Caitlan Mitchell Editor-in-Chief

Caitlan Mitchell Editor-in-Chief

Bringing a new beverage to market has never been for the faint-hearted, but right now the conditions are particularly punishing. Inflationary pressures, tightening consumer budgets, and competing for retail shelf space make NPD launches tougher than ever. Even strong concepts are struggling to secure listings, let alone stay in the market long enough to build momentum.

In New Zealand, the craft beverage sector is feeling the squeeze. After a decade of growth driven by innovation and a supportive consumer base, many smaller producers are now facing higher input costs, stricter distribution requirements, and shifting consumer priorities. While demand for unique, authentic products remains, it is tempered by price sensitivity. This is pushing local brands to work harder on value perception, branding, and points of difference.

Globally, the landscape is just as complex. In mature markets such as the US and the UK, consolidation continues, with larger players acquiring successful niche brands. In developing markets, regulatory changes and sugar taxes are influencing formulation decisions, while e-commerce and direct-to-consumer models offer alternative routes to market for nimble operators. Across the board, premiumisation remains a factor, but “premium” now must come with a functional or sustainability story to justify the investment.

Flavour profiles are also shifting. Botanicals, exotic citrus, and hybrid flavour concepts are trending strongly, while low- and no-alcohol products continue to broaden their repertoire beyond traditional formats. Consumers are showing interest in layered, complex tastes that feel crafted and intentional, rather than overtly sweet or onedimensional.

One particular challenge facing both established and emerging brands is working with “natural sugars”. While the clean-label movement drives demand for more recognisable ingredients, many alternative sweeteners and natural sugar sources come with a bitter or lingering aftertaste that can be difficult to mask without adding cost or complexity. Formulation expertise and iterative testing are becoming non-negotiable, especially as discerning consumers are quick to reject products that don’t deliver on flavour promises.

In this issue, we take a deeper look at the innovations, strategies, and market forces shaping the beverage world today, and the lessons that could help the next wave of brands navigate this tricky terrain.

Looking ahead, September will see one of the most significant events in the beverage calendar: drinktec in Germany. This global expo is a mustvisit for anyone serious about the beverage industry, offering unrivalled opportunities to see innovation firsthand, connect with suppliers and buyers, and explore emerging trends before they hit the mainstream. We will be there, bringing our readers exclusive coverage, insights, and the trends that will shape the sector in the year to come.

caitlan@reviewmags.com

IN ASSOCIATION WITH

PUBLISHER: Tania Walters

GENERAL MANAGER: Kieran Mitchell

EDITORIAL DIRECTOR: Sarah Mitchell

EDITOR-IN-CHIEF: Caitlan Mitchell

ADVERTISING SALES: Caroline Boe, Daniel Rogers

EDITORIAL ASSOCIATE: Jenelle Sequeira, Sam Francks

SENIOR DESIGNER: Raymund Sarmiento

GRAPHIC DESIGNER: Raymund Santos

Access to and evolution of today’s information culture enable brands to create products tailored to the targeted nutrition needs of consumers of any age and life stage.

When consumers were asked in a consumer trends research about their preferred nutrition approaches, balanced nutrition was the top choice, followed by age-specific nutrition, gender-specific nutrition, lifestyle-based nutrition, condition-specific nutrition, and performance nutrition. Innova identifies opportunity gaps in targeted nutrition, as indicated by the discrepancy between consumer demand for targeted nutrition approaches and their actual purchases of products offering targeted nutrition benefits, particularly in lifestyle nutrition and performance nutrition.

Research conducted by Innova on consumer trends found that weight management is the top global consumer health concern. Brands are responding with product innovations for consumer health needs, such as weight management. They are also creating beverages tailored to various specific nutrition and lifestyle concerns. This goes beyond producing generic beverage products. Another area of opportunity for targeted nutrition to meet consumer needs is the development of nutritionally fortified foods.

This trend highlights consumer interest in extraordinary and exciting food and beverage products. Companies globally are responding to beverage trends with surprising beverage mashups that bring the “wow” factor to consumers. This is what consumers say they are looking for. In a recent consumer trends research, nearly half of consumers responded that they want “crazy creations” that feel indulgent. Rich flavour and flavour

combinations are tools for bringing the wow factor to consumers.

Another path toward flavour innovation is through limited edition products. Limited editions from large global companies continue to provide new, surprising, and exciting taste experiences. This is what consumers are looking for. They say that seasonal and limited-edition flavours, including those in beverage products, help drive their choices when purchasing food and beverages.

Beverage trends suggest that consumers also seek imaginative adventures in taste and flavour combinations. The process of discovering new tastes enhances the pleasure and enjoyment of food and beverage products. Manufacturers can innovate around strong and intense flavours for beverages. Innova is monitoring trends such as sweet flavours and dessert flavours in new beer launches.

According to consumer trends research, digestive and gut health is the top benefit consumers seek in functional food and beverage products. Beverage trends indicate that older consumers, in particular, are seeking digestive health, as well as other functional benefits related to healthy ageing, including heart health, bone health, and overall well-being. Gut health innovations have infiltrated several beverage subcategories, including iced tea, carbonates, juices, and nectars.

Consumers globally seek to preserve the flavours of their culinary heritage and traditions authentically. Manufacturers can use tradition to connect consumers with their cultural roots and memories. Some ways to achieve this are to create

beverages with local ingredients and familiar flavours prepared in traditional ways.

Consumers are nostalgic and would like to see more traditional products and recipes in the supermarket. They are also interested in new products that feature traditional flavours. In beverages, consumers indicate a preference for both traditional and craft preparations. In fact, one-quarter of consumers participating in a global consumer trends research study say that they are most influenced by traditionally made and crafted claims when buying beer.

Beverage trends with mental benefits help connect consumers with mental and emotional well-being. Beverage innovations that offer mental health benefits can enhance the consumer experience. Vitamins are one beverage ingredient with the potential to enhance mood and improve overall well-being. A solid proportion of new beverage launches tracked with a brain health claim feature at least one B vitamin ingredient. Beverages with botanical ingredients – launches are most prominent in the US – target consumers with stress relief benefits.

Companies globally are responding to beverage trends with surprising beverage mashups that bring the “wow” factor to consumers. This is what consumers say they are looking for. In a recent consumer trends research, nearly half of consumers responded that they want “crazy creations” that feel indulgent.

Today’s consumers are increasingly embracing the convenience and variety offered by online shopping, and the beverage industry is no exception.

As the online beverage market flourishes, understanding consumers’ evolving needs is paramount to winning online. Unfortunately, many CPG beverage brands haven’t fully embraced the online market, lacking a strong e-commerce presence and efficient direct-to-consumer channels.

Focusing solely on traditional models may hinder their ability to cater to the growing consumer demand for healthy, convenient, and sustainable beverage options that are readily available online.

Growing health and wellness trends are exerting a significant influence on online beverage sales. With a growing emphasis on holistic well-being, consumers are gravitating toward beverages that provide immunity boosters, low-sugar options, and other wellness-enhancing ingredients. This shift in consumer preferences has led to a surge in demand for beverages fortified with vitamins, antioxidants, and other functional ingredients, as consumers prioritise products that support their overall health goals.

One notable trend in the realm of health-focused beverages is the remarkable rise of sparkling water, which has garnered attention for its refreshing taste and potential health benefits. Additionally, sparkling water brands are increasingly incorporating antioxidants and vitamins into their products, capitalising on consumer interest. This growing demand for healthy options underscores the importance of offering beverages that align with consumers’ health-conscious lifestyles, driving the expansion of online beverage sales in the health and wellness segment.

Consumer demand for convenience is also shaping the online beverage sales landscape, prompting brands to innovate and adapt to meet evolving preferences. With today’s fastpaced lifestyles and busy schedules, consumers prioritise convenience when it comes to their beverage choices. This shift has propelled the rise of single-serve options and subscription services, catering to consumers’ desire for hassle-free consumption experiences. Moreover, the convenience factor extends beyond the purchasing process to include aspects such as packaging and delivery.

Brands are leveraging e-commerce platforms to offer a wide array of convenient beverage solutions, ranging from graband-go formats to customisable subscription models, allowing consumers to access their favourite drinks with just a few clicks.

