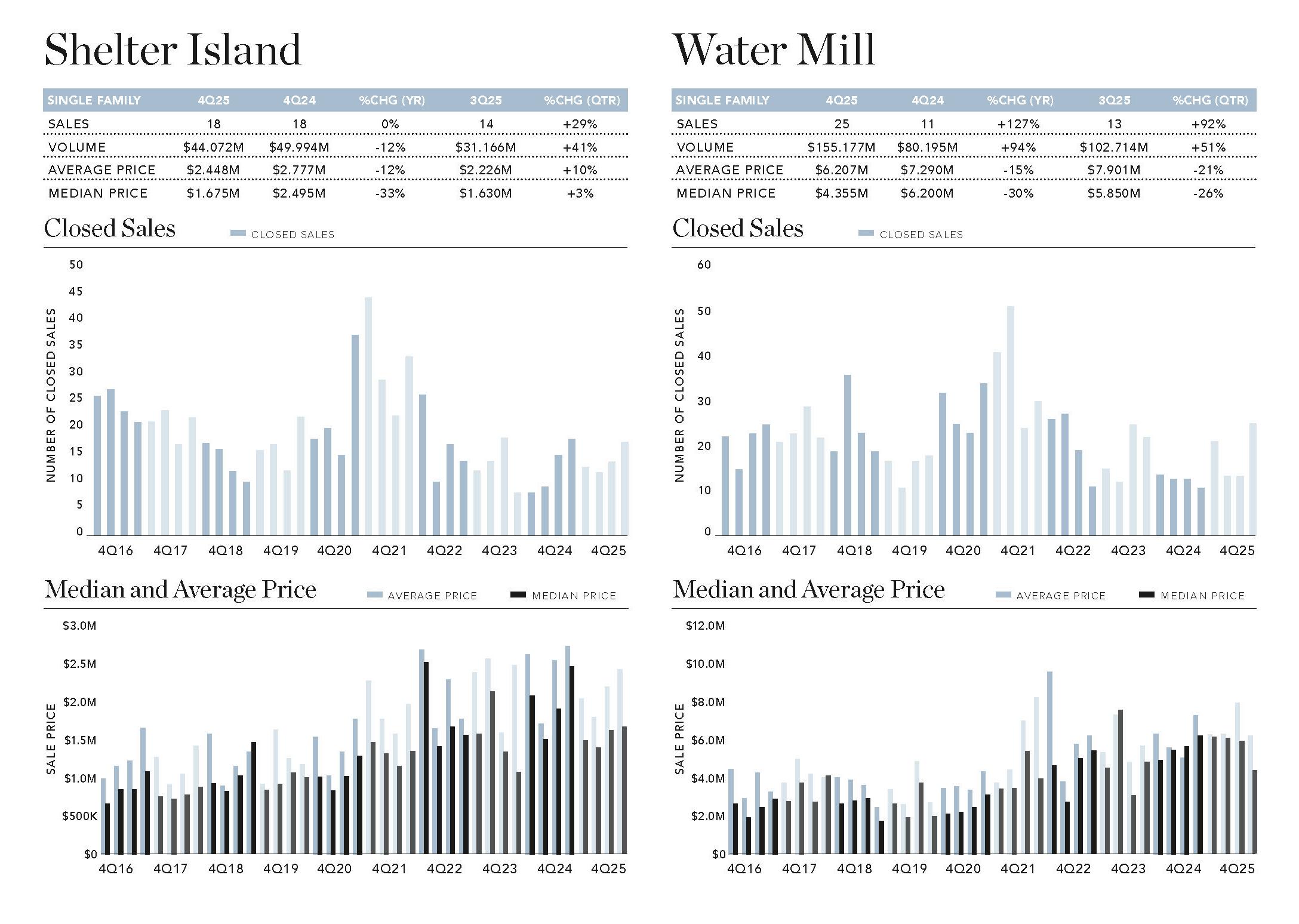

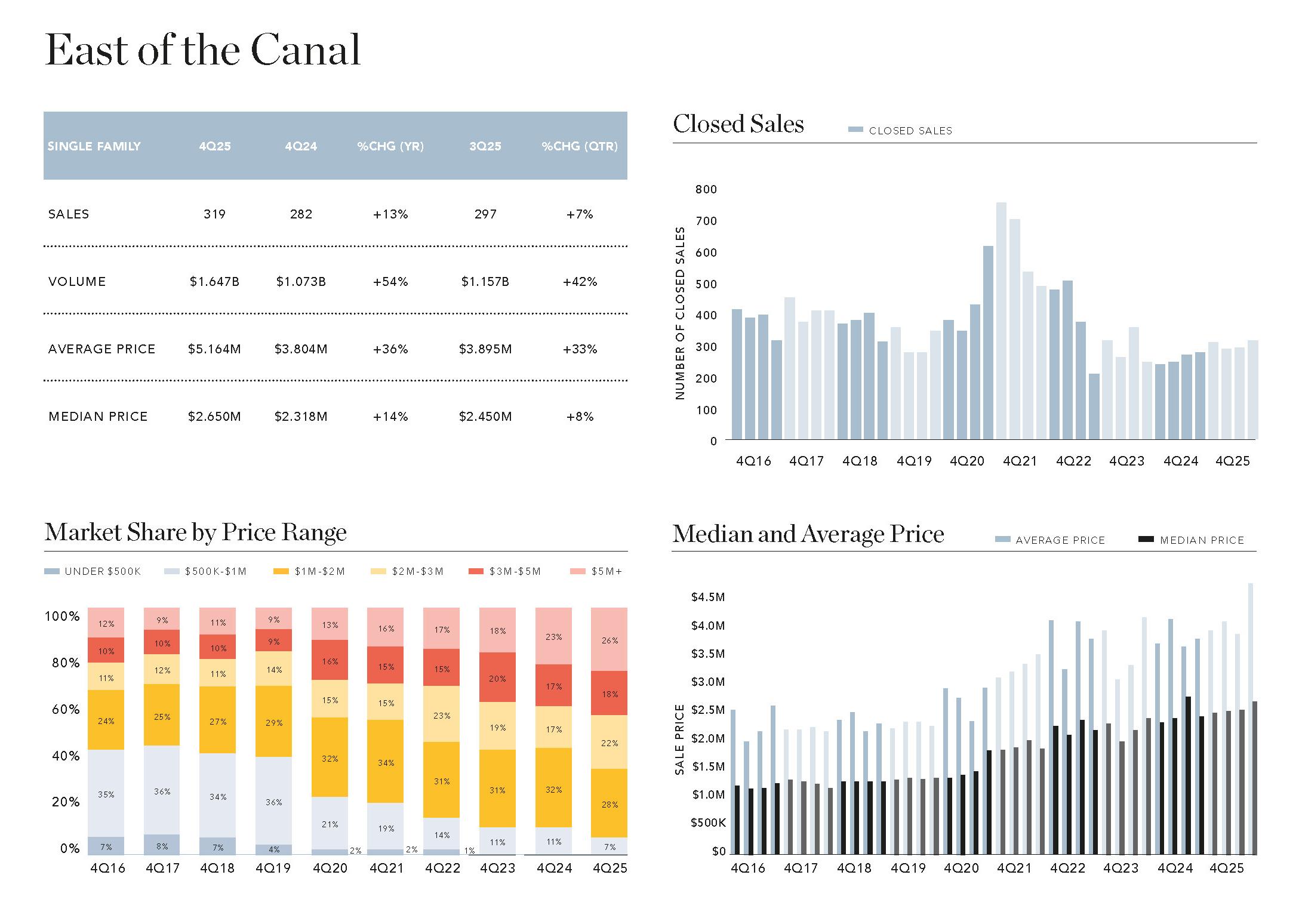

The South Fork reported 434 single-family home sales in Fourth Quarter 2025, the same number of closings reported a year before. This was the fifth consecutive quarter without a year-over-year decline in reported activity, which has not happened since 2021.

