FROM SETBACKS TO CEOS

By Georgette Gouvei a / ggouveia@westfairinc.com

By Georgette Gouvei a / ggouveia@westfairinc.com

By Gary Larkin / glarkin@westfairinc.com

FAIRFIELD – First Selectperson Christine Vitale’s administration will begin implementing a program to make local streets safe as part of a $300,000 federal grant procured through federal transportation agencies.

“This grant helps to fund our road safety campaign for Fairfeld,” said Vitale, who is carrying out the program as part of her late predecessor Bill Gerber. “The Federal Highway Administration (FHWA) and U.S. Department of Transportation funding is an important source of revenue that helps us to direct taxpayer funds to other important town (projects).” The grant is a continuation of

consultant, Hurley said. Throughout the process, there will be public input through surveys and meetings.

Hurley and Vitale were joined by U.S. Rep. Jim Himes, Fairfeld Chief of Police Michael Paris, Town of Fairfeld Director of Public Works Frank Petise and Sarah Roy, past chair of the Fairfeld Bicycle and Pedestrian Committee as they announced the federal demonstration grant.

Chief Paris pointed out the need for making the streets safer.

“In 2025, we’ve had 1,925 crashes, 323 involving injuries,” he said. “What’s scary is that injury crashes are preventable. By using all of these tools in our tool chest we have the ability to make efective change in Fairfeld.”

“If you get Safe Streets right, you create a community with fewer accidents and a more vibrant downtown where people can walk safely and stay healthy.”

the Fairfeld Safe Streets Alliance program that was announced in June 2025, just prior to Gerber’s death from a brain tumor.

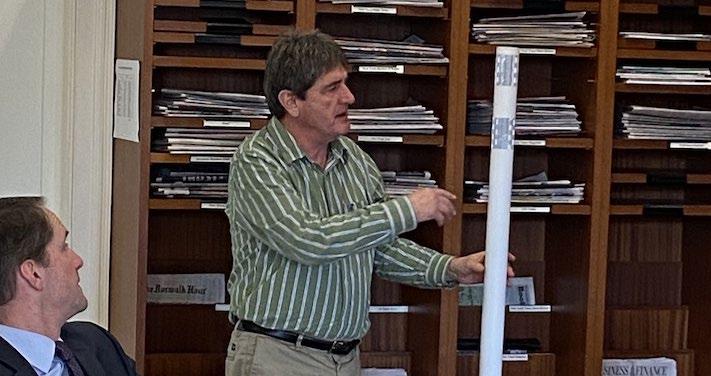

“This grant is extension of a previously award safety action plan, which provides a roadmap to prioritize high injury and fatality locations in the town,” William Hurley, the town’s engineering manager said during a press conference Jan.29 at the Westport Library. “The intent is to reduce speed, increase safety for non-motorized users and to follow up on the town’s commitment to Vision Zero.”

The town will need to fnalize an agreement with the FHWA, go through the town boards to formally accept the grant and then hire a

— U.S. Rep. Jim Himes

Hurley explained how the grant will be implemented during peak congestion hours when cut-through drivers use school zones, residential streets and areas where there are older adults.

“This federal demonstration grant will enable the town to implement short-term demonstration activities as a prelude to future construction projects containing the proven safety counter-measures trafc-calming devices and measures,” Hurley said. “Examples are planters, speed tables, curb extension and delineator posts and temporary removable trafc-calming (tools).”

A delineator is a retro-refective, vertical marker similar to a trafc cone temporarily installed along roadsides, curves, or work zones to guide trafc, mark alignment, and enhance visibility. Hurley mentioned that is one of the many tools at the town’s disposal as it tries to determine which areas in town need roads to be narrowed for safety.

“The Safe Streets process is a process that involved planning and demonstrating that ultimately results in construction and changes to our physical environment,” Himes said.

“Safe Streets takes a community like Fairfeld, which in many instances runs very substantial safety risks.

“We want children to be able to walk to the store or walk to school (on such roads near the Westport Library, for instance).

“And that is a huge management problem. If you get it right, you got a community where at least two wonderful things are true: No. 1 a lot fewer motor vehicle accidents without condition. It also creates for a much more vibrant downtown where people can walk and get that exercise that we know is so healthy.”

The Gateway Development Commission (GDC) says that the Trump administration has not been providing promised funds and that construction of the $16 billion Hudson Tunnel Project will have to stop if disbursements of federal funds do not resume in the coming days.

GDC notifed the contractors working on the Hudson Tunnel Project on Jan. 27 that funding for construction will run out on Feb. 6. GDC’s contractors will spend the next two weeks winding down work at the active construction sites in New York, New Jersey, and on the Hudson River. As of Feb. 6, construction will stop until additional funding becomes available.

New York Gov. Kathy Hochul

By Peter Katz / pkatz@westfairinc.com

said, “Today's announcement by the Gateway Development Commission is just the latest collateral damage of Donald Trump's vindictive quest to hurt New Yorkers no matter the cost. The stakes are enormous: hundreds of thousands of daily commuters, 10,000 union jobs and billions of dollars in economic benefts all now imperiled by Donald Trump's attempts to rip away infrastructure funding from New York. Make no mistake, the Gateway Tunnel is vital to the economy of this state and the entire region, and I will fght like hell to ensure it gets built.”

GDC CEO Thomas Prendergast said, “Over the past two years, GDC, together with our federal and state partners, have made signifcant

progress building the most urgent passenger rail infrastructure project in the country. Since federal funding was paused in October, we have done everything in our power to keep construction moving forward as planned, but we cannot fund this work on credit indefnitely. Pausing construction is the absolute last resort.”

Of the Hudson Tunnel Project’s $16 billion budget, roughly $12 billion is funded by federal grants. The other $4 billion is funded through USDOT Build America Bureau loans to be repaid by the States of New York and New Jersey and by the Port Authority of New York and New Jersey.

More than $1 billion has been spent on construction of the Hudson Tunnel Project to date. Since October, GDC has utilized available funding sources and credit to keep the project moving forward as planned while federal

funding disbursements have been paused. GDC says it has now drawn down nearly all available sources and credit and can no longer continue funding construction without access to the project’s funds.

Pausing construction will result in the immediate loss of nearly 1,000 jobs. An extended pause would put at risk approximately 11,000 construction jobs on the current projects, as well as the 95,000 jobs and $19.6 billion in economic activity that construction of the Hudson Tunnel Project is anticipated to generate overall. It also increases the risk that the 116-year-old North River Tunnel, already a leading cause of delays that impact hundreds of thousands of riders, will shut down, severing the most heavily used passenger rail line in the country and leading to billions of dollars in lost time and productivity.

For over 25 years, we’ve transformed uncertainty into unwavering assurance, creating sophisticated spaces where care and comfort naturally intertwine. Because the best decisions often begin with ‘I’m not sure.’

Payroll jobs down 500 after job gain of 2,100 in November

By Gary Larkin / glarkin@westfairinc.com

WETHERSFIELD – Connecticut’s unemployment rate jumped 0.2% in December 2025 to 4.2%, according to the state Department of Labor’s (DOL) latest job figures.

DOL Commissioner Danté Bartolomeo on Monday released the December Labor Situation report that showed that after gaining 2,100 jobs in November, payroll jobs declined by an estimated 500 in December.

“There was considerable volatility in 2025 with national issues playing a role in dampening Connecticut’s job growth,” the commissioner said. “Over the past year, Connecticut’s workforce declined; that makes it harder for employers to hire and it reduces retail and services spending. Employers have around 70,000 open jobs in the state.”

The state has 1,935,700 people in the labor force. Over the past six months, Connecticut’s labor force dropped by 20,000 workers. Average weekly earnings were up 3.0% over the year, essentially ofsetting infation.

“Connecticut’s economy has shown resilience through some ups and downs this year,” said CTDOL Director of Research Patrick Flaherty. “As we’ve said in the past, the state’s economy will follow national trends, so we remain watchful of infation, the impact of tarifs, and overall hiring. Looking ahead to 2026, we expect a modest growth year in Connecticut — as long as the U.S. economy avoids an economic downturn.”

State Senate Republican leadership had some sharp, politicized criticism of the December jobs fgures.

“Where’s the economic growth?” said a statement from Sens. Stephen Harding, Henri Martin, Rob Sampson, Ryan Fazio, Eric Berthel, Jef Gordon, Paul Cicarella and John Kissel. “It’s apparently not here in deep blue (Democrat) Connecticut. We lost 2,200 jobs in 2025. Our labor force is declining by tens of thousands of people. (actually 20,000)

“And our healthcare jobs? Anemic growth there, even as the rest

of the country is seeing healthcare jobs increase. It boils down to one word: Unafordability.”

SOME OF THE HIGHLIGHTS OF THE DECEMBER 2025 JOBS REPORT:

• Job growth over the year — December 2024 to December 2025 — has been volatile. Connecticut added jobs in six of 12 months; however, state employers lost 2,200 jobs overall for the year.

• Top gainers in 2025: Healthcare and social assistance, professional and scientifc services, and local government.

• Retail trade, accommodation and food services, and private education lost the most jobs in 2025.

• Connecticut’s labor force participation rate was unchanged at 64% compared to the national rate of 62.4%

Continued unemployment claims are around 35,000, slightly higher than last year at this time when they were around 32,000.

By Bill heltzel / bheltzel@westfairinc.com

The owner of a White Plains motel who petitioned for bankruptcy protection is blaming ICE agents for his financial troubles.

Central Motel Court Yard de -

clared $9.2 million in assets and $7.7 million in liabilities in a Chapter 11 reorganization petition fled on Jan. 21 is U.S. Bankruptcy Court, White Plains.