Additionally, streamlined delivery options, such as sameday or scheduled delivery, further enhance the convenience of online beverage shopping, ensuring that consumers can enjoy their favourite drinks whenever and wherever they choose. As consumer demand for convenience continues to drive online beverage sales, brands must remain agile and responsive, continuously refining their offerings to meet the evolving needs of modern consumers.

In an era marked by heightened awareness of health and environmental concerns, consumers are increasingly scrutinising product labels to make informed purchasing decisions. By offering clarity on ingredient sourcing, processing methods, and nutritional content, brands foster trust and confidence among consumers, who value transparency as a hallmark of authenticity and integrity in their beverage choices.

Furthermore, consumers’ growing commitment to sustainability is driving consumers to seek beverages packaged in materials that minimise environmental impact, such as recyclable or biodegradable packaging. Brands are responding to this demand by implementing sustainable packaging solutions, reducing carbon footprints, and embracing ecofriendly manufacturing processes.

Capitalising on emerging trends is imperative for brands seeking to maintain a competitive edge and drive growth in the online beverage sector.

To thrive in the competitive e-commerce landscape, CPG brands must adopt a multifaceted approach that leverages omnichannel presence, social media marketing, and subscription services to enhance customer engagement and drive sales.

Within the US, 86 percent of CPG dollar sales are represented by “omnichannel shoppers.” This means consumers are purchasing CPG products through every channel, often simultaneously. By strategically leveraging online marketplaces alongside their own digital storefronts, brands can expand their reach and tap into diverse consumer segments while maintaining control over their brand image and customer experience.

In addition to omnichannel presence, social media marketing has emerged as a powerful tool for CPG brands to connect with consumers and foster brand awareness. Platforms like TikTok offer a dynamic environment for brands to showcase their products through engaging content, such as trendy recipe creation and lifestyle-oriented videos.

By capitalising on the viral nature of TikTok and other social media platforms, brands can effectively reach and resonate with their target audience, driving both online and offline sales.

To cater to diverse consumer preferences and encourage exploration, CPG brands are embracing the concept of variety packs as a strategic initiative in product development. These curated assortments offer consumers the opportunity to sample different flavours and beverage types within a single purchase, catering to both adventurous taste preferences and the desire for convenience.

By bundling a range of flavours and beverage variants into variety packs, brands can tap into consumer curiosity and encourage trial purchases, driving incremental sales and fostering brand loyalty. Additionally, as sustainability becomes increasingly important to consumers, CPG brands are investing in eco-friendly packaging solutions as a key strategy for product development.

Walking into a local supermarket here in Sydney, it feels like you are standing in front of a drinks fridge that looks more like a wellness aisle than a beverage section. Waters with protein, energy drinks promising mental clarity, iced teas with magnesium and collagen… hardly a humble can of cola in sight.

Welcome to the new world of beverages. And if you’re a manufacturer, it’s time to take notes.

Let’s start with the rise of functional drinks. We’re not just talking protein shakes anymore – we’re talking protein in sparkling waters, iced coffees, and even kombuchas. Brands like BODIE’Z and ROCKIT are putting protein into formats that are as refreshing as they are recovery-friendly. Even Muscle Nation has jumped in with sparkling protein waters, bridging the gap between gym junkies and your average thirsty shopper. So what? The boundaries between food and drink are blurring. Drinks are no longer just about quenching thirst –they’re about doing something for you. If your product isn’t working harder,

smarter or healthier, it risks being overlooked.

The energy space isn’t sitting still either. While caffeine remains king, consumers are getting savvier. They’re asking: What kind of energy am I getting? How long will it last? Will I crash?

We’re seeing next-gen energy drinks like GHOOST Energy, which combine caffeine with nootropics for brainboosting benefits, and V Riise, which uses slow-release carbs like isomaltulose for a steady lift. Even mainstream brands are reformulating to meet these new expectations – energy that’s focused, not frantic.

So what? This is a signal to manufacturers: the energy category is ripe for disruption. It’s not just about more – it’s about better. And consumers will pay for it.

Here’s the kicker: taste is still nonnegotiable. Consumers might want less sugar, but they don’t want to taste like they’ve made a compromise. And the debate between natural and artificial sweeteners? It’s still confusing the heck out of people.

Brands like PepsiCo have taken steps to reduce sugar in key products, but shoppers are left wondering if they’re better off with stevia, sucralose or the real thing. It’s a flavour arms race – and whoever balances sweetness, health, and clarity best will win.

So what? Taste innovation is crucial. But so is transparency. Shoppers want to know what’s in their drinks, and why. If your label reads like a science experiment, expect questions.

The at-home favourites are on the move. We’re seeing more brands shift to ready-to-drink (RTD) formats, making once-niche health drinks available in grab-and-go cans and bottles.

Look at Nexus Super Protein + Sparkling Energy Drink – it delivers protein, caffeine, and hydration in one slick, fridge-friendly can. Even powders like Liquid I.V. are gaining traction, boosted by Chemist Warehouse distribution and the ever-growing

demand for on-the-go wellness.

So what? If your brand is still focused solely on at-home formats, it’s time to think outside the pantry. Portability and packability are more important than ever.

If you’ve noticed more Matcha, Yuzu, and Lychee on drinks labels lately, you’re not imagining things. Asian-inspired flavours are finding their way into everything from sparkling waters to cold brews – and Aussie consumers are loving the twist.

Brands like Remedy Drinks have launched Yuzu-flavoured kombuchas, blending tangy citrus with gut-health benefits. Meanwhile, ITO EN’s Matcha Love range is expanding into readyto-drink cans, offering the earthy, antioxidant-rich goodness of matcha in convenient formats. Even mainstream brands are infusing Asian flavours into their lineups to add intrigue and a sense of sophistication.

So what? Global palates are going local. These flavours offer both novelty and health credibility, aligning with trends in functional wellness and foodie curiosity. For manufacturers, it’s an invitation to experiment with bold new profiles that appeal to adventurous consumers without alienating the mainstream.

The 2025 beverage aisle is a blend of science lab, health food store, and global pantry. For manufacturers, the opportunity (and the pressure) has never been greater.

• Rethink what consumers want from a drink – health benefits, great taste, global flair, and convenience

• Double down on flavour and function –one without the other won’t cut it

• Explore global influences – especially the rise of Asian flavours with built-in wellness credentials

• Consider your packaging and portability – if it’s not easy to grab and go, it might get left behind

It’s a bold new world in beverages –and the brands willing to innovate with agility, authenticity, and a great flavour profile will be the ones that lead the fridge.

The New Zealand non-alcoholic beverage industry is, arguably, in a more dynamic space than ever, and transformation is very much the name of the game.

CGRANT JEFFREY Co-Chair NZ Beverage Council

anvas the views of NZ Beverage Council members and the message is clear – this transformation is due, to a large degree, to consumers wanting more from their beverages. Great taste and thirst satiation were once the key beverage boxes to tick. Good, yes, but consumers of today also want their beverages to DO good. Functional drinks are the new norm.

Beverages of today (and looking to the future) are being called upon to play a significant role in providing hydration, energy boosts, gut health, immunity, muscle recovery, mental clarity, relaxation and even mood support… a big ask, yet the industry is delivering and continuing to investigate transformative ways to do so.

The word from our Beverage Council’s key formulators is that functional ingredients that were once confined to the world of powdered supplements and pills are now being integrated into convenient, ready-to-drink formats. Proteins, electrolytes, nootropics and pre-workout formulas are all part of that equation. We’ve seen the emergence, for example, of sparkling water that delivers added magnesium for stress support, energy drinks with a focus on cognitive performance instead of just caffeine and sugar, and iced teas that are infused with collagen. Thanks to evolution within the industry, beverages can be thirst-quenching while also making health simple and accessible.

The team at Alchemy Agencies - a leading supplier of beverage and food ingredients in New Zealand - reports that a top trend shaping the non-alcoholic beverage industry is the popularity of prebiotic sodas, adaptogen-infused drinks, and nootropic beverages – these are gaining traction. Unsurprisingly, products that support immunity, energy, relaxation, and mental

clarity are in demand.

In addition, “Clean label” and low-sugar options are preferred, especially among health-conscious millennials and Gen Z. The NZ Beverage Council is, of course, a proponent of healthy options - the industry continues to provide more choice. Good inroads have been made in recent years to reduce sugar content in beverages, and this will remain a focus into the future.