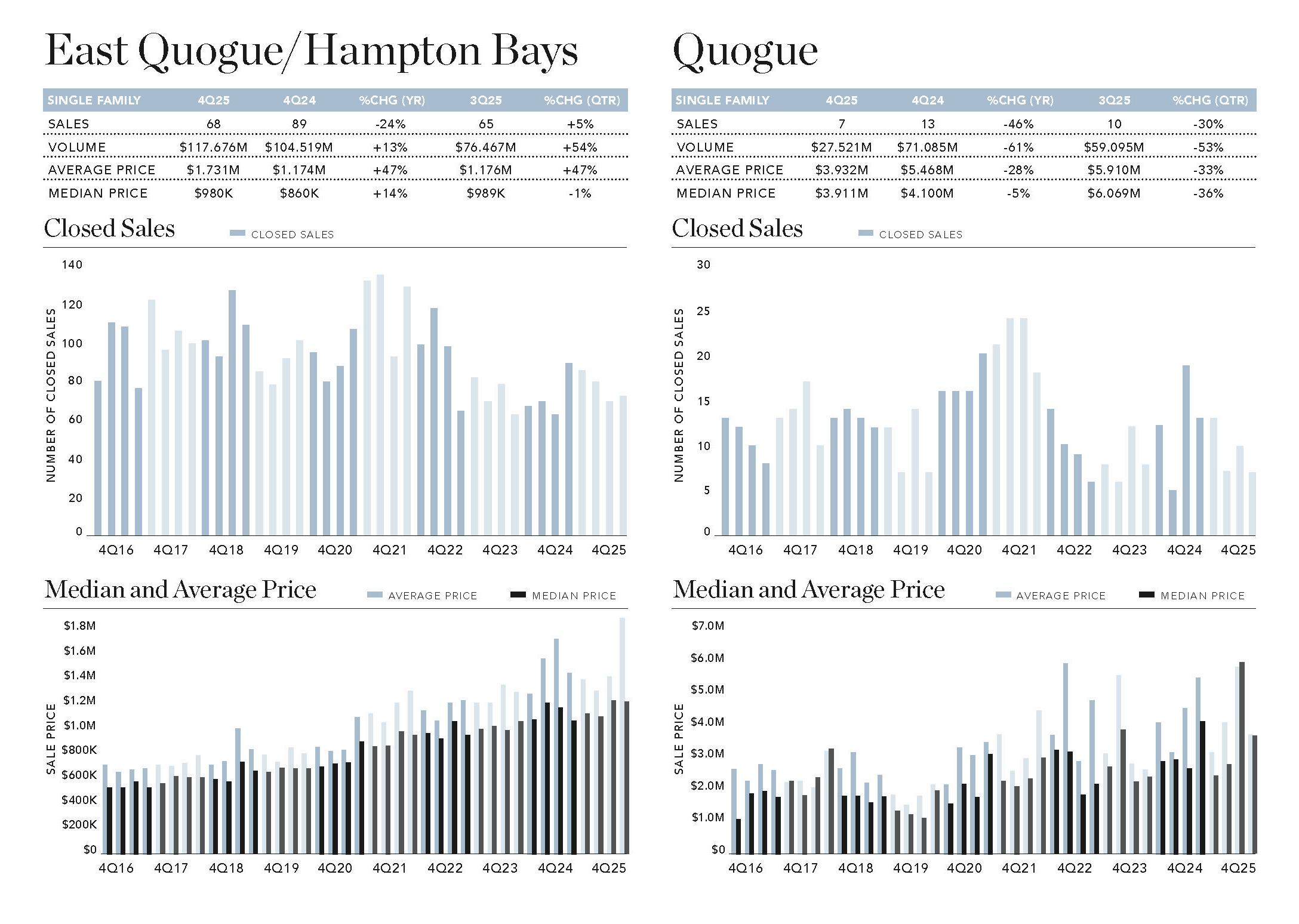

Although all four submarkets west of the canal saw year-over-year declines in contract activity, only two submarkets east of the canal experienced the same slowdown. Sag Harbor/North Haven stood out on the upside, posting the largest nominal gain with 21 additional sales. Meanwhile, East Quogue/Hampton Bays sat at the opposite end, recording an equally sized drop to claim the sharpest annual decline.

Median and average price climbed to record highs, propelling a 42% surge in sales volume. Across the region, ten submarkets posted year-over-year volume gains, while only four moved in the opposite direction. Amagansett saw the most dramatic percentage gain, boosted by a $115M sale on Further Lane, whereas a year ago the most expensive sale was $11M. At the other end of the spectrum, Quogue saw the steepest decline, with dollar volume sliding 61% compared to a year earlier because there were half as many sales at a lower average price.

Median price increased 33% to $2.4M, driven by annual gains in nine of the 14 South Fork submarkets. Average price also soared, rising 42% year-over-year. Amagansett posted the largest percentage increase for both price metrics. Average price was heavily influenced by the $115M sale, while median price rose as high-end transactions, particularly those over $5M, made up a larger share of the market.