Bookings began to decline due to the Covid-19 pandemic, owner Warren Miranda stated in an afdavit, and then continued "because of the presence and enforcement actions of the U.S. Immigration and Customs Enforcement agents. Simply said, the number of people (predominantly immigrant labor) staying at the motel while simultaneously maintaining

jobs in Westchester County has signifcantly decreased."

Miranda does not say whether ICE agents specifically targeted the motel or were active nearby. White Plains police spokesman Anthony Drago said the police department does not have statistics on ICE activities in the city.

Central Motel Court Yard is a 2-story structure with 28 rooms on Central Avenue at Waldo Avenue, across the highway from The Dalewood shopping center.

In 2024, the motel booked more than $1.1 million in revenues, according to the petition. Last year revenues declined by 84%, to $178,447.

Miranda bought the motel in 2013 for $3,135,000, according to the deed, under his corporate name, Meryde Group of Hotels LLC. In 2017 he bought a 2-story house next door on

Waldo Avenue, that is included in the bankruptcy, for $325,000.

Miranda sought land use approvals from the city in 2021 to demolish the motel and replace it with a 4-story, 87-rooom Comfort Inn franchise hotel. In June 2023, the plans were put on hold.

Now Miranda values the motel at $8.5 million and the house at $700,000.

He owes $7.2 million to an afliate of Centra Capital Investments, a Rochelle Park, New Jersey lender that holds the mortgage. Last year, Centra fled a foreclosure action.

The motel owes the City of White Plains $241,333 in property taxes, according to the petition.

Miranda has no funds for defending against the foreclosure action, according to his afdavit, he has been unable to fnd investors, and he has decided to sell the property.

Amsterdam Hotel

19 Clarks Hill Ave., Stamford 06902 327-4300 • stamfordamsterdam.com sales@stamfordamsterdam.com

Balancing Act Financials LLC

1074 Hope St., Suite 203 Stamford 06907 54 022 balancingactfnancials.com anne balancingactfnancials.com

BCM Media

30 Old Kings Highway South Darien 06820 326-1477 • bcmmedia.biz bmckenna@bmcmedia.biz

Benay Enterprises Inc.

30 Main St., Suite 303, Danbury 06810 744-6010 • benay.com info@benayei.com

BMW of Darien

140 Ledge Road, Darien 06820 656-1804 • bmwdarien.com

Co-Communications Inc.

Mochulsky and Aimee Roden, co-founders

2 Forest Park Drive, Farmington 06032 860-676-4400 • cocommunications.com stacey@cocommunications.com Stacey Cohen, president and CEO

COUTUREDossier

43 Greenwich Ave., Greenwich 06831 900-1600 • couturedossier.com info@couturedossier.com

Danika Communications

15 E. Putnam Ave., No.386 Greenwich, CT 06830 661-3663 • danikapr.com ryan@danikapr.com

E.R. Becker Company Inc. 16 Betts Place, Norwalk 06855 852-8077 • erbeckercompany.com ellie@erbecker.com

Fairfeld Marketing Group

830 Sport Hill Road, Easton 06612 2 1 5 55, ext. 202 fairfeldmar eting.com info fairfeldmar eting.com

Gilda Bonanno LLC

and Andrey Omelich, founders

25 Old Kings Highway North Darien 06820 979-5117 • gildabonanno.com info@gildabonanno.com Gilda Bonanno, founder and owner

Greenwich Medical Spa

1285 E. Putnam Ave., Riverside 06878 637-0662 • greenwichmedicalspa.com

As a leader in commercial interior design and architecture at both the local and national levels, Julia Riso Livingston, RA Northeast Regional Managing Principal of MKDA Stamford—has been instrumental in building and sustaining MKDA’s 20-year presence in the Stamford market. At its milestone 20th anniversary, MKDA Stamford stands under her leadership as a trusted regional design partner, serving commercial building owners, developers, and tenants across workplace, healthcare, retail, and multifamily sectors.

Julia’s reputation is built on a strategic, advisory-driven approach, which pairs design excellence with a deep understanding of branding, leasing, and market positioning. Frequently called upon by commercial

building owners, she advises on large-scale repositionings, capital improvements, and prebuilt and turnkey programs that enhance asset value and accelerate leasing. Her ability to anticipate market shifts and guide clients through evolving workplace and real estate demands has resulted in a high rate of repeat business and long-standing client relationships.

“Good design is always a team e ort,” said Julia. “Purposeful collaboration in our open studio environment produces the strongest solutions. We listen carefully, o er informed guidance, and build relationships rooted in trust – because that partnership is ultimately our greatest strength.”

Over the course of her career, Julia has led the design of interiors for rms including

Eldridge Industries, Guggenheim Partners, Wiggin & Dana, Lovesac, and PURE Insurance. On the landlord side, she has delivered major capital improvement and repositioning projects on behalf of George Comfort & Sons, Alchemy-ABR Investment Partners, Black Diamond Capital Management, The Feil Organization, and Lincoln Property Company, among others.

In recent years, Julia has successfully expanded MKDA Stamford’s reach into new and growing sectors. She has spearheaded a strategic push into healthcare design, leading multiple projects for Orthopedic Neurosurgery Specialists and serving as on-call building architect for prominent medical o ce properties. She has also guided the studio into retail and emerging markets, including

the launch of Hi! People’s rst Connecticut location, with additional sites underway. Julia’s professional excellence has earned her numerous industry recognitions, including Woman Making an Impact by the Westchester County Business Journal, Women of In uence by GlobeSt.com, and Leading Lady in Commercial Real Estate by Real Estate Weekly.

“In o ering exceptional design and rst-rate service, Julia has formed lasting business relationships and made signi cant contributions to Stamford’s real estate and business communities,” said Michael Kleinberg, CEO of MKDA. “Her strategic mindset, leadership, and adaptability continue to make a meaningful impact for our clients, our rm, and the industry at large.”

Organization

Impact Personnel Inc.

1698 Post Road East, Westport 06680 866-2444 • impactpersonnel.com maryann@imactpersonnel.com

Inno ati e isplay esign 1452 Barnum Ave., Bridgeport 06610 800-858-9450 • innov-8.com

e McIntyre Group 2 Enterprise Drive, Shelton 06484 956-2343 • themcintyregroup.com mdamato@themcintyregroup.com

President Year company established

Maryann Donovan, president1989

ecruiting frm for temporary, temp to hire and full time positions in the felds of sales, marketing, human resources and administrative

Donna Shea, founder and CEO1986

Exhibits, event and branded-environment production company

Michelle D’Amato, president1986 Staffng agency

Nest of Southport 362 Pequot Ave., Southport 06890 255-1734 • nestofsouthport.com esanta@nestofsouthport.com Elizabeth Santa 2002 Interior design, upholstery, windows

Nielsen’s Florist Garden Shop 1405 Post Road, Darien 06820 55 2541 nielsensforist.com nielsen nielsensforist.com

PCI Creative Group 562 Glenbrook Road., Suite 2-301 Stamford 06906 327-0410 • pcigroup.net annec@pcigroup.net

Pellicci’s Restaurant 96 Stillwater Ave., Stamford 06902 323-2542 • pelliccis.com tonilupinacci@hotmail.com

e Ridgefeld lay ouse 0 . idge oad, idgefeld 0 4 5 95 ridgefeldplayhouse.org

Saugatuck Commercial Real Estate LLC 9 Burr Road, Westport 06680 222-4190 • saugatuckcommercial.com pwickey@saugatuckcommercial.com

TFI Envision Inc. 111 Westport Ave., Norwalk 06851 45 0 00 tfenvision.com li tfenvision.com

Women’s Business Development Council

184 Bedford St., Suite 201 Stamford 06901 353-1750 • ctwbdc.org info@ctwbdc.org

Sandy Nielsen, general manager 1944 Florist

principal 1985

Cross media marketing company utilizing multiple communication channels to help clients meet their goals

Allison Stockel, executive director 1983

Penny P. Wickey, principal2004

nonproft theatre

Full service, commercial real estate bro erage frm representing tenants, landlords, developers, owners, investors, as well as buyers and sellers

Elizabeth Ball, creative connector and president 1975 Mar eting and design frm

Fran Pastore, CEO and founder1986 ntrepreneurial and fnancial training

For more than ve decades, Cuddy & Feder LLP has focused on creating an environment where talented professionals can build long, ful lling careers. From the rm’s early years to today, that commitment has shaped a culture grounded in mentorship, collaboration, and long-term opportunity. Women attorneys and professional sta have played an integral role in the rm’s growth, contributing across practice areas and leadership roles while developing careers that evolve alongside the rm itself.

Many of the rm’s women have spent a signi cant portion of their professional lives at Cuddy & Feder, developing deep institutional knowledge that strengthens client service and reinforces continuity across teams. This longevity allows attorneys and sta to work e ciently, draw on shared ex-

“LONGEVITY,

perience, and maintain strong relationships internally and externally. Clients bene t from working with professionals who understand not only the legal landscape, but also the history, context, and long-term goals behind their matters.

Cuddy & Feder recognizes that career paths are not linear. The rm supports attorneys through di erent stages of their professional journeys, whether that means developing technical skills early on, expanding leadership responsibilities over time, or balancing evolving professional and personal priorities. Through ongoing mentorship, hands-on experience, and opportunities to lead client matters, attorneys are encouraged to grow in ways that align with both their strengths and the needs of the rm.

The rm’s commitment to exibility and professional development has helped

foster sustained leadership and meaningful engagement. Women attorneys and sta are encouraged to take on roles that allow them to contribute to rm initiatives, mentor others, and help shape the rm’s future. This approach supports continuity while also creating space for new ideas, perspectives, and growth.

Investing in people remains central to Cuddy & Feder’s success. A focus on the retention and advancement of women strengthens teams and brings diverse viewpoints to complex legal and business challenges. The result is a rm shaped by experience, perspective, and collaboration— one that values long-term relationships and thoughtful counsel. As Cuddy & Feder continues to evolve, its commitment to building careers that last remains a de ning part of its identity.