We note that beverage marketing has moved beyond a focus on the benefits of solely physical health. Increasingly, emotional well-being is very much a thing in the beverage marketing world. Alternatives to alcohol are one result, hence the popularity of “relaxation mocktails” and “mood-enhancing” drinks. Our Beverage Council members report that words like “sophisticated flavours” have become part of our vernacular. What we are seeing is the demand for complex, adult-style flavour in non-alcoholic drinks, driven by the “sober curious” movement. Alcohol-free cocktails and spirits are becoming mainstream, especially in social settings and hospitality and, in some cases, brands are using distillation and fermentation techniques to mimic traditional alcohol profiles without the alcohol.

Furthermore, as those at Alchemy, for example, will also attest, hydration is now seen as a “lifestyle statement” with premium water brands and influencer-backed products leading the way.

At Sensient - a leading global manufacturer and marketer of colours, flavours and other specialty ingredients - there’s no doubt Kiwi consumers are increasingly health-centric. They’ve seen consumer demands change over recent years in terms of increased interest in fresh, natural and authentic tastes. Now, in 2025, they’re noting consumers are continuing in their pursuit of uncovering “unexpected flavours and memorable experiences”… especially those that have the potential to convert to viral social media content.

Within New Zealand’s non-alcoholic beverage industry, it’s not just what consumers want in their beverages that is driving transformative change. There’s a total package to consider beyond the beverage.

For example, both social media and artificial intelligence are increasingly impacting our sector, changing the way products are marketed and developed. We’ve noticed how emerging beverage brands are, by and large, picking up on the power of socials, building demand and credibility online. Instagram, influencers, or going viral on TikTok are their marketing/ advertising tools. This digital-first mindset is undeniably another key trend and sign of our times.

Also of our times are tech-enhanced experiences. AI and AR are being used in product development and marketing to personalise consumer experiences. In addition, smart packaging and interactive labels are emerging to engage tech-savvy consumers. We anticipate AI may shape a lot of our future, not only in terms of how research is conducted and a product developed, but also how that technology (from a decision-making point of view) may be used by consumers or by stockists. What we see now in terms of the reach of AI isn’t necessarily what we will see in a few years’ time – just look how quickly things have changed over the last few years.

Unchanging in terms of commitment is the sector’s focus on sustainability, with eco-conscious packaging a major focal point. Think recyclable, refillable, and on-the-go formats, as these are trending.

While we don’t have a crystal ball at our disposal, we do have savvy formulators in touch with where things are and offering a glimpse into the future.

Beverage and Food Gurus (BFG) managing director Sam Borgfeldt tells us that, if he had to list three major factors impacting the “dynamic transformation” of our industry, they would be: health-conscious consumers, innovation, and agile entrepreneurs. Look at the brands thriving today, he says, and chances are they will have combined sciencebacked functionality with social media savviness, and “most importantly”, they will include the ability to innovate at high speed. How speedily? Well, start-ups, for example, now work in cycles of weeks or months, not years, he tells us.

Reassuringly, this leading New Zealand formulator is of the belief that when it comes to beverage innovation, “New Zealand has access to high-quality ingredients, smart and ambitious founders, agile supply chain partners and a retail landscape that’s increasingly open to new and exciting formats”.

It’s a positive viewpoint for beverage council members to take on board, reassuring, no doubt, for those who have recently joined the NZBC – we welcome these hugely talented entrepreneurs who hail from varied backgrounds, and not just beverage or food sectors.

The NZBC remains appreciative of the support it receives from long-standing ingredients and development companies – such as the aforementioned Alchemy, Sensient and BFG – in helping NZBC thrive.

The NZBC membership is diverse, and ranges from large multinational brands, local New Zealand producers, to those companies that provide a wide range of goods and services to the industry. Members represent over 75 percent of the nonalcoholic ready-to-drink industry sold at a retail level.

We are committed to providing our members with a strong and united voice so as to create an environment in which our members thrive – ultimately resulting in a stronger New Zealand Beverage Industry, poised to take us forward to face whatever will next transform us.

In just around five weeks, drinktec 2025 will open its doors. From September 15 to 19, 2025, the world of the beverage and liquid food industry will meet again in Munich. Around 1,100 exhibitors will present cuttingedge solutions and future technologies in eleven halls at the Munich Exhibition Center.

They will once again be dialogue partners for all national and international decision-makers when it comes to investment decisions and the strategic orientation of brands. This exchange will be based on a complete overview of all raw materials, process technologies, filling and packaging technology, logistics, and IT directly at drinktec, where all projects with the experts can be discussed. With a comprehensive range of products covering the entire value chain of beverage and liquid food production, visitors to drinktec will gain inspiration for the future orientation of their product portfolios and learn about the latest trends in the industry. With around 70 percent of exhibitors coming from outside Germany, drinktec

once again demonstrates its highly international character – a clear indication of the global significance of this platform within the industry. The largest groups of exhibitors (after Germany) come from Italy, the USA, and China, countries that have been bringing together the widest range of offerings for the industry at several drinktec editions.

The new “Liquidrome” format provides additional impetus. Under this branding, the trade fair team in Hall C4 is presenting a wide-ranging supporting programme: exhibitor talks,

• More than 1,100 exhibitors – 70% of them international

• Supporting programme in Hall C4: Liquidrome as a new hotspot for knowledge exchange and networking

•

Lively use of online pre-registration

presentations on research projects, and practical insights form the backdrop for strategic decisions in visitors’ own market and brand scenarios. In this environment, numerous start-ups will also be showcasing new solutions and answering critical questions from the audience during start-up pitches.

All offerings in Liquidrome focus on the key topics of “Circularity & Resource Management,” “Data2Value,” and “Lifestyle & Health.” “Here on our large Wave Stage, we have a diverse programme that includes macro trends, AI solutions for practical use, and numerous ideas for resource-efficient production,” emphasizes Markus Kosak, Executive Director of the drinktec Cluster. With several offerings on innovation strategies and insights from the start-up scene, the Deep Dive Lounge in the Liquidrome complements the programme and offers ample space for networking.

“We also see strong potential in the functional beverages sector – for example, beverages with health benefits – which is why we have integrated a health bar into the Liquidrome. There, selected partners offer tastings of innovative beverages. This allows them to provide the industry with ideas on how to potentially tap into the segment of beverages with added benefits,” says Markus Kosak. The entire offering at Liquidrome is free of charge for visitors and available at drinktec | Supporting Programme at the Liquidrome.

By purchasing tickets via online registration, visitors benefit from lower ticket prices and are guaranteed quick access to the exhibition halls

even after the trade fair opens. All visitors who want to prepare for their visit to the trade fair in advance can already find all exhibitor offers online in the drinktec| Exhibitor & products database. The information provided in the Official innovation guide of drinktec is particularly exciting. Exhibitors with innovative solutions are listed in this overview and can be viewed by trade fair visitors on their mobile phones when they enter the grounds.

The entire drinktec 2025 site can be accessed via the West, Northwest, North, and East entrances, providing optimal connections to both the subway from downtown Munich and the parking garages and outdoor parking areas. Connections to the airport (arrivals and departures) are available from the North entrance and the East entrance (departures only). All information on travel planning is available online at drinktec.com/en-US/visit/travel-stay.

“Market data indicates that positive developments are expected for beverages and liquid foods in many regions,” emphasizes Markus Kosak. “drinktec is definitely the global economic summit and therefore a mustattend event for shaping the future of the industry. Plan your stay now and take advantage of the affordable online booking options. The entire trade fair team at YONTEX looks forward to welcoming all industry players from Germany and abroad to drinktec!”

A tasty, gut friendly alternative to regular cow’s milk, Anchor Zero Lacto has been developed for baristas to use in coffee, alongside being a great replacement for regular dairy milk as an ingredient in cooking and baking.

Creating a smooth and velvety profile.

With the consistency and stability of full cream milk, it’s much easier to steam than all alternative milk variants.

Lactose Free growing 3x faster than non-dairy globally.

With a subtle sweetness that pairs well with coffee.

We started the plant-based milk category in New Zealand in 1985 when we launched Vitasoy out of Hong Kong, and then in 2012 we introduced Alpro (Belgium) to NZ and grew the brand way beyond our wildest dreams.. We now start the journey with our own range of Barista Milks that we have developed in New Zealand and produce in Australia. We are using Organic ingredients wherever possible, and our Oat Milk is fully certified Organic using Australian Oats. The Barista Coconut Milk is made with Organic Coconut Cream, and it is also Soy Free.