483 FIRST NECK LANE, SOUTHAMPTON $21,500,000 | WEB ID:927640

LUXURY MARKET

THE RESIDENTIAL LUXURY MARKET

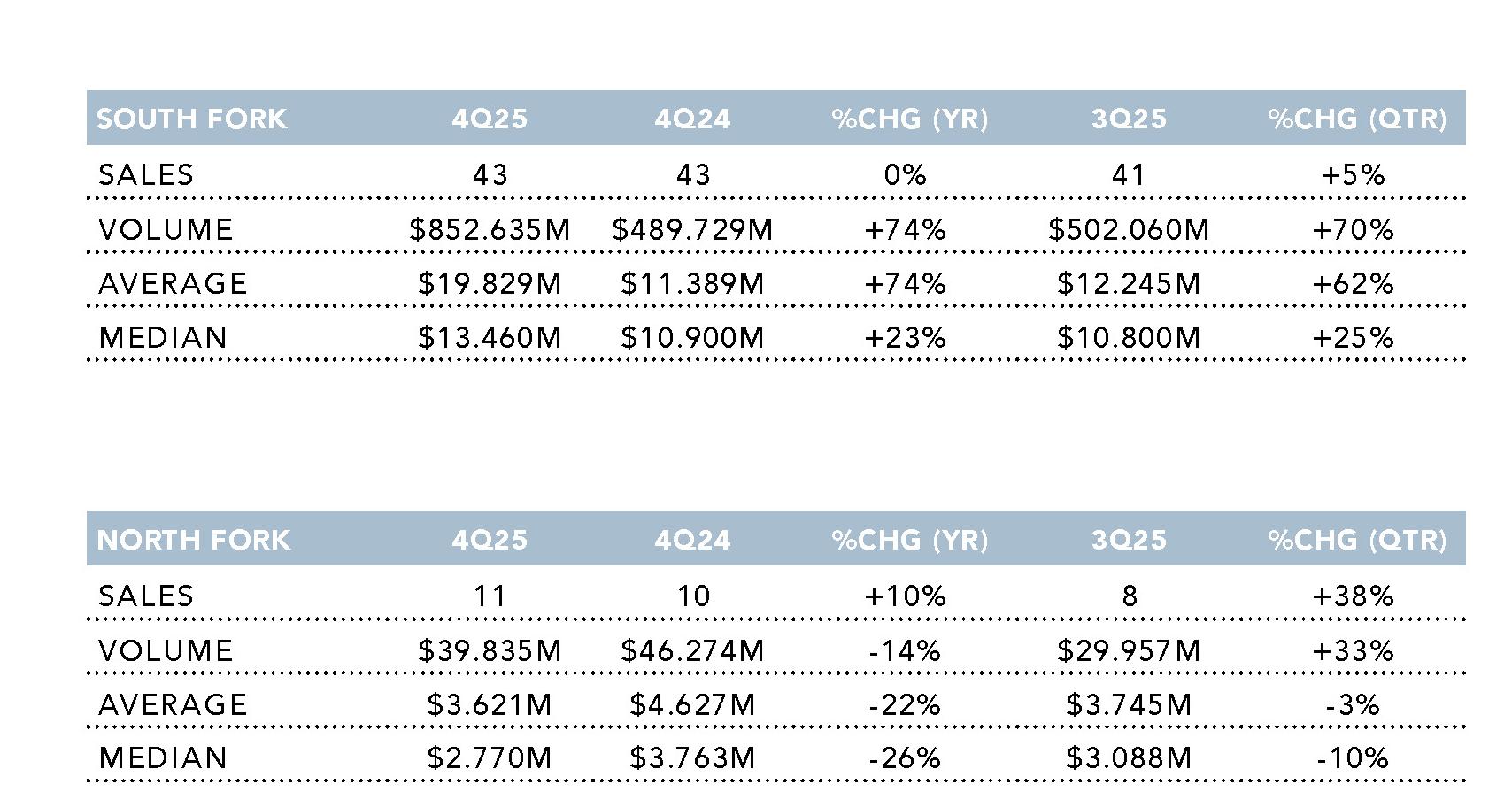

The luxury market is the top 10% of all home sales by price during the quarter. As various factors redefine the high-end market in any given period, price figures may exhibit more volatility than the market overall. However, because the luxury market is a fixed percentage of the overall market, its changes in the number of sales will always match the overall market. In Fourth Quarter 2025, South Fork luxury average price surged 74% to $19.829M. The number of transactions above $20M expanded significantly, rising from just two last year to 11 this year. This increased concentration of ultra high-end sales, combined with a reduced share of transactions below $10M, also pushed the South Fork luxury median price up 23% to $13.46M. A year ago, 16 sales below $10M fell within the top 10% of the market; this year none did. The most expensive sale of Fourth Quarter 2025 was an oceanfront residence on Further Lane in Amagansett, which traded off-market for $115M. Bridgehampton/Sagaponack recorded the highest number of South Fork luxury transactions, with eight closings reported during the quarter. The average luxury sale price for the North Fork fell 22% annually, and median price declined 26% year-over-year. The decreases were a result of a much smaller share of sales over $4M than a year ago. The highest-priced North Fork sale was a 10,000-square-foot shingle-style home with 140 feet of bayfront that sold for $11.2M.

50 GIN LANE, SOUTHAMPTON PRICE UPON REQUEST | WEB ID:926118

LAND MARKET & INVENTORY

LAND MARKET

The South Fork recorded 29 vacant land closings this quarter, down 34% annually. Sales volume followed the same trend, dropping 9%. However, median price increased 21% to $1.800M. The quarter’s highest-priced land sale was a $20M property on Lily Pond Lane in East Hampton, situated behind an oceanfront home purchased by the same buyer. Reported North Fork land closings jumped 86% year-over-year, an increase of six transactions. Despite the higher sales figure, dollar volume edged up only 1%. Both average price and median price fell, with average price down 46% due to last year’s figure being inflated by a single $3M sale. Median price dropped 23% due to a smaller share of sales over $750K.

INVENTORY

Inventory is the number of East End properties listed for sale at the end of the quarter. At the end of December, there were 1,440 active listings, down 22% annually to the lowest level on record.