Ingenuity, thoughtfulness and insight have been the hallmarks of our law firm for over 50 years. Our attorneys help local, regional, national and multi-national clients alike identify and implement nuanced solutions to complex legal challenges in the following key practice areas: Real Estate; Land Use, Zoning & Development; Litigation; Trusts, Estates & Elder Law; Finance; Corporate; Telecommunications; Energy & Environmental; and Cannabis Law.

llan M. Block gency Inc.

24 S. Broadway, Tarrytown 10591 631-4353 • ambins.com jmurray@allanblockinsurance.com

Arch Street Communications Inc.

31 Mamaroneck Ave., Suite 400 White Plains 10601 821-5100 • asc-pr.com nmadonick@asc-pr.com

Buzz Creators Inc.

400 Columbus Ave., Second foor Valhalla 10596 358-5080 • buzz-creators.com crae@buzz-creators.com

C&A Digital One North Broadway White Plains, NY 10601 914-607-7888 elenaracheek@cadigitalny.com

Co-Communications Inc.

120 Bloomingdale Rd, Suite 305 White Plains, NY 10605 666-0066 • cocommunications.com stacey@cocommunications.com

Eileen Fisher Inc. 2 Bridge St., Irvington 10533 591 5 00 eileenfsher.com onlinesupport eileenfsher.com

The Flower Bar 11 Addison St., Larchmont 10538 4 4900 the fower bar.com orders the fower bar.com

Formé Urgent Care and Wellness Center 7-11 S. Broadway, White Plains 10601 723-4900 • formeurgentcare.com

Fullerton Beck LLP

1 W. Red Oak Lane., White Plains 10604 305-3464• fullertonbeck.com kbeck@fullertonbeck.com

GMG Public Relations, Inc.

23 Blauvelt Street, Nanuet, NY 10954 996-8100 • gmgpr.com

Madison pproac ta fng Inc.

7 Skyline Dr. Hawthorne 10532 428-4800 • madisonapproach.com info@madisonapproach.com

At 4 a.m., Keith’s pain became so unbearable that he went to the White Plains Hospital emergency room. Dr. Andrew Casden, Chief of Orthopedics, determined his leg pain was caused by a severely compressed spinal nerve and operated immediately. Keith returned home pain-free that same day—on his way to a full recovery and back onto the tennis courts he loves.

LISTED ALPHABETICALLY

Organization President Year company established

Mary nn ie ert Inc. u lis ers 140 Huguenot St., third foor New Rochelle 10801 740-2100 • lieber tpub.com info@liebertpub.com

e e Crystal Restoration Enterprises Inc. 109 S. Regent St., Port Chester 10573 937-0500 • newcrystalrestoration.com lisa@crystalrestoration.com

enny inc er Bouti ue 184 Harris Road (Route 117 Bypass) Bedford Hills 10507 241-2134 • pennypincherboutique.com info@pennypincherboutique.com

Rey Insurance gency

219 N. Broadway, Sleepy Hollow 10591 631-7628 • reyinsurance.com service@reyinsurance.com

Ru y Media Group

115 N. Broadway, White Plains 10603 268-8645 • rubymediagroup.com • krisruby.com kruby@rubymediagroup.com

Scalise & Hamilton PC 670 White Plains Road Scarsdale, NY 10583 725-2801 • scaliseandhamiltonpc.com

il erman Realty Group Inc. 237 Mamaroneck Ave. White Plains 10605 683-8000 • silvermanrealty.com info@silvermanrealty.com

Thompson & Bender 1192 Pleasantville Road Briarcliff Manor 10510 762-1900 • thompson-bender.com liz@thompson-bender.com

Uovo Moderno 156 Katonah Ave., Katonah 10536 401-9298 • uovomoderno.org sales@uovomoderno.com

Westfair Communications Inc. 4 Smith Ave., Suite 2 Mount Kisco, NY 10549 694-3600 • westfaironline.com • wagmag.com dee@westfairinc.com

Women’s Enterprise Development Center Inc.

901 N. Broadway, Suite 23 White Plains 10603 948-6098 • wedcbiz.org ajaniak@wedcbiz.org

WOMENINBUSINESS.ORG

P.O. Box 277, Purchase 10977 288-9888 • womeninbusiness.org toby@womeninbusiness.org

Mary Ann Liebert 1980

Publishing frm serving the scientifc, technical, medical and information felds

Lisa Cordasco, president 1960 A disaster response and property restoration company serving Westchester County

Arkin, owner 1985

luxury consignment

Laura Rey Iannarelli, owner1987 Independent insurance broker

Kris Ruby 2009

A. Scalise NA

Bonnie Silverman N

Commercial real estate development and management frm

Elizabeth Bracken-Thompson, partner 1986

Advertising and marketing, public relations, creative and digital services, special events planning and promotion

Marry Ann Hawley, owner and manager 2013

Dee DelBello 1090

General gift store with items for the home as well as clothing and jewelry

Publishing frm: Westchester and Fairfeld County Business Journals, WAG magazine and associated websites

Anne M. Janiak, CEO and founder 1997 Entrepreneurial training programs and services

Toby Nadler, founder NA

National distinction for infuential and successful women entrepreneurs, executives and professionals in all business sectors

Fairfield County's 40 Under Forty is more than just an accolade; it's a powerful platform to recognize the individuals who are achieving remarkable milestones in their industries and enriching our community. These individuals embody grit and inspire others with their innovative ideas and passion. This honor showcases their accomplishments and enhances their professional visibility, potentially opening doors to future opportunities. We not only set the standard for excellence, we raise the bar every year demanding the best from those who dare to redefine success.

1. Be over 25 and under 40 years of age 2. Be a leader who’s part of Fairfield County's business growth 3. Live or work in Fairfield county 4. Has not previously won this competition

Brookfield Chamber of Commerce | CBIA | Darien Chamber of Commerce | Fairfield Chamber of Commerce | Greater Danbury Chamber of Commerce | Greater Norwalk Chamber of Commerce | Greater Valley Chamber of Commerce | Greenwich Chamber of Commerce | Bridgeport Regional Business Council | Ridgefield Chamber of Commerce | Stamford Chamber of Commerce | Westport-Weston Chamber of Commerce | Wilton Chamber of Commerce

Sponsorship inquiries: Anne Jordan Duffy anne@westfairinc.com

Event information: Natalie Holland nholland@westfairinc.com

“How much of ourselves do we allow in the room?”

It’s a question that moderator Chelsea Blancato, a partner in Citrin Cooperman, posed during the 2026 “Women in Power” panel discussion, presented by Citrin Cooperman and Westfair Business Journal on Thursday, Jan. 29, at Manhattanville University in Purchase.

Judging from the panelists’ responses, the answer was “everything.” Indeed, this was one of the frankest, most poignant “Women in Power” events we’ve covered as Lola Gazivoda, founder and CEO of the Bota Consulting Group in White Plains; Fran Pastore, founder and CEO of the Women’s Business Development Council (WBDC) in Stamford; and Maria Trusa, co-owner and CEO of Formé Medical Center and Urgent Care in White Plains, shared intimate, often searing details about the challenges they’ve encountered in their quests for professional and personal success.

Pastore, whose nonproft helps women launch and scale their businesses, ofered an overview of what these struggles have been for American women historically, with women being treated as chattel prior to the 20th century. Even then, they did not attain the vote until 1920; credit cards without a male co-signer until 1974 (the passage of the Equal Credit Opportunity Act, or ECOA); and commercial loans without a male co-signer until 1988 (the Women’s Business Ownership Act).

Pastore’s own narrative took her from a traditional Italian-American family in Brooklyn -- in which women made pasta sauce on Sunday

“The hardest thing is putting yourself frst — but it’s me frst for my daughter, my family, my business and my community.”

— Maria Trusa, Co-owner & CEO, Formé Medical Center and Urgent Care

mornings and she, a single Connecticut mother with two daughters, was expected to come home to live in a basement apartment and get a job –to an entrepreneurial epiphany.

“Entrepreneurship is born when it flls an unmet need,” Pastore said of her own need to be an entrepreneur—and aid other women entrepreneurs. “Empowered women empower women.”

In this, she said, she was surrounded by “a lot of women and a few good men” who believed in her ability to fulfll that dream. And despite anxieties and sleepless nights, she never stopped believing in “the power of education and knowledge” to make it a reality.

Pastore began with a $120,000 grant and two employees. Today, she added, the 30-year-old organization has 40 employees and a budget of $10 million.

The trajectories of Gazivoda and Trusa, both immigrants from poor countries, contained more obstacles and even trauma.

Gazivoda grew up in a small village near the city of Shkodër, Albania, while the country was still communist. (It became a parliamentary democracy after the fall of the Soviet Union and the collapse of the People’s Socialist Republic of Albania in 1991-92.) But even when she came to the United States at age 14, life was still a struggle. The family lived on 233rd Street in The Bronx amid the violence of gangs like the Bloods and the Crips. She entered high school without a word of English.

“What infuenced me the most was the culture,” she said of an Albanian community in which “a good woman keeps her mouth shut and cooks and

cleans.” Gazivoda married at 18.

Having mastered English, however, she also excelled academically, ultimately earning a degree in fnance from Pace University. She served as a loan portfolio manager and empowerment zone director for the city of Yonkers, overseeing federal funds and economic development initiatives, then entered the corporate world. Gazivoda spent almost 20 years in executive roles at JPMorgan Chase & Co., Capital One and M&T Bank, where she led high-performing teams and managed extensive business banking portfolios.