Our purpose with this range is to offer a premium product with high-quality ingredients and outstanding performance at a very competitive price. A win for Baristas, consumers and sustainability.

Otis High Fibre is packed with prebiotics and free from seed oils, offering only clean, natural goodness, while nourishing and supporting a healthy gut.

Powered by chicory root, this oat milk is rich in fibre and provides

a smooth, subtly sweet flavour without any added sugars. Made in New Zealand with New Zealand grown oats, pour it over muesli, blend it into smoothies, or enjoy it straight from the carton, it’s the perfect creamy, healthy addition to your day.

Roasted in Tāmaki Makaurau, proudly poured at over 100 cafes and restaurants across Aotearoa.

Frech, ambient and carbonated

Since 1968, the iconic blue and red giraffe image has appeared on the side of the cups used by dairies, ice cream parlours, cafes and takeaways for milkshakes and thickshakes. Nearly every Kiwi will have had a shake in one of these cups and the sight of one will bring back memories of walking home from the local pool on a hot summer’s day, Friday fish and chips wrapped in paper or holidaying at the beach with family. Each memory triggered by the thought of slurping down a cold shake.

Today The Longest Drink In Town remains New Zealand’s favourite milkshake and Kiwis of all ages still love popping down to the local shop and getting a cold shake with their own favourite flavour. These flavours have been made for the last ten years by Delmaine Fine Foods, one of New Zealand’s leading food manufacturers, through high quality milkshake syrups under the Longest Drink in Town brand. This summer make sure you take advantage of the country’s love for milkshakes and the brand that brings back so many memories, by having a good supply of The Longest Drink In Town cups and syrups.

To find your nearest stockist contact Delmaine Fine Foods on 0800 335 624 or speak with your local representative

BARKER’S PROFESSIONAL BLACKCURRANT FRUIT SYRUP IS AN EASY TO USE FULL OF FLAVOUR SYRUP.

With a 1:9 ratio, 1 Litre of syrup will make 10 litres of finished drink. A 200ml serve using 20ml of Blackcurrant Fruit Syrup mixed with 180ml of water will provide 70% of the recommended daily intake of Vitamin C. Barker’s Professional Syrups taste great mixed with both still or sparkling water. Wherever you need a great blackcurrant flavour you can use this syrup. This syrup is Gluten Free, Dairy Free and Vegan Suitable. Make sure you check out the full range of Barker’s Professional Fruit Syrups, Crafted Syrups & Fruit Tea Syrups. www.barkersprofessional.nz, @barkersprofessional

Bringing you the best of nature with their 100% Pure Cherry Juice, Eden Orchards crafts each bottle using over two kilograms of cherries! Each sip bursts with the rich, succulent flavour of New Zealand’s finest cherries, grown in Central Otago. Beyond its delicious taste, this juice is packed with antioxidants and phytonutrients, offering impressive health benefits. Whether customers are looking for a natural sleep aid, relief from inflammation, arthritis, or gout, or a post-workout recovery drink, Eden Orchards’ Pure Cherry Juice delivers. This family-owned and operated business has been growing premium cherries for over 30 years, staying true to their belief that nature creates the best flavours. With no added sugars, preservatives, or artificial ingredients, its juice is pure and wholesome. Enjoy it chilled, drizzled over yoghurt, or a small serving before bed to aid restful sleep. A daily serving of 30-100ml is all it takes to unlock the powerful benefits of Eden Orchards Cherry Juice. For more information visit www.edenorchards.co.nz

Frech, ambient and carbonated

For over 150 years, Bickford’s has been crafting Australia’s favourite premium cordials, building a legacy of quality and innovation. The new No Added Sugar range, featuring Lime, Tropical and Raspberry, is hand blended with up to 30% real fruit juice to help deliver bold, authentic flavour. With no artificial colours, flavours or sweeteners, these cordials offer a full-flavoured experience without the usual aftertaste of reduced sugar drinks. They’re ideal for anyone looking to cut back on sugar without compromising on taste, and perfect for mixing with still, sparkling water, or creating your favourite mocktail.

www.bickfords.net

Enquiries: chris.bhimy@bickfordsgroup.com

Cameo make delicious and handsome coffee syrups for cafes and people who like good things. They’re the perfect partner for specialty coffee in cafes that care. Proudly made in Hawke’s Bay, New Zealand

We make the coffee flavours that you know and love, we just make them better. We don’t have a thousand different flavours (no one needs a mint chocolate latte) but we have the ones you need. See our range online at www.cameocafesyrups.com , includes Vanilla, Caramel, Chai, Lemon Honey Ginger and Hazelnut.

We use quality suppliers, fair trade organic sugar, New Zealand honey, real juices, organic ginger and other quality ingredients. Hell, we even compost.

Quality: Our syrups are made well from good ingredients so your drinks will be top notch. Sustainable: We bottle in glass not plastic and each bottle makes ~ 50 drinks making them a low waste choice. Unique: You’ll see us in some good spots around town but we’re not in every cafe on your block. Stand out. Available on Upstock. Visit www.cameocafesyrups.com or email: hi@cameocafesyrups.com

Frech, ambient and carbonated

Premium citrus-based beverages

St Andrews Limes are quality producers of lime and lemon juice and real No/Low sodas.

Sodas

Low sugar and no added sugar sodas crafted with fresh New Zealand citrus, ginger or passionfruit and manuka honey. Super refreshing, keto-friendly, and great for reducing kids’ sugar intake.

Juices & Mixers

Pure NZ lime and lemon juice - 100% natural juice with no additives and no preservatives. Great for cooking, hot drinks or cocktail mixers. Our Margarita Sour Mix is a great cocktail base for a authentic Mexican-style Margarita! Available on Upstock. Visit www.limes.co.nz or email: orders@limes.co.nz

Our Lemon Honey Ginger Syrup is a hug in a mug and uses the best ingredients around. We mix organic ginger, organic NZ honey, NZ lemon juice and a touch of black pepper for some heat. It is perfect served with hot water for a soothing drink or with sparkling water for a crisp, dry soda with a ginger kick. Our Lemon Honey Ginger Syrup makes 15 drinks and is naturally sweetened with Fair Trade organic sugar. It is free from artificial flavours, colours, or preservatives. It’s suitable for vegetarians.

Available on Upstock. For more information or to become a stockist, contact orders@sixbarrelsoda.co, find us on Upstock, or visit www.sixbarrelsoda.co

QUARTERPAST’s new double-concentrated Milkshake Syrups bring café-quality shakes into your home, providing an easy win for busy mornings, after-school treats, or a quick pick-me-up between meals.

The range features fruity favourites and nostalgic childhood classics, each coldbrewed to deliver authentic flavour, before sweetness, a feel-good pantry staple the whole family can enjoy.

With each bottle delivering up to 35 serves, these syrups are made for sharing. Simply pour 20mL over ice, top with the milk of your choice, and watch those smiles grow!

Let’s connect!

Website: https://quarterpast.nz/ Facebook: https://www.facebook.com/QUARTERPASTBeverages/ Instagram: https://www.instagram.com/quarterpast_drinks/ Contact: orders@quarterpast.com

Since 2012, Six Barrel Soda has been shaking upthe soda game with experimental batches and bold, flavourful creations. This small but passionate team of soda enthusiasts produces small-batch, restaurant-quality drinks that are made to be savoured. Their soda syrups and cordials feature real ingredients such as New Zealand citrus juice, Central Otago cherries, organic ginger, organic rose petals, and fair-trade organic cane sugar.

From their soda kitchen in Hawke’s Bay, Six Barrel Soda crafts natural drinks that not only taste exceptional but look spectacular too

To learn more or enquire about becoming a stockist, contact orders@sixbarrelsoda.co, find them on Upstock, or visit www.sixbarrelsoda.co

CVending in New Zealand is dynamically evolving, driven by advancements in technology and AI-powered systems. While traditional vending machines continue to serve key sectors reliably, there’s a growing appetite for something new and exciting.

oca-Cola in New Zealand (Coca-Cola Oceania and CocaCola Europacific Partners New Zealand) has answered the call with a new cutting-edge technology solution called Coke&GO. Coke&GO utilises Computer Vision and Artificial Intelligence (AI) technology to offer a faster, smarter, and more personalised experience. The process is simple.