Still, she told the audience of 150, that she wanted more out of life than just constantly building a banking career. She created Bota as an ofshore recruiting, consulting and management frm that connects U.S. businesses with talent from her native Albania. The company also partners with onshore organizations to drive revenue growth, streamline project management and provide strategic consulting services.

It's also enabled her to make time for herself – for yoga and meditation as well as her husband and three children in Bedford.

“If you don’t love your true self and focus on it, you’re going to break,” she said.

Trusa knows all about that. Her earliest memories were of carefree innocence, running barefoot on the island of the Dominican Republic. That innocence ended when she was raped at age 9. It’s a story she tells in her autobiography, “Yo Digo No Más” (“I Say No More”), which is

also the name of the nonproft she founded to help protect children from sexual predators.

“We get to be creators, or we get to be victims,” Trusa said. She dreamed of being a doctor. While that was not possible, she remained focused on health care. For 26 years, she served as executive director of Scarsdale Medical Group, growing the practice from six physicians and 35 employees to more than 45 physicians and 200 employees.

But a near-death experience at age 50 brought the clarity, she said, of wanting something else, something more, out of life. In September 2015, Trusa joined Formé as co-owner (with founder Gina Cappelli )and CEO, serving more than 25,000 patients a year. She also holds healing retreats on her 12-acre property in Vermont. That healing extends to herself. She trained for an Ironman competition – without knowing how to cycle or swim in the beginning – while caring for her daughter as she spent seven weeks in a hospital.

“The hardest thing is putting yourself frst,” said Trusa, whose mantra is “as within so without.” “But It’s me frst for my daughter....It’s me frst for family, business, community and the world.”

Trusa said she begins her day with a kiss for the face in the mirror and an acknowledgement of its beauty.

“The No. 1 thing is confdence,” Pastore added, “and knowing your value.”

But what if the “me” doesn’t think she belongs in the room where it all

happens? In the question-and-answer session that followed the panel, one questioner brought up the imposter syndrome that disproportionately afects women.

“Own it,” Pastore said until the day that confdence comes.

Earlier in the panel discussion, Gazivoda spoke about the diference between the woman she sees in her mirror, sporting red lipstick and high heels, and her inner life.

“I work to show up day to day as this powerful woman.” While inside she may feel less powerful, she said, “I have the ability to deal with what’s inside.”

Surveying the panel and the audience at the end, she was still struck by the setbacks she had overcome and the company in which she now found herself. Her conclusion: They all had to be confdent women.

“We’ve got this, right?” she said. “I mean, why not?”

Added Trusa, “I have a saying: As within, so without.”

Gazivoda has seen that transformation. “I work to show up day to day in heels and red lipstick as this powerful woman.” While the inner woman may not be quite so powerful, she said, “I have the ability to deal with what’s inside.”

And looking around the room, not quite believing where she was – on a panel with other CEOs in a university setting – she concluded that they all must be pretty confdent to attain what they have achieved.

“We’ve got this,” she said. “I mean, why not?”

By Georgette Gouvei a / ggouveia@westfairinc.com

An exhibit featuring works by some of the most celebrated women photographers has arrived at the Hudson River Museum in Yonkers for its only metro-area appearance.

“Modern Women | Modern Vision: Photographs From the Bank of America Collection” (through May 10), features almost 100 images from 1905 to 2015 by such artists as Diane Arbus, Berenice Abbott, Margaret Bourke-White, Barbara Kruger, Dorothea Lange, Cindy Sherman and Carrie Mae Weems.

“Women have shaped photography from its earliest days, pioneering movements and styles that continue to infuence the art form,” Masha Turchinsky, director and CEO of the Hudson River Museum, said in a statement. “This exhibition celebrates their vision and invites all to experience how these artists framed, and continue to defne, the modern world through the camera lens.”

“Through our Art in our Communities program, Bank of America provides curated exhibitions from our art collections at no cost, fostering discovery and learning for all,” added José Tavarez, president, Bank of America New York City and Westchester County. “It’s with great pride that we share ‘Modern Women | Modern Vision: Photographs From the Bank of America Collection’ with the Hudson River Museum, providing visitors a unique view through the lens of women photographers.”

The exhibition is organized into six thematic sections, chronicling the trailblazing technical and artistic contributions of the artists who worked during each era, including Modernist Innovators, Documentary Photography and the New Deal, The Photo League, Modern Masters, Exploring the Environment and The Global Contemporary Lens.

“Since photography’s inception in 1839, women have stood among its artistic and technological pioneers, at the forefront of every photographic movement and style,” the exhibit text notes. Northern Europe took the lead, with women in France, Germany and Scandinavia opening photography businesses as early as the 1840s. (The frst U.S. photography studios run by women opened in New York City in the 1890s.)

But it was the frst half of the 20th century that established women’s place in photography and photojournalism, with the greats staking out diferent genres. Berenice Abbott (1898-1991) would become known for crystallizing New York as it emerged as an ascendant cosmopolis; Margaret Bourke-White (1906-71) for her work as the frst female war correspondent in World War II, the frst woman photographer for Life magazine and the frst foreigner to photograph Soviet industry; Imogen Cunningham (1883-1976) for her sensuous botanicals and nudes; and Dorothea Lange (1895-1965) for her searing images of homeless farm families and migrant workers in the Great Depression.

In the second half of the 20th century and our own times, such women artists as Carrie Mae Weems, Diane Arbus and Cindy Sherman took to combining photography with other media and using it to explore the role of identity, race, sex and gender in our culture.

“Celebrated images now familiar to us are placed in historical and thematic contexts, and contemporary works are given new prominence,” the show says of their works. “’Modern Women / Modern Vision’ reveals the bold and dynamic ways women have contributed to the development and evolution of the art of photography.”

By Gary Larkin / glarkin@westfairinc.com

Bridgeport business leaders receive ‘solutions’ as part of a class on state and local politics

FAIRFIELD —John Charles Meditz College of Arts and Sciences at Fairfield University undergraduate students have presented the Bridgeport Regional Business Council (BRBC) policy recommendations addressing some of the Greater Bridgeport region’s most pressing economic and infrastructure challenges.

s part of the “State & Local Politics” course taught by Professor Gayle Alberda, PhD, students conducted semester-long research on priority regional issues identifed by the BRBC Government Relations Committee.

Working in small groups, students produced policy briefs and presented two to three actionable recommendations per topic to Dan Onofrio, president and CEO of the BRBC, at the conclusion of the course.

Working in groups that focused on separate issues, the students came up with the recommendations during the completed fall semester.

The BRBC identifed seven high-priority policy areas, including workforce and afordable housing, zoning barriers, high-speed rail access, and renewable energy. Each student group examined data, evaluated existing policies, and proposed solutions designed to inform real-world decision-making.

This group recommended adopting a program similar to the Norwalk Workforce Housing Program, which requires 10 percent of new housing units to be designated as workforce housing. Students also evaluated initiatives such as Good Neighbor Next Door and the Work with RIDE Act.

“The goal is not to push change simply for the sake of change, but to develop practical solutions that support working families, essential workers, and the long-term stability of the Greater Bridgeport region,” said student Amauri Rodriguez.

The group focused on households earning 60 to 120 percent of the area median income, or up to approximately $148,900 annually. These families often earn too much to qualify for traditional afordable housing yet continue to struggle in the region’s housing market. Students found that Connecticut’s housing shortage has contributed to more than 70,000 unflled jobs statewide, as workers are unable to live near employment centers.

Another group recommended exploring private investment in rail service, reconfguring seating to improve accessibility, and increasing long-term

infrastructure funding. The group examined Bridgeport’s exclusion from Acela high-speed rail service, noting that despite the city’s population and redevelopment eforts, it has not experienced benefts such as increased economic activity and higher property values. Students cited Connecticut’s underinvestment in rail infrastructure, compared with states such as Rhode Island, as a contributing factor.

Another group analyzed the broader regional housing shortage, identifying a need for 6,318 additional housing units. Restrictive zoning in surrounding municipalities has created regional imbalances, leading to rising rents and stagnant wages. With Bridgeport issuing only 15 housing permits in 2023 and facing limited zoning capacity, students proposed streamlining permitting processes, enhancing regional coordination, and ofering targeted development incentives.

“I am grateful to the BRBC for giving us this opportunity to learn more about the housing landscape of the Greater Bridgeport area,” said student Melody Olivan Sanchez. “I was able to practice analytical and critical thinking skills on a research project that is directly within my neighborhood.”

Another group focused on renew-

able energy, highlighting ofshore wind’s estimated $1.2 billion annual economic output, while also acknowledging challenges such as high electricity costs and lengthy environmental review timelines. While projects like Revolution Wind, which is based in New London and has an impact on Bridgeport, ofer long-term benefts, students recommended expanding distributed solar and battery storage as faster, more cost-efective options for businesses.

“Working on this project over the semester has helped me gain insight into what is calling for action outside of our campus and the research we conducted was not only engaging, but important for the BRBC and our surrounding community,” said student Kathryn Grace Blangiardo.

BRBC leadership praised the collaboration and the students’ work.

“After listening to the student presentations, I was genuinely grateful for the collaboration and impressed by the level of detail and research they brought to real challenges impacting businesses across our region, county, and state,” said Onofrio. The partnership refects Fairfeld University’s commitment to experiential learning, civic engagement, and community-based research, connecting classroom learning with real-world policy challenges facing the region.

By Gary Larkin / glarkin@westfairinc.com

This version of the story includes some corrections from the original.

RIDGEFIELD – A Ridgefield High School junior has come up with a way to battle the depressing national news and vitriol that fills up TVs, laptops and mobile phones on a daily basis. Max Nadoraski sells merch under the Lead the Change name with short positive statements meant to lift the spirits of all.

Some of the positive statements and words you see on his T-shirts, hoodies, tote bags and mugs are “Lead the Change,” “Kindness is my superpower” and “Kind is the new cool.” The top sellers are “Walk a mile. Then speak” and “Empathy: The Silent Rebellion Against Selfshness.” He recently just added trucker hats and beanies to his product line.

For Nadoraski, it all started with a simple way to raise funds for Sphere CT, a Ridgefeld-based 501 (c) (3) non-proft that helps those with developmental disabilities. That efort has now grown to 19 states and three countries and gives 20% of its revenue to Sphere.

“I have been volunteering with an organization called Sphere,” Nadoraski said. “They had a profound impact on my life. That’s why I started Lead the Change. Me and my mom (Amy Polacko) always joke around and said that they are the nicest people I have ever talked to. I started the business to help them and they wound up being the ones who bought the shirts.”

Max also gives credit to some of his high school teachers. One, in particular, is Jesse Peterkin, a business/senior teacher.

“I met Max this school year,” Peterkin said. “He has quickly made an impression on our business department with his entrepreneurship venture Lead the Change. He is very driven and hard working and we are looking forward to having Max in our classes and business clubs.

“Max’s business is a testament to the modern 'social entrepreneur.' It is impressive to see a student successfully merge business with an inspirational focus on positivity. The fact that at such a young age Max is making a difference in the lives of so many people is incredible.”

Max started Lead the Change in July

2025 with no investment at all. He later received a modest $3,000 investment from a judge at Ridgefeld’s “Tiger Shark Tank” pitch event at the Ridgefeld Playhouse on Oct. 28, 2025, hosted by the Ridgefeld Economic & Community Development Commission. His presentation sparked repeated applause from the audience and landed him that investor, solidifying Lead the Change’s place as a rising youth-driven social impact venture.

“There were fve other presenters in the Shark Tank event,” Nadoraski said. “Most were adults who started their own business. They were the main presenters and I was the intermission ‘act’ while they were voting on the winner.”

Prior to his Tiger Shark Tank presentation, Peterkin said Max met with the school’s team of business educators to refne his pitch. “We conducted a mock presentation session where we provided feedback on his value proposition and visual storytelling,” he said. “Max was incredibly receptive; he integrated our suggestions and delivered a sophisticated, professional presentation that resonated with the judges.”

During his presentation the young Nadoraski pitched his business as an idea to address the problem of divisiveness in the world.

The PowerPoint posited the following problem we all face:

• Too much negativity and division in our world

• Kindness is undervalued in today’s culture

• The lack of a bridge between the societal divide

• Teens struggle to connect with each other

His marketing strategy is straight forward: Social media storytelling on Instagram, Facebook and LinkedIn, reach out to infuencers and the press, attend local events and pop-ups and paid advertising.

“What means the most to me is seeing people embrace kindness,” said Nadoraski. “Every time someone wears one of our tees or hoodies, they’re helping support adults with disabilities and showing the world what they stand for.”

The business has started to take of as Nadoraski rolls out his strategy.

Recently, Congressman Jim Himes wore Nadoraski’s “Walk a Mile, Then Speak” design on his fight back to Washington, D.C., and shared a photo on social media. His public support highlighted the reach and resonance of the teen-led brand.

Even more recently, the longtime actor Harvey Fierstein, who lives in Ridgefeld, wore a Lead the Change “empathy” shirt after Max sent him a box of the shirts to distribute. And on Martin Luther King Day Fierstein was in the news as he was honored at the

Ridgefeld Playhouse with the annual MLK Award.

In addition to reaching out to infuencers, Nadoraski has physically networked with HAYVN in Darien, a women-based co-working space. “I set up a table there with other local businesses,” he said. “Because of that I have my shirts in two stores in Ridgefeld. One is called Flipping Creative and the other one is Nature’s Temptations.”

The marketing has started paying of as Nadoraski described how he wound up with a customer in Hawaii.

“A woman in Hawaii I didn’t know bought six shirts for her family,” Nadoraski said. “I love the fact that Lead the Change is spreading good vibes there and in so many other states.”

For Max, the business’ overhead is limited to paying for his online website and merchandise supplier.

“I had a lot of startup costs,” he said. “But once you get going, it gets better. My store runs through an online store platform called Shopify. Also, I use a print-on-demand company (Gelato) that runs through Shopify.”

He hopes to continue running the business when he attends college next year with aspirations of bringing in $50,000 in revenue. He hopes to get accepted by Fordham University, Fairfeld University or Bentley College in the Boston area.

By Peter Katz / pkatz@westfairinc.com

The New York State Public Service Commission (PSC) on Jan. 22 approved electric and gas rate increases for Con Edison covering the next three years. The rate hikes that were approved are about 90% less than what the utility had asked for.

Con Edison is New York’s largest electric and gas utility, with more than 3.6 million electric customers and 1.1 million natural gas customers in New York City and Westchester County.

Approved was the so-called Joint Proposal that had been negotiated by the Westchester Municipal Consortium and other entities.

The adopted Joint Proposal will result in electric revenue increases of $234 million in the frst year, $409.7 million in the second year, and $421.1 million in the third year. This amounts to rate hikes of 2.8% percent per year, or 4.4% increase in delivery revenues. The gas increases will be $27.5 million in the frst year, $68.8 million in the second year, and $70.3 million in the third year, with total revenue increases of 2.0% and delivery revenue increases of 2.8% per year. The rate hikes will guarantee that Con Edison receives a return on equity of 9.4%.

“The adopted joint proposal meets the legal requirement that the company continue to provide safe and adequate service at just and reasonable rates,” said Public Service Commission Chair Rory M. Christian. “The threeyear rate plan is in the public interest. It is a forward-looking plan that benefts customers and includes provisions that further important state and commission

objectives, while keeping customer afordability frst and foremost in mind.”

The PSC says that the approved rate hikes for the next three years are approximately the rate of infation.

Con Edison had been seeking to increase its electric delivery revenues by approximately $1.6 billion (an 11.3% increase in total revenues or 17.9% increase in base delivery revenues), and its natural gas delivery revenues by approximately $349 million (a 10.5% increase in total revenues or 14.9% increase in base delivery revenues).

State Senators Shelley Mayer, Robert Jackson, and Nathalia Fernandez, Assembly Members Chris Burdick, Dana Levenberg, and MaryJane Shimsky signed onto a joint statement reacting to the PSC decision.

"In approving this rate hike, the Public Service Commission failed to uphold its duty to protect ratepayers and act in the public interest,” they said. “The consequences of this decision are devastatingly real – not just ‘emotional’ or ‘political,’ as a commissioner suggested during their commentary. People will be forced to choose between heat and healthcare. Seniors will skip medications. Families will cut back on necessities just to pay the bills.

"We are deeply disappointed by this decision. It refects a profound failure of responsibility. We will continue to fght alongside our colleagues in the Legislature, and the Governor, using every legislative tool available to protect New Yorkers and to hold both utilities and regulators accountable. The public deserves better, and we will not stop demanding it."