Vending is playing an increasingly pivotal role in CCEP NZ’s strategy to meet the growing demand for on-the-go and impulse consumption. Coke&GO enables us to meet this demand with cutting-edge digital experiences while also maintain the reliable, familiar service of classic vending.

Vendswift is unique payment

and rewards platform that rewards consumers and unlocks promotional activity for sites and customers. The Vendswift platform allows CCEP Vending to run any promotion in a Vending Machine or Coke&GO cooler for example 2 for deals, merchandise promotions or prize entry. This platform also works as a coffee style stamp card with every 10th beverage free. VendSwift is available on all CCEP NZ vending machines and Coke&GO Coolers.

We’re receiving incredibly positive feedback from the businesses that have adopted Coke&GO during our trial.

The Facilities Management Team of Victoria University of Wellington shared: “our involvement in the Coke&Go trial allowed us to explore how AI

A Consumer Taps their card on the front mounted card reader to release the door lock.

Once the door is opened, consumers can grab their desired drink(s) then image recognition technology & cameras identify what has been chosen.

After the door is closed, the consumer can walk away & the payment is processed on the card used.

can enhance everyday interactions. The feedback from students was overwhelmingly positive. Students and staff appreciated the speed, ease, and the loyalty rewards.”

Our Planograms are flexible based on the customer’s needs and requirements. With our online inventory system, we also have data on sector specific trends and understand requirements for each occasion. We can tailor planograms for sites based on their requirements, insights and local knowledge. Along with this we understand the importance of site-specific branding and have our traditional red coolers for the majority of sites but also have various other branding available.

Over the next five years, we see vending

evolving into a more accessible, seamless, and widely adopted channel for both consumers and business hosts. Coke&GO is a global, highly scalable solution and our vision is for it to become a go-to refreshment option for any occasion.

We envision Coke&GO coolers becoming a familiar sight in high-traffic locations such as airports, train stations, gas stations, and accommodation sites, all available 24/7. When you’re travelling Coke&GO will be there to deliver a consistent, convenient experience.

Coke&GO is designed to work across all sectors. From sporting facilities and hospitals to workplaces and public venues, the flexibility of the platform allows it to meet the needs of diverse locations.

No matter where a consumer interacts with a Coke&GO cooler, they’ll enjoy the same ease of use, speed, and digital rewards.

• Our Service is free of Charge – All we require is power

• We deliver the Cooler or Vendor

• We replenish the Cooler or Vendor

• We service and complete any maintenance

• Your guests or staff are provided an easy-to-use 24/7 retail solution

Want a Coke&GO Cooler or Vendor? Visit Coke & Go | Coca-Cola Europacific Partners

From dawn to dusk, Americans sip their way through an average of 57 beverage moments a week, about 90 ounces a day, and the “why” behind those sips is changing faster than ever.

Keurig Dr Pepper released its inaugural State of Beverages 2025 Trend Report, an insightrich report that explores the functional, emotional, and generational dynamics driving America’s beverage choices.

More than just a look at what’s in our cups, the report dove into why we drink what we do, drawing primarily from national surveys and KDP’s own proprietary data. The result is a robust view into how beverages are shaping and reflecting American life in 2025.

“Today’s consumers don’t just drink to hydrate; they drink to energise,

indulge, connect, feel comforted, express themselves and more. Whether seeking well-being or a nostalgic favourite, beverages are deeply personal and understanding what’s driving those choices has never been more critical,” said Tim Cofer, CEO of Keurig Dr Pepper.

“Our inaugural trend report makes clear the essential role beverages continue to play in consumers’ everyday lives and strongly indicates that Americans, led by the younger consumer, are seeking even more personalisation, variety and better-for-you options than ever before. The key for companies like ours is being in sync with people’s lives,

showing up with the right beverage for the right moment, with the flavour, function and feeling they’re looking for.”

Among the top findings in the report:

Coffee is our non-negotiable ritual. Fifty-two percent of Americans reach for coffee first thing, with 59 per cent saying they’d rather skip breakfast than miss their caffeine fix. Additionally, 73 per cent of those aged 21 and above confirm that they’d rather give up all alcohol at night than skip their morning coffee or caffeine.

Carbonated soft drinks (CSDs) are a refreshing indulgence. 58 percent of

Today’s consumers don’t just drink to hydrate; they drink to energise, indulge, connect, feel comforted, express themselves and more.

Americans say CSDs are more refreshing than other beverages, and they are the top beverage chosen as a treat.

Flavour drives choice: 59 percent of Americans rate ‘new flavours’ as the overwhelming winning attribute that motivates new beverage trial, versus 29 percent low/zero sugar and 28 percent physical health benefits.

Gen Z is leading beverage exploration: 72 percent of Gen Z (compared to 44 percent of Americans) try new beverages monthly. Seventy-five percent customise their beverages, and more than half choose beverages to “stand out”.

Premiumisation is appealing: 46 percent of consumers are willing to pay more for beverages that they consider premium, which they associate with better quality, better ingredients and attractive packaging.

Sips are sought for wellness: An overwhelming majority of Americans (82 percent) say drinking their favourite beverages helps restore their mental health, and 66 percent seek out beverages that improve their physical health.

Sober-curious is on the rise. 58 percent of consumers now prefer non-alcoholic beverages when hanging out with friends, and Gen Z (21+) is leading the shift, with only 39 percent choosing alcohol as their go-to beverage for socialising.

Unlike traditional consumption reports, the State of Beverages 2025 Trend Report looked beyond volume and sales to explore the emotional and functional motivations behind beverage choices, as heard directly from consumers.

Crafted with wild Aotea mānuka honey and bottled in glass, Barrier Buzz is a refreshing new take on classic sodas. With three naturally sweetened flavours — Cola, Lemonade, and Ginger Beer — we’ve ditched the refined sugar and artificial nasties for something that tastes good and feels better. Every bottle celebrates the wild beauty of Aotea Great Barrier Island and supports our local community of makers and stakeholders.

Whether you’re a retailer looking to offer a healthier New Zealand-made soda, or a café ready to serve a buzz with purpose, Barrier Buzz is ready to stock your fridge.

Try Barrier Buzz today — bursting with better. Trade orders via Upstock: The Aotea Company Ltd –

Upstock

Online: https://theaoteacompany.co.nz

Enquiries: enquiries@theaoteacompany.co.nz

Follow us: @drinkbarrierbuzz

Bundaberg Refreshingly Light – the new low sugar offering by the brewers of the iconic Bundaberg Ginger Beer! Available in three delicious and exciting flavour combinations, Raspberry + Pomegranate, Lemon + Watermelon and Apple + Lychee, there’s something to suit everyone. They are all made with real fruit and craft-brewed over three days for maximum flavour. Each slimline 250ml can is only 20 calories and contains no artificial sweeteners, colours or flavours. Bundaberg Refreshingly Light is the perfect guilt-free treat for when you need an afternoon pick-me-up or something delicious to enjoy with friends on the weekend. For more information, please email salesnz@bundaberg.com

Alchemy & Tonic Partners with Gindulgence to Celebrate Local Flavour

This summer, your favourite mixer could be your ticket to New Zealand’s favourite gin festival.

Alchemy & Tonic, the country’s fastest-growing mixer brand, is teaming up with Gindulgence, Aotearoa’s original boutique gin festival, to celebrate bold flavour and local craft. With all-natural ingredients and a playful personality, Alchemy & Tonic will be mixing it up alongside some of New Zealand’s top distilleries to create the ultimate gin and tonic experience. To celebrate, Alchemy & Tonic is launching a summer campaign with exclusive prizes. Shoppers who purchase Alchemy & Tonic in participating supermarkets will go in the draw to win double passes to Gindulgence — plus other exciting giveaways.