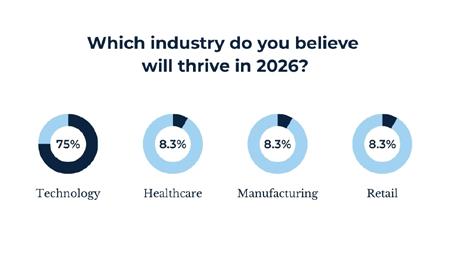

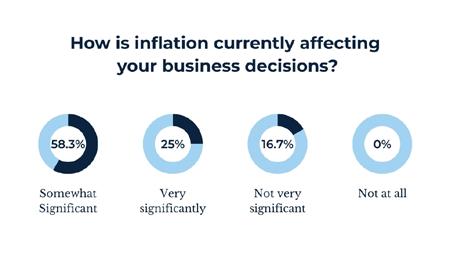

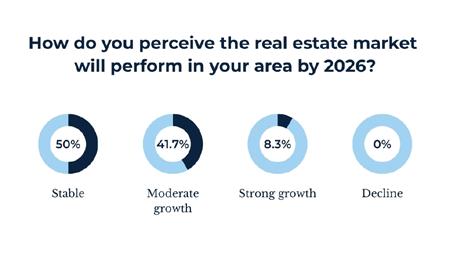

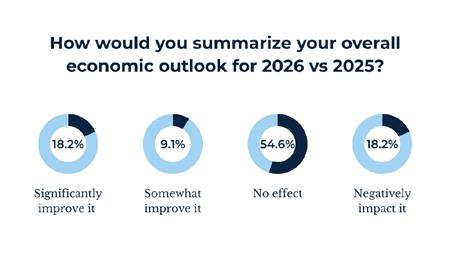

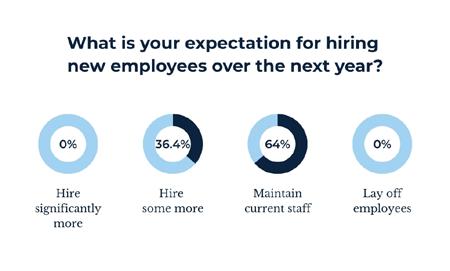

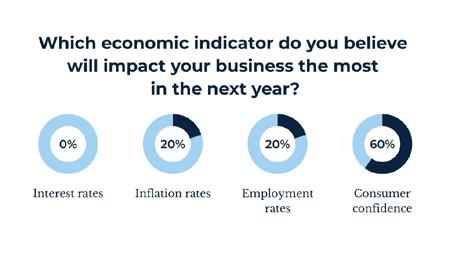

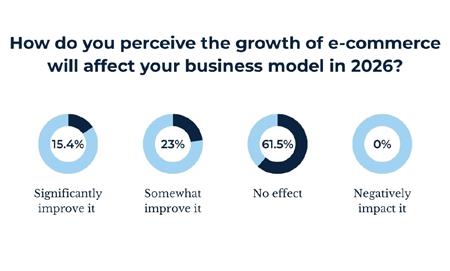

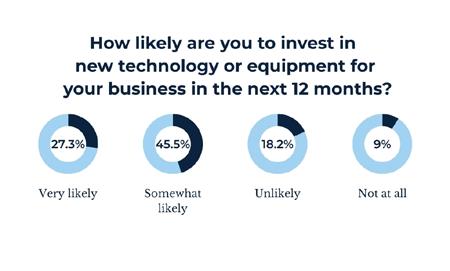

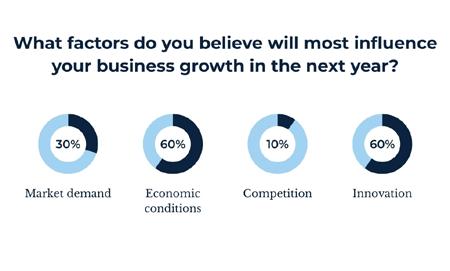

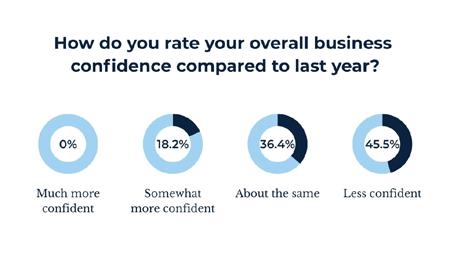

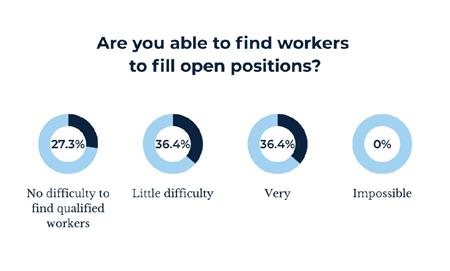

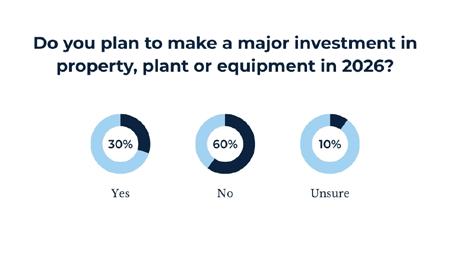

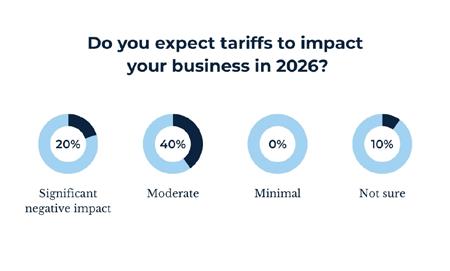

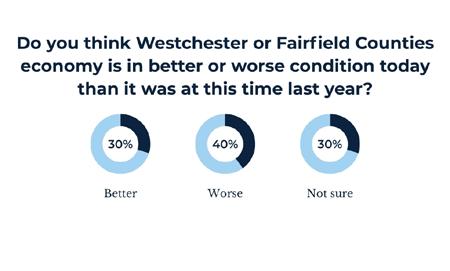

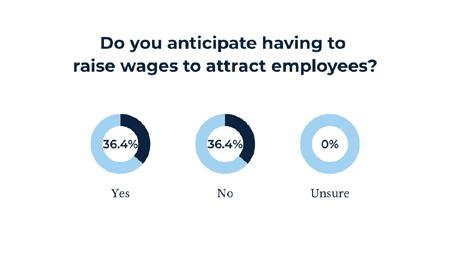

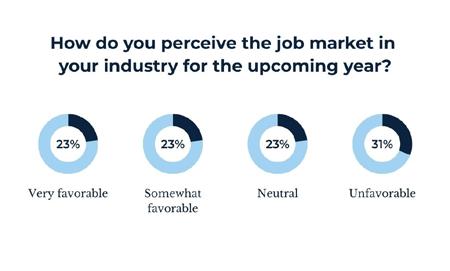

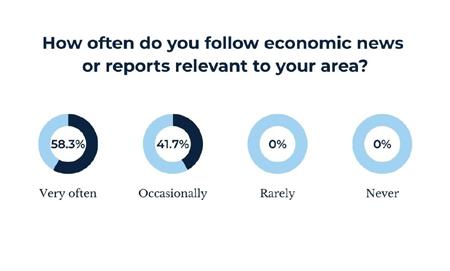

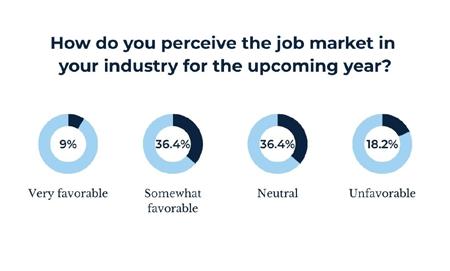

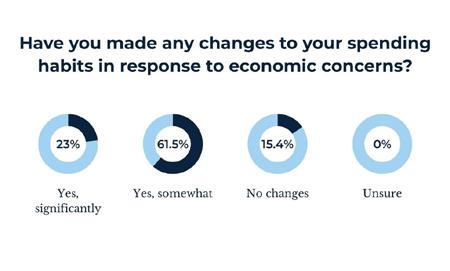

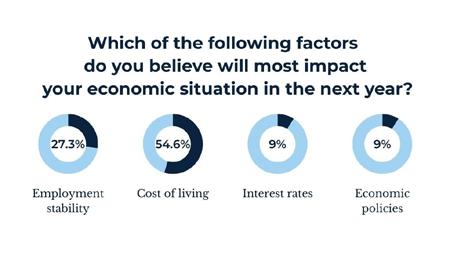

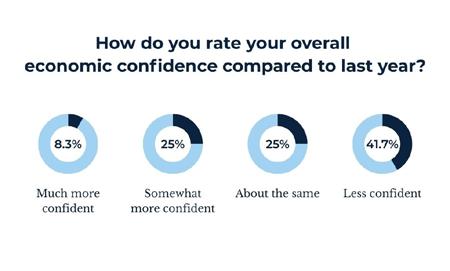

As the economic landscape continues to evolve, understanding how local business leaders are feeling is more important than ever. Westfair Business Journal conducted this survey to capture the current sentiment of business owners across Westchester and Fairfeld counties, focusing on their confdence in the economy and how changing conditions are impacting day-to-day operations.

The results reveal a nuanced picture: while many business owners remain cautiously optimistic, others point to ongoing challenges such as rising costs, workforce concerns, and uncertainty around future growth. At the same time, respondents identifed emerging opportunities, including innovation, strategic investment, and adaptability as key drivers for long-term success.

Together, these insights highlight the resilience of our local business community and underscore the need for informed dialogue and strategic planning.

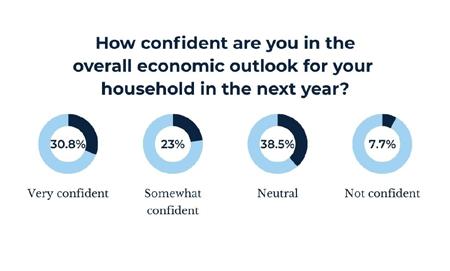

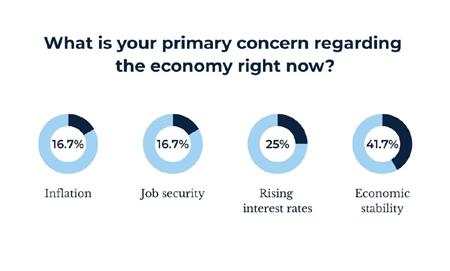

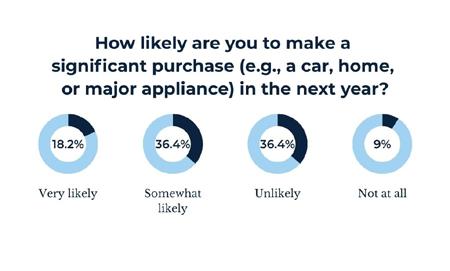

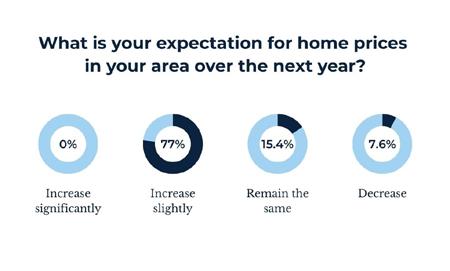

Consumer confdence plays a critical role in the overall health of the regional economy. To better understand how residents are feeling, Westfair Business Journal surveyed consumers across Westchester and Fairfeld counties to gauge their fnancial outlook, spending habits, and concerns about current economic conditions.

The fndings ofer valuable insight into how households are navigating rising costs, managing discretionary spending, and planning for the months ahead. While some respondents express optimism about their personal fnances, others cite uncertainty around infation, housing, and long-term economic stability. Together, these responses provide a clearer picture of consumer sentiment and its potential impact on local businesses and economic activity.

The City of Kingston has chosen a development team for a housing project to be built on city-owned property at 25 Field Court. The team selected to develop the site is a partnership between Affordable Housing Conservancy, Fulcra Development, and Sisters of Charity Housing Development Corporation.

Kingston had issued a Request for Expressions of Interest (RFEI) seeking out qualifed applicants to be considered for selection as the site developer.

“We were pleased with the proposals we received and the exciting ideas for 25 Field Court,” Mayor Steven Noble said.”The selected project team proposed a high-density, afordable residential rental project with both retail and community-serving spaces on the ground foor and will make a meaningful connection to the Midtown Linear Park and surrounding neighborhood. The project team’s proposal really understood the character and personality of Midtown

By Peter Katz / pkatz@westfairinc.com

and proposed partnering with local non-profts for new commercial spaces. We are thrilled to work with the project team to bring this Midtown development to fruition.”