Contact: Jenna Lee, Marketing Manager - Alchemy & Tonic jenna@naturalsugars.co.nz alchemyandtonic.com

Orginal, craft and sugar-free

The iconic and most popular soft drink brand from Mexico, now available via more retail outlets in New Zealand. Bottled in Mexico, Jarritos has captured the colours, vibrancy and palate-tingling tastes of a Mexican festival. The bold natural colours are highly visible through the vintage-shaped, clear glass proprietary bottle, so they have become instantly recognisable on shelf. These sodas, bursting with flavour and bright tastes, make a similar impression on the palate. Lightly carbonated, made with natural colours and cane sugar, the 370ml bottle range of 6 is made up of 5 tropical flavours, lime, pineapple, mango, guava, and mandarin, plus the hero SKU Mexican cola available now. New, 4 packs set to launch later this year. Already a firm favourite in NZ with many, Acorn Group Limited are excited to be expanding the brand footprint so more people can enjoy Jarritos. Get ready to taste the fiesta! Visit www.acorngroup.co.nz

Iconic, Italian, 100% natural. The premium range from Sanpellegrino Italian Sparkling Drinks made with the finest fruit, ripened under the Mediterranean sun. Our favourite Italian Sparkling Drinks just got even more natural, more stylish, and more sustainable. Look out for the elegant design of the new bottles and sleek cans. Flavours include: Aranciata, Limonata, Clementina, Pompelmo, Aranciata Rossa, Melograno & Arancia. For more information, visit federalmerchants.co.nz or contact Clientservices@federalmerchants.co.nz, (09) 578 2619

Foxton Fizz has been increasing distribution in the last 12 months, adding to the 104 year old brands’ footprint in the grocery and convenience channels. In addition to increased distribution, they’ve been working on their NPD and have recently re-introduced Foxton Fizz Pineapple in the 250ml bottle. Pineapple is an old favourite, last bottled around 2004, meaning the 20 year hiatus is over. The new Pineapple flavour is not the only new retail product – the Foxton Fizz Sampler Pack, consisting of 2 bottles of each of the 6 flavours, is now available as a retail pack and is proving to be very popular as a take home pack or gift. The small town soda brands, of which there used to be over 200, were strongly associated with family gatherings and holidays such as Christmas and Easter, and it seems this continues.

Foxton Fizz is supplied o the grocery channel by DKSH New Zealand. Phone +64 6 356 5323, Email: customeservice.nz@dksh.com

As Kiwis embrace bold flavours, natural ingredients, and drinks that look as good as they taste, Calypso is stealing the spotlight. Originally from the USA, Calypso is famous for its vibrant, refreshing flavours, real lemon bits, and eye-catching, Instagram-worthy packaging that stands out on shelf. Since launching in New Zealand, it has quickly built a loyal fan base, particularly among those looking for flavour-forward drinks that are as shareable as they are enjoyable. Available in a wide variety of flavours, from classic lemonade to exotic blends, Calypso taps into the growing demand for unique, indulgent refreshment experiences. With its summerready vibe and strong consumer appeal, Calypso is set to be one of 2025’s must-have beverages for warm weather occasions.

Brought to you by Zebra International Visit www.zebrainternational.co.nz or call 0800 932 724

Pete’s Natural’s new 250ml cans come in Lemonade, Feijoa, Kola (caffeine-free), and Sparkling Water. Made with freshly squeezed NZ fruit, 30-50 percent less sugar than traditional sodas and absolutely NO concentrates or preservatives these sodas are a hit with health-conscious shoppers. Each can supports local NZ growers through Pete’s FairTrade@Home model helping reduce fruit waste while delivering real fruit flavour. Produced in a solar-powered factory with fully recyclable packaging Pete’s Natural aligns with rising demand for sustainable better-for-you drinks. Perfect for fridges, takeaways and impulse shelves this graband-go range offers retailers a fresh local option that’s as good for business as it is for the planet.

Stock Pete’s Natural Cans today, for more info emailinfo@petesnatural.co.nz

Coffee is often believed to be dehydrating but this is not so, according to a study published in the US National Library of Medicine.1 The study showed that coffee, when taken in moderation, does not cause dehydration, indicating a potential market for coffee with hydration-boosting ingredients such as electrolytes.

HONG TAN Principal Food and Drink Analyst, Mintel

This also indicates that as consumer hydration needs evolve, brands need to move beyond traditional beverage categories and deliver enhanced hydration through hybrid drinks. With a growing health awareness borne out of the pandemic, consumers are now leading more active lifestyles and are more aware of their physical and mental wellbeing and the environment, and how it affects them. Thus, hydration is no longer just a necessity but a lifestyle focus.

Interestingly, water isn’t the top choice for hydration among consumers. In China, for example, Mintel research shows that more than half of consumers prefer energy drinks and electrolyte drinks for quick hydration and energy during exercise or physical labour. Only 34 percent prefer water, highlighting opportunities for functional beverages to extend their relevance beyond sportsrelated occasions.2

While juices and carbonated soft drinks are often criticised for high sugar content, there’s room for repositioning. Beverage brands can reimagine sodas as enhanced hydrating drinks that can be consumed more regularly, but with low or free from sugar.

One reason consumers may avoid plain water is its lack of taste. Juices, on the other hand, can serve as hydrating alternatives due to their high water content and naturally occurring electrolytes in certain fruits. Carbonated soft drinks can also evolve by incorporating elements of sports drinks and juices, offering a fizzy, flavorful, and refreshing hydration option with added functional benefits.

In Germany, for instance, 42 percent of consumers report drinking carbonated soft drinks for hydration.3

Juices also pair well with other ingredients to create hybrid drinks.

Coconut water, which is rich in potassium and contains electrolytes like sodium and magnesium, is now seen in products like sparkling water mixed with watermelon. Watermelon itself is widely recognised as an excellent hydrating fruit due to its high water content and naturally occurring electrolytes.

Meanwhile, pickle juice is also gaining popularity due to its distinct flavour and health benefits, which include helping exercise recovery, regulating blood sugar, and improving gut health. Pop culture has helped drive interest as well as singer Dua Lipa’s TikTok video, showcasing her Diet Coke, jalapeño, and pickle juice concoction, has garnered approximately 13 million views globally.4

• Reposition coffee and tea: Challenge the perception that these beverages are dehydrating. For example, cold brew coffee or tea can be reformulated with electrolytes to provide refreshing postworkout hydration.

• Expand the role of energy and sports drinks: Go beyond athletic contexts by highlighting benefits for physical and mental energy, stress relief, and daily performance.

• Redefine juice as a wellness drink: To overcome its high-sugar image, emphasise the health benefits of juices made from hydrating fruits such as watermelon and coconut.

Consumer needs are changing when it comes to hydrating themselves. Brands need to keep up by going beyond traditional beverage formats and introducing hybrid drinks that not only taste good but are also good for health.

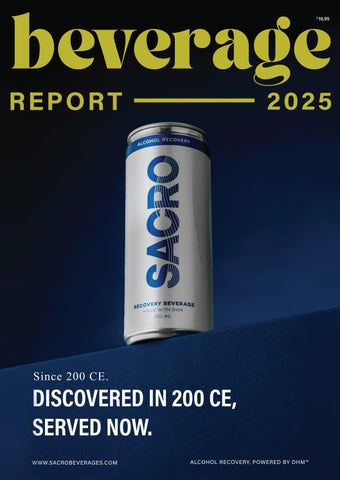

DISCOVERED IN 200 CE, SERVED NOW.

Functional beverages continue to gain ground as one of the most dynamic and commercially promising segments in the drinks category, offering brand owners significant scope to innovate and scale.

Global demand is being fuelled by a shift toward proactive health management, with consumers increasingly seeking drinks that offer more than hydration, targeting benefits such as gut health, cognitive support, energy, and immunity.

According to recent data from Research and Markets, the global functional beverage market reached USD 154 billion in 2023 and is expected to grow to USD 205 billion by 2028. Published forecasts suggested that the category could reach USD 339.6 billion by 2030, reflecting an annual growth rate of over eight percent.

Innova Market Insights reported that over a quarter of all new beverage launches now feature a gut health claim, with prebiotics and probiotics among the most commonly used ingredients.

At the same time, NielsenIQ data highlights robust online growth driven by products offering low sugar, added functionality, and clean-label positioning. These figures are echoed across the Australasian market, where consumer trends have shifted towards botanical, fermented, and plantbased drinks, often enhanced with adaptogens, nootropics, and naturally sourced antioxidants.

For brand owners, the opportunity lies in formulating credible and appealing products that meet these needs while standing out in a fastgrowing space. FB Tech recently profiled Zynamite S, a water-soluble mango leaf extract clinically shown to improve focus and reduce stress, an ideal ingredient for ready-to-drink formats and nootropic waters.

Other emerging inclusions, such as L-theanine, lion’s mane, ashwagandha, and electrolytes, continue to gain traction, particularly in energy, hydration, and wellness-positioned beverages. However, flavour has remained a critical differentiator. New Zealand and Australian consumers are increasingly drawn to profiles that signal natural health or premium indulgence. Trending ingredients include turmeric, matcha, yuzu, elderflower, manuka honey, hibiscus and lavender.

These not only offer functional appeal but also deliver on sensory expectations. Whether incorporated into sparkling waters, low-calorie sodas, sports drinks or adaptogen teas, these flavour combinations help define the next generation of wellness beverages.

“There has been a significant increase in the number of start-ups I work with entering the beverage category, and they’re bringing some truly exciting ideas to the table. From ingredients we’ve never seen before to bold new functional benefits, this wave of innovation is shaking things up,” said Laura Feavearyear, founder of Creative Jam.

However, despite all that innovation, Feavearyear has noticed a steady shift toward simpler, more streamlined messaging on the packaging. She said that the days of front panels cluttered with badges, ticks, and awards are behind us. Today’s consumers have become more discerning than ever. With so many options on the shelf, they want to understand what a drink is and why it matters, fast.

“What’s really fascinating is how this surge of functional beverage brands is starting to influence the big players. I’ve seen large corporations quietly tweak their labels, refine their USPs, and pare back the fluff. And when the giants start shifting, you know the market is moving.”

She added that one area still up for disruption is packaging. There are very few truly sustainable options available, especially in small quantities.

“Most emerging brands are forced into cans by default, not necessarily by choice, and you can see the result in supermarket fridges. Both Foodstuffs and Woolworths are practically overflowing with a rainbow of canned drinks, with both banners expanding their fridges.”

Functional beverages present an interesting case for NPD, positioning and brand value. For those ready to invest in intelligent formulation and authentic storytelling, there could be an opportunity to tap into this health-focused consumer shift.

Both Foodstuffs and Woolworths are practically overflowing with a rainbow of canned drinks, with both banners expanding their fridges.”

The global beverage industry is undergoing a dynamic transformation, fuelled by innovation, health-conscious consumers and a new wave of agile entrepreneurs.

SAM BORGFEDLT Director Beverage & Food Gurus

The days of slow product development cycles and me-too launches seem to be behind us. Today, the brands that are thriving are those that combine sciencebacked functionality with social media savviness, and most importantly, the ability to innovate at high speed.

We are lucky to have a front row seat to spotting and understanding how these trends are impacting the New Zealand market as we work with clients to develop new alcoholic and non-alcoholic beverage products for launch both locally and beyond.

From protein and electrolytes to nootropics and pre-workout formulas, consumers are no longer content with beverages that just taste good - they want drinks that do good. Functional ingredients that were once confined to the world of powdered supplements and pills are now being integrated into convenient ready-to-drink formats. There is a blurring of the lines between food

and supplements with the aim to make wellness both effortless and portable.

Consumers are now looking for more than just great taste and refreshment from their beverages. They also want hydration, energy, mood support, gut health or even muscle recovery, and they want it in a format they can grab on the go that is delicious and affordable, which is where we can help. Beverages can be thirst-quenching while also making health simple and accessible.

This convergence of health, convenience, and innovation is redefining traditional drink categories. Iced teas now come infused with collagen and green tea extracts, sparkling waters deliver added magnesium for stress support and energy drinks lean into cognitive performance instead of just caffeine and sugar. Protein is another feature of this development, now being incorporated into everything from cold brew coffee to juice-based blends.

One of the defining traits of the current beverage boom is speed. The traditional

product development timeline of 12 to 18 months has been replaced by lean, iterative innovation. Startups now work in cycles of weeks or months, not years. Some of our clients are launching products in under eight weeks. They test, learn, and adapt fast and are using innovative methods to connect with consumers for rapid feedback. These companies are close to their consumers, so they instinctively know what they want and can constantly adjust to embrace what’s working or what’s not. They are confident to develop a product quickly and learn as they go, launching it to market and then paying attention to feedback and reacting quickly to any improvement opportunities.

These disruptors often launch direct-toconsumer or in the gym, on social media, or through a limited run in a boutique supermarket, keeping the risk low while they are testing and learning. Once proven, they’re ready to scale, and they do it rapidly. It’s a strategy that big beverage players are now watching closely and even emulating, setting up their own start-up incubators and partnering with agile firms like us to enable a quick turnaround of projects.

This digital-first mindset is another key trend. Emerging beverage brands are no longer waiting to ‘get picked’ by major retailers. Instead, they build demand and credibility online, creating FOMO on Instagram, going viral on TikTok, or being championed by influencers. By the time they approach supermarkets, they already have a proven audience, a strong brand story and sales traction.

New Zealand’s beverage ecosystem is uniquely positioned to capitalise on these emerging trends. We have a culture of innovation, a consumer base that embraces health and sustainability, and a reliable network of local contract manufacturers and formulation experts that can cater to the specific requirements of New Zealand start-ups. When it comes to beverage innovation, NZ has access to high-quality ingredients, smart and ambitious founders, agile supply chain partners and a retail landscape that’s increasingly open to new and exciting formats. Current successful brands are bold, they value functionality, digital savviness and rapid innovation, and it is paying off.

Whether it’s adaptogens for stress, botanicals for mood, or protein for muscle recovery, the future opportunities to combine science and storytelling are huge. Functional drinks are the new normal, and the brands that embrace them might just shape the future of our industry.

Quietly launched earlier this year, Sacro is the latest innovation in functional beverages. Sacro (pronounced sacro) is a premium recovery beverage formulated to support faster, whole-body recovery after drinking. Made with electrolytes, vitamins and key ingredient DHM (Dihydromyricetin) an ancient ingredient used in traditional Chinese medicine to support liver function and improved alcohol detoxification.

Crisp, light and carbonated, Sacro contains just 28 calories per serve with no artificial colours or flavours. Best enjoyed chilled or over ice, Sacro offers a refreshing, revitalizing experience.

Visit www.sacrobeverages.com or email online@ sacrobeverages.com for more information.

Shake2Go is the latest protein-packed, 5-star health-rated innovation designed for busy Kiwis on the move. Each 350ml can delivers 30g of high-quality protein, 19 essential vitamins and minerals, and premium bovine collagen to support energy, recovery, and skin health, all with less than 200 calories and a low sugar formulation. Available in indulgent flavours, Chocolate, Vanilla, and Iced Coffee, Shake2Go is perfect for post-gym refuelling, breakfast on the run, or a nutritious pick-me-up anytime. No blender. No prep. No Excuses. Just Shake and Go. For orders, contact your local Alliance Marketing Territory Manager or Account Manager Nick Cleaver (021 986 769) or email ncleaver@alliancemarketing.co.nz

Elem is redefining what it means to hydrate well. Elem delivers clean, crisp hydration.

We focus on functional sparkling water made with natural ingredients that hydrate, refresh, and nourish your body. Elem helps you stay energised and balanced, no matter what life demands.

Each 250mL can is carefully formulated with magnesium, L-theanine, Vitamin C & B6 with no added sugars, caffeine and artificial flavours. Perfect for those seeking clean hydration options throughout the day, whether you’re working, exercising, or simply winding down. Available in two refreshing flavours: Lemon & Lime and Apple & Peach. Enjoy great taste without compromise.

Sugar-free. Caffeine-free. Proudly made in New Zealand. For more information or to become a stockist, visit https:// elementdrinks.co.nz or email contact@elementdrinks.co.nz

OxyShred Energy is an exciting functional Energy Drink now available in New Zealand! Designed for health conscious, active go-getters to ‘DO MORE’ throughout their day by providing long-lasting energy with zero jitters and zero crash and supporting overall health and wellness. OxyShred Energy has driven growth in the Australian market through new to Category customer recruitment, over-indexing in Premium, Gen Z and Millennial segments.

OxyShred Energy goes beyond traditional energy drinks with the same benefits as the flagship OxyShred thermogenic fat burner, including enhancing calorie burn during exercise, boosting metabolism, increasing immunity and elevating focus and mood. It provides a healthier boost of feel-good energy with sensible levels of caffeine, zero sugar, zero calories and better-for-you ingredients making it great on its own or before exercise! For information talk to your PAVÉ Ltd. sales rep or call 09 302 1190.