The details of the site plan still are being worked out but it is expected that the project will include approximately 100 new rental units ofering a mix of unit sizes, along with new ground-foor commercial space. A signifcant portion of the new units will be for afordable housing. The development is to be called The Parkline.

The development team issued a statement saying, in part, “We appreciate the city’s continued leadership in advancing afordable housing and look forward to working closely with the Kingston community, the City of Kingston, and Ulster County to transform a long-vacant, contaminated site into a sustainable and thriving contribution to Midtown.”

Kingston acquired the site in April 2024. It is approximately 0.85-acre in a mixed commercial and resi-

dential area in the Midtown part of Kingston, directly adjacent to the Midtown Linear Park and near the Broadway business corridor. The property has frontage on two roads, 125 feet of frontage along Field Court, and approximately 120 feet of frontage along O’Neil Street. The property currently contains an unoccupied single-story 12,000 square foot brick building constructed in 1966, and has a parking lot fronting Field Court and another parking lot

facing O’Neil Street.

Under the City’s recently adopted form-based zoning code, the site is zoned as T5 Flex, which allows for a wide variety of uses and building types. Any site sales are dependent upon the approval of the City of Kingston Common Council.

In 2024, Mayor Noble set a goal of approving 1,000 units of housing by 2030. Since that time, almost 300 new housing units have been approved in the city.

By Peter Katz / pkatz@westfairinc.com

Mission Veterinary Partners, which is among the nation’s largest consolidators of veterinary practices and owns, operates or controls hundreds of veterinary practices, is proposing to open an animal hospital at 718 Central Park Ave. in the Town of Greenburgh, with a Scarsdale mailing address. The plan is convert a former restaurant into the hospital facility.

The site is where Ben’s Kosher Delicatessen Restaurant and Caterers had operated for several years, having opened in 2013. In addition to the ground foor deli, Ben’s had a

second-story catering venue along with a full bar.

Andrew Beck of FMD Architects in Fairlawn, Ohio, told Greenburgh ofcials that they were seeking a special permit for a change of occupancy and change of use of an existing building. He said that only interior renovation work would be done at the building and exterior signage for the hospital would be added.

Beck described the existing building as having two stories above ground and a basement totaling in a 11,202 square feet. He said that the proposed veterinary fa -

cility would operate seven days a week from 8:00 am to 8:00 pm. The veterinary facility would have 40 to 55 employees and the building capacity would be limited to 74 occupants.

Beck said that the animals to be treated at the hospital would be dogs and cats and that routine health examinations and surgical procedures would be provided. There would be a separate ward for dogs. Beck said that the landscaping between the existing parking lot and residential district would remain in place. He said that pedestrian and vehicular trafc patterns would remain the same. He said that the veterinary facility will not have any signs, noise, fumes, or lights that are disruptive

and the building is soundproofed and there would be no ofensive odors.

A Greenburgh staf report noted that the property was 1.08 acres in size. It noted that the animal hospital would require 53 of-street parking spaces and 75 of-street parking spaces exist on the site. The report said that the applicant is not proposing any overnight boarding of animals, except as medically necessary. According to Greenburgh’s building inspector, no area variances would be required for the project. The staf report noted that the proposed action would not create a material confict with an adopted land use plan or zoning regulations and that the property is situated within a well-established commercial area.

By Georgette Gouvei a / ggouveia@westfairinc.com

Valentine’s Day (Saturday, Feb. 14) is once more around the corner, with celebrants gearing up to spend billions to say, “I love you.”

According to the National Retail Federation’s 2026 survey, consumers were expected to spend a record $29.1 billion, up from last year's $27.5 billion, the previous record.

Shoppers are budgeting $199.78 on average for gifts, an increase from $188.81 last year that exceeds the previous record of $196.31, set in 2020.

And while candy remains the No. 1 gift, Valentine's participants will spend the most on jewelry — $7 billion. Already Tifany & Co., with The Landmark fagship in Manhattan as well as stores in White Plains and Greenwich, has unveiled its 2026 Valentine’s Day Gift Guide, featuring such Tifany designs as HardWear, Knot, T, Lock and the new Bird on a Rock by Tifany fne jewelry collection. The Tifany HardWear collection – with its gauge links in 18-karat yellow, rose or white gold, as well as sterling silver and often featuring pavé diamonds – co-stars with actress Adria Arjona in the luxe emporium’s marketing campaign “Celebrating Love Stories Since 1837.” In the campaign’s short flm, set against the Manhattan skyline at night, a couple are not quite what they appear to be. Arjona sports a HardWear by Tifany suite — a graduated necklace and matching earrings and bracelet, along with a Tifany Setting engagement ring that plays a key role in the plot.

Nonprofts as well as retailers and restaurants are also looking to capitalize on the lovefest. The Glass House, the historic New Canaan home of architect Philip Johnson, has a curated collection of Modernist Valentine-related objects, books and art editions in its Design Store.

Bedford Playhouse celebrates with a screening of the 1987 romantic comedy “Roxanne,” a retelling of Edmond Rostand’s play “Cyrano de Bergerac,” in which a brilliant man with a pronounced proboscis (nose) helps a handsome but dim-witted rival woo the woman he secretly loves. The 7 p.m. screening includes wine, a charcuterie board and a sweet treat as movie munchies.

Increasingly, however, the holiday has become an opportunity not only to purchase a Tifany heart but to

talk about the psychological one.

“There can be a lot of pressure surrounding Valentine’s Day,” Emily Bly, Ph.D., said in a statement.

“It’s a day with high expectations, and it’s often hard for reality to match up with the messages we’ve received over the years about what the holiday is supposed to be like. But there are ways to manage expectations and feelings – and maybe even enjoy the day.”

We reached out to Bly – CEO and clinical director of Psychology Partners Group, with ofces in Hartsdale and Chappaqua – to get more details. She started our conversation by noting that when it comes to Valentine’s Day – which began as a blend of ancient Roman and early Christian traditions before morphing into a romantic celebration in the Age of Chivalry, the Middle Ages –social media is both a help and a hindrance. On the one hand, its videos and memes can leave singletons with FOMO (Fear of Missing Out) and perhaps remembering all those times in grammar school when your pile of Valentines from classmates may not have been as high as those of others. But social media, which can leave you feeling jaded about the day, also ofers ways to open it up. And broadening our notion of Valentine’s Day is key, said Bly, who received her Ph.D. in clinical psychology from The Graduate Center, City College in New York and completed an internship at New York Presbyterian Hospital/Columbia University Medical Center, Department of Psychiatry, before going on to postdoctoral training at Columbia University’s Counseling and Psychological Services.

“You have to expand the defnition of love, and that includes self-love in a healthy way. Who do you want in your circle of love and how do you want to honor that? It doesn’t have to be about romantic love.”

Apparently, shoppers are already heeding that message. “Valentine’s Day is a cherished holiday that resonates with many Americans, as seen with expected record-breaking spending this year,” NRF Vice President of Industry and Consumer Insights Katherine Cullen said in a statement. “Much of that growth is driven by middle- and high-income shoppers who are expanding their gift lists to include friends, co-workers and even pets in addition to loved ones.”

Begin, Bly added, by “setting your intention for the day. Have a plan.” And have a plan B. It might be a day of service to your community, in the manner of Martin Luther King Day, or with family and friends. Ever since the idea appeared on the TV series “Parks and Recreation” in 2010, women have taken to celebrating Feb. 13 as “Galentine’s Day,” with brunches, gift exchanges and spa treatments revolving around their gal pals.

Or for those who want the full-on traditional Valentine’s Day, Bly offered a reminder that there’s nothing stopping you from treating yourself to anything from a mini preserved red rose ($3.95 at CVS) to a piece of Tifany hardware.

“As Miley Cyrus sings, ‘I can buy myself fowers,’” Bly added. “It’s a great female empowerment song.”

By Georgette Gouvei a / ggouveia@westfairinc.com

It’s estimated that women control about one-third, or $10-plus trillion, of household wealth in this country. But by 2030 they’re expected to have $30 trillion, or two-thirds, of those U.S. assets.

This is due in part to “the Great Wealth Transfer” from baby boomers, as women, who tend to live on average six years longer than men, inherit money from their deceased husbands, becoming increasing investors.

This fnancial scenario may also refect educational and professional trends that fnd women ascendent. They dominate enrollment in colleges (60%) and professional schools, earning 58 to 60% of bachelor’s degrees, twice as many master’s degrees than men and 40% more doctorates, a phenomenon with far-reaching efects for the legal, medical, dental, veterinary and pharmacological professions.

And yet, women still earn only 83 to 84 cents for every dollar men do. (Indeed, it will take them until March 4, Equal Pay Day in the United States this year, to earn what men did in 2025.)

Women also tend to be less knowledgeable about fnance, a profession in which the average adviser is a 63-year-old male. But they also have a hunger for that knowledge – and for connecting with the right person to share it with them, Hillary Ambrose McGrail said.

McGrail knows all about connecting. She is a senior relationship manager at King Financial Network (KFN) in New Canaan, part of a team of 15 people who manage $1.2 billion in assets under Catera Wealth Services LLC.

“What’s most important to me is listening to my clients and what they care about. What keeps them up at night? …It’s not just macroeconomics, it’s micro. It starts with having a plan.”

McGrail has more than 20 years of experience in the fnancial sector, serving as a managing director, adviser consultant and equity stakeholder at FLX Networks Inc., where she worked closely with fnancial professionals to

enhance their service oferings and optimize investment strategies. Before that, she was a top-ranked vice president at LoCorr Funds and Neuberger Berman, where she specialized in advising fnancial professionals on investment selection and portfolio integration, helping them align their strategies with their clients' fnancial objectives.