Atutahi’s taste echoes across centuries. It is made with deep respect for the land. It is why we act as guardians to this taonga, diligently collecting ingredients from key whãnau sites throughout Te Waipounamu.

Governed by Tikanga and crafted with purpose, Atutahi offers premium beverages rooted in Aotearoa’s native botanicals and Māori rongoā traditions. Proudly owned by Kiwi Kai, our drinks are more than refreshing – they’re functional, with wellness benefits drawn from ancient knowledge. Every bottle is made using artisan water and produced using solar-powered systems, reinforcing our deep commitment to sustainability and reducing our carbon footprint.

From native Kawakawa, Horopito to Kumarahou, each ingredient is thoughtfully sourced and infused to create a drink that’s clean, conscious, and uniquely New Zealand. Whether you’re after a health-boosting alternative or simply love supporting local, Atutahi brings the essence of the whenua straight to your lips. Atutahi is available for cafés, restaurants, stores, events, and wellness spaces. Let your customers sip something special. www.atutahi.nz

Good Sh*t Soda isn’t your average fizz - it’s a soda that works like a supplement. Each can is packed with one billion CFU of probiotics and 39 percent of your daily fibre, making it as good for your gut as it is for your taste buds. The synbiotic blend of pre + probiotics works to nourish your microbiome, support digestion and help you feel your best, all while tasting like the real deal. Available in four crave-worthy flavours: Cola, Citrus, Ginger, and Tropical, Good Sh*t is crafted to deliver that classic soda experience without the gut-busting sugar crash. It’s low sugar, gluten-free and made for anyone who wants a little extra love for their insides while enjoying a refreshingly satisfying drink. From the first sip to the last bubble, Good Sh*t proves that looking after yourself doesn’t mean giving up the things you love, it just means drinking smarter. For more information, please go to https://lovegoodshit.com/

Good kombucha does exist, and it’s brewed right here in Tauranga, New Zealand. Crafted the traditional way, our kombucha is raw and alive, made from natural ingredients, New Zealand spring water and live cultures to support gut health and tastes good while doing it. No shortcuts, just the good stuff.

With a wide range of brews under our belt, there’s something special about our A Series: premium batch-brewed blends inspired by New Zealand’s best fruitgrowing regions, pairing bold flavours like Gisborne Lemon with Manuka Leaf and Ginger.

Good Kombucha is our buzz. Real kombucha. Real ingredients. Real benefits. Really good taste. www.goodbuzz.nz

At Wildly, our mission is simple: bring real, wild fermentation into the mainstream—pure, alive, delicious, and made the traditional way. No lab-grown cultures. No forced carbonation. No shortcuts.

Call us crazy, but we craft everything in-house at our own fermentary, driven by unrelenting passion and complete transparency. With over 500 real reviews, its hard to ignore the magic!

Contact us today. Email: customerlove@wildly.co.nz or Independents, order through the Upstock platform. www.wildly.co.nz

We know choosing something “healthier” normally means you’re making a compromise i.e. it either tastes bad or it’s full of artificial nasties that make you feel just as guilty as the sugary option. But why should you have to compromise to get that classic soft drink experience? Well, luckily guilt-free just got better for you. Sodaly is the deliciously different, 100% natural soft drink you’ve been longing for! It’s big on flavour but low on cals. It’s full of prebiotic goodness, with no sugar. They say you can’t have it all, they were wrong! For more information or to become a stockist, visit www.remedydrinks.com/en-nz

We’re calling it. You’re going to love this summery, aromatic brew. It’s devilishly juicy, with delicate floral notes of ripe lychee mashed together with wild strawberries.

Born from a love of fermentation and indulgent flavour combinations, Remedy’s handcrafted Small Batch kombucha is made the old-school way in Melbourne. Brewed over 30-days in a small, huggable pot, using high-quality, all-natural ingredients from around the world. For more information or to become a stockist, visit www.remedydrinks.com/en-nz

Whether you’re feeling run down, indulged in one too many late-night snacks or need a pick-me-up, we’ve built you your own wellness artillery in the form of Remedy Shots; Remedy Immune+, Remedy Digestion and Remedy Energy.

Like all Remedy Drinks, Remedy Shots contain no sugar, naturally, and are packed with the perfect blend of delicious and functional ingredients to provide you with a direct hit of goodness. Remedy Shots are the easy and tasty way to give your immune system a boost, ease your digestion and give you an energy kick (boo-yah!).

For more information or to become a stockist, visit www.remedydrinks.com/en-nz

Shnack isn’t just another beverage - it’s a bold first. Born here in New Zealand, Shnack is the first dairy-free protein drink of its kind, packing 17g of clean, plant-based protein into every deliciously smooth can. It blew up online for its nocompromise combo of performance and flavour, earning cult status with fans across the country. Shnack delivers serious fuel with natural sweetness, no chalky aftertaste, and all the good vibes.

Crafted locally, Shnack is made to move with you - whether you’re hitting the gym, chasing deadlines, or just need something sweet to get through those afternoon slumps. Tasty as. Protein-packed. That’s Shnack. Visit www.shnack.co.nz or email: Hello@shnack.co.nz

Journey into the wild with Lime Cola, a premium small-batch Kefir Soda from The Wild Fermentary, in collaboration with Six Barrel Soda Co. This well-rounded classic cola brings together award-winning Cola Six syrup with fresh local lime juice and billions of gut-loving probiotics to aid digestion and uplift the mind.

Finally, a Cola that loves you back! By working together, The Wild Fermentary and Six Barrel Soda Co have proudly created NZ’s first ever ‘living cola’, an all-natural, low sugar option. The Wild Fermentary was named Beverage Winner of the NZ Food Awards 2022 for their Beet & Berry Kefir Soda.

Kefir Soda full range: Lime Cola / Ginger / Berry Blush / Lemon Manuka / Beet & Berry. www.thewildfermentary.co.nz hello@thewildfermentary.co.nz

Rejuva is the top-selling brand in the popular Aloe Vera Drinks segment, with a huge 50.4% Value Share in Total NZ Supermarkets. Consumers love Rejuva’s delicious, refreshing taste and the goodness from its huge 41% aloe vera content. For people wishing to lower their sugar intake, Rejuva Light uses natural stevia extract to reduce sugar by 50% – while still offering 41% aloe vera. Rejuva Light has a drier, fresh flavour so is the ideal drink on a summer day. Available in 1.5L and 500mL PET bottles. For more details visit www.rejuva.co.nz or phone 09-302-1190

* Source: Nielsen Scan Data Total NZ Supermarkets MAT to 16/6/24.

The trade shows, Anuga Drinks and Anuga Hot Beverages, are presenting themselves in top form at Anuga from in October 2025. Both segments are recording continual growth, high international participation and are setting strong impulses in the section of sustainable, healthy and innovative beverage concepts.

With just under 530 exhibitors participating in Anuga Drinks and over 140 exhibitors in Anuga Hot Beverages, both segments are recording a strong participation and there are also numerous innovative and young companies in the Start-up Area. Particularly gratifying: In some sections the demand already exceeds the available amount of space - there are many interested parties are on the waiting list.

Anuga Drinks is a good example for the transformation of the global beverage industry. Its spectrum ranges from refreshments that are rich in vitamins and minerals, to high-fibre hydration solutions, through to creative alcohol-free alternatives. All of these developments react to an increasing need for holistic well-being – a trend that the data of Anuga’s knowledge partner, Innova Market Insights, confirms. In this way, the global market for soft drinks and sports drinks recorded an annual average growth rate of 22 percent between 2021 and 2023. Beverages that combine hydration with “beauty benefits” have registered particularly strong growth, for example with added skin care ingredients – this segment achieves a CAGR of 109 percent.

The transformation is also noticeable in the product range: Functional ingredients like vitamins, minerals and fibre are becoming an integral part of many new beverage products. Drinks rich in vitamin are displaying around 10 percent growth annually, high-fibre products about 18 percent. This is

enhanced by limited editions and brand cooperations that have generated an increasing amount of attention over the past five years with a CAGR of 17 percent – especially in the iced tea segment that grows by 44 percent annually. Consumer behaviour is also changing: 37 percent of the consumers worldwide are consciously reducing their alcohol consumption. The demand for alcohol-free cocktails and aromatised mixed drinks is correspondingly high – with a 26 percent CAGR between 2019 and 2023.