After attending the Loyola School, a private, coeducational Jesuit college preparatory school in Manhattan, McGrail went on to a Bachelor of Arts degree from The Catholic University of America in Washington, D.C. Besides sitting on the Loyola School’s alumni board, she volunteers with New Canaan Cares, a nonproft designed to advance the health of youths and families, and St. Mark’s Church, also in New Canaan, where she lives with her husband, Frank; their son, John, and the family Labrador, Fritzy.

Recently, the Westfair Business Journal caught up with McGrail to let her, a passionate listener, do the talking about all things fnancial:

First, thank you for taking the time. Since women are poised to become bigger players in the market, what should women know about money?

“….That it’s not just about investments and picking stocks and bonds. It’s taking a step back, a big step back, and asking the question, What does fnancial security mean to me? What’s keeping me up at night? What are my hopes and dreams? It varies for each individual. And it starts with learning about you and what’s important to you. Women should have a copy of the family’s fnancial plan and understand it – even at a high level.”

Speaking about fnancial literacy – something many of us lack – we wonder what else should women be doing?

“Women need to be involved in meetings with a family adviser and all reviews. They should also ask the adviser to connect them with any educational opportunities that the adviser

“What does fnancial security mean to me? … It’s not just macroeconomics — it’s micro. It starts with having a plan.”

may have, for example, seminars, webinars, private briefngs, etc.”

About 23% of married couples in the U.S. had no joint accounts in 2023, up from 15% in 1996, with reasons cited including marrying later in life and thus having already established fnances but also the increasing professional and fnancial autonomy of women. Should women have separate bank accounts?

fnd it’s so important to be coordinated with the tax expert, insurance expert and estate planning attorney as examples. The statistic that stopped me in my tracks in 2005 was a study that 70% of all widows change advisers upon the death of their spouses within 12 months. This stat has not changed. It remains 70%. I look to help change that number. Women deserve attention, patience and to be heard. I believe fnancial planning can be an overwhelming and complex subject, and we try to handhold our clients through the process.”

Tax season is once again upon us. We know you cannot dispense advice but any general tips?

“My most important tax tip: Connect with your accountant. Don’t leave that process to the spouse. My suggestion would be not to do your own taxes. One common scenario we see is folks who manage their own investments and miss the opportunity to tax loss harvest.) The logic is that they are saving a fee by not having a fnancial adviser. However, in a year like 2025, April was an excellent time to tax loss harvest to ofset gains.

“Another scenario is a family who makes charitable contributions and writes a check. This is a missed opportunity to pass along gains (save in taxes) to the charity or nonproft of your choice, instead of writing a check or using your credit card.”

— Hillary Ambrose McGrail, Senior Relationship Manager, King Financial Network

“I think this is a personal preference driven by family circumstances. It’s not absolutely necessary for the spouse to have his or her own fnancial account. But it’s very important that any accounts they do have jointly are titled properly.”

You’re known for taking holistic approach to fnancial planning, particularly with women, who may be new to this and fnd themselves uncertain and anxious.

“I’ve spent most of my career on the investment side of our business but can now help families and women with so much more than investments. We

“Hillary Ambrose McGrail is a senior relationship manager at King Financial Network (KFN), offering securities through Cetera Wealth Services LLC, member FINRA/SIPC. Advisory services ofered through Cetera Investment Advisers LLC, a registered investment adviser. Cetera is under separate ownership from any other named entity. 140 Elm St., New Canaan, Connecticut, 06840.

For a comprehensive review of your personal situation, always consult with a tax or legal advisor. Neither Cetera Wealth Services LLC nor any of its representatives may give legal or tax advice.”

By Peter Katz / pkatz@westfairinc.com

Congressman George Latimer, a Democrat who represents New York’s 16th Congressional District that includes part of Westchester and the Bronx has introduced legislation that, if passed, would require certain federal agencies to do more and spend more to help small businesses innovate and then commercialize what they create.

The legislation is known as the the SBIR Administrative Funding Act. SBIR stands for the Small Business Innovation Research (SBIR) Program. The SBIR and Small Business Technology Transfer (STTR) programs, otherwise known as America’s Seed Fund, require certain federal agencies to allocate a portion of their research and development funding to support small businesses. Small businesses in New York that have received SBIR and STTR grants are innovating in sectors from aviation and health care to manufacturing and agriculture.

“Small businesses in Westchester County and the Bronx are on the cutting edge of research, development, and innovation,” Latimer said. “The SBIR and STTR programs are a critical tool for the federal government to support this innovation and assist small businesses in achieving commercial success. I look forward to working with my colleagues on the Small Business Committee to advance this legislation as we work to reauthorize the SBIR and STTR programs.”

After being introduced by Latimer, the legislation was referred to the House Committee on Small Business, and in addition to the Committee on Science, Space, and Technology, for a length of time to be determined by Republican Speaker of the House Mike Johnson.

Funding to establish the technical merit and commercial potential of an idea typically ranges from $50,000 to $314,363 for six to 12 months. Fol-

By Peter Katz / pkatz@westfairinc.com

Westchester County Clerk Tom Roach says that in view of the growing crime of stealing houses by filing fraudulent deeds his o#ce is exploring introducing an electronic system to quickly notify people when a new deed has been filed for property that is recorded in their name.

“Under state law we will send a letter when a property changes hands to the last owner to say, ‘hey, you sold your house,’ it doesn’t say it that way, but the idea is if you didn’t you can immediately take action,” Roach said on Jan. 27. “We are now exploring a way to use an electronic version of that, which

would immediately trigger a message alerting you to that, so the sooner you take action the better.”

Roach said that when New York State Attorney General Letitia James recently held an event at the White Plains Public Library dealing with deed fraud people from his ofce were there.

Westchester County Clerk Tom Roach

“We were able to ofer free certifed copies of deeds and we served more than 60 people in that way,” Roach said. He pointed out that people can go online to the County Clerk Ofce’s website for free look to see what paper-

work is on fle related to their property.

“You can see what’s been fled regarding your property and if you see that the last thing fled was your deed that you were involved in you can relax,” Roach said.

In July of 2024, a new law establishing deed theft as a crime in New York state and expanding the Ofce of the Attorney General’s ability to prosecute deed theft went into efect. Deed theft is now legally considered grand larceny, and can be prosecuted as such.

The legislation was co-authored by Attorney General James and sponsored by State Sen. Zellnor Myrie and Assemblymember Landon C. Dais. The law established deed theft as a crime and amended the statute of

“The sooner you take action, the better.”

—

Westchester County Clerk Tom Roach

low-up awards to develop prototypes typically range from $750,000 to $2,095,748 and can last for two years.

The 11 agencies participating in SBIR include: Department of Agriculture; Department of Commerce; Department of Defense (DOD); Department of Education; Department of Energy (DOE); Department of Health and Human Services( HSS); Department of Homeland Security; Department of Transportation; Environmental Protection Agency; NASA; and the National Science Foundation (NSF). Only the DOD, DOE, HHS, NASA, and NSF participate in the STTR program.

Latimer explains that one element of his SBIR Administrative Funding Act would require the fve largest participating SBIR agencies (the DOD, DOE, HHS, NASA, and NSF to transfer at least 10% of their administrative funds to the Small Business Administration (SBA) for SBIR and STTR program administration. It also would clarify the need for the SBA to report on the uses of these funds.

limitations to give homeowners and prosecutors more time to seek justice, and grants Ofce of Attorney General original criminal jurisdiction to prosecute deed theft. Prosecution must begin within fve years of the theft or within two years after the rightful homeowner realizes their deed has been stolen, whichever occurs later.

Roach, who at the beginning of January succeeded Tim Idoni as county clerk said that he was excited to be able to take part in a naturalization ceremony on Jan. 7 that made 87 people citizens of the U.S. He said he asked some how long it had taken them to be able to become a citizen and found that it typically was 10 years.

“Judge Charles Wood presided and I was able to lead the soon-to-be-citizens in their oath. It becomes emotional because you realize how hard these people worked to become a citizen,” Roach said. “It’s a celebration not only for the people who are becoming citizens but for us as Americans to have this new wave of people, full of ambition, who want to get to work and want to make our country a better place.”

At the Westchester County Association’s (WCA) Annual Business Breakfast held Jan. 22 at the New York Athletic Club in Pelham Manor formation of the Westchester Economic Alliance was announced. The Alliance is a joint countywide economic development initiative launched by WCA in partnership with Westchester County government. The Alliance is designed to bring together business, government, higher education, and civic leaders to come up with ways to strengthen the county’s long-term economic competitiveness.

“Westchester is operating in a faster, more competitive, and more complex economic environment,” said Michael Romita, president and CEO of the WCA. “In partnership with county government, we will focus on where we are today and where we are headed.”

The frst concrete step will be the creation of a report with the title Blueprint ‘26. It’s described as being intended to defne where Westchester’s economic position is now and to help

set the direction for the future. It is to look at where the county stands, where it has real competitive advantage, and then establish a foundation for decisions that shape long-term growth.”

Westchester County Executive Ken Jenkins said, “A strong economy doesn’t happen by accident. This initiative brings together the data, the expertise, and the partnerships needed to make informed decisions about Westchester’s future. Working with the WCA and leaders across sectors, we’re focused on positioning the county to compete, innovate, and succeed. We want to continue to move forward from an economic development perspective—making sure families want to live here, businesses want to grow here, and people want to visit Westchester.”

In the coming weeks, the WCA plans to bring together a steering committee, chaired by WCA Board Chair Chris Fisher and County Director of Operations Joan McDonald who is due to succeed retiring Deputy County Executive Richard Wishnie when he

By Peter Katz / pkatz@westfairinc.com

“A strong economy doesn’t happen by accident.”

— Westchester County Executive Ken Jenkins

retires at the end of